ORDER

Manish Agarwal, Accountant Member. – The captioned appeal is filed by Revenue against the order dated 20.11.2024 passed by Ld. Commissioner of Income Tax (A)-3, Noida [“Ld.CIT(A)”] in Appeal No.CIT (Appeal), NFAC/2017-18/10088227 u/s 250 of the Income Tax Act, 1961 [“the Act”] arising out of assessment order dated 01.06.2021 passed u/s 143(3) r.w.s 144B of the Act pertaining to assessment year 2018-19.

2. Brief facts of the case are that the assessee company is engaged in the business of a real estate developer primarily covering residential projects, identification and acquisition of land, to the planning, execution and marketing of the projects. It had filed its return of income on 30.102.2018, declaring total income of INR NIL. Thereafter, notice u/s 143(2) of the Act was issued on 23.09.2019 and served through e-filing account of the assessee on the registered e-mail id of the assessee. The case of the assessee company was selected for complete scrutiny on various issues which are, (i) claim of any other amount allowable as deduction in Schedule BP; (ii) stock valuation; (iii) investments/advances/loans; (iv) business loss; and (v) unsecured loans. Subsequently, notices u/s 142(1) were issued from time to time, in reply the assessee had filed its replies. After verification of the submissions made by assessee, the assessment order was passed u/s 143(3) r.w.s. 144B of the Act vide order dated 01.06.2021wherein the total income of the assessee was assessed at INR 12,17,08,119/-.

3. Against the said order, assessee filed an appeal before Ld. CIT(A) who vide order dated 20.11.2024, partly allowed the appeal of the assessee.

4. Aggrieved by the order of Ld.CIT(A), Revenue is in appeal before the Tribunal by taking following grounds of appeal:-

| 1. | | “Whether on facts and circumstance of the case and in law, Ld. CIT (A)-3, Noida has erred in deleting the addition of Rs.22,37,89,198/ made on account of disallowances of interest u/s 36(1)(iii) of the Income Tax Act, 1961, without appreciating the facts brought on record by the Assessing Officer during the course of assessment proceedings. |

| 2. | | Whether on facts and circumstance of the case and in law, Ld.CIT (A)-3, Noida has erred in deleting the addition of Rs. 22,37,89,198/-, disregarding the facts that the assessee has advanced huge interest free loan to the sister concerns/private parties/individuals and despite being given proper opportunity during the course of assessment proceedings failed to prove that the said loans were given out of interest free funds. The commercial expediency in respect of these loan has also not been proved by the assessee; hence, the AO has rightly disallowed the interest of Rs. 22,37,89,198/ being 12% of interest bearing funds of Rs. 194,70,54,951/-worked out on day to day basis. |

| 3. | | Whether on facts and circumstance of the case and in law, Ld.CIT (A)-3, Noida has erred in deleting the said addition, without appreciating the facts that the assessee during the course of assessment proceedings as well as appellate stage completely failed to furnish cogent documentary evidences regarding interest bearing and interest free fund available with it, which could establish that the assessee has utilized the interest free fund for advancing the loan. |

| 4. | | Whether on facts and circumstance of the case and in law, Ld. CIT (A)-3, Noida has erred in deleting the addition by not considering the facts that the assessee failed to establish that there was direct nexus between the interest of Rs. 25,92,89,000/-debited in the Profit and Loss Account and income earned by the assessee on account of interest bearing fund raised by it. |

| 5. | | That the appellant craves leave to add, alter or amend any ground or grounds on or before the date of hearing of appeal.” |

5. Before us, Ld.CIT DR for the Revenue submits that the case of the assessee was selected for complete scrutiny and during the course of assessment proceedings, AO found that the assessee has given interest free advances to various parties and claimed huge amount of interest of INR 25,92,89,000/- in the P&L Account on the unsecured loans of INR 28,52,64,000/-. Ld. CIT DR submits that major source of the advances was the interest bearing funds available with the assessee and therefore, it is evidenced that the assessee has utilized interest bearing funds for making interest free advances to its sister concerns and other companies. Ld. CIT DR submits that the assessee has not received any interest on the advances/loans given however, paid interest on loans which was claimed as deduction in the P&L Account though there was a direct nexus between the borrowed funds and interest free loans given. Ld.CIT DR submits that assessee has failed to justify the business expediency of such interest free advances and therefore, the AO has invoked the provision of section 36(1)(iii) of the Act and computed the disallowance of INR 22,37,89,198/-however, the same was deleted by Ld.CIT(A) by not appreciating the fact that the assessee has failed to prove the nexus between the interest free funds and the interest free advances given and further failed to establish the commercial expediency in providing such loans therefore, Ld. CIT DR vehemently supports the order of AO and requested to confirm the order of AO.

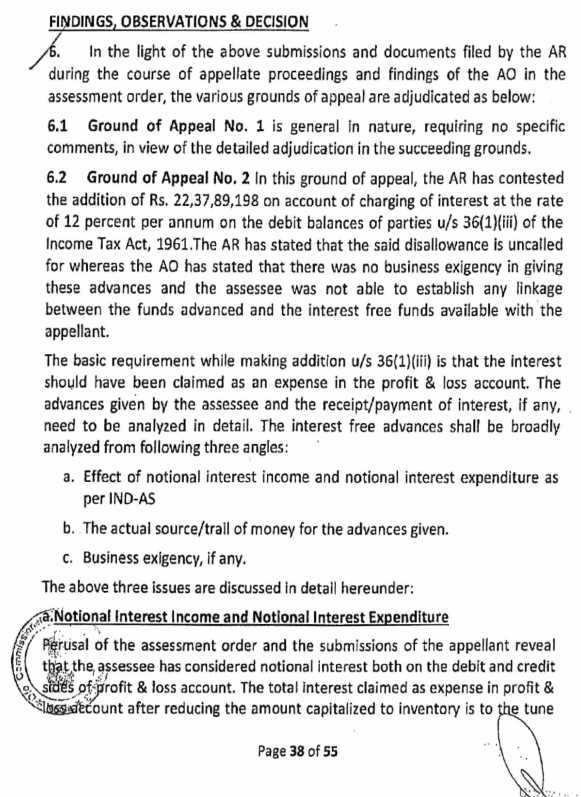

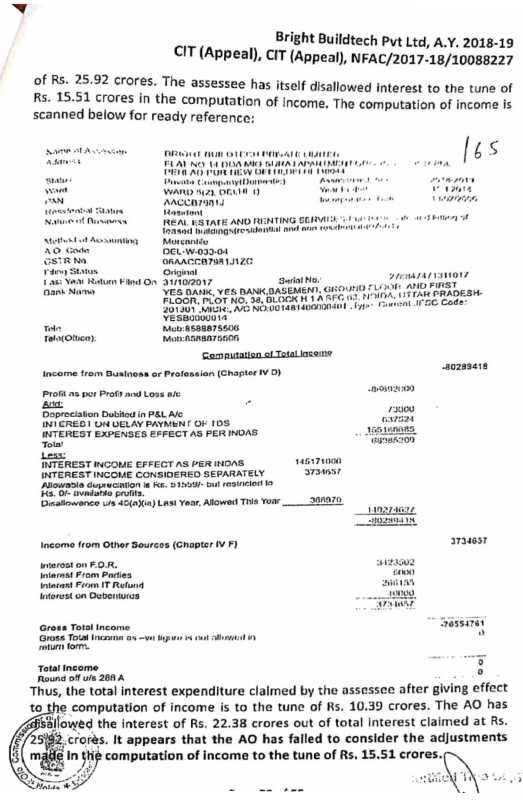

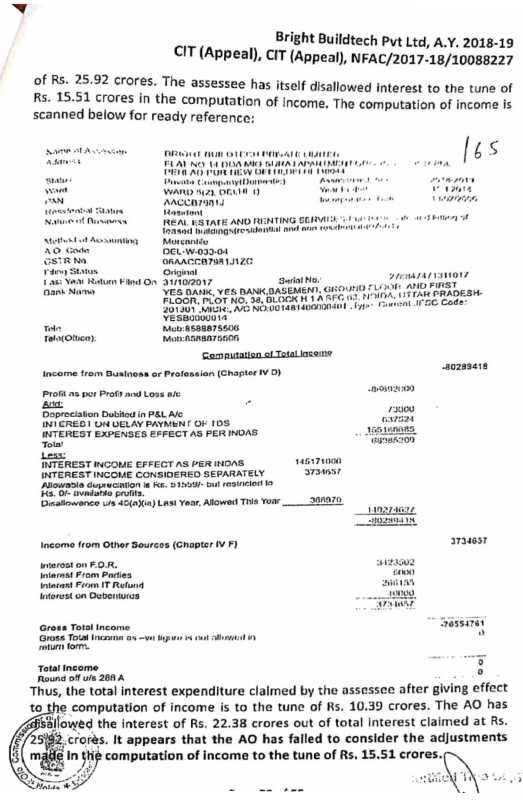

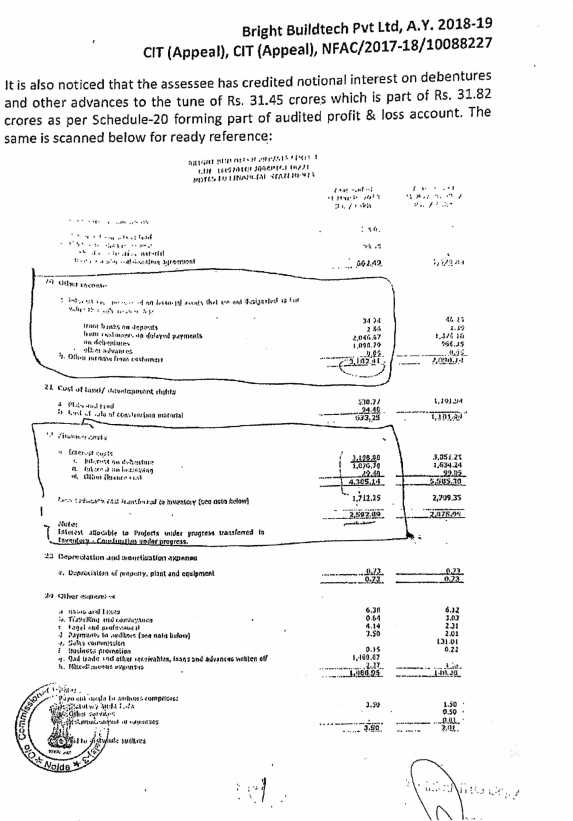

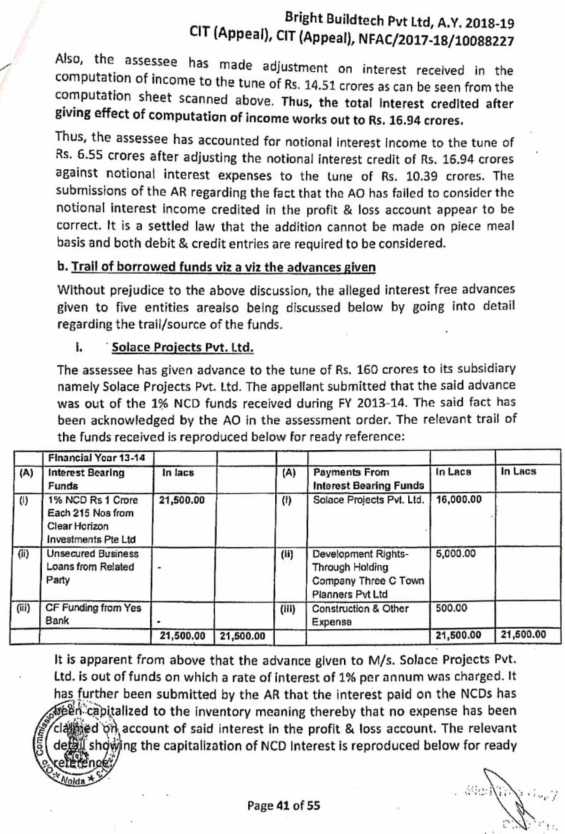

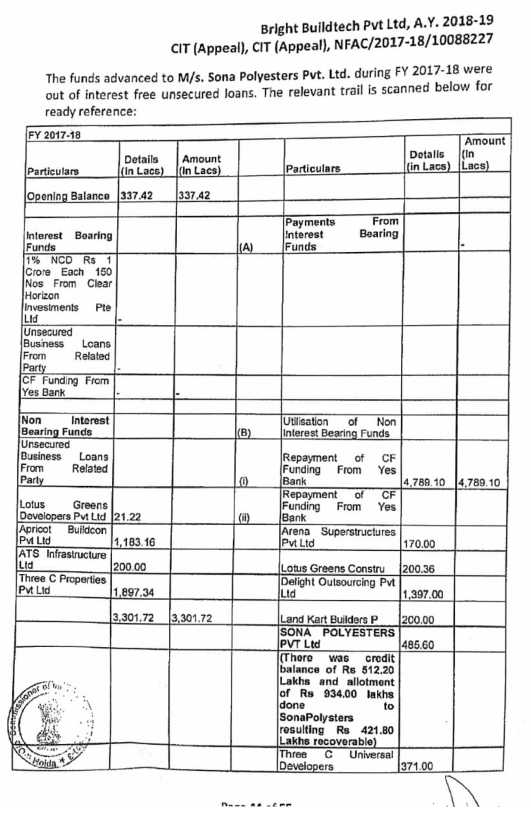

6. On the other hand, Ld.AR for the assessee submits that during the year under appeal, assessee was having sufficient interest free funds/ low interest bearing funds in the shape of unsecured loans, own share capital and non-convertible debenture having coupon rate of interest of only 1% per annum. Ld.AR submits that in compliance to Ind AS, assessee made debit and credit entries towards notional interest on advances given and received respectively, in the books of accounts and finally offered positive interest income as against the allegation of the AO of claiming interest expenses in the P&L A/c. Ld. AR further submits that assessee has also established the source of each interest free loans/advances given where date-wise trail was established before Ld.CIT(A). Ld. AR drew our attention to the computation of income wherein the debit entry of notional interest expenses as per Ind-AS adjustments and corresponding credit entry notional interest income as per Ind-AS adjustments were added back and reduced from the taxable income. According to computation of income, there was total interest payment of INR 10.39 crores as against which the AO observed that the assessee has paid total interest of INR 25.92 crores and disallowed interest expenses of INR 22.38 crores. Ld.AR further submits that assessee has made entries of notional interest on debentures and advances of INR 21.45 crores in the P&L Account which is evident from Schedule 20 to financial statements and further submits that after reducing the adjustments towards the amount of INR 14.5 crores in the computation of income, net income of INR 16.94 crores was offered for tax.

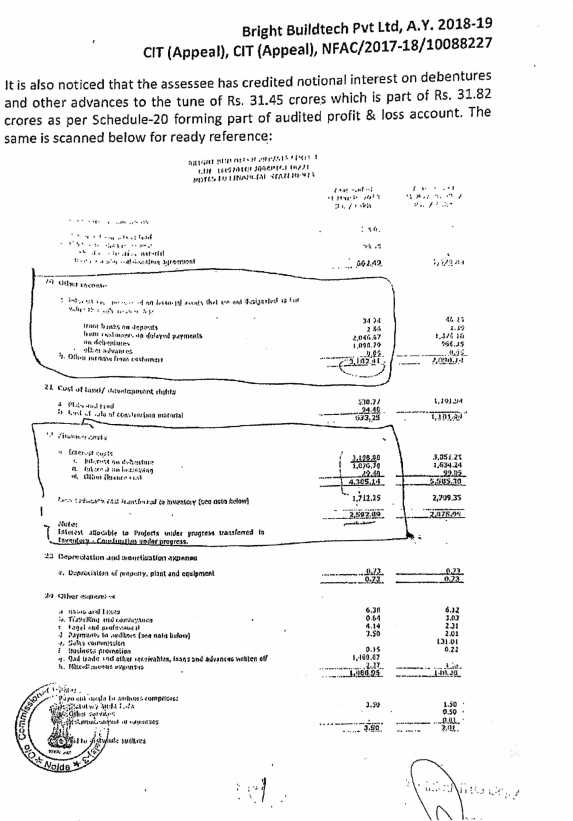

7. Ld. AR further submits that in the case of Solace Projects Pvt. Ltd., the assessee has given advances out of NCDs on which 1 % interest was paid, however, the interest so paid was capitalized to the value of the inventory and no expenses was claimed in the P&L Account. He further submits that notional interest on the advances given to Solace Projects Pvt. Ltd. of INR 10.98 crores was credited in the P&L Account. He further submits that in Assessment year 2014-15 when the advances were made to M/s Solace Projects Pvt. Ltd., the reassessment order was passed u/s 147 of the Act vide order dated 21.05.2024 i.e. after passing the assessment under appeal before us, where no disallowance was made on this account. Ld.AR also submits that in the case of other companies to whom advances were given, they were either given out of interest free funds or the interest paid on the borrowed funds was capitalized and no expenditure was claimed in the P&L Account. He thus, submits that Ld. CIT(A) after considering these facts, deleted the additions made wherein Ld.CIT(A) has categorically held that the advances were given under commercial expediency and solely for the betterment and for the support of the business of the assessee thus, provisions of section 36(1)(iii) could not be invoked.

8. Ld.AR also placed reliance on the written submissions filed by the assessee which read as under:-

1. “That the respondent ‘Bright Buidtech Private Limited’ is a real estate developer primarily covering residential projects covering the aspects of real estate development, from the identification and acquisition of land, to the planning and marketing of the projects.

2. That the respondent has followed Ind AS for very first time during the FY 2017-18 and reinstated the financial statements for FY 2016-17. Please refer the submissions of the appellant reproduced by CIT(A) in para 3 and 3.1 page 9 of the CIT(A) Order.

3. The respondent was issued a notice under Section 143(2) of the Income Tax Act, 1961 on 23rd September 2019, in respect of various issues flagged during the course of scrutiny. Subsequently, the assessment was completed under Section 143(3) read with Section 144B of the Act.

4. The A.O. noticed that the appellant has debited huge interest amounting to 25.92 Cr in P/L A/c, and has given interest free advances to outsiders and sister concerns. However, the A.O. failed to consider that the interest debited is primarily on account of application of IndAS. Refer para 5.2 of page 22 of the Assessment Order at page 158 of the PB.

5. In the impugned assessment order, the AO has made an addition of ^22,37.89,198/- by invoking Section 36(1)(iii), alleging that the assessee had advanced funds to various parties without charging interest. The AO has computed a notional interest at the rate of 12% per annum on a dayto-day basis, thereby treating the same as disallowable interest expenditure (refer para 5.13 page 27-29 & para 6 page 29 of the Assessment Order at page 163-165 of the PB.).

| S.No | Party | Subsidiary | Purpose of advance | Nature | 133(6) issued by AO | Interest disallowed 36(1)(iii) |

| 1 | Ace Infracity Developers Pvt. Ltd. | NA | Business | Advance for development | Yes | 2,15,40,822.00 |

| 2 | Piyush IT Solutions Pvt. Ltd. | NA | Business | Recoverable for sale of 15 units of flats (Land) | Yes | 9,81,304.00 |

| 3 | Sona PolysterPvt. Ltd. | NA | Business | Advance for land | Yes | 31,47,194.00 |

| 4 | Doyen Town Planners Pvt. Ltd. | 100% | Business | Advance for land | Yes | 66,45,905.00 |

| 5 | Solace Projects Pvt. Ltd | 100% | Business | Advance for railway project | Yes | 19,14,73,973.00 |

| Total | | | | | 22,37,89,198.00 |

6. That the notional interest disallowance made by the AO is devoid of legal and factual justification, and the same has already been elaborately rebutted and found untenable by the CIT(A), as detailed in the preceding paragraphs and supported by documentary and judicial evidence.

7. That the AO has arbitrarily applied a notional interest rate of 12% per annum on a day-to-day basis in respect of the advances made by the assessee, solely on the ground that both business receipts and loan proceeds were deposited in the same bank account, without drawing any distinction between the two (refer para 5.13 page 27 of the Assessment Order at page 163 of the PB). The AO has failed to conduct any independent verification or analysis of the actual fund trail, and has not established any nexus between the interest-bearing borrowed funds and the advances in question. Mere deposit of funds in a common bank account cannot lead to an automatic presumption that the advances were made out of interest-bearing loans.

8. Such approach is contrary to settled judicial principles, wherein it has been consistently held that in the absence of a direct nexus, no disallowance of interest under Section 36(1)(iii) can be sustained merely because funds were pooled in a common bank account. The commercial expediency and availability of interest-free funds have already been demonstrated and accepted by the CIT(A). The findings of the CIT(A) is dealt at page 38-54 of the CIT(A) order.

9. That the CIT(A) has granted relief to the appellant after a comprehensive evaluation of all relevant aspects, including:-

| • | | The impact of notional interest both on income and expenditure, |

| • | | The actual source and trail offunds utilized for the advances made, and |

| • | | The existence of commercial and business expediency in relation to such advances. |

The CIT(A), after appreciating the detailed submissions and documentary evidence placed on record, rightly concluded that the disallowance of interest under Section 36(1)(iii) was uncalled for in the given circumstances. The findings are based on a factual matrix that clearly establishes that the advances were either made from interest-free funds or, where borrowed funds were used, the interest had been capitalised to inventory or not claimed at all in the computation of income.

10. That the CIT(A) has held that the AO erroneously invoked the provisions of Section 36(1)(iii) of the Income Tax Act without appreciating that the provision is applicable only in cases where the assessee has actually claimed interest as an expenditure in the computation of income. In the present case, the appellant has not claimed any deduction of interest in respect of the advances in question, as the interest has either been capitalized to inventory or appropriately adjusted in the computation of income. The AO has overlooked these crucial facts and proceeded to make a notional disallowance under Section 36(1)(iii), which is legally unsustainable and contrary to the settled position of law that unless the interest is actually claimed as a deduction, there can be no question of disallowance.

| Impact of eotional lets rest botn on iecome and expenditure |

| s. No. | Particulars | In Cr | Remarks |

| 1 | Details of notional interest debited | | (a) | | That the total interest expenditure claimed in the Profit & Loss Account, after reducing the amount capitalised to inventory, stands at Rs. 25.92 crores. Out of the same, an amount of Rs. 15.51 crores has already been disallowed in the computation of income by the assessee. Please refer page 132 of the PB. |

| (b) | | The net interest expenditure claimed in the computation of income works out to Rs. 10.39 crores only. The A.O. failed to consider notional interest credited to P/L A/c. Refer page 39 of the CIT(A) Order. |

|

| Notional interest debited in P/L | 25.92 |

| Less: Interest reduced by making adjustment in computation of income due to Ind AS effect | (15.51) |

| Total notional interest claimed in P/L | 10.39 |

| II | Details of notional interest credited | | (a) | | Additionally, the assessee has credited a sum of Rs. 31.45 crores as notional interest income on debentures and other advances, which is reflected under Schedule 20 of the audited Profit & Loss Account. Please refer page 22 and 38 of the PB. |

| (b) | | Out of this amount, an adjustment of Rs. 14.51 crores has already been made in the computation of income. Accordingly, the net interest income credited, after considering the computation adjustments, stands at Rs. 16.94 crores. Refer page 132 of the PB. Refer page 40-41 of the CIT(A) Order. |

|

| Notional interest credited in P/L | 31.45 |

| Less: Interest reduced by making adjustment in computation of income due to Ind AS effect | (14.51) |

| Total notional interest claimed in P/L | 16.94 |

| III | Net notional interest income (II-I) | 6.55 | Thus, the assessee has effectively considered net interest income of Rs. 6.55 crores, after adjusting the notional interest income of Rs. 16.94 crores |

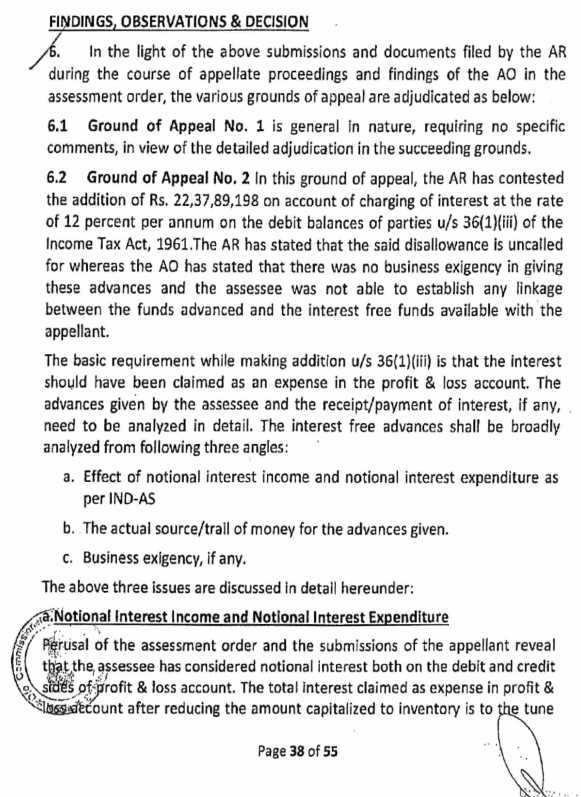

11. That the CIT(A) at para no. ‘a’, page 38 of the CIT(A) Order has discussed the issue of “notional interest income and notional interest expenditure” and finally concluded that the assessee has not claimed any interest but has considered for net interest income of Z6.55 Cr after adjustment of interest income. That the Ld. CIT(A) at page no. 41 of the CIT(A) Order has held that the claim of the appellant regarding notional interest income is required to be considered is correct. That the CIT(A) further observed that addition cannot be made on a piecemeal basis and that both debit and credit entries must be considered before making any disallowance

12. The actual source and trail of funds utilized for the advances made:-

The Ld. CIT(A) has elaborately discussed the trail and application of borrowed funds vis-a-vis the advances extended by the respondent in para ‘b’ page 41-52 of the CIT(A) Order. The notional interest at the rate of 12%, as applied by the AO in page 28-29 of the Assessment

Order at page 164-165 of the PB, pertains to advances given to the following entities:

| S.No. | Entit y | Amount | Year of Adva nee | Source | Purpose | Treatment | Remarks |

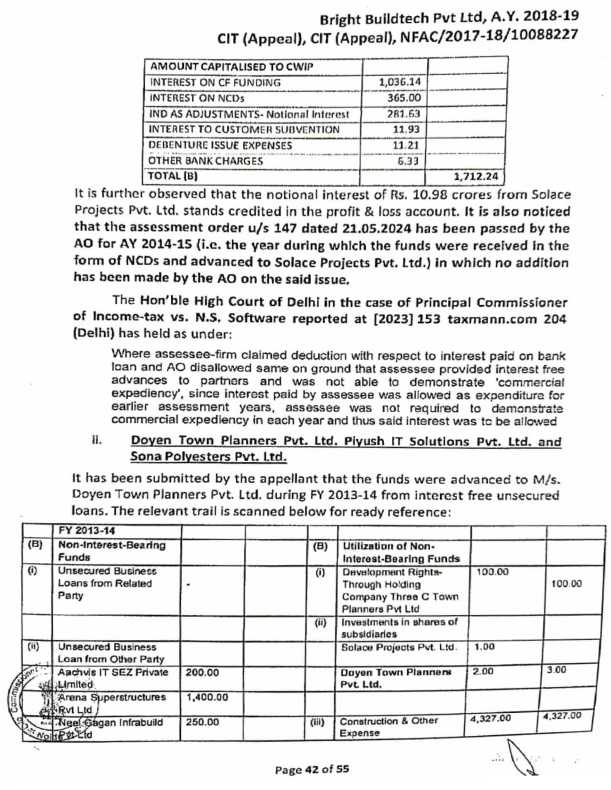

| 1. | Solace Projects Pvt. Ltd. | 160 Cr | 2013-14 | Interest bearing funds | Business | Capitalized | | 1. | | Your Honour’s will appreciate that the appellant has already capitalized interest of 17.12 Cr in ‘Inventory’ as per schedule no. 22 of the Audited B/S (refer page 22 of the PB). |

| 2. | | The CIT(A)’s findings are at page 52, wherein it is concluded that no addition is warranted as the interest has been duly capitalized. Kindly refer to page 42 of the CIT(A) order, where the details of capitalization have been reproduced. |

| 3. | | The assessments for A.Y. 2014-15 and A.Y. 2016-17 were completed under section 147 (on 21.05.2024) and section 143(3) (on 30.12.2018) respectively. It is respectfully submitted that in both assessment years, no addition has been made on account of the business advance in question. Kindly refer to pages 103 to 114 of the PB for relevant details. |

| 4. | | The advance to Solace Projects Pvt. Ltd. was supported by a formal agreement (refer page 77-88 of the PB) and disclosed under the head “Advance to Related Parties.” It was extended to the subsidiary for railway projects, with funds ultimately transferred to Parsvnath Rail Land Projects Pvt. Ltd. (PRLPPL), which made payments to the railway authorities. The matter went into litigation, and following a favourable ruling by the Hon’ble Delhi High Court, the amount was subsequently refunded. Thus, the transaction was wholly commercial and business-driven. Refer page 13 & 52 of the CIT(A) Order. |

| 5. | | The Assessing Officer confirmed the transaction by issuing a notice under section 133(6); however, no significance was to the outcome of the inquiry. Refer page 13 of the CIT(A) order. |

| 6. | | Without prejudice to above the AO has wrongly applied hypothetical rate of 12% irrespective of the fact that 1% was only paid on NCD’s. |

|

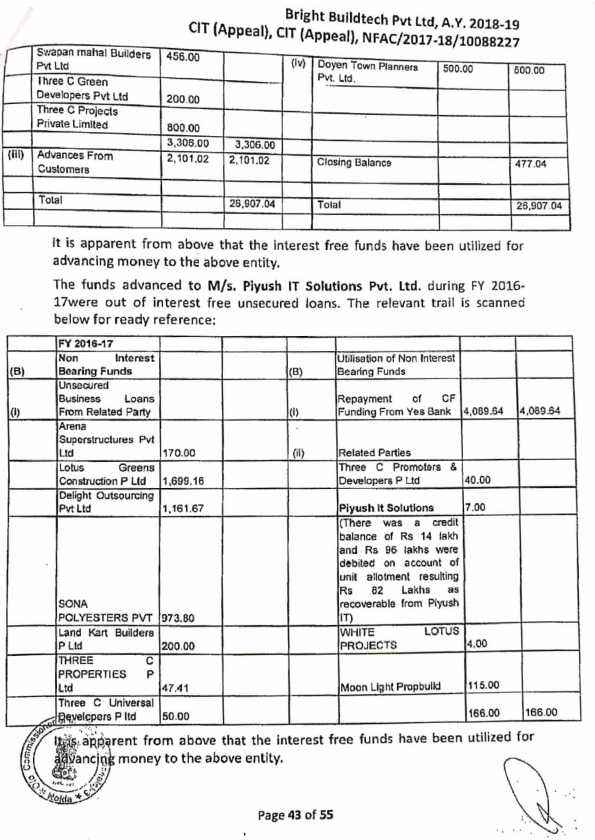

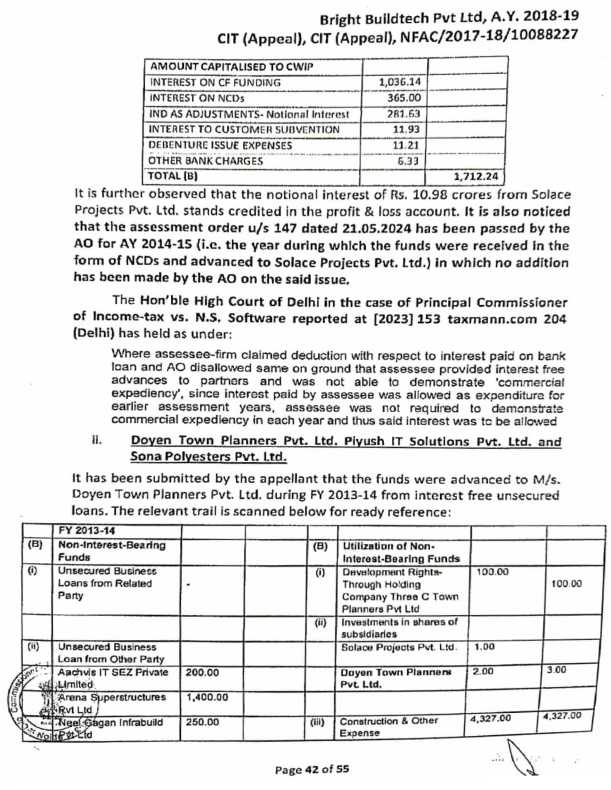

| 2. | Doye n Town Plann er Pvt. Ltd. | 5Cr | 2013 14 | Noninterest bearing funds | Business | NA | | 1. | | The amount was advanced out of interest-free funds available with the assessee in FY 2013-14. The fund trail is reproduced at page 16 of the CIT(A) order, and the final findings are at page 52. Accordingly, the question of disallowing interest is merely hypothetical. |

| 2. | | The amount was given for business, for purchase of land and the advance is appearing under the head ‘Advances given for Land’ in B/S filed for AY 2018-19. Refer page 35 of the PB and schedule 6 of the Audited Financial Statements. |

| 3. | | The assessments for A.Y. 2014-15 and A.Y. 2016-17 were completed under section 147 (on 21.05.2024) and section 143(3) (on 30.12.2018) respectively. It is respectfully submitted that in both assessment years, no addition has been made on account of the business advance in question. Kindly refer to pages 103 to 114 of the PB for relevant details. |

| 4. | | From the above facts and circumstances, the Hon’ble CIT(A) was justified in deleting the addition. |

|

| 3. | Piyus h IT Solut ions Pvt. Ltd. | 82 lacs | Unsec ured loan conver ted into advan ce due to sale of flats | Noninterest bearing funds | Business | NA | | 1. | | That the interest free unsecured loan of Piyush IT Solutions Pvt. Ltd. was converted into advance in FY 2017-18. |

| 2. | | The amount recoverable 82 lacs was on account of 15 flats allotted which resulted into Debit balance. Moreover, no amount was advanced through bank, but the balance was arrived due to adjustment entry of flats. Refer page 14 of CIT(A) Order. The ledger A/c is placed at page 115 of the PB. |

| 3. | | Thus, the CIT(A) was justified in deleting the addition, as no interest bearing funds were used. Refer page 52 of the CIT(A) Order. |

|

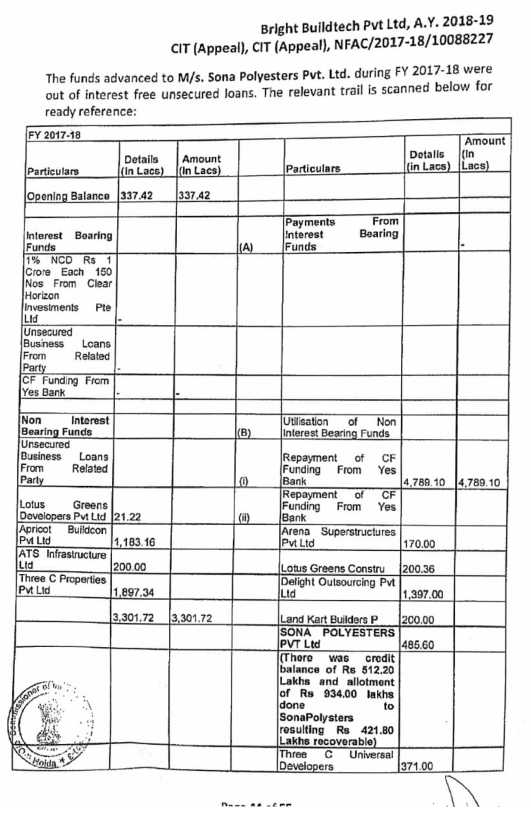

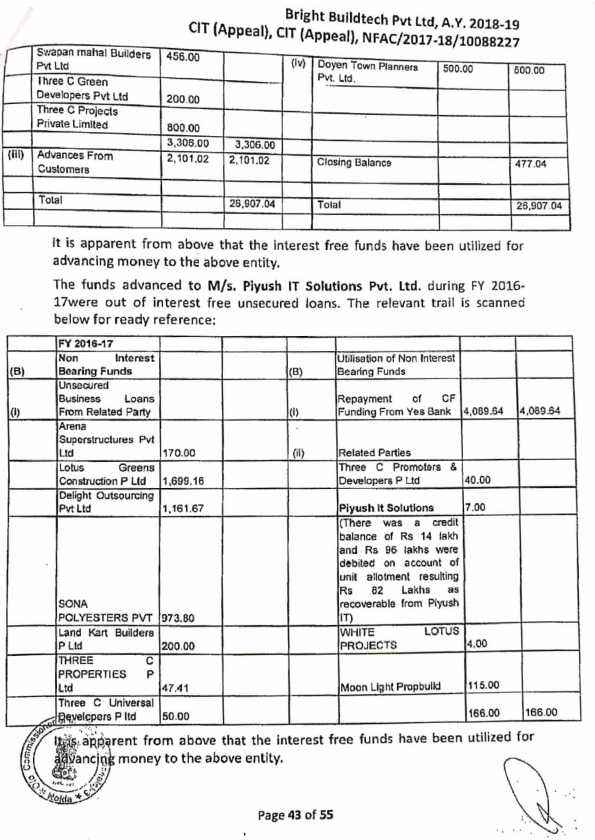

| 4. | Sona Polye sters Pvt. Ltd. | 4.21 Cr | Unsec ured loan conver ted into advan ce | Noninterest bearing funds | Business | NA | | 1. | | The amount was advanced out of interest-free funds available with the assessee in FY 2017-18. Moreover, some business transaction regarding allotment of flats were also carried out. The fund trail is reproduced at page 44 of the CIT(A) order, and the final findings are at page 52. Accordingly, the question of disallowing interest is merely hypothetical. |

| 2. | | The amount was given for business, for purchase of land and the advance is appearing under the head ‘Advances given for Land’ in B/S filed for AY 2018-19. Refer page 35 of the PB and schedule 6 of the Audited Financial Statements. |

| 3. | | From the above facts and circumstances, the Hon’ble CIT(A) was justified in deleting the addition. |

|

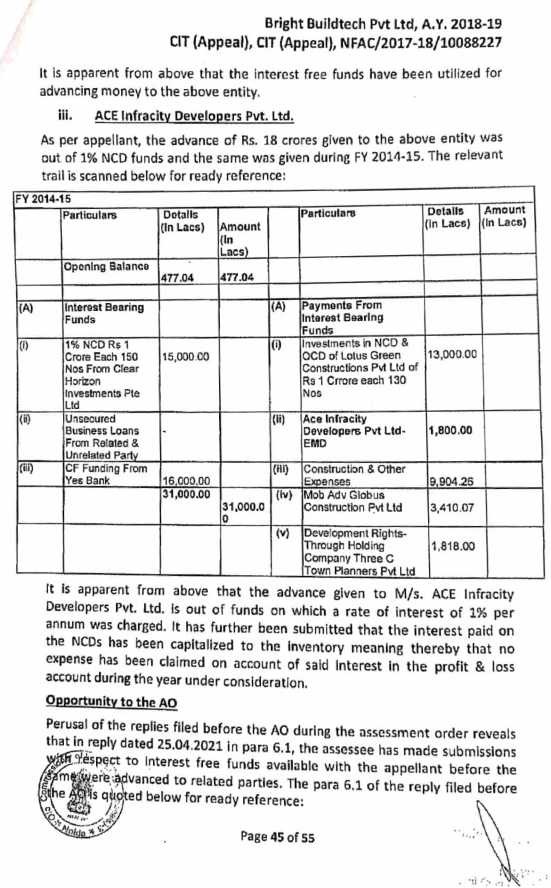

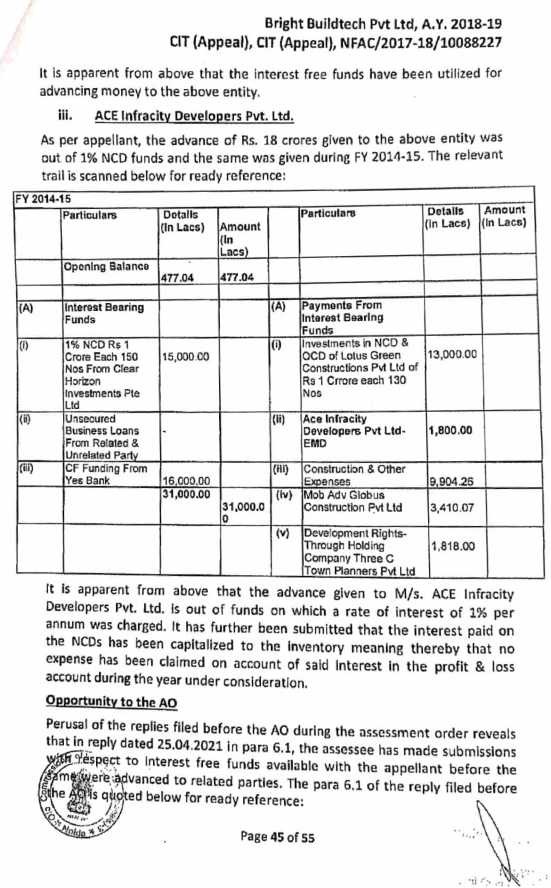

| 5. | Ace Infra city Devel opers Pvt. Ltd. | 18 Cr | 2014 15 | Interest bearing funds | Business | Capitalized | | 1. | | Your Honour’s will appreciate that the appellant has already capitalized interest of 17.12 Cr in ‘Inventory’ as per schedule no. 22 of the Audited B/S (refer page 22 of the PB). No expenses has been claimed in the P/L A/c. Findings of the CIT(A) are given at page 45 of the CIT(A) Order. |

| 2. | | The CIT(A)’s findings are at page 52, wherein it is concluded that no addition is warranted as the interest has been duly capitalized. Kindly refer to page 42 of the CIT(A) order, where the details of capitalization have been reproduced. |

| 3. | | The assessment for A.Y. 2016-17 was completed under section 143(3) (on 30.12.2018). It is respectfully submitted that no addition has been made on account of the business advance in question. Kindly refer to pages 103 to 111 of the PB for relevant details. |

| 4. | | The advance to Ace Infracity Developers Pvt. Ltd. was supported by a formal agreement (refer page 116-126 of the PB) and disclosed under the head “Advance given for supply of goods.” It was extended for development work. Refer page 25 & 52 of the CIT(A) Order. |

| 5. | | The Assessing Officer confirmed the transaction by issuing a notice under section 133(6); however, no significance was to the outcome of the inquiry. Refer page 38 of the CIT(A) order. |

| 6. | | Without prejudice to above the AO has wrongly applied hypothetical rate of 12% irrespective of the fact that 1% was only paid on NCD’s. Refer page 17 of the CIT(A) Order where trail of advance has been submitted. |

|

13. Lack of AO response despite multiple opportunities Additions deleted by CIT(A)

That the CIT(A) had provided an opportunity to the AO vide letter dated 23rd October 2024 and emails dated 2nd November 2024 and 12th November 2024 regarding the availability of industry funds. The submissions made by the assessee were also forwarded to the AO for comments; however, no response was received. Therefore, the CIT(A) was justified in deleting the addition. Kindly refer to pages 46 and 47 of the CIT(A) Order.

14. No Disallowance Warranted in case where amount advanced to subsidiaries were for business purpose

In this regard reliance is placed on the following case laws:

| (a) | | (SC), SUPREME COURT OF INDIA, Principal Commissioner of Income Tax-9 v. E City Investments And Holdings Company (P.) Ltd. |

| (b) | | (SC), SUPREME COURT OF INDIA, Hero Cycles (P.) Ltd. v. Commissioner of Income-tax (Central), Ludhiana |

| (c) | | (Bombay), Principal commissioner of Income-tax. V. ESSEL Infra Projects Ltd |

| (d) | | (Bombay), Commissioner of Incometax, Panaji v. V.S. Dempo Holding (P.) Ltd |

| (e) | | (Bombay), Principal Commissioner of Income Tax, Mumbai v. Concentrix Services (I) (P.) Ltd. |

| (f) | | (Delhi), HIGH COURT OF DELHI, Principal Commissioner of Income-tax v. Reebok India Company |

| (g) | | (Allahabad), HIGH COURT OF ALLAHABAD, J. K. Synthetics Ltd. v. Commissioner of Income-tax |

| (h) | | (ALL.), HIGH COURT OF ALLAHABAD, Commissioner of Income-tax v. Dhampur Sugar Mills Ltd |

| (i) | | (ALL.), HIGH COURT OF ALLAHABAD, Commissioner of Income-tax, Lucknow v. Dhampur Sugar Mills Ltd. |

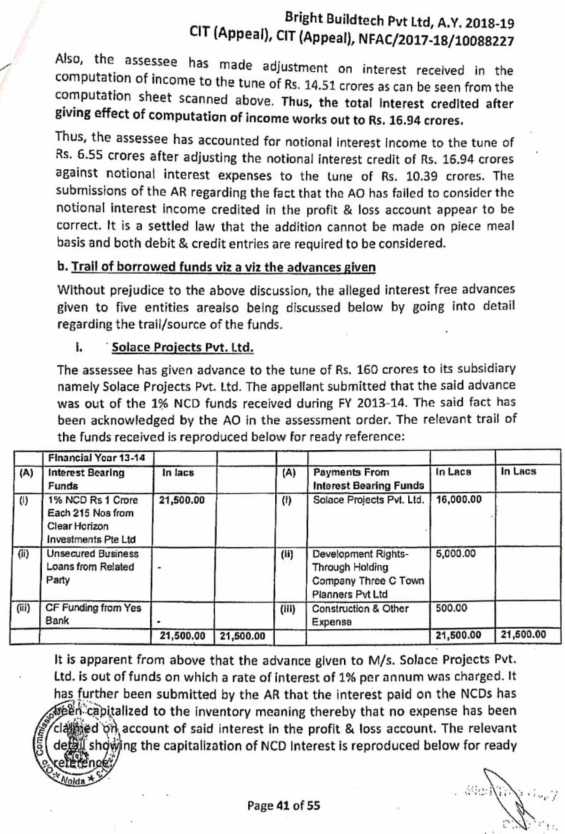

9. Heard the contentions of both the parties and perused the material available on record. In the instant case, AO by alleging that assessee has given interest free advances to various companies which includes two of its subsidiary companies and made the disallowance out of interest paid of INR 22,37,89,198/- by invoking the provision of section 36(1)(iii) of the Act by taking the rate of interest of 12 % per annum. The claim of the assessee was that the company has followed Ind-AS according to which, entries for notional interest on advances received and paid were made in the books of accounts and in the computation of income final adjustment was given where ultimately, assessee has offered net interest income. The assessee further claimed that all such interest free advances were given under commercial expediency as assessee is engaged in the business of Real Estate where these advances were given for the development of projects and acquisition of lands for execution of the projects etc. thus, they were made under business expediency. It was further claimed that interest paid was never claimed as expenditure in the P&L Account. Assessee also filed Party-wise details of the funds given and corresponding source of the same and further explained the capitalization of interest in the written submissions which is reproduced herein above.

10. Ld.CIT(A) after considering the submissions of the assessee had deleted the disallowance by making categorical findings in this regard which are as under:-

11. Before us, the Revenue has failed to controvert the findings of the Ld.CIT(A). It is also a matter of fact that in the computation of income, assessee has ultimately offered excess interest income where the notional income credited of INR 16.94 crores as against notional interest expenditure claimed at INR 10.39 crores. Accordingly, we find that the assessee has offered interest income of INR 6.55 crores thus, there is no occasion to hold that interest bearing funds were utilised for making interest free advances and no income was offered. This being so, we find no infirmity in the order of Ld. CIT(A) who while deleting the disallowances made by AO by invoking the provisions of section 36(1)(iii) of the Act has appreciated these facts. It is further seen that Ld.CIT(A) has not only followed the judicial pronouncements but also considered the facts and after due application of mind on the entries passed in the books of accounts towards notional interest received and paid and their adjustments in the computation of income, had deleted the disallowances. Thus we find no infirmity in the order of Ld. CIT(A) which is hereby upheld. All the grounds of appeal raised by the Revenue are dismissed.

12. In the result, appeal of the Revenue is dismissed.