v.

Endurance Technologies Ltd.

ORDER

1. The above batch of 8 appeals filed by the Revenue are directed against the separate orders dated 13.06.2024 and 10.06.2024 of the Ld. CIT(A) / NFAC, Delhi relating to assessment years as mentioned above. For the sake of convenience, all these appeals were heard together and are being disposed of by this common order.

ITA No.1657/pUN/2024 (A.Y. 2011-12)

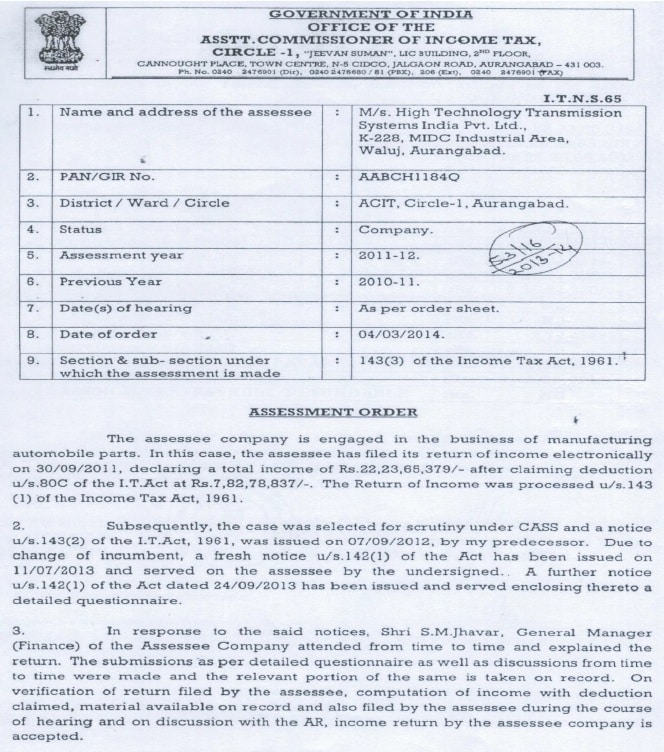

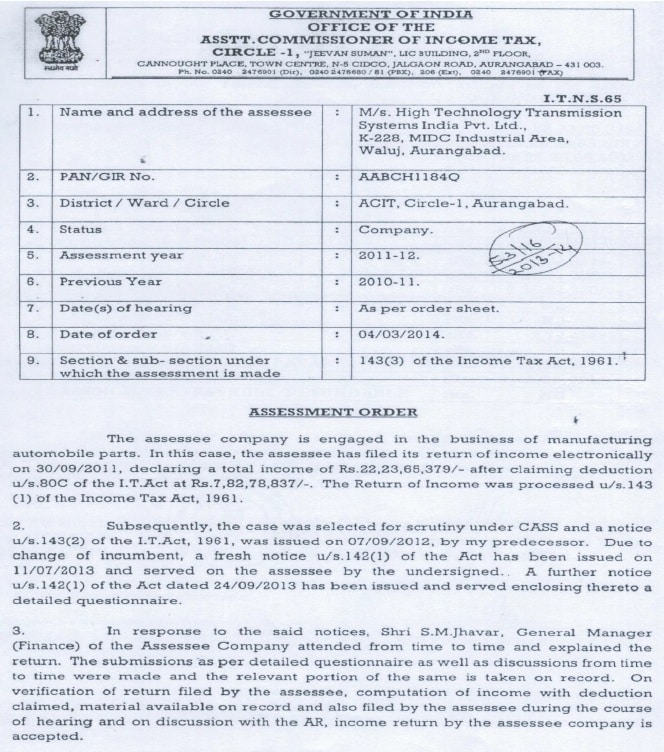

2. Facts of the case, in brief, are that the assessee is a company engaged in the business of manufacturing of automobile parts. It filed its original return of income on 30.09.2011 declaring total income of Rs.22,23,65,379/- after claiming deduction u/s 80IC of the Income Tax Act, 1961 (hereinafter referred to as ‘the Act’) at Rs.7,82,78,837/-. The return was processed u/s 143(1) of the Act. Subsequently, the case was selected for scrutiny and statutory notices u/s 143(2) and 142(1) of the Act were issued and served on the assessee in response to which the assessee filed the requisite details. The Assessing Officer completed the assessment u/s 143(3) of the Act on 04.03.2014 assessing the total income at Rs.22,23,65,380/-.

3. Subsequently, the Assessing Officer reopened the assessment as per the provisions of section 147 of the Act on the ground that the assessee has wrongly claimed the deduction of Rs.3,58,47,391/- u/s 35(2AB) which has escaped assessment. The Assessing Officer thereafter issued notice u/s 148 of the I.T. Act, 1961.

4. The assessee objected to the reasons recorded by the Assessing Officer which were not accepted by him and he passed an order disposing off the objections to notice u/s 148 of the Act on 29.10.2018. Subsequently, the Assessing Officer issued notices u/s 143(2) and 142(1) of the Act asking the assessee to explain the deduction claimed in the return u/s 35(2AB). Rejecting the various explanations given by the assessee, the Assessing Officer made addition of Rs.2,63,91,741/- for want of report in Form 3CL from the prescribed authority by observing as under:

“11. The explanation put-forth by the assessee is duly considered in the light of provisions of Income Tax Act. However the same is not tenable. In absence of report in Form No. 3CL from the prescribed authority, it is not ascertainable that what amount was actually incurred towards R&D activities. The assessee during the course of assessment proceedings has not submitted Form No. 3CL, therefore it is construed that the same was not issued to the assessee. Accordingly, the deduction claimed u/s 35(2AB) of the Act of Rs.2,63,91,741/- [Rs.94,55,651 + 1,69,36,090] is disallowed. However expenditure @ 100% of actual expenditure u/s. 35(1)/37(1) of the Act related to revenue expenditure is allowed. Penalty proceedings u/s 271(1)(c) of the Income tax Act, for furnishing of inaccurate particulars of income are initiated separately.”

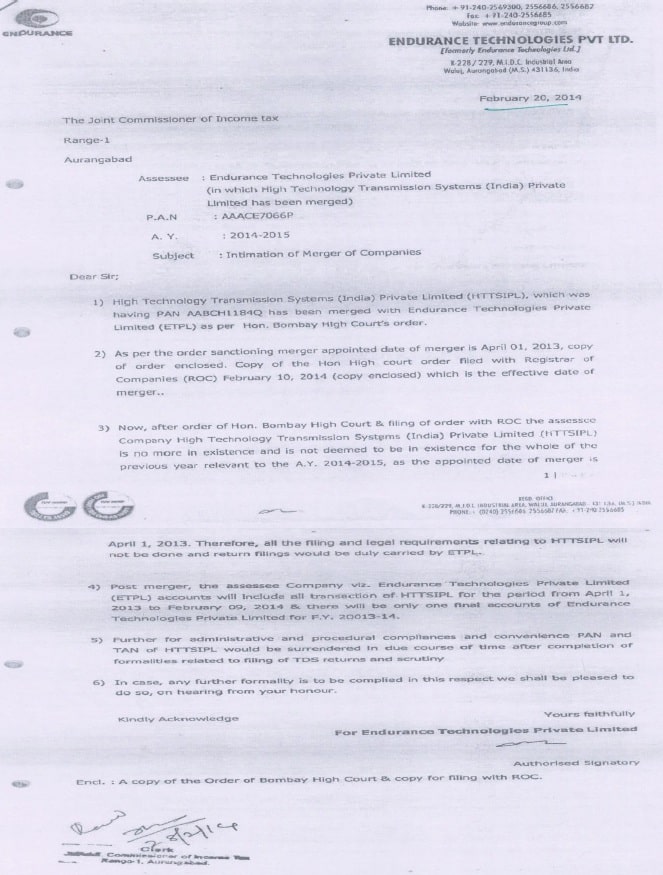

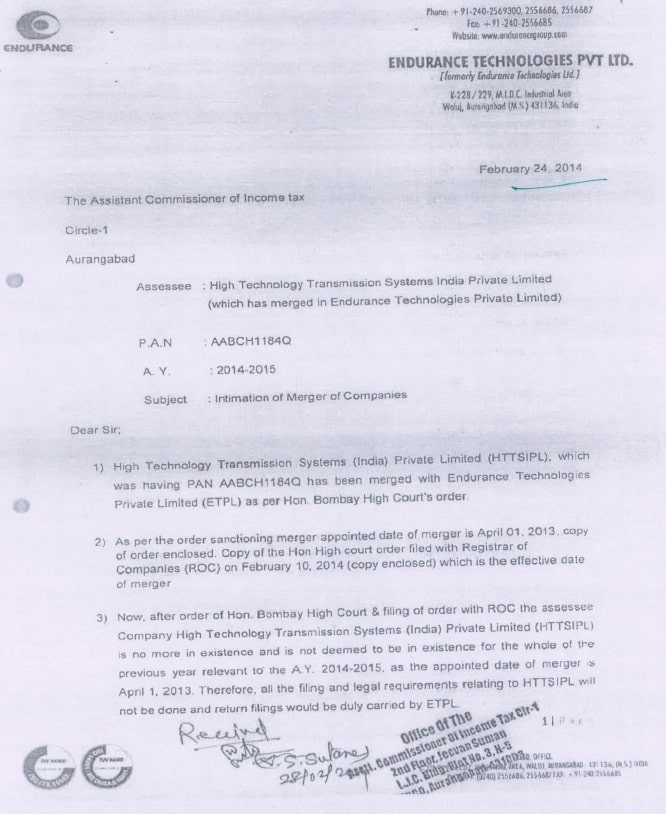

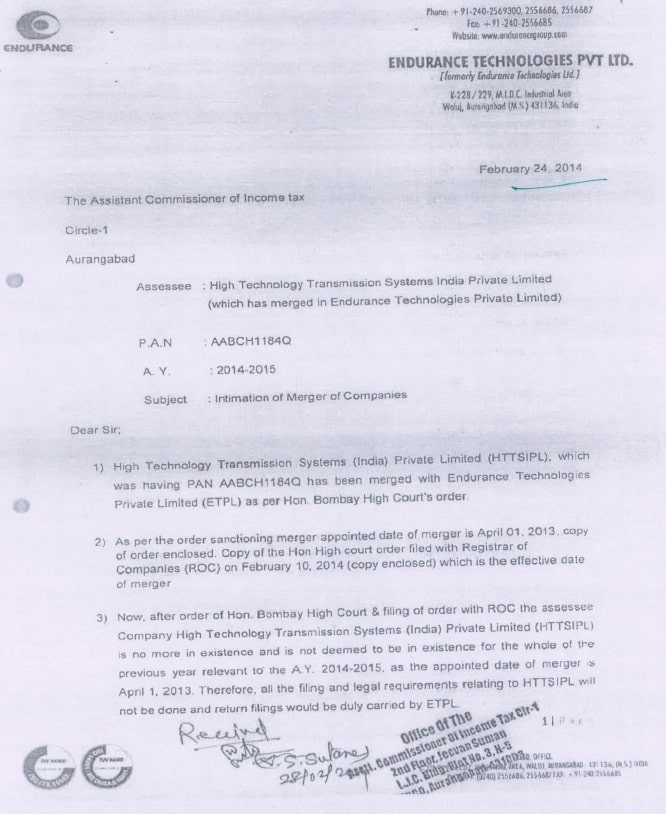

5. Before the Ld. CIT(A) / NFAC the assessee, apart from challenging the addition on merit, challenged the validity of assessment on the ground that the erstwhile company High Technology Transmission System India Pvt. Ltd. in whose name the order has been passed, has merged with Endurance Technologies Limited w.e.f. 01.04.2013 pursuant to the order of Hon’ble Bombay High Court dated 10.01.2014. It was submitted that Endurance Technologies Limited had filed a letter dated 20.02.2014 along with the copy of High Court order filed with the Registrar of Companies on 10.02.2014. Thus, High Technology Transmission System India Pvt. Ltd. had ceased to exist from the appointed date on the receipt of filing of High Court order w.e.f. 10.02.2014. Endurance Technologies Limited has also filed a letter with the Assessing Officer, Aurangabad informing of the merger. Since the Assessing Officer has passed the order on a non-existing entity, therefore, in view of the decision of the Hon’ble Supreme Court in the case of Principal Commissioner of Income Tax, New Delhi v. Maruti Suzuki India Ltd. 515 (SC) and various other decisions, it was argued that such an order passed on a non-existing entity is invalid in the eyes of law.

6. So far as the merit of the case is concerned, it was argued that all the required compliance for getting approval for availing deduction u/s 35(2AB) of the Act was made and all the relevant documents were also submitted to the DSIR which had not issued a letter to the assessee company. Further, the assessee has received Form No.3CM for the period from 01.04.2006 to 31.03.2009 and also for the period from 01.04.2015 to 31.03.2017. The assessee has been doing the same activity consistently year on year without discontinuation, therefore, DSIR has no reason for not issuing Form 3CM for the period under consideration. Since it was a procedural lapse on the part of DSIR and since From No.3CM was processed by DSIR as per the information obtained under the Right to Information Act, it was argued that the deduction claimed u/s 35(2AB) of the Act should be allowed to the assessee.

7. Based on the arguments advanced by the assessee, the Ld. CIT(A) / NFAC directed the Assessing Officer to allow the weighted deduction u/s 35(2AB) of the Act by observing as under:

“5. Decisions

I have carefully gone through the facts of the case, assessment order, grounds of appeal and submission made by the Appellant. I find that the Appellant is aggrieved with the disallowance of weighted deduction Rs.2,63,91,741/- u/s 35(2AB) of the Income Tax Act made in the assessment order dated 31 December 2018. This was the only addition made by AO.

During the course of assessment proceedings, the AO noted that, as per Rule 6(5A) of the Income tax rules, the prescribed authority for the purpose of section 35(2AB) of the Income Tax Act is the Secretary, Department of Scientific and Industrial Research (DSIR), Govt. of India. Information from DSIR reveals that the R&D unit of M/s HTTSPL (now merged with appellant company) was not approved u/s 35(2AB) of the Income Tax Act. The AO held that the Appellant Company did not enter into any agreement for research and development facility for the year under consideration, as per existing provision of law and hence the deduction claimed u/s 35(2AB) of the Act was not allowable. Such material facts were not brought to the notice of Assessing officer by the Appellant Company during the course of assessment proceedings u/s 143(3) of the Income Tax Act. This modus operandi tantamount to concealment of income has come into light as a result of information gathered from DSIR also.

I find from the submission of the Appellant that the all required compliances to get the approval for availing deduction u/s 35(2AB) of Income Tax Act has been made. The Appellant has submitted entire chain of documents which was submitted to DSIR. The DSIR has not issued any rejection letter to Appellant Company.

Further, the appellant has submitted that the appellant has received the form 3CM for the period from 1 April 2006 to 31 March 2009 and also for the period from 1 April 2015 to 31 March 2017. The Appellant Company has been doing same activity consistently year on year without discontinuation hence DSIR has not any reason to not issuing the form 3CM for the period under consideration. It is procedural lapse on part of DSIR. The Appellant submits the form 3CM of above captioned year.

In addition to the above, the appellant has submitted the additional evidence of the response made by DSIR under Right to Information Act. Where it is cleared that form 3CM was processed by DSIR however being the old record, DSIR doesn’t have the copy of 3CM.

From the perusal of the above submission, it is observed that Form 3CM is mandatory requirement to allow the deduction u/s 35(2AB) of the Act for the year under consideration. Further, the appellant has submitted all the documents to DSIR for getting the form however due to procedural lapse it was not issued within time by DSIR. Further, as per response received under Right to Information Act from DSIR, it is clear that form 3CM & Form 3CL was issued to the Appellant Company however the physical copy of the form is not available with DSIR.

The appellant’s jurisdiction ITAT in the case of Strides Arcolab Limited v. The Deputy Commissioner of Income Tax, Circle 15(3)(2), Mumbai (ITA 1903/Mum/2015) has held that

“Therefore prior to 1.7.2016 there was no legal sanctity for Form No.3CL in the context of allowing deduction u/s 35(2AB) of the Act. This view has been held by the various judicial pronouncements as relied…….” There are similar views has been held by the various judicial pronouncement.

It is noted that AO has the information which was sought from DSIR that no approval was given to appellant accordingly, the deduction was denied. However the appellant has the evidence of the response from DSIR where it was accepted by DSIR that form 3CM was issued.

Respectfully following the order of ITAT, Mumbai I hold that form 3CM is suffice to claim the deduction u/s 35(2AB) of the Income Tax Act. The form 3CM was issued by DSIR as confirmed by RTI response of DSIR. The AO is directed to examine the evidence and allow the weighted deduction u/s 35(2AB) of the Act.

In result, the appeal of the assessee is allowed.”

8. So far as the legal ground raised before the Ld. CIT(A) / NFAC challenging the validity of assessment order which has been passed on a non-existing entity is concerned, he allowed the appeal of the assessee by holding that the assessment order passed on a non-existing entity is a nullity and void ab initio. While doing so he noted that the erstwhile company High Technology Transmission System India Private Limited in whose name the orders have been passed has merged with Endurance Technologies Limited w.e.f. 1 April 2013 pursuant to the order of Hon’ble Bombay High Court dated 10 January 2014. Endurance Technologies Limited had filed letter on 28 February 2014 along with copy of High Court order filed with Registrar of companies on 10 February 2014. Thus, High Technologies System India Private Limited had ceased to exist from the appointed date on the receipt of filing of High Court order w.e.f. 10 February 2014. Endurance Technologies Limited filed a letter with the Assistant Commissioner of Income Tax Circle-1, Aurangabd and informed the merger. It was also informed that HTTS is not deemed to be in existence w.e.f. 1 April 2013 and hence all the legal compliances will be carried out by Endurance Technologies Limited. Further, the order has been passed on 31.12.2018 by the same jurisdictional officer who has recorded that HTSS is a non-existing entity. Therefore, it cannot be a case that the department was not aware of the merger of erstwhile company with ETL. Relying on the decision of Hon’ble Supreme Court in the case of Maruti Suzuki India Ltd. (supra) he held that since the notice has been issued to a non-existing entity, therefore, the entire assessment order is null and void. He accordingly quashed the same.

9. Aggrieved with such order of the Ld. CIT(A), the Revenue is in appeal before the Tribunal by raising the following grounds:

| 1. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in deleting the addition of Rs.2,63,91,741/- which was claimed by the assessee company as deduction u/s.35(2AB). |

| 2. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in holding that Form 3CM and Form 3CL was issued by DSIR, for the year under consideration. Whereas, the DSIR, vide its letter dated 24.01.2018 has categorically informed the department that M/s. High Technology Transmission System India Pvt Ltd was not issued report in Form 3CL because their R&D unit located at K-226/1, MIDC Industrial area, Waluj, Aurangabad was not approved u/s.35(2AB) for the F.Y.2010-11 to F.Y.2013-14. |

| 3. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in admitting the additional evidence of the assessee during appellate proceedings, without giving Assessing officer an opportunity of examining/cross examining of the additional evidence. |

| 4. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order treating the same against non-existing entity without considering the facts that in the assessment order passed u/s.143(3) r.w.s.147 of the Act, both the names were mentioned as “M/s. High Technology Transmission System India Pvt. Ltd (Now merged with Endurance Technologies Ltd) P. No. K-226/1, MIDC, Waluj, Aurangabad-431136” |

| 5. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order without considering that the mistake in name of the assessee company is curable u/s.292B of Income Tax Act. |

| 6. | | The order of the Assessing Officer may be restored and that of the CIT(A), NFAC, Delhi be vacated. |

| 7. | | The appellant craves leave to add, amend or alter ail or any of the grounds of appeal. |

10. The Ld. DR while objecting to the order of the Ld. CIT(A) / NFAC referred to the grounds raised by the Revenue and submitted that the Ld. CIT(A) / NFAC has violated the provisions of Rule 46A of the IT Rules. Referring to the order of the Co-ordinate Bench of the Tribunal in the case of ACIT v. Ajeet Seeds Ltd. 14/199 ITD 600 (Pune – Trib.), he submitted that the Tribunal in the said decision has held that deduction u/s 35(2AB) is not allowable if the approval was not granted by DSIR. He heavily relied on the order of the Assessing Officer and submitted that the order of the Ld. CIT(A) / NFAC being not in accordance with law should be reversed and that of the Assessing Officer be restored.

11. The Ld. Counsel for the assessee on the other hand reiterated the same arguments as made before the Ld. CIT(A) / NFAC and supported his order. He submitted that High Technology Transmission System India Pvt. Ltd. had merged with Endurance Technologies Private Limited as per the order of Hon’ble Bombay High Court dated 10.02.2014. The appointed date of merger was 01.04.2013 which was informed to the JCIT, Range-1, Aurangabad vide letter dated 20.02.2014, copy of which is placed at pages 4 and 5 of the of the paper book. Referring to pages 6 and 7 of the paper book, he submitted that the fact of amalgamation was also informed to the ACIT, Circle-1, Aurangabad vide letter dated 24.02.2014. He submitted that the Assessing Officer had issued notice u/s 148 of the Act on 16.02.2018 which was issued in the name of High Technology Transmission System India Pvt. Ltd. even though the said company had already merged with Endurance Technologies Pvt. Ltd. w.e.f. 01.04.2013 as per the order of Hon’ble Bombay High Court dated 10.02.2014. He submitted that the assessee had duly informed the Assessing Officer regarding the fact of merger along with the copy of the order of Hon’ble High Court. Therefore, issue of notice u/s 148 of the Act on 16.02.2018 in the name of a non existing entity is bad in law. For the above proposition, he relied on the decision of Hon’ble Bombay High Court in the case of City Corporation Ltd. v. Asstt. CIT 301 (Bombay). He submitted that in this case also the Assessing Officer had issued notice u/s 148 in the name of Amanora Future Towers Pvt. Ltd. which had merged with City Corporation Ltd. The Hon’ble Bombay High Court has held that the notice issued u/s 148 in the name of a non existing entity is bad in law.

12. The Ld. Counsel for the assessee submitted that the Assessing Officer passed the order u/s 147 of the Act wherein he has mentioned under the name column “High Technology Transmissions Systems India Pvt. Ltd. (now merged with Endurance Technologies Ltd.)”. However, the PAN mentioned by the Assessing Officer in the assessment order is AABCH1184Q which belongs to High Technologies Transmissions Systems India Pvt. Ltd. He submitted that the Assessing Officer should have mentioned PAN of Endurance Technologies Pvt. Ltd. Since the PAN of High Technologies Transmissions Systems India Pvt. Ltd. has been mentioned, therefore, the assessment order passed in the PAN of the nonexistent entity is bad in law. He relied on the following decisions to the proposition that the order passed on a non existing entity is bad in law:

| (a) | | Maruti Suzuki India Ltd. (supra) |

| b. | | Uber India Systems (P.) Ltd. v. Asstt. Commissioner of Income 200 (Bombay) |

| c. | | Alok Knit Exports Ltd. v. Dy. CIT 221/446 ITR 748 (Bombay) |

| d. | | Capgemini Technology Services India Ltd. v. ACIT 616 (Pune – Trib.) |

13. So far as the merit of the case is concerned, the Ld. Counsel for the assessee submitted that the assessee had claimed deduction u/s 35(2AB) of Rs.3,58,47,391/- which was denied by the Assessing Officer on the ground that the relevant R & D unit was not approved by DSIR u/s 35(2AB) and therefore, the assessee is not entitled to claim the deduction. He submitted that before the Assessing Officer it was clarified that the assessee had made an application before DSIR and merely because the prescribed authority had not submitted Form 3CL, the deduction should not be disallowed.

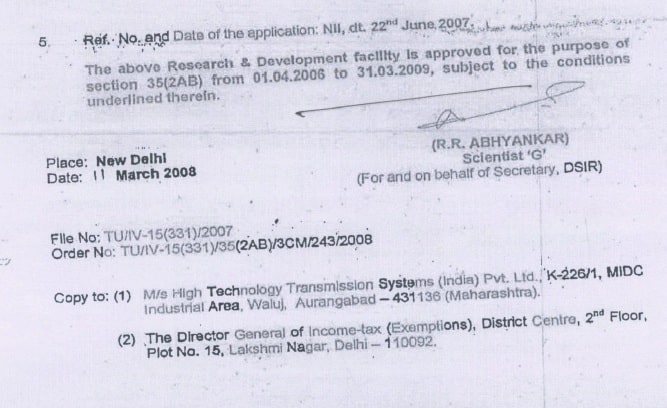

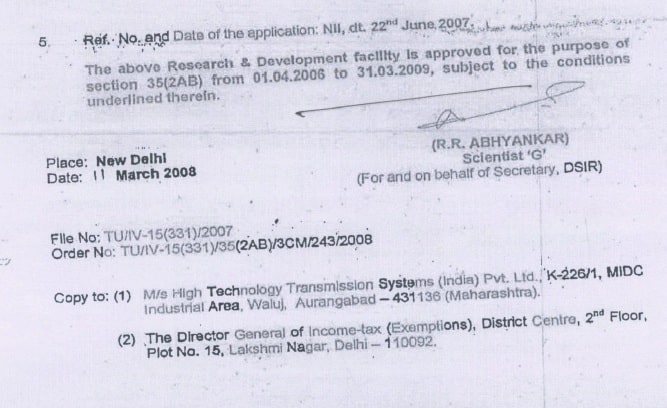

14. Referring to page 29 and 30 of the paper book, the Ld. Counsel for the assessee submitted that the R & D unit at K-226/1, MIDC Industrial, Waluj, Aurangabad-431136 was approved as an eligible R & D unit u/s 35(2AB) by DSIR in Form No. 3CM dated 11.03.2008. In the said Form 3CM, DSIR has mentioned that the R & D facility is approved for the purposes of section 35(2AB) from 01.04.2006 to 31.03.2009. Referring to paper book pages 31 and 32 he submitted that the said unit has been approved by DSIR for the purposes of weighted deduction u/s 35(2AB) for the period 01.04.2015 to 31.03.2017. Referring to pages 40-41 of the paper book, he submitted that for the period 01.04.2009 to 31.03.2012, the said unit was recognized as a R & D unit by DSIR.

15. Referring to pages 42 and 43 of the paper book, he submitted that the recognition has been issued by DSIR for the period from 01.04.2012 to 31.03.2015. Referring to pages 33 to 39 of the paper book, he submitted that the assessee had also applied for approval in Form 3CK. He submitted that since DSIR had given its approval for the period 01.04.2006 to 31.03.2009 and also for the subsequent period from 01.04.2015 to 31.03.2017 and there is no dispute that the assessee had made an application in Form 3CK for the intervening period and there is no order of DSIR rejecting the application filed by the assesse, therefore, the claim of deduction u/s 35(2AB) cannot be denied. For the above proposition, he relied on the following decisions:

| a. | | Minilec India (P.) Ltd. v. Asstt. CIT 213/171 ITD 124 (Pune – Trib.) |

| b. | | Advance Enzyme Technologies (P.) Ltd. v. Asstt. CIT 498/183 ITD 50 (Mumbai – Trib.) |

| C. | | Asstt. CIT v. Meco Instruments (P.) Ltd. 24 (Mumbai) |

| d. | | Nath Bio Genes (India) Ltd. v. Asstt. CIT [IT Appeal Nos. 367 and 417 (Pun.) of 2012, dated 27-1-2014] |

16. He submitted that the approval issued by DSIR for the period 01.04.2006 to 31.03.2009 was approved by DSIR for the first time which was in Form 3CM. In the said form issued by DSIR, it is stated that the facility is approved from 01.04.2006 to 31.03.2009. Referring to Form 3CM as per the Income Tax Rules, he submitted that the period of validity prescribed by DSIR in its approval dated 11.03.2008 was not a condition stipulated in Form 3CM which was prescribed by CBDT. The date and validity of recognition to be granted by DSIR was introduced in Form 3CM w.e.f. 01.07.2016. Accordingly, till that time, DSIR had no authority to prescribe the period of validity in Form 3CM. He accordingly submitted that once the unit has been approved by DSIR, the assessee would be eligible for weighted deduction and the period of validity prescribed by DSIR in Form 3CM is beyond its jurisdiction since there was no such condition prescribed in Form 3CM at the relevant period of time. He accordingly submitted that the claim of deduction u/s 35(2AB) should be allowed.

17. Referring to page 45 of the paper book, the Ld. Counsel for the assessee submitted that the assessee had filed an application before DSIR under RTI and had sought information as to whether Form 3CM was issued by it for the concerned period. Referring to page 46 of the paper book, he submitted that in response to the RTI application, DSIR replied that as per its record, Form 3CM and 3CL was generated for the concerned period. However, it was also stated that the copy of the same is not available since it is an old record. He accordingly submitted that the above reply of DSIR clearly indicates that the assessee company was granted approval in Form 3CM for the period concerned and on this ground also the claim of weighted deduction is justified in law. He accordingly submitted that the order of Ld. CIT(A) / NFAC being in accordance with law should be upheld and the grounds raised by the Revenue should be dismissed.

18. So far as the decision relied on by the Ld. DR in the case of Ajeet Seeds Ltd. (supra) is concerned, the Ld. Counsel for the assessee submitted that the Tribunal in the said decision has held that deduction u/s 35(2AB) is not allowable if the approval was not granted by DSIR. He submitted that the said decision is not correct and per incuriam. He submitted that in that case the Ld. CIT(A) / NFAC has allowed the claim of deduction u/s 35(2AB) by following the decisions of the Pune Bench of the Tribunal in the case of Minilec India Pvt. Ltd. (supra) and Nath Bio Genes India Ltd. (supra). Although the Tribunal in the case of Ajeet Seeds Ltd. (supra) refers to this fact in para 6 of its order, however, without following the above two decisions or without distinguishing the same or without any discussion as to how these two decisions are not applicable to the facts of the present case before it, the Tribunal simply dismissed the claim of deduction u/s 35(2AB). Therefore, the decision relied on by the Ld. DR cannot be followed the same being per incuriam. Further, in para 13 of the order in the case of Ajeet Seeds Ltd. (supra), the Tribunal has discussed regarding the decisions in the case of Meco Instruments (P.) Ltd. (supra) and Advance Enzyme Technologies Pvt. Ltd. reported in 498. It has been held by the Tribunal that these decisions are not applicable since in those cases admittedly the requisite approval in Form 3CM was obtained by the assessees for the relevant assessment year. The Ld. Counsel for the assessee submitted that the above factual assertion in para 13 of the order is also not correct.

19. Referring to the decision in the case of Meco Instruments Pvt. Ltd. (supra) he submitted that in that case the concerned assessment year was 2005-06. Referring to para 6.1 of the said order he submitted that the Tribunal has clearly held that no approval was issued for the relevant assessment year. He drew the attention of the Bench to para 6.1 of the said order which reads as under:

“6.1 In the backdrop of these facts, the issue before us is whether nonavailability of the approval in the prescribed form for the relevant assessment year could disentitle the assessee of deduction under section 35(2AB) or not. In this regard, we may first refer to section 35 which deals with expenditure on scientific research. This section entitles the assessee to get deduction in respect of expenditure on scientific research laid out or expended in relation to business.”

20. He submitted that thereafter, it has been held that even if the approval in Form No.3CM was not issued the claim of deduction u/s 35(2AB) cannot be rejected. Similarly in the case of Advance Enzyme Technologies Pvt. Ltd. (supra) is concerned, he submitted that the assessment year was 2010-11. In para 5 it has been clearly mentioned that the deduction u/s 35(2AB) has been denied on the ground that the approval in Form No.3CM was not available for the year under consideration. Thereafter, it has been held that the deduction u/s 35(2AB) is allowable. The Ld. Counsel for the assessee drew the attention of the Bench to para 17 of the order which reads as under:

“17. In this case, it is undisputed fact that the recognition was valid from 1-42001, and which was available during this period. The application for approval in form 3CK was filed as back as in 9-1-2002. The assessee has claimed deduction u/s 35(2AB) of the Act right from A.Y 2001-02 to A.Y 2008-09 and such claim was accepted by the department. Further, the facility was approved/recognized up to 31.032016, vide communication dated 15-1-2014, and such approval was once again renewed up to 31-3-2019. From the above, it is very clear that the assessee facility was approved by the competent authority i.e. the Secretary DSIR, but there was no approval in form No. 3CM for the impugned Assessment year. Therefore, we are of the considered view that from the settled legal position of the law by the various cases of High Courts as discussed here in above in preceding paragraphs what is relevant to decide eligibility for weighted deduction u/s 35(2AB) of the Act, is existence of R&D facility and recognition of such facility by the competent authority. Once the facility has been approved by the competent authority, then there is no cut off date is prescribed for approval of such facility and the benefit of deduction u/s 35(2AB) of the Act, should be given to the assessee as long as the recognition is in force. Hence, we are of the considered view that the AO as well as Ld. CIT(A) were in correct in denied the benefit of weighted deduction claimed u/s 35(2AB) of the Hence, we direct the AO to allow weighted deduction claimed u/s 35(2AB) of the Act.”

21. He accordingly submitted that although in both the above referred cases of the Mumbai Bench of the Tribunal the approval in Form 3CM was not granted for the concerned assessment year, still the Tribunal in those cases held that the deduction u/s 35(2AB) was allowable. However, the Tribunal in the case of Ajeet Seeds Ltd. (supra) has mentioned that these decisions are not applicable since in those cases the approval in Form 3CM was granted for the relevant assessment year. Thus, reasonings given by the Tribunal in the case of Ajeet Seeds Ltd. (supra) is totally incorrect and therefore, on this ground also the decision cannot be followed. The Ld. Counsel for the assessee reiterated that the decision in the case of Ajeet Seeds Ltd. (supra) is per incuriam and is not applicable to the facts of the present case.

22. The Ld. Counsel for the assessee referring to the decision of Hon’ble Andhra Pradesh High Court in the case of CIT v. B.R. Constructions 473/202 ITR 222 (Andhra Pradesh) (Full Bench) submitted that the Hon’ble High Court in the said decision has held that the decision, which is per incuriam is not a binding precedent. He accordingly submitted that since the said decision is not applicable to the facts of the present case, the argument of the Ld. DR on this issue has to be rejected outright. He submitted that a similar view has been taken by the Mumbai Bench of the Tribunal in the case of Mehratex India Ltd. v. Dy. CIT [2005] 3 SOT 539 (Mumbai). The Ld. Counsel for the assessee referring to the decision of Hon’ble Gujarat High Court in the case of Claris Lifesciences Ltd. reported in APL Apollo Tubes Ltd. v. Commissioner, State Tax GST 113 (Allahabad) submitted that the Hon’ble High Court has specifically held that Form No.3CM, which is order of approval as provided by the Rules in this behalf also does not have any mention of the date of approval rather it speaks only of the approval. This fact has been ignored by the Tribunal in the case of Ajeet Seeds Ltd. (supra).

23. Referring to para 11 of the order of the Tribunal in the case of Ajeet Seeds Ltd. (supra), he submitted that the Tribunal in the said decision has stated that the application of the assessee for extension of the approval was denied by the prescribed authority on account of the fact that the assessee company had not adhered to the prescribed conditions. However, in the present case, DSIR has confirmed that the approval was granted to the assessee and therefore, even on factual aspects also the said decision is not applicable. He accordingly submitted that the argument of the Ld. DR on this issue should be rejected.

24. We have heard the rival arguments made by both the sides, perused the orders of the Assessing Officer and Ld. CIT(A) / NFAC and the paper book filed on behalf of the assessee. We have also considered the various decisions cited before us. We find the original assessment in the instant case was completed u/s 143(3) on 04.03.2014 accepting the returned income filed by the assessee. Subsequently, the Assessing Officer reopened the assessment u/s 147 of the Act on the ground that the assessee has wrongly claimed deduction u/s 35(2AB) of the Act which tantamount to concealment of income and which came to light as a result of information gathered from DSIR. We find the Assessing Officer, rejecting the various explanations given by the assessee and observing that the assessee has not obtained Form 3CL from the prescribed authority for which it is not ascertainable as to what amount was actually incurred towards R&D activities, rejected the claim of deduction u/s 35(2AB) of the Act amounting to Rs.2,63,91,741/-. We find before the Ld. CIT(A) / NFAC the assessee, apart from challenging the addition on merit, challenged the validity of the assessment on the ground that the same has been passed on a non existing entity. We find the Ld. CIT(A) / NFAC not only directed the Assessing Officer to delete the addition on merit but also held that the assessment order, which has been passed on a non existing entity, is null and void. While holding so, he relied on the decision of Hon’ble Supreme Court in the case of Maruti Suzuki Ltd. (supra). The reasonings given by the Ld. CIT(A) / NFAC while allowing the claim of deduction on merit has already been reproduced in the preceding paragraphs.

25. We do not find any infirmity in the order of the Ld. CIT(A) / NFAC on this issue. Admittedly the erstwhile company High Technology Transmission System India Pvt. Ltd., in whose name the orders have been passed, has merged with Endurance Technologies Limited w.e.f. 01.04.2013 pursuant to the order of Hon’ble Bombay High Court dated 10.01.2014. We find the assessee, vide letter dated 20.02.2014, has addressed to the JCIT, Range-1, Aurangabad (copy of which is placed at pages 4 and 5 of the paper book) has intimated regarding the merger of the company, the contents of which read as under:

26. Similarly, the assessee vide letter dated 24.02.2014, copy of which is placed at pages 6 and 7 of the paper book, has addressed a letter to the ACIT, Circle-1, Aurangabad intimating the merger of the company which reads as under:

27. Thus, High Technology Transmission System India Pvt. Ltd. had ceased to exist from the appointed date on the receipt of filing of High Court order w.e.f. 10.02.2014 which has been duly intimated to the JCIT as well as the Assessing Officer. Therefore, we do not find any infirmity in the order of the Ld. CIT(A) / NFAC holding that it cannot be a case where the department was not aware of the merger of the erstwhile High Technology Transmission System India Pvt. Ltd. with Endurance Technologies Limited. Further, we find that although the Assessing Officer in the assessment order in column 1 has mentioned the name and address of the assessee as M/s. High Technology Transmission System India Pvt. Ltd. (now merged with Endurance Technologies Limited), however, he has used the PAN number AABCH1184Q which is the PAN of High Technology Transmission System India Pvt. Ltd. which can be verified from the original order passed u/s 143(3) of the Act on 04.03.2014 and page 1 of the assessment order reads as under:

28. Thus, the Assessing Officer despite being informed by the assessee has passed the assessment order on a non existing entity.

29. We find an identical issued had come up before Hon’ble Bombay High Court in the case of City Corporation Ltd. (supra). In that case there was merger of AFTPL into assessee company CCL w.e.f. 01.04.2018 and the merger was brought to the notice of the department. The Revenue issued notice u/s 148 of the I.T. Act, 1961 in the name of AFTPL. Since the impugned notice was issued on a non existing company despite Revenue’s knowledge of its non-existence, the Hon’ble Bombay High Court, following the decision of Hon’ble Supreme Court in the case of Maruti Suzuki India Ltd. (supra) quashed such notice. The relevant observations of Hon’ble Bombay High Court read as under:

“21. The averments in the above paragraphs support the Petitioner’s case. In paragraph 4.3, there is a clear admission that the amalgamation of the company was brought to the notice of the Department. The only explanation is that ” notice was issued on the non-existing company due to technical glitch in the system wherein no field in the notice u/s 148 of the Act is editable.”

22. In paragraph 4.2, the approval obtained from the Principal Commissioner for the issue of impugned notices is emphasised. The affidavit states that files were moved proposing notices in the names of both entities, AFTPL and the Petitioner (CCL). There was a reference to seizure proceedings, the two PAN numbers, and the lack of an editable field on this notice. Therefore, it was submitted that the notice was generated on AFTPL’s PAN.

23. In short, the averments in paragraphs 4.2 and 4.3 of the affidavit purport to apportion the blame on the department’s utility system. Based upon this, the fundamental error is sought to be passed off as a mere technical glitch. Finally, the concluding sentence ofparagraph 4.2 of the affidavit urges this Court:

“Thus, Hon’ble Court is requested to direct petitioner to treat the notice as good as in the name of existent entity. ”

24. Based on the above averments and the arguments, we are afraid we cannot condone the fundamental error in issuing the impugned notices against a nonexisting company despite full knowledge of the merger. The impugned notices, which are non-est cannot be treated as “good” as urged on behalf of the Respondents. In Maruti Suzuki (supra), the Hon’ble Supreme Court has held that issuing notice in the name of a non-existing company is a substantive illegality and not a mere procedural violation of the nature adverted to in Section 292B of the IT Act.

25. Mr Suresh Kumar’s contention about the facts in the present case being akin to those in Skylight Hospitality LLP (supra) cannot be accepted. Except for submitting that the facts are similar or comparable, nothing was shown to us based upon which such a submission could be entertained, much less sustained. In any event, the Hon’ble Supreme Court, in the case of Maruti Suzuki (supra), considered the Delhi High Court’s decision in Skylight Hospitality LLP (supra) and held that the same was delivered “in the peculiar facts of wp.6076-2023 & ors.docx the case”. In fact, even the Delhi High Court had clarified that the decision was in the case’s peculiar facts.

26. In that case, there was substantial and affirmative material and evidence on record to show that issuing the notice in the name of the dissolved company was only a mistake. The Court held that the Special Leave Petition filed by the Skylight Hospitality LLP (supra) against the judgment of the Delhi High Court rejecting its challenge was dismissed in the peculiar facts of the case, which weighed with the Court in concluding that there was merely a clerical mistake within meaning of Section 292B. The Hon’ble Supreme Court held that in Maruti Suzuki (supra) the notice under Section 143(2) under which jurisdiction was assumed by the assessing officer, was issued to a non-existent company. The assessment order was issued against the amalgamating company. “This is a substantive illegality and not a procedural violation of the nature adverted to in Section 292B”.

27. The argument now sought to be raised by Mr Suresh Kumar based on Skylight Hospitality LLP (supra) was considered and rejected by the Gujarat High Court in Anokhi Realty (P) Ltd. v. Income-tax Officer5. In Adani Wilmar Ltd. v. Assistant Commissioner of Income-tax 6, another Division Bench of the Gujarat High Court rejected the Revenue’s argument based on lack of inter-departmental coordination or non-application of mind when materials relating to amalgamation were already available with the department. The Court held that based upon such grounds, notices could not have been issued to a non-existent company.

28. The Delhi High Court, in the case of Principal Commissioner of Income Tax -7, Delhi v. Vedanta Limited 7 rejected a contention very similar to that raised by Mr Suresh Kumar, relying on Skylight Hospitality LLP (supra). The Delhi High Court noted that the decision of the Supreme Court in Maruti Suzuki (supra), while enunciating the legal position concerning an order being framed in the name of a non- existent entity, had unequivocally held as being a fatal flaw which could neither be corrected nor rectified. It had held explicitly that such an order cannot be salvaged by taking recourse to Section 292B of the IT Act. The Court also noticed the peculiar facts obtained in Skylight Hospitality LLP (supra), which alone had led to the Supreme Court upholding the assessment made, albeit in the name of an entity that had ceased to exist.

29. Accordingly, after considering the above facts and circumstances and the law, we are satisfied that the impugned notices deserved to be quashed and set aside. We do so by making the rule absolute in these petitions.

30. Before we conclude, we need to clarify that nothing in this order would preclude the respondents from issuing a fresh notice to CCL for reassessment, should the law otherwise permit it, and if the circumstances justify it. We have quashed the impugned notices only because they were issued to a non- existing company or entity despite the respondents’ knowledge of its non-existence. All contentions in this regard are left open because we have not addressed them in this order.”

30. The various other decisions relied on by the Ld. Counsel for the assessee also supports his case to the proposition that the issue of notice u/s 148 of the Act on a non existing entity is void ab initio. We, therefore, do not find any infirmity in the order of the Ld. CIT(A) / NFAC holding that the entire assessment order, which has been passed in the case of a non existing entity is null and void. The grounds raised by the Revenue on this issue are accordingly dismissed.

31. Even otherwise on merit also we do not find any infirmity in the roder of the Ld. CIT(A) / NFAC on this issue. We find the Assessing Officer in the instant case rejected the claim of deduction u/s 35(2AB) on the ground that the relevant R & D unit is required to be approved by DSIR u/s 35(2AB). Since the unit of the assessee was not approved by DSIR u/s 35(2AB), therefore, he rejected the claim of the assessee. We find the Ld. CIT(A) / NFAC allowed the claim of the assessee, the reasons of which have already been reproduced in the preceding paragraphs.

32. We do not find any infirmity in the order of the Ld. CIT(A) / NFAC. It is an admitted fact that R & D unit at K-226/1, MIDC Industrial, Waluj, Aurangabad is an eligible R & D unit u/s 35(2AB) by DSIR in Form No. 3CM dated 11.03.2008, copy of which is placed at pages 29-30 of the Paper Book. A perusal of the said Form 3CM shows that DSIR has mentioned that the R & D facility is approved for the purposes of section 35(2AB) from 01.04.2006 to 31.03.2009. Page 2 of the said order reads as under:

33. Similarly, the said unit has been approved by DSIR for the purposes of weighted deduction u/s 35(2AB) for the period 01.04.2015 to 31.03.2017, copy of which is placed at pages 31-32 of the Paper Book. We find for the period 01.04.2009 to 31.03.2012, the said unit was recognized as a R & D unit by DSIR and the copy of the recognition dated 09.04.2009 is placed at pages 40-41 of the Paper Book. Similarly the recognition issued by DSIR for the period from 01.04.2012 to 31.03.2015 vide letter dated 18.07.2012 is placed at pages 42-43 of the Paper Book. We further find from pages 33 to 39 of the Paper Book that the assessee had also applied for approval in Form 3CK.

34. So far as the period between 01.04.2009 to 31.03.2015 is concerned, there is no dispute to the fact that the assessee had made an application under Form 3CK which has not been rejected by DSIR. Further DSIR had granted recognition to the said unit for period from 01.04.2009 to 31.03.2012 and for the period from 01.04.2012 to 31.03.2015. Therefore, when the approval has been granted for the earlier period as well as the subsequent period, we find merit in the argument of the Ld. Counsel for the assessee that the claim of weighted deduction u/s 35(2AB) should not be denied for the intervening period.

35. We further find from Form 3CM approved by DSIR for the period from 01.04.2006 to 31.03.2009 that the facility of the assessee is approved for the said period. The period of validity prescribed by DSIR in its approval dated 11.03.2008 was not a condition stipulated in Form 3CM which was prescribed by CBDT. The date and validity of recognition granted by DSIR was introduced in Form 3CM w.e.f. 01.07.2016. Therefore, till that time, DSIR had no authority to prescribe the period of validity in Form 3CM. We further find merit in the argument of the Ld. Counsel for the assessee that once the unit has been approved by DSIR, the assessee would be eligible for weighted deduction and the period of validity prescribed by DSIR in Form 3CM is beyond its jurisdiction in absence of such condition prescribed in Form 3CM at the relevant period of time. We find when the assessee filed an application before DSIR under RTI and had sought information as to whether Form 3CM was issued by it for the concerned period, DSIR filed a reply that as per its record, Form 3CM and 3CL were generated for the concerned period. However, it was also stated that the copy of the same is not available since it is an old record. The copies of RTI application and reply of DSIR are placed at pages 45 and 46 of the Paper Book. A perusal of the reply given DSIR clearly indicates that the assessee company was granted approval in Form 3CM for the concerned period. Therefore, we find merit in the argument of the Ld. Counsel for the assessee that the weighted deduction was rightly allowed by the Ld. CIT(A) / NFAC.

36. We find the Pune Bench of the Tribunal in the case of Minilec India (P.) Ltd. (supra) has held that if recognition to facility given by prescribed authority which is mandate of section 35(2AB) is maintained, assessee has to be accorded deduction under section 35(2AB); non-receipt of Form No. 3CM is at best a procedural lapse and is not fatal for denial of claim of deduction under section 35(2AB). The relevant observations of the Tribunal at para 30 read as under:

“30. The issue which arises is whether the assessee can be denied deduction under section 35(2AB) of the Act for non receipt of form No.3CM. The assessee admittedly, had received recognition in the initial period and thereafter, it is case of renewal of recognition of in-house R&D facility, which was also granted by the prescribed authority for the period ending 31.03.2012 and also for the period ending 31.03.2015. The correspondence between the assessee and DSIR for the third phase reflects a reminder being sent by DSIR to renew the recognition of inhouse R&D facility beyond 31.03.2012. In other words, DSIR had not derecognized the facility for the years 2009-12. The recognition to the facility has been granted from start till date and has not been withdrawn. In other words, recognition given by the prescribed authority which is mandate of section 35(2AB) of the Act is maintained and once the recognition is so maintained, the assessee has to be accorded deduction under section 35(2AB) of the Act. The non receipt of form No.3CM for the intervening three years is at best a procedural lapse and is not fatal for denial of claim of deduction under section 35(2AB) of the Act. Accordingly, we hold so. The prescribed authority in any case under the preamended provisions had no authority to look into the nature and quantum of expenditure except in the first year to see investment in land and building. After recognition of facility and approval by DSIR, the Assessing Officer is to allow the claim of assessee after verifying the same. Thus, we direct the Assessing Officer to allow deduction claimed under section 35(2AB) of the Act to the facility for the year under appeal. The ground of appeal No.1 raised by the assessee is thus, allowed.”

37. We find the Mumbai Bench of the Tribunal in the case of Advance Enzyne Technologies Pvt. Ltd. (supra) has held that once existence of R & D facility was not disputed and expenditure for that purpose was genuine in nature and recognition to facility was granted way back in 2001-02, which was valid during relevant period, then merely for reason of non-issue of approval for certain period in prescribed Form 3CM by competent authority, weighted deduction claimed under section 35(2AB) could not be denied. The relevant observations of the Tribunal from para 15 to 20 read as under:

“15. In this case, on perusal of facts available on record, we find that the assessee facility was approved from assessment year 2001-02 and such recognition was continued up to 31.07.2012. Thereafter, the assessee has filed an application for recognition on 09.06.2012 and such recognition has been granted by the competent authority vide its communication dated 15.01.2014, which is valid up to 31.03.2016, subsequently, the renewal has been granted up to 31.03.2019. Further, the A.O neither disputed existence of R&D facility nor genuineness of expenditure incurred by the assessee. Once existence of R&D facility was not disputed and expenditure for that purpose is genuine in nature and also the recognition was granted way back in 2001-02, which is valid even now, then merely for the reason of non issue of approval for certain period in prescribed form 3CM by the competent authority, even though, the assessee has made an application for approval in prescribed form 3CK and also filed necessary evidence including details of expenditure then, the assessee cannot be furnished non issue of such approval by the competent authority and weighted deduction claimed u/s 35(2AB) cannot be denied.

16. Coming back to the case laws relied upon by Ld. DR for the Revenue. The Ld. DR has vehemently argued the case in light of the decision of ITAT Mumbai, in the case of PCP Chemicals Pvt Ltd. , v. ITO (supra) and submitted that facts of the present case are entirely similar to facts considered by the Tribunal and hence the assessee case is covered squarely by the decision of ITAT Mumbai, in the case of PCP Chemicals Pvt Ltd., v. ITO. We find that although the Tribunal has distinguished the decision of Hon’ble Gujarat High Court in the case of Claris LifeScience Ltd., v. CIT and Hon’ble Delhi High Court in the case of Maruthi Suzuki India Ltd. v. Union of India, but fact remains that in the case of PCP Chemical Pvt Ltd. , v. ITO (supra) the assessee has filed an application for recognition / approval on 12.08.2011 and in form No. 3CK and the competent authority has approved the facility for the period from 01.04.2011 to 31.03.2013. The assessee has claimed deduction for the A.Y 2011-12 for which neither recognition nor approval from the competent authority was received by the assessee. Under those facts, the Tribunal came to the conclusion that when the initial approval / recognition was granted with effect from 01.04.2011 on the basis of application filed by the assessee on 12.08.2011 then the deduction for expenditure incurred for the previous period i.e before the facility was approved by the competent authority cannot be claimed u/s 35(2AB) of the Act. We further, noted that in the case before the Tribunal in PCP Chemicals Pvt Ltd., (supra) the facts were entirely different because the unit was first approved from 01.04.2011 and for the assessment year prior to 01.04.2011 there was no recognition / approval from the competent authority. The assessee has filed an application on 12.08.2011 on that basis the competent authority has given approval with retrospective effect from 01.04.2011. From the above, it is clear that although the Tribunal has taken a different view in the matter, but it has followed the ratio laid down by the Hon’ble Gujarat High Court in the case of Claris lifescience Ltd v. CIT (supra) and the Hon’ble Delhi High Court in the case of Maruthi Suzuki India Ltd., v. Union of India (supra), which is evident from the fact that approval cannot be taken back from the financial year form which date the assessee has filed its application in form No. 3CK. In fact, the case law relied upon by the DR in PCP Chemicals Pvt Ltd., (supra) supports the case of the assessee in as such the Tribunal has accepted the decision Gujarat High Court to the effect that the approval should be granted from the first day of the financial year in which the application is filed, irrespective of the date of the order granting such approval. Coming back to another case relied upon by the Ld. DR in the case of Nivo Controls Ltd. v. CIT. We find that the Tribunal has rejected the claim of the assessee on entirely different facts which is evident from the fact that in 263 proceedings it has upheld the findings of the Ld. CIT for rejection of deduction u/s 35(2AB) of the Act, on the ground that the assessee has failed to maintain separate books of account for its R&D facility on the basis of admission of authorized representative of the assessee that no such separate books of accounts were maintained.

17. In this case, it is undisputed fact that the recognition was valid from 01.04.2001, and which was available during this period. The application for approval in form 3CK was filed as back as in 09.01.2002. The assessee has claimed deduction u/s 35(2AB) of the Act, right from A.Y 2001-02 to A.Y 2008-09 and such claim was accepted by the department. Further, the facility was approved / recognized up to 31.032016, vide communication dated 15.01.2014, and such approval was once again renewed up to 31.03.2019. From the above, it is very clear that the assessee facility was approved by the competent authority i.e the Secretary DSIR, but there was no approval in form No. 3CM for the impugned Assessment year. Therefore, we are of the considered view that from the settled legal position of the law by the various cases of High Courts as discussed here in above in preceding paragraphs what is relevant to decide eligibility for weighted deduction u/s 35(2AB) of the Act, is existence of R&D facility and recognition of such facility by the competent authority. Once the facility has been approved by the competent authority, then there is no cut off date is prescribed for approval of such facility and the benefit of deduction u/s 35(2AB) of the Act, should be given to the assessee as long as the recognition is in force. Hence, we are of the considered view that the A.O as well as Ld. CIT(A) were in correct in denied the benefit of weighted deduction claimed u/s 35(2AB) of the. Hence, we direct the A.O to allow weighted deduction claimed u/s 35(2AB) of the Act.

18. In the result, appeal filed by the assessee is allowed.”

38. We find the Mumbai Bench of the Tribunal in the case of Meco Instruments Pvt. Ltd. (supra) has held that merely on ground of technicalities of procedure, benefit bestowed by legislature (section 35(2AB) of Income-tax Act) cannot be denied. The relevant observations of the Tribunal from para 6.1 read as under:

“6.1 In the backdrop of these facts, the issue before us is whether non-availability of the approval in the prescribed form for the relevant assessment year could disentitle the assessee of deduction u/s.35(2AB) or not. In this regard, we may first refer to section 35 which deals with expenditure on scientific research. This section entitles the assessee to get deduction in respect of expenditure on scientific research laid out or expended in relation to business.

6.2 Section35(2AB) deals with a situation where a company engaged in the business of [bio-technology] or in the business of manufacture or production or any other article or thing not specified in the list of 11th Schedule]] incurs any expenditure on scientific research (not being expenditure in the nature of cost of any land and building) on in-house research and development facility as approved by the prescribed authority i.e. Secretary, Government of India, Ministry of Science and Technology, Department of Scientific & Industrial Research. It is pertinent to note that this section talks of only approval of the prescribed authority but nowhere in the section the phrase “as prescribed” has been used. Therefore, if the approval simpliciter is available from the prescribed authority, then as per this section, no objection could be raised. However, sub-section(4) of Section 35 requires the prescribed authority to submit its report in relation to the approval of the said facility to the Director General in such form and within such time as may be prescribed. Therefore, it would be too technical to hold that merely because the term ‘prescribed’ has not been used in section 35(2AB)(i) it follows that there were no prescribed rules for the same. However, at the same time, absence of phrase ‘prescribed’ in section 35(2AB)(i) mitigates the assessee’s default. Rule 6 of the I.T.Rules prescribes the authority for expenditure on scientific research and as per Rules 6(1B) for the purposes of sub-section (2AB) of section 35, the prescribed authority shall be the Secretary, Department of Scientific and Industrial Research. The sub-Rule (4) requires the company to furnish the application in Form No.3CK. As per sub-Rule (5A), if the prescribed authority is satisfied that the conditions provided in this rule and in sub-section (2AB) of section 35 of the Act are fulfilled, then pass an order in writing in Form No. 3CM. However, as per the proviso to sub-rule (5A), if the prescribed authority is not so satisfied it is to grant reasonable opportunity to the assessee company before rejecting its application. Sub-Rule (7A) prescribes the certain conditions subject to which approval is to be granted. A close reading of the section r.w. Rule 6 would reveal that nowhere any time has been prescribed within which the application is required to be filed by the assessee company. Further, nowhere, any condition has been prescribed regarding cut off date from which the approval could be made effective. Therefore, once the assessee company is granted approval it will apply till it is revoked with reference to all the assessment years, which come within the ambit of that period. Therefore, mere mentioning of 1.4.2007 in the order dated 28.8.2008 was of no consequence and the approval granted in Form 3CM was also applicable for A.Y. 2005-06. In this regard, it is further noticeable that while granting of approval on 28.8.2008, the prescribed authority has, inter alia, observed in para 5 as under:-

‘Ref.No. and Date of the application : Ref NBil dated 16.8.2007

The above Research & Development facility is further approved for the purpose of section 35(2AB) from 1.4.2007 to 31.3.2011 subject to the conditions underlined therein.”

The term ‘further’ makes it clear that the approval was not limited to 1.4.2007 to 31.3.2011 but was in addition to periods already approved. It is further noticeable that information obtained under RTI clearly showed that the assessee’s applications were processed for earlier years also but no orders have been passed with reference to earlier assessment years. At the same time, the assessee has not been given any opportunity of being heard as required under proviso to Rule 6 (5A) before rejecting the said application. Therefore, impliedly, the application for the entire period, for which it was made, has to be deemed to have been granted. On the basis of above discussion, we are of the opinion that the assessee was entitled for weighted deduction u/s. 35(2AB).

6.3 Now, we will also examine the issue having regard to the object of legislation. The entire scheme deals with the granting of approval to the facilities and the object is that the research and development facility is not related purely to market research, sales promotion, quality control, testing, commercial production, style changes, routine data collection or activities of a like nature. The purpose is to have research and development facilities which contribute to the technological advancement and not merely limited to earning of profits. Therefore, once the approval is there by the prescribed authority, it could be easily concluded that the same met the basic requirement and merely the same is not in prescribed form, it would not lead to the conclusion that the approval was of no purpose. As per the terms and conditions of the recognition of In-house R&D unit framed by the Ministry of Science and Technology, the assessee company is required to submit brief summary of the achievements of the R&D unit to the Department of Science and Industrial Research every year which includes paper published, patents obtained and processes developed, new products introduced, awards and prizes received and other achievements. Further, as per clause 8, commercial exploitation of the know-how/process developed by in-house R&D Unit was to be solely governed by the licensing policies in operation from time to time and the decision of the licensing authorities in this regard is considered to be final. Thus, stringent conditions have been imposed by the prescribed authority itself though the said approval was not meant for tax exemption but in substance, there was not much difference between the objects sought to be achieved by these approvals.

6.4 Further, in any view of the matter, at best it could be said that it was only a procedural defect and from the various decisions, noted in the arguments of ld Counsel for the assessee, it is clear that merely on the ground of technicalities of procedure, the benefit bestowed by legislature cannot be denied. When it comes to follow the prescribed procedure, the exemption provisions have to be liberally construed and if in substance, the assessee has fulfilled the basic requirements then the exemption cannot be denied.

6.5 We find that similar view has been taken by the Ahmedabad Bench of the Tribunal in the case of Claris Lifesciences Ltd (supra), which has been confirmed by the Hon’ble Gujarat High Court, reported in 113 (Guj)(supra).”

39. So far as the decision relied on by the Ld. DR in the case of Ajeet Seeds Ltd. (supra) is concerned, we find the Tribunal in the said decision without considering the decisions of the Coordinate Benches of the Tribunal and mentioning incorrect factual details of the Mumbai Benches of the Tribunal has passed the order holding that the deduction u/s 35(2AB) is not allowable if the approval was not granted by DSIR. The Ld. Counsel for the assessee has successfully demonstrated before us as to how the said decision is per incuriam and therefore has to be disregarded. Since in the decision of Ajeet Seeds Ltd. (supra) relied on by the Ld. DR there is no discussion at all as to how the decisions in the cases of Minilec India Pvt. Ltd. (supra) and Nath Bio Genes India Ltd. (supra) are not applicable and the reasoning given for not following the decisions in the cases of Meco Instruments Pvt. Ltd. (supra) and Advance Enzyne Technologies Pvt. Ltd. (supra), are based on incorrect facts, therefore, the decision of the Tribunal in the case of Ajeet Seeds Ltd. (supra) cannot be followed being per-incurium.

40. We find Hon’ble Andhra Pradesh High Court in the case of B.R. Constructions (supra) has held that a decision which is per-incurium is not a binding preceding. We find the Mumbai Bench of the Tribunal in the case of Mehratex India Ltd. (supra) has held that a decision, which is per-incurium is not a binding judicial precedent. Therefore, the decision relied on by the Ld. DR being per incurium is not applicable to the facts of the present case. In this view of the matter and in view of the detailed reasoning given by the Ld. CIT(A) / NFAC, we do not find any infirmity in his order allowing the claim of deduction u/s 35(2AB). Accordingly, the same is upheld. The appeal filed by the Revenue is accordingly dismissed.

ITA Nos.1659/pUN/2024 (A.Y. 2012-13)

41. Grounds raised by the Revenue are as under:

| 1. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in deleting the addition of Rs.3,96,39,745/- which was claimed by the assessee company as deduction u/s.35(2AB). |

| 2. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in holding that Form 3CM and Form 3CL was issued by DSIR, for the year under consideration. Whereas, the DSIR, vide its letter dated 24.01.2018 has categorically informed the department that M/s. High Technology Transmission System India Pvt Ltd was not issued report in Form 3CL because their R&D unit located at K-226/1, MIDC Industrial area, Waluj, Aurangabad was not approved u/s.35(2AB) for the F.Y.2010-11 to F.Y.2013-14. |

| 3. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in admitting the additional evidence of the assessee during appellate proceedings, without giving Assessing officer an opportunity of examining/cross examining of the additional evidence. |

| 4. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order treating the same against non-existing entity without considering the facts that in the assessment order passed u/s.143(3) r.w.s.147 of the Act, both the names were mentioned as “M/s. High Technology Transmission System India Pvt. Ltd (Now merged with Endurance Technologies Ltd) P. No. K-226/1, MIDC, Waluj, Aurangabad-431136” |

| 5. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order without considering that the mistake in name of the assessee company is curable u/s.292B of Income Tax Act. |

| 6. | | The order of the Assessing Officer may be restored and that of the CIT(A), NFAC, Delhi be vacated. |

| 7. | | The appellant craves leave to add, amend or alter ail or any of the grounds of appeal. |

ITA No.1683/pUN/2024 (A.Y. 2013-14)

42. Grounds raised by the Revenue are as under:

| 1. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in deleting the addition of Rs.6,86,91,937/- which was claimed by the assessee company as deduction u/s.35(2AB). |

| 2. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in holding that Form 3CM and Form 3CL was issued by DSIR, for the year under consideration. Whereas, the DSIR, vide its letter dated 24.01.2018 has categorically informed the department that M/s. High Technology Transmission System India Pvt Ltd was not issued report in Form 3CL because their R&D unit located at K-226/1, MIDC Industrial area, Waluj, Aurangabad was not approved u/s.35(2AB) for the F.Y.2010-11 to F.Y.2013-14. |

| 3. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in admitting the additional evidence of the assessee during appellate proceedings, without giving Assessing officer an opportunity of examining/cross examining of the additional evidence. |

| 4. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order treating the same against non-existing entity without considering the facts that in the assessment order passed u/s.143(3) r.w.s.147 of the Act, both the names were mentioned as “M/s. High Technology Transmission System India Pvt. Ltd (Now merged with Endurance Technologies Ltd) P. No. K-226/1, MIDC, Waluj, Aurangabad-431136” |

| 5. | | On the facts and in the circumstances of the case, the CIT(A), NFAC, Delhi has erred in quashing the entire assessment order without considering that the mistake in name of the assessee company is curable u/s.292B of Income Tax Act. |

| 6. | | The order of the Assessing Officer may be restored and that of the CIT(A), NFAC, Delhi be vacated. |

| 7. | | The appellant craves leave to add, amend or alter ail or any of the grounds of appeal. |

43. After hearing both sides, we find the grounds raised by the Revenue in ITA No.1659/pUN/2024 for assessment year 2012-13 and ITA No.1683/pUN/2024 for assessment year 2013-14 are identical to the grounds raised by the Revenue in ITA No.1657/pUN/2024 for assessment year 2011-12. We have already decided the issues and dismissed the appeal of the Revenue. Following similar reasonings, we dismiss the grounds raised by the Revenue in ITA No.1659/pUN/2024 for assessment year 2012-13 and ITA No.1683/pUN/2024 for assessment year 201314. The above 2 appeals filed by the Revenue are accordingly dismissed.

ITA No.1660/pUN/2024 (A.Y.2014-15)

44. Facts of the case, in brief, are that the assessee filed its original return of income declaring total income of Rs.155,40,57,180/-. The Assessing Officer completed the assessment u/s 143(3) on 28.12.2016 determining the taxable income at Rs.155,66,27,455/-. Subsequently the PCIT set aside the order u/s 263 of the I.T. Act to the file of the Assessing Officer. During the proceedings subsequent to order u/s 263 the Assessing Officer noted that the assessee company had received incentive from the government of Maharashtra under the package scheme Incentive-2007 amounting to Rs.3,08,80,000/-. However, it had reduced the same amount from computation of total income for income tax purpose. As the Incentive was only for fixed assets, therefore, the assessee was required to reduce the same from the cost of assets for the purpose of calculating depreciation in the fight of provisions of section 43(1) [explanation 10]. In appeal, the Ld. CIT(A) / NFAC deleted the addition and the Revenue is not in appeal before the Tribunal. Therefore, we are not concerned with the same.

45. Further, on perusal of return of income the Assessing Officer noted that the assessee had claimed deduction u/s.35(2AB) of the income Tax Act, 1961 of Rs.50,48,37,056/- towards Revenue and Capital expenditure related to R&D activity. However, no prescribed report i.e. Form No.3CL was issued to the assessee for claiming the said deduction. Hence, in absence of the same, he held that the assessee is entitled for claiming deduction on actual incurred basis only. Thus, the company had wrongly claimed weighted deduction. He, therefore, disallowed the amount of Rs.5,15,77,309/- on account of excess deduction u/s 35(2AB) of the Act.

46. In appeal, the Ld. CIT(A) / NFAC deleted the addition made by the Assessing Officer by observing as under:

“Decision

I have carefully gone through the facts of the case, grounds of appeal and submission of the appellant I find from the submission of the appellant that the quantification of expenditure has been prescribed vide IT (Tenth Amendment) Rules, 2016 w.e.f. 1st July 2016 amendment, no such power was with DSIR i.e. after approval of facility. As rightly contended by the assessee in the case of Omni Active Health Technologies Ltd v. ACIT (ITA/ 7284/Mum/2018) where hon’ble ITAT hold that

“the issue is squarely covered in assessee’s favor by the decision of Pune Tribunal in Cummins India Ltd. v. DCIT 576 15/05/2018) wherein the coordinate bench has observed as under:-

38. We have heard the rival contentions and perused the record. The issue which arises in the present appeal is against the claim of deduction under section 35(2AB) of the Act ie expenditure incurred on Research & Development activity For computation of business income under section 35 of the Act, expenditure on scientific research is to be allowed on fulfillment of certain conditions which are enlisted in the said section Under various sub-sections of section 35 of the Act, the conditions and the allowability of expenditure vary. Sub-section (1) to section 35 of the Act deals with expenditure on scientific research, not being in the nature of capital expenditure, is to be allowed to research association, university, college or other institution, for which an application in the prescribed form and manner is to be made to the Central Government for the purpose of grant of approval or continuation thereto. Before granting the approval, the prescribed authority has to satisfy itself about the genuineness of activities and make enquiries in this regard. Under sub-section (28) to section 35 of the Act, a company engaged in the specified business as laid there on, if it incurs expenditure on scientific research or in-house Research & Development facility also needs to be approved by the prescribed authority, is entitled to deduction, provided the same is approved by the prescribed authority.

39. Now, coming to sub-section (2AA) to section 35 of the Act, it talks about granting of approval by the prescribed authority but the approval to the expenditure being incurred is missing under the said section. Similar is the position in sub-section (2A) Further in sub-section (2AB), it is provided that facility has to be approved by the prescribed authority, then there shall be allowed deduction of expenditure incurred whether 100%, 150% or 200% as prescribed from time to time. Clause (2) to section 35 of the Act provides that no deduction shall be allowed in respect of expenditure mentioned in clause (1) under any provisions of the Act. Clause (3) further lays down that no company shall be entitled for deduction under clause (1) unless it enters into agreement with prescribed authority for co-operation in such R & D facility The Finance Act, 2015 w.ef. 01.04.2016 has substituted and provided that facility has to fulfill such condition with regard to maintenance of accounts and audit thereof and for audit of accounts maintained for that facility.

40. Under Rule 6 of Income Tax Rules, 1962 (in short ‘the Rules ‘), the prescribed authority for expenditure on scientific research under various subclauses has been identified. As per Rule 6(1B) of the Rules for the purpose of subsection 2AB of section 35 of the Act, the prescribed authority shall be the Secretary, Department of Scientific and Industrial Research i.e. DSIR. Under subrule (4), application for obtaining approval under section 35(2AB) of the Act is to be made in form No.3CK. Under sub-rule (5A) of rule 6 of the Rules, the prescribed authority shall, if satisfied that the conditions provided in the rule and in sub-section (2AB) being fulfilled, pass an order in writing in form No.3CM. The proviso however lays down that reasonable opportunity of being heard is to be granted to the company before rejecting an application. So, the application has to be made under sub-rule (4) in form No.3CK and the prescribed authority has to pass an order in writing in form No 3CM. Sub-rule (7A) provides that the approval of expenditure under sub-section (2AB) of section 35 of the Act, shall be subject to the conditions that the facilities do not relate purely to market research, sales promotion, etc. Clause (b) to sub-rule (7A) at the relevant time provided that the prescribed authority shall submit its report in relation to the approval of inhouse R & D facility in form No. 3CL to the DG (Income-tax Exemption) within sixty days of its granting approval. Under clause (c), the company at the relevant time had to maintain separate accounts for each approved facility, which had to be audited annually. Clause (b) to sub-rule (7A) has been substituted by IT (Tenth Amendment) Rules, 2016 w.e.f. 01.07.2016, under which the prescribed authority has to furnish electronically its report (1) in relation to approval of in-house R&D facility in part A of form No.3CL and (ii) quantifying the expenditure incurred on in-house R & D facility by the company during the previous year and eligible for weighted deduction under sub-section 2AB of section 35 of the Act in part B of form No.3CL In other words the quantification of expenditure has been prescribed vide IT (Tenth Amendment) Rules, 2016 w.e.f. 01.07 2016. Prior to this amendment, no such power was with DSIR ie. after approval of facility.

41. Under the amended provisions, beside maintaining separate accounts of R & D facility, copy of audited accounts have to be submitted to the prescribed authority. These amendments to rules 6 and 7a are w.e.f. 01.07.2016 re under the amended rules, the prescribed authority as in part A give approval of the facility and in part B quantify the Act. The first issue which arises is the recognition of facility by the prescribed authority as provided in section 35(2AB) of the Act.

42. The issue which is raised before us relates to pre-amended provisions and question is where the facility has been approved by the prescribed authority, can the deduction be denied to the assessee under section 35(2AB) of the Act for non issue of form No 3CL by the said prescribed authority or the power is with the Assessing Officer to look into the nature of expenditure to be allowed as weighted deduction under section 35(2AB) of the Act. The first issue which arises is the recognition of facility by the prescribed authority as provided in section 35(2AB) of the Act.

43. The Hon’ble High Court of Gujarat in CIT v. Claris Lifesciences Ltd. 113/[2010] 326 ITR 251 have held that weighted deduction is to be allowed under section 35(2AB) of the Act after the establishment of facility. However, section does not mention any cutoff date or particular date for eligibility to claim deduction. The Hon’ble High Court held as under “8 The Tribunal has considered the submissions made on behalf of the assessee and took the view that section speaks of

| (i) | | development of facility, |

| (ii) | | incurring of expenditure by the assessee for development of such facility: |

| (iii) | | approval of the facility by the prescribed authority, which is DSIR and |

| (iv) | | allowance of weighted deduction on the expenditure so incurred by the assessee. |

9. The provisions nowhere suggest or imply that R&D facility is to be approved from a particular date and, in other words, it is nowhere suggested that date of approval only will be cut-off date for eligibility of weighted deduction on the expenses incurred from that date onwards. A plain reading clearly manifests that the assessee has to develop facility, which presupposes incurring expenditure in this behalf, application to the prescribed authority, who after following proper procedure will approve the facility or otherwise and the assessee will be entitled to weighted deduction of any and all expenditure so Incurred. The Tribunal has, therefore, come to the conclusion that on plain reading of section itself, the assessee is entitled to weighted deduction on expenditure so incurred by the assessee for development of facility. The Tribunal has also considered r. 6(5A) and Form No 3CM and come to the conclusion that a plain and harmonious reading of Rule and Form clearly suggests that once facility is approved, the entire expenditure so incurred on development of R&D facility has to be allowed for weighted deduction as provided by s. 35(2AB). The Tribunal has also considered the legislative intention behind above enactment and observed that to boost up R&D facility in India, the legislature has provided this provision to encourage the development of the facility by providing deduction of weighted expenditure Since what is stated to be promoted was development of facility, intention of the legislature by making above amendment is very clear that the entire expenditure incurred by the assessee on development of facility, if approved, has to be allowed for the purpose of weighted deduction.

10. We are in full agreement with the reasoning given by the Tribunal and we are of the view that there is no scope for any other interpretation and since the approval is granted during the previous year relevant to the assessment year in question, we are of the view that the assessee is entitled to claim weighted deduction in respect of the entire expenditure incurred under s. 35(2AB) of the Act by the assessee.”

44. The Hon’ble High Court of Delhi in CIT v. Sandan Vikas (India) Ltd 216/[2011] 335 ITR 117 (Del) on similar issue of weighted deduction under section 35(2AB) of the Act held that the condition precedent was the certificate from DSIR, but the date of certificate was not important, where the objective was to encourage research and development by the business enterprises in India. In the facts before the Hon’ble High Court of Delhi, the assessee had approached DSIR vide application dated 10.01.2015. The DSIR vide letter dated 23.02.2006 granted recognition to in-house research and development facility of assessee. Further, vide letter dated 18.09.2006, DSIR granted approval for the expenses incurred by the company on in-house research and development facility in the prescribed form No.3CM. The Assessing Officer in that case refused to accord the benefit of aforesaid provision on the ground that recognition and approval was given by DSIR in the next assessment year. The Tribunal allowed the claim of assessee relying on the decision of the Hon’ble High Court of Gujarat in Claris Lifesciences Ltd.’s case (supra). The Hon’ble High Court of Delhi taking note of the decision of the Hon’ble High Court of Gujarat observed that it has been held that cutoff date mentioned in the certificate issued by DSIR would be of no relevance where once the certificate was issued by DSIR, then that would be sufficient to hold that the assessee had fulfilled the conditions laid down in the aforesaid provisions.