ORDER

Manjunatha G., J. – This appeal has been filed by the Revenue against the order dated 28.03.2023 of the learned CIT(A)-11, Hyderabad, relating to the assessment year 2012-2013.

2. The Revenue has raised the following grounds in the instant appeal :

| 1. | | “The Ld. CIT(Appeals) erred both in law and on the facts of the case in granting relief to the assessee. |

| 2. | | In the facts and circumstances of the case, the Ld. CIT(Appeals) erred in holding that there is not violation of the provisions of section 13(1)(c) r.w.s.13(2)(c), 13(2)(g) and 13(2)(h) of the Act by the assessee society. |

| 3. | | In the facts and circumstances of the case, the Ld. CIT(Appeals) erred in not appreciating that the service agreement entered into between the assessee Society and M/s. Sri Kalyan Chakravorthy Memorial Educational Trust (SKCMET) and the companies M/s. Varsity Education Management Pvt. Ltd. And M/s. Junior Varsity Education Pvt. Ltd. are all sham transactions as M/s. SKCMET is controlled by the same group and that it was clearly a device to benefit the interested persons i.e. the daughters of the members of the assessee society. |

| 4. | | In the facts and circumstances of the case, the Ld. CIT(Appeals) erred in not appreciating the fact that the loss/profit incurred by a charitable society enjoying the benefit of Sec. 12 has no relevancy to determine whether the income of the society was used for the benefit of the specified persons u/s. 13(3) of the IT Act, in violation of the provisions of Sec. 13(1)(c), 13(2)(c) and 13(2)(g) of the IT Act. |

| 5. | | In the facts and circumstances of the case, the Ld. CIT(Appeals) erred in concluding that the assessee society has not violated the provisions of Sec. 13(1)(c), 13(2)(c) and 13(2)(g) of the IT Act in current assessment year i.e. AY 2012-13 since the said provisions were not invoked by the AO for AY 2013-14 to 2016-17 ignoring that the assessment proceedings were separate and distinct for each year. |

| 6. | | The appellant craves leave to amend or alter any ground or add any other grounds which may be necessary.” |

3. Brief facts of the case are that, the assessee-society viz., Sri Chaitanya Educational Committee is registered under the Societies Registration Act and registered with Register of Societies, Machilipatnam, Krishna District in the year 1987 with the predominant object of establishing, running, aiding educational institutions and hostel for them. The society is also registered under section 12A of the Income Tax Act, 1961 [in short “the Act”] vide Order of the Commissioner of Income Tax, Visakhapatnam dated 14.08.1992. The appellant-society is operating 186 colleges/ institutions for imparting education at Intermediate level. Out of the 186 colleges, 80 colleges/institutions were established by the appellant-society and the remaining 106 colleges/ institutions were established by various Societies and Trusts, but, these colleges are being run and managed by the appellant-society. During the year under consideration, there was 2,21,891 students studying in all these colleges/institutions. The appellant-society has filed it’s return of income for the assessment year 2012-13 on 03.09.2013 after claiming exemption under section 11 of the Act. The appellant-society has reported gross receipts of Rs.575,27,14,974/- and application of income for it’s objects at Rs. 575,40,66,365/-.

3.1. The case of the appellant-society was selected for scrutiny and during the course of assessment proceedings, the Assessing Officer noticed that, the appellant-society had entered into a “Service Agreement” with M/s. Sri Kalyana Chakravarti Memorial Educational Trust [in short “M/s. SKCMET”] for operation, management and administration of the colleges/institutions vide agreement dated 31.03.2011. The Assessing Officer further noted that, the said service agreement with above named trust was approved by the Executive Committee vide resolution dated 10.03.2011 to entrust the operation, management and administration of colleges/institutions to the above Trust w.e.f. 01.04.2011. As per the terms of the agreement, the Trust i.e., M/s. SKCMET agreed to provide the services in relation to administration, collection of fees, provision and maintenance of hostel facilities and mess, recruitment of employees for teaching and non-teaching staff, provision of content curriculum and related services, management of all the administrative activities of the colleges/institutions etc. The services to be provided by the above Trust is part of Annexure-1 of agreement which was reproduced by the Assessing Officer in his assessment order. Further, in pursuance of the service agreement, M/s. SKCMET has sub-contracted the work of operation, management and administration of colleges to two companies viz., M/s. Varsity Education Management Pvt. Limited and M/s. Junior Varsity Education Management Pvt. Limited. These two companies are owned by Smt. B. Sushmasree and Smt. B. Suma daughters of Sri Dr. B. Satyanarayana and Smt. Dr. B. Jhansi Lakshmi Bai who are the Founders/Authors of the appellant-society. In pursuant to the above service agreement, an amount of Rs.232,15,33,642/- was paid to M/s. Junior Varsity Education Management Pvt. Limited and Rs.24,84,30,000/- was paid to M/s. Varsity Education Management Pvt. Limited.

3.2. During the course of assessment proceedings, the Assessing Officer observed that, the appellant-society had entered into service contract agreement with the above two companies owned by the related parties as defined u/sec.13(3) of the Act and observed that, since the service contract payments were made to companies owned by the related parties, the provisions of sec.13(1)(c) r.w.s.13(3) of the Act are applicable. Therefore, called-upon the appellantsociety to file relevant evidences and justify payments made to M/s. SKCMET, which, in turn, made the said payment to the above named two companies viz., M/s. Varsity Education Management Pvt. Limited and M/s. Junior Varsity Education Management Pvt. Limited. In response, the appellant-society has submitted service agreement between the appellant-society and M/s. SKCMET and also sub-contract agreement entered into with the above two companies. The appellant-society had also furnished relevant details of services rendered by the above named Trust, M/s. SKCMET and also payment made to the Trust for the year under consideration and claimed that, the appellant-society has entrusted the work of complete operation and management a various colleges/institutions run by the appellant-society to the above two companies, for which, the remuneration has been paid as per the terms of agreement between the parties.

3.3. The Assessing Officer after considering relevant service agreement and also sub-contract agreements between the parties has discussed the issue at length in light of provisions of section 13(1)(c) r.w.s.13(3) of the Act and observed that, as per the provisions of section 13(3) there is no bar for any interested persons including trustees of a trust or office bearers of an institution for undertaking contract work or supply of goods or services for the trust/ institution. However, the rate at which the interested persons are remunerated should be at Arms Length Price [in short “ALP”] more particularly, in light a proviso to section 13(1)(c) of the Act. The Assessing Officer further observed that, since the above two companies are owned by the relatives of Founder Trustees, the payment made to above companies falls under the purview of section 13(1)(c) and proviso provided therein and, therefore, observed that, the payment made by the appellant society for rendering services needs to be examined in terms of section 13(1)(c) r.w.s.13(3) of the Act. Therefore, called-upon the appellant society to file relevant evidences including basis for payment and also comparative expenditure incurred by the appellant society for the financial year 2010-2011 and 2011-2012. The Assessing Officer discussed the issue at length in light of agreements and composition of above two companies and observed that, appellant-society has entrusted the work of operation, management and administration of colleges/ institutions to the related parties and in turn, the related parties being above two companies have earned substantial profit out of payment received from the appellant society. Therefore, the Assessing Officer observed that, the appellant-society has violated the provisions of section 13(1)(c) r.w.s.13(2)(c) and 13(2)(g) of the Act and thus, rejected the exemption claimed by the appellant society under section 11 of the Act.

3.4. Further, the Assessing Officer had also discussed the issue of payment of service charges to above named two companies in light of expenditure incurred by the appellantsociety for the purpose of it’s objects for the previous financial year 2010- 2011 and observed that, the appellantsociety has made excessive and unreasonable payment to the above two companies for rendering services, which attracts section 13(2)(c) of the Act, where if any amount is paid by way of salary, allowances or otherwise during the previous year to any person referred to in sub-section-(3), out of the resources of the Trust or Institution for services rendered by that person, to such Trust or Institution and the amount so paid is in excess of what may be reasonably paid for such services, then, same is treated as benefit allowed to persons specified u/sec.13(3) of the Act. Since the appellant-society has paid substantial amount to the above two companies for the services of operation, management and administration of colleges/ institutions, the Assessing Officer observed that, the appellant society has received gross receipts of Rs.516,44,00,000/- for the financial year 2010-2011 and as against this, the total expenditure incurred was at Rs.522,31,00,000/-. However for the financial year 2011- 2012, the appellant society has received gross receipts of Rs.575 crores and as against this, the total expenditure incurred was at Rs.575.40 crores. Thus, there is an increase of 11.39% in revenue and an increase of 10.16% in expenditure in the financial year 2011-2012 compared to the preceding year. Therefore, the Assessing Officer observed that, when there is no substantial or material changes in activities carried-out by the appellant society for the year under consideration when compared to earlier financial year and further, when there is no substantial increase in receipts or expenditure, then, the payment in the form of service charges to the above two companies owned by the related parties is excessive and unreasonable. Therefore, by taking into account the total expenditure incurred by the appellant society during the financial year 2011-2012, the Assessing Officer reduced the amount paid to the above two companies for the services rendered by them and arrived at an amount of expenditure incurred by the Trust on its own. Further, the Assessing Officer has considered the total expenditure incurred during the financial year 2010-2011 and then, reduced the expenditure incurred by the appellant society on its own account in the financial year 2011-2012 and arrived at a balance amount to be paid to the about two companies for rendering services at Rs.203,90,00,000/-. Further, the Assessing Officer after considering the relevant inflation at an estimated amount of 5.1%, has arrived at total outsourcable expenditure at Rs.214.10 crores and on that expenditure made, addition @ 8% profit that normally any business person earned in this kind of works-contract to arrive at a final payment towards outsourced expenditure of Rs.231.23 crores. In other words, as against the total payment made by the appellant society to the two companies for services rendered in pursuance to agreements at Rs.256.91 crores, the Assessing Officer has arrived at a reasonable payment to be paid to the third party for rendering similar services at Rs.231.23 crores and finally arrived at excess payment of Rs.25,76,43,593/- and observed that, the said amount is the value of benefit given to the interested persons specified under section 13(3) of the Act in violation of section 13(1)(c) r.w.s.13(2)(c) of the Act. Further, the Assessing Officer after considering relevant provisions of the Act and also applying provisions of sec.40A(2)(a) observed that, appellant society has made excessive and unreasonable payment to the above two companies for rendering services which cannot be allowed as deduction. Thus, the Assessing Officer disallowed a sum of Rs.25,76,43,593/- u/sec.40A(2)(a) of the Act. The relevant findings of the assessing officer are as under.

“23. In the instant case the society has forfeited exemption in respect of the value of benefit conferred on the two companies M/s. Varsity Education Management Pvt Ltd and M/s. Junior Varsity Education Management Pvt Ltd as long term contracts of worth more than Rs.3000 Crores were given to these companies under the circumstances narrated in the aforementioned paragraphs. During the year under consideration the contract amount paid by the assessee to these companies and the details of turnover and profit of these companies is as under as per the Annual Reports of the said companies for the year 2011-12:

Contract amount paid to:

Junior Varsity Education Management Pvt Ltd (JV) Rs. 2321525540

Varsity Education Management Pvt Ltd (VEMPL) Rs. 248438102

Total Rs. 2569963642

| Company | Total turnover for the F. Y. 2011-12. | Profit eefoYe taxfor the F. Y. -011-12 |

| Junior Varsity Education Management Pvt Ltd (JV) | 286.81 Crores | 78.05 Crores |

| Varsity Education Management Pvt Ltd (VEMPL) | 60.99 Crores | 16.93 Crores |

24. Now the question to be decided is what is the value of the benefit that arose to the two companies from the contract awarded to them by the assessee via the service provider trust. Admittedly these two companies rendered services to the assessee society. In such a situation the value of the benefit arising to the companies has to be determined with reference to the payment which would have been normally made by the assessee to a person other than the specified person for similar services from such person. Reasonable compensation paid to the interested persons for the services rendered by them cannot be considered as benefit passed on to the interested person as there is no prohibition in the Act for taking services from the interested persons at commensurate rates. In view of this the value of benefit conferred on the two companies consequent to the contracts awarded to them without any public auction/tenders has to be worked out after excluding the amount which the assessee would have normally paid to an unrelated contractor for rendering the same services. Thus, the quantum of benefit arising to the promoters of the two companies is worked out as under:

| Total expenditure incurred by the assessee during the F.Y. 2011-12 as per the income & expenditure account Filed along with the return of income. | Rs. 575,40,66,365 |

| Less: Amount paid to the two companies for the services Rendered by them interms of the agreement entered into Between the service provider trust and the companies. | Rs. 256,99,63,642 |

| Amount of expenditure incurred by the trust on behalf of the assessee. | Rs. 318,41,02,723 |

Now the issue to be examined is that out of the amount of Rs.256.99 Crores paid to the companies what the assessee would have paid had the contracts been awarded on the basis of competitive bidding. For calculating the said amount the amount of expenditure that was incurred by the assessee during the immediately preceding year on account of the services outsourced in the current financial year, has been taken as a base figure. In the immediately preceding year assessee incurred the entire expenditure on its own and no contracts were given. Such expenditure was accepted in the assessment completed u/s. 143(3). As such, the amount that would have been payable to a contractor other than the interested companies for rendering the same services is worked out as under. For this purpose the expenditure figures of the immediately preceding year have been adopted as a starting point as the operations / activities of the assessee remained same during preceding year as well as the current year and there is no significant expansion or reduction in operations in terms of the number of institutions run by the society. During the F.Y. 2010-11 the gross receipts of the assessee and total expenditure of the assessee as per the return of income are under :

| Total receipts | Rs.516,44,88,995 |

| Total expenditure | Rs.522,31,85,658 |

As against the above mentioned particulars for the last year the income and expenditure particulars for the current year are as under:

| Total receipts | Rs.575,27,14,974 |

| Total expenditure | Rs. 575,40,66,365 |

Thus, there is an increase of 11.39% in revenue and an increase of 10.16% in expenditure in the F.Y. 2011-12 compared to the preceding year. The income & expenditure have increased more or less at the same rate in this year compared to the immediately preceding year. Hence, there is sufficient justification for adopting the expenditure figure of F.Y. 2010-11 as a staring point to calculate the value of benefits conferred on the interested persons. Accordingly, the same is calculated as under:

| Total expenditure during the F.Y. 2010-11 | Rs.522,31,85,658 |

| Less: Expenditure incurred by the assessee on its own account in the F.Y.2011-12 as worked out above. | Rs. 318,41,02,723 |

| Balance | Rs.203,90,82,936 |

The amount of Rs.203,90,82,936/- corresponds to the cost of services outsourced by the assessee from the two companies as the said amount was incurred by the assessee itself in the preceding year. In other words this would have been the cost to the assessee if the assessee had not awarded the contracts and had undertaken the work on its own. Since, provision has to be made for increase in prices in F.Y. 2011-12 due to inflation an estimated amount of 5% of Rs.203,90,82,936/- is added to take care of the increase in prices. Accordingly, the amount of expenditure after making adjustment for inflation works out to Rs.214,10,37,082/-. Thus, this is the cost to the assessee for the services outsourced by it during the year under consideration. Since the assessee had decided to outsource the work and if the work was given to an unrelated person the cost to the assessee would further goes up as no body works without profit. With regard to the rate of profit that contractor would expect to earn for the contract the rates accepted in the decision of various decisions of Courts/Tribunals ranging from 8% to 12% can be taken as reasonable rates. In the instant case, the rate of profit at 8% is adopted as a reasonable rate in the facts and circumstances of the case as the promoters of the company also got the benefit of investment from the investor who had invested by purchasing the shares at premium. Hence, adoption of the minimum rate of 8% is justified in the present case. Thus, the reasonable amount for which a contractor would have offered the services outsourced by the assessee to the interested persons works out to as under:

Cost to the assessee after making allowance for inflation Rs.214,10,37,082

| Add: Profit @ 8% which the unrelated party would have Expected. Rs. 17,12,82,967 |

| Rs. 231,23,20,049 |

Thus, the amount of Rs.231,23,20,049/- would have been a reasonable consideration for the services rendered by the two companies. As against the said amount the assessee paid an amount of Rs.256,99,63,642/-. Thus, the excess amount of Rs.25,76,43,593/- is taken as the value of benefit conferred on the promoters of the two companies who are the daughters of the author / founder of the assessee. Accordingly, the said amount has to be taxed at maximum marginal rate. In addition to this the assessee has also forfeited exemption in respect of the amount of Rs.34,77,166/-which was invested in the company in which the persons specified u/s. 13(3) had substantial interest during the year (as discussed in paragraph No. 20 above). Thus, the total amount which has to suffer tax at maximum marginal rate works out to Rs.26,11,20,759/-.

25. As discussed in the above paragraphs when an assessee forfeits exemption consequent to violation of provisions of section 13(1)(c) the amount of income forfeited exemption suffers tax at maximum marginal rate and the other income suffers tax at normal rate. In the instant case it has to be seen as to under which head of income the other income of the assessee is taxable. This is so because income has to be necessarily computed under one of the heads of income specified in the Act and hence income of the assessee as appearing in the income and expenditure account cannot be lifted directly and subjected to tax. Before taxing any income it has to be found out under which head of income it has to suffer tax. In Chapter-IV of the Act there are four heads of income viz., ‘salaries’, income from house property’, ‘profits and gains of business or profession’ and capital gains and income from other sources. In the instant case considering the activity of the assessee the other income which has to be taxed at normal rates has to be computed under the head ‘profits and gains of business or profession’ as the activity of the assessee is akin to that of commercial activity having the characteristics of business. Therefore, the other income of the assessee has to be computed in accordance with the provisions contained in Part-D of Chapter-IV. Thus, the provisions of section 28 to Section 44 DB are the relevant sections for computation of the other income. In the income and expenditure account assessee claimed loss of Rs.13,51,391/-. Thus, for computing the business income the expenditure mentioned in sections 28 to 44DB has to be allowed from the gross receipts of the assessee and similarly the disallowances of expenditure mentioned in those provisions have to be made.

26. In the instant case it was found that the assessee had made transactions with related parties and awarded work contracts to them. In the aforementioned paragraphs it has been established that the amount paid on account of such contracts was excessive and unreasonable when compared to the amount that would have been payable had the contracts been awarded through competitive bids. In view of this the payments made to related parties are hit by the provisions of section 40A(2)(

a) of the I.T. Act. As per the said section where the assessee incurs any expenditure in respect of which payment has been made to specified persons referred to in Clause-b of the Section and the Assessing Officer is of the openion that such expenditure is excessive or unreasonable having regard to the fair market value of the services rendered then so much of the expenditure as is considered by the A.O as excessive or unreasonable is not allowable as deduction. In the instant case the payments made to the two companies

i.e. M/s. Varsity Education Management Pvt Ltd and M/s. Junior Varsity Education Management Pvt Ltd are covered by the circumstances mentioned in Sub-Clause (

vi) of Clause-b of Section 40A(2). As per the said sub-clause payment made by an AOP to any person who carries on business or profession and in which any relative of the member /members of the AOP has a substantial interest then such payment is recognized as a related party transaction for the purposes of section 40A(2)(

a). In the present case the promoters of the two companies are the daughters of the members of the assessee AOP and hence the contract amount paid to them squarely falls within the definition of the related party transaction envisaged by section 40A(2)(

a). In the aforementioned paragraphs an amount of Rs.25,76,43,593/- has been determined as excessive payment made to the two companies when compared to the market value of the services rendered by them to the assessee. In this regard, reliance is place on the decision reported in

261 ITR 258 (Mum) in the case of

CIT v.

Shatranjay Diamonds wherein it was held that onus is on the assessee to prove that the price paid is reasonable. In the present case no such proof has been adduced. On the contrary evidences brought on record showed that the amount paid was excessive. Hence, this amount is not allowable as expenditure u/s. 40A(2)(

a) of the I.T. Act. Subject to this observation the other income of the assessee being profits and gains of business is computed as under :

| Loss returned as per income & expenditure account | Rs. 13,51,391 |

| Add: Disallowance of expenditure u/s. 40A(2)(a) as discussed above. | Rs. 25,76,43,593 |

| Income from Business | Rs. 25,62,92,202 |

Thus, business income of Rs.25,62,92,202/- computed in accordance with the provisions of Part-D of Schedule-IV is chargeable at normal rates.”

4. Being aggrieved by the assessment order, the appellant society preferred appeal before the learned CIT(A). Before the learned CIT(A), the appellant society has reiterated it’s submissions made before the Assessing Officer and argued that, the assessing officer has erred in invoking the provisions of section 13(1)(c)/40A(2)(a) without appreciating the fact that, there is no unreasonable and excess payment made to the above two companies for rendering services of operation, maintenance and administration of colleges/institutions. The appellant society had also negated various observations made by the Assessing Officer in light of agreement between the parties, composition of Board of Directors of above two companies and their relation to the appellant society to invoke the provisions of section 13(1)(c) and argued that, there is no dispute with regard to the fact that, the above two companies are owned by related parties of the appellant society. However, payment made to the above two companies for rendering services is commensurate with services rendered by above companies which is evident from the gross receipts and gross expenditure of the appellant society for the financial year 2010-2011 and 2011-2012. The Assessing Officer without understanding the provisions of section 40A(2)(a) of the Act, has made adhoc disallowance of Rs.25,76,43,593/- by extrapolation of figures without pointing out how payment made by the appellant society for rendering services is excessive and unreasonable by bringing on record any comparable cases of similar nature or the industry average for this kind of activity carried-out by any third party.

4.1. The learned CIT(A) after considering the relevant submissions of the appellant-society and also taken note of various facts including the relevant agreement between the parties and the provisions of section 13(1)(c) r.w.s.13(2)(c) and sec.40A(2)(a) of the Act and also by taking into account the relevant financial statements of appellant society for the two financial years and also financial statement of the above two companies who rendered services to the appellant society, observed that, the Assessing Officer has made an adhoc disallowance of expenditure u/sec.40A(2)(a) without bringing on record any comparable case of similar nature or the industrial average of this nature of industry to allege that, the appellant society has made excessive payment to the related parties, which attracts provisions of section 13(1)(c) r.w.s.13(2)(c) of the Act. The learned CIT(A) had also discussed the issue in light of the comparative figures of gross receipts and expenditure of the appellant society for the financial years 2010-2011 and 2011-2012 and also the subsequent assessment order passed by the Assessing Officer for the assessment year 2013-2014 to 2016-2017 where similar kind of payments have been made by the appellant society in pursuance to service agreement with M/s. SKCMET and further sub-contract agreement with above two companies observed that, in subsequent financial year, the Assessing Officer had accepted the payments made by the appellant society for rendering the services without any disallowance. Therefore, the learned CIT(A) observed that, the Assessing Officer was erred in making disallowance of expenditure u/sec.40A(2)(a) of the Act. Thus, directed the Assessing Officer to delete the addition made for disallowance of expenditure of Rs.25,76,43,593/-. The relevant observations of the learned CIT(A) are as under :

6. Decision:

In the instant case, the AO made an addition of Rs.25,76,43,593/- by disallowing the expenditure u/s 40A(2)(a) r.w.s. 13(1)(c) r.w.s. 13(3) of the 1.T. Act, 1961.

It is seen that the Assessing Officer, in the para 27 of the order, has computed the tax liability on two counts which are income chargeable at MMR of Rs.25,76,43,593/- and calculated tax liability at Rs.11,84,85,235/- and business income at normal rates of Rs.25,62,92,202/-, and calculated the tax liability at Rs.11,77,72,357/-. The AO gave a demand notice of Rs. 11,84,85,235/- plus Rs.11,77,72,357/- thus arriving at a total demand of Rs.23,62,37,592/-. Thus, the AO has calculated the income twice for the same disallowance and gave a demand notice of almost double the liability. The AO made an addition that the appellant has violated provisions of Section 13(1)(c) and applied provisions of section 164(2) and made the same addition u/s 40(a)(2b) and calculated the demand for both the additions and made the appellant liable for both the demands in the notice u/s 156. This was a case of double addition.

It is seen that the Assessing Officer initiated rectification proceedings u/s. 154 of the Act and issued a notice u/s. 154 dated 02.02.2016 and in response to the same, the appellant filed a reply on 09.02.2016 and a consequent order U/s. 154 of the Act was passed on 12.02.2016 by reducing the same income taxed twice and the income was determined at Rs.25,76,43,593/- by removing the double entry u/s 40(A)(2)(b) taxing twice. Besides, the Assessing Officer made an addition of Rs.34,77,166/- in the order u/s 154, thus arriving at a total income of Rs.26,11,20,759/-. It is however seen that the appellant has not filed any appeal against the said rectification order nor furnished any submissions with regard to the said addition in the present appellate proceedings.

Brief facts of the case are that the appellant society was constituted on 31.01.1987 and has been operating a number of colleges and institution and is imparting education at the level of Intermediate. The Assessing Officer noted that the appellant has been managing/operating 186 colleges and 2,21,891 students were studying in the said colleges.

The addition contested by the appellant in the present appeal is with regard to the addition of Rs.25,76,43,593/-u/s 40A(2)(a) r.w.s. 13(1)(c) r.w.s. 13(3) of the I.T. Act, 1961. The addition relates to disallowance of excess expenses paid to M/s. Junior Varsity Education Management Pvt Ltd (JV for short) and M/s. Varsity Education Management Pvt Ltd (VEMPL for short). The appellant entered into an agreement on 31.03.2011 with M/s. Sri Kalyana Chakravarthy Memorial Educational Trust (SKCMET for short) for work operation, management and administration of the colleges by SKCMET. The total payment made by the said Trust to these two entities, M/s. JV and M/s. VEMPL, was Rs.256,99,63,642/ and the AO concluded that the sum of Rs.25,76,43,593/- was the excess payment and these two parties should have been paid only a sum of Rs.231,23,20,049/-. The payments made are as under :

| M/s. Junior Varsity Education Management Pvt Ltd (JV) Rs.232,15,25,540 |

| M/s. Varsity Education Management Pvt Ltd (VEMPL) | Rs. 24,84,38,102 |

| Total | Rs.256,99,63,642 |

The first 83 pages of the assessment order are devoted towards the fact that JV and VEMPL are related parties to the appellant, Sri Chaitanya Educational Committee (SCEC). The AO noted that the two companies, JV and VEMPL have made the following profits:-

| Company | Total turnover for the F.Y. 2011-12. | Profit before tcv for theF.Y. 2011-12 |

| Junior Varsity Education Management Pvt Ltd (JV) | 286.81 Crores | 78.05 Crores |

| Varsity Education Management Pvt Ltd (VEMPL). | 60.99 Crores | 16.93 Crores |

Thus, the AO concluded that the appellant had violated the provisions of Section 13(1)(c) r.w.s. 13(2)(c) and 13(2)(g) of the 1.T. Act. The AO has noted that he is not convinced with the reasons for handing over coaching centers to JV and VEMPL. The AO further noted that the appellant has incurred a loss during the immediately preceding year and also during the present year. The appellant has incurred a loss of Rs.13,51,391/ during the year under consideration on a receipt of Rs.575,27,14,974/-, thus, has incurred an expenditure of Rs.575,40,66,365/-.

The AO further noted that there is no reason to give the North India Operations to M/s. JV when it could have given the same to other entity. However, the AO has neither given a reason nor has given any other entity to do such humongous activity with regard to the services rendered by the JV. The AO noted that as per rule 17, the appellant is required to handover operations to another charitable entity to do the operations but they have given the operations to the persons specified u/s. 13(3) of the Income Tax Act, 1961.

It is important to note that this observation is not correct as the payment by the appellant, SCEC has been made to another trust M/s. Sri Kalyan Chakravarthy Memorial Educational Trust (SKCMET) and the said Trust in turn has paid to JV and VEMPL.

The AO, however, held that the society has forfeited exemption tax on account of the violations and, therefore, the income is chargeable u/s 164(2) of the Income Tax Act, 1961 and also cited the CBDT Circular No. 387 dated 06.07.1984 in this regard.

The AO’s observation regarding the excess payment is on the following basis as mentioned in the page 91 of the assessment order, which is as under For THIS purpose the expenditure figures of the immediately preceding pear have been adapted as a starting point as the operations/activities of the assesse remained same during preceding year as well as the current your and there is no significant expansion or reduction in operations in terms of the number of institutions run by the society. During the F.Y. 2010-11 the gross receipts of the assessee and total expenditure of the assessee as per the return of income are under

| Total receipts | Rs. 576,44,88995 |

| Total expenditure | Rs. 522,31,85,658 |

As against the above mentioned particulars for the last year the income and expenditure particulars for the current year are as under :

| Total receipts | Rs. 575,27,14,974 |

| Total expenditure | Rs. 575,40,66,365 |

Thus, there is an increase of 11.39% in revenue and an increase of 10.10% in expenditure in the F.Y. 2011-12 compared to the preceding year. The income & expenditure have increased more or less at the same rate in this year compared to the immediately preceding year. Hence, there is sufficient justification for adopting the expenditure figure of F.Y. 2010-11 as a starting point to calculate the value of benefits conferred on the interested persons The primary observation of the AO itself is faulty as if one looks at the financials for F.Y. 2010-11, there is a receipt of Rs.516,44,88,995/- and expenditure of Rs.522,31,65,658/-, which the AO has formed the basis to consider unreasonableness in payments to related parties this year. The loss for that year was Rs.5,86,96,663/, which was 1.13% of the turnover, after considering the expenses incurred in that year for which the AO has no objection and forms the basis for excess payment in the year under consideration.

In the present year the total receipts are Rs.575,27,14,974/ and the total expenditure is Rs.575,40,66,365/- which implies a loss of Rs.13,51,391/-being 0.023% of the turnover/receipts. Therefore, in the present year the loss as a percentage of total receipts is 0.023% which is less than the loss of 1.13% of receipts of earlier year. Thus, after making the payment to related party the loss to the trust has decreased and thus the observation of the AO is completely on a tangent to the reality.

The AO has further written that there is an increase of revenue of 11.36% and an increase of expenses by 10.18%. This is a healthy situation as compared to past year and it is in the favour of the appellant and cannot be used against the appellant. Rather it makes out a case that the appellant, by appointing related party, has better managed the operations and the loss returned is much lesser and thus it has been financially a benefit for the appellant as a whole.

There is no major change brought out by the Ad as compared to the earlier financial year which leads to a situation of examination otherwise or giving a different perspective to these figures and break-up of these figures. The acceptance of the earlier year data by the AO rather fortifies the case of the appellant of having a better performance than the earlier year.

The AO has further cited that the related party have made sizeable profits and their profits should only be restricted to 8%. The first issue is that the magic figure of 8% has no legal sanctity and further the fact that the efficiency of the organizational finances improved as compared to last year when making payments to different unrelated entity implies that even the third party were being paid equivalent sum rather more, if one looks at the operational loss of the past year. The arm’s length price is not determined on the basis of the profit of that entity which is rendering the service but on the basis of the market condition. The efficiency of an entity which is a related party cannot be held against it for receiving a payment from a related entity. The related entity this year has benefitted as per the financials relied upon by the AO by making payments to the related parties. Therefore, there is no case in the AO’s observation to make disallowances for the payments made to JV and VEMPL through SKCMET.

It is also important to note that there have been scrutiny assessments in the case of the appellant for Asst. Years 2013-14 to 2016-17. The assessment orders do not invoke such disallowances made to JV and VEMPL and sums have been paid to these parties in those years too. The assessment order for AY 2013-14 was passed on 30.03.2016 at an income of Nil. The assessment order for AY 2014-15 was passed on 30.12.2016 at an income of Rs.9,06,01,800/- wherein certain administrative expenses and mess charges were disallowed for want of invoices. The order for AY 2015-16 was passed at an income of Rs.30,95,220/- on 28.12.2017 making addition with regard to function hall rental income and the order for AY 2016-17 was passed on 30.12.2018 on account of disallowance of hire charges of Rs.47,68,512/-.

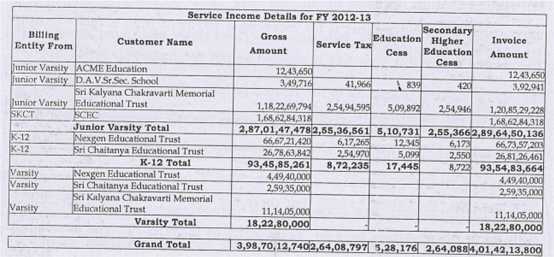

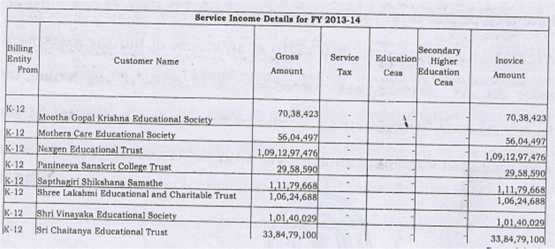

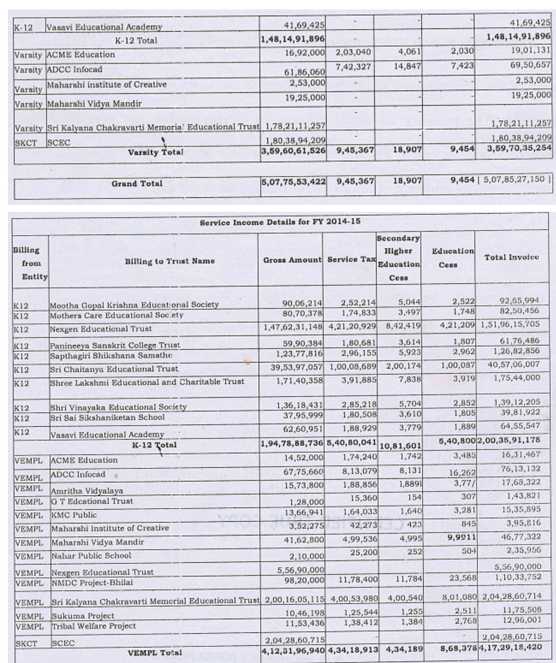

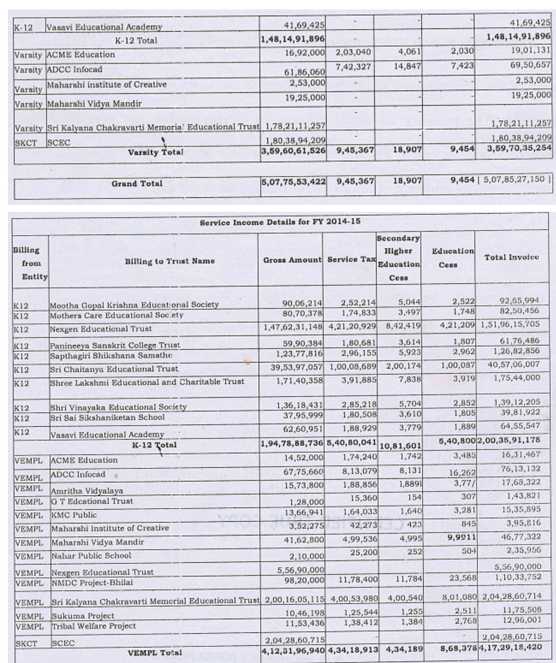

There is no disallowance with regard to payments made to JV and VEMPL wherein it is noticed that the payment has been made to JV and VEMPL by SKCMET in the financial years 2012-13, 2013-14 and 2014-15. The following are the details of payments made :-

Thus, the payments made by the appellant to SKCMET and further, the payments made by SKCMET to JV and VEMPL have been accepted by the Assessing Officer for subsequent years and no addition has been made. In view of the same on consistency also there is no basis for the AO to make the addition. The primary basis of addition for disallowance this year itself was incorrect and defective as discussed elaborately above. In view of the above discussion, the addition of Rs.25,76,43,593/- is hereby deleted.

In view of the same, the quantum relief is granted to the appellant and the ground no. 2 is allowed regarding the excess payment and the other part of the ground becomes inconsequential. The other grounds become inconsequential for separate adjudication in view of the discussion above.

In view of the same, the appeal is allowed accordingly.”

5. MS. M. Narmada, learned CIT-DR submitted that, the learned CIT(A) erred in law and on facts in holding that, there is no violation of provisions of section 13(1)(c) r.w.s.13(2)(c), 13(2)(g) and 13(2)(h) of the Act by the appellant society. Learned DR further submitted that, the service agreement entered into between the appellant society and M/s. SKCMET and the companies viz., M/s. Varsity Education Management Pvt. Ltd., and M/s. Junior Varsity Education Management Pvt. Ltd., are all sham transactions as M/s. SKCMET controlled by the same group and that, it was clearly advised to benefit the interested persons i.e., daughters of the Founders of the appellant-society. The learned CIT-DR referring to the composition of appellant-society, M/s. SKCMET and Board of Directors of above two companies submitted that, the above two companies are owned by the daughter’s of Founders of the appellant-society. Further, the service agreement was entered into for the first time from 01.04.2011 and prior to this agreement, the appellant society which was managing, operation maintenance and management of the colleges/institutions. The Assessing Officer had also brought-out the purpose of creation of above two companies and also agreement between the Trust and further agreement with the above two companies and brought-out the facts with regard to super profit earned by two companies from the services and also purpose of earning above profit to raise funds from non-resident investors. From the facts brought on record by the Assessing Officer, it is undisputedly clear that, the service agreement with above named Trust and further agreement with above two companies is an arrangement between the appellant society and the related parties to allow the benefit of Trust funds to related parties in violation of section 13(1)(c) r.w.s.13(2)©, 13(2)(h) and 13(2)(g) of the Act. Although, the Assessing Officer has brought-out clear facts in light of relevant evidences and also made disallowance of excessive and unreasonable payment in light of expenditure incurred by the appellant society for the previous financial year when compared to the year under consideration, the learned CIT(A) deleted the addition made by the Assessing Officer without considering relevant evidences considered by the Assessing Officer. Therefore, she submitted that, the order of the learned CIT(A) should be set-aside and the additions made by the Assessing Officer should be sustained.

6. Shri A.V. Raghuram, Learned Counsel for the Assessee, on the other hand, supporting the order of the learned CIT(A) submitted that, the Assessing Officer has erred in making adhoc disallowance of expenditure incurred in relation to payment of service charges in pursuance to service agreement between the appellant society and M/s. SKCMET even though the appellant society has demonstrated with evidences that the payment made to above two companies is commensurate with the services rendered by above two companies and there is no excessive and unreasonable payment to benefit related parties. Learned Counsel further supporting the order of the learned CIT(A) submitted that, there is no dispute with regard to the fact that the service agreement of the appellant-society with M/s. SKCMET and further agreement of sub-contracting to above two companies is between the related parties and such transactions falls within the purview of section 13(1)(c) r.w.s.13(2)(c) of the Act. But the fact remains that, whether payment made by the appellant society is a benefit given to the Trustees/Members of the Society or compensation given for rendering services which is commensurate with the services rendered by above two companies or any excessive or unreasonable payment is made, has to be seen. The appellant society has filed all evidences to prove that, the payment made to the above two companies is reasonable and commensurate with services rendered by the above two companies, which is evident from the fact that, the gross receipts of the appellant society and expenditure incurred against such receipt is increased of about 10% when compared to previous financial year and, therefore, the method followed by the Assessing Officer to arrive at a reasonable amount of payment for services in pursuant to the said agreement and considering the payment made by the appellant society as excessive and reasonable is only a jugglery of figures without there being any substance. Further, the Assessing Officer has also invoked provisions of section 40A(2)(a) of the Act without understanding the relevance of said provisions and also how the said provision can be invoked in the given facts and circumstances of the case. The learned CIT(A) after considering the relevant facts, has rightly deleted the addition made by the Assessing Officer and, therefore, the order of the learned CIT(A) should be upheld.

7. We have heard both the parties, perused the material on record and the orders of the authorities below. There is no dispute with regard to the fact that, the appellant-society had entered into service agreement with M/s. SKCMET for operation, maintenance and administration of various colleges/institutions run by the appellant society. The said service agreement was entered into with effect from 01.04.2011 and in pursuance to the said agreement for rendering various services, the appellant society has made payment of Rs.256,99,63,642/- to above two companies. The Assessing Officer invoked the provisions of section 13(1)(c) r.w.s.13(2)(c), 13(2)(g) and 13(2)h) and observed that, since the transaction is between the specified persons referred to under section 13(3), the payment made by the appellant society to the above companies in pursuant to service agreement needs to be examined in light of provisions of sec.13(1)(c) r.w.s.40A(2)(a) of the Act. It is an undisputed fact that, the appellant society entered into service agreement with M/s. SKCMET which is a related Trust of the appellant society. Further, it is also not in dispute that M/s. SKCMET had entered into service agreement with M/s. Varsity Education Management Pvt. Ltd., and M/s. Junior Varsity Education Management Pvt. Ltd., for rendering services. In fact, the Assessing Officer never disputed the fact that, the appellant-society has received services from the above two companies in pursuant to service agreement for operation, maintenance and administration of colleges/institutions. However, the only dispute is with regard to the quantum of service charges paid to the above two companies in light of provisions of section 13(1)(c) of the Act. According to the Assessing Officer, payment made by the appellant society through M/s. SKCMET to the above two companies is excessive and unreasonable. The Assessing Officer has arrived at excessive payment by computing the amount by taking into account the total expenditure incurred by the appellant society for the financial year 2010-2011.

8. Admittedly, the appellant society had incurred total expenditure of Rs.522.31 crores for the financial year 2010-2011 on its own. For the financial year 2011-2012, the total expenditure incurred by the appellant society is at Rs.575.40 crores, out of which, Rs.256.99 crores has been paid to the above two companies for the services rendered in terms of service agreement. Therefore, the net expenditure incurred by the appellant society on its own for the financial year 2011-2012 was at Rs.318.41 crores. If we consider the total receipts and the total expenditure of financial years 2010-2011 and 2011- 2012, there is an increase of 11.39% in total receipts and increase of 10.16% in expenditure in the financial year 2011-2012, when compared to the earlier financial year 2010- 2011 and this fact has been noted by the Assessing Officer in page-11 of the assessment order. In other words, there is no substantial or material changes in the activities carried out by the appellant society during the year under consideration, except to the extent of outsourcing part of services to the above two companies in pursuant to service agreement. Further, there is almost 10% increase in revenue and 10% in expenditure for the year under consideration. Therefore, it is necessary for us to examine the reasons given by the Assessing Officer to make adhoc disallowance of excessive and unreasonable payment in terms of section 40A(2)(a) of the Act.

9. The Assessing Officer has taken total expenditure of financial year 2010-2011 as base expenditure which was at Rs.522.31 crores. From the above expenditure, the Assessing Officer has detected total expenditure incurred by the appellant society on its own account for the financial year 2011-2012 which was at Rs.318.41 crores. Thus, the Assessing Officer has arrived at a difference in expenditure of Rs.203.90 crores and observed that, the said expenditure is relatable to expenditure payable for outsourced activities. The Assessing Officer considered Rs.203.90 crores corresponding to the cost of services outsourced by the appellant society from the above two companies for the impugned financial year i.e., 2011-2012. In other words, it was the observation of the Assessing Officer that, this would have been the cost to the appellant society, if the appellant society had not awarded the contracts to the above two companies and further, it had undertaken the work on it’s own. Therefore, the Assessing Officer went on to compute excessive amount by taking into account Rs.203.90 crores and on this amount, made adjustment towards inflation at an estimated rate of 5% and also made adjustment of 8% profit, which the un-related party would have expected on similar services and finally arrived at total amount that would have been paid by the appellant society for the services rendered by above two companies in pursuant to said service agreement at Rs.231.23 crores. Since the appellant society has paid the amount of Rs.256.99 crores, the Assessing Officer considered that, the appellant society has paid excessive and unreasonable amount of Rs.25,76,43,593/- which is the benefit given to the persons specified u/sec.13(3) of the Act and, therefore, not allowable under section 40A(2)(a) of the Act.

10. The provisions of section 11 deals with exemption provided to a Society/Trust or an Institution registered under section 12A of the Income Tax Act, 1961. The exemption provided under sections 11 and 12 are subject to certain conditions provided under section 13 of the Income Tax Act, 1961. Section 13 deals with any part of income or any property of the Trust or Institution directly and directly used for the benefit of any person referred to in section 13(3) of the Act. Section 13(2) deals with deemed benefit given to the interested persons referred to under section 13(3) of the Act and as per said provisions, if any part of the income or property of the Trust or Institution is given to the specified persons referred to under section 13(3) for rendering any services and the amount so paid in-excess of what may be reasonably paid for such services, then, same is considered as benefit to persons specified u/sec.13(3) of the Act. In other words, as per section 13(2)(c), if any amount is paid by way of salary, allowance or otherwise during the previous year to any person referred to in subsection-(3), out of the resources of the Trust/Institution for such services rendered by that person to such Trust/ Institution and the amount so paid in excess what may be reasonably paid for such services, then, the excess payment may be deemed to be used or applied for the benefit of a person referred to in sub-section (3) of section 13 of the Income Tax Act, 1961.

11. In the present case, the Assessing Officer has considered service agreement between the appellant society and M/s. SKCMET and further sub-contract agreement between the two companies for rendering services to the appellant society for operation, maintenance and administration of colleges/institutions run by the appellant society and consequent payment made to the above two companies as excessive and unreasonable and also computed excessive amount of Rs.25,76,43,593/- in terms of 40A(2)(a) of the Income Tax Act, 1961. There is no dispute with regard to the fact that, the service agreement with M/s. SKCMET and further agreement with the above two companies falls under the provisions of section 13(1)(c) r.w.s.13(2) r.w.s.13(3) of the Income Tax Act, 1961 because, the transaction is between the related parties. In fact, the appellant society never disputed the fact that, the transaction is between the related parties. But, what has to be seen whether payment made to the related-persons specified u/sec.13(3) of the Act for rendering any services is commensurate with such services or excessive payment when compared to similar services provided by the third party needs to be examined. In case, the payment made by the appellant-society/trust is commensurate with services rendered by the said persons when compared to third party transactions under similar uncontrolled circumstances, then, merely for the reason of entering into agreement with related-parties, it cannot be alleged that said payment falls under the purview of sec.13(2)(c) r.w.s.13(2) r.w.s.13(3) of the Act. In case, the payment made by the appellant-trust / society is excessive when compared to the services rendered by them and said finding is based on any evidence, then, the Assessing Officer can examine the payment in light of provisions of sec.40A(2) of the Act. However, in order to invoke the provisions of section 40A(2)(a) of the Act, the Assessing Officer must bring on record some evidence including any comparative cases of similar nature or the industrial average of such nature of activity to allege that, the payment made by the appellant society to the related parties is excessive and unreasonable. In other words, the payment made by the appellant society to the related parties for services rendered by them is excessive, when compared to similar services rendered by third party in the given facts and circumstances of the case. In the present case, the Assessing Officer examined the payments under the provisions of section 13(1)(c) because, the appellant-society has made payment to the related parties specified under sub-section 13(3) of the Act. But, the Assessing Officer erred in computing excessive and unreasonable amount of Rs.25,76,43,593/- by invoking the provisions of section 13(2)(c) without bringing on record any comparable cases of similar nature. The Assessing Officer has simply taken total expenditure incurred by the appellant society for the financial year 2010-2011 as base expenditure, but, arrived at a reasonable amount to be payable for the above services and then compared with payment made by the appellant society for the year under consideration to allege that, the payment made by the appellant society is excessive and unreasonable. In our considered view, the action of the Assessing Officer in making adhoc disallowance of expenditure is purely on suspicion and surmises manner without there being any evidence to suggest that, expenditure incurred by the appellant society is excessive and unreasonable which fall under section 40A(2)(a) of the Act. In our considered view, unless the Assessing Officer brings on record certain evidences to prove that, payment made by the appellant society to the above two companies is excessive and unreasonable going by the evidences which suggest that, for similar services, third party would have rendered services for such an amount referred to by the Assessing Officer, in our considered view, merely on suspicion and surmises, adhoc disallowance cannot be made.

12. In the present case, the Assessing Officer by making a jugglery of figures, has arrived at excessive amount of Rs.25,76,43,593/-, even though, there is no evidence with the Assessing Officer to allege that, services rendered by the above two companies to appellant society is not commensurate with the payment made by the appellant society. Therefore, we are of the considered view that, the reasons given by the Assessing Officer to allege that, appellant society has made excessive and unreasonable payment in terms of section 40A(2)(a) to the above two companies for rendering services is devoid of merits and cannot be accepted. Further, the Assessing Officer has ignored the fact that, the above two companies have rendered services to the appellant society, for which, the appellant society has paid remuneration, which is commensurate with the services provided by the above two companies. Therefore, in our considered view, the Assessing Officer should have verified the payment with any comparable cases of similar nature or the industrial average of this kind of services provided by third party. In absence of any comparable case of similar nature or industrial average, the reasons given by the Assessing Officer to compute excessive and unreasonable payment cannot be up upheld. The learned CIT(A) after considering the relevant facts has rightly deleted the addition made by the Assessing Officer Thus, we are inclined to uphold the findings of the learned CIT(A) and dismiss the appeal filed by the Revenue.

13. In the result, the appeal filed by the Revenue is dismissed.