ORDER

M. Balaganesh, Accountant Member.- These are the appeals filed by the different assessees and the revenue against the separate assessment orders for various assessment years.

2. Most of the issues are identical in all these years. Hence, they are taken up together and disposed of by this common order for the sake of convenience.

3. The additional ground raised by the assessee for AYs 2011-12, 2012-13, 2013-14, 2014-15, 2018-19 claiming deduction of education cess was stated to be not pressed by the ld AR at the time of hearing. Accordingly, the said additional ground is not even admitted herein.

4. The ld AR filed a detailed chart containing various issues spreading across years, some of which are identical and common. With the consent of the both the parties, we proceed to dispose of the appeals, issue wise by giving corresponding reference of the relevant grounds numbers in each of the AYs under consideration.

5. The first issue to be decided is with regard to transfer pricing adjustment made on account of advertisement, marketing and sales promotion (AMP) expenses.

Ground Nos. 4 to 4.7 for AY 2011-12 (assessee’s appeal)

Ground Nos. 4 to 4.7 for AY 2012-13 (assessee’s appeal)

Ground Nos. 5 to 5.12 for AY 2013-14 (assessee’s appeal)

Ground Nos. 5 to 5.12 for AY 2014-15 (assessee’s appeal)

Ground Nos. 1 to 2 for AY 2011-12 (revenue’s appeal)

Ground Nos. 2 to 2.12 for AY 2006-07 (assessee’s appeal)

Ground Nos. 2 to 2.12 for AY 2005-06 (assessee’s appeal)

5.1 For this purposes the facts and figures for AY 2011-12 are taken as the lead case and taken up for adjudication. The decision rendered shall apply mutatis mutandis for other AYs also except with variance in figures.

5.2 We have heard the rival submissions and perused the material available on record. The LG Group is a diversified business group, active in most sectors of the Korean economy. LG Electronics Inc. (“LGEK”) is an LG group company focusing on strategic businesses such as electronic display tubes (“EDT”), air conditioners, information storage devices (like Compact Disk Read Only Memory(“CD ROM”) and Digital Versatile DiscRead Only Memory (“DVD ROM”) drives, appliances (washing machines, refrigerators and microwave ovens) and next generation products including digital televisions, Plasma Display Panels (“PDP”) and information and communication terminals (handheld Personal Computers, Personal Digital Assistants “PDAs”).

5.3 LGEIL is a 100% subsidiary of LGEK. LGEIL is registered under the Companies Act, 1956 and was incorporated on January 20, 1997. The Company is engaged in assembly/trade and sale of colour televisions, air conditioners, compressors, washing machines, microwave ovens, refrigerators, colour monitors, Digital Versatile Disc (“DVDs”), Digital Audio Video System, Liquid Crystal Displays (“LCD”), Global System for Mobile Communications (“GSM”), and optical storage devices and other consumer electronics and home appliances. In 2002 LG Sys, a company engaged in the business of manufacturing and trading in telecommunication equipment (“CDMA/WLL”) merged into LGEIL to form the Telecommunication Systems division of LGEIL (“TS division”).

5.4 The shares of the assessee company are fully held with LG Electronics Korea. The assessee during the year under consideration incurred following expenses on advertisement, marketing and sales promotion expenses:-

| a. | advertisement and sales promotion expenses- | Rs. 720,92,63,905/- |

| b. | Other discount and rebates | Rs. 2304,59,02,948/- |

| Total | Rs. 3025,51,66,853/- |

less

| a. | institutional discount | Rs. 1,19,16,259/- |

| b. | canteen store/ departmental store discount | Rs. 8,80,965/- |

| c. | price protection | Rs. 39,23,45,128/- |

| d. | shop, sales, execution, remuneration | Rs. 125,53,76,689/- |

| e. | trade discount on invoices | Rs. 1658,73,81,046/- |

| Total | Rs. 1200,72,66,766/- |

5.5 The ld TPO sought to treat the AMP expenses as an international transaction within the meaning of Section 92B of the Act. For this purposes, he undertook benchmarking analysis of AMP expenditure applied Bright Line Test by comparing ratio of AMP expenditure to the sales of the assessee with that of the comparable companies and held that any expenditure in excess of bright line was for promotion of the brand/ trade name owned by the AE, requiring suitable compensation from the AE. The ld TPO for applying bright line test compared AMP expenditure incurred by the assessee as percentage of total turnover @ 9.56% with average AMP expenses of 3.69% of various comparable companies. The TPO concluded that AMP expenditure incurred by the assessee was for brand promotion and development of marketing intangible for the AE. The ld TPO charged a mark up of 12.26% and proposed a transfer pricing adjustment of Rs. 809,06,65,961/- on account of alleged brand building activity undertaken by the assessee for the AE as under:-

| Computation of TP adjustment | Rs. |

| Value of sales | 1,25,64,10,00,000 |

| AMP/Sales of the comparables | 3.69% |

| Amount that represents bright line | 4,636,152,900 |

| Expenditure on AMP by assessee | 12,007,266,766 |

| Expenditure in excess of bright line | 7,371,113,866 |

| Mark-up at 12.26% | 903,698,560 |

| Reimbursement that assessee should have received. | 8,274,812,426 |

| Reimbursement actually received | 184,146,465 |

| Adjustment to assessee’s income | 8,090,665,961 |

5.6 The ld DRP by placing reliance on the decision of the special bench of this tribunal in assessee’s own case for AY 2007-08 held that AMP expenses constitutes an international transaction. However, the ld DRP directed the ld TPO to recompute the AMP expenditure after due consideration of special bench order in assessee’s own case. Accordingly, the ld TPO recomputed the TP adjustment as under:-

| Particulars | Amount |

| Advertising Expenditure | 2,52,74,88,725 |

| Dealer Promotion | 10,24,29,340 |

| Sponsorship | 34,92,99,040 |

| Point of sales Activity | |

| Consumer Promotion event | 27,15,42,950 |

| Meeting Dealer Event, | 17,21,73,327 |

| Promotion and marketing support dealer and distributors, shop in shop display and shop renovation (50%) | 39,52,42,422 |

| Total AMP expenditure | 3,81,81,75,804 |

The AMP/Sales ratio of the appellant was computed as under:

| Particulars | As per TPO order | After considering DRP directions |

| AMP Expenditure | 12,00,72,66,766 | 3,81,81,75,804 |

| Gross Sales | 1,25,64,10,00,000 | 1,25,64,10,00,000 |

| AMP /Sales | 9.56% | 3.04% |

5.7 The ld DR before us made detailed arguments by stating that the issue in dispute is already settled in favour of the revenue by the special bench decision of this Tribunal in assessee’s own case for AY 2007-08 L.G. Electronics India (P.) Ltd. v. Assistant Commissioner of Income-tax [2013] 29 taxmann.com 300 /140 ITD 41 (Delhi – Trib.) and pleaded that AMP expenditure incurred by the assessee do constitute an international transaction warranting benchmarking separately as a portion of it was incurred for promoting the brand of the parent company. The ld DR tried to buttress the argument of the ld AR that the Hon’ble Jurisdictional High Court in various cases had held that AMP expenditure is not an international transaction and hence, no separate benchmarking is warranted. The ld DR filed e-written submission in support of his oral arguments which are reproduced herein:-

“Sub: Written submission in the above case-reg.

In addition to written submission made during the course of hearing on 23.01.2025 (copy enclosed) and in support of order of the TPO, wherein detailed discussion has been made on legal and factual aspects of the case based on observations in TP Study Report(TPSR) and various agreements, following further submission is being made in respect of issue of TP adjustment on account of Advertisement, Marketing and Publicity (AMP) expenses based on the arguments made during the course of hearing:-

1. Hon’ble Special Bench, ITAT, DELHI BENCH in the case of L.G. Electronics India (P.) Ltd. v. Assistant Commissioner of Income-tax, Circle 3, Noida] [29 taxmann.com 300] had held that AMP expenses incurred by the assessee constitute International Transaction within the meaning of section 92B of the I.T. Act. Appeal of the assessee against the said decision of the Hon’ble Special Bench is still pending before Hon’ble Allahabad High Court implying that the said decision of Special Bench has not been overruled by subsequent High Court decision in the case of assessee till now. While delivering the said decision in the case of assessee, Hon’ble Special Bench had taken into consideration and relied upon the specific factual aspects of the assessee’s case including ‘Blue Ocean’ strategy of the assessee group, role played by the Associated Enterprise in relation to AMP activities among others to reach a conclusion that the AMP spend made by the Assessee was part of overall strategy of the LG group at global level and was decided/guided by foreign AE of the assessee company. Therefore, it can not be said that in the case of the assessee, the issue of determination of international transaction on account of AMP spend was decided by the Hon’ble Special Bench of Tribunal merely by applying Bright Line Test (BLT), a test which has been declared by the Hon’ble Delhi High Court as invalid in the case of Sony Ericsson Mobile Communications India (P.) Ltd v. Commissioner of Income-tax -III[2015] 55 taxmann.com 240 (Delhi). Infact, as mentioned in subsequent para, the Hon’ble High Court has concurred with part of the above decision of the Hon’ble Special Bench. Since aforesaid decision of the Hon’ble Special Bench was also based on specific facts of the case of the assessee discussing elaborately about role played by the AE of the assessee in overall AMP strategy, its execution and said decision still holds field so far as case of the assessee is concerned, ration of said decision of Hon’ble Special Bench (other than that related to application of Bright line Test) will squarely apply to the case of the assessee and will act as binding precedent for this Hon’ble Bench so far as instant case of the assessee is concerned despite the ruling of Hon’ble Delhi High Court in the case of Sony Ericsson (supra). It needs to be noticed here that the assessee has neither argued not brought any material on record to prove that facts of the cases of the assessee for the relevant A.Y. are different from the facts for the assessment year dealt by the hon’ble Special Bench.

2. It is submitted that Hon’ble High Court of Delhi in the case of Sony Ericsson (supra) has affirmed part of the findings of Special Bench decision in the case of LG (supra) and disagreed with some of the findings. So far as agreement is concerned, the Hon’ble High Court has upheld existence of International Transaction on account of AMP expenses in paras 51 to 57 of its decision. While upholding the same, the Hon’ble High Court had observed that in most cases, the assessed had claimed that international transaction between them and their AEs had included AMP expenses. In other words, the International Transaction declared by those assessed included element ofAMP expenses.

3. In the present case too, the assessee on its own has shown part reimbursement of AMP expenses as International Transaction. In other words, the assessee itself is admitting that international transaction shown by it in TP Study Report also included AMP expenses. Therefore, in light of such peculiar similarity, the ration of the decision in case of Sony Ericsson (supra), will squarely apply to facts of the instant case and AMP expenses will qualify as International Transaction.

There is one more way of appreciating this aspect. As per assessee’s own submission, the reimbursement of AMP expense by AE is shown as an International Transaction. It means that the assessee has provided some the AMP related services to its AE and there were some transactions between two parties on this count. So, now only question which remains to be determined is regarding the benchmarking of such services provided by the Assessee relating to AMP for its AE.

4. In the case of the assessee, there is reimbursement of part of the AMP expenses by the A.E. Further the assessee is engaged in both licensed manufacturing and distribution activities. Hon’ble Special Bench decision in the case of the assessee elaborately discusses and records the role played by the foreign AE in deciding and guiding overall group strategy relating to AMP, which was followed by the assessee in India too. In light of the same, the ratio of decisions of Hon’ble ITAT Delhi in the cases of BMW India Ltd. [2017] 88 taxmann.com 26 and Toshiba India Private Ltd. [2017] 85 taxmann.com 298 are squarely applicable to the case of the assessee to hold that AMP expenses in case of the assessee will constitute International Transaction.

5. It is pertinent to highlight here that it is incorrect to say that existence of International Transaction on account of AMP expenses was not agitated by the assessee covered by the decision of Hon’ble Hight Court of Delhi in the case of Sony Ericsson (supra). Infact, one of the substantial questions of law raised by the petitioners was relating to question of existence of International Transaction on account of AMP expenses. However, in most of those case, it was claimed by the assessee that they were compensated by their AEs for AMP expenses in one way or other. For example, the assessee Sony Ericsson Mobile Communications India (P.) Ltd had claimed before Hon’ble ITAT that it had received some credit note from AE towards part of AMP expenses. In the case of the assessee, Canon India Pvt. Ltd., there was reimbursement of part AMP expenses. It was in the backdrop of such reimbursement or credit note from AE that the Hon’ble High Court has made observation in para 52 of its order in case of Sony Ericsson(supra). Orders of ITAT in these cases clarifies this aspect.

6. Further, as recorded by the TPO in its order for AYs 2005-06 and 2006-07, the Assessee had not submitted the details called for during the course of hearing, which had bearing on determination of facts relating to role played by the AE with regard to AMP activities undertaken in India, for which expenses have been claimed as deduction by the assessee. In fact, the assessee submitted only very few sketchy details. In A.Y. 2011-12 too, the assessee did not furnish Transfer Pricing Policy of the group, AEs and same were not furnished (para 2.8.1 of TP order). This non-compliance from the side of assessee was specifically highlighted by the undersigned during the course of hearing, as it prevented the TPO from examining the factual aspect relevant to the issue, therefore such non-compliance should be viewed adversely against the assessee & presumption should be drawn that assessee did not produce such detail before TPO as the same could have unearthed the important role played by AE in deciding AMP activities in India.

7. Further, it is pertinent to mention here that Hon’ble High Court of Delhi in the case of Sony Ericsson Mobile Communications India (P.) Ltd. has clearly noted in Para 118 of its decision that assessed in those cases were engaged in both distribution and licensed manufacturing. Therefore, it would not be justified to restrict the ration of Delhi High court decision in case of Sony Ericsson Mobile Communications India (P.) Ltd (supra) to a case of distributor only. The assessee is also engaged both as distributor and licenced manufacturer.

8. The decisions of Hon’ble Delhi High court in the case of Whirlpool of India Ltd (64 taxmann.com 324), Bausch and Lomb Eyecare India Pvt Ltd. (ITA 643/2014) and Maruti Suzuki India Ltd. 64 taxmann.com 150, do not support the case of the assessee due to distinguishable facts as highlighted during the course of hearing. In these cases, the BLT was used by the TPO to establish that AMP constituted International Transaction. This is not a case here. In instant case, Hon’ble Special Bench has elaborately discussed facts of the case such as Blue ocean strategy adopted by LG group in its decision mentioned above. Further, TPO has also discussed observations from TPSR and agreements to substantiate that AMP constitute an International Transaction de hors application of BLT. Further, in some of above cases decided by Hon’ble high court, reimbursement of AMP expense was not shown as an International Transaction, which is contrary to case of the present assessee. In fact, Hon’ble ITAT in case of BMW (I) Pvt. Ltd (supra) has distinguished the judgment in case of Maruti Suzuki in para 11 of its order. Said distinguishment exist vis-a-vis case of the instant assessee too.

9. The assessee company is having three divisions namely ‘Appliance and media division- Assembly segment, Appliance and media division- Distribution segment and Telecom division. The assessee has used TNMM as most appropriate method for benchmarking the transactions pertaining to each of these three divisions. However, it is noted that in its TP study report, the assessee has also shown several transactions which have been named as Appliance and media division -Common transaction, which are not forming part of any of above mentioned three divisions. These common transactions include ‘Reimbursement of advertising and other expenses to LGEIL’, Royalty paid, Design and Development Fee Paid, among others. In TPSR for AY 2011- 12, the assessee has put a note below ‘Summary of the International Transactions Analysed’ mentioning as under :

“These transactions are closely linked to either assembly or distribution or both the segments of LGEIL. However, accurate division of these between the two is not possible. However, since both the segments of LGEIL are at arm’s length, these transactions have also been considered to be at arm’s length.”

It is evident from the perusal of above note and economic analysis forming part of the TP study report that these common transactions have effectively not being benchmarked by the assessee. Thus, the common transactions such as reimbursement advertising expenses, royalty paid, design and development fee paid have not been benchmarked either along with transactions mentioned in the assembly segment or transaction mentioned in distributor segment as they were not broken up and analysed segment wise and thus, no aggregated with or assigned to any of the segments. The assessee has basically presumed these common transactions to be at arm’s length only because the transactions in distributor segment and assembly segment were found to be at arm’s length. It is pertinent to mention here that the assessee has done segment wise benchmarking by using TNMM. Thus, when the assessee benchmarked the transactions of assembly or distribution segment by using TNMM, naturally it would have selected the comparables, which would have been in consonance or which would have been having similar FAR profile as the FAR profile of the assessee in these segments. Since the International Transaction categorised as common transactions or part of the such common transactions had not been aggregated or considered with any of the segments, it is quite obvious that while selecting the comparable for benchmarking of such segments, the assessee would not have selected comparable keeping in view the FAR associated with such common transaction. In fact, the assessee itself is not sure or not knowing which common transaction pertains to which segment or upto what extent. In the case of the assessee, therefore, it is very evident that the common transactions remained to be benchmarked by the assessee by using any of the prescribed method for benchmarking under TP laws.

In view of the above discussion, it cannot be considered that the common transaction such as royalty paid, design and development fee paid, reimbursement of advtg. expenses were benchmarked by the assessee by way of aggregating the same with the transaction of either assembly segment or distribution segment. Facts of the case suggest that they remained to be benchmarked. Accordingly, the TPO was justified in benchmarking these transactions, which have been forming part of common transactions in TP study report separately on transaction-by-transaction basis.

Copy of decisions discussed above have been submitted during the course of hearing. Further, it is submitted that earlier submission made on 23/01/2025 may kindly be taken into consideration for purpose of all the Assessment years involving AMP issue.

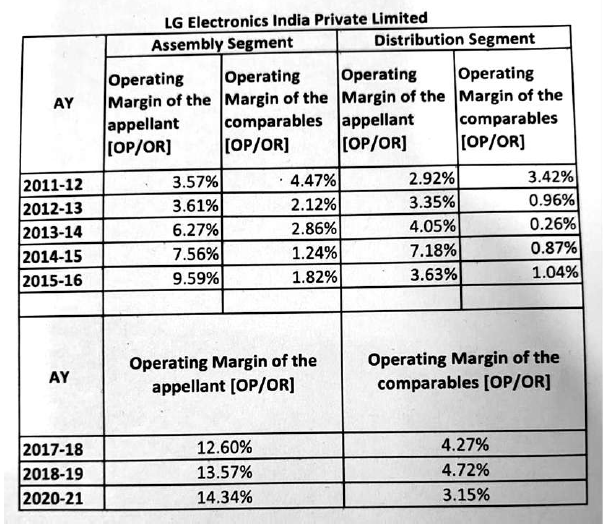

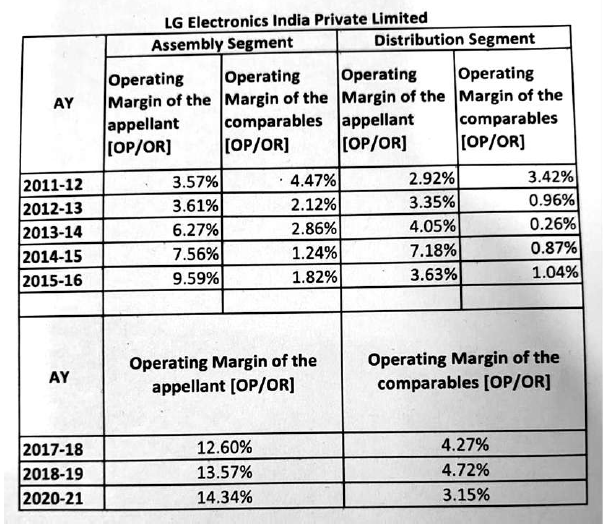

5.8 We find that the assessee in the instant case had benchmarked its international transaction by adopting Transactional Net Margin Method (TNMM). The ld AR submitted that the issue in dispute is settled in favour of the assessee by the decision of the coordinate bench in assessee’s own case for AYs 2008-09, 2009-10, 2010-11 wherein, it had held that AMP expenditure cannot be construed as an international transaction per se and even on merits it was held that as long as the operating margins of the assessee are higher when compared to those of comparable companies, no separate adjustment on account of AMP expenses is warranted. It is not in dispute as stated earlier that assessee had benchmarked its international transaction by applying TNMM on aggregate benchmarking analysis at entity level. The ld AR placed on record workings of operating margins earned by the assessee as well as by the comparable companies in assembly segment and distribution segment which is reproduced herein:-

5.9 Further, it is pertinent to note that the ld TPO in the instant case had not disputed the aggregate/ combined benchmarking analysis undertaken in the transfer pricing study in respect of all the international transactions. This is evident from the fact that the international transactions of the assessee were accepted by the ld TPO to be at arm’s length price except AMP expenditure which was sought to be treated as an international transaction and benchmarked separately by applying bright line test method.

5.10 We find that the entire issue in dispute before us had already been elaborately discussed by the coordinate bench of this Tribunal in assessee’s own case for AY 2008-09 in L.G. Electronics India (P.) Ltd. v. Assistant Commissioner of Income-tax [2019] 102 taxmann.com 186 (Delhi – Trib.)/ITA No. 6253/Del/2012 dated 14.01.2019 wherein after considering all the judgments of the Hon’ble Jurisdictional High Court; based on the judgment of special bench in assessee’s own case for AY 2007-08, the Tribunal held that AMP expenses incurred by the assessee cannot be construed as an international transaction per se. Further, the Tribunal held that since the combined benchmarking analysis undertaken in the transfer pricing study report in respect of the international transaction applying TNMM have been accepted by the ld TPO to be at arm’s length and further held that AMP expenses incurred by the assessee are only for promoting the sales of its products in India and that the such expenses are directly and closely connected with the entire sales and profit at entity level. All the arguments of the ld DR both oral and written, have already been considered in the said order passed by this Tribunal for AY 2008-09. The relevant operative portion of the Tribunal order dated 14.01.2019 is as under:-

“9. Before us, the ld. AR has vehemently stated that the TPO has proceeded by inferring the expenses of international transaction by applying BLT by drawing support from the judgment of the Special Bench of the Tribunal in the case of assessee in ITA No. 5140/DEL/2011.

10. At the outset, we have to state that the Hon’ble High Court of Delhi in the case of Sony Ericsson Mobile Communications India Pvt Ltd v. CIT 374 ITR 118 has discarded the BLT. The Hon’ble High Court, at para 120 held as under:

“120. Notwithstanding the above position, the argument of the Revenue goes beyond adequate and fair compensation and the ratio of the majority decision mandates that in each case where an Indian subsidiary of a foreign AE incurs AMP expenditure should be subjected to the bright line test on the basis of comparables mentioned in paragraph 17.4. Any excess expenditure beyond the bright line should be regarded as a separate international transaction of brand building. Such a broad-brush universal approach is unwarranted and would amount to judicial legislation. During the course of arguments, it was accepted by the Revenue that the TPOs/Assessing Officers have universally applied bright line test to decipher and compute value of international transaction and thereafter applied Cost Plus Method or Cost Method to compute the arm’s length price. The said approach is not mandated and stipulated in the Act or the Rules. The list of parameters for ascertaining the comparables for applying bright line test in paragraph 17.4 and, thereafter, the assertion in paragraph 17.6 that comparison can be only made by choosing comparable of domestic cases not using any foreign brand, is contrary to the Rules. It amounts to writing and prescribing a mandatory procedure or test which is not stipulated in the Act or the Rules. This is beyond what the statute in Chapter X postulates. Rules also do not so stipulate.”

11. Respectfully following the judgment of the Hon’ble High Court of Delhi [supra], we hold that BLT has no mandate under the Act and accordingly, the same cannot be resorted to for the purpose of ascertaining if there exists an international transaction of brand promotion services between the assessee and the AE.

12. In our considered opinion, while dealing with the issue of benchmarking of AMP expenses, the Revenue needs to establish the existence of international transaction before undertaking bench marking of AMP expenses and such transaction cannot be inferred merely on the basis of BLT. For this proposition, we draw support from the judgment of the Hon’ble Delhi High Court in the case of Maruti Suzuki India Ltd. 381 ITR 117.

13. In this case, the Hon’ble High Court held that existence of an international transaction needs to be established de hors the Bright Line Test. The relevant finding of the Hon’ble High Court reads as under:

“43. Secondly, the cases which were disposed of by the judgment, i.e. of the three Assessees Canon, Reebok and Sony Ericsson were all of distributors of products manufactured by foreign AEs. The said Assessees were themselves not manufacturers. In any event, none of them appeared to have questioned the existence of an international transaction involving the concerned foreign AE. It was also not disputed that the said international transaction of incurring of AMP expenses could be made subject matter of transfer pricing adjustment in terms of Section 92 of the Act.

44. However, in the present appeals, the very existence of an international transaction is in issue. The specific case of MSIL is that the Revenue has failed to show the existence of any agreement, understanding or arrangement between MSIL and SMC regarding the AMP spend of MSIL. It is pointed out that the BLT has been applied to the AMP spend by MSIL to (a) deduce the existence of an international transaction involving SMC and (b) to make a quantitative ‘adjustment’ to the ALP to the extent that the expenditure exceeds the expenditure by comparable entities. It is submitted that with the decision in Sony Ericsson having disapproved of BLT as a legitimate means of determining the ALP of an international transaction involving AMP expenses, the very basis of the Revenue’s case is negated.

XXX

51. The result of the above discussion is that in the considered view of the Court the Revenue has failed to demonstrate the existence of an international transaction only on account of the quantum of AMP expenditure by MSIL. Secondly, the Court is of the view that the decision in Sony Ericsson holding that there is an international transaction as a result of the AMP expenses cannot be held to have answered the issue as far as the present Assessee MSIL is concerned since finding in Sony Ericsson to the above effect is in the context of those Assessees whose cases have been disposed of by that judgment and who did not dispute the existence of an international transaction regarding AMP expenses.

XXX

60. As far as clause (a) is concerned, SMC is a non-resident. It has, since 2002, a substantial share holding in MSIL and can, therefore, be construed to be a non-resident AE of MSIL. While it does have a number of ‘transactions’ with MSIL on the issue of licensing of IPRs, supply of raw materials, etc. the question remains whether it has any ‘transaction’ concerning the AMP expenditure. That brings us to clauses (b) and (c). They cannot be read disjunctively. Even if resort is had to the residuary part of clause (b) to contend that the AMP spend of MSIL is “any other transaction having a bearing” on its “profits, incomes or losses”, for a ‘transaction’ there has to be two parties. Therefore for the purposes of the ‘means’ part of clause (b) and the ‘includes’ part of clause (c), the Revenue has to show that there exists an ‘agreement’ or ‘arrangement’ or ‘understanding’ between MSIL and SMC whereby MSIL is obliged to spend excessively on AMP in order to promote the brand of SMC. As far as the legislative intent is concerned, it is seen that certain transactions listed in the Explanation under clauses (i) (a) to (e) to Section 92B are described as ‘international transaction’. This might be only an illustrative list, but significantly it does not list AMP spending as one such transaction.

61. The submission of the Revenue in this regard is: “The mere fact that the service or benefit has been provided by one party to the other would by itself constitute a transaction irrespective of whether the consideration for the same has been paid or remains payable or there is a mutual agreement to not charge any compensation for the service or benefit.” Even if the word ‘transaction’ is given its widest connotation, and need not involve any transfer of money or a written agreement as suggested by the Revenue, and even if resort is had to Section 92F (v) which defines ‘transaction’ to include ‘arrangement’, ‘understanding’ or ‘action in concert’, ‘whether formal or in writing’, it is still incumbent on the Revenue to show the existence of an ‘understanding’ or an ‘arrangement’ or ‘action in concert’ between MSIL and SMC as regards AMP spend for brand promotion. In other words, for both the ‘means’ part and the ‘includes’ part of Section 92B (1) what has to be definitely shown is the existence of transaction whereby MSIL has been obliged to incur AMP of a certain level for SMC for the purposes of promoting the brand of SMC.

XXX

68 In other words, it emphasises that where the price is something other than what would be paid or charged by one entity from another in uncontrolled situations then that would be the ALP. The Court does not see this as a machinery provision particularly in light of the fact that the BLT has been expressly negatived by the Court in Sony Ericsson. Therefore, the existence of an international transaction will have to be established de hors the BLT.”

14. In the light of the aforesaid finding of the Hon’ble High Court, before embarking upon a benchmarking analysis, the Revenue needs to demonstrate on the basis of tangible material or evidence that there exists an international transaction between the assessee and the AE. Needless to mention, that the existence of such a transaction cannot be a matter of inference.

15. The Hon’ble Delhi High Court in case of Whirlpool of India Ltd v. DCIT 381 ITR 154 has held that there should be some tangible evidence on record to demonstrate that there exists an international transaction in relation with incurring of AMP expenses for development of brand owned by the AE. In our considered opinion, in the absence of such demonstration, there is no question of undertaking any benchmarking of AMP expenses. The relevant findings of the Hon’ble High Court in the case of Whirlpool of India Ltd [supra] read as under:

“32. Under Sections 92B to 92F, the pre-requisite for commencing the TP exercise is to show the existence of an international transaction. The next step is to determine the price of such transaction. The third step would be to determine the ALP by applying one of the five price discovery methods specified in Section 92C. The fourth step would be to compare the price of the transaction that is shown to exist with that of the ALP and make the TP adjustment by substituting the ALP for the contract price.

XXX

34. The TP adjustment is not expected to be made by deducing from the difference between the ‘excessive’ AMP expenditure incurred by the Assessee and the AMP expenditure of a comparable entity that an international transaction exists and then proceed to make the adjustment of the difference in order to determine the value of such AMP expenditure incurred for the AE.

35. It is for the above reason that the BLT has been rejected as a valid method for either determining the existence of international transaction or for the determination of ALP of such transaction. Although, under Section 92B read with Section 92F (v), an international transaction could include an arrangement, understanding or action in concert, this cannot be a matter of inference. There has to be some tangible evidence on record to show that two parties have “acted in concert”.

XXX

37. The provisions under Chapter X do envisage a ‘separate entity concept’. In other words, there cannot be a presumption that in the present case since WOIL is a subsidiary of Whirlpool USA, all the activities of WOIL are in fact dictated by Whirlpool USA. Merely because Whirlpool USA has a financial interest, it cannot be presumed that AMP expense incurred by the WOIL are at the instance or on behalf of Whirlpool USA. There is merit in the contention of the Assessee that the initial onus is on the Revenue to demonstrate through some tangible material that the two parties acted in concert and further that there was an agreement to enter into an international transaction concerning AMP expenses.

XXX

39. It is in this context that it is submitted, and rightly, by the Assessee that there must be a machinery provision in the Act to bring an international transaction involving AMP expense under the tax radar. In the absence of any clear statutory provision giving guidance as to how the existence of an international transaction involving AMP expense, in the absence of an express agreement in that behalf, should be ascertained and further how the ALP of such a transaction should be ascertained, it cannot be left entirely to surmises and conjectures of the TPO.

XXX

47. For the aforementioned reasons, the Court is of the view that as far as the present appeals are concerned, the Revenue has been unable to demonstrate by some tangible material that there is an international transaction involving AMP expenses between WOIL and Whirlpool USA.

In the absence of that first step, the question of determining the ALP of such a transaction does not arise. In any event, in the absence of a machinery provision it would be hazardous for any TPO to proceed to determine the ALP of such a transaction since BLT has been negatived by this Court as a valid method of determining the existence of an international transaction and thereafter its ALP.”

16. The case of the Revenue is that Indian subsidiary incurred certain expenses for the promotion of brands in India and for development of the Indian market and the creation of marketing intangibles in India which remain the functions of the parent company which is the entrepreneur. The brands are owned by the parent company. The Indian subsidiary only acts on behalf of the parent company. The Revenue alleges that eventual beneficiary of the acts of the Indian subsidiary is the parent company. Any benefit that may accrue to the Indian subsidiary is at best incidental to the entire exercise. This action of the Indian subsidiary amounts to rendering of a service to its foreign AE for which arm’s length compensation was payable by foreign AE to its Indian subsidiary.

17. It is the say of the ld. DR that the functions carried out by the assessee are in the nature of development, enhancement, maintenance, protection and exploitation of the relevant intangibles and thus, the assessee deserves compensation.

18. The case of the ld. DR is that the act of incurring of AMP expenses by the assessee is not a unilateral act and is an international transaction for following reasons:-

(i) Though, the AMP expenditure may be for the purpose of business of the assessee but it is in performance of function of market development for the brands and products of the AE that enhances the value of the marketing intangibles owned by the foreign AE, and hence there is a transaction of rendering of service of market development to the AE.

(ii) The short term benefit of the transaction accrues both to assessee and AE in terms of higher sales but long term benefit accrues only to the AE.

(iii) The benefit to the AE is not incidental but significant. Once, it is established that the act of incurring of AMP expenditure is not a unilateral act of the assessee; the AE needs to compensate the assessee for AMP expenses.

(iv) It is a fact that brands are valuable and even loss making enterprises having no real assets are purchased for substantial value for their brand and marketing intangibles.

(v) The issue is not that of transfer of marketing intangibles to AE as the brands and marketing intangibles are already owned by the AE. The issue is that of addition in the value of marketing intangibles owned by the AE owing to the services of development of brand and markets by the assessee for the AE and that of compensation for rendering these services not provided unilaterally by the assessee.”

19. We do not find any force in the aforesaid contentions of the ld. DR. As mentioned elsewhere, the Revenue needs to establish on the basis of some tangible material or evidence that there exists an international transaction of provisions of brand building service between the assessee and the AE. We find support from the decision of the Hon’ble Delhi High Court in the case of Honda Seil Power Products Ltd v. DCIT ITA No 346/2015.

20. The Hon’ble Delhi Court in its recent decision in the case of CIT v. Mary Kay Cosmetic Pvt Ltd (ITA No.1010/2018), too, dismissed the Revenue’s appeal, following the law laid down in its earlier decision (supra) and held as under:

“We have examined the assessment order and do not fnd any good ground and reason given therein to treat advertisement and sales promotion expenses as a separate and independent international transaction and not to regard and treat the said activity as a function performed by the respondent-assessee, who was engaged in marketing and distribution. Further, while segregating / debundling and treating advertisement and sales promotion as an independent and separate international transaction, the Assessing Officer did not apportion the operating profit/ income as declared and accepted in respect of the international transactions.”

21. In our understanding of the facts and law, mere agreement or arrangement for allowing use of their brand name by the AE on products does not lead to an inference that there is an “action in concert” or the parties were acting together to incur higher expenditure on AMP in order to render a service of brand building. Such inference would be in the realm of assumption/surmise. In our considered opinion, for assumption of jurisdiction u/s 92 of the Act, the condition precedent is an international transaction has to exist in the first place. The TPO is not permitted to embark upon the bench marking analysis of allocating AMP expenses as attributed to the AE without there being an ‘agreement’ or ‘arrangement’ for incurring such AMP expenses.

22. The aforesaid view that existence of an international transaction is a sine qua non for invoking the transfer pricing provisions contained in Chapter X of the Act, can be further supported by analysis of section 92(1) of the Act, which seeks to benchmark income / expenditure arising from an international transaction, having regard to the arm’s length price. The income / expenditure must arise qua an international transaction, meaning thereby that the (i) income has accrued to the Indian tax payer under an international transaction entered into with an associated enterprise; or (ii) expenditure payable by the Indian enterprise has accrued / arisen under an international transaction with the foreign AE. The scheme of Chapter X of the Act is not to benchmark transactions between the Indian enterprise and unrelated third parties in India, where there is no income arising to the Indian enterprise from the foreign payee or there is no payment of expense by the Indian enterprise to the associated enterprise. Conversely, transfer pricing provisions enshrined in Chapter X of the Act do not seek to benchmark transactions between two Indian enterprises.

23. The Revenue further contends that the assessee is not an independent manufacturer but is manufacturing for the benefit of the group entities and his status is akin to that of a contract manufacturer. Hence AMP activity is not for the sole benefit of the assessee but for the group as a whole.

24. It is the say of the Id. DR that pricing regulations are to applied keeping in mind the overall scheme of the tax payer’s business arrangement. The contention of the ld. DR can be summarized as under:

(a) The assessee being part of a group is not completely independent in its pricing policies including price of raw material purchased from AE, payments in respect of copyrights and patents payable to the AE. Even their product pricing is not completely independent. Under such circumstances, the benefits emanating from the AMP function cannot be enjoyed by the assessee alone. The assessee is not an independent manufacturer who takes all the risks and enjoys all the benefits of the functions performed by them.

(b) The assessee is not engaged only in manufacture. It is also engaged in distribution of goods by its own admission. In fact, the assessee has a dual function of manufacturer and distributor. In any case, given its distribution function, the assessee is covered by the judgment of Hon’ble Delhi High Court in M/s Sony Ericsson.

(c) The benefits to the AE from AMP function continue to be the same as in the case of distributor like increase in sale of raw material, components and spare parts, increase in dividend, and increase in copyright and patent payments apart from creation/enhancement of Brand value. Therefore, the argument advanced by the assessee would not have any bearing on the existence of ‘international transaction ‘ just because it is engaged in manufacture has not merit.

25. Considering the aforesaid contention of the Revenue, we are of the considered view that the Hon’ble High Court in the case of Maruti Suzuki India Ltd [supra] held that the findings of the Hon’ble High Court with regard to existence of international transaction was only with respect to the case of three limited risk distributors namely, Sony Ericsson, Canon and Reebok etc., wherein the existence of international transaction was admitted and not in dispute. The Court accordingly held that such findings in the case of Sony Ericsson cannot be applied to the case of the manufacturers.

26. The Hon’ble High Court held as under:

“43. Secondly, the cases which were disposed of by the Sony Ericsson judgment, i.e. of the three Assessees Canon, Reebok and Sony Ericsson were all of distributors of products manufactured by foreign AEs. The said Assessees were themselves not manufacturers. In any event, none of them appeared to have questioned the existence of an international transaction involving the concerned foreign AE. It was also not disputed that the said international transaction of incurring of AMP expenses could be made subject matter of transfer pricing adjustment in terms of Section 92 of the Act.

XXX

45. Since none of the above issues that arise in the present appeals were contested by the Assessees who appeals were decided in the Sony Ericsson case, it cannot be said that the decision in Sony Ericsson, to the extent it affirms the existence of an international transaction on account of the incurring of the AMP expenses, decided that issue in the appeals of MSIL as well.”

27. At this stage, it would not be out of place to refer to para 6.38 of the OECD Transfer Pricing Guidelines which apply only to limited risk distributors and not to full risk manufacturers like the assessee. The said para from OECD TP Guidelines read as under:

“6.38 Where the distributor actually bears the cost of its marketing activities (i.e. there is no arrangement for the owner to reimburse the expenditures), the issue is the extent to which the distributor is able to share in the potential benefits from those activities. In general, in arm’s length transactions the ability of a party that is not the legal owner of a marketing intangible to obtain the future benefits of marketing activities that increase the value of that intangible will depend principally on the substance of the rights of that party. For example, a distributor may have the ability to obtain benefits from its investments in developing the value of a trademark from its turnover and market share where it has a long-term contract of sole distribution rights for the trademarked product. In such cases, the distributor’s share of benefits should be determined based on what an independent distributor would obtain in comparable circumstances. In some cases, a distributor may bear extraordinary marketing expenditures beyond what an independent distributor with similar rights might incur for the benefit of its own distribution activities. An independent distributor in such a case might obtain an additional return from the owner of the trademark, perhaps through a decrease in the purchase price of the product or a reduction in royalty rate.”

28. The Hon’ble High Court in the case of Sony Ericsson Mobile Communications India Pvt Ltd (supra) has further held that no transfer pricing adjustment in respect of AMP expenses can be made where the assessee (Indian entity) has economic ownership of the brand/logo/trademark in question, in the case of long term right of use of the same. This principle also squarely covers the present case. The assessee has a long term agreement for the use of the trademark LG ‘in India. This clearly evidences the fact that the economic benefit arising out of the alleged promotion of the AE’s logo is being enjoyed by the assessee. There is a clear opportunity and reasonable anticipation for the assessee to benefit from the marketing activities undertaken by it. This is clearly evidenced by the significantly higher profits made by assessee compared to its industry peers and also the very sizeable year on year increase in its turnover. In view of the aforesaid, it is respectfully submitted that the economic ownership of the trademark ‘LG’ rests with the assessee. The Honble High Court in the case of Sony Ericsson Mobile Communications India Pvt Ltd (supra) disagreed with the finding of the Special Bench that the concept of economic ownership is not recognized under the Act. The relevant observations in paras 151 to 154 of the judgment are reproduced hereunder: “151. Economic ownership of a trade name or trade mark is accepted in international taxation as one of the components or aspects for determining transfer pricing. Economic ownership would only arise in cases of long-term contracts and where there is no negative stipulation denying economic ownership. Economic ownership when pleaded can be accepted if it is proved by the assessed. The burden is on the assessed. It cannot be assumed. It would affect and have consequences, when there is transfer or termination of economic ownership of the brand or trademark.

152. Determination whether the arrangement is long-term with economic ownership or short-term should be ordinarily based upon the conditions existing at the start of the arrangement and not whether the contract is subsequently renewed. However, it is open to the party, i.e. the assessed, to place evidence including affirmation from the brand owner AE that at the start of the arrangement it was accepted and agreed that the contract would be renewed.

153. Economic ownership of a brand is an intangible asset, just as legal ownership. Undifferentiated, economic ownership brand valuation is not done from moment to moment but would be mandated and required if the assessed is deprived, denied or transfers economic ownership. This can happen upon termination of the distribution-cum-marketing agreement or when economic ownership gets transferred to a third party. Transfer Pricing valuation, therefore, would be mandated at that time. The international transaction could then be made a subject matter of transfer pricing and subjected to tax.

154. Brand or trademark value is paid for, in case of sale of the brand or otherwise by way of merger or acquisition with third parties…………………………

Re-organisation, sale and transfer of a brand as a result of merger and acquisition or sale is not directly a subject matter of these appeals. As noted above, in a given case where the Indian AE claims economic ownership of the brand and is deprived or transfers the said economic ownership, consequences would flow and it may require transfer pricing assessment.” (emphasis supplied)

29. As held by the Hon’ble Delhi High Court in the case of Sony Ericsson Mobile Communications (supra), if the Indian entity is the economic owner of the brand and is incurring AMP expenses for the purpose of promotion of such brand, benefit is only received by the Indian entity. It was submitted that the economic ownership of the brand rests with the assessee and accordingly, the assessee cannot be expected to seek compensation for the expenditure incurred on the asset economically owned by it. No Transfer Pricing adjustment on account of AMP expenses would be warranted. The aforesaid test is fully satisfied in the case of the assessee and the Transfer Pricing adjustment on account of AMP expenses made by the TPO is liable to be deleted.

30. The assessee being a full-fledged manufacturer, entire AMP expenditure is incurred at its own discretion and for its own benefit for sale of LG products in India. In the case of the appellant, the advertisements are aimed at promoting the sales of the product sold under trademark LG’ manufactured by the assessee and not towards promoting the brand name of the AE. In such circumstances, the alleged excess AMP expenditure does not result in an international transaction and the assessee cannot be expected to seek compensation for such expenses unilaterally incurred by it from the AE.

31. The Revenue has strongly objected for the aggregated bench marking analysis for the AMP. According to the Revenue, the assessee company has not been able to demonstrate that there is any logic or rationale for aggregation or that the transactions of advertisement expenditure and the other transactions in the distribution activity are inter-dependent, the clubbing of transactions cannot be allowed. According to the Revenue, benchmarking of AMP transaction is to be carried out using segregated approach and for determination of ALP of such transactions, Bright Line is used as the tool.

32. This contention of the Revenue is no more good as BLT has been discarded by the Hon’ble High Court of Delhi as mentioned elsewhere. The Hon’ble High Court of Delhi in the case of Sony Ericsson Mobile Communications India Pvt Ltd in Tax Appeal NO. 16 of 2014 has held that if the Indian entity has satisfied Transactional Net Margin Method (TNMM), i.e., as long as the operating margins of the Indian enterprise are higher than the operating margins of comparable companies, no further separate compensation for AMP expenses is warranted. The Hon’ble Court held as under:

“101. However, once the Assessing Officer/TPO accepts and adopts TNM Method, but then chooses to treat a particular expenditure like AMP as a separate international transaction without bifurcation/segregation, it would as noticed above, lead to unusual and incongruous results as AMP expenses is the cost or expense and is not diverse. It is factored in the net profit of the inter-linked transaction. This would be also in consonance with Rule 10B(1)(e), which mandates only arriving at the net profit margin by comparing the profits and loss account of the tested party with the comparable. The TNM Method proceeds on the assumption that functions, assets and risk being broadly similar and once suitable adjustments have been made, all things get taken into account and stand reconciled when computing the net profit margin. Once the comparables pass the functional analysis test and adjustments have been made, then the profit margin as declared when matches with the comparables would result in affirmation of the transfer price as the arm’s length price. Then to make a comparison of a horizontal item without segregation would be impermissible.”

33. Considering the aforementioned findings of the Hon’ble Jurisdictional High Court of Delhi. In the case in hand, the operating profit margin of the assessee is at 5.01% in the manufacturing segment and 4.52% in the distribution segment and the same is higher than that of the comparable companies at 4.04% in the manufacturing segment and 4.46% in the distribution segment. TNMM has undisputedly been satisfied. Since the operating margins of the assessee are in excess of the selected comparable companies, no adjustment on account of AMP expenses is warranted.

34. Considering the facts of the case in hand in totality, we are of the view that the Revenue has failed to demonstrate by bringing tangible material evidence on record to show that an international transaction does exist so far as AMP expenditure is concerned. Therefore, we hold that the incurring of expenditure in question does not give rise to any international transaction as per judicial discussion hereinabove and without prejudice to these findings, since the operating margins of the assessee are in excess of the selected comparable companies, no adjustment is warranted. Ground Nos. 3 to 3.34 of the assessee are allowed.”

5.11 We find that this tribunal in assessee’s own case for AY 2009-10 in L.G Electronics India (P.) Ltd. v. ACIT [IT Appeal No. 953 (Delhi) of 2014, dated 15-2-2019] and for AY 2010-11 in L.G. Electronics India (P.) Ltd. v. ACIT [2023] 150 taxmann.com 365 (Delhi – Trib.)/ITA No. 755/Del/2015 dated 16.08.2022 had further elaborated on this issue by covering all the arguments of the ld CIT DR in this regard. More importantly the argument advanced by the present CIT DR before us had already been captured in the order passed by this Tribunal for AY 2010-11 dated 16.08.2022. The operative portion of the order are not reproduced herein for the sake of brevity. Respectfully following the aforesaid orders passed in assessee’s own case, the transfer pricing adjustment made on account of AMP expense both on substantive as well as protective basis are hereby directed to be deleted. The grounds raised by the assessee in this regard are hereby allowed and grounds raised by the revenue are dismissed.

6. The next issue to be decided is with regard to transfer pricing adjustment made on account of international transaction on payment of royalty.

| Ground No. | Assessment Year | Appeal by |

| Ground Nos. 5 to 5.7 | AY 2011-12 | Assessee |

| Ground Nos. 5 to 5.7 and additional ground of appeal | AY 2012-13 | Assessee |

| Ground Nos. 6 to 6.7 and additional ground of appeal | AY 2013-14 | Assessee |

| Ground Nos. 6 to 6.7 | AY 2014-15 | Assessee |

| | |

6.1 We have heard the rival submissions and perused the material available on record. As per the transfer pricing study report, the assessee company has made payment of royalty to LG Electronics Korea for providing right to use technology knowledge, know how, process, specification, layout, design, drawing and quality standards, standard calculation, data and information, development pertaining to production, assembly and sale of Colour Televisions, washing machines, air conditioners, refrigerators and micro wave oven and other products agreed between tax payers and the licensor; for commitment to supply to the taxpayer capital goods, moulds, dyes, jigs, tool, CVUs, SKD/ CKD assemblies, components, raw material and spares of capital goods and agreed products etc for right to export finished goods manufactured by the tax payers; for the use of LG Brand name and trade mark for the licensed products manufactured in India; for commitment of assistance by the licensor to set up, develop and improve of R&D facilities; commitment of assistance in selection of foreign exports including South Korean for employment in India by the taxpayer in the field of production, quality control, process engineering, testing and R&D. The assessee company submitted the agreement regarding payment of royalty with LG Electronics, Korea before the ld TPO. The ld TPO observed on examination of the agreement submitted by the assessee, that the assessee company used to pay 1% royalty to LGEK till 01.01.2003 which was then increased to 3% and subsequently increased to 5% of both domestic and export sales w.e.f. 01.04.2004. It was noticed that the rate of royalty payment have been unilaterally increased from 1% to 5% within a span of 3 years without commensurate enhancement in the rights and benefits to the assessee company. Vide letter dated 19.12.2014 filed before the ld TPO, the assessee company submitted the search conducted to find out payment of royalty of other 3rd parties together with the list of comparable companies thereon. The ld TPO pursuant to the direction of the ld DRP in earlier years proceeded to take the comparables companies of Toshiba Corporation, Kenwood Design Corporation and Victor Company of Japan and arrived at the average royalty of 4.5% for colour TV products. The ld TPO noted that a person having a perpetual agreement cannot be compared with a person having a license for a limited purpose of time, considering the fact that technology changes with a period of time. Hence, a long term arrangement having the same royalty right puts the licensor in an advantageous position and independent person would expect a lower rate of royalty. When a comparable company enter into royalty and technology assistance agreement, for a limited purpose of time, it obtains latest technology and decides the products as per the market needs. Every technology has its commercial life, after which the technology becomes a common knowledge and lose its commercial significance. In the case of perpetual agreement, the assessee company used to pay royalty for product technology which might have been procured long back and technology has become commonly available/ common knowledge. The ld DRP by following the decision of this tribunal for AY 2007-08 in assessee’s own case held the arm’s length royalty to be at 4.05% and determined the transfer pricing adjustment on account of royalty at Rs. 18,70,787/- for AY 2001-12. We direct accordingly.

6.2 We find that similar adoption of royalty rate was applied by this Tribunal in assessee’s own case for AY 2008-09 in L.G. Electronics India (P.) Ltd. (supra); for AY 2009-10 in ITA 953/Del/2014 dated 15.02.2019 and AY 755/Del/2015 dated 16.08.2022. We direct accordingly.

6.3 For AY 2012-13, the same is directed to be adopted for the year under consideration also. For AY 2012-13, the assessee had paid royalty @4.16% on sales. The same was within the tolerance range +/- 5% and accordingly transaction was considered to be at arm’s length. We direct accordingly.

6.4 For AY 2013-14, the assessee paid royalty @4.12% on sales. The same was within the tolerance range of +/- 3% and accordingly the transaction was considered to be at arm’s length. We direct accordingly.

6.5 For AY 2014-15, the assessee paid royalty @1.89% on sales. This is also supported by royalty certificate issued by a Chartered Accountant. This transaction was considered to be at arm’s length. We find that this document of royalty certificate has been filed by the assessee as additional evidence before us. The said additional evidence is hereby admitted. Hence, in the interest of justice and fairplay, we deem it fit and appropriate to restore this issue to the file of the ld AO to decide the same in the light of additional evidence submitted by the assessee.

6.6 Accordingly, the grounds raised by the assessee in this regard on payment of royalty are disposed of in the abovementioned terms.

7. The next issue raised by the assessee is challenging the transfer pricing adjustment in respect of international transaction of allocation of ‘Asian Regional Headquarter Expenses’.

Ground Nos. 6 to 6.13 for AY 2011-12 (assessee’s appeal)

Ground Nos. 7 to 7.11 for AY 2012-13 (Assessee’s appeal)

Ground Nos. 7 to 7.11 for AY 2013-14 (assessee’s appeal)

Ground Nos. 7 to 7.10 for AY 2014-15 (assessee’s appeal)

7.1 We have heard the rival submissions and perused the material available on record. The ld DR before us vehemently submitted that in respect of management fees, the assessee did not produce the cost allocation basis even through this issue was dealt with by this Tribunal in AY 2007-08 but the Tribunal did not have an occasion to deal with non furnishing of cost allocation sheet by the assessee. Hence, the reliance placed by the ld AR on the decision of this Tribunal for AY 2007-08 in assessee’s own case becomes factually distinguishable. To buttress this argument, the ld AR vehemently submitted that very same argument of the ld DR has already been considered by this Tribunal for AY 2010-11 in L.G. Electronics India (P.) Ltd. (supra) for AY 2010-11 dated 16.08.2022. We are in complete agreement with the argument of the ld AR with respect to this issue. The relevant operative portion of the Tribunal order dated 16.08.2022 for AY 2010-11 in assessee’s won case is reproduced below:-

“51. The Id. DR further questioned the allocation of expenses in ratio of domestic sales as it results in higher allocation of the expenses to the Indian company and further questioned the allocation of president cost and general overheads of the AE.

52. Referring to earlier years decision of this Tribunal, the ld. DR stated that in earlier Assessment Years, factum of rendition of services was not disputed by the Revenue, but this year, the same is being challenged.

53. We have given thoughtful consideration to the rival contentions. In our considered opinion, the assessee is free to conduct business in the manner that the assessee deems ft and the commercial or business expediency of incurring any expenditure has to be from the assessee’s point of view, which means that the Assessing Officer cannot step into the shoes of a business man. In our considered view, an item of expenditure has to be incurred wholly and exclusively for the purpose of business of the assessee and whether the assessee has derived any benefit from incurring such expenditure is, according to us, irrelevant consideration for the purpose of determination of ALP.

54. There is no dispute that the brand LG is owned by LG Korea but such expenses are incurred for undertaking marketing or promoting sale of the group companies which includes the assessee. Therefore, it can be safely concluded that the same has been incurred for the purpose of the business of the assessee in ordinary course of its business.

55. We have already decided the quarrel relating to the aggregate bench marking while deciding Ground No. 4 relating to AMP expenses and the same reasoning would fully apply here also.

56. In so far as relevancy of the documents is concerned, we find that the following evidence and documents placed in the paper book, relate to the year under consideration:

| S. No. | Particulars | Page Number | Remarks |

| 1 | 2010 Marketing Capability Building Program | 2038-2044 (Vol 6) | Marketing Capability building program, Presentation dated February, 2010 |

| 2 | Market Trend and Competitor information – Early Warning Indicator | 2143-2150 (Vol 6) | Analysis of Market share trend and competitor analysis – dated September, 2009 |

| 3 | Review Report dated October 2009 | 2167-2207 (Vol 6) | Presentation/ report on exploring performance of marketing activities and identifying areas for improvement in relationship with retailers. |

| 4 | Report on DCR study – India, 2009 | 2208-2310 (Vol 6) | Evaluation of appellant’s marketing activities and discussion on further strengthen dealer relationship |

| 5 | E-mail dated August2009 regarding marketing and PR initiative launched by the associated enterprise | 2311-2313 (Vol 6) | Video and other promotional material in connection with FI Rocks with Golden Ticket’ project launched by the associated enterprise |

| 6 | E-mail dated April 2009 regarding marketing and PR initiative launched by the associated enterprise | 2314-2318 (Vol 6) | Promotional material in connection with marketing project launched by the associated enterprise |

| 7 | E-mail dated May 8, 2009 regarding strategy training workshop organised by the associated enterprises | 2319-2328 (Vol 6) | E-mail dated May, 8, 2009 |

| 8 | Copy of Detailed presentation on ‘Developing Strategy and problem solving’ | 2329-2518 | Detailed presentation on strate. development – May 22nd and 23d, 2009 |

| 9 | E-mail communication between Corporate marketing team of the associated enterprise and the employees of the appellant | 2519-2523 (Vol 6) | E-mail dated 05-04-2009 |

| 10. | Brand in depth study – Report dated October, 2009 | 2524-2588 (Vol 7) | In depth study to diagnose the current status of brand and to identify influencing factors for brand preference |

| 11 | Presentation on global communication campaign | 2630-2677 (Vol 7) | Report/presentation discussing marketing strategy for creating market awareness about innovative products offered by LG and to increase sales in Asian countries. Campaign was undertaken during April to December, 2009 with budget of USD 7.60 million (page 2632) |

| 12 | Marketing presentation on VC/AP (Air purifier) launch in India | 2678-2698 (Vol 7) | Report/presentation on launch of new products in India – July, 2009. Report contains Marketing Plan Training Schedule etc. |

| 13 | Marketing Presentation dated July, 2009 | 2699-2807 (Vol 7) | Presentation/ Report dated July 7, 2009 on Marketing Strategy, Product strategy and Design Lab and Corporate design. Contains analysis of marketing strategy of competitors |

| 14 | E-mail dated 3 October, 2009 | 2124-2142 (Vol 6) | Promotional and marketing material for launch of Borderless Series of TV. |

57. In so far as allocation of expenses in proportion to sale is concerned, we find that the same is supported by the decision of the Hon’ble Madras High Court in the case of Manjushree Plantations Ltd 130 TR 908 which has been approved by the Hon’ble Apex Court in the case of Consolidated Coffee 248 TR 432 and also supported by the Hon’ble Delhi High Court in the case of EHPT India Pvt. Ltd. 350 ITR 41.

58. Considering the facts of the case in totality in light of the judicial decisions discussed hereinabove, and considering the past history of the assessee, we do not find any merit in the transfer pricing adjustment in respect of allocation of Asian Regional Headquarter expenses and direct the Assessing Officer/TPO to delete the same. Ground No. 6 is allowed.”

7.2 Respectfully following the same, this issue is decided in favour of the assessee and accordingly, grounds raised in this regard are hereby allowed.

8. The next issue to be decided is challenging transfer pricing adjustment in respect of service warranty charges received by the assessee by apportioning a margin on such cost of apportioning a margin on such cost of reimbursement.

Ground Nos. 7 to 7.5 for AY 2011-12 (assessee’s appeal)

Ground Nos. 8 to 8.5 for AY 2012-13 (assessee’s appeal)

Ground Nos. 8 to 8.5 for AY 2013-14 (assessee’s appeal)

Ground Nos. 8 to 8.5 for AY 2014-15 (assessee’s appeal)

8.1 We have heard the rival submissions and perused the material available on record. Both the parties before us stated that this issue is covered in favour of the assessee by the order of this Tribunal for AY 2010-11 in L.G. Electronics India (P.) Ltd. (supra). The relevant operative portion of this order is reproduced below:-

“68. Ground No. 8 relates to the adjustment to the service warranty charges received by the assessee by apportioning a margin of 32.95% on such cost of reimbursement.

69. Facts on record show that the TPO has made an adjustment of Rs. 19,17,39,195/- in respect of reimbursement of warranty service charges received from the AE on cost to cost basis. According to the TPO, the assessee is providing a service to the AE by servicing the warranty claims and, therefore, the assessee ought to have earned a mark-up of 32.95% on cost incurred for provisions of such services.

70. The ld. counsel for the assessee drew our attention to the decision of this Tribunal in assessee’s own case for Assessment Year 2009-10 in ITA No. 953/DEL/2014 wherein the Tribunal has decided this issue in favour of the assessee.

71. The ld. DR vehemently contended that providing service warrantee to the customers is a contractual obligation of the assessee and its primary responsibility. It is the say of the ld. DR that since the assessee is providing service, the assessee should also charge mark-up on the same.

72. The ld. DR further stated that there is no reciprocity in the arrangement and the mark up should have been charged for providing warranty support services. Once again, referring to the combined TNMM analysis, the ld. DR contended that the same does not benchmark this transaction and even otherwise, the margin of the assessee is less than that of the comparable companies. The ld. DR also contended that adjustment relating to products such as monitors compressors which are not covered under royalty agreement should be sustained.

73. After considering the rival contentions, we are of the considered view that the assessee, as an independent distributor, has sold the products purchased from the AE in the domestic market and has earned profit margin of 5.78% from such sale. In our considered opinion, warrantee is an inherent obligation of the assessee while selling products to third party customers. To discharge such obligation, the assessee has engaged third party service providers and entire functions related to rendering of such warranty services are performed by such third party service providers.

74. It is an undisputed fact that the products are imported from the AE, which is the manufacturer and, therefore, the ultimate warranty liability/cost is to be borne by manufacturing entity i.e. the AE. In such a scenario, the assessee is only acting as a pass through. The entire cost incurred in providing warranty services is reimbursed by the AE and now, such reimbursement, in our considered view, there is no basis for charging of mark-up by the assessee.

75. Further, we find that the facts are identical to the facts considered by this Tribunal in ITA No. 953/DEL/2014 for Assessment Year 2009-10. Therefore, considering the facts in totality, in light of the decision already taken on this issue by this Tribunal, we direct the Assessing Officer/TPO to delete the impugned adjustment. Ground No. is 8 allowed.”

8.2 Respectfully following the same, the grounds raised by the assessee in this regard are hereby allowed.

9. The next issue to be decided in this appeal is challenging the transfer pricing adjustments in respect of international transaction of payment of design and development charges wherein, it was alleged by the revenue that the assessee has in house research and development facility to perform such activity and there is no need for making payment separately.

Ground Nos. 8 to 8.10 for AY 2011-12 (Assessee’s appeal)

Ground Nos. 6 to 6.7 for AY 2012-13 (Assessee’s appeal)

9.1 We have heard the rival submissions and perused the material available on record. Both the parties before us stated that this issue is covered in favour of the assessee by the order of this Tribunal in assessee’s own case for AY 2010-11 dated 16.08.2022. The relevant operative portion of the order of this Tribunal is reproduced below:-

“76. Ground No. 9 relates to the TP adjustment of Rs. 43,46,50,613/- in respect of international transaction of payment of design and development charges.

77. Facts on record show that the assessee has paid a sum of Rs. 43.46 crores on account of payment for design and development services rendered by the AE. The TPO was of the firm belief that design and development services are covered under the royalty agreement and, therefore, determined ALP of this international transaction at NIL.

78. Before us, it was strongly submitted that R&D department for each product of the assessee determines the need for carrying out changes in the design or specifications of the product and seeks assistance from the AE in case it does not have the technical know-how to carry out such modifications and on such service, the technical team of the AE undertakes the development of the product in consultation with the assessee and in light of the specifications provided by the assessee.

79. It is the say of the ld. counsel for the assessee that design and development fee specification relates to the customization of products specific to the assessee. The ld. counsel for the assessee vehemently stated that the AE performs R&D activities on a global basis to develop platform technologies for new products. However, modifications and customization of these products are needed for certain markets as per their local regulations and cultural needs.

80. The ld. counsel drew our attention to the license agreement dated 01.07.2001 entered into by the assessee with the AE and pointed out that it clearly provides for additional and separate consideration for new models designed and developed by the AE for the assessee as provided under clause 4.2 of the agreement.

81. The ld. counsel for the assessee further pointed out that out of the total design and development fee of Rs. 43,46 crores, a sum of Rs. 16,01 crores relates to products such as monitors and compressors which are not covered under royalty agreement.

82. Strong reliance was placed on the decision of the co-ordinate bench in the case of Denso India Ltd ITA No. 1857/DEL/2014 and Mitsubishi Electric Automotive India Pvt Ltd in ITA No. 312/DEL/2015.

83. The ld. counsel for the assessee further stated that for the purpose of applying the TNMM, operating profit was computed after taking into consideration payment towards design and development fee to the AE and since the operating margin of the assessee is in the range +/- 5% with that of the comparable companies, no adjustment is required.

84. We have given thoughtful consideration to the orders of the authorities below qua the rival contentions. At the very outset, we have to reiterate that the international transactions entered into by the assessee have been aggregated for the purpose of benchmarking applying TN MM as the most appropriate method. The comparables selected by the assessee were earning average margin of 3.70% as against margin of the assessee at 4.700% for manufacturing segment. As mentioned elsewhere, and for the sake of repetition, we have to state that OPM of the assessee is within +/- 5% range of the comparable companies and, therefore, international transaction entered into by the assessee has to be considered being at arm’s length.

85. For this proposition, we draw support from the TP Guidelines for multinational corporations and tax administrations by the Organization for Economic Co-operation and Development [OECD] which state the following on aggregation of transactions:

“3.9 Ideally, in order to arrive at the most precise approximation of arm ‘s length conditions, the arm’s length principle should be applied on a transaction-by-transaction basis. However, there are often situations where separate transactions are so closely linked or continuous that they cannot be evaluated adequately on a separate basis. Examples may include I. some long-term contracts for the supply of commodities or services, 2. rights to use intangible property, and 3. pricing a range of closely-linked products (e.g. in a product line) when it is impractical to determine pricing for each individual.”

86. Similar guidance is given by the US and Australian TP Regulations on this issue and the same read as under:

“The combined effect of two or more separate transactions (whether before, during, or after the taxable year under review) may be considered, if such transactions, taken as a whole, are so interrelated that consideration of multiple transactions is the most reliable means of determining the arm’s length consideration for the controlled transactions. Generally, transactions will be aggregated only when they involve related products or services.”

The US regulations gives examples. One of the examples which is relevant to the issue is reproduced below:

“Enters into a license agreement with SI. Its subsidiary, which permits SI to use a proprietary manufacturing process anil to sell the output from this process throughout a specified region. SI uses the manufacturing process and sells its output to S2, another subsidiary of P, which in turn resells (he output to uncontrolled parties in the specified region. In evaluating the arm’s length character of the royalty paid by SI to P, it may be appropriate to consider the arm’s length character of the transfer prices charged by SI to S2 and the aggregate profits earned by SI and S2 from the use of the manufacturing process and the sale to uncontrolled parties of the products produced by SI”