A revised return opting for the 115BAA regime is valid.

Issue

Can a company switch to the concessional tax regime under Section 115BAA of the Income-tax Act, 1961, by filing a revised return, and can it set off its normal brought-forward business and capital losses against the income computed under this new regime?

Facts

- An assessee-company initially filed its return of income under the normal provisions of the Income-tax Act.

- Subsequently, it filed a revised return under Section 139(5) in which it opted for the concessional tax regime under Section 115BAA.

- The assessee also claimed the set-off of its brought-forward business loss and capital loss against its income.

- The Commissioner (Appeals) conducted a verification and gave a categorical factual finding that the brought-forward losses of the assessee were not of the nature that is specifically prohibited from being set off under the provisions of Section 115BAA(2).

Decision

The court ruled in favour of the assessee on all key points.

- It held that a revised return validly substitutes the original return, and therefore, a taxpayer can use a revised return to opt for the concessional tax regime under Section 115BAA.

- It confirmed that once the concessional regime is allowed, the assessee is no longer eligible to claim any MAT credit.

- Most importantly, it held that since the assessee’s brought-forward losses were factually verified and found to be not of the prohibited nature, the assessee was fully entitled to set off these losses against their income.

Key Takeways

- A Revised Return Can Be Used to Change the Tax Regime: A revised return of income completely replaces the original return for all legal purposes. It is a valid and permissible mechanism for a taxpayer to change their initial choice and opt into a beneficial tax regime like the one provided under Section 115BAA.

- No MAT Credit Under the 115BAA Scheme: Opting for the concessional 22% tax rate under Section 115BAA comes with a clear trade-off. A company that chooses this regime automatically forfeits its right to claim any brought-forward Minimum Alternate Tax (MAT) credit.

- The Bar on Set-off of Losses is Specific, Not General: The restriction on the set-off of losses under Section 115BAA(2) is not a blanket ban. It is a very specific bar that applies only to losses that are attributable to certain special, profit-linked deductions (like those under Section 10AA, 32AD, 35, etc.).

- Normal Business Losses Can Be Set Off: Normal brought-forward business losses and capital losses that are not connected to the specifically prohibited deductions can be set off against the income computed under the Section 115BAA regime, provided the return is filed on time.

IN THE ITAT HYDERABAD BENCH ‘B’

Assistant Commissioner of Income-tax

v.

Lahari Holiday Homes (P.) Ltd.

VIJAY PAL RAO, Vice President

and MADHUSUDAN SAWDIA, Accountant Member

and MADHUSUDAN SAWDIA, Accountant Member

IT Appeal No.600 (Hyd) of 2025

[Assessment year 2021 -22]

[Assessment year 2021 -22]

OCTOBER 8, 2025

Dr. Narendra Kumar Naik, CIT-DR for the Appellant. J.J. Varun, C.A. for the Respondent.

ORDER

Madhusudan Sawdia, Accountant Member.- This appeal is filed by the Revenue, feeling aggrieved by the order passed by the Learned Commissioner of Income Tax (Appeals), National Faceless Appeal Centre (NFAC), Delhi (“Ld. CIT(A)”), dated 20.02.2025 for the A.Y. 2021-22.

2. The Revenue has raised the following grounds of appeal :

| (i) | The learned CIT(A) erred in allowing relief to the assessee to take credit for taxes paid under MAT though the assessee has opted for section 115BAA. |

| (ii) | The learned CIT(A) erred in appreciating the fact that the assessee opted for section 115BA to set-off the tax liability on account of capital gains for the AY 2021-22 out of the unverified “capital loss” of Rs.8.57 crores for AY 2020-21 as claimed in ITR towards brought forward losses. |

| (iii) | The learned CIT(A) erred in appreciating that the CBDT Circular No.29/2019 dt.02/10/2019 was clarificatory in nature and mentioned that MAT credit will not be allowed to assessee’s opting sec.H5BAA and the Circular never mentioned that brought forward “capital losses” will be allowed. |

| (iv) | Any other ground that may be urged at the time of appeal hearing. |

3. The brief facts of the case are that, M/s. Lahari Holiday Homes Pvt. Ltd. (“the assessee”) filed its original return of income for A.Y. 2021-22 under the normal provisions of the Income Tax Act, 1961 (“the Act”) claiming MAT credit. Thereafter, the assessee filed a revised return on 15.02.2022, opting for the concessional tax regime under section 115BAA of the Act. The Learned Assessing Officer (“Ld. AO”) rejected the revised claim on the ground that once the assessee filed the original return under MAT, subsequent exercise of section 115BAA option through a revised return amounts to “withdrawal” prohibited by CBDT Circular No. 29/2019. The Ld. AO further disallowed the set-off of brought-forward business losses of Rs.3,17,89,595/- and capital losses of Rs.8,57,73,902/-, holding that section 115BAA(2) read with Circular No.29/2019 bars such set-off. Accordingly, the Ld. AO assessed income at Rs.11,96,79,556/-.

4. Aggrieved with the order of Ld. AO, the assessee filed appeal before the Ld. CIT(A). The Ld. CIT(A) vide order dated 20.02.2025, allowed the assessee’s appeal contending that a revised return under section 139(5) of the Act substitutes the original return and hence exercise of section 115BAA of the Act through revised return before the due date is valid. He also held that, losses disallowed by the Ld. AO were not covered by the specific restrictions of section 115BAA(2) of the Act, therefore, set-off of such business and capital losses was allowable.

5. Aggrieved with the order of Ld. CIT(A), the Revenue has preferred the present appeal. At the outset, the Learned Departmental Representative (“Ld. DR”) submitted that only two issues are involved out of the grounds of appeal of the revenue. As regards to the first issue regarding concessional tax regime under section 115BAA of the Act, the Ld. DR submitted that, the assessee had initially filed its original return under MAT provisions and claimed MAT credit. Subsequently, only in the revised return the assessee opted for the concessional tax regime under section 115BAA of the Act. However, CBDT Circular No.29/2019 clearly states that once any one of option is exercised, the same cannot be withdrawn subsequently. By choosing MAT at the first instance, the assessee had opted out of 115BAA, and later revised return amounts to impermissible withdrawal. Accordingly, the option for concessional tax regime under section 115BAA of the Act cannot be allowable to the assessee.

6. As regards the second issue related to set off of carried-forward losses and unabsorbed depreciation, the Ld. DR argued that the concessional tax regime under section 115BAA of the Act is subject to strict conditions. The provision expressly prohibits the set-off of carried-forward losses and unabsorbed depreciation attributable to deductions specified in section 115BAA(2). The Ld. AO correctly interpreted the restriction, and the Ld. CIT(A) erred in enlarging the scope of eligible set-off. Finally, the Ld. DR prayed that the order of the Ld. CIT(A) be reversed and that the assessment order of the Ld. AO be restored in toto.

7. Per contra, as regards to the first issue regarding concessional tax regime under section 115BAA of the Act, the Learned Authorised Representative (“Ld. AR”) submitted that the assessee had exercised the option under section 115BAA of the Act for the first time in its revised return filed within the statutory due date. In this regard, the assessee relied on CBDT’s own clarification in FAQ on ITR-6 (uploaded on the Income-tax Department’s official portal), wherein it is categorically stated that a company may file a revised return opting for section 115BAA of the Act, even if the original return was filed otherwise. He further contended that under settled law, a revised return under section 139(5) of the Act substitutes the original return and is deemed as filed under section 139(1) of the Act. Thus, the Ld. AO’s interpretation of “withdrawal” is misconceived, since there was no earlier exercise of section 115BAA of the Act that could be withdrawn.

8. As regards the second issue related to set off of carried-forward losses and unabsorbed depreciation, the Ld. AR pointed out that the assessee had not claimed any deduction under section 32(1)(iia), 32AD, 35, 35CCC, 35CCD, or Chapter VI-A (other than 80JJAA/80M) of the Act. The brought-forward business loss and capital loss were regular in nature, not attributable to any disallowed items specified under section 115BAA(2) of the Act. He further submitted that the Ld. AO misconstrued CBDT Circular No.29/2019, which only bars setoff of losses attributable to additional depreciation or specified deductions, not regular losses. He accordingly prayed for dismissal of the Revenue’s appeal.

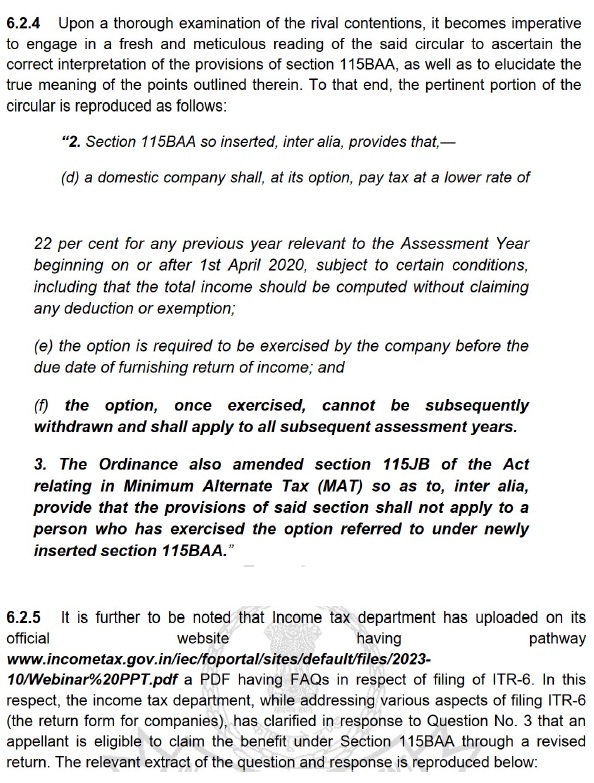

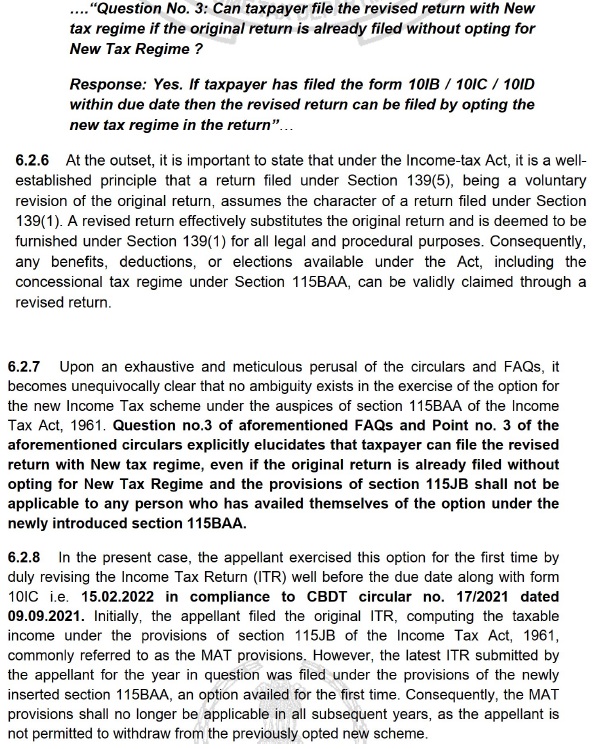

9. We have heard rival submissions and perused the material placed on record. On the first issue, there is no dispute on the fact that the assessee filed a revised return within the due date, exercising the option under section 115BAA of the Act for the first time. In our considered view, a revised return substitutes the original return and assumes the character of a return under section 139(1) of the Act. In this regard, we have gone through the para nos.6.2.4 to

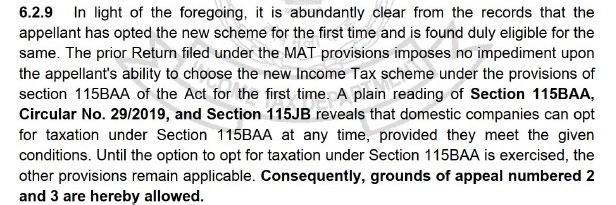

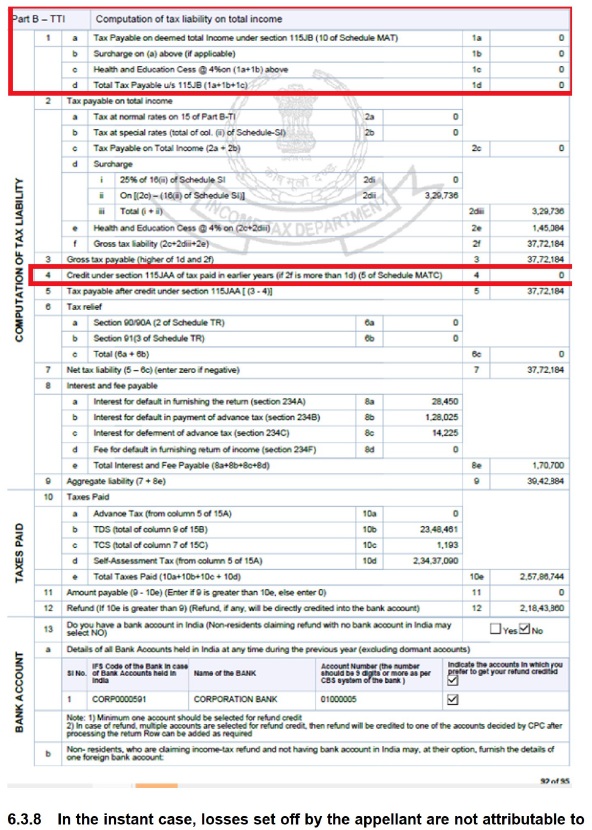

6.2.9 of the order of Ld. CIT(A), which is to the following effect :

10. On perusal of above, we find that the Ld. CIT(A) has extracted FAQ no.3 of CBDT’s own clarification at para no.6.2.5 of its order which permits exercise of the 115BAA option in a revised return. Therefore, the interpretation of the Ld. AO that such filing constitutes a withdrawal of earlier option is legally untenable. Further, we also hold that once the concessional tax regime is allowed to the assessee for A.Y. 2021-22, the assessee would not be eligible to claim any MAT credit in the A.Y. 2021-22. Accordingly, we uphold the findings of the Ld. CIT(A) on this issue subject to verification of claim of MAT credit Accordingly, we direct the Ld. AO to verify the MAT credit, which the assessee is not eligible for A.Y. 2021-22.

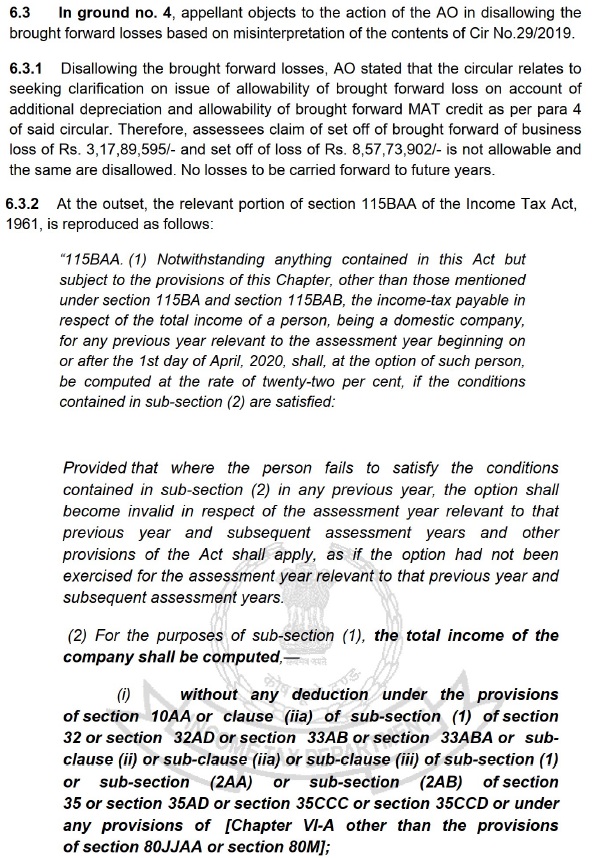

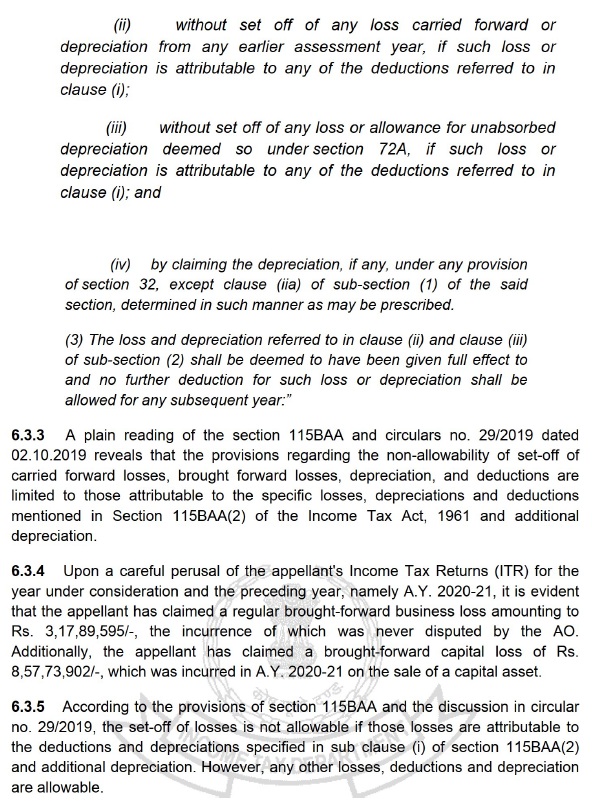

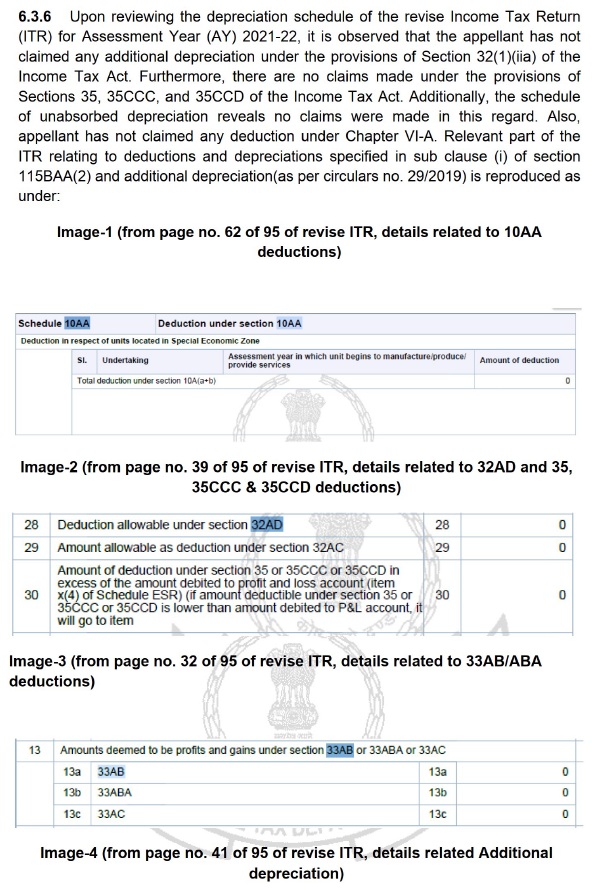

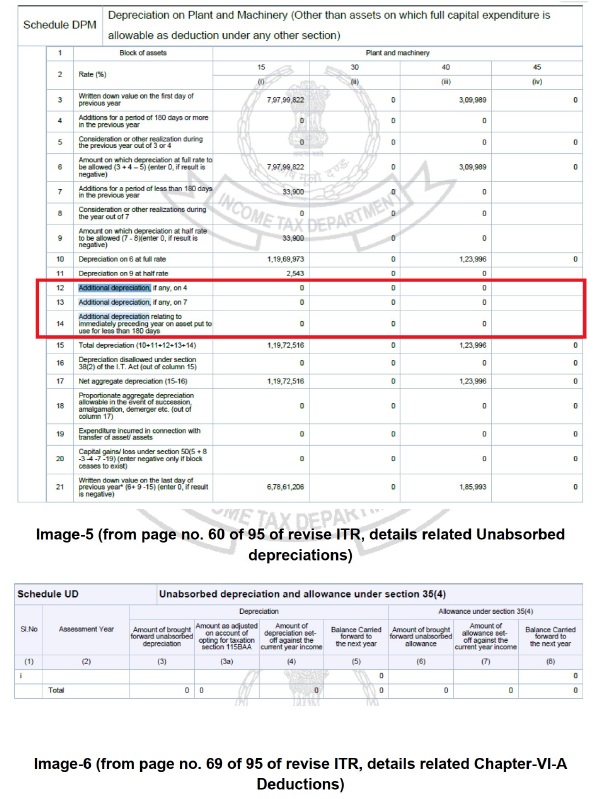

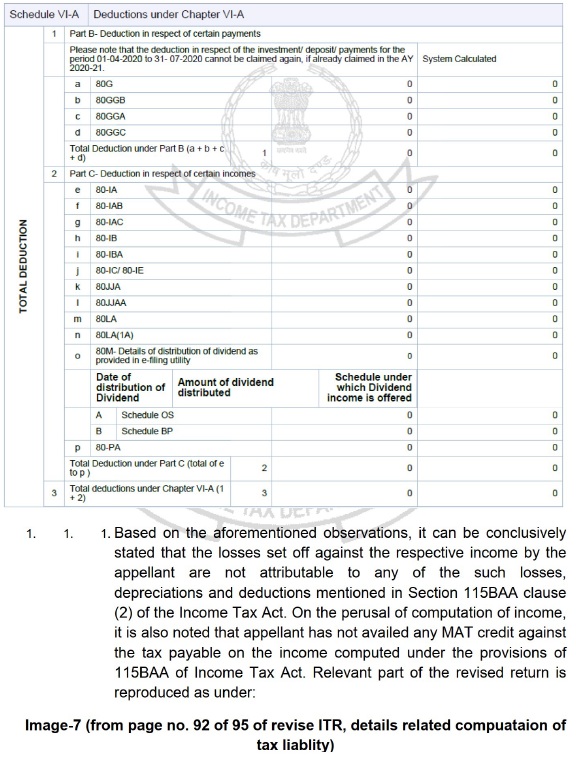

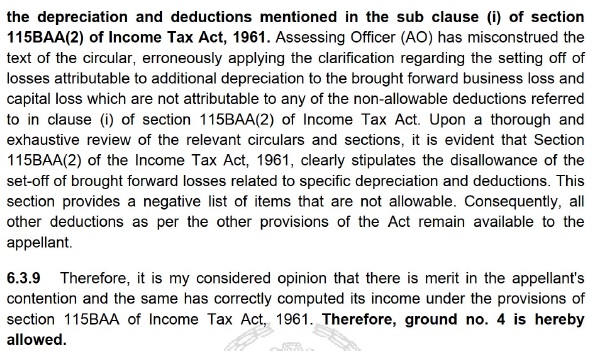

11. On the second issue, we have gone through the para nos. 6.3 to 6.3.9 of the order of Ld. CIT(A), which is to the following effect :

12. On perusal of above, we find that the Ld. CIT(A) has extracted the provisions contained in section 115BAA of the Act. Further, on perusal of section 115BAA(2) of the Act, we find that section 115BAA(2) of the Act specifically prohibits set-off of losses attributable to certain deductions such as section 10AA, 32(1)(iia), 32AD, 35, 35CCC, 35CCD, and unabsorbed depreciation relatable thereto. We also find that the Ld. CIT(A) after verifying the revised return and supporting schedules has categorically given a factual finding that, the assessee’s brought-forward business loss and capital loss are not of such nature, which has been prohibited under section 115BAA(2) of the Act. Hence, we hold that the assessee is entitled to set-off of these losses. Accordingly, we uphold the findings of the Ld. CIT(A) on this issue.

13. In the result, the appeal filed by the Revenue is dismissed, in terms of our above observation.