ORDER

Dr. Manish Borad, Accountant Member.- The captioned cross appeals at the instance of assessee and Revenue pertaining to Assessment Year 2018-19 are directed against the order dated 04/10/2023 passed by the Learned Commissioner of Income Tax (Appeals)-13, Pune (for short, “CIT(A)”) u/s. 250 of the Income Tax Act, 1961 (for short, “Act”) which is arising out of order u/s.143(3) r.w.s.144C(13) of the Act, dated 30.06.2022 passed by Ld. Assistant Commissioner of Income Tax, Circle-1(1), Pune, dated 30.06.2022.

2. We observe in the case of instant assessee for A.Y. 201819 after filing of income tax return, an intimation has been issued u/s. 143(1)(a) of the Act by the CPC making certain adjustments which were challenged before the Ld. CIT(A) and assessee has been granted relief. Against such relief granted by Ld. CIT(A), Revenue is in appeal vide ITA No. 1256/pUN/2023. Further, post selection of the assessee’s case for complete scrutiny, a final assessment order u/s. 143(3) r.w.s. 144C(13) of the Act has been framed on 30/06/2022 making various additions and adjustments against which assessee has preferred appeal before this Tribunal vide ITA No. 632/pUN/2022.

3. First we will take up assessee’s appeal in ITA No. 632/pUN/2022.

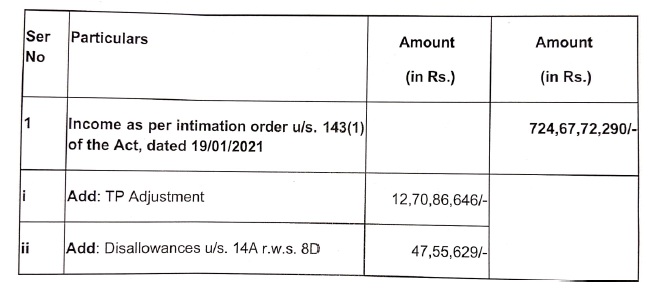

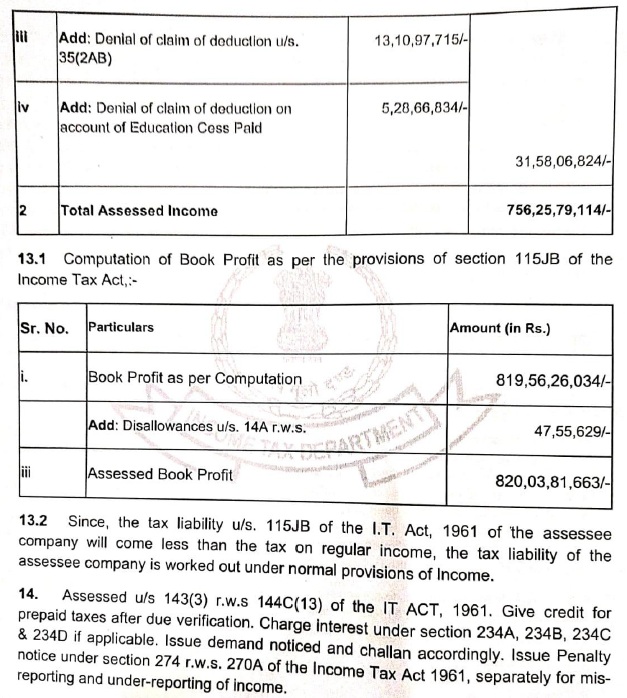

4. Brief facts of the case as culled out from the records are that assessee is a limited company and declared income of Rs. 420,19,55,310/- in the return of income for A.Y. 2018-19 e-filed on 01/12/2018 which was subsequently revised on 23/03/2019 and again revised on 23/08/2019 showing total income of Rs. 527,10,75,950/-. The return has been processed by CPC u/s. 143(1)(a) of the Act determining income at Rs. 724,67,72,290/-, after making two adjustments, firstly, denied deduction claimed u/s. 80JJA at Rs. 60,72,090/- and also denied claim of deduction u/s. 10AA at Rs. 196,96,24,249/-, both on account of delay in filing return of income. Subsequently, case selected for scrutiny through CASS under complete scrutiny category and valid statutory notices u/s. 143(2) of the Act were served. The assessee company is engaged in manufacturing and sale of Internal Combustion Engines and is a 51% subsidiary of Cummins Inc. USA. There were certain international transactions and arms’s length price (ALP) of such transactions was required to be determined. With the necessary approval of PCIT, reference was made to the Ld. Transfer Pricing Officer (TPO). On due consideration of submissions filed by the assessee, Ld.TPO vide order dated 29/07/2021 passed an order u/s. 92CA(3) of the Act proposing TP adjustment of Rs. 12,70,86,646/-. Ld.AO along with TP adjustments also, proposed various other additions amounting to Rs. 68,14,79,984/- and passed a draft assessment order u/s. 143(3) r.w.s. 144C(1) r.w.s. 144B of the Act vide order dated 03/09/2021.

5. Against the draft assessment order passed by the Faceless Assessing Officer, assessee filed objections before Ld. Dispute Resolution Panel (DRP), who after considering the submissions of the assessee, passed the order u/s. 144C(5) of the Act on 18/05/2022 giving various directions. Ld.AO thereafter, passed a final assessment order on 30/06/2022 making various adjustments and instead of considering the income declared by the assessee in the final revised return, adopted the income as per intimation order u/s. 143(1)(a) of the Act dated 19/01/2021. The total income assessed by the Ld.AO is as follows:-

6. Aggrieved by the assessment order, assessee now is in appeal ITA No.632/PUN/2022 before this Tribunal raising the following grounds of appeal:-

“Based on the facts and circumstances of the case, Cummins India Limited (hereinafter referred to as “the Company” or “the Appellant” or “Cummins India”) respectfully craves leave to prefer an appeal for the assessment year (“AY”) 2018-19 under section 253 of the income-tax Act, 1961 (“the Act”) against the order dated 30 June 2022, passed under section 143(3) read with section 144C(13) read with section 1448 of the Act, by the learned additional/ Joint/ Deputy/Assistant Commissioner of Income tax, National Faceless Assessment Centre, Delhi (hereinafter referred to as “Assessing Officer /”AO”) in pursuance of the directions issued by the Hon’ble Dispute Resolution Panel – 3, Mumbai [“hereinafter referred to as “DRP”] on the following grounds, which are independent of and without prejudice to each other :

General ground:

1 Ground for not following the due procedures laid down in the Income Tax regulations in force:

1.1 The learned Assessing Officer erred in law and on the facts and circumstances of the case in not following the due procedures laid down in the Income Tax regulations in force, particularly Section 144B of the Act while completing the assessment by not issuing any show cause notice, including a personal hearing through video conferencing despite specific request of the Appellant, while proposing a variation prejudicial to the Appellant. In view of the same, the assessment needs to be declared null and void.

Grounds on Transfer Pricing issue

2. General ground: Transfer pricing addition of INR 12,70,86,646/

2.1 The Ld. AO pursuant to the directions of the Hon’ble DRP erred in law and on the facts and in circumstances of the case in making an upward adjustment of INR 12,70,86,646/- vis-a-vis the international transaction of payment of royalty by the Appellant.

2.2 The Ld. AD pursuant to the directions of the Hon’ble DRP erred in law and on the facts and in circumstances of the case in rejecting the benchmarking of the international transaction of payment of royalty by the Appellant and in making an upward adjustment of INR 12,70,86,646/

3. Rejection of “Aggregation approach” for benchmarking the international transaction of payment of royalty for use of technology with the manufacturing activity:

3.1 The Ld. AO pursuant to the directions of the Hon’ble DRP has erred in law and on the facts and in circumstances of the case in upholding the application of Comparable Uncontrolled Price (“CUP”) method as the most appropriate method to determine the arm’s length nature of payment of royalty for use of technology disregarding the application of Transactional Net Margin Method (“INMM”) as documented by the Appellant, in the Transfer Pricing documentation, wherein the payment of royalty was aggregated with the manufacturing activity for determining the arm’s length price.

3.2 The Ld. AD pursuant to the directions of the Hon’ble DRP erred in law and on the facts and in circumstances of the case in not following the principle of consistency and rejecting the aggregation approach (which has been accepted in the earlier years by the learned AO/Transfer Pricing Officer and Hon’ble DRP) for benchmarking the impugned transaction of payment of royalty for use of technology

4. Erroneous dissection of payment of royalty for benchmarking:

4.1 Without prejudice to the other grounds raised by the Appellant, the Ld. AO pursuant to the directions of the Hon’ble DRP erred in law and on the facts and in circumstances of the case, by questioning the commercial wisdom of the Appellant and dissecting the international transaction of payment of royalty for use of technology, into royalty paid on sales made to domestic customers and royalty paid on sales made to export customers, while benchmarking the impugned transaction.

5. Not establishing the criteria under Section 92C(3) of the Act to disturb the arm’s length price determined by the Assessee

5.1 On the facts and in circumstances of the case and in law, the Ld. AO pursuant to the directions of Hon’ble DRP, has erred by not establishing any of the four criteria mentioned under section 92C(3) of the Act and has proceeded to benchmark the said royalty transaction on his own and has made adjustments to the arm’s length price determined by the Assessee

Grounds on Corporate Tax issues:

6. Erroneously considering the total income of the Appellant in excess in terms of the ‘Intimation’ issued u/s 143(1) of the Act

6.1 The Ld. AO/Hon’ble DRP has erred in considering the total income of the Appellant under the normal provisions of the Act in excess in terms of the “Intimation’ issued u/s. 143(1) of the Act, ignoring the submission of the Appellant against such variation in the said intimation.

6.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject the disallowance made in terms of the intimation issued u/s. 143(1) is misconceived, erroneous, illegal and unwarranted.

6.3. The Appellant submits that the Ld. AO be directed to consider the correct total income of the Appellant and to re-compute the tax thereon accordingly.

7. Non granting of exemption u/ s. 10AA of the Act of INR 196,96,24,249/

7.1 The Ld. AO/Hon’ble DRP has erred in not granting exemption u/s 10AA (i.e. INR 196,96,24,249/) of the Act.

7.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject, it is inter alia eligible for claiming exemption u/s. 10AA of the Act and the stand taken by the Ld. AO/Hon’ble DRP in this regard is illegal, incorrect, erroneous and misconceived.

7.3 The Appellant submits that the Ld. AD be directed to grant exemption u/s. 10AA of the Act and to re-compute its total income and tax liability accordingly.

8. Non granting of weighted deduction u/ s. 35(AB) of the Act on expenditure of INR 13,10,97,715 incurred by the Appellant

8.1 The Ld. AO/Hon’ble DRP has erred in not granting weighted deduction of 200% u/s. 35(248) (ie. Rs. 26,21,95,429/-) of the Act in respect of expenditure of Rs. 13,10,97,715/- incurred by the Appellant.

8.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject, it is inter-alia eligible for a weighted deduction of Rs. 26,21,95,429/-u/s. 35(2AB) of the Act on the expenditure of Rs. 13,10,97,715/-incurred by it, and the stand taken by the Ld. AO/Hon’ble DRP in this regard is illegal, incorrect, erroneous and misconceived.

8.3 The Appellant submits that the Ld. AO be directed to grant weighted deduction on the amount of expenditure incurred by the Appellant u/s 35/2AB) of the Act and to re-compute its total income and tax liability accordingly.

9. Disallowance u/ s. 14A of the Act

9.1 The Ld. AO/Hon’ble DRP has erred in disallowing a further sum of INR 47,55,629/- u/s 14A of the Act r.w.r. BD of the Incometax Rules, 1962.

9.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject no further disallowance u/s. 14A of the Act is called for in addition to the amount of INR 48,48,551/- suo-moto disallowed by the Appellant and the stand taken by the Ld. AO/Hon’ble DRP in this regard is misconceived and incorrect.

9.3 The Appellant submits that the id. AO be directed to delete the additional disallowance so made by him and to re-compute its total income accordingly.

10. Non-granting of deduction u/s. 80JJAA of the Act while computing the total income:

10.1 The Ld. AO/Hon’ble DRP while computing the total income of the Appellant for the year under consideration has erred in not allowing a deduction u/s. 80JJAA of the Act.

10.2 The Appellant submits that considering the facts and circumstances of its case, and the law prevailing on the subject, the Appellant is eligible to claim deduction u/s. 80JJAA of the Act and the same ought to have been allowed while computing the income for the year under consideration.

10.3 The Appellant submits that the Ld. AO be directed to recompute its total income and tax thereon after allowing deduction u/s 80JJAA of the Act.

11. Disallowance u/s. 14A of the Act while computing book profits’ u/s. 115JB of the Act:

11.1 The id. AD/Hon’ble DRP have erred in increasing the “book profits” for the purposes of section 11518 of the Act by an amount of Rs. 47,55,629/-being disallowance u/s. 14A of the Act for the year under consideration.

11.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject no adjustment whatsoever can be made to its “book profits” while computing its income u/s. 115JB of the Act and the stand taken by the Ld. AO/Hon’ble DRP in this regard is incorrect, erroneous, misconceived and not in accordance with law.

11.3 The Appellant submits that the Ld. AO be directed to delete the addition of Rs. 47,55,629/-made to the “book profits” and to recompute its book profit accordingly.

12. Initiation of Penalty Proceedings

12.1 The learned AO pursuant to the directions of the Hon’ble DRP erred on the facts and in law in initiating penalty proceedings under section 270A of the Act.

The Appellant prays leave to add, alter, vary, omit, amend, substitute or delete grounds of appeal at any time before or at the time of appeal, so as to enable the Hon’ble Income Tax Appellate Tribunal to decide this appeal in accordance with the law.

7. At the outset, learned counsel for the assessee requested for not pressing ground No.1 and, therefore, the same is dismissed as not pressed.

8. So far as ground Nos. 2 to 5 raised by the assessee are concerned, the same relates to international transaction of payment of royalty for use of technology used for manufacturing of goods. Ld. DRP has affirmed the TP adjustments proposed by the Ld.AO based on the TPO’s report. Finding of the Ld. DRP on the said addition on account of international transaction of payment of royalty reads as under:-

“11.4.1 It is seen that similar adjustment had been proposed by the TPO in respect of the international transaction pertaining to payment of royalty for use of technology in the case of the assessee for earlier years and that the assessee had taken identical grounds of objection before DRP for A.Y. 2017-18 against such adjustment proposed by the TPO for the said year. After considering the facts of the case and objections of the assessee, the DRP had upheld similar adjustment proposed by the TPO for A.Y. 2017-18, observing as under:

“3.4.1 The assessee, as per the Transfer Pricing Study Report (TPSR), operates both in India and overseas markets. While the domestic sales are made to third party customers as per the customer’s requirement, bulk of the export sales are to the related parties.

3.4.2 The assessee had, during the year under consideration, inter alia, entered into various international transactions, such as (i) import of parts and components of Internal Combustion Engines; (ii) reversal of import of parts and components of IC engines; (iii) export of manufactured IC engines and components; (iv) import of cooling systems and stamping machines; (v) payment of royalty for use of technology; (vi) rendering of internal audit services; (vii) receipt of design engineering and testing services; (viii) insite pro registration charges; (ix) user licence fees; (x) receipt of warranty service; and (xi) receipt of training service, with its AE. For the purpose of benchmarking, the assessee had aggregated all these transactions as related to its manufacturing activity and used TNMM as the most appropriate method. The assessee worked out its margin from the manufacturing activity at 14.79% and contended that the margins obtained in the case of 10 independent comparable companies ranged from 6.87% to 10.90%. Accordingly, it was claimed by the assessee that these international transactions were at arm’s length.

3.4.3 The TPO, however, found that the royalty was claimed to have been paid in recognition of the direct and ongoing benefit derived by the assessee company from the continuing research, development and engineering of Diesel Engines conducted by the AE (Cummins Inc., USA) at its research and engineering facilities. Further, the royalty had been paid at the rates of 1% to 5% on products sold in the domestic market and at the rates of 8% on products exported. The TPO also held the view that benchmarking carried out by the assessee aggregating the transactions and at entity level is not acceptable, as only those transactions, the pricing of which have a bearing on each other, can be aggregated and that as per the royalty agreement, the royalty rate does not have any bearing on the pricing of other transactions and is solely dependent on the type of product being manufactured, irrespective of the fact whether the sale is domestic or export. He also observed that actual bifurcation of royalty paid products sold in the domestic market and exported is available. As per the same, the assessee was found to have paid royalty at the rate of 1.43% on domestic sale and at the rate of 7.96% on export sales. During the course of the transfer pricing proceedings, in response to a show cause notice issued by the TPO, the assessee had conducted a search for independent five royalty agreements and as per the search results, the arm’s length average margin of royalty payments worked out to 4.10%. However, the TPO was of the view that one more comparable, excluded by the assessee, should also be included in the comparables list and after including it, he found that the arm’s length royalty rate worked out to 2.75%. Accordingly, the TPO issued a show cause notice requiring the assessee to explain the transaction of royalty payment on export sales should not be segregated and the arm’s length royalty rate should not be considered at 2.75%. The assessee filed detailed submissions before the TPO, in response to the said show cause notice.

3.4.4 The TPO rejected various contentions raised by the assessee before him. The assessee had contended that the transaction relating to payment of royalty was closely linked to its manufacturing activity, and, hence, the transaction should be aggregated with other transactions relating to the manufacturing activity. However, the TPO observed that the royalty payment constitutes only 2.90% of the total turnover of the assessee company, with which the transaction had been aggregated by the assessee benchmarking a related party transaction or closely linked related party transactions, it is relevant that the value of such transaction(s) should form a substantial part of the transactions being analyzed together as a group. Otherwise, profit from other unrelated transactions would subsume the profit/loss from the related party transaction(s). Further, examination of the profit at a very broad level would mask the arm’s length price of the related party transaction and would not lead to correct determination of its ALP. Transactions are said to be closely related when the decision of price of one product/service depends on the price of another product/service. The royalty transaction does not in any manner impact or influence the pricing of the sale price or other transactions in the manufacturing segment. Accordingly, the benchmarking carried out by the assessee by aggregating the royalty payment transaction with other transactions relating to manufacturing activity cannot be accepted. In this regard, the TPO placed reliance on the decisions of Hon’ble ITAT in the cases of UCB India (P) Ltd. V. ACIT (2009) 30 SOT 95 (Mumbai), Twinkle Diamond (2010-TII-09-ITAT-Mum-TP), Tez Diamond (2009-TII-02-ITAT-Mum-TP), Starlite Pvt. Ltd. (2010-TII-28-ITAT-Mum-TP) and the decision of Hon’ble Punjab & Haryana High Court in the case of Knorr-Bremse India (P) Ltd. v. ACIT (2016) 380 ITR 307 as also the Hon’ble Delhi High Court decision in the case of Denso India Ltd. v. ACIT (ITA No.443/2013 and ITA No.451/2013). The assessee had also contended before the TPO that the Hon’ble ITAT, Pune, in its own case had upheld the principle of aggregation and considered the transaction of royalty to be at arm’s length. However, the TPO observed that the Hon’ble ITAT had not considered the issue regarding aggregation of royalty payment transaction with other transactions. Regarding the contention that TNMM is the most appropriate method for benchmarking the transaction, the TPO observed that either CUP method or ‘Other Method’ can be considered to be the most appropriate method.

3.4.5 The TPO observed that same technology is being received and applied on various products that are sold in domestic as well as export markets, and, therefore, the rate of royalty should also be same and that in line with uncontrolled transactions. The TPO held the view that such high variation in royalty rates for same/similar technology received is unreasonable. The assessee had also contended before the TPO that for calculating the effective rate of royalty, the net sales at entity level should be considered. However, the TPO held that when actual bifurcation of royalty on domestic and export market is available, the effective rate should be calculated at overall domestic and export segment level, which was, accordingly, calculated by him at the rate of 0.97% and 6.00% on domestic sales and export sales, respectively. While doing so, the TPO considered the net export sales at 628.61 Cr., as against Rs.474.12 Cr. proposed by him in the show cause notice, accepting the objection raised by the assessee in this regard. Further, he considered the arm’s length royalty rate at 4.10%, as per the results of the search conducted by the assessee during the TP proceedings. Accordingly, the TPO worked out the excess royalty payment on export sales at Rs.11,95,85,010/- and proposed an adjustment of the same amount.

3.4.6 We have considered the submissions of the assessee. We agree with the TPO that the benchmarking analysis carried out by the assessee by following aggregation approach does not lead to proper determination of ALP of the transaction of payment of royalty. The assessee had considered both the domestic sales and export sales for the purpose of determining the ALP of the transaction. As stated above, it has been stated in the TPSR that the entire domestic sales are made to third parties and bulk of the export sales are made to the AEs. Therefore, if the entire sales are considered, as observed by the TPO, the low profit earned from export sales (bulk of which are to AEs) on account of higher rate of royalty paid, if any, would get adjusted by the profit from domestic sales made to third parties. It is also important to note here that the assessee’s export sales constitute only 35.6% and domestic sales constitute 64.4% of its total sales for the year under consideration. Therefore, the benchmarking analysis carried out by the assessee on aggregate basis cannot be accepted.

3.4.7 The assessee has contended that payment of royalty for use technology is a single transaction and the TPO is not justified in further splitting up the transaction into payment of royalty on domestic sales and export sales. We find that as per the Royalty Agreement entered into between the assessee and its AE itself, the rate of royalty payable for various products in the domestic market is 1%, 2%, 2.5% and 5%. However, the royalty payable on all the existing range of products and new models to be introduced as well as components is 8%. As stated above, the assessee’s export sales constitute only 35.6% and domestic sales constitute 64.4% of its total sales for the year under consideration. Out of the total payment of royalty of Rs.51,26,51,778/-, royalty payment of Rs.37,73,15,679/- relates to export sales. Thus, 73.6% of the total royalty is paid on 35.6% of the total sales, while only 26.4% of the royalty paid is attributable to 64.4% sales. This fact has not been disputed by the assessee. The assessee has not explained this vast difference in the rates of royalty payable for the similar products sold in the domestic market and export market, when the same technology received from the AE is used by the assessee for manufacture of the products sold in the domestic market and export market. By charging/ paying royalty at much higher rate on export sales and lower rates on domestic sales, the AE and the assessee have ensured higher amount of royalty can be paid, but, at the same time, the total royalty payment can be claimed to be arm’s length, by considering both the domestic sales and export sales, thereby adjusting the low profit/loss earned (on account of royalty payment) from the export sales (the bulk of which are made to the AEs). In other words, the assessee and its AE have arranged the transaction of payment of royalty for use of technology in such way that though the royalty is paid at higher rate as compared to the arm’s length rate of royalty, it can still claim the payment to be at arm’s length. Though the assessee has entered into a single agreement for payment of royalty with its AE, in our view, it actually involves two transactions of (i) payment of royalty on domestic sales and (ii) payment of royalty on export sales, as two different prices have been charged on domestic sales and export sales. A single transaction cannot have two different pricing. Therefore, though there is only a single agreement entered into between the assessee and AE for payment of royalty, as per the provisions of Section 92F(v) of the Act, it can be said that there are actually two transactions undertaken by the assessee (i) payment of royalty on domestic sales; and (ii) payment of royalty on export sales. Further, the bifurcation of royalty paid on domestic sales and export sales is available and all the relevant data for benchmarking the transaction of payment of royalty on export sales is also available. Accordingly, the TPO was justified in splitting the transaction of payment of royalty for use of technology reported by the assessee. We also agree with the TPO that CUP method is the most appropriate method for benchmarking the transaction.

3.4.8 We find that the TPO had followed similar approach for benchmarking the international transaction pertaining to payment of royalty for use of technology in the case of the assessee for A.Y. 2016-17 also and the DRP had also upheld the same, observing as under:

“2.4.1 The assessee had, for the purpose of benchmarking, grouped its international transactions and specified domestic transactions under five categories, viz. Manufacturing Activity, Trading Activity, Market Support Service Activity, Engineering Service Activity and Procurement Support Service Activity and these five activities were benchmarked using Transactional Net Margin Method (“TNMM”) as the most appropriate method (MAM) by using third party comparable companies. However, the TPO partially rejected the “Aggregation Approach” adopted by the assessee to benchmark its international transaction pertaining to payment of royalty for use of technology.

2.4.2 The fact that the assessee has received technology has not been disputed by the TPO. However, the TPO has disputed the value of the rate of royalty payment that is made on exports. This transaction of payment of royalty on exports is Rs.37.18Cr. which is only 2.32% of the total turnover of the company of Rs. 1599.86 Cr. with which it has been aggregated and then benchmarked. For a related party transaction or the related party closely linked transactions to be benchmarked correctly, their value should form a substantial part of the transactions being analyzed together as a group. In absence of the same, profitability from other unrelated transactions subsumes the profit/loss from the related party transactions being analyzed and examination of the profit at a very broad level masks the arm’s length price of the related party transaction and does not lead to correct determination of its ALP. The TPO is of the view that in order to determine the most precise approximation of arm’s length conditions, the arm’s length principle should be applied on a transaction-by-transaction basis, unless the transactions are closely related. In the case of the assessee, the royalty transactions do not in any manner impact or influence the pricing of the sale price or other transactions in the manufacturing segment. Therefore, aggregation of royalty transactions with other transactions in such situation would be incorrect.

2.4.3 Section 92C(1) refers to arm’s length price in relation to an international transaction. Rule 10B(1) (e) read with section 92C deals with TNMM and it refers to only net profit margin realized by enterprise from an international transaction or a class of such transaction. The Hon’ble ITAT in case of UCB India (P) Ltd. V ACIT (2009) 30SOT 95 (Mumbai), after referring to the OECD Guidelines and the provisions of law, while examining applicability of TNMM at entity level or at transaction by transaction basis has held that under TNMM an international transaction or a class of such transactions should be evaluated on standalone basis. The relevant part of the judgment is extracted below:

“In our understanding, the international transaction or an aggregate of similar international transactions, have to be evaluated, on a standalone basis and then compared with similar analysis undertaken on independent transactions. Comparison of the operating profits of the assessee company as a whole, with the overall operating profits of certain other companies, without any adjustments, in our considered opinion, would not satisfy the requirements of evaluating an international transaction under TNMM, for the purpose of arriving at the arm’s length price. In this case, the assessee has taken all the activities of the company as one unit and on an analysis of its profit & loss account, arrived at an overall operating profit margin of 27 per cent. This is compared with the chart of overall operating profit margins of identified comparable companies, which is summarized in Table 5 of the report. No adjustments or segregations have been made between turnovers involving licensed manufacturing, patented drugs, trading and other revenues No exercise has been done to iron out the variations by making suitable adjustments. In other words, what the assessee has tried to do is to compare the overall operating profit of one entity, with the overall operating margins of the assessee and as the operating margin of the assessee is higher, it asserts that all its international transactions done with its AE are at arm’s length price.

This cannot be accepted. Thus, as already stated we agree with the revenue that provisions of section 92C(3) are attracted in the instant case on this ground. As we have decided this issue in favour of the revenue on this ground, we do not feel it necessary to go into other arguments of the revenue. Once the method adopted by the assessee is rejected, the revenue is duty bound to compute the ALP by adopting a most appropriate method and it has also to substantiate and justify the use of such a method.”

2.4.4 Some other decisions that support a transaction-by-transaction approach for benchmarking are M/s Twinkle Diamond (2010-TII-09-ITAT-Mum-TP), Tez Diamond (2009-TII-02-ITAT-Mum-TP) and the case of Starlite Pvt Ltd. (2010-TII-28-ITAT-Mum-TP). The transaction of ‘Payment of fees for IGS is also considered separately for the purpose of transfer pricing analysis. A separate benchmarking of the services is also supported by the recent Punjab & Haryana High Court’s decision rendered in the case of Knorr-Bremse India (P) Ltd. v. ACIT [2016] 380ITR 307(P&H) and Delhi High Court’s decision in the case of Denso India Ltd. v. ACIT (ITA No. 443/2013 and ITA No. 451/2013). The Delhi Tribunal in case of ITW India Ltd [TS-128-ITAT-2015(HYD)-TP] held against the taxpayer by not agreeing to adoption of combined TNMM on an entity level in respect of six separate sets of distinct international transactions. Purchase of raw materials, purchase of plant & machinery, commission expenses, sale of finished goods, commission income and reimbursement of expenses. The Delhi Tribunal held that the arm’s length price of more than one transaction can be determined as one unit, only if they are closely linked transactions. In such a case, the plural of international transactions shall be considered as a singular for the purposes of benchmarking as a single transaction. It held that therefore the above sets of six transactions by no standard can be considered as ‘closely linked’.

2.4.5 The most appropriate method (MAM) for benchmarking of the royalty transaction, either the Comparable Uncontrolled Price/Other Method can be considered to be the most appropriate method. It is noted that assessee is making royalty payment based on various rates ranging between 1% to 5% in the domestic market and 4% to 8% on the export sales. An important observation is that with respect to the domestic sales, an overwhelming majority of the sales are with respect to product on which rate of royalty is 1%; vis-a-vis this, in case of exports, the maximum amount of sales are on royalty rate of 8%. As the same technology is being received and applied on various products that are sold in domestic as well as export market, the rate of royalty should also be similar and that in line with uncontrolled transactions. Such high variation in royalty rates for same/similar technology that is received remained to be explained and substantiated. The revised royalty range works out to 2.50% to 3%, being the 35th percentile and 65th percentile, respectively. As the margin of royalty on exports falls outside the range as prescribed in the Indian TP Regulations, the median royalty rate of 2.75% is considered as arm’s length rate.

2.4.6 In view of the above, the transaction of royalty payment on export sales is to be segregated and benchmarked on a transaction-by-transaction basis, as done by the TPO. Therefore, the TPO was justified in making an adjustment of Rs. 12,35,00,000/- to the value of international transactions pertaining to payment of royalty on export sales.

2.4.7 It has been the assessee’s contention that in assessee’s own case for earlier years, the Hon’ble ITAT has considered and allowed the aggregation of various transactions. In this regard, as observed the DRP during the proceedings for A.Y. 2015-16, on perusal of the said ITAT order, it is observed that the ITAT has not opined on aggregation of AE and Non AE segment for the manufacturing activity in those particular years. Aggregation of royalty with other transactions was not an issue being discussed in the ITAT order. Therefore, referring to the Pune ITAT order in the present facts would be incorrect.

2.4.8 Here, it is also pointed out that at present, only the assessee has a right to appeal against the final assessment order framed by the AO after incorporating the directions of the DRP and the Department does not have any such right of appeal. It is also seen that in the case of the assessee for A.Y. 2015-16, the DRP had decided this issue against the assessee, and the appeal filed by the assessee for A.Y.2015-16 is pending before the ITAT. Therefore, notwithstanding the observation made in para 2.4.7 above, if we decide this issue against the Department and in favour of the assessee, the Department will not be in a position to take its stand on the issue before higher appellate forums, and if the issue is eventually decided by the Hon’ble Supreme Court in favour of the Department, there will be no recourse available for collecting the revenue attributable to the said issue in the case of the assessee. Accordingly, with due respect to the decision of the Hon’ble ITAT, we are of the humble view that no interference to the order of Ld. TPO is called for on this issue.

2.4.8 In view of the above discussion, we hold that the TPO was justified in disregarding the “Aggregation Approach” adopted by the assessee for benchmarking the international transaction pertaining to payment of Royalty for use of technology. We also find that the TPO has correctly rejected the assessee’s benchmarking, and correctly selected the comparable agreement and finally making an adjustment of Rs. 12,35,00,000/-.”

3.4.9 In view of the discussion in the foregoing paragraphs and also Following the decision of DRP in earlier year, we uphold the adjustment of Rs. 11,95,85,010/- proposed by the TPO in respect of the transaction of payment of royalty for use of technology on export sales.

3.4.10 Grounds of Objection No. 2, 3, & 4 are, accordingly, rejected. “

9. Learned counsel for the assessee, at the outset, submitted that similar issue has come up before the Hon’ble Jurisdictional High Court in assessee’s own case for A.Ys. 2015-16 to 017-18 and the Hon’ble Court vide order dated 28/07/2023 has decided the issue in favour of the assessee.

10. On the other hand, ld. Departmental Representative (DR), though supported the order of ld. DRP, but failed to controvert the contentions of the learned counsel for the assessee.

11. We have heard rival contentions and perused the records placed before us. Ld.AO in the final assessment order has made upward adjustments of Rs. 12,70,86,646/-on account of international transaction involving payment of royalty by the assessee to its Associated Enterprises (AEs) for use of technology for manufacturing of goods. We find that similar type of adjustments have been made in the hands of the assessee in the past for A.Ys. 2015-16 to 2017-18 and the matter has travelled upto Jurisdictional High Court vide Cummins India Ltd. v. Asstt. CIT (Bombay)/Income Tax Appeal No. 126 of 2023, dated 28/07/2023. Hon’ble Court on due adjudication of the said issue, has answered the questions in favour of the assessee. For the sake of convenience, three questions of law dealt with by the Hon’ble Court and brief facts, observed by the Hon’ble Court reads as under:-

“1 These appeals are filed by Assessee under Section 260A of the Income Tax Act 1961 (the Act) against the order dated 28th September 2022 passed by the Income Tax Appellate Tribunal (ITAT) for A.Y.2015-2016, 2016-2017 and 2017-2018. The issue is in respect of transfer pricing adjustments. The appeals were admitted on 11th April 2023 and in the three appeals, the following three questions of law were framed:-

“(1) Whether the Appellate Tribunal has erred in law in passing the order dated 28th September 2022 directly contrary to the view taken by the Appellate Tribunal in Appellant’s own case for earlier assessment years on identical facts and law without referring the issue to a Special (Full) Bench in the event that it wished to differ from the view taken by a co-ordinate Bench of the Tribunal ?

(ii) Whether the order dated 28th September 2022 passed by the Appellate Tribunal is bad in law as the same is passed ignoring the fact that on the very same transaction the department has accepted the methodology applied by the Appellate for benchmarking the transactions for transfer pricing purposes in seven (7) earlier years in view of inter alia binding order of the Tribunal?

(iii) Whether in the facts and in the circumstances of the case and in law the Tribunal erred in passing the impugned order dated 28th September 2022 purporting to rely on decision of Delhi High Court in the case of Magneti Marelli Power Train India P. Ltd. v. Deputy Commissioner of Income-tax which ex-facie did not support and was in fact contrary to the view set out in the impugned order?”

2 Assessee is engaged in the business of manufacture and sale of Internal Combustion Engines, Spares, Components (including Bought-Outs) thereof & Generating Sets, service of Engines & Gensets / Generating Sets & Allied Equipment, etc. Assessee also has a 100% Export Oriented Unit at Pirangut which is engaged in manufacture and exports of internal combustion engines and its accessories and generating sets and accessories. The returns filed by Assessee was selected for scrutiny assessment by issuing statutory notices under section 143(2) and section 142(1) of the Act. During the years under consideration, Assessee had entered into various international transactions with its Associated Enterprise(s) in the course of its business. Assessee had paid royalty amounting to Rs.54,30,69,318/-for A.Y.2015-2016, Rs.46,99,15,361/- for A.Y.2016-2017 and Rs.51,26,51,778/-for A.Y. 2017-2018 to its Associated Enterprise, i.e., Cummins Inc. for providing technical know how and technical knowledge for manufacturing of engines to be sold to the customers.

For A.Y.-2015-16 Assessee filed its return of income on 30th November 2015 declaring total income of Rs.3,83,80,77,530/-For A.Y. 2016-2017 Assessee filed its return of income on 30th November 2016 declaring total income of Rs.4,10,59,82,510/-, and for A.Y. 2017-2018 Assessee filed its return of income on 30th November 2017 declaring total income of Rs.4,98,57,18,870/-. The returns filed by Assessee were processed and accepted under the provisions of Section 143(1) of the Act.”

12. We further find that Hon’ble Jurisdictional High Court has decided the above referred questions of law holding as under:-

“10 In our view, the Tribunal has entirely misread the law as laid down in Magneti Marelli (supra). It is correct that in that case also Assessee had paid royalty to its associate Enterprise for use of technical support for manufacturing its product and the court held that royalty and technical assistance fee did not form part of a composite transaction and have to be treated as two separate transactions for the purpose of benchmarking and computing the ALP because Assessee had paid the royalty and separately technical assistance fees. During the transfer pricing proceedings, Assessee was unable to substantiate the need for payment of technical assistance fees to its foreign associate Enterprise and the TPO had observed that Assessee did not undertake any cost benefit analysis or any benchmarking exercise at the time of entering into the agreement. The court observed that the initial burden is upon Assessee to prove that the international transaction was at ALP but Assessee was unable to explain why he had paid technical assistance fee which did not form part of composite transaction. But in the case at hand, the assessing officer has accepted that Assessee had received technology from Cummins Inc. Associate Enterprise and the rate of royalty payment was made on exports. The TPO has also accepted that Assessee has used the TNMM method as the most appropriate method to benchmark its international transactions under the manufacturing activity including royalty that it had paid on the export sales as well. The TPO has accepted the TNMM method as the most appropriate method to benchmark Assessee’s international transactions under the manufacturing activity but decided to separately benchmark the royalty. This is what has been held not permissible (and we respectfully agree with this view) in Magneti Marelli (supra), where paragraph 16 reads as under:

“16. As far as the second question is concerned, the TPO accepted TNMM applied by the assessee, as the most appropriate method in respect of all the international transactions including payment of royalty. The TPO, however, disputed application of TNMM as the most appropriate method for the payment of technical assistance fee of 38,58,80,000 only for which Comparable Uncontrolled Price (“GUP”) method was sought to be applied. Here, this court concurs with the assessee that having accepted the TNMM as the most appropriate, it was not open to the TPO to subject only one element, i.e payment of technical assistance fee, to an entirely different (CUP) method. The adoption of a method as the most appropriate one assures the applicability of one standard or criteria to judge an international transaction by each method is a package in itself, as it were, containing the necessary elements that are to be used as filters to judge the soundness of the international transaction in an ALP fixing exercise, If this were to be disturbed, the end result would be distorted and within one ALP determination for a year, two or even five methods can be adopted. This would spell chaos and be detrimental to the interests of both the assessee and the revenue. The second question is, therefore, answered in favour of the assessee; the TNMM had to be applied by the TPO/AO in respect of the technical fee payment too. (emphasis supplied)

11 Therefore, the TPO having accepted that TNMM method applied by Assessee was the most appropriate method in respect of all the international transactions including payment of royalty cannot dispute application of TNMM method as the most appropriate method for the payment of royalty only for which CUP method was sought to be applied. We would concur with Mr. Mistri that having accepted the TNMM method as the most appropriate, it was not open to the TPO to subject only one element, i.e. payment of royalty, to an entirely different CUP method. The adoption of a method as the most appropriate one assures the applicability of one standard or criteria to judge an international transaction. Each method is a package in itself, as it were, containing the necessary elements that are to be used as filters to judge the soundness of the international transaction in an ALP fixing exercise. If this were to be disturbed, the end result would be distorted and within one ALP determination for a year, two or even five methods can be adopted. This would spell chaos and be detrimental to the interests of both Assessee and the revenue.

12 Further the Tribunal was totally incorrect in saying that accepting aggregation of royalty payment with other international transactions under the manufacturing segment for the Assessment Year 2006-2007 was in the context of an earlier agreement under which the royalty was paid. But Assessee having entered into a new agreement on 16th September 2010 with Cummins Inc. under which the technical support was received for which payment of royalty was made by Assessee for the year under consideration and hence they need not follow the earlier approach of the Tribunal. This is because the new agreement on which reliance has been placed by the Tribunal was dated 16th September 2010, and even after the said agreement was entered into, for the Assessment Year 2011-2012 to Assessment Year 2014-2015 the TPO himself had accepted the benchmark of the international transaction of payment of royalty under the aggregation approach along with transactions of the manufacturing segment. The Tribunal failed to recognize that the royalty agreement for the years under consideration was the same agreement. We have to notice that neither the TPO nor the DRP had even whispered or mentioned in their orders about any facts being different from the earlier orders. In such situation, the Tribunal was not justified in taking a different view for these three assessment orders. The Apex Court in Radhasoami Satsang v. CIT has held that in the absence of change in material facts, the department is bound by the previous decision.

13 Once the Tribunal in its earlier orders has held that the transaction of payment of royalty for use of technology is inextricably linked with manufacturing activity and should be aggregated with other international transactions in the manufacturing segment for the purposes of benchmarking the same, and the TPO having accepted the aggregating of international transaction of payment of royalty with other international transactions in the manufacturing segment and not drawn any adverse inferences in respect of such aggregation of royalty payment under identical agreement, the Tribunal should have followed the order of the co-ordinate bench rendered under identical facts. More so, when in a majority of the years from the Assessment Year 2006-07 up to the Assessment Year 2014-15 it was under the very same agreement and the orders were passed after thoroughly scrutinising the international transactions entered into by assessee, the transfer pricing report obtained and the transfer pricing documentation maintained. “

13. On going through the judgment of Hon’ble Jurisdictional High Court and applying the ratio laid down therein on the facts of the present case, we find that the same are squarely applicable and, therefore, we hold that ld. DRP’s directions confirming the action of TPO making the upward adjustment on the transaction of payment of royalty proposing separate benchmarking and on the other hand accepting the method adopted by the assessee i.e. Transactional Net Margin Method (TNMM) for the other international transactions is uncalled for. Therefore, the ALP of the international transactions of payment of royalty calculated by the assessee based on TNMM deserves to be accepted. Grounds of appeal Nos. 2, 3, 4 & 5 raised by the assessee are allowed.

14. Ground No.7 has been raised by the assessee against non-granting of exemption u/s. 10AA of the Act at Rs. 196,96,24,249/-.

15. At the outset, learned counsel for the assessee submitted that against the adjustments made by CPC in the order u/s. 143(1)(a) of the Act denying exemption u/s. 10AA of the Act, assessee has got relief from Ld.CIT(A) and Revenue is in appeal against the said adjustment. He further submitted that since the case of the assessee has been selected for scrutiny and final assessment order has been framed u/s.143(3) of the Act, the previous order u/s. 143(1)(a) of the Act gets merged with the final assessment order and Ld.AO while calculating the total assessed income ought to have adopted the income declared in the final return of income prior to making of alleged additions/adjustments. However, Ld.AO has inadvertently adopted the figure of total income calculated by the CPC u/s. 143(1)(a) of the Act, which is not in accordance with law.

16. Ld. DR, on the other hand, supported the order of Ld. CIT(A).

17. We have heard rival contentions and perused the records placed before us. We find merit in the contention of the learned counsel for the assessee and note that Ld.AO while passing final assessment order has not taken-up the issue of exemption claimed u/s. 10AA of the Act separately and without dealing with such adjustments, has merely adopted total income determined by the CPC. However, since the issue of adjudication u/s.10AA of the Act has also been raised by the Revenue in its appeal ITA No. 1256/pUN/2023 filed against the relief granted by the Ld. CIT(A) against the adjustments made by the CPC, this ground shall be dealt subsequently along with the ground raised by the Revenue in ITA No.1256/pUN/2023 against the finding of Ld.CIT(A) allowing exemption u/s. 10AA of the Act.

18. Ground Nos. 8 raised by the assessee against nongrating of weightage deduction u/s. 35(2AB) of the Act on expenditure of INR 13,10,97,715/

19. At the outset, learned counsel for the assessee referring to the decision of this Tribunal in assessee’s own cases from A.Ys. 2009-10 to 2013-14 submitted that till completion of the proceedings before Ld.AO for framing of final assessment order, assessee had not received certificate issued by Department of Scientific and Industrial Research (DSIR) which is granted on Form No.3CL and is an approval determining the expenditure incurred in the activities relating to research and development. Learned counsel for the assessee referring to paper book submitted that assessee has received the required Form No. 3CL from DSIR and the issue may please be restored to the Ld. Jurisdictional Assessing Officer (JAO) for necessary verification.

20. Ld. DR, on the other hand, has no objection if the issue is restored to the file of Ld.JAO for necessary verification of Form No. 3CL issued by DSIR based on which assessee can claim deduction u/s. 35(2AB) of the Act.

21. We have heard rival contentions and perused the records placed before us. We observe that assessee’s claim of deduction u/s. 35(2AB) of the Act at Rs. 13,10,97,715/- has been denied by the Ld.AO only for want of certificate on Form No.3CL which is issued by DSIR. Learned counsel for the assessee has stated that Form No.3CL is received post passing of the final assessment order. Considering the said contention, we deem it appropriate to remit back the issue to the file of Ld. JAO for carrying out necessary verification of certificate issued by the DSIR on Form No. 3CL and also examine the nature of expenditure claimed by the assessee and if the same is found to be correct, assessee’s claim of deduction u/s. 35(2AB) of the Act may be allowed in accordance with law. Ground No.8 raised by the assessee is allowed for statistical purposes.

22. Ground No.9 raised is against the disallowance u/s. 14A of the Act at Rs. 47,55,629/-.

23. Learned counsel for the assessee, at the outset, submitted that the issue is covered by the decision of this Tribunal in assessee’s own case for various A.Ys. 2008-09 to 2016-17.

24. On the other hand, ld. DR supported the order of Ld.AO.

25. We have heard rival contentions and perused the records placed before us. We observe that during the year under consideration, assessee has earned total exempt income of Rs. 96,04,18,088/-. The assessee has suo-motu disallowed Rs. 48,48,551/- in the computation of income. However, Ld.AO has calculated disallowance @1% of the total exempt income which comes to Rs. 96,04,180/- and after reducing the disallowance, suo-motu offered by the assessee has made the alleged disallowance of Rs. 47,55,629/-. We observe that the year under consideration, the amended Rule 8D w.e.f. 02/06/2016 reads as under:-

8D. (1) Where the Assessing Officer, having regard to the accounts of the assessee of a previous year, is not satisfied with—

| (a) | | the correctness of the claim of expenditure made by the assessee; or |

| (b) | | the claim made by the assessee that no expenditure has been incurred, |

in relation to income which does not form part of the total income under the Act for such previous year, he shall determine the amount of expenditure in relation to such income in accordance with the provisions of sub-rule (2).

[(2) The expenditure in relation to income which does not form part of the total income shall be the aggregate of following amounts, namely:—

| (i) | | the amount of expenditure directly relating to income which does not form part of total income; and |

| (ii) | | an amount equal to one per cent of the annual average of the monthly averages of the opening and closing balances of the value of investment, income from which does not or shall not form part of total income: |

Provided that the amount referred to in clause (i) and clause (ii) shall not exceed the total expenditure claimed by the assessee.]

26. From perusal of the above Rule 8D(1) of the Rules, 1962 provides that calculating the disallowance as per the method provided in Rule 8D(2), Ld.AO has to first satisfy about the correctness of the claim about the expenditure incurred or not incurred by the assessee in relation to income which does not form part of the total income. We find that Ld.AO has duly examined this aspect and after being satisfied that the expenses incurred on account of time given by BoD to MD, CFO, VC and treasury team directly involved in making the investments have not been considered by the assessee in suo-motu disallowance, has enhanced the disallowance from Rs.48,48,551/- offered by the assessee to Rs. 96,04,180/-calculating it @1% of the exempt income.

27. We observe that as per the method provided in rule 8D(2), disallowance u/s. 14A would have been aggregate of two amounts; firstly, the amount of expenditure directly relating to income which does not form part of total income; and secondly, an amount equal to one per cent of the annual average of the monthly averages of the opening and closing balances of the value of investment, income from which does not or shall not form part of total income. Had Ld.AO applied the formula of Rule 8D(2), the disallowance u/s. 14A of the Act would have been much higher amount. However, Ld.AO in the final assessment order has only made the disallowance u/s. 14A @1% of exempt income which clearly indicates that after properly getting satisfied with the details of calculation of disallowance u/s. 14A filed by the assessee along with the information available in the financial statements had taken a plausible view. Further, we find that reliance placed by the learned counsel for the assessee on the decision of this Tribunal in assessee’s own case pertains to the assessment years prior to the amendment brought in by the Income Tax (14 amendment) Rules 2016 effective from 02/06/2016 and, therefore, the same will not be applicable on the facts of the present case. We, therefore, find no infirmity in the disallowance made by the Ld.AO u/s. 14A of the Act at Rs.47,55,629/-. Ground No.9 raised by the assessee is dismissed.

28. Apropos ground No.10 regarding non-granting of deduction u/s. 80JJAA of the Act, we note that assessee has raised this ground because Ld.AO has adopted the income assessed by the CPC in the return processed u/s. 143(1)(a) of the Act wherein deduction was disallowed for delay in filing of income tax return. It is brought to our notice that in the ground No. 3 has been raised by the Revenue against the finding of Ld.CIT(A) allowing the assessee’s claim of deduction u/s. 80JJAA of the Act. We therefore deem it appropriate to deal with this ground while adjudicating the Revenue’s appeal in ITA No. 1256/pUN/2023 in subsequent paras.

29. Ground No.11 raised by the assessee is that for computing book profit u/s. 115JB, disallowance u/s. 14A was not required to be added.

30. On due consideration of the judgment of the Special Bench of Delhi Tribunal in the case of Asstt. CIT v. Vireet Investment (P.) Ltd. ITD 27/58 ITR(T) 313 (Delhi – Trib.) relied on by the learned counsel for the assessee, we find that in the light of the decision of the Special Bench, we are inclined to hold that computing the book profit u/s. 115JB of the Act, disallowance u/s. 14A of the Act is not required to be added to the book profits. Ground No.11 raised by the assessee is allowed.

31. In the additional ground of appeal No.1, it is stated that LTCG of Rs. 7,90,51,252/- has been taxed twice. We have gone through the written submissions filed by the assessee and also considered the contention of the Ld. DR. We find that total income computed as per the final assessment order is INR 756,25,79,114/- (after including LTCG), however, while computing the tax liability in the income-tax computation sheet, the income considered is INR 764,16,30,370/-. Though, assessee has moved rectification application dated 13/07/2022, but the same is stated to have not been disposed of till the time of hearing of this appeal. Under these given facts and circumstances, we remit the issue to Ld. JAO and direct the Ld.JAO to re-calculate the total income and tax applicable thereon. Ground No.1 of additional ground raised is allowed for statistical purposes.

32. Ground No.2 of additional ground is with regard to levy of interest u/s. 234C of the Act. Considering the request made by the learned counsel for the assessee, we restore this issue also to the file of the Ld.AO for correct computation of interest u/s. 234C of the Act on the tax due on returned income. Ground No.2 of additional ground raised is allowed for statistical purposes.

33. Ground Nos.3 & 4 of additional grounds raised by the assessee relating to short credit of tax deducted at source (TDS)/tax collected at source (TCS) of Rs. 14,59,293/- and short credit of dividend distribution tax (DDT) at Rs. 50,78,82,579/- respectively. Considering the contention of learned counsel for the assessee and also observing that the rectification application filed by the assessee on 13/07/2022 is not yet disposed of, we remit the issues raised in ground Nos. 3 & 4 of additional grounds, to the file of Ld.JAO for necessary verification and made the correct TDS/TCS as well as grant of credit of correct dividend distribution tax eligible to the assessee and decide in accordance with law. Ground Nos. 3 & 4 of additional grounds raised by the assessee are allowed for statistical purposes.

34. Now, we take up Revenue’s appeal ITA No. 1256/pUN/2023. The revised grounds of appeal raised by the Revenue are as follows :

“1. On the facts and the circumstances and in law, the Ld.CIT(A) erred in adjudicating that the deduction u/s.10AA is denied by CPC, only on account of the fact that the assessee has failed to file its return of income for the year under consideration within the due date prescribed.

2. On the facts and the circumstances and in law, the Ld.CIT(A) erred in ignoring the fact that the deduction u/s.10AA was denied by the CPC on account of mismatch of amounts claimed in various schedules of ITR.

3. On the facts and the circumstances and in law, the Ld.CIT(A) erred in adjudicating against the disallowance of deduction u/s.80JJAA of the Act instead of the correct disallowance made by the CPC, i.e. 80JJA of the Act.

4. The appellant craves to add, amend, alter or delete the above ground of appeal during the course of appellate proceedings before the Hon’ble Tribunal.”

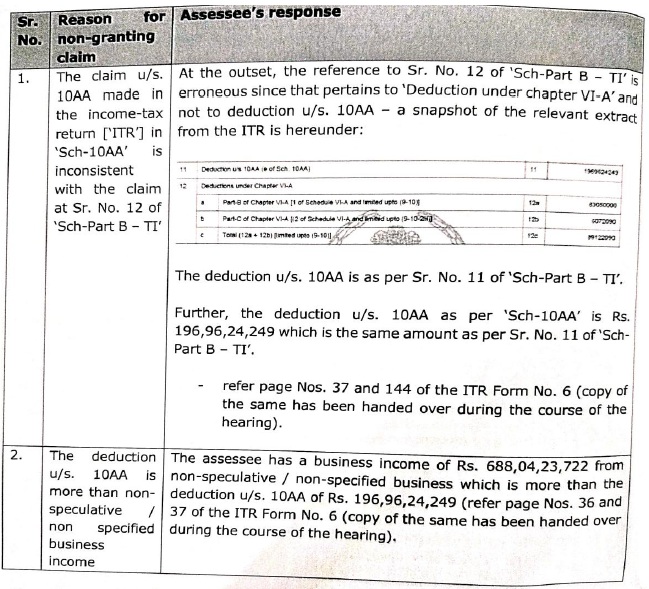

35. Ground Nos. 1 & 2 raised by the Revenue relating to non-granting of exemption u/s. 10AA of the Act. We observe that due date of filing of return for A.Y. 2018-19 is 30/11/2018 and the return was e-filed by the assessee on 01/12/2018. For this delay of 01 day in filing of return, the assessee’s claim for exemption u/s. 10AA of the Act has been denied. The CPC denied the claim treating the same to be incorrect claim u/s. 143(1)(a)(ii) of the Act and also invoking the provisions of section 143(1)(a)(v) of the Act. We further notice that the said claim has been denied not on the ground of non-fulfillment of relevant conditions prescribed u/s. 10AA of the Act, but the same has been denied solely for delay in filing the return of income. The Ld.CIT(A) on observing that audit report which is required to be filed by an Accountant in terms of explanation to section 288(2) of the Act has been furnished within the prescribed time limit certifying that assessee is eligible for deduction u/s. 10AA of the Act at Rs. 196,96,24,249/-, had allowed the assessee’s claim u/s. 10AA of the Act observing as follows:-

“2.2 I have carefully considered the facts of the case and submission filed by the appellant. Deduction is granted under section 10AA of the Income Tax Act in respect of the “profits and gains derived by a unit set up in an SEZ” which is engaged in the manufacturing or production of articles or things or provision of services subject to the terms and conditions specified in the said section. The AO(CPC) has denied the deduction under section 10AA of the Act by treating the same to be an “Incorrect Claim under section 143(1)(a)(ii) of the Act” and also invoking provisions of “section 143(1)(a)(v) of the Act. I agree with the appellant’s contention that erroneous information provided in Sr. No.12 in Schedule Part B-TI of the income tax return viz., details of deduction under Chapter VIA, does not pertain to claim of deduction under section 10AA of the ITA. Hence disallowance on account of the said reason as an incorrect claim envisaged u/s 143(1)(a)(ii) is not proper.

2.2.1 In the present case, the eligibility to claim a deduction under section 10AA per se is not being disputed by the AO and the deduction is denied only on account of the fact that the appellant has filed its return of income for the year under consideration after the due date prescribed. Due date for the present Assessment year was 30.11.2018 and the Appellant filed its original return of income on 01 December 2018 after claiming deduction u/s. 10AA of the Act of INR 1,96,96,24,249/. As mentioned by the appellant above, the return of income could not be filed within 30 November 2018 due to technical glitches and the same was filed on December 1, 2018, i.e. within one day of the statutory timeline. There is no specific provision in section 10AA of the Act which requires filing of the return of income within the due date specified under section 139(1) of the Act to be eligible to claim a deduction under section 10AA. As required u/s 10AA, for claiming the said deduction, the appellant had obtained and filed electronically the prescribed Report in Form No.56F on 30 November 2018. This is a report of an accountant, as defined in the Explanation below sub-section (2) of section 288, certifying that the deduction has been correctly claimed in accordance with the provisions of this section. Unlike provisions of Section 10A and 10B, the provision mandating requirement of filing the return within the due date u/s 139(1) was not there in section 10AA in the current AY 2018-19.This has become mandatory by way of insertion of a proviso after clause (ii) of sub-section (1) of section 10AA by the Finance Act, 2023, w.e.f. 1-4-2024

2.2.2. The Appellant also has brought my attention to certain recent judgments wherein it has been held that filing of return of income within specified due date is not a pre-condition for claiming deduction u/s 10AA:

| (a) | | Arvind Kumar Agarwal v. ITO reported in (Delhi-ITAT) |

| (b) | | ACIT v. Vishnu Export in ITA No. 1840/Ahd/2018 (Ahd – ITAT) dtd 31.03.2023 |

| (c) | | OPTO Circuits (India) Ltd. v. ACIT (Bangalore Trib.) |

In view of the above discussion and respectfully following the decisions cited above, the AO is directed to grant deduction u/s 10AA to the undertaking of the appellant. Appeal is allowed on this ground. “

36. Dissatisfied with the finding of Ld.CIT(A), Revenue is now in appeal before this Tribunal. Ld. CIT-DR has contended that return of income has not been furnished within the time prescribed in section 139(1) of the Act and therefore, assessee’s claim u/s. 10AA of the Act deserves to be denied.

37. On the other hand, learned counsel for the assessee firstly contended that due to technical error and heavy load on the income tax website, assessee’s original return could not be uploaded upto the last minute of the day closing on 30/11/2018 and only after few hours of the beginning of the next day starting on 01/12/2018, return has been uploaded. He further submitted that, that such delay arising solely for technical reasons, should not disentitle the assessee for a legitimate claim u/s. 10AA of the Act. Learned counsel for the assessee placed reliance on the following decisions:-

| (a) | | Arvind Kumar Agarwal v. ITO ITD 247 (Delhi – Trib.) |

| (b) | | ACIT v. Vishnu Export ITD 184 (Ahmedabad – ITAT)/ITA No. 1840/Ahd/2018 |

| (c) | | OPTO Circuits (India) Ltd. v. Asstt. CIT (Bangalore – Trib.) |

| (d) | | Capgemini Technology Services India Ltd. v. Dy. CIT [IT Appeal Nos. 1857 & 1935 (Pun.) of 2017, dated 30-8-2022] |

| (e) | | Asstt. CIT v. Dhir Global Industria (P.) Ltd. /[2011] 43 SOT 640 (Delhi); and |

| (f) | | Shri Bhagyalaxmi Co-operative Credit Society Ltd. v. Dy. CIT [IT Appeal No. 01 (Pan.) of 2023]; and |

| (g) | | Sangam Souharda Credit Sahakari Ltd. v. Dy. CIT [IT Appeal No. 30 (Pan.) of 2023]. |

38. Learned counsel for the assessee also stated that timely filing of return of income is not a pre-requisite for allowabilty of deduction u/s. 10AA of the Act prior to amendment brought in by Finance Act, 2023 effective from 01/04/2024. He submitted that amendment brought in section 10AA of the Act by the Finance Act, 2023 effective from 01/04/2024 is prospective in nature and through the said amendment, it is provided that no deduction u/s. 10AA of the Act shall be allowed to an assessee, who does not furnish return of income on or before the due date specified u/s. 139(1) of the Act. Learned counsel for the assessee further took us the following written submission filed on 12/09/2024:

“1. In terms of the Intimation dated 29 January 2021 u/s. 143(1), the deduction u/s. 10AA of the Act had been disallowed / non granted by the CPC by invoking section 143(1)(a)(ii) and section 143(1)(a)(v) of the Act for the following reason(s):

| ? | | the claim u/s. 10AA made in the income-tax return in ‘Sch-10AA’ is inconsistent with the claim at Sr. No. 12 of ‘Sch-Part B – TP; or |

| ? | | the deduction u/s. 10AA is more than non-speculative / non specified business income. |

– refer the aforementioned snapshot from the said Intimation u/s. 143(1) for the reasons.

2. While doing so, in the said Intimation, the CPC has at the outset considered the date of filing the revised return of income and not the date of filing the original return of income.

3. The assessee submits that there is no incorrect claim as per section 143(1)(a)(ii) and the reasoning thereof has been tabulated hereunder:

4. Thus, the assessee submits that there is no incorrect claim made by it in the Income-tax return filed vis-a-vis section 10AA of the Act and the action of the CPC denying deduction u/s. 10AA by invoking section 143(1)(a)(ii) is erroneous, incorrect and bad in law.

Section 143(1)(a)(v) cannot override when there are no explicit provision(s) in section 10AA to file return of income before the due date u/s. 139:

5. In terms of section 143(1)(a)(v), an adjustment to the total income will be made by disallowance of deduction claimed u/s. 10AA if the return of income is furnished beyond the due date specified u/s. 139(1) the relevant extract of the said section as applicable for the year under consideration is as under:

“143 (1) Where a return has been made under section 139, or in response to a notice under sub-section (1) of section 142, such return shall be processed in the following manner, namely:-

(a) the total income or loss shall be computed after making the following adjustments, namely:

……(v) disallowance of deduction claimed under sections 10AA, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID or section 80-IE, if the return is furnished beyond the due date specified under sub-section (1) of section 139″

6. Given that there is no specific requirement in section 10AA to file the return of income within the due date in order to be allowed a deduction under the said clause section 143(1)(a)(v) of the Act cannot be invoked by the Appellant to deny the deduction u/s. 10AA of the Act for not filing the return of income within the due date u/s. 139(1) of the Act.

7. Thus, it is submitted that a machinery provision i.e. section 143(1) cannot override or add any requirement to the explicit terms of the provision i.e. section 10AA to make a disallowance/adjustment if there is no such explicit requirement in the main provision itself i.e. section 10AA.

8. Reliance in this regard is placed on the following decisions wherein it has been held that machinery provisions cannot override or add to a section any requirement / condition when there are no such requirement in the provision itself:

| ? | | Decision of the Karnataka High Court in the case of Fatheraj Singhvi v/s. Union of India reported in (Karnataka); and |

| ? | | Decision of the Pune Bench of the Tribunal in the case of Medical Superintendent Rural Hospital, DOBI BK v/s. DCIT (TDS) reported in (Pune – Trib.). |

– A copy of the said decisions is forwarded herewith as “Appendix – B” – refer Page Nos. 37 to 54 of the compilation.

Timely filing of return of income is not a pre-requisite for allowability of deduction u/s. 10AA of the Act:

9. In the instant case, the eligibility to claim a deduction under section 10AA per se is not being disputed and the deduction is denied only on account of the fact that the asssessee has filed its return of income for the year under consideration after the due date prescribed I.e. only by 7 hours and due to a fault in the software / system mandated to be used by the department.

10. It is submitted that there is no specific provision in section 10AA of the Act, as it stood for the year under consideration, which required filing of the return of income within the due date specified under section 139(1) of the Act to be eligible to claim a deduction under section 10AA of the Act.

11. The only requirement prescribed is in section 10AA(8) which inter-alia provides that the provisions of section 10A(5) will be applicable i.e. the only requirement in law for claiming deduction under section 10AA of the Act was to furnish the prescribed report along with the return of income.

12. In the instant case, the assessee had filed the said Report in Form No. 56F claiming deduction u/s. 10AA on 30 November 2018.

13. It may be noted that wherever the legislature intended that a return of income ought to be filed before the due date prescribed to be eligible to claim a deduction, the same has been specifically provided for / mandated in law i.e. section 10A(1A) and section 1 08(1) of the Act.

Filing of return u/s. 139 to be eligible for deduction u/s. 10AA is prospective w.e.f. 01 April 2024 by the Finance Act, 2023

14. Here it may also be noted that the Finance Act, 2023 has made amendments to section 10AA to mandate that deduction shall be allowed only if the return of income is filed within the due date prescribed u/s. 139(1)

“Following proviso shall be inserted after clause (ii) of sub-section (1) of section 10AA by the Finance Act, 2023, w.e.f. 1-4-2024:

Provided that no such deduction shall be allowed to an assessee who does not furnish a return of income on or before the due date specified under sub-section (1) of section 139″.

15. The Memorandum to the Finance Bill, 2023 clearly states that the said amendment has been introduced to align the provision of filing return of income to be eligible to claim a deduction u/s. 10AA with the provision of section 143(1) and the same is prospectively applicable from the Assessment Year 2024-25 onwards a copy of the relevant extract of the Memorandum to the Finance Bill, 2023 as reported in the Income Tax Report [ITR] at 451 ITR 269 is enclosed as “Appendix C” refer Page Nos. 55 to 57 of the compilation.

16. It is submitted and it will be appreciated that the amendment by the Finance Act, 2023 and the Memorandum to the Finance Bill, 2023 amply clarify that the condition of filing return of income on or before the due date u/s. 139(1) of the Act for claiming deduction u/s. 10AA is effective prospectively from 1 April 2024 and there was no such condition for the year under consideration i.e. AY 2018-19.

17. Reliance in this regard is placed on the following decisions wherein it has been held that deduction u/s. 10AA cannot be denied for not filing return of income within the due date specified u/s. 139(1) refer to the case law compilation at Page Nos. 41 to 127:

| ? | | Decision of the Delhi Bench of the Tribunal in the case of Arvind Kumar Agarwal v/s. ITO reported in (Delhi – ITAT); |

| ? | | Decision of the Ahmedabad Bench of the Tribunal in the case of ACIT v/s. Vishnu Export in ITA No. 1840/Ahd/2018 (Ahd – ITAT); |

| ? | | Decision of the Bangalore Bench of the Tribunal in the case of OPTO Circuits (India) Ltd. v/s. ACIT reported in (Bangalore – Trib.); and |

| ? | | Decision of the Pune Bench of the Tribunal in the case of Capgemini Technology Services India Limited v. DCIT in ITA No. 1857 and 1935/pun/2017. |

Delay in filing of the return of income beyond the control of the assessee:

18. As mentioned above, due to certain technical problems in uploading the.xml (which had been generated on 30 November 2018) on the portal, which is an event beyond the control of the assessee, the return of income could not be filed on 30 November 2018 but only in the early morning of 01 December 2018.

19. The assessee had also obtained and filed electronically the prescribed Report in Form No. 56F, Form No. 10DA and accountant report in Form 3CD on 30 November 2018 l.e., well within the timeline.

20. Reliance in this regard is placed on the following decision wherein deduction claimed has been allowed inspite delay in filing the return of income beyond the control of the assessee / on a reasonable cause made out and also other prescribed form / report had been filed within time refer to the case law compilation [‘CLC’]:

| ? | | Decision of the Delhi Bench of the Tribunal in the case of Arvind Kumar Agarwal v/s. ITO reported in (Delhi ITAT) – Page Nos. 41 to 46 of the CLC; |

| ? | | Decision of the Chandigarh Bench of the Tribunal in the case of Shree Ganesh Concast Group of Industries v/s. DCIT in ITA No. 829/Chd/2018 Page Nos. 26 to 31 of the CLC |

| ? | | Decision of the Delhi Bench of the Tribunal in the case of Hansa Dalakoti v/s. ACIT reported in [2012] 50 SOT 511 (Delhi ITAT) Page Nos. 37 to 40 of the CLC; |

| ? | | Decision of the Chandigarh Bench of the Tribunal in the case of DCIT v/s. Symbiosis Pharmaceuticals (P.) Ltd reported in (Chandigarh Trib.) Page Nos. 141 to 156 of the CLC; and |

| ? | | Decision of the Chandigarh Bench of the Tribunal in case of Symbiosis Pharmaceuticals P. Ltd v/s. the DCIT reported in (Chandigarh Trib.) Page Nos. 01 to 12 of the CL.C. |

In view of the foregoing provisions and the legal precedents, since there is no requirement in section 10AA of the Act as it stood for the year under consideration, there is no requirement to file the return of income on/ or before the due date prescribed in section 139(1) of the Act to be eligible to claim a deduction under section 10AA of the Act, and as explained above there is no incorrect claim as per section 143(1)(a) and thus we submit that that the Order of the CIT(A) be upheld and CPC be directed to grant deduction u/s. 10AA of the Act.”

39. We have heard rival contentions and perused the records placed before us. Revenue is aggrieved with the finding of Ld.CIT(A) allowing assessee’s claim for deduction u/s. 10AA of the Act at Rs. 196,96,24,249/-. It is not in dispute that deduction has not been denied by the CPC for non-fulfillment of the conditions by the assessee which are required as per the provisions of section 10AA of the Act. The alleged exemption has been disallowed by the CPC solely for delay in filing the original return and that too, which is delayed by few hours from the closing of last day of filing of return i.e. 30/11/2018. Learned counsel for the assessee has successfully demonstrated that the return was uploaded with a delay of few hours due to technical error and extra load on the Income Tax website on the last day of filing the return. Admittedly, on the last day of filing of return of income, there is heavy load on the income tax website and this is a common problem faced by all the return filers on the last date when the returns are not uploaded due to heavy traffic on the income tax website. Certainly there can be a view that why the assessee waited till last minute and could have easily furnished the return at much prior date, but then there can equally be another view that why such technical problems are faced on the last date and as to why not the capacity of income tax website is enhanced to reduce the pressure occurring on the last date of filing the return.