ORDER

Ms. Madhumita Roy, Judicial Member.- This bunch of appeals filed by the assessee are directed against the orders passed by the Ld. CIT(A)-31, New Delhi, all dated 31.07.2018 arising out of the orders passed by the ACIT, Central Circle -8, New Delhi, under Section 153A r.w.s. 143(3) of the Income Tax Act, 1961, (hereinafter referred to as ‘the Act’) for Assessment Year 2009-10 to 2014-15. Since, all the matters relate to the same assessee and as the issue involved herein are identical, these are heard analogously and are being disposed of by a common order for the sake of convenience.

2. ITA No.6158/DEL/2018 (AY: 2009-10)

The brief facts leading to the case are that the assessee before us, an individual, filed its return of income originally on 20.07.2010 declaring total income at Rs.1,37,940/- for the year under consideration. Subsequently, a search and seizure operation under Section 132 of the Act was conducted on Karan Luthra group of assessees on 14.03.2014. During the search operation some incriminating documents/informations relating to the assessee were claimed to have been found and seized. Thereafter a consequential search and seizure operation was conducted at the premises of the assessee on 29.04.2014. The case of the assessee thereafter, was centralized with central circle-8, New Delhi. by and under the order dated 19.08.2015 passed by the PCIT Delhi, under Section 127 of the Act. Notice under Section 153A dated 28.08.2015 was served upon the assessee directing the assessee to furnish a true and correct income for the year under consideration. Since nothing was forthcoming notice under Section 274 r.w.s 271 of the Act was issued and the assessee ultimately filed a letter dated 22.08.2016 stating that the return filed under Section 139(1) of the Act be treated as return filed in response to the notice under Section 153A of the Act. Such re-assessment proceeding was finally culminated in making addition of Rs.12,02,364/- which was in turn confirmed by the First Appellate Authority. Hence, the instant appeal before us.

3. The assessee filed an application for additional ground of appeal whereby and whereunder the maintainability of the proceeding has been challenged on this count that the approval under Section 153D of the Act obtained by the Assessing Officer in the matters is mechanical in nature; the same is, therefore, invalid and assessment is, thus, liable to be quashed. The Ld. Counsel appearing for the assessee since raised the issue of maintainability of the proceeding at a belated stage he has also made submissions explaining the reasons for such delay in making the application for admission of additional this ground under Section 11 of the ITAT Rules. According to him after the assessment proceedings, there was a change of counsel namely one Mr. Narendra Srivastav to conduct the matter before the First Appellate Authority who also filed the appeals before us. The original Form No. 36 which was filed and prepared by him contained specific ground challenging the approval given by the Additional Commissioner of Income Tax under Section 153D of the Act is without application of mind. However, when the matter has been assigned to the present counsel it was found that no application in support of the same has been filed which was thereafter, duly filed on 13.01.2022. Hence, the filing of application got delayed. It was further contended by him that the additional ground raised, involves purely legal issue and facts in relation to the same are already available on record and therefore, assessee should not be precluded from raising this particular ground at this stage. Reliance has been made on very many judgments passed by the Hon’ble Supreme Court including the judgment passed by National Thermal Power Company Ltd. v. CIT 358/229 ITR 383 (SC) and Dalmia Power Ltd. v. Asstt. CIT 252/ 352 (SC). It was further submitted that “procedural law” is not a tyrant and is not an obstruction but a servant and aid to justice. The procedural presumption is handmaid and not the mistress, the lubricant and not a resistant in the administration of justice as held by the Hon’ble Apex Court in the case of Sambhaji v. Gangabai (2008) 17 SCC 117 as further contended by him.

4. Such submissions made by the ld. A.R has not been able to be controverted by the Ld DR and having regard to the explanation rendered by the assessee in support of the delay in filing the application before us as narrated hereinabove seems to be genuine inasmuch as there is no change in the fact of the matter nor any additional evidence, rather issue involves purely on legal basis, we admit the additional ground of appeals raised by the assessee.

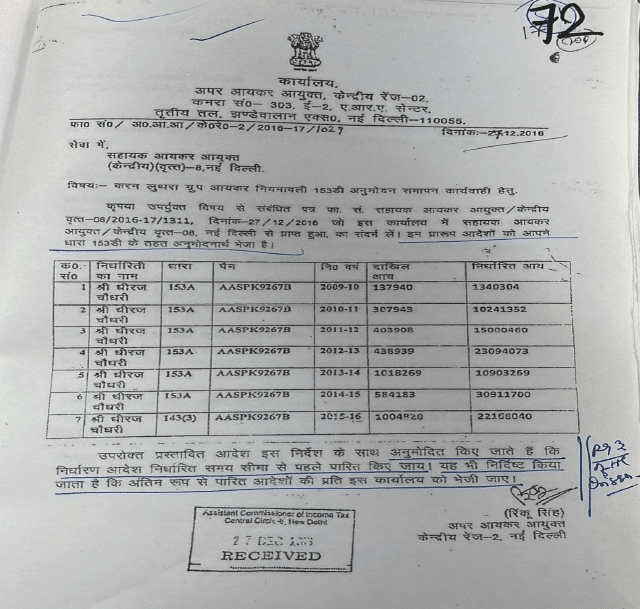

5. At the time of hearing of the instant appeal, the Ld. Counsel appearing for the assessee submitted before us that the proposal for approval under Section 153D of the Act in these matters were sought for by the ACIT, Central Circle-08, New Delhi from the Additional Commissioner of Income Tax, Central Range-02, New Delhi, on 27.12.2016 enclosing the draft assessment orders in the case of the assessee for Assessment Year 2009-10 to 2015-16. In this regard, he has drawn our attention to page 71 of the paper book filed before us. It was obtained by the assessee upon making application under RTI Act, 2005 dated 05.07.2021. He has further drawn our attention to the approval granted by the Additional Commissioner of Income Tax, Central Circle-2, New Delhi, dated 27.12.2016 annexed at page 72 of the paper book filed before us. Relying upon these particular two documents at the very threshold of the matter it was submitted by him that the approval has been given on the same day i.e on 27.12.2016, the day the approval was sought for by the Assistant Commissioner of Income Tax from the Additional Commissioner of Income Tax enclosing the draft assessment orders to be issued by ACIT. Further that approval has been given in all the matters of 6 years and not each assessment year separately. Relying upon the approval issued by the Additional Commissioner of Income Tax, Central Circle -2 appearing at page 72, it was contended by the Ld. A.R that no movement of file is reflecting from the said approval, neither sanction for each year has been given separately, nor it establishes appraisal report is seen and, therefore, approval was granted mechanically, without application of mind by the Additional Commissioner which vitiates the assessment orders too. In this regard, he has relied upon the judgment passed by the Hon’ble Orissa High Court, in the case of ACIT v. Serajuddin & Co. 146/292 566/454 ITR 312. It was further submitted by him that the said judgement passed by the Orissa High Court in favour of the assessee quashing the assessment order was further challenged before the Hon’ble Apex Court by the department. However, the said order passed by the Orissa High Court was upheld by and under the judgment dated 28.11.2023 by the Hon’ble Apex Court in the matter of ACIT v. Serajuddin and Co. 448. He has further relied upon the judgment passed by the Hon’ble Apex Court in the case of PCIT v. Anuj Bansal 466 ITR 254 whereby and whereunder the SLP filed by the department against the order passed by the Hon’ble Delhi High Court quashing the assessment order was dismissed holding the approval granted under Section 153D was a mechanical approval, without application of mind, would be invalid in the eyes of law. The judgment passed by the Hon’ble Delhi High Court in the said matter was thus upheld as the discrepancy in assessment year or such search material has not been noticed while granting approval under Section 153D of the Act by the ACIT and the same was, therefore, held to be mechanical approval.

6. On the other hand, it was submitted by the Ld. D.R. that the range head is fully involved in guiding and supervising the assessment proceedings. Discussions and consultation between the AO and the range heads are sometimes not formally put in the form of letters on record. It is not the JCIT/Additional CIT is seeing issues for the first time which are in the draft order as alleged by the assessee. It was further contended by him that no government officer or even a layman will ever sign a legal paper/sensitive order without seeing and applying his/her mind where he can be held responsible/accountable later.

7. We have heard the rival submissions made by the respective parties, we have also perused the relevant materials available on records including the orders passed by the authorities below. The proposal for approval under Section 153D of the Act made by the ACIT Central Circle-8, New Delhi to the Additional Commissioner Income Tax, Central Circle-2, New Delhi dated 27.12.2016 appearing at page 71 of the paper book is reproduced herein below:

OFFICE OF THE

ASSISTANT COMMISSIONER OF INCOME TAX

CENTRAL CIRCLE-08, ROOM NO. 333, 3RD FLOOR,

E-2 JHANDEWALLAN EXTN, ARA CENTRE, NEW DELHI-110055

PH-011-23593405

F.No.ACIT/Central Cir.08/2016-17/1311

Dated: 27.12.2016

To

The Addl. Commissioner of Income Tax,

Central Range-02, New Delhi

Madam,

Subject: Proposal for approval u/s 153D of the I T Act, 1961 in the case of Shri Dheeraj Chaudhary (PAN AASPK9267B), Flat No. 1-A, Empire Estate, Sultanpur, New Delhi-110030-Reg

Kindly refer to the above

Please find enclosed herewith draft assessment orders in the case of above mentioned assessee for the assessment years 2009-10 to 2015-16 (being search case) for your kind approval as required u/s 153 D of the Income Tax Act-1961.

| Name of the assessee | PAN | A.Y. | Section | Returned Income | Assessed Income |

| Shri Dheeraj Chaudhary | AASPK9267B | 2009-10 | 153A | Rs.1,37,940/- | Rs.13,40,304/- |

| Shri Dheeraj Chaudhary | AASPK9267B | 2010-11 | 153A | Rs.3,07,943/- | Rs.1,02,41,352/ – |

| Shri Dheeraj Chaudhary | AASPK9267B | 2011-12 | 153A | Rs.4,03,908/- | Rs.1,50,00,460/ – |

| Shri Dheeraj Chaudhary | AASPK9267B | 2012-13 | 153A | Rs.4,38,939/- | Rs.2,30,94,073/ – |

| Shri Dheeraj Chaudhary | AASPK9267B | 2013-14 | 153A | Rs.10,18,269/- | Rs.1,09,03,269/ – |

| Shri Dheeraj Chaudhary | AASPK9267B | 2014-15 | 153A | Rs. 5,84,183/- | Rs.3,0911,700/- |

| Shri Dheeraj Chaudhary | AASPK9267B | 2015-16 | 143(3) | Rs.10,04,820/- | Rs.2,21,68,040/ – |

Yours faithfully,

Sd/-

(Pratibha Singh)

Asstt. Commissioner of Income Tax

Central Circle-08, New Delhi

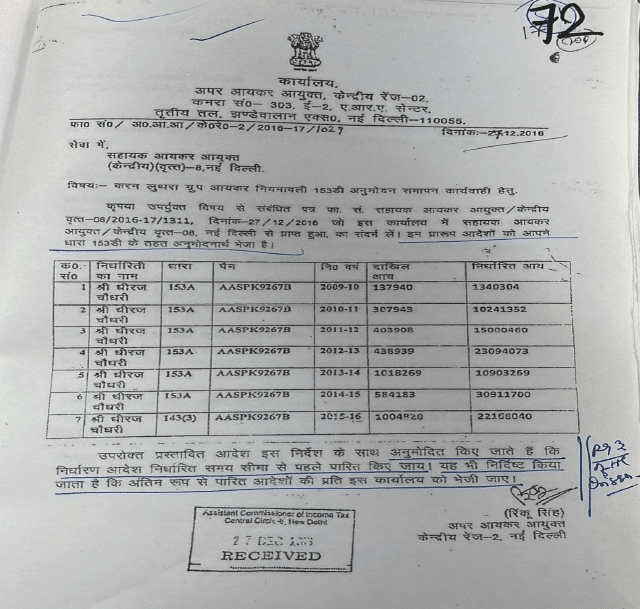

8. It appears from the above that the draft assessment orders claimed to have been annexed for Assessment Year 2009-10 to 2015-16 along with the said proposal dated 27.12.2016 made by the ACIT, Central Circle-08, New Delhi. We have further perused the approval granted by the Additional CIT dated 27.12.2016 under Section 153D of the Act appearing at page 72 of the paper book filed before us which is reproduced herein below:

9. It appears from the above that the approval has been granted on 27.12.2016 in respect of all 7 Assessment Years by the Additional Commissioner of Income Tax, Central Range-2 noting that approval has been granted within time. This particular document does not speak of movement of file. No mention of appraisal report been seen; no sanction has been given separately for each Assessment Year. Moreso, no reason has been assigned as to how the approval has been given neither indicating that the approving authority has examined the draft orders and found that it meets requirement of law. In a search matter before the order of assessment or re-assessment is passed, requirement of prior approval of superior officer is a mandatory requirement in terms of the provision of law particularly under Section 153D of the Act. The same equally must contain the reason for such approval and further that reflection of due application of mind made by the approving authority on the draft assessment orders in respect of search and seizure operation as placed before him is also necessary in the absence of which the same is nothing but a mechanical approval vitiates the entire assessment proceeding. In this regard, we have considered the judgment passed by the Hon’ble Apex Court as relied upon by Ld. A.R in the case of. Serajuddin and Co. (supra) and also the order passed by the Hon’ble Orissa High Court dated 15.03.2023 against which the said appeal was preferred by Revenue department before the Hon’ble Supreme Court. Quashing the assessment order due to approval under Section 153D having being found mechanical, the SLP was dismissed upholding the order passed by the Hon’ble Orissa High Court.

10. In this regard the relevant observation of the Hon’ble Orissa High Court is as follows:

“2. While admitting the present appeals on 4th August 2022, the following question was framed for consideration:

“Whether on the facts and circumstances of the case, the ITAT was correct in holding that the Approving Authority has not applied his mind for giving approval under Section 153D?”

3. The background facts are that a search and seizure operation under Section 132 of the Act was conducted in the case of the Assessee and various persons and concerns of the Assessee on 28th May, 2008. Notice dated 11th March 2010 under Section 153A of the Act was served on the Assessee. Notices under Section 142 (1) of the Act dated 19th May 2010 and reminders dated 1st July and 21st July 2010 were also issued. On 30th December 2010, the Assistant Commissioner of Income Tax (ACIT) Circle-1(2), Bhubaneswar (hereafter, the Assessing Officer-AO) passed assessment orders under Section 143(3)/144/153A of the Act making various additions/disallowances.

4. The Assessee then filed appeals before the CIT (A). One of the grounds for challenge was the non-compliance with Section 153D of the Act which requires prior approval of the Additional Commissioner of Income Tax (Additional CIT). The stand of the Revenue was that such approval had been sought by the AO and granted by the Additional CIT prior to the passing of the assessment order.

5. By an order dated 28th February 2013, the CIT (A) partly allowed the appeals. The CIT (A), however, held that it is not necessary that the fact of approval of the Additional CIT was required to be mentioned in the body of the assessment order. The CIT (A) observed that there was a consolidated approval order dated 30th December 2010 given by the Additional CIT for AYs 2003-04 and 2009-10 and therefore, this ground had no merit.

6. The Assessee filed further appeals before the ITAT contending that the guidelines contained in Circular No.3 of 2008 dated 12th March 2008 issued by the Central Board of Direct Taxes (CBDT) had not been followed. It was further contended by the Assessee that the so-called approval of the Additional CIT under Section 153D of the Act had been granted in a mechanical manner without application of mind. Reference was made to the letter dated 29th December 2010 of the AO addressed to the Additional CIT Range-1 seeking approval under Section 153D of the Act and the letter dated 30th December 2010 of the Additional CIT addressed to the AO communicating the approval. Reference was also made to the decision dated 29th November 2019 of the ITAT in IT (SS) A Nos. 66 to 71/CTK/2018 (Dillip Construction Pvt. Ltd. v. ACIT) which held the guidelines contained in the aforementioned Circular to be mandatory and binding on the Department.

7. The ITAT has, in the impugned order, referred to the decision of the Bombay High Court in Akil Gulamali Somji and other decisions of the ITAT to come to the conclusion that the approving authority did not apply his mind to the relevant assessment records or to the draft assessment orders prior to granting approval to the AO under Sections 143(3)/144/153A. The assessment orders were accordingly set aside. As a result, the cross appeals of the Revenue were held to be infructuous and disposed of as such.

8. Mr. T.K. Satapathy, learned Senior Standing Counsel for the Revenue made the following submissions:

| (i) | | In the present case, prior approval had in fact been taken by the AO from the Additional CIT and there was no illegality in that regard. |

| (ii) | | The approval of the superior officer was distinct from the assessment order. It was a mere administrative order and not open to challenge before a court of law. In other words, it was submitted that the approval granted by the Additional CIT was not justiciable and could not form the basis for challenging the assessment order. |

| (iii) | | What could only be challenged is want of sanction. Reliance was placed on the decision of the ITAT, Mumbai in ITA No.3874/ Mumbai/2015(Pratibha Pipes & Structural Limited v. DCIT dated 10.04.2019) |

| (iv) | | There was no requirement for any hearing to be given to the Assessee by the supervisory officer prior to giving approval although Clause-9 of the Manual of Office Procedure stipulates it. This, therefore, cannot be said to be mandatory. Reliance was placed on the decisions of the Karnataka High Court in Gopal S. Pandit v. CIT 233 and Rishab Chand Bhansali v. DCIT 267 ITR 577 and of the Madras High Court in Sakthivel Bankers v. ACIT 255 ITR 144 which were all in the context of Section 158 BG of the Act. |

| (v) | | The mere irregularity in granting approval in the context of Section 158BG of the Act was held not to be fatal to the assessment order. Reliance was placed on the orders of the Kolkata ITAT in Shaw Wallace & Co. Ltd. v. ACIT, 68 ITD 148 and of the Delhi ITAT in Kailash Moudgil v. DCIT, 72 ITD 97. Reliance was also placed on the decision of the Karnataka High Court in Gayathri Textiles v. CIT, where it was held that for the purpose of Section 271 (1) (c) of the Act, the failure to obtain prior permission from the IAC for imposing penalty was only a procedural error and not fatal to the order of penalty. |

| (vi) | | Since the entire documents were already available to the Additional CIT in the file sent for approval, there was no need for exchange of the said documents prior to the grant of formal approval under Section 153D of the Act. |

| (vii) | | Lastly, it was submitted that even if there had been a violation of the principles of natural justice, unless prejudice were shown by the Assessee, no interference with the assessment orders was warranted. Reliance was placed on the decisions in Dharampal Satyapal Limited v. Deputy Commissioner of Central Excise Gauhati (2015) 8 SCC 519; Managing Director, ECIL v. B. Karunakar (1993) 4 SCC 727; Haryana Financial Corporation v. Kailash Chandra Ahuja (2008) 9 SCC 31; State Bank of Patiala v. S.K. Sharma (1996) 3 SCC 364; P.D. Agrawal v. State of Bank of India (2006) 8 SCC 776 and State of U.P. v. Sudhir Kumar Singh. It was then submitted that where initiation was valid but completion was not correct, the order may not be invalid but only irregular because the intervening irregularity is a curable one. Reliance was placed on the decision of the Kerala High Court in Panicker (CGG) v. CIT, (1999) 237 ITR 443 and CIT v. M. Krishnan (N) (1999) 235 ITR 386. It was submitted that mere technicality should not defeat justice. |

9. On behalf of the Assessee submissions were made by Mr. Ramesh Singh, Senior Advocate; Mr. Sidhartha Ray, Senior Advocate; Mr. Ashok Kumar Parija, Senior Advocate as well as Mr. S. Ganesh, Senior Advocate. They drew attention of the Court to the relevant clauses of the CBDT Circular dated 12th March 2008 and the decisions in Sahara India (Firm,) Lucknow v. Commissioner of Income Tax (2008) 14 SCC 151; Rajesh Kumar v. Deputy CIT, (2007) 2 SCC 181 and the decisions of the Delhi High Court in ESS Advertising (Mauritius) v. Assistant Commissioner of Income Tax, (2021) SCC OnLine Del 3613; Principal Commissioner of Income Tax-6 v. M/s. N.C. Cables Ltd., 2017 SCC OnLine Del 6533; Yum ! Restaurants Asia Pte. Ltd. v. Deputy Director of Income Tax,(2017) 397 ITR 665; Syfonia Tradelinks Private Limited v. Income Tax Officer; 2021 SCC OnLine Del 2692 and German Remedies Limited v. DCIT 2006 (1) Maharashtra Law Journal 517.

10. At the outset, it requires to be noticed that many of the decisions referred to both on the side of the Revenue as well as the Assessee do not directly refer to Section 153D of the Act which was inserted with effect from 1st June, 2007. There is no doubt about the applicability of the said provision since the proceedings under Section 153A of the Act was initiated in the present case after that date.

11. Among the changes brought about by the Finance Act 2007 was the insertion of Section 153D of the Act. The CBDT circular dated 12th March 2008 refers to the various changes and inter alia also to the change brought about by the insertion of a new Section 153D of the Act. Paragraph 50 of the said circular is relevant and reads as under:

“50. Assessment of search cases–Orders of assessment and reassessment to be approved by the Joint Commissioner.

50.1 The existing provisions of making assessment and reassessment in cases where search has been conducted under section 132 or requisition is made under section 132A, does not provide for any approval for such assessment.

50.2 A new section 153D has been inserted to provide that no order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner except with the previous approval of the Joint Commissioner. Such provision has been made applicable to orders of assessment or reassessment passed under clause (b) of section 153A in respect of each assessment year falling within six assessment years immediately preceding the assessment year relevant to the previous year in which search is conducted under section 132 or requisition is made under section 132A. The provision has also been made applicable to orders of assessment passed under clause (b) of section 153B in respect of the assessment year relevant to the previous year in which search is conducted under section 132 or requisitioned is made under section 132A.

50.3 Applicability- These amendments will take effect from the 1st day of June, 2007.”

12. It must be noted at this stage that even prior to the introduction of Section 153D in the Act, there was a requirement under Section 158BG of the Act, which was substituted by a Finance Act 14 of 1997 with retrospective effect from 1st January 1997, of the AO having to obtain a previous approval of the JCIT/Additional CIT by submitting a draft assessment order following a search and seizure operation.

13. The CBDT issued the Manual of Office Procedure in February 2003 in exercise of the powers under Section 109 of the Act. Para 9 of Chapter 3 of Volume-II (Technical) of the Manual reads as under:

“9. Approval for assessment: An assessment order under Chapter XIV-B can be passed only with the previous approval of the range JCIT/ADDL.CIT (For the period from 30-6-1995 to 31-12-1996 the approving authority was the CIT.). The Assessing Officer should submit the draft assessment order for such approval well in time. The submission of the draft order must be docketed in the order-sheet and a copy of the draft order and covering letter filed in the relevant miscellaneous records folder. Due opportunity of being heard should be given to the assessee by the supervisory officer giving approval to the proposed block assessment, at least one month before the time barring date. Finally once such approval is granted, it must be in writing and filed in the relevant folder indicated above after making a due entry in the order-sheet. The assessment order can be passed only after the receipt of such approval.The fact that such approval has been obtained should also be mentioned in the body of the assessment order itself.”

14. The requirement of prior approval under Section 153D of the Act is comparable with a similar requirement under Section 158BG of the Act. The only difference being that the latter provision occurs in Chapter-XIV-B relating to “special procedure for assessment of search cases” whereas Section 153D is part of Chapter-XIV.

15. A plain reading of Section 153D itself makes it abundantly clear that the legislative intent was to be obtaining of “prior approval” by the AO when he is below the rank of a Joint Commissioner, before he passes an assessment order or reassessment order under Section 153A(1)(b) or 153B(2)(b) of the Act.

16. That such an approval of a superior officer cannot be a mechanical exercise has been emphasized in several decisions. Illustratively, in the context of Section 142 (2-A) which empowers an AO to direct a special audit. The obtaining of the prior approval was held to be mandatory. The Supreme Court in Rajesh Kumar v. Dy. CIT (2007) 2 SCC 181 observed as under:

“58. An order of approval is also not to be mechanically granted. The same should be done having regard to the materials on record. The explanation given by the assessee, if any, would be a relevant factor. The approving authority was required to go through it. He could have arrived at a different opinion. He in a situation of this nature could have corrected the assessing officer if he was found to have adopted a wrong approach or posed a wrong question unto himself. He could have been asked to complete the process of the assessment within the specified time so as to save the Revenue from suffering any loss. The same purpose might have been achieved upon production of some materials for understanding the books of accounts and/ or the entries made therein. While exercising its power, the assessing officer has to form an opinion. It is final so far he is concerned albeit subject to approval of the Chief Commissioner or the Commissioner, as the case may be. It is only at that stage he is required to consider the matter and not at a subsequent stage, viz., after the approval is given.”

17. It is therefore not correct on the part of the Revenue to contend that the approval itself is not justiciable. Where the approval is granted mechanically, it would vitiate the assessment order itself. In Sahara India (Firm) Lucknow v. Commissioner of Income Tax (supra), the Supreme Court explained as under:

“8. There is no gainsaying that recourse to the said provision cannot be had by the Assessing Officer merely to shift his responsibility of scrutinizing the accounts of an assessee and pass on the buck to the special auditor. Similarly, the requirement of previous approval of the Chief Commissioner or the Commissioner in terms of the said provision being an inbuilt protection against any arbitrary or unjust exercise of power by the Assessing Officer, casts a very heavy duty on the said high ranking authority to see to it that the requirement of the previous approval, envisaged in the Section is not turned into an empty ritual. Needless to emphasise that before granting approval, the Chief Commissioner or the Commissioner, as the case may be, must have before him the material on the basis whereof an opinion in this behalf has been formed by the Assessing Officer. The approval must reflect the application of mind to the facts of the case.”

18. The contention of the Revenue in those cases that the non- compliance of the said requirement does not entail civil consequences was negatived. Reiterating the view expressed in Rajesh Kumar (supra), the Supreme Court in Sahara India (Firm) Lucknow v. Commissioner of Income Tax (supra) held as under:

“29. In Rajesh Kumar (2007) 2 SCC 181 it has been held that in view of Section 136 of the Act, proceedings before an Assessing Officer are deemed to be judicial proceedings. Section 136 of the Act, stipulates that any proceeding before an Income Tax Authority shall be deemed to be judicial proceedings within the meaning of Sections 193 and 228 of Indian Penal Code, 1860 and also for the purpose of Section 196 of I.P.C. and every Income Tax Authority is a court for the purpose of Section 195 of Code of Criminal Procedure, 1973. Though having regard to the language of the provision, we have some reservations on the said view expressed in Rajesh Kumar’s case (supra), but having held that when civil consequences ensue, no distinction between quasi judicial and administrative order survives, we deem it unnecessary to dilate on the scope of Section 136 of the Act. It is the civil consequence which obliterates the distinction between quasi judicial and administrative function. Moreover, with the growth of the administrative law, the old distinction between a judicial act and an administrative act has withered away. Therefore, it hardly needs reiteration that even a purely administrative order which entails civil consequences, must be consistent with the rules of natural justice. (Also see: Maneka Gandhi v. Union of India (1978) 1 SCC 248 and S.L. Kapoor v. Jagmohan (1980) 4 SCC 379).

30. As already noted above, the expression “civil consequences” encompasses infraction of not merely property or personal rights but of civil liberties, material deprivations and non-pecuniary damages. Anything which affects a citizen in his civil life comes under its wide umbrella. Accordingly, we reject the argument and hold that since an order under Section 142 (2A) does entail civil consequences, the rule audi alteram partem is required to be observed.”

19. To the same effect, are the decisions of the Delhi High Court in Yum! Restaurants Asia Pte. Ltd. v. Deputy Director of Income Tax (supra) which dealt with the requirement under Section 151 (2) of the Act for initiating proceedings under Section 147 read with 148 of the Act. It was observed as under:

“11. The purpose of Section 151 of the Act is to introduce a supervisory check over the work of the AO, particularly, in the context of reopening of assessment. The law expects the AO to exercise the power under Section 147 of the Act to reopen an assessment only after due application of mind. If for some reason, there is an error that creeps into this exercise by the AO, then the law expects the superior officer to be able to correct that error. This explains why Section 151 (1) requires an officer of the rank of the Joint Commissioner to oversee the decision of the AO where the return originally filed was assessed under Section 143 (3) of the Act. Further, where the reopening of an assessment is sought to be made after the expiry of four years from the end of the relevant AY, a further check by the further superior officer is contemplated.”

20. The non-compliance of the requirement was held to have vitiated the notice for reopening of the assessment. Likewise, in Syfonia Tradelinks Private Limited v. Income Tax Officer (supra) the Delhi High Court disapproved of the rubber stamping by the superior officer of the reasons furnished by the AO for issuance of the sanction.

21. It is seen that in the present case, the AO wrote the following letter seeking approval of the Additional CIT:

GOVERNMENT OF INDIA

OFFICE OF THE ASST. COMMISSIONER OF INCOME TAX, CIRCLE-1(2), BHUBANESWAR No. ACIT/C-1(2)//Approval/2010-11/5293 Dated, Bhubaneswar, the 27/29th December, 2010

To

The Addl. Commissioner of Income-tax, Range-1, Bhubaneswar.

Sub: Approval of draft orders u/s 153D of the I.T. Act 1961 in the case of M/s. Serajuddin & Co. 19A, British India Street, Kolkata (in Serajuddin Group of Cases)- matter regarding.

Sir,

Enclosed herewith kindly find the draft orders u/s 153A of the I.T.Act, 1961 along with assessment records in the case of M/s Serajuddin & Co., 19A, British India Street, Kolkata for kind perusal and necessary approval u/s.153D.

| No. | Name of the assessee | Section under which order passed Asst. Year | |

| 1. | M/s Serajud 153A/143(3)/14 Kolkata | din & Co. 19A, u/s 4/145(3) British India Street, | 2003-04 |

| 2. | -do- | -do- | 2004-05 |

| 3. | -do- | -do- | 2005-06 |

| 4. | -DO- | -DO- | 2006-07 |

| 5. | -DO- | -DO- | 2007-08 |

| 6. | -DO- | -DO- | 2008-09 |

| 7. | -DO- | U/s. 143(3)/144/153B(B)/145(3) | 2009-10 |

The above cases will be barred by limitation on 31.12.2010.

Encl: As above Yours faithfully,

Sd/-

Asst. Commissioner of Income-tax,

Circle-1(2), Bhubaneswar of the Tribunal itself Government of India

OFFICE OF THE ADDL. COMMISSIONER OF INCOME TAX,

3 Floor, Range-1, Bhubaneswar

No. Addl. CIT/R-1/BBSR/SD/2010-11/5350

Dated, Bhubaneswar, the 30th December, 2010

To

The Assistant Commissioner of Income Tax, Circle-1(2), Bhubaneswar.

Sub: Approval u/s 153D-in the case of M/s Serajuddin & Co., 19A, British India Street, Kolkata-Matter regarding.

Ref: Draft Orders u/s 153A/143(3)/144 for the A.Y. 2003- 04 to 200809 u/s.143(3)/153B (b)/144 of the A.Y.2009-10 in the case of above mentioned assessee.

Please refer to the above

The draft orders u/s 153A/143(3)/144 for the A.Y. 2003-04 to 2008-09 and u/s. 143(3)/153B(b)/144 for the A.Y. 2009-10 submitted by you in the above case for the following assessment years are hereby approved:

| Assessment Year | Income Determined (Rs) |

| 2003-04 | 11,66,22,771 |

| 2004-05 | 36,46,80,016 |

| 2005-06 | 65,70,12,805 |

| 2006-07 | 60,02,65,791 |

| 2007-08 | 130,03,13,307 |

| 2008-09 | 274,68,87,069 |

| 2009-10 | 301,17,05,952 |

You are requested to serve these orders expeditiously on the assessee, submit a copy of final order to this office for record.

Sd/-

Addl. Commissioner of Income Tax, Range-1, Bhubaneswar

22. As rightly pointed out by learned counsel for the Assessee there is not even a token mention of the draft orders having been perused by the Additional CIT. The letter simply grants an approval. In other words, even the bare minimum requirement of the approving authority having to indicate what the thought process involved was is missing in the aforementioned approval order. While elaborate reasons need not be given, there has to be some indication that the approving authority has examined the draft orders and finds that it meets the requirement of the law. As explained in the above cases, the mere repeating of the words of the statute, or mere “rubber stamping” of the letter seeking sanction by using similar words like ‘see’ or ‘approved’ will not satisfy the requirement of the law. This is where the Technical Manual of Office Procedure becomes important. Although, it was in the context of Section 158BG of the Act, it would equally apply to Section 153D of the Act. There are three or four requirements that are mandated therein, (i) the AO should submit the draft assessment order “well in time”. Here it was submitted just two days prior to the deadline thereby putting the approving authority under great pressure and not giving him sufficient time to apply his mind; (ii) the final approval must be in writing; (iii) The fact that approval has been obtained, should be mentioned in the body of the assessment order.

23. In the present case, it is an admitted position that the assessment orders are totally silent about the AO having written to the Additional CIT seeking his approval or of the Additional CIT having granted such approval. Interestingly, the assessment orders were passed on 30th December 2010 without mentioning the above fact. These two orders were therefore not in compliance with the requirement spelt out in para 9 of the Manual of Official Procedure.

24. The above manual is meant as a guideline to the AOs. Since it was issued by the CBDT, the powers for issuing such guidelines can be traced to Section 119 of the Act. It has been held in a series of judgments that the instructions under Section 119 of the Act are certainly binding on the Department. In Commissioner of Customs v. Indian Oil Corporation Ltd. 2004 (165) E.L.T. 257 (S.C.) the Supreme Court observed as under:

“Despite the categorical language of the clarification by the Constitution Bench, the issue was again sought to be raised before a Bench of three Judges in Central Board of Central Excise, Vadodara v. Dhiren Chemicals Industries: 2002 (143) ELT 19 where the view of the Constitution Bench regarding the binding nature of circulars issued under Section 37B of the Central Excise Act, 1944 was reiterated after it was drawn to the attention of the Court by the Revenue that there were in fact circulars issued by the Central Board of Excise and Customs which gave a different interpretation to the phrase as interpreted by the Constitution Bench. The same view has also been taken in Simplex Castings Ltd. v. Commissioner of Customs, Vishakhapatnam 2003 (5) SCC 528. The principles laid down by all these decisions are: (1) Although a circular is not binding on a Court or an assessee, it is not open to the Revenue to raise the contention that is contrary to a binding circular by the Board. When a circular remains in operation, the Revenue is bound by it and cannot be allowed to plead that it is not valid nor that it is contrary to the terms of the statute.”

(2) Despite the decision of this Court, the Department cannot be permitted to take a stand contrary to the instructions issued by the Board.

(3) A show cause notice and demand contrary to existing circulars of the Board are ab initio bad (4) It is not open to the Revenue to advance an argument or file an appeal contrary to the circulars.”

25. For all of the aforementioned reasons, the Court finds that the ITAT has correctly set out the legal position while holding that the requirement of prior approval of the superior officer before an order of assessment or reassessment is passed pursuant to a search operation is a mandatory requirement of Section 153D of the Act and that such approval is not meant to be given mechanically. The Court also concurs with the finding of the ITAT that in the present cases such approval was granted mechanically without application of mind by the Additional CIT resulting in vitiating the assessment orders themselves.

26. The question of law framed is therefore answered in the affirmative i.e., in favour of the Assessee and against the Department.

27. The appeals are accordingly dismissed, but in the circumstances, with no order as to costs.”

11. The SLP was dismissed with the following observations:

“Having regard to facts and circumstances of the case, we are not inclined to interfere in the matter. The Special Leave Petition is dismissed.”

12. It was further considered in that particular judgment that the assessment order must contain the fact of seeking approval by the Assessing Officer from the Additional Commissioner of Income Tax and such approval has been duly given. In the absence of mentioning of this particular fact the orders were found to be not in compliance with the requirement spelt out in paragraph 9 of officials procedure reproduced in paragraph 23 therein.

13. The contention made by the Ld. D.R. in that matter that since the entire documents were already available to the Additional CIT in the file sent for approval, there was no need for exchange of the said document prior to the grant of formal approval under Section 153D of the Act as also made before us by the Ld Dr was ultimately not accepted by the Court.

14. We have further considered the judgment passed by the Hon’ble Apex Court in the case of Anuj Bansal (supra) whereby and whereunder the order passed by the Hon’ble Dehli High Court quashing the assessment order on the ground of mechanical approval granted under Section 153D of the Act has been upheld. The Honble Delhi High Court passed orders in the following manner:

“6. The appellant/revenue via this appeal seeks to assail the order dated 29.04.2022 passed by the Income Tax Appellate Tribunal [in short, “Tribunal’]

7. The Tribunal has via the impugned order set aside the additions made qua the income of the respondent assessee inter alia, on the ground that there was no application of mind by the Additional Commissioner of Income Tax (In short, “ACIT”] in granting approval under Section 153D of Income Tax Act 1961 [in short, the Act’].

8. To be noted, an assessment order was framed qua the respondent/assessee under Section 153A, read with Section 143(3) of the Act.

8.1. This order was carried in appeal by the respondent/assessee, right up till the Tribunal.

9. Insofar as the Assessing Officer (AO) was concerned, he made certain additions against the returned income.

9.1 The respondent had declared an income amounting to Rs 87,20,500/-However, while making the additions, strangely, the AO noted that the returned income was Rs. 11,00,460/-.

10. There were two additions made by the AO. The first addition was made qua cash deposited in the bank amounting to Rs. 15,04,35,000/-. The second addition was made with regard to cash introduced via an entry operator i.e. one, Mr. Vipin Garg The amount added qua this aspect was pegged at Rs.1,54,07,100/-.

11. Despite these additions, which would have taken the assessed income well beyond what was crystallised by the AO i.e. 1.65,07,560, the ACIT failed to notice the error.

12. This aspect was brought to the fore by the Tribunal in the impugned order. The Tribunal thus concluded there was a complete lack of application of mind, inasmuch as the ACIT who granted approval, failed to notice the said error.

12.1 More particularly, the Tribunal notes that all that was looked at by the ACIT, was the draft assessment order.

13. In another words, it was emphasised that the approval was granted without examining the assessment record or the search material. The relevant observations made in this behalf by the Tribunal in the impugned order are extracted hereafter:

“17.1 However, in the present case, we have no hesitation in stating that there is complete non application of mind by the Learned AddI. CIT before granting the approval. Had there been application of mind, he would not have approved the draft assessment order, where the returned income of Rs.87,20,580/-. Similarly, when the total assessed income as per the AO comes to Rs.16,69,42,560/-, the Addl. CIT could not have approved the assessed income at Rs. 1.65,07,560 had he applied his mind The addition of Rs.15,04,35,000/- made by the AO in the instant case is completely out of the scene in the final assessed income shows volumes.

17.2 Even the factual situation is much worse than the facts decided by the Tribunal in the case of Sanjay Duggal (supra) In that case, at least the assessment folders were sent whereas in the instant case, as appears from the letter of the Assessing Officer seeking approval, he has sent only the draft assessment order without any assessment records what to say about the search material. As mentioned earlier, there are infirmities in the figures of original return of income as well as total assessed income and the Addl. CIT while giving his approval has not applied his mind to the figures mentioned by the AO Therefore, approval given in the instant case by the AddI. CIT, in our opinion, is not valid in the eyes of low. We therefore, hold that approval given u/s 153D has been granted in a mechanical manner and without application of mind and thus it is invalid and bad in low and consequently vitiated the assessment order for want of valid approval u/s 153D of the Act.

In view of the above discussion, we hold that the order passed u/s 153A r.w.s. 43(3) has to be quashed, thus ordered accordingly. The ground raised by the Assessee is accordingly allowed”

[Emphasis is ours]

14. In this appeal, we are required to examine whether any substantial question of law arises for our consideration.

15. Having regard to the findings returned by the Tribunal, which are findings of fact, in our view, no substantial question of law arises for our consideration. The Tribunal was right that there was absence of application of mind by the ACIT in granting approval under Section 153D. It is not an exercise dealing with a immaterial matter which could be corrected by taking recourse to Section 292B of the Act.

16. We are not inclined to interdict the order of the Tribunal.”

15. While dismissing the SLP preferred by the revenue, the Hon’ble Apex Court observed as follows:

“Having regard to peculiar facts of these cases, we are not inclined to interfere in the matters. Hence, the Special Leave Petitions are dismissed.”

16. Having heard the Ld. Counsels appearing for the parties, having regard to the facts and circumstances of the case, the order of approval issued by the Additional Commissioner of Income Tax appearing at page 72 of the paper book filed before us found to be invalid in view of this particular fact that the said approval does not speak of movement of any file. Neither given approval for each year separately nor assigned any reason for such approval; the same is nothing but a product of total non-application of mind by the order approving authority. Further that the impugned order of approval dated 27.12.2016 has been issued on the same day when the draft assessment orders in respect of these assessment years have been placed before him and in hot haste the approval has been granted. The same does not establishes review of the assessment records and search materials by the Additional CIT too; the same is, thus, a mechanical approval and hence the judgments relied upon by the Ld AR as discussed above are found to be rightly applicable. Respectfully relying upon the ratio laid down by the Hon’ble Apex Court in these matters mentioned above, in the case in hand the approval since granted mechanically, without application of mind by the Additional Commissioner that too without assigning any reason, in our considered view, is invalid and thus deserves to be quashed. With the aforesaid observation we, therefore, quash the impugned approval dated 27.12.2016. The assessment orders are also, therefore, vitiated, void-ab-initio and thus, quashed. The assessee’s appeal, is, therefore, allowed. As the appeal is allowed on this ground all other grounds taken by the assessee become academic and no order needs to be passed.,

17. The order passed in this matter is applied mutatis mutandis in all the other appeals preferred by the assessee on the identical facts.

18. In the result, all the appeals preferred by the assessee are allowed.

Avdhesh Kumar Mishra, Accountant Member.- I am unable to persuade myself with the draft order quashing the approval dated 27.12.2016 granted by the Additional Commissioner of Income Tax (hereinafter, the ‘Addl. CIT’) and also allowing the assessee’s appeals by quashing the assessment orders passed by the Assessing Officer (hereinafter the ‘AO’) being vitiated and void-ab-initio. The relevant part of the finding in the draft order is reproduced hereunder:

“16. Having heard the Ld. Counsels appearing for the parties, having regard to the fact and circumstances of the case, the order of approval issued by the Additional Commissioner of Income Tax appearing at page 72 of the paper book filed before us found to be invalid in view of this particular fact the said approval does not speak of movement of any file. Neither given approval for each year separately nor assigned any reason for such approval; the same is nothing but product of total non-application of mind by the order approving authority. Further, the impugned order of approval dated 27.12.2016 has been issued on the same day when the draft orders in respect of these assessment years have been placed before him and in hot haste the approval has been granted. The same does not establishes review of the assessment records and search materials by the Additional CIT too; the same, is, thus, a mechanical approval and hence the judgements relied upon by the Ld. AR as discussed above are found to be rightly applicable. Respectfully, relying upon the ratio laid down by the Hon’ble Apex Court in these matters mentioned above, in case in hand the approval since granted mechanically, without application of mind by the Additional Commissioner that too without assigning any reason, in our considered view, is invalid and thus deserved to be quashed. With the aforesaid observation we, therefore, quash the impugned approval dated 27.12.2016. the aforesaid orders are also, therefore, vitiated, void-ab-intio and thus, quashed. The assessee’s appeal, is therefore, allowed. As the appeal is allowed on this ground all other grounds taken by the assessee become academic and no no order needs to be passed.

17. The order passed in this matter is applied mutatis mutandis in all the other appeals preferred by the assessee on the identical facts.”

2. The submission of the Ld. CIT-DR mentioned in the draft order is worth extracting herein under at the cost of repetition:

“6. On the other hand, it was submitted by the Ld. D. R that the range head is fully involved in guiding and supervising the assessment proceedings. Discussions and consultation between the AO and the range heads are sometimes not formally put in the form of letters on record. It is not the JCIT/Additional CIT is seeing issues for the first time which are in the draft order as alleged by the assessee. It was further contended by him that no government officer or even a layman will sign a legal paper/sensitive order without seeing and applying his/her mind where he can be held responsible/accountable later.”

3. The Ld. AR did not say anything in response to the submission of the Ld. CIT-DR and also failed to controvert the submission of the Ld. CIT-DR. The Hon’ble Delhi High Court (Full Bench), in the case of CIT v. Kelvinator of India Ltd.256 ITR 1, on the basis of the statutory presumption under section 114(e) of the Indian Evidence Act, 1872, had drawn a presumption in the Income Tax matter that all official actions were performed regularly unless controverted by the corroboratory evidence. Thus; in the present case, the onus is on the assessee to rebut that the Addl. CIT while approving the case had not applied his mind. The Hon’ble Supreme Court, in the cases of State of Bihar v. PP Sharma AIR 1991 SC 1260, State of MP v. Harishankar Bhagwan (2010) 8 SCC 655, CS Krishnamurthy v. State of Karnataka AIR 2005 SC 2790 and State of Maharashtra v. Ishwar Piraji Kalpatri AIR 1996 SC 722 has held that even in cases where the sanction order does not demonstrate the independent perusal of material and does not carry recital of reasons in view of the statutory presumption under section 114(e) of the Indian Evidence Act, 1872 if it is established that all the relevant material were duly put up for perusal before the authority, then the sanction cannot be considered as vitiated.

4. The Ld. AR failed to demonstrate and establish that there was any other document(s), letter(s), internal correspondence folder(s), etc. available on the record other than those submitted by him before us, which might show that the Additional Commissioner of Income Tax (hereinafter, the ‘Addl. CIT’) was not involved actively in the search assessments. The documents submitted by Ld. AR are self-serving and cannot be termed exhaustive in drawing the inference that the Addl. CIT was not performing his official work with the application of mind in this case.

5. The documents produced before us which found scanned in the draft order were obtained, in the RTI Application, by the assessee. The information sought is limited and to the extent of copies of letters through which the approval sought by the AO and approval granted by the Addl. CIT. It does not establish beyond doubt that there is no other document(s), letter(s), etc. showing further correspondence, discussion, order sheet noting(s) dealing this issue. The assessee had not sought the information with respect to the correspondence, discussion, order sheet noting(s), interaction, consultation, etc. taken place between the AO and the Addl. CIT on the issue of approval under section 153D of the Act and issues emerging from the seized material in this case. Thus, it cannot be ruled out that there is no other evidence showing movement of the assessment records between the AO and the Addl. CIT on the day on which the approval sought under section 153D of the Act. Selective information sought in the RTI Application should not be considered as exhaustive as far as the issue of approval sought under section 153D of the Act is concerned. The purpose, context and nature of information sought under the RTI Application have to be taken in totality to draw the inference.

6. The Ld. CIT-DR, on the day of hearing, was ready to produce the entire files including the assessment records, letters, correspondences, etc. showing involvement of the Addl. CIT in the search assessments on regular basis in the present case. It was further submitted by the Ld. CIT-DR that such files, records, etc. would demonstrate the active involvement of the Addl. CIT in the search assessments from the point of receipt of the Appraisal Report to the date approval granted under section 153D of the Act.

7. The Appraisal Report is a report prepared by the search conducting Assistant/Deputy Director of Income Tax (Investigation) highlighting the incriminating material along with the outcome of the investigations from the day ofcommencement of search operations to culmination of the Appraisal Report. The copy of the Appraisal Report is provided to the AO, Addl.CIT and the jurisdictional Principal Commissioner of Income Tax. This report is in the nature of a comprehensive report for the Search Unit (Investigation Directorate) and the Assessment Unit (Central Charge) of the Income Tax Department. Thereafter, the AO along with the Addl. CIT get involved in issuing statutory notices, preparing the Action Points, drafting Questionaries, etc. Neither the AO nor the Addl. CIT works in isolation as far as search assessments are concerned. Basically, they work as team during the course of search assessments. The approval accorded by the Addl. CIT under section 153D of the Act is nothing but the culmination of day-to-day involvement of the AO and the Addl. CIT in search assessments. The fact is that the AO and the Addl. CIT works as team members and the AO works under the supervision of the Addl. CIT. The team work gets culmination by the approval under section 153D of the Act. Such involvement of the Addl. CIT in the search assessment is in routine in the Central Charges of the Income Tax Department where the search assessments are completed. It is not a case where the assessment records, other files, investigation folders, etc. of a search case change hands for the first time between the AO and the Addl. CIT at the time of approval of the search assessment. The detail mentioned above is based on my personal experience while working in each hierarchy (AO onwards) of the Central Charges of the Income Tax Department.

8. The Ld. AR, in counter, did not say anything and controvert the submission of the Ld. CIT-DR. Further, the Ld. AR failed to demonstrate and establish that there was no other document(s), letter(s), correspondence(s), etc. other than submitted by him on the record which also might show involvement of Additional Commissioner of Income Tax (hereinafter, the ‘Addl. CIT’) in the search assessments. Further, the appellant/assessee has never sought the copy of the letter of the AO through which the assessment records were sent to the Addl. CIT on the day on which the approval was sought under section 153D of the Act. Thus, it cannot be ruled out that the AO had not sent the case record through any other letter/order sheet noting/by hand, etc. other than the letter cited in the draft order.

9. As per the Wharton’s Concise Law Dictionary the word ‘satisfied’ means being free of anxiety, doubt, perplexity, suspense or uncertainty. Whereas ‘approval’ means ‘to have or express a favourable opinion or to accept as satisfactory’. The ‘sanction’ requires an independent perusal of facts and record and also the recital of the reasons for granting approval. As seen from the meaning of the words ‘satisfied’, ‘approval’ and ‘sanction’ they constitute a hierarchy of endorsement of a proposed action. The word ‘approval’ under section 153D of the Act is not a sanction. Sanction requires more independent application of mind with respect to facts and provisions of law; whereas the ‘approval’ as contemplated under section 153D of the Act, being administrative in nature, the preliminary satisfaction of the Addl. CIT is required to the extent that the AO has looked into all seized material and has given proper opportunity of being heard to the assessee by confronting the evidences and the proposed additions. The Addl. CIT, while granting approval under section 153D of the Act, does not enter into the realm of deciding whether the additions proposed by the AO is legally sustainable.

10. The CBDT Circular No. 3 of 2008, dated 12.3.2008 mentions the legislative intent of section 153D of the Act. Further,the section 153D of the Act does not lay the procedure and manner of granting approval under section153D of the Act. The approval under section 153D of the Act by the Addl. CIT is merely administrative in nature to safeguard internal checks & balances without affecting the quasi-judicial powers of the AO or creating any prejudice to assessee. In fact, while granting approval under section153D of the Act, the Addl. CIT does not act as a Reviewing/Appellate Authority to allow or disallow the additions proposed by the AO.

11. The manner of arriving satisfaction for granting administrative approval itself could not have been matter of adjudication in the draft order in view of ratio laid by the Hon’ble Supreme Court in the case of DGIT(Inv) v. Space Wood Furnishers Pvt. Ltd. 292/232 131/374 ITR 595 / Civil Appeal No.4394 of 2015 [para12]. Hence, I am not in agreement with the finding “With the aforesaid observation we, therefore, quash the impugned approval dated 27.12.2016.” in the draft order on the simple reasoning that the approval is not a matter of adjudication before us. Respectfully, following the decision of the Hon’ble Supreme Court in the case of Space Wood Furnishers Pvt. Ltd.(supra) [para12] and Mumbai ITAT decision in the case of Pratibha Pipes & Structurals Ltd. v. Deputy Commissioner of Income-tax 147 (Mumbai – Trib.)/ITA No. 3874/Mum/2015, I do not quash the approval granted by the Addl. CIT under section153D of the Act.

12. In view of the above, I am not inclined to concur with the finding in the draft order that no physical movement of records from the AO to the Addl. CIT have not gone on the day of approval granted under section 153D of the Act particularly when selective information sought in the RTI Application did not establish the fact that the AO has not sent the assessment records to the Addl. CIT AO through some other letter, if not sent with the letter scanned in the draft order on the day on which the approval was sought under section 153D of the Act. Selective information sought in the RTI Application should not be considered as exhaustive submission to hold that there was non-application of mind by the Addl. CIT in granting approval under section 153D of the Act. The purpose, context and nature of information sought in the RTI Application have to be taken in totality to draw the inference and also the information which were not sought by the assessee. The documents submitted by Ld. AR are self- serving and cannot be termed exhaustive. In the RTI Application, the assessee had not sought the information with respect to the interaction, consultation, etc. taken place between the AO and the Addl. CIT on the issues emerging from the seized material in the appellant/assessee’s case.

13. As per the SOP prescribed in the Search Manual and other instructions/guidelines issued by the CBDT, there is a close monitoring of search assessments by the Addl. CIT by way of internal correspondence folder(s), order sheen noting, meeting(s), discussions, electronic communications, etc. from time to time throughout the year. Since the Addl. CIT and the AO of the present case were in room apart in the same building, therefore, movement of records, etc. by hand over phone also could not be ruled out. Since, the Addl. CIT, as per the SOP issued by the CBDT for search assessments, could not be ruled out to be not actively involved in the search assessments; therefore, the issues emerged in the search assessments were on his/her tips at the time of granting approval under section 153D of the Act. It is also not the case that the Addl. CIT has come to know of the facts/details of assessment proceedings at the time of approval under section 153D of the Act. The entire process of monitoring is a continuous process even before the receipt of draft order seeking the approval under section 153D of the Act. The approval under section 153D of the Act is culmination of joint exercise carried out as team lead by the Addl. CIT. The AO had worked under the supervision of the Addl. CIT.

14. The Ld. AR failed to cite any facts in the assessment order which may shown non-application of mind of the Addl. CIT while granting approval under section 153D of the Act. The Hon’ble High court of Delhi, in the case of Anuj Bansal (supra) has cited many instances of inaccuracy/ mistake/error/lapses, etc. in the approval under section 153D of the Act and the details mentioned in the assessment order to hold that there was non-application of mind of the Addl. CIT while granting approval under section 153D of the Act. however, here in the present case, the Ld. AR failed to demonstrate such instances of inaccuracy/mistake/error/lapses, etc. in the approval under section 153D of the Act and the details mentioned in the assessment order. Hence, the facts of this case are held distinguishable from the case of Anuj Bansal (supra). Therefore, I am of the considerable view that the decision of the Hon’ble High in the case of Anuj Bansal (supra) is not applicable in the present case. Rather, this case supports my view in view of the decision of the Hon’ble Delhi High Court (Full Bench) in the case of Kelvinator of India Ltd. (supra) and the fact that the Ld. AR failed to pin point any inaccuracy/ mistake/ error/lapses, etc. in the approval under section 153D of the Act and the details mentioned in the assessment order. Similarly, the decision of the Hon’ble Orrisa High Court in the case of Serajuddin (supra) is also held distinguishable on the facts as the Ld. AR failed to demonstrate that the search assessment orders did not mention the approval of the Addl. CIT. In the present case, it cannot be ruled out that these were not completed in violation of Circular-3 of 2008 and SOP for search assessments. The Ld. AR failed to establish that the guidelines enunciated by the Search& Seizure Manual,Circular-3 of 2008 and SOP for search assessments have been flouted by the Ao and the Addl. CIT and there was no application of mind by them.

15. It is equally a well-settled position on the law of precedent that a ruling of a court is to be read, understood and interpreted in the context of not only the issue that was under adjudication but also in the context of the points of arguments canvassed by both the sides. Though there is plethora of judicial precedents on this aspect, it will suffice here to reproduce the relevant part of the judgment of the Hon’ble Supreme Court in the case of CIT v. Sun Engineering Works (P) Ltd.198 ITR 297, which is self-explanatory:

“It is neither desirable nor permissible to pick out a word or sentence from the judgment of this court, divorced from the context the question under consideration and treat it to be the complete law declared by this court.”.

16. In the case of UOI v. Dhanwanti Devi (1996) 6 SCC 44, the Hon’ble Supreme Court observed as under:

” 9…….What is of the essence in a decision is its ratio and not every observation found therein nor what logically follows from the various observations made in the judgement. Every judgment must be read as applicable to the particular facts proved, since the generality of the expressions which may be found there is not intended to be exposition of the whole law, but governed and qualified by the particular facts of the case in which such expressions are to be found.

10. Therefore, in order to understand and appreciate the binding force of a decision is always necessary to see what were the facts in the case in which the decision was given and what was the point which had to be decided. No judgment can be read as if it is a statute. A word or a clause or a sentence in the judgment cannot be regarded as a full exposition of law. Law cannot afford to be static and therefore, Judges are to employ an intelligent interpretation in the use of precedents..”

[Emphasis has been supplied]

17. The dismissal of SLP has no binding force in terms of Article 141 of the Constitution of India. Consequently, it has no binding precedent value, in contradiction with a reasoned order of the Hon’ble Supreme Court or an order passed in appeal. Reliance is placed on the decisions of the Hon’ble Supreme Court in the cases of Kunhayammed v. State of Kerala 245 ITR 360 (SC) and Khoday Distilleries Ltd. v. Mahadeshwara Sahakara Sakkare Karkhane Ltd. 279 (SC)].The Hon’ble Supreme Court, in the case of State of Orissa v. Dhirendra Sundar Das (2019) 6 SCC 270 (SC)] has clarified this position with the following observations at Para 9.27:

“9.27 It is a well settled principle of law emerging from a catena of decisions of this Court, including Supreme Court Employees’ Welfare Association v. Union of India &Anr. and State of Punjab v. Davinder Pal Singh Bhullar, that the dismissal of a S.L.P. in limine simply implies that the case before this Court was not considered worthy of examination for a reason, which may be other than the merits of the case. Such in limine dismissal at the threshold without giving any detailed reasons, does not constitute any declaration of law or a binding precedent under Article 141 of the Constitution.”

Thus, the finding in the draft order “Respectfully, relying upon the ratio laid down by the Hon’ble Apex Court in these matters mentioned above, in case in hand the approval since granted mechanically, without application of mind by the Additional Commissioner that too without assigning any reason, in our considered view, is invalid and thus deserved to be quashed.” is held to have not laid down any ratio as inferred in the draft order. Therefore, the facts of the case will determine the fate of this appeal.

18. In view of the discussion herein before, it is held that the approval granted under section 153D of the Act is not invalid and therefore, the additional ground of the appellant/assessee stands dismissed. Further, these appeals, on merit, are required to be heard as these cases were not heard on any other issue other than the issue of the approval granted under section 153D of the Act. Thus, the above draft order allowing the appeal of assessee, according to me, is not justified. Therefore, I am of the considered view that the appeal of assessee should be kept alive as of now in the interest of justice and to be heard on merit and to be decided accordingly.

19. In the result, the appeals of the assessee is decided accordingly.

Mahavir Singh, Vice President (As a Third Member).- By the order of President, ITAT vide U.O. No.F.28-Cent.Jd(AT)/2025 dated 24th March, 2025, the undersigned has been nominated to adjudicate the difference of opinion between the learned Judicial Member and learned Accountant Member on the following question:-

“As to whether under the present facts and circumstances of the matters, the approval granted by the ACIT, dated 27.12.2016 under Section 153D of the Income Tax Act, 1961 are sustainable in the eyes of law or not.”

2. Brief facts are that a search under Section 132 of the Income-tax Act, 1961 (hereinafter referred to as ‘the Act’) was carried out on the assessee group of cases on 27th April, 2014. Consequently, for the assessment years 2009-10 to 2015-16, notices under Section 153A of the Act were issued by the Revenue to the assessee. The assessee, during the course of assessment proceedings, submitted that the original returns filed be considered as returns filed in response to notices under Section 153A of the Act. Accordingly, assessments were framed by the ACIT, Central Circle-8, New Delhi for the relevant assessment years 2009-10 to 2015-16 vide different orders dated 27th December, 2016 under Section 153A read with Section 143(3) of the Act. Aggrieved by the additions made by the Assessing Officer, the assessee preferred appeals before learned CIT(A) and learned CIT(A) also passed appellate orders for these above assessment years. Aggrieved against the appellate orders, assessee preferred appeals before the Tribunal. The assessee, vide letter dated 27th October, 2021, for these assessment years, raised additional ground in all these appeals. The ground as raised is identical and hence, I will take the ground raised in assessment year 2009-10, which reads as under:-

“3. The CIT(A) has erred in law in confirming the addition made by the AO, without considering that the mandatory approval given by the Addl. CIT in this case U/s 153D has been given, in a complete mechanical manner, without application of mind and the same therefore makes the entire assessment order bad in law and void ab initio.”

3. This ground was adjudicated by the learned Judicial Member and learned Accountant Member after admitting the same and there is no dispute about admissibility of this ground. Before me, learned Counsel for the assessee filed copy of approval (which is in Hindi language but assessee filed a translated copy), which reads as under:-

“F.No./A.C.I.T./C.R.-2/2016-17/1029

Dated:- 27-12-2016

To,

The Assistant Commissioner of Income Tax

(Central) (Circle)-8, New Delhi.

Subject:- Karan Luthra Group Income Tax Rules 153D for approval andclosing proceedings.

Please refer to letter F.No. Assistant Commissioner of Income Tax/Central Circle-08/2016-17/1311, dated – 27/12/2016 received in this office from Assistant Commissioner of Income Tax/Central Circle-08, New Delhi regarding the above subject. These draft orders are sent by you for approval under section 153D.

| S.No. | Name of the Assessee | Section | PAN | A.Y. | Filed Income | Assessed Income |

| 1 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2009-10 | 137940 | 1340304 |

| 2 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2010-11 | 307943 | 10241352 |

| 3 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2011-12 | 403908 | 15000460 |

| 4 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2012-13 | 438939 | 23094073 |

| 5 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2013-14 | 1018269 | 10903269 |

| 6 | Mr. DheerajChoudhary | 153A | AASPK9267B | 2014-15 | 584183 | 30911700 |

| 7 | Mr. DheerajChoudhary | 143(3) | AASPK9267B | 2015-16 | 1004820 | 221698040 |

The above proposed orders are approved with the direction that the assessment orders be passed before the prescribed time limit. It is also specified that a copy of the final orders passed be sent to this office.

(Rinku Singh)

Additional Commissioner of Income Tax

Central Range-2, New Delhi“

4. Learned Counsel stated that the copy of approval is obtained through RTI and Department, vide letter dated 2ndAugust, 2021, provided this approval. Accordingly, the additional grounds are raised vide application dated 27th October, 2021. Learned Counsel for the assessee made argument that as per the mandate of Section 153D of the Act, the approval is to be granted to the assessment order by the Additional CIT/JCIT after due application of mind. Learned Counsel for the assessee stated that this approval dated 27.12.2016 was granted in lieu of proposal sent by the Assessing Officer i.e. the Assistant Commissioner of Income Tax, Central Circle-08, New Delhi dated 27.12.2016. It means, according to learned Counsel, the Additional CIT granted approval of these seven draft assessment orders on the same date. He further explained that as per this proposal, the Assessing Officer, no assessments records, search materials, replies filed by assessee or any material related to these assessments was provided or examined by the Additional CIT. In view of these facts, learned Counsel argued that that this issue is now settled by the decision of Hon’ble Delhi High Court in the case of PCIT(Central) v. Anuj Bansal /466 ITR 251 (Delhi)and PCIT v. Shiv Kumar Nayyar ITR 186 (Delhi). Even this issue has been dealt with by Hon’ble Orissa High Court in the case of. Serajuddin & Co. (supra). Similar view is taken by Hon’ble Allahabad High Court in the case of Pr. CIT v. Sapna Gupta 288. Learned Counsel argued that the jurisprudence arising out of the above case laws is that an approval under Section 153D of the Act is considered to be as given with no application of mind and given in a mechanical manner when the approval itself does not reflect any application of mind. He narrated the facts of the present case stating that on 27th December, 2016, the Assessing Officer sent the draft assessment order to the Additional CIT for approval and on the very same date i.e., 27th December, 2016, the Additional CIT granted approval. He produced before us the said letter of the Assessing Officer along with approval granted by the Additional CIT. From a perusal of the above said approval, it was argued that there is not even a token of mention of the draft orders having been perused by the Additional CIT, rather, the letter simply grants approval. He argued that even the bare minimum requirement of the approving authority, having to indicate what the thought process was involved was, is missing in the aforementioned approval order. In the approval order, there is no whisper in regard to the fact that the Additional CIT has examined the seized documents or the proposed additions made in the draft assessment order as the same was forwarded to him for her perusal. From the approval, it is clear that there is no reason given and it is bare minimum for the approving authority that there should have been some indication that the approving authority has examined the draft orders and finds that it meets the requirement of the Act. In terms of the above, learned Counsel for the assessee stated that the above approvals are mechanical and without application of mind and hence, the assessment orders approved without application of mind is to be quashed. He supported the order of learned Judicial Member.

5. On the other hand, learned CIT-DR Ms. Pooja Swaroop submitted that as pointed out during the course of hearing, there is a mistake in the question of law framed, as reproduced below:-

“As to whether under the present facts and circumstances of the matters, the approval granted by the ACIT, dated 27.12.2016 under Section 153D of the Income Tax Act 1961 are sustainable in the eyes of law or not.”

She submitted that approvals under Section 153D of the Act are granted by the Joint/Additional CIT. However, in the present case, ACIT has been stated, which is incorrect, because ACIT is actually Assistant Commissioner of Income Tax and not Additional Commissioner of Income Tax. Without prejudice to the above, she drawn our attention to Paragraph 11 and 14 to 17 of the draft order of learned Accountant Member. She also produced copies of relevant guidelines enunciated by the Search & Seizure Manual and relevant SOPs for search assessments issued by the CBDT. She also referred to Appendix-V of the Assessment Manual issued by the Income-tax Department in regard to search and seizure assessments dated 22nd December, 2006 vide F.No.286/161/2006-IT(Inv.II). She particularly referred to Paragraph 1.3 and argued that the Range Head i.e., Additional CIT/JCIT is involved in scrutinizing the seized material and issuance of notices under Section 153A, 153C and 148 of the Act and also where assessment in other than the searched person is to be done. The relevant Paragraph 1.3 referred by her reads as under:-

“1.3 On receipt of the appraisal report and seized material, the Assessing Officer and Range Head should jointly scrutinize the appraisal report and seized material and prepare an Examination Note to decide:

| i. | | Cases where notices u/s 153A of the Income-tax Act, 1961 (the Act) are required to be issued. |

| ii. | | Cases where notices u/s 153C of the Act are required to be issued. |

| iii. | | Cases where notices u/s 148 of the Act are required to be issued. |

| iv. | | Cases where seized material pertains to persons other than those whose cases have been centralised.” |

6. Subsequently, she referred to Paragraph 2.9 and stated that in case the Assessing Officer is not in agreement with any findings/conclusions drawn in the Appraisal Report, the matter should be brought to the knowledge of the Additional CIT/JCIT who should resolve the issue with the concerned Addl./Joint DIT(Inv) and also with CIT(Central) or DIT(Inv). She further referred to Paragraph 2.10 of the Manual and stated that even the Additional CIT/JCIT can issue instructions to the Assessing Officer in terms of Section 144A of the Act. She stated that even the Additional CIT/JCIT is involved in the preparation of final assessment order by way of instructing the Assessing Officer issuing final show cause notice. She referred to Paragraph 3.2 of the Manual, which reads as under:-

“3.2 All the issues and evidence that is going to be relied upon in the assessment order should be made available to the assessee. The final show cause notice should be prepared in consultation with the Addl. CIT and should contain:

| i. | | The proposed structure of the order; |

| ii. | | The evidence in possession of the department; |

| iii. | | The case laws being relied upon; |

| iv. | | The opportunity of rebuttal being provided to the assessee.” |

In view of the above, she prayed that approval under Section 153D of the Act is neither invalid nor bad in law nor given without application of mind by the Additional CIT, as emphasized by the learned Accountant Member in his order.

7. I have heard the rival submissions and gone through the facts and circumstances of the case. Admitted facts are that for all the relevant six assessment years, only one approval is granted by the Additional CIT as is available on record, which is a part of this order at Paragraph 5. The provisions of Section 153D of the Act where prior approval is made necessary for assessments in search and seizure cases is introduced by the legislature by the Finance Act, 2007 with effect from 1st June, 2007. The relevant provisions of Section 153D read as under:-

“153D. No order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner in respect of each assessment year referred to in clause (b) of sub-section (1) of section 153A, or the assessment year referred to in clause (b) of sub-section (1) of section 153B, except with the prior approval of the Joint Commissioner.”