Trading PM Permits is a Taxable Supply of Goods (HSN 4907) Liable to 12% GST.

Issue

Whether the trading of “Particulate Matter (PM) permits” under the GPCB Emission Trading Scheme constitutes a taxable “supply” under GST, and if so, whether these permits are classified as “goods” or “services” and what is the applicable HSN code and tax rate.

Facts

- The applicant, a GST-registered firm, participates in the mandatory GPCB Emission Trading Scheme for Particulate Matter.

- The applicant is allocated PM permits, which are then traded (bought and sold) on the NeML exchange at a market-determined price.

- The applicant contended that these permits are mere regulatory incentives, and their trading is not a “business” activity, hence it should not be a taxable supply.

- The applicant sought a ruling on the nature of the supply (goods or services), its HSN classification, and the applicable GST rate.

Decision (Ruling of the AAR)

The Authority for Advance Ruling (AAR) ruled in favour of the revenue:

- It is a Taxable Supply: The trading of PM permits is a supply made for a “consideration” in the “course or furtherance of business.” The AAR rejected the argument that it was a non-business activity, noting that the permits have a clear monetary value, are traded on a market, and can be sold for a profit.

- It is “Goods,” Not Services: The permits are tradable instruments, akin to Renewable Energy Certificates (RECs) and Priority Sector Lending Certificates (PSLCs).

- Classification is HSN 4907: Following CBIC circulars on similar instruments, the AAR held that PM permits are not “securities.” They are “documents of title” that confer a specific right (to emit) and have a fiduciary value far exceeding their intrinsic value (the paper they are on). This fits the description of goods under HSN 4907.

- Applicable Rate is 12%: The applicable GST rate for goods falling under HSN 4907 is 12%.

Key Takeaways

- Tradable Permits are a “Supply”: The sale of any tradable permit, license, or scrip that has a market-determined value is a taxable supply under GST.

- Integral to Business: Even if participation in a scheme is mandatory, the subsequent trading of the permits acquired under that scheme is considered “integrally connected” to the business operations and thus a “business” activity.

- Classification as Goods (HSN 4907): Tradable permits and certificates (like PM permits, RECs, PSLCs) are generally classified as “goods” under HSN 4907. This heading covers “documents of title” and similar instruments.

- Rate of Tax: The sale of PM permits is liable to 12% GST.

AUTHORITY FOR ADVANCE RULING, GUJARAT

Randhir Dyeing and Printing Mills, In re

SUSHMA VORA and VISHAL MALANI, Member

Advance Ruling No. GUJ/GAAR/R/2025/38

(In Application No. Advance Ruling/SGST & CGST/2025/AR/13)

(In Application No. Advance Ruling/SGST & CGST/2025/AR/13)

SEPTEMBER 15, 2025

Samir Siddhapuria, Adv. for the Applicant.

ORDER

Brief facts:

1. M/s. Randhir Dyeing and Printing Mills, 33/2, Plot No. 1, Behind Subjail, Khatodra, Surat, Gujarat-395002 [for short – ‘applicant’] is registered under GST and their GSTIN is 24AADFR1112P1ZC.

2. The applicant has stated that they are a partnership firm and are engaged in the business of manufacturing and selling of garments and made up fabrics as well as doing the job work of dyeing and printing of fabrics.

3. The Gujarat Pollution and Control Board (GPCB) regulates the manufacturing and processing units under the Water Act, 1974, Air Act, 1981 and the Environment (Protection) Act, 1986. The applicant is having permission from GPCB vide AWH 123809 dtd. 12.01.2023 valid upto 29.01.2028. In pursuance to the letter dtd. 06.03.2019 of the Ministry of Environment, Forest and Climate Change, which directed the Government of Gujarat to introduce a pilot market-based regulation using Continuous Emission Monitoring System (CEMS), the GPCB introduced an Emission Trading Scheme for Particulate Matter (ETS-PM) in Surat. This has subsequently been extended to similar units in Ahmedabad.

4. An Emission Trading Scheme (ETS), also known as ‘cap-and-trade’ system, is a market-based policy tool designed to reduce pollution while minimizing costs to industries. ETS establishes the maximum load of a pollutant, or a ‘cap’ over a geographical area from participant industrial sources. Based on the capitalisation of these industries, Particulate Matter (PM) permits are allotted to industries. These industrial units participate in the market by buying or selling (trade) permits to ensure their permit holdings equal their actual emissions to be in compliance. The ETS approach aims for a win-win scenario by reducing emission costs, protecting the environment and increasing firm profits, thereby fostering economic growth.

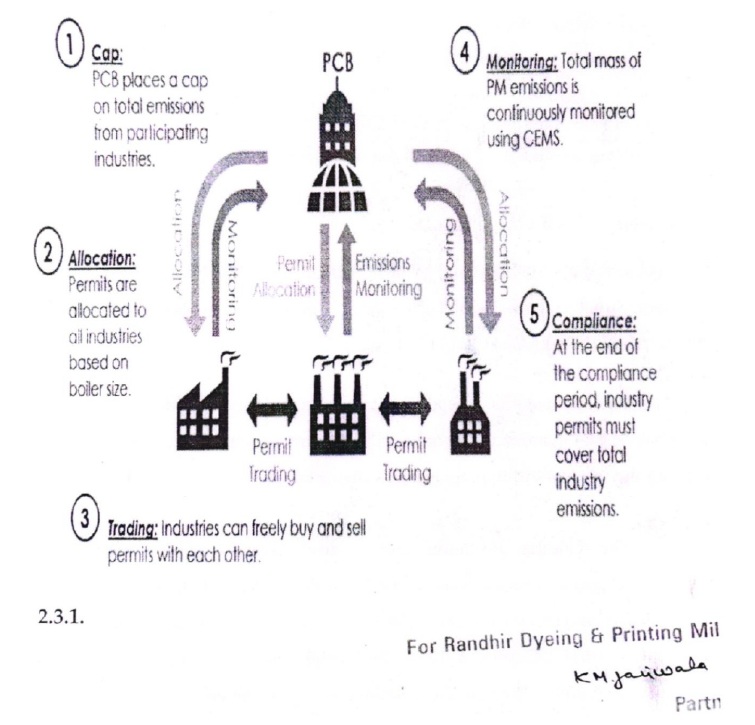

5. A diagram as to how ETS Works is shown below: –

The regulator i.e GPCB sets a limit on the total mass of emissions released by all participant industries (the market cap). The regulator creates emission permits equal to the cap and allocates the permits among participating industries, as per their pollution potential, estimated using a predetermined rule. Industries can trade permits with each other through a trading platform. The price of the permits is determined by supply and demand, mainly during auctions held periodically. At the end of a compliance period, industries must have enough permits to cover their total emissions. If they do not, they are liable to penalty.

6. Permits:

6.1 Definition of permit A permit is a permission to the permit holder to emit a kilogram of suspended particulate matter (SPM) within a compliance period. The number of permits in the market are equal to the market cap. Permits hold monetary value and can be bought/sold in the market. These permits are not tradeable in the open market and can only be traded in an emission market.

6.2 Scope of Permit: The scope of a permit is the geographical area corresponding to the Cap-and-Trade Scheme for which the permit is created.

6.3 Permit creation and validity: Permits are digitally created on the trading portal hosted by NeML and are valid from the date of creation and till the end of the compliance period. Compliance period is a predefined period for which the market cap and permits are defined. GPCB announces compliance period through a circular and they usually extend for two months.

6.4 Permit allocation: In the ETS-PM markets, a combination of free allocation or ‘grandfathering’ and auctioning is used to allocate permits. 80% of the permits are distributed free of cost to industries based on the effective capacity stated in the official documentation (Consent to operate). Effective capacity is the measure of the combined heat output of emissions sources at each unit. The balance 20% of the permits are auctioned in the market and are offered by GPCB at the base price of Rs. 5/kg at the first auction.

6.5 Permit Trading: Industries for whom it is cheap to cut pollution have an incentive to make large reductions in emissions, as this leaves them with excess permits that can be sold to other market participants. Meanwhile, those industries for whom it is very expensive to reduce emissions, can choose to buy permits from others in the market. Permit trading occurs in auctions designed to occur periodically.

7. Market Rules:

7.1 Market Cap: The total mass of particulate matter pollution that can be emitted by all participating units during a compliance period as set by the regulator. Accordingly, the cap is the sum of all permits across participating units in one compliance period.

7.2 Market Compliance: Compliance in the market is defined when the permit holdings of a participant unit equals its pollution mass at the end of a compliance period. Non-compliant units, those not having enough permit holdings for their pollution mass are levied a penalty of Rs. 200/kg.

7.3 Market Auctions: Participants trade in auctions held daily/weekly to trade permits. Two types of auctions take place:

| (a) | Uniform Price auction: An auction format wherein one uniform price is discovered for the week based on the price discovery mechanism. These are conducted periodically on every Tuesday. |

| (b) | Continuous Matching auction: An auction format where trades are carried out at the predetermined price among participating units. These auctions occur daily from Wednesday to Monday with the exception of public holidays. These do not overlap with uniform auctions. |

7.4 Price discovery and Price Collar: The market price is discovered based on the bids placed by the participants in the uniform price auctions on Tuesdays. The price is discovered based on the price and quantity of permits declared in buy and sell bids put forward by the participants. The price discovered in the uniform price auction continues for the rest of the week and industries can buy and sell permits until the following Monday in the daily Continuous Market, at the week’s cleared price. Price collars are instituted to protect the price of permits against unexpected escalations. The price ceiling is set at Rs. 100/permit and the floor price is set at Rs. 5/permit.

8. Stakeholders under ETS:

8.1 NeML Portal and Trading: NCDEX e-Markets Limited (NeML) is the leading Indian electronic web based, online commodities spot market and services company and is a delivery based e-markets platform for transparent and robust price discovery across commodities and intangibles. The ETS trading platform is hosted and operated by NeML wherein the permits under ETS are traded within a closed circle of participants industries in Surat and Ahmedabad. NeML charges an annual fee from participants in the trading platform for which GST is applied. As applicable, e-commerce operators are required to deduct a TCS of 1% on the sale of goods or provision of services or both made by the e-commerce participant made on a platform developed by e-commerce operators. NeML currently deducts 1% TCS on the permitted sale amount in ETS market.

8.2 Gujarat Pollution Control Board: The Gujarat Pollution Control Board is the regulator and implementing partner. Their primary role includes setting and approving market rules, monitoring the CEMS data, setting of market cap and issuance of permits, and ensuring compliance with the market rules.

8.3 Industry Participants and Registration: GPCB selects the industries based on the polluting nature of the industry to be part of the market and releases the government notification before the launch of the program in a district. All industries selected by GPCB are mandatorily required to be part of the market. All participant industries are required to register on the NeML portal. The registration process entails all industries to provide details regarding their stack characteristics and CEMS device, and once verified and approved by the GPCB, the industries are provided with a login ID which they can use to access the portal for trading and CEMS data monitoring.

8.4 Market Research Team: The market research team consists of leading global experts from the University of Chicago, Yale University and the University of Warwick along with researchers from J-PAL South Asia and EPIC India. The role of the research team in Gujarat has been as advisors and technical partners on the development and implementation of the markets.

9. In view of the above facts, the applicant has sought a ruling on the following questions: –

| (i) | As to whether trading of Particulate Matter Permits vide Bill of Supply No. 1 dtd. 05.10.2024 is liable to tax under the GST Act or not? |

| (ii) | If yes, then it is Goods or Services under the GST Act? |

| (a) | If it is goods, then as to whether trading activity of Particulate Matter Permits is covered by which HSN Code and rate of GST? |

| (b) | If it is services, then as to whether trading activity of Particulate Matter Permits is covered by which SAC code and rate of GST? |

10. The applicant further submits as under: –

| (a) | As per Section 7(2) of the CGST Act, transactions listed under Schedule II are neither considered supply of goods nor services. The Particulate Matter Permits do not constitute tangible goods or services, but rather an intangible right to offset emissions. The Permits arose on account of the manner in which the business is carried on. It is nothing but an incentive given to an industrial unit for reduction of the emission of hazardous air/gases including carbon dioxide/monoxide. Therefore, they are privilege/entitlement given to industries for reducing the emission in the course of their industrial activity. |

| (b) | Industries that maintain healthy boiler as well as Air Pollution Control devices and better quality fuel emit lower PM emissions thereby saving the allotted permits which can be traded and sold in the Open Market via NeML portal, while on the contrary industries emitting high PM load due to under maintained boilers/abatement devices or burning low quality fuel will have to purchase the required permits from the open market to meet their higher emissions compared to allotted permits. |

| (c) | Thus, consumption of PM permits is action based/event based and considering the importance of environment protection and the need to promote the measures to protect it, the Particulate Matter Permits are requested to be considered as no income supply. |

| (d) | The objective being reduction of emissions of greenhouse gases and encourage the industry for lesser emissions, taxing it would put extra burden on buyers resulting in less demand of Particulate Matter Permits. |

| (e) | They may be treated as ‘Securities’ as they appear to fall under the wide term ‘Other marketable securities of like nature in or of any incorporated company or other body corporate’. |

They are also alike duty credit scrips prevalent in Customs, which are exempt under GST.

| (f) | They are only for regulatory compliance and any transactions related to them are not considered business income. Therefore, the income received from sale of permits are not supply of goods or service in the course of furtherance of business. |

| (g) | The GST law does not explicitly define the permits as goods or services. The legislative intent to tax it is absent. |

| (h) | Imposing GST on it discourages participation in environmental sustainability programs. |

11. Personal hearing was granted on 29.07.2025 wherein Shri Samir Siddhapuria, Advocate appeared on behalf of the applicant and reiterated the facts & grounds as stated in the application. During the course of hearing, he was requested to provide a write up on the applicability of CBIC’s Circular No. 34/8/2018-GST dtd. 01.03.2018 and Circular No. 46/20/2018-GST dtd. 06.06.2018.

11.1 In their letter dtd. 25.08.2025, the applicant submitted that the Circulars dtd. 01.03.2018 and 06.06.2018 deal with Priority Sector Lending Certificates (PSLCs), Renewable Energy Certificates (RECs) and Duty Credit Scrips, which are marketable financial instruments and the scope of the Circulars is restricted to these instruments. Unlike financial scrips, the Particulate Matter Permits are non-tradeable and cannot be freely transferred in the open market. These permits also get expired within 1 to 2 months, when not sold. They also do not constitute goods under Section 2(52) of the CGST Act as they are neither movable property nor marketable commodities. Neither do they fall within the definition of ‘services’ under Section 2(102) of the Act, as they are not supplied for consideration in the course or furtherance of business. Further, classification under Heading 4907 is confined to documents of title or tradable certificates (such as PSLCs, RECs, duty scrips) and PM Permits being statutory permissions, do not partake the nature of such tradable documents and hence cannot be imported into the same classification.

Discussion and findings

12. At the outset, we would like to state that the provisions of both the CGST Act and the GGST Act are the same, except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the GGST Act.

13. We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made both oral and written during the course of personal hearing. We have also considered the issue involved, the relevant facts & the applicant’s submission/interpretation of law in respect of question on which the advance ruling is sought.

14. We find that the appellant is engaged in the business of manufacturing and selling of garments and made-up fabrics. On the instructions of the Ministry of Environment, Forest and Climate Change a pilot project of Emission Trading Scheme for Particulate Matter was started by the Gujarat Pollution Control Board (GPCB). Under this scheme, the regulator i.e the GPCB sets a total cap on the emissions released by the participant industries. Emission permits equal to the cap are created and allocated to the participant industries. The industries can trade the permits with each other through a trading platform i.e NCDEX emarkets Limited (NeML). At the end of the compliance period, industries must have enough permits to cover their total emissions failing which they are liable to penalty. Thus, those who make large reduction in emissions are left with excess permits which they can trade with other industries for whom it very expensive to reduce emissions. The applicant is seeking a ruling as to whether they are liable to pay GST on the trading of Particulate Matter Permits (PM-permits).

15. The first averment of the applicant is that the PM-permits are not tangible goods or services but rather represent an intangible right to offset emission. Therefore, PM-credits are privilege/entitlement given to the industries for reducing the emission in the course of their industrial activity. We find that CBIC has issued Circular No. 34/8/2018-GST dtd. 01.03.2018, amended vide Circular No. 46/20/2018-GST dtd. 06.06.2018, wherein it has been clarified that Priority Sector Lending certificates (PSLC) has been considered as goods and not securities by the Reserve Bank of India. Further, PSLC are akin to freely tradable duty scrips, Renewable Energy Certificates (REC), REP licences or replenishment licence, which attracted VAT. It was also clarified that the RECs and PSLCs are goods which are classified under heading 4907 and will accordingly attract GST @ 12%.

16. PSLCs are tradable instruments that allow banks to meet their mandatory Priority Sector Lending (PSL) targets set by the Reserve Bank of India (RBI). Banks that lend more than their PSL targets to priority sectors can sell PSLCs to earn revenue, while banks that fall short can buy these certificates on the RBI’s e-Kuber platform to cover their shortfall. This mechanism creates a market for credit, incentivizes banks to lend more to essential sectors like agriculture and MSMEs, and helps ensure equitable credit distribution across the economy. The Renewable Energy Certificate (REC) mechanism is a market-based instrument, to promote renewable sources of energy and development of market in electricity. The REC mechanism provides an alternative voluntary route to a generator to sell his electricity from renewable sources just like conventional electricity and sell the green attribute separately to obligated entities to fulfil their Renewable Purchase Obligation (RPO). Trading of RECs is being undertaken on Power Exchanges on the last Wednesday of every month.

17. Thus, from the above, it can be seen that both PSLCs and RECs are tradable instruments like Particulate Matter Permits (PM-permits). All these instruments are used in their respective industry for earning revenue by trading the instruments to those entities who fail to fulfil the obligations imposed by the regulator. PSLCs are instruments used in Banking sector, RECs are used in the Electricity sector and PM-permits are used in the industries which are highly polluting. Thus, PM-permits would also fall under the category of goods and would be classified under Heading 4907.

18. We also find that heading 4907 covers ‘documents of title’. The same is reproduced below: –

| 4907 | Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have. a recognized face value; stamp-impressed paper: bank notes; cheque forms; stock, share or bond certificates and similar documents of title | ||

| 4907 00 | — Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognized face, value; stamp-impressed paperbank notes; cheque farms; stock, share or bond certificates and similar documents of title: | ||

| 4907 00 10 | — Unused postage, revenue or similar stamps of current or new issue in the country winch they have, or will have a recognized face value | kg. | 18% |

| 4907 00 20 | — Bank notes | kg | 18% |

| 4907 00 30 | — Documents of title conveying the right to use Information Technology software | kg | 18% |

| 4907 00 90 | — Other | kg | 18% |

HSN explanatory notes to 4907 explains that the characteristic of the products of this heading is that on being issued (if necessary, after completion and validation) by the appropriate authority, they have a fiduciary value in excess of the intrinsic value. These explanatory notes further explain that the products under heading 4907 comprise :

| (A) | xx xx xx |

| (B) | xx xx xx |

| (F) | Stock, share or bond certificates and similar documents of title Stock: These are formal documents issued, or for issue, by public or private bodies conferring ownership of, or entitlement to certain financial interests, goods or benefits named therein. |

PM-permits in question would qualify as ‘documents of title’ conferring benefits on the Applicant. From the nature of the document in question, it is evident that the permit is a permission to the permit holder to emit a kilogram of suspended particulate matter (SPM) within a compliance period. Thus, these certificates provide benefit to the applicant inasmuch as these certificates can be used by applicant to offset their organization’s emissions. These permits also hold monetary value as they can be bought and sold in the market. Therefore, these permits would fall under the residuary heading of 4970 00 90.

18.1 The second averment made by the applicant that PM-permits are securities as they appear to fall under the wider term, “other marketable securities of a like nature in or of any incorporated company or other body corporate.” CGST Act defines securities as that which has the same meaning as assigned to it in Section 2(h) of the Securities Contracts (Regulation) Act, 1956. As per Section 2(h):

“securities” include-

| (i) | shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate; |

| (ia) | derivative; |

| (ib) | units or any other instrument issued by any collective investment scheme to the investors in such schemes; |

| (ic) | security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002; |

| (id) | units or any other such instrument issued to the investors under any mutual fund scheme; |

| (ii) | Government securities; |

| (iia) | such other instruments as may be declared by the Central Government to be securities; and |

| (iii) | rights or interest in securities; |

The above definition is an inclusive definition, which defines the securities to include only the above. The applicant’s contention is that the PM-permits can be covered under ‘other marketable securities of a like nature’. In this connection, we would like to invoke the rule of ejusdem generis, a rule of interpretation, which has been relied upon by the courts in a large number of cases for interpreting statutes. The rule of ejusdem generis means ‘of the same kind’. As per this rule, general words following specific ones are limited to the same class as the specific words. In the instant case, the statute lists specific type of securities, such as bonds, stocks and debentures. Therefore, the other marketable securities would only refer to other securities similar in nature to bonds, stocks and debentures and not something fundamentally different. PM-permits are permits which allow the holder to emit a kilogram of suspended particulate matter within a compliance period and cannot be equated to a bond, stock and debenture.

19. The next averment of the applicant is that the permits are only for regulatory compliance and any transactions related to them are not considered business income. They are nothing but incentives given by GPCB on the basis of capitalization in consonance with lesser emission of hazardous gases. Therefore, income received from sale of permits are not supply of goods or services in the course or furtherance of business. We do not agree with this contention of the applicant that buying and selling do not come under the ambit of business income. We find that the permits hold monetary value and the applicant have in their submissions submitted that the trading of these permits is carried out by way of an auction (both weekly and daily) and the market price is discovered based on the bids placed by the participants. Price collars are also instituted to protect the price of permits against unexpected escalations, with the maximum ceiling set at Rs. 100/permit and the floor price at Rs. 5/permit. The price of the permits is determined by supply and demand, mainly during auctions held periodically. Thus, an industry who is holding permits can make a profit by selling the permits, which is reflected in their income. Further, the applicant has also not indicated as to how they account for these incomes in their books of account. Therefore, it appears that the trading of permits would come under the ambit of business income.

20. As regards the averment that sale of the permits is not in the course or furtherance of business, we observe that the applicant themselves have submitted that GPCB selects the industries based on the polluting nature of the industry to be part of the market and releases the government notification before the launch of the program in a district. All industries selected by GPCB are mandatorily required to be part of the market. As per Section 7 of the CGST Act, 2017, all forms of supply of goods to be made for a consideration by a person in the course or furtherance of business comes under the scope of supply. We find that in the case of Commissioner of Gift-tax v. P. Gheevarghese, Travancore Timbers & Products [1972] 83 ITR 403 (SC)/(1972) 4 SCC 323, while explaining the meaning of the phrase “in the course of business” in the context of Gift Tax Act, 1958, it was observed that the phrase “in the course of carrying on of business” means that the gift should have some relationship with the carrying on of the business. There should be some integral connection or relation between the making of the gift and the carrying on of the business. In the instant case, the Emission Trading scheme for Particulate Matter is a mandatory scheme for the applicant and has a relation with the applicant carrying on their business. As part of this scheme, the applicant has to be in their possession, permits equal to their pollution mass at the end of a compliance period. If there is a shortfall, they would have to buy it from the participating units. If the permits are in excess, they have the option to sell it to another participating unit. This goes on to show that the trading of permits is in the course and furtherance of their business.

21. Lastly, the applicant has submitted that unlike financial scrips, PM-permits are non-tradable and cannot be freely transferred in the open market. Further, if permits are not sold it gets expired at the end of each compliance period and industry cannot reuse them to account for future emissions. Firstly, the averment that the permits are not tradable is not correct as the applicant have themselves submitted that it is traded on the NeML portal and any person who is participating in the ETS-PM scheme can purchase the permits. Further, the averment that it cannot be freely transferred in the open market but only in the emission market is also of no significance as it is an instrument conferring benefits on the Applicant and therefore, falls under HSN 4907 and liable to GST. For the same reason, the fact that it has an expiry period is also of no significance.

22. Having held that the trading of PM-permits is liable to tax under GST under HSN 4907, we move on to the next question, as to what is the appropriate rate of GST. We would like to reproduce the relevant portions of the rate notification viz.

Notification No. 1/2017-CT (Rate) dated 28.6.2017, as amended

SCHEDULE II – 6%

| S.No. | Chapter/ Heading/ Sub-heading/Tariff item | Description of Goods |

| 128. | 4907 | Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognised face value; stamp-impressed paper; banknotes; cheque forms; stock, share or bond certificates and similar documents of title |

From the above, it is seen that the appropriate rate for goods falling under Heading 4907 is 12 %. Therefore, the applicable rate of GST for trading of PM-permits is 12%.

23. In view of the foregoing, we rule as under: –

RULING

Q.1 As to whether trading of Particulate Matter Permits vide Bill of Supply No. 1 dtd. 05.10.2024 is liable to tax under the GST Act or not ?

Ans: Yes

Q.2 If yes, then is it Goods or Services under the GST Act ?

| (a) | If it is goods, then as to whether trading activity of Particulate Matter Permits is covered by which HSN Code and rate of GST ? |

Ans: Particulate Matter Permits are goods under GST and fall under HSN 4907. The applicable rate of GST is 12%.

| (b) | If it is services, then as to whether trading activity of Particulate Matter Permits is covered by which SAC code and rate of GST ? |

Ans: Not answered, in view of answer at (a) above.