ORDER

Rathod Kamlesh Jayantbhai, Accountant Member. – These two appeals are filed by assessee and are arising out of the order of the Learned Commissioner of Income Tax (Exemption), Jaipur [for short ‘CIT(E)] passed under section 12AB and 80G of the Income Tax Act, 1961 [for short Act] both dated 19.07.2024 respectively.

2.1 In ITA No. 1184/JP/2024 the assessee has raised the following grounds: –

| 1. | | The order passed by Id. CIT Exemption in form no. 10AD is bad in law as well as on the facts of the present case and hence the same is liable to be quashed |

| 2. | | The Id. CIT Exemption, Jaipur erred in law as well as on the facts of the present case in rejecting registration application made by the assessee u/s 12AB of the Act and accordingly it may be directed to grant exemption sought by the assesseee |

| 3. | | The Id. CIT Exemption erred in law as well as on the facts of the present case in not giving full opportunity to the assessee before rejecting of application made by the assessee and hence the rejection of application is bad in law and on facts of the present case |

| 4. | | The Id. CIT Exemption erred in law as well as on the facts of the present case in holding the objects of the assessee for the benefit of a particular community which is incorrect on facts and hence such findings may be quashed |

| 5. | | The Id. CIT Exemption erred in law as well as on the 0 facts of the present case in holding the activities of the assessee as non-genuine which is incorrect on facts and hence such findings may be quashed |

| 6. | | The Id. CIT Exemption erred in law as well as on the facts of the present case in holding the dissolution clause of the assessee as not being charitable which is based on misinterpretation of facts on record and hence such findings are prayed to be quashed |

| 7. | | The assessee prays your goodself indulgence to add, amend, modify or delete all or any ground of appeal on or before the date of hearing |

2.2 In ITA No. 1185/JP/2024 the assessee has raised the following grounds: –

“1. The order passed by ld. CIT Exemption in form no. 10AD is bad in law as well as on the facts of the present case and hence the same is liable to be quashed

2. The Id. CIT Exemption, Jaipur erred in law as well as 0 on the facts of the present case in rejecting registration application made by the assessee u/s 80G of the Act and accordingly it may be directed to grant exemption sought by the assessee

3. The Id. CIT Exemption erred in law as well as on the 0 facts of the present case in not giving full opportunity to the assessee before rejecting of application made by the assessee and hence the rejection of application is bad in law and on facts of the present case.

4. The Id. CIT Exemption erred in law as well as on the facts of the present case in holding that the assessee violated conditions for granting of registration u/s 80G which is contrary to the law and facts on record and consequently rejection of application is also bad in law

5. The assessee prays your goodself indulgence to add, amend, modify or delete all or any ground of appeal on or before the date of hearing.

3. The assessee-applicant vide application in form no. 10AB sought registration u/s.12AB of the Act. In that proceeding ld. CIT(E) gave four opportunity to the assessee to substantiate their claim of registration. Vide letter dated 29.06.2024 the assessee was asked to resolve various queries raised by the Id. CIT(E) but the assessee – applicant did not file the complete details and therefore, the application for registration of the applicant-trust as was rejected for registration u/s 12AB of the Act was rejected on the following grounds recording the reasons thereof : –

| • | | Discrepancies in dissolution clause |

| • | | Object for the benefit of particular community |

| • | | Non Genuineness of Activities. |

4. Aggrieved from that order of rejection u/s 12AB of the Act, assessee preferred the present appeal before this Tribunal on the ground as reproduced hereinabove. To support the various grounds raised by the assessee, ld. AR of the assessee, has filed the written submissions in respect of the various grounds raised which reads as follows;

GOA 1,2,4,5,6: The order passed is bad in law

Brief Facts: The assessee is a registered charitable trust under the Rajasthan Public Trust Act, 1959 (refer clause (iv) PB 4). The trust is established on dt.28-11-1963 and the first trust deed is enclosed at PB 56-62.

The trust deed was modified in the year 2018 and the revised instrument dt.12-3-2018 is placed at PB 63-69.

The assessee was also duly registered u/s 12A of the Income Tax Act since 105-2002 and a copy of the certificate u/s 12A is placed at PB 52.

Later the assessee was again issued registration u/s 12A in form 10AC on dt.30-3-2022 from AY 2022-23 to AY 2026-27 with unique registration no. AAATA8639FE20213.

In the new regime for charitable trusts, the assessee again filed form no. 10AB on dt.2-1-2024, a copy of which is placed at PB 32-40 for seeking registration u/s 12AB of the Act. The application was made under sub-section (iii) of clause (ac) of sub section (1) of section 12A. This application was rejected for three reasons as would appear from the last page of the order passed by the ld. CIT (Exemption) (herein after referred to as the CIT) precisely on the following three grounds:

| a. | | Discrepancy in dissolution clause-trust is revocable |

| b. | | Object for the benefit of the particular community |

| c. | | Non genuineness of activities Now the assessee filed this appeal against the rejection of the application. |

Our Submission:

Assessee a very old trust: It is extremely relevant to mention that the assessee trust is a very old trust carrying out its activities since year 1969 and there is no finding of the ld. CIT that in the past years any of the activities of the trust were found non-genuine or the objects were not eligible for registration as charitable trust. There being no change in the activities of the trust in the year under consideration, prima facie the activities of the trust cannot be held to be non-genuine or objects non-charitable.

Without prejudice to above, at the outset it is submitted that the three grounds on which the application made by the assessee is rejected is misconceived and contrary to the facts and evidences on record and the same is being discussed herein below:

I. OBJECT OF THE TRUST NOT SOLELY FOR PAREEK SAMAJ

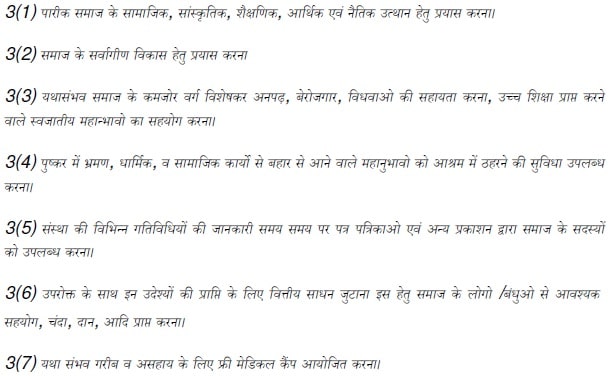

Objects are not for benefit of particular community: The ld. CIT has stated that the trust has been established trust is actually meant for activity and assets are created for Pareek samaj only. We may submit that the observation of the ld. CIT is apparently incorrect. The objects of the assessee trust are duly appearing in modified trust deed at PB 63-64 which are as follows:

From the above objects it is clear that the objects are not limited to the welfare of Pareek samaj but the trust is meant for activities for the entire society including the poor and helpless people and therefore the conclusion drawn by the ld. CIT is apparently incorrect.

Ld. CIT has not considered all the objects: In the order passed, the ld. CIT has not reproduced object no. 3(4) and 3(7) as the same is not appearing in the order at page 5-6 of the order where this issue is considered. Apparently the ld. CIT has failed to take into consideration two vital clauses which were directly linked to the charitable activities for the entire society.

Except in clause 3(1), there is nothing to suggest that the activities shall be for Pareek Samaj only.

Charitable activities carried out by the trust: The complete description of the charitable activities carried out by the trust is appearing in the reply submitted before the ld. CIT at PB 11:

We provide service of hospitality to pilgrims coming to Pushkar in our ashram including food at free of cost. We also provide ashram for marriage of poor girls at free of cost. However any other miscellaneous facility require for marriage are taken from outsiders and expenses of the same reimbursed by booking families like generator expenses, decoration and other related services. We also provide food without stay and without any charges to poor and needy people. We also held medical camp at our ashram for poor and needy people at free of cost. A 24*7 drinking water facility is also provided at our ashram through water cooler for every person. Every time we charge just nominal charges to stop misuse and undue advantage of ashram. Our ashram is always available for cultural activities without any charges like shiv katha, Ram Katha, Bhagwat Katha and other related cultural activity. This ashram is also meant for free of cost educational tour stays of students and at the mean time we have educational stationary for student’s development at free of cost. It is a Ritual of Rajasthan that every person who have visited Char Dham Yatra, the Yatra will not be Completed without taking bath in Holy Pushkar Kund, and also after “Asthi Visarjan” in Haridwar people visit and take bath in Holy Pushkar Kund. We provide free of cost stay, food and guide to every above cited persons. A photo of board sign showing this charitable facility is attached for your kind perusal.

Thus it is not a case that the assessee carried out activities for any specific caste Charitable activities carried out for the entire society and not just for pareek samaj: There is incorrect observation of the ld. CIT that the trust is working only for Pareek samaj which is apparently incorrect and contrary to the information and evidences brought on record by the assessee.

Some of the activities carried out by the trust are as follows which were submitted before the ld. CIT in its response PB 1-31 and the relevant reply is appearing at PB 12-13:

Details of charitable and religious activities carried out by the trust is as follows:

| S No | Description | Date | Venue | Number Of beneficiaries | Object to which related | Amount spent |

| 1 | Stay and food for needy and poor peoples | 04-07-2023 to 12-07-2023 | Akhil Bharatvarshiya Pareek Ashram Pushkar | 500 persons | Religious | 13,42,148/- |

| 2 | Stay and food for poor & needy persons | Available for complete financial year | Akhil Bharatvarshiya Pareek Ashram Pushkar | 471 peoples | Charitable | 128750/- |

| 3 | Free food on the occasion of pushkar fair on “chathurdashi & purnima ” in kartik month | 25/11/2023 & 26/11/2023 | Akhil Bharatvarshiya Pareek Ashram Pushkar | 750 pilgrims | Charitable | 65900/- |

| 4 | School fees payment for need and poor students by creating separate fund named as “pratibha gyan shiksha kosh” | Request letter from students are attached | Akhil Bharatvarshiya Pareek Ashram Pushkar | 3 students | Charitable | 115650/- |

| 5 | Separate study room facility free of cost to students coming from out of station in the exam days | In every exam dated | Akhil Bharatvarshiya Pareek Ashram Pushkar | 125 students | Charitable | 17550 |

| 6 | Medicines for Cow in the pandemic of Lumpy disease | September 2022 to march 2023 | Akhil Bharatvarshiya Pareek Ashram Pushkar | 122 cows | Charitable | 15300/- |

| 7 | Donation to other trust for charitable purpose | 16/07/2022 14/10/2022 | Akhil Bharatvarshiya Pareek Ashram Pushkar | 3 other trusts | Charitable | 11000/ 11000/- |

| 8 | Donation for “samuhik vivah” | 27/05/2022 23/02/2024 | Akhil Bharatvarshiya Pareek Ashram Pushkar | 30 couples | Charitable | 11000/ 11000/- |

It is clear the assessee trust carried out activities for the entire society as well as needy and helpless and not just for Pareek Samaj and the observation of the ld. CIT is incorrect and unjustified.

Bills, Images and evidences of the activities also submitted: The assessee has submitted bills and evidences and also images in support of the activities carried out by it. Some of the relevant images are placed from PB 130-141 and 144 and further copies of forms and supporting have been submitted at PB 145-159.

Specific attention of the hon’ble Bench is invited to PB 130-134 showing that the activities were for the entire society and not just limited to Pareek Samaj Incorrect allegation on boarding and lodging arrangements of children: The ld. CIT has also alleged at page 6 of the order that the trust has only made boarding and lodging arrangements for Pareek samaj children only. However this allegation is factually incorrect in so far as the free facilities were available for the entire society and not just limited to Pareek Samaj. The relevant forms and supporting are placed from PB 145-159 and specifically at PB 149-153,156-159 the forms of children of other caste are placed to whom financial and other assistances was given by the trust.

Thus the very observation of the ld. CIT is incorrect and consequent assumptions are also misplaced and uncalled for.

No ‘specified violation’ as defined u/s 12AB(4)(d) in the present case: The Id. CIT has referred to the provisions of clause (d) of sub section (4) of section 12AB which read as under:

Explanation.—For the purposes of this sub-section, the following shall mean “specified violation”,—

(d) the trust or institution established for charitable purpose created or established after the commencement of this Act, has applied any part of its income for the benefit of any particular religious community or caste; or However as already explained with facts and evidences that in the case of the assessee the activities were not for any specific community but for the society as a whole and therefore, the registration cannot be denied by invoking of above clause Decisions quoted by ld. CIT distinguishable, not correctly interpreted and rather support the case of the assessee: The ld. CIT has referred to two decisions of Hon’ble Supreme Court on page 7 of its order in case of Dawoodi Bohara and also Palghat Shadi Mahal Trust. However, both the decisions do not support the case of the revenue.

Hon’ble ITAT Jaipur such interpretation incorrect in similar circumstances: The Hon’ble Jaipur ITAT has found similar interpretation made by the ld. CIT holding the trust for specific community as incorrect. Please refer to the decision in case of Porwal Yuvak Sangh, Kota v. CIT Exemption ITA No. 708/JPR/2024 dt.20-12-2024, a copy of which is enclosed herewith.

Without prejudice to above Section 13(1)(b) cannot be made basis at the time of registration: In the instant case, the ld. CIT quoted provisions of section 13(1)(b) for coming to the conclusion that assessee is not eligible for registration as charitable trust. Though the object of the assessee were not for any specific community as has been discussed above still without prejudice to the same it is submitted that the provisions of section 13(1)(b) will come into picture only when determining issue of allowing exemption u/s 11 r/w 12 of the Act and not at the time of registration.

Even the decision of Hon’ble Supreme Court in Dawoodi Bohara which is quoted by the ld. CIT is also in respect of exemption to the assessee and not in respect of registration. The decision itself talks of circumstances in which the decision was delivered. The relevant extract is being reproduced herein below:

COMMISSIONER OF INCOME TAX v. DAWOODI BOHARA JAMAT (2014) 268 CTR (SC) 1

16. Therefore, under the scheme of the Act, ss. 11 and 12 are substantive provisions which provide for exemptions available to a religious or charitable trust. Income derived from property held by such public trust as well as voluntary contributions received by the said trust are the subject-matter of exemptions from the taxation under the Act. Secs. 12A and 12AA detail the procedural requirements for making an application to claim exemption under ss. 11 or 12 by the assessee and the grant or rejection of such application by the CIT. A conjoint reading of ss. 11, 12, 12A and 12AA makes it clear that registration under ss. 12A and 12AA is a condition precedent for availing benefit under ss. 11 and 12. Unless an institution is registered under the aforesaid provisions, it cannot claim the benefit of ss. 11 and 12. Sec. 13 enlists the circumstances wherein the exemption would not be available to a religious or charitable trust otherwise falling under s. 11 or 12 and therefore, requires to be read in conjunction with the provisions of ss.

11 and 12 towards determination of eligibility of a trust to claim exemption under the aforesaid provisions.

Thus without prejudice to above submission the above decision clearly held that the application of section 13(1)(b) to be seen at the time of assessment for determining exemption Further the headnotes of the decision in case of Palghat Shadi Mahal Trust read as follows:

COMMISSIONER OF INCOME TAX v.

PALGHAT SHADI MAHAL TRUST (2002) 254 ITR 212 (SC)

Charitable Trust—Exemption under s. 11—Disqualification under s. 13(1)(b)— Trust for benefit of Muslims—Trust created for educational social, economic and religious development of Muslims as recognised by Muslim Law— Extension of benefits to other communities impermissible— Trust disqualified under s. 13(1)(b) from availing benefit of s. 11 The above decision is in respect of eligibility of exemption of the assesse u/s 11 r/w 12 and not registration and therefore, inapplicable on the fact of the present case In this regard, we may also refer to Hon’ble Gujarat High Court decision which is delivered on the new section 12AB of the Act

COMMISSIONER OF INCOME TAX (EXEMPTION) v. JAMIATUL BANAAT TANKARIA (2024) 8 NYPCTR 1456 (Guj)

7. In view of the findings recorded by the Tribunal, supported by decision of this Court in case of CIT v. Bhaya Kutchhi Dasa Oswal Jain Mahajan Trust (2017) 8 IRT-OL 493 (Guj) that the objects of the trust are not wholly for the benefit of a particular religious community, but are largely charitable in character for general public at large and for the purpose of granting registration under s. 12A of the Act, the provision of s. 13(1)(b) cannot be referred to. Sec. 13(1)(b) is to be applied while granting exemption to the trust. In view of above finding, we do not 4 / 5 find any question of law much less any substantial question of law arises for consideration.

8. The appeal is accordingly dismissed.

The fact of the case of the assessee are identical and therefore, the findings of the above decisions are squarely applicable in the present case also and accordingly the provisions of section 13(1)(b) cannot be referred.

Reason for non-reply to the show cause notice: Though the issue is self-explanatory as the ‘objects as a whole’ do not lead to conclusion that the activities of the trust are for Pareek samaj only however still it is accepted that the reply could not be furnished to the show cause notice issued by the ld. CIT. The reason for non-reply to the notice was due to omission to file reply on the part of the consultant of the assessee CA Manish Pareek. The trust has duly forwarded the notice to the office of CA Manish Pareek however due to omission, the reply could not be made. However the ld. CIT has not allowed any further opportunity despite the case not time barring immediately.

All facts already on record-incorrect interpretation by ld. CIT-non reply not fatal to the case of the assessee: Though there was genuine omission in filing reply to the show cause notice still it was not fatal in as much as the complete information and evidences were already on record and it was only matter of incorrect interpretation by the ld. CIT which lead to rejection of application. Therefore, per se this issue can very well be decided by the hon’ble ITAT as all facts and evidences being on record.

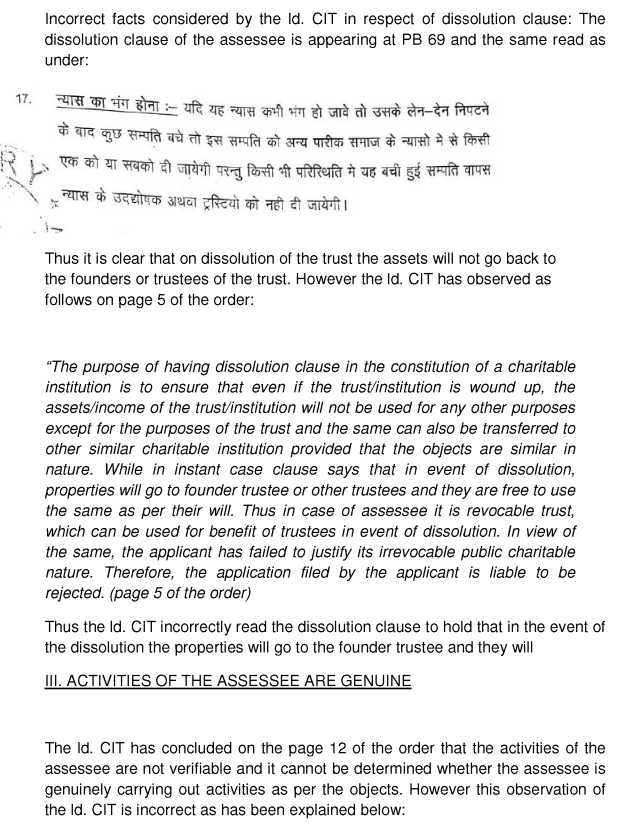

II. LD. CIT INCORRECTLY HELD TRUST REVOCABLE

Assessee provided complete details, bills, vouchers and evidences as desired: We may submit that the assessee has duly provided the details, information and books of accounts extracts as and when desired and its incorrect observation of the ld. CIT as is explained below.

The ld. CIT has given the summary of the information on page 12 of the order which was allegedly not provided in the proceedings. Now we are giving herewith the explanation thereof:

| S.No. | Issue | Response | PB |

| 1 | Not furnished details of activities as asked vide this office letter dated 10.04.2024 | Complete details of charitable activities were given alongwith the amount expended on major activities | PB 11 PB 12 (response dt.5-5-2024) |

| 2 | Bills/vouchers of expenses, bank book/cash book, ledger a/c, payments of all payments | Assessee submitted bank statement | PB 11 point no.3 PB 15 PB 97-99 |

| 3 | Not furnish details of donation of Rs. 11,000/- given to Mahrishi Parashar Pareek Sewa Samiti, Chomu, which is not as per objects of the trust. | Appeallant donate amount Rs. 11000 to Mahrishi Parashar trust for “Vivah Sammelan” which is cover under the trust objects and in support of our context we submit the receipt of Donee trust for the above mention objects | PB 13 PB 112 |

| 4 | Not furnish annual accounts for the F.Y. 2023-24 | – Duly furnished financial statements for the Fy 202223 and 2020-21 – FY2023-24 were not audited till the time of proceeding | PB 4 PB 160-171 |

| 5 | No details furnish that the trust has done beneficiary activities related to non- Pareek and Pareek Samaj | List of activities performed by trust in response submitted dt.05.05.2024 | PB 12 PB 13 PB 149-153 PB 156-159 |

| 6 | As per I/E account, ashram/bhawan running on rent, not furnish any details of such expense. | No rental income as already submitted before Ld. CIT (exemption) | PB 11 point no.2 |

| 7 | Not furnish details of rental income from Pareek Bhawan | No rental income as already submitted before Ld. CIT (exemption) | PB 11 point no.2 |

| 8 | Not furnish details of 13(3) persons | No payment made to such persons | PB 11 point no. 5 |

The ld. CIT observed submission of bills and vouchers in order u/s 80G: It is notable that the ld. CIT himself has observed in the order passed in form no.10AD rejecting application u/s 80G of the Act.

“3.1 On perusal of the details of charitable activities and bills/ vouchers, the trust society as organised——–” (page 3 of Id. CIT -form 10AD)

Thus the ld. CIT has himself observed submissions of bills and vouchers by the assessee and therefore, subsequent allegation of not submitting bills/ vouchers is contrary to the facts on record Therefore, in the light of the above facts and circumstances of the case the assessee may please be directed Without prejudice to above

GOA 3: The ld. CIT(Exemption) not provided proper opportunity of being heard Brief facts: In this case, the ld. CIT has passed the order after observing that no reply to the show cause notice has been received.

Reason for non-reply to the show cause notice: The reason for non-reply to the notice was due to omission to file reply on the part of the consultant of the assessee CA Manish Pareek. The trust has duly forwarded the notice to the office of CA Manish Pareek however due to omission, the reply could not be made.

However the ld. CIT has not allowed any further opportunity despite the case not time barring immediately.

Had a proper opportunity in light of principle of natural justice be provided the assessee could have explained its stand on the issue raised in the show cause notice.

Therefore without prejudice to the ground that the ld. CIT is prayed to be directed to allow registration u/s 12AB of the Act, the application may please be restored back to

5. To support the contention so raised in the written submission reliance was placed on the following evidence / records / decisions:

| Sr. | Particulars | Pages |

| 1. | Copies of responses before ld.CIT(Exemption) | 1-31 |

| 2. | Copy of Form No. 10AB for registration under section 12AA | 32-40 |

| 3. | Copies of Hearing Notices issued by ld.CIT(Exemption) | 41-51 |

| 4. | Copy of order u/s 12A(a) dt.10.05.2002 | 52 |

| 5. | Copies of Trust registration, trust deed and MOA and AOA | 53-72 |

| 6. | Copy of Form No. 10AB for registration under section 80G | 73-81 |

| 7. | Copies of responses before Ld. CIT (Exemption) | 82-99 |

| 8. | Copies of Hearing notices issued by Ld.CIT (Exemption) | 100-102 |

| 9. | Copy of declaration under section 13(1)(c) of The Act | 103-105 |

| 10. | Copy of Projected Receipts & payments account submitted before the ld. CIT(Exemption) | 106 |

| 11. | Copy of List of corpus donations | 107-111 |

| 12. | Copy of relevant donation slip | 112 |

| 13. | Copies of Invoices in respect of expenditure incurred by the trust | 113-119 |

| 14. | Copies of land registration documents | 120-129 |

| 15. | Copies of photographs of social welfare events | 130-141 |

| 16. | Copies of demand notice and payment slip of Office of Nagar Palika, Pushkar (Ajmer) | 142-143 |

| 17. | Copies of documents of free services of food and stay facilities for the students and their parents | 144-159 |

| 18. | Copies of Form 10B along with Financials Statements for the FY 2020-21 | 160-168 |

| 19. | Copy of Financial statements for the FY 2022-23 | 169-171 |

Case laws relied upon:

| • | | CIT Exemption v. Jamiatul Banaat Tankaria (Gujarat)/Tax Appeal No. 968 of 2024 dated 9th Oct., 2024, (2024) 8 NYPCTR 1456 (Guj.) |

6. The ld. AR of the assessee in addition to the above written submission so filed vehemently argued that so far as the reasons for discrepancies in dissolution clause, the assessee could not explain the same as the assessee could not reply to the last show cause notice in full. But in fact as per clause 17 of the trust deed already on record the observations of the ld. CIT(E) and the clause which is available on record is contrary and needs to be explained before the ld. CIT(E). Therefore, in the interest of justice he submitted that the assessee be given a chance to cure that observation. As regards the other two observations, ld. AR of the assessee submitted that the assessee is registered and enjoining the benefit of section 11 & 12 since it inception from 28.11.1963 and in past, there was no observation of the kind that has been observed by the ld. CIT(E) and the activities are not for the benefit of any particular caste or community. In fact that observations and also curable as the assessee could not submit all the details and therefore, this observation. In the light of that argument he prayed that the matter be remanded back to the file of the ld. CIT(E) so as to clarify the issues raised in the application of registration u/s. 12AB of the Act.

7. As regards the application made for registration u/s. 80G of the Act the same was rejected on the ground that since the application for 12AB was rejected approval under section 80G cannot be granted and that the activities of the trust were considered as religious in nature, and therefore, that application so made on 03.01.2024 was rejected on 19.07.2024.

In that matter ld. AR of the assessee submission that since the matter for registration u/s. 12AB has been prayed to be restored, this is also required to be restored to the file of the ld. CIT(E).

8. Per contra, the ld. DR relied upon the order of ld. CIT(E) and prayed that the rejection order are speaking and after giving sufficient opportunity to the assessee the finding of the ld. CIT(E) be sustained. She also submitted that observations for the dissolution clause was not got clarified and it is also correct observations of the ld. CIT(E) based on the reasons recorded in the order. It is also a finding of fact that the assessee working for the benefit of a particular community as is evident from the order and since the assessee could not clarify the complete details called for vide notice dated 29.06.2024, it was the assessee’s noncompliance. Therefore, she submitted that in the absence of complete details, the observations of the ld. CIT(E) are to be considered. As regards the matter of recognition u/s 80G of the Act, ld. DR submitted that the observations of the ld. CIT(E) are also required to be sustained because the assessee could not submit the details called for.

9. We have heard the rival contentions and perused material available on record. The bench noted that the application u/s 12AB of the Act was rejected on account of three reasons. The first reason was that there was discrepancy in dissolution clause. On the basis of the details available on record it is noted that the assessee much before changed that clause but could not so demonstrate before the ld. CIT(E), and the assessee has placed on record the modified trust deed. Based on this aspect of the matter, we feel that the observation so made is curable in nature and since the assessee admitted that in the last letter it could not file the complete details and that, the assessee be given a chance to rectify that observation. As regards the other two observations of ld. CIT(E) that the assessee works for the benefit of particular community and that its activities are not genuine, we find force that the assessee trust is working as a charitable trust since 1963 and has been assessed as such taking the benefit of sections 11 and 12 of the Act and therefore, the observations of the ld. CIT(E) that assessee works for a particular community and activities were not genuine come to be made as the assessee could not supply complete details in response to the letter issued on 29.06.2024. Based on the details placed on record in the paper book, we are of the considered view that the said observations also are curable in nature. Therefore, considering the reasons advanced the defects being curable in nature, we are of the considered view that the assessee applicant needs one chance to establish its stand on merits. Based on the overall facts as discussed herein above, bench adopts a lenient view and feels that the assessee should be given one more chance to produce documents before the ld. CIT(E) as regards application for registration u/s 12AB of the Act. In view of all facts and circumstances, the matter is restored to the file of ld. CIT(E) for afresh adjudication by providing by adequate opportunity of being heard to the assessee regarding the registration of the trust u/s 12AB of the Act. Thus, the appeal of the assessee i.e ITA No. 1184/JP/2024 is disposed off for statistical purposes.

10. Since we restore the appeal of the assessee regarding the registration u/s 12AB of the Act to the file of ld. CIT(E) for afresh adjudication as on outcome, the other appeal of the assessee u/s 80G of the Act is also restored the file of ld. CIT(E). Thus, the appeal of the assessee i.e ITA No. 1185/JP/2024 is also disposed off for statistical purposes.

In the result, the appeals of the assessee in ITA No. 1184 & 1185/JP/2024 are disposed of for statistical purposes.