ORDER

ITA No.670/Ind/2024 (Assessment Year 2017-18)

1. This is an appeal filed by the assessee Under Section 253 of the Income Tax Act, 1961 (hereinafter referred to as the “Act” for sake of brevity) before this Tribunal. The assessee is aggrieved by the order bearing Number ITBA/NFAC/S/250/2024-25/ 1065838986(1) dated 19.06.2024 passed by Ld. CIT(A) u/s 250 of the Act which is hereinafter referred to as the “Impugned order”. The relevant Assessment Year is 2017-18 and the corresponding previous year period is from 01.04.2016 to 31.03.2017.

2. FACTUAL MATRIX

2.1 That as and by way of an assessment order (quantum) bearing No. ITBA/AST/S/143(3)/2019-20/1023302634(1) dated 28.12.2019 (Assessment Year 2017-18) made u/s 143(3) of the Act, the total income of the assessee exigible to tax was computed and assessed at Rs.16,94,610/-. The return of income was at Rs.9,20,910/-. An addition of Rs.7,73,704/- was made on the ground of loss disallowed (House property). That the aforesaid assessment order is hereinafter referred to as the “impugned assessment order”. In the “impugned assessment order” issuance of a penalty notice u/s 274 r.w.s. 270A(1)/ 270A(9)(a) of the Act was contemplated too.

2.2 That as and by way of an order (penalty) passed u/s 270A of the Act i.e. “Misreporting penalty u/s 270A” a penalty of Rs.4,16,860/- was levied on the assessee being 200% of Tax on unreported income. That the aforesaid penalty order bears No. ITBA/pNL/F/270A/2021-22/1041697988(1) and that same is dated 26.03.2022 which is hereinafter referred to as the “impugned penalty order”. The core reason for levying penalty was recorded as under:-

“5xxxxAccordingly, the show cause notice u/s 274 r.w.s. 270A of the Income Tax Act, 1961 dated 29.11.2021 was served to the assessee. Assessee has furnished his submission through Eresponse on 01.01.2022 wherein, he has requested for immunity from penalty proceedings u/s 270A of the Act. However assessee has not furnished duly filled Form No. 68 required as per Rule 129 in accordance with the provisions of section 270AA of the Act for immunity from penalty proceedings u/s 270A. Assessee has submitted that due to some technical glitch while filing the return of income, the Annual Letting Value(ALV) of Rs. 1,80,000/-shown by the assessee has been reversed by the system. Assessee has quoted a few case laws in favour of his contention.

6. The reply of the assessee was perused and considered. Since the assessee has not furnished Form No. 68 required as per Rule 129 in accordance of the provisions of section 270AA of the Act for immunity from penalty proceedings u/s 270A, hence order u/s 270AA(4) cannot be passed in the case of the assessee and immunity from imposition of penalty cannot be granted to the assessee. The case laws quoted by the assessee have been considered but it is found that these case laws are distinct from the prevailing issues in this case hence, same are not applicable in this case.

7. The penalty proceedings were taken up online and another notice was electronically issued on the e-filing profile of the assessee on 17.11.2021. In response to the show cause notice issued, assessee furnished his reply on 01.01.2022 through EPortal. Assessee was again show caused vide notice dated 14.03.2022 as to why penalty u/s. 270A of the Act should not be levied for under reporting of income in consequence to misreporting. No reply was received from the assessee in response to notice issued on 14.03.2022.

8. Therefore, it can be inferred that the assessee is well aware of Penalty proceedings. So it can be clearly inferred that the assessee had nothing to say in this matter and Wrong claim of deductions u/s 24(b) as narrated in preceding paragraphs which leads to under reported income in consequence of misreporting thereof.

9. From the above discussion, it can be seen that the assessee has under reported income in consequence of misreporting thereof. Hence, the assessee is liable for penalty to the tune of two hundred percent of the amount of tax payable on the under reported income in consequence of misreported income within the meaning of section 270A(9)(a). The income tax payable on under reported income in consequence of misreported income has been arrived at Rs. 2,30,930/- and two hundred percent penalty for the same works out to Rs. 4,61,860/-.

10. I hereby levy penalty of Rs. 20,478/- (i.e. two hundred percent of the tax payable on the under reported income in consequence to misreporting of income).

Working of penalty:

| Particulars | Amount in Rs. |

| 1.Assessed income | 16,94,610/- |

| 2. Under reported Income | 7,73,704/- |

| 3. Income excluding underreported income in consequence to misreporting of income (1-2) | 9,20,906/- |

| 4. Tax on Assessed Income (Tax+SC+EC only) | 3,43,388/- |

| 5. Tax on Income excluding under reported Income in consequence to misreported income (3) | 1,12,458/- |

| 6. Tax on underreported Income in consequence to misreported income (4-5) | 2,30,930/- |

| Penalty leviable at 200% | 4,61,860/- |

| Penalty leviable (Rounded off) | 4,61,860/- |

(Rupees: Four Lacs sixty one thousand eight hundred and sixty only)

This order has been passed after obtaining the prior approval from the Additional Commissioner of Income tax(IT), Ahmedabad as per section 274(2) of the Income Tax Act, 1961 vide letter issued vide DIN 22/1041672758(1) dated 26.03.2022.”

2.3 That the assessee being aggrieved by the “impugned penalty order” prefers the first appeal u/s 246A of the Act on 06.11.2023 (Form No.35) before Ld. CIT(A) who by the “impugned order” has dismissed the appeal of the assessee on the grounds and reasons stated therein. The core ground and reasons for dismissal of 1st appeal was as under:-

“There exists no sufficient or good reason for condoning inordinate delays of more than 560 days in filing appeal. Accordingly, this appeal is dismissed as barred by limitation. Accordingly I decline to condone the delay of 560 days, and dismiss this appeal of the appellant as barred by limitation.

In view of the above discussion appeal is rendered as inadmissible. Hence stand dismissed”. (Last page 22 of the impugned order)

2.4 That the assessee being aggrieved by the “impugned order” has preferred the instant second appeal on 03.09.2024 before this Tribunal and has raised following grounds of appeal in the Form 36 against the “impugned order” which are as under:-

“1. That, on the facts and in the circumstances of the case Ld. AO has erred in levying penalty U/s 270A of Income Tax Act, 1961 amounting to Rs. 4,61,860 without considering the application U/s 270AA of appellant for granting immunity from penalty U/s 270A in an arbitrary manner.

2. That Ld. CIT (A) erred in confirming the penalty by arbitrarily rejecting condonation of delay application in filing the first appeal of appellant and consequently dismissing the first appeal in an arbitrary manner.

3. That the assessee craves leave to add, amend, alter or delete any of the grounds of appeal and all the above grounds are without prejudice to each other”.

3. Record of Hearing

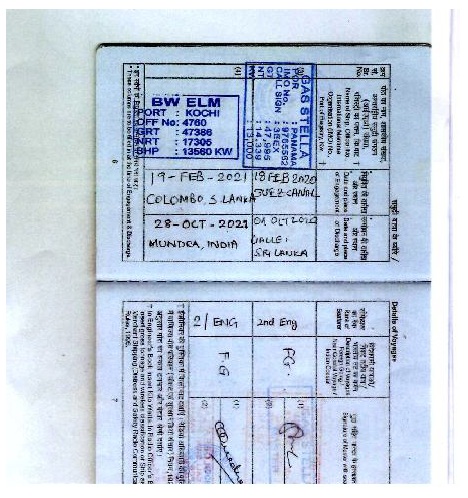

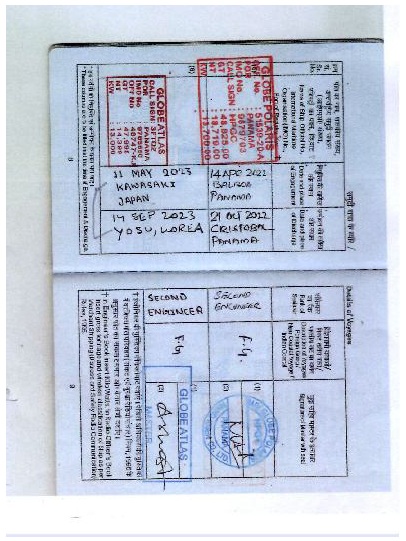

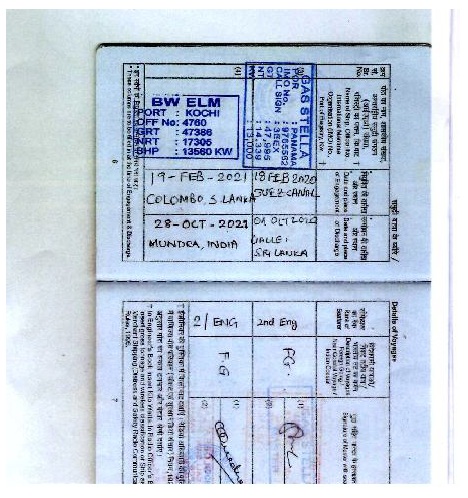

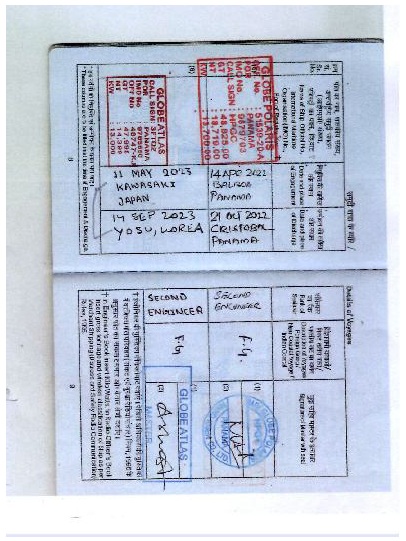

3.1 The hearing in the matter took place on 06.10.2025 afresh when the Ld. AR for and on behalf of the assessee appeared before this tribunal and placed on record “a set of documents” (compilation) from pages 1 to 34 and “a set of compilation for Assessment Year 2017-18”, CBDT notification dated 05.10.2016 [S.O.3150(E)], a document called Continuous Discharge Certificate (CDC) of the Mariner assessee and interalia contended that the “impugned order” has not taken in to the consideration the merits of the case of the assessee Mariner and that the very first appeal of the assessee against the “impugned penalty order” has been dismissed on the ground of delay in filing the same (560 days delay). The condonation of delay application made before the first appellate authority i.e. Ld. CIT(A) was not considered and it was held that the same had not shown the “sufficient cause” for the purposes of the condonation of delay. There was a delay of 560 days in preferring the first appeal (Internal page 4 of the impugned order). It was urged that the “impugned penalty order” is dated 26.03.2022 and that the same was received by the assessee on 28.08.2023. The payment of fee of Rs.1000/- was made on 26.08.2023 (Form No.35). The first appeal was filed on 06.11.2023. It was pleaded before the Ld. CIT(A) vide para 15 of the Form No.35 that the assessee is an officer in the Merchant Navy and that he was on ship. Only few documents were with him and as soon as he landed in India the appeal was filed. It was also submitted that a condonation of delay application was filed before the Ld. CIT(A) as aforesaid stated in the Form No.35 along with an affidavit in support. The same was not considered by the Ld. CIT(A) in the impugned order. The total delay in filing the first appeal was of 560 days. The Ld. AR has also now placed on record a photo copy of CDC (Continuous Discharge Certificate) of the assessee, a Merchant Navy Officer and has invited our attention basis CDC which shows that assessee was on ship from 19.02.2021 to 28.10.2021, from 14.04.2022 to 21.10.2022 and from 11.05.2023 to 14.09.2023. The relevant extract of the CDC is reproduced below:-

3.2 In a fresh discussion and debate which took place in the hearing in so far as the aspect of delay of 560 days before the Ld. CIT(A) was concerned it was pleaded by the Ld. AR that this tribunal be pleased to condone the delay which had occurred while filing the first appeal before the Ld. CIT(A) as the assessee herein is a Merchant Navy Officer and by the very nature of his job he is required to be on the sea on a ship. The assessee herein is not gaining anything by causing the delay of 560 days before the first appellate authority while filing the first appeal. The Ld.AR pleaded before the tribunal that the matter now be at least considered on merits by this tribunal and let the cause of justice triumph. It was also pleaded by the Ld. AR during the course of hearing that the real tax demand has already been paid and no first appeal is filed on the quantum assessment order (supra). The Ld. AR has placed reliance on set of documents (compilation) for (Assessment Year 2017-18) filed during the hearing where there is a notice of demand dated 28.12.2019 u/s 156 of the Act for the Assessment Year 2017-18 which shows Rs.0/- (set of documents (compilation) for (Assessment Year 2017-18).

In brief it was contended by the Ld. AR that for both the assessment year i.e. Assessment Year 2017-18 and Assessment Year 2018-19 the tax demands stands paid and no appeals are filed before the Ld. CIT(A) on the quantum assessment orders. It was further pleaded basis (set of documents (compilation) for (Assessment Year 2017-18) which is a notice dated 17.11.2021 for Assessment Year 2017-18 u/s 274 r.w.s. 270A wherein the assessee was called upon to show cause and appear on 29.11.2021 before the Ld. A.O. In this regard on 28.12.2021 [set of documents (compilation) for (Assessment Year 2017-18)] a reply was sent to the Ld. AO which is reproduced as below:-

To,

THE INCOME TAX OFFICER

International Taxation

BHOPAL (M.P)

REG:- MANOJ KUMAR GANGADHARAN

12, CTO BAIRAGH BHOPAL

Respected Sir.

Sub:-Penalty Proceedings u/s 270A of the Sub: Request for Immunity from Income Tax Act, 1961 for Assessment Year 201718

The assessee is in receipt of your notice under section 274 r.w.s. 270A of Income Tax Act 1961, dated 28.12.2019 consequent to assessment order passed by you honor for assessment year 201718 directing us to show cause as to why the said penalty u/s 270A should not be levied on us. Following points are submitted before you for your kind consideration and perisual.

1. Sir, it is humbly submitted that the assessee has shown the correct figures and pictures in the return of the total income filed by the assessee. Sir, there is no under reporting and misreporting of the income.

2. Sir, the intentions of the assessee are bonafide, however due to some technical glitch while filing the return of total income, the ALV of Rs. 180000.00 shown by the assessee has been reversed by the system which has resulted this situation, sir, similar facts are also submitted by the assessee during the course of the assessment proceedings. The facts has been duly verified from your office and confirmed that the property is partly let out during the period under consideration. Sir in the similar case (CIT V/s. Sania Mirza (87 DTR 371) (AP) it was held that no penalty can be imposed upon the inadvertent errors while filing the return of the total income.

3. Sir, it is pertinent to note that the assessee has no mis reported or under reported the particulars in the return of the income filed by the assessee. During the course of the assessment proceedings the loss claimed by the assessee has been reduced to some extent. Sir it is most respectfully submitted that the such reduction of the loss has not resulted to additional tax liability if any payable by the assessee. Sir the reduction of the loss is not due to submission of the inaccurate particulars by the assessee. (Dilip N. Shroff v. CIT (

291 ITR 519) (SC)] (Reliance Petro Products (P) Ltd (

322 ITR 158 (SC)]

4. sir it is humbly submitted that due to the reduction in the loss there is no tax liability upon the assessee. Sir it is once again requested to you to kindly consider the facts and circumstance of the case, where in there is no defauilt of the assessee

4. Sir, it is pertinent to note that assessee is having the prepaid taxes in his credit and the tax liability due on account has been adjusted against the prepaid taxes, the assessee is not making any application of the appeal in response to the order of the assessment passed by your honor.

Sir as the tax and interest payable as per the order of assessment or reassessment under sub-section (3) of section 143, has been paid within the period specified in such notice of demand; and no appeal against the outer referred to in clause (a) hits, sir the assessee is a normal salaried assessee and deriving the salary from the rendering his services for merchant navy. Most of the time the assessee used to be on ship and there are no indented inaccurate particulars submitted by the assessee hence it is humbly requested to you to be kind enough to drop the penalty proceedings u/s 270A and kindly grant the immunity for the same.

We shall be highly obliged.

Thanking you

Yours faithfully.

Manoj Kumar Gangadharan

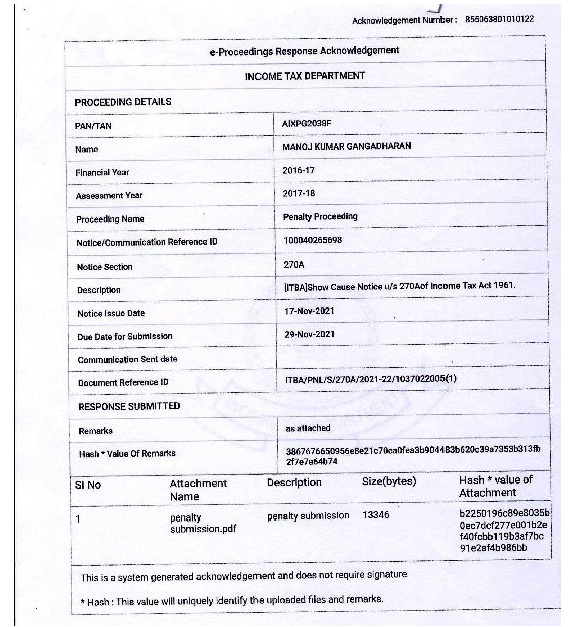

The above letter dated 28.12.2021 was acknowledged by the department on 01.01.2022 [set of documents (compilation) for (Assessment Year 2017-18)] which is reproduced below:-

That basis [set of documents (compilation) for (Assessment Year 2017-18)] the revenue vide a notice dated 14.03.2022 stated that with reference to e-response dated 01.01.2022 wherein the request for the immunity from the penalty proceedings u/s 270A of the Act is sought, the assessee has not furnished the Form No.68 as required as per Rule 129 in accordance with the provisions of section 270AA of the Act for the purpose of claiming the immunity from the penalty proceedings u/s 270A of the Act.

The Ld. AR finally contended that the application for the immunity is made as can be inferred from letter dated 28.12.2021 (supra). The order of Ld. AO (quantum) is dated 28.12.2019 for the Assessment Year 2017-18. The tax demands are all paid for both the assessment years 2017-18 and 2018-19. No appeals are filed on the quantum assessment orders for Assessment Years 2017-18 and 2018-19. Basis [set of documents (compilation) for (Assessment Year 2017-18)] it was submitted that an inference can be drawn that assessee’s reply dated 28.12.2021 is nothing but an application within the meaning of section 270AA of the Act. The requirement of the Form No.68 therein is a procedural requirement in nature. Reliance was placed on the order of ITAT C Bench, Chennai in case of New Dawath Traders v. ITO [ITA No.2717(Chny) of 2024, dated 14-02-2025] in support of the plea that the non filing of the Form No.68 is only a technical or a venial breach. Para 5 was relied upon. Reliance was also placed on order of ITAT Jodhpur Bench in ITA No.454/ Jodh/2023 dated 21.03.2024 in case of Punam Kanwar Bhati v. ITO and emphasis was made on para 8 therein, in support of the plea that the filing of Form No.68 is only a technical or a venial breach of procedural law.

Per contra the Ld. DR appearing for and on behalf of revenue contended that with regard to the delay of 560 days in preferring the first appeal before the Ld. CIT(A) the assessee is changing stand time and again as has been seen in the proceedings held before this tribunal. The Ld. DR placed reliance on page 4,5,6&7 of the impugned order of Ld. CIT(A). It was pointed out by him that the assessee is now taking a contrary stand in a fresh hearing which is not permissible. The plea of Ld. AR that the assessee is a Merchant Navy Officer and requires acclimatization for 2 to 3 months period before boarding a ship and after deboarding a ship are all wrong. The kind of period of 2 to 3 months which the Ld. AR has spoken about it is not required even by astronaut returning from the planets in universe back to the earth. Therefore no lenient view should be taken by this tribunal on the delay of 560 days before the Ld. CIT(A) as the assessee is twisting the facts on and off. On one hand he is on ship and on the other hand he is not on ship during the relevant periods involved. The approach of the assessee is therefore inconsistent basis CDC records. This tribunal therefore should not condone the delay of 560 days particularly so incorrect facts are on record.

3.3 The Ld. AR has also additionally submitted that in respect of the “impugned assessment order” (quantum) dated 28.12.2019 (Assessment Year 2017-18) no first appeal was filed before the Ld. CIT(A). Section 270A of the Act contemplates penalty for under reporting and mis-reporting of income whereas Section 270AA of the Act contemplates immunity from the imposition of penalty etc. and for which two conditions must be fulfilled by virtue of Section 270AA(1) which are (1) Assessee must accept the income and pay tax and interest thereon as per the assessment order within the period specified in notice of demand. (2) No appeal is filed against the assessment order. The Ld. AR therefore pleaded that in the instant case both these two conditions are satisfied by the assessee, the requisite tax with interest has been paid as per the demand notice and no first appeal is filed before the CIT(A) against the quantum assessment orders before CIT(A). The Ld. AR however with regard to the requirement of filling of form No.68 as per Section 270AA(2) contended that the Form No.68 was not filed. It was further argued that filing of the requisite form No.68 is procedural in nature and Section 270AA(2) of the Act should be liberally construed. It was contended that the “impugned assessment order” is dated 28.12.2019 (Assessment Year 2017-18). However as per the Ld. AR the exercise u/s 270AA of the Act was done on 01.01.2022. Reliance was placed on para 5 page 3 of the “impugned penalty order”. Per contra Ld. DR additionally has submitted that there is delay in filing the first appeal for which no sufficient cause is shown and as far as merits are concerned u/s 270AA a strict mechanism and procedure is laid down with regard to the immunity from the imposition of penalty which too is not complied with by the assessee strictly as per the law. The letter dated 01.01.2022(supra) is as and by way of a request only. The Form No.68 and other material details and the ingredients of Section 270AA are totally absent. The Ld. DR stated that the instant appeal should be dismissed on ground of IBS Software (P) Ltd v. UOI (Kerala) -. Photo copy of judgment cited by Ld. AR of Chennai Bench of ITAT and Jodhpur Bench of ITAT were furnished under a compilation from page 1 to 19.

4. Observations,findings & conclusions.

4.1 We now have to adjudge and adjudicate the present appeal filed by the assessee on basis of the records of the case and the contentions canvassed before us during the course of the hearing. In brief we have to decide the legality, validity of the “impugned order”.

4.2 We have carefully perused the records of the case as presented to this tribunal by both the Ld. AR and the Ld. DR to determine the legality, validity of the “Impugned Order” basis law and by following the due process of law.

4.3 We basis records of the case and so also after hearing and upon examining the rival contentions are of the considered opinion that the “impugned order” is correct and proper on the delay aspect. We hold that the delay of 560 days in preferring the first appeal has not been explained properly basis any sufficient cause. The Ld. CIT(A) has rightly held that “no sufficient cause” is shown and he has arrived at this conclusion basis condonation of delay application (Form 35) and an affidavit which was placed on record before Ld. CIT(A). We notice and observe that the “impugned penalty order” was dated 26.03.2022 and that the same was received by the assessee on 28.08.2023. The fee for the first appeal was paid on 26.08.2023 and finally the first appeal was filed on 06.11.2023 before the first appellate authority (Form No.35). We therefore hold that time begins to run from 26.03.2022 because as to how the impugned penalty order was received on 28.08.2023 is not explained. Further we notice and observe that the fee for the first appeal was paid on 26.08.2023 and an first appeal was filed on 06.11.2023. This time gap is too not explained. In brief, no satisfactory explanation save and except that the assessee is in merchant navy and was on ship is given for 560 days delay from 26.03.2022 to 06.11.2023 therefore the Ld. CIT(A) has rightly held that no sufficient cause is shown and has dismissed the first appeal as time barred. We concur with his findings. Further basis CDC we hold that the assessee was on board a ship from 19.02.2021 to 28.10.2021, from 14.04.2022 to 21.10.2022 and from 11.05.2023 to 14.09.2023. It is therefore wrong on the part of the assessee to say that the impugned penalty order was received by him on 28.08.2023 when admittedly on this date the assessee was on ship i.e 11.05.2023 to 14.09.2023 [CDC (supra)]. It is also required to be noted that when the impugned penalty order was passed on 26.03.2022 the assessee was not on ship i.e. 14.04.2022 to 21.10.2022 [CDC (supra)]. We therefore hold that the assessee herein has failed to give satisfactory and bonafide explanation before the Ld. CIT(A) with regard to delay of 560 days in preferring the first appeal but has also failed to convince this tribunal on the ground of Bonafide and the sufficient cause. We concur with the views expressed by the Ld. DR that the assessee has twisted the facts on and off and is therefore not entitled for any relief whatsoever.

5. Order

5.1 In the premises set out herein above, we dismiss the appeal of the assessee on the ground of delay before the 1st appellate authority and upheld the “impugned order”.

5.2 In the result appeal of the assessee is dismissed.

5.3 ITA No.671/Ind/2024 (Assessment Year 2018-19)

The facts and circumstances are more or less similar and identical save and except Assessment Year hence the finding given by us in ITA No.670/Ind/2024 would mutadis mutandis will apply to this appeal too.

5.4 In result both the appeals are dismissed.