JUDGMENT

Prathiba M. Singh, J. – This hearing has been done through hybrid mode.

CM APPL.64880/2025 (for exemption)

2. Allowed, subject to all just exceptions. Application is disposed of.

W.P.(C) 15841/2025 & CM APPL. 64879/2025 (for stay)

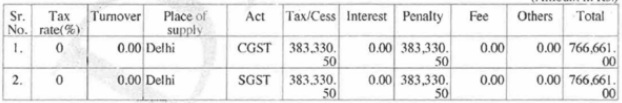

3. The present petition has been filed by the Petitioner under Article 226 of the Constitution of India, inter alia, challenging the impugned order dated 4th February, 2025 issued by the Respondent Department (hereinafter, ‘impugned order’), by which the following demands have been raised against the Petitioner:

4. A brief background of the present case is that, there were notices issued to 670 parties. In the said notices, during the investigation pursuant thereto, it was revealed that there were various firms in Sita Ram Bazar and Naya Bazar, which were used to generate fake invoices. A total of 55 non-existing bogus supplier firms were found and more than 553 crore as inadmissible ITC was passed on to 5,962 recipients/beneficiary firms.

5. The Petitioner appears at serial No.209 in the said list of 670 parties. After the investigation was concluded, the demand was raised against the Petitioner.

6. A Show Cause Notice was issued to the Petitioner on 3rd August, 2024 (hereinafter, ‘SCN’), by the Respondent Department, to which the Petitioner filed a reply on 14th October, 2025.

7. The submission of ld. Counsel for Petitioner is that the aforesaid reply which was filed by the Petitioner to the SCN, was not properly considered by the Adjudicating Authority.

8. On the other hand, ld. SSC for the Respondent objects to the writ petition being entertained on the ground that this case involves fraudulent availment of ITC, and as per the settled precedents which this Court has already pronounced, the writ petition would not be maintainable. Further, ld. SSC for the Respondent contends that the appeal would also not be maintainable, as there is substantial delay, as the impugned order is dated 4th February, 2025.

9. This Court has consistently taken the view thatin cases involving fraudulent availment of ITC, ordinarily, the Court would not be inclined to exercise its writ jurisdiction. It is routinely seen in such cases that there are complex transactions involved which require factual analysis and consideration of voluminous evidence, as also the detailed orders passed after investigation by the Department. In such cases, it would be necessary to consider the burden on the exchequer as also the nature of impact on the GST regime, and balance the same against the interest of the Petitioners, which is secured by availing the right to statutory appeal.

10. It would be apposite to refer to some of the cases which have been decided by the Supreme Court as also by this Court on these aspects. The Supreme Court in the context of Central Goods and Service Tax Act, 2017, has, in Civil Appeal No. 5121/2021 dated 3rd September, 2021 titled ‘Asstt. Commissioner of State Tax v. Commercial Steel Ltd. (SC), has held as under:

“11. The respondent had a statutory remedy under section 107. Instead of availing of the remedy, the respondent instituted a petition under Article 226. The existence of an alternate remedy is not an absolute bar to the maintainability of a writ petition under Article 226 of the Constitution. But a writ petition can be entertained in exceptional circumstances where there is: (i) a breach of fundamental rights; (ii) a violation of the principles of natural justice; (iii) an excess of jurisdiction; or (iv) a challenge to the vires of the statute or delegated legislation.

12. In the present case, none of the above exceptions was established. There was, in fact, no violation of the principles of natural justice since a notice was served on the person in charge of the conveyance. In this backdrop, it was not appropriate for the High Court to entertain a writ petition. The assessment of facts would have to be carried out by the appellate authority. As a matter of fact, the High Court has while doing this exercise proceeded on the basis of surmises. However, since we are inclined to relegate the respondent to the pursuit of the alternate statutory remedy under Section 107, this Court makes no observation on the merits of the case of the respondent.

13. For the above reasons, we allow the appeal and set aside the impugned order of the High Court. The writ petition filed by the respondent shall stand dismissed. However, this shall not preclude the respondent from taking recourse to appropriate remedies which are available in terms of Section 107 of the CGST Act to pursue the grievance in regard to the action which has been adopted by the state in the present case”

11. Thereafter, this Court in W.P.(C) 5737/2025 titled Mukesh Kumar Garg v. Union of India (Delhi) dealing with a similar case involving fraudulent availment of ITC had held as under:

“11. The Court has considered the matter under Article 226 of the Constitution of India, which is an exercise of extraordinary writ jurisdiction. The allegations against the Petitioner in the impugned order are extremely serious in nature. They reveal the complex maze of transactions, which are alleged to have been carried out between various non-existent firms for the sake of enabling fraudulent availment of the ITC.

12. The entire concept of Input Tax Credit, as recognized under Section 16 of the CGST Act is for enabling businesses to get input tax on the goods and services which are manufactured/supplied by them in the chain of business transactions. The same is meant as an incentive for businesses who need not pay taxes on the inputs, which have already been taxed at the source itself. The said facility, which was introduced under Section 16 of the CGST Act is a major feature of the GST regime, which is business friendly and is meant to enable ease of doing business.

13. It is observed by this Court in a large number of writ petitions that this facility under Section 16 of the CGST Act has been misused by various individuals, firms, entities and companies to avail of ITC even when the output tax is not deposited or when the entities or individuals who had to deposit the output tax are themselves found to be not existent. Such misuse, if permitted to continue, would create an enormous dent in the GST regime itself.

14. As is seen in the present case, the Petitioner and his other family members are alleged to have incorporated or floated various firms and businesses only for the purposes of availing ITC without there being any supply of goods or services. The impugned order in question dated 30th January, 2025, which is under challenge, is a detailed order which consists of various facts as per the Department, which resulted in the imposition of demands and penalties. The demands and penalties have been imposed on a large number of firms and individuals, who were connected in the entire maze and not just the Petitioner.

15. The impugned order is an appealable order under Section 107 of the CGST Act. One of the co-noticees, who is also the son of the Petitioner i.e. Mr. Anuj Garg, has already appealed before the Appellate Authority. 16. Insofar as exercise of writ jurisdiction itself is concerned, it is the settled position that this jurisdiction ought not be exercised by the Court to support the unscrupulous litigants.

17. Moreover, when such transactions are entered into, a factual analysis would be required to be undertaken and the same cannot be decided in writ jurisdiction. The Court, in exercise of its writ jurisdiction, cannot adjudicate upon or ascertain the factual aspects pertaining to what was the role played by the Petitioner, whether the penalty imposed is justified or not, whether the same requires to be reduced proportionately in terms of the invoices raised by the Petitioner under his firm or whether penalty is liable to be imposed under Section 122(1) and Section 122(3) of the CGST Act.

18. The persons, who are involved in such transactions, cannot be allowed to try different remedies before different forums, inasmuch as the same would also result in multiplicity of litigation and could also lead to contradictory findings of different Forums, Tribunals and Courts.”

12. This position was also followed in Sheetal and Sons v. Union of India (Delhi)/2025: DHC: 4057-DB. The relevant portion of the said decision read as under:

15. The Supreme Court in the decision in Civil Appeal No 5121 of 2021 titled ‘The Assistant Commissioner of State Tax & Ors. v. M/s Commercial Steel Limited’ discussed the maintainability of a writ petition under Article 226. In the said decision, the Supreme Court reiterated the position that existence of an alternative remedy is not absolute bar to the maintainability of a writ petition, however, a writ petition under Article 226 can only be filed under exceptional circumstances.

XXXX

16. In view of the fact that the impugned order is an appealable order and the principles laid down in the abovementioned decision i.e. The Assistant Commissioner of State Tax & Ors. (supra), the Petitioners are relegated to avail of the appellate remedy.”

13. Recently, this Court in W.P.(C) 5815/2025 titled MHJ Metaltechs (P.) Ltd. v. Central GST Delhi South (Delhi) held as under:

“16. This Court, while deciding the above stated matter, has held that where cases involving fraudulent availment of ITC are concerned, considering the burden on the exchequer and the nature of impact on the GST regime, writ jurisdiction ought not to be exercised in such cases. The relevant portions of the said judgment are set out below:

“11. The Court has considered the matter under Article 226 of the Constitution of India, which is an exercise of extraordinary writ jurisdiction. The allegations against the Petitioner in the impugned order are extremely serious in nature. They reveal the complex maze of transactions, which are alleged to have been carried out between various non-existent firms for the sake of enabling fraudulent availment of the ITC.

12. The entire concept of Input Tax Credit, as recognized under Section 16 of the CGST Act is for enabling businesses to get input tax on the goods and services which are manufactured/supplied by them in the chain of business transactions. The same is meant as an incentive for businesses who need not pay taxes on the inputs, which have already been taxed at the source itself. The said facility, which was introduced under Section 16 of the CGST Act is a major feature of the GST regime, which is business friendly and is meant to enable ease of doing business.

13. It is observed by this Court in a large number of writ petitions that this facility under Section 16 of the CGST Act has been misused by various individuals, firms, entities and companies to avail of ITC even when the output tax is not deposited or when the entities or individuals who had to deposit the output tax are themselves found to be not existent. Such misuse, if permitted to continue, would create an enormous dent in the GST regime itself.

14. As is seen in the present case, the Petitioner and his other family members are alleged to have incorporated or floated various firms and businesses only for the purposes of availing ITC without there being any supply of goods or services. The impugned order in question dated 30th January, 2025, which is under challenge, is a detailed order which consists of various facts as per the Department, which resulted in the imposition of demands and penalties. The demands and penalties have been imposed on a large number of firms and individuals, who were connected in the entire maze and not just the Petitioner.

15. The impugned order is an appealable order under Section 107 of the CGST Act. One of the co-noticees, who is also the son of the Petitioner i.e. Mr. Anuj Garg, has already appealed before the Appellate Authority.

16. Insofar as exercise of writ jurisdiction itself is concerned, it is the settled position that this jurisdiction ought not be exercised by the Court to support the unscrupulous litigants.

17. Moreover, when such transactions are entered into, a factual analysis would be required to be undertaken and the same cannot be decided in writ jurisdiction. The Court, in exercise of its writ jurisdiction, cannot adjudicate upon or ascertain the factual aspects pertaining to what was the role played by the Petitioner, whether the penalty imposed is justified or not, whether the same requires to be reduced proportionately in terms of the invoices raised by the Petitioner under his firm or whether penalty is liable to be imposed under Section 122(1) and Section 122(3) of the CGST Act.

18. The persons, who are involved in such transactions, cannot be allowed to try different remedies before different forums, inasmuch as the same would also result in multiplicity of litigation and could also lead to contradictory findings of different Forums, Tribunals and Courts. ”

17. Under these circumstances, this Court is not inclined to entertain the present writ petition. However, the Petitioners are granted the liberty to file an appeal.

18. Accordingly, the Petitioners are permitted to avail of the appellate remedy under Section 107 of the CGST Act, by 15th July, 2025, along with the necessary pre-deposit mandated, in which case the appeal shall be adjudicated on merits and shall not be dismissed on the ground of limitation.

19. Needless to add, any observations made by this Court would not have any impact on the final adjudication by the appellate authority.”

14. The decision in MHJ Metaltechs (P.) Ltd. (supra) has also been carried to the Supreme Court in SLP(C) 27411/2025 titled Metal Techs v. Central GST, Delhi South (SC). In the said SLP, the Supreme Court vide order dated 22nd September, 2025 has merely extended the time for filing the appeal. The same order reads as under:

“ORDER

| 2. | | Having heard learned counsel for the petitioner, we are not satisfied that it is a fit case to exercise our discretion under Article 136 of the Constitution of India. |

| 3. | | The present petition is, accordingly, dismissed. |

| 4. | | The time period for filing the appeal granted by the High Court till 15.07.2025 is extended upto 15.10.2025. |

| 5. | | Pending application(s), if any, shall stand disposed of.” |

15. Additionally, it is noted that in respect of this very impugned order, one of the other noticee i.e., Giftco Exports, has already filed a writ petition being Giftco Exports v. Principal Commissioner of Central Tax [W. P. (C) No. 13979/2025], in which vide order dated 11th September, 2025, the Petitioner has also been relegated to the Appellate Remedy. The relevant portion of the said order reads as under:

“13. Under these circumstances, in cases involving fraudulent availment of ITC, writ jurisdiction usually ought not to be exercised. Thus, the Court is not inclined to entertain the present writ petition.

14. The Petitioner is permitted to file separate appeals challenging each of the three Orders-in-Original. If any amount has already been deposited, adjustment thereof be given to the Petitioner in respect of the pre-deposits.

15. Upon the appeals being filed by 31st October 2025, the same shall be adjudicated by the Appellate Authority on merits with a reasoned order being passed.”

16. Under these circumstances, since this Court has already considered the same very issue involving fraudulent availment of ITC, in several matters including the W.P.(C) 13979/2025 filed by Giftco Exports, the Court is not inclined to entertain the present writ petition.

17. Insofar as reply filed by the Petitioner is concerned, the reply was filed on 14th October, 2024, along with various relied upon documents.The said documents are permitted to be relied upon by the Petitioner as there is no detailed discussion in the impugned order in respect thereof.

18. The Petitioner is permitted to file the appeal by 30th November, 2025, along with requisite pre-deposit.

19. If the appeal is filed by the Petitioner within the stipulated time, it shall be adjudicated on merits and shall not be treated as barred by limitation.

20. Accordingly, the present petition is disposed of in above terms. Pending applications, if any, are also disposed of.