Refund Claim for Data Hosting Services Remanded: Appellate Authority to Reconsider Export Status in Light of CBIC Circular and Precedents

Issue:

Whether data hosting services rendered by a petitioner-assessee to foreign affiliates constitute “export of services” under the Integrated Goods and Services Tax Act, 2017 (IGST Act), and thus qualify for a refund of IGST, especially when a recent CBIC Circular clarifies their export status and various prior orders (including from the Appellate Authority itself) have upheld identical services as exports.

Facts:

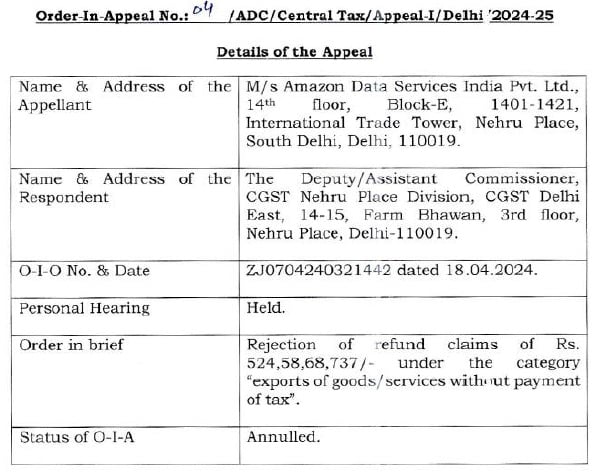

For the period August 2019 to March 2020, the petitioner-assessee provided data hosting services to its foreign affiliates. The department rejected the assessee’s refund claim, contending that the services did not constitute “export” as per the Export of Services Rules, 2017. The assessee challenged this order passed by the Appellate Authority via a writ petition.

Crucially, the court noted two significant points:

- CBIC Circular No. 232/26/2024-GST, dated September 10, 2024: This circular explicitly clarified that the supply of data hosting services provided by service providers located in India would constitute exports. (Research indicates this circular clarifies that such services are not intermediary services and their place of supply is the recipient’s location outside India, thereby qualifying as export).

- Prior Consistent Decisions: Various orders had already been passed by the Appellate Authority itself, as well as certain Orders-in-Original by the Adjudicating Authority, in favor of the assessee (or similar assessees), holding identical data hosting services as constituting exports. These orders had not been challenged in appeal by the department.

Decision:

The court ruled in favor of the assessee. Instead of entertaining the challenge in the instant writ petition, the court directed the Appellate Authority to reconsider the impugned orders once again. This reconsideration was specifically to be done in light of the Appellate Authority’s own prior orders and the clarifying CBIC Circular No. 232/26/2024-GST. Therefore, the impugned orders-in-appeal were set aside, and the matter was remanded for fresh adjudication.

Key Takeaways:

- Clarification by CBIC Circular: CBIC Circular No. 232/26/2024-GST (dated 10th September 2024) is a pivotal clarification, explicitly stating that data hosting services provided by Indian service providers to overseas cloud computing service providers constitute “exports.” This is based on the understanding that such services are provided on a principal-to-principal basis and are not intermediary services, with the place of supply being the location of the recipient outside India.

- Binding Nature of Circulars: The decision reinforces that CBIC Circulars are binding on the tax authorities. Failure to adhere to clarifications issued by the Board can lead to orders being set aside.

- Consistency in Adjudication: The existence of prior favorable orders from the Appellate Authority itself and unappealed Orders-in-Original from the Adjudicating Authority for identical services further strengthened the assessee’s case. Consistency in departmental interpretation and application of law is expected.

- Intermediary vs. Export of Services: This case illustrates the ongoing debate and clarification process around what constitutes “intermediary services” (place of supply is supplier’s location, making it taxable in India) versus a direct “export of services” (place of supply is outside India, making it zero-rated). Data hosting, in this context, is confirmed as an export.

- Remand for Reconsideration: When an order is found to be contrary to clear statutory clarifications (circulars) or binding precedents, the typical judicial remedy is to set aside the order and remand the matter for fresh adjudication in conformity with the established legal position.

- Section 13 (Place of Supply): The ruling implicitly relies on the general rule under Section 13(2) of the IGST Act, which states that the place of supply of services (where the supplier or recipient is outside India) shall be the location of the recipient, unless specifically covered by other sub-sections (like 13(8)(b) for intermediary services, which was ruled out by the Circular).

- Favour of Assessee: The outcome is in favor of the assessee, as their refund claim for export of services is likely to be reconsidered positively based on the new circular and past precedents.

| S. No | Period | SCN date | Order in original | Order passed by Appellate Authority |

| j | L Writ Petition No. 7235/2025 (Aug 2019 to March 2020) [Item 69] | |||

| 1. | August, 2019 | 31.10. 2020 | 05.03.2021 (@ Annexure P2, Writ Petition No. 7235/2025) | 31.08.2022 (@ Annexure P1, Writ Petition No. 7235/2025) |

| 2. | Sept, 2019 | 31.10. 2020 | 05.03.2021 (@ Annexure P3, Writ Petition No. 7235/2025) | |

| 3. | Oct Dec 19 | 06.05. 2021 | 30.05.2021 (@ Annexure P4, Writ Petition No. 7235/2025) | |

| 4. | Jan-Mar’20 | 06.05. 2021 | 30.05.2021 (@ Annexure P5, Writ Petition No. 7235/2025) | |

| 5. | Apr-June 20 | 06.05. 2021 | 05.03.2021 (@ Annexure P6, Writ Petition No. 7235/2025) | |

| 6. | July-Sept’20 | 17.05. 2021 | 04.06.2021 (@ Annexure P7, Writ Petition No. 7235/2025) | |

| II. Writ Petition No. 7281/2025 (Oct 2020 to March 2021) [Item 81] | ||||

| 7. | Oct Dec no | 06.09. 2021 | 30.11.2022 (@ Annexure P2, Writ Petition No. 7235/2025) | 29.01.2024 (@ Annexure P1, Writ Petition No. 7281/2025) |

| 8. | Jan-March ‘ 21 | 06.09. 2021 | 02.12.2022 (@ Annexure P3, Writ Petition No. 7235/2025) | |

| III. Writ Petition No. 7196/2025 (Apr 2021 to Sept 2021) [Item 54] | ||||

| 9. | April -Sept’21 | 11.04. 2023 | 04.05.2023 (@ Annexure P2, Writ Petition No. 7196/2025) | 15.02.2024 (@ Annexure P1, Writ Petition No. 7196/2025) |

| IV. Writ Petition No. 7191/2025 (Oct 2021 to March 2022) [Item 51] | ||||

| 10. | October 2021-March 2022 | 04.07. 2023 | 28.07.2023 (Annexure P2, Writ Petition No. 7196/2025) | 25.07.2024 (Annexure P1, Writ Petition No. 7191/2025) |