ORDER

Keshav Dubey, Judicial Member. – These appeals at the instance of the assessees are directed against the orders of the ld. Assistant Commissioner of Income Tax, International Taxation, Circle-1(2), Bengaluru both dated 22/01/2025 vide DIN & Order No. ITBA/AST/S/143(3)/2024-25/1072440682(1) as well as DIN & Order No. ITBA/AST/S/143(3)/2024-25/1072440694(1) passed u/s 143(3) r.w.s. 144C(13) of the Income Tax Act, 1961 (in short “The Act”) for the assessment year 2022-23. Since the issues involved in both these appeals are common including the amounts in disputes and hence, these are taken up together and disposed off by this common order for the sake of convenience & brevity.

2. None appeared on behalf of the assessee. Accordingly, we proceed to dispose of these appeals by hearing the ld. D.R. and after pursuing the materials available on the record.

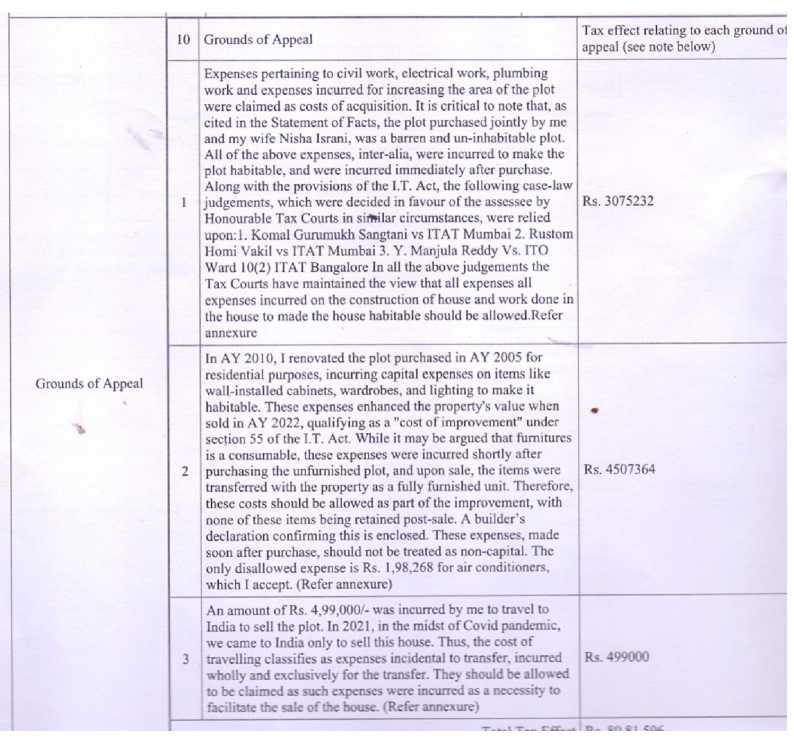

3. Now first we take up the appeal of the assessee in ITA No. 607/Bang/2025 in the case of Vijay Lakshmi Chand Israni for adjudication. The assessee has raised the following grounds of appeal :

4. Brief facts of the case are that assessee being a senior citizen non-resident deriving his income under the head House property, capital gains and income from other sources filed his return of income for the AY 2022-23 u/s. 139 of the Act on 16.06.2022 declaring a total income of Rs.35,67,355/-. The said return was processed u/s. 143(1) of the act on 16.08.2022 by accepting the returned income. The case of the assessee was thereafter selected for scrutiny under CASS and accordingly notices u/s. 143(2) and 142(1) of the Act were issued to the assessee. The assessee filed his submission on various dates during the course of assessment proceedings. The AO noted that the during the year under consideration, the assessee sold a house property situated at Villa No.72, Adarsh Palm Retreat, Bangalore for Rs.4,02,00,000/- (50% of Rs.8,04,00,000). The said residential property was purchased jointly with his wife Ms. Nisha Vijay Israni in the year 2005 which was a non-furnished/ dilapidated/ inhabitable plot at the time of purchase. The assessee claimed that soon after the purchase they incurred expenditure for construction of the house and made it habitable by incurring certain capital expenditures and thereby increasing the value of the property.

4.1 From the computation of income, the AO seen that the assessee made an expense of Rs.25,72,807/- towards items of personal effect such as roof top solar plant, air conditioners, wall speakers, microwave oven etc. which the assessee had claimed as the cost of improvement. Since the assessee had made expenses of Rs.25,72,807/- towards items of personal effect, the AO accordingly disallowed the same as cost of improvement while computing the capital gain.

4.2 Further, it was come to the notice of the AO that the assessee had claimed an expenses of Rs.4,99,000/- for travel and courier and claimed it as sale expenses for the purpose of computation of capital gain. The AO was of the view that there is no such provision in the Act to claim travelling cost as sale expenses. Further, there is no way the assessee can substantiate that the travelling was made solely for the sale of said property. The assessee had also not provided any supporting submission to substantiate the sale expenses and accordingly, the AO disallowed the sum of Rs.4,99,000/- claimed as travel and courier expenses.

4.3 Lastly, the AO observed that the assessee while computing the cost of acquisition had claimed Rs.11,35,023/- as “other charges” incurred on dated 25.06.2005. The assessee neither produced any relevant bank statements nor produced any bills/vouchers etc to justify the genuineness of the said expenses. Further, the AO noted that the bifurcation produced by the assessee is just an approximate expense and not the final expenses which is clearly mentioned on the table. The table submitted clearly shows that it is just a “prefinal cost”. Further neither any cheque no., bill no. nor any date of payment was written against any of the payment and accordingly expenses of Rs.11,35,023/- claimed as cost of acquisition was disallowed. Thus, the AO completed the assessment proceedings on a total assessed income of Rs.1,20,25,302/- by adding Rs. 84,57,947/- under head capital gains.

5. Aggrieved by the assessment completed u/s. 143(3) r.w.s 144C (13) of the Act dated 22.01.2025, the assessee has filed the present appeal before this Tribunal. Before us, the assessee has also filed statement of facts, grounds of appeal along with the written submissions.

6. We have heard ld. Department Representative Dr. Divya.K.J., CIT and perused the material available on record. The assessee being a senior citizen non-resident deriving his income under the head House property, capital gains and income from other sources. During the year under consideration, the assessee along with his wife sold a property in jointness situated at Villa No.72, Adarsh Palm Retreat, Bangalore for Rs.4,02,00,000/- (50% of Rs.8,04,00,000). On going through the assessment order, we take a note of the fact that the assessing officer rejected Rs.11,35,023/- claimed by the assessee as cost of acquisition for the following reasons:-

I) The bifurcation produced by the assessee is just an approximate expense and not the final expenses.

II) No cheque no. or bill no. or any date of payment is written against any of the payments.

III) The table submitted by the assessee shows that it is just a prefinal cost.

6. 1 The assessee by way of written submissions before the both the authorities below had submitted that said expenses are very much real and raised by the builder M/s. Akash Infotech and Infrastructure. Further, we take a note of the fact that the assessee claimed to have submitted the complete payment details along with the submissions as detailed below:-

| Date | Particulars of Documents | Raised by | Amount | Share of Assessee | Marked as |

| 11.09.09 | Statement of payments | Builder | 2270045/- | 1135023/- | Annexure-1 |

| 04.05.10 | Receipt by Builders No. 125 | Builder | 1763525/- | 881763/- | Annexure-2 |

| 05.05.10 | Inter-office Memorandum (Revised Final Charge) | Builder | 602501/- | 301251/- | Annexure-3 |

| 09.05.10 | Possession Certificate and confirmation of Full payment received | Builder | N.A. | N.A. | Annexure-4 |

6. 2 Further, the ld. D.R.P-2, Bangalore noted that the assessee had incurred above cost related to the civil work, plumbing and electrical charges for improvement of property, however as the assessee had not submitted any proof with regard to these expenses before the AO and accordingly held that the approach of the AO is right in disallowing the same. We are of the considered opinion that both the authorities below failed to appreciate that the total payment of Rs.22,70,045/- (assesses’s share 11,35,023/-) were paid to the builder itself relating to civil work, plumbing and electrical charges. The assessee had also produced the statements of payments to builder marked as Annexure-1. We also take the note of the fact that before the AO, the assessee had also submitted the bifurcation of said expenses in a tabular form. The assessee had also submitted the copies of all the receipts issued by the builders/contractor which were in the possession of the assessee. Further, we find force in not submitting the bank statements, as the assessee could not produce the same due to closure of his bank accounts for more than 10 years back. We are also of the consider opinion that the builder will give the possession certificate only after receiving all his considerations and therefore, we find no infirmity in claiming of Rs.11,35,023/-(50% of 22,70,045) as cost of acquisition and accordingly, we allowed this ground of appeal of the assessee.

6.3 Now with regard to disallowance of Rs.25,72,807/- claimed towards cost of improvement, the AO from the computation of income seen that the assessee made an expenses of Rs.25,72,807/- towards items of personal effect such as roof top solar plant, air conditioners, wall speakers, microwave oven etc. which the assessee claimed as cost of improvement and subsequently claimed the indexation on the said items. Since the assessee had made expenses of Rs.25,72,807/-towards items of personal effect, the AO accordingly, disallowed the same as cost of improvement while computing the capital gain. The ld. D.R.P-2, Bangalore noted that the assessee had not submitted any additional evidence with regard to said claim. Further, ld.D.R.P-2, Bangalore noted that the assessee had made the above expenditure for the use of personal effects and which are not categorised under the cost of improvement/ construction of building and accordingly did not find any infirmity in the approach of the AO in disallowing the same. The assessee before both the authorities below submitted that while selling and giving away the possession of the house, the assessee did not taken a part of these items or remove the said items from the house and property was sold on “as is where is basis”. Further, the assessee claimed that all these cost were incurred in order to make the house habitable and proper for living conditions without which no building could ever be categorised as a liveable house. The assessee all along pleaded that the purchase of various items was made in order to make the house habitable and proper for living condition which is very normal and would be incurred by every citizen who is purchasing a property from a builder. The assessee in his written submission stated that without incurring the impugned expenses claimed as cost of improvement, the house constructed by him would not be habitable at all and accordingly claimed that the aforesaid cost would form an integral part of the total amount invested for acquisition of the house property. The assessee placed reliance on the decision of ITAT, “SMC” Bench, Mumbai in the case of Komal Gurumukh Santani v. ITO ITA no.1200 and 1201/MUM/2020 in support of his contention. The ld. AO simply brushed aside the entire contention of the assessee by stating that the impugned expenditures were incurred only on account of personal effects and the same would not eligible as cost of improvements and consequently not eligible for deduction while computing the capital gains. On going through the list of expenditures as detailed in a tabular form submitted before both the authorities below, we are in complete agreement with the arguments advanced by the assessee before both the lower authorities in respect of aforesaid expenses that these expenses are incurred only in order to make the house habitable. From the perusal of the list of expenses incurred, we find that majority of the items are embedded to the wall and becomes part and parcel of the building itself which is subject matter of sale by the assessee and his wife. We also take a note of the fact that in the said list items like air conditioners, Girias appliances- 2 etc would certainly fall under the ambit of “personal effects” not liable for deduction. However, in respect of remaining items, the assessee would certainly be eligible for deduction as it becomes an integral part of the building. Before us, the assessee by way of written submission and with the intension of resolving the dispute in a spirit of co-operation with the department and to buy peace of mind offered to consider a sum of Rs.5,49,644/- out of the total of Rs.25,72,807/- as item of “personal effects” and accordingly plead that balance sum of Rs.20,23,163/- may be allowed of cost of improvements being permanent fixtures and wall/ ground embedded. We agree with the contention of the assessee as we already held that the expenditure incurred which are permanent fixture, wall/ ground embedded are incurred only in order to make the house habitable and it becomes the part and parcel of building itself which is subject matter of sales by the assessee. Accordingly, we direct the AO to disallow Rs 5,49,644/- out of total cost of improvements amounting to Rs.25,72,807/-. Accordingly, this ground of the assessee is partly allowed.

6. 4 Further, on going through the assessment order, we take a note of the fact that the assessee had claimed an expenses of Rs.4,99,000/- for travel and courier and claimed it as sale expenses for the purpose of computation of capital gain. The AO is of the view that there is no such provision in the Act to claim travelling cost as sale expenses. Further, there is no way the assessee can substantiate that the travelling was made solely for the sale of said property. The assessee had also not provided any supporting submission to substantiate the sale expenses and accordingly, the AO disallowed the sum of Rs.4,99,000/- claimed as travel and courier expenses. The ld. D.R.P-2, Bangalore find fit the AO’s reasoning for disallowing the claim of assessee amounting to Rs.4,99,000/-. The assessee by way of written submission stated that section 48(i) of the Act allows the deductions of all the expenditure incurred wholly and exclusively in connection with such transfer. On going through the details of combined expenses incurred by the assessee and his wife claimed to have been incurred wholly and exclusively in connection with the transfer of house property, we take a note of the fact that the assessee had claimed air tickets, boarding cost at Bangalore and Mumbai, meals, local travels and miscellaneous cost, courier fees etc. and claimed the same as incurred in connection with such transfer. We are of the considered opinion that so far as clause (i) of section 48 is concerned, the expression used by the legislature in its wisdom is wider than the expression “for the transfer”. The expression “in connection with such transfer” mean intrinsically related to transfer and it is certainly wider than the expression “for the transfer”. Any amount of payment of which is absolutely necessary to effect the transfer will be an expenditure covered by this clause. Further, the words “wholly and exclusively” require and mandate that the expenditure should be genuine and expression “in connection with the transfer” require and mandate that expenditure should be connected and for the purpose of transfer. The expenditure which is not genuine or sham is not to be allowed as deduction. It is an undisputed fact that the assessee sold a house property jointly with his wife at Bangalore. In the present case we find that assessee had claimed air tickets from Mumbai to Bangalore and return along with the boarding cost, meals, miscellaneous cost etc. as cost incurred wholly and exclusively in connection with the transfer of house property which is completely unacceptable. If the sole motive of assessee for coming to India was the sale of immovable property situated at Bangalore, then we could not understand why the assessee will incur boarding cost for one week at Mumbai and claim Rs.64,000 as boarding cost incurred at Mumbai for the sale of house property at Bangalore. Further, we also could not understand how the meals taken by the assessee and local travel like cars and cabs etc. incurred are related to the expenditure incurred wholly and exclusively in connection with the transfer of the property at Bangalore. The claim of the assessee that the sole and specific purpose of the visit to India was to dispose of the house is not clearly established. Further, we are of the consider opinion that the Air Freight, meals, local travel, boarding cost etc. are no way connected to the transfer of immovable property and accordingly the same cannot be allowed as expenses wholly and exclusively incurred for transfer of house property and accordingly this ground of the assessee is dismissed.

7. In the result, the appeal filed by the assessee is partly allowed.

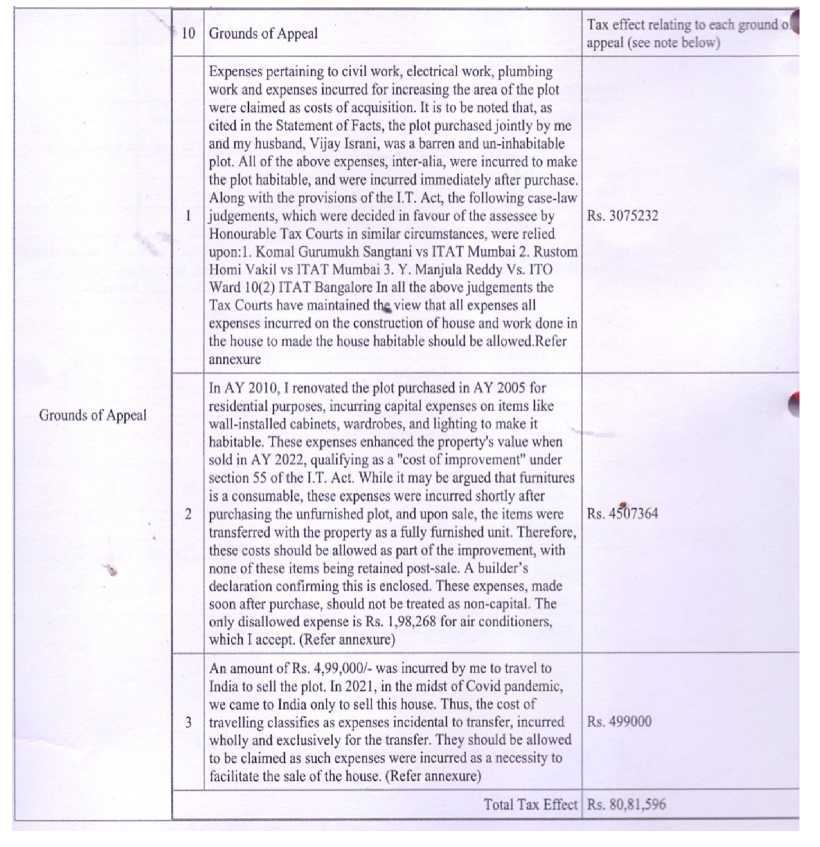

8. Now we take up assessee’s appeal in IT(IT)A No.608/Bang/2025, wherein the assessee has raised the following grounds of appeal:

9. Since identical grounds have been taken by the assessee in this appeal for the Assessment year 2022-23 and the facts including the amounts in dispute being similar, the reasonings given in ITA No. 607/Bang/2025 will apply mutatis mutandis to the present case of the assessee and accordingly, we partly allow the appeal of the assessee for the asst. year 2022-23 also.

10. In the result, the appeal filed by the assessee is partly allowed.

11. In the combined result, both the appeals filed by the assessee are partly allowed.