Addition Deleted as AO Mistakenly Treated Product Brands as Separate Items, Creating an Artificial Discrepancy

Issue

The central issue is whether an addition for unexplained expenditure under section 69C of the Income-tax Act, 1961, can be sustained when the alleged discrepancy in quantitative stock details is solely due to the Assessing Officer’s incorrect methodology of treating different brands/sub-heads of the same parent product as distinct and independent items.

Brief Facts

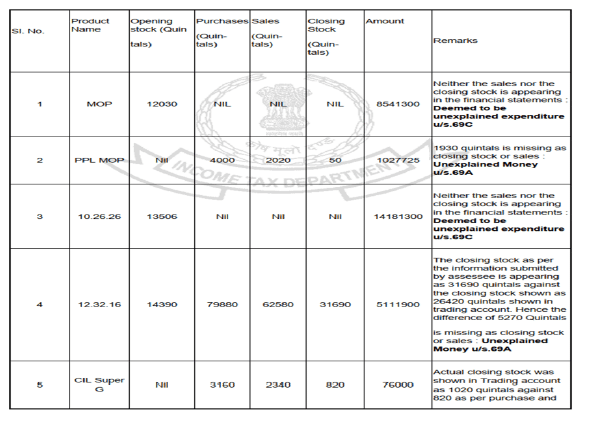

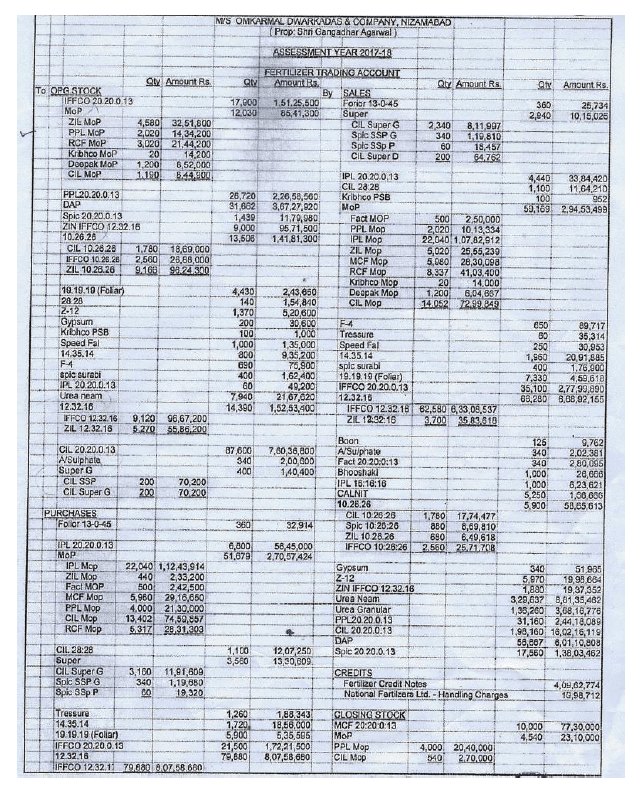

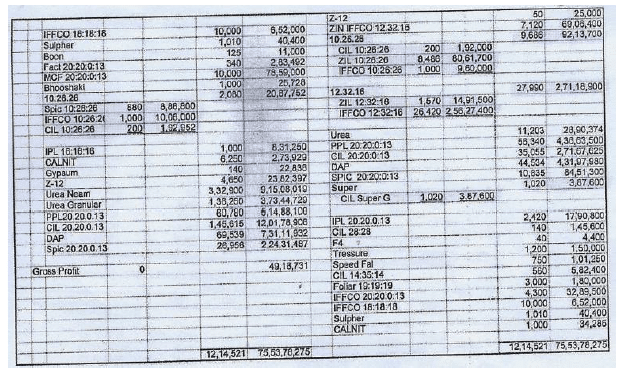

The assessee, a fertilizer trader, was selected for a limited scrutiny to examine its quantitative stock details. The Assessing Officer (AO) performed a reconciliation (Opening Stock + Purchases – Sales = Closing Stock) and found that the figures did not tally. Based on this, the AO made a significant addition under section 69C, alleging a mix of suppressed sales, undisclosed purchases, and sales made without any corresponding stock.

The assessee argued that the AO had made a fundamental error. The entire discrepancy arose because the AO treated various brands of a fertilizer as separate items, distinct from their parent product. For example, the AO would note the “opening stock” of a parent item like “Urea” but would then treat the “sales” of “Brand X Urea” and “Brand Y Urea” as sales of new items with no corresponding opening stock, creating a glaring mismatch.

To prove their case, the assessee submitted a summary of their turnover as declared in their VAT returns for the year, which perfectly matched the sales and purchase figures in their income tax return.

Decision

The court ruled decisively in favor of the assessee.

It found that the entire discrepancy was artificial and was a direct result of the AO’s flawed understanding and “glaringly distorted” calculations. The court accepted the assessee’s explanation that the brands were simply sub-heads of the main parent items and should have been consolidated for the stock tally.

The assessee’s submission of VAT returns provided strong corroborative evidence that the total purchases and sales disclosed were genuine and accurate. Since the AO’s conclusion was based on a flawed premise rather than actual concealment by the assessee, the addition could not be sustained. The court, therefore, deleted the addition in its entirety.

Key Takeaways

- Methodology Matters: An addition cannot be based on a discrepancy that is created solely by the AO’s incorrect methodology or misunderstanding of the assessee’s business and inventory system.

- Corroborative Evidence: Data from other statutory filings, such as VAT returns, serves as powerful evidence to prove the genuineness of the figures reported in the income tax return.

- Substance Over Form: The AO must look at the substance of the inventory—the parent product—rather than getting misled by the form, such as different brand names, to create an artificial discrepancy.

and G. Manjunatha, Accountant Member

[Assessment year 2017-18]

“.13. Section 115 BBE was inserted by Finance Act 2012 w.e.f 01.04.2013. As on 01.04.2016 the financial year in which the subject seizures occurred Section 155BBE provided for 30% tax on income refereed to in Sections 68, 69, 69A, 69B, 69C and 69D. The same was amended by the 2nd Amendment Act; w.e.f. 01.04.2017, enhancing the rate to 60%. Hence there was no new liability created and the rate of tax merely stood enhanced which is applicable to the assessments carried on in that year. The enhanced rate applies from the commencement of the assessment year, which relates to the previous financial year.”

| OBERVATIONS (Based on a conjoint perusal of the “Fertilizer trading A/c” and the Reconciliation /Explanation of the assessee) | |

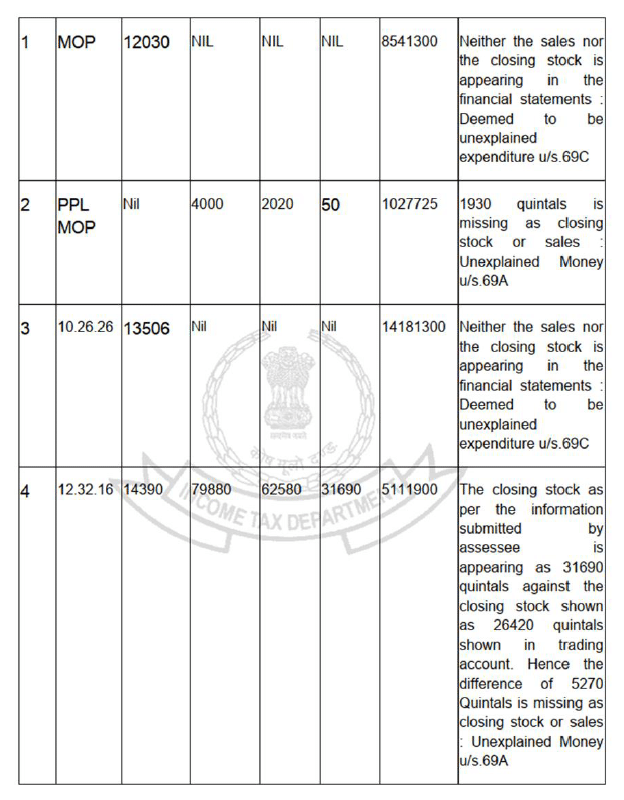

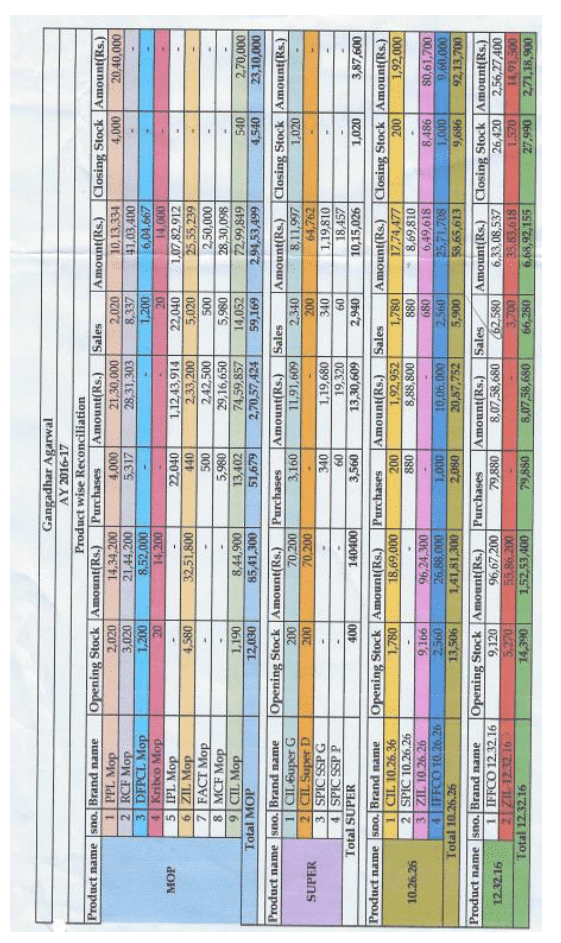

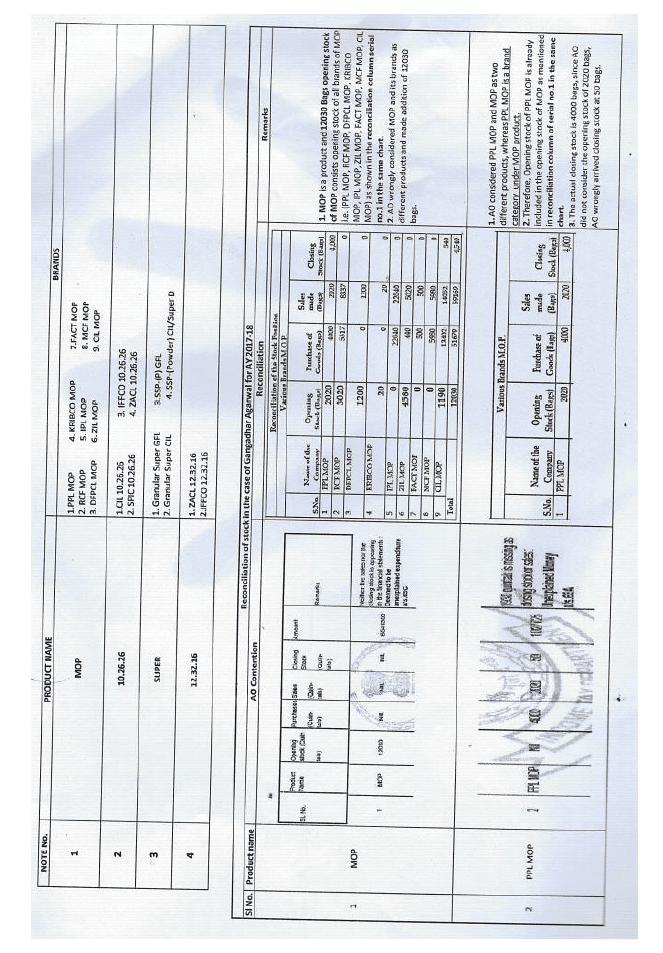

| MOP | 1. We find that the “Opening stock” of 12030 bags of “MOP” (parent product) comprises of various brands (recorded by the assessee manufacturer-wise), viz. (i). PPL MOP; (ii). RCF MOP; (iii). DFPCL MOP; (iv). KRIBHCO MOP; (v). IPL MOP; (vi). ZIL MOP; (vii). FACT MOP; (viii). MCF MOP; and (ix). CIL MOP. 2. We find that though the assessee had disclosed the “Opening stock” consolidatedly, but, the “closing stock” was bifurcated based on manufacturer/brand wise details. 3. The A.O., mistakenly, considered MOP and its various brands as different products and thus, lost sight of the purchases, sales and closing stock reflected under the various brands of MOP, and wrongly observed that the assessee had suppressed the sales/closing stock of MOP and on the said count made an addition of Rs. 85,41,300/ 4. We find that on a consolidation of the quantitative details of the opening stock, purchases, sales, and closing stock of MOP and its aforesaid brands (as can be gathered from the “Fertilizer trading A/c and the reconciliation filed by the assessee), there is no suppression of the Sales/Closing stock of MOP. We, thus, direct the A.O. to delete the addition of Rs. 85,41,300/- made by him u/s 69C of the Act. |

| PPL MOP | 1. The A.O., mistakenly, considered PPL MOP and MOP as two different products, whereas PPL is a brand of the MOP product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 2020 bags of PPL MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the assessee had an actual “Closing stock” of 4000 bags on 31.03.2017. 2. The A.O. had based on his wrong observation, concluded that the assessee had suppressed his sales/closing stock of 1930 bags and thus, on the said count, made an addition of Rs. 10,27,725/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 2020 bags of PPL MOP that formed part of “Opening Stock” of 12030 bags MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no suppression of the Sales/Closing stock of PPL MOP. We, thus, direct the A.O. to delete the addition of Rs. 10,27,725/-made by him u/s 69A of the Act. |

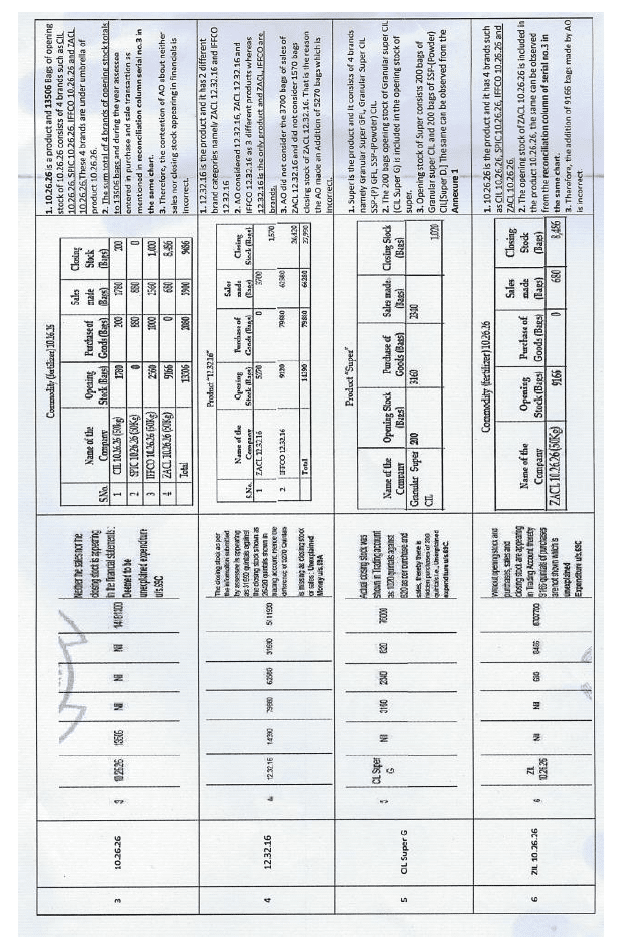

| 10.26.26 | 1. We find that the “Opening stock” of 13506 bags of “10.26.36” (parent product) comprises of four brands (recorded by the assessee manufacturer-wise), viz. (i). CIL 10.26.26; (ii). SPIC 10.26.26; (iii). IFFCO 10.26.26; and (iv). ZACL 10.26.26. 2. We find that though the assessee had disclosed the “Opening stock” of 10.26.26 (parent product) and its brands consolidatedly, but, the “closing stock” was bifurcated based on manufacturer/brand wise details. 3. The A.O., mistakenly considered 10.26.26 (parent product) and its brands as different products, and thus, lost sight of the corresponding purchases, sales and closing stock reflected under the aforesaid 4 brands of 10.26.26 (parent product), and wrongly observed that the assessee had suppressed its Sales/Closing stock of 10.26.26 (parent product) and made an addition on the said count of Rs. 1,41,81,300/ 4. We find that on a consolidation of the quantitative details of the opening stock, purchases, sales, and closing stock of 10.26.26 (parent product) and its aforesaid brands (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no suppression of the Sales/Closing stock of 10.26.26. We, thus, direct the A.O to delete the addition of Rs. 1,41,81,300/-made by him u/s 69C of the Act. |

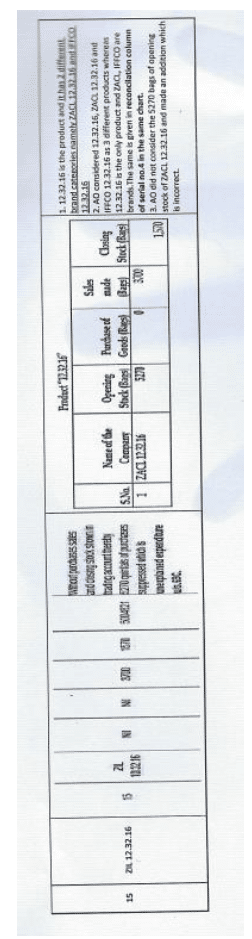

| 12.32.16 | 1. We find that the “Opening stock” of 14390 bags of “12.32.16” (parent product) comprises of two brands (recorded by the assessee manufacturer-wise), viz. (i). ZIL 12.32.16; and (iv). IFFCO 12.32.16. 2. We find that the A.O had observed that though the “Closing Stock” as per the information submitted by the assessee is appearing at 31690 bags, but, the same had been disclosed by him in his “trading account” at 26420 bags. Accordingly, the A.O. observing the suppression of the “Closing stock” by 5270 bags [31690 bags (-) 26420 bags] made an addition of Rs. 51,11,900/- under Section 69A of the Act. 3. We find substance in the Ld. AR’s claim that though the A.O had considered the sale of IFFCO 12.32.16 of 62580 bags, but had failed to consider the “Sales” of ZIL 12.32.16 (3700 bags) and also the “Closing stock” of ZIL 12.32.16 (1570 bags). The A.O., mistakenly, had considered only the “Closing Stock” of IFFCO 12.32.16 of 26,420 bags on 31.03.2017. Accordingly, after considering, viz. (i) ”Sales” of ZIL 12.32.16 (3700 bags); and (ii). “Closing Stock” of ZIL 12.32.16 (1570 bags) the ‘Closing Stock” of 12.32.16 (parent product) on 31.03.2017 works out at 27,990 bags. [Op. Stock: 14,390 bags (+) Purchases: 79,880 bags (-) Sales: 66,280 bags =”Closing” Stock: 27,990 bags]. 4. We, thus, considering the fact that the assessee had disclosed “Closing stock” of 12.32.16 of 27,990 bags, viz. [(i). ZIL 12.32.16: 1570 bags (+) IFFCO 12.32.16: 26420 bags AND that the A.O had not taken cognizance of the “Sales” of ZIL 12,32.16 (3700 Qtl), had wrongly observed that there was a suppression of 5270 Qtl of “Closing Stock” of 12.23.16, direct the A.O to vacate the addition of Rs. 51,11,900/-made by him u/s 69A of the Act based on his aforesaid wrong observations. |

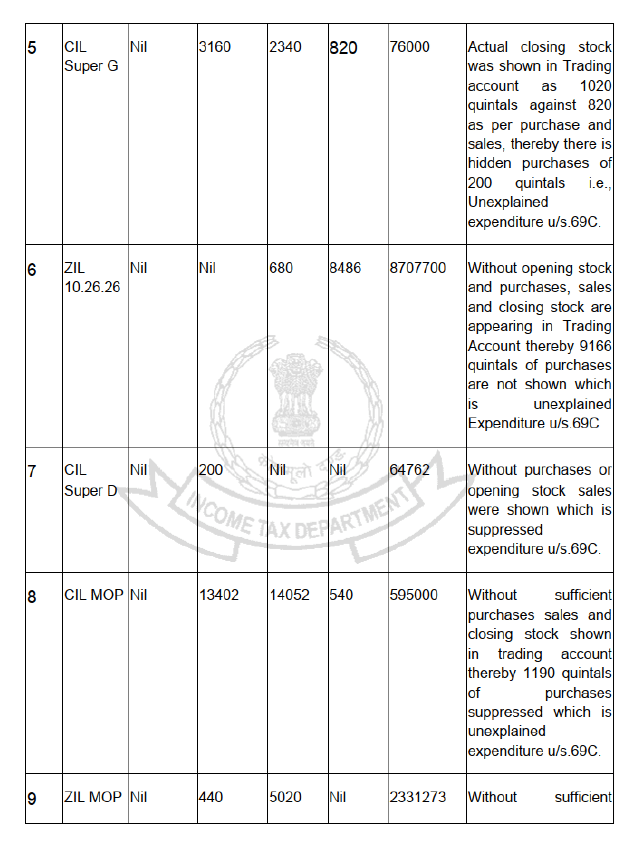

| CIL Super G (sub-product of SUPER) | 1. The A.O., mistakenly, considered CIL Super G (brand) and SUPER (parent product) as two different products, whereas CIL Super G is a brand of the SUPER product (parent product). Thus, the A.O had lost sight of the fact that as the “Opening stock” on 01.04.2016 of 200 bags of CIL Super G was already included in the “Opening Stock” of 400 bags of SUPER (parent product) on 01.04.2016, therefore, the assessee had an actual “Closing stock” of 1020 bags of CIL Super G on 31.03.2017. 2. The A.O. had based on his wrong observation, concluded that the assessee had made unaccounted purchases of 200 bags of CIL Super G and thus, on the said count made an addition of Rs. 76,000/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 200 bags of CIL Super G [that formed part of “Opening Stock” of 400 bags of SUPER (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), therefore, the “Closing stock” of 1020 bags of CIL Super G is found to be duly explained. We, thus, direct the A.O. to delete the addition of Rs. 76,000/- made by him u/s 69C of the Act. |

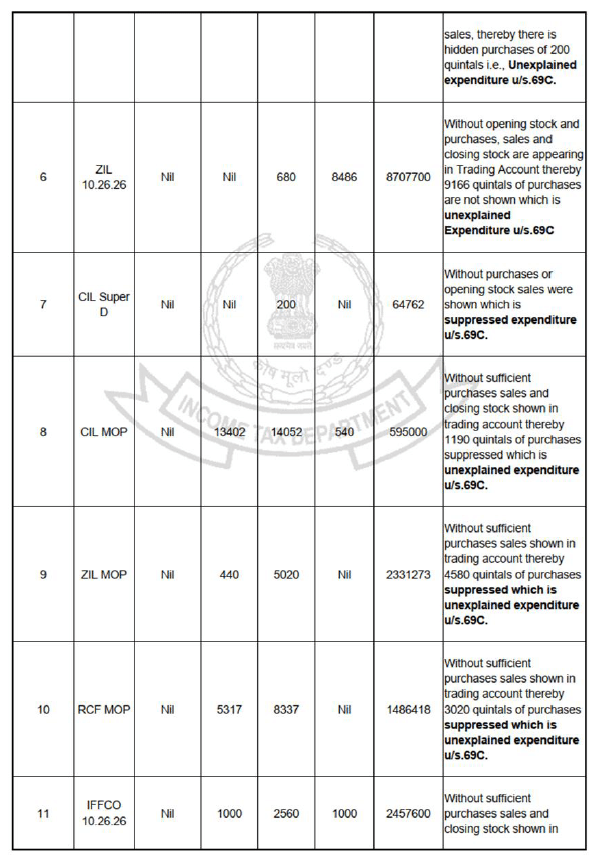

| ZIL 10.26.26 | 1. The A.O., mistakenly, considered ZIL 10.26.26 and 10.26.26 as two different products, whereas ZIL 10.26.26 is a brand of the 10.26.26 product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 9166 bags of ZIL 10.26.26 was already included in the “Opening Stock” of 13506 bags of 10.26.26 (parent product) on 01.04.2016, therefore, the assessee had a duly explained “Sales” of 680 bags and “Closing stock” of 8486 bags on 31.03.2017. 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure of Rs. 87,07,700/- for purchase of 9166 bsags of ZIL 10.26.26 (disclosed by him as Sales (680 bags) and Closing Stock (8486 bags)] and thus, on the said count made an addition of Rs. 87,07,700/- u/s 69C of the Act. 3. We find that as the A.O had lost sight of the “Opening stock” of 9166 bags of ZIL 10.26.26 [that formed part of “Opening Stock” of 13506 bags of 10.26.26 (parent product) (as can be gathered from the “Fertilizer trading A/c and the reconciliation filed by the assessee), there is no unaccounted purchases of ZIL 10.26.26. We, thus, direct the A.O. to delete the addition of Rs. 87,07,700/- made by him u/s 69C of the Act. |

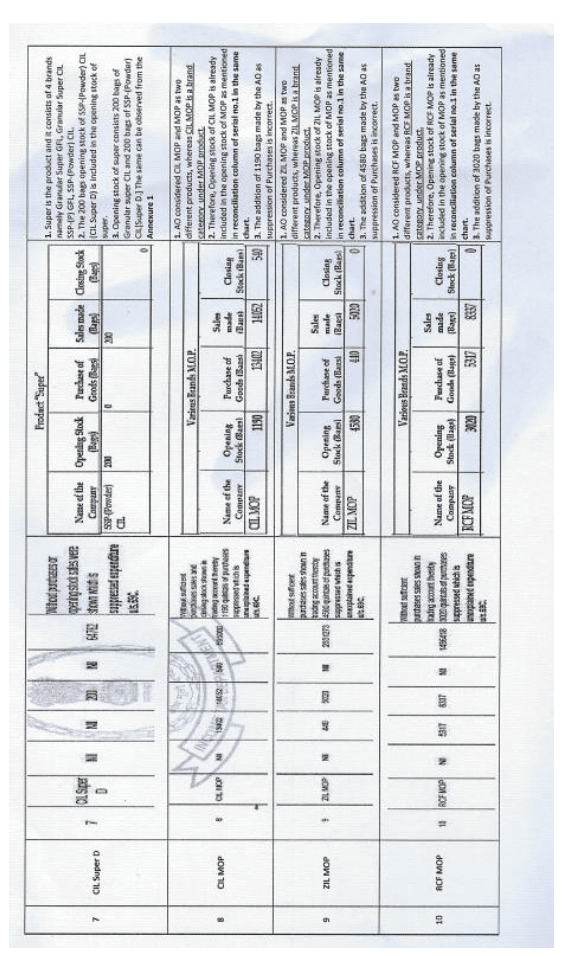

| CIL SUPER D (sub-product of SUPER) | 1. The A.O., mistakenly, considered CIL Super D (brand) and SUPER (parent product) as two different products, whereas CIL Super D is a brand of the SUPER product (parent product). Thus, the A.O. lost sight of the fact that as the “Opening stock” on 01.04.2016 of 200 bags of CIL Super D was already included in the “Opening Stock” of 400 bags of SUPER (parent product) on 01.04.2016, therefore, the assessee had sold 200 bags of CIL Super D during the subject year from the duly explained “Opening stock” that was available with him on 01.04.2016. 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unaccounted expenditure for purchase of 200 bags of CIL Super D that were sold by him during the subject year and thus, on the said count had made an addition of Rs. 64,762/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 200 bags of CIL Super D that formed part of “Opening Stock” of 400 bags of SUPER (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), therefore, the sale of 200 bags of CIL Super D is duly explained. We, thus, direct the A.O. to delete the addition of Rs. 64,762/- made by him u/s 69C of the Act. |

| CIL MOP | 1. The A.O., mistakenly, considered CIL MOP and MOP as two different products, whereas CIL MOP is a brand of the MOP product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 1190 bags of CIL MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the “Sales” (14052 bags) and “Closing Stock” on (540 bags) of CIL MOP by the assessee during the subject year was sourced out of the “Opening stock” (1190 bags)) and “Purchases” (13402 bags) for the subject year. 2. The A.O. had based on his wrong observation concluded that the assessee had incurred unexplained expenditure for purchase of 1190 bags of CIL MOP and thus, on the said count had made an addition of Rs. 5,95,000/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 1190 bags of CIL MOP that formed part of “Opening Stock” of 12030 bags of MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by him for purchase of 1190 bags. of CIL MOP. We, thus, direct the A.O. to delete the addition of Rs. 5,95,000/-made by him u/s 69C of the Act. |

| ZIL MOP | 1. The A.O., mistakenly, considered ZIL MOP and MOP as two different products, whereas ZIL MOP is a brand of the MOP product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 4580 bags of ZIL MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the “Sales” (5020 bags) of ZIL MOP by the assessee was sourced out of the “Opening stock” (4580 bags)) and “Purchases” (440 bags) for the subject year. 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure for purchase of 4580 bags of ZIL MOP and thus, on the said count had made an addition of Rs. 23,31,273/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 4580 Qtls of ZIL MOP that formed part of “Opening Stock” of 12030 bags MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by the assessee for purchase of 4580 Qtls. of ZIL MOP. We, thus, direct the A.O. to delete the addition of Rs. 23,31,273/- made by him u/s 69C of the Act. |

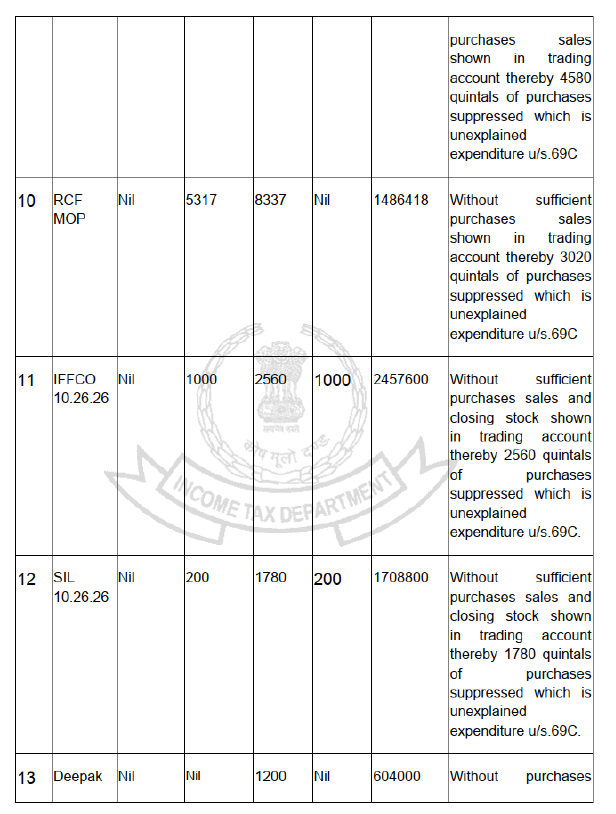

| RCF MOP | 1. The A.O., mistakenly, considered RCF MOP and MOP as two different products, whereas RCF MOP is a brand of the MOP product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 3020 bags of RCF MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the “Sales” (8337 bags) of RCF MOP by the assessee was sourced out of the “Opening stock” (3020 bags)) and “Purchases” (5317 bags) for the subject year. 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure for the purchase of 4580 bags of RCF MOP and thus, on the said count had made an addition of Rs. 14,86,418/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 3020 bags of RCF MOP [that formed part of “Opening Stock” of 12030 bags MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by the assessee for purchase of 3020 bags of RCF MOP. We, thus, direct the A.O. to delete the addition of Rs. 14,86,418/- made by him u/s 69C of the Act. |

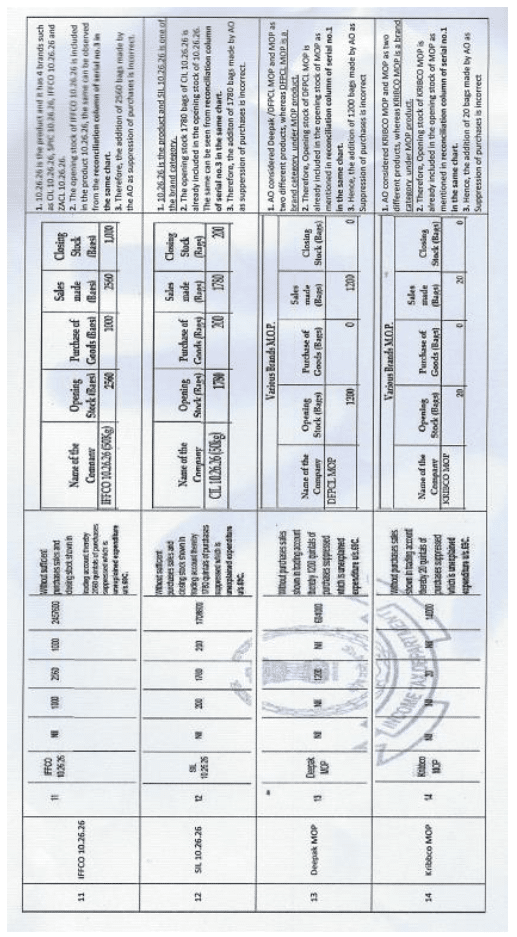

| IFFCO 10.26.26 | 1. The A.O., mistakenly, considered IFFCO 10.26.26 and 10.26.26 as two different products, whereas IFFCO 10.26.26 is a brand of the 10.26.26 product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 2560 bags of IFFCO 10.26.26 was already included in the “Opening Stock” of 13506 bags. of 10.26.26 (parent product) on 01.04.2016, therefore, the “Sales” (2560 bags) and “Closing Stock” (1000 bags) of IFFCO 10.26.26 were sourced out of the “Opening Stock” (2560 bags) and “Purchases” (1000 bags). 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure of Rs. 24,57,600/- for purchase of 2560 bags of IFFCO 10.26.26 (disclosed by him as Sales (2560 bags) and Closing Stock (1000 bags] and thus, on the said count had made an addition of Rs. 24,57,600/- u/s 69C of the Act. 3. We find that as the A.O had lost sight of the “Opening stock” of 2560 Qtl of IFFCO 10.26.26 that formed part of “Opening Stock” of 13506 bags of 10.26.26 (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted purchases of IFFCO 10.26.26. We, thus, direct the A.O. to delete the addition of Rs. 24,57,000/-made by him u/s 69C of the Act. |

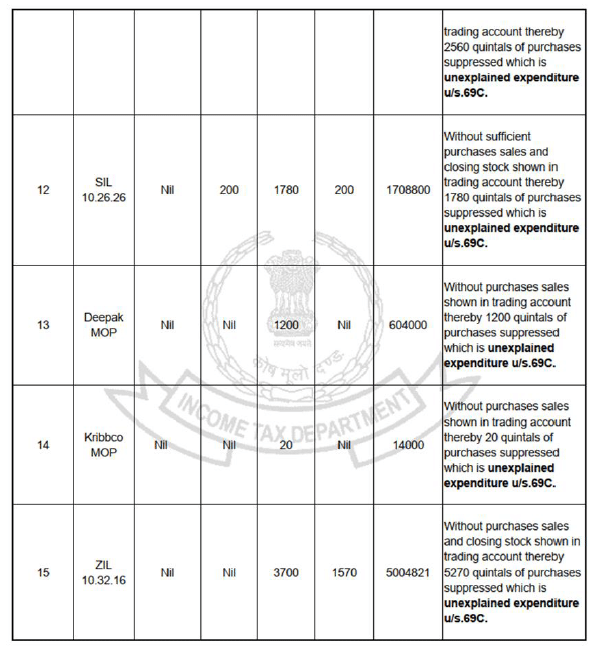

| CIL 10.26.26 | 4. The A.O., mistakenly, considered CIL 10.26.26 and 10.26.26 as two different products, whereas CIL 10.26.26 is a brand of the 10.26.26 product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 1780 bags of CIL 10.26.26 was already included in the “Opening Stock” of 13506 bags. of 10.26.26 (parent product) on 01.04.2016, therefore, the “Sales” (1780 bags) and “Closing Stock” (200 bags) of CIL 10.26.26 were sourced out of the “Opening Stock” (1780 bags) and “Purchases” (200 bags). 5. The A.O. had based on his wrong observations, concluded that the assessee had incurred unexplained expenditure of Rs. 17,08,800/- for purchase of 1780 bags of CIL 10.26.26 and thus, on the said count had made an addition of Rs. 17,08,800/- u/s 69C of the Act. 6. We find that as the A.O had lost sight of the “Opening stock” of 1780 bags of CIL 10.26.26 [that formed part of “Opening Stock” of 13506 bags of 10.26.26 (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted purchases of CIL 10.26.26. We, thus, direct the A.O. to delete the addition of Rs. 17,08,800/- made by him u/s 69C of the Act. |

| DFPCL MOP | 1. The A.O., mistakenly, considered Deepak MOP (DFPCL) and MOP as two different products, whereas DFPCL MOP is a brand of the MOP product (parent product). Thus, the A.O had lost sight of the fact that as the “Opening stock” on 01.04.2016 of 1200 bags of DFPCL MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the “Sales” (1200 bags) of DFPCL MOP by the assessee was sourced out of the “Opening stock” (1200 bags) for the subject year. 2. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure for the purchase of 1200 bags of DFPCL MOP and thus, on the said count had made an addition of Rs. 6,04,000/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 1200 bags of DFPCL MOP that formed part of “Opening Stock” of 12030 bags MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by the assessee for purchase of 1200 bags of DFPCL MOP. We, thus, direct the A.O. to delete the addition of Rs. 6,04,000/- made by him u/s 69C of the Act. |

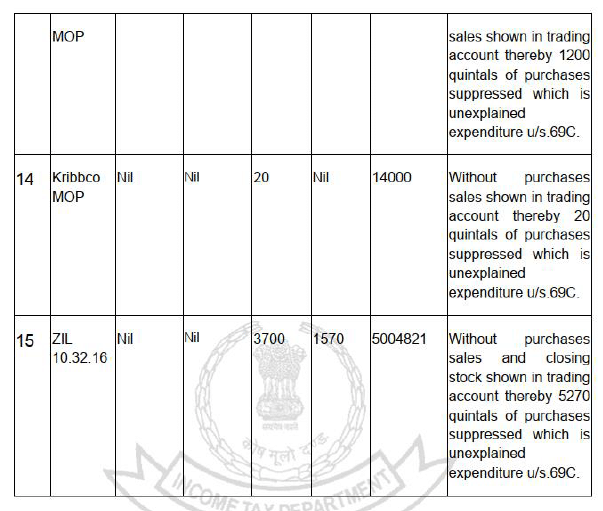

| Kribhco MOP | 4. The A.O., mistakenly, considered KRIBCCO MOP and MOP as two different products, whereas KRIBHCO MOP is a brand of the MOP product (parent product). Thus, the A.O had lost sight of the fact that as the “Opening stock” on 01.04.2016 of 20 bags of KRIBHCO MOP was already included in the “Opening Stock” of 12030 bags of MOP (parent product) on 01.04.2016, therefore, the “Sales” (20 bags) of KRIBHCO MOP by the assessee was sourced out of the “Opening stock” (20 bags) for the subject year. 5. The A.O. had based on his wrong observation, concluded that the assessee had incurred unexplained expenditure for purchase of 20 bags of KRIBHCO MOP and thus, on the said count made an addition of Rs. 14,000/-. 6. We find that as the A.O had lost sight of the “Opening stock” of 20 bags of KRIBHCO MOP that formed part of the “Opening Stock” of 12030 bags MOP (parent product) (as can be gathered from the “Fertilizer trading A/c” and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by him for purchase of 20 bags of KRIBHCO MOP. We, thus, direct the A.O. to delete the addition of Rs. 14,000/-made by him u/s 69C of the Act. |

| ZIL 12.32.16 | 1. The A.O., mistakenly, considered ZIL 12.32.16 and 12.32.16 as two different products, whereas ZIL 12.32.16 MOP is a brand of the 12.32.16 product (parent product). Thus, the A.O lost sight of the fact that as the “Opening stock” on 01.04.2016 of 5270 bags of ZIL 12.32.16 was already included in the “Opening Stock” of 14390 bags of 12.32.16 (parent product) on 01.04.2016, therefore, the “Sales” (3700 bags) and “Closing Stock” (1570 bags) of ZIL 12.32.16 were sourced out of the “Opening stock” (5270 bags) for the subject year. 2. The A.O. had based on his wrong observations, concluded that the assessee had incurred unexplained expenditure for purchase of 5270 bags of ZIL 12.32.16 and thus, on the said count made an addition of Rs. 50,04,821/-. 3. We find that as the A.O had lost sight of the “Opening stock” of 5270 bags of ZIL 12.32.16 that formed part of “Opening Stock” of 14390 bags of 12.32.16 (parent product) (as can be gathered from the “Fertilizer trading A/c and the reconciliation filed by the assessee), there is no unaccounted expenditure incurred by him for purchase of 5270 bags of ZIL 12.32.16. We, thus, direct the A.O. to delete the addition of Rs. 50,04,821/- made by him u/s 69C of the Act. |