Surcharge on dividend income for discretionary trusts is levied at slab rates, not the maximum 37%.

Issue:

Whether the surcharge on dividend income earned by a private discretionary trust, which is taxable at the Maximum Marginal Rate (MMR) under Section 164 of the Income-tax Act, 1961, should be levied at the highest rate (e.g., 37%) or based on the slab rates provided in the First Schedule to the Finance Act, 2023.

Facts:

- The assessee is a private discretionary trust that earned dividend income from companies for Assessment Year 2022-23.

- The assessee initially calculated surcharge on dividend income at the rate of 10 percent.

- The Assessing Officer (AO), however, calculated surcharge on the dividend income at the rate of 37 percent.

- It was established that the assessee was a Family Trust and its income was indeed liable to be taxed at the Maximum Marginal Rate (MMR) as per Section 164, read with Section 2(29C) of the Income-tax Act, 1961.

- The assessee’s income fell within the slab rate of Rs. 50.00 lakh to Rs. 1 crore.

Decision:

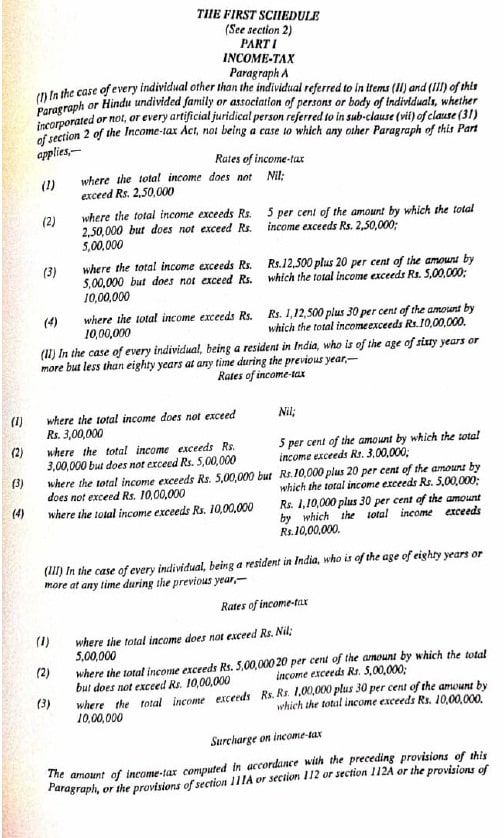

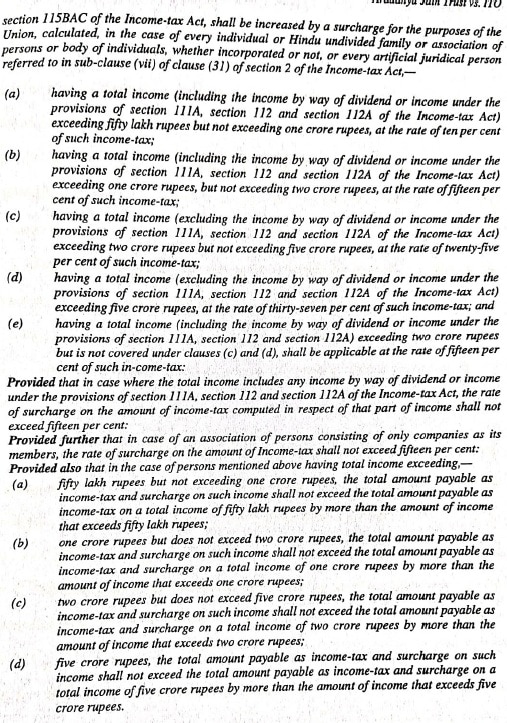

The court ruled in favor of the assessee. It held that while the income of a private discretionary trust is taxable at the Maximum Marginal Rate (MMR), the surcharge on dividend income should be levied based on the slab rates referred to in Paragraph A of Part I of the First Schedule to the Finance Act, 2023. Consequently, the surcharge on dividend income could not exceed 15 percent. Since the assessee’s income was between Rs. 50.00 lakh and Rs. 1 crore, the surcharge was leviable at the rate of 10 percent.

Key Takeaways:

- Maximum Marginal Rate (MMR) for Discretionary Trusts: Private discretionary trusts are generally taxed at the MMR, as their beneficiaries’ shares may be indeterminate (Section 164 read with Section 2(29C)). MMR refers to the highest slab rate of income tax applicable to an individual.

- Surcharge Applicability to MMR: While the basic income tax for such trusts is at MMR, the surcharge thereon is not automatically at the highest possible rate (e.g., 37%). Instead, the surcharge rates are determined based on the income slabs provided in the relevant Finance Act.

- Slab-based Surcharge: The Finance Act specifies graded surcharge rates based on income thresholds for individuals, associations of persons (AOPs), and bodies of individuals (BOIs). These slab rates also apply to the income of discretionary trusts for the purpose of calculating surcharge.

- Dividend Income Surcharge Cap: Specifically for dividend income, and certain other special incomes (e.g., those taxable under sections 111A, 112A), the maximum surcharge rate is capped at 15 percent, irrespective of the total income slab.

- Correct Surcharge Calculation: In this case, despite the trust being taxed at MMR, its total income being between Rs. 50 lakh and Rs. 1 crore meant that the applicable surcharge rate for dividend income was 10 percent, consistent with the slab rates for individuals and the cap on dividend income surcharge.

and Vinay Bhamore, Judicial Member

[Assessment year 2022-23]

| 1. | ITO v. Tayal Sales Corporation [2003] 1 SOT 579 (Hyd.) |

| 2. | Lintas Employees Professional Development Trust v. ITO (ITA No. 4791/Mum/2023 decided on 29.05.2024) |

| 3. | Sriram Trust, Hyderabad v. ITO (ITA Nos. 439, 440 & 441/Hyd./2024, decided on 19.06.2024) |

| 4. | Ujjwal Business Trust v. CPC (in ITA No. 602/Mum2024 decided on 28.06.2024) |

| 5. | Lintas Employees Holiday Assistance Trust v. CPC (ITA No. 1796/Mum/2024 decided on 26.07.2024) |

| 6. | Jitendra Gala Navneet Trust v. DDIT and Dilip Sampat Navneet Trust v. DDIT (ITA Nos. 2484 & 2485/Mum/2024 decided on 22.10.2024) |

| 7. | Lintas Employees Holiday Assistance Trust v. 3949/Mum/2024 decided on 20.01.2025) ITO (ITA No. |

| 8. | V. Meera Charitable Trust v. ITO (ITA No. 2140/Chny/2024 decided on 07.02.2025).” |