ORDER

Anadee Nath Misshra, Accountant Member.- This appeal vide I.T.A. No.88/Lkw/2024 has been filed by the assessee for assessment year 2017-18 against impugned appellate order dated 20/12/2023 (DIN & Order No.ITBA/NFAC/S/250/2023-24/1058934412(1) of Commissioner of Income Tax (Appeals) [“CIT(A)”] for short]. In this appeal the assessee has raised the following grounds:

“‘1. That the learned CIT (Appeals) has erred both in law and on facts in confirming the income of the appellant company at Rs.10,46,10,080/- as against declared income at Rs.1,21,38,950/-.

2. That the CIT (Appeals) erred on facts and in law in confirming the addition of Rs.9,24,71,130/- representing cash sales and erroneously held to be unexplained credit u/s 68 of the Income Tax Act,1961.

3. That the learned CIT (Appeals) has failed to appreciate that the approach adopted to assume and hold that the sales as of08.11.2016 are abnormal sales and therefore assumption and presumption that sales of Rs.9,24,71,110/- represent unexplained money is illegal invalid and untenable.

4. That the appellant company had paid TCS of Rs.1,67,361/- on sales aggregating to Rs.1,67,36,087/- on 08.11.2016 where the buyers had paid in cash the amount in excess of Rs. 2.00 Lac as per provisions of the Income Tax Act, 1961 and these sales had also not been accepted by the A.O. and also not considered by the learned CIT(A) without any valid reason.

5. That the ld. CIT(A) has erred both in law and on facts in confirming the addition u/s 68 of the Income Tax Act, 1961 in the case of the appellant company without appreciating that the provisions of Section 68 of the Income Tax Act, 1961 are not applicable in the present facts of the case since the appellant company had already accounted for income represented by cash deposited in the bank and therefore, the same cannot fee considered to be undisclosed income as per provisions of Section 68 of the Income Tax Act, 1961 resulting into double addition/taxation as the amount ofcash deposits by way of sales had been shown in Profit and Loss Account for the year ended 31.03.2017, which had been accordingly shown in return of income as well as accepted by the VA T authorities.

6. That there was no dispute in respect of the purchases and sales which were duly disclosed in VAT return, VA T Order and also in books of accounts maintained by the appellant audited under the Companies Act, 2013 and also under section 44 AB of the Act, no adverse inference could be drawn in respect of the declared profit by the appellant company in spite of admitting that the sales were out of explained stock in hand.

That the entire addition is based on whimsical, fanciful assumptions, arbitrary inferences and overlooks the factual position on record and therefore, the same is invalid, illegal and hence unsustainable, which had arisen “m the abnormal situation,.'”.••

7. That the entire addition is based on whimsical, fanciful assumptions, arbitrary inferences and overlooks the factual position on record and therefore, the same is invalid, illegal and hence unsustainable, which had arisen in the abnormal situation.

8. That the ld. CIT(A) agreed with the ld. Deputy Commissioner of the Income Tax and erred in law and on facts in invoking the provisions contained in section 145(3) of the Act to make the instant addition.

9. That the provisions of Section 115BBE of the Income Tax Act, 1961 and determining tax liability as per aforesaid section without appreciating that the provisions of Section 68 of the Income Tax Act, 1961 were not applicable in the facts of the case and the income which had already been included in the return of income which cannot be deemed to be undisclosed income u/s 68 of the Income Tax Act, 1961 attracting the provisions of Section 115BBE of the Income Tax Act, 1961. Besides this these provisions are not applicable in A. Y 2017-18 for levying 60 percent Tax.

10. That the learned CIT (Appeals) erred on facts and in law in confirming the levy of interest of Rs.2,36,06,055/- u/s 234B of the Act, which are not leviable on the facts of the instant case.”

(A.1) The assessee has also raised the following additional grounds:

(B) In this case assessment order dated 30/12/2019 was passed u/s 143(3) of the Act wherein the assessee’s total income was determined at Rs.10,46,10,080/- as against returned income of Rs.1,21,38,950/-. In the aforesaid assessment order, an addition of Rs.9,24,71,130/- was made by the Assessing Officer u/s 68 of the Act on account of cash deposits made in the bank. The assessee is in the business of ornaments and jewellery (of gold, silver & diamond) and other items of gold, silver and diamond. The assessee made a total deposit of Rs.10,28,38,468/- in the bank out of cash sales made on 08/11/2016. The aforesaid cash deposits in bank were made out of Specified Bank Notes (“SBN” for short) in the denomination of 1000 and 500, which were demonetized with effect from 09/11/2016. Out of the aforesaid total amount of Rs.10,34,06,468/-, the Assessing Officer treated cash sale of Rs.75,99,348/- as genuine and added the remaining amount of Rs.9,24,71,130/- to the income of the assessee u/s 68 of the Act. The Assessing Officer disbelieved that cash sale of aforesaid amount was made in the limited time after announcement of demonetization. The Assessing Officer, in disbelieving the assessee’s explanation, and in making the aforesaid addition, placed reliance on the cases of Hon’ble Supreme Court reported at

Kale Khan Mohammad Hanif v.

CIT [1963] 50 ITR 1 (SC)

, Roshan Di Hatti v.

CIT [1977] 107 ITR 938 (SC) and

Smt. Srilekha Banerjee v.

CIT 1964 AIR 697 (SC) for the proposition that the onus was on the assessee to satisfactorily explain the source of money found to have been received by the assessee. The Assessing Officer placed further reliance on the orders of Hon’ble Supreme Court reported at

Sumati Dayal v.

CIT (SC) and

CIT v.

Durga Prasad More [1971] 82 ITR 540 (SC) for the view that apparent was not real in the present case. The assessee’s appeal was dismissed by the learned CIT(A)

vide impugned appellate order dated 20/12/2023. The learned CIT(A) placed reliance on the case of

Sapta Panchait Kirshk Seva Swablambi Sahkari Samiti Ltd. v.

UOI (Patna) and on the case of

Vaishnavi Bullion (P.) Ltd. v.

ACIT (Hyderabad –

Trib.). The learned CIT(A) also rejected the assessee’s contention that section 115BBE of the Act was not applicable in the present case. Aggrieved, the assessee has filed the present appeal in Income Tax Appellate Tribunal.

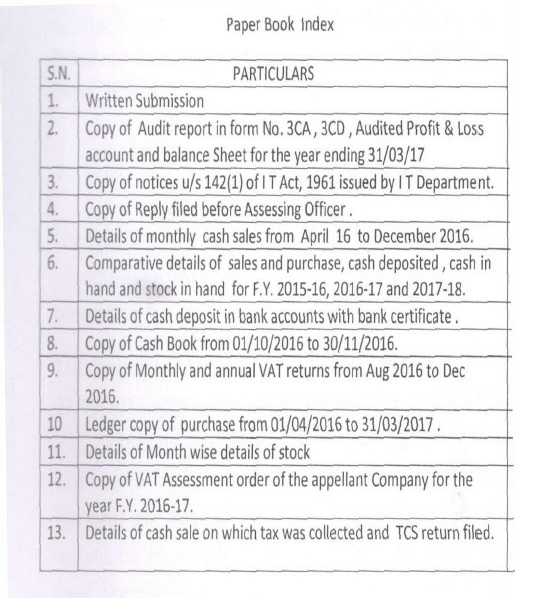

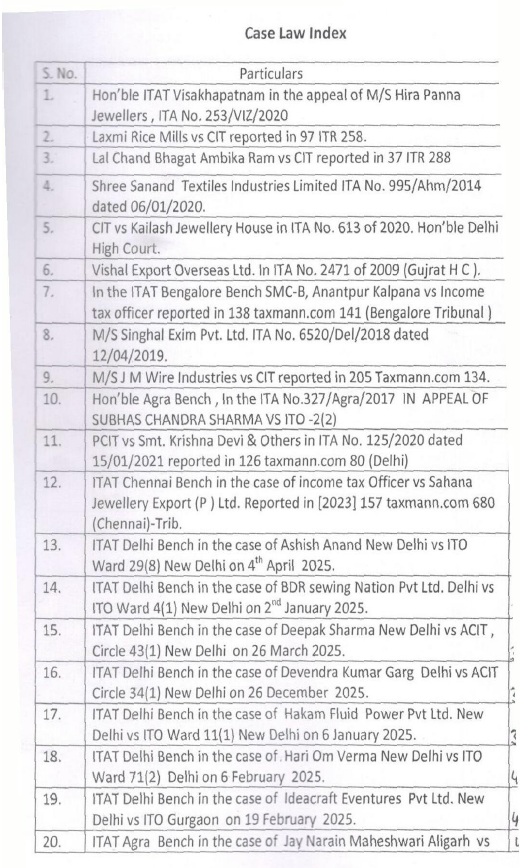

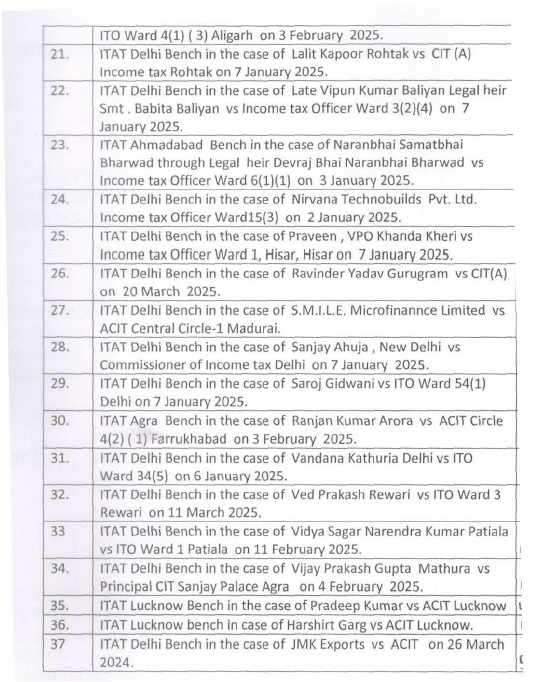

(C) In the course of appellate proceedings in Income Tax Appellate Tribunal, the learned Counsel for the assessee filed paper book and also filed compilation of following case laws in support of assessee’s appeal; the particulars of which are as under:

(D) At the time of hearing before us, the learned Counsel for the assessee, in response to objection by the learned D.R., withdrew the aforesaid additional grounds of appeal referred to in foregoing paragraph (A.1) of this order.

(D.1) Learned Counsel for the assessee drew our attention to written submissions and placed reliance on the same, included in the aforesaid paper book, which are reproduced below for the ease of reference:

Brief facts of the case

The appellant is a private limited Company, engaged in the business of wholesale and retail trade of gold & silver bullion and gold and silver ornaments.

The appellant filed his return of income for A.Y. 2017-18 u/s 139(1) on 27/09/2017 with acknowledgement No. 223447111270917 at income of Rs.1,21,38,950/-. The said income includes Net profit from sale of gold & silver bullion and gold and silver ornaments. The books of account of the company are Audited under the companies Act, as well as under the income tax act u/s 44AB of I T Act, 1961. During the relevant assessment year, the appellant company has shown turnover of Rs.26,75,79,570/- from sale of Gold & Silver Bullion and Gold and Silver ornaments. The revised return was also filed on 18/03/2019.The case of the appellant was selected for scrutiny and notice u/s 143(2) of I T Act, was issued on 27/09/2019.Thereafter notice u/s 142(1) were issued dated 23/10/2019 requiring the appellant to furnish the details and source of cash deposit in of Rs.10,28,38,000/-in bank during the demonetization.

In compliance to the said notice the appellant submitted before the Ld. AO details and source of cash deposited. It was explained that the source of cash deposit was cash available out of cash sales of gold & silver bullion and gold and silver ornaments made during the 08/11/2016 to 31/12/2016 and in this regard the appellant submitted complete details of cash sales made during the demonetization period along with copy of sale bills. The appellant also submitted cash book sale register, purchase register, stock summary, monthly Vat Return and VAT Assessment order. Complete details of purchase of gold bullion in form of purchase bill and purchase ledger and stock summarywere also submitted before Ld. AO. The Ld. AO has not doubted/disbelieved these evidences. The Ld. AO has also not doubted the availability of stock of bullion and gold ornaments and the purchase made. No defect has been pointed out in these details. The Ld. AO has also accepted the trading results and did not reject the books of account. With respect to the sales made by the appellant during the demonetization period. No defect has been pointed out in the sales made and the documents submitted in support of the sales. It is not the case of revenue that stock was not available and thus sale could not have been made.

The Ld. AO treated that cash deposited of Rs.10,28,38,000/-as non-genuine and made an addition of Rs.10,28,38,000/- as unexplained cash credit u/s 68 of I T Act.

Before the Ld. CIT(A) the assesse submitted all the evidences of cash deposit but the LD. CIT(A) confirmed the addition by relied on the theory of circumstantial evidence and preponderance of probabilities and completely ignored the documentary evidences in the form of sales Bill, VAT return, Vat Assessment order, Stock register and purchase Register.

1. SUBMISSION ON THE GROUNDS OF APPEAL No. 1 to 8, ON THE ISSUE OF ADDITION OF Rs.10,28,38,000/-U/S 68 OF THE I T ACT R.W.S. 115BBE OF IT ACT BEING CASH DEPOSIT IN BANK DURING THE DEMONETIZATION PERIOD.

With due respect it is prayed that the appellant is a private Limited Company which is engaged in the business of wholesale and retail trade of Gold Bullion, Silver and Gold & Silver Ornaments.

During the relevant assessment year, the assesse filed it return of income u/s 139(1) of I T Act, 1961 declaring income of Rs.1,21,38,948/-on 27/09/2017. The said income includes net profit from the private limited Company M/S Kashinath Seth Sarraf Private Limited as per Audited profit & Loss account and balance sheet.

The books of the assesse have been Audited u/s 44AB of I T Act, 1961 by the Chartered Accountant vide audit Report dated 01/09/2016. Copy of Audit report Audited Profit & Loss account and balance Sheet for the year ending 31/03/2017 are at page-No.18-49 of the Paper Book.

The case was selected for scrutiny and notice u/s 143(2) of I T Act, was issued on 27/09/2019.Thereafter notice u/s 142(1) were issued dated 23/10/2019 requiring the appellant to furnish the source of cash deposit of Rs.10,28,38,000/-in bank during the demonetization period.

Copy of notices u/s 142(1) of I T Act, 1961 issued by I T department are enclosed at page No. 50-60of Paper Book.

In compliance to the said notice the assesse has filed reply before Assessing Officer. Copy of reply of the assesse are at page No. 61-69 of the Paper Book.

According the assessee submitted the following details alongwith the reply.

| 1. | | Details of business premises. |

| 2. | | Details of bank accounts held by Assessee. |

| 3. | | Details of cash deposit in each bank. |

| 4. | | Monthwise chart of cash sale cash deposit in bank, cash withdrawals from bank and closing Cash balance. |

| 5. | | Details of unsecured loan. |

| 6. | | Copy of VAT return and VAT assessment order. |

| 7. | | Details of cash sales of above Rs.2 lacs alongwith name, PAN and Address of the customers is enclosed. |

Even a TCS return has been filed for collecting the TCS of Rs 1,67,361/- on sales aggregating to Rs 1,67,36,087/- from the persons to whom the sales has been made more than Rs 2 lakhs. The copy of the TCS return for evidence is enclosed at page No.l 93-207.

| 8. | | Details of all the parties from whom purchase of material has been made. |

The learned assessing Officer failed to appreciate that as per the provisions of the Act, Assessee cannot ask from the customer to provide their PAN details and KYC where cash sale is below 2 lacs. Further sale has been out of the stock of gold, silver and gold and silver ornaments available. All these details had never been disbelieved or found to be incorrect.

Thus, it is prayed that ld. A.O. examined all these details and have not point out any defects in the books of account of the assesse and cash balance maintained as per cash book and neither gave any adverse finding on the explanation offered however treated that cash sales as bogus and unexplained. Accordingly, the learned A.O. made the addition 10,28,38,000/-u/s 68 read with section 115BBE.

It is prayed that in the course of Appellate proceedings in order to substantiate the cash sales made during the demonetization period which was later on deposited in Bank Accounts on different date. The assessee submitted the copy of Sale register/ purchase register. The Appellant also filed the copy of monthly VAT Returns. These VAT Returns were never revised. The Assessee filed the Purchase register and Purchase Bills to substantiate the availability of Stock. Monthly Stock Summary of Gold Bullion and Ornaments was also submitted. Copy of cash book from 01.10.2016 to 31.12.2016 were also submitted.

It was explained before the Ld. CIT (Appeals) that all the purchases made by the assessee are from registered VAT Dealers and authorized dealers of Bullion and purchase bills and Purchase Register were filed in the course of assessment proceeding. The Ld. C.I.T (A) had not doubted the purchases of gold and gold ornaments made by the assessee. The Availability of the Stock of Gold Bullion and Gold ornaments has also not been doubted by the Ld. C.I.T (A). The Sales made of Gold Bullion and Gold ornaments during the demonetization period duly reported in the VAT returns and VAT Assessment was also completed by VAT Authorities, where in the sales, Purchases and stock of the Assessee were duly accepted by the VAT Authorities. The Ld CIT (Appeals) have confirmed the addition solely on the basis that there is substantial increase in cash sales in one single day when the demonetizations was announced.

The Ld. C.I.T (A) in Para 5.3 of the Appellate order while confirming the addition of Cash Deposit had relied on the theory of preponderance of probabilities and circumstantial evidence and in this regard, placed reliance on the decision of Hon’ble High Court in the case of CIT v. Kailash Jewellery House.

The case laws cited by the Appellant have been considered but they are distinguished on facts from the instant case. In view of the above discussion, the addition of Rs.9,24,71,130/- made by the assessing officer u/s 68 of the Act on account of unexplained cash credit is hereby confirmed.

It is prayed that the Ld CIT (Appeals) have not considered the documentary evidence filed in support of the cash deposited in bank account in the form of Sales Ledger from 01.10.2016 to 31/12/2016 along with copy of Sale invoices during the period from 01.10.2016 and 31/12.2016 in the sale invoices submitted for the above period.

In the said sales invoices, particulars of amount sold, weight of bullion, quantity and name of buyer is duly mentioned and VAT tax has been collected on the above sale as per Law. The Assessee furnished the details of the buyer along with their name. Further, the sales have been made out of the availability of Stock in hand of Gold Bullion & Gold ornaments and as a result of sales, the stock of the assessee has depleted and cash has been realized against the sales made.

Apart from the above information which was mentioned in the sale invoices, there were no other requirement specified under the law which was to be maintained by the assessee as all the sales were below Rs. 2 Lacs. It is prayed that these are over the Counter Sales and taking KYC and Mobile Numbers or addresses from customers has not been mandated under the Income Tax Act, in respect of Sales incurred below Rs. 2 Lacs.

The AO and the Ld CIT(A), both the lower authorities, without understanding the law, that as per Rule 114B of Income tax rules, 1962, there is no need for the Assessee to collect the PAN details of the buyers, if the sale value is less that Rs. 2 Lakhs. Further, threshold limit under PMLA was reduced to Rs. 50,000/-only w.e.f. 4-5-2023, for which the KYC norms were prescribed to collect the identity of such customers. Since, the Assessee was not required to maintain KYC of its customers. in case, the sales do not exceed the prescribed limit, the assessee has simply taken name of the persons who purchased gold jewellery/ Bullion without there being any PAN. Thus the observations of the Ld. CIT(A) that no identifiable particulars have been maintained are incorrect as there is not requirement under the Law for the same. In this regard reliance is placed on the decision of ITAT, Chennai Bench in the case of Income-tax officer v. SahanaJewellery Exports (P) Ltd reported in (Chennai-Trib) [20-12-2023] wherein it was held as under:-

“Whether furthermore assessee had furnished name and address of customers from whom it had received cash for sale of jewellery and law did not mandate assessee to collect PAN details of persons, if sale value of jewellery did not exceed Rs. 2 Lakhs,assessee had satisfactorily discharged onus cast upon to furnish name and address of persons and thus, additions under section 68 was unwarranted- Held, yes [Paras 13,14 and 15]” Copy of full case law are enclosed in the case law index.

The assessee has submitted Purchase Register / Ledger for F.Y.2016-17 along with purchases made during 01.04.2016 to 31/03/2017. Purchases of Gold Bullion have been shown to be made from Authorized Bullion Dealer’s. The Assessee also submitted the copy of all the purchase invoice made during the period from 01.10.2016 to 31/12/2016.Ld CIT (Appeals) did not consider that sales have been made out of stock of gold bullion and Gold ornaments and the availability of stock has not been doubted. All these evidences have not been doubted at any stage of proceedings nor the availability of stock of Gold Bullion has been questioned by the ld. CIT(A).

Thus, when the sales are supported through purchases and the availability of stock which has been doubted, Sales of Gold Bullions & gold Ornaments made from 01/10/2016 to 31/12/2016 which is supported by Sales Invoice on which due VAT Tax has been Collected from customer and deposited with State Government Authorities cannot be doubted merely on presumptions, and preponderance of probability by ignoring corroborative evidences in the form of purchase bills, sale invoice, stock summary, VAT returns. Thus, the observation of the Ld. CIT (A) that no cogent reasoning supported by documentary evidences is merely based on presumption and probabilities and completely ignoring the evidences filed in support of the above transactions.

It is further prayed that the Ld. CIT (A) confirmed the addition u/s 68 as unexplained case credit of the same amount which was accounted in the books as sales. In this regard, it is worthwhile to look into section 68 which reads as under:

“68. Where any sum is found credited in the books of an assessee maintained for any previous year, and the assessee offers no explanations about the nature and source thereof or the explanation offered by him is not, in the opinion of the [Assessing] Officer, satisfactory, the sum so credited may be charged to income -tax as the income of the assessee of that previous year:”

From the perusal of section 68, the sum found credited in the books of accounts for which the assessee offers no explanation the said sum is deemed to be income of the assessee. In the instant case of assessee had :-

duly explained the source as sales produced the sale bills and admitted the same as revenue receipt. Once there is no defect in the purchases and sales and the same are matching with inflow and the outflow of stock and cash, there is no reason to disbelieve the sales.

The Ld. CIT(A) had already examined theses details and did not pointed out any mistake in the regard.

The Ld. CIT(A) has not doubted the Sales of the Assessee which has been duly disclosed in the monthly VAT Returns.

Furthers, the VAT Returns of the assessee has never been revised/ rectified after the demonetizations and the VAT assessment of the assessee firm has been completed by Deputy Commissioner, Commercial Tax Department vide order dated 31-1-2020 where in the Sales, Purchases and Stock of the Assessee have been duly accepted.

The Ld. A.O had already accepted the Trading Results being Gross Profit and Net Profit and also accepted the Audited Books of Accounts of the Assessee, Which have been audited under the Income tax Act u/s 44AB of I.T. Act.

The Ld. CIT(A) has not doubted the purchases of bullions & gold ornaments made between 01.10.2016 to 08.11.2016 which has been made through authorized bullion Dealer.

The Ld. CIT (A) has not doubted the availability of stock of bullion, details of stock summary were duly furnished along with purchase bills.

The entries in the books of accounts were found to be genuine by the A.O and the Balance in Cash and Sales are matching with the books of accounts and the source and nature of cash has been duly explained.

It is also pertinent to note that whatever cash has been deposited by the Assesseein Bank accounts has been deployed / utilized in the business of the assessee by way of making payment for purchase of bullion and further for payment of VAT Tax. All these details have already been explained to Ld. A.O wherein details of all debit entries in bank account were given. Thus, the funds of the business collected from sales have been redeployed / reutilized in the business of Assessee firm.

It is further prayed the Hon’ble ITAT Visakhapatnam in the appeal of M/s HirapannaJewellers in ITA no. 253/Viz/2020 have allowed the appeal of the assessee wherein the revenue has made the addition of Rs.4,71,35,500/-on account of cash deposit from sales made in a single day on 08.11.2016. The relevant finding of the Tribunal are as under:-

“7. We have heard both the parties and perused the material placed on record. In the instant case, the assessee has admitted the receipts as sales and offered for taxations. The assessing officer made the addition u/s 68 as unexplained cash credit of the same amount which was accounted in the books as sales. In this regard, it is worthwhile to look into section 68 which reads as under:-

68. Where any sum is found credited in the books of an assessee maintained for any previous year, and the assessee offers no explanation about the nature and source thereof or the explanation offered by him is not, in the opinion of the [Assessing] Officer, satisfactory, the sum so credited by may be charged to income tax as the income of the assessee of that previous year:-

From the perusal of section 68, the sum found credited in the books of accounts for which the assessee offers no explanation the said sum is deemed to be income of the assessee. In the instant case the assessee had explained the source as sales, produced the sale bills and admitted the same as revenue receipts. The assessee is engaged in the jewellery business and maintaining the regular stock registers. Both the DDIT (Inv.) and the AO have conducted the surveys on different dates, independently and no difference was found in the stock register or the stocks of the assessee. Purchased sales and the stock are interlinked and inseparable. Every purchase increases the stock and every sale decreases the stock. To disbelieve the sales either the assessee should not have the sufficient stocks in their possession or there must be defects in the stock registers stocks. Once there is no defect in the purchases and sales and the same are matching with inflow and the out flow of stock, there is no reason to disbelieve the sales. The assessing officer accepted the sales and the stocks. He has not disturbed the closing stock which has direct nexus with the sales. The movement of stock is directly linked to the purchase and the sales. Audit report u/s 44AB, the financial statements furnished in paper book clearly shows the reduction of stock position and matching with the sales which goes to say that the cash generated represent the sales. The assessee has furnished the trading Account, P& L account in page No……..of paper book and we observe that the reduction of stock is matching with the corresponding sales and he assessee has not declared the exorbitant profits.Though certain suspicious features were noticed by the AO as well as the DDIT (Inv.) both are authorities did not find any defects is the books of accounts and trading account, P& L Account and the financial statements and failed to disprove the condition of the assessee. Suspicion however strong it may be, it should not be decided against the assessee without disproving the sales with tangible evidence. Thus, the addition made u/s 68 of the sales already reported in the books of accounts is bad in law.

The addition u/s 68 cannot be made where sale has been offered taxation as held by High court and ITAT

1.) JKG Exports v. ACIT Del Third Member has held in para 16 and 20 that in case similar to appellant addition can not be made u/s 68 held by third member in following para as under :-

“16. As rightly observed by learned Accountant Member, since the Assessing Officer has started the computation of income with the returned income of the assesee, it goes to prove that the entire trading account shown in the financial statement filed with the return of income has been accepted by the Assessing Officer. I also agree with learned Accountant Member that once the sales made by the assessee are supported by stock register, sale bills, payments through banking channel and sales have not only been disclosed in VAT returns but stand duly verified and accepted by VAT Department, such sales cannot be treated as bogus, so as to enable the Assessing Officer to invoke the provisions of section 68 of the Act. Thus, in my view, the addition made u/s. 68 of the Act was rightly deleted.”

“20. At this stage, I must observe that in course of hearing learned Standing Counsel appearing for the Revenue, though, had fairly agreed that provisions of section 69 cannot get attracted, however, he urged and pleaded that the addition made u/s. 68 of the Act should be sustained. In my view, aforesaid contention of learned Standing Counsel is unacceptable considering the fact that the mandate given to me as Third Member is very limited in its scope and I have to agree with the view expressed by one of the Members. In the facts of the present appeal, learned Accountant Member has given a clear cut finding that no addition u/s 68 of the Act can be made. Whereas, learned Judicial Member has returned a finding that the addition has to be made u/s. 69 of the Act. In other words, learned Judicial Member impliedly agrees that the addition could not have been made u/s. 68 of the Act. Thus, in my view, there is no disagreement between the learned Members with regard to applicability of section 68 of the Act to the disputed addition. Since, it is a purely factual issue, there is no need to dwell in detail on various judicial precedents cited before me. However, I am of the view that the ratio laid down in the decisions referred to by learned Accountant Members clinches the issue in favour of the assessee. Thus, after considering the totality of facts and circumstances of the case, I hold that, the additions made u/s. 68 of the Act are unsustainable. Accordingly, I agree with the view expressed by learned Accountant Member.”

2.) Tirupati Proteins Pvt. Ltd. v. The ACIT Circle- 4(1)(2) Ahmedabad [1213/Ahd/2018][copy of judgment enclosed para 55]

As regard the issue raised in Ground No.6 of this appeal relating to the addition of Rs.10,04,170/- made by the Assessing Officer and confirmed by the learned CIT(A) on account of unexplained cash credit, the learned Counsel for the assessee has submitted that the said amount actually represented realization of sale proceeds as explained on behalf of the assessee before the authorities below. He contended that the same, therefore, cannot be treated as unexplained cash credit and Section 68 of the Act has no application. We find merit in this contention of the learned Counsel for the assessee and since the learned DR has not been able to dispute the position that the amount in question represented sale proceeds realized by the assessee-company, we accept the contention of the learned Counsel for the assessee that Section 68 of the Act has no application and the addition made by the Assessing Officer and confirmed by the learned CIT(A) on this issue by invoking Section 68 of the Act cannot be sustained. Ground No.6 of assessee’s appeal is accordingly allowed.

7.1 In the case of CIT v. Associated Transport (P) Ltd. (Cal.) the tribunal found that the assessee had sufficient cash in hand in the books of account of the assessee, therefore held that there was no reason to treat this amount as income from undisclosed sources and it was not a fit case for treating the said amount as concealed income of the assessee. The revenue moved to Calcutta High Court against the order of the tribunal and the Hon’ble High Court has confirmed the order of the Tribunal while deleting the penalty, Hon’ble Calcutta high court held as under:

8. “The Tribunal was of the view that assessee had sufficient cash in hand. In the books of account of the assessee, cash balance was usually more that Rs. 81,000/-. There is not reason to treat this amount as income from undisclosed sources. It is not a fit case for treating the amount of Rs.81,000/- as concealed income of the assessee and consequently imposition of penalty was also not justified in the case.”

Submission on Ground No. 9

With due respect, it is prayed that the Ld. CIT(A) confirm the addition of Rs 9,24,71,130 as unexplained cash credit u/s 68 of I T act, 1961 read with section 115BBE of I T Act. The said cash treated by Ld. CIT(A) as unexplained was available out of sale of gold bullion which were duly credited in the trading and profit & Loss account and profit arising there on was brought to tax in shape of net profit and tax was paid on the said profit and income was assessed accordingly by the assessing Officer. Thus, in these circumstances when the assesse has already shown the impugned amount in its trading account and paid tax thereon, further addition confirmed by the CIT (A) by again treating the same cash as unexplained will amount to ‘Double Addition’in the hands of the assesse. Which is obviously not the intent of the law and thus cash sales cannot be treated as undisclosed income and no addition could be made once again in respect of the same. It is further stated that as explained above cash has been deposited out of recovery of sale consideration/ provision of service and thus, when the assesse sells the goods and paid the VAT tax there on, the buyer of the goods become the debtor of the assesse and any receipts of money /recovery of sale consideration in the realization of such debt and thus, provision of section 68 of the I T Act, cannot be invoked in respect of recovery of sales consideration. Accordingly, the case laws relied by the CIT(A) as above are distinguishable as it is not a case where section 68 can be invoked and addition can be made.

Reliance in placed on following case laws:-

| 1. | M/S Singhal Exim P. Ltd ITA No. 6520/Del/2018 dated 12/i)4/2))19 Copy of full case law is at page……….of the case law index. | In view of the above we hold that the assessing Officer was not right in concluding that the high sea sales are not genuine. Moreover section 68 would also not be applicable in respect of recovery of sales consideration. Once the sales consideration. Once the assesse sold the goods, the buyer of the goods becomes the debtor of the assesse and any receipt of money from him realization of such debt and therefore, we are of the opinion that in respect of recovery of sale consideration, section 68 can not be applied. In view of the above, we find no justification for upholding the addition of 59,51,29,517/-. |

Without prejudice to the above

It is prayed that the ld. CIT (A) has not accepted that cash deposit made by the assesse during demonetization periodon grounds of preponderance of probabilities. It is prayed that if the Assessing Officer make addition of cash deposit against the sales. Then the assessing Officer is bound to further reduce from the said amount from the total sales figure which has already been included in the sales account and once said amount is reduced from the sales figures, there will be no further addition on account of cash deposit.

Submission on Ground no.-09:

Subject to prejudiced above: we would like to state that the ld assessing officer has erred in law in taxing the addition made under section 68 of the Act and taxing the same under section 115BBE: Taxing under section 115BBE results in taxing at 60% plus surcharge of 25%. The appellant has challenged the same keeping in view the under citations: -:

The Hon’ble Madurai bench of the Madras High Court in its order on the case of SMILE Microfinance Ltd. v. ACIT Central Circle-1, Madurai has while considering this issued has held as under-(Atpage no. of paper book)

16. The next contention raised by the Learned Senior Counsel is that the under section 115BBE the rate of tax imposed is increased from 30% to 60% and the same is applicable with effect from 01.04.2017 onwards as per the amendment. Therefore, the same is applicable to any transaction from 01.04.2017 onwards and nor prior to any transactions prior to 01.04.2017. Since in the present case all alleged transactions are for the period from 08.11.2016 to 30.12.2016, hence the erstwhile rate of tax 30% only is applicable. But the contention of the revenue is that the amendment was with effect from 01.04.2017 and hence the same is applicable for the financial year 2016-2017 and the assessment year 2017-2018. Further the amendment to section 115BBE is directlyrelated to demonetization which would be evident from objects and reasons for such amendment. In order to consider the same, the objects and reasons of Taxation Laws (Second Amendment) Bill 2016 is extracted hereunder:

Press Information Bureau Government of India Ministry of Finance 28-November-2016 15:56 IST Taxation Laws (Second Amendment) Bill, 2016 introduced in Lok Sabha; A scheme namely, ‘Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016’ (PMGKY) proposed in the Bill.

Evasion of taxes deprives the nation of critical resources which could enable the Government to undertake anti-poverty and development programmers. It also puts a disproportionate burden on the honest taxpayers who have to bear the brunt of higher taxes to make up for the revenue leakage. As a step forward to curb black money, bank notes of existing series of denomination of the value of Rs.500 and Rs. 1000 [Specified Bank Notes(SBN)] have been recently withdrawn the Reserve Bank of India. Concerns have been raised that some of the existing provisions of the Income tax Act, 1961 (the Act) can possibly be used for concealing black money. The Taxation Laws (Second Amendment) Bill, 2016 (‘the Bill’) has been introduced in the Parliament to amend the provisions of the Act to ensure that defaulting assessees are subjected to tax at a higher rate and stringent penalty provision. Further, in the wake of declaring specified bank notes “as not legal tender”, there have been suggestions from experts that instead of allowing people to find illegal ways of converting their black money into black again, the Government should give them an opportunity to pay taxes with heavy penalty and allow them to come clean sothat not only the Government gets additional revenue for undertaking activities for the welfare of the poor but also the remaining part of the declared income legitimately comes into the formal economy.

In this backdrop, an alternative Scheme namely, ‘Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016’ (PMGKY) has been proposed in the Bill. The declarant under this regime shall be required to pay tax @ 30% of the undisclosed income, and penalty @10% of the undisclosed income. Further, a surcharge to be called ‘Pradhan MantriGaribKalyanCess’ @33% of tax is also proposed to be levied. In addition to tax, surcharge and penalty (totaling to approximately 50%), the declarant shall have to deposit 25% of undisclosed income in a Deposit Scheme to be notified by the RBI under the ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’. This amount is proposed to be utilised for the schemes of irrigation, housing, toilets, infrastructure, primary education, primary health, livelihood, etc., so that there is justice and equality.

17. In the aforesaid objects and reasons nowhere it is stated that due to “demonetization” the unaccounted money ought to be charged 60% rate of tax. It only states that step had been taken to curb black money by withdrawing Specified Bank Notes of denomination of Rs.500 and Rs.1000. And also states the people may find illegal ways of converting their black money into black again, hence as per experts advice heavy penalty ought to be levied. From the language of the object “that instead of allowing people to find illegal ways of converting their black money into black again”, it is evident that the government is intended to impose the same for future transactions. Especially the use of word “again” in the object would clearly indicate it is for future transactions i.e. from 01.04.2017. Therefore, this Court is of the considered opinion that the revenue is empowered to impose 60% rate of tax for the transactions from 01.04.2017 onwards and not prior to the said cut-off date. And for prior transaction the revenue is empowered to impose only 30% rate of tax. The hon’ble bench has ruled that the increased rates of 60%(tax) + 25% (surcharge) will be applicable on transactions from 01.04.2017 i.e A.Y- 2018-19 and not in the present year A.Y-2017-18. There are many orders has been pronounced by various benches of the Hon’ble ITAT. The order is enclosed in case law paper book for kind references.”

(D.1.1) The learned Counsel for the assessee also drew our attention to synopsis and placed reliance on the same, reproduced below for the ease of reference:

Synopsis of M/s Kashi Nath Seth Sarraf Private Limited

A.Y- 2017-18 Pan No. AACCK3717F

The appellant is engaged in the business of retail of Jewellery & Bullion having its registered business premises at Cinema Road, Hardoi- 241001.The assessment has been made for the A.Y- 2017-18 u/s 143(3) of the Income Tax Act, on 30/12/2019 by making an addition of Rs 9,24,71,130/-u/s 68 of the Income Tax Act, 1961.

The addition is of the amount deposited during the demonetization period. Thereafter a CIT appeal order has been passed by confirming the addition on the ground of abnormal sales made. The addition made by the leaned A.O and the CIT (A) both have confirmed the addition merely on the suspicion basis that there cannot be so much amount of sale on 08/11/2025.However,what amount of sales are bogus or what amount of sales are in excess of the expectation of the department on 08/11/2016. Are there any parameter or guidelines that a person should have made only a limited sales on such extraordinary event and to what extent. The addition has been made merely on presumption basis without any basis of it.

The learned A.O and even learned CIT(Appeal) both didn’t find any of the defect in sales bills or books of accounts and the addition has been made merely on the basis of suspicion. The learned CIT (A) has treated the sale as bogus cash sales and dismissed the appeal on the ground of unexplained money deposited in the bank account.

That the amount of Rs 10,28,38,000/- was deposited on 10-11-2016 to 13-11-2016 out of the sales proceeds made on 07-11-2016 & 08-11-2016 of Rs 10,34,06,468/-. However, the addition of Rs 9,24,71,130has been made by the A.O. The learned A.O has accepted the sales made on 08-11-2016 of Gold of Rs 75,99,348 and Rs 1,63,220/- of silver on presumption basis and the rest of the sales is being treated as bogus. No parameter of accepting the aforesaid sales are mentioned in the order.

That the assessee had filed monthly purchase details, monthly sales details and monthly opening and closing stock details before the ld. AO and the ld. AO had not pointed out any discrepancy in any of these. Even the TCS return was also filed with the details of Pan no. of sales made of Rs 1,67,36,087/-. The assessee had also submitted the cash book 1.10.2016 to 8.11.2016 before the ld. Assessing Officer and the ld. AO had not pointed out any discrepancy in the same and even the sales bills are also vouched by the Learned Assessing officer for the same period. Neither, books of accounts have been rejected, nor any purchases or sales bills has been rejected. The addition has been made merely on the presumption by ignoring the such incomparable event of demonetization of 08-11-2016.

The other important fact of the case proceedings are as under summarized -:

| 1. | | That the order has been passed u/s 143(3) without rejecting any books of accounts and the addition has been made u/s 68 of the Income tax Act, 1961. That the addition u/s 68 cannot be made where sale has been offered for taxation. (JKGExports v. ACIT Del – Third Member – ). The other ruling on relief on section 68 is enclosed. |

| 2. | | The VAT assessment has already been made for the F.Y- 2016-17. The copy of the VAT order is being enclosed in paper book. The sales & purchases has been accepted in the Vat order without raising any defect in the order. No vat return has been revised by appellant. |

That the assessee had sufficient stock in hand for the sale of goods in the month of Oct &Nov and even on 8th Nov -2016.

| 3. | | There is no abnormality in sales as sales of each year has increased. |

| 4. | | The books of accounts are accepted by the learned assessing officer and no defect has been pointed by the learned assessing officer in the books of accounts. |

| 5. | | The learned A.O has verified all the sales bills, cash memo and purchases and no defect or objection has been raised to it. Even the books are impounded with the Income Tax department itself till date. |

| 6. | | The purchases and stock in hand of the appellant are never in dispute. The learned A.O has not raised any doubt against the stock in hand of in respect of purchases. |

| 7. | | The expenses of the appellant in the books of accounts are allowed and no other addition has been made other than the cash deposit. |

| 8. | | The cash in hand as on 07th& 8thwas never doubted by the learned A.O |

| 9. | | The appellant had sufficient stock in hand at the time of sale made during demonetization. There is a substantial amount of purchases made by the appellant even after demonetization period. |

| 10. | | Purchases are made in accordance of provisions of section 40A(3) and no defect has been pointed out by the learned assessing officer in respect of any of the purchase bill. |

| 11. | | The sales receipts are below Rs 2 lac and are in accordance with the Income Tax provisions.There is no requirement of KYC below Rs 2 lac sale and all the sales bills are in accordance with Income Tax Provisions. For the sales made above Rs 2 lac, TCS return has been filed for sale of Rs 1,67,36,087/- and deposited TCS of Rs 167,361/-. The tcs return was filed with the pan no details. |

| 12. | | That the addition has been made only on presumption basis u/s 68. The addition made u/s 68 is bad in law and the addition made is prayed to be deleted. |

Thus, as it can be analysed from above facts, figures and submission that the assessee clearly had the necessary stocks in its possession to effect the sales. It is further submitted that any comparisons of the assessee’s sales with sales for any previous year, were odious in view of the fact that the assessee’s business was expanding. As the assessee was not required to obtain KYC in respect of such customers, the ld. AO was not justified in treating such deposits as unexplained because they had been made out of sales and from stocks that had not been questioned and therefore, the provisions of section 68 could not apply.

It is further submitted that any addition under section 68 on this account would amount to double taxation because the receipts had already been offered to tax and therefore, the entire amount could not be brought to tax again. Thus, your honor it is prayed that the order passed by the learned CIT(A) be quashed and the addition of Rs 9,24,71,130/- be prayed to be deleted.

The addition u/s 68 cannot be made where sale has been offered taxation as held by High court and ITAT

1.) J KG Exports v. ACIT Del Third Member has held in para 16 and 20 that in case similar to appellant addition can not be made u/s 68 held by third member in following para as under:-

“16. As rightly observed by learned Accountant Member, since the Assessing Officer has started the computation of income with the returned income of the assessee, it goes to prove that the entire trading account shown in the financial statement filed with the return of income has been accepted by the Assessing Officer. I also agree with learned Accountant Member that once the sales made by the assessee are supported by stock register, sale bills, payments through banking channel and sales have not only been disclosed in VAT returns but stand duly verified and accepted by VAT Department, such sales cannot be treated as bogus, so as to enable the Assessing Officer to invoke the provisions of section 68 of the Act. Thus, in my view, the addition made u/s. 68 of the Act was rightly deleted. “taxation

“20. At this stage, I must observe that in course of hearing learned Standing Counsel appearing for the Revenue, though, had fairly agreed that provisions of section 69 cannot get attracted, however, he urged and pleaded that the addition made u/s. 68 of the Act should be sustained. In my view, aforesaid contention of learned Standing Counsel is unacceptable considering the fact that the mandate given tome as Third Member is very limited in its scope and I have to agree with the view expressed by one of the Members. In the facts of the present appeal, learned Accountant Member has given a clear cut finding that no addition u/s 68 of the Act can be made. Whereas, learned Judicial Member has returned a finding that the addition has to be made u/s. 69 of the Act. In other words, learned Judicial Member impliedly agrees that the addition could not have been made u/s. 68 of the Act. Thus, in my view, there is no disagreement between the learned Members with regard to applicability of section 68 of the Act to the disputed addition. Since, it is a purely factual issue, there is no need to dwell in detail on various judicial precedents cited before me. However, I am of the view that the ratio laid down in the decisions referred to by learned Accountant Members clinches the issue in favour of the assessee. Thus, after considering the totality of facts and circumstances of the case, I hold that, the additions made u/s. 68 of the Act are unsustainable. Accordingly, I agree with the view expressed by learned Accountant Member.”

2.) Tirupati Proteins Pvt. Ltd. v. The ACIT Circle- 4(1)(2) Ahmedabad [1213/Ahd/2018][copy of judgment enclosed para 55]

As regard the issue raised in Ground No.6 of this appeal relating to the addition of Rs.10,04,170/- made by the Assessing Officer and confirmed by the learned CIT(A) on account of unexplained cash credit, the learned Counsel for the assessee has submitted that the said amount actually represented realization of sale proceeds as explained on behalf of the assessee before the authorities below. He contended that the same, therefore, cannot be treated as unexplained cash credit and Section 68 of the Act has no application. We find merit in this contention of the learned Counsel for the assessee and since the learned DR has not been able to dispute the position that the amount in question represented sale proceeds realized by the assessee-company, we accept the contention of the learned Counsel for the assessee that Section 68 of the Act has no application and the addition made by the Assessing Officer and confirmed by the learned CIT(A) on this issue by invoking Section 68 ofthe Act cannot be sustained. Ground No.6 of assessee’s appeal is accordingly allowed.

3.) The Gujrat High court in the case of has Principal commissioner of income tax v. Tripati Proteins (P) Ltd [2024](gujarata) confirm the order of ITAT on this point para 18

4.) Vishakapatnam bench ITAT ACIT v. HirapannaJewellers [held in para 9]ITAT

9. In view of the foregoing discussion and taking into consideration of all the facts and the circumstances of the case, we have no hesitation to hold that the cash receipts represent the sales which the assessee has rightly offered for taxation. We have gone through the trading account and find that there was sufficient stock to effect the sales and we do not find any defect in the stock as well as the sales. Since, the assessee has already admitted the sales as revenue receipt, there is no case for making the addition u/s 68 or tax the same u/s 115BBE again. This view is also supported by the decision of Hon’ble Delhi High Court in the case of Kailash Jewellery House (supra) and the Hon’ble Gujarat High Court in the case of Vishal Exports Overseas Ltd. (supra), Hence, we do not see any reason to interfere with the order of the Ld. CIT(A) and the same is upheld.

5.) Pradeep kumar v. ACIT- 1 ITA No.198/LKW/2024held in para 13 as under

13. In other cases also, on which reliance has been placed by the assessee, it has been held that the cash receipts represent the sales which the assessee therein had rightly offered for taxation. Since the assessee had already admitted the sales as revenue receipt, there was no case for making the addition under section 68 of the I.T. Act.

6.) Banglore bench Anantpurkalpana v. ITO [2022]

The Hon’ble Vishakapatnam Tribunal in the case of Hirapanna Jewellers (supra) on identical facts held that when cash receipts represent the sales which the assessee has offered for taxation and when trading account shows sufficient stock to effect the sales and when no defects are pointed out in the books of account, it was held that when Assessee already admitted the sales as revenue receipt, there is no case for making the addition u/s 68 or tax the same u/s 115BBE again. I am of the view that in the light of the facts and circumstances of the present case, the addition made is not sustainable and the same is directed to be deleted.

7.) CIT v. Chandra surana ITAT Jaipur ITA No 166/JP/2022

As regards the addition of Rs.2,90,93,500/- made by the AO by applying the provisions of Section 68 of the Act, it is noted that provisions of Section 68 are not applicable on the sale transactions recorded in the books of accounts as sales are already part of the income which is already credited in P&L account. Hence, there is no occasion to consider the same as income of the assessee by invoking the provisions of Section 68 of the Act. In view of the above deliberations and case laws relied upon by both the parties, we find that the AO was notjustified in making an addition of Rs.2,90,93,500/- u/s 68 of the Act which has rightly been deleted the ld. CIT(A) and we concur with his findings. Thus the appeal of the Revenue is dismissed.

8.) LKS Bullion Import and export)pvt ltd v. ito 2(1)(3) ITA No 382/Ahd/2022

9.2. In light of the above findings, we conclude that the addition of Rs.1,92,29,000/- as unexplained cash credit under Section 68 of the Act is unwarranted, given that the amount represents sales already declared and taxed. Therefore, the addition made by the AO and confirmed by the Ld.CIT(A) is deleted, and these grounds of appeal are allowed.

Section cannot be changed by ITAT

1. ) Smt Sarika Jain v. CIT ALLAHABAD HIGH COURT

“17. In view of the above, it can safely be said that the Tribunal travelled beyond the scope of the appeal in making the addition of the said income under Section 69-A of the Act. It may be worth noting that the Tribunal has recorded a categorical finding that “it is clear that under the provisions of Section 68, the addition made by the Assessing Officer and sustained by the CIT (Appeals) cannot be sustained, meaning thereby that the Tribunal was of the opinion that the Assessing Officer and the CIT (Appeals) committed an error in adding the aforesaid amount in the income of the appellant-assessee under Section 68 of the Act.

18. In view of the above, when the said income cannot be added under Section 68 ofthe Act and the Tribunal was not competent to make the said addition under Section 69-A of the Act, the entire order ofthe Tribunalstand vitiated in law.

Thus the addition made u/s 68 is liable to be deleted

In the following judgments has held that where cash deposited post-demonetization by assessee was out of cash sales which had been shown in VAT Department and not doubted by Assessing Officer and there was sufficient stock available with assessee to make cash sales, sales made by assessee out of existing stock were sufficient to explain deposit of cash (obtained from realization of sales) in bank account and, thus, cash deposits could not have been treated as undisclosed income of assessee u/s 68.

1.) Chandigarh bench ITAT Smt. Charu Aggarwal v. CIT [held in para 10.13 PB 135]

10.13 In the present case also the cash deposited post demonetization by the assessee was out of the cash sales which had been accepted by the Sales Tax/VAT Department and not doubted by the AO, there was sufficient stock available with the assessee to make cash sales and there was festive season in the month of October 2016 prior to the making of the cash deposit in the bank account out of the sales. So, respectfully following the aforesaid referred to orders by the various Hon’ble High Courts and the Coordinate Benches of the ITAT, we are of the view that the impugned addition made by the AO and sustained by the Ld. CIT(A) was notjustified, accordingly the same is deleted.

2.) ITAT Chandigarh Bench DCIT v. Roop fashion

In the present case the AO accepted the trading results and had not doubted opening stock purchase sales and closing stock as well as GP rate shown by the assessee. Therefore, the addition of Rs. 97,50,000/- made by the AO on the basis of surmises and conjectures was rightly deleted by the Ld. CIT(A). We do not see any valid ground to interfere with the detailed and logical findings given by the Ld. CIT(A) in the impugned order.

3.) ITAT Delhi Bench ‘B’ income tax officer v. J.K. Woods

15. Sales made by the assessee and shown in the regular books of account have been accepted as such by VAT authorities while framing the VAT assessment. The assessee was having sufficient stock in hand for making the impugned sales during the demonetization period and it is not the case of the Assessing Officer that the assessee has shown bogus purchases to show bogus sales to cover up cash deposited during the demonetization period.

4.) Shbalwinderkumar v. ITO ITAT Amritsar ITA No 256/ASr/2022

5.) ITAT Visakhapatnam sobha devi dilipkumar v. income tax officer

6.) ITAT Lucknow Bench Sunny Kapoor v. income tax officer

In following case where deposit in bank from sufficient cash balance in book ofA/c no addition is required is been made

1.) Mehta parikh co. v. CIT 30ITR 181 Supreme court

2.) Lalchand bhagat ambica ram v. CIT 37ITR 288 Supreme court

3.) CIT v. Associate transport Pvt Ltd 212 ITR417 CALCUTTA

4.) CIT v. Associated transport(p) ltd

5.) ITAT Lucknow Sita ram rastogi v. ITO ITA No. 23/LKW/2022

6.) 97 ITR258 in the case of Laxmi Rice Mills the Patna High court has held that when book of A/c were accepted and cash balance is sufficient to cover high demonetization notes held by the assessee, assessee was not required to prove source of receipt of said high demonetization notes which were legal tender at the time.

In following cases where Sufficient stock and sale offered for taxation, no addition is required to be,made

1.) Chandigarh bench in case of Smt. Charu Aggarwal v. CIT

10.4 On a similar issue the ITAT Chandigarh Third Member Bench in the case of Bansal Rice Mills (supra) held that ” since the sales proceeds have already been accounted for in the trading account no addition could be sustained even if the said deposits could be treated as bogus sales as complete stock tally was there”.

10.5 In the present case also the assessee was maintaining complete stock tally, the sales were recorded in the regular books of accounts and the amount was deposited in the bank account out of the sale proceeds, therefore, the addition made by the AO and sustained by the Ld. CIT(A) was notjustified.

2.) Shree Sanand Textiles Industries Ltd. V. DCIT vide ITA No. 1166/AHD/2014 [para 9.3 &9.4& 9.6 of PB 335 & 336]

9.3. Admittedly, the amount of sale as claimed by the assessee was offered to tax by reflecting the same in the trading and profit and loss account. This fact has not been doubted by the authorities below. However, the existence of the parties was not proved by the assessee based on the documentary evidence during the proceedings. Accordingly, the learned CIT (A) treated the amount received from such parties as unexplained cash credit under section 68 of the Act. In this connection we note that the impugned amount has been taxed twice firstly the same was treated as sales and secondly the same was treated as unexplained cash credit under section 68 of the Act. Even if we assume that the action of the learned CIT (A) is correct i.e. the impugned amount is representing the cash credit as provided under section 68 of the Act. Then, the learned CIT (A) was duty-bound to reduce the same from the amount of sales as the same does not represent the sale but unexplained cash credit. As such, the same amount cannot be held taxable twice as per the wish of the learned CIT (A). In our considered view the action of the learned CIT (A) is erroneous to the extent of treating the same as sale proceeds and the unexplained cash credit simultaneously.

9.4. However, we are also conscious to the fact that there is no allegation from the authorities below that the impugned amount represents the unexplained cash credit over and above the sale proceeds.

In following case theaddition has been deleted

1.) Bawa jwellerspvt ltd v. DCIT Delhi bench ITA No 352/DEL/2021

14. We further observe that the decision of the Delhi Tribunal in the case of

Agson Global Pvt. Ltd. v.

ACIT (supra) has also been affirmed by the Delhi High Court in the case of PCIT v. Agson Global Pvt. Ltd. (

441 ITR 550), wherein the Hon’ble High Court at para 17.6 held as under: –

“17.6 Having regard to the extensive material which has been examined by the Tribunal, in particular, the trend of cash sales and corresponding cash deposited by the assessee with earlier years, we are of the view that there was nothing placed on record—which could have persuaded the Tribunal to conclude that the assessee had, in fact, earned unaccounted income i.e., made cash deposits which were not represented by cash sales. Therefore, in our opinion, the Tribunal correctly found in favour of the assessee and deleted the addition made by CIT(A) of Rs. 73.13 crores, under section 68 of the Act.”

Bombay High Court – R.B. Jessaram Fatehchand (Sugar Deptt.) v. CIT [1970] 75 ITR 33 (Bombay HC)

there was no necessity whatsoever for the assessee to have maintained the addresses of cash customers, the failure to maintain the same or to supply them as and when called for cannot be regarded as a circumstance giving rise to a suspicion with regard to the genuineness of the transactions. The Tribunal, therefore, was not right, in our opinion, in setting aside the order of the Appellate Assistant Commissioner and restoring that of the Income-tax Officer. There are no circumstances disclosed in the case nor is there any evidence or material on record which would justify the rejection of the book results.

Delhi ITAT – M/s Singhal Exim Pvt.Ltd., v. ITO (ITA No.6520/Del/2018)

12. Coming to the cash payment of sale consideration, we are of the opinion that it certainly raises the doubt but again, when there are documentary evidences from the government agencies like custom authorities, the genuineness of sales cannot be doubted. Moreover, at the relevant time, there was no law which prohibited receipt of sale consideration in cash.

15. In view of the above, we hold that the Assessing Officer was not right in concluding that the high sea sales are not genuine. Moreover, Section 68 would also not be applicable in respect of recovery of sales consideration. Once the assessee sold the goods, the buyer of the goods becomes the debtor of the assessee and any receipt of money from him is the realisation of such debt and therefore, we are of the opinion that in respect of recovery of sale consideration, Section 68 cannot be applied. In view of the above, we find no justification for upholding the addition of Rs.59,51,29,517/-. The same is deleted.

(D.1.2) The learned Counsel for the assessee further drew our attention and placed reliance on the following case laws:

| (ii) | | ACIT v. Harshit Garg (Lucknow – Trib.) |

| (iii) | | Dy. CIT v. Santosh Trust (Delhi-Trib) |

| (iv) | | Shyam Sunder Bhartia v. Dy. CIT (International Taxation) (Lucknow–Trib) |

| (v) | | Ajantha Industries v. CBDT [1976] 102 ITR 281 (SC) |

| (vi) | | Rahul Tyagi v. ITO (Raipur – Trib.) |

| (vii) | | Tack Exim (P.) Ltd. v. Asstt. CIT [IT Appeal No.324/LKW/2024, dated 29-11-2024] |

| (viii) | | Shagun Jewellers (P.) Ltd. v. Dy. CIT [IT Appeal No.3168/Del/2023, dated 27-2-2025] |

| (ix)Pr. | | CIT v. Akshit Kumar (Delhi) |

| (x) | | Smt. Sarika Jain v. CIT ITR 254 (Allahabad) |

| (xi) | | Motor Fab Sales (P.) Ltd. v. DCIT/ACIT [IT Appeal No.351/Lkw/2020, dated 30-6-2025] |

| (xii) | | Pradeep Kumar (supra) |

(E) In his oral submissions, learned Counsel for the assessee further contended that Revenue had doubted the sale made by the assessee in cash, on 08/11/2016, without any evidence and basis. He submitted that the addition has been made based merely on conjecture, suspicion and doubt without appreciating the real facts and circumstances existing on 08/11/2016. He submitted that after the announcement of demonetization, there was sudden rush of customers wanting to make purchase in cash using SBNs in the denominations of Rs.1000 and Rs.500; because the customers were worried that they would not be able to make purchases with the SBNs from 09/11/2016 onwards. He further submitted that the customers were not exercising any choice or selection and were instead, purchasing instantly whatever was visible to them on the counter of the assessee. He further submitted that the assessee is the most reputed jewellery shop in town and therefore, there was maximum rush of customers at the assessee’s shop. He also submitted that in order to attend to extraordinary rush, the assessee called family members, close relatives and friends and trusted neighbors etc. to assist the assessee in dealing with the sudden rush of customers. He further submitted that the assessee also took the help of staff of other business entities in the neighborhood, known to the assessee, and their staff were also helpful in dealing with and attending to the customers. The learned Counsel for the assessee submitted that there were many other customers who could not be attended to although they were present at the shop; once deadline for validity of SBNs (by midnight of 08/11/2016) had passed. The learned Counsel for the assessee submitted that the assessee refused to attend to any customer after the midnight of 08/11/2016 who wanted to make payments in SBNs; in respectful compliance of the deadline announced for demonetization of SBNs; because of which the assessee had to face displeasure and dissatisfaction of the customers who could not be attended. However, the assessee did not accept any SBN after the midnight of 08/11/2016; being a law abiding person, he submitted.

(E.1) Learned D.R. strongly supported the assessment order and the impugned appellate order. Like the Assessing Officer, the learned D.R. for Revenue also placed reliance on the orders of Hon’ble Supreme Court in the case of Sumati Dayal (supra). He also placed reliance on the order of Hon’ble Supreme Court in the case of Durga Prasad More (supra) and Hersh W. Chadha v. Dy. DIT, International Taxation 1 (Delhi)/IT Appeal Nos. 3088 to 3098 & 3107/Del/2005 for the proposition that Revenue authorities should take into consideration materials available on record, surrounding circumstances, human conduct, preponderance and probabilities and nature of information/evidence available on record. The learned D.R. further contended that the Assessing Officer had expressed that he was not satisfied with the cash sales made by the assessee on 08/11/2016, and on this basis he sought to distinguish the case. He also submitted that under Uttar Pradesh Dookan Aur Vanijya Adhishthan Adhiniyam, 1962, the assessee was not permitted to open its shop beyond normal closing time and keep its women employees beyond the normal time. He also contended that the assessee had claimed receipt of sales proceeds in cash; in amounts exceeding Rs.2,00,000/-, which were in contravention of section 269ST of the Act, which invited penalty u/s 271DA of the Act from more than 70 customers, which showed that the assessee was fully aware of the implications of cash sales. As regards the ground No. 9 of appeal, in which the assessee has claimed that section 115BBE imposing rate of tax @60% was not applicable in the present case, the learned Departmental Representative contended that the assessees reliance on order of Hon’ble Madras High Court in the case of S.M.I.L.E. Microfinance Ltd. (supra), and on other judgments of Income Tax Appellate Tribunal, in which the order of Hon’ble Madras High Court has been followed; was not correct because, in the opinion of the learned Departmental Representative, the order of Hon’ble Madras High Court was ‘per incuriam’.

(E.2) In response, the learned Counsel for the assessee submitted that it is common in business establishments to remain open beyond normal hours in extraordinary situation such as festive occasions (Dhan Teras, Akshay Tritiya etc.). He further submitted that even women employees volunteer to serve beyond normal hours on such occasions without any hesitation. He contended that if there was any violation of Uttar Pradesh Dookan Aur Vanijya Adhishthan Adhiniyam, 1962, the consequences for it would fall under the said law, if any, and not under Income Tax Act. He submitted that it was an extraordinary situation on 08/11/2016 because of which the assessee had to keep the establishment open beyond normal closing time for the sake of safety and security because the huge crowd of customers, which had assembled, might have turned aggressive and violent; and may have caused damage/harm to life and property; if the assessee had not attended to them in the charged and desperate atmosphere prevailing after announcement of demonetization. He further submitted that some customers had made cash purchases exceeding Rs.2,00,000/-, making them liable for penalty u/s 271DA of the Act (for contravention of section 269ST of the Act), as pointed out by the learned D.R. from these customers (totaling seventy in number). Such sales receipts amounted to Rs.1,67,36,087/-. If the assessee had any intention to book bogus sales in cash, as alleged by Revenue, then, the learned Counsel for the assessee submitted, the assessee would not have booked cash sales amounting to more than Rs.2,00,000/-. This itself proves that the cash sales shown by the assessee were genuine, he contended. He further submitted that the aforesaid cash sales of Rs.1,67,36,087/- have not been booked serially in the sales record of the assessee. Instead, the cash sales of more than Rs.2,00,000/- were interspersed in cash sales below Rs.2,00,000/- which again showed that the sales transactions in cash were not concocted or bogus but were real. He further submitted that in any case, the sales were recorded in the books of account and taxes had been paid on the profit earned on such sales. Therefore, he contended, the addition made by the Assessing Officer amounted to double addition, which was against the law. Without prejudice, he also submitted, that the addition made by the Assessing Officer could not have been made u/s 68 of the Act as has been held by Third Member decision of Income Tax Appellate Tribunal in the case of JKG Exports (supra); and in many other precedents.

(E.2.1) We have heard both sides. Although, several grounds of appeal have been taken, in substance there are three issues. The first is whether the assessee’s claim of cash sale of aforesaid amount of Rs.9,24,71,130/- on 08/11/2016 in SBNs is acceptable. The second issue is whether the addition can be done u/s 68 of the I.T. Act. The third issue is whether provisions of section 115BBE are applicable in the facts and circumstances of this case. We have perused the materials on record. In any given case, whether the sales claimed by the assessee are genuine or not, is a question of fact and the answer will depend on specific facts and circumstances of the case. In the present case, the addition has been made, disbelieving the assessee’s claim that cash sales in SBNs were made, amounting to Rs.9,24,71,130/- on 08/11/2016. The case of Revenue rests essentially on hypothesis that it was unlikely, based on materials available on record, surrounding circumstances, human conduct, preponderance of probabilities and nature of incriminating information/evidence available on record, that cash sales amount to aforesaid amount of Rs.9,24,71,130/- were made in SBNs on 08/11/2016. No specific transaction of sale, not even one, has been proved by Revenue, with supporting evidence, to be bogus or untrue. In fact the Assessing Officer himself has treated sale amounting to Rs.75,99,348/-(made in SBNs) to be genuine but has disbelieved the remaining amount of Rs.9,24,71,130/-. In the absence of any direct evidence to show that any specific sale transaction was not genuine or untrue, the question of fact before us is whether in the given facts and circumstances it is possible that the assessee might have made sale of aforesaid amount of Rs.9,24,71,130/-in cash on 08/11/2016. It is quite understandable, that after announcement of demonetization, the people in possession of SBNs were desperate to use it for purchase of gold, diamond and silver jewellery and other items before the deadline after which SBNs could not have been used. In such a desperate situation, it is quite understandable that customers would not exercise choice in selection as they might have done in normal course. Therefore, the submissions made from assessee’s side that the customers instantly purchased whatever they saw on the counter, using SBNs, is acceptable. Further it is quite understandable that the assessee brought additional manpower to deal with and to attend to the extraordinary rush of customers. Therefore, the submission made from the assessee’s side that family members, relatives, friends and staff of other business entities were utilized to attend the extraordinary rush of customers is also acceptable. It is not in dispute that the aforesaid sale of Rs.9,24,71,130/- included sale amounting to Rs.1,67,36,087/- which attracted penalty u/s 271DA of the Act for contravention of section 269ST of the Act. Further it is not in dispute that the aforesaid total sales of Rs.1,67,36,087/- (consisting of each transaction exceeding Rs.2,00,000/- in cash) were not made through serially numbered sales vouchers. Instead, these transactions were interspersed with other sale transactions in cash, below Rs.2,00,000/-. These facts clearly establish that the sales claimed by the assessee to have been made in cash were genuine. Moreover, the contention that if the assessee had any intention to book bogus sales, then the assessee would not have booked sales inviting penalty u/s 271BA of the Act is a reasonable one. It is further seen that the Assessing Officer has not rejected the assessee’s books of account. Moreover, the assessee has shown the sales in VAT returns, which have been accepted by VAT authorities. It is not in dispute that the assessee had sufficient stock in trade to make sale as claimed, on 08/11/2016. Revenue has not doubted the purchases made by the assessee. Further not even a single specific sale transaction has been proved to be fake, bogus or untrue. In similar facts and circumstances, for an assessee in the same line of business, Coordinate Bench of the ITAT, Lucknow in the case of Harshit Garg (supra), deleted the addition made by the Assessing Officer. Further in the case of Pradeep Kumar (supra), in similar facts and circumstances for an assessee in the same line of business, Coordinate Bench of ITAT, Lucknow has deleted the addition. Also, following the similar reasoning, in the case of Motor Fab Sales (P.) Ltd. (supra) and Tack Exim (P.) Ltd. (supra), Coordinate Bench of the ITAT, Lucknow has deleted the addition. Moreover, following similar reasoning, Division Bench of the Income Tax Appellate Tribunal in the case of Santosh Trust (supra), has deleted the similar addition. Also in the case of Shagun Jewellers (P.) Ltd. (supra), an assessee in same line of business, ITAT, Delhi Bench has deleted the similar addition. Hon’ble Delhi High Court in the case of Akshit Kumar (supra) has also upheld the decision of ITAT deleting the addition made on account of cash deposit made in assessee’s bank account. In view of the foregoing and respectfully following the aforesaid decisions, it is held that the allegation of Revenue holding that the cash sales of aforesaid amount of Rs.9,24,71,130/-, claimed by the assessee to have been made on 08/11/2016 to be untrue; is without convincing materials. The aforesaid addition of Rs.9,24,71,130/- has been made by Revenue based merely on suspicion, doubt, conjecture and guess work. In the special facts and circumstances prevailing on 08/11/2016, after announcement of demonetization and the desperate situation that arose because of announcement of demonetization, it is quite understandable that customers rushed to use SBNs for making purchases without exercising selection and choice. The assessee side has provided convincing material to show that it had sufficient stock, sufficient man power and sufficient time to make the aforesaid sale of Rs.9,24,71,130/- even after announcement of demonetization. Therefore, the claim of cash sales of aforesaid amount of Rs.9,24,71,130/- is found to be acceptable.

(F) Further the assessee has contended that in any case the addition could not have been made u/s 68 of the Act. For this purpose the assessee has relied on Third Member decision of Income Tax Appellate Tribunal in the case of JMK Exports (supra). The assessee has also placed reliance on the decision of Ahmedabad Bench of the ITAT in the case of Tirupati Proteins (P.) Ltd. v. ACIT [IT Appeal No. 1213/Ahd/2018, dated 16-11-2022], Vishakapatnam Bench of ITAT in the case of Hirapanna Jewellers (supra); Lucknow Bench of ITAT in the case of Pradeep Kumar (supra) and Hon’ble Delhi High Court in the case of Kailash Jewellery House (supra).

(F.1) Moreover, in the case of Sarika Jain (supra), Hon’ble Allahabad High Court, which is jurisdictional High Court, has held that Tribunal travelled beyond the scope of appeal in making an addition u/s 69A of the Act when subject matter of dispute all through before appeal in Tribunal was only with regard to addition of alleged amount u/s 68 of the Act. To quote from the order of Hon’ble Allahabad High Court, it was held as under:

“’16. In the present case, it is apparent that the subject matter of the dispute all through before the Tribunal in appeal was only with regard to the addition of alleged amount of the gift received by the appeiiant-assessee as his personal income under Section 68 of the Act and not whether such an addition can be made under Section 69-A of the Act

17. In view of the above, it can safely be said that the Tribunal travelled beyond the scope of the appeal in making the addition of the said income under Section 69-A of the Act. It may be worth noting that the Tribunal has recorded a categorical finding that “it is clear that under the provisions of Section 68, the addition made by the Assessing Officer and sustained by the CIT (Appeals) cannot be sustained, meaning thereby that the Tribunal was of the opinion that the Assessing Officer and the CIT (Appeals) committed an error in adding the aforesaid amount in the income of the appellant-assessee under Section 68 of the Act.”

(F.2) The learned Departmental Representative relied on order of learned CIT(A) and Assessing Officer on this issue.

(F.2.1) Thus, in view of the aforesaid precedents, it is held that the aforesaid addition of Rs.9,24,71,130/- could not have been made u/s 68 of the Act and Tribunal cannot sustain the addition under any other section.

(G) In view of the discussion in the foregoing paragraphs, the Assessing Officer is directed to delete the aforesaid addition of Rs.9,24,71,130/-.

(H) The issue as to whether section 115BBE is applicable in this case, is merely academic, in view of our decision directing the Assessing Officer to delete the aforesaid addition of Rs.9,24,71,130/-. Therefore, this issue is not decided.

(I) The additional ground has been withdrawn by the assessee at the time of hearing before us, therefore; the additional ground is dismissed as withdrawn.