JUDGMENT

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

CM APPL. 68769/2025 (for exemption)

2. Allowed, subject to all just exceptions. Application is disposed of.

W.P.(C) 16754/2025 & CM APPL. 68768/2025 (for interim relief)

3. The present petition has been filed by the Petitioner- M/s J M Jain through its proprietor Mr. Jeetmal Choraria under Article 226 of the Constitution of India, inter alia, assailing the Show Cause Notice dated 26th June, 2025 issued by the Joint Director, Directorate General of GST Intelligence, Delhi Zonal Unit (hereinafter, ‘SCN’).

4. In addition, the Petitioner has also challenged the Constitutional validity of Section 75(2) of the Central Goods and Services Tax Act, 2017 (hereinafter, ‘CGST Act’). The prayer in present petition is as under:

“Prayer

It is, therefore, most respectfully prayed that this Hon’ble High Court be pleased to:

| A) | | issue a writ of certiorari / mandamus or any other appropriate writ/ order/ direction against the Respondents by quashing sub-section (2) of section 75 of the CGST Act, 2017 as ultra vires to CGST Act, 2017 and unconstitutional; |

| B) | | issue a writ of certiorari / mandamus or any other appropriate writ/ order/ direction against the Respondents by declaring that the provisions of section 132(4) and the provisions of section 292C of the Income Tax Act 1961 have no applicability to the proceedings initiated under the CGST Act, 2017 and/or IGST Act, 2107 as said provisions have limited applicability to the Income Tax Act only; |

| C) | | issue a writ of certiorari/ mandamus or any other appropriate writ/ order/ direction against the Respondents by quashing the impugned Show Cause Notice No. DGGI/DZU/39 2025-26, dated 26.06.2025 (at Annexure P1) by declaring that the impugned Show Cause Notice No. DGGI/DZU/39 2025-26, dated 26.06.2025 in vague, without following the procedure established by law and based on the findings recorded in the income tax assessment orders without any independent examination of records, findings and evidences by DGGI, Delhi/ Respondent, is bad in law & without jurisdiction; |

| D) | | issue such other writ/order/ direction and further orders as the Hon’ble Court may deem just and proper in the facts and circumstances of the case.” |

FACTUAL BACKGROUND

5. The brief background of the Petitioner’s case is that, investigation was conducted against the Petitioner, based on an intelligence, by the Income Tax Department (hereinafter, IT Department’), on 28th May, 2022.

6. According to the SCN, the IT Department had, in its search, unearthed a secret server which had the name JSK on it, from the registered address of the firm being 2285/9, Gali Hinga Beg, Tilak Nagar, New Delhi, Delhi-110006.

7. According to the IT Department, the said server contained records of unaccounted transactions and consideration amounts which were hid by the Petitioner. The allegations of the IT Department are that the Petitioner was maintaining two sets of Books of Accounts i.e., regular books and parallel books which contained unaccounted transactions. This led to the IT Department proceeding against the Petitioner under the Income Tax Act, 1961 (hereinafter, ‘IT Act’).

8. Parallelly, the IT Department had given the information relating to the search and their findings of the investigation along with the Relied upon documents (hereinafter, ‘RUDs), special audit reports, statements made by various persons etc. to the Goods and Services Tax Department (hereinafter, ‘GST Department’), for scrutiny.

9. Thereafter, the GST Department issued the impugned SCN, which is under challenge in the present petition.

10. As per the SCN, various demands and penalties are proposed to be imposed against the Petitioner, as also the connected family members, accountants etc., of the Petitioner, under the provisions of CGST Act.

SUBMISSIONS ON BEHALF OF THE PETITIONER

11. Mr. J.K. Mittal, ld. Counsel appearing on behalf of the Petitioner raises an important issue in respect of admissibility of evidence collected by the IT Department under provisions of the IT Act, and the presumption under Section 292C of the IT Act. The submission of ld. Counsel for the Petitioner is that any presumption under Section 292C IT Act would apply only in respect of proceedings under the IT Act and the same cannot form the basis for any investigation under the CGST Act.

12. Further, it is submitted that the statements recorded by the IT Department, from the concerned parties, can be relied upon as evidence, only in proceedings under the Income Tax laws and not under the GST Laws.

13. Thus, it is his submission that the SCN does not give any basis for the GST Department to raise any demands against the Petitioner, merely on the basis of the findings of the IT Department. It is submitted that such an SCN could not have been issued, unless there was independent supporting evidence with the GST department, in support of the SCN.

14. In addition, it is also alleged by ld. Counsel for the Petitioner that some of the judgments referred to in paragraph 21 of the SCN do not exist, and are Artificial Intelligence generated judgments.

15. Ld. Counsel for the Petitioner also places reliance upon the decision in SLP(C) No. 6092 of 2025 titled Armour Security (India) Ltd. v. Commissioner, CGST, Delhi East Commissionerate GST 400/101 GSTL 289 (SC). According to ld. Counsel, what can form the basis of an SCN has been set out in paragraph 66, 67 and 85 of the said judgement. The said judgment has also laid down the manner in which the SCN should set out all the allegations, the evidence, the RUDs, and the action proposed to be taken. In the absence of the same, the SCN could not be tenable. Further, other judgments have also been relied upon to argue that if the SCN does not have any tangible evidence, there cannot be any assumptions made by the GST Department, as the same would be an error in law. The other decisions relied upon by Mr. Mittal, ld. Counsel for the Petitioner are as under:

| • | | Commissioner of Customs (Imports), Chennai v. Flemingo (DFS) (P.) Ltd. 2010 (251) E.L.T. 348 (Mad.) |

| • | | Union of India v. Garware Nylons Ltd. 1996 (87) E.L.T. 12 (SC)/(1996) 10 SCC 413 |

| • | | Goa University v. Joint Commissioner of Central GST GSTL 513 (Bombay)/2025 SCC OnLineBom 1262 |

16. It is further submitted by Mr. Mittal that, the documents which may be relied upon by the IT Department, as an outcome of the investigation conducted by the IT Department, cannot be the basis of assessment by other Departments.

17. Further, it is argued that in the list of GST department’s RUDs, none of the digital evidence is relied upon, which are seized by the IT Department.

18. Lastly, ld. Counsel for the Petitioner submits that an examination of paragraph 49.1 and 49.2 of the SCN reflects that the SCN is itself vague.

SUBMISSIONS ON BEHALF OF THE GST DEPARTMENT

19. Per contra, Mr. Ojha, ld. SSC for the GST Department submits that the IT Department had informed the GST Department about search and action taken by them. Thereafter, the GST Department has independently scrutinised the material received from the IT Department.

20. It is further submitted that the IT Department looks into IT evasion. However, the fundamental basis of the IT evasion is that services were rendered in a clandestine manner, and no GST was paid. Consequently, this would also result in evasion of GST. Thus, the SCN is fully tenable, though the same is based on the search material unearthed by the IT Department.

21. Additionally, it is also submitted that the correct citation for one of the judgements mentioned in paragraph 21 of the SCN namelySurjeet Singh Chhabra v. Union of India (89) E.L.T. 646 (SC), and only the citation is wrongly recorded.

22. Insofar as the challenge to Section 75(2) of the IT Act is concerned, it is submitted by ld. SSC that the same is completely premature, inasmuch as the GST Department has not taken any decision to convert the inquiry or the proceedings, to proceedings under Section 73(1) of the CGST Act. Therefore, under such circumstances, no presumption can be made that the proceedings would be converted into proceedings under Section 73(1) of the CGST Act, and no challenge can be raised to Section 75(2) of the CGST Act.

ANALYSIS

23. The Court has considered the matter. Undoubtedly, the IT Department did conduct a search at the Petitioner’s premises, and various materials have been recovered. The said materials include computer servers, audit books, statutory audit records, digital devices including WhatsApp communication, etc. On the basis of the search and inspection, the statements of various employees were recorded. The manner in which the alleged evasion was being conducted, has also been set out in the SCN, as a background to the SCN.

24. In terms of the SCN, the Petitioner was engaged in the trading of readymade garments and was working as a commission agent. Out of the discount, which was received from the suppliers, the Petitioner used to retain 3% fixed margin. As part of the investigation, statements of following persons were also recorded by the IT Department:

| • | | Mr. Shalinder Mohan on behalf of Mr. Jeetmal Choraria |

25. The Special Audit Reports for the Financial Years 2019-20, 2020-21, 2021-22 were also submitted by the IT Department to the GST Department. After recording the receipt of the Special Audit Reports, paragraph 15 of the SCN proceeds as under:

“15. The above documents submitted by the Income Tax Department were scrutinized with the GST point of view as per the Central Goods and Services Tax Act, 2017.”

26. From the above extracted paragraph 15 of the SCN, it is clear that the GST Department has independently scrutinised the records received from the IT Department, and various observations have been made by the IT Department. The Special Audit conducted by the IT Department were considered by the GST department and the findings are set out in detail in the SCN. For Financial Year 2019-2020 the following were the conclusions:

“15.1.6 – The special audit for FY 2019-20 presents strong evidence of GST evasion through the maintenance of parallel books on the JSK server. The commission income and interest income reflected therein were systematically suppressed and not reported before tax authorities. The nature, structure, and non-cooperation by the taxpayer confirm intentional evasion of GST liabilities.”

27. Similarly, the Special Audit conducted for Financial Year 2020-2021 pertaining to the proprietor Mr. Jeetmal Choraria, also reveals and mentions about the electronic evidence, and the WhatsApp chats. The conclusion based on the Special Audit Report and the supporting evidence is recorded as under:

“15.2.7 – Based on the audit records and supporting evidence, it is clear that the income was intentionally concealed to avoid paying GST. The JSK Server was not just a secondary or unofficial tool—it served as the main operational record of M/s JIM Jain’s actual business activities. The consistent pattern, scale, and repetition of such concealment strongly point to deliberate tax evasion. The evidence recovered—such as WhatsApp chats, handwritten “kachchiparchis,” branch-wise commission details, and digital ledgers— collectively form a strong and credible basis for GST evasion by the assessee. The findings for FY 2020-21 further reinforce the ongoing pattern of concealment, showing how M/s JM Jain continuously withheld information about commission and interest income.”

28. Insofar as the Special Audit conducted for Financial Year 2021-2022 for the proprietor Mr. Jeetmal Choraria is concerned, the audit findings record is as under:

“15.3.8 – The audit findings for the financial year 2021-22 clearly reveal a serious and systematic case of GST evasion by M/s J.M. Jain. The firm operated a parallel accounting system through the JSK server, which was used to record unaccounted transactions that were deliberately kept out of the official books. A significant portion of the business was carried out in cash, bypassing the formal financial system, and thereby avoiding tax liability. What makes the evasion even more apparent is the use of coded names, fictitious or dummy entities, and misleading identifiers to mask the true nature of transactions. This intentional layering created obstacles in tracing the flow of income and determining the actual turnover of the firm. Despite being given multiple opportunities, the entity showed reluctance and non-cooperation during the audit process, further indicating an attempt to withhold material information. The income earned from providing commission-based facilitation services, as well as interest on delayed payments, was never reported to the tax authorities. This concealment was not incidental but part of a deliberate and well-planned strategy to evade GST. A variety of corroborative evidence reinforces these findings. Forensic examination of electronic devices recovered during the search revealed incriminating WhatsApp conversations and internal communications. These included details of financial transactions that were never reflected in the official accounts. Additionally, handwritten “kachchiparchis- (unofficial slips or records) and internal branch-level documents clearly pointed to a substantial volume of concealed business operations. Taken together, the findings for FY 2021-22 add yet another layer to the growing body of evidence against M/s J.M. Jain, establishing a consistent pattern of suppression of income and tax evasion.”

29. Apart from the Special Audit Reports, the findings of the IT Department are also considered by the GST Department, and the conclusion that has been arrived at is that there is a consistent pattern of income suppression by the Petitioner, the business structure and the modus operandi of the Petitioner has also been set out in the SCN, wherein it is recorded that the 3% of the commission was being retained in an unaccounted server, only in order to escape the tax liabilities. The total commission that is stated to be alleged to be concealed by the Petitioner, is over Rs.88 crores, and the conclusions for the various financial years is captured as under:

29.1 For Financial Year 2019-20 (RUD-1)

Insofar as the Financial Year 2019-20 is concerned, after considering the entire record, the IT Department’s conclusion is set out below:

“16.2.7 – The assessment order for FY 2019-20 reaffirms that M/s J.M. Jain operated a parallel accounting system to deliberately suppress commission and interest income. These amounts were not occasional or clerical omissions—they were methodically tracked and concealed through the JSK Server. The non-disclosure of taxable amount of Rs.221,60,58,929/- purely on account of commission, interest and other income (cash receipts and others) — supported by SAP logs, employee testimony, and cross-referencing—reveals a deliberate effort to evade GST and Income Tax. The AO’s approach to dissect the JSK Server data and correlate it with real trade activity was methodical and conclusive.”

29.2 For Financial Year 2020-21 (RUD -1)

In respect of Financial Year 2020-21, after considering the entire record, the IT Department’s conclusion is set out below:

“16.3.6- The assessment for FY 2020-21 reaffirms the continuing pattern of income suppression by M/s JM Jain through its JSK Server. The concealment of Rs.88,08,31,933/- in commission, interest and other income, backed by employee statements, ledger entries, and digital records, paints a clear picture of deliberate evasion of both income tax and GST. The AO’s methodical treatment, backed by legal and factual evaluation, not only uncovered hidden income but also connected it directly with GST implications, reinforcing that this was not a simple error but a structured scheme to evade tax liabilities.”

29.3 For Financial Year 2021-22 (RUD -1)

Pertaining to Financial Year 2021-22, after considering the entire record, including the reply of the Petitioner, the IT Department’s conclusion is set out below:

“16.4.7 – The assessment for the year 2021-22 is the final and most important part of the ongoing findings from the JSK Server. The entries in the records, how the system was set up, and the statements given by employees all clearly show that M/s J.M. Jain was using two sets of accounts. The real income earned from commission and interest on delayed payments was purposely kept hidden from the tax departments. The Assessing Officer’s investigation proved that this was not a mistake—it was a planned and repeated effort to hide income. An additional taxable value of Rs. 46,41,50,000/-was found, which included unreported commission, interest and other income (cash receipt). This matches the same pattern seen in earlier years and confirms that the business was involved in evading both income tax and GST.”

30. After analyzing and scrutinizing the special audit reports and the assessment orders, the GST Department made its own observations, on the basis of the data which was received from the IT Department. The statements of various persons associated with M/s JM Jain, including Mr. Sandeep Dugar, the authorized signatory of M/s JM Jain were also considered. On the basis of the statement of Sandeep Dugar, the SCNsets out the analysis and the conclusion of the GST Department which is as under:

“19.1.3 From the above statement, it is understood that Sandeep Dugar along with his subordinate staff was custodian of the Pen Drive which contained parallel books named JSK. Entries in the JSK were made by Accounts Section. Further, Sandeep Dugar maintained and managed cash receipts and cash payments through his Cash Department. Sandeep Dugar also explained the modus operandi adopted by M/s JM Jain for affecting unaccounted transactions which were not recorded in any books of accounts. Therefore, it is confirmed that Jain Group operated a deliberate and well-organized parallel accounting system under the code name “JSK” to conceal actual cash transactions. These transactions were deliberately kept off the official books and GST returns by classifying them as “non-taxable.” The existence of secret records, coded diaries, and use of a separate JSK server accessible via pen drive clearly shows intent to evade GST liabilities.

19.1.4 The involvement of Sh. JeetmalChoraria, indicates that this was a planned, systematic effort to hide real income and avoid tax payments. This evidence establishes that the firm was engaged in willful GST evasion through:

| (a) | | Maintaining dual books of accounts |

| (b) | | Suppressing actual turnover and taxable supplies |

| (c) | | Concealing cash sales and commissions |

| (d) | | Using coded records and restricted access software systems to avoid detection |

19.1.5 In order to confront statement given by him before Income Tax Department, summonses dated 22.04.2025, 30.04.2025, 21.05.2025 and 11.06.2025 (RUD 11A)were issued to him. However, he never appeared for tendering statement.”

31. Thereafter, the statement of Mr. Shreyans Kumar Bhatera was also analyzed and it was found that M/s JM Jain was working under two business models i.e., the Pakka and Kachcha models. The Kachcha transactions were cash dealings and the Pakka transactions were alleged to be the payments made by cheques. Conversions and chats recovered from his mobile phone which was seized during the search, are stated to have confirmed these facts. Summons were issued by the GST Department to Mr. Shreyans Kumar Bhatera. However, he did not appear. Moreover, the GST Department found that his conduct was not bonafide. In this regard the SCN records as under:

“19.2.3 In order to confront statement given by him before Income Tax Department, summonses dated 22.04.2025, 30.04.2025, 21.05.2025 and 11.06.2025 (RUD 12A) were issued to him. However, he never appeared for tendering statement. Instead, he submitted letters dated 05.05.2025 and 26.05.2025 (RUD 12B) alleging that summonses are without jurisdiction on the grounds that they are issued by Senior Intelligence Officer whereas summonses should be issued by officers not below the rank of Joint Commission and whether summonses have been issued taking prior permission of proper officer not below the rank of Joint Commission in writing. He further alleged that the summonses fail to disclose nature and reasons for proceedings, reasons for his presence and summonses are in violation of circulars and instructions. Thus, he questioned the legality and authority of the summonses It is pertinent to mention that both the letters submitted are same in their contents but have different dates. 19.2.4 The allegations made in his letters are baseless as the summons issued following due procedure contained all necessary disclosures such as, DIN Number, issuing authority, issuing section, name, purpose for issuing summons and name of assessee under investigation etc. All these details were duly recorded in the summonses issued to him. Though all the required details were already duly recorded in the summonses, he intentionally sent unwarranted letters which clearly bring out his malafide intention of avoiding and delaying investigation.”

32. Furthermore, statement of Mr. Magan Das, who was the accountant of M/s JM Jain, was also analyzed. He informed that Mr. Jeetmal Choraria, the proprietor of M/s JM Jain was responsible for cash collection and maintaining the records at Tilak Bazar office. In order to confront him with the said statement, summons were issued to Mr. Magan Das. However, he also failed to appear before the GST Department.

33. Additionally, statement of Mr. Vinod Kumar Sharma was also analyzed. He is an employee of M/s JM Jain and allegedly used to collect cash from the customers and deliver it to vendors. WhatsApp chats recovered from his phone exposed the secret cash sales system of M/s JM Jain. In order to confront him with the statement given to the IT Department, summons were issued to him but he also failed to appear before the GST Department.

34. Thereafter, statement of Mr. Vinay Kumar Baid was also analyzed. He is the senior executive of M/s JM Jain, managed banking operations, and audits. He denied having knowledge of any fact of unrecorded cash transactions of M/s JM Jain.

35. Pursuant thereto, statement of Mr. Radhey Shyam Saran was also assessed. He is an employee of cash department of M/s JM Jain who is stated to have confirmed that he used to collect cash on the directions of Mr. Magan Das. The WhatsApp chats with Mr. Magan Das, retrieved from his mobile phone, were also admitted by him. He confirmed that the large amount of cash was counted which were over Rs.1 crore. However, when summons were issued to him, he also refused to appear before the GST Department.

36. Further, statement of Mr. Paras Mal Khater was also analyzed. He was working as cash executive of M/s JM Jain. and stated that he used to deposit Rs.1.5 to Rs.2 lakhs cash in the company on a daily basis. However, he also did not respond to the summons by GST Department.

37. Thereafter, statement of Mr. Rakesh Chhajer was also examined. He is a senior accountant and customer relation manager of M/s JM Jain. He also confirmed that there were two business models i.e., Pakka and Kachcha models and that the dual billing systems were being operated at M/s JM Jain. He also did not respond to the summons and did not appear before the GST Department.

38. Following therefrom, statements of other employees of M/s JM Jain i.e., Mr. Satya Narayan Sharma, who was marketing manager, Mr. Ravinder Kumar, accountant, Mr. Nand Kishore Solanki, head accountant, Mr. Naveen Dugar, marketing executive, Mr. Sanjay Kumar Choraria, an employee, were all analyzed by the GST Department.

39. Insofar as Mr. Nand Kishore Solanki is concerned, he confirmed a hidden system under JSK server for unrecorded cash transactions.

40. On the basis of all the statements of various employees of M/s JM Jain, the GST Department came to the following conclusion:

“20. The conclusion of all the statements: The statements from various employees of M/s JM Jain clearly reveal a carefully planned and organized effort to evade GST. The firm maintained two sets of accounts—one official and one secret—where many cash sales were kept completely off the books. This hidden system, known as “JSK,” used coded language, special software, and handwritten records to hide the real income. They regularly issued underpriced invoices, with customers paying the rest in unreported cash. Large amounts of cash were moved between cities, handled by trusted staff using secret codes on WhatsApp to avoid detection. During the investigation, significant amounts of unaccounted cash were found, which were neither recorded officially nor deposited in banks. The proprietor Sh. Jeet Mal Choraria actively directed these practices, showing that this was a deliberate and systematic scheme. The involvement of select employees with access to the special software helped keep the tax evasion hidden for years. Overall, the evidence points to a well-organised GST evasion operation that caused serious GST revenue loss to the exchequer. The key findings of all above statements are as under:

| (i) | | All employees admitted that two models of work — Pakka and Kachcha were prevailing in M/s JM Jain (now M/s JM Jain LLP); |

| (ii) | | Kachcha transactions were recorded in JSK Server; |

| (iii) | | JSK Server is the parallel books of accounts of M/s JM Jain; |

| (iv) | | Transactions recorded in JSK server were never recorded in any of the books of M/s JM Jain group; |

| (v) | | M/s JM Jain facilitated clandestine sales of goods between suppliers and buyers by way of movement of cash through their employees, several WhatsApp chats evidencing movement of cash by employees of M/s JM Jain were seized during search; |

| (vi) | | The transactions of JSK Server were never disclosed to GST Department; |

| (vii) | | The cash transactions for the clandestine supply of goods and for the commission for facilitating these unaccounted transactions were carried out in a secret, systematic and well organised racket by the employees of M/s JM Jain on the instructions of Jeetmal Choraria, owner of M/s JM Jain.” |

41. Pertinently, Mr. Jeetmal Choraria, the proprietor of M/S JM Jain had given a statement, which was also examined by the GST Department. Summons were issued by the GST Department from April to June, 2025. However, instead of appearing in person, Mr. Jeetmal Choraria authorised Mr. Shalinder Mohan, Chartered Accountant as his authorized representative, whose statement was recorded by the GST Department.

42. Thereafter, investigation was also conducted against the suppliers and buyers of M/s JM Jain, whose names were retrieved through JSK server, and the statements pertaining to the following entities were also analyzed by the GST Department:

| • | | M/s Empire Apparel Pvt. Ltd. |

| • | | M/s J K Jain Sparky (India) LLP |

43. Thus, the GST Department concluded that all the employees and their statements give a consistent story. Additionally, the WhatsApp messages and data retrieved from electronic devices are alleged to corroborate the extent of GST evasion in the following terms:

“35.4 The employee statements tell a consistent story. They described how the firm used the JSK Server to manage cash-based sales and commissions, all of which were kept outside the regular accounting system. These facilitation services between suppliers and buyers brought in large sums of commission, which were received in cash but never reported. Employees also admitted that the firm earned interest on delayed client payments, which again was not recorded in GST returns. This shows that the firm avoided paying GST not just on commission income but also on interest recovered from the parties for late payment which is considered as additional consideration for the commission service and is taxable in GST.

35.5 WhatsApp messages retrieved from employee phones further confirm the manipulation. These chats included instructions about splitting commission, cash movements, and unrecorded entries. They matched the details found in the JSK Server and even aligned with physical notes like “kachchiparchis” seized during the raid. This overlapping evidence—oral, digital, and physical—proves that the firm had created a hidden system to dodge taxes.”

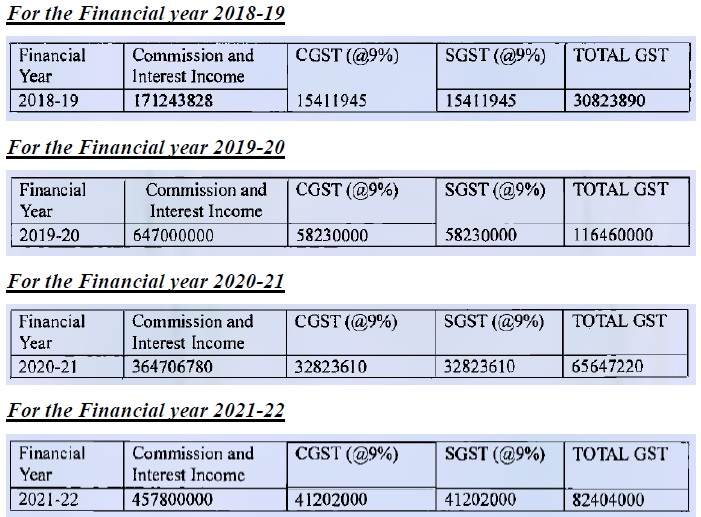

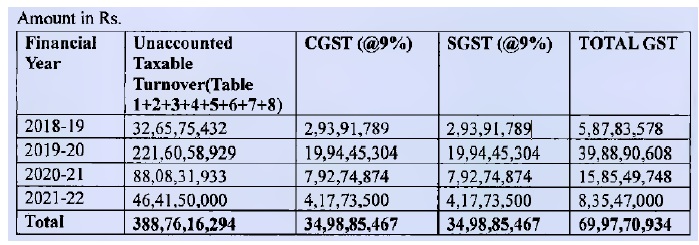

44. On the basis of the evidence before the GST Department, the computation of GST liability for the various financial years was done as under:

45. In addition, certain ‘Bad Debts’ and revenue receipts under the head Neel Ratan Sarkar, which form a part of consideration under GST, were also computed for all the financial years and finally, the GST liability was calculated in the following terms:

46. The GST Department then applied various provisions of the Act and the SCN was issued to the Petitioner.

47. Thus, the SCN records that there is large scale GST evasion on the part of the Petitioner, and on the basis of three judgments, and in view of the unaccounted cash, parallel Books of Accounts, etc., the IT Department has issued notices for re-assessment.

48. Lastly, the SCN proposes to impose various demands and penalties. The list of RUDs attached with the SCN indicate that all the relevant statements, letters, summons, assessment orders and notices of the IT Department, etc. have all been attached as RUDs. These RUDs have also been supplied to the Petitioner.

49. At present, the case is at the stage of SCN. The question is whether the SCN deserves to be quashed at this stage on the basis of the case set up by the Petitioner and submissions made by Ld. Counsel. The basic submission is that the material recovered by the IT department cannot constitute evidence and cannot lead to GST liability.

50. Insofar as the provisions of the IT Act are concerned, Section 132(4) and Section 132(4A) are relevant and are extracted below:

“132. Search and Seizure

xxx

(4) The authorised officer may, during the course of the search or seizure, examine on oath any person who is found to be in possession or control of any books of account, documents, money, bullion, jewellery or other valuable article or thing and any statement made by such person during such examination may thereafter be used in evidence in any proceeding under the Indian Income-tax Act, 1922 (11 of 1922) or under this Act.

(4A) Where any books of account, other documents, money, bullion, jewellery or other valuable article or thing are or is found in the possession or control of any person in the course of a search, it may be presumed—

(i) that such books of account, other documents, money, bullion, jewellery or other valuable article or thing belong or belongs to such person;

(ii) that the contents of such books of account and other documents are true; and (iii) that the signature and every other part of such books of account and other documents which purport to be in the handwriting of any particular person or which may reasonably be assumed to have been signed by, or to be in the handwriting of, any particular person, are in that person’s handwriting, and in the case of a document stamped, executed or attested, that it was duly stamped and executed or attested by the person by whom it purports to have been so executed or attested.”

51. In addition, Section 292C of the IT Act is also relevant and the same is extracted below:

“[292C. Presumption as to assets, books of account, etc.—

[(1)] Where any books of account, other documents, money, bullion, jewellery or other valuable article or thing are or is found in the possession or control of any person in the course of a search under section 132[or survey under section 133A], it may, in any proceeding under this Act, be presumed—

(i) that such books of account, other documents, money, bullion, jewellery or other valuable article or thing belong or belongs to such person;

(ii) that the contents of such books of account and other documents are true; and

(iii) that the signature and every other part of such books of account and other documents which purport to be in the handwriting of any particular person or which may reasonably be assumed to have been signed by, or to be in the handwriting of, any particular person, are in that person’s handwriting, and in the case of a document stamped, executed or attested, that it was duly stamped and executed or attested by the person by whom it purports to have been so executed or attested.]

[(2) Where any books of account, other documents or assets have been delivered to the requisitioning officer in accordance with the provisions of section 132A, then, the provisions of sub-section (1) shall apply as if such books of account, other documents or assets which had been taken into custody from the person referred to in clause (a) or clause (b) or clause (c), as the case may be, of sub-section (1) of section 132A, had been found in the possession or control of that person in the course of a search under section 132.]”

52. The aforesaid provisions have been interpreted in various decisions of the Supreme Court and the High Courts. InP. R. Metrani v. CIT (SC)/(2007) 1 SSC 789, the Supreme Court was dealing with Section 132, and specifically Section 132(4) and 132(4)(A) of the IT Act, and had observed as under:

“17. Section 132 is a code in itself. It provides for the conditions upon which and the circumstances in which the warrants of authorisation can be issued. Sub-section (2) authorises the authorised officer to requisition the services of any police officer or of any officer of the Central Government or of both to assist him for all or any of the purposes for which the search is conducted. Under sub-section (4) the authorised officer can during the course of search or seizure examine on oath any person who is found to be in possession or control of any books of account, documents, money, bullion, jewellery or other valuable article or thing and any statement made by such persons during such examination may thereafter be used in evidence in any proceeding under the Act [.]

xxx

21. Search and seizure under Section 132 is a serious invasion into the privacy of a citizen, therefore, it has to be construed strictly. Subsection (4-A) was inserted by the Taxation Laws (Amendment) Act, 1975 with effect from 1-10-1975 to permit a presumption to be raised in the circumstances mentioned therein. Before the insertion of sub-section (4-A) the onus of proving that the books of account, other documents, money, bullion, jewellery, etc. found in possession or control of a person in the course of a search belonged to that person was on the Income Tax Department. Sub-section (4-A) enables an assessing authority to raise a rebuttable presumption that such books of account, money, bullion, etc. belonged to such person; that the contents of such books of account and other documents are true, and, that the signatures and every other part of such books of account and other documents are signed by such person or are in the handwriting of that particular person.

xxx

23. A presumption is an inference of fact drawn from other known or proved facts. It is a rule of law under which courts are authorised to draw a particular inference from a particular fact. It is of three types, (i) “may presume”, (ii) “shall presume” and (iii) “conclusive proof”. “May presume” leaves it to the discretion of the court to make the presumption according to the circumstances of the case. “Shall presume” leaves no option with the court not to make the presumption. The court is bound to take the fact as proved until evidence is given to disprove it. In this sense such presumption is also rebuttable. “Conclusive proof” gives an artificial probative effect by the law to certain facts. No evidence is allowed to be produced with a view to combating that effect. In this sense, this is irrebuttable presumption.

24. The words in sub-section (4-A) are “may be presumed”. The presumption under sub-section (4-A), therefore, is a rebuttable presumption. The finding recorded by the High Court in the impugned judgment that the presumption under sub-section (4-A) is an irrebuttable presumption insofar as it relates to the passing of an order under sub-section (5) of Section 132 and rebuttable presumption for the purpose of framing a regular assessment is not correct. There is nothing either in Section 132 or any other provisions of the Act which could warrant such an inference or finding.

xxx

28. Presumption under Section 132(4-A) is available only in regard to the proceedings for search and seizure and for the purpose of retaining the assets under Section 132(5) and their application under Section 132-B. It is not available for any other proceeding except where it is provided that the presumption under Section 132(4-A) would be available.

29. In our considered view, the High Court of Allahabad in Pushkar Narain Sarraf [(1990) 183 ITR 388 (All)] and the High Court of Delhi in Daya Chand [(2001) 250 ITR 327 (Del)] have taken the correct view in holding that the presumption under Section 132(4-A) is available only in regard to the proceedings for search and seizure under Section 132. Such presumption shall not be available for framing the regular assessment. The High Court of Karnataka in the impugned judgment has clearly erred in holding to the contrary. Consequently, Question 1 of the Revenue is answered in the affirmative i.e. against the Revenue and in favour of the assessee.”

53. As per the above judgment of the Supreme Court, the language of Section 132(4)(A) would show that the presumption in respect of documents and material which are seized, is a rebuttable presumption. The said presumption is only for the purpose of action being taken under Section 132 and would not be available for framing the regular assessment.

54. Similar is the position in respect of Section 292C of the IT Act, which was considered by the Calcutta High Court in CIT v. Ashok Kumar Poddar (Calcutta)/2023 SCC OnLine Cal 6527, where the Calcutta High Court, following the decision in P. R. Metrani (supra),had observed as under:

“20. A presumption may be rebuttable or irrebuttable. If it is irrebuttable, it is conclusive proof of the fact. The court will not admit any evidence to disprove the presumption. Take for example, the common law presumption that a child under seven years of age is incapable of committing a crime. It is an irrebuttable presumption. Or the fact that the sun rises in the east. When a fact may be presumed by the court or shall be presumed by the court makes the presumption rebuttable. The assertion of fact is taken to be true till it is disproved.

21. The question is who has the onus of disproving the presumed fact. One who challenges the presumption has the onus to disprove the fact.

22. Therefore, the adjudicating authority has two options, either not to presume that the papers and other documents seized during search and seizure belonged to the assessee, the contents are true and that the signatures appearing thereon are that of the assessee or not to presume so. In this case, the Assessing Officer has made the presumption and proceeded accordingly.

23. Now, the drawing of a presumption by the Assessing Officer in terms of section 292C, in our opinion, is based on assessment of facts and discretionary and should not ordinarily be interfered with by an appellate authority.

24. Once this presumption had been made, the onus squarely shifted to the respondent assessee to disprove those facts. The Tribunal was enjoined with a duty to appreciate this law and to examine whether the assessee had been able to discharge the burden.”

55. In Pepsi Foods (P.) Ltd. v. Asstt. CIT [ (Delhi)/2014 SCC OnLine Del 4029, a Co-ordinate bench of this Court had considered both Section 132(4A) and Section 292C, and it was held as under:

“6. [.] Section 132(4A)(i) clearly stipulates that when, inter alia, any document is found in the possession or control of any person in the course of a search it may be presumed that such document belongs to such person. It is similarly provided in section 292C(1)(i). In other words, whenever a document is found from a person who is being searched the normal presumption is that the said document belongs to that person. It is for the Assessing Officer to rebut that presumption and come to a conclusion or “satisfaction” that the document in fact belongs to somebody else. There must be some cogent material available with the Assessing Officer before he/she arrives at the satisfaction that the seized document does not belong to the searched person but to somebody else. Surmise and conjecture cannot take the place of “satisfaction”.”

56. The aforesaid view was followed by the Gujarat High Court in Pr. CIT v. Himanshu Chandulal Patel (Gujarat)/2019 SCC OnLineGuj 2899, where it was held as under:

“[.] Section 132(4A)(i) clearly stipulates that when, inter alia, any document is found in the possession or control of any person in the course of a search it may be presumed that such document belongs to such person. It is similarly provided in section 292C(1)(i). In other words, whenever a document is found from a person who is being searched the normal presumption is that the said document belongs to that person. It is for the Assessing Officer to rebut that presumption and come to a conclusion or “satisfaction” that the document in fact belongs to somebody else. There must be some cogent material available with the Assessing Officer before he/she arrives at the satisfaction that the seized document does not belong to the searched person but to somebody else. Surmise and conjecture cannot take the place of”satisfaction”.”

57. A perusal of the above-mentioned decisions would show that the presumption under Section 132(4A) and 292C of the IT Act is merely for the purposes of the proceedings under the specific provisions of the IT Act. The said presumption is a rebuttable presumption, and the assessee can rebut the same. The presumption is also for the purpose of provisional assessment and not for framing of the final assessment order.

58. Under such circumstances, the question would be whether there is a presumption in respect of proceedings under the CGST Act, qua the said assets which are seized during the search.

59. The IT Act and the CGST Act are taxation statutes and are to be interpreted strictly. It is clear from the above-mentioned judicial precedents that, the documents and material seized under the IT Act could be used to make provisional assessments and the presumptions therefrom either from the material or usage of the statements given constituting evidence would all be rebuttable by the Assessee. The said material and statements cannot even be the basis of framing final assessments, by themselves. Insofar as the CGST Act is concerned, such material cannot lead to any presumptions nor can they straightaway constitute evidence under the CGST Act. However, the concerned authorities under the CGST Act would not be prevented from considering the documents and material seized for the purpose of investigation under the CGST Act.

60. In the present case, the seized documents and material passed on by the IT Department to the GST Department were scrutinized by the GST Department, prima facie, on its own. This is clear from a perusal of the SCN itself. The GST department did not simply take the findings of the IT department. Before issuing the SCN, the GST department analysed the documents, material, statements etc., and came to its own conclusions. At this stage the GST department has merely issued a SCN, which can be replied to and rebutted by the Petitioner. All grounds and legal objections would be available to the Petitioner.

61. Thus, while the prima facie presumption as existing under the IT Act would not apply under the CGST Act, the assets and material seized could form the basis of an independent investigation by the GST Department.

62. Additionally, under Section 132(4) of the IT Act, statements which can be used as evidence in proceedings under the Income Tax Act, can be a starting point for investigation under the CGST Act, though they may not directly constitute evidence for proceedings under the CGST Act.

63. Thus, Section 132(4), Section 132(4)(A) and Section 292C of the IT Act would not act as a bar against the GST Department, from independently scrutinizing the RUDs as also the documents and material seized under the IT Act. The GST Department can independently scrutinize the documents and material seized, arrive at its own prima facie findings, and can rely upon the said material for issuing the SCN under the CGST Act. In fact, under Section 144of the CGST Act material and evidence from any source can be considered for the purpose of initiating proceedings, if there is suspicion of evasion and there are certain presumptions qua the said material, which again would be rebuttable presumptions.

64. Insofar as the decision of Armour Security (India) Ltd (supra) is concerned, the relevant portion of the said decision is set out below:

“65. A show cause notice is a document served on a noticee, requiring them to explain why a particular action should not be initiated against them. Under the GST regime, issuance of a show cause notice is a mandatory precondition for raising a demand. It forms the bedrock for proceedings related to the recovery of tax, interest, and penalty. The notice ensures adherence to the principles of natural justice by granting the assessee an opportunity to present their case before any adverse action is taken. In essence, it serves as both a procedural safeguard and a legal necessity, marking the commencement of quasi-judicial adjudication under the Act.

66. A show cause notice sets the law in motion concerning the liability under the statute, containing charges that a specific person is called upon to answer. In other words, it sets out the alleged violations of legal provisions and requires the assessee to explain why the duty should not be recovered from them. Thus, a show cause notice cannot be vague, nor can any allegations be made without evidence being commensurate with the gravity of the charges levelled against the noticee.

67. It sets forth the framework for the proceedings proposed to be undertaken and provides the noticee with an opportunity to submit their explanation before the adjudicating authority. It outlines the background for the initiation of such proceedings, whether arising from an audit of accounts by the internal audit wing, scrutiny of returns, or intelligence gathered by officers of the Audit and Intelligence Commissionerate. It is further mandated that the authority issuing the notice must meticulously set out all relevant legal provisions under which the alleged contraventions are framed. The materials obtained through summons and relied upon for issuing the show cause notice must be appended and disclosed to the assessee. In essence, a show cause notice enumerates the charges levelled against the notice.

[XXX]

85. From the above exposition of law, we can safely conclude that a show cause notice delineates the scope of the proceedings in the expression of subject matter with which the authority would be dealing. It would be impermissible for an authority to invoke such rules, claims or grounds at a later stage which do not figure in the show cause notice. That is to say, any ground, reasoning or claim which does not figure out in the show cause notice cannot be permitted to adversely affect the noticee. Such recognition has even been made statutorily, as per sub-section (7) of Section 75 of the Act, which reads as thus:

“75. General provisions relating to determination of tax.—.

xxx

(7) The amount of tax, interest and penalty demanded in the order shall not be in excess of the amount specified in the notice and no demand shall be confirmed on the grounds other than the grounds specified in the notice.””

65. A perusal of the above decision would show that any SCN has to comply with the following conditions:

| (i) | | The SCN cannot be vague; |

| (ii) | | Evidence supporting the allegations that are made against the assessee; |

| (ii) | | Background of the proceedings initiated; |

| (iv) | | Legal Provisions alleging the contraventions should be mentioned; |

| (v) | | The materials obtained and relied upon are to be disclosed to the assessee. |

66. A perusal of the SCN would show that, at this stage, it cannot be said that the SCN is bereft of material particulars or that it is vague, in fact, all the documents, statements, evidence, etc. which was seized by the IT Department, and passed onto the GST Department is well within the knowledge of the Petitioner. Moreover, the RUDs have been supplied to the Petitioner. Thus, the SCN cannot be held to be baseless or vague.

67. In respect of the genuineness of the three judgements which were cited in paragraph 21 of the SCN are concerned, the said paragraph reads as under:

“21. Evidentiary Value of Statement Recorded underSection 132(4) of the Income Tax Act, 1961 During a search conducted by the Income Tax Department, statements were recorded under Section 132(4) of the Income Tax Act, 1961, from key employees of M/s J.M. Jain, including employees, some of the suppliers and buyers etc. These statements were made under oath and revealed that the entity was engaged in systematic suppression of taxable turnover, maintenance of parallel accounts through a concealed “JSK Server,” and non-payment of GST on substantial volumes of supply. In this regard, it is pertinent to note that statements recorded under Section 132(4) are admissible as valid evidence in subsequent proceedings. The Supreme Court of India, in the case of Pullangode Rubber Produce Co. Ltd. v. State of Kerala [(1973) 91 ITR 18 (SC)], held that: “An admission is an extremely important piece of evidence but it is not conclusive; it is open to the maker to show it is incorrect.

21.1 Further, in Surjeet Singh Chhabda v. Union of India [(1997) 223 ITR 506 (SC)], the Hon’ble Supreme Court affirmed that such statements are legally acceptable as the foundation for assessment and penal action.In the case of Kishan Lal v. Union of India [ (Delhi)/[2002] 258 ITR 359 (Delhi)], the Hon’ble Delhi High Court categorically held that a statement under Section 132(4) can form the sole basis for initiating proceedings, unless it is retracted promptly and convincingly.”

68. There can be no doubt that technological tools, such as Artificial Intelligence, may be used by Government Departments for analysis of evidence, preparation of summaries etc., subject to proper verification. However, there can also be no doubt that there cannot be any fake or nonexistent judgments that can be cited by the Department. In the SCN, in the present case, the following are the judgments that are cited:

| Case Name | Case Citation as recorded in the SCN |

| Pullangode Rubber Produce Co. Ltd. v. State of Kerala | [1973] 91 ITR 18 (SC) |

| Surjeet Singh Chhabra | (supra) |

| CIT v. Kishan Lal (HUF) | ITR 359 (Delhi) |

69. The Court has called for the physical books from the High Court library to verify the existence of the aforesaid judgements, and the Court finds as under:

| (i) | | First – in so far as the case of Pullangode Rubber Produce Co. Ltd. (supra) is concerned, the Court has physically verified the same from the books and the alternate citation is Pullangode Rubber Produce Co. Ltd. (supra). This judgment has been correctly cited by the GST Department. |

| (ii) | | Secondly, in the case of Surjeet Singh Chhabda (supra), the same is found to be non-existent upon a physical verification from the books. The judgment given at citation Surjeet Singh Chhabda (supra) is namely Neela Production v. Commissioner of Income Tax. |

| (iii) | | Thirdly, in the case Kishan Lal (supra), a physical verification from the books would reveal that for citation Kishan Lal (supra), the actual judgement is Kishan Lal (HUF) (supra) and the same relates to Section 234A and Section 234B of the IT Act. |

70. Thus, there are discrepancies in the judgments which are cited by the GST Department. The GST Department and even other Departments, including the IT Department ought to be careful while citing judicial precedents in this manner, specially if the same has been produced or accessed through Artificial Intelligence software, as there is a clear possibility of the citations themselves being fake, as is clear from one of the judgments, which is cited in the present SCN.

71. In this regard, various High Courts have cautioned against using Artificial Intelligence while citing case laws. Recently, a Coordinate Bench of Bombay High Court in KMG Wires (P.) Ltd. v. National Faceless Assessment Centre (Bombay)/2025:BHC-OS:19789-DB, while deciding a challenge to an Assessment order under Section 143(3) read with Section 144B of the IT Act had quashed the Assessment order and recorded as under:

“[.]

9. On the second issue of addition of peak balances in respect of loans from directors, it can be be seen that while calculating peak balance, Respondent No. 1 has considered the opening balance, and for which purpose, he has relied upon three decisions. The judicial decisions relied upon are completely nonexistent. In other words, there are no such decisions at all which are sought to be relied upon by Respondent No. 1. It is for Respondent No. 1 to show from where such decisions were fetched. In this era of Artificial Intelligence (‘AI’), one tends to place much reliance on the results thrown open by the system. However, when one is exercising quasi judicial functions, it goes without saying that such results [which are thrown open by AI] are not to be blindly relied upon, but the same should be duly cross verified before using them. Otherwise mistakes like the present one creep in. It is also one of the grievances of the Petitioner that they are clueless as to how the figures are arrived at as no basis or working was ever shown to the Petitioner, nor was any Show Cause Notice issued before making the addition of peak balance. Even this grievance of the Petitioner is justified.”

72. Additionally, in the context of an IP infringement matter, this Court in Christian Louboutin SAS v. Shoe Boutique [CS (COMM) No. 583 of 2025] had cautioned against the usage of Artificial Intelligence in adjudication of legal issues and placing reliance on incorrect responses by Artificial Intelligence. The order dated 22nd August, 2023 records as under:

“[.]

28. The above responses from ChatGPT as also the one relied upon by the Plaintiffs shows that the said tool cannot be the basis of adjudication of legal or factual issues in a court of law. The response of a Large Language Model (LLM) based chatbots such as ChatGPT, which is sought to be relied upon by Id. Counsel for the Plaintiff, depends upon a host of factors including the nature and structure of query put by the user, the training data etc. Further, there are possibilities of incorrect responses, fictional case laws, imaginative data etc. generated by AI chatbots. Accuracy and reliability of AI generated data is still in the grey area. There is no doubt in the mind of the Court that, at the present stage of technological development, AI cannot substitute either the human intelligence or the humane element in the adjudicatory process. At best the tool could be utilised for a preliminary understanding or for preliminary research and nothing more”

73. The above-mentioned judicial precedents clearly demonstrate the risk of Artificial Intelligence hallucinating, by citing fake and nonexistent judgements. Under such circumstances, the GST Department as well as the IT Department must exercise utmost caution while citing judgements and must take full responsibility in case the same is cited or generated by using Artificial Intelligence softwares. Moreover, before issuing SCNs or finalising assessments, all judgements ought to be verified.

74. Insofar as the challenge to Section 75(2) of the CGST Act is concerned, the SCN at this stage has been issued under Section 74 of the CGST Act and therefore, there cannot be a presumption that this would be converted into Section 73(1) of the CGST Act. If such a situation arises, the Petitioner is at liberty to challenge the vires at that stage, if the Petitioner is aggrieved in any manner.

75. Finally, this Court notices that the present writ petition is the second one, which has been filed by the Petitioner. In the earlier writ petition, at the time of inspection of the premises of the Petitioner, J M Jain v. Union of India [W. P. (C) No. 1206 of 2025]was filed by the Petitioner, which was rejected by the Co-ordinate Bench of this Court vide order dated 30th January, 2025 in the following terms:

“2. Having heard learned counsel for the writ petitioner and on going through the various disclosures and averments that are made in the writ petition, we find ourselves unable to either appreciate the challenge which stands raised or stand convinced that the writ petition is liable to be entertained at this stage.

3. We presently note that the respondents have issued more than four summons to the management of the writ petitioner, all of which have not been responded to. The challenge to the commencement of investigation is also addressed on extremely vague grounds. This becomes apparent from a reading of the grounds that form part of the writ petition as well as the oral arguments that were addressed before us.

4. Consequently, and for the aforesaid reasons, the writ petition shall stand dismissed.

5. This order, however, shall be without prejudice to the rights and contentions of respective parties on merit.”

76. Additionally, the Supreme Court has dismissed the W.P.(C) 1206/2025 vide the J M Jain v. Union of India [SLP (C) Nos. 8544 of 2025, dated 7-4-2025], in the following terms:

“ORDER

1. Having heard the learned counsel appearing for the petitioner and having gone through the materials on record, we see no reason to interfere with the impugned order passed by the High Court.

2. The Special Leave Petition is, accordingly, dismissed.

3. Pending application(s), if any, stands disposed of.”

77. Under these circumstances, this Court is of the opinion that the challenge to the SCN is completely pre-mature. The Petitioner ought to reply to the SCN, and participate in the proceedings. The Petitioner ought to be given a chance of personal hearing, and the SCN is directed to be decided in accordance with law.

78. The Petitioner is at liberty to take all objections in respect of the material or statements relied upon in the SCN, in accordance with law.

79. Needless to add, that the Court has not considered the merits of the allegations against the Petitioner.

80. The petition is disposed of in these terms. Pending Applications, if any, are also disposed of.