ORDER

Khettra Mohan Roy, Accountant Member.- This appeal by the assessee is directed against the order of the Ld. Commissioner of Income Tax (Appeals)-30, New Delhi, dated 08.02.2024 pertaining to Assessment Year 2021-22.

2. The assessee has raised following grounds of appeal:-

| 1. | | That having regard to the facts and circumstances of the case, Ld. CIT(A) has erred in law and on facts in confirming the action of Ld. AO in framing the impugned reassessment order and that too without assuming jurisdiction as per law without following the due procedure in accordance with law. |

| 2. | | That having regard to the facts and circumstances of the case, Ld. CIT(A) ought to have quashed the impugned assessment passed by Ld. AO u/s 143(3). Ld. AO having initiated the proceedings u/s 153C which is evident from the following facts but the Ld. AO has erred in not mentioning section 153C in and on the assessment order: |

| (a) | | Satisfaction in terms of section 153C was recorded by Ld. AO for the AO for the AY 2015-16 to AY 2021-22. |

| (b) | | Notices u/s 153C were issued for other AYs i.e. 2015-16 to AY 2020-2021. |

| (c) | | Approval u/s 153D for passing the impugned assessment order was taken by Ld. AO. |

| 3. | | That in any case and in any view of the matter, action of Ld. CIT(A) in confirming the action of Ld. AO in framing the impugned assessment order u/s 143(3) is bad in law inter alia for the reasons: |

| (a) | | Because the notice u/s 143(2) dated 30.06.2022 and the assessment proceeding u/s 143(3) initiated vide notice u/s 143(2) dated 30.06.2022 got abated/came to an end in terms of the second proviso to section 153A(1) r.w.s. 153C(1). |

| (b) | | Because the impugned assessment order u/s 143(3) was passed after taking approval from Addi. CIT which means interference in quasi-judicial function of Ld. AO. |

| 4. | | In any view of the matter, action of Ld. CIT(A) in confirming the action of Ld. AO in framing the impugned assessment order u/s 143(3) dated 08.02.2024 is bad in law and against the facts and circumstances of the case. |

| 5. | | That having regard to the facts and circumstances of the case, Ld. CIT(A) has erred in law and on facts in confirming the action of Ld. AO in making aggregate addition of Rs.4,89,00,000/- by treating it as alleged unexplained investment u/s 69 and taxing the same u/s 115BBE and that too by recording incorrect facts and findings and without considering the submissions filed by the assessee and without following the principles of natural justice and without providing the entire adverse material on record and without providing the opportunity of cross examination. |

| 6. | | That in any case and in any view of the matter, action of Ld. CIT(A) in confirming the action of Ld. AO in making aggregate addition of Rs. 4,89,00,000/- by treating it as alleged unexplained investment u/s 69 and taxing the same u/s 115BBE, is bad in law and against the facts and circumstances of the case. |

| 7. | | That in any case and in any view of the matter, Ld. CIT(A) has erred in confirming the addition made by Ld. AO in the impugned order is beyond jurisdiction and illegal, also for the reason that such order could not have been made since no incriminating material has been found as a result of search. |

| 8. | | That in any case and in any view of the matter, Ld. CIT(A) has erred in confirming the action of Ld. AO in making the impugned addition and passing the impugned appellate order dated 08.02.2024 is illegal, bad in law, void ab-initio and against the facts and circumstances of the case and in gross violation of principles of natural justice and barred by limitation also. |

| 9. | | That having regard to the fact and circumstances of the case, Ld. CIT(A) has erred in law and on facts in not reversing the action of Ld. Assessing Officer in charging the interest u/s 234A, 234B and 234C of the Income Tax Act, 1961.” |

3. The sole ground of adjudication is whether the addition is not sustainable u/s 143(3) of the Act instead of 153C of the Act. The learned Authorized Representative of the assessee produced before us the order of Ashok Jain in Ashok Jain v. Dy. CIT [IT Appeal No.1185(Delhi) of 2024, dated 29-1-2025], which is exactly on the same issue. The ld. Bench has observed in paras-3 to 7 of the order as under:-

“3. We have heard the rival submissions and perused the materials available on record. For the assessment year 2021-22, the assessee had filed his return of income showing income under the head „income from salary”, „income from house property”, „income from capital gains” and „income from other sources”. It was submitted that the assessee was not doing any business during the year under consideration and hence no books of accounts were required to be maintained by the assessee. The return of income for the assessment year 2021-22 was filed by the assessee on 30-12-2021 declaring total income of Rs 17,03,960/-. The Learned AO observed in Para 3 of the assessment order that a search and seizure operation under section 132 of the Act was carried out at the premises of Shri Parveen K Jain / M/s Jainco Ltd on 6-1-2021 wherein mobile phone of Shri Vaibhav Jain was seized. On perusal of WhatsApp chats of Shri Vaibhav Jain with Asyush Jain, it was observed that there was an image of agreement to sell relating to sale of property at D-60, Preet Vihar,

Delhi-110092 was found. On perusal of the said image, it was observed that total sale consideration of the property was fixed for Rs 7,40,00,000/- and advance payment of Rs 50,00,000/- was received on 26-092020. The Learned AO of the searched person on perusal of the income tax return of the assessee found that assessee had declared only Rs. 2,51,00,000/- as sale consideration of the above mentioned property and accordingly concluded that a sum of Rs 4,89,00,000/- (7,40,00,000/- minus 2,51,00,000/-) represent cash consideration received by the assessee which was not disclosed by him in the income tax return. Accordingly, the Learned AO [DCIT Central Circle 31, New

Delhi (who was the assessing officer of the searched person)] recorded a satisfaction note on 23-08-2022 that the said information contained in the mobile phone represent seized document belonging to Ashok Kumar Jain and accordingly handed over the said seized document to the assessing officer of the assessee herein to take action under Section 153C of the Act. This satisfaction note is recorded in pages 43 to 44 of the paper book. Later, the assessing officer of the assessee who is same as the assessing officer of the searched person recorded a separate satisfaction note on 25- 11-2022 for initiating proceedings against the assessee under Section 153C read with Section 153A of the Act for assessment years 2015-16 to 2021-22. This satisfaction note is enclosed in Page 45 of the Paper Book. The law as laid down by the Hon”ble Supreme Court in the case of

CIT v.

Jasjit Singh reported in

458 ITR 437 (SC) is very clear that the date of handing over of the seized document by the AO of the searched person to the AO of the third party (i.e assessee herein) shall become the date of search qua the third person. Accordingly, the date of search qua the assessee becomes 25-11-2022 relevant to assessment year 2023- 24. Hence, the year under consideration i.e assessment year 2021-22 falls within the block period of assessments to be framed under Section 153C of the Act, whereas, the learned AO for the assessment year 2021-22 had framed the assessment under Section 143(3) of the Act based on the original date of search of 6-1-2021 (relevant to Assessment Year 2021-22) conducted in Hans group of cases.

4. The Ld AR before us placed on record the orders passed by the Coordinate Benches of Tribunal in connection with the same search wherein similar assessments framed under section 143(3) of the Act on the third person was declared void abinitio as under:-

(a) Decision of Delhi Tribunal in the case of Raja Varshney v. DCIT Central Circle 31, New Delhi in ITA No. 1459/Del/2024 dated 26-9-2024 for Assessment Year 2021-22 wherein it was held as under:- “13. From the above discussion the date of recording of the satisfaction will be the deemed date for the possession of the seized documents which is 03-10-2022 and six years would be reckoned from this date. The submission made by Ld AR is tenable that the assessment year relevant for previous year in which search was conducted in the case of the assessee will be AY 2023-24 and six years immediately preceding the assessment year relevant for u/s 153C of the Act will be AY 2018-19 to 2022-23. The assessment for AY 2021-22 should have been carried out by issuing notice u/s 153C of the Act and not u/s 143(2) of the Act. Therefore the assessment order dated 29-12-22 passed u/s 143(3) of the Act is bad in law and liable to be quashed and quashed accordingly. The additional grounds filed by the assessee are allowed. ”

(b) Decision of Delhi Tribunal in the case of Mukul Rani Thakur v. DCIT Central Circle 31, New Delhi in ITA No. 1483/Del/2024 dated 20-11-2024 for Assessment Year 2021-22 wherein it was held as under:-

“14. We find substantial force in the plea raised on behalf of the assessee. While search in the instant case was carried on 06-01-2021 ie. Previous year relevant to Assessment Year 2021-22, the documents were handed over in the previous year relevant to Assessment Year 2022-23. Based on such matrix, the assessment upto Assessment Year 2021-22 stood covered within ambit of section 153C of the Act. This being so, domain for assessment qua undisclosed income for Assessment Year 2021-22 falls within sweep of section 153C of the Act. The AO has committed substantive error in proper appreciation of jurisdictional provisions of section 153C of the Act by excluding Assessment Year 2021-22 from the ambit of section 153C of the Act erroneously based on actual date of search rather than based on date of receipts of incriminating documents. In order to frame assessment based on the searched document, the notice ought to have been issued under section 153A r.w.s. 153C of the Act. 15. The regular assessment passed by issuance of notice u/s 143(2) of the Act without aid of section 153C of the Act despite satisfaction note” from AO of searched person thus, is not supportable in law. The impugned assessment framed under section 143(3) of the Act thus, is void ab-initio as rightly pleaded on behalf of the assessee. Hence, the assessment order passed is vitiated in law and requires to be quashed at the threshold.”

5. The ratio laid down in the aforesaid decisions qua the same search squarely applies to the facts of the instant case before us. Respectfully following the said decisions, we quash the assessment framed under section 143(3) of the Act for the Assessment Year 2021-22 as it ought to have been framed under section 153C of the Act. Accordingly, the Ground Nos. 2 & 3 raised by the assessee are allowed.

6. Since the entire assessment is quashed, the other legal ground and grounds raised on merits need not be gone into as it would be academic in nature. Hence they are left open.

7. In the result, the appeal of the assessee is allowed.”

4. The Ld. AR further submitted that the issue is identical and the ratio of aforesaid order may kindly be followed in this matter also.

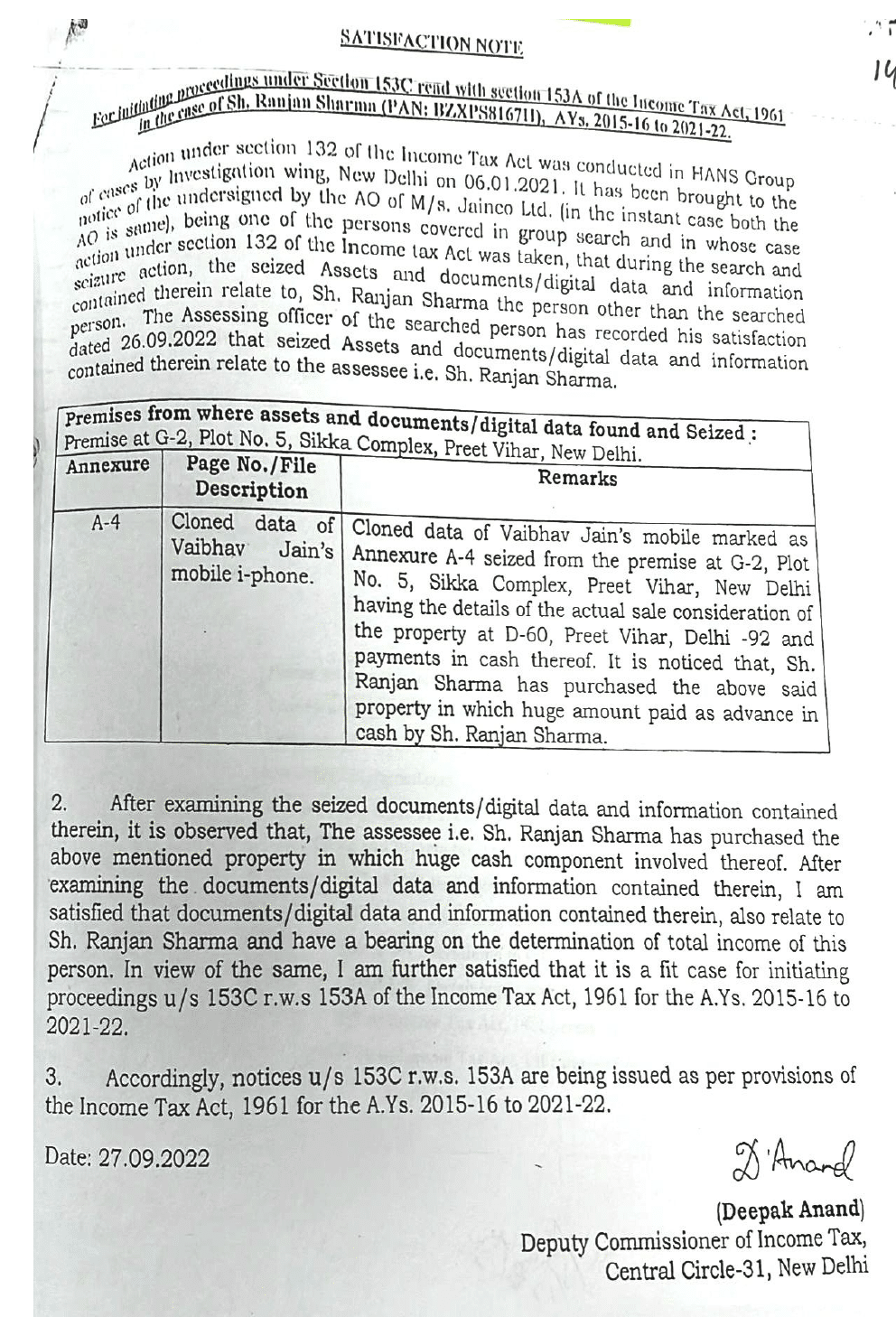

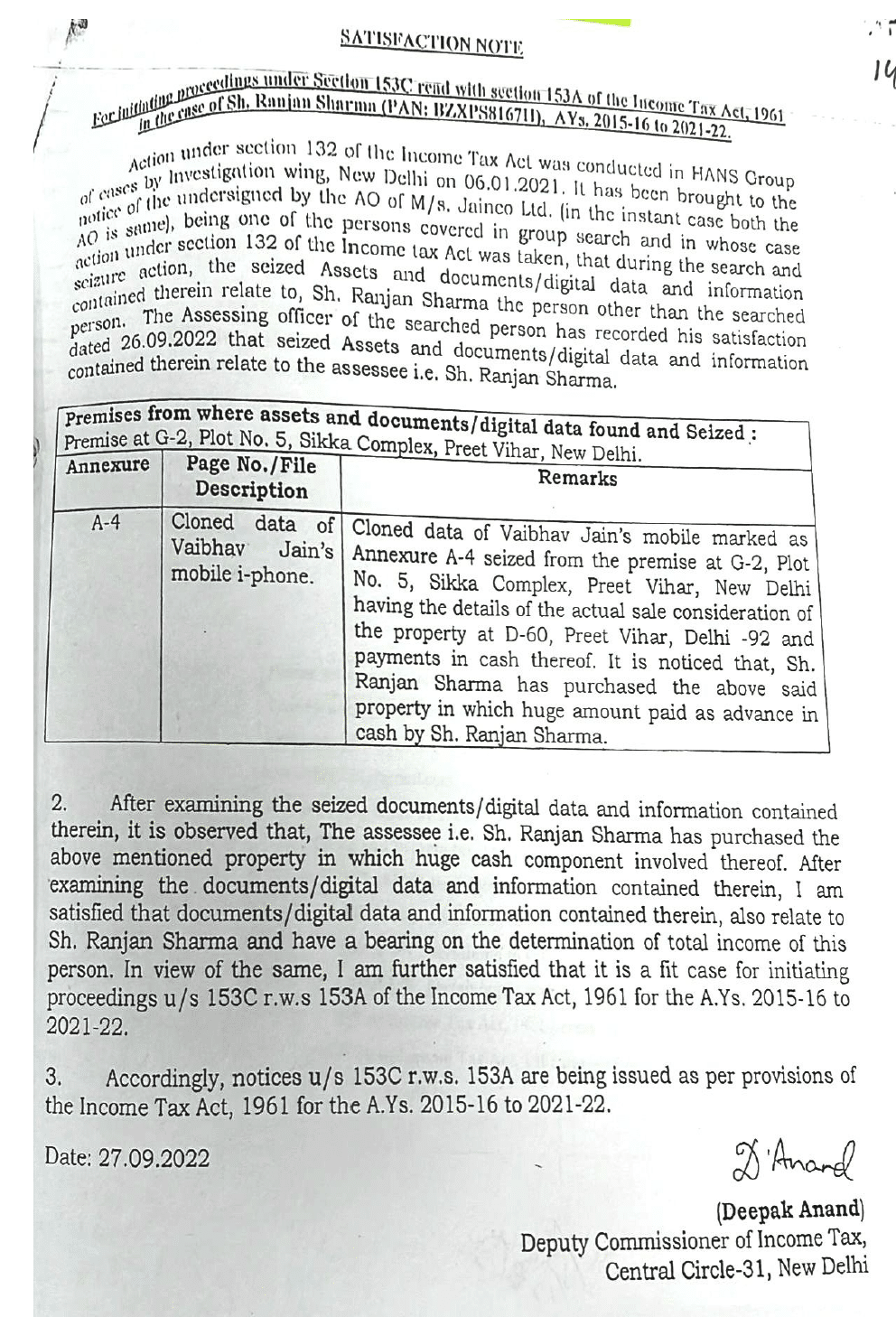

5. The Ld. CIT-DR could not controvert the submission of the assessee and failed to produce any justifiable explanation to compel us to take a different view. In this regard, we gainfully reproduced the satisfaction note drawn by DCIT Central Circle-31, New

Delhi dated 27.09.2022. The same is reproduced as under:-

6. Further, we also refer to the order u/s 7(1) of the Right to Information Act, 2005. The relevant part of this order is reproduced as under:-

| Sl. No. | Information sought | Reply |

| To furnish the following information for research purposes |

| a. Whether any Notice u/s 153C was issued for AY 2021-22 and if yes, please provide certified copy of such approval | No notice u/s 153C of the Act was issued as the assessment in the instant case was completed u/s 143(3) of the Act. |

| b. Whether any approval u/s 153D was taken for AY 2021-22 and if yes, please provide certified copy of such approval | No approval u/s 153D of the Act was taken as the assessment in the instant case was completed u/s 143(3) of the Act. |

| c. Also provide certified copy of order sheet entries | Copy of the same is enclosed as Annexure-1. |

7. We fail to understand that when the Assessing Officer himself has drawn of satisfaction note clearly pointing out that the assessment should be completed u/s 153C of the Act, then why at the time of passing of assessment order, he did not resort to that provision. This is a clear fundamental lapse on the part of the Assessing Officer, which cannot be condoned. By placing reliance on the various legal propositions and the acceptable judicial precedence, the assessment order is not sustainable as it has been passed without following the due rigours of law. Since, the assessee is successfully in assailing the jurisdictional issue; we refrain from dealing on the facts of the case.

8. In the result, the appeal of the assessee is allowed.