ORDER

Kul Bharat, Vice President.- These two appeals by the assessee against two different orders of the Ld. Commissioner of Income Tax (Appeals), pertaining to the A.Y. 2016-17 and A.Y. 2018-19.

2. For the sake of convenience and brevity, both appeals were heard together and are being disposed of by way of consolidated order. First, we take up the ITA. No. 577/LKW/2024, pertaining to the A.Y. 2016-17. The assessee has raised the following grounds of appeal: –

ITA. No.577/LKW/2024

| “1. | | That the Authorities below erred on facts and in law in making addition of Rs. 52,66,764/- i.r.o completed Assessment by resorting to proceedings u/s 154 of IT Act without considering that it is not a case of ‘mistake apparent from record and thus initiation of rectification proceedings is invalid, illegal ab initio and liable to be quashed. |

| 2. | | That the Authorities below erred on facts and in law in not considering that the commission / grant receivable from sugar mills Rs. 52,66,764/- as enhanced by the Ld AO is also eligible for deduction u/s 80P as there is no change in the nature of income. |

| 3. | | That the Ld. C.1.T. (A) erred on facts and in law in not considering that when part of the commission income from sugar mills has already been allowed for deduction u/s 80P then the balance income shall also be eligible for deduction u/s 80P as there is no change in the nature of income. |

| 4. | | That the Authorities below erred on facts and in law in not considering that when the entire income of the Society is exempt u/s 80P then any profit increased as a result of addition/ disallowance shall also be eligible for deduction u/s 80P. |

| 5. | | That the addition made is highly excessive, contrary to the facts, law and principle of natural justice and without providing sufficient time and opportunity to have its Say on the reasons relied upon by CIT (A).” |

3. It is transpired from the record that the present appeal is barred by limitation for 25 days. The assessee has filed an application seeking condonation of delay. It is stated on behalf of the assessee that the delay was caused because the brother of the Ld. Authorized Representative of the assessee was diagnosed with cancer. The Ld. AR for assessee was occupied with the medical emergency and was also not in a proper state of mind. Therefore, an unintended delay occurred in filing the present appeal. It is submitted on behalf of the assessee that the delay is caused for bona fide reason and there was no deliberate Act on behalf of the assessee for such a delay. It is, therefore, prayed that the delay be condoned and the appeal be admitted for hearing.

4. On the contrary, the Ld. Departmental Representative opposed the submissions of the Ld. Counsel for the assessee and contended that there was no reasonable cause for filing the present appeal belatedly. He, therefore, contended that the appeal deserves to be dismissed on the ground of the limitation alone.

5. Heard the Ld. Representatives of the parties and perused the material on record. There is a delay of 25 days in filing the present appeal. The reason for such delay is stated to be medical emergency caused by brother of Ld. AR was diagnosed with cancer. The Ld. Authorized Representative of the assessee was pre-occupied for attending the medical emergency and was also not in a proper state of mind. The reasons stated in the application is also supported with an affidavit. The Revenue has not brought any material to rebut the averments made by the assessee. Therefore, considering the facts of the present case, we hereby condone the delay of 25 days and admit the appeal for hearing on merits.

6. The assessee in this appeal has raised multiple grounds but only effective ground is regarding confirmation of addition of Rs. 52,66,764/- made by the Assessing Officer on account of commission income by rectifying the assessment order passed u/s 143(3) of the Act.

7. The facts in brief are that in this case the Assessing Officer (AO) had framed the assessment u/s 143(3) of the Act. Thereby, he assessed loss at Rs.36,34,947 (Rounded of at Rs.36,34,950/-) vide order dated 16.08.2018. Thereafter, on the basis of audit objection regarding commission income. The AO had observed that as per Form 26AS, the assessee had earned commission at Rs.1,13,49,264/- and claimed credit of tax deducted at source (TDS) of Rs.11,34,972/- on such commission income but the assessee had offered for taxes a sum of Rs.60,79,500/- and balance commission of Rs.52,66,764/- was categorized in the balance-sheet as under the head other receivable from the sugar mills. Therefore, treating it as mistake apparent on record, the Assessing Officer re-computed the income of the assessee and made impugned addition of Rs.52,66,764/-. Aggrieved by this, the assessee preferred in appeal before the Ld. CIT(A), who also sustained the addition and dismissed the appeal of the assessee. Now, the assessee is in appeal before this Tribunal.

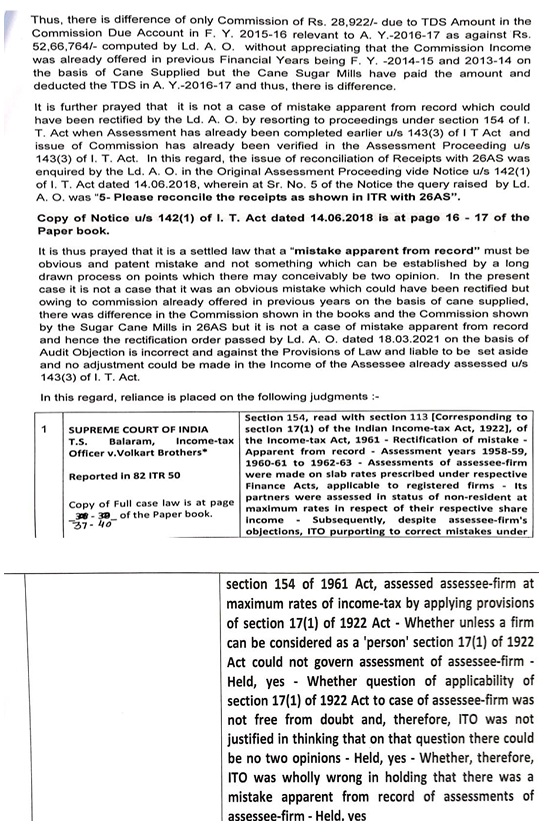

8. Apropos to the grounds of appeal, Ld. Counsel for the assessee contended that the Ld. authorities below grossly failed to appreciate the fact that even if the addition is made on account of non-offer of the amount for taxes then also such amount would qualify for deduction u/s 80P of the Act since the deduction u/s 80P of the Act would be available on the income received by the assessee in the form of commission. He further contended that the authorities below have not considered the circular issued by CBDT dated 02.11.2016 and the decision of the Co-ordinate Bench of this Tribunal rendered in the case of ITO v. Co-operative Cane Development (Lucknow – Trib.). He further reiterated the submissions as made in the written submissions. For the sake of clarity, the submissions are reproduced as under:-

“1O ON THE ISSUE OF GROUNDS OF APPEAL NO. 2, 3 & 4

With due respect, it is prayed that the Appellant is a Cane Society of Cane Growers who are the members of the Cane Society. The appellant is registered under the U. P. Cooperative Societies Act by the Registrar Cane Societies. The appellant Society has been formed under the U. P. Sugar Cane (Regulation of Supply and Purchase) Act 1953 and U. P. Sugar Cane Regulation of Supply and Purchase Rules 1954. The main activities of the Cane Grower’s Co-operative Society is to market the agriculture produce being sugar cane grown by its members so as to facilitate better price of sugar cane from Sugar Mills to Cane Growers and to provide credit facilities to its members for purchase of Pesticides, Fertilizers and Agriculture Implements.

During the relevant assessment year, the Assessee society received commission of Rs. 60,79,500/from the Sugar Factories assigned in those areas as per Section 18 of the U. P. Sugar Cane (Regulation of Supply and Purchase) Act 1953 read with Rule 45 of the U. P. Sugar Cane Regulation of Supply and Purchase Rules 1954.

During the year, the Assessee filed its Return of Income on 20.08.2016 claiming deduction u/s 80P(2)(a)(iii) of I. T. Act. The case of the Assessee was selected for scrutiny u/s 143(3) of I. T. Act in order to verify the deduction claimed. In the course of assessment proceeding, the Assessee filed the Balance Sheet and Profit and Loss Account wherein Commission of Rs. 60,79,500/- was shown to be received from Sugar Factories. The Ld. A. O. verified all these details, however, passed the Order u/s 143(3) of I. T. Act by disallowing the deduction claimed under section 80P w. r. t. Interest income on FDR’s Rs. 2,49,172/- by applying the Judgment of Hon’ble Supreme Court in the case of Totgars Co-operative Sale Society and thereby treating the interest on FDR’s as the Income from other source u/s 56 of I. T. Act. However, the deduction on Commission Income was allowed by the Ld. A. O. in the order u/s 143(3) of I. T. Act dated 16.08.2018. Copy of Assessment order dated 16.08.2018 is at page 09 -11 of the Paper book.

Thereafter, proceedings u/s 154 of I. T. Act was initiated by the Id. A. O. on the basis of Revenue Audit Party Observation that as per 26AS assessee has received Commission of Rs. 1,13,49,264/- and whereas in the Audited Books Commission of Rs. 60,79,500/- only has been shown in the Income and Expenditure Account and therefore, on the basis of observation of Revenue Audit party, the Ld. A. O. added the difference being Rs. 52,69,764/- as Income of the Society.

Copy of Audited Balance Sheet and Income and Expenditure Account is at page 12 – 13 of the Paper book.

The Ld. A. O. while making the addition of Commission Income of Rs. 52,69,764/- did not allow the deduction u/s 80P(2)(a)(iii)of I. T. Act on the increased income of Commission as the Commission Income is eligible for deduction u/s 80P(2)(a)(iii) and has been previously allowed by Ld. A. O. in the Assessment Order dated 16.08.2018.

Since the Commission Income has been derived by the Appellant Society from the Marketing of Agriculture produce of its members being Sugar Cane as per Section 18 of the U. P. Sugar Cane (Regulation of Supply and Purchase) Act 1953 read with Rule 45 of the U. P. Sugar Cane Regulation of Supply and Purchase Rules 1954, thus any increased income / enhanced income by way of Commission will again be eligible for deduction u/s 80P(2)(a)(iii) of I. T. Act as the same has been derived from the activity of Supply of Sugar Cane.

In this regard, reliance is placed on the Judgment of Hon’ble ITAT, Lucknow Bench in the appeal of ITO v. Sahkari Ganna Vikas Samiti Limited, Rupapur Chauraha, Hardoi, in ITA No. 467/LKW/2013, has held as under :

“6. Ground No. 2 is as under :

2.That the Learned Commissioner of Income Tax (Appeals) is not justified in deleting the addition of Rs. 8,26,188/on account of disallowance of P. F. deduction the addition as the Assessee had not only failed to deposit the amount recovered from its employees but also failed to deposits own contribution as the same would be allowable deduction as per provisions of section 36(1)(vi)/43B”.

7. Learned D. R. of the Revenue supported the Assessment Order whereas Learned A. R. of the Assessee supported the Order of Learned CIT(A).

8. We have considered the rival submissions. We find that it is held by Learned C.I.T. (A) that even the enhanced income by way of making addition u/s 36(1)(va) and 2(24)(x) will be eligible for deduction u/s 80P of the Act. We do not find any infirmity in the order of CIT (A) on this issue. Accordingly, this ground is also rejected.”

Copy of full case law is at page 18 – 21 of the Paper book.

Further in the Appeal before Hon’ble 1.T.A.T. Lucknow Bench-A, Lucknow in ITA No. 108/Lucknow/2017, the Hon’ble Bench in Para 6 held as under:

“6. We have perused the case records, analysed the facts and circumstances of the case. So far as the contribution to the P. F. Account of Seasonal Employees is concerned, we find that as per the facts and circumstances and the decision of the Co-ordinate Bench of ITAT, even if there is an increase in addition, still [8:45 AM, 10/9/2025] Self: deduction under section 80P of the Act is applicable and therefore, relief granted by the Ld. C.I.T. (A) on this issue is upheld.”

Copy of full case law is at page 22-25 _ of the Paper book.

Further in the Appeal of Hon’ble I.T.A.T., Lucknow Bench-B, Lucknow in the appeal of Income Tax Officer v. Co-operative Cane Development Union Limited reported in have held that Commission Income derived by the Cooperative Cane Societies in Marketing of Sugar Cane grown by its members is eligible for deduction under section 80P of I. T. Act. The Relevant findings of the Hon’ble Bench is as under :

“The present matter relates to whether the commission that has been earned by the Cane Development Councils or Cooperative Cane Development Unions (Cane Growers Cooperative Society or Societies) are income arising from their business activities and thereby liable for deduction under section 80P, or whether they are income from other sources. It is observed that both Cane Development Councils and the Cooperative Cane Development Union (Cane Growers Cooperative Society or Societies) function under the U.P. Sugar Cane (Regulation of Supply and Purchase) Act, 1953 and the U.P. Sugar Cane (Regulation of Supply and Purchase) Rules, 1954. The functions of the Cane Development Council are laid down in section 6 of the said Act which specify that the Councils will consider and approve plans for the development of sugarcane production in a zone and devise ways and means for its execution. It has also been tasked with taking steps for development of irrigation and other agricultural facilities in the zone, to take steps for the prevention of disease and for pest control, to impart training and technical knowhow to farmers and support in the form of fertilizers, manures and seeds and other functions as may be prescribed. The functions of the Cane Growers Cooperative Society have been laid down in rule 57 of the rules to be all arrangements in connection with the sowing, supply and sale of sugarcane by the members of those societies in accordance with the general or special instructions issued by the Cane Commissioner from time to time. Thus from a perusal of the Act and Rules, it is evident that the Cane Development Councils and the Cooperative Cane Development Unions play an important role in the Sugarcane production and supply within the areas that are assigned to them. The Act also lays down what payments are to be made to these bodies by the occupier of the factories. In section 18 of the said Act, it has been stated that the occupier of a factory or a Gud, Rab or Khandsari sugar manufacturing unit, shall make a contribution for every one maund of cane purchase by the factory or the Gud, Rub or Khandsari sugar manufacturing unit [Para 7]

In the rules, with regard to payments, it had been pointed out in rule 45 that the payments for the cane shall be made only by the cane grower or to his representative duly authorized by him in writing or to a Cane Grower Cooperative Society. With regard to commission, it has been laid down in rule 49, that the occupier of a factory Shall pay commission on cane purchase at the rate of 3 per cent of the minimum statutory cane price fixed by the Government of India of which 75 per cent shall be payable to the Cane Grower Cooperative Society and 25 per cent would be payable to the Council. Rule 50 lays down that in determining the proportion in which the payments of the commission shall be made to the Council and the Cane Growers Cooperative Society of an area, the State Government may take into consideration the, the financial resources and the working requirements of the Council and the Cane Growers Cooperative Society. [Para 7.1]

A perusal of the Act and the rules shows that both the Cane Development Council and the Cooperative Cane Development Unions (or Cane Growers Cooperative Society) perform an important role in the cane production and marketing in a particular area or zone. While the unions are directly involved in the marketing of the sugar cane to the various factories, the Council performs a number of functions to facilitate the production and supply of sugarcane in the area assigned to it. Therefore, it is quite clear that the commission that is paid by the occupier of the factory or by Gud, Rub or Khandsari units is not on account of some investment that is made by these Councils or Unions with the factories but rather because of their role in production and marketing of sugar cane in that particular area. The payment of commission is therefore, attributable to the activity of production and marketing of sugarcane for which the Cane Development Councils and the Co-operative Cane Development Unions have been set up under the Sugarcane Act and Rules. Since the Commissioner (Appeals) has made references to the functions performed under this Act and the Rules framed thereunder in his order, it is held that the revenue is not justified in contending that he has not given a finding on the nature of the Commission received by the assessees. Therefore, the decision of the Commissioner (Appeals) to allow the same to be deducted under section 80P as they are receipts from the business and not income from other sources is upheld. Accordingly, all the appeals of the revenue, which do not seem to have taken cognizance of the assigned roles of the Cane Development Councils or Cooperative Cane Development Unions in the production of marketing of cane as per the U.P. Sugarcane (Regulation of Supply & Purchases) Act, 1953 read with the U.P. Sugarcane (Regulation of Supply & Purchases) Rules, 1954, are fit to be dismissed. [Para 7.2].”

Copy of full case law is at page 26 – 31 of the Paper book.

Reliance is further prayed that on Judgement of Jurisdictional Allahabad High Court in the case of C/T v. Zila Sahkari Bank Limited reported in wherein it has been held as under :

“After hearing both the parties and on perusal of the record, it appears that the assessee is enjoying the benefit of Section 80P of the Act and as such the tax on an income is exempted. Even if the addition is sustained there will be no tax demand as the tax effect will be NIL.”

Copy of full case law is at page 32 – 33 of the Paper book.

Reliance is also placed on the judgement of Bombay High Court in the case of PCIT v. Lionbridge Technologies Pvt. Ltd. reported in have held as under :

“9. After noting the rival contentions, the Tribunal found that it will not be possible to disregard the judgment of the Division Bench of this Court. The Assessing Officer/Transfer Pricing Officer had proposed disallowance under Section 40(a)(v) in respect of tax borne by the employer which was claimed as exempt by the employee under Section 10(10CC) of the IT Act. However, deduction under Section 10A was not allowed on the revised business profit so enhanced because of disallowance under Section 40(a)(v). The Tribunal found that the Division Bench judgment in Gem Plus Jewellery India Ltd. (supra) squarely covers the issue under consideration, and therefore, the Assessing Officer will have to be directed to allow deduction under Section 10A on the enhanced business profit of the assessee, namely, profit to be increased by the amount of disallowance made under Section 40(a)(v) since the assessee has no income other than the income eligible for deduction under Section 10A of the IT Act.” Copy of full case law is at page 34 – 36 of the Paper book.

It is therefore prayed that the increased income of Rs. 52,66,674/being Income from Commission will also be available for deduction u/s 80P(2)(a)(iil) of I. T. Act in view of the above settled judicial position and there will be no addition as made by the Ld. A. O.

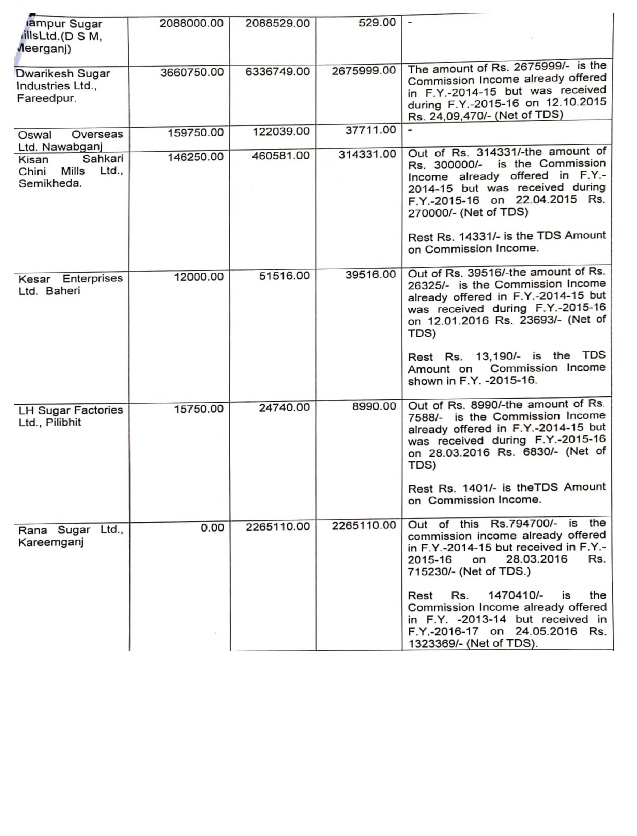

2 ON THE ISSUE OF GROUNDS OF APPEAL NO. 1

With due respect, it is prayed that in this case the Commission is received from Sugar Cane Factories / Mills against supply of Sugar Cane by the Cane Growers in the Area assigned to the Cane Societies. The Commission is computed as per Rule 45 and 49 of the U.P. Sugar Cane (Regulation of Supply and Purchase) Rules 1954, wherein occupier of a Factory shall pay Commission @ 3% of the minimum Statutory Cane Price fixed by the Government of India of which 75% is payable to the Cane Societies and 25% to the Cane Councils. During the Relevant Assessment Year the Cane supplied / purchased by the Sugar Cane Factories which are assigned within the area is 2716050.66 Quintal and the Commission computed @ 75% comes to Rs. 61,11,114/which is the commission due during F. Y. — 2015-16 relevant to A. Y.2016-17 from the Cane Factories.

The details of cane supplied and the Commission due is at page 14 – 15 of the Paper book.

In the Audited Books of Account, we have shown Commission of Rs. 60,79,500/- being the Commission due on the basis of cane supplied by the Cane Growers to the Cane Factories. The excess Commission shown in 26AS by the Cane Factories pertain to previous years which have been paid by the Cane Factories during the relevant assessment year but the Commission was already offered in earlier years.

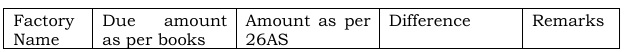

The details are explained as under: –

9. On the other hand, the Ld. Departmental Representative for the Revenue opposed the submissions and supported the orders of the lower authorities. He further submitted that the Assessing Officer was justified in making the addition as the assessee himself did not disclose such commission in the return of income.

10. We have heard the rival contention and perused the material available on records. The Hon’ble Jurisdictional High Court rendered in the case of CIT v. Zila Sahkari Bank Ltd (Allahabad) has held that on perusal of the record, it appears that the assessee is enjoying benefit of Section 80P of the Act and as such the tax on an income is exempted. Even if, addition was sustained, there will be no tax demand and tax effect will be nil. Further, the CBDT, in para no. 2 and 3 of Circular No. 37/2016 [F. No. 279/Misc./140/2015/ITJ] dated 02.11.2016, has stated as under: –

“2. The issue of the claim of higher deduction on the enhanced profits has been a contentious one. However, the courts have generally held that if the expenditure disallowed is related to the business activity against which the Chapter VI-A deduction has been claimed, the deduction needs to be allowed on the enhanced profits. Some illustrative cases upholding this view are as follows:

(i) If an expenditure incurred by assessee for the purpose of developing a housing project was not allowable on account of non-deduction of TDS under law, such disallowance would ultimately increase assessee’s profits from business of developing housing project. The ultimate profits of assessee after adjusting disallowance under section 40(a)(ia) of the Act would qualify for deduction under section 80-IB of the Act. This view was taken by e courts in the following cases:

Income-tax Officer – Ward 5(1) v. Keval Construction, Tax Appeal No. 443 of 2012, December 10, 2012, Gujarat High Court.

Commissioner of Income-tax-IV, Nagpur v. Sunil Vishwambhamath Tiwari, IT Appeal No. 2 of 2011, September 11, 2015, Bombay High Court.2

(ii) If deduction under section 40A(3) of the Act is not allowed, the same would have to be added to the profits of the undertaking on which the assessee would be entitled for deduction under section 80-IB of the Act. This view ‘as taken by the court in the following case:

Principal CIT, Kanpur v. Surya Merchants Lid., I.T. Appeal No. 248 of 2015, May 03, 2016, Allahabad High Court:

The above views have attained finality as these judgments of the High Courts of Bombay, Gujarat and Allahabad have been accepted by the Department.

3. In view of the above, the Board has accepted the settled position that the disallowances made under sections 32, 40(a), (ia), 40A(3), 43B, etc. of the Act and other specific disallowances, related to the business activity against which the Chapter VI-A deduction has been claimed, result in enhancement of the profits of the eligible business, and that deduction under Chapter VI-A is admissible on the profits so enhanced by the disallowance.”

11. The Co-ordinate Bench of this Tribunal under the identical facts has examined elaborately and held as under: –

“7.2 A perusal of the Act and the rules shows that both the Cane Development Council and the Cooperative Cane Development Unions(or Cane Growers Cooperative Society) perform an important role in the cane production and marketing in a particular area or zone. While the unions are directly involved in the marketing of the sugar cane to the various factories, the Council performs a number of functions to facilitate the production and supply of sugarcane in the area assigned to it. Therefore, it is quite clear that the commission that is paid by the occupier of the factory or by Gud, Rub or Khandsari units is not on account of some investment that is made by these Councils or Unions with the factories but rather because of their role in production and marketing of sugar cane in that particular area. The payment of commission is therefore, attributable to the activity of production and marketing of sugarcane for which the Cane Development Councils and the Co-operative Cane Development Unions have been set up the under the Sugarcane Act and Rules. Since the Ld CIT(A) has made references to the functions performed under this Act and the Rules framed thereunder in his order, we hold that the Revenue is not justified in contending that he has not given a finding on the nature of the Commission received by the Assessees. We, therefore, uphold the decision of the ld. CIT(A) to allow the same to be deducted under section 80P as they are receipts from the business and not income from other sources. Accordingly, all the appeals of the Revenue, which do not seem to have taken cognizance of the assigned roles of the Cane Development Councils or Cooperative Cane Development Unions in the production of marketing of cane as per the U.P. Sugarcane (Regulation of Supply & Purchases) Act, 1953 read with the U.P. Sugarcane (Regulation of Supply & Purchases) Rules, 1954, are fit to be dismissed.”

12. The Revenue has not brought on record any other binding precedent to the contrary. Therefore, respectfully following the binding precedents, we hereby direct the Assessing Authority to allow the assessee’s claim of deduction on the remaining part of commission and delete the impugned addition. The grounds raised in this regard are allowed.

13. In the result, the appeal of the assessee is allowed.

14. Now, coming to the assesse’s appeal in ITA. No.578/LKW/2024, pertaining to the A.Y. 2018-19. The assessee has raised the following grounds of appeal: –

“1. That the Authorities below erred on facts and in law in not allowing deduction u/s 80P(2)(a)(iii) of I. T. Act on Interest received on Investments held with Banks in form of FDR’s Rs. 5,35,562-64.

2. That the Authorities below erred in relying on the decision of Hon’ble Supreme Court in the case of Totgars Co-Operative Sale Society Ltd. v. ITO without appreciating that it was a sale society and the facts of the case of the assesse are distinguishable from the facts prevailing in the case of Totgars Co-operative Sale Society and hence reliance placed on the said judgment is misplaced.

3. That the Ld. C.I.T. (A) erred on facts and in law in not considering that the A. O. has nowhere demonstrated in the Assessment Order that the Interest Income on FDR’s and Saving Bank Accounts was on account of surplus funds of the Society and in absence of such finding the decision of Hon’ble Supreme Court In case of Totgars cannot be relied upon in Appellant’s Case.

4. That the Ld. C.1.T. (A) erred on facts and in law in not considering that the Law has used the word “attributable” and not the word “derived” in section 80P so as to include income from sources other than the actual conduct of the Business of the Society and thus Interest Income on FDR’s & S. B. A/c is attributable to the business of providing credit facilities and providing assistance to cane growers for better development cane crops.

5. The Ld. C.1.T.(A) erred on facts and in law in not considering that the funds of the Society in form of Share Capital from members and the society being co-operative society is statutorily required to maintain a Reserve Fund of a minimum 25% of its profit and thus the investments in form of deposits with Banks to the extent of the Share Capital and Reserve Funds cannot be said to be made out of surplus funds.

6. That Ld. C.1.T. (A) erred on facts and in law in not considering that the P. F, Balance of seasonal employees of society which is held in the form of deposits are not the investments of the society and accordingly interest accruing on the said amount cannot be said to be the Income of the Society.

WITHOUT PREJUDICE TO ABOVE

7. That the Authorities below erred on facts and in law in not allowing proportionate deduction for ‘Management Expenses and ‘Interest paid debited in the Profit and Loss Account from the gross interest of Rs. 5,35,562/-.

8. That the Authorities erred on facts and in law in not considering that only the real income/profit can be taxed and accordingly, the expenses incurred in earning the said income has to be determined and deducted from the Gross Income.

9. That the addition made is highly excessive, contrary to the facts, law and principle of natural justice and without providing sufficient time and opportunity to have its say on the reasons relied upon by CIT (A).”

15. It is transpired from the record that the present appeal is barred by limitation for 17 days. The assessee has filed an application seeking condonation of delay. It is stated on behalf of the assessee that the delay was caused because the brother of the Ld. Authorized Representative of the assessee was diagnosed with cancer. The Ld. AR for assessee was occupied with the medical emergency and was also not in a proper state of mind. Therefore, an unintended delay occurred in filing the present appeal. It is submitted on behalf of the assessee that the delay is caused for bona fide reason and there was no deliberate Act on behalf of the assessee for such a delay. It is, therefore, prayed that the delay be condoned and the appeal be admitted for hearing.

16. On the contrary, the Ld. Departmental Representative opposed the submissions of the Ld. Counsel for the assessee and contended that there was no reasonable cause for filing the present appeal belatedly. He, therefore, contended that the appeal deserves to be dismissed on the ground of the limitation.

17. Heard the Ld. Representatives of the parties and perused the material on record. There is a delay of 17 days in filing the present appeal. The reason for such delay is stated to be medical emergency caused by brother of Ld. AR was diagnosed with cancer. The Ld. Authorized Representative of the assessee was pre-occupied for attending the medical emergency and was also not in a proper state of mind. The reasons stated in the application is also supported with an affidavit. The Revenue has not brought any material to rebut the averments made by the assessee. Therefore, considering the facts of the present case, we hereby condoned the delay of 17 days and admit the appeal for hearing on merits.

18. The facts in brief are that the case of the case of the assessee was selected for limited scrutiny. The reason for selection was to examine the eligibility of deduction claimed under Chapter VI-A of the Act. Therefore, statutory notices were issued to the assessee. In response thereto, the assessee filed its submissions; however, the same were not accepted by the Assessing Authority, who proceeded to make an addition of Rs.5,35,562/- in respect of the interest income claimed as exempt by the assessee. Aggrieved against this, the assessee preferred in appeal before the Ld. CIT(A), who sustained the addition and dismissed the appeal of the assessee. Now, the assessee is in appeal before this Tribunal.

19. Apropos to the grounds of appeal, the Ld. Counsel for the assessee submitted that the authorities below are not justified in making the addition. He contended that the authorities below failed to appreciate the fact that the assessee was under statutory obligation to keep certain amount in the form of fixed deposits with National Bank in terms of RBI guidelines. The assessee had made fixed deposit with Nationalized Bank in pursuance of the RBI direction. Therefore, he prayed that the impugned addition may be deleted and appeal be allowed. He further contended that the issue is otherwise covered in favour of the assessee by the decision of Co-ordinate Bench.

20. On the other hand, the Ld. Departmental Representative opposed the submissions and supported the orders of the lower authorities. He contended that in view of the judgment of the Hon’ble Supreme Court in the case of Totgar’s Co- operative Sale Society Ltd v. ITO (SC).

21. Heard the Ld. Representatives of the parties and perused the materials available on record. The short issue that arises for our consideration is whether the impugned addition made by the AO by disallowing claim of assessee qua interest income earned from F.D.R as business income under the facts and circumstances of the case is sustainable. The reliance is placed on the decision of the Co-ordinate Bench of this Tribunal rendered in the case of Co-operative Cane Development Union Limited v. ACIT [ITAppeal No. 165(LKW) of 2023] for the A.Y. 2017-18, vide order dated 30.09.2024 wherein the identical grounds were raised by the assessee. For the sake of clarity, the grounds raised by the assessee are reproduced as under: –

(1) That the Authorities below erred on facts and in law in not allowing deduction u/s 80P(2)(a)(iii) of 1. T. Act on Interest received on Investments held with Banks in form of FDR’s Rs. 28,13,215/-.

(2) That the Authorities below erred in relying on the decision of Hon’ble Supreme Court in the case of Totgars Co-Operative Sale Society Ltd. v. ITO without appreciating that the decision of Hon’ble Supreme Court is distinguishable on facts from the case of the Appellant Assessee.

(3) That the Ld. C.I.T. (A) erred on facts and in law in considering that the A. O. has failed to demonstrate in the Assessment Order that the Interest Income on FDR’s and Saving Bank Accounts was on account of surplus funds of the Society and in absence of such finding the decision of Hon’ble Supreme Court cannot be relied upon in Appellant’s Case.

(4) That the Ld. C.I.T. (A) erred on facts and in law in not considering that the Law has used the word “attributable” and not the word “derived” in section 80P so as to include income from sources other than the actual conduct of the Business of the Society and thus Interest Income on FDR’s & S. B. A/c is attributable to the business of providing credit facilities and providing assistance to cane growers for better development cane crops.

WITHOUT PREJUDICE TO ABOVE

(5) The Ld. C.I.T.(A) erred on facts and in law in not considering that the funds of the Society in form of Share Capital from members and the Society being cooperative Society is statutorily required to maintain a Reserve Fund of a minimum 25% of its profit and thus the investments in form of deposits with Banks to the extent of the Share Capital and Reserve Funds cannot be said to be made out of surplus funds.

(6) That Ld. C.I.T. (A) erred on facts and in law in not considering that the P. F. Balance of seasonal employees of Society which is held in the form of deposits are not the investments of the Society and accordingly interest accruing on the said amount cannot be said to be the Income of the Society.

WITHOUT PREJUDICE TO ABOVE

(7) That the Authorities below erred on facts and in law in not allowing proportionate deduction for ‘Management Expenses and ‘Interest pald’ debited in the Profit and Loss Account from the gross interest of Rs. 28,13,215/-.

(8) That the Authorities erred on facts and in law in not considering that only the real income/profit can be Taxed and accordingly, the expenses incurred in earning the said income has to be determined and deducted from the Gross Income.

(9) That the addition made is highly excessive, contrary to the facts, law and principle of natural justice and without providing sufficient time and opportunity to have its say on the reasons relied upon by CIT (A).”

22. The Co-ordinate Bench of this Tribunal after having thoroughly examined the subject matter held as under: –

“13. We have duly considered the facts and circumstances of the case. And also the arguments made by both parties. Since the case of the Revenue is based on the decision of the Hon’ble Supreme Court in the case of Totgars Cooperative Sale Society Limited v. Income Tax Officer (supra), it would be pertinent to first consider the decision of Hon’ble Supreme Court in that matter. As pointed out by the ld. Sr. DR, as per the said judgment, the income in respect of which deduction is sought must constitute the operational income and not the other income which accrues to the society. In that particular case, the Hon’ble Supreme Court observed that, in the facts and circumstances of that case, the assessee society had earned interest on funds which were not required for business purposes at the given point of time. Therefore, as it clarified, on the facts and circumstances of that case, they rendered their judgment that such interest income fell in the category of, “other income” which had rightly been taxed by the Department under section 56 of the Act and therefore, was ineligible for deduction under section 80P of the Act. The two judgments of Hon’ble Allahabad High Court that have been cited by the ld. Sr. DR have followed the principle laid down by the Hon’ble Supreme Court and held, that the objects of the society did not provide for investment of money in a post office or bank and earn interest and therefore, the interest earned out of the investments made in the bank would be an interest, which in turn would be income from other sources that would be chargeable to tax under section 56 of the Act. However, as the ld. Authorized Representative has pointed out, the arguments of the nature that the fixed deposits were made on account of the Statutory provisions (of sections 58 and 59 of the U.P. Cooperative Societies Act in this case) and was therefore, the condition precedent to doing of business and accordingly “attributable” to the activities of the assesse cooperative, was not brought before the Hon’ble Allahabad High Court in either of the judgments cited by the ld. Sr. DR. Furthermore, M/s Cane Cooperative Development Council had appealed the judgment of Hon’ble Allahabad High Court in ITA No. 183/2016 to the Hon’ble Supreme Court in Civil Appeal No. 7405 to 7409 of 2021 and placed the statutory rules before the Hon’ble Supreme Court. After considering that such rules may have a bearing on the nature of income and entitlement to exemption under section 80P of the Act, the Hon’ble Supreme Court had remitted the matter back to the Income Tax Appellate Tribunal to decide the appeals afresh, without being bound or influenced by the earlier orders passed by them or by the Hon’ble High Court. In view of such orders of the Hon’ble Supreme Court, the case laws of the jurisdictional Hon’ble Allahabad High Court cited by the ld. Sr. DR did not constitute a binding precedent for the ITAT, Lucknow Bench in the case of Cooperative Cane Development Council in ITA Nos. No.285/Lkw/2015, 474/Lkw/2015, 525/Lkw/2015, 536/Lkw/2015 and 540/Lkw/2015.

The Hon’ble ITAT, Lucknow Bench after considering the byelaws and the statutory rules, the decisions of Hon’ble Allahabad High Court in CIT v. Krishak Sahkari Ganna Samiti Limited 258 ITR 594 (Alld)and CIT v. Cooperative Cane Development Union Limited 118 ITR 770 (Alld) and the decisions of the Tribunal in Income Tax Officer v. Sahkari Ganna Vikas Samiti, Rupapur Chouraha (Munder), Hardoi in ITA No. 467/Lkw/2013 held as under:-

“7.1 Now the parties are again before us. We find that assessees had earned interest from fixed deposits from bank and co-operative society. Hon’ble Supreme Court, after acceptance of additional documents had set aside the issue before this Tribunal for readjudication. We find that the arguments of the assessees are that the assessees had placed the funds in the form of fixed deposits with nationalized banks and Co- operative banks in view of the specific requirements of U.P. Co- operative Societies Act. We find that section 58 of the U.P. Cooperative Societies Act requires the net profit to be distributed as under: ”

(a) An amount not less than twenty five percent shall be transferred to a fund called the reserved fund:

(b) Not less than such amount as may be prescribed, shall be credited to a Cooperative Education fund to be established in the manner prescribed, and this shall be applicable to such cooperative society also which incur loss in the year, [Provided that the provisions of this clause shall not apply to a Primary Agriculture Credit Co-operative Society, a Central Cooperative Bank or the Apex Bank.’,]

(c) An amount that may be prescribed shall be credited to the research and development fund created in the Apex Societies of the concerned class of Cooperative society and which shall be maintained for the purpose of Research and development in the prescribed manner.

(d) an amount not exceeding twenty percent as may be prescribed shall be transferred to a fund called the Equity Redemption Fund to be established and utilized in the manner prescribed by such co- operative Society which has the subscription of the State Government in its share capitals.”

7.2 Hon’ble Allahabad High Court in the case of CIT v. Krishak Sahkari Ganna Samiti Ltd. [2002] 258 ITR 594 (Alld) has held that the investment by co-operative Society in the form of Government securities, equivalent to 25% of its profit, was the requirement of keeping the same as statutory reserve therefore, has held that such earning of interest was attributable to Allahabad High Court are reproduced below: “Clause (c) of Section 80-P(2) exempts income of cooperative society to the extent mentioned in that section if the profits or gains are ‘attributable’ to the activity in which the Cooperative Society is engaged. The findings are that under statutory provisions the Cooperative Society is bound to invest 25% of its profits in Government securities. The assessee complied with this provision. In the process, it earned interest on these investments. The question is whether such profits or gains are attributable to the activity of supplying sugarcane carried on by the assessee. In Cambay Electric Supply Industrial Co. Ltd. v. CIT [1978] 113 1TR 84 the Supreme Court held that the expression ‘attributable to suggests that the Legislature intended to cover receipts from sources other than the actual conduct of the business of the assessee. The investment of the statutory percentage of its profits in Government securities was a condition of the carrying on the business. The profits or gains from such investments were connected with or incidental to the carrying on of the actual business. They were, in our opinion, rightly held by the Tribunal to be attributable to the activity carried on by the assessee within the “meaning of clause (c) aforesaid. We therefore, answer the question referred to us in the affirmative in favour of the assessee and against the Department. 8. Following the aforementioned ratio laid down by the Division Bench which we consider binding on us, we too answer the question referred to us in the affirmative in favour of the assessee cooperative Society and against the Revenue.”

7.3 Further we find that the assessee has relied on a judgment of Raipur Tribunal in the case of Gramin Sewa Sahakari Samiti Maryadit v. Income Tax Officer (Raipur-Trib.) wherein the Tribunal has held that the interest earned by the assessee from deposit with co-operative bank and nationalized bank was eligible for deduction u/s 80P(2)(a) of the Act.

7.4 The above two judgments respectively by Hon’ble High Court and Tribunal hold that the interest earned by a Co-operative Society on deposits, which are statutorily required to be kept in the form of bank deposits or Government securities, are attributable to the business of an assessee.

7.4 Here in the present cases, we do not find the figures regarding the interest which the assessees may have earned on fixed deposits attributable to the making of statutory reserves. We further find that bye laws of the assessee has to be gone through which, though are available in the paper book, but require examination by the Assessing Officer as these were filed before Hon’ble Supreme Court as additional evidences. Therefore, we deem it appropriate to remit the issue of deduction u/s 80P for re-adjudication by the Assessing Officer, who, in the light of judgment of Hon’ble Supreme Court and keeping in view the judgments relied on by the assessee and keeping in view the additional documents, as filed before Hon’ble Supreme Court, will adjudicate the issue afresh. Needless to say that the assessees will be provided sufficient opportunity of being heard.”

14. Subsequent on the said remand, the matter was examined by the Revenue and after consideration of the decision of the Hon’ble Supreme Court and the other judgments relied upon by the Hon’ble ITAT while remanding the matter back to him, the ld. Assessing Officer held as under:-

“3.3 Reason for inference drawn that no variation is required on this issue:

The submissions made by the Assessee have been examined thoroughly particularly the bylaws of the Assessee Society and the U. P. Cooperative Societies Act. On going through the by-laws of the Assessee Society, it has been noticed that its Part 14 i.e. “Disposal of Net Profit and Societies” Assets and funds and appropriation thereof deals with the appropriation of Net Profits and Funds of the Assessee Society. Further, it has also been noticed that the aforementioned Part-14 of the bylaws of the Societies are in accordance with section 58 and 59 of the U. P. Co-operative Societies Act. Further, it has also been noticed that the secured reserve as well as other reserves are created in Annual General Meeting of the Society as per its bylaws and get accumulated over the year. These reserves are kept in co-operative and nationalized banks from where the Assessee earns the interest income under question. In view of the aforementioned facts, it is inferred that the reserve funds kept by the Assessee with Co-operative and nationalized banks are as per the by-laws of the Society and accordingly interest income arising from these funds can be held to be attributable to its main activities and therefore, the assessee is eligible for deduction in respect of this interest income under section 80P(2)(a) of the Act as per the case laws referred to and relied upon by the Hon’ble L.T.A.T. i.e. Judgments of Hon’ble Allahabad High Court in the case of CIT v. Krishak Sahkari Ganna Samiti Limited [2002] 258ITR594 (Allahabad) and ITAT, Raipur in the case of Gramin Sewa Sahakari Samiti Maryadit v. Income Tax Officer 92022), (Raipur Tribunal).”

15. Thus, the principle that interest income arising from investments in statutory reserve funds and other funds as per the provisions of sections 58 and 59 of the U.P. Cooperative Societies Act is “attributable” to the main activities of that Society, has been accepted by the Revenue. The assessee is governed by the same U.P. Cooperative Societies Act and Rules as the Cooperative Cane Development Council, Lakhimpur and therefore, in its case also, it must be held that interest earned from investment made by it as per sections 58 and 59 of the U.P. Cooperative Societies Act r.w.r.173 of the U.P. State Cooperative Rules, is attributable to the activity in which the assessee is engaged and therefore, is eligible to be deducted under section 80P(2)(a) of the Act.

16. We have further observed that the Hon’ble Madras High Court in the case of K. 2058, Saravanampatti Primary Agricultural Co-Operative Credit Societies Ltd. v. Income Tax Officer 426 ITR 251 (Mad), after considering that the Societies was required to maintain a statutory reserve of 25% under the Tamilnadu Cooperative Societies Act held that the same could not be regarded as the surplus funds of the Society as decided in M/s Totgars Cooperative Sale Society Limited (supra) and therefore, it set aside the assessment of the ld. Assessing Officer in the light of the decision of the Hon’ble Supreme Court in CIT v. Nawanshahar Central Cooperative Bank Ltd. 289 ITR 6 (SC) ‘.Therefore, in view of the arguments made by the learned Authorized Representative, that the investment in fixed deposits and other securities or on account of the provisions of sections 58 and 59 of the U.P. Cooperative Societies Act, 1965 and section 173 of the U.P. Cooperative Societies Rules, 1968, it is quite clear that since it has been held that interest on such investment is attributable to the main activity of the assessee cooperative society, the interest earned from such investments ought not to be regarded as a surplus within the meaning of Totgar’s Case, but an interest attributable to the main activity of the assessee cooperative and therefore, deductible under section 80P. The assessee has submitted copies of its byelaws and the detailed breakup of investments and interest arising on the same. However, we observe that the ld. Assessing Officer has not examined the breakup of such investments and the interest earned on the same, with reference to the byelaws or sections 58 and 59 of the U.P. Cooperative Societies Act, 1965 and 173 of the U.P. Cooperative Societies Rules, 1968 as he was of the view that no such interest was deductible in view of the decision of Hon’ble Supreme Court in the case of Totgars (supra). Now that the position with regard to such investments has been clarified by the Hon’ble ITAT in the case of Cooperative Cane Development Council, Lakhimpur and accepted by the Revenue in the consequent assessment, we deem it appropriate to restore the matter in all three cases back to the file of the ld. Assessing Officer for the limited purpose of re-computing the admissible deduction under section 80P with reference to the interest earned on investments made in accordance with sections 58 and 59 of the U.P. Cooperative Societies Act, 1965 and 173 of the U.P. Cooperative Societies Rules, 1968. Ground numbers 1 to 5 are accordingly allowed. With regard to Ground no 6 on the issue of adding back the interest on PF balance of the seasonal employees of the society, we observe that the same cannot be considered to be the investments of the society and accordingly the interest accruing on the said amount cannot be said to be income of the society. Therefore, any adding back of such interest income to the income of the society is not maintainable and accordingly, additions made on this account in A.Ys. 2017-18 and 2020-21 are deleted. In view of the fact that we have allowed Ground numbers 1 to 5, Ground numbers 7 to 9 are rendered infructuous and are dismissed as such.”

23. In the light of the decision of Co-ordinate Bench of this Tribunal rendered in the case of Co-operative Cane Development Union Limited v. ACIT (supra), we hereby set aside the impugned order and restore the issue to the file of the Assessing Officer who would verify the correctness of the claim of the assessee that the interest earned from the fixed deposits made in pursuance of the RBI guidelines and the statutory provision governing the maintenance of reserve funds. The grounds raised in this appeal are allowed for statistical purposes.

24. In the result, in the combined result in ITA. No.577/LKW/2024 is allowed and ITA. No.578/LKW/2024 is allowed for statistical purposes.