ORDER

1. In this writ petition, the assessment order dated 30.12.2019 in respect of assessment year 2013-2014 is challenged.

2. The petitioner, which is a partnership firm engaged in the business of developing real estate, had filed its return of income on 28.09.2013. Pursuant to a search conducted at the premises of Mr.K.S.Thirumalaivasan, a partner of the petitioner firm, on 11.10.2012, loose sheets were recovered. These documents indicate that the petitioner had entered into a joint development agreement on 14.06.2010 with one Mr.M.S.Vijayakumar and his family in respect of development of a bare land at Alandur, Thiru-vi-ka Industrial Estate, Guindy. After recording a satisfaction note on 27.03.2019, a notice under Section 153C was issued to the petitioner. Eventually, the impugned assessment order was issued on 30.12.2019.

3. Learned counsel for the petitioner contended that the petitioner filed income tax returns for the assessment year 2013-2014 on 28.09.2013, whereas the satisfaction note was recorded only on 27.03.2019. He also pointed out that the assessing officer was common both in respect of the searched person and the petitioner. Therefore, he submitted that it was a case wherein the relevant file was transferred by the assessing officer of the searched person to herself. Since such exercise was undertaken after almost six years from the date of filing of the relevant return of income, learned counsel contended that interference is warranted, irrespective of whether the proceedings are barred by limitation.

4. He also referred to the impugned assessment order and contended that the said order indicates that the relevant land was sold not to the petitioner but to a firm under the name and style of M/s.Sree Sathyanarayana Enterprises. He further submitted that the alleged profit was arrived at by assuming that the value was Rs.1,67,67,000/- and that the profit of Rs.67,50,000/- could be treated as profit earned by the petitioner’s firm.

5. Mr.A.N.R.Jayaprathap, learned junior standing counsel, made submissions in response and to the contrary. At the outset, he submitted that the petitioner had the option of filing a statutory appeal against the impugned assessment order. He also pointed out that the assessment proceedings relating to assessment year 2013-2014 fall clearly within the six year period provided under Section 153C. Therefore, he contended that the proceedings are not barred by limitation. Since the proceedings are not barred by limitation, learned junior standing counsel contended that the petitioner should be relegated to the statutory remedy of filing an appeal and that no case is made out for interference under Article 226 of the Constitution of India.

6. The petitioner averred in the affidavit that the return of income for assessment year 2013-2014 was filed on 28.09.2013. The search operation admittedly took place on 11.10.2012 at the premises of Mr.K.S.Thirumalaivasan. It is not disputed that the assessing officer for Mr.K.S.Thirumalaivasan and the petitioner’s assessing officer were the same person. In those circumstances, even if the assessment proceedings are within the period of limitation, it is clear that the satisfaction note was recorded belatedly on 27.03.2019.

7. The question as to whether interference is warranted should be examined against this back drop. In the impugned assessment order, the following conclusions were recorded:

“7.1 During the course of search u/s 132 of the Income Tax Act, 1961 in the case of Shri.K.S.Thirumalaivasan, partner, on 11.10.2012, certain loose sheets and Diary were found in the premises of M/s.Krishna Energy Pvt. Ltd. at 184/2, SIDCO Industrial Estate, Thirumudivakkam, Chennai 600044 and seized vide annexure ANN /RS / KEPL / B&D / (LS) / S2 and ANN /RS/KEPL/B&D/S1. Shri. K.S.Thirumudivakkam is the Managing Director of M/s.Krishna Energy Pvt. Ltd. On examination of the contents of the seized loose sheets in page no.140 to 144 (Annexure) and page no.9 of the Diary and the letter dated 21.03.2013 of Shri.K.S.Thirumalaivasan, Partner, it is seen that the assessee firm has entered into a Joint Development Agreement on 14.06.2010 with one Shri.M.S. Vijayakumar and his family members to develop a bare land shed in B-14, Survey No.70 part, Block 6, Alandur Hamlet, Mambalam- Guindy Taluk, Thiru Vi Ka Industrial Estate, Guindy, admeasuring 4840 sq.ft., for which an EMD of Rs.1,00,00,000/- was paid by the assessee firm on 14.06.2010.

7.2 Subsequently, vide letter dated 26.11.2011 of Shri.K.S.Thirumalaivasan, Partner, to Shri.M.S. Vijayakumar, the assessee firm decided to quit from the project and cancel the Joint Development Agreement on payment of Rs.1,20,00,000/- in lieu of Rs.1,00,00,000/- paid by it. However, since the sellers were not in a position to refund the security deposit, a portion of the land admeasuring 1869 sq.ft. was offered by the sellers and the same was registered in the name of M/s.Sree Sathyanarayana Enterprises in which Shri.K.S.Thirumalaivasan and his spouse, Smt.T.Parvatham are Partners. Smt.T.Parvatham is the other Partner in the assessee firm.

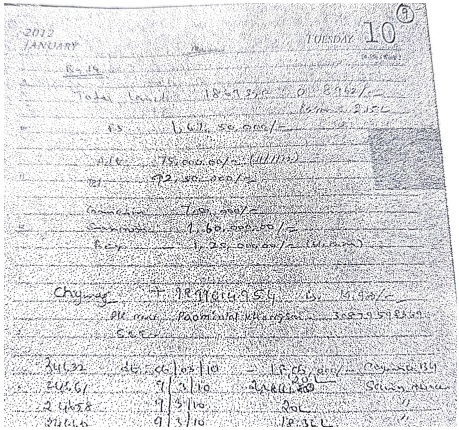

7.3 However, notings in page no.9 of the seized diary establishes the fact that the value of the said property is Rs.1,67,50,000/-. The page no.9 is scanned and appended below:

7.4 It is clear from the above diary page no.9 that, in respect of the property at ‘B-14’ being land admeasuring ‘1869 sq.ft.’ at ‘Rs.8962/ -‘ per sq.ft., the assessee has earned a profit of Rs.67,50,000/- (1,67,50,000/- 1,00,00,000) on account of cancellation of the Joint Development Agreement entered into with Shri.M.S.Vijayakumar and others.”

From the above extracts, it is evident that the profit of Rs.67,50,000/- was attributed to the petitioner on the basis of the registration of the immovable property in the name of M/s.Sree Sathyanarayana Enterprises. Such assessment was made on best judgment basis because the petitioner had not shown cause in response to the notice.

8. Although the respondent cannot be faulted for completing the assessment on best judgment basis in the facts and circumstances, it is also clear that an assessment was made several years after the petitioner filed the return of income on the basis of material unearthed in course of search in 2012. When these facts and circumstances are considered cumulatively, I am of the view that it is appropriate that the petitioner be provided an opportunity of being heard before the reassessment is concluded. Solely for this reason, the impugned assessment order calls for interference.

9. Consequently, the impugned assessment order is directed to be treated as a show cause notice. The petitioner shall file a reply on such basis within a maximum period of 15 days from the date of receipt of a copy of this order. Upon receipt thereof, the assessing officer is directed to provide a reasonable opportunity to the petitioner, including a personal hearing, and thereafter issue a fresh assessment order within a period of two months from the date of receipt of the petitioner’s reply.

10. The writ petition is disposed of on the above terms. There will be no order as to costs. Consequently, connected miscellaneous petitions are closed.