ORDER

Vikram Singh Yadav, Accountant Member.- This is an appeal filed by the assessee against the order of the Learned Commissioner of Income Tax (Appeals)-National Faceless Appeal Centre (NFAC), Delhi [„Ld. CIT(A)’], dated 17-12-2024, pertaining to Assessment Year (AY) 2021-22.

2. At the outset, it is noted that there is a delay of 84 days in filing the appeal as pointed out by the Registry. After hearing both the parties and perusing the facts placed on record, we find that there was reasonable cause for the delay in filing the present appeal and hence, the delay is hereby condoned and appeal is admitted for adjudication.

3. Briefly the facts of the case are that the assessment in this case was completed u/s. 143(3) r.w.s. 144B of the Income Tax Act, 1961 („the Act’) vide order dt. 13-12-2022, wherein the AO has brought to tax undisclosed sales amounting to Rs. 2,79,87,351/- u/s. 69A r.w.s. 115BBE of the Act. Thereafter, the assessee carried the matter in appeal before the Ld.CIT(A), who has since sustained the said findings of the AO and against the said order, the assessee is in appeal before us.

4. During the course of hearing, the Ld.AR submitted that the case of the assessee was selected for complete scrutiny assessment u/s.143(3) of the Act pursuant to notice u/s.143(2) issued on 27-06-2022 by the Faceless Assessment Centre. Subsequently, a notice u/s.142(1) dated 17-08-2022 was issued calling for information such as nature of business, financials, computation of income, etc. During that stage, no questions were raised or clarifications sought with regard to any unexplained transactions or parties. Thereafter, a show cause notice was issued on 30-11-2022, proposing an income variation of Rs.2,79,87,351/- and the assessee was directed to respond before 03-12-2022 i.e., less than three days time, in clear violation of the principles of natural justice and the standard operating procedure requiring a minimum of seven days response time.

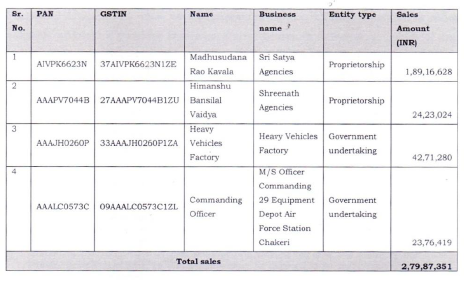

5. It was submitted that the show cause notice was based on information uploaded on the Insight Portal, wherein the AO alleged that the assessee had made bogus payments to the following four entities:

| iii. | | Sri Satya Agencies (Madhusudan Rao Kavala) |

| iv. | | Shreenath Agencies (Himanshu Bansilal Vaidya) |

It was alleged that these were non-filers and that the payments were sham in nature.

6. It was further submitted by the Ld.AR that despite the extremely short notice, the assessee submitted a response on 05-12-2022, whereby it was clarified that-

| • | | No such expenses were claimed in the income tax return or in the books of accounts maintained under the Companies Act that involved the said parties. |

| • | | Heavy Vehicles Factory and Commanding Officer are Government undertakings, and cannot, under any reasonable standard, be treated as sham entities. These entities are in fact customers of the assessee and not vendors. |

| • | | The only payments ever made to these two entities were Earnest Money Deposits (EMD); no business expenditure was claimed in respect of them. |

| • | | With respect to Sri Satya Agencies and Shreenath Agencies, the assessee clearly stated that no expenses were booked or claimed in relation to these parties. |

Accordingly, the assessee requested that the Show Cause Notice be dropped in its entirety, as the very basis of the proposed addition was factually incorrect.

7. It was also submitted that a particularly concerning aspect of the assessment proceedings is the fundamental shift in the basis of the allegation, driven by a change in the information source-from data on the Insight Portal to that from the GST Department. Astonishingly, the allegation against the assessee underwent a complete and contradictory shift between the Show Cause Notice and the final assessment order and also submitted that initially, in the Show Cause Notice dated 30-11- 2022, the AO alleged that the assessee had claimed bogus expenses amounting to Rs.2,79,87,351/- by making payments to four parties, namely, Heavy Vehicles Factory, Commanding Officer, Sri Satya Agencies (Madhusudan Rao Kavala), and Shreenath Agencies (Himanshu Bansilal Vaidya), who were flagged as non-filers of income-tax returns. The allegation clearly implied that these were sham vendors, and the related expenses were fictitious.

8. It was submitted that in the final assessment order dated 13-12-2022, the AO abandoned this premise entirely and instead relying on GST Department data, alleged that these same four parties were customers and that the assessee had made unaccounted sales to them. Based on this new allegation, the AO concluded that the income from such sales was undisclosed and brought it to tax u/s.69A r.w.s. 115BBE of the Act. It was submitted that despite the complete change in basis of addition based on change in the alleged source of information, the AO did not think it was necessary to issue a fresh show cause or seek any clarification in this regard. Thus, the assessee was not provided an appropriate opportunity of being heard, thereby violating the principles of natural justice.

9. It was submitted that the assessment order u/s.143(3) of the Act thus rests on a completely new and untested foundation, in clear violation of the principles of natural justice, and suffers from non-application of mind and argued that Courts have consistently held that – “assessment order passed without giving 7 days time to assessee to file objections in response to SCN issued prior to said order was in breach of principles of natural justice and deserved to be quashed.” In the present case, the assessee was neither given sufficient time to respond to the original show cause notice (less than three days), nor was any fresh show cause issued when the basis of the proposed addition completely changed. This clearly amounts to a denial of a reasonable opportunity of being heard, rendering the assessment order bad in law due to violation of the principles of natural justice.

10. Coming to the order of the Ld.CIT(A), it was submitted that in the appellate proceedings the Ld.CIT(A) failed to appreciate the procedural lapses and violation of natural justice and upheld the assessment order and consequently, the order u/s. 250 of the Act is also bad in law.

11. It was submitted that the order passed u/s.250 of the Act by the Ld.CIT(A) suffers from serious procedural and substantive lapses. Rather than making an independent and reasoned determination of the issues raised and submissions made by the assessee, the Ld.CIT(A) has merely reproduced the original show cause notice issued by the AO, assessment order and the short version of statement of facts and grounds of appeal in the Form-35. The detailed grounds of appeal, statement of facts, and comprehensive documentary evidence furnished by the assessee including confirmation letters from the two authorised dealers, namely, Sri Satya Agencies and Shreenath Agencies, invoices for (Heavy Vehicles Factory and Commanding Officer), reconciliation of invoices and GST e-way bills clearly recording the impugned sales have not been analysed or even acknowledged. This reflects a gross error and failure to apply judicial mind, thereby resulting in a miscarriage of justice.

12. It was further submitted that surprisingly, the Ld.CIT(A) proceeded to conclude that the assessee had failed to reconcile each sale transaction with the relevant parties sales ledger, and that the explanation provided-supported by sample invoices was insufficient in the absence of more granular reconciliation and confirmations from the four parties. This observation disregards the fact that the assessee had already submitted confirmation letter from the two authorised dealers, namely, Sri Satya Agencies and Shreenath Agencies, sample invoices, reconciliation of invoice and GST e-way bills evidencing the inclusion of the impugned sales in the gross revenue as reported in both the books of account and GST returns and submitted that the Ld.CIT(A)’s reasoning becomes even more untenable in light of the fact that the AO never issued a fresh show cause notice when the basis of the addition was completely altered from bogus purchases to unaccounted sales and the assessee was denied an adequate opportunity to respond to this revised allegation, amounting to a clear violation of the principles of natural justice. It is also unjust for the Ld.CIT(A) to ignore this procedural lapse and simultaneously disregard the detailed rebuttals and documentation submitted during the appellate proceedings and argued that the order of the Ld.CIT(A), which relies solely on the findings of the AO, without independent examination of the assessee’s submissions, which is bad in law and prayed that the same should be quashed.

13. It was further submitted by the Ld.AR that during FY.2020-21, the assessee had effected sales to the following four parties, which form an integral part of the overall sales recorded in the books of account and duly reported in the GST returns:

14. It was submitted that as can be seen from above table, Heavy Vehicles Factory and Commanding Officer are Government undertaking to which sales were made. Further, Madhusudana Rao Kavala and Himanshu Bansilal Vaidya operate in proprietorship capacity and in the business name Sri Satya Agencies and Shreenath Agencies respectively.

15. It was further submitted that sales made by the assessee to these four parties were uploaded on the GST portal, as per GST E-invoicing Rules, supported by e-way bills issued for movement of goods to the listed entities, wherever applicable. Supporting documents for transactions with these four parties include:

| i. | | Certificate from Sri Satya Agencies along with details of invoices including e-Way bill and date; |

| ii. | | Certificate from Sreenath Agencies along with details of invoices including e-Way bill and date; |

| iii. | | Copy of invoices and reconciliation of invoice and GST e-way bills in case of Heavy Vehicles Factory and Commanding Officer |

16. It was submitted that sales revenues from transactions with these four parties are included in the gross turnover of the assessee for the FY.2020-21 and offered to tax as business income.

17. It was further submitted that Section 69A of the Act deals with unexplained money, bullion, jewellery, or other valuable articles. It provides that where an assessee is found to be owner of any money, bullion, jewellery or other valuable article and such money, bullion, jewellery or valuable article is not recorded in the books of account, if any, maintained by him for any source of income, and the assessee offers no explanation about the nature and source of it then the AO may construe it as income of the assessee. It was submitted that in the present case, the foundational requirement for invoking section 69A is entirely absent. The assessee has not been found to be the owner or in possession of any unexplained money, bullion, jewellery, or other valuable article. There is also no allegation or finding that any such asset is not recorded in the books of account. Therefore, the preconditions for application of section 69A are not met, and the invocation of this provision is legally untenable.

18. It was further submitted that the transactions in question pertain to sales made by the assessee to four entities during the relevant financial year. These sales have been duly recorded in the assessee’s books of account, reported in the GST returns, and conducted entirely through banking channels. These are not cash transactions, nor are they unrecorded. In fact, the documentary evidence filed clearly demonstrates that the sales form part of the assessee’s declared revenue and argued that it is thus wholly unclear how transactions duly accounted for in books of account and GST returns could be treated as “unaccounted income” u/s. 69A of the Act and notably, the AO has not brought on record any cogent evidence or analysis to support such a drastic and contrary conclusion.

19. It was further submitted that the only basis cited by the AO in the assessment order is that data received from the GST Department shows that the assessee had made sales to the said four parties. This, however, is not a disputed fact which the assessee has consistently maintained from the outset, including in its reply to the show cause notice, that it had indeed made sales to these entities. What is conspicuously missing from the assessment order is any reasoning or evidentiary basis for the conclusion that these sales are not recorded in the assessee’s books of account. There is no reconciliation exercise, no comparative analysis of books versus GST returns, and no reference to any material suggesting that these sales were suppressed or unaccounted. The conclusion that these were “undisclosed sales” is thus a mere assertion, unaccompanied by any cogent finding or supporting analysis. Such an unreasoned presumption cannot form the basis of an addition u/s. 69A of the Act especially when the primary condition-non-recording in the books-is neither alleged with specificity nor demonstrated and finally prayed that the addition u/s 69A of the Act amounting to Rs.2,79,87,351/- be deleted.

20. Coming to the issue of short grant of TDS credit, the Ld.AR submitted that the AO has erred in granting credit for TDS amounting to Rs.42,07,957/- instead of Rs.42,32,957/- claimed by the assessee in the return of income and prayed that the entire TDS of Rs. 42,32,957/- be granted to the assessee.

21. Per contra, the Ld.DR is heard, who has relied on the order passed by the AO and that of the Ld.CIT(A) and our reference was drawn to the findings of the ld CIT(A) which read as under:

“In the light of above facts of case, on perusal of that the appellant is contending that the order of AO u/s 143(3) r.w.s 144B of I.T Act as bad in law as it involves assessment of sales as made with the four parties namely 1) Madhusudana Rao Kavala (2) Heavy vehicles factory (3) Himanshu bansilal Vaidya and (4) Commanding officer totaling to Rs. 2,79,87,351/- as unexplainable when the same is indeed reflected in the turnover of the appellant and thereby contended the order of the AO as not maintainable involving assessment of this amount of Rs. 2,79,87,351/- as unexplained money u/s. 69A of I.T.Act. Accordingly appellant pleaded to delete the order of AO as not maintainable as the transactions took place with these four parties stands reconciliable as explained sales of the appellant for the year. Precisely in this analogy appellant is contending the entire transaction as made with the four parties as explainable sales only and having admitted these sales in the books such assessment of same as unexplained money by the AO as not maintainable and the failure to explain the same before AO is attributable to AOs mistaken SCN reflecting these transactions as expenses instead of sales is the contention of the appellant. Accordingly appellant has advanced various inter related overlapping GOA prescisely contending as above and requesting to delete the order of AO as bad in law. However on perusal of facts on record as brought out by the AO, it is clearly noticeable that the appellant was indeed asked in categorical terms in the SCN dated 30.11.2022 seeking explanation of the transactions as took place with these four parties during the year by the appellant. However on the face of it, appellant denied such claim of expense as not incurred against these four parties and accordingly denied the possibility of expenses claimed against these parties However appellant admitted two parties as recognizable customers of appellant namely heavy vehicles party and commanding officer for whom they are rendering services and are likely involved in payment of EMDs to them. On the same analogy appellant ought to have further examined entire gamut of transactions as took place with these two parties during the year for its reconciliation to confirm that there exists no transaction of sale/expense with these parties involving payment of EMDs, if any. Further with reference to other two parties namely Madhusudana Rao Kavala and Himanshu bansilal Vaidya appellant could not even admit these parties as customers involving transactions with the appellant. Appellant ought to have verified their GST returns at least to examine the entire gamut of transactions as available or as took place during the year with these four parties so as to explain the specific SCN with amounts as issued by the AO with clear mention of related amounts against each parties instead of merely denying incurring of any expenditure with these parties. When specific amounts are mentioned by the AO in the SCN, appellant ought to have made basic efforts in all its fairness to deny the amounts apart from the simple verification of the character of the transactions as only expenses as per SCN as it involves emphatic show cause from the AO involving clear amount of transaction in this SCN of AO. In view of the same, AO has brought the entire amount as unexplainable and assessed the same as per the provisions u/s.69A of I.T.Act as reasoned in the assessment order. In the light of these facts on record, now appellant is adducing the correctness of the entire transactions as indeed took place with these four parties with correctness of amounts as brought out by the AO in SCN but claiming the same as attributable sales as against of expenses adduced by the AO in the SCN. Accordingly appellant contends that the entire transactions having admitted in the sales are reconciliable against these four parties and accordingly assessment of same as unexplained by AO as not acceptable as appellant identified the transactions as observed by AO as part of sales. In this analogy appellant contends the addition made as unexplained money as not acceptable as the amounts transacted with these four parties during the year are being attributable sales only against these parties only and for which only appellant claims having filed of GST returns etc as per due procedure and from which only AO could have obtained this details is the contention of the appellant However appellant could not submit detailed gross sales ledger as applicable to each of these four parties as appearing in appellant books of accounts and as namely (1) Madhusudana Rao Kavala (2) Heavy vehicles factory (3) Himanshu bansilal Vaidya and (4) Commanding officer totaling to Rs. 2,79,87,351/- as only attributable sales of appellant and purchase of these four parties as reflected in the books of accounts of these transacting parties against the appellant as creditor for their purchases Further appellant ought to have submitted such confirmation as obtained from the two individual parties namely Madhusudana Rao Kavala and Himanshu bansilal Vaidya being the proprietory concerns of these two individuals having transacted with the appellant and its reflection in their books of accounts against the appellant. These basic confirmations are indeed needed as it is noticeable from the order of AO that there exists an enquiry by the AO u/s. 133(6) of I.T.Act as issued to these four parties to explain the transactions as took place with the appellant and for which no such compliance is made by this four parties as brought out by AO in the assessment order under para (2.4). In the light of these facts appellant ought to have reconciled the each item of sale bill/invoice as took place with these four parties as reconciliable with the sales ledger of the respective parties for its overall reconciliation with gross sales of the appellant as admitted in the books of accounts for this A.Y. to conclusively establish correctness of appellant claim in reflecting these transactions as part of gross sales as contended by the appellant. In the absence of these finer details involving supporting workings/proofs and its supporting confirmations from the four parties involved, appellant mere claims to treat the same as sales as attributable to these four parties by adducing some sale invoices as attributable to these parties is neither reasonable nor justifiable as a conclusive and comprehensive explanation of the appellant as per I.T.Act. This becomes more so when the same is indeed denied as not took place before AO even as expense mistakenly as contended during the assessment proceedings even after issue of specific SCN with clear amounts of transactions makes it more justifiable to treat the same as not comprehensively explained by the appellant as contended in the GOA/written submissions filed as discussed above. In view of the same, appellant all grounds of appeal as advanced are to be treated as not maintainable as there exists no infirmity in the order of AO as reasoned and discussed supra. Accordingly appellant appeal is dismissed as not maintainable as per facts available on record and on consideration of appellants submission as reasoned and explained above.

6 Accordingly, appellant appeal is dismissed as not maintainable as per facts available on record as reasoned by AO as discussed supra.”

22. We have heard the rival contentions and perused the material available on record. The matter under consideration relates to sales effected by the assessee amounting to Rs 2,79,87,351/- to two government undertakings namely, Heavy Vehicles Factory and Commanding officer, Air Force Station, Chakeri; and two other individuals who operate in proprietorship capacity namely, Madhusudana Rao Kavala (Sri Satya Agencies) and Himanshu Bansilal Vaidya (Shreenath Agencies), which have remain unaccounted as alleged by the AO leading to addition as undisclosed sales u/s 69A of the Act. As per the assessee, the sales so effected are duly recorded in the books of accounts, duly reported in GST returns as well as return of income filed for the impugned assessment year 2021-22. In support of its submissions, the assessee has furnished copy of invoices, e-way bills, reconciliation of invoices with the books of accounts and confirmation from Madhusudana Rao Kavala (Sri Satya Agencies) and Himanshu Bansilal Vaidya (Shreenath Agencies).

23. We find that during the course of assessment proceedings, the showcause issued by the AO talked about payments made to aforesaid parties which are non-filers and the payments thus made as non-genuine which has been refuted by the assessee in its response, however, the AO finally held that these are unaccounted sales while passing the assessment order. The assessee has challenged the findings of the AO on account of lack of appropriate time to respond to the initial show-cause and thereafter, changing the very basis of making the addition from bogus purchases to unaccounted sales and that too, without issue a fresh show-cause before passing the assessment order. At the same time, during the appellate proceedings, the assessee has placed on record the aforesaid documentation in support of its submission that the sales so made are duly accounted for in books of accounts and duly offered to tax. The Ld. CIT(A) has acknowledged the fact that the assessee has submitted these documentation and at the same time, has held that the assessee ought to have furnished invoice-wise reconciliation and sales ledger with these parties to conclusively establish its claim of recorded sales. In our understanding, given that the assessee has filed additional documentation during the appellate proceedings, it would have been appropriate to call for the remand report from the AO and at the same time, where required, the assessee could have been directed to furnish additional documentation where required.

24. Given that the necessary documentation are already on record and there is no finding on merit of the addition so made, we deem it appropriate, as so agreed to by both the parties during the course of hearing, that the matter be remitted to the file of the AO to carry out the necessary examination/verification and where required, he can call for further documentation/explanation from the assessee and where on verification, the claim of the assessee is found acceptable, allow the necessary relief to the assessee.

25. In the result, we set-aside the order of the Ld.CIT(A) and the matter is set-aside to the file of the AO with aforesaid directions.

26. In the result, the appeal of the assessee is allowed for statistical purposes.