ORDER

Keshav Dubey, Judicial Member.- This appeal at the instance of the assessee is directed against the order of the AO, Assessment Unit, Income Tax department dated 19.6.2024 vide DIN No.ITBA/AST/S/143(3)/2024-25/1065876641(1) for the AY 2020-21 passed u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Income Tax Act, 1961 (in short “The Act”).

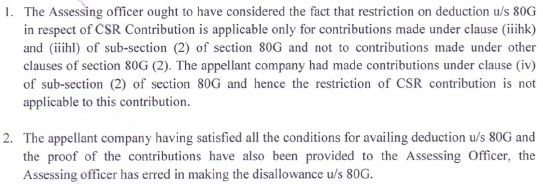

2. The assessee has raised following grounds of appeal:

3. Brief facts of the case are that Assessee is a Private Limited Company engaged mainly in the business of manufacture and export of spice oils, spice oleoresins and other spice products. For the Assessment Year 2020-21, it filed the return of income on 27.01.2021 declaring a total income of Rs.160,94,63,940/-. In respect of International Transactions entered into by the assessee company, the Assessing officer made a reference to the Transfer Pricing Officer (TPO) u/s 92CA (l) of the Act for determining the arm’s length price in respect of the International Transactions. By order passed u/s 92CA(3) of the Act, the Transfer Pricing Order made an adjustment of Rs.2,03,38,752/- towards notional guarantee commission in respect of corporate guarantee given by the assessee for its Subsidiary. After receiving the order of the TPO, the Assessing Officer made a draft assessment order u/s 144(1) proposing to make the following adjustments:-

| i. | | Addition as proposed by TPO — towards notional Guarantee Commission – Rs.2,03,38,752/- |

| ii. | | Disallowance of deduction u/s 80G in respect of donations made to eligible entities out of CSR Funds -Rs.49,34,550/- |

3.1 On receipt of Draft Order u/s 144C (l), assessee filed its objections before the Dispute Resolution Panel (in short “DRP”) u/s 144C against the variations proposed by the Assessing Officer.By its order dated 31.05.2024, the ld. DRP reduced the additions in respect of Corporate Guarantee Commission amounting to Rs. 5,50,206/-. However, the disallowance proposed by the Assessing officer in the Draft Assessment Order in respect of deduction claimed u/s 80G of the Act amounting to Rs. 49,34,550/- in respect of donation made to eligible entities out of CSR Funds was upheld by the ld. DRP. Accordingly, the Assessing Officer passed the final Assessment Order u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Act by disallowing the deduction u/s 80G amounting to Rs. 49,34,550/-.The AO accordingly completed the assessment on a total income of Rs.161,49,48,696/- u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Act.

4. Being aggrieved by the disallowance of deduction u/s 80Gof the Act by the Assessing officer the assessee has filed the present appeal before this Tribunal.

5. Thus, the solitary issue raised before us is whether the AO justified in rejecting claim u/s 80G of the Act on the expenses incurred on account of Corporate Social Responsibility (CSR).

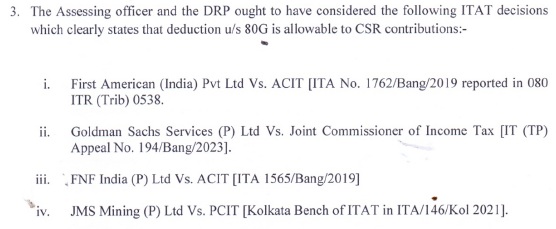

6. Before us, the ld. A.R. of the assessee vehemently submitted that the assessee company having satisfied all the conditions for availing deduction u/s 80G of the Act and the proof of the contribution have also been provided to the AO and therefore, the AO has erred in making the disallowance u/s 80G of the Act. Further, ld. A.R. of the assessee vehemently submitted that the restriction on deduction u/s 80G of the Act in respect of CSR contribution is applicable only for contribution made under clause (iiihk) and (iiihl) of sub-section (2) of section 80G of the Act and not to contribution made under other clauses of section 80G (2) of the Act. As the assessee company had made contribution under clause (iv) of sub-section (2) of section 80G of the Act and hence, the restriction of CSR contribution is not applicable to this contribution.

7. Before us, the ld. D.R. relied on the order of authority below.

8. We have heard the rival submissions and perused the materials available on record. It is undisputed fact that the assessee had incurred expenses amounting to Rs.98,69,100/- on account of Corporate Social Responsibility (CSR) in line with the guidelines issued under the Companies Act, 2013. On this payment, the assessee was found to have claimed deduction to the extent of Rs.49,34,550/- u/s 80G of the Act. The AO is of the opinion that such a claim is not permissible as the voluntary nature of donations is not in consonance with the mandatory nature of undertaking CSR expenditure and accordingly the claim u/s 80G of the Act as made by the assessee with respect to donation made to various entities listed in the income tax return amounting to Rs.98,69,100/- spent under CSR activity was disallowed and hence the claim of 50% of the eligible amount of Rs.49,34,550/- is also treated as not required to be allowed u/s 80G of the Act.

8.1 In the similar facts and circumstances the coordinate bench of this Tribunal in the case of Peak XV Partners Advisors (P.) Ltd. v. Dy. CIT (Bangalore – Trib.)/ ITA Nos. 2045 & 2046/Bang/2024 vide order dated 3.3.2025 held as under:

“5.1 As can be seen above, the existing approval u/s 80G(5)(vi) of the Act expiring on or after 1st October, 2009 shall be deemed to have been extended in perpetuity unless specifically withdrawn. Further, any new approval obtained u/s 80G(5) of the Act on or after 1.10.2009 would be a one time approval, which would be valid till it is withdrawn. Therefore, in view of the above circular, we are of the opinion that this ground of the ld. CIT(A)/NFAC is not tenable.

5.2 Further, we take a note of the fact that section 37(1) of the Act pertains solely to the computation of income from business or profession and its scope is confined to allowing or disallowing expenditure incurred for business purposes. On the other hand, section 80G of the Act provides deduction for donation made to specified funds and institutions while computing the taxable income of the assessee. The disallowance of CSR expenditure under explanation 2 to section 37(1) of the Act applies only in the context of determining its income from business and does not preclude an assessee from claiming deduction under Chapter VIA (which includes section 80G) for eligible donation.

5.3 While CSR expenditure is mandatory u/s 135 of the Companies Act, 2013, the assessee retains discretion over the recipients of such contributions. When such contributions are made to approved institutions or fund u/s 80G of the Act, they qualify as donation “for the purpose of that section, even if incurred under a statutory obligation”. The term “donation” u/s 80G of the Act includes both voluntary contributions and mandatory payments made to specified entities. The mandatory nature of CSR expenditure does not dilute its eligibility for deduction u/s 80G of the Act, as the deduction depends on the nature of recipient and compliance of the conditions specified u/s 80G of the Act.

5.4 We also note that the coordinate bench of this Tribunal in the case of Allegis Services (Inia) Pvt. Ltd. v. ACIT in ITA No.1693/Bang/2019 dated 29.4.2020 held as under:

10. Section 135 of Companies Act, 2013 requires companies with CSR obligations, with effect from 01/04/2014.

Finance (No.2) Act, 2014 inserted new Explanation 2 to subsection (1) of section 37, so as to clarify that for purposes of subsection (1) of section 37, any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to be an expenditure incurred by the assessee for the purposes of the business or profession.

11. This amendment will take effect from 1/04/2015 and will, accordingly, apply to assessment year 2015-16 and subsequent years.

12. Thus, CSR expenditure is to be disallowed by new Explanation 2 to section 37(1), while computing Income under the Head ‘Income form Business and Profession ‘. Further, clarification regarding impact of Explanation 2 to section 37(1) of the Income Tax Act in Explanatory Memorandum to The Finance (No.2) Bill, 2014 is as under:

“The existing provisions of section 37(1) of the Act provide that deduction for any expenditure, which is not mentioned specifically in section 30 to section 36 of the Act, shall be allowed if the same is incurred wholly and exclusively for the purposes of carrying on business or profession. As the CSR expenditure (being an application of income) is not incurred for the purposes of carrying on business, such expenditure cannot be allowed under the existing provisions of section 37 of the Income-tax Act.

Therefore, in order to provide certainty on this issue, it is proposed to clarify that for the purposes of section 37(1) any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to have been incurred for the purpose of business and, hence, shall not be allowed as deduction under section 37. However, the CSR expenditure which is of the nature described in section 30 to section 36 of the Act shall be allowed deduction under those sections subject to fulfilment of conditions, if any, specified therein.”

13. From the above it is clear that under Income tax Act, certain provisions explicitly state that deductions for expenditure would be allowed while computing income under the head, ‘Income from Business and Profession” to those, who pursue corporate social responsibility projects under following sections.

• Section 30 provides deduction on repairs, municipal tax and insurance premiums.

• Section 31, provides deduction on repairs and insurance of plant, machinery and furniture

• Section 32 provides for depreciation on tangible assets like building, machinery, plant, furniture and also on intangible assets like know-how, patents, trademarks, licenses.

• Section 33 allows development rebate on machinery, plants and ships.

• Section 34 states conditions for depreciation and development rebate.

• Section 35 grants deduction on expenditure for scientific research and knowledge extension in natural and applied sciences under agriculture, animal husbandry and fisheries. Payment to approved universities/research institutions or company also qualifies for deduction. In-house R&D is eligible for deduction, under this section.

• Section 35CCD provides deduction for skill development projects, which constitute the flagship mission of the present Government.

• Section 36 provides deduction regarding insurance premium on stock, health of employees, loans or commission for employees, interest on borrowed capital, employer contribution to provident fund, gratuity and payment of security transaction tax.

Income Tax Act, under section 80G, forming part of Chapter VIA, provides for deductions for computing taxable income as under:

• Section 80G(2) provides for sums expended by an assessee as donations against which deduction is available.

(a) Certain donations, give 100% deduction, without any qualifying limit like Prime Minister’s National Relief Fund, National Defence Fund, National Illness Assistance Fund etc., specified under section 80G(1)(i)

(b) Donations with 50% deduction are also available under Section 80G for all those sums that do not fall under section 80G(1)(i).

Under Section 80G(2) (iiihk) and (iiihl) there are specific exclusion of certain payments, that are part of CSR responsibility, not eligible for deduction u/s80G.

14. In our view, expenditure incurred under section 30 to 36 are claimed while computing income under the head, ‘Income form Business and Profession”, where as monies spent under section 80G are claimed while computing “Total Taxable income” in the hands of assessee. The point of claim under these provisions are different.

15. Further, intention of legislature is very clear and unambiguous, since expenditure incurred under section 30 to 36 are excluded from Explanation 2 to section 37(1) of the Act, they are specifically excluded in clarification issued. There is no restriction on an expenditure being claimed under above sections to be exempt, as long as it satisfies necessary conditions under section 30 to 36 of the Act, for computing income under the head, “Income from Business and Profession”.

16. For claiming benefit under section 80G, deductions are considered at the stage of computing “Total taxable income”. Even if any payments under section 80G forms part of CSR payments(keeping in mind ineligible deduction expressly provided u/s.80G), the same would already stand excluded while computing, Income under the head, “Income form Business and Profession”. The effect of such disallowance would lead to increase in Business income. Thereafter benefit accruing to assessee under Chapter VIA for computing “Total Taxable Income” cannot be denied to assessee, subject to fulfillment of necessary conditions therein.

17. We therefore do not agree with arguments advanced by Ld.Sr.DR.

18. In present facts of case, Ld.AR submitted that all payments forming part of CSR does not form part of profit and loss account for computing Income under the head, “Income from Business and Profession”. It has been submitted that some payments forming part of CSR were claimed as deduction under section 80G of the Act, for computing “Total taxable income”, which has been disallowed by authorities below. In our view, assessee cannot be denied the benefit of claim under Chapter VI A, which is considered for computing ‘Total Taxable Income”. If assessee is denied this benefit, merely because such payment forms part of CSR, would lead to double disallowance, which is not the intention of Legislature.

19. On the basis of above discussion, in our view, authorities below have erred in denying claim of assessee under section 80G of the Act. We also note that authorities below have not verified nature of payments qualifying exemption under section 80G of the Act and quantum of eligibility as per section 80G(1) of the Act.

20. Under such circumstances, we are remitting the issue back to Ld.AO for verifying conditions necessary to claim deduction under section 80G of the Act. Assessee is directed to file all requisite details in order to substantiate its claim before Ld.AO. Ld.AO is then directed to grant deduction to the extent of eligibility. Accordingly grounds raised by assessee stands allowed for statistical purposes.

In the result appeal filed by assessee stands allowed.”

5.5 In view of the above elaborated discussion and following findings of the coordinate bench of this Tribunal in the above-mentioned case, we hereby set aside the orders of ld. AO and direct him to delete the addition made in both these assessment years. Hence, the grounds of appeal of the assessee in both these years are allowed.”

8.2 In view of the above decision of this Tribunal, we hereby set aside the order of the AO and direct him to delete the addition made by disallowing the deduction claimed u/s 80G of the Act. Hence, the grounds of appeal of the assessee are allowed.

9. In the result, appeal filed by the assessee is allowed.