ORDER

ITA Nos.636, 637/Bang/2025 :

1. These two appeals are filed by the assessee against separate Orders passed by the CIT(A) forAssessment Years 2015-16, 2016-17 vide DIN and Order No.ITBA/APL/S/250/2024-25/1072438130(1) dated 22.01.2025 and No.ITBA/APL/S/250/2024-25/1072472429(1) dated 24.01.2025 respectively.

2. The Revenue has also filed appeals against the above Orders passed by the learned CIT(A).

3. The grounds raised by the assessee and Revenue are as follows:

3.1 Grounds raised in ITA No. 636/BANG/2025 are as under:-

| 1. | | The orders of the authorities below in so far as they are against the appellant are opposed to law, equity, weight of evidence, probabilities, facts and circumstances of the case. |

| 2. | | The learned CIT[A] is not justified in partially sustaining addition to the extent of Rs. 4,08,08,845/- from out of the original addition of Rs. 8,35,45,883/- made as the alleged bogus expenditure paid to sub-contractors under the facts and in the circumstances of the appellant’s case. |

| 2.1 | | The learned CIT[A] failed to appreciate that the addition sustained on an erroneous impression of the facts and that the addition made on the basis of suspicion and surmise, assumptions and presumptions and hence, the same ought to have been deleted in full. |

| 3. | | Without prejudice to the above, the addition sustained by the learned CIT[A] is excessive and liable to be reduced substantially. |

| 4. | | For the above and other grounds that may be urged at the time of hearing of the appeal, your appellant humbly prays that the appeal may be allowed and Justice rendered and the appellant may be awarded costs in prosecuting the appeal and also order for the refund of the institution fees as part of the costs. |

3.2 Grounds raised in ITA No. 637/BANG/2025 are as under:-

| 1. | | The orders of the authorities below in so far as they are against the appellant are opposed to law, equity, weight of evidence, probabilities, facts and circumstances of the case. |

| 2. | | The learned CIT[A] is not justified in sustaining the disallowance made u/s. 40A[3] to the extent of Rs. 1,86,85,221/- out of the |

| original | | disallowance of Rs. 2,72,00,000/- under the facts and in the circumstances of the appellant’s case. |

| 3. | | The learned CIT[A] is not justified in partially sustaining addition to the extent of Rs. 3,90,56,482/- from out of the original addition of Rs. 16,78,53,449/- made as the alleged bogus expenditure paid to sub-contractors under the facts and in the circumstances of the appellant’s case. |

| 3.1 | | The learned CIT[A] failed to appreciate that the addition sustained on an erroneous impression of the facts and that the addition made on the basis of suspicion and surmise, assumptions and presumptions and hence, the same ought to have been deleted in full. |

| 4. | | Without prejudice to the above, the disallowances sustained by the learned CIT[A] is excessive and liable to be reduced substantially. |

| 5. | | For the above and other grounds that may be urged at the time of hearing of the appeal, your appellant humbly prays that the appeal may be allowed and Justice rendered and the appellant may be awarded costs in prosecuting the appeal and also order for the refund of the institution fees as part of the costs. |

3.3 Amended grounds raised in ITA No. 637/BANG/2025 are as under:-

| 1. | | The orders of the authorities below in so far as they are against the appellant are opposed to law, equity, weight of evidence, probabilities, facts and circumstances of the case. |

| 2. | | The learned CIT[A] is not justified in sustaining the disallowance made u/s. 40A[3] to the extent of Rs. 1,86,85,221/- out of the original disallowance of Rs. 2,72,00,000/- under the facts and in the circumstances of the appellant’s case. |

| 3. | | The learned CIT[A] is not justified in partially sustaining addition to the extent of Rs. 10,54,16,443/- from out of the original addition of Rs. 17,06,53,449/- made as the alleged bogus expenditure paid to sub-contractors under the facts and in the circumstances of the appellant’s case. |

| 3.1 | | The learned CIT[A] failed to appreciate that the addition sustained on an erroneous impression of the facts and that the addition made on the basis of suspicion and surmise, assumptions and presumptions and hence, the same ought to have been deleted in full. |

| 4. | | Without prejudice to the above, the learned CIT[A] ought to have deleted the addition out of the alleged bogus sub-contract payments of Rs. 5,90,17,292/- instead of Rs. 5,75,71,834/- deleted by him consistent with the deletion of the addition made towards subcontractors for whom no signed cheque books were not found at the time of search. |

| 5. | | Without prejudice to the above, the disallowances sustained by the learned CIT[A] is excessive and liable to be reduced substantially. |

| 6. | | For the above and other grounds that may be urged at the time of hearing of the appeal, your appellant humbly prays that the appeal may be allowed and Justice rendered and the appellant may be awarded costs in prosecuting the appeal and also order for the refund of the institution fees as part of the costs. |

3.4 Grounds raised in ITA No. 768/BANG/2025 are as under:-

| 1. | | Whether on the facts and circumstances of the case and in law, the Id. CIT(A) has erred in not considering the statement recorded under section 132(4) on oath as the same has evidentiary value and is permitted to be used in evidence. |

| 2. | | Whether on the facts and circumstances of the case and law, the Id. CIT(A) has erred in deleting addition on account of bogus expenditure without considering the fact that the key employees of the assessee firm have admitted that there was no proper documentation, and hills were made afterwards. |

| 3. | | Whether on the facts and circumstances of the case and law, the Id. CIT(A) has erred in deleting the additions made on account of bogus expenditure as it is a settled position of law that the admission made by the assessee in his statement recorded under oath is an important piece of evidence and refrained from making any further enquiries into the matter as held by Hon’ble Supreme Court in the case of Awadh Kishore DassVsRamGopal Awadh Kishore Das v. Ram Gopal AIR 1979 SC 861, Hon’ble Delhi High Court in the caseRs. 14526319 of PCIT v. Avinash Kumar Setia (2017) (Delhi), Hon’ble Chhattisgarh High Court in the case of ACTT v. Hukum Chand Jain (2010), Kantilal C. Shah v. ACIT (20I1) 133ITD 57 (Ahmedabad), PCIT v. Shri Roshan Lal Sancheti in D.B.ETA No. 47/2018 vide its judgement dated 30.10.2018, the Hon’ble Rajasthan High Court and Hon’ble High Court of Kerala in the case of Commissioner of Income Tax v. 0 Abdul Razack in(Kerala)/[2013] 350 ITR 71 (Kerala). |

3.5 Grounds raised in ITA No. 769/BANG/2025 are as under:-

| 1. | | Whether on the facts and circumstances of the case and in law, the Id. CIT(A) has erred in not considering the statement recorded under section 132(4) on oath as the same has evidentiary value and is permitted to be used in evidence. |

| 2. | | Whether on the facts and circumstances of the case and law, the Id. CIT(A) has erred in deleting addition on account of bogus expenditure without considering the fact that the key employees of the assessee firm have admitted that there was no proper documentation, and bills were made afterwards. |

| 3. | | Whether on the facts and circumstances of the case and law, the Id. CIT(A) has erred in deleting addition of cash expenditure of Rs. 50,61,988/- by considering that these are covered under Rule 6DD of the IT Rule without substantiating with documentary evidences. |

| 4. | | Whether on the facts and circumstances of the case and law, the Id. CIT(A) has erred in deleting the additions made on account of bogus expenditure as it is a settled position of law that the admission made by the assessee in his statement recorded under oath is an important piece of evidence and refrained from making any further enquiries into the matter as held by Hon’ble Supreme Court in the case of Awadh Kishore Dassvs Ram Gopal Awadh Kishore Das v. Ram Gopal AIR 1979 SC 861, Hon’ble Delhi High Court in the case of PCITvsAvinash Kumar Setia [2017] (Delhi), Hon’ble Chattisgarh High Court in the case of ACIT v. Hukum Chand Jain [2010], Kantilal C. Shah v. ACIT (Ahmedabad – ITAT)/[2011] 133 ITD 57 (Ahmedabad – ITAT), PCIT v Shri Roshan Lal Sancheti in D.B. ITA No. 47/2018 vide its judgement dated 30.10.2018, the Hon’ble Rajasthan High Court and Hon’ble High Court of Kerala in the case of Commissioner of Income Tax v Abdul Razack in (Ker.) |

4. The issues involved in these appeals are arising due to search conducted in the Ananthpur Office and Bangalore Office on 23.11.2016. Accordingly, the AO issued notice under section 153A of the Act on 03.09.2018. The issue regarding sub-contractor payments additions are common for both the years. Therefore, we are passing a common Order. Another issue is disallowance made u/s. 40A(3) for AY 2016-17.

5. Briefly stated the facts of the case are that search and seizure action under section 132 of the Act was conducted in the case of assessee SR Constructions (hereinafter referred as SRC) at # 7/272, Ground Floor, Kakateeya Residency, Anantapur, Andhra Pradesh – 515 001 as well in Bangalore Office premises No.1/58-4, 2nd Floor, Croma Building, Sycon Polaries, 8th Main, RMV Extension, Sadashiva Nagar, Bangalore – 560 080, in connection with search proceedings in the case of SRC group. The case was centralized. Thereafter, notice under section 153A of the Act was issued on 03.09.2018 to file return of income within 30 days from the date of receipt of notice which was duly served on the assessee on 05.09.2018. Assessee filed return of income under section 139(1) of the Act on 30.08.2015 and 08.08.2016 for the AY 2015-16& 2016-17 respectively. In response to notice under section 153A of the Act the assessee filed return of income declaring income as under:

| Assessment Year | Section | Date of filing ITR | Amount | Excess Amount declared in 153A return |

| 2015-16 | 139(1) | 30.08.2015 | 9,63,69,550/- | |

| 2016-17 | 139(1) | 08.08.2016 | 11,77,58,180/- | |

| 2015-16 | 153A | 04.10.2018 | 15,21,46,130/- | 5,57,76,580/- |

| 2016-17 | 153A | 04.10.2018 | 18,55,63,600/- | 6,78,05,420/- |

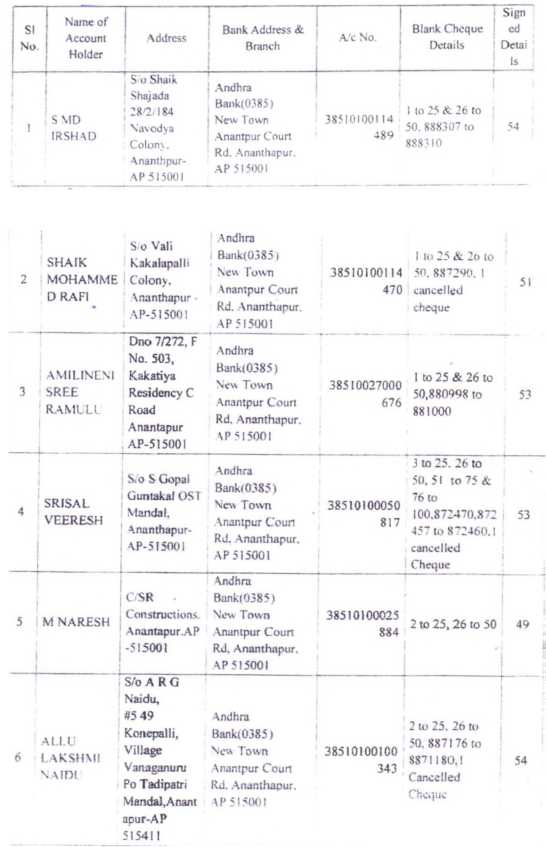

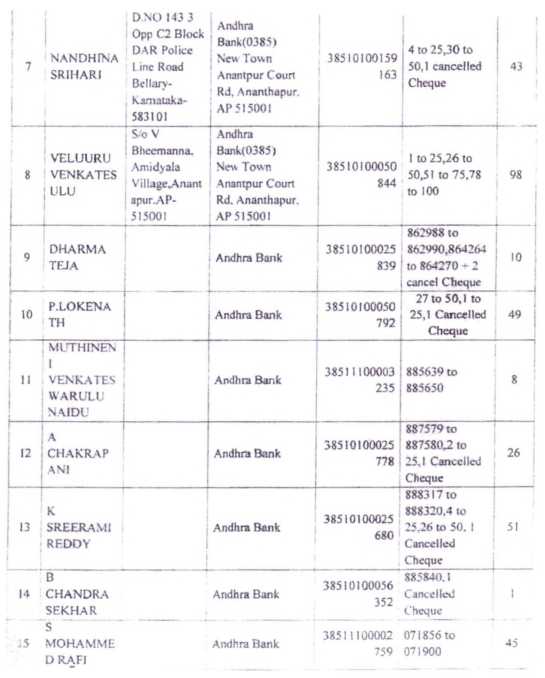

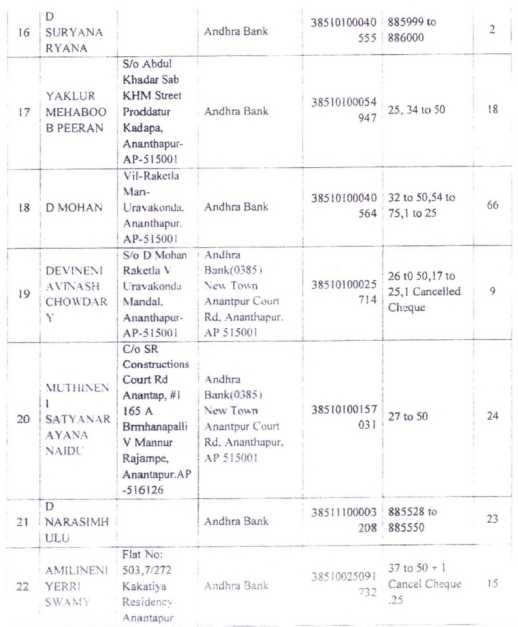

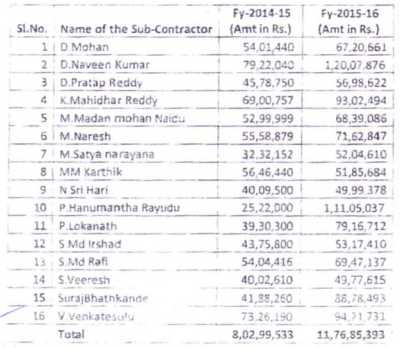

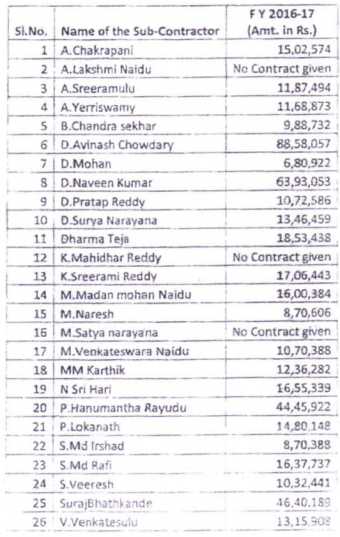

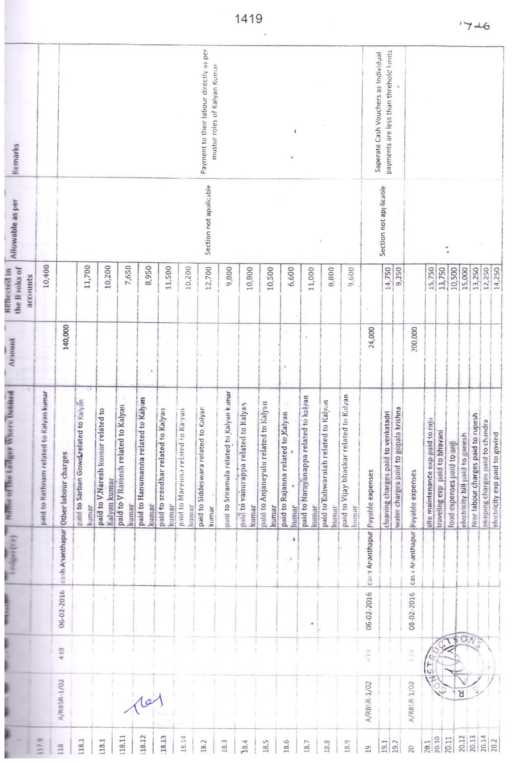

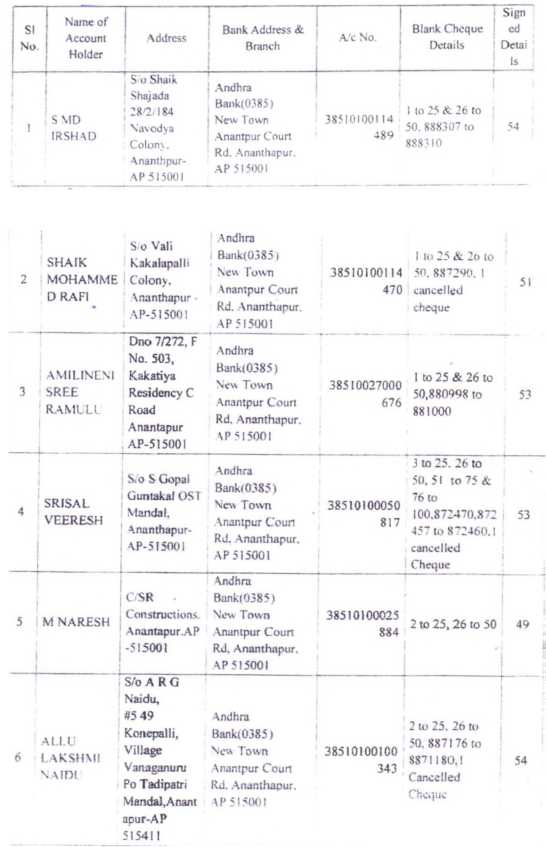

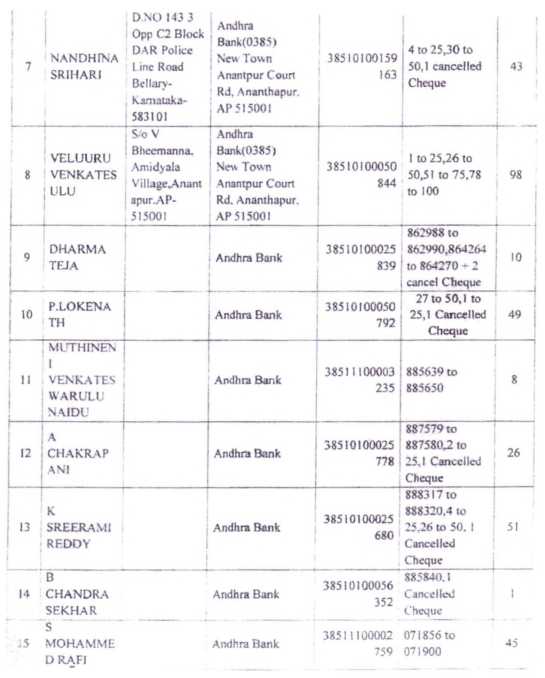

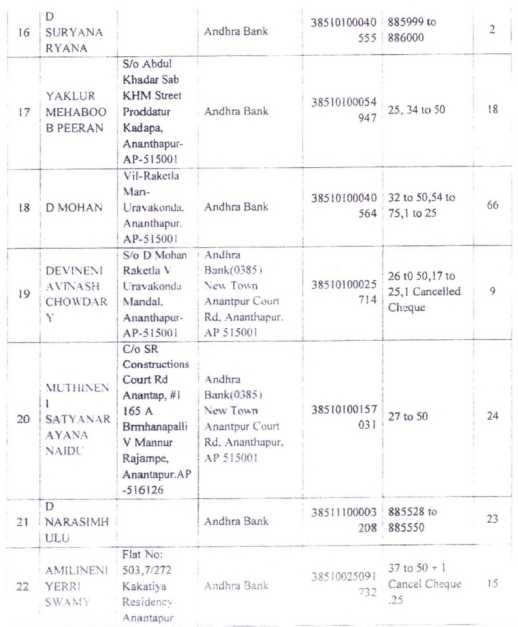

6. After filing of return of income notice under section 143(2) of the Act was issued to the assessee on 06.10.2018 and subsequently other statutory notices were issued to the assessee. Assesseefileddetailed submissions. After examining the detailed submissions of the assessee the AO issued show cause notices on 22.11.2018 and 28.11.2028 observing that admitted undisclosed income of Rs.8.35,45,883/- and Rs.16,78,53,440/- for Assessment Years 2015-16 and 2016-17 were not disclosed in the return of income. During the course of search proceedings in the premises of Ananthpur Office, one green colour bag containing signed and unsigned cheque books of some of the Subcontractors were found. These cheque books were kept at Ananthpur Office for the sake of convenience (as per statement of sub contractors) due to the fact that various sub contract works were located in remote areas where there was no access for banking facility. During the course of search a list of 22 sub-contractors was prepared whose cheque books were found as per question answer No. 08 of the statement recorded of Shri Devineni Venkatesulu recorded u/s 132(4) of the Act.As per question No. 12 a list of sub-contractors payment made for the F/Y 2014-15 and 2015-16 of Anantpur was prepared and total payments made during the F/Y 2014-15 and 2015-16 was quantified at Rs. 5,90,22,934/- and Rs. 9,07,73,475 respectively and were proposed to be treated as bogus expenditure by the search team. Further for Bangalore office list of 16 sub contractors were prepared and amount of Rs. 8,02,99,533 and Rs. 11,76,,85,393 for the F/Y 2014-15 and 2015-16 respectively was sou moto prepared by the assessee as per question answer No. 10 of Surendra Babu on 25.11.2016.

7. The authorized officer based on the bank pass books and signed & unsigned cheque books found in the green bag near bathroom attached to Shri. Venkatesulu Devineni Cabin which is also used by the other partners in the office of SRC, Ananthpur, identified the list of eleven (11) suspected subcontractors and carried out further enquiry. The details of the list of SubContractors are as below :

| SI No. | Name of the Subcontractor | AY 2014-15 | AY 2015-16 |

| 1 | ShrL A Lakshmi Naidu | 44,32,911 | 52,37,437 |

| 2 | Shri. A Sreeramulu | 38,50,760 | 92,72,621 |

| 3 | ShrL A Yemsivamy | 49,16,250 | 89,36,047 |

| 4 | Shri. B Chandra Sekhar | 44,86,736 | 94,25,895 |

| £ – | Shri. D Surya Narayana | 90,65,925 | 66,12,583 |

| 6 | Shri. K Sree Rami Reddy | 55,15,830 | 73,17,497 |

| 7 | Shri. M Venkateswara Naidu | 72,07,180 | 52,04,610 |

| 8 | Shri. Chakrapani | 43,71,189 | 90,78,587 |

| 9 | Shri. D DhramaTeja | 51,79,696 | 66,27,341 |

| 10 | Shri. D Avinash Chowdary | 81,84,117 | 1,55,66,291 |

| 11 | Shri. Y MahaboobPeeran | 18,12,340 | 74,94,566 |

| Total | 5,90,22,934 | 9,07,73,475 |

8. The statement of one of the sub-contractor Shri Avinash Choudhary was recorded under section 132(4) of the Act on 23.11.2016 and as per question number 17, 18, 19 and 20, he stated that he has not received any work order from SRC, he has not maintained any RA bills & any invoices which is done directly by the company. He further stated in his statement that he didn’t have any documentary evidence to substantiate the work. However, he confirmed that he had executed sub-contractor work for SRC.

9. Further, Shri. S Ravinder who is a bank employee working as Cashier of Andhra Bank, New town branch, Ananthpur was summoned and his statement was recorded under section 132(4) of Income Tax Act on 23.11.2016. In his statement Shri. S Ravinder has stated that bearer cheques are carried by the regular employees of SRC withwhomthey have daily transactions. He stated that as per rule, bank is supposed to take the copy of Photo ID, contact number and signature for any amount more than Rs. 50,000/ – for cheque clearances for bearer cheques. He further stated that he knows persons of SRC who carry many bearer cheques and at regular basis he does not take Photo ID proof. He submitted copies of both sides of bearer cheques encashed by the employees of SRC.

10. Further, during the course of search based on 8 bearer cheques produced by cashier of Andhra bank, one of the labour contractors Shri. G Ramarao was summoned under section 131 of the Act and his statement was recorded on 23.11.2016. In his statement under section 131 of the Act he stated that he is a small time labour contractor and receives Rs. 50 to 60 thousand every month. He further stated that wherever SRC people say he will sign and keep all the cheque books with SRC and all the things are managed by them only. He further stated that he doesn’t maintain any books of accounts and everything is managed by SRC.

11. Further the statement of Shri. Venkatesulu Devineni was recorded on 25.11.2016 confronting him with the evidences and statements recorded in Ananthpur office of SRC, the signed and unsigned cheque books, statements of Shri. Avinash Choudary, Shri. Ravinder and Shri. Ramarao. He was asked why all the eleven sub-contractor of Ananthapur Office found in the office premise of SRC should not be treated as bogus contractors payments and should not be taxed as undisclosed income in the hands of SRC for the respective Assessment Years. Shri. Venkatesulu Devineni in his statement dated 25.11.2016 has stated that right now he is not in a position to prove the genuineness of the sub contractors in the absence of suitable documents, he admitted undisclosed income of Rs.5,90,22,934/- and Rs. 9,07,73,475/ – for Assessment Years 2015-16 and 2016-17 respectively in the hands of SRC.

12. Further during the course of search and seizure in the office premises of SRC, Bangalore, based on the findings in the office premises of Ananthpur office, Shri. Rajagopal and Shri Surendra Babu were confronted and they were asked to produce list of bogus sub contractors. In their statement on 25.11.2016 under section 132(4) of the Act, Shri. Rajagopal Muttineni and Shri Surendra Babu agreed and declared undisclosed income of Rs.8,02,99,533/- Rs.11,76,85,393/- and Rs.4,97,63,178/- for Assessment Years 2015-16, 2016-17 and 2017-18 respectively in the hands of SRC.

13. It is seen from their statement that a list of additional 16 sub-contractors was prepared by Shri. Rajagopal Muttineni, partner of SRC which were used by them to claim bogus expenditure in the guise of sub-contracting. This statement under section 132(4) of Income Tax Act of Shri. Rajagopal recorded on 25.11.2016 is signed by both Shri. Rajagopal Muttineni and Shri. Surendra Babu Amalineni. In his statement dated 25.11.2016 under section 132(4) of the Act Shri. Rajagopal Muttineni was asked to produce the bogus subcontractors list. He stated that because of operational difficulties the documents related to sub-contractors are maintained by them. He stated that in the statement of Shri. Venkatesulu Devineni a detailed answer has already been given about the usage of cheque books of sub-contractors and submitted the list of l6additional sub-contractors for disallowance for Assessment Years 2015-16 and 2016-17 in answer to Q.No.10. Further statement of Shri. Venkatesulu Devineni was shown to Shri. Rajagopal Muttineni and Shri. Surendra Babu Amalineni and asked why the expenditure claimed against the bogus sub-contractors as stated by Shri. Venkatesulu Devineni and Shri. Rajagopal Muttineni himself should not be disallowed for Assessment Year 2017-18 also. Shri. Rajagopal Muttineni voluntarily agreed to disallow the expenditures claimed by them against 27 sub-contractors (11 Ananthpur office and 16 additional sub-contractors as per Q.No.10 in Bangalore office) for Financial Year 2016-17 till date of search. Covering all the subcontractors declared at both Ananthpur office and Bangalore office, Shri. Rajagopal Muttineni declared undisclosed income of Rs. 13,93,22,467/-, Rs. 20,84,58,868/ – and Rs. 4,97,63,178/ – for Assessment Year 2015-16, 2016-17 and 2017-18 respectively in the hands of SRC.

14. Based on the above statements under section 132(4) of the Act of various persons (partners, employees, sub- contractors and bank cashier third party), the above amounts were treated as undisclosed income in the hands of SRC and a show cause notice was issued to the assessee. Assessee filed detailed written submissions, replied to every objection raised by the AO and after considering entire submissions of the assessee, the AO made addition of Rs.8,35,45,883/- which is difference amount of income declared during the statement recorded under section 132(4) of the Act and additional income offered by the assessee in the return filed under section 153A of the Act of Rs.5,57,76,580/- for the Financial Year 2015-16 and for Assessment Year 2016-17 disallowed by the AO of Rs.6,78,05,420/-. After considering the additional income declared by the assessee under section 153A of the Act completed assessment on 30.12.2018 for both the Assessment Years.

15. Aggrieved from the above Order, assessee filed appeal before the learned CIT(A). The learned CIT(A) partly allowed appeal of the assessee.

16. Aggrieved from the above Order, assesseeand Revenue are in appeal before the Tribunal.

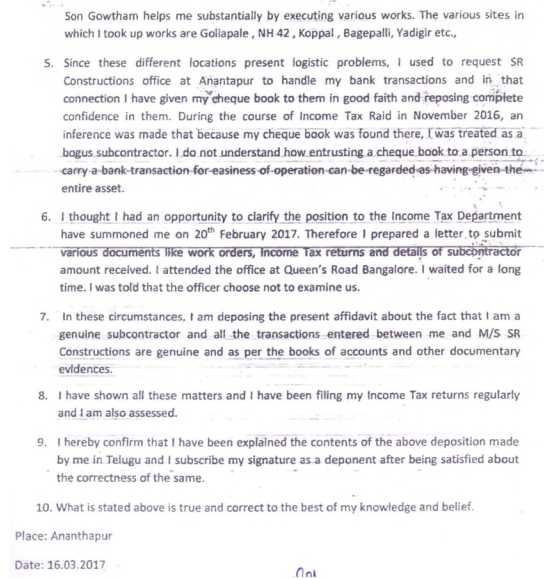

17. The learned Counsel reiterated the submissions made before the AO as well as CIT(A), statements recorded during the search and post search proceedings and filed written synopsis which is as under:

“FACTUAL BACKGROUND:

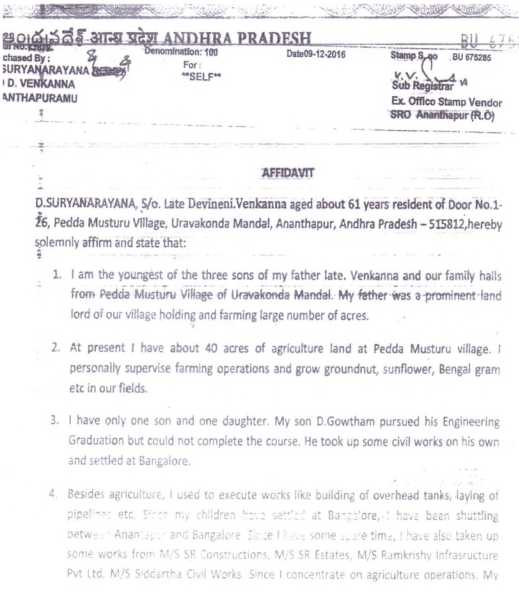

| 1. | | Appellant, a partnership firm, is in the business of carrying out civil construction contracts including roads and irrigation, primarily for Government departments for the past 27 years. Appellant’s registered office is in Anantapur, and they have their corporate office at Bangalore where the accounts are maintained for the works carried out. The partners of the Appellant are: |

| (a) | | Sri. D. Venkatesulu, based at Anantapur |

| (b) | | Sri. M Rajagopal, based in Bangalore |

| (c) | | Sri. A. SurendraBabu, based in Bangalore |

| 2. | | There was a search u/s 132 of the Act carried out by the Income Tax Department between 23/11/2016 and 25/11/2016 at Bangalore and Anantapur. |

| 3. | | During the search, no unexplained or unrecorded cash, bullion, or other valuable article or movable or immovable assets or documents were found either at Bangalore or Anantapur. |

| 4. | | During the search in Anantapur, one green bag containing certain cheque books of some of the sub-contractors was found. The Appellant engages sub-contractors for carrying out some of the works for which regular payments are made through banking channels after deducting TDS. Based on the chequebooks found in the premises of the Appellant at Anantapur, the visiting search team started suspecting that the payments to sub-contractors were not genuine. Thereafter, the entire case came to be built by the search team on this surmise. |

| 5. | | It was explained by the partners in the very first instance that these cheque books were kept at Anantapur office for the convenience of the sub-contractors since works were being executed by these subcontractors in remote areas with no banking access. Sub-contractors engaged labour and required cash for payments of wages and expenditure on site facilities, and therefore the staff of the Appellant in Anantapur used to help these sub-contractors by withdrawing cash and making disbursements as directed or desired by the respective subcontractors. |

| 6. | | The search team surmised that the transactions with the subcontractors were not genuine. They obtained a bank cashier’s statement confirming withdrawals from the bank account of the sub-contractors by the staff of the Appellant at Anantapur, a fact which was never denied. This does not constitute incriminating evidence to justify any adverse inference especially when there is no material found to show that the cash withdrawn from the banks flowed back to the Appellant firm. Partner of the Appellant firm, Sri D. Venkatesh, based at Anantapur, explained the reasons for the presence of the cheque books and cash withdrawals made contemporaneously in his statement dated 24/11/2016. (pages 61-74 of the paper book Volume 1). |

| 7. | | However, search team obtained statement from sub-contractor G. Rama Rao u/s 132(4) dt. 23/11/2016. G Rama Rao’s answers were clear until Q.19, but from Q.20 onwards, under pressure and references to penal provisions, the tenor changed. (pages 88-92 of the paper book Volume 1) |

| 8. | | The search team has taken statement from another subcontractor D Avinash Chowdary (pages 83-87 of the paper book Volume 1). A common theme that runs through the statements of both these subcontractors is that they have never denied the fact of carrying out the sub-contracts and receipt of the money. However, D. Avinash Chowdary made certain statements that contradicted the existing evidence at the instance of the search team but clarified later through an affidavit, confirming partnership in Dharma Constructions and existence of work orders/RA bills (many of these documents formed part of the seized material). (Affidavit of D. Avinash Chowdary is in pages 252-257 of paper book Volume 2) |

| 9. | | Showing these confused statements of the sub-contractors, the search team recorded the statement of partner D. Venkatesulu u/s 132(4). In the statement, he agreed to disallow all payments made to 11 sub-contractors for FY 14-15 & FY 15-16. |

| 10. | | Thereafter, the search team examined both the Partners M. Rajagopal and A. Surendra Babu at Bangalore on 25/11/2016. Statement is placed at pages 75-82 of the paper book Volume 1. While examining the Partners at Bangalore, the Department desired that additional income be offered by estimating the total income at 8% of the turnover. When the disallowance offered by D. Venkatesh did not tally with the pre-determined 8% of turnover, partners at Bangalore were confronted, and a larger disclosure was obtained on 25/11/2016, covering 16 additional sub-contractors (even without cheque books being found), cash payments, diary entries, and extending the period to FY 16-17 as well. |

| 11. | | The very manner in which statements are taken shows that there was a pre-set target at quantum of income which is not based on any evidence or material irregularities found and documented at the time of search. |

| 12. | | It has all through been submitted by the Appellant that the offer of income at the time of search is not admission of any wrongdoing but only to buy peace, and since the offer of income is in the wee hours of the third day of the search, it cannot be considered as out of free will or voluntary. |

| 13. | | In all statements of the Partners, they never admitted that the sub-contractors were bogus; they consistently sought time to verify records before answering. The prolonged search was only to extract a pre-decided disclosure, not based on facts or materials. |

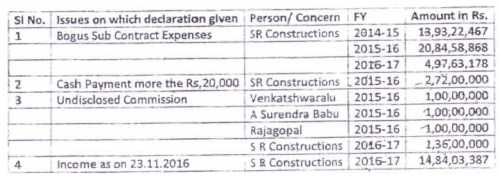

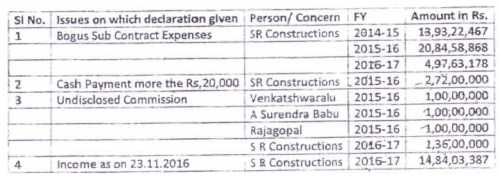

| 14. | | In all, the total additions that were taken in the statement u/s 132 is as below which were across FY 2014-15, FY 2015-16, FY 201617: |

| SI No. | Issues on whch declaration given | Person / Concern | FY | Amount in Rs. |

| 1 | Bogus sub contract expenses | SR Constructions | 2014-15 | 13,93,22,467 |

| | | 2015-16 | 20,84,58,868 |

| | | 2016-17 | 4,97,63,178 |

| 2 | Cash payment more the Rs. 20,000 | SR Constructions | 2015-16 | 2,72,00,000 |

| 3 | Undisclosed Commission | Venkatshwaralu | 2015-16 | 1,00,00,000 |

| | A Surendra Babu | 2015-16 | 1,00,00,000 |

| | Rajagopal | 2015-16 | 1,00,00,000 |

| | SR Constructions | 2016-17 | 1,36,00,000 |

| 4 | Income as on 23.11.2016 | SR Constructions | 2016-17 | 14,84,03,387 |

RETURN FILED AFTER SEARCH:

| 15. | | Despite the fact that the Appellant believed all sub-contractor payments were genuine, the Partners of the Appellant were conscious of the fact that they had admitted to offer income at 8% of turnover to cover for any errors or omission or commission. They also desired to purchase peace and avoid any protracted litigation. Hence, while filing the return of income u/s 153A for AY 15-16 and AY 16-17, certain additional income came to be disclosed. The following is the original income declared, and the additional income declared for AY 15-16 and AY 1617 (returns are placed in pages 134-195 of the paper book Volume 1: |

| Income as per Returns filed | AY 15-16 | AY 16-17 |

| Returned u/s 139(1) | 9,63,69,550 | 11,77,58,180 |

| Returned u/s 153A | 15,21,46,130 | 18,55,63,600 |

| Additional income offered u/s 153A | 5,57,76,580 | 6,78,05,420 |

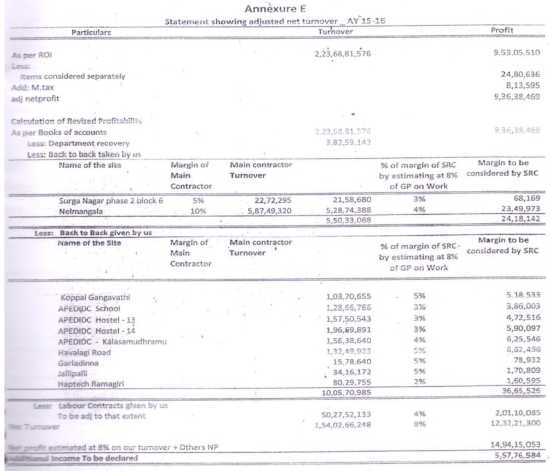

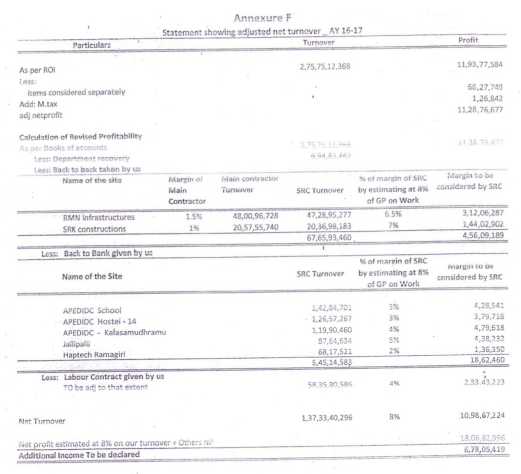

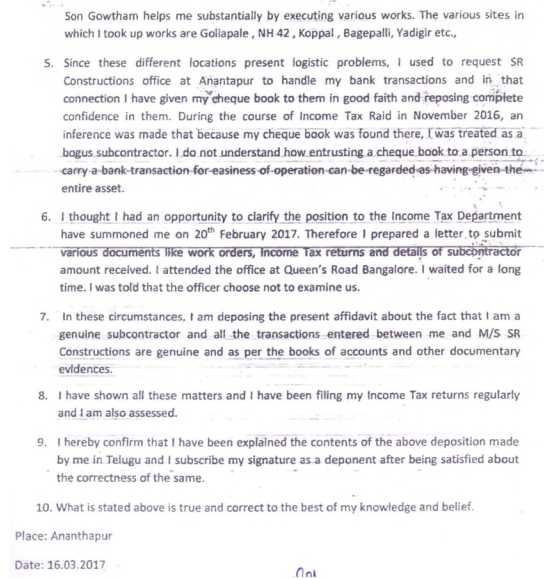

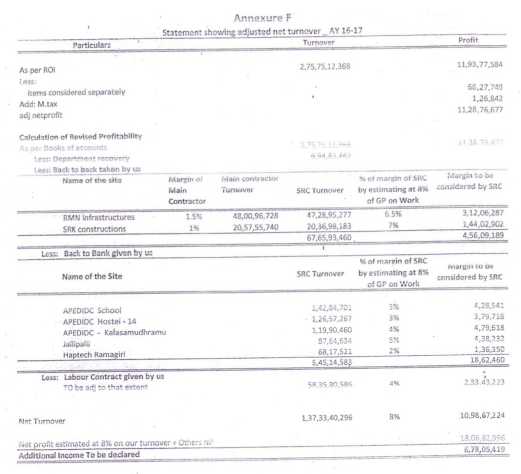

| 16. | | The above income was declared to honour the commitment to the search team, by estimating income at 8% of adjusted turnover (after excluding fixed-margin back-to-back contracts where margin is much lower). The declared income does not represent real income or assets; it was offered only to honour the declaration and cover any deficiencies in proof. Calculation of adjusted turnover is in the paper book Pages 1403 to 1405 of Paper book Volume 7. |

ASSESSMENT PROCEEDINGS:

| 17. | | In course of the assessment proceedings, the Appellant’s stand was that all the sub-contractors are genuine; disclosure was only to buy peace, quantum was forced at 8% of turnover as there was no incriminating material. |

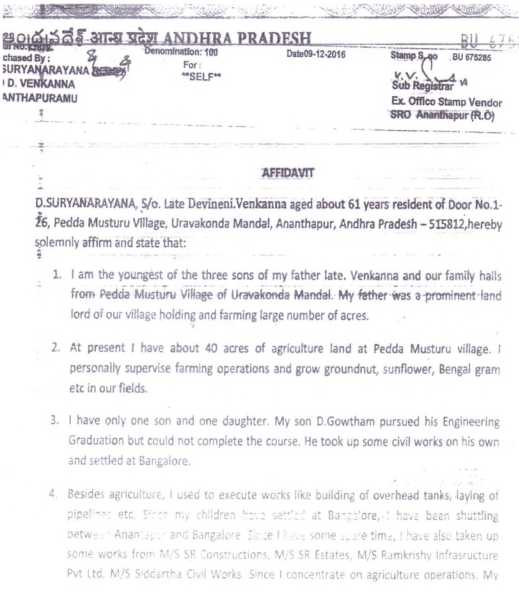

| 18. | | To establish the genuineness of sub-contractor payments the Appellant has filed substantial documentary evidence by way of work orders, RA bills, tax returns, audit reports where applicable, and affidavits from all sub-contractors affirming that works carried out were genuine, and not just confirmation letters. Many of these documents were also found during the search and formed part of the seized materials. These are submitted as paper books Volumes 2-7. |

| 19. | | It is pertinent to mention that after these affidavits were filed by the sub-contractors, the LAO did not choose to examine these subcontractors on their affidavits. Thus, there is no material gathered by the LAO to contradict the averments made on oath in the affidavit and hence having regard to the judgment of Hon’ble Supreme Court in the case of Messrs Mehta Parikh & Co v. The Commissioner of Income-Tax (1956 AIR 554), the evidence in the affidavit cannot be discarded. |

| 20. | | Apart from the above, the following facts were also stated to bring out the genuineness of the contentions: |

| (a) | | No undisclosed money, bullion, jewellery, valuables, assets, or entries were found; even the diary entry arose from mistaken advice post-demonetization. The additional income was offered solely to pay taxes. |

| (b) | | Only 2 contractors were examined. No cheque book of G. Rama Rao was found, and though a statement was recorded from G. Rama Rao, no addition was made for payments made to G. Rama Rao though the same was used to obtain a statement from the Partner. |

| (c) | | Out of 27 sub-contractors whose payments were disallowed, only one sub-contractor was examined. The other 26 were not examined, despite issuing summons to many of them at the time of search (see page 120-133 of paper book Volume 1 where summons issued u/s 131(1A) by the investigation wing is placed). On 20/02/2017, despite full attendance by the summoned sub-contractors, the Department abandoned the process. Sub-contractors later deposed affidavits before a notary, as no opportunity was given to state facts before the department. (Affidavits are in pages 252-328 to of the paper book Volume 2). |

| (d) | | Similarly, 5 sub-contractors were summoned on 13/12/2018, and these sub-contractors attended the summons on the appointed date, but that process was also not completed by the Department. (Summons are in pages 1594-1604 in paper book Volume 7). |

| (e) | | During the assessment proceedings the LAO tried to examine some of the vendors of the Appellant (not related to sub-contract payments) without the knowledge of the Appellant (such as M/s Valmiki Constructions, C. Ranganath, B. Pradeep Reddy, and P. ChowdaReddy). When it was found that there is no discrepancy, the department ignored the same and did not mention any such verification. |

| (f) | | In light of the above, every time the department attempted to investigate, it became increasingly clear that the evidence is in favourof the Appellant’s version, and the surmises of the department are without any basis. This shows that the department failed to substantiate its allegation that they were bogus sub-contractors. |

CONTENTIONS:

| 21. | | It is the Appellant’s case that the statements made u/s 132(4) were not based on any incriminating material or evidence found during the search barring the green bag containing cheque books found at Anantapur. Even that have been explained by the Appellant, and nothing incriminating results therefrom. On the contrary, the voluminous evidence filed by the Appellant in the course of assessment brings out the genuineness of the sub-contractors and clarifies the factual position. |

| 22. | | The Appellant has never denied that the employees of the Appellant are assisting the sub-contractors to carry out their obligations. However, this was explained along with the context in which this support was given to the sub-contractors which was not accepted by the Department on suspicion and surmise. |

| 23. | | No material has been gathered by the Department even after search to show that payments made to the sub-contractors were bogus. No material has been adduced to show that the cash withdrawals from the bank account of the sub-contractors had flown back to the Appellant firm. |

| 24. | | No opportunity for cross-examination whatsoever was given to draw any adverse inference based on the initial statement. |

| 25. | | Even clerical errors, non-cash payments and transactions such as material recoveries etc., are ignored which shows the mechanical and summary nature of proceedings and non-application of mind. |

| 26. | | Summary tables showing the details and abstracts of work carried out by the sub-contractors for AY 15-16, AY 16-17, AY 17-18 is in pages 573-599 of the paper book Volume 3. This gives the description of the work carried out by them, and the extent of the payments made. |

| 27. | | Summary and break-up of contractors whose cheque books were found, not found, are shown in Page 2149 and Page 2177 of the paper book Volume 8. |

| 28. | | No action was taken by the Department against the so-called ‘bogus’ sub-contractors u/s 148 or other provisions of law except for issuing summons and abandoning the process thereafter. In fact, all the sub-contractors have filed returns of income and paid taxes on their profits. It is also submitted that neither the Appellant nor the subcontractors have ever been blacklisted by the Government. |

| 29. | | Details of the material recoveries and other fund utilization by the sub-contractors was also explained before the CIT(A) in pages 2129-2147, pages 2151-2170, and pages 2173-2176 in paper book Volume 8, which are summarized here_ for ready reference: |

| SR Constructions – AY 2015-16 | Amount (Rs) | SR Constructions – AY 16-17 | Amount (Rs) |

| Declaration made in statement (A) | 13,93,22,463 | Declaration made in statement (A) | 20,84,58,869 |

| Less: | | Less: | |

| Cheque books not found | 3,70,58,246 | Cheque books not found | 5,90,17,292 |

| Clerical mistakes | 56,78,792 | Clerical mistakes | 62,19,713 |

| Other than cash utilization of contractors | 1,04,00,000 | Other than cash utilization of contractors | 2,07,00,000 |

| Material and hire recoveries | 36,20,304 | Material and hire recoveries | 3,61,64,620 |

| Incomes offered by sub-contractors | 69,13,881 | Incomes offered by sub-contractors | 80,92,433 |

| TDS | 13,93,000 | TDS | 14,94,000 |

| Total non-cash items of 20 sub-contractors (B) | 6,50,64,223 | Total non-cash items of 20 sub-contractors (B) | 13,16,88,058 |

| Balance amount (A-B) | 7,42,58,240 | Balance amount (A-B) | 7,67,70,811 |

| Already offered in 153A return | 5,57,76,580 | Already offered in 153A return | 6,78,05,420 |

| 30. | | At least half the declared amount does not even qualify for being disbelieved, and cash withdrawals are also inevitable since labour is essential for executing works. The expenditure is thus not improbable. Yet, to honour its word and in the spirit of cooperation, the Appellant made a substantial disclosure, expecting that no further liability would be imposed. |

| 31. | | Even for the sake of argument, while vehemently denying, it is considered that the amounts withdrawn from the bank account of the sub-contractors with the assistance of the Appellant’s employees was not expenditure, a substantially similar quantum has been offered as additional income while filing return u/s 153A by estimating income at 8% of the adjusted turnover. So, there cannot be any further additions made. |

| 32. | | CIT(A), while disposing the first appeal, partially accepted the contention of the Appellant to the extent of payments made to subcontractors in whose case cheque books were not found at the time of search. CIT(A) has confirmed the addition, principally relying on the declaration u/s 132(4) which he states is corroborated by the cheque books found. CIT(A) while accepting that the statement of the Partner Sri. A. Surendra Babu (page 75-82 of paper book Volume 1) is not backed by evidence, has only granted relief in respect of contractors whose cheque book was not found. |

| 33. | | Both LAO and CIT(A) have disregarded the explanation of the Appellant as well as the voluminous evidence showing the genuineness of sub-contractor payments, and clarificatory affidavits, which does not stand impeached. The LAO did not consider the reply letters dated 20/12/2018, 21/12/2018, and 24/12/2018, and only considered the letter filed on 07/12/2018 (Letter dt. 30/11/2018). The LAO did not even consider the clerical mistakes while completing the assessment. |

| 34. | | The LAO did not reject the books of account, and the additions are made solely on the basis of statements recorded u/s 132 without corroborative evidence. |

| 35. | | It is pertinent to note that the LAO accepted the calculation at 8% on adjusted turnover for the AY 2017-18 and completed the assessment by accepting the return filed u/s 139(5). However, the same calculation of 8% was not accepted for AY 2015-16 and AY 2016-17. The original and revised ITRs filed for AY 2017-18 and the Assessment Order are enclosed as Annexure 1 to this Synopsis. Thus, the manner in which the Appellant has computed and offered income post search has been accepted by the Revenue and therefore it is not open to partially reject the same and make disallowance of any expenditure claimed especially when income has been offered on estimated basis as explained in paragraph 15 supra. |

| 36. | | No new evidence was filed before the CIT(A). The CIT(A), while granting reliefs for clerical mistakes, sub-contractors where cheque books were not found, and payments to government, has sustained most of the additions made by the LAO. |

| 37. | | There is no real basis for the additions at all except by reference to statement u/s 132(4) which itself is not based on any material. In this regard, Appellant has relied on several judgments which are listed out at Page 1732 of the Paper Book Volume 8. |

| 38. | | Once the additions are made on an estimated basis, there cannot be further addition on account of Section 40A(3) for AY 16-17. Regarding Ground No. 2 of this Appeal, the submissions made by the Appellant in respect of 40A(3) disallowance is available in pages 1406 to 1473 of the paper book Volume 8. None of the cash payments violate Section 40A(3). |

| 39. | | For AY 2016-17, in respect of the contractors for whom cheque books were not found, the CIT(A) has allowed only Rs 5.75 crore, but the actual figure of payment made to these sub-contractors is Rs 5.90 crores which is clear from the summary at Page 2149 of the paper book Volume 8. |

18. In addition to the above written synopsis, the learned Counsel submitted that during the course of search and seizure proceedings, no incriminating documents were found except the signed and unsigned cheque books. In the signed cheque books, there was no amount mentioned in favour of the assessee. It was just facilitating to the sub contractors of the assessee to withdraw the money for making payment to the labourers. The labourers are to be paid on weekly basis for their day to day works at the remote areas where there is no banking facility available. To save the time of the subcontractors and to fulfill the minimum requirement of labourers who are working in the remote area, assessee has provided cash facility to give the immediate payments to the sub contracts so that they complete the works within the stipulated time without wasting their precious time. He further submitted that RA bills, income tax return, audit report wherever applicable and sworn affidavits from 27 sub contractors, which is placed at Paper Book page no 265 to 328, affirming that works carried out were genuine and not just confirmation letters, were submitted during the course of assessment proceedings. Copy of ledger accounts were also submitted. The AO issued summons to the sub contractors but after recording statement from one or two sub contractors, he dropped the proceedings for recording statements from sub contractors which clearly shows that he was satisfied with entire payments made to sub contractors as the payments were genuine and there are no bogus payments. The moment account payee cheques are issued to the subcontractors, they are recorded immediately in the books of accounts of the assessee. Assessee declared during the search statement only to buy peace of mind. In case of Bangalore Office, no cheque books of any sub-contractors were found. During the course of appellate proceedings before the CIT(A), the entire objections raised by the AO were answered. The books of accounts are audited by CA and profit shown in the audit report has been accepted and there is no rejection of Books of accounts. If the payments made to the sub contractors are bogus or the assessee has received back money from the subcontractor, then some evidence should have been found and the AO could have rejected the books of accounts. All the sub contractors have filed their return of income, which is placed in the Paper Book at Pages 359 to 572 for AY 2015-16 and at Pages 600 to 894 for AY 2016-17. There is no proceeding pending against any sub contractors. The return of income shown by them has been accepted by the Revenue Department. Therefore, the addition made in the hands of the assessee as bogus expenditure is only on the basis of statement recorded during the course of search proceedings under section 132(4) of the Act of partners and others. No incriminating material was found during the course of search proceedings except the statements in which assessee has declared as undisclosed income which is not correct as per the judgement of the Hon’ble Apex Court in the case of Pr. CIT v. Abhisar Buildwell (P.) Ltd. ITR 212 (SC). Both these Assessment Years are unabated assessments and no assessment proceeding was pending on the date of search and the assessee filed return of income under section 139(1) of the Act. Assessee has voluntarily to buy peace of mind offered additional income and filed return of income in response to notice under section 153A of the Act. Search team wanted to get declaration of 8% profit on the turnover. While filing return u/s.153A, the assessee had declared 8% profit on its adjusted annual turnover as per working placed in Paper Book at Pages 1403 to 1405. Accordingly, the return has been filed.

19. It is an important fact that these sub contractors are income tax assessees for the various years, had declared Rs.1.01 Crores as net profit on a turnover of Rs.13.93 Crores. All these facts were not considered. All the contracts executed by the firm either by itself or in association with others are Govt contracts. Ift he figures given in the declaration are adopted the combined disclosed profit will be 11.85% for the Assessment Year 2015-16 which is not considered. Keeping in view the various submissions above, the transactions with subcontractors may not be treated as bogus or ingenuine. However, in the same breath, the assessee wishes to honour the spirit of the declaration given in the statement under section 132(4) of the Act. It is understood that basically, the visiting team was looking at taking a declaration of about 8% of the works executed as income against the actual incomes declared in the returns of income for the Assessment Year2015-168% on the total turnover of Rs.800 crores would be approximately Rs 64.00 crores. Thus, the total quantum of declaration is worked out as Rs. 64 Crores (i.e. 8%) less Rs 21.46 Crores =”Rs.42.54″ Crores. This Rs.42.54 Crores is taken in the following 4 components:

| Financial Year 2014-15 – | Rs.13.93 Crores |

| Financial Year2015-16 | – | Rs. 20.84 Crores |

| Financial Year2016-17 | – | Rs. 4.97 Crores |

| Financial Year2015-16 | – | Rs. 2.72 Crores |

19.1 Further, it was submitted that in this process, the original trigger for giving rise of suspicion, namely, the finding of cheque books at Anantapur office was considered. Therefore, names of the subcontractors whose cheque books were not found at Anantapur and names of some sub-contractors who are attached to the Bangalore office where no cheque books at all were found, were also taken into account to arrive at the quantum of declaration. Thus this declaration is not with reference to any money, bullion, jewellery or any amount found in the books of accounts or documentary evidence. Assessee was not fully agreeing with the search team to offer 8% on the turnover as estimated income for declaration purposes. The assessee has stated in the various statements that were recorded during the course of search that various aspects are required to be verified from voluminous documents and it requires time for the same. However due to the procedural exigencies of an income tax raid the visiting team has made some fast back of the envelope calculations to arrive at the figure of disclosure for these years. In the stressful and constraining circumstances at the time of search, the assessee did not have an idea about the quantum of figures and could not analyze the details properly.

19.2 After considering back to back contracts of works allotted to sub contractors on fixed margins, net profit @ 8% was arrived on the adjusted annual turnover of Rs.1,54,02,62,488/- which is Rs.5,57,76,584/- which has been offered for taxation in the return filed under section 153A of the Act for the Assessment Year 2015-16 and similar calculation was made for the AY 2016-17.

19.3 Thus, for AY 2015-16, the only addition was with reference to subcontractor expenses. As submitted hereinabove, the AO has solely rested his caseonforcibly extracted confessions u/s 132(4) but did not make any effort to consider the detailed answers and voluminous submissions made by the assesse. Simple extraction of assessee’s letter of submissions in the Assessment Order does not amount to considering the submissions therein. He has not discussed as to why the assessee’s submissions were wrong; and also why the AO has not considered the assessee’s submission on analysis of seized material and what are his observations on the facts and affidavits brought to his kind notice. Thus, it was stated once again that submissions made and the evidences produced to show that the sub-contractors are all genuine; that they have themselves carried out the works entrusted to them, the contemporaneous evidences, the corroborative evidences in the form of seized material, the analysis and summaries of the data which was found at the time of search. There are no after thoughts there are no additional evidences and no new submissions. Further, it was submitted that the assessee’s offer of additional income is with reasonable and consistent basis after detailed calculation.

19.4 As the visiting team observed that the assessee is having turnover of around Rs.250 Crores and executing several contracts, the figure of Rs.4.36 crores was not sufficient or commensurate with the size of the firm, the net profits offered are less than 8%, the search was continued and nothing suspicious was found. However, one bag containing a few cheque books of sub-contractors was found at the Ananthapur office. So, using this finding it is sought to be established that these sub-contractors may be bogus and since cash withdrawals are made by the assessee’s employees, the expenditure is considered as not allowable. Putting aside the merits of the matters, the quantum sought to the arrived to make the disclosure is 8% of the total turnover for 2 years namely FY 2014-15 & FY 2015-16.

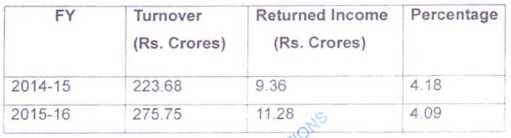

19.5 The following table shows the turnovers achieved and the net profit returned for the above 2 years.

So, the 8% profit on the combined turnover of 2 years of approx. Rs.499.50 Crores is Rs.39.96 Crores. After deducting the returned income of Rs.20.60 Crores for these 2 years, they wanted disclosure for Rs.19.36 Crores approximately. After deducting Rs.4.36 Crores already agreed, they arrived at a disclosure of about Rs.15 Crores which is taken from the partner D.Venkatesulu on 24.11.2016 (second day of search) at question no.12. The figures of Rs.5,90,22,934/- and Rs.9,07,73,475/- respectively for both the years which totaled uptoRs.14.97 Crores was arrived accordingly. Thus the disclosures taken u/s 132(4) are based on the estimated Percentages of the assessee’s turnover and not on the basis of any pin pointed evidence.

19.6 In the assessee’s case, substantial chunk of work entrusted to subcontractors is the labour component. As explained in the various submissions the main reason for entrusting work to sub-contractors is the difficulty of managing labourer. Unless a responsible stake holding person closely supervises the labour or workmen, there will be a number of issues arising like slackness in work, absenteeism, switching loyalties etc., When works containing labour components are awarded, the rates of the constituent workmen like mates, females, masons, mazdoors, Skilled, unskilled semiskilled, experience etc., will be considered and the prevailing rates for the required personnel will be decided and accordingly the rates will be awarded for the respective works.

19.7 As regards the cash and non cash components of the withdrawals of Shri D.Avinash Chowdary for the FY 2014-15 it is found from the income tax returns of the person, that he was undertaking the contracts from other firms also. His total turnover is Rs.105.51 Lakhs out of which work executed for SRC is about Rs.82 lakhs. Based on the bank statements provided and submitted the total debits of his bank account summed uptoRs.136.84 Lakhs out of which Rs.96.84 Lakhs is Cash and Rs.40.01 lakhs are non cash payments. As per his income and expenditure particulars about Rs.42.66 Lakhs are labour payments and other payments which normally require cash are Gravel, Sand, Stone/Metal are Rs.37 Lacs.

19.8 As regards the cash and non cash components of the withdrawals of Shri D. Avinash Chowdary for the FY 2014-15 it is found from the income tax returns of the person, that he was undertaking the contracts from other firms also. His total turnover is Rs.195.47 Lakhs out of which work executed for SRC is about Rs.155 66 lakhs. Based on the bank statements provided and submitted the total debits of his bank account summed uptoRs.122.51 Lakhs out of which Rs.81.78 Lakhs is Cash and Rs.40.73 lakhs are non cash payments. As per his income and expenditure particulars about Rs.107.41 Lakhs are labour payments and other payments which normally require cash are Gravel, Sand, Stone/Metal arc Rs.60.67 Lacs.

19.9 Thus It cannot be said that entire contract receipts have been spent only in cashor as they have not executed any works as they have far too many transactions in their books which they have submitted to income tax and sales tax authorities regularly. Thus the sub contractors cannot be either termed as bogus or expenditure incurred by them is ingenuine.

19.10 Thus the various works awarded to the sub contractors are all based on the contracts awarded to the assessee from its principals who are, in turn, based on estimates arrived at in line with the SSR or SOR rates. The same are also suitability applied by the assessee in its awarding to the works to the sub contractors. As these examples are given from the seized materials there is. nothing that can be considered as after thought or some made up explanation. The Profiles and the transactions of the sub contractors also are independent and cannot be considered as acting only for the assessee. Thus the offer made in the spirit of estimation of profit considering any short coming or ground realities due to the inherent nature of the business and especially on insistence of the visiting search team may be considered as sufficient requiring no further addition.

20. On the other hand, learned DR relied on the Order of AO to the extent of addition confirmed by the ld. CIT(A) and submitted that during the course of search proceedings, signed and unsigned cheque books were found in the business premises of the assessee at Ananthpur and statement of cashier has been recorded in which it has been clearly stated that amounts are withdrawn by staff of SRC on behalf of sub contractors and one sub contractor has accepted that entire amount withdrawn from the account of sub contractors are not given. It establishes that cash payments are bogus payments. The learned DR also referred to statements recorded of the partners and other persons. The learned DR relied on the Order of Hon’ble Apex Court in the case of Roshan Lal Sanchiti v. Pr. CIT ITR 229 (SC) and submitted that statement recorded during the course of search under section 132(4) of the Act has great evidentiary value. The amount declared during the course of search cannot be retracted. However, while filing return of income, assessee did not disclose the entire admitted income as undisclosed income. The statement itself is one kind of incriminating material since it establishes the transactions carried out by the assessee. The search team after admitting undisclosed income they stopped further search proceedings. Assessee furnished details of the sub contractors to whom bogus payments were made. Shri.D. Avinash Chaudhry was also examined and statement was also recorded under section 132(4) of the Act. From the statement of Shri. D.Avinash Chaudhry it is clear from question answer Nos.18, 19, 24, 25 that he is partner in M/s. Dharma Constructions and the statement of G. Rama Roa was also recorded. During the course of assessment proceedings, it is found from the Affidavits filed by sub contractors that the contents are common and that they will not be in a position to understand the entire business model or the circumstances of the business of SRC.

20.1 The presence of signed cheque books of the sub-contractors along with the statement of sub-contractors and the statements recorded from bank employees and also the employees of the assessee very clearly states that assessee is in the process of sub-contract inflation of expenses. The assessee is not maintaining documentary proof which was evidenced during search and post- search proceedings. Assessee did not provide details of sub-contractors and there were various statements recorded from the employees which are enclosed to this assessment order wherein, the quality surveyor Ms. Viajyaa Priya and Ms. Sindhu and Sri. D. Sridhar Sr. General Manager and Sri. Gummala Somashekar, Mechanical side supervisor have confirmed that the there were no proper documentation and bills were made afterwards. The returns of income of the sub-contractors are filed by one chartered accountant and most of the sub-contractors accounts are not audited. Further, this is the clear case of retraction and it cannot be accepted because of the ratios held in various case laws relied by the authorities. Hence once it is shown that the statement was voluntary then, the assessee cannot retract later, as held by the judgment of the Hon’ble Supreme Court in the case of Surjeet Singh Chhabra v. UOI (SC)/AIR 1997-SC 2560. Further there is no material on record to suggest the statement was given under a mistaken belief either of facts or law. The statement under section 132(4) has greater evidentiary value than statement given under other provisions of the statute. He also relied on the judgments in the case of P. R. Metrani v. CIT ITR 209 (SC), Awadh Kishore Das v. Ram Gopal AIR 1979 SC 861, Chennai the Hon’ble High Court of Madras in B. Kishore Kumar v. Dy. CIT (Madras). The cash withdrawn by the employees of SRC on behalf of sub contractors from the Ananthpur Office, genuineness of sub contractors could not be established.

20.2 During the course of search partners accepted that contractors are bogus and offered income during the course of search proceedings. This is nothing but a method to block the investigation and buy time from the Department. The admission is not defined in Income Tax Act. So, as per general clauses Act and Indian Evidence Act sections 16 to 21, admission is defined and it clearly lays a norm that once there is an admission on part of the assessee any investigating authority or courts need not go into the nitty-gritties and details. This is exactly the case in this assessee. He has agreed before the investigation wing and now before the AO he is disagreeing in the fag end of the assessment proceedings. The statement of the partners and staff were confronted to other partners also and all the partners agreed to disclose the income. This shows that assessee was maintaining the cheque books of Sub-contractors in his office and got the signature of them and withdrew cash which is used for personal or for making any inadmissible expenses.

21. In the rejoinder by the ld. AR he submitted that the documentary evidence explicitly confirms that they were submitted to prove the genuineness of sub contractors. The declaration taken by the Department at the time of search lacks consistency. For example, declaration has been taken where cheque books of the sub contractors were found and that the same logic cannot be extended to the case where no cheque books were found. In fact a huge amount of Rs.3.71 Crores is added by adding more sub contractors to the list where no cheque books were found. Similarly materials supplied to the sub contractors found in the bills were ignored as such transactions could not be treated as cash expenses. The total amount of material supplied or equipment given on hire to these sub contractors for various works executed by them is Rs.1.99 Crores.

21.1 He further submitted that the assessee has around 450 subcontractors on its panel. Based on the resource availability and their past performance in execution of similar nature of works the subcontractors are enrolled on to the panel. During the course of search and seizure after intensive search that took place, there are no unexplained assets or cash or any such symbols of hoarding/any valuable assets found. There are no suspicious papers either. On the contrary, various evidences were submitted in course of the assessment to dispel any lurking suspicion about the genuineness of the sub-contractors. He referred to the copies of the affidavits worn by all the sub-contractors, copies of their income tax returns and other papers that could be gathered relating to their individual state of affairs and where their accounts were subjected to tax audit, copies of the tax audit reports. Similarly, if they were subjected to any indirect tax compliances, such proofs were also submitted as per the detailed narrations given in Annexure D. While documentary evidence and explicit confirmations are submitted to prove the genuineness of the sub contractors, the declaration taken by the department at the time of search lacking consistence cannot be relied upon.

21.2 He submitted that during the course of assessment proceedings, the assesse filed Affidavits from all 27 sub-contractors after which they have not been examined by the AO and therefore, the contents of their Affidavits were correct and the AO was satisfied from the contents of the Affidavits. During the first appellate proceedings, the same documents were also produced before ld. CIT(A) and he also did not ask anything about the contents of the Affidavits. This clearly proves that both the Revenue Authorities have accepted the Affidavits filed by the sub-contractors. Therefore, the acceptance by the sub-contractors regarding receipt of full payments from the assesse and genuineness of the works carried out by them cannot be denied. The acceptance was made the partners of the assesse because of the pressure of search operations, which cannot be relied upon. The books of accounts have been accepted and not rejected. Therefore, the additions made by the AO on the basis of the statements are not sustainable. He also submitted that the case laws relied upon by the ld. DR are not applicable to the facts of the assesse’s case.

22. Considering the rival submissions, perusing the entire materials available before us and paper books filed by assessee counsel in 8 volumes, we noted that search was conducted at the Anantpur Office on 23.11.2018 and statements were recorded of the partners, staff of the assessee and other persons. During the course of search and seizure proceedings a list of 27 subcontractors were prepared (infra) and the payments made to these sub-contractors was accepted to be treated as undisclosed income during the search statements under section 132(4) of the Act. However while filing return of income under section 153A of the Act, the entire income offered at the time of search were not disclosed in the returns of income filed by the assesse and the AO made the addition for the difference amount that was not disclosed in the return under section 153A of the Act. He added it as bogus payment to the sub- contractors after considering the entire documents and statements recorded of the partners and various other persons. For the sake of convenience, we are reproducing some of the statements recorded and referred by both the parties which are as under:

Shri G. Ramaraoundersection131 of the Act, dated 23.11.2016

Q 7 Please state from whom you are taking contract work and what type of contract Work you are doing.

Ans. I am taking contract work of earthworks only. I have taken contract work from S R. Constructions only. I only do the work pertaining to SR Constructions and I do not do any other work on my own or sub contract to any other persons.

Q 09 Please give details of the contract regarding Gollapally reservoir like what was the contract amount, whether any agreement has been entered between you and S R Constructions and the mode of payment made by S R Constructions.

Ans. There is no lumpsum contract amount. The bills are made as per the work and is presented to the S R Constructions every fortnight. The site engineer checks the bill and is submitted to the office of S R Construction. Then the bill is cleared. The payment is by cheque only. No agreement has been made between me and S R Constructions. I have received approximately an amount of Rs.70-75 lakhs.

Q 10 Please state whether you are maintaining books of accounts.

Ans. No. I am not maintaining any books of account as my income is below the limit for maintaining books of account.

Q 13 Please state whether payments made to the labours with respect of work carried on by you will be made by you or any others.

Ans. I only make payments to my labourers working with me in respect of work done by me, I also confirm that no one else will be making the payments to my labourers make payments to laourers once in a week on every Sunday.

Q 14 Please state whether you have issued any bearer cheque to anybody?

Ans. I keep the signed cheque book at the office of S R Constructions at Ananthpur. The cheque leaves are signed by me and the staff of S R Construction present cheques on my behalf. The money is used to make payment to the labourers at sites.

Q 15 Please state the signed cheques which are being kept in the office of M/s S R Constructions are being crossed.

Ans. I would like to state that I only sign the cheque and hand over to Sri. Chakrapani, attender who is working in M/s. S R Constructions. I don’t cross cheque. All the cheque will be self cheque without date signed on back of the cheque also. At a time I will sign around 10-15cheques which will be kept with M/s. SR constructions.

Q 16 Please state the purpose of keeping self-drawn cheques being kept with M/s. SR Constructions.

Ans. Since I will not be in the city draw the cheque the same will be kept with Mis. SR Constructions. The same will be drawn on my instructions, which. I will be informing Sri. Venkatesh, Managing Partner regarding the amount to be withdrawn.

Q 18 Please confirm whether the whole amount drawn from your account from the blank cheque kept with M/s. SR Constructions will be handed over to you.

Ans. I confirm that whole amount drawn from the bank will be handed over to me without any deductions made.

Q 20 I am again drawing your attention towards the following provisions of the Indian Penal Code,

Sec 79 – Refusing to answer question.

Sec 181- giving / making false statement on oath

Sec 180– refusing to sign the statement,

Besides, your attention is also drawn to the following provisions of the Income Tax Act, 1961

Sec 275A Refusing to provide any password.

Sec 277A Enabling others to evade tax.

Any contravention of the above mentioned provisions shall attract penal action against you. In light of these provisions please state why the bearer cheques were presented by the employees of S R Construction and not by you. Do you have any evidence in support of getting the money so encashed by the staff of S R Construction.

Ans. As I was not there in the bank timing that is why I gave the bearer cheque to the S R Construction. After clearing the cheque, the S R Constructions will make the payment as I deserve and the rest amount is kept by S R Construction only. The payment is made by Shri A. Chakrapani. They will give me payment of Rs.50 or 60 thousand. I do not have any evidence for the receipt of cash.

Q 21. It is seen from the bank account of yours that in a single day cash withdrawal of around Rs.7 lakhs is done within a single day. Whereas in the answer to Q.No. 20 you stated that you get only Rs.5060 thousand. Please comment.

Ans. Sir, here I would like to state the truth that I am receiving Rs.5060 thousand only and the balance is kept by them. I am a small time labour contractor and I do this for my day to day living. Wherever they tell me to sign, I sign it and that is the reason why my cheque books are with them.

My sites are located at Gollapally Reservoir site. I supply around 20-25 labourers. For male labourers the payment is in the range of Rs.250 per day and for female labourer it is Rs.200 per day. I get in in equal numbers both male and female labourers. I do not prepare any bills or vouchers. These things arc prepared by S R Construction engineer at the site. Whatever they tell me to sign. I sign it in good faith. Hence I receive only part payment from S R Constructions.

Shri Devineni Venkatesulu u/s 132(4) dated 24.11.2016

Q 06 Kindly give specific details in case of sub-contract awarded to friend or relatives wherein how the sub contracting bills are made and how the payments are made and how the accounting is made.

Ans. Sir, not only friends and relatives but most of these sub contractor are in unorganized sector. As stated above most of our sub contracts are given for labour work. Usually they are the persons coming from different part of the state and also neighboring states who come with a group of labourers. As these people do not have an any resources to furnish the bills and maintain the accounts, we at our office help them to make the bills and submit the same to us. The payments are all made by way of RTGS or cheques by deducting the necessary amount to the sub-contractors. Bank accounts are also opened in our known bank itself i.e Andhra Bank, New Town Branch. Ananthpur. This is done to reduce the manpower and time wasted for bank work if the same bank accounts are opened in different. Also we have special facility of OD in which there is immediate transfer of amount from S R Construction bank account to the sub-contractor.

Q. 7 During the course of search, it was noticed that in a green bag several signed and unsigned cheque books were found near the bathroom attached to your cabin which is also used by other partners. Kindly describe the content in it.

Ans. This green bag was kept near the bathroom by the house keeping staff who had come for cleaning without knowing the contents kept in the bag. As stated in my earlier replies some of these cheque books belong to uneducated and illiterate and unorganized subcontractors who are dependent on us for their day to day activities including getting cash from the banks and giving it to them.

Q 08 In continuation to the Q.No.07, a detailed description has been made regarding the cheque books which is as per the chart below. Kindly go through the same and explain the contents in detail.

Ans. Sir as stated in my earlier replies. These cheque books belong to the sub-contractors who are friends, relatives and outsiders. Due to the business urgencies and other reasons stated in my earlier replies, the signed cheque books are kept in this office only to facilitate the smooth flow of business which is usually time-bound. These sub contractors supply majority of our labour force with whom our construction activities are done. Sir, you should understand in our field that government allocates different kinds of work in most interior parts where banks and post offices do not exist. Also most of the labourers are migratory for whom cash payments have to be made by the subcontractors for their daily wages for their day to day living. If one week payment is delayed these labourers shift their loyalties to other contractor as labourers are in very scarce and are in very much demand. Their demands have to be fulfilled in time. If you see most of our subcontracts, the sub contractors are operating in far flung remote places where material and other resources are not available. Hence these subcontractors need cash payments for whom we facilitate their cash payments. These cash payments are facilitated from our office.

Q 09 Kindly furnish the agreements or contracts signed between all the sub-contractors who are mentioned in the list at Q. No. 08.

Ans. Sir, these contracts are maintained in our Bangalore office and the same will be submitted in due course.

Q 12 On going through the sub-contractor list which has been mentioned at Q.No. 08, it is noticed that several sub contractors are either very close relatives or very associates or persons working in your organization. The list of the same is mentioned in the table below and also their labour contracts made during the F.Y. 2014-15 and 2015-16 have also been tabulated. In this regard why the total expenditure of Rs.5,90,22,394/- for F.Y. 2014-15 and Rs.9,07,731475/- for F.Y. 201516 should not be treated as bogus expenditure in the guise of subcontracting.

| Sl. No. | Name of the Subcontractor | 14-15 FY | 15-16 FY |

| 1. | A. Lakshmi Naidu | 4,432,911 | 5,237,437 |

| 2. | A.Sreeramulu | 3,850,760 | 9,272,621 |

| 3. | A. Yerrisamy | 4,916,250 | 8,936,047 |

| 4. | B. Chandra Sekhar | 4,486,736 | 9,425,895 |

| 5. | D. Surya Narayana | 9,065,925 | 6,612,583 |

| 6. | K. Sree Rami Reddy | 5,515,830 | 7,317,497 |

| 7. | M. Venkateswara Naidu | 7,207,180 | 5.204,610 |

| 8. | A.Chakrapani | 4.371,189 | 9.078,587 |

| 9. | D.DharmaTeja | 5,179,696 | 6.627,341 |

| 10. | D.Avinashchowdary | 8,184,117 | 15,566,291 |

| 11. | Y.Mahaboobperan | 1,812,340 | 7,494,566 |

| Total | 59,022,934 | 90,773,475 |

Ans. Sir, I will be declaring the same for the relevant F.Y. in the hands of M/s S R Constructions as income. Sir, I would like to request you to get confirmation of the same from the other two partners of S R Constructions i.e Shri A Surendrababu and Shri Rajagopal M.

Q 16 1 am showing you the brown folder A/SRC/ATP/03, A/SRC/ATP/04, A/SRC/A1T/05, A/SRC/ATP/06, A/SRC/ATP/07 and A/SRC/ATP/08 containing loose sheets found and seized during the course of search u/s 132 of the Income Tax Act at 7/272, Court Road, Kakteeya Residency, Ananthpur — 515001 on 23rd November 2016. Kindly go through the contents and explain the same.

Ans. Sir, 1 have gone through the contents and I confirm that the same has been found and seized from this premise. These seized materials pertain to cheque books signed and unsigned of various sub-contractors. The same has been explained at answer to Q.No.08 and 09.

Shri Rajagopal, statement recorded u/s 13132(4) dated 25.11.2016

08. l am showing the statement of Shri. Devineni Venkatesulu recorded during the course of search u/s 132(2) at M/s S.R. Constructions office premises located at 7-272, Court road, Anantapur on 24.11.2016. Kindly go through the same and also your attention is invited for the question No.12 wherein your partner Mr. Venkatesulu had declared an amount of Rs.5,90,22,934/- and Rs.9,07,73,475/- for the F.Y.2014-15 and F.Y.2015-16 respectively as the same are to be disallowed as Bogus expenditure in guise of sub-contracting and has agreed to pay the tax for which your consent is required.

Ans. Sir, we have gone through this statement of Mr. Venkateswaralu and we abide by his statement. We would pay the taxes for disallowed expenditure on sub-contracting amounting to Rs. 5,90,22,934/- and Rs.9,07,73,475/- for the F.Y.2014-15 and F.Y.2015-16 respectively.

Sir, we would like to state here that the said declaration is given purely on the basis that we are not in a position to furnish the required records as called by you. Further we would like to state that sub-contracting work is not completely bogus. But there are some instances we are not in a position to explain certain expenditure which have to be incurred for smooth running of business.

Q9. Does your concern SR Constructions at Bangalore also follow the same modus operandi with respect to sub-contracting of works to your close associates, friends, relatives and employees as illustrated in the statement of Shri. Devineni Venkatesulu recorded during the course of search u/s 132(2) at M/s S.R. Constructions office premises located at # 7272, Court road, Anantapur on 24.11.2016.

Ans: Sir, as stated in our earlier reply and also the detailed explanation given by our partner Mr. Venkateswaralu in the said statement holds good. Here we would like to clarify there is no intention of evading the taxes nor doing any illegal works by creating disallowable bogus expenditure. The intention was to run the business smoothly which has been clearly illustrated by Mr. Venkateswaralu in his statement.

Q.10. You have been given an opportunity to give the complete list of bogus expenditure incurred in the guise of sub-contracting from financial year 2010-11 to till date. This opportunity is given u/s 132(4).

Ans. Sir, we started this firm in a very small way and we. have come up to this level by seer hard work and consistently improving upon our quality of work. There was a sudden jump in our trade In financial year 2014-15 where in new governments came to the bower at both State and Centre. Hence there was a complete change in the approach of-the government contracting business. From F.Y. 2014-15 there has been some expenditures which cannot be explained. Further I would also like to state that in our business majority of the labourers are sent by the subcontractors with whom our construction activity is done. The kind of work we do is very labour oriented and also these works are in the interior part of the state where banks and post offices do not exist. Hence the subcontractors have to carry sufficient amount of cash to do the day to day payments to these labourers. A detailed answer has already been given by our partner Mr. Venkateswaralu in his statement for withdrawing huge amount of cash by maintaining the cheque books of our office staff.

Below is the list of labour sub-contractors for F.Y. 2014-15 and 201516 which can be disallowed and I would abide to pay the tax accordingly arising from such disallowances.

We voluntarily declare an amount of Rs.8,02,99,533 and Rs.11,76,85,393 as undisclosed income for F.Y. 2014-15 and 2015-16 respectively to buy peace with the department.

Q11 From your response to question no 10, it is seen that from F.Y. 2014-15 there has been a change in your business module. in this regard you have declared undisclosed income for F.Y. 2014-15 and 2015-16 only. Kindly explain why the same sub-contractors as mentioned by yourself in response to question no 10 and also the sub-contractors mentioned by your partner Mr. Venkateswaralu in his statement should not be treated as bogus expenditure in the guise of sub-contracting.

Ans. Sir, I stated in our earlier responses not all sub-contracts for the same persons are bogus and I am voluntarily disallowing the below said expenditures to buy peace as per the chart below and pay the taxes accordingly.

| 27. Y MahaboobPeeran | 11,48,815 |

| Total | 4,97,63,178 |

We voluntarily declare an amount of Rs.4,97,63,178/- as undisclosed income for F.Y. 2016-17 respectively to buy peace with the department.

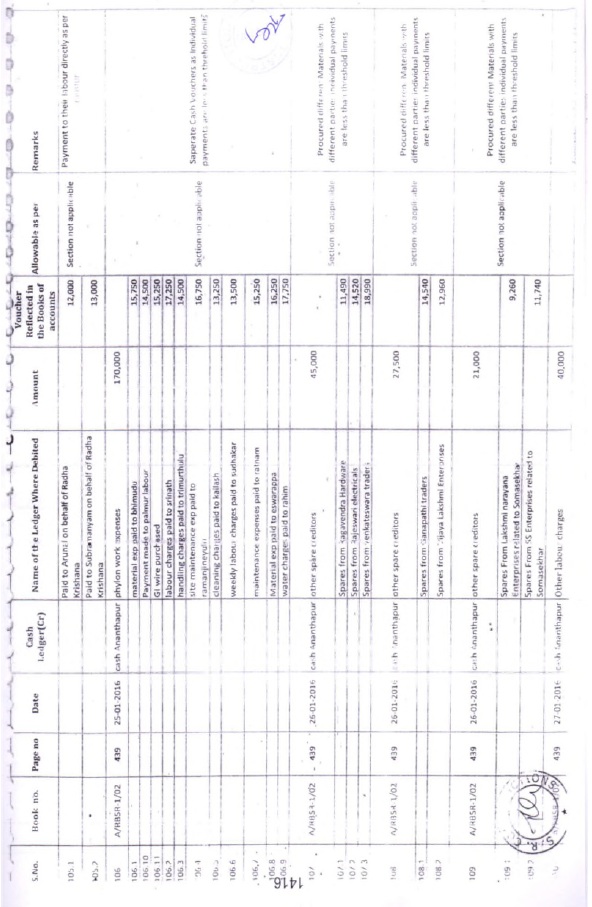

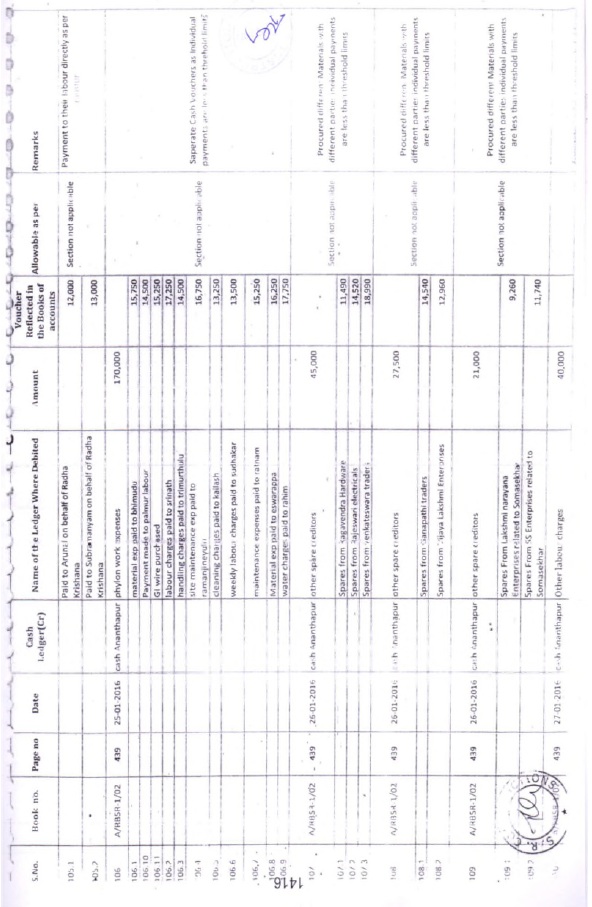

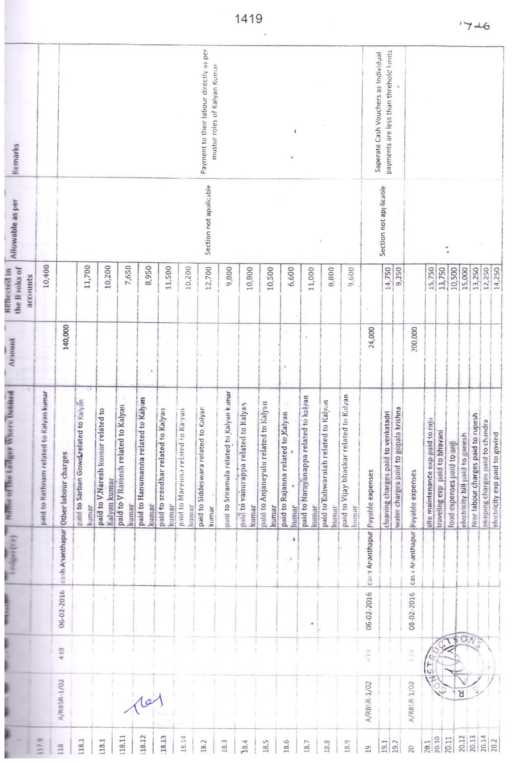

Q12. I am showing you the page numbers from 439 to 436 marked in Box folder A/RBSR-01/02 which was found and seized during the course of the search, wherein several cash payments amounting to Rs. 2.72 crores for F.Y 2015-16 has been found. Kindly go through the same and why the same should not be disallowed as per the provisions of IT Act and the same will be brought to tax

Ans. Sir, most of these payments were made in remote places as stated in my earlier replies where banks and post offices are not available in these remote places. But to buy peace we declare an amount of Rs. 2.72 Crs in FY 2015-16 and pay tax accordingly.

Q. 14. I am showing the statement recorded from Mr. N Harikrishnau/s 131 during the course of search, wherein he has clearly stated that cash of Rs. 1 crore was paid to yourselves and your other partner Mr. Venkateshwarlu. Please offer your comments why the same should not be treated as undisclosed income in your individual capacities.

Ans. Sir, all the three partners have received Rs. 1 crore each on 16.03.2016. This amount is out of the books one time commission received from different vendors. We offer the same as undisclosed commission for F.Y 2015-16 in our individual hands and taxes will be paid accordingly.

Q18. Do you have anything else to say?

Ans. Sir, we have completely cooperated with the department during the search proceedings and we have also voluntarily declared the undisclosed income as per the chart below. So kindly do not initiate any penalty proceedings.