ORDER

R. K. Panda, Vice Precident. – This appeal filed by the Revenue is directed against the order dated 31.01.2025 of the Ld. Addl / JCIT(A)-2, Gurugram relating to assessment year 2022-23. The assessee has filed the Cross Objections vide CO No.19/PUN/2025 against the appeal filed by the Revenue. For the sake of convenience, the appeal filed by the Revenue and the Cross Objections filed by the assessee were heard together and are being disposed off by this common order.

ITA No.825/pUN/2025

2. Facts of the case, in brief, are that the assessee is an artificial juridical person and is an autonomous statutory body established in 1965 by Special Act in Maharashtra State Legislative Assembly under the provisions of the Maharashtra Act No.41 of 1965 i.e. Maharashtra Secondary and Higher Secondary Education Boards Act, 1965. It conducts the higher secondary certificate and secondary school certificate examinations in the entire state of Maharashtra through its nine Divisional Boards located at Pune, Mumbai, Chhatrapati Sambhajinagar, Nashik, Kolhapur, Amravati, Latur, Nagpur and Ratnagiri. It filed its return of income on 23.11.2022 declaring Nil income after claiming exemption u/s 10(46) of the Income Tax Act, 1961 (hereinafter referred to as ‘the Act’). During the year under consideration the total receipts of the assessee were Rs.1,91,86,33,440/- out of which the total application of income towards the objects of the assessee board were Rs.1,85,94,67,002/- and the assessee board has balance amount of Rs.5,91,66,438/- which was claimed as exempt. The assessee has filed audit report in Form No.10B on 31.03.2024 along with copy of audited Income & Expenditure statement for financial year ending as on 31.03.2022. The CPC vide intimation dated 28.07.2023 rejected the claim of deduction u/s 10(46) of the Act.

3. Before the Ld. Addl / JCIT(A) it was argued that it was inadvertently claimed exemption u/s 10(46) whereas the assessee is entitled to claim exemption u/s 10(23C) of the Act. It was submitted that the approval for exemption u/s 10(23C) has been granted by the PCIT for assessment years 2022-23 to 2026-27.

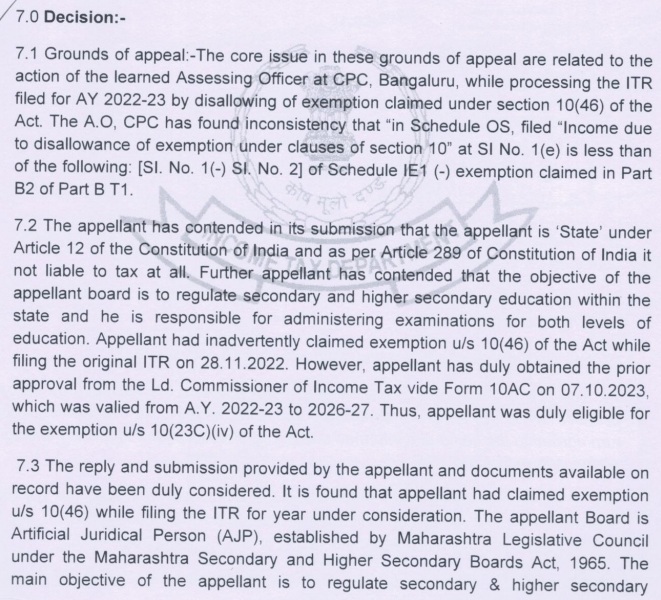

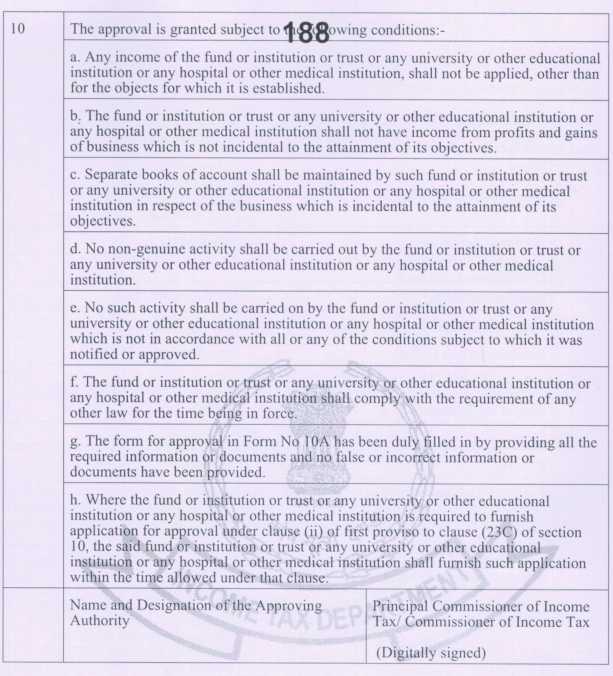

4. Based on the arguments advanced by the assessee the Ld. Addl / JCIT(A) allowed the claim of deduction u/s 10(23C)(iv) of the Act by observing as under:

5. Aggrieved with such order of the Ld. Addl / JCIT(A), the Revenue is in appeal before the Tribunal by raising the following grounds:

| 1. | | On the facts and circumstances of the case, the Ld. Addl/JCIT(A) has erred in allowing claim of exemption by the assessee at the appellate stage despite the fact that the same was not claimed in the original return of income. |

| 2. | | On the facts and circumstances of the case, the Ld. Addl/JCIT(A) has failed to appreciate that the intimation u/s 143(1) was issued correctly based on the information available in the return of income, wherein the assessee had claimed exemption u/s 10(46) of the Act and not u/s 10(23C)(iv) of the Act. |

| 3. | | On the facts and circumstances of the case, the Ld. Addl/JCIT(A) has erred in deciding that the total accumulation of income of the assessee of Rs.5,91,66,438/- was claimed inadvertently as exempt u/s 10(46) instead of u/s 10(23C)(iv) of the Act when it was consciously claimed by the assessee in the return of income. |

| 4. | | On the facts & circumstances of the case, it is prayed to restore the computation u/s 143(1) of the Act dated 28.07.2023 in accordance with law as determined by the CPC. |

| 5. | | The appellant craves leave to add, alter or amend any or all the grounds of appeal. |

6. The assessee has also filed the Cross Objection by raising the following grounds:

| 1. | | On the facts and in the circumstances of the case and in law, the learned Addl. Commissioner of Income Tax (Appeals) erred in not adjudicating the other grounds of appeal raised by the appellant, despite allowing relief on the limited ground that the appellant is eligible for exemption under section 10(23C)(iv) of the Act and therefore, it is submitted that the learned Addl CIT(A) ought to have adjudicated all grounds independently to ensure comprehensive disposal of the appeal in accordance with law. |

| 2. | | On the facts and in the circumstances of the case and in law, the intimation order passed u/s 143(1) of the Act by the Ld CPC Bengaluru for AY 202223 is invalid, without jurisdiction and hence, bad in law and therefore, may please be quashed. |

| 3. | | On the facts and in the circumstances of the case, the question of the Appellant’s eligibility for exemption under section 10 of the Act involves complex and debatable issues requiring detailed examination of facts, legal interpretation, and verification of records, which cannot be adjudicated through a summary mechanism like section 143(1) and therefore, the adjustment of Rs.5,91,66,438 made by the CPC, Bengaluru in the impugned intimation under section 143(1) is without jurisdiction and liable to be quashed along with the said intimation. |

| 4. | | On the facts and in the circumstances of the case and in law and without prejudice to any other ground, Ld. CPC Bengaluru has erred in denying the exemption u/s 10(23C)(iv) of the Act and thereby further erred in assessing the total income of the Appellant at Rs.5,91,66,438/- as against the returned income of Rs NIL which is factually and legally incorrect and invalid and hence, the said addition of Rs.5,91,66,438/- made to the returned income should be set aside and the demand raised by the CPC may please be deleted. |

| 5. | | On the facts and in the circumstances of the case and in law and without prejudice to other grounds, the Appellant is ‘State’ within the meaning of Article 12 of the Constitution of India and hence, as per Article 289 of Constitution of India it not liable to tax at all and therefore, the impugned addition of Rs.5,91,66,438/- and consequential demand raised is unconstitutional and thus, illegal, invalid and bad in law and therefore, the addition made as well as demand raised may please be quashed and set aside. |

| 6. | | On the facts and in the circumstances of the case and in law and without prejudice to any other ground and assuming but without admitting appellant was not eligible for exemption u/s 10(23C)(iv), Ld. CPC Bengaluru has erred in denying the exemption under section 10(46) of the Act whereby the entire income earned by the Appellant board was exempt and therefore, the impugned addition of Rs.5,91,66,438 made in the intimation order is invalid and bad in law and therefore, the same may please be quashed and set aside. |

| 7. | | On the facts and in the circumstances of the case and in law and without prejudice to any other ground, Ld. CPC Bengaluru has erred in levying interest u/s 234A, 234B and 234C and hence, the same may please be deleted. |

| 8. | | On the facts and in the circumstances of the case and in law and without prejudice to any other ground, Ld. CPC Bengaluru has erred in the levying fee u/s 234F and hence, the same may please be deleted. |

7. The Ld. DR submitted that since the assessee has not claimed the deduction u/s 10(23C)(iv) of the Act, therefore, the CPC was justified in rejecting the claim of exemption u/s 10(46) of the Act for which the assessee is not entitled. The assessee has made a wrong claim in the return of income by mentioning wrong figures under wrong clauses, therefore, the CPC was fully justified in rejecting the claim. The Ld. Addl / JCIT(A) without appreciating the facts properly has allowed the claim of deduction u/s 10(23C)(iv) of the Act which is not correct. He accordingly submitted that the order of the Ld. Addl / JCIT(A) be reversed and that of the Assessing Officer / CPC be restored.

8. The Ld. Counsel for the assessee on the other hand while supporting the order of the Ld. Addl / JCIT(A) drew the attention of the Bench to the decision of Hon’ble Bombay High Court in the case of Sanchit Software & Solutions (P.) Ltd. v. CIT ITR 404 (Bombay). He submitted that the Hon’ble High Court in the said decision has held that where in return of income the assessee had sought to exclude its dividend income and long term capital gains from sale of shares u/s 10 but by mistake, omitted to exclude them, Commissioner should rectify the return and revision could not be denied.

9. Referring to the decision of the Delhi Bench of the Tribunal in the case of Smt. Ashrafi Devi Shiksha Samiti v. ITO (Exemption) (Delhi – Trib.), he submitted that the Tribunal in the said decision has held that where assessee, an educational institution, claimed exemption under section 10(23C)(iiiad) only after it received approval under section 10(23C)(i) read with section 10(23C) (vi) for relevant year, it was entitled for claiming exemption under section 10(23C) even though it was not registered under section 12A.

10. Referring to the decision of the Lucknow Bench of the Tribunal in the case of Desh Bharti Public School Samiti v. Assessing Officer/Dy. CIT ITD 600 (Lucknow – Trib.), he submitted that the Tribunal in the said decision has held that where assessee, a trust, in earlier years had been claiming exemption under section 10(23C) and it got registration under section 12A on 2-9-2014 and it in return filed for assessment year 2014-15 claimed exempt income under section 10(23C) instead of claiming same under section 12A, mistake had occurred as a human error and thus Assessing Officer was to be directed to allow exemption under section 12A.

11. Referring to the CBDT Circular No.14(XL-35)/1955 dated 11.04.1955, he submitted that according to the said circular, the tax officers are required to assist the taxpayers in making legitimate claims for exemption or relief. He submitted that the assessee in the instant case is entitled for claim of deduction u/s 10(23C)(iv) of the Act since the approval u/s 10(23C)(iv) was granted on 07.10.2023 for assessment years 2022-23 to 2026-27. Further, the exemption u/s 10(23C) was fully granted by the CPC for subsequent assessment years 2023-24 and 2024-25, copies of which are placed at pages 235 to 255 of the paper book.

12. Referring to the decision of Hon’ble Bombay High Court in the case of CIT, Central-I v. Pruthvi Brokers & Shareholders ITR 336 (Bombay) and the decision of the Hon’ble Karnataka High Court in the case of Pr. CIT v. Karnataka State Co-operative Federation Ltd. (Karnataka), he submitted that a new claim / exemption can be raised at appellate stage. He submitted that mere claim under incorrect section will not disentitle exemption and the wrong information in the ITR can be rectified. He accordingly submitted that the claim of exemption u/s 10(23C)(iv) of the Act could not even be denied merely because there was wrong information in the ITR.

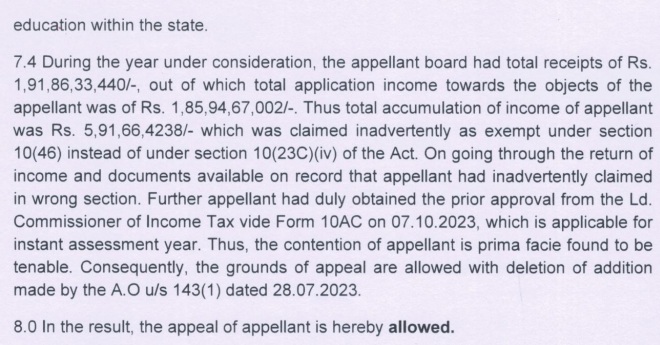

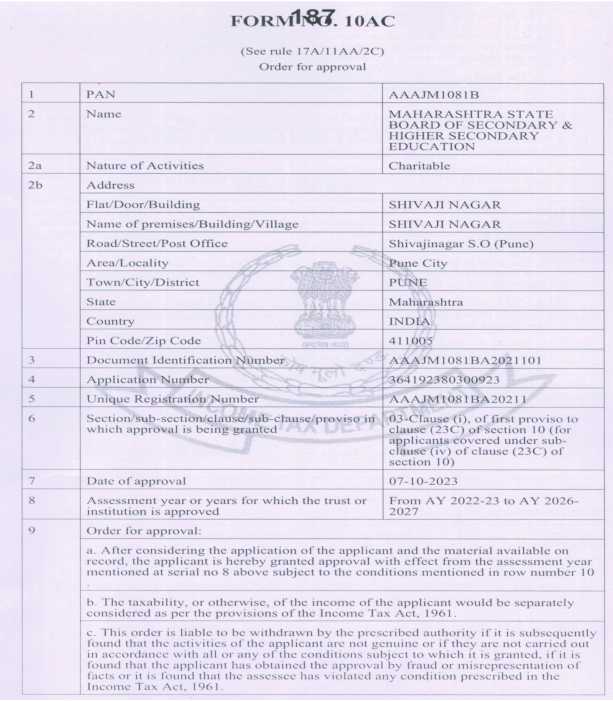

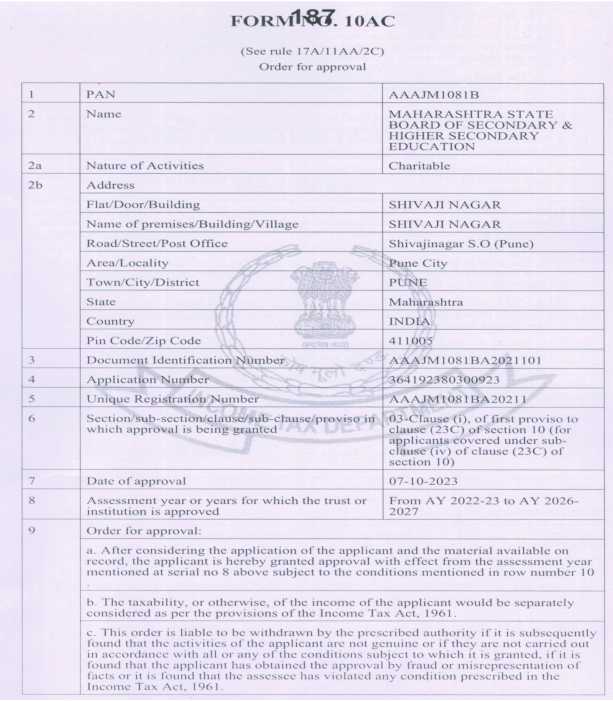

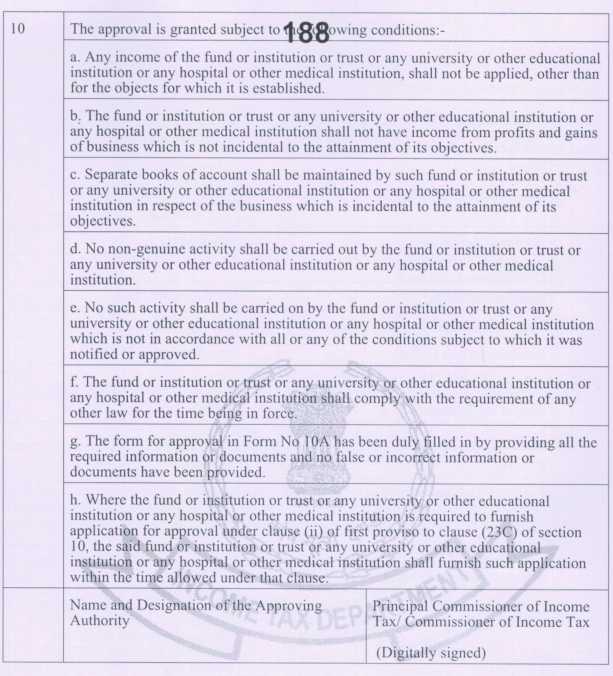

13. We have heard the rival arguments made by both the sides, perused the orders of the CPC / Assessing Officer and the Ld. Addl / JCIT(A) and the paper book filed by both the sides. We have also considered the various decisions cited before us. We find the assessee in the instant case instead of claiming the deduction u/s 10(23C)(iv) made wrong claim u/s 10(46) of the Act which was denied by the CPC in the intimation u/s 143(1) of the Act. We find in appeal the Ld. Addl / JCIT(A) after appreciating the facts properly allowed the claim of deduction u/s 10(23C)(iv) of the Act. We do not find any infirmity in the order of the Ld. Addl / JCIT(A) on this issue. Admittedly the assessee vide order dated 07.10.2023 has been granted the approval u/s 10(23C)(iv) of the Act for assessment years 2022-23 to 2026-27 which is as under:

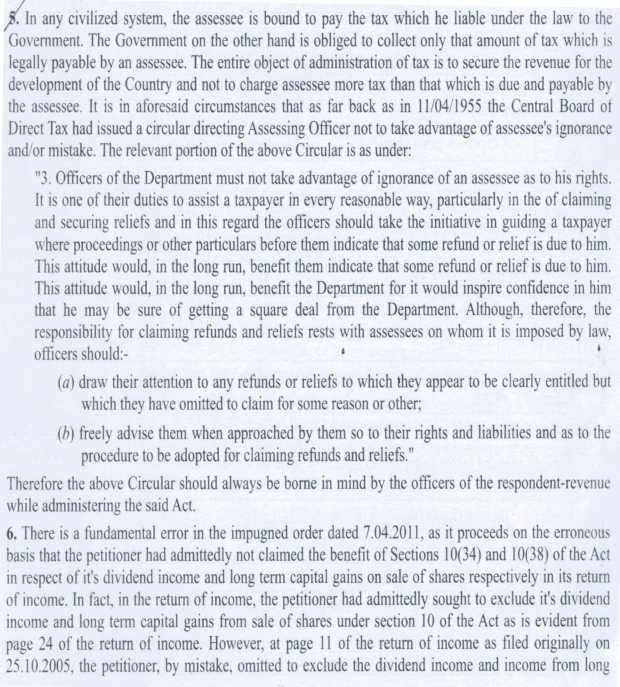

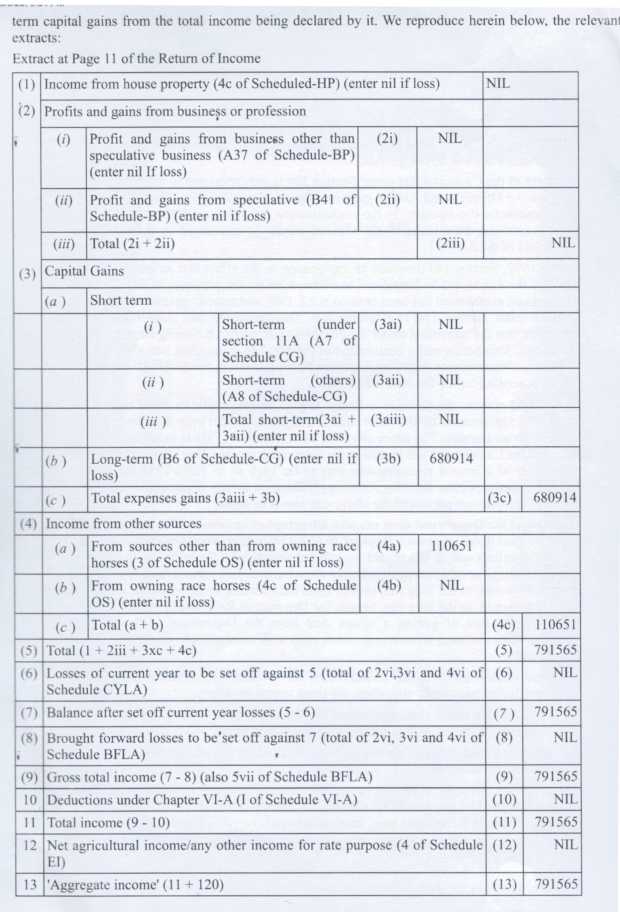

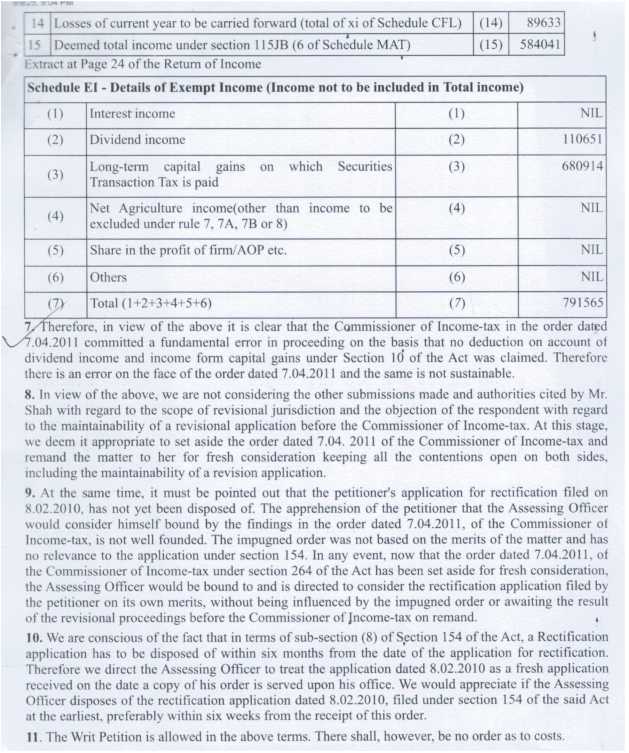

14. We find Hon’ble Bombay High Court in the case of Sanchit Software & Solutions (P.) Ltd. (supra) has held that where the assessee sought to exclude its dividend income and long term capital gains from sale of shares u/s 10 but by mistake, omitted to exclude them, revision could not be denied. The Hon’ble High Court while deciding the issue has observed as under:

15. We find the Delhi Bench of the Tribunal in the case of Smt. Ashrafi Devi Shiksha Samiti (supra) has held that where assessee, an educational institution, claimed exemption under section 10(23C)(iiiad) only after it received approval under section 10(23C)(i) read with section 10(23C) (vi) for relevant year, it was entitled for claiming exemption under section 10(23C) even it was not registered under section 12A. We find the Tribunal at para 6 has observed as under:

“6. We have heard both parties at length and have perused the material available on the record. The issue before us is only that whether the adjustment of Rs.77,43,697/-, in absence of approval under section 12A and 10(23C)(i) rws 10(23C)(vi) of the Act can be done in the processing of ITR under section 143(1) of the Act. In principle, we are in agreement of the finding of the Ld. Addl/JCIT(A)-9, Mumbai as the impugned order is well reasoned. But the anomaly has arisen after the approval vide order dated 08.07.2024 under section 10(23C)(i) rws 10(23C)(vi) of the Act for the relevant year as the assessee’s entire income having derived from the educational institution is fully exempted even after the said adjustment of Rs.77,43,697/- as the tax cannot be levied on the exempted income. In such facts and circumstances, we have no option except to restore the matter back to the AO to give effect to the order passed under section 10(23C)(i) rws 10(23C)(vi) of the Act for relevant year as the assessee is entitled for claiming exemption under section 10(23C) of the Act. We, therefore, direct the AO to allow the benefit of section 10(23C) of the Act and allow consequential relief to the assessee.”

16. We find the Lucknow Bench of the Tribunal in the case of Desh Bharti Public School Samiti (supra) while holding that the assessee due to mistake claimed exemption u/s 10(23C) of the Act instead of claiming the same u/s 12A, is entitled for exemption u/s 12A. The relevant observations from para 4 onwards read as under:

“4. We have heard the rival parties and have gone through the material placed on record. We find that it is undisputed fact that assessee got registration u/s.12A of the Act w.e.f. 1.4.2013 vide order dated 2.9.2014, a copy of such registration certificate is placed in P.B. pg.24. It is also an undisputed fact that assessee in the earlier years has been claiming exemption u/s.10(23C) of the Act and which was being allowed by the department also as the receipt of the assessee in the earlier years were less than Rs.1.00 crore. During the year under consideration, the assessee got the registration u/s.12A of the Act on 2.9.2014 and filed the income tax return on 20.9.2014. Along with filing of return of income, the assessee also uploaded Form-10B which is audit report u/s. 12A(b) of the Act. However, in the return of income, the assessee claimed exempt income u/s.10(23C) instead of claiming the same u/s.12A of the Act. The CPC rejected the claim of the assessee u/s.10(23C) by holding that the assessee had not obtained necessary approval from the prescribed authority and the receipts of the assessee exceeded Rs.1.00 crore. The application for rectification u/s.154 was also rejected and on appeal before ld. CIT(A), the ld. CIT(A) also dismissed the appeal of the assessee by first holding that there was no mistake apparent from record and further held that there is lot of difference between the claim of exemption u/s.10(23C) and Section 11 of the Act. However, nowhere in the appellate order the ld. CIT(A) disputed the fact that assessee was not registered u/s.12A of the Act. The registration certificate granted by the department on 2.9.2014 is on record. Further the uploading of Form-10B which is a audit report u/s.12A(b) of the Act, proves that the mistake committed by assessee in claiming exemption u/s.10(23C) is inadvertent mistake as by committing such a mistake the assessee is not going to gain anything. Fact of the matter is that assessee is registered u/s.12A of the Act and is eligible for exemption u/s.11 of the Act. Therefore for inadvertent mistake the assessee cannot be penalized. Since the assessee has been claiming exemption u/s.10(23C) in the earlier years therefore during the year under consideration there is high probability that assessee again claimed exemption u/s.10(23C) by overlooking the fact that it had already got registration u/s.12A of the Act which in any case was available with the assessee before the filing of return of income. The mistake has occurred as a human error and should have been judicially considered. The CBDT vide Circular No.14 (XL35) dated 11.4.1955 in Para 3 has held as under:

“Officers of the Department must not take advantage of ignorance of an assessee as to his rights. It is one of their duties to assist a taxpayer in every reasonable way, particularly in the matter of claiming and securing reliefs and in this regard the Officers should take the initiative in guiding a taxpayer where proceedings or other particulars before them indicate that some refund or relief is due to him. This attitude would, in the long run, benefit the Department for it would inspire confidence in him that he may be sure of getting a square deal from the Department. Although, therefore, the responsibility for claiming refunds and reliefs rests with assessees on whom it is imposed by law, officers should:—

(a) Draw their attention to any refunds or reliefs to which they appear to be dearly entitled but which they have omitted to claim for some reason or other;

(b) Freely advise them when approached by them as to their rights and liabilities and as to the procedure to be adopted for claiming refunds and reliefs.”

5. In view of above facts and circumstances, we direct the Assessing Officer to allow the exemption to the assessee u/s.12A of the Act in accordance with law.

6. In the result, the appeal of the assessee is allowed.”

17. In view of the above discussion and considering the fact that the assessee has already been granted approval u/s 10(23C)(iv) of the Act for assessment years 2022-23 to 2026-27, therefore, merely because there was an inadvertent error on the part of the assessee by claiming exemption u/s 10(46) instead of u/s 10(23C)(iv), the assessee could not be deprived of the legitimate claim. We, therefore, we do not find any infirmity in the order of the Ld. Addl / JCIT(A) in granting exemption u/s 10(23C)(iv) of the Act. We, therefore, uphold the same and the grounds raised by the Revenue are dismissed.

CO No.19/pUN/2025

18. Since the appeal filed by the Revenue is dismissed, the CO filed by the assessee becomes infructuous. Accordingly the same is dismissed.

19. In the result, the appeal filed by the Revenue and the Cross Objection filed by the assessee are dismissed.