Reopening an assessment after four years is invalid without new material or proof of the assessee’s failure to disclose.

Issue

Can an assessment be reopened under Section 147 after four years from the end of the assessment year based on information that was already disclosed by the assessee during the original assessment proceedings?

Facts

- The assessee’s original assessment was completed.

- The Assessing Officer (AO) later issued a reopening notice after four years, citing information from the Insight portal and the Directorate of Investigation about “suspicious” high-value transactions.

- However, the bank accounts and transactions in question were already fully disclosed by the assessee in the original proceedings through the tax audit report, financial statements, and income tax return.

- The AO did not bring any new or tangible material on record that was not available during the initial assessment.

- The “reasons to believe” failed to specify any failure on the part of the assessee to disclose all material facts fully and truly.

Decision

The High Court held that the reassessment proceedings were not sustainable in law and were quashed. It ruled that since the reopening was initiated after four years and there was no failure by the assessee to disclose material facts, the jurisdictional conditions for reopening the assessment were not met.

Key Takeaways

- Conditions for Reopening After 4 Years: To reopen an assessment after four years, the revenue must prove two things: (1) income has escaped assessment, and (2) this escapement was due to the assessee’s failure to disclose all material facts fully and truly.

- No Fishing Expeditions on Old Facts: An AO cannot simply re-examine the same set of facts and documents that were already on record and form a different opinion. This amounts to a “change of opinion,” which is not a valid ground for reopening.

- New Tangible Material is a Must: The basis for reopening must be some fresh, tangible information that came to the AO’s possession after the original assessment was completed. Information already part of the record does not qualify.

An addition for unsecured loans is not justified if the assessee proves genuineness, even if lenders have low income.

Issue

Can an Assessing Officer treat unsecured loans as unexplained cash credits under Section 68 solely on the grounds that the lenders have low declared incomes or have not filed tax returns, even when the assessee provides substantial evidence to prove the transaction’s genuineness?

Facts

- The assessee received unsecured loans from four different parties and submitted documentary evidence to prove their genuineness, including:

- Loan confirmations, PANs, ITRs, and bank statements of the lenders.

- Proof that the loans were received through proper banking channels.

- Evidence that the loans were fully or substantially repaid with interest, and TDS was duly deducted.

- The AO disregarded this evidence and made an addition under Section 68, reasoning that the transactions were not genuine because the lenders either had low incomes or had not filed returns.

- The AO did not conduct any independent inquiry to disprove the evidence furnished by the assessee or to establish that the money actually belonged to the assessee.

Decision

The court held that there was no justification for sustaining the additions under Section 68. However, it remanded the matter back to the Assessing Officer for the limited purpose of verifying the fact of loan repayment.

Key Takeaways

- The Three Pillars of Section 68: To discharge the initial onus under Section 68, an assessee must prove three things about the creditor: (1) Identity, (2) Creditworthiness, and (3) the Genuineness of the transaction.

- Repayment is Strong Evidence: The subsequent repayment of a loan, along with interest, is a very strong indicator of the genuineness of the transaction.

- AO Cannot Act on Suspicion Alone: An AO cannot reject the evidence provided by the assessee based on mere suspicion or assumptions (like the lender’s low income). The AO must conduct their own inquiry and bring contrary evidence on record to disprove the assessee’s claims.

- Low Income of Lender is Not Conclusive: While a lender’s financial capacity is relevant, their having a low taxable income is not, by itself, a sufficient reason to treat a loan as non-genuine, especially when the transaction is documented and routed through banks.

and Girish Agrawal, Accountant Member

[Assessment year 2018-19]

| Name of Donee | INR | Eligible | INR |

| Social Empowerment And Economic Development Society (Seed) | 60,00,000 | 50% | 30,00,000 |

| SEVA MANDIR | 65,00,000 | 50% | 32,50,000 |

| PRATHAM Mumbai Education Initiative | 10,00,000 | 50% | 5,00,000 |

| NETWORK IN THANE BY PEOPLE | 15,00,000 | 50% | 7,50,000 |

| WATER FOR PEOPLE INDIA TRUST | 1,20,00,000 | 50% | 60,00,000 |

| ACTION AND ASSOCIATION | 30,00,000 | 50% | 15,00,000 |

| Total Donation | 3,00,00,000 | 1,50,00,000 |

| Net Profit before tax as per P&L | 9,83,03,15,142 | ||

| ADD: DISALLOWANECS | |||

| Donation | 85,000 | ||

| Depreciation / Amortisation as per books | 1,56,50,99,857 | ||

| Disallowance under section 14A (As per TAR) | 77,052 | ||

| Corporate Social Responsibility | 16,72,37,651 | ||

| Amount of Interest paid to Micro, Small and Medium Enterprises (As per Sec 23 of MSMED) | 29,43,000 | ||

| Expenses allocable to Income from House Property | 4,09,562 | ||

| Municipal Tax allocable to Income from House Property | 11,70,880 | ||

| Income under section 41(3) – Sale of RTC asset | 30,502 | ||

| Employee Stock Option debited to P&L – IND AS adjustment | 9,41,63,548 | ||

| Disallowance under section Sec 40(a) (as per TAR) | 35,92,56,632 | ||

| Disallowance under section Sec 43B (as per TAR) | 5,87,47,640 | ||

| Amortisation of Prepaid Expenses for Security Deposited (INDAS) | 1,75,82,362 | ||

| Loss on sale of Fixed Assets | 16,58,981 | ||

| Provision for Doubtful Debt | 15,30,330 | ||

| Gratuity + Pension benefits considered in Comprehensive Income | 1,64,59,336 | ||

| Disallowance us 40A(3) | 38,372 | ||

| Penalty | 4,93,806 | 2,28,69,84,512 | |

| LESS: ALLOWANCES | |||

| Exceptional Items | |||

| Employee Stock Option Payments/Trf of employees – IND AS adjustment | 9,22,27,077 | ||

| Amortisation of Notional Interest income for Security | 1,76,85,249 | ||

| Deposited (INDAS) | |||

| Depreciation as per Income tax (As per TAR) | 1,77,35,32,863 | ||

| Allowance under 32AD | 8,66,55,495 | ||

| Interest Income considered separately | 27,25,34,751 | ||

| Rental Income considered separately | 1,96,87,500 | ||

| Deduction under section Sec 40(a) (as per TAR) | 11,30,08,030 | ||

| VRS deduction u/s.35DDA | 5,85,10,841 | ||

| 2,43,38,41,806 | |||

| Income from Business or Profession | 9,68,34,57,848 | ||

| Income from other sources | |||

| 244A Interest on Refund | |||

| Interest Income | 27,25,34,751 | ||

| Less: Tax free interest income | 2,22,21,350 | 25,03,13,401 | |

| Total Income from other sources | 25,03,13,401 | ||

| Income from House Property | |||

| Rental Income | 1,96,87,500 | ||

| Municipal Tax | 11,70,880 | ||

| 1,85,16,620 | |||

| Less: 30% | 55,54,986 | 1,29,61,634 | 1,29,61,634 |

| Income from Capital Gain | |||

| Long term capital gain on maturity of a Bond | |||

| Long term capital Gain on sale by way of Slump Sale | |||

| Less: Brought forward loss | |||

| GROSS TOTAL INCOME | 9,94,67,32,883 | ||

| Chapter VI A deduction: | |||

| Section 80G(2)-Donations | 1,50,00,000 | ||

| Section 80JJAA – Workmen | 70,67,807 | 2,20,67,807 | |

| TOTAL INCOME | 9,92,46,65,076 | ||

| ROUNDED TO | 9,92,46,65,071 | ||

| Tax @ 30% on Other than Capital Gain | 2,97,73,99,521 | ||

| Tax @ 20% on Capital Gain | |||

| 2,97,73,99,521 | |||

| Surcharge @ 12% | 35,72,87,943 | ||

| Education CESS @ 3% | 10,00,40,624 | ||

| Total tax payable including surcharge | 3,43,47,28,088 | ||

| Tax payable u/s. 115JB – MAT | 2,09,68,56,443 | ||

| Higher of the two | 3,43,47,28,088 | ||

| Less: MAT credit | |||

| Net tax liability | 3,43,47,28,088 | ||

| Less: Credit u/s 91 | |||

| Less: Tax Deducted Source | 2,72,18,632 | ||

| Balance Payable | 3,40,75,09,456 | ||

| Less: Advance Tax paid | |||

| June 15, 2017 | 40,00,00,000 | ||

| Sept 15, 2017 | 1,00,02,00,000 | ||

| Dec 14, 2017 | 1,02,00,00,000 | ||

| Mar 15, 2018 | 90,80,00,000 | ||

| Balance payable/(Refundable) | 8,74,99,310 | 3,41,56,99,310 | |

| Add: Interest u/s.234C | 81,89,846 | ||

| Balance Payable | (8) |

“1. With respect to Foreign Outward Remittances, made during the year please provide following:

1a) Kindly submit details of all the payments made under various to no-residents in the below format. Also explain the source of Foreign remittance made with supporting documents:

| Name of Payee | Amount (Rs.) | Country of Residence of Payee | Nature of Payment |

1b) Kindly explain for each such payment, weather income tax was not deducted or was deducted at lower rate. If you have any certificate to that extent from the Tax Department, please submit copy of the same.

1c) For all such payments where income tax is not deducted or deducted at lower rate, kindly submit copies of bills and TRC submitted by those parties along with copies of agreements entered into with them for those transactions.

1d) Please reconcile the amount of foreign remittances with the 15CA/CB certificates available with the department for the year consideration.

1e) kindly provide the complete bank account statement, highlighting such transactions.

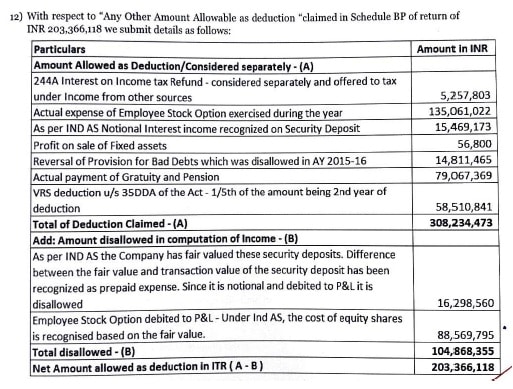

5. With respect to Any Other Amount Allowable as deduction “claimed in Schedule BP of return, please furnish the justification on allowability of these deductions with supporting and legal arguments with respect specific section under Income tax Act.”

“A bare reading of section 263 of the Income-tax Act, 1961, makes it clear that the prerequisite for the exercise of jurisdiction by the Commissioner suo moto under it, is that the order of the Income-tax Officer is erroneous in so far as it is prejudicial to the interests of the Revenue. The Commissioner has to be satisfied of twin conditions, namely, (i) the order of the Assessing Officer sought to be revised is erroneous; and (ii) it is prejudicial to the interests of the Revenue. If one of them is absent–if the order of the Income-tax Officer is erroneous but is not prejudicial to the Revenue or if it is not erroneous but is prejudicial to the Revenue– recourse cannot be had to section 263(1) of the Act. The provision cannot be invoked to correct each and every type of mistake or error committed by the Assessing Officer, it is only when an order 7 is erroneous that the section will be attracted. An incorrect assumption offacts or an incorrect application of law will satisfy the requirement of the order being erroneous “.

13. We, therefore, hold that in order to exercise power under sub-section (1) of section 263 of the Act there must be material before the Commissioner to consider that the order passed by the Income-tax Officer was erroneous in so far as it is prejudicial to the interests of the Revenue. We have already held what is erroneous. It must be an order which is not in accordance with the law or which has been passed by the Income-tax Officer without making any enquiry in undue haste. We have also held as to what is prejudicial to the interests of the Revenue. An order can be said to be prejudicial to the interests of the Revenue if it is not in accordance with the law in consequence whereof the lawful revenue due to the State has not been realised or cannot be realised. There must be material available on the record called for by the Commissioner to satisfy him prima facie that the aforesaid two requisites are present. If not, he has no authority to initiate proceedings for revision. Exercise of power of suomotu revision under such circumstances will amount to arbitrary exercise of power. It is well-settled that when exercise of statutory power is dependent upon the existence of certain objective facts, the authority before exercising such power must have materials on record to satisfy it in that regard. If the action of the authority is challenged before the court it would be open to the courts to examine whether the relevant objective factors were available from the records called for and examined by such authority. Our aforesaid conclusion gets full support from a decision of SabyasachiMukharji J. (as his Lordship then was) in Russell Properties Pvt. Ltd. v. A. Chowdhury, Addl. CIT. In our opinion, any other view in the matter will amount to giving unbridled and arbitrary power to the revising authority to initiate proceedings for revision in every case and start re-examination and fresh enquiries in matters which have already been concluded under the law. As already stated it is a quasi judicial power hedged in with limitation and has to be exercised subject to the same and within its scope and ambit. So far as calling for the records and examining the same is concerned, undoubtedly, it is an administrative act, but on examination “to consider” or in other words, to form an opinion that the particular order is erroneous in so tar as it is prejudicial to the interests of the Revenue, is a quasi-judicial act because on this consideration or opinion the whole machinery of re-examination and reconsideration of an order of assessment, which has already been concluded and controversy which has been set at rest, is set again in motion. It is an important decision and the same cannot be based on the whims or caprice of the revising authority. There must be materials available from the records called for by the Commissioner.

14. We may now examine the facts of the present case in the light of the powers of the Commissioner set out above. The Income-tax Officer in this case had made enquiries in regard to the nature of the expenditure incurred by the assessee. The assessee had given detailed explanation in that regard by a letter in writing. All these are part of the record of the case. Evidently, the claim was allowed by the Income-tax Officer on being satisfied with the explanation of the assessee. Such decision of the Income-tax Officer cannot be held to be “erroneous” simply because in his order he did not make an elaborate discussion in that regard. Moreover, in the instant case, the Commissioner himself, even after initiating proceedings for revision and hearing the assessee, could not say that the allowance of the claim of the assessee was erroneous and that the expenditure was not revenue expenditure but an expenditure of capital nature. He simply asked the Income-tax Officer to re-examine the matter. That, in our opinion, is not permissible. Further inquiry and/or fresh determination can be directed by the Commissioner only after coming to the conclusion that the earlier finding of the Income-tax Officer was erroneous and prejudicial to the interests of the Revenue. Without doing so, he does not get the power to set aside the assessment. In the instant case, the Commissioner did so and it is for that reason that the Tribunal did not approve his action and set aside his order. We do not find any infirmity in the above conclusion of the Tribunal.”

“1. In our view at the relevant time two views were possible on the word ‘profits’ in the proviso to section 80HHC(3). It is true that vide 2005 amendment the law has been clarified with retrospective effect by insertion of the word ‘loss’ in the new proviso. We express no opinion on the scope of the said amendment of 2005. Suffice it to state that in this particular case when the order of the Commissioner was passed under section 263 of the Income-tax Act two views on the said word ‘profits’ existed. In our view the matter is squarely covered by the judgment of this Court in the case of Malabar Industrial Co. Ltd. v. CIT [2000] 243 ITR 83 as also by the judgment of the Calcutta High Court in the case of Russell Properties (P.) Ltd. v. A. Chowdhury, Addl. CIT [1977] 109 ITR 229 at 243.

2. At this stage we may clarify that under para 10 of the judgment in the case of Malabar Industrial Co. Ltd. (supra) this Court has taken the view that the phrase “prejudicial to the interest of the revenue” under section 263 has to be read in conjunction with the expression “erroneous” order passed by the Assessing Officer. Every loss of revenue as a consequence of an order of the Assessing Officer cannot be treated as prejudicial to the interest of the revenue. For example, when the Income-tax Officer adopted one of the courses permissible in law and it has resulted in loss of revenue; or where two views are possible and the Income-tax Officer has taken one view with which the Commissioner does not agree, it cannot be treated as an erroneous order prejudicial to the interest of the revenue, unless the view taken by the Income-tax Officer is unsustainable in law. According to the learned Additional Solicitor General on interpretation of the provision of section 80HHC(3) as it then stood the view taken by the Assessing Officer was unsustainable in law and therefore the Commissioner was right in invoking section 263 of the Income-tax Act. In this connection he has further submitted that in fact 2005 amendment which is clarificatory and retrospective in nature itself indicates that the view taken by the Assessing Officer at the relevant time was unsustainable in law. We find no merit in the said contentions. Firstly, it is not in dispute when the Order of the Commissioner was passed there were two views on the word ‘profit’ in that section. The problem with section 80HHC is that it has been amended eleven times. Different views existed on the day when the Commissioner passed the above order. Moreover the mechanics of the section have become so complicated over the years that two views were inherently possible. Therefore, subsequent amendment in 2005 even though retrospective will not attract the provision of section 263 particularly when as stated above we have to take into account the position of law as it stood on the date when the Commissioner passed the order dated 5-3-1997 in purported exercise of his powers under section 263 of the Income-tax Act.”