ORDER

Dr. Arjun Lal Saini, Accountant Member.- Captioned appeal filed by the assessee, pertaining to Assessment Year 2012-13, is directed against the order passed under section 250 of the Income Tax Act, 1961 (hereinafter referred to as “the Act”) by National Faceless Appeal Centre (NFAC), Delhi/Commissioner of Income-tax (Appeals), dated 30/06/2025, which in turn arises out of an order passed by the Assessing Officer dated 23/12/2019 u/s 143(3) r.w.s. 147 of the Income Tax Act, 1961.

2. Grounds of appeal raised by the assessee are as follows:

| 1. | | The Id CIT(A) has erred in law and facts in not considering need the addition made relates to capital gain and the statutory position of capital gain specifically required to reduce the purchase cost with index cost from the sale while considering the addition which needs deduction in respect of purchase cost with index cost it’s jantri price in respect of purchase value. The appeal order is therefore erroneous. |

| 2. | | The Id CIT(A) has erred in law and facts in not giving deduction in respect of purchase cost with index and jantri price also and he sustain addition made U/s. 50C thus he considered that transaction pertain to capital gain while invoking provisions of section 50 C but erred in not considering deduction due in respect of purchase cost with index |

| 3. | | The Id CIT(A) has erred in law and facts in passing appeal order on 30-06-2025 without considering the compliance made by the assessee in respect of hearing notice dated 2105-2025 vide ack no.103837471030625 thus complied well before appeal order pass. The appeal order is therefore erroneous. |

| 4. | | The Ld. A.O. erred in law as well as on facts in making addition of Rs. 12,45,081/- The Ld CIT(a) has also erred in confirming the same. The same needs cancellation. |

| 5. | | The Ld. A.O. erred in law as well as on facts in making addition of Rs. 12,45,081/-without cogent reason or cogent material brought on records. The Ld CIT(a) has also The same needs erred in confirming the same. cancellation. |

| 6. | | The Ld. A.O. erred in law as well as on facts in making addition of Rs.12,45,081/-without giving proper opportunity and adequately considering the matter. The Ld CIT(a) has also erred in confirming the same. The same needs cancellation. |

| 7. | | The Ld. A.O. erred in law as well as on facts in making addition of Rs. 12,45,081/ based on irrelevant consideration. The Ld CIT(a) has also erred in confirming the same. The same needs cancellation. |

| 8. | | The Ld. A.O. erred in law as well as on facts in making addition of Rs.12,45,081/- based on presumption and surmises. The Ld CIT(a) has also erred in confirming the same. The same needs cancellation. |

| 9. | | Taking into consideration legal, statutory, factual and administrative aspects no addition as made ought to have been made. The Ld CIT(a) has also erred in confirming the same. The same needs cancellation |

| 10. | | The Ld. A.O. erred in law as well as on facts in not giving due deductions while completing assessments. The Ld CIT(a) has also erred in confirming the same. The same needs to be allowed. |

| 11. | | The Ld. A.O. erred in law as well as on facts in not giving due exemption while completing assessments. The Ld CIT(a) has also erred in confirming the same. The same needs to be allowed. |

| 12. | | Without prejudice The initiation of proceedings u/s. 147 is bad in law needs cancellation. The Ld CIT(a) has also erred in confirming the same. |

| 13. | | Without prejudice, The Ld. A.O. erred in law as well as on facts in not considering that the initiations of the assessment proceeding is itself beyond limitation as prescribe. The Ld CIT(a) has also erred in confirming the same. The same needs to be quashed. |

| 14. | | Without prejudice, no reasonable opportunity has been given by the Ld. A.O. while completing assessment. The Ld CIT(a) has also erred in confirming the same. The same needs annulment. |

| 15. | | Without prejudice, there being no legal service of the notice of hearing issued and therefore the assessment needs annulment. The Ld CIT(a) has also erred in confirming the same. |

| 16. | | Without prejudice, no sufficient and reasonable opportunity has been provided at appellate stages. The Ld CIT(a) has also erred in confirming the same. This is erroneous. |

| 17. | | The appellant craves leave to add/alter/amend and/or substitute any or all grounds of appeal before the actual hearing takes place. |

3. Brief facts qua the issue are that in this case the information was received from ITO (I&CI), Rajkot, regarding the issue of capital gain u/s. 50C of the Income Tax Act, 1961. Subsequently, the reassessment proceedings u/s. 147 of the I.T. Act was initiated by issuing a notice u/s.148 to the assessee on 28.03.2019 after recording the reasons for reopening and with the prior approval of the Pr. Commissioner of Income Tax – I, Rajkot by invoking the provisions of Capital Gain including section 50C of the I.T. Act for the property transactions made by him during the financial year 2011-12. The Assessee has not filed his original return of income. In response to the notices issued u/s 148 the assessee filed his return of income on 21.11.2019 declaring income as Rs. 41,870/-. In response to the notice u/s. 143(2) & 142(1) issued and served to the assessee, the assessee furnished submission/explanation. Accordingly, a final show cause notice was issued on 16.12.2019 asking the assessee to submit the required details. The relevant portion of the show cause notice is reproduced as under:

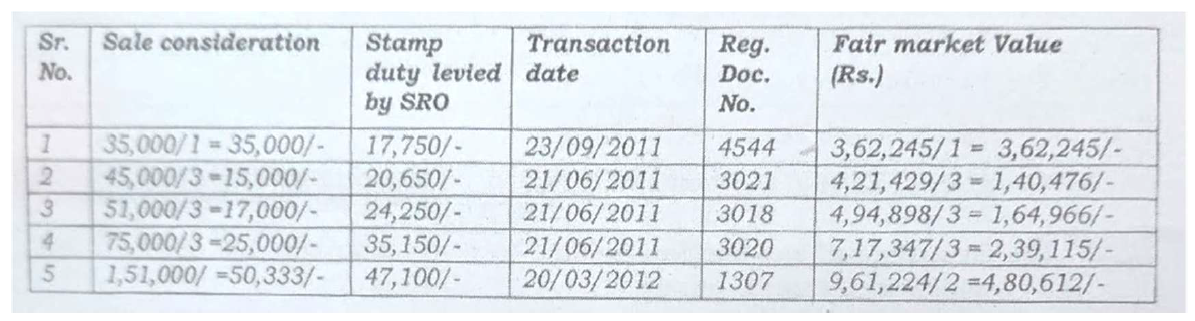

“It is seen from the data available on record & you have return filed on 21.11.2019 against u/s 148 of the IT Act on 28.03.2019 & you have sold immovable properties:-

On further verification of details available on record, it is noticed that, the stamp duty valuation authority has levied a total stamp duty of Rs. 1,44,900/-. And total Sale consideration of Rs. 1,42,333/-. The fair market value of the property works out as per stamp duty levied by the stamp duty valuation authority of Rs. 13,87,414/- Since you have sold the above immovable property below the value determined by the stamp duty valuation authority, being sellers, provisions of section 50C attracts in your case. Before discussing the addition on account of Section 50C of the Act, it is better to have a look on the provisions of the said section. For ready reference, relevant part of Section 50C is being reproduced hereunder:

“Special provision for full value of consideration in certain cases.

50C. (1) Where the consideration received or accruing as a result of the transfer by an assessee of a capital asset, being land or building or both, is less than the value adopted or assessed by any authorities of a State Government (hereinafter in this section referred to as the “stamp valuation authority”) for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed shall, for the purposes of section 48, be deemed to be the full value of the consideration received or accruing as a result of such transfer,”

In view of the above provisions of Section 50C, you are hereby asked to show cause as to why an amount of Rs. 12,45,081/- ((13,87,414-1,42,333)] not be added to your income u/s 50C of the I. T. Act, for A. Y. 2012-13.

You are requested to this office to refer the valuation of the property to the Departmental Valuation Officer vide your letter dated 21.11.2019. Therefore the same is referred to the Departmental Valuation Officer, Rajkot. The report of the Valuation Officer is awaited. As the matter is barred by the limitation date 31.12.2019 this office has proposed addition as mentioned above, without waiting the report of Valuation Officer.

Your case is fixedfor hearing on 18.12.2019 at 11:00 A.M. You are requested tofurnish reply, if any, along with the documentary evidences in support of the claim on the said date. This letter may please be treated as notice u/s 142(1) of the Act. Please note that if nothing is heard from your side, the assessment in your case for A.Y. 2012-13 will be completed ex-parte on the basis of the materials available on record and no further correspondence will be made in this regard.”

4. The assessee has requested, to refer matter to the Departmental Valuation Officer, for valuation of the said property. The report of the Valuation Officer is awaited. As the matter is barred by the limitation date 31.12.2019. The assessing officer has proposed addition as mentioned above, without waiting the report of Valuation Officer. On verification, it is found that the during the year under consideration the assessee had sold residential plot situated Jetpur for the total sale considering amount of Rs. 1,42,333/-. However, the stamp duty valuation authority levied total stamp duty of Rs. 1,44,900/-, the total fair market value worked out at Rs. 13,87,414/-. Therefore, as per section 50C of the I.T. Act, the difference between market value (Jantri Value) and sale deed consideration comes to the Rs. 12,45,081/- (13,87,4141,42,333), require to be added to the total income of the assessee. Therefore, the difference of Rs. 12,45,081/- is not shown by the assessee in his return of Income for the year consideration.

5. In response to the above said show cause notice, the assessee failed to furnish the jusitfication with respect to the difference in the market value adopted by the Stamp valuation Authorities and the value shown in the return of Income. Further, the market value adopted by the Stamp Valuation Authorities was adopted as per the below mentioned reasons.

| (i) | | The Jantri rates fixed by the State Govt. for the area in which the land in question is situated. As per Section 50C, when Stamp duty valuation of a property is higher than the apparent sale consideration shown in the instrument of transfer then onus to prove that fair market value of the property is lower than such valuation by the Stamp Duty authority is on the assessee who can reasonably discharge this onus by submitting necessary material, such as, valuation report of an approved valuer. Here, it is pertinent to point out that assessee has not submitted any valuation report in support of his claim that the valuation of the plots is lower than the prevailing jantri rate. |

| (ii) | | Further, the valuation made by Stamp Duty Authority has not been challenged in any court or before any Revenue Authority. The assessee has made arguments without any supporting documents. Moreover, in his submission, the assessee has also not availed the opportunity under section 50C (2) of the I.T. Act as to demonstrating that fair market value less than stamp duty valuation. |

| (iii) | | The provision of said section 50C are basically deeming provision and the AO has the mandate to replace the sale consideration shown by the assessee with that the valuation adopted by the SVA in those cases where the sale consideration is lower than the valuation adopted by the SVA. |

| (iv) | | As per section 50C, “Where the consideration received or accruing as a result of the transfer by an assessee of a capital asset, being land or building or both, is less than the value adopted or assessed by any authorities of a State Government (hereinafter in this section referred to as the “stamp valuation authority”) for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed shall, for the purposes of section 48, be deemed to be the full value of the consideration received or accruing as a result of such transfer,” |

6. In view of the above discussion, provisions of section 50C is applicable in the case of the assessee as he has shown less sale consideration in the sale deed executed against the Jantry rate calculated by the Stamp Duty Authority and the assessee paid stamp duty as calculated by the said authority. The capital gain need to be reworked out by replacing the sale consideration as per the registered document taken by the assessee with that of the prevailing jantri rate as valued by the Stamp Duty Authority. The assessing officer noticed that in absence of any satisfactory explanation the difference in the Market value and the value adopted by the assessee worked out to Rs. 13,87,414/-. Therefore, as per section 50C of the I.T. Act, the difference between market value (Jantri Value) and sale deed consideration comes to the Rs. 12,45,081/-(13,87,414-1,42,333) which was added to the total income of the assessee.

7. Aggrieved by the order of the assessing officer, the assessee carried the matter in appeal before the Ld.CIT(A), who has confirmed the addition made by the assessing officer, observing as follows:

“From the above, it is evident that the AO has adopted the value as per the DVO and accordingly modified the addition in the rectification order. Thus, there is no mistake in the addition made by the AO in the order passed under Sec. 143(3) r.w.s 147.

The appellant has not submitted any specific submission along with the necessary documentary evidence in support of the grounds raised regarding Deductions and Exemptions, accordingly the grounds raised by the appellant are liable to be dismissed. As seen from AO order at Para No.6, the AO has not recomputed the capital gains, the addition was made only on the difference in the market value of the property to the returned income i.e., the income which is admitted by the appellant.

Further When the appellant challenges the validity of the reopening of assessment, reasonable opportunity not given and service of notice then the onus lies upon the appellant to substantiate the claim by bringing on record cogent material or submitting relevant evidence in support of such contention. In the absence of any supporting documentation or credible submission, the issue cannot be adjudicated upon meaningfully. Accordingly, the grounds raised on this aspect are dismissed.

8. Aggrieved by the order of the Ld.CIT(A), the assessee is in appeal before this Tribunal.

9. During the course of hearing, neither the assessee appeared nor any Counsel on behalf of the assessee appeared, despite of issuing notice on the address of the assessee as provided in the Form-36. On the other hand, the Ld. DR for the revenue submitted that the assessee has submitted only written submission, which can be considered and adjudicate the appeal of the assessee, and these written submissions should be sent to the assessing officer for verification of the documents and evidences involved in these written submissions.

10. I have heard Ld. DR for the revenue, and gone through the written submission submitted by the assessee, which are as follows:

“1. The assessee sold five immovable properties during the year. As mention at Para 41 page 2 of the assessment order dated 23-12-2019 the Id A.O. mentions that total cost of the property purchase is rs. 1,42,333 as per Para 4.1 and 4.3 at page no. 3 of the assessment order the Id A.O. mentions that addition U/s. 50C of rs. 12,45,081 needs to be made U/s. 50C since juntri value there of comes to rs 13,87,414 deducting there from the purchase cost of rs. 1,42,333 comes to rs. 12,45,081 needs to be made U/s. 50C being juntri value of the 5 properties sold at rs. 1,42,333. He there fore made addition of rs. 12,45,081 ultimately as per Para 6 of the assessment order page no.4

2. There after for considering juntri price and sale value the matter was referred to the departmental valuation officers at the instant of the assessee and the Id DVO valued the total 5 properties at rs. 10,74,849. The Id A.O. accepted the same and reduce the addition made of rs. 12,45,081 to rs. 9,32,516

3. The important issue in all the appeal is that there is an error in assessing al the properties at there purchase value consider at rs. 1,42,333 which is raised to rs. 12.45.081 and ultimately reduce to rs. 9,32,516 addition made of 15 9.32.5106 ultimately made on total sale value of rs 1,42.333. While doing so the ld. A.O. though assessed income as capital gain and there after applied provisions of section SOC there on. Thus record indicate that sale vale is to be reduced by its purchase cost, stamp duty and registration charges paid there on and index cost there of out of 5 properties 3 property where sold for is. 45000,51000 and 75000 where purchase on 01-03-2004 and index cost there on 109 which is increased to is. 184 in the year of appeal thus there is a lacuna in assessing all the 5 properties at rs. 1,42,333 which is sale value in the year of assessment an provisions of capital gam describe that out of sale value purchase value is to be deducted

Thus, the short and only grievance of the assessee is that sale value assessed by the Id A.Q. together with addition u/s, 50C as jantri value may kindly be directed to be reduced by the purchase cost, stamp value and registration charges and index cost there of has judicially prescribed under the provisions of income tax act itself as also relating to capital gain.

5 Since it is settled law that no sale come without purchase and therefore sale value is always to be assessed after reducing the purchase cost as well as index cost and jantri value thereof.

6. It is therefore earnestly prayed that appeal of the assessee may kindly be allowed as prayed for.”

11. After going through the above written submission, I noticed that the assessee has not submitted documentary evidences and details, which is mentioned in the written submission, therefore, I set-aside the order of the Ld.CIT(A) and remit the matter back to the file of the assessing officer with the direction to the assessee to submit the relevant documents and details before the assessing officer, in respect of the above written submission. The assessee’s appeal is allowed for statistical purposes.

12. In the result, the appeal filed by the assessee is allowed for statistical purposes.