ORDER

Dr. Dipak P. Ripote, Accountant Member.- This is an appeal filed by the assessee against the order of ld.Commissioner of Income Tax (Exemption) dated 24.07.2024 rejecting registration under section 12A(1)(ac) of the Income Tax Act, 1961. The Assessee has raised the following grounds of appeal:

| “1 | | The learned CIT (Exemption), Pune has erred in rejecting application for registration /renewal submitted by Assessee charitable organisation by passing order under clause (iii) of section 12A(1)(ac) r.w.s. 12AB of the Income Tax Act, 1961 dated 24 July 2024 |

| 2. | | Without considering the facts and circumstances of the case and provisions of law, the Id CIT Exemption has erred in rejecting Assessee’s application for registration /renewal. |

| 3. | | Without appreciating the fact that the Assessee Company is pursuing object of education, de facto students are learning in the school of the Assessee Company, there is error of not granting registration to the Assessee Company |

| 4. | | The order of rejection has been passed without considering submission and explanation filed by the Assessee and thus suffers from infirmity |

| 5 | | The Order passed by the CIT Exemption, Pune rejecting the Assessee’s application is not in keeping with provisions of law, is bad in law and thus the same needs to be set aside |

| 6. | | The learned CIT erred in passing the order without affording adequate opportunity of being heard to the assessee. |

| 7 | | The Ld. CIT. without considering the fact that educational activities are de facto carried out, he is not right in doubting the genuineness of activities of Company and the compliance while passing the rejection order |

| 8 | | The Assessee prays for any other relief may be allowed to the Assessee under provisions of income tax law. |

| 9. | | The assessee craves leave to add, alter, amend, modify, delete any of the grounds of appeal.” |

Delay :

2. There was a delay of one day in filing appeal before this Tribunal. We have perused the request of the Assessee and are convinced that there is sufficient and reasonable cause for delay, accordingly, the Delay in condoned.

Brief facts of the case :

3. In this case, Assesseei.e. Harmony Educational Foundation filed an application in Form No.10AB for registration u/s.12A on 13.01.2024. The ld.Commissioner of Income Tax (Exemption) [ld.CIT(E)] issued various notices to the Assessee and Assessee has complied to those notices. The Assessee in its submission dated 12.07.2024 filed before ld.CIT(E) submitted that Assessee had applied for obtaining required permission to Government of Maharashtra, however, Assessee’s application had been rejected. The ld.CIT(E) in the order noted that Assessee has claimed that it runs a School, but admittedly it does not have required permission from Government of Maharashtra or CBSE/SSC. Ld.CIT(E) noted in the order that as per the financials of the Assessee, the Assessee has been running a School without any prior permission from the Government of Maharashtra or CBSE/SSC. Ld.CIT(E) further noted that inspite of having no permission to run a school, Assessee has been charging exorbitant fees from the students. Ld.CIT(E) in the order stated that as per Section 12AB(1)(B) the ld.CIT(E) has to verify the compliance of any other law applicable. In this case, Assessee has violated the applicable provisions for running school. Therefore, ld.CIT(E) finally held as under in para 6 of his order :

“6. In view of the above, the undersigned is not satisfied about the charitable nature and the genuineness of activities of the assessee and compliance to requirements of any other law for the time being in force by the trust / institution as are material for the purpose of achieving its objects. Therefore, the application filed by the assessee is hereby rejected and the provisional registration granted on 28/05/2021 under section 12AB read with section 12A(1)(ac)(vi) of the Income Tax Act, 1961 is hereby cancelled.”

3.1 Thus, ld.CIT(E) rejected the application of the Assessee. Aggrieved by the order of ld.CIT(E), Assessee filed appeal before this Tribunal.

Submission of Id.AR :

4. In this case, CA-Abhay Avchat appeared along with Mrs.Ruchi Agarwal, Director of the Assessee Company. Ld.AR filed a paper book. Ld.AR submitted that Assessee is a Company duly incorporated under Companies Act on 27.12.2019. The Certificate of incorporation is in the paper book. Ld.AR further submitted that the Directors of the Company are Ruchi Hemant Agarwal and Mukesh Kumar Seth.

5. Ld.AR however, admitted that Assessee has started a School called “KALPA VRIKSHA ACADEMY”. Ld.AR submitted some sample copies of admission forms of students, admitted in the said school. Ld.AR however, admitted that Assessee had applied to Government of Maharashtra for starting a school called Kalpa Vriksha Academy at Gat No.1430, Satavasti, Wagholi in July 2022. Ld.AR invited our attention to page no.160 of the paper book which was the photocopy of the covering letter of the application. Ld.AR further admitted that Assessee’s Application No.1406231972 for starting self-financed school, was rejected by Competent Authority on 29.06.2023.Ld.AR invited our attention to page no.243 which was the copy of the rejection. Ld.AR further admitted that till date Assessee has not made any application to Competent Authority for approval of the school.

6. Mrs.Ruchi Agarwal-Director also admitted that the school do not have any approval. However, she submitted that they admit the students in this school and at the stage of 10th standard the students are made to appear for Board Examination as private students. She has invited our attention to copy of Marks list of the some of the students who appeared for the examination conducted by Maharashtra Board of Secondary and Higher Secondary Education as Private Students. She submitted that since the school is not recognised by the Government of Maharashtra or SSC, the students have to appear as private students.

Submission of Id.DR :

7. Ld.Departmental Representative(ld.DR) for the Revenue strongly relied on the order of ld.CIT(E). However, ld.DR submitted that as per THE MAHARASHTRA SELF-FINANCED SCHOOL(Establishment and Regulation) Act, 2012 and Rules, every school in Maharashtra has to obtain approval of the Competent Authority as mentioned in the Act. In the case of the Assessee, Maharashtra Government Competent Authority has rejected Assessee’s application for approval of running school. The ld.DR therefore, submitted that Assessee is running the school in violation of the Act and Rule which is illegal. Ld.DR also invited our attention to the Profit and Loss Account which is at page no.85 of the paper book to explain that Net Profit earned by Assessee as on 31.03.2023 was 25%, Proft as on 31.03.2022 was 33%, which is exorbitant. Ld.DR submitted that Assessee is doing the business of education. Hence, ld.DR submitted that Assessee is not eligible for registration u/s.12A of the Act.

Findings &Analysis :

8. We have heard both the parties and perused the records. It is observed that Assessee is a Section 8 company duly incorporated on 27.12.2019 under the Companies Act. Copy of Certificate of Incorporation is at page no.14 of the paper book.

9. It is an admitted fact by the ld.AR and Mrs.Ruchi Hemant Agarwal-Director of the Assessee Company that Assessee is running a school called KALPA VRIKSHA ACADEMY since F.Y.2022-23. It is also accepted by Id.AR and Mrs.Ruchi Agarwal that Assessee’s application for starting the school was rejected twice in the year 2022 and 2023 by Competent Authority of Government of Maharashtra.

9.1 Thus, there is no doubt that Assessee has been running a school without approval of the Competent Authority of Government of Maharashtra.

10. We have studied the MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATION) ACT, 2012 and MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATIONS) RULES, 2020. The ld.AR has accepted that this Act and Rules are applicable in the case of the Assessee.

10.1 The relevant Section 15 of MAHARASHTRA SELF FINANCED SCHOOLS (ESTABLISHMENT AND REGULATION) ACT, 2012 is reproduced here as under :

“15. Provisions of Act to apply to school seeking affiliation to any Board or institution in the State, outside State or outside India.— (1) 2[Any registered company or a registered trust] or a registered society or a local authority intending to establish or run a school which it proposes to have it affiliated to any Board or any Institution in the State, outside the State or outside India shall be bound to comply with the requirements for establishing such school in the State in addition to any other requirements of any such Board or Institution in the State, outside the State or outside India and any application for permission to establish or run such school made by 3[such company, trust], society or local authority in that behalf shall be processed in accordance with the provisions of this Act.

(2) No such school shall be established without obtaining the permission under this Act, and merely because an application is made in that behalf it shall not be deemed that a permission is granted for establishing such school in this State.

(3) 4[The registered company or a registered trust] or registered society or local authority as the case may be, shall ensure that the school is run as per the provisions of this Act or the rules made thereunder, and the specified norms and standards and shall be committed to provide quality education to the children.”

10.2 As per the said Act and Rules, it is mandatory to obtain permission of Government of Maharashtra before commencement of school. In the Act and Rules, the procedure for obtaining permission has been explained.

10.3 As per MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATION) ACT, 2012 and MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATIONS) RULES, 2020, a company or society desirous of establishing a new school shall submit the application online in the format given. The Competent Authority verifies the application and then issues letter of intent as per Rule 4, specifying the conditions to be satisfied. As per Rule 5, after receiving letter of intent, the applicant has to comply the conditions mentioned in the letter of intent. As per Rule 6, the Field Level Authority verifies it and submits report to Government, then as per Rule 8, letter of approval is issued.

10.4 In this case, Assessee’s application was rejected at the initial stage itself. It had not even received the letter of intent as per the Rule-4. Therefore, Assessee was not entitled to start a school.

10.5 However, we have noted that Assessee has been running the school. We have studied the website of the assessee in the presence of Authorised Representative during the hearings and noted that Assessee has not mentioned on the website that the school is not duly approved by Government of Maharashtra. Thus, Assessee is hiding the information of not having State Government Approval from the parents of students who seek admission.

11. We have studied the admission Form of KALPA VRIKSHA ACADEMY, which is the school run by assessee and observed that nowhere in the admission form, it has been acknowledged by the Assessee that it does not have Government Permission to run the school. Thus, they are hiding the information.

11.1 Running such a school without approval of Government of Maharashtra which is charging exorbitant, fees is against the public policy and they are playing with the life of the innocent students.

11.2 Be it as it may be, Section 12AB of the Act is reproduced as under :

“Procedure for fresh registration.

12AB. (1) The Principal Commissioner or Commissioner, on receipt of an application made under clause (ac) of sub-section (1) of section 12A, shall,—

| (a) | | where the application is made under sub-clause (i) of the said clause, pass an order in writing registering the trust or institution for a period offive years; |

| (b) | | where the application is made under sub-clause (ii) or sub-clause (iii) or sub-clause (iv) or sub-clause (v) 94[or item (B) of sub-clause (vi)] of the said clause,— |

| (i) | | call for such documents or information from the trust or institution or make such inquiries as he thinks necessary in order to satisfy himself about— |

| (A) | | the genuineness of activities of the trust or institution; and |

| (B) | | the compliance of such requirements of any other law for the time being in force by the trust or institution as are material for the purpose of achieving its objects; |

| (ii) | | after satisfying himself about the objects of the trust or institution and the genuineness of its activities under item (A) and compliance of the requirements under item (B), of sub-clause (i),— |

| (A) | | pass an order in writing registering the trust or institution for a period of five years; or |

| 95[(B) | | if he is not so satisfied, pass an order in writing, – |

| (I) | | in a case referred to in sub-clause (ii) or sub-clause (iii) or sub-clause (v) of clause (ac) of sub-section (1) of section 12A rejecting such application and also cancelling its registration; |

| (II) | | in a case referred to in sub-clause (iv) or in item (B) of sub-clause (vi) of sub-section (1) of section 12A, rejecting such application, after affording a reasonable opportunity of being heard;] |

11.3 Thus, as per Section 12AB of the Act, the ld.CIT(E) has to satisfy himself about objects of the Trust, Genuineness of the Activities and violation of any other law applicable.

12. In this case, MAHARASHTRA SELF-FINANCED SCHOOLS(ESTABLISHMENT AND REGULATION) ACT, 2012 and MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATIONS) RULES, 2020 are the most important applicable law for a school in Maharashtra. Admittedly, Assessee has violated these laws, by running a school without obtaining a permission. They have been running a school without approval for almost for three years.

12.1 Therefore, in our considered opinion, ld.CIT(E) was right in rejecting assessee’s application for registration u/s.12A r.w.s 12AB of the Act.

13. On perusal of the financials submitted by the Assessee, it is observed that fees collected and profit earned by the Assessee was as under :

| Year | Fees | Net Profit | Profit % |

| F.Y.2022-23 | Rs.2,08,93,010/- | Rs.44,52,000/- | 25% |

| F.Y.2021-22 | Rs.18,59,000/- | Rs.6,64,000/- | 33% |

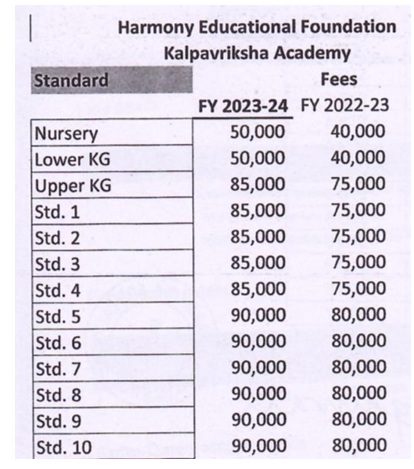

13.1 The Fee Structure as submitted by Assessee is as under :

14. The Hon’ble Supreme Court in the case of Islamic Academy of Education v. State of Karnataka [Writ Petition (Civil) No. 350 of 1993, dated 14-8-2003] observed as under :

Quote.”Of course there can be no profiteering and capitation fees cannot be charged.”

………………

135. While this Court has not laid down any fixed guidelines as regard fee structure, in my opinion, reasonable surplus should ordinarily vary from 6% to 15%, as such surplus would be utilized for expansion of the system and development of. education.”Unquote.

15. The Hon’ble Supreme Court in the case of T M A PAI Foundation v. State of Karnataka [Writ Petition (Civil) No. 317 of 1993, dated 31-10-2002] has observed as under :

Quote”57. We, however, wish to emphasize one point, and that is that inasmuch as the occupation of education is, in a sense, regarded as charitable, the government can provide regulations that will ensure excellence in education, while forbidding the charging of capitation fee and profiteering by the institution. Since the object of setting up an educational institution is by definition “charitable”, it is clear that an educational institution cannot charge such a fee as is not required for the purpose of fulfilling that object. To put it differently, in the establishment of an educational institution, the object should not be to make a profit, inasmuch as education is essentially charitable in nature. There can, however, be a reasonable revenue surplus, which may be generated by the educational institution for the purpose of development of education and expansion of the institution.”Unquote.

16. The Hon’ble Supreme Court (supra) has laid down the law that profiteering is not allowed in Educational Institutes. In the case of the Assessee, the Assessee has been earning more than 25% Net Profit which is nothing but profiteering. Thus, even on this ground, Assessee is not eligible for registration u/s.12A of the Act. The issue of exorbitant fee has been discussed by ld.CIT(E) in his order.

17. It will not be out of place to mention that on the website of the assessee, Assessee has provided false information. We have already mentioned that Assessee’s Website was studied by the Bench in the presence of Authorised Representative and Departmental Representative during the hearing. The relevant portion of the website is reproduced here as under :

17.1 Though, Assessee do not have a valid registration u/s.12A of the Income Tax Act, Assessee has falsely claimed on the website that it has valid 12A registration of the Income Tax Act.

18. The Assessee has submitted a copy of Memorandum of Association in the paper book. As per the said Memorandum of Association, Assessee’s objects are as under:

“1. To carry on in India or elsewhere the business to promote, own, establish, acquire, run, operate, manage, maintain, develop, administer, advertise, either on its own or through franchisee fully equipped schools, colleges, educational institutes, universities including deemed or autonomous universities, to promote and disseminate knowledge, to provide alternate methods for education of children, teachers, parents and community, based on the principles of creative and application based learning, to create awareness and provide a common forum of interaction amongst academicians, professionals and government agencies, establish effective co-ordination, to set up a Centre for remedial education and mental health centers, to organize training courses and special programmes to impart training, education in all disciplines, online, distinct, correspondence courses, coaching classes for any stream, any level, any profession, courses for information technology, computer technology, software, hardware, networking, any certified or recognized courses of Government, all types of school, university or any recognized institute courses whether aided or unaided, and to carry on extracurricular activities, skill building activities, fun activities, Indoor and outdoor games, computer training, horse riding, swimming, yoga, martial arts, music, dancing etc., Providing ancillary services to educational institutions. The services will cover, but will not be restricted to, remedial teaching, sports, catering, transport, and technical knowledge enhancement, to set up a Production house for educational games, books, toys and sale of the same, to do all such related activities which are incidental and ancillary to provide all types of education & consultancy services related to it.”(emphasis supplied)

19. On perusal of the said object, it is clearly visible that assessee’s object is to do business of education.

19.1 One of the Objects of the Assessee is to Set up Production House for Educational games, Books, Toys, and Sale of the Same.

19.2 Thus, some of the objects are not charitable as defined u/s.2(15) of the Income Tax Act. To set up Production House for Educational games, Toys and Sale the same is not a charitable object as defined in section 2(15) of the Income Tax Act.

20. In these facts and circumstances of the case, we are of the opinion that ld.CIT(E) was right in rejecting assessee’s application for registration u/s.12A r.w.s 12AB of the Act. Accordingly, we uphold the order of ld.CIT(E) dated 24.07.2024 rejecting assessee’s application for registration u/s.12A r.w.s 12AB of the Income Tax Act. Accordingly, Ground Nos.1 and 2 raised by the Assessee are dismissed.

21. Ground No.3 :

“3. Without appreciating the fact that the Assessee Company is pursuing object of education, de facto students are learning in the school of the Assessee Company, there is error of not granting registration to the Assessee Company.”

21.1 The Hon’ble Supreme Court has held that „Education means Structured Education’. The Hon’ble Gujarat High Court in the case CIT v. Sorabji Nusserwanji Parekh (Guj), held as under :

‘There should be activity of normal schooling or actual imparting of education by the institution.’

22. For the purpose of Section 2(15) of the Income Tax Act, Education means Structured Education. In the case of the Assessee, Assessee is running a school without having approval of Competent Authority which is an act against public policy. Therefore, the so-called school run by Assessee is in violation of applicable Act and Rules i.e.MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATION) ACT, 2012 and MAHARASHTRA SELF-FINANCED SCHOOLS (ESTABLISHMENT AND REGULATIONS) RULES, 2020. Therefore, ld.CIT(E) has not erred in rejecting Assessee’s application. Accordingly, Ground No.3 raised by the Assessee is dismissed.

Ground No.4 :

23. Ld.CIT(E) has considered the submission filed by the Assessee. We have studied the paper book filed by the Assessee and observed that ld.CIT(E) has considered the documents filed by Assessee. Therefore, there is no merit in alleging that ld.CIT(E) has not considered Assessee’s submission. Hence, Ground No.4 raised by the Assessee is dismissed.

Ground No.5 :

24. Ld.CIT(E) has rejected Assessee’s application as per Section 12AB r.w.s 12A of the Income Tax Act, 1961. We have already discussed at length in earlier paragraphs the provisions of Section 12AB r.w.s 12A of the Income Tax Act. Accordingly, Ground No.5 of the Assessee is dismissed.

Ground No.6 :

25. Ld.CIT(E) had provided opportunities to the Assessee. Assessee has filed submission on various dates which is mentioned in the order of ld.CIT(E). We have also referred in earlier paragraphs assessee’s submission dated 12.07.2024 filed before ld.CIT(E). Therefore, there is no merit in Ground No.6. Accordingly, Ground No.6 raised by the Assessee is dismissed.

Ground No.7 :

26. Ld.CIT(E) has rejected Assessee’s application as per Section 12AB of the Act. We have at length discussed in earlier paragraphs the submission of the Assessee and provisions of the Act. The Assessee is running school without obtaining permission from the Government of Maharashtra Competent Authority. Assessee School also do not have any Affiliation to CBSE/SSC Board or State Education Board. This explains that assessee’s activities are not genuine. Therefore, we have no doubt in upholding the order of ld.CIT(E). Accordingly, Ground No.7 raised by the Assessee is dismissed.

27. Ground No.8 and 9 are general in nature, hence, needs no adjudication. Accordingly, Ground No.8 and 9 raised by the Assessee are dismissed.

28. To sum up, all grounds of appeal raised by the Assessee are dismissed.

29. In the result, appeal of the Assessee is dismissed.