Loss from Hedging Export Receivables is a Business Loss, Not Speculative.

Issue

Whether a loss arising from the settlement of forward contracts, which were entered into to safeguard against foreign exchange fluctuation risks on export sales, should be treated as a speculative loss under Section 43(5) or as an allowable business loss.

Facts

- The assessee, a manufacturer and exporter of automotive parts, entered into forward contracts with its bank.

- The purpose of these contracts was to hedge its export receivables in foreign currency and protect itself from potential losses due to adverse exchange rate movements.

- The assessee incurred a loss upon the settlement of these forward contracts and claimed it as a business expenditure.

- The Assessing Officer (AO) disallowed this claim, treating the loss as speculative under Section 43(5) and thereby refusing to set it off against the assessee’s regular business profits.

- The assessee provided evidence that the contracts were directly linked to its export business and were not for trading or speculation in foreign currency.

Decision

- The court ruled in favour of the assessee, holding that the loss was an allowable business loss.

- It concluded that the forward contracts were not speculative in nature because they fell within the exception provided in proviso (a) to Section 43(5).

- The court found that the hedging activity was integral and incidental to the assessee’s core business of exports. The contracts were a prudent measure to mitigate a genuine business risk.

Key Takeaways

- Motive Matters: The crucial difference between a speculative transaction and a hedging transaction is the underlying intent. A contract to guard against a loss on a business asset (like export receivables) is a hedge, not a speculation.

- Hedging is a Business Activity: When a forward contract is directly linked to an underlying business transaction, any loss or gain from it is treated as a normal business loss or gain.

- Statutory Exception: The Income-tax Act specifically excludes hedging contracts entered into to guard against price fluctuations in raw materials or merchandise from the definition of “speculative transaction.” This principle is extended to hedging against currency fluctuations on business receivables.

- Not a Separate Business: The assessee was not in the business of trading foreign currency. The forward contracts were a tool to manage the risks of its primary manufacturing and export business.

IN THE ITAT DELHI BENCH ‘C’

Deputy Commissioner of Income-tax

v.

Fiem Industries Ltd.

Vikas Awasthy, Judicial Member

and M. Balaganesh, Accountant Member

and M. Balaganesh, Accountant Member

IT Appeal No. 3696 (Delhi) OF 2015

[Assessment year 2011-12]

[Assessment year 2011-12]

OCTOBER 8, 2025

Ms. Namita Khurana, CIT-DR for the Appellant. Shailesh Gupta, CA for the Respondent.

ORDER

M. Balaganesh, Accountant Member. – The appeal in ITA No.3696/Del/2015 for AY 2011-12, arises out of the ld. Commissioner of Income Tax (Appeals)-3, New Delhi [hereinafter referred to as „ld. CIT(A)’, in short] in Appeal No. 393/2013-14 dated 10.03.2015 against the order of assessment passed u/s 143(3) of the Income-tax Act, 1961 (hereinafter referred to as „the Actr) dated 11.02.2014 by the Assessing Officer, Addl. CIT, Range-11, New Delhi (hereinafter referred to as ‘ld. AO’.

2. The first issue to be decided in this appeal is as to whether the Learned CITA was justified in deleting the addition of Rs 17,70,51,673/- made by the Learned AO on account of settlement of forward contracts. The inter connected issue involved thereon is challenging the deletion of addition of Rs 88,83,314/- by the Learned CITA on account of Exchange Difference Derivatives.

3. We have heard the rival submissions and perused the materials available on record. The assessee is primarily engaged in the business of manufacturing of auto components, mainly automotive lighting and signaling equipments, rear view mirrors, sheet metal parts to be supplied to various domestic and overseas customers who manufacture two wheelers and four wheelers viz. scooters, motorcycles, mopeds, trucks, tractors, etc. The return of income for the assessment year 2011-12 was filed by the assessee company on 29-112011 declaring total income of Rs 4,54,80,370/-. The assessment was completed under section 143(3) of the Act determining total income at Rs 23,14,43,240/-after making addition of Rs 17,70,51,673/- against the claim of expense on account of “loss on settlement of target redemption forward contracts” and Rs 88,83,314/- against the claim of expense on account of “Exchange difference -derivatives” and Rs 24,880/- against the claim of deduction under section 80IC of the Act from its undertaking situated at Nalagarh. The claim of deduction under section 80IC of the Act is not in dispute in the impugned appeal before us.

4. The assessee being a manufacturer of automotive lightings and mirrors supplies its goods to domestic Original Equipment Manufacturers (OEMs) viz. HMSI, TVS, Suzuki motorcycles etc and also undertakes exports to various customers located in Japan, Europe, Indonesia etc. In order to hedge its export receivables in foreign currency, the assessee entered into sophisticated forward contracts with its bankers to hedge the exchange loss, if any, arising through future price fluctuations. It incurred loss during the year on account of settlement of the forward contracts to safeguard the outstanding receivables denominated in Japanese yen amounting to Rs 17,70,51,673/-. It also incurred loss on account of the settlement of the forward contracts to safeguard the outstanding receivables denominated in USD amounting to Rs 88,83,314/-. The Learned AO sought to treat both the losses as arising from speculative transactions under the provisions of section 43(5) of the Act and accordingly did not allow set off against the profits of the business.

5. It was submitted that the loss on settlement of the target redemption forward contract to the extent of Rs 17,70,51,673/- has been made on the final maturity date as specified in the contracts and thereby it is a crystallized loss and not a notional or fictitious loss. The assessee entered into two agreements with M/s Ichikoh Industries Ltd, Japan for the production and supply of prismatic mirrors and door mirror glass. The agreements are dated 9-5-2007 and 28-92007. Prior to these agreements, the assessee has entered into a technical support agreement with the same company in Japan on 11-11-2005, which allowed the Japanese company to grant licenses to the assessee to manufacture and sell in India certain mirrors Ichikoh may develop in future and assist the assessee in selling such mirrors to car manufacturers in India, with main focus on Japanese car manufacturers who are building automobiles in India. It was also stipulated that Ichikoh desires to purchase from the assessee certain mirror components at the lower cost. Article 2 of the agreement dealt with the procurement of components by Ichikoh from assessee on achieving satisfactory quality and cost advantage. Article 4 of the agreement dealt with the remuneration to be paid by the assessee to Ichikoh and Article 13 of the agreement identified the duration of the contract as 5 years, extendable on an yearly basis thereafter unless either party gives 6 months prior notice to the other party. Article 8 of the agreement seek to lean and gain support from the technical support agreement dated 11-11-2005 on the various items and issues. Post the above two agreements, Ichikoh Industries had placed Letters of Intent dated 18-05-2007 for the prismatic mirror plate and 1-10-2007 for the door mirror plate. The letter of intent refers to the product names, basic unit price with an acceptable range of increase, the production volume, targeted date of production and the price validity periods in the case of the door mirror plate was till 31-03-2010. Post the agreements, the assessee started importing the capital goods and machinery such as line beveller, washing machine prisma, grinding machine prisma, cutting machines, edge grinding machines, washing machines, filter press machine, etc for the manufacture of the above said items. The targeted date of the start of the production as per letter of intent was January 2008. The assessee started to export from February 2008.

6. Based on the letter of intent dated 18-05-2007 and 1-10-2007, the assessee company entered forward contracts dated 9-10-2007 as against letter of intent dated 18-05-2007 and 19-02-2008 as against letter of intent dated 1-10-2007 in USD / JPY with the Standard Chartered Bank known as Target Redemption Forward Contracts. The calculation showing the amount of exposure on Japanese Yen as per the targeted annual production is extracted below along with the details of the amount contracted with the Standard Chartered Bank for the target redemption are as under:-

| CALCULATION SHOWING AMOUNT OF EXPOSURE ON JAPANESE YEN (JPY) AS PER TARGETTED ANNUAL PRODUCTION FOR PRISMATIC MIRROR AND DOOR MIRROR AS PER LOI RECEIVED FROM ICHIKOH INDUSTRIES | |||||

| S.No. | NAME OF THE ITEM | Date of LOI | Targetted Production (in number of pieces) | Per piece Rate In Jpy | Amount in JPY |

| 1 | PRSIMATIC MIRROR | 18.05.2007 | 3,60,000 | 120.00 | 4,32,00,000 |

| 12,40,000 | 102.00 | 12,64,80,000 | |||

| TOTAL-A | 16,00,000 | 16,96,80,000 | |||

| 2 | DOOR MIRROR | 01.10.2007 | 19,20,000 | 80.00 | 15,36,00,000 |

| TOTAL-B | 19,20,000 | 15,36,00,000 | |||

DETAIL OF AMOUNT CONTRACTED WITH STANDARD CHARTERED BANK FOR TARGET REDEMPTION FORWARD CONTRACT (IN USDJPY)

| S.No. | Date of Contract | Amount in USD | Rate(USDJPY) | Total JPY | Months | Total JP (P-a) |

| 1 | 09.10.2007 | 1,25,000 | 108 | 1,35,00,000 | 12 | 16,20,00,000 |

| 2 | 19.02.2008 | 1,25,000 | 101 | 1,26,25,000 | 12 | 15,15,00,000 |

| TOTAL | 31,35,00,000 |

The exports made by the assessee in subsequent year are as under:-

April 2008 – 64,90,800 Yen

May 2008 – 36,64,800 Yen

June 2008 – 92,92,800 Yen

July 2008 – 1,36,12,800 Yen

Aug 2008 to Feb 2009 – 20,73,600 Yen to 93,02,400 Yen

7. It was submitted that the assessee had imported capital goods and machinery for around Rs. 8 crores for the purpose of manufacturing of mirror plates to be exported. The assessee stuck to the production date and started exporting from February 2008 and as the production was scaling up slowly, there was a global economic crisis and slowdown in September 2008. The assessee entered into forward contract dated 9-10-2007 and 19-2-2008 with Standard Chartered Bank for the target redemption. The figures were arrived and negotiated based on the anticipated quantities of the export. The price payable and the total Japanese Yen arrived under the forward contracts were closely matching.

8. The Learned AO entertained a view that forward contracts entered into by the assessee were speculative in nature on the following grounds:-

| “a | . There were no legally binding agreements or commitment by the foreign buyers compelling the assessee to make the said supplies; |

| b. | The two Target Redemption forward contracts viz. Standard Chartered bank on 9/10/2007 & 19/02/2008 were complex derivatives obliging the bank to sell USD 1,25,000 at a specified rate if the reference USD-JPY exchange rate on a specified date was above the agreed strike rate. It also obliged the assessee to buy USD 2,50,000 at a specified rate if the reference USD-JPY exchange rate on a specified date was below the agreed strike rate. The expiry dates were mentioned in the contracts for each month starting from the month of the contract & ending 36 months later. The buy strike rate was fixed at 108 for the contract dated 09/10/2007 & the contract was terminating on 12/10/2010. Similarly the strike rate was 101 for the contract dated 19/02/2008 & the contract was terminating on 22/02/2011. |

| c. | The contention of the assessee that the contracts were entered into for the purpose of hedging Japanese Yen (JPY) Export receivables was false as the contracts entered into by the assessee were based on US Dollar- Japanese Yen exchange rate and not the JPY – Rupee exchange rate; |

| d. | The exports in JPY did not have any component of imported raw material in USD & hence the Unking of JPY-USD forward contract is unsustainable; |

| e. | After not disputing the genuineness of the forward contracts or the prohibition cast through the RBI guidelines during the relevant period, the Assessing Officer has concluded that what is important under the Income Tax Act, is the actual correlation between the exposure to a particular currency receivable and amount hedged; |

| f. | The supplies were to be made on continuing basis, implying that the exposure of the assessee to contracted supply at a pre-determined rate would continue to reduce as the supplies were made & therefore the hedged amount did not have any co-relation with the amount remaining to be supplied, or for that matter with the average net receivable of the assessee in JPY at any point of time. |

| g. | The Assessing Officer concluded looking at the export performance that no effort was made by the assessee to make any changes to the hedged amount despite the exposure being reduced considerably over the three year period and there was no need for the hedging; |

| h. | The forward contracts were not for the purpose of hedging export receivables in JPY & neither are these incidental to the assessees business, nor is there any direct or proximate nexus with the export business of the assessee. |

| i. | The contracts entered were for makng bets on the currency rate movement between USD-JPY & not for hedging of the export receivables as the exports in JPY were lower than the contracted amounts. |

| j. | The Assessing Officer held that the transactions do not fall under proviso (a) to Section 43 (5) and finally concluded that the loss being a speculative is to be disallowed. |

| k. | The Assessing Officer has stated that the claim of the loss on a forward contract based on USD-JPY exchange rate has been made for the first time in A. Y 2011-12 by the assessee, therefore, the contention that similar claims have been allowed in the past assessments is devoid of the merit. “ |

9. The assessee furnished detailed written submissions before the Learned CITA filing rebuttal for each of the observations of the Learned AO. The Learned CITA duly appreciated the contentions of the assessee and held that the forward contracts form an integral part and are incidental to the core business of the export of automotive lightings and mirror plates of the assessee and held the said loss to be not speculative in nature and eligible for set off against the normal business profits. The relevant observations of the Learned CITA with regard to allowing the loss of Rs 17,70,51,673/- are as under:-

“32 Having gone through the various submissions made by the assesee, the order of assessment made by the Assessing Officer and the material placed on the record, it emerges that it is a undisputed fact that the assessee is carrying on the business of manufacturing & supply of Automotive Lighting, Mirrors etc. to various reputed Two-wheeler & Four-wheeler original equipment manufacturers viz HMSI, TVS Motors, Suzuki Motorcycles etc. It also exports its goods to overseas customers located in Japan, Europe, Indonesia etc. viz. Ichikoh industries Japan, Aspock Systems GMBH, Austria, Piaggio, Italy, PT TVS Motors Co. Ltd. Indonesia etc. It also has an undisputed track record of export sales for the past several years. While conducting its business it has entered into sophisticated forward contracts with M/s Standard Chartered Bank & Citi Bank N.A. to hedge its export receivables denominated in the foreign currency. The same were offered by the bankers after verifying the underlying export orders & buy-back agreements executed with internationally renowned MNCs. The contracts were based on the governing law prescribed by “Itternationai Swaps & derivatives Association” (ISDA). They also confrmed to the regulations & eligibility criteria prescribed by the Reserve bank of India which is the regulatory authority for allowing such “Over the Counter” (OTC) derivatives contracts. The contracts were entered by the assessee with the Standard Chartered Bank in F.Y. 2007-08 for hedging the currency pair of USD-JPY against exports to be made to M/s Ichikoh Industries Japan for the supply of prismatic mirror plates & door mirror plates. The assessee has fled a copy of the technical collaboration agreement entered with Ichikoh in the year 2005 for the purpose of providing technical know-how for the development of Automotive mirrors to be supplied to car manufacturers in India as well as subsequent export to Ichikoh at the low cost. The subsequent agreements for 100% buy-back of prismatic & door-view mirrors executed in May 2007 & Oct. 2007 by Ichikoh coupled with the execution of LOI’s for the supply of contracted quantity with price have also been filed. The compete details of the machineries purchased for the manufacture of the mirrors alongwith the copies of the invoices have also been produced. The order of the Assessing Officer does not dispute the genuineness of the assessee in carrying out its business including its exports. It also does not doubt the infrastructure employed, the collaboration agreement followed by the two latter agreements for 100%o buy-back of mirrors. It nowhere disputes the contracting terms with the bankers & the scientific basis & historical analysis of the currency rates which went into freezing the negotiations of the forward contracts.

3.3. The assessee had undisputedly exported goods denominated in JPY commencing from Feb. 2008. However as explained by the assessee the targeted/ anticipated annual turnover as agreed in the buy-back agreements could not be achieved due to the collapse of the biggest investment banker M/s Lehmann Brothers in Sep. 2008 which rocked the US economy leading to unprecedented global recession. It was informed that when the production was speaking in July-August 2008, the target plans went awry because of the global melt down & the business could never pick up thereafter.

3.4 Hedging is defined as ‘To enter into transactions that will protect against loss through a compensatory price movement’. A hedging transaction is one which protects an asset or liability against a fluctuation in the foreign exchange rate. Any person having an exposure to the foreign currency may resort to hedging in the course of his manufacturing business to guard against the loss through future price fluctuations in respect of his contracts for the actual delivery of goods.

3.5 On the question raised by me regarding the reason for claiming the losses in the A. Y 2011-12 & not in the previous two years, the counsel referred to the terms of the forward contracts enclosed at Page No. 71-76 & 77-86 of the paper notebook filed. On perusal of the contracts it is observed that they were entered into on the strength of the underlying orders for the exports. The nature of the contracts evidences the fact that they consisted of a series of 36 monthly contracts in which one contract expired each month. The purpose of the transaction was to hedge the counter parties (assesses) JPY receivables against USD at a fixed rate, thereby protecting the counter party against the USD appreciation with the condition that the entire structure including any accumulated but not delivered settlement will terminate if the Target knock-out event or Any time knock-out event occurs. The purpose of the transaction was stated as – “‘This is a cost reduction strategy for the clients JPY receivables. The contract dated 09/10/2007 stipulated a buy strike rate of 108 with final maturity date of 12/10/2010. It had monthly expiry dates from 1 month to 36 months as per the expiry schedule given. The other contract stipulated a buy rate of 101 with final maturity date of 22/02/2011. The monthly notional amounts for both the contracts offered were USD 1,25,000/2,50,000 & were agreed at zero premium. The same were structured in such a way that in case the reference rate exceeded the strike rate on the monthly expiry date of any contract then the same was immediately settled by the banker & profit was credited to the bank of the assessee. Simultaneously the excess of the reference rate over the strike rate enabled the assessee to accumulate points known as Accumulated Intrinsic Value’ (AIV). However if the reference rate was below the strike rate on any monthly expiry date, then the loss was assumed to be a notional as per the terms of the contracts.

No loss was payable immediately on the individual expiry date & the settlement was postponed to the final maturity date stipulated in both the contracts. The mechanism was embedded in the contracts to give an opportunity to the assessee to mitigate the losses incurred on the expiry date by giving an exit route on the occurrence of two events in the future.

| (i) | Achieving Any time knock-out barrier of 120.75 in the contract with strike rate of 108 or barrier level of 112 in contract with strike rate of 101. |

| (ii) | Achieving of the Target redemption knock-out trigger whenever there was an accumulation of 40 pts. (AIV) i.e. wherever the reference rate on each expiry date exceeded the strike rate, then the excess of the reference rate over the spot rate was to be accumulated for all the expiry dates & the contract was knocked-off if the sum total of the AIV was accumulated to a figure of 40 & above. |

The above clauses indicate that the notional loss incurred on each expiry date was to be converted into a actual loss only if none of the conditions specified above were achieved in the balance period of the contract. They clearly specify that the losses could not be claimed by the assessee on accrual basis in the previous years as they were to be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the assessee. The terms of the Target redemption forward contracts enabled the assessee to wait for the occurrence or non-occurrence of the aforesaid two events in the future to avoid /nullify the notional losses incurred at each expiry date. In the first year of the contracts the assessee had earned crystallized pro ft of Rs. 62 Lacs in the F. Y 2008-09 which was duly offered for the taxation. The assessee has correctly claimed the losses in the F. Y 2010-11 wherein the losses were crystallized as per the terms of the agreement. The complete chart & monthly average rates of USD-INR have been submitted by the assessee evidencing the fact that the reference rate were quoting below the strike rates for around 23 months till the date of final maturity of the contracts. The assessee had to incur losses in both the contracts as the USD-JPY rate at the end of the contracts were quoting between 83-83.5 in the F. Y. 2010-11 when the contracts came to an end.

The historical data of the USD-JPY rate submitted by the assessee from the year 1991-2007 clearly indicates that the assessee had taken a calculated risk as the annual average USD-JPY rate carried a range of low of 94 in the year 1995 to a high of 134.46 in the year 1991. The assessee applied his commercial prudence based on the historical rates to accept the terms of the contract. The same cannot be termed as betting in the foreign currency.

3.6 The view of the Assessing Officer in forming an adverse opinion for treating the transactions as speculative in nature seems to be based on certain fallacious facts. The reasoning that there was no binding agreement or commitment by the foreign buyer compelling the assessee to make the said supples defies commercial & contractual logic. It overlooks the existence of a technical collaboration agreement & two independent agreements for the production & supply of prismatic mirror plates & door glass mirror plates entered with M/s Ichikoh Industries of Japan. The corporate existence of the assessee & that of the foreign buyer who is a proclaimed branded entity in Japan in the Automobile sector is not in dispute. The order of assessment has not disputed the technical competence nor the availability of infrastructure to meet the targeted production for the exports. It has not questioned the financial viability & the competence of the assessee to produce goods. It overlooks the economic realities prevailing at the time of execution of the contracts. It is also oblivious of the volatility & turbulence in the foreign exchange markets due to the global met down. There appears to be no material evidence to suggest that the contracts as planned in the F. Y. 2007-08 could not have got executed. The absence of a clause for a guaranteed procurement cannot alone be held as a vitiating factor when the agreements are examined from a complete perspective. An adverse factual assumption is possible only after assimilation of the entire facts & cannot be drawn on the basis of piecemeal appreciation of the evidence.

3.7 The conclusion of the Assessing Officer that the hedging is not on the basis of JPY export receivables as the contract with the bankers was based on USD-JPY exchange rate & not on the JPY-INR exchange rate is indicative of the absence of the understanding of the working mechanism of the foreign exchange market. As explained in the note issued by the Standard Chartered Bank, the USD is known as currency major in the Fx market which trades in few select currency pairs. The currency pairs in which the forwards contracts were available at the time of entering the contracts did not consist of INR as one of the currencies. Accordingly the contract in USD-JPY was offered by the bankers to the assessee. As explained by the bank the real currency pairs traded in Fx market are USD-JPY. The JPY-INR rate is nothing but a mathematical derivation of two rates & is not a traded rate. In fact, INR is stated directly against USD only & in rest of the cases the rates are derived. The note fled at Page No. 26-28 of the paper book brings to light the critical aspect that the USD forms the base for computing the calculations & equations between INR & any other foreign currency. The bankers have offered the derivative contracts based on the governing law of ISDA & also the master circular issued by the RBI for the Risk Management The eligibility calculations were based on the basis of the underlying export agreements & connected LOI’s after due diligence that the exports were intended for Japan & the buyer would be making payments only in JPY. The USD was only the index or the base for the computation. This is the standard practice & not an exception resorted to in this case. The inference of the Assessing Officer Unking the contracts to USD-INR & also the non presence of the imported raw materials / components against USD payments is virtually irrelevant

3.8 The Assessing Officer has doubted the nature of the contracts & has expressed concerns on the purpose of the contract The doubts in the mind of the Assessing Officer are based on the fact that the assessee’s export in JPY were much lower when compared to the targeted annual production stipulated in the agreements executed with M/s Ichikoh Industries Japan. The order of assessment opines that the purpose was for making bets on currency rate movements between USD-JPY & not for hedging of the export receivables. The forward contracts were based on the transactions that were in accordance with the normal business practices. The agreements were executed for a bona fide business purpose & were entered as an integral part of the export business. The assessee is not a dealer in the foreign exchange & in no sense the transactions were “Adventure in the nature of Trade”. The Assessing Officer has not disputed the genuineness of the forward contracts & the same cannot be said to be a colourable transactions in order to reduce the taxes. After pursuing the facts & various documents submitted by the assessee, it is clearly demonstrated that the contracts for the actual delivery of goods were in place before entering into the derivative contracts. The future events cannot be anticipated & hence the purpose of contracts cannot be held to be in the nature of betting on Fx as against the real purpose of hedging of export receivables. In my view there is no requirement of correlation of the value of the actual exports with the contractual obligations agreed in the forward contracts. The facts & circumstances explained in the submissions buttress the reasons for nonachievement of the anticipated export turnover due to the unprecedented global met down starting from Sep. 2008 due to the crash of the biggest investment banker M/s Lehmann Brothers in US.

3.9 The Assessing Officer has also examined the claim of the loss under the provisions of Sec. 43(5) of the Act. It has been concluded that the assessee has not entered into any forward contract for raw material or merchandise, & to the contrary, the forward contracts with the bankers are for the moneys to be paid or received, without actual delivery of the foreign exchange depending upon the prevailing USD-JPY exchange rate with reference to base rate. Therefore the transaction is held to be a speculative transaction & loss arising there from is held to be a speculation loss & accordingly disallowed.

The assessee has relied on various case laws. The relevant extracts from the cited judgements are reproduced to understand the correct treatment of Fx contracts entered during the course of the business by the exporter:

In the case of CIT v. Soorajmal Nagarmull reported in 129 ITR 0169, the High Court of Kolkata has noted the facts and held as under:-

“The assessee firm carried on the business of import and export of jute. In the course of its business it used to enter into foreign exchange contracts in foreign exchange in order to cover the loss arising due to difference in foreign exchange valuation. The assessee had entered into foreign exchange contracts in 1952 with the Hindustan Mercantile Bank. The difference payable by the assessee on the forward contract was determined in December, 1952, but the assessee disputed its ITA NO. 5316/Del/2011 liability. The dispute was settled in 1955, and its account in the bank was debited in June, 1955. The assessee claimed this loss amounting to Rs. 80,491/- as a revenue expenditure in the assessment year 1956- 57. The ITO disallowed the claim on the ground that the loss was a speculative loss and, in any event, as the assessee was following the mercantile system, it could not claim the loss in 1956-57. The AAC found that the transaction in which the loss arose was not speculative and this finding was upheld by the Tribunal. The AAC held that the loss did not relate to the relevant accounting year but the Tribunal held that it was allowable in 1956-57 on a reference:

Held, (i) that the assessee was not a dealer in foreign exchange.

Foreign exchange contract were only incidental to the assessee’s regular course of business. The AAC had made a categorical finding to this effect which had been upheld by the Tribunal. The loss was not a speculative loss but was incidental to the assessee’s business and allowable as such.

(ii) That though the claim related to the breach alleged to have occurred in 1952, the settlement of liability was done by agreement between the parties in the year of account relevant to the assessment year 1956-57. The amount of Rs. 80,491/-was allowable in the assessment year 1956-57,”

In the case of CIT v. Badridas Gauridu (P) Ltd. reported in 261 ITR 0256, the High Court of Bombay held as under:-

“‘Tee assessee was an exporter of cotton. The assessee had entered into forward contract with the banks in respect of foreign exchange. Some of these contracts could not be honored by the assessee for which it had to pay Rs. 13.50 lakhs, which was debited to the profit and loss account. The assessee claimed the same as business loss. The Assessing Officer held that the loss was not deductible as a business loss as it was incurred in a speculative transaction. The Tribunal held that it was a business loss. On further appeal to the High Court:

Held, dismissing the appeal, that the assessee was not a dealer in foreign exchange. The assessee was an exporter of cotton. In order to hedge against losses, the assessee had booked foreign exchange in the forward market with the bank. However, the export contracts entered into by the assessee for export of cotton in some cases failed. In the circumstances, the assessee was entitled to claim deduction in respect of Rs. 13.50 lakhs as a business loss.”

Moreover the High Court of Bombay very recently in the case of CIT v. Vishindas Holaram reported in 337has held as under: –

“Section 43(5) of the Income Tax Act 1961- Speculative transactions (Meaning of) Whether once main business of assessee is Assessment year 2003-04 identified, if some incidental activities or transactions or dealing in foreign exchange is undertaken but that is also related to some extent to main business activity, then, it could not be said that assessee is in speculative business – Held, yes.

The division bench held that once the main business of the assessee is identified, if some incidental activities or transaction or dealing in foreign exchange is undertaken but that is also related to some extent to the main business activity then, it could not be said that the assessee is in speculative business or speculative dealings is ordinarily a part of his business. We find that any larger question or controversy need not be addressed in facts of the case before us. Once it is undisputed the assessee is in the business of export of diamonds & he credited the exchange difference which is for the purpose of transaction which was undertaken in foreign exchange & that transaction fell within the parameters of law as laid down by the division bench, then, this is not a ft case for interference in further appellate jurisdiction.”

a. The assessee has also submitted the judgements of the Hon be High Court of Gujarat in the case of CIT v. Friend & Friends Shipping Pvt. Ltd. (ITA No.251 of 2010) & CIT v. Panchmahal Steel Ltd. (ITA No. 131 of 2013) which have followed the judgements of the Kolkata High Court & Bombay High Court mentioned above & have held that the losses incurred were not speculative but were incidental to the assessee’s business & were allowable as such. The aforesaid judicial precedents have been consistently approved by various benches of the ITA T viz

| (i) | Samsung Telecommunications India v. ACIT ITAT Delhi (ITA No.5316/DEL/2011) |

| (ii) | London Star Diamond Co. (I) Pvt. Ltd. v. DCIT-Mumbai ITAT (ITA No. 6169/ MUM/2012) |

| (iii) | HANUMAN Weaving Factory v. ACIT- Bangalore ITAT (ITA No.1320/BANG 2012). |

| (iv) | ACIT v. Balar Exports (ITA T- Ahmedabad (ITA No. 2856/AHD/2012). |

On perusal of the plethora of legal decisions & facts demonstrated by the assessee, I am of the view that the genuinity of the business of the assessee is not in doubt & it can be safely concluded that the forward contracts form an integral part & are incidental to the core business of the export of Automotive Lightings & Mirror Plates of the assessee. The complex nature of the contracts or the settlement of the contracts by way of delivery of the difference is not relevant. The relevant issue to be considered is that whether the transactions can be deemed to be incidental to its business & have a direct nexus with the existing export orders. The Hon be Supreme Court in the case of Ramchander Shivnarayan v. CIT reported in 111 ITR 263, has observed that If there is a direct & proximate nexus between the business operation & the loss or it is incidental to it, then the loss is deductible, as without the business operation and doing all that is incidental to it, no profit can be earned. It is in that sense that from a commercial standard, such a loss is considered to be a trading one & becomes deductible from the total income, although in terms of neither the 1922 Act nor in the 1961 Act, there is a provision”. The foreign forward contracts entered cannot be considered in isolation as the assessee is not a trader of the foreign currency. The banks could not entertain contracts of speculative nature as per the RBI regulations. The contracts could have been offered only to the exporters like the assessee for the purpose of hedging only. I am of the considered opinion that the transactions cannot be treated as speculative as defined in Sec. 43(5) of the Act. The Assessing Officer is therefore directed to allow the loss of Rs. 17,70,51,673/- as a business loss to be set off against the normal business profts. “

10. The relevant observations of the Learned CITA with regard to allowing the loss of Rs 88,83,314/- are as under:-

“It was submitted that the assessee company has been making exports to various customers situated in Europe. Indonesia Srilanka etc. which were denominated in USD. The assessee had entered into forward contracts with M/s Citi Bank N.A. based on the underlying exports as per the parameters of risk management prescribed by Reserve Bank of India. The company had entered into 2 contracts (a) for USD 80,000 dated 27/04/2007 & (b) USD 1,00,000 dated 8/08/2007. The assessee was able to achieve a turnover of USD 23,90,549 as against the annual forward contracts of USD 21,60,000 which were well within the underlying limits of the confirmed export orders in hand.

The assessee also submitted the compete party-wise details of the purchase orders against which exports were made during the year which are enclosed alongwith the copies of P.O’s exceeding USD 25,000.

It was reitereated that the provisions of Sec. 43(5) of the Act 1961 were clearly inapplicable to the hedging contracts entered by the assessee with its bankers due to the following reasons:

| (a) | The assessee had existing contracts for the actual delivery of goods manufactured by it. |

| (b) | The contracts offered by the bankers were based on the existing & underlying exports to be made. |

| (c) | The hedging contracts entered were incidental to the business of the assessee & were intended to guard against the losses through future price fluctuations. |

| (d) | The assessee is not a dealer in foreign exchange. It is an exporter of Automotive Lighting & Signalling Equipment as well as Automotive mirrors etc. |

| (e) | No speculation or trading in foreign exchange was allowed to Residents in India in the F. Y 2007-08 when the contracts were entered. The hedging contracts were offered by the banks only to the exporters having evidence of past exports as well as confirmed orders in hand. |

| (f) | Forward contracts were entered into on the strength of orders of export and the loss occurred due to unprecedented volatility in the foreign currency due to global meltdown from the F. Y2008-09; |

| (g) | The contracts were entered into based on scientific analysis and past history. |

| (h) | The assessee had taken a very conservative and calculated risk while finalising the terms of the forward contract; |

| (i) | When exports commenced as per the scheduled target dates and was expected to increase the biggest investment collapse through Lehmann Brothers in September 2008 occurred rocking the US economy and leading to an unprecedented global recession; |

| (j) | None of the economies could constitute an exception to this global meltdown. |

| (k) | These forward contracts met both the commercial standards and the regulatory requirements of the RBI. It is mandatory under the RBI regulations and master circulars that forward contracts are permissible only on the strength of prudent, commercial underlying transactions; |

1) The company had entered into forward contracts only with reputed banks which is mandated to follow the statutory norms and obligations;

(m) The assessee was the actual user of the forward contracts and not trading in foreign currency derivatives which were also not allowed under the FEMA Regulations, 2000 or SEBI during FY 2007-08 when the forward contracts were entered by the assessee. “

43…………………………………

4.4 Nature of the Contracts

(a) The assessee had entered into two hedging contracts in USD-INR with Citi Bank NA for USD 80,000 on 27/04/2007 & with the Standard Chartered Bank for USD 100,000 on 8/8/2007 against the exports to be made in USD to European & other countries. The underlying exposure for the eligibility of the same was worked out by the bank on the basis of the average of the export & import achieved by the assessee in past years as per the RBI guidelines prevailing in Financial Year 2007-08. The exposure in Forward Contracts contracted was well within the limits of the orders in hand with various customers. The year wise monthly exports sales in USD stating from F. Y 2007-08 to F. Y 2010-11 have been filed.

4.5 The facts of the contracts entered into in USD-INR for the hedging export receivables are similar to the facts explained in the contracts entered in USD-JPY as detailed in Para 2-6 above except that the monthly contracts were settled on the expiry date itself & no delayed settlement was prescribed. After going through the terms of the contracts & the evidence of the confirmed orders available with the assessee for making exports denominated in USD, the view expressed by me based on the reasoning given in para 6 above is equally applicable to this ground also. The forward contracts formed an integral part & are incidental to the core business of the export of Automotive Lightings & Mirror Plates of the assessee. The contracts could have been offered only to exporters like the assessee for the purpose of hedging only. I am of the considered opinion that the transactions cannot be treated as speculative as defined in Sec. 43(5) of the Act. The Assessing Officer is therefore directed to allow the loss of Rs.88,83,314/- as a business loss to be set off against the normal business profits. “

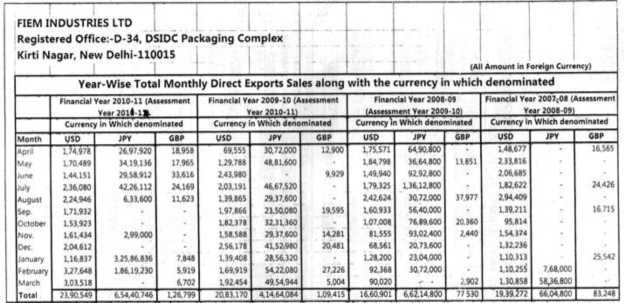

11. The Learned DR vehemently argued that the quantum of automobile business carried out by the assessee are in lakhs and whereas the hedging contracts for the export receivables were done in crores. Accordingly it could be concluded that the hedging activity was carried out as a separate activity by the assessee and hence the loss incurred thereon, on account of exchange fluctuation need to be construed as speculative in nature, thereby not eligible to be set off against the business income. During the course of hearing, the bench directed the Learned AR to produce the financial statements of the assessee company and also complete details of the forward contracts with supporting documents. The same were duly furnished by the Learned AR in subsequent hearing and Learned DR was granted sufficient time to rebut the same. On perusal of the additional paper book filed by the Learned AR at the behest of the Bench containing the audited financial statements of the assessee company for the year under consideration and the complete details of hedging contracts with facts and figures and supporting evidences thereon, we find that assessee had reported total turnover of Rs 407.98 crores from manufacturing activity of automotive goods, moulds, dyes and tools and Rs 9.30 crores of trading of mould, dyes and tools in its audited financial statements. Out of the aforesaid revenue, export sales amount to Rs 13.07 crores in manufacturing activity and Rs 2.92 crores in trading activity. The assessee has furnished the complete details of export sales made by it from assessment years 2008-09 to 2011-12 month wise in various foreign currencies which are tabulated as under:-

12. We find that the revenue had sought to dispute the export exposure of the assessee in Japanese Yen alone in the instant case. The rationale for assessee entering into hedging contracts in view of its export exposure has already been explained in detail in the table depicted in the earlier part of this order. We find that the argument of the revenue that automobile business transactions of the assessee are in lakhs whereas the hedging contract of export receivables are in crores is to be dismissed as devoid of merit as it is not supported by the facts and figures depicted in the financial statements of the assessee company. Further, the assessee had declared exchange gains from these hedging contracts in the earlier year which has been taxed as business income by the revenue. Merely because there is a loss arising on hedging contracts during the year under consideration, the same cannot be treated as speculative in nature by taking a divergent stand. Further it is pertinent to note that the assessee is not engaged in trading of foreign currency in the instant case. The forward contracts are entered into in the instant case by the assessee only for hedging its risk on account of exchange fluctuations, which had to be construed as being incidental to the main core business of the assessee of export of automative lightings and mirror plates. The same cannot be construed as speculative in nature. It is to be noted that the underlying asset is confirmed export orders available with the assessee. We find further that the issue in dispute is settled by the decision of Hon’ble Jurisdictional High Court in the case of PCIT v. Simon India Ltd 389/450 ITR 316 (Delhi) wherein it was held that where assessee claimed loss against forward contracts, entered into so as to hedge risk against foreign exchange fluctuations to cover its exports and imports, since assessee was reinstating its debtors and creditors in connection with execution of contracts and had submitted necessary details in regards to same, disallowance made by treating loss as speculative was erred. The relevant operative portion of the said judgement is reproduced below:-

“30. Undisputedly, the Forward Contracts, in the present case, are hedging transactions. The Assessee has reinstated its debits and credits from the underlying transactions on the value of the foreign exchange on the due date. The corresponding losses/gains under the Forward Contracts, thus, were also required to be accounted for to arrive at the real profits. It would be anomalous if on the one hand, debtors and creditors, in respect of current assets, are stated at the current value of foreign exchange and the corresponding loss on the hedging transaction is not accounted for. In essence, the Assessee has stated his income by taking into account the foreign exchange value as it stands on the due date. It is well settled that the CBDT Instructions and circulars which are contrary to law are not binding.

31. This Court finds no fault with the order of the learned CIT(A) as well as the learned Tribunal in finding that the loss, on account of Forward Contracts, cannot be considered as speculative and the AO had erred in disallowing the same. The questions raised (Questions I and II) are thus, covered by the decision of the Supreme Court in Woodward Governor India (P.) Ltd. (supra).

32. No substantial question of law arises from the ITA 976/De/2013.

13. In view of the aforesaid observations and respectfully following the judicial precedent relied upon herein above, we hold that the loss of Rs 17,70,51,673/-and Rs 88,83,314 are to be construed as normal business loss arising on hedging contracts which are integral and incidental to the core business of the assessee of export of automative lightings and mirror plates and accordingly the same is eligible to be set off against the business income. The said loss cannot be construed as speculative in nature in view of the proviso to clause (a) of section 43(5) of the Act. Accordingly, we do not find any infirmity in the order of the Learned CITA granting relief to the assessee. The grounds raised by the revenue are dismissed.

14. In the result, the appeal of the revenue is dismissed.