Retrospective GST Registration Cancellation Invalid Due to Vague SCN; Cancellation Valid Only from SCN Date

Issue:

Whether a show cause notice (SCN) issued for retrospective cancellation of GST registration is valid if it vaguely alleges non-compliance of unspecified provisions of the GST Act and Rules, thereby preventing the assessee from filing a proper reply. If the SCN is invalid, what is the appropriate effective date for the cancellation of registration.

Facts:

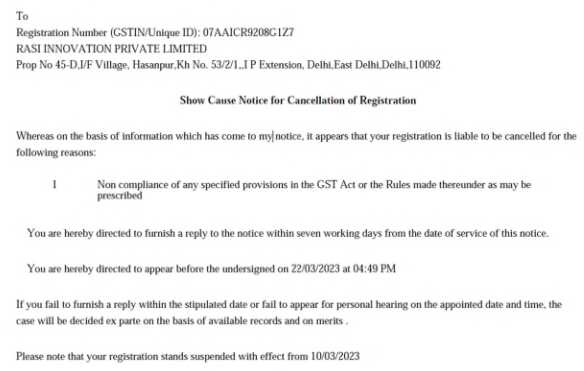

For the period 2022-23, a Show Cause Notice (SCN) was issued on March 10, 2023, proposing the cancellation of the assessee’s GST registration with retrospective effect from May 10, 2018. The assessee did not file any reply to this SCN. The core issue of the SCN’s validity stemmed from its wording: it generally alleged “non-compliance of unspecified provisions of GST Act and Rules” without mentioning any specific Section or Rule that had been violated.

Decision:

The court ruled in favor of the assessee on the validity of the SCN. It held that the alleged violation, as stated in the SCN, was completely incomprehensible as it generally alleged non-compliance of unspecified provisions of the GST Act and Rules, with no specific Section or Rule mentioned. The court emphasized that a GST official issuing such a notice ought to be careful to mention the specific provision of the GST Act and Rule of which the violation was alleged. It was only then that the assessee could give a proper reply to such an SCN. Therefore, the SCN was found to be completely untenable in law as there was no clarity as to the aspect on which the assessee had to show cause, thus preventing the assessee from being enabled to give a proper reply.

However, in view of the medical exigency faced by the Director and the fact that no business was carried out (which implies a cessation of business activities), the court held that the cancellation of GST Registration would be valid only with effect from the date of the SCN, i.e., March 10, 2023, and not retrospectively from May 10, 2018.

Key Takeaways:

- Specificity of Show Cause Notice: An SCN must be specific. It is a fundamental principle of natural justice that a notice must clearly and precisely inform the recipient of the allegations against them, including the specific statutory provisions violated. Vague or general allegations of “non-compliance” are insufficient and render the notice invalid.

- Opportunity to Reply: A vague SCN deprives the assessee of a proper and effective opportunity to file a reply and defend themselves, thereby violating the principle of audi alteram partem.

- Consequences of Invalid SCN: An SCN that is “completely untenable in law” can lead to the setting aside of the subsequent order passed based on it.

- Retrospective Cancellation is Discretionary: While Section 29 allows for retrospective cancellation, courts typically limit its application, especially when the assessee demonstrates a genuine reason for non-compliance or cessation of business, and the SCN itself is defective. The discretion must be exercised judiciously, not mechanically.

- Effective Date of Cancellation: When retrospective cancellation is not justified, the effective date is often fixed from the date of the show cause notice or the date of cessation of business, rather than a much earlier retrospective date. This limits the period of compliance burden on the assessee.

- Medical Exigency/No Business Activity: These factual elements acted as mitigating circumstances, influencing the court’s decision to limit the retrospective effect of the cancellation.

- Favor of Assessee: The decision is significantly in favor of the assessee, as it invalidates the retrospective cancellation from 2018 and limits the cancellation to a prospective effect from the date of the SCN, substantially reducing potential liabilities for the intervening period.

| Financial Year | Tax Period | Date of Filing | Status |

| 2022-2023 | March | 18/04/2023 | Filed |

| 2022-2023 | February | 16/03/2023 | Filed |

| 2022-2023 | January | 17/02/2023 | Filed |

| 2022-2023 | December | 19/01/2023 | Filed |

| 2022-2023 | November | 20/12/2022 | Filed |

| 2022-2023 | October | 17/11/2022 | Filed |

| 2022-2023 | September | 19/10/2022 | Filed |

| 2022-2023 | August | 17/09/2022 | Filed |

| 2022-2023 | July | 29/08/2022 | Filed |

| 2022-2023 | June | 21/07/2022 | Filed |

| Financial Year | Tax Period | Date of Filing | Status |

| 2022-2023 | March | 07/04/2023 | Filed |

| 2022-2023 | February | 04/03/2023 | Filed |

| 2022-2023 | January | 07/02/2023 | Filed |

| 2022-2023 | December | 06/01/2022 | Filed |

| 2022-2023 | November | 05/12/2022 | Filed |

| 2022-2023 | October | 08/11/2022 | Filed |

| 2022-2023 | September | 08/10/2022 | Filed |

| 2022-2023 | August | 08/09/2022 | Filed |

| 2022-2023 | July | 09/08/2022 | Filed |

| 2022-2023 | June | 08/07/2022 | Filed |