Ex-Parte Order Due to Accountant’s Failure to Intimate SCN Quashed; Matter Remanded.

Issue

Whether an ex-parte adjudication order should be set aside and remanded for a fresh hearing when the taxpayer failed to reply to the Show Cause Notice (SCN) because their accountant failed to bring the notice to their attention.

Facts

Period: 2019-20.

The Default: The petitioner was issued an SCN which afforded an opportunity to file a reply. However, no reply was filed.

Reason for Default: The petitioner explained that their accountant failed to intimate them about the SCN and the subsequent order. Consequently, the proceedings escaped their attention, leading to an ex-parte demand.

The Challenge: The petitioner filed a writ petition seeking the quashing of the order on the grounds of denial of natural justice (lack of proper opportunity).

Decision

The High Court (likely Delhi HC based on context) ruled in favour of the assessee and set aside the impugned order.

Natural Justice Prevails: The Court noted that since no reply was filed, the petitioner effectively did not get a “proper opportunity to be heard” on the merits of the case.

Remand: To ensure justice is done, the matter was remanded back to the Adjudicating Authority.

Directions: The petitioner was granted liberty to file a reply, and the Authority was directed to pass a fresh order after affording a personal hearing.

Key Takeaways

Human Error is a Valid Ground: Courts often condone procedural lapses attributed to the negligence of employees or consultants (like accountants) to ensure that a substantial tax demand is adjudicated on merits rather than by default.

Right to be Heard: The judgment reinforces that an effective hearing requires the taxpayer to participate. If participation was missed due to genuine reasons, the clock can be reset.

Challenge to Notifications Extending Limitation for FY 2019-20 Subject to Supreme Court Verdict.

Issue

Whether Notification No. 9/2023-Central Tax and Notification No. 56/2023-Central Tax (and corresponding State notifications), which extended the time limit for passing adjudication orders for FY 2019-20, are legally valid.

Facts

The Challenge: The petitioner challenged the validity of the Central and State notifications that extended the limitation period for issuing orders under Section 73 for the period 2019-20.

Notifications:

Notification No. 9/2023-CT (dated 31-03-2023).

Notification No. 56/2023-CT (dated 28-12-2023).

Decision

The High Court disposed of this specific challenge without a final ruling on the merits.

Pending Litigation: The Court observed that the validity of the Central Notifications is pending consideration before the Supreme Court, and the State Notification is pending before the High Court.

Conditional Outcome: Therefore, the Court directed that the petitioner’s challenge to these notifications (and consequently the validity of the remanded adjudication order on the point of limitation) will be subject to the outcome of the decisions in those pending higher court cases.

Key Takeaways

Limitation Defense is Alive: Taxpayers are successfully keeping the “limitation” defense alive in writ petitions. If the Supreme Court later strikes down the extension notifications, all orders passed during the extended period (including this remanded one) could potentially be invalid.

Sub-Judice Status: The extension of timelines for FY 2018-19 and 2019-20 under Section 168A is currently a contested legal issue, with the final word awaited from the Apex Court.

CM APPL. No. 67842 and 67843 OF 2025

| • | Notification No.09/2023-Central Tax dated 31st March, 2023; |

| • | Notification No.09/2023-State Tax dated 22nd June, 2023; |

| • | Notification No. 56/2023- Central Tax dated 28th December, 2023; and |

| • | Notification No. 56/2023- State Tax dated 11th July, 2024 (hereinafter, ‘the impugned notifications’). |

“1. The subject matter of challenge before the High Court was to the legality, validity and propriety of the Notification No.13/2022 dated 57-2022 & Notification Nos.9 and 56 of 2023 dated 31-3-2023 & 8-12-2023 respectively.

2. However, in the present petition, we are concerned with Notification Nos.9 & 56/2023 dated 31-3-2023 respectively.

3. These Notifications have been issued in the purported exercise of power under Section 168 (A) of the Central Goods and Services Tax Act. 2017 (for short, the “GST Act”).

4. We have heard Dr. S. Muralidhar, the learned Senior counsel appearing for the petitioner.

5. The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order under Section 73 of the GST Act and SGST Act (Telangana GST Act) for financial year 20192020 could have been extended by issuing the Notifications in question under Section 168-A of the GST Act.

6. There are many other issues also arising for consideration in this matter.

7. Dr. Muralidhar pointed out that there is a cleavage of opinion amongst different High Courts of the country. 8. Issue notice on the SLP as also on the prayer for interim relief, returnable on 7-3-2025.”

“65. Almost all the issues, which have been raised before us in these present connected cases and have been noticed hereinabove, are the subject matter of the Hon’ble Supreme Court in the aforesaid SLP.

66. Keeping in view the judicial discipline, we refrain from giving our opinion with respect to the vires of Section 168-A of the Act as well as the notifications issued in purported exercise of power under Section 168-A of the Act which have been challenged, and we direct that all these present connected cases shall be governed by the judgment passed by the Hon’ble Supreme Court and the decision thereto shall be binding on these cases too.

67. Since the matter is pending before the Hon’ble Supreme Court, the interim order passed in the present cases, would continue to operate and would be governed by the final adjudication by the Supreme Court on the issues in the aforesaid SLP-4240-2025.

68. In view of the aforesaid, all these connected cases are disposed of accordingly along with pending applications, if any.”

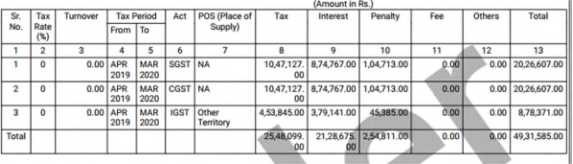

And whereas, the taxpayer had neither deposited the proposed demand nor filed their objections/ reply in DRC-06 within the stipulated period of time, therefore, following the Principle of Natural Justice, the taxpayer was granted opportunities of personal hearing for submission of their reply/objections against the proposed demand before passing any adverse order.

And whereas, neither the taxpayer filed objections/reply in DRC 06 nor appeared for personal hearing despite giving sufficient opportunities, therefore, the undersigned is left with no other option but to upheld the demand raised in SCN/DRC 01. DRC 07 is issued accordingly.

| • | Mobile No. :9643000033 |

| • | E-mail Address :narwanaoffice01 @gmail.com |