ORDER

Laxmi Prasad Sahu, Accountant Member. – These appeals at the instance of the assessee are directed against the orders of ld. CIT(A)/NFAC, Delhi both dated 23.09.2024 vide DIN & Order No. ITBA/NFAC/S/250/2024-25/1068988279(1) for the assessment year 2016-17 and vide DIN & Order No.ITBA/NFAC/S/250/2024-25/1068999127(1) for the assessment year 2017-18 passed u/s 250 of the Income Tax Act, 1961 (in short “The Act”). Since both these appeals and the stay petition are of the same assessee for the different assessment years, these are clubbed together, heard together and disposed of by this common order for the sake of convenience and brevity.

ITA No.2059/Bang/2024 (AY 2016-17):

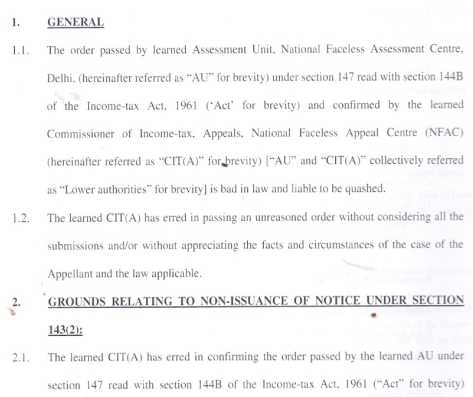

2. First, we take up ITA No.2059/Bang/2024 for the AY 201617 wherein the assessee has raised the following grounds of appeal:

2 .1 The assessee has raised the following additional grounds of appeal:

3. We have heard both the parties on admission of additional grounds. In our Opinion all the facts are already on record and there is no necessity of investigation of any fresh facts for the purpose of the adjudication of above grounds. Further we are also of the opinion that the additional grounds raised in the present case are legal in nature & therefore these are critical for a fair adjudication of the matter. The Madras High Court in CIT v. Indian Bank (Madras) held that Rule 11 of the I.T. Rules makes it clear that the assessee has the right to raise additional grounds and if the same is beneficial to the assessee, the same should be considered by the Tribunal.

3.1 The Hon’ble Supreme Court in National Thermal Power Co. Ltd. v. CIT held that the Tribunal has jurisdiction to examine a question of law which did not arise before lower authorities but arose before it from facts as found by lower authorities and having a bearing on tax liability of assessee. The Hon’ble Allahabad High Court in CIT v. Sahara India(Allahabad) held that a question of law which can be decided with reference to materials on record can be admitted even though not raised before. Accordingly, we inclined to admit the additional grounds for the purpose of adjudication as there was no investigation of any fresh facts otherwise on record and the action of the assessee is bonafide.

4. Brief facts of the case are that the Assessee is a Resident individual who was employed by SmartPlay Technologies India Pvt. Ltd. The Assessee also held shares in SmartPlay Global PCC [‘Smartplay’]. The assessee filed his return of income for the assessment year 2016-17 on 05.08.2016 declaring total income of Rs.56,25,08,490/-. During the year under appeal, the Assessee sold his investment in SmartPlay. The short-term capital gains (‘STCG’) of Rs 75,73,97,892/- arose from such sale. The assessee in the same previous year i.e. on 10.09.2015 and 11.09.2015 also purchased 87,000 shares of Bharat Electronics Limited [‘BEL’ for brevity] amounting to Rs.29,69,98,853/-. Further on 14.09.2015, the BEL allotted 1,74,000 bonus shares to the Assessee. The Assessee sold 87,000 original shares for consideration of Rs. 9,45,84,420 on 16.09.2024 which resulted in short-term capital loss (‘STCL’) of Rs. 20,24,90,717/-. The said short-term capital loss was set off against short-term capital Gain arising from the sale of investment in SmartPlay and the net short-term capital gain of Rs. 55,49,07,175/- (Rs.75,73,97,892 – Rs.20,24,90,717/-) was offered to tax.

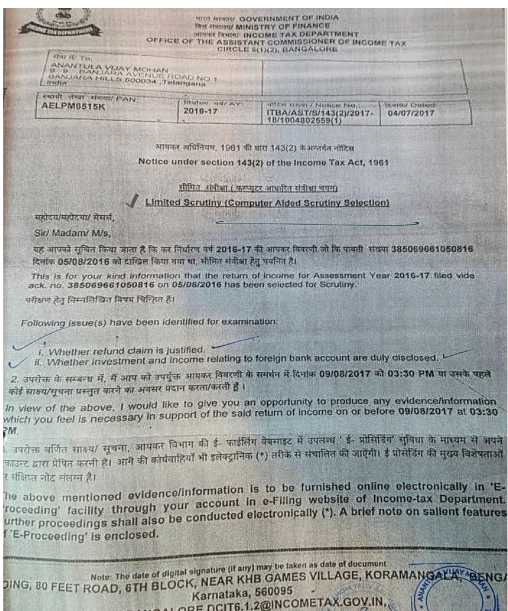

4.1 Thereafter, the case of the assessee was selected for scrutiny and accordingly notice under section 143(2), 142(1) as well as 131 of the Act were issued. In response to notices & summon, the assessee appeared on various dates and filed submissions related to relevant details, particulars and clarifications as called for. Further in response to summon also the assessee appeared and a statement u/s 131(1A) was recorded. It is worthwhile here to note that the notice issued u/s 143(2) of the Act provided for the ‘Limited Scrutiny’. The issues stated to be identified for examination were:

| i. | | Whether refund claim is justified. |

| ii. | | Whether investment and income relating to foreign bank account are duly disclosed. |

4.2 Finally, after taking into consideration the submission of the assessee, the AO, while passing the assessment order under section 143(3) of the Act, treated the transaction of purchase and sale of BEL shares as an adventure in the nature of trade. The AO stated that the purchase of BEL shares was made with a premeditated intention to sell 87,000 BEL shares upon allotment of bonus shares. The BEL shares (original and bonus shares) were recharacterized as stock in trade. The cost of 87,000 Original BEL Shares was apportioned equally between the original and bonus shares. As a result, (i) set off of STCL of Rs. 20,24,90,717 was disallowed (ii) business loss was computed at Rs. 44,91,482 and (iii) 1,74,000 bonus shares were treated as closing stock, valued at Rs.19,79,99,235/-.The main contention of the AO in his assessment order was that the assessee has made artificial arrangements to generate the capital loss and accordingly the claim of capital loss amounting to Rs.20,24,90,717/- was disallowed & business loss of Rs. 44,91,482 was determined which in the opinion of AO, the assessee can set off against capital gains from acquisition of SmartPlay start-up by Aricent.

5. Aggrieved by the assessment order of the AO, the assessee preferred an appeal before the learned CIT(A)/NFAC.

5.1 The ld. CIT(A)/NFAC partly allowed the appeal of the assessee. The learned CIT(A) upheld the treatment by the AO of purchase and sale of BEL shares being regarded as adventure in nature of trade. Having held thus, it was held that the full cost of Original BEL Shares at Rs. 29,69,98,853/- be treated as deduction for computing business income and business loss of Rs.20,24,90,717 be allowed to set off against the STCG, cost of bonus shares be treated as ‘Nil’.

6. Aggrieved by the order of learned CIT(A)/NFAC, the assessee filed the present appeal before this Tribunal. The assessee has also filed a paper book comprising 336 pages along with the case law compilation & other materials in two volumes.

7. Now first we take up the Additional legal Ground Nos. 1, 2 and 3, which are withregard to the expansion of the scope of ‘limited scrutiny’ without following mandatory procedure laid down by the CBDT, & thus variations made in the assessment order is without jurisdiction and hence liable to be deleted.

7.1 Before us, the ld. A.R. of the assessee vehemently submitted that the assessee’s case was selected under the Computer Aided Scrutiny Selection (CASS) Cycle 2017. For the cases selected in the CASS 2017 as well as 2018 cycles, the CBDT issued an Order No. F.No.225/402/2018/ITA.II dated 28.11.2018 in which it has been directed that in ‘Limited Scrutiny’ cases, the assessing officer shall not travel beyond the issues for which the case was selected. It also provides that the scope of ‘Limited Scrutiny’ may be expanded only if the matter is placed before the PCIT/CIT and his approval is obtained. The notice under section 143(2) of the Act issued to the assessee provides for ‘limited scrutiny’. The ld. A.R. submitted that the notice was meant to verify refund of Rs.23,78,460/- claimed in the return. It was not meant to confer jurisdiction to scrutinize the transactions in BEL shares.

7.2 He further submitted that the AO has expanded the scope of ‘limited scrutiny’ without obtaining prior approval of the PCIT/CIT as provided in the CBDT order. As prior approval was not taken, the expansion of the scope of limited scrutiny is bad in law. The impugned variations arising as a result of the expanded scope, sans prior approval, are without jurisdiction. The assessment order as passed is therefore liable to be quashed.

8. The ld. D.R. on the other hand although admitted the fact that the case of the assessee was identified for limited scrutiny to verify whether refund claim is justified & whether investment and income relating to foreign bank account are duly disclosed. However, as the refund arises out of all the items included in the computation of income and accordingly the AO can verify all the heads of income declared in the return because of which refund results like complete scrutiny. Hence, the AO is justified to verify the issue of set off of short term capital loss claimed against short term capital gain by the assessee.

9. We have heard the rival submissions and perused the materials available on record. It is undisputed fact that the case of the assessee was selected for limited scrutiny under the CASS by issuing notice u/s 143(2) of the Act dated 4.7.2017 which are reproduced below for the sake of convenience and brevity:

9.1 On going through the above, we take a note of the fact that the case was identified for limited scrutiny (CASS) for the examination of the following two issues only:

| i. | | Whether refund claim is justified? |

| ii. | | Whether investment and income relating to foreign bank account are duly disclosed? |

9.2 However, on going through the assessment order passed u/s 143(3) of the Act dated 12.12.2018, we take a note of the fact that on the ground of artificial arrangement to generate capital loss, The AO has disallowed the capital loss of Rs.20,24,90,717/- and further business loss of Rs.44,91,482/- is determined by allowing the assessee to set off against capital gain from acquisition of smartplay startup by aricent, which in our opinion was not identified for examination under the limited scrutiny. The sole basis of the assessment is completely based on the AO’s presumption that there is a artificial arrangement to generate capital loss whereas the case was selected for the examination of whether refund claim is justified & whether investment and income relating to foreign bank account are duly disclosed. Further, it is also an admitted fact that the AO had also failed to convert the limited scrutiny to complete scrutiny by following the due procedures as directed in various instructions/orders issued by the CBDT which is binding on him. On going through the various instructions/order issued by the CBDT regarding scope of the limited scrutiny under CASS, we take a note of the important directions as below:

9.3 The instruction no.20/2015 dated 29.12.2015 clarifies the scope and applicability of the limited scrutiny cases.

The procedure for handling “limited scrutiny” case clarified are as under:

| (a) | | In “limited scrutiny” cases, the reasons/issues shall be forthwith communicated to the assessee concerned. |

| (b) | | The questionnaire under section 142(1) of the Act in “limited scrutiny” cases shall remain confined only to the specific reasons/issues for which case has been picked up for scrutiny. Further, the scope of enquiry shall be restricted to the “limited scrutiny” issues. |

| (c) | | These cases shall be completed expeditiously in a limited number of hearings. |

| (d) | | During the course of assessment proceedings in “limited scrutiny” cases, if it comes to the notice of the AO that there is potential escapement of income exceeding Rs.5 lakhs (for Metro Rs.10 lakhs) requiring substantial verification on any other issues then, the case may be taken up for complete scrutiny with the approval of the Principal CIT/CIT concerned. |

| (e) | | The Principal CIT/CIT shall accord the approval in writing after being satisfied about the merits of the issue necessitating “complete scrutiny”. |

| (f) | | Further, such cases shall be monitored by the Range Head concerned and the procedure indicated at point No.(a), (b) & (c) above shall no longer remain binding in such cases. |

9.4 Further the instruction No. 5/2016 dated 14.7.2016 state that in order to ensure that maximum objectivity is maintained in converting a case falling under “limited scrutiny” into a “complete scrutiny” case, the AO while forming the reasonable view would ensure that:

| (a) | | There exist credible material or information available on record for forming such view. |

| (b) | | This reasonable view should not be based on mere suspicion, conjecture or unreliable source and |

| (c) | | There must be direct nexus between the available material and formation of such view. |

9.5 In the said instruction, it is further clarified that in cases under “limited scrutiny”, the scrutiny assessment proceeding would be confined only to issues under “limited scrutiny” and questionnaires, inquiry, investigation, etc. would be restricted to such issues.

9.6 Further, the CBDT vide F.No.225/402/2018/ITA.II dated 28.11.2018 has again reiterated that in “limited scrutiny” cases the AO shall not expand the scope of enquiry/investigation beyond the issues on which the case was flagged for “limited scrutiny”. Further, it is also provided that the scope of “limited scrutiny” may be expanded only if the matter is placed before the ld. PCIT/CIT for his administrative approval and subject to monitory limits as per earlier instruction dated 29.12.2015.

9.7 The CBDT vide F.No.225/402/2018/ITA.II dated 28.11.2018 also directed to adopt the following procedures while examining the additional issue-

| (i) | | The AO shall duly record the reasons for expanding the scope of ‘Limited Scrutiny’ to the extent where credible material or information has been /is provided by any law-enforcement/intelligence/regulatory authority or agency regarding tax-evasion by an assessee. |

| (ii) | | The same shall be placed before the Pr. CIT/CIT concerned and upon his approval, further issue can be considered during the assessment proceeding; |

| (iii) | | The AO shall issue an intimation to the assessee concerned that additional issue would also be considered during the course of pending assessment proceeding; |

| (iv) | | To ensure proper monitoring in these cases, provisions of section 144A of the Act may be invoked in suitable cases. |

| (v) | | Further, to prevent fishing and roving enquiries in these cases, it is desirable that these cases are invariably picked up for review/inspection by the administrative authority. |

9.8 In the present case, admittedly the same AO who had issued the notice u/s 143(2) of the Act, while issuing notice u/s 142(1) of the Act dated 31.5.2018 had asked to submit details only with regard to high ratio of refund to TDS (part B-TTI of ITR) and large balance in foreign bank account (Schedule FA of ITR) along with the copy of Return, Computation of Income, Audited accounts & report as identified for the examination under ‘limited scrutiny.’ However, after the change in incumbency, on going through the notice u/s 142 (1) of the Act dated 5.10.2018 issued by the new AO, we find that AO has asked detailed questionnaire relating to number of shares purchased and sold along with the details of bonus shares and cost of acquisition as well as the details of dividend received, which in our view was not the issues identified for examination under the notice u/s 143(2) of the Act under the “limited scrutiny”. We are further of the opinion that the AO has over stepped his jurisdiction without duly recording the reasons for expanding the scope of ‘Limited Scrutiny’. The same also not placed before the Pr. CIT/CIT concerned for his approval & the assessee had also not been intimated that additional issue would also be considered during the course of pending assessment proceeding. If we consider the argument of the ld. D.R. that since the refund arises out of all the items included in “computation of income”, the AO can verify all the heads of income because of which refund results, then in our view, it will completely frustrate the very objective of “limited scrutiny”.

9.9 We are of the considered opinion that when the tax authorities are scrutinizing/examining whether refund claimed is justified, they should confined themselves whether the gross receipts on which the TDS credit is sought has been declared in the return or not, Whether TDS claimed are reflecting in the Form 26AS of not, whether the assessee had actually paid any excess advance tax or not & the reasons for claiming the refund. In the present case, the AO completed the assessment on the sole presumption that that the assessee has made artificial arrangements to generate the capital loss and accordingly the claim of capital loss amounting to Rs.20,24,90,717/- was disallowed & business loss of Rs. 44,91,482 was determined which in our opinion are not identified for the limited examination u/s 143(2) of the Act. Under these circumstances, in our opinion, even if some other issues comes to the notice of AO during the course of assessment proceedings, he cannot make any other addition/disallowance without obtaining prior approval from concerned PCIT/CIT as per the instruction issued by the CBDT cited (supra). In our opinion, the AO has exceeded the jurisdiction by calling for details and carrying out inquiries by issuing notice u/s 142(1) of the Act dated 5.10.2018.

9.10 Considering the facts of assessee’s case and also the CBDT instruction cited (supra) we are of the considered view that the AO has exceeded his jurisdiction in inquiring into those issues which are beyond the scope of “limited scrutiny” which is clear violation of mandate given by the CBDT in the above instructions/orders which are binding on the AO and accordingly without jurisdiction & bad in law. We are of the view that CBDT has specifically clarified that in a “limited scrutiny”, the scope of enquiry shall be restricted to the “limited scrutiny” issues. It will be confined only to issues and questionnaire, inquiry, investigation, etc. would be restricted to such issues in the “limited scrutiny”.

9.11 In view of the above, the bench is of considered opinion that the very exercise of jurisdiction to examine/scrutinize the transaction in BEL shares are not covered in the any of the issues identified for the examination under the “limited scrutiny”. The examination of refund claim in a limited scrutiny cannot be construed as giving jurisdiction to a complete scrutiny. The AO has expanded the scope of “limited scrutiny” without following due procedure as directed under various instructions/orders. Therefore we are inclined to hold that the AO has exceeded his jurisdiction in disallowing the capital loss of Rs.20,24,90,717/- and further determining the business loss of Rs.44,91,482/- by allowing the assessee to set off against capital gain from acquisition of smartplay startup by aricent and accordingly we set a-side the order of the AO being without jurisdiction & bad in law.

9.12 As the additional grounds raised by the assessee are allowed and accordingly other ground of appeal on merits of the case are not adjudicated and are kept open.

10. In the result the appeal filed by the assessee is allowed.

ITA No.2060/Bang/2024 (AY 2017-18):

11. Now, we take up ITA No.2060/Bang/2024 for the AY 201718, wherein the assessee has the raised following grounds of appeal:

11.1 The assessee has raised the following additional grounds of appeal:

12. We have heard both the parties on admission of additional grounds. In our Opinion all the facts are already on record and there is no necessity of investigation of any fresh facts for the purpose of the adjudication of above grounds. Further we are also of the opinion that the additional grounds raised in the present case are legal in nature & therefore these are critical for a fair adjudication of the matter. The Madras High Court in Indian Bank (supra) held that Rule 11 of the I.T. Rules makes it clear that the assessee has the right to raise additional grounds and if the same is beneficial to the assessee, the same should be considered by the Tribunal.

12.1 The Hon’ble Supreme Court in National Thermal Power Co. Ltd. (supra) held that the Tribunal has jurisdiction to examine a question of law which did not arise before lower authorities but arose before it from facts as found by lower authorities and having a bearing on tax liability of assessee. The Hon’ble Allahabad High Court in CIT v. Sahara India ITR 331 (Allahabad) held that a question of law which can be decided with reference to materials on record can be admitted even though not raised before. Accordingly, we inclined to admit the additional grounds for the purpose of adjudication as there was no investigation of any fresh facts otherwise on record and the action of the assessee is bonafide.

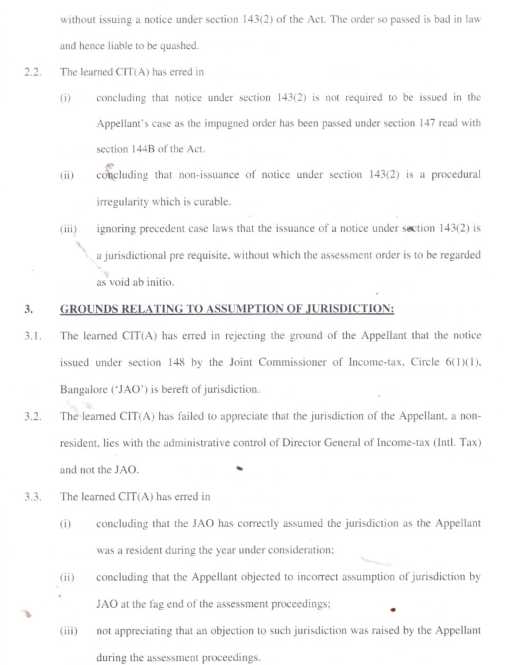

13. Now the brief facts of the case are that the Assessee being a non-resident individual filed his return of income for the A.Y. 2017-18 on 28.11.2017 declaring total income of Rs. 65,09,010/-. During the year under consideration, the Assessee sold bonus shares of Bharat Electronics Limited (“BEL”) allotted to him in F.Y. 2015-16. The bonus shares were held by him as long term capital asset before he sold them for a consideration of Rs. 22,55,37,300/-. The assessee in his return, inter-alia claimed an exemption under section 10(38) qua long term capital gain (‘LTCG’) of Rs. 22,55,37,300/- arising from sale of bonus shares. The Assessee was issued a notice under section 148 of the Act by the learned Deputy Commissioner of Income Tax, Circle 6(1)(1) (“AO”) on 31.03.2021 to reassess the income for AY 2017-18. The notice required the Assessee to file a return of income within 30 days. The Assessee filed the return on 31.05.2021. Subsequently, vide notices under section 142(1) of the Act, reasons to believe were supplied and additional information were sought by the AO. The Assessee complied with the notices issued by the AO. Finally, the AO recharacterized the LTCG from sale of bonus shares to business income and denied the exemption claimed under section 10(38) of the Act and treated the same as business income amounting to Rs.22,55,37,300 & assessed on a total Income of Rs.23,20,46,310/-

13.1 The AO passed the final assessment order on 29/03/2022 under section 147 of the Act without issuing a draft order under section 144C(1) of the Act to the Assessee. A notice under section 156 of the Act for demand of Rs. 12,94,74,425/- was also issued on the same date.

14. Aggrieved by the order of the AO, the Assessee preferred an appeal before the learned CIT(A)/NFAC.

15. The learned CIT(A)/NFAC upheld the action of AO in treating the transaction of sale of bonus shares of BEL as taxable under head Profits and Gains of Business.

16. Aggrieved by the order of the learned CIT(A)/NFAC, the assessee filed the appeal before this Tribunal. The assessee has also filed paper book & case law compilations in two volumes along with other material comprising 1039 pages.

17. Now first we take up the Additional legal Ground Nos. 1 & 2, which are with regard to the passing of the final order u/s 147 of the Act without complying with the mandatory requirement of issuing a draft assessment order u/s 144C(1) of the Act and accordingly illegal & void ab-intio.

18. Before us, the ld. A.R. for the assessee submitted that Section 144C(1) of the Act is a non-obstante clause. It is submitted that the Non-resident individuals were included in the definition of ‘eligible assessees’ by way of an amendment in section 144C(15) of the Act with effect from 01.04.2020. Section 144C falling in Chapter XIV is a procedural law & is mandatory in nature. Failure to issue draft assessment order before passing the final assessment order constitutes non-compliance of the requirements of section 144C(l) of the Act. Further the non-compliance of the mandatory procedure under section 144C(l) of the Act strikes to the root of the matter and shall render the entire assessment void ab initio. He further submitted that the Jurisdictional High Court in CIT v. Cisco System Services B. V ITR 50 (Karnataka) held that the non-compliance of section 144C(l) is not a curable defect. The ld. A.R. submitted that as the draft assessment order was not issued in this case, accordingly the assessment order dated 29.03.2022 is void ab initio and liable to be quashed.

19. The ld. DR on the other hand supported the order of the authority below & vehemently submitted that non issuance of the draft assessment order before passing the final assessment order is only a procedural irregularity which could be cured by remitting the matter to authority. In this regard the ld. DR also relied upon the judgement of Apex Court in the case of Home Finders Housing Ltd. v. ITO as well as judgement of the Apex Court in the case of Sky Light Hospitality LLP v. Asstt. CIT

20. We have heard the rival submissions & perused the material available on record. It is undisputed that the Assessee is a nonresident during the previous year as observed by the AO in his assessment order. Hence, he is an ‘eligible assessee’ under section 144C(15)(b) of the Act. It is also undisputed that draft assessment order was not issued to the Assessee before passing the final assessment order u/s 147 of the Act. Section 144C of the Act is a machinery provision which has been incorporated for the benefit of the assessee including the “eligible assessee”. The non-resident Indian has been included in the definition of ‘eligible assessee’ u/s 144C (15)(b)(ii) of the Act w.e.f. 1st April, 2020 and therefore, the assessment proceeding in respect of a non-resident Indian undertaken after the said date are to be governed under the provisions of section 144C of the Act. Further, we are of the opinion that failure on the part of AO to follow procedure u/s 144C(1) is not merely a procedural or inadvertent error but a breach of a mandatory provision. The AO by not following the procedure laid down in section 144C(1) of the Act to pass and furnish a draft assessment order to the assessee and directly passing a final assessment order without giving assessee an opportunity to raise objection before the DRP is not mere a procedural irregularity but an incurable illegality and even provisions of section 292B of the Act would not protect such order as section 292B of the Act cannot be read to confer jurisdiction on assessing officer where none-exist as held by the Hon’ble High Court of Bombay in the case of S.H.L. (India)(P) Ltd. v. DCIT (Bombay). The statutory provisions make it abundantly clear that the procedure laid down u/s 144C of the Act is of great importance and is mandatory. We take a support and guidance from the judgement of Hon’ble High Court of Gujarat in the case of CIT v. C-SAM (India) (P) Ltd. (Gujarat) wherein it is held as under:

4. Learned Single Judge of Madras High Court in case of Vijay Television Ltd. (supra) has taken a view that the procedure laid down under Section 144C of the Act is mandatory and the order passed by the Assessing Officer without following such procedure is illegal and the defect is not a curable defect. This view has also been taken by the Andhra Pradesh High Court in case of Zuari Cements Ltd. (supra) against which we are informed that SLP has been dismissed. We notice that the Delhi High Court in case of ESPN Star Sports Mauritius S.N.C. ET Compagnie v. Union of Indiam [2016] though was not strictly concerned with the issue at hand, however, held and observed that the Assessing Officer is bound by the orders passed by the Dispute Resolution Panel and the order passed by the Assessing Officer disregarding such order is ab-initio void.

5. Section 144C of the Act refers to the Dispute Resolution Panel. Subsection (1) of Section 144C provides that in case of an eligible assessee, the Assessing Officer shall notwithstanding anything to the contrary contained in the Act forward a draft of the proposed order of assessment to the assessee if he proposes to make on or after 01st day of October, 2009 any variation in the income or loss returned which is prejudicial to the interest of the assessee. Under sub-section (2) of Section 144C, the assessee gets an opportunity to file his objections within thirty days of such variation before the Dispute Resolution Panel as well as before the Assessing Officer. As per sub-section (3) of Section 144C, the Assessing Officer would complete the assessment on the basis of the draft order if the assessee either intimates his acceptance of the variation or does not raise objections within the time prescribed. Under sub-section (5) of Section 144C, the Dispute Resolution Panel could issue such directions to the Assessing Officer as it thinks fit for his guidance to enable him to complete the assessment in case the assessee has raised an objection. Under subsection (7) of Section 144C, it is open for the Dispute Resolution Panel to make further inquiries or have such inquiries made before issuing the directions referred to in sub-section (5). Sub- section (8) of Section 144C recognizes wide powers of the DRP to confirm, reduce or enhance the variations proposed in the draft order subject to the limitation that it shall not set aside any proposed variation or issue any direction under sub- section (5) for further inquiry. As per subsection (10) of Section 144C, every direction issued by the DRP would be binding on the Assessing Officer. Sub-section (13) of Section 144C further provides that upon receipt of the directions issued by the DRP under sub-section (5), the Assessing Officer shall in conformity with the directions complete the assessment without providing any further opportunity of being heard to the assessee.

6. These statutory provisions make it abundantly clear that the procedure laid down under Section 144C of the Act is of great importance and is mandatory. Before the Assessing Officer can make variations in the returned income of an eligible assessee, as noted, sub-section (1) of Section 144C lays down the procedure to be followed notwithstanding anything to the contrary contained in the Act. This non- obstante clause thus gives an overriding effect to the procedure ‘notwithstanding anything to the contrary contained in the Act’. Sub-section (5) of Section 144C empowers the DRP to issue directions to the Assessing Officer to enable him to complete the assessment. Sub-section (10) of Section 144C makes such directions binding on the Assessing Officer. As per sub-section (13) of Section 144C, the Assessing Officer is required to pass the order of assessment in terms of such directions without any further hearing being granted to the assessee.

7. The procedure laid down under Section 144C of the Act is thus of great importance. When an Assessing Officer proposes to make variations to the returned income declared by an eligible assessee he has to first pass a draft order, provide a copy thereof to the assessee and only thereupon the assessee could exercise his valuable right to raise objections before the DRP on any of the proposed variations. In addition to giving such opportunity to an assessee, decision of the DRP is made binding on the Assessing Officer. It is therefore not possible to uphold the Revenue’s contention that such requirement is merely procedural. The requirement is mandatory and gives substantive rights to the assessee to object to any additions before they are made and such objections have to be considered not by the Assessing Officer but by the DRP. Interestingly, once the DRP gives directions under sub-section (5) of Section 144C, the Assessing Officer is expected to pass the order of assessment in terms of such directions without giving any further hearing to the assessee. Thus, at the level of the Assessing Officer, the directions of the DRP under subsection (5) of Section 144C would bind even the assessee. He may of course challenge the order of the Assessing Officer before the Tribunal and take up all contentions. Nevertheless at the stage of assessment, he has no remedy against the directions issued by the DRP under sub-section (5). All these provisions amply demonstrate that the legislature desired to give an important opportunity to an assessee who is likely to be subjected to upward revision of income on the basis of transfer pricing mechanism. Such opportunity cannot be taken away by treating it as purely procedural in nature.

8. Reference by the Revenue to the circulars dated 03.06.2010 and 19.11.2013 in this regard would be of no avail. First of these circulars was an explanatory circular issued by the Finance Ministry in which it was provided that these amendments (which included Section 144C of the Act) are made applicable with effect from 01.10.2009 and will accordingly apply in relation to assessment year 2010-11 and subsequent assessment years. In the latter clarificatory circular dated 19.11.2013, it was provided that in the earlier circular there was an inadvertent error and Section 144C would apply to any order which is being passed after 01.10.2009 irrespective of the concerned assessment year. The latter circular was thus merely in the nature of a clarificatory circular and clarified which all along was the correct position in law. Sub-section (1) of Section 144C itself in no uncertain terms provides that the Assessing Officer shall forward a draft order to the eligible assessee, if he proposes to make any variation in the income or loss which is prejudicial to the interest of the assessee on or after 01st day of October 2009. The statute was thus clear, permitted no ambiguity and required the procedure to be followed in case of any variation which the Assessing Officer proposed to make after 01.10.2009. The earlier circular dated 03.06.2010 did not lay down the correct criteria in this regard. The assessee cannot be made to suffer on account of any inadvertent error which runs contrary to the statutory provisions. No question of law arises. Tax appeal is therefore dismissed.

20. 1 Further, under the similar facts and circumstances, Hon’ble High Court of Bombay at Goa in the case of Gigabyte Technology (India) (P) Ltd. v. CIT CTR 585 (Bom.) held as under:

21. The rival contentions now fall for our determination.

22. In this case, there is no dispute that the provisions of s. 144C of the said Act were applicable and, further, such provisions were not complied with by the AO before passing the assessment order dt. 18th Dec., 2009.

23. Sec. 144C(1) of the said Act provides that the AO shall, notwithstanding anything to the contrary contained in the said Act, in the first instance, forward a draft of the proposed order of assessment (hereinafter in this section referred to as the draft order) to the eligible assessee if he proposes to make, on or after the 1st day of October, 2009, any variation in the income or loss returned which is prejudicial to the interest of such assessee.

24. Sec. 144C(2) then provides that on receipt of the draft order, the eligible assessee shall, within thirty days of the receipt by him of the draft order,-file his acceptance of the variations to the AO; or-file his objections, if any, to such variation with,—(i) the DRP; and (ii) the AO.

25. Sec. 144C(3) then provides that the AO shall complete the assessment based on the draft order, if the assessee intimates to the AO the acceptance of the variation; or no objections are received within the period specified in sub-s. (2).

26. Sec. 144C(4) provides that the AO shall, notwithstanding anything contained in s. 153, pass the assessment order under sub-s. (3) within one month from the end of the month in which, the acceptance is received, or the period of filing of objections under sub-s. (2) expires.

27. Sec. 144C(5) provides that the DRP shall, in a case where any objection is received under sub-s. (2), issue such directions, as it thinks fit, for the guidance of the AO to enable him to complete the assessment.

28. Sec. 144C(6) provides that the DRP shall issue the directions referred to in sub-s. (5), after considering the following :

| (b) | | objections filed by the assessee; |

| (c) | | the evidence furnished by the assessee; |

| (d) | | the report, if any, of the AO, Valuation Officer or TPO or any other authority; |

| (e) | | records relating to the draft order; |

| (f) | | evidence collected by, or caused to be collected by, it; and |

| (g) | | result of any inquiry made by or caused to be made by, it. |

29. Sec. 144C(7) provides that the DRP may, before issuing any directions referred to in sub-s. (5), make such further inquiry, as it thinks fit; or cause any further inquiry to be made by any IT authority and report the result of the same to it.

30. Sec. 144C(8) provides that the DRP may confirm, reduce or enhance the variations proposed in the draft order so, however, that it shall not set aside any proposed variation or issue any direction under sub-s. (5) for further enquiry and passing of the assessment order.

31. In this case, there is no dispute that the provisions of s. 144C, r/w s. 92CA of the said Act were applicable. There is no dispute that in the present case, the AO before making the assessment order dt. 18th Dec., 2009 gave a complete go-by to the detailed provisions contained in s. 144C of the said Act. Therefore, the first question that arises for determination is, whether the assessment order dt. 18th Dec., 2009 made by the AO in clear breach of the mandatory provisions of s. 144C of the said Act, was merely erroneous, as contended by Ms. Linhares, or, whether the same was null and void as contended by Mr. Kalra, the learned counsel for the assessee.

32. In Zuari Cement Ltd. (supra), the Division Bench of the Andhra Pradesh High Court, in almost identical circumstances, held that the assessment order is contrary to the mandatory provisions of s. 144C of the said Act and is ‘one without jurisdiction, null and void and unenforceable’. In answer to the objection that no writ petition be entertained because the assessee had a statutory appellate remedy, the Court held that since the impugned order was without jurisdiction, the objection about alternate remedy will not come in the way of the writ Court to grant relief. By order dt. 21st Feb., 2012, the Hon’ble Supreme Court dismissed the special leave to appeal against the decision of the Division Bench of Andhra Pradesh High Court in Zuari Cement Ltd. (supra).

33. In Control Risk India (P) Ltd. (supra), the Division Bench of Delhi High Court, held that consequent upon order of TPO under s. 92CA(3) of the said Act, it is incumbent upon the AO to pass a draft assessment order under s. 144C of the said Act and this is a settled position as explained by the Court in its decision in Turner International India (P) Ltd. v. Dy. CIT (2017) 297 CTR (Del) 460 : (2017) 152 DTR (Del) 303 : In the said case the AO overlooked the above legal position and proceeded to pass the final order, thereby depriving the assessee of an opportunity of questioning the draft assessment order under s. 144C of the said Act before the DRP, the Court had no hesitation in setting aside the impugned assessment order and consequently the notice of demand. Again the Special Leave to appeal against this decision was dismissed by the Hon’ble Supreme Court on 16th March, 2018.

34. In International Air Transport Association (supra), the Division Bench of this Court has also taken a view that special rights are made available to an eligible assessee under s. 144C of the said Act. These special rights contemplate the making of a draft assessment order under s. 144C by the AO before he makes a final assessment order under s. 143(3) of the said Act. Such a draft assessment order bestows certain rights upon an eligible assessee, such as to approach the DRP with its objections to such a draft assessment order. This is for the reason that an eligible assessee’s grievance can be addressed before a final assessment order is passed and appellate proceedings invoked by it. However, these special rights were made available to eligible assessee under s. 144C of the said Act are rendered futile, if directly a final order under s. 143(3) of the said Act is passed, without being preceded by a draft assessment order. In such a situation, the assessment order made by the AO ‘is completely without jurisdiction’. The Division Bench of this Court followed the decision of Andhra Pradesh High Court in M/s Zuari Cement Ltd. (supra) and based on the same, not only set aside the assessment order but also consequential order on rectification application, as well as the penalty.

35. Again in Lionbridge Technologies (P) Ltd. (supra), another Division Bench of this Court, following the decision in International Air Transport Association (supra) held that a draft assessment order is necessary in terms of s. 144C(1) of the said Act before the AO can proceed to pass a final assessment order. In the absence thereof, the order is without jurisdiction. Non-issue of draft assessment order could not be corrected by issuing a corrigendum to a final assessment order. The Division Bench even rejected the contention that the assessee was estopped from challenging the corrigendum, as it was expected by it that such a contention overlooked the fact that there can be no estoppel on the issue of law about jurisdiction. This Court held that if the corrigendum dt. 16th April, 2004 and the order dt. 12th March, 2014 of the AO were without jurisdiction, then, such an issue of jurisdiction can be raised at any time and the principles of estoppel will not apply. Mere consent of the parties does not bestow jurisdiction if the order is beyond jurisdiction.

36. To a similar effect is the law laid down by Madras High Court in Vijay Television (P) Ltd. (supra). The Court held that the order passed by the AO lacked jurisdiction and when there is a statutory violation in not following the procedure prescribed and such an order cannot be cured by merely issuing a corrigendum. This decision has been approved by the Division Bench of this Court in Lionbridge Technologies (P) Ltd. (supra).

36. Thus, from the conspectus of the aforesaid decisions, the legal position which emerges is that where a final assessment order is made by the AO without compliance with the mandate of s. 144C of the said Act, the same is not merely an erroneous order as contended by Ms. Linhares, but such an order is without jurisdiction, as held by this Court or, null and void, as held by Andhra Pradesh High Court. The assessment order dt. 18th Dec., 2009 was therefore not merely an erroneous order but the same was an order without jurisdiction, null and void.

2 0.2 We respectfully following the judgements of Hon’ble High Court of Gujarat and Hon’ble High Court of Bombay at Goa cited (supra), held that the order passed by the AO lacked jurisdiction as there is a statutory violation in not following the procedure prescribed and the same order also cannot be cured. As the order passed by the AO is without jurisdiction, the assessment order dated 29.3.2022 is without jurisdiction, null and void.

2 0.3 As the additional grounds raised by the assessee are allowed & accordingly other ground of appeal on merits of the case are not adjudicated & are kept open.

21 . In the result, appeals filed by the assessee are allowed.

SP No.67/Bang/2024 (AY 2017-18):

22 . The assessee filed a stay petition for the AY 2017-18, wherein he has raised various grounds of stay. Since the appeal for the assessment year 2017-18 is allowed in favour of the assessee, the stay petition filed by the assessee becomes infructuous and dismissed.