ORDER

Prashant Maharishi, Vice President.- This appeal is filed by Vijayanagar Educational Trust (the ‘assessee’, ‘appellant’, ‘Trust’) for the assessment year 2019-20 against the order passed by the ld. Commissioner of Income Tax (Exemptions), Bengaluru [ld. CIT or CIT (E)] dated 13.08.2019 cancelling the registration granted to the trust w.e.f. AY 201516 and directing the AO to invoke the provisions of section 115TD of the Income Tax Act, 1961 [the Act].

2. The assessee aggrieved with the same has preferred the following grounds:-

” 1. That, in the facts and circumstances of the case, the order passed by Ld.CIT (Exemption) u/s 12AA (4) of IT Act 1961 dated 13/08/2019 is opposed to law and fact of the case.

2. That, in the facts and circumstance of the case, the Ld CIT(E) erred in cancellation of registration of the trust u/s 12AA(4) w.e.f 201516 without bringing on record why and how the provision of section 12AA(4) can be invoked in order to cancel registration of the trust u/s 12A of IT Act 1961.

3. That, in the facts and circumstances of the case, Ld. CIT (E) erred in appreciating the fact that in order to invoke provision of section 12AA (4) of IT Act 1961, even though conditions of provisions are not fulfilled i.e. the object of the trust are not charitable in nature and its activities are not carried out in accordance with the object of the trust.

4. That, in the facts and circumstances of the case, the Ld. CIT(E) failed to appreciate the fact that in order to invoke section 12AA(4) of IT Act 1961, it is pre-condition for CIT(E) to prove that the activity of the trust are being carried out in manner that the provision of section 11 & 12 of IT Act 1961 do not apply to exclude either whole or any part of the income of such trust or institution due to operation of sub-section (1) of section 13 of IT Act 1961.

5. That, in the facts and circumstances of the case, the Ld.CIT(E) was erred in cancellation of registration of the trust u/s 12A(ab) of IT Act 1961, even though objects of the trust are charitable in nature and are being carried out its activities as per the object of the trust.

6. That, in the facts and circumstances of the case, the Ld.CIT (E) was erred in cancellation of the registration u/s 12AA (4) with retrospective effect from AY 2015-16.

7. That, in the facts and circumstances of the case, the Ld.CIT (E) was erred in not considering the objection filed by assessee where it was explained that there was reasonable cause for the activities to be carried out in said manner.

8. The appellant craves leave to amend or alter any grounds or add a new ground which may be necessary.”

3. The brief facts of the case show that assessee is a public charitable trust having the main object of imparting education by establishing schools & colleges. It has established and managing various colleges and schools since 1980 and has also got itself registered u/s. 12A of the Act vide order dated 12.1.1999.

4. The objects of the trusts are as under:-

“a.To start nursery, primary and high school and college in the medium of English, Kannada and Hindi in the State of Karnataka.

b. To open college, technical institute, training institute for training nursery, primary and high school teachers in the State of Karnataka.

c. To open efficient library and reading rooms for free use of public.

d. To encourage sports activities to the boys and girls.

e. To encourage the fine arts and culture.

f. To open hostel for school going students i.e. boys and girls.

g. To acquire movable and immovable properties for the use of trust.

h. To do such other things as are necessary and conducive for the promotion.

i. To open Medical College, Dental College, health care, nursing college, engineering college, para medical college/ course, management college/course and other professional colleges to serve the underserved and under privileged people in Bangalore rural or urban area or people of Karnataka.”

5. On 11.2.2019 a survey u/s. 133A of the Act was conducted on the premises of the trust. During the course of survey, statement of the trustee was recorded. Post survey, the ITO(E), Ward-2, Bengaluru, submitted a report dated 11.3.2019 wherein he sent a proposal to withdraw the registration u/s. 12A of the Act.

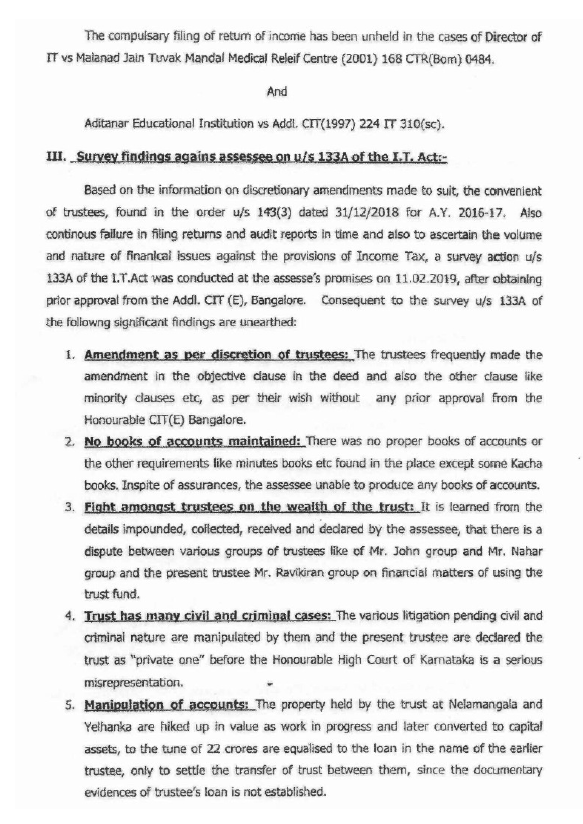

6. The proposal sent by the ld AO was as under: –

7. The ld. CIT (E) issued a show cause notice on 6.6.2019 which was replied to. After considering the reply, the ld. CIT(E) in para 6 cancelled the registration of the assessee trust granted u/s. 12A of the Act for the following reasons:-

| i. | | With respect to the amendments made in the trust deed, the assessee submitted that the amendments were made in order to carry out objectives more effectively such amendments are not repugnant to the provisions of section 11 to section 13 of the act and no prior approval of Commissioner is required. With regard to the amendments made in the trust deed on 20/11/2014, assessee submitted that changes to the minority clause was for the purpose of extending benefit of trust to the general public irrespective of its cast, creed and community. It was also submitted that there is neither a stipulation in the certificate granting registration and nor there is a requirement in the law that prior approval is necessary to amend the trust deed where there is no change in the objects. The learned CIT E rejected the contention of the assessee. He held that the amendment in the trust deed was made without prior approval of the CIT (E), as he was of the view that assessee has carried out the amendment to the trust deed according to the provisions of section 12A(ab) which ought to have applied afresh for registration within 30 days of modification, which it failed to do so and hence it has violated the provisions of section 12A(ab) of the Act. |

| ii. | | On the issue of loan obtained by trustees of the trust from banks and Finance Companies, which was repaid from the sources of the trust, the assessee submitted that trustees have obtained loan from Standard Chartered Bank as assessee trust was not eligible for borrowing from the bank. The said loans from banks and institutions have taken by the trustees by mortgaging their personal properties and deposited the sum in the trust for the purpose of the objects of the trust in view of the financial needs of the trust. The trust has repaid the loan for which necessary entry from the bank book can be verified. Funds are used by the trust and as soon as money is available with the assessee trust, same was repaid to the banks and Finance Companies. The funds have not bene used by the trustees for their own use. Therefore, assessee submitted that it is incorrect to say that the trust has repaid loan which was personal liabilities of the trustees without bringing on record any document to prove that the loans were utilized for personal purposes. The claim of the assessee is that loan was utilized the objects of the trust, borrowed by the trustees by mortgaging their own assets, the funds were utilized in the trust, and this loan is now repaid by the trust. The learned CIT E did not accept the explanation. The ld. CIT(E) also noted that the trustees along with their family members borrowed a sum of Rs.1.30 crores as mortgage loan from Standard Chartered Bank against their house and also borrowed a gold loan of Rs.9,13,990 from Muthoot Finance Ltd. This loan was repaid of Rs.1,49,66,540/- to Standard Chartered Bank and Rs.9,30,990/- to the Muthoot Gold Loan. As these loans were never obtained for the benefit of the trust, the repayment of the loan was made out of the trust funds, thus it violates the provisions of section 13(1)(d) of the Act. The ld. CIT(E) held that as it is not shown that the fund is used for the benefit of the trust, thus it is apparent that the trustees have misused the fund. |

| iii. | | On the issue of loan to Mr. K Girish, assessee submitted that trust has obtained loan from Mr. K Girish which is recorded in the books of accounts and same has been repaid through banking channel. The trust is not aware of any transaction between managing trustee Mr. John and Mr. K Girish for property at Bangalore. The trust has taken loan from Shri K Girish and same was repaid by banking channels. However, the ld. CIT(E) also noted that one of the trustees has entered into transaction with one, Mr. K. Girish, who has advanced a loan of Rs 20 lakhs for purchase of property, however, the said loan was never transferred to the trust and therefore this transaction was for the personal benefit of the trustee, hence it violates the provisions of section 13(1)(d) of the Act. The ld. The ld. CIT(E) relied on the decision of the Hon’ble Supreme Court in the case of Director of Income Tax v. Bharat Diamond Bourse (SC)/[2003] 259 ITR 280 (SC). |

| iv. | | Regarding late filing of ROI and audit report in form no 10B assessee submitted that it cannot be the reason for cancellation of registration. It may be the case for allowing benefit of section 11 and 2 of the act for the particular assessment years. The ld. CIT(E) held that assessee for AYs 2013-14 to 2018-19 has filed its return of income and Form 10B reports late and therefore violated the provisions of section 12A of the Act. |

| v. | | Regarding loan to Kuriakose Trust, assessee submitted that the transaction is through banking channel and is recorded in the books of account, Assessee submit that it is the statement of a disgruntled ex-Trustee, which assessee trust has nothing to do. The ld. CIT(E) noted that for AY 2018-19 audited financial statements shows an outstanding amount of Rs.1,45,30,000, however such loan is already settled in 2013 itself. Therefore, the loan amount shown as outstanding in the books of account pertaining to Kuriakose Trust, Kerala is false. |

| vi. | | Further, the various loans shown in the name of the trustees in the books of account of the trust, they are also disbelieved as it was not backed by any documentary evidence and details of source of funds were not furnished. Explanation of the assessee was rejected that it is the old loans of the trustee received by the trust long back and is supported by bank statements and confirmations of the trustees. |

| vii. | | Further, during the course of survey, the Secretary of the trust has disclosed an income of Rs. 5,87,70,870 and also paid the tax. The affairs of the trust are mismanaged and further the books of account of the trust are also not produced. |

| viii. | | The ld. CIT(E) further noted that for AYs 2012-13 and 2011-12, salary is paid to the family members of trustees, who are not involved in the activities of the trust and therefore there is misappropriation and misapplication of the trust funds. Trust has violated the provision of section 13 (1)(d) of the act. |

| ix. | | During the course of dispute between the trustees contested before the Hon’ble Karnataka High Court, between Shri S.K. Nahar and the trustees, it was stated that the Vijayanagar Educational Trust is a private trust and not a public charitable trust, is a misrepresentation. Assessee’s explanation is that assessee is a public charitable trust was rejected. |

| x. | | On the basis of the above findings, the ld. CIT(E) relying upon the decision of the Hon’ble Supreme Court in the case of CIT v. Islamic Academy of Education (SC), cancelled the registration of the trust. |

8. Accordingly, the ld. CIT (E) was of the view that the trust has violated the provisions of section 11 & 13 and hence cancelled the registration u/s. 12A of the Act w.e.f. 2015-16 and directed the ld. AO to invoke the provisions of section 115T of the Act in accordance with law by order passed on 13.8.2019 u/s 12AA (4) of The Act, against which the assessee is aggrieved.

9. The ld. AR filed two paper books containing 318 pages and 145 pages along with written submissions and synopsis along with financial statements and Board resolution in the 3rd paper book containing 58 pages. The ld AR submitted the back grounds of the case and stated that because of the complaint by one of the disgruntled trustees, the issues have arisen, and false allegation have been made against the trust. He also submitted that Same Trustee was also an intervener in this appeal and now the ITAT has passed order rejecting his claim. He submits that even otherwise the issues are to be decided on its own merit whether the provision of section 12 AA (4) of the Act are correctly invoked or not. According to the assessee, same were invoked purely based on the complaint of the ExTrustee Mr Nahar. The Ld AR claimed that ld CIT E has not made any inquiry on its own but has merely relied up on the proposal of the ld AO and cancelled the registration.

10. He submitted With respect to ground No.3 that the ld. CIT(E) has failed to bring out that the objects of the trust are not charitable in nature and its activities are not carried out in accordance with the objects of the trust, the ld. AR submitted that ld. CIT(E) has raised this issue, he referred to the fact that trust has made few amendments from time to time which are with respect to the change in the trust deed and further amendments are made to explain the primary objects of the trust, which is education by extending the scope of operation. These amendments were only clarificatory in nature as original objects in the trust deed were general and covered range of charitable activities. He states that the trust is registered in 1999 w.e.f. 1.4.1998 and the provisions of section 12AA(ab) came into effect from 1.4.2018 and prior to that provisions of section 12AA did not stipulate any condition, other than the registration within the time period and filing of the audit reports. He therefore submitted that merely because of all these changes which are merely clarificatory, could not have resulted into cancellation of the registration of the trust. To support the argument, he relied on the decision of the Hon’ble Supreme Court in the case of CIT v. Paramount Charitable Trust (SC) and also the decision of the Chennai Bench of the Tribunal in the case of Saranaalayam Trust v. CIT (Exemptions) (Chennai – Trib.).

11. With respect to the violation of the provisions of section 13(1)(d) of the Act, he submitted that the Standard Chartered Bank loan of Rs. 1,49,66,540 was borrowed by the family members and was introduced as loan in the trust with the object to carry on activities of the trust because trust was facing acute shortage of money. It was submitted that loans were obtained in F.Y. 2009-10 and same were repaid in FY 2014-15. He further referred to the loan statement placed at page 104 of PB and stated that it was taken for the purposes of the trust and used for the purpose of the trust. He submits that the loans borrowed were duly accounted for in the books of the trust and loans repaid are also recorded in the books of the trust. With respect to the loan from Mr. K Girish, he submits that the allegation is that the advances are received from Mr. Girish for personal land deal, and it was repaid by the trust. He submits that in fact money received from Mr. Girish was introduced into the trust and deposited into the bank account of the trust on 24.4.2011 and same was considered as unsecured loan in the balance sheet. He referred to pg. 146 of PB. He further referred to the annual accounts for FY 2011-12 at page 129 submitting that the same are duly accounted for in the books of account. He submitted that ld. CIT(E) has merely acted on the statement recorded of ex Trustee by the ld AO without bringing any corroborative evidence and further no violation u/s. 13(1)(d) of the Act can be found from the payment of the same since there is no benefit accruing to the trustees at all.

12. With respect to the allegation of gold loan from Muthoot Finance of Rs. 9,13,990 and repayment of such loan of Rs. 9,30,990, he submitted that the allegation is that loan borrowed by Mrs. Johnson. He submits that in fact that money received from gold loan was introduced into the trust and same was deposited into bank account of the trust, considering as unsecured loan in the balance sheet. He referred to the balance sheet for AYs 2011-12, 2012-13 & 2013-14 which are placed at page 129, 115 & 103 of the PB. He submits that there cannot be any violation u/s. 13(1)(d) of the Act since there is no benefit accruing to the trustees.

He submits that funds were introduced in the trust and same are also repaid. There is no benefit of even a penny to the trustees.

13. With respect to the belated return filing for which registration is cancelled, he submits that delay is attributable to few factors such as change in auditors, transfer, etc. Further he submits that the provision is applicable from 1.4.2018 and therefore it applies from AY 2019-20 onwards and is not relevant for the year under consideration for which there has been delay. He further stated that merely delay in filing the return does not say that the activities of the trust are not genuine and are not carried out in accordance with the provisions of the trust.

14. With respect to the alleged falsification of the books of account being loan due to Kuriakose Trust of Rs.1,45,30,000, it was submitted that this loan was repaid in full in 2013 itself and no loan is outstanding. He submitted that there is no falsification of accounts as the trust has not repaid the money and if the other litigant trustee has paid out of the books, it is their own concern and assessee trust is not required to address the same. He submits that one of the ex-trustees has entered into allegedly fraudulent transaction with respect to this loan and the ld. CIT(E) is merely acting on the statement recorded without bringing any corroborative evidence.

15. With respect to the wrongful claim of depreciation of Nelamangala property, he submitted that it is alleged that during the AY 2017-18 the work-in-progress at the Nelamangala property has been capitalized as addition to the building and assessee has claimed depreciation thereon @ 10%. The building was under construction in 2005 and completely abandoned and therefore the depreciation claimed in the audit report is factually incorrect. He submitted that the trust has claimed deductions towards the amounts spent on capital expenses and has not claimed any depreciation. No depreciation is charged in the books of account or as an application u/s. 11(1) of the Act. He submits that assessee only made an alternative argument in AY 2016-17 where the ld. AO disallowed the total capital expenditure to grant depreciation. This cannot be used as any wrongful claim of depreciation.

16. With respect to the loans in the names of the trustees, the ld. AR submitted that the ld. CIT(E) is acting on assumptions, surmises and conjectures without bringing any substance to his argument. He submits that all loans are taken for the purposes of the object of the trust and are genuine. He also referred to pg. 140 to 144 of the PB to show the details of loans and also stated that these are not relevant for determining the cancellation of registration as it did not determine the activities of the trust as not genuine.

17. With respect to the statement of Mrs. Rashmi Ravikiran for making a voluntary disclosure for 3 assessment years, it was submitted that such statement was taken by the Department at 4 AM in the morning and therefore is not valid. The same were not accepted in the return filed u/s. 148 and even otherwise the nature of admission was with respect to the capital expenses and unpaid provisions. Even otherwise those can be issues of computation of deduction, but does not show any ungenuine activity. It was further stated that the statement does not have any corroborative evidence at all and therefore it could not have been used against the assessee.

18. He further stated that the allegation by ld. CIT(E) of non-maintenance of books of account is absolutely false as books of account are audited every year and submitted before the tax authorities and based on that, assessments have been made.

19. With respect to the salaries paid to the family members, it was submitted that the ld. CIT(E) is acting on surmises without bringing any substance to the argument. The salaries have been paid to the trustees for the work carried out and even otherwise provisions of section 12AA (4) were introduced w.e.f. 1.10.2014 and therefore it does not have any relevance for the purpose of cancellation of registration of the trust.

20. With respect to the dispute between the trustees and it was declared before the Hon’ble High Court that it is private trust and not a public charitable trust, he submitted that assessee is registered u/s. 12AA as public charitable trust with substantive evidence in the form of registration as educational trust and the extensive records available with the Income Tax Department clearly show that it is a public charitable trust following the provisions of the Trusts Act as well as Income-tax Act. The dispute between the trustees and the statements made by them before the Hon’ble High Court does not have any bearing with respect to these income tax proceedings. It is to be examined by the ld. CIT(E) that whether the assessee is a public charitable trust or not. The action of the ld. CIT(E) by first granting registration, then making an assessment and after that passing an order on cancellation of registration clearly show that assessee is a public charitable trust as these provisions apply to that only.

21. With respect to ground No.5, he submitted that when the objects of the trust are charitable and activities are carried out as per objects of the trust, there cannot be any reason for the cancellation of the registration because section 13(1) of the Act applies to it. To support his contention, he relied upon the decision of Krupanidhi Educational Trust v. DIT (Bangalore)/[2012] 139 ITD 228 (Bangalore)Cancer Aid & Research Foundation v. Director of Income-tax (Exemption) ITR(T) 56/66 SOT 86 (Mumbai) and several other judicial precedents. He submits that the provisions of section 12AA(4) are discretionary in nature as it used the word “may” which is similar to section 186 where the status of the firm can be withdrawn. It is the discretion of the ld. CIT(E) not to cancel the registration even in spite of the default of the assessee. He relied upon the decision of the Hon’ble Madras High Court in J.M. Sheth v. CIT [1965] 56 ITR 293 (Madras) which is though in the context of provisions of section 186 of the Act, but equally applies to this case.

22. He further says that the provisions of section 12AA(4) and 12AA(3) of the Ac have different wordings wherein the provisions of sub-section(3) used “shall”, whereas the provisions of sub-section (4) uses the word “may”. He further submitted that cancellation of the registration results into serious consequences which is penal in nature and therefore discretion is confirmed which should be used on the basis of strong evidence and not merely on conjectures and surmises. He further referred to decision of the Hon’ble Andhra Pradesh High Court in CIT v. Panduranga Engg. Co [1997] 223 ITR 400 (Andhra Pradesh).

23. He further submitted that assuming while denying that there is a violation of the provisions of section 13(1) of the Act, it should not result into cancellation of the registration of the trust, unless it is shown that the activities of the trust are not genuine.

24. In the end, he referred to the financial statements of the trust for FY 2009-10 and 2010-11 which show that the loan amounts are reflected in the books of account of the assessee trust and further referred to the Board resolution of the trust dated 30.9.2000 wherein the provisions of salary to the trustees were provided. He specifically stated that Dr. A Rose Johnson is a Doctor of Medicine and Asst. Professor since 1.7.2000 and therefore salary paid to her could not have been considered as any benefit unless it is shown that it is not at the market rate. Therefore, he submitted that cancellation of registration by the ld. CIT(E) is devoid of any merit.

25. He referred to the registration granted to the assessee trust which is placed at page 103 of PB on 12.1.1999. He submits that no further conditions are attached to the said registration granted. It was further stated that the trust was found to be carrying on the educational activities at the time of registration. During the course of hearing, he referred to the copies of the bank statement of SCB of the trustees, copies of the bank statement of the assessee trust, copy of gold loan ledger statements. He further referred to the reconciliation of Receipt & Payment a/c and the fixed assets schedule of the assessee trust. He further submitted that it is an accepted fact before the Tribunal also that there was a dispute amongst the trustees which has resulted into the cancellation of the trust registration. That cannot be a reason so far as the trust activities are found to be genuine and trust has nothing to do with the cancellation of the registration of the trust.

26. The ld. DR vehemently referred to the statement of report of survey u/s. 133 of the Act which is placed on record. It is the recommendation of the ld. AO on 11.3.2019 to the ld. CIT(E), Bangalore. She submits that the ld. AO has given various reasons and based on this, there is a proposal for withdrawal of registration u/s. 12A of the Act and therefore there is no infirmity in the order of the ld. CIT(E).

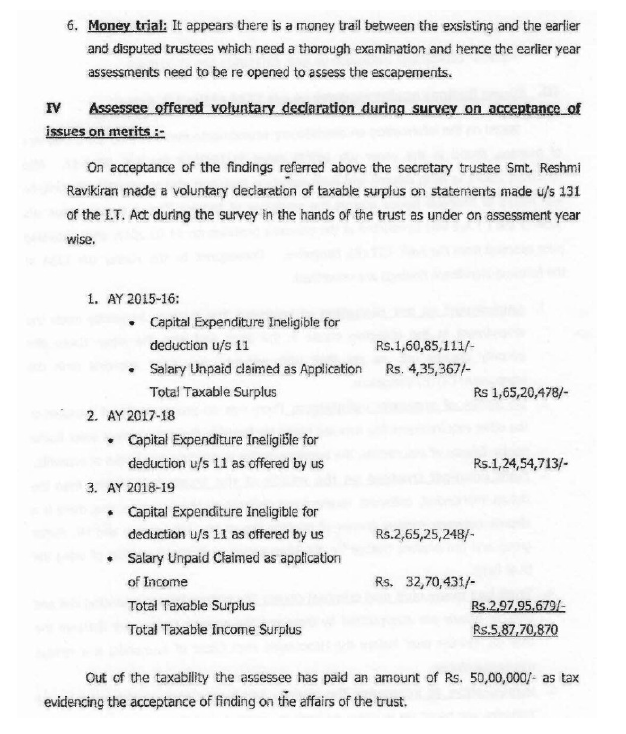

27. We have carefully considered the rival contention and perused the orders of the learned Commissioner Of Income Tax (Exemption), Bangalore dated 13 August 2019 under section 12 AA (4) of the income tax act 1961 by which the registration granted to the Assessee trust vide order number 718/10 A/B -286/98 – 99/T/woman to dated 12/1/1999 under section 12A of the act was cancelled. As it is stated that the trust was granted registration on 12 January 1999. The assessment for assessment year 2016 – 17 was passed under section 143 (3) of the act on 13 December 2018 wherein assessee was denied the deduction under section 11 of the act on merits. Subsequently there was a tax evasion petition which was received by the assessing officer from investigation directorate and based on the same, the assessing officer conducted a survey under section 133A of The Income Tax Act on 11/2/2019. Subsequently because of survey, the assessee has made a voluntary disclosure of taxable income for assessment year 2015 – 16 to assessment year 2017 – 18 of a total sum of ? 58,770,870/- and has also deposited tax of Rs 1 crore on such disclosure, the assessee was also issued summons under section 131 of the act to the trustees and witnesses and from that he has gathered an information that the activities of the trust are not carried out in accordance with the law. Therefore, the learned assessing officer sent a proposal for withdrawal of registration under section 12 A of the act.

28. Based on this, show cause notice was issued to the assessee on 6 June 2019 which were replied and based on that the ld CIT (E) cancelled the registration. By concluding that the trust has violated the provisions of section 11 and provisions of section 13 as its activities and affairs are not in tune with the said provision and it is a fit case for cancellation of registration under section 12 AA (4) of The Income Tax Act. Therefore, he cancelled the registration granted to the trust under section 12 A of the act with effect from the assessment year 2015 – 16 and the assessing officer was directed to invoke the provisions of section 115TD of the act.

29. Section 12 AA (4) provides that: –

4) Without prejudice to the provisions of sub-section (3), where a trust or an institution has been granted registration under clause (b) of sub-section (1) or has obtained registration at any time under section 12A [as it stood before its amendment by the Finance (No. 2) Act, 1996 (33 of 1996)] and subsequently it is noticed that-

| 94 [(a) | the activities of the trust or the institution are being carried out in a manner that the provisions of sections 11 and 12 do not apply to exclude either whole or any part of the income of such trust or institution due to operation of sub-section (1) of section 13; or |

| (b) | the trust or institution has not complied with the requirement of any other law, as referred to in sub-clause (ii) of clause (a) of sub-section (1), and the order, direction or decree, by whatever name called, holding that such noncompliance has occurred, has either not been disputed or has attained finality, |

then, the Principal Commissioner or the Commissioner may, by an order in writing, cancel the registration of such trust or institution:]

Provided that the registration shall not be cancelled under this sub-section, if the trust or institution proves that there was a reasonable cause for the activities to be carried out in the said manner.]

30. According to the provisions of section 12 AA (4) of the act, where the trust or an institution who have been granted registration under the provisions of section 12 (1) (b) or under the section 12A of the act and subsequently if it is found that the activities of the trust or institution are being carried out in a manner that the provisions of section 11 and 12 do not apply to exclude either wholly or partly any of the income of such trust or institution due to the operations of section 13 (1) of the act and then the principal Commissioner or the Commissioner may by an order in writing cancel the registration of such trust or institution. The registration shall not be cancelled if the trust or institution proves that there was a reasonable cause for the activities to be carried out in the same manner. With effect from 1/9/2019 by the Finance (number 2) act, 2019 there was an amendment to the above section wherein one more condition is included which provides that if the trust or institution has not complied with the requirement of any other law, order, directions decree then also such a registration can be cancelled.

31. The First Reason for cancellation is that the assessee trust has made amendment to the trust deed without prior permission of the ld. CIT (E). We find that after obtaining the registration, the trust has made an amendment as per trustees meeting dated 5 July 1996 by passing a resolution to open medical colleges, dental colleges, nursing colleges, engineering colleges and other professional colleges. Further on 20 November 2014 new trustees were added. On the same date the beneficiaries of the trust were also extended beyond Christian minorities in India but to the other community also. The learned CIT exemption has stated that these amendments have been made to the trust deed without his prior permission and therefore he cancelled the registration. The assessee has placed the registration certificate granted u/s 12 A of the Act at page number 103 of the paper book wherein on 12 January 1999 the assessee was granted such a registration with effect from 1 April 1998. At the time of granting registration, it was not the condition that if there is any amendment to the trust deed, it can only be with prior permission/approval of the registering authority. At page number 57 of the paper book the assessee has placed trust deed dated 10 March 1980. These trust deed was amended by a supplementary deed dated 11th day of August 1994 (prior to granting of registration). Further, On 19 October 1998, there was a supplementary deed by which it was provided that the benefit of the trust is open to all irrespective of caste, creed, or religion. Earlier it was open to the Christian minority community. Further on 23 September 2000 an amendment was made to substitute the word ‘schools and colleges with ‘open medical colleges, dental colleges, nursing colleges, engineering colleges and other professional colleges”. Thus, the Amendment indeed clarified and further explained that the trust has also object of opening these colleges. None of the Amendment was shown to us that it violates any of the provision of section 11,12 or 13 of the Act. It is also not shows that such amendment was any way deviating from the objects of the education enshrined in the original Trust deed. Provision of section 12 A (ab) also provides that amendments which does not conform to the original conditions of registration then also the requirement is to inform and apply and obtain fresh registration before the authorities about such modifications. This is effective from 1st April, 2018. These provisions also does not provide for prior approval. Thus, there is no deviation in the object of the trust as per original trust deed because of these amendments. The Honourable Gujarat High Court in Commissioner of Income-tax v. Paramount Charity Trust (Gujarat)[21-08-2018] has dealt with identical situation and has held that where existing objects as well as those which were added by an amendment in the trust deed. The objects in the original trust deed were sufficiently wide and cover range of charitable activities relatable to education, medical aid and help to poor in times of calamities. The existing objects would have enabled the Trust to support its activities as long as it was done for charitable purpose. The amended objects clarify that such amended objects do not change the basic objects of charitable nature. Therefore we find that ld CIT (E) was not correct in cancelling the registration u/s 12 AA (4) of the Act because of this reason.

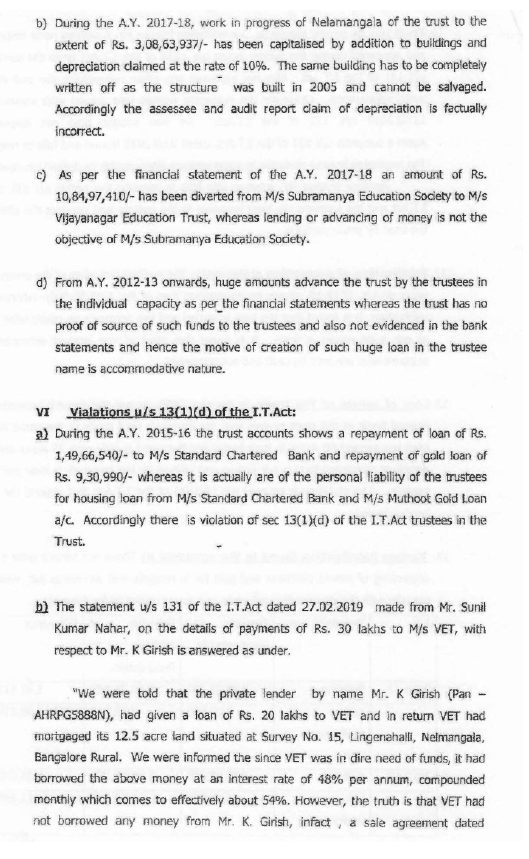

32. Second reason for cancellation of registration is the applicability of provision of section 13 (1)(d) of the Act when loan amount borrowed by trustees were repaid by the trust. It is the allegation of the CIT(E) that the Trustees of the Appellant Trust availed a loan from Standard Chartered Bank during FY 2009-10 and that the repayment thereof was made using Trust funds, thereby conferring a benefit on the Trustees in violation of Section 13(1)(d) of the Income Tax Act, 1961. Factual matrix and the documentary evidence furnished in response to the show cause notice shows that the Trust was undergoing acute financial distress during the relevant period due to substantial funds being tied up in ongoing capital projects. Owing to its already high debt exposure and weakened financial position, the Trust was not in a position to raise further institutional loans in its own name. In these circumstances, the Trustees, in their individual capacity borrowed funds from Standard Chartered Bank by mortgaging their personal assets and introduced the loan proceeds into the Trust. Thus, said borrowings were made for the benefit of the Trust. The funds were introduced into the Trust, were reflected in its books, and were applied for charitable and Trust-related activities. Significantly, the CIT(E) did not dispute the accounting of the said transaction in the books of the Trust. In fact, the allegation is premised on the assertion that the loan—though taken in the personal name of the Trustees—was repaid using Trust funds. As the loans were utilised by the trust, naturally undisputedly the trust repaid those loans. But there was no reason shown before us that how this has given a benefit to the trustees. In fact, the borrowing was detrimental to the trustees as trustees have mortgaged their personal immovable properties for obtaining this loan for the purposes of the trust and trust used that money on the strength of security of the properties of the trustees. The Ld. CIT has not shown to support the conclusion that such repayment resulted in any personal benefit to the Trustees or that the funds so introduced were not used for Trust purposes. Assessee has produced audited financial statements for FY 2009-10 to FY 2013-14 which reflect the said loan transactions. The CIT(E) has also not brought on record any material to establish misuse or misapplication of the said funds. The CIT(E)’s observation regarding the Appellant’s inability to raise institutional loans in its own name is wholly unfounded, anyway it does not show any violation of section 13 (1) of the Act. Similarly is the transaction of borrowings by the trustees from Muthoot Finance by pledging their own gold jewellery and obtaining loan, funds were utilised for the purposes of the trust objects. Loan money has been brought into the bank account of the Trust and used for the purposes of the Trust. The bank statement containing the introduction of money was placed at page no 117 of the paper book. Thus, said borrowings were made solely for the benefit of the Trust. The funds were introduced into the Trust, were reflected in its books where the said loan reflected as a liability and were applied solely for charitable and Trust-related activities. In fact, the existence of a financial crisis is also acknowledged by the CIT(E) in para 12.2 of the impugned order while dealing with another issue. Thus, the very basis of the CIT(E)’s conclusion is not only unsupported by evidence but also contrary to the record. Thus, the allegation of violation under Section 13(1)(d) is misconceived. Thus, this transaction could not have been considered as a violation warranting cancellation or adverse inference under Section 12AA (4) of the Act.

33. The Third allegation is regarding financial transaction with Mr Girish. it is submitted that the said loan money has been brought into the bank account of the Trust and used for the purposes of the Trust. The bank statement containing the introduction of money was presented before the ld. CIT(E) and produced in paper book page no 146. The funds were introduced into the Trust, were reflected in its books where in at page no 129 on the paper book the said loan is reflected as a liability and funds were not alleged to have applied for non-charitable activities. Funds are in fact in the books of the trust shown as the liability and same were tied up in the assets of the trust. The ld CIT(E) could not show that what is the personal benefit of trustees involved in this transaction. The Appellant has also categorically denied any element of personal benefit or diversion of funds to the Trustees. Further repayment, if any, was in the normal course and in discharge of legitimate obligations towards the Trustees qua creditors of the Trust. Thus, it is a clear transaction of borrowings by the trust and repayment. It is also immaterial so far as trust is concerned what other trustees did. So far as the money is borrowed by the trust, duly recorded in its books, used for charitable purposes, and returned through proper banking channel, this transaction could not have any element by which the registration of trust could have been cancelled. Thus, the ld CIT (E) has incorrectly used this transaction for cancellation of registration u/s 12 AA (4) of the Act.

34. Fourth reason for cancellation is belated filing ROI and form No 10 B by the appellant. The provision of section 12A(1) (ba) were introduced with effect from 1/4/2018 and therefore for the impugned assessment year., the ld CIT E could not have cancelled the registration u/s 12 A of the Truste by invoking Provision of section 12 AA (4) of the Act. Further mere delay in filing the return of income cannot be construed as a violation so grave as to justify cancellation of registration under Section 12AA(4), especially in the absence of any finding that the activities of the Trust were not genuine or were not being carried out in accordance with the objects of the Trust. It is not the case of the revenue that assessee did not file its returns of income or in ROI it is found that activities of the assessee are not genuine. Thus, the this reason does not confer any power on the ld. CIT (E) to cancel registration u/s 12 AA (4) of The Act. Even otherwise delay in filing the return was unintentional and arose due to change in the auditors, changes in Trustees, accountants. Despite the delay, the return was ultimately filed, and full disclosures were made, and the books of account were maintained by assessee. Further the registration under Section 12AA is not linked to the assessment of income or to procedural lapses like delay in filing returns. Any violation of Section 11/12 should be examined during assessment and not through cancellation of registration.

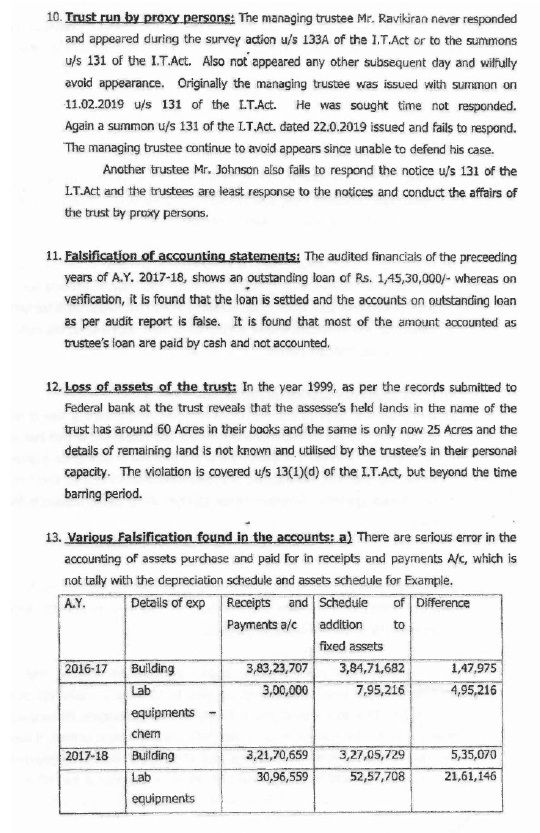

35. Fifth reason is that the trust has falsified its books of accounts as it has received loan from trustees, claimed depreciation etc. The Allegation of the PCIT is based on the statements of One Mr Nahar where in it is stated that assessee has taken loan from one Trust Kuriakose Trust of Rs 1,45,30,000/- for the AY 2017-18. It is the claim of the assessee that transaction in question involving the loan was tainted by fraudulent conduct on the part of Mr. Nahar. The Appellant Trust has subsequently discovered that Mr. Nahar discharged the said loan using his personal funds while misrepresenting himself as a Trustee of the Appellant Trust and for what reason. This misrepresentation was made with the intent to secure the release of the mortgage over the Trust’s property, evidently for personal benefit. It is submitted that this act was carried out without the knowledge, consent, or authority of the Trust or its legitimate Trustees. Consequently, multiple criminal proceedings, including cases involving charges of breach of trust and forgery, are currently pending adjudication before the competent Civil Courts. We find that the ld CIT(E) has merely relied up on the statements of third party without verifying the books of accounts of the appellant trust or also not corroborating with any evidence. Thus merely on the basis of a statement of third party without any corroborative evidence this reason is used for cancellation of registration u/s 12 A of the Act. Even the trustees of Kuriakose Trust ere also not examined or no information was called for u/s 133 (6) of the Act. Thus this allegation by the ld PCIT is merely an allegation without any evidences. So far as the evidence are concerned the above loan is shown in the books of accounts of the trust as payable. There is no confirmation from Kuriakose Trust that it has received the money back and by which mode. Thus, cancellation has been made merely on the basis of conjectures and surmises.

36. With respect to claim of depreciation assessee has submitted that no claim for depreciation has been made either in the books of account in respect of the Nelamangala property or by way of application of income under Section 11(1) of the Act. The CIT(E), in the impugned order, has questioned the Appellant’s alleged inconsistent stand regarding claim of depreciation for AY 2017-18. Appellant, in its rectification application, merely raised an alternative plea for allowance of depreciation in light of the fact that the entire capital expenditure was disallowed as application of income in the assessment proceedings. It is reiterated that no depreciation was, in fact, claimed on any asset during the year in question. The alternative ground was taken only to mitigate the disallowance of capital expenditure and does not constitute any inconsistent or impermissible claim. Thus, there is neither a claim of depreciation in the books of accounts or in the Income tax return. The ld CIT(E) has also not shown any evidence that whether the assessee has claimed the depreciation as alleged. Even otherwise, the merely making an alternative claim of allowance of depreciation if the cost of the assets is not allowed as utilisations, does not make the activities of the trust as Non genuine or in violation of provision of section 11, 12 or 13 of the Act.

37. With respect to loan from the trustees it is submitted that entire basis of the allegation appears to rest on suspicion rather than on any concrete evidence. The CIT(E) has failed to bring on record any documentary or corroborative evidence to establish that the loans advanced by the Trustees were either fictitious or not applied for the purposes of the Trust. Such action, bereft of material, is unsustainable in law. Countering this it is submitted that All loans are genuine and for the purpose of the Trust: These loans were received through proper banking channels and duly utilized for capital expenditure or operational needs of the Trust, as evident from the financial records. There is no allegation has been made that the said loans were bogus or are for non-charitable purpose. Further the loans were taken before several years and trust is assessed to tax after that. As loans are very old, it does not give any indication that activities of the trust are not genuine. Assessee has shown that loan is outstanding in the name of the trustees and is also accounted for by the trustees. Thus, in these instances there is no application of provisions of section 13 of the Act and hence cancellation of registration u/s 12AA (4) for this reason is incorrect.

38. Sixth Reason was with respect to the disclosure made by the trustees and further payments of taxes in pursuance of the same. Thus there is a voluntary disclosure made by the trustee of the trust during survey of ? 58,770,870/- and paid an amount of Rs 1,00,00,000/- as tax clearly shows that the trust affairs have been mismanaged. Brief facts shows that during the course of survey disclosure was made by Mrs. Rashmi Ravikiran for AYs 2015-16, 2017-18, and 2018-19 of Rs 5.87 Crores.

39. It is the claim of the assessee that the statements is devoid of evidentiary value and cannot be relied upon for adverse inference. The so-called voluntary declarations were recorded at an unreasonably odd hour, around 4:00 AM, under mental and physical stress during the course of survey/search proceedings. It is settled law that statements made under such coercive circumstances are not voluntary in nature and hence cannot form the basis for additions, unless duly corroborated by independent material. Despite the alleged declarations, no such income or disallowances were offered in the returns filed by the assessee u/s 148 for the relevant assessment years. This shows that upon due reflection and consultation, the assessee did not consider the declarations to have any merit or legal basis for inclusion. In the absence of any subsequent ratification in the return, the statement loses all sanctity in law The department has not brought any corroborative material on record to establish that the declarations relate to undisclosed income or bogus claims. Without independent evidence, such statements cannot be the sole basis for adverse inference is respectfully submitted that the nature of the disallowances allegedly admitted by Mrs. Rashmi Ravikiran pertains primarily to capital expenditure and provisions for expenses. While such items may generally not be allowable as deductions under the head “profits and gains of business or profession” in the context of regular business entities, the same do qualify as application of income under Section 11 of the Income-tax Act in the case of charitable or religious trusts. The admission made by Mrs. Rashmi Ravikiran was under a misguided belief, induced at the time of recording, that such expenses are not eligible as application of income and hence are liable to be taxed. It is submitted that this erroneous understanding was a result of lack of technical guidance at the time of the statement, and the incorrect inference was drawn under pressure during the proceedings. Subsequently, upon taking professional advice, it was clarified that capital expenditure and legitimate provisions towards charitable activities do constitute application of income under trust law. Consequently, the said items were not offered to tax in the returns filed in response to the notices issued u/s 148 of the Act for the relevant assessment years. This clearly demonstrates that (i) The statement was made under incorrect legal understanding, and (ii) There was no actual income escaping assessment in terms of the provisions applicable to charitable trusts.

40. On careful consideration of the whole issue, it is apparent that the statements were recorded of the one of trustees of the assessee who admitted of the income of Rs 5.87 Crores and Trust also deposited RS 1 Crore as Tax on that disclosure. The issues are whether based on such disclosure in the facts of the case could show that activities of the trust are not genuine. Fact shows that trustee declared during survey that some of the expenditures are of capital nature and same were not claimed as application of income and further for these years some of the salaries are not paid outstanding. Indeed, trustee declared this sum and offered to pay tax on it and in fact paid Rs 1 Cr for that reason. The issues are that assessee trust has incurred some capital expenditure which are allowable to the assessee either as an application of income u/s 11 of the act or it can claim depreciation thereon. It is not the case of the revenue that such expenses are not for the purpose of creating assets of the trust to be used for the educational purposes. It is also not the case that these expenses are bogus in nature. There is no corroborative evidence that these expenses are not for the object of the trust. Merely there are capital expenditure in the trust which cannot be claimed as application of Income but on which depreciation is allowable if disclosure is made on such a mistaken belief. It cannot result in to holding that activities of the trust are not genuine. Similarly, the salaries unpaid at the end of the year, unless proved to be bogus claim, could not result in to holding that activities of the trust are not genuine. Activities of the trust is education, which is being carried out by the trust undeniably, statement of trustee could not have been used for cancellation of registration of the Trust.

41. Seventh reason is about non maintenance of regular books of accounts.It is submitted that books of accounts were in fact maintained and also audited periodically. The same were compiled before the audit and were duly submitted along with the return of income under Section 139. The accounts have also been subjected to audit under Section 12A(b). There are no adverse opinions by the auditors in their audit reports relating to non-maintenance of accounts. Alternatively, the Appellant submits that the ground of non-maintenance of books of account cannot justify the cancellation of registration granted under Section 12A of the Act in the absence of finding in the impugned order that the activities of the Appellant Trust were either not genuine or were not being carried out in accordance with its objects, as required under Section 12AA(4). Section 12AA(4) is intended to target misuse of charitable status—not procedural lapses. If the activities of the Trust are charitable in nature, then mere technical lapses in bookkeeping do not justify cancellation. We find that when the assessee is filing ROI along with audit report the observation of the ld PCIT that assessee does not maintain regular books of accounts is devoid of any merit. The proposal of the ld AO simply states that minute’s book was not found at the time of survey. Minutes book is not the books of accounts. It is not the finding of the ld AO that assessee has not maintained any books of accounts. His report also says “proper books of accounts’. The ld CIT (E) has without any independent inquiry has held that assessee does not maintain regular books of accounts which for which no evidence is available to support his finding. Against this it is apparent that assessee filed ROI and audit Report also.

42. Eighth Reason is that salary is paid to the relatives of the trustees which has resulted in to the benefit to them u/s 13 (1) (d) of the Act. The CIT(E) has raised objections regarding the salaries paid to certain individuals allegedly related to the Trustees, without bringing on record any material evidence to establish either the existence of such relationship or that the payments were excessive or without commensurate services. The action of the CIT(E) is solely based on assumptions, surmises and conjecture, which cannot form the valid basis for invoking the drastic measure of cancellation under Section 12AA(4) of the Act. It is shown that Ms. Avita Johnson was one of the Trustees of the Appellant Trust during the Financial Years 2011-12 and 2012-13 and Her engagement was disclosed and documented in the records of the Trust. The services rendered by her were in furtherance of the educational and administrative objects of the Trust and the payments were neither shown to be excessive having regard to her qualification as a Doctor nor unrelated to the work undertaken by her as the Trust runs Nursing and Pharmacy institutions. It is also shown to us that show cause notice issued by the CIT(E) does not raise any specific allegation or question regarding the said payments to relatives. Thus, the ld CIT E is not correct in cancelling registration of the trust for this reason.

43. On the last allegation about the dispute between the trustees and the statements that assessee is a private trust and hence its registration is cancelled, we find that when the assessee is registered by the Income tax Authorities u/s 12 A of the act where in it is recorded that it satisfies the provision of section 2(15) of the act being charitable in nature., further it is assessed regularly for so many years i.e. from 1999 onwards till 2015 as charitable trust, merely because of dispute between the of the trustees which reached before Hon’ble High Court and one of the party stated that the trust is private trust does not make it a private trusts which prompts the ld CIT(E) to cancel the registration by passing an order u/s 12AA(4) of the Act, such order cannot be sustained.

44. Thus, according to us the order passed by the ld CIT E u/s 12 AA (4) of the Act cancelling the registration of the trust is not sustainable and hence quashed.

45. In the result appeal of the assessee is allowed.