Cash deposits matching books of account cannot be taxed as unexplained money despite demonetization spike

Issue

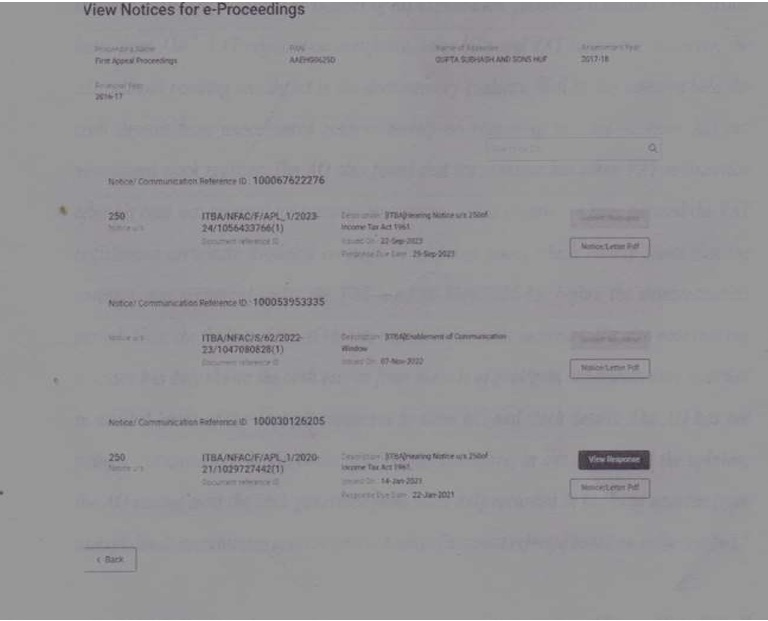

Whether the Assessing Officer was justified in making an addition under Section 69A of the Income-tax Act, 1961, treating cash deposits made during the demonetization period as unexplained money, despite the assessee maintaining books of account reflecting corresponding cash sales.

Facts

Scrutiny Assessment: The assessee’s return for Assessment Year 2017-18 was selected for scrutiny.

AO’s Observation: The Assessing Officer (AO) noted “abnormally high” cash deposits in the assessee’s bank account during the demonetization period compared to the previous financial year.

Addition Made: The AO rejected the assessee’s explanation regarding the nature and source of the cash and made an addition under Section 69A (Unexplained moneys).

Assessee’s Submission:

Sales Model Change: The assessee claimed a shift in business strategy, moving from credit sales to increasing “over-the-counter” cash sales.

Deposit Matching: The assessee made cash sales of ₹75.29 lakhs during the year. Deposits were ₹3 lakhs (pre-demonetization) and ₹75 lakhs (during demonetization), matching the sales figures.

Turnover Decline: The assessee acknowledged a drastic drop in total turnover (from approx. ₹6–8 Crores in previous years to ₹96.51 lakhs in the current year) but maintained that the cash deposited was solely from the reported sales.

Books Maintained: Proper books of account were maintained supporting these transactions.

Decision

Books Justify Deposits: The Tribunal noted that the assessee had maintained proper books of account. The cash deposits in the bank account corresponded with the cash sales recorded in the cash book.

Source Explained: Since the source of the cash (sales) was clearly recorded in the books, the deposits could not be treated as “unexplained” merely because they were made during the demonetization period.

Turnover Drop Irrelevant to Genuineness: While the total turnover had dropped significantly compared to earlier years, the specific cash deposits were fully covered by the reported sales of ₹96.51 lakhs.

Addition Deleted: The Tribunal held that since the cash book and books of account justified the deposits, the addition made by the AO under Section 69A was unsustainable and was ordered to be deleted.

Key Takeaways

Books of Account as Evidence: If cash deposits are backed by entries in regular books of account (e.g., Cash Book/Sales Register), they cannot easily be taxed as unexplained money under Section 69A.

Demonetization Scrutiny: The mere fact that deposits were made during the demonetization period does not automatically render them bogus if the source (sales) is documented.

Business Model Changes: Tax authorities must consider changes in business models (e.g., shifting from credit to cash sales) when analyzing financial trends, rather than relying solely on historical turnover comparisons.

and Rifaur Rahman, Accountant Member

[Assessment year 2017-18]

The Hon’ble ITAT Mumbai in Earthmetal Electricals (P.) Ltd. v Income Tax Officer, Ward 9(1)(3) in ITA No. 239/Mum/2005 reported at [2005] 4 SOT 484 (Mum) held that the assessee cannot be held responsible for the where omission in filing the appeal occurred on part of tax consultant’s state.

“4. Adverting to the facts of the present case it is seen that on account of some communication gap the appeal could not be filed in time because the chartered accountant appears to have misplaced the papers and the assessee did not enquire the fate of its appeal. In our opinion there is no mala fide imputable to the assessee. The delay in our considered opinion in filing the appeal is the result of some omission on the part of its Tax Consultant’s staff. It must be remembered that in every cause of delay there can be some lapse of the litigant concerned. That alone is not enough to turn down the plea and to shut the doors against him. If the explanation does not smack of mala fide or it is not put forth as a part of dilatory strategy, the Courts must show utmost consideration to such litigant. As observed by the Hon’ble Supreme Court in the case of N. Balakrishnan (supra) the length of delay is immaterial. It is the acceptability of the explanation. That is the only criteria before condoning the delay. Therefore, taking into consideration the overall circumstances we condone the delay in filing the appeal and proceed to decide it on merit.”

The Hon’ble Amritsar ITAT in Ram Lal & Sons v. Income Tax Officer in ITA No. 390/Asr/2005 reported at (2006) 99 TTJ (Asr) 63 held that assessee cannot be held responsible for delay occurred due to lapse on part of assessee’s advocate.

“5. Therefore, the submission of the assessee that delay occurred due to lapse on the part of their advocate, appears to be correct. The bona fide of the assessee is further established as the advocate representing the case was changed. Under these circumstances, the observations made by the learned CIT(A) that assessee might have asked the counsel not to file an appeal does not appeal to my mind, Relying on the judgment of Hon’ble Punjab & Haryana High Court in the case of Manoj Ahuja and Anr. v. IAC (supra), the decision of Cochin Bench in the case of C.G. Paul & Co. v ITO MANU/IN/O185/1994 : (1994) 49 TTJ (Coch) 692: (1994) 52 ITD 276 (Coch) where it has been held that a liberal View should be taken in a case where delay occurs due to lapse on the part of advocate chartered accountant and for promoting the cause of justice, I am of the view that the CIT(A) ought to have condoned the delay in filing the appeal. I, therefore, set aside the order of CIT(A) and direct him to treat the appeal on time. This ground of appeal is allowed”

The Hon’ble Delhi High Court in Shiv Singh v N. P. C. C. Ltd reported at MANUDE/01 20/1998 substantial justice cannot be denied where delay is imputed to the counsel and not to the petitioner. The ‘sufficient cause’ depends upon the facts of the case and it is the court which has to be satisfied that there was a sufficient cause.

“37. Apart from the fact that the delay in this case cannot be imputed to the petitioner but to his Counsel, there is other consideration of denial of substantial justice if delay is not condoned in this case. As noticed below the learned Arbitrator has declined to award interest pendente lite covering a period of about 5 years under misconception and ignorance of law declared by the Supreme Court and that part of the award is patently wrong and contrary to law. The award to this extent, unless it is corrected ill result in substantial injustice and loss to the petitioner. In view of the legal position as noticed above to advance substantial justice, technical ground of delay should not be allowed to stand in its way.

| S. No. | Description | Amount |

| 1. | 1 otai Sale ot the Croods | Rs.96,51,421/- |

| 2. | Non-cash Sale | Rs.21,21,618/- |

| 3. | Cash Sale | Rs.75,29,803/- |

| S. No. | Description | Amount |

| 1. | total cash deposit in Bank in h.Y. 2016-17 | Rs.78,00,000 |

| 2. | Total cash deposit in Bank from 01.04.2016 to 08.11.2016 (pre-demonetization) | Rs.3,00,000 |

| 3. | Total cash deposit in Bank from 09.11.2016 to 31.12.2016 (demonetization period) | Rs.75,00,000 |

However, in spite repeated no satisfactory reply with nature and source of cash deposit as well as justification with regard to unusual drastically rise in the cash deposit has been received from the assessee. It is pertinent to mention here that during same period in the financial year 2015-16. the cash deposit was of Rs.22.38.000/- Hence, there is unusual, unexplained and drastically hike in the case deposit during demonetization period is hereby added to taxable income of the assessee u/s. 69A of the Income Tax Act. 1961

The Ld. AO has therefore erred in failing to pass the order on merits and has passed only a nonspeaking order founded entirely on surmise and conjecture, without any real consideration of the Appellant’s substantive evidence and submissions. Now in this respect it is further submitted that:

| • | No enquiry was conducted by the Ld. A.O. under Sec.l42(2) of the Act to substantiate the finding and allegation that the source of cash deposited in the bank by the Appellant was ingenuine: |

8.4 That the Ld. AO has made the entire impugned addition merely on the basis of surmises and conjectures without conducting any specific enquiry whatsoever in this regard to substantiate his findings and alleging that the money deposited into the bank account was out of bogus sale while making the impugned addition u/s 69A r.w.s 115BBE of the Act. Furthermore, it is pertinent to note that the Ld. A.O., in making the addition, has not provided any specific rationale nor has he demonstrated any reasonableness in evaluating the adequacy of the explanation and supporting documents regarding the disputed cash deposit. The deposit was necessitated by the demonetization announcement, which rendered currency notes of rupees five hundred and one thousand to become invalid as legal tender, thus requiring their deposit into a bank account. Simply asserting that the explanation or source of the cash deposit constitutes the undisclosed income of the Appellant and attributing it to demonetization lacks substantive evidence and relies solely on suspicion, conjecture, and unsubstantiated assumptions.

8.5 Reliance in this regard is placed on the decision of the Hon’ble Supreme Court in the case of Lalchand Bhagat Ambica Ram v. CIT, Lalchand Bhagat Ambica Ram v. Commissioner of Income-tax [1959] 37 ITR 288 (SC)), wherein under similar facts and circumstances the Hon’ble Court has held that:

| 15. It is in the light of these observations that we have to determine the question arising before us in the present appeals It is clear on the record that the appellant maintained its books of account according to the mercantile system and there were maintained in its cash books two accounts: one showing the cash balances from day to day and the other known as “Almirah account” wherein were kept large balances which were not required for the dayto-day working of the business. Even though the appellant kept large amounts in bank deposits and securities monies were required at short notice at different branches of the appellant. | In the present case, the Appellant has been maintaining duly audited books of accounts and cash books which were submitted before the Ld. A.O. and Ld. CIT(A) during the course of the assessment and appeal proceedings respectively. |

| 15…. The Appellant had submitted a statement of the cash balance for the relevant year before the income-tax authorities. The entries in the statement showed that there was Rs.3,10,68113-9 and it was highly probable that the high denomination notes of Rs.2,91,000 were included in this sum of Rs.3,10,681. | The Appellant herein had submitted the statement of cash sales/balance (cash books) reflecting the cash sales before the lower authorities. It is this cash, emanating from cash sales that was deposited in the bank account. |

| 15… The books of account of the appellant were not challenged in any other manner except in regard to the interpolations relating to the number of high denomination notes of Rs.1,000 each obviously made by the appellant in the accounts for the assessment year in question in the manner aforesaid and even in regard to these interpolations the explanation given by the appellant in regard to the same was accepted by the Tribunal. | In the case at hand, neither the books of accounts were challenged nor the cash sales made during the year were rejected. Rather the cash deposited (arising from the cash sales and the cash in hand) during the demonetization period – that has been added back. The Appellant was not asked either during the assessment nor even during appellate proceeding for producing books of accounts. |

16. If these were the materials on record which would lead to the inference that the appellant might be expected to have possessed as part of its cash balance at least Rs.1,50,000 in the shape of high denomination notes on January 12, 1946, when the Ordinance was promulgated_was there any material on record which would legitimately lead the Tribunal to come to the conclusion that the nature of the source from which the appellant derived the remaining 141 high denomination notes of Rs.1,000 each remained unexplained to its satisfaction. If the entries in the books of account in regard to the balance in Rokar and the balance in Almirah were held to be genuine, logically enough there was no escape from the conclusion that the appellant had offered reasonable explanation as to the source of the 291 high denomination notes of Rs.1,000 each which it encashed on January 19, 1946. It was not open to the Tribunal to accept the genuineness of these books of account and accept the explanation of the appellant in part as to Rs.1,50,000 and reject the same in regard to the sum of Rs.1,41,000. Consistently enough, the Tribunal ought to have accepted the explanation of the appellant in regard to the whole of the sum of Rs.2,91,000 and held that the appellant had satisfactorily explained the encashment of the 291 high denomination notes of Rs.1,000 each on January 19. 1946. The Tribunal, however, appears to have been influenced by the suspicions, conjectures and surmises which were freely indulged in by the Income-tax Officer and the Appellate Assistant Commissioner and arrived at its own conclusion, as it were, by a rule of thumb holding without any proper materials before it that the appellant might be expected to have possessed as part of its business, cash balance of at least Rs. 1,50,000 in the shape of high denomination notes on January 12, 1946,—a mere conjecture or surmise for which there was no basis in the materials on record before it. | In the present case, the veracity of the documents submitted evidencing the genuineness of the cash sales made during the year under consideration has not been doubted. Hence, the approach adopted by the lower authorities in making the addition of cash deposited by the Appellant (generated out of the cash sales) on one hand and not rejecting the documents submitted vis-a-vis the genuineness of the cash sales (which forms part of books of accounts) on the other hand is unreasonable and self-contradictory. Thus, the same amounts to double addition. |

21. Unless the Tribunal had at the back of its mind the various probabilities which had been referred to by the Income-tax Officer as above it could not have come to the conclusion it did that the balance of Rs.1.41,000 comprising of the remaining 141 high denomination notes of Rs. 1.000 each was not satisfactorily explained by the appellant. 22. If the entries in the books of account were genuine and the balance in Rokar and the balance in Almirah on January 12, 1946, aggregated to Rs.3,10,681-13-9 and if it was not improbable that a fairly good portion of the very large sums received by the appellant from time to time, say in excess of Rs. 10.000 at a time, consisted of high denomination notes, there was no basis for the conclusion that the appellant had satisfactorily explained the possession of Rs.1,50,000 in the high denomination notes of Rs. 1.000 each leaving the possession of the balance of 141 high denomination notes of Rs. 1.000 each unexplained. Either the Tribunal did not apply its mind to the situation or it arrived at the conclusion it did merely by applying the rule of thumb in which event the finding of fact reached by it was such as could not reasonably be entertained or the facts found were such as no person acting judicially and properly instructed as to the relevant law could have found or the Tribunal in arriving at its findings was influenced by irrelevant considerations or indulged in conjectures, surmises or suspicions in which event also its finding could not be sustained. | The lower authorities in the present case have accepted the cash sales, which was duly declared in the books of accounts by the Appellant. However, the cash deposited by the Appellant in his bank account emanating out of such sales has been added back. The said addition is made only on the basis of surmises and conjectures and no enquiry has been conducted by the Ld. A.O. for doubting the veracity/ genuineness of the cash sales made during the year. |

| 23… The mere possibility of the appellant earning considerable amounts in the year under consideration was a pure conjecture on the part of the Income-tax Officer and the fact that the appellant indulged in speculation (in Kalai account) could not legitimately lead to the inference that the profit in a single transaction or in a chain of transactions could exceed the amounts, involved in the high denomination notes,—this also was a pure conjecture or surmise on the part of the Income-tax Officer. | In the present case also, the lower authorities have heavily relied on the fact that the cash sales during the year under consideration had substantially increased; however, no enquiry was conducted to conclude the in-genuineness of the said cash sales. Further, the lower authorities have also ignored the fact the Appellant had been disposing the stock purchased during the year in the same year itself. |

| 27. It is, therefore, clear that the Tribunal in arriving at the conclusion it did in the present case indulged in suspicions, conjectures, and surmises and acted without any evidence or upon a view of the facts which could not reasonably be entertained or the facts found were such that no person acting judicially and properly instructed as to the relevant law could have found, or the finding was, in other words, perverse and this court is entitled to interfere. 28. We are, therefore, of opinion that the High Court was clearly in error in answering the referred question in the affirmative. The proper answer should have been in the negative having regard to all the circumstances of the case which we have adverted to above. | Thus, in light of the similarity with the Judgement of the Hon’ble Supreme Court the present addition deserves to be deleted. |

| (i) | Hon’ble Supreme Court in the case of CIT v. Orissa Corporation (P) Ltd. (1986) AIR 1849 (AIR); |

| (ii) | ITAT, Kolkata Bench in M/s. SPML Infra Ltd. v. DCIT, ITA No.1228/KOL/2018; |

| (iii) | ITAT, Delhi Bench in ACIT v. Sur Buildcom Pvt. Ltd., ITA No.6174/Del/2013; |

| (iv) | ITAT Ahmedabad Bench in Shree Sanand Textile Industries Ltd. v. DCIT (OSD), Circle 8, Ahmedabad – ITA No.995/Ahd/2014 & CO No.167/Ahd/2014; |

| (v) | ITAT, Delhi Bench in ITO Karnal v. JK Wood India Pvt. Ltd., ITA No.1550/Del/2020; |

| (vi) | ITA, Delhi Bench in Harisons Diamond Pvt. Ltd. v. ACIT, Delhi, ITA No.1426/Del/2021; |

| (vii) | ITAT, Bangalore Bench in Anantpur Kalpana v. ITO in ITA No.541/Bang/2021; |

4.3.2 Further, not a single line is submitted by the appellant on why the cash sales were so abnormally high in the year, how they relate to the demonetization period Nature of business and how the cash sales arise is also not explained The appellant just goes on to submit case law after case law without establishing the facts. None of the case laws have similar facts and business circumstances being same as the appellant is not brought out Further, the next year A.Y. 2018-19, sales are 0 and the same trend of nil/loss/minimal sales in seen in all the succeeding years. The AO considering the trend has allowed the amount of cash deposits in previous year as coming from cash sales, even though the turnover is less, thus allowing for any increase in cash sales for the year.

4.3.3 In this respect, what is clear is that there is money with the appellant and the appellant has not given any explanation of how the money came about and whether it is taxable income that has been brought to tax or not The AO has invoked section 69A of the IT Act in bringing the cash deposits to tax.

| • | The Learned CIT(A) erred in dismissing the Appellant’s appeal by concluding that books are incorrect on surmises and conjectures and not proceeding to reject them and making addition on estimate basis would have resulted in reduction of income which being out of purview of AO -the same justified sustaining the addition – citing it to be a procedural aspect. |

| (a) | Severe Business Downturn (F.Y. 2015-16 & 2016-17): In the financial years 2015-16 and 2016-17, the Appellant was confronted with extraordinarily adverse market conditions that exacted a heavy toll on his trading operations, culminating in a pronounced deterioration of the business’s financial health. The closing stock position is as follows: |

| Sr No. | Contents | Figures |

| 1. | Closing Stock as on 31.U3.2U13 | Nil |

| 2. | Closing Stock as on 31.U3.2U14 | Nil |

| 3. | Closing stock as on J1.UJ.2U15 | 2,34,64,224 (Stock in transit) |

| 4. | Closing Stock as on J1.UJ.2U10 | Nil |

| 5. | Closing Stock as on 31.03.2017 | Nil |

| (b) | Distress-Sale Strategy (F.Y. 2016-17): This predicament necessitated a desperate strategy of distress sales during F.Y. 2016- 2017. Faced with mounting liabilities which was unusual to the Appellant’s established practice of realising and clearing each year’s stock within that same year, it became imperative to implement a distress-sale programme in F.Y. 2016-17. To generate immediate liquidity (to address the escalating burden of certain opening creditors). The Appellant disposed of inventory rapidly via both cheque and over-the-counter cash receipts. |

| (c) | Shift in Commercial Focus & Its Impact on Gross Margins : With this urgent objective in mind, the Appellant, driven by pressing business needs, shifted focus from maximising gross profit to prioritising stock liquidation and debt repayment, which in turn led to an increase in gross profit ratio. Thus, although cash sales were not part of the Appellant’s usual business practice, the dire circumstances compelled him to resort to over-the-counter cash transactions during the festival season starting October 2016. It is respectfully submitted that the Ld. A.O. and the Ld.CIT(A) has therefore erred in confirming the addition of ?52,62,000, flagrantly disregarding the core facts of the Appellant’s case – namely, that the cash generated from the impugned sales was applied directly to discharge trade creditors, as evidenced by the substantial reduction in outstanding payables during the year under review as visible vide the table below. Consequently, this urgent strategy led to a significant reduction in debt liability by Rs.1,02,73,252 during F.Y 2016-2017. This was achieved as creditors were promptly repaid immediately following the sale of stock. See: |

| Sr No. | Particulars | Opening value as on 01.04.2016 | Addition/ Purchase during the year | Closing value as on 31.03.2017 | Ditterence |

| 1. | Uni excel Polychem | 86,12,054 | 15,63,054 | 70,49,000 | |

| 2. | Um cl ear Logistics | 32,18,252 | 32,18,252 | ||

| 3. | Him Logistics Pvt Ltd | 6000 | 6000 | ||

| 4. | Shaoxing County Honest Imp. & Exp. Co. Ltd | 10,41,117.98 | 10,41,117.98 | ||

| Grand Total | 1,02,73,252 |

| (d) | The ledger accounts and bank statements documenting the aforementioned creditor repayments, were submitted during the Assessment proceedings and have also been made part of the PB I at Pages 38-55. Regarding the cash deposits, since the Appellant had engaged in over-the-counter cash sales, the accumulated cash had to be deposited into the banks following the Government of India’s demonetization directive issued on 08.11.2016. This was necessary to facilitate the required payments to creditors. It is respectfully submitted that, even without the imposition of demonetisation, the cash receipts would necessarily have been remitted to the banking system in order to discharge the Appellant’s trade creditors, cash payments being prohibited by virtue of Section 40A(3) of the Act. |

4.3.7 In this respect, it is also to be noted that, the appellant at no point of time in the appeal provided the books or the supporting evidences only relying on the AO’s verification of the same. AO will not maintain an entire copy of complete books and supporting documents to provide the same to the appellate authority and it was the duty of the appellant to do the same on request of the appellate authority. Evidently, the appellant has not produced the same. Further, emphasizing the AO’s verification, but countering AO findings that the cash sales are not supporting the deposits, are two contradictory positions adopted by the appellant.

In Abishek Prakashchand Chhajed v. I TO, ITA No.ll 3/ADH/2023, decision dated 04.10.2023, the Hon’ble Tribunal opined as follows:

“We have heard the rival contentions of both the parties and perused the materials available on records. Admittedly, the assessee deposited cash during the demonetization period for Rs.50 lakhs in two different bank accounts. The sources of such deposit were explained by the assessee as sales proceeds of jewelry business in which he indulges during the month of October 2016. The assessee, in support of his explanation, furnished a business permission letter from AMC, VAT registration certificate, sales bills and VAT return etc. However, the AO, without pointing any defect in the documentary evidence filed by the assessee held the cash deposit from unaccounted sources merely on reasoning that the assessee has not maintained stock register. The AO also found that the assessee has taken VAT registration after his case was selected for scrutiny assessment. In this regard, we have perused the VAT registration certificate available on page 91 of paper books which clearly states that the assessee was registered under the VAT w.e.f 06-May-2016 i.e. before the demonetization period. Thus, the finding of the AO in this regard is factually incorrect. We also note that the assessee has duly shown the cash receipt from the sale of gold/gold ornaments duly recorded in audited books of the account supported by sales bill and stock details. The AO has not pointed out any defect in the books of accounts. Therefore, in our considered the opinion, the AO cannot treat the cash generated from sales duly recorded in books of account from unexplained/unaccounted sources unless books of account rejected based on valid reasons. ”

“4. Aggrieved against the said order, the assessee filed an appeal before the Commissioner of Income-tax (Appeals), Karnal. The appeal filed by the assessee was partly allowed by the CIT(A), Karnal vide his order dated 12-8-2004 and the addition of Rs. 20,83,752 made by the Assessing Officer was deleted. While allowing the said deletion the CIT (Appeals), Karnal, observed as under :—

“The matter has been considered. It is seen that the addition has been made by the Assessing Officer without pointing out any specific defect in the books of account. The Assessing Officer has rejected the books of account only on the ground that the appellant has not been able to keep records of raw material consumed in respect of each and every item produced by the appellant. The Assessing Officer has rejected without any justification the explanation of the appellant that consumption of raw material for each of the products cannot be reconciled in the case of the appellant because the product pattern was large and items of different designs and sizes etc. were produced by the appellant. There was no legal obligation on the part of the appellant to maintain such a record. Audited accounts could not have been rejected without pointing out any specific defect or deficiencies in the books of account maintained by the appellant. Moreover, the appellant’s income was 100per cent exempt and there could not have been any tax liability and higher income being declared. Thus, no purpose of the revenue has been served by making such additions. Keeping in view all these facts, addition of Rs. 20,83,752 is directed to be deleted.”

8. We find no force in the arguments raised by the learned counsel for the revenue. While allowing the appeal of the assessee, the CIT(A) has given a finding offact that the additions have been made by the Assessing Officer without pointing out any specific defect in the books of account. The said finding has been further upheld by the Tribunal During the course of arguments, learned counsel was unable to point out any illegality or perversity in the said finding of fact. Thus, we find no infirmity in the order of the Tribunal. No substantial question of law is arising for determination of this Court in this appeal and the same is hereby dismissed. ”