ORDER

1. This batch of appeal of the revenue was preferred against the order of the Learned Commissioner of Income-tax (Appeals)-50, Mumbai [hereinafter called, ‘the Ld.CIT(A)’] passed u/s 250 of the Income-tax Act, 1961 (in short, ‘the Act’) on dated 15/07/2025 for Assessment Years 2001-02 to 2006-07. The impugned orders were emanated from the order of the Learned Deputy Commissioner of Income-tax, Central Circle 3(3)(1), Mumbai for A.Ys 2001-02 & DCIT, Central Circle 8(2), Mumbai (in short, ‘Ld.AO’) for A.Ys.2002-03 to 2006-07. All the assessment orders were framed under section 143(3) r.w.s. 147 of the Act, date of order 30/12/2019 for A.Y. 2001-02 and for rest of the assessment years, the date of orders is 29/09/2021.

2. All the appeals have same nature of facts and common issue, so ITA No.6229/Mum/2025 for A.Y. 2002-03 is taken as lead case.

3. The revenue has raised the following grounds:-

ITA No.6229/Mum/2025

“1. Whether on the facts and in circumstances of the case and in law, the Ld. CIT(A) was justified in deleting the substantive as well as protective additions made an account of deposits and interest income received by the assessee in the foreign bank account with HSBC Bank, Geneva, by disregarding the fact that the assessee had opened and failed to disclose the said foreign bank account in his Return of Income?

2. Whether on the facts and in circumstances of the case and in law, the learned CIT(A) was justified in not treating the BUP IDs as account numbers, thereby disregarding the information received in the Base Note from the Government of France under the Indo-France DTAA?”

3. Whether on the facts and in circumstances of the case and in law, the Ld.CIT(A) was justified in deleting the substantive as well as protective addition made on account of deposits and interest income in the foreign bank account maintained by the assessee with HSBC Bank, Geneva, by disregarding the fact that the assessee had refused to provide consent in favour of the department for obtaining necessary record from HSBC Bank, Geneva which would have been established the additions in the hand of the assessee?

4. The appellant craves leave to add, alter, amend or withdraw any of the above grounds at the time of hearing.”

4. The brief facts of the case are that the assessee filed the return of income declaring a total income of Rs.7,11,89,070/-, which was processed under section 143(1) of the Act. Subsequently, reasons were recorded and notice under section 148 was issued. The assessment was thereafter completed under section 147 read with section 143(3) of the Act. The Ld. AO, relying upon the report of the Addl. DGIT (Investigation), concluded that certain bank accounts existed in the name of “Canbar Holdings Corporation” with HSBC Bank, Geneva, having a peak balance of US$ 55,44,646.99 in November 2005. The account was stated to have been opened in 2001 and closed in 2006. It was further reported that one Mr. M.K. Shetty was the attorney holder of this account, and that the account was held for the benefit of Late Shri Dhirubhai H. Ambani. Upon his demise on 06/07/2002, his legal heirs, Shri Anil D. Ambani and Shri Mukesh D. Ambani became entitled to the beneficial interest.

The legal heirs of Late Shri Dhirubhai H. Ambani filed a return of income on 09/08/2011 for A.Y. 2006-07 declaring a total income of Rs.24,73,46,660/-, including the aforesaid peak balance of US$ 55,44,646 offered as income from other sources, and paid tax of Rs.14,03,59,731/-. On receipt of this information, the Ld. AO reopened the assessment for A.Y. 2006-07 and issued notice under section 148 on 23/11/2011. The legal heirs requested that the voluntarily filed return dated 09/08/2011 be treated as the return filed in response to the notice. The reassessment was completed under section 143(3) read with section 147 on 13/01/2012, accepting the income declared therein.

Subsequently, for A.Ys. 2001-02 to 2006-07, assessments were again reopened under section 147 by notice dated 29/03/2019. The reopening was based on information received from the French Government under the Indo-France DTAA pertaining to a bank account in the name of “Canbar Holdings Corporation” with HSBC Bank, Geneva (Client ID 5091327690), having the same peak balance of US$ 55,44,646. It was stated that the account was opened by Mr. M.K. Shetty under instructions of Late Shri Dhirubhai H. Ambani, and after his death, the names of his sons, Shri Anil D. Ambani and Shri Mukesh D. Ambani were included as beneficiaries.

It was further alleged that another account existed in HSBC Bank with BUP ID 5090260976, opened in the year 2000, which had not been disclosed by the legal heirs. The Ld. AO completed assessments under section 143(3) read with section 147, holding that in the absence of clarity regarding the exact share of beneficial ownership among the deceased assessee and his two sons, the additions were to be allocated equally among the three. Accordingly, 1/3rd of the amounts were added substantively in the hands of each person and the remaining 2/3rd on a protective basis. Similarly, the assessee’s assessments for A.Ys. 2001-02 to 200607 were reopened on the basis of a “Base Note” available with the Ld. AO, purportedly containing details of deposits in bank accounts with HSBC Bank, Geneva. In the recorded reasons, the Ld. AO referred to three alleged accounts bearing Client Profile No. 5091327690, BUP ID No. 5090260976, and BUP ID No. 5090160983. The Ld. AO alleged that initial deposits of US$ 1,00,000 (for opening each account), deposits of US$ 55,44,646, and annual maintenance charges of US$ 300 per account were unexplained, and issued show-cause notices accordingly. The assessee explained that the so-called BUP IDs were merely internal customer identifiers and not bank accounts. The assessee also submitted that the income relating to the relevant client profile had already been voluntarily offered to tax by Late Shri Dhirubhai H. Ambani in A.Y. 2006-07. However, the Ld. AO rejected the explanation and proceeded to treat the assessee, his brother Shri Mukesh D. Ambani, and his late father as joint beneficial owners, thereby adding 1/3rd of the alleged amounts substantively and the remaining 2/3rd protectively. The assessee challenged the additions before the Ld. CIT(A). After considering the submissions and the factual position, the Ld. CIT(A) deleted the additions. Aggrieved by the relief granted, the revenue has preferred the present appeal before us.

5. The Ld.DR argued and stated that the assessee’s ‘Base Note’ is not verified by the Ld.AO. In the appeal order, the Ld.CIT(A) had not discussed properly the factual position. Even the assessee had not provided the consent certificate found by the Ld.AO. So accordingly, he prayed to uphold the addition. The Ld.DR invited our attention to assessment order page 7, para 9.8, which is extracted below:-

“9.8 during the assessment proceedings, a notice dated 16.10.2019 was issued and served to the assessee requesting him to fill up a Consent Waiver Form. Consent Waiver Form is a form whereby the assessee gives consent to the HSBC Bank, Geneva that his account details should be forwarded to himself. Due to secrecy laws of Swiss Banks, such mode was adopted where an assessee who does not have a copy of his bank account in HSBC Bank, Geneva would give a Consent Waiver Form to the Income Tax Department which would then be forwarded to HSBC Bank, Geneva. Upon confirmation of identify and signature of the individual, HSBC Bank, Geneva sends the copy of Bank Statement and CD to those individuals in whose favour the Consent Waiver Form is filed.”

6. The Ld. AR submitted that the Ld. AO had received information from the Government of India, transmitted through the French Government under the DTAA, in exercise of sovereign exchange-of-information powers. This information pertained to certain Indian nationals and residents holding undisclosed foreign bank accounts with HSBC, Geneva, Switzerland, which had not been reported to the Indian tax authorities. The Ld. AR pointed out that this issue has been squarely dealt with by the Ld. AO in the impugned assessment order. In this context, the Ld. AO has recorded, at paragraph 3 on page 2 of impugned assessment order, the following:—

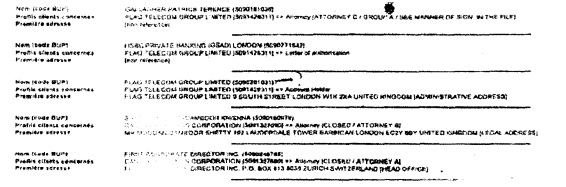

“3. On perusal of copy of the Base Note of Shri. Anil D. Ambani having BUP ID 5090160983 it has also been observed that the narration of people related to customer profile includes following: -1) Flag Telecom Grp Ltd (BUP ID 5090281031) and;

2) First Corporate Director Inc. (BUP ID 5090248786) of which relevant customer profile is Canbar Holdings Corporations (BUP ID 5091327690)

Both these entities are located outside India. It follows that the assessee has links with and/or interests in these two foreign entities as well. As per the provisions of proviso 2 to Sec 147 of Income Tax Act, 1961, these are covered as asset including financial interest in any entity located outside India. The assessee has neither disclosed these assets located outside India nor Income there from in the return of income filed for AY 2001-02.”

7. The Ld.AR further stated that both the BUP IDs are related to one person and the issue was already brought to the notice of the department and the tax on the same was paid by late Shri Dhirubhai H. Ambani in A.Y. 2006-07. The same fact is brought to the notice of the Ld. AO who has dealt the issue in the paragraph 9.6 of impugned assessment order is extracted below:-

“9.6 The assessee has mentioned that he, jointly with his brother Shri Mukesh D. Ambani had filed a return of income on 09-08-2011 as legal heirs of his father i.e., Late Shri Dhirubhai Hirachand Ambani for the financial year 2005-06. As per the return of income it is seen that Shri Mukesh D. Ambani and Shri Anil D. Ambani in the capacity of legal heirs of Late Shri Dhirubhai H. Ambani have declared an income of Rs.24,73,46,660/- and has paid taxes of Rs.14,09,59,731/-. The taxpayer has also submitted that there is an account in the HSBC Bank, Geneva having links with his late father. The said account was in the name of Canbar Holdings Corporation bearing Account No 5091327690. The taxpayer has declared the income in relation to the above mentioned bank account in HSBC Bank, Geneva in the hands of his Late father i.e., Shri Dhirubhai H. Ambani for the financial year 2005-06. Though the taxpayer had offered the income in respect of the aforesaid foreign bank account for taxation in the hands of Late Shri Dhirubhai H. Ambani but he had not cooperated with the Income-tax Authority for providing complete date-wise details of transactions in the above mentioned bank account. Further, no income has been offered with respect to the other account in the name of Canbar Holdings Corporation having BUP ID 5090260976 and in respect of account in the name of the taxpayer having BUP ID 5090160983.”

8. The Ld.AR further argued and invited our attention in paragraph 18 & 18.1 of impugned assessment order, which is as under:-

“18. S. No. Name 1. Shri Mukesh D. Ambani 2. Shri Anil D. Ambani Hence, the share of each of the persons Late Shri Dhirubhai Ambani, Shri Mukesh D. Ambani and Shri Anil D. Ambani in the account under consideration is taken at one third. As per available information in public domain, a deposit of USD 1,00,000 is to be made to open such an account and cost of about USD 300 per year would be incurred. In the assessment order u/s 143(3) r.w.s. 147 of the Income-tax Act, 1961 for AY 2001-02 dated 30.12.2019, the amount required to open the account of USD 1,00,000 was added in the name of Canbar Holdings Corporation with BUP ID 5090260976. In light of these facts and as per the information available on record, one third (1/3) of the amount required to open the account of USD 1,00,000 and deposit of USD 55,44,646 as on March, 2002 equivalent to Rs. 48,80,000/- and Rs. 27,05,78,725/- respectively (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-03-2002 as per Rule 115 of Income Tax Rules) in the account in the name of Canbar Holdings Corporation with BUP ID 5091327690 is assessed in the hands of the assessee. Hence, the amount of USD 33,333 and USD 18,48,215 and as on March, 2002 equivalent to Rs. 16,26,667/ and Rs. 9,01,92,908/- (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-03-2002 as per Rule 115 of Income Tax Rules) is assessed as unexplained money u/s 69A of the Income Tax Act, 1961 and added to the total income of the assessee. Further, one third (1/3) of the amount required to maintain the accounts of USD 300 each as on March, 2002 equivalent to Rs. 14,640/- (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-03-2002 as per Rule 115 of Income Tax Rules) in the account in the name of Canbar Holdings Corporation with BUP ID 5090260976 and 5091327690 is assessed in the hands of the assessee. Hence, the amount of USD 100 each as on March, 2002 equivalent to Rs. 4,880/- (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-03-2002 as per Rule 115 of Income Tax Rules) is assessed as unexplained money u/s.69A of the Income Tax Act, 1961 and added to the total income of the assessee.

18.1. Further, since the undisclosed foreign bank account in the name of Canbar Holdings Corporation with BUP ID 5091327690 was opened in June, 2001 with the deposit of USD 55,44,646, the assessee has earned interest income on the said deposit which is not disclosed by the assessee. As per the historical interest rate data available on the website of Swiss National Bank, it is seen that the official interest rate for the year 2002 was 2.75%. Therefore, the undisclosed interest income earned by the assessee is calculated as under:-

| Amount (in USD) | Interest rate (in % per annum) | Total interest For 12 months (in USD) | No. of Months for Which amount deposited | Total interest earned during the year (in USD) | Share of assessee (one third) |

| 55,44,646 | 2.75 | 1,52,478 | 9 | 1,14,358 | 38,119 |

Hence, the interest amount of USD 38,119 as on March, 2002 equivalent to Rs. 18,60,207/-(calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31 03-2002 as per Rule 115 of Income Tax Rules) is assessed as unexplained money u/s 69A of the Income TaxAct, 1961 and added to the total income of the assessee. 18.2. The amount required to open the account of USD 1,00,000 as on March, 2002 equivalent to Rs. 48,80,000/- (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-03-2002 as per Rule 115 of Income Tax Rules) in the account in the name of assessee himself with BUP ID 5090160983 is assessed as unexplained money u/s 69A of the Income Tax Act, 1961 and added to the total income of the assessee. Further, the amount required to maintain the account of USD 300 as on March, 2002 equivalent to Rs. 14,640/- (calculated at the exchange rate of INR of 48.8 to 1 USD prevailing as on 31-032002 as per Rule 115 of Income Tax Rules) in the account in the name of assessee himself with BUP ID 5090160983 is assessed as unexplained money u/s 69A of the Income Tax Act, 1961 and added to the total income of the assessee.

Penalty proceeding is initiated separately u/s. 271(1)(c) of the Income Tax Act, 1961 for concealment of particulars of income.”

9. The Ld. DR further argued and relied on the order of co-ordinate bench of ITAT, Mumbai in the case of Renu T Tharani v. DCIT [2020] (Mum Trib.). The relevant para 13 is reproduced as below:-

“13. To adjudicate on this question, facts of the case, in detail, need to be taken note of. The assessee before us is an individual. The assessee had filed her income tax return, on 29th July 2006, disclosing an income of Rs. 1,70,800 for the relevant previous year, but subsequently the investigation wing of the income tax department, as noted in the earlier part of this order, received information that the assessee is having a bank account with HSBC Private Bank (Suisse) SA Geneva. Based on this information, a copy of which is placed before us at pages 3 to 12 of the assessee’s paper-book, this case was reopened for fresh assessment on 30th October 2014, When the assessee was confronted with the information so received by the Assessing Officer, the ussessee’s representative, vide letter dated 9th January 2015 (wrongly stated to be letter dated 9th January 2014 in the paper-book; copy placed at pages 37 onwards in the assessee’s paper-book). wrote to the Assessing Officer that “enclosed please find herewith a letter dated 14th November 2015 and 5th September 2011, which confirms that Mrs. RenuTharani has neither been an account holder of HSBC nor a beneficial owner of any assets deposited in account with HSBC Private Bank (Suisse) SA, Switzerland, during the last 10 years”. It was further stated that HSBC Private Bank (Suisse) SA has also “confirmed that GWU Investments Ltd was holder of the account number 1414771, and, according to their records, GWU Investments Limited used to be an underlying company of Tharani Family Trust for which Mrs. Renu Tharani was a discretionary beneficiary and that “(t)he Tharani Family Trust was terminated and none of the assets deposited with them were distributed to Mrs. RenuTharani”. It was further stated that “with this letter, as an evidence, it is now very clear that Mrs. RenuTharani does not hold any account with HSBC Private Bank (Suisse) SA, either in Geneva or any other place in Switzerland, hence the base note issued by you is inaccurate as she does not have any account with HSBC Bank Geneva bearing number BUP SIFIC PER ID 5090178411 or any other number”. Copies of HSBC Private Bank (Suisse) SA’s letters dated 5th January 2015 from to one Mr Mahesh Tharani in China, and dated 5th September 2011, copies of which were also placed on record at pages 39 and 40 of assessee’s paper-book, were also furnished to the Assessing Officer. In a subsequent communication dated 16th February 2015- a copy of which is placed before us at paper-book pages 41 onwards, the Assessing Officer was further, inter alia, informed as follows:

In the letter dated 5th January (2015) received from HSBC Private Bank (Suisse) SA in Zurich also confirms the fact that account number 1414771 which is started in your base note belongs to GWU Investments Ltd, having its address at Avalon Management Limited, Landmark Square,1st floor, Earth Close 64, West Bet Beach South, Grand Cayman, (PO Box No 715, KYI-1107), and is does not belong to Mrs. Renu Tikamdas Tharani. The bank further clarifies that as per their records GWU Investments Lid used to be an underlying company of Tharani Family Trusts for Mrs. RenuTharani was a discretionary beneficiary.

The HSBC Bank in Geneva may have asked GWL Investments Lid the proof of identity as well as proof of address of all the beneficiaries. The company may have provided my passport as proof of her identity and proof of address. As the address mentioned in the passport is that of Mumbai, hence the base note showed the account of GWU Investments Lid along with my Mumbai address,

As the address does not maintain any bank account with HSBC Private Bank (Suisse) SA in Switzerland, the question of explaining any source of deposit does not arise. Without prejudice to above, the 11SBC Private Bank (Suisse) SA also confirms the fact, in their letter dated 5th January 2015, that according to their best of knowledge. Tharani Family Trust (GWL Investments Limited) has been terminated and none of the assets deposited with HSC Bank Private Bank (Suisse) SA were distributed to Mrs. Renu Tharani.”

10. The Ld.AR further argued and stated the Ld.AO had made same additions with the father and two brothers. The same fact was duly brought before the coordinate bench of the ITAT-Mumbai in case of father, DCIT v. Dhirubhai Ambani ITA Nos 4324, 4331 & 4345 to 4348/Mum/2024, date of order 09/01/2025 for A.Ys. 21001-02 TO 2006-07 and in case of DCIT v. Mukesh D Ambani [ITA Nos 5141, 5140, 512, 5121, 5118 & 5117(Mum) of 2024, dated 31/01/2025 for AYs 2001-02 to 2006-07.. On both the issues, the coordinate bench ITAT-Mumbai has taken view in favour of assessee and deleted the addition. In case of Dhirubhai H Ambani (supra), the Ld.AR invited our attention to paras 11.2 to 11.4, where the coordidate bench has distinguished the order in the case of Renu T. Tharani (supra), and the same was distinguished, which is as under:-

“11.2 We have also perused the decision of ITAT in the case of DCIT v. Rasiklal Mehta (2022) (ITA No. 438 to 442/Mum/2022) wherein addition was only made u/s 69A in respect of client profile code without making any adjustment of name BUP ID as also discussed in the order of Ld. CIT(A). In the case of DCIT v. Kumar Rasiklal Mehta (2022) ITA No. 438 to 442/Mum/2022 as referred by the Id. CIT(A) in that case addition was only made for client profile irrespective of the similar other particulars like the case of the assessee available in the base note. In that case ITAT also held that addition of initial deposit was made on surmises which stand merged in the balances shown carried forward. It is clear from the facts and material discussed that (BUP ID) 5090260976 was merely a business partner identification. number for the entity and there existed no separate account.

11.3 We find the decision of ITAT, Mumbai in the case of Renu T Tharani DCIT (International Taxation) (Mumbai) relied upon by the Id. DR are distinguishable from the case of the assessee. In that case the assessee was clearly beneficial owner of deposit in foreign bank account showing Rs. 196 crores peak amount based on Base Note. In that case the assessee has not explained the contents ofthe Base Note and claimed that assessee was a non-resident and was chargeable to tax only on income which accrues or arises in India. Whereas in the case of the assessee it was explained after referring the relevant material that customer profile 5091327690 for account holder Canbar Holding Corporation mentioned in the Base Note showing maximum peak balance of USD 55,46,646 has already been taxed in the A.Y. 2006-07 vide order dated 13.01.2012 u/s 143(3) r.w.s. 147 of the Act and the BUP ID 5090260976 was the name id of Canbar Holding Corporation linked to a/c no. 5091327690 and not another bank account as discussed supra in the order.

11.4 Looking to the above facts and finding we don’t find any infirmity in the decision of Ld. CIT(A), therefore, ground of appeal 1 to 3 of the revenue are dismissed. In the result, the appeal of the Revenue is dismissed.”

11. The Ld.AR also invited our attention to the order of coordinate bench of ITAT-Mumbai in the case of Mukesh D Ambani (supra). The relevant paragraphs 5 to 10 are extracted below:-

“5. Ld. Counsel clarified the specific queries by the Bench on certain aspects. The first specific query raised by the Bench was in respect of whether any specific submissions/clarification was furnished before the Id. Assessing Officer in the course of assessment proceedings on the claim made as to only one BUP ID exist which starts with “5090” and the another ID is only a customer profile which starts with “5091” and thus there is only one bank account and two as alleged by ld. Assessing Officer. To this specific query Id. Counsel referred to a detailed written submission, dated 01.03.2021, which was submitted in the course of assessment proceeding in response to notice u/s. 142(1), dated 24.02.2021 placed in the paper book at page 27 to 30. In para-3 of this written submission, detailed explanations in respect of BUP ID and customer profile number was explained and the same is extracted below:

“3. Further as regards various BUFIDs mentioned in your notice viz. 5090160984 (Sh. Mukesh D. Ambani), 5091327690 (Canhar Holdings Corporation) and 5090260976 (Canbar Holdings Corporation) and various information sought with reference to these BUP IDs, at the outset we submit that:

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

3.1. The Base Note shows the two IDs at one single place as under:

3.2. Even though, the copy provided is not in English language, the same has been attempted to be understood and the English version would read as

Name (BUP code): Canbar Holdings Corporation (50902 60976)

Customer Profiles concerned: Canbar Holdings Corporation (50913 27690) Account Holder (CLOSED)

3.3. Hence, it can be understood that there are not multiple/ different BUP IDs as you mentioned in your notice. Evidently, ID no. 50902 60976 is a BUP ID Whereas, nowhere can it be seen that the ID No. 50913 27690 was also a BUP ID. That has been referred as Customer Profile ID, In fact, in all the items listed in Base note, account number are not mentioned as BUP ID

3.4. As per international practice of banking, the Assessee understands that BUP ID is a Business Partner Identification assigned to the entity itself Whereas, bank account number is different from the said BUP ID and is linked with the same.

3.5. Accordingly, the Assessee submits that from the Base Document, only one bank account appears with one BUP ID and bank account number.

3.6. This is further confirmed from details mentioned in the same Buse Note, under the heading “AutresPersonnesLiees Aux Profils Clients, which in English would mean Other people linked to customer profiles for other entities. The screenshot of the same is as under:

3.7. In all the above cases, there is one BUP ID mentioned against the name field, which starts with 5090. There is another ID mentioned against the Customer Profile, which starts with 5091. This is irrespective of schether the name of the customer is same with the profile name. Hence, it is evident that the BUP ID is like a customer relationship number and the profile no is like a bank account number.

5.1. On another query by the Bench in respect of how ld. Assessing Officer arrived at a figure of USD 1,00,000 (approx.) as initial deposit made to open the bank account and cost of about USD 300 per year to be incurred towards maintenance of the said account. In this respect Id. CIT DR referred to the reasons recorded for the process of re-opening of the case and pointed that the same is contained as under:

“As per available information a deposit of USD 100000 (approx) is to be made to open such an account and cost of about USD 300 per year would be incurred, which information and the source thereof have not been disclosed by the assessee in the said return of income.”

5.2. Further, Id. Counsel also referred to para-18 and pointed out that Id. Assessing Officer merely stated that this figure is based on information available in public domain for which Id. Counsel thus asserted that Id. Assessing Officer proceeded merely on the basis of surmises that assessee had deposited USD 1,00,000 to open an account and cost of USD 300 incurred per year to make the addition. There is no ascertainment of fact as to whether the said amount was actually deposited in the bank account as claimed by the Id. Assessing Officer for the purpose of making addition and actual incurrence of maintenance cost of USD 300 for the same.

6. In addition to the alleged bank account dealt by the Co-ordinate Bench in the order relating to late Shri Dhirubhai H. Ambani (supra) in the present case of the assessee, Id. Assessing Officer also alleged about assessee being beneficiary of another account with BUP ID 5090160984″ for which addition was made towards initial deposit inAssessment Year 2002-03 of USD 1,00,000 having Rs. 48,80,000/-and maintenance of USD 300, ie., Rs.14,640/- and for Assessment Year 2003-04 to 2006-07, USD 300 with equivalent Rupees in each of these years towards maintenance charges on substantive basis u/s.69A of the Act. In this respect also, Id. Counsel pointed from the base note in the order of the Co-ordinate Bench, copy of which is already extracted above, by referring to the right-hand top corner which contains the customer ID of the assessee which the Id. Assessing Officer claimed itto be the bank account number. Ld. Assessing Officer thus, held that there were total three accounts related to the assessee, one BUP ID 5090260976, second BUP ID 5091327690 and the third BUP ID 5090160984 and made the additions with respect to these three alleged accounts in HSBC Bank. For the alleged bank accounts at Sr. No.1 and 2, the matter has been already extensively dealt by the Co-ordinate Bench (supra). Facts specific to the assessee in respect to these two alleged BUP IDs have already been discussed in above paragraphs.

7. In respect of the BUP ID at Sr. No.3, similar assertions are made by the assessee explained and corroborated from the base note and relevant material placed on record. Relevant portion from the submissions made by the assessee in this respect is extracted below:

18. As regards the BUP ID 5090160984, it/only appears at one place in the Base Note, which is extracted as under-

The above field appears to contain personal details such as date of birth, place of residence, sex, marital status, etc. It is logical to contain a business partner identification number along with such details. Besides, the BUP ID 5090160984 is quoted under the heading “identifiers internes which translates in to “internal identifiers. A business partner identification no. which is akin to (customer relation no. in India).

18.2 The factual details regarding the BUP ID has already been discussed in while deciding the additions made on account of BUP ID 50901 60976 in the A.Y 2001-02. It is observed that for every person the BUP ID is only stated in the “Name” field. Nowhere in the Client Profile Concerned field, is there any reference of BUP ID. Most importantly, nowhere in the Base Note, the account likedetails such as maximum balance, status, type, etc. is shown for any of the BUP ID. Had the BUP ID been an account there is no reason for similar details, os given for the Client Profile No.s, would not have been in the Base Note. In fact, this is the I reason that while the AG has made additions towards the peak balance and interest for the Chent Profile No. 5091327690 in the subsequent assessment years, he dal not make any such addition for the BUP ID 5090160984.

18.3 Further whale deciding the appeal for A.Y 2001-02, it is already discussed that the HSBC bank, Geneva, vide letter dated 30th June 2011, confirmed that the appellant did not hold any account by himself or beneficially. Therefore, no addition could be made u/s. 69A alleging that the Appellant held any account in the said bank

7.1. On the above, assessee also submitted that for the BUP IDs of Flag and FCDI, letter from HSBC Bank dated 30.06.2011 very specifically explains that assessee was a member of the Board of Directors of Flag Telecom Limited and was an Authorised Signatory for the account held by Flag. HSBC Bank confirmed in this letter that assessee did not hold any account in HSBC Bank, Switzerland by himself or as a beneficial owner.

7.2. Thus, on the above facts and submissions which are parimateria to the other two IDs, we do not find any reason to interfere with the findings arrived at by Id. CIT(A) in respect of third BUP ID ie. 5090160984.

8. Considering the facts discussed above and issue already dealt elaborately by the Co-ordinate Bench on identical fact pattern in the case of late Shri Dhirubhai H. Ambani in ITA Nos. 4324, 4331 and 4345 to 4348/Mum/2024, respectfully following the same, we do not find any reason to interfere with the findings of the Id. CIT(A). Accordingly. grounds raised by the Revenue are dismissed.

8.1. In the result, appeal by the Revenue is dismissed.

9. Since we have dismissed the appeal filed by the Revenue vide ITA No.5141/Mum/2024 AY: 2001-02 as discussed supra in this order, therefore, on similar issue on identical facts, applying the finding of the same mutatis mutandis, all the other captioned five appeals of Revenue are also dismissed.”

12. Considering the detailed factual matrix, the submissions of both parties, and, most importantly, the binding decisions of the co-ordinate benches of the ITAT, Mumbai in the cases of Dhirubhai H. Ambani (supra) and Mukesh D. Ambani (supra), we find that the issues raised in the present appeal stand squarely covered. The co-ordinate benches have categorically held that:

| • | | the BUP IDs reflected in the Base Note do not represent separate bank accounts, |

| • | | the peak balance in the customer profile No. 5091327690 pertaining to Canbar Holdings Corporation had already been assessed and taxed in the hands of Late Shri Dhirubhai H. Ambani for A.Y. 2006-07, |

| • | | the alleged BUP IDs were merely internal identifiers/customer relationship numbers, and |

| • | | no independent material existed to support the additions made under section 69A. |

The facts of the present appeal being identical, we respectfully follow the judicial discipline and consistency adopted in the cases of the assessee’s father and brother. The additions made by the Ld. AO on substantive and protective basis merely on the strength of BUP IDs, internal identifiers, and presumptive opening deposits are unsustainable. The Ld. CIT(A) has rightly appreciated the factual position, the nature of the Base Note, and the binding jurisdictional precedents while deleting the additions. The Ld. DR relied on the order of the Renu T. Tharani (supra) which is distinguished & the same view was taken by the coordinate bench in case of Dhirubhai H Ambani (supra).

Accordingly, all grounds raised by the revenue fail and stand dismissed.

In the result, appeal of the revenue ITA No. 6229/Mum/2025 is dismissed.

13. ITAs No. 6228, 6230 to 6233/Mum/2025

The facts and circumstances in all these appeals are identical to appeal in ITA No.6229/Mum/2025, which we have decided above. Therefore, the decision arrived at therein shall apply mutatis mutandis to these appeals also.

14. In the result, all the appeals filed by the revenue ITA No 6228 to 6233/Mum/2025 are dismissed.