Non-Speaking Order Rejecting 80G Approval Quashed; Remanded for De Novo Consideration

Issue

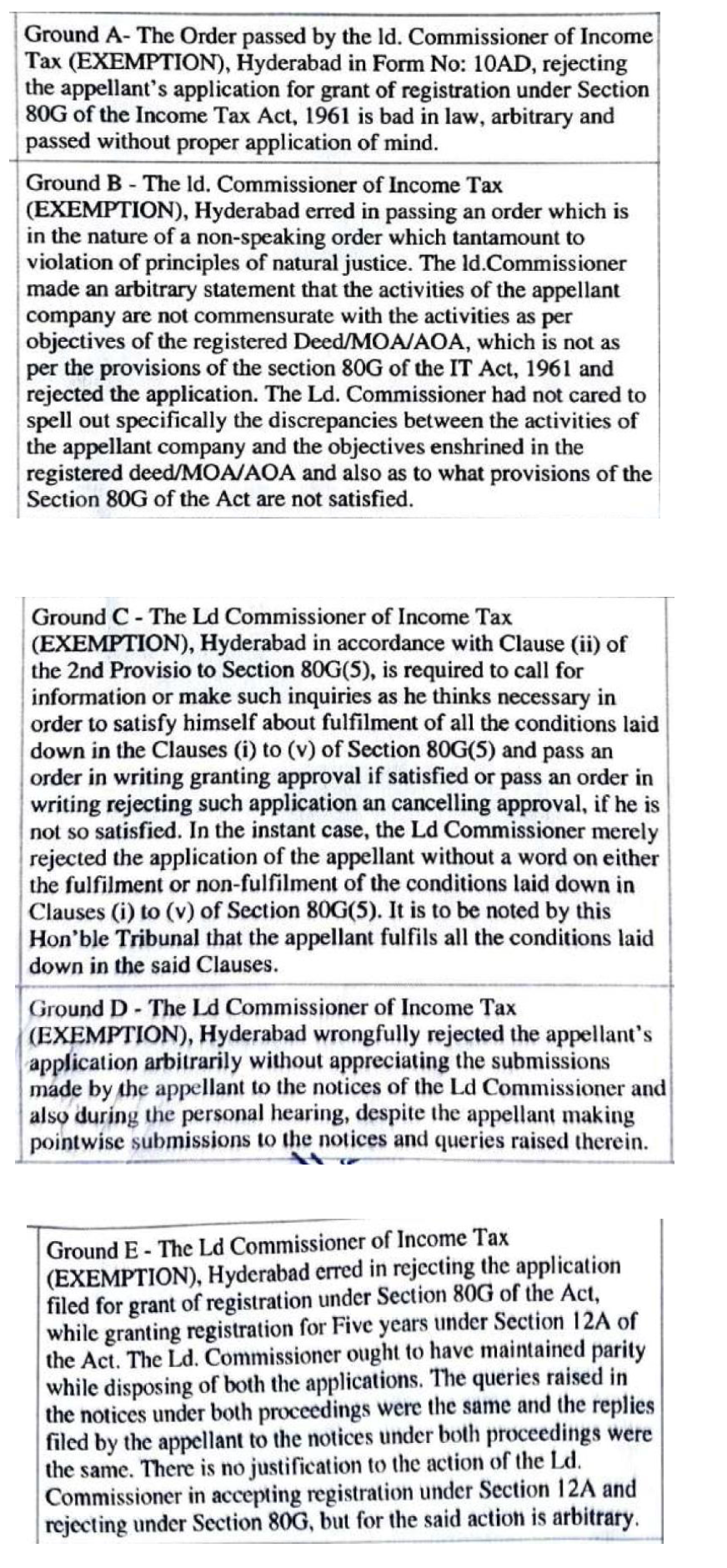

Whether the rejection of an application for approval under Section 80G of the Income-tax Act via a non-speaking order is legally sustainable, particularly when the same Commissioner (Exemptions) subsequently granted registration under Section 12AB to the assessee, thereby implicitly accepting the genuineness of its charitable activities.

Facts

The Application: The assessee-company, engaged in charitable activities, filed an application in Form No. 10AB seeking final registration/approval under Section 80G for the Assessment Year 2023-24.

The Proceedings: During the registration proceedings, the Commissioner (Exemptions) issued two notices. The assessee duly responded to these notices with detailed submissions and supporting documents.

The Rejection: The Commissioner (Exemptions) rejected the application.

The Flaw: The rejection order was found to be a “non-speaking order”. It was devoid of any discussion on the submissions made by the assessee and did not record any specific deficiency, contradiction, or violation of the conditions required for Section 80G approval.

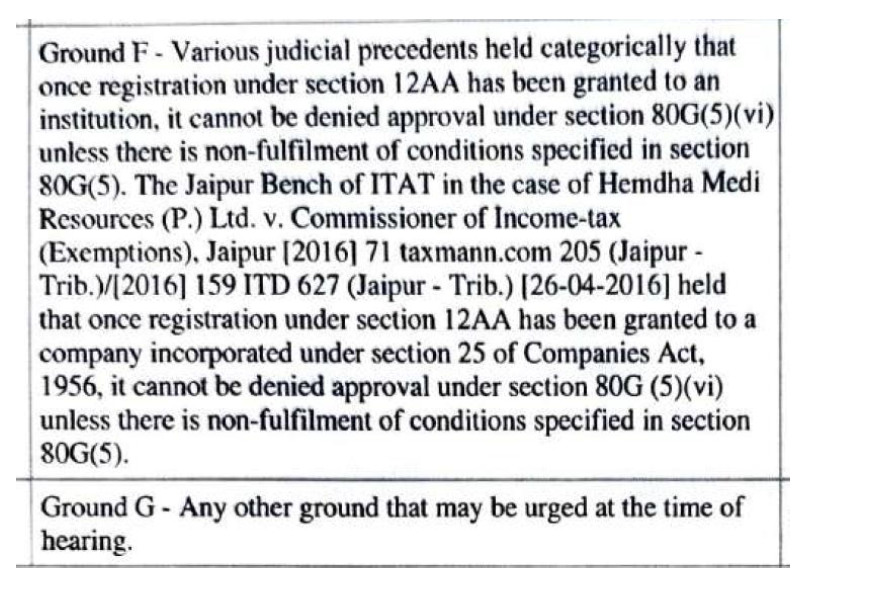

The Contradiction: It was noted that the same Commissioner (Exemptions) had subsequently granted registration to the assessee under Section 12AB. Since Section 12AB registration also requires verification of the “nature and genuineness of activities,” this subsequent grant indicated that the Commissioner was satisfied with the assessee’s charitable nature, making the earlier 80G rejection inconsistent.

Decision

The Tribunal/Court ruled in favour of the assessee (by way of remand).

Violation of Natural Justice: The authority held that an adjudicating officer must pass a “speaking order” that addresses the objections and documents submitted by the applicant. Rejecting an application without dealing with the submissions is a violation of the principles of natural justice.

Inconsistency: The grant of Section 12AB registration by the same authority served as implicit proof that the activities were genuine, undermining the unreasoned rejection of the 80G application.

Outcome: The impugned order was set aside. The matter was restored (remanded) to the file of the Commissioner (Exemptions) for de novo consideration.

Direction: The Commissioner was directed to pass a fresh order on merits after duly examining the submissions and granting the assessee a further opportunity of being heard.

Key Takeaways

Speaking Orders are Mandatory: Quasi-judicial authorities cannot reject statutory applications with vague or template orders. They must specifically state why the submissions were not accepted.

Link Between 12AB and 80G: While Section 12AB and 80G have distinct conditions, the core requirement of “genuineness of activities” is common to both. If the department accepts genuineness for 12AB, it cannot arbitrarily reject it for 80G without specific, recorded reasons.

Remand for Fresh Adjudication: In cases of non-speaking orders or procedural lapses, the appellate tribunal typically restores the matter to the original authority to decide afresh in accordance with the law.

and MADHUSUDAN SAWDIA, Accountant Member

[Assessment year 2023-24]