JUDGMENT

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

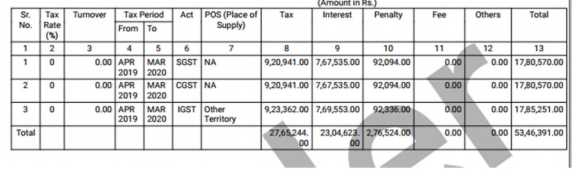

2. The challenge in this petition is raised to the order dated 28th August, 2024 passed by the Office of Sales Tax Officer Class II, AVATO, Delhi (hereinafter, ‘the impugned order’), pursuant to the SCN dated 29th May, 2024 (hereinafter, ‘the impugned SCN’) raising a demand of Rs. 53,46,391/-for the financial year 2019-2020 in the following terms:

3. The background of the case is that initially, a notice under Section 61 of the Delhi Goods and Service Tax Act, 2017 (hereinafter, ‘the Act’) was issued to the Petitioner on 6th February, 2021, after scrutiny of returns under Form GST ASMT-10.

4. The discrepancies which were observed in the said notice issued u/s 61 of the Act was in respect of the ITC reflected in Form GSTR-2A, ITC claimed in Form GSTR-3B and liability shown in Form GSTR-1. In respect of the said notice dated 6th February, 2021, a reminder was issued on 29th March, 2021 and an explanation was sought in the following terms:

“NOTICE FOR SEEKING EXPLANATION REGRDING DISCREPANCIES IN THE GSTR’S RETURN AFTER SCRUTINY

Whereas during scrutiny of the returns, it has come to my notice that there is Mis Match in GSTR1 & GATR 3B. You are hereby directed to explain the reasons along with all relevant documents in original regarding supply/receiving of goods like sale/ purchase invoices their GRs, E-way bills, stock statement, balance sheet, bank statement, bank details, party- wise ledger accounts, ITR etc. in this office in hard copy and as well as uploaded online by given date, failing which proceedings in accordance with CGST Act may be initiated against you without making any further reference to you in this regard.”

5. The petitioner had then submitted a detailed reply dated 14th September, 2021, along with the requisite documents. After perusing the same, the matter was closed on 26th April, 2023 by FORM GST ASMT-12. The details of the said ‘Order of acceptance of reply against the notice issued under section 61’, dated 26th April, 2023 is as under:

“The reply filed by the dealer seems to be satisfactory and the dealer has submitted documents.”

6. The grievance raised by the Petitioner presently is that on the same grounds as the above notice, DRC-01 has beenagain issued on 29th May, 2024 in respect to the same very transactions and the impugned order was then passed.

7. Ld. Counsel for the Petitioner has drawn the attention of the Court to Section 61 of the Act, as per which, once an explanation of the Petitioner is found acceptable upon reconciliation, no further action can be taken, including issuance of a notice under Section 73 of the Act.

8. Ms. Urvi Mohan, ld. counsel for the Respondent submits that the impugned order is an appealable order and the Petitioner can avail of the appellate remedy.

9. The Court has heard the submissions made on behalf of the parties.

Section 61 of the Act, reads as under:

“Section 61. Scrutiny of returns:-

(1) The proper officer may scrutinize the return and related particulars furnished by the registered person to verify the correctness of the return and inform him of the discrepancies noticed, if any, in such manner as may be prescribed and seek his explanation thereto.

(2) In case the explanation is found acceptable, the registered person shall be informed accordingly and no further action shall be taken in this regard.

(3) In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the registered person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted, the proper officer may initiate appropriate action including those under section 65 or section 66 or section 67, or proceed to determine the tax and other dues under section 73 or section 74 [or section 74A].

Section 73 of the Act reads as under:

73. (1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised for any reason, other than the reason of fraud or any wilful misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been so paid or which has been so short paid or to whom the refund has erroneously been made, or who has wrongly availed or utilised input tax credit, requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under section 50 and a penalty leviable under the provisions of this Act or the rules made thereunder.

10. Further, the Division Bench of the Rajasthan High Court in Goverdhandham Estate (P.) Ltd. v. State of Rajasthan (Rajasthan)/(2024:RJ-JP:2730-DB), has clearly held that in the statutory scheme of Section 61(2) of the Act, further proceedings cannot be drawn. The relevant portion is stated as under:

27. Considering the statutory scheme as engrafted in Section 61(2) read with Rule 99 of the Rules, there is clear scheme of statute that once the explanation with regard to discrepancy in the return is offered and accepted, further proceedings are not required to be drawn.

28. Learned counsel for the respondents laid much emphasis on the enclosure to ASMT-12. It appears that the proper officer under a misconceived notion of law sought to retain jurisdiction contrary to the provisions of law. Where the discrepancy in the return is found, the law requires explanation to be obtained from the registered person. The power under Section 73 could be invoked only when the explanation offered is not satisfactory. Once the explanation is accepted, no further proceedings could be drawn.

11. A similar view has also been taken by the Madras High Court in Radiant Cash Management Services Ltd. v. Asstt. Commissioner (ST) [W. P. No. 2981 of 2024, dated 11-3-2024], in which the Court has held as under:

6. In these circumstances, it is necessary to examine the impugned assessment order to verify whether the same demand was resurrected. On examining the impugned assessment order, I find that the confirmation of demand relates to the same assessment period and the same amounts towards SGST, CGST and IGST. The only difference is that interest and penalty has been imposed thereon to arrive at the aggregate sum indicated therein. Upon issuance of an order in Form ASMT-12 recording that no further action is required, the continuation of proceedings culminating in the impugned assessment order is undoubtedly unsustainable.

12. In the opinion of this Court, a perusal of Section 61 of the Act would show that the scheme of the said provision is that whenever any discrepancies are found by the proper officer, a notice can be issued to the tax payer and an explanation can be sought. Upon the explanation being furnished, there are two courses of action-

• One, if the explanation is found acceptable, then no further action can be undertaken,

• Two, if the explanation is not satisfactory and the same has not been accepted, the discrepancies are accepted. If upon such acceptance, the tax payer does not take corrective measures, then action under other provisions of the Act including Section 73 and 74 of the Act would be permissible.

13. The above provision i.e., Section 61(2) of the Act would create an embargo against any further demands being raised under Section 73 of the Act, as the term ‘further action’ under Section 61(2) of the Act would include demands under Section 73 of the Act as well. Further, Section 73 of the Act does not have a non-obstante clause. Under such circumstances, the issuance of demand on the same ground on which the explanation was in fact found acceptable previously, would not be tenable.

14. Thus, in facts of the present case, the issuance of impugned SCN under Section 73 of the Act and passing of the consequent impugned order, after the acceptance of the explanation vide, order of acceptance dated 26th April, 2023, deserves to be set aside.

15. Accordingly, the impugned SCN dated 29th May, 2024 along with impugned order dated 28th August, 2024, passed pursuant thereto are quashed.

16. However, considering the delay of the Petitioner in approaching this Court, he is directed to deposit a cost of Rs. 20,000/- with the Delhi Legal Services Authority within a period of two weeks.

17. The petition is accordingly disposed of, along with the pending applications.