ORDER

Vijay Pal Rao, Vice-President.- This appeal by the assessee is directed against the order dated, 17/05/2025 of CIT (Exemption) whereby the application of the assessee in Form 10AB seeking regular approval u/s 80G of the Act was rejected on the ground of barred by limitation.

2. The assessee has raised the following grounds of appeal:

“1. Ld. CT (Exemptions). Hyderabad erred in rejecting the application for Registration U’s. 80G for technical reasons, Ld. CTE), Hyd, Order dated 17-06-2025 (Form No 104AD) is bad in law and in gross violation of principles of natural justice.

2. Ld. CIT(E), Hyderabad, erred in not Considering the Provisional Registration granted on 31-12-2022 u/s 80G from 31-12-2022 to A.Y 2025-26

3. The learned CIT(E) Hyderabad, failed to consider the Registration Granted u/s. 12AB on 25-06-2025 and the Trust is a charitable institution.

4 Ld. CIT(E), Hyd, failed to consider the applicat1on Forn 10AB filed on 15-11-2024 and ought to have consider the application.

5. Ld CITIE), Hyd, failed to appreciate that the activities of Charitable Trust were commenced on 29. 12-2018 and fulfills all the Conditions prescribed in section 80G.

6. Ld CIT(E), Hyd, tailed to appreciate that the delay in filing the application for registration was on account of reasonable cause.

7. Ld. CIT(E), Hyd, failed to consider the Jurisdictional ITAT Hyderabad decision in KMV Foundation

8. Ld. CIT(E), Hyd, failed to observe the Principles of Natural justice and the assessee is a genuine Charitable Trust.

9. Ld. CIT(E), Hyd, erred in drawing a conclusion that application filed under section 80G for final registration is beyond time limit prescribed under the referred section without considering the effect of provisions of sub-clause (ii) to first proviso of sub-clause (5) to Section 80G of the Act is for benefit of the donors who donating money to the charitable trusts for claiming exemption in their returns of Income.

10 Ld. CIT(E), Hyd, failed to examine the information filed by the assessee The assessee received donations for a sum of Rs. 60,910/- in FY 2021-22, Rs. 13.57.1321- in FY 2022-23 and Rs. 82,39,940/- in FY 2023-24. Form 10BD also filed for FY 2023-24.

11. The learned CIT (Exemption) Hyderabad failed to serve the notice before rejection of the application in Form 10AB dated 15/11/2024 and petition for condonation of delay.

12. Learned CIT (Exemption) Hyderabad has granted final registration to the applicant trust u/s 12A on 25.06.2025 for a period from A.Y 2023-24 to 2027-28.

13. Learned CIT (Exemption) Hyderabad failed to appreciate that the assessee is completely engaged in genuine charitable activities as defined u/s 2(15) of the Act.

14. The applicant craves leave to add, amend and/or alter the above grounds of appeal, at any time before or at the time of hearing of the appeal”.

3. The learned Counsel for the assessee has submitted that the CIT (Exemption) has given the wrong reasons for rejecting the application of the assessee and treating the same as time barred and particularly referring the CBDT Circular No.7/2024 dated 25/04/2024 which is not applicable in the case of the assessee when the provisional registration/approval was valid up to 31/03/2025 i.e. up to A.Y 2025-26. He has further submitted that though the limitation for filing the application was up to 30/09/2024, however, the application in Form 10AB could not be filed within the limitation due to technical glitches in the system and the assessee could file the e-application only on 15/11/2024 resulting a delay of 46 days in filing the application. The learned Counsel for the assessee has contended that the said delay was not in the control of the assessee and it was because of the reason that the Department System did not accept Form 10AB whenever the Auditor of the assessee made attempts to upload the application. Therefore, the delay is attributable to non-functioning of the Portal of the I.T. Department at the Auditors Office, which made several attempts. He has also filed an affidavit of the Trustee of the assessee trust explaining the cause of the delay in filing the application. The learned Counsel for the assessee has also referred to the proviso to section 12A(1)(ac) of the Act and submitted that earlier the CBDT used to extend the limitation for filing the application by issuing the circulars including the Circular No.7/2024, however, by considering the hardships faced by the Trusts/Institutions, an amendment is brought to the Act whereby the powers are vested with the Pr. CIT/CIT for condonation of the delay, if there is a reasonable cause for filing the application. Thus, the learned Counsel for the assessee has submitted that in view of the amendment of inserting the proviso to section 12A(1)(ac) and the cause of delay in filing the application has been explained by the assessee, the same may be treated as filed within the period of limitation. In support of his contention, he has relied upon the following decisions:

| (i) | | Hon’ble High Court of Delhi in the case of Director of Income Tax (Exemption) v. Vishwa Jagriti Mission (Delhi) |

| (ii) | | CIT(E) v. Vananchal Kelavani Trust (Surat – Trib.). |

| (iii) | | CIT(E) v. Swachh Vapi Mission Trust (Surat – Trib.) |

| (iv) | | Bhamashah Sundarlal Daga Charitable Trust v. Commissioner of Income-tax (Exemption) (Jodhpur – Trib.)/ ITA No.268/JODH/2023. |

| (v) | | CIT(E) v. Yogvanshan Seva Sabstghab – (Jaipur – Trib.). |

| (vi) | | Sri Balbheemasena Gowseva Trust v. Income-tax Officer (Hyderabad – Trib.). |

| (vii)Peoples | | Progress Trust v. Commissioner of Income -Tax (Exemptions) (Hyderabad – Trib.) |

| (viii) | | CIT(E) v. Baburao Chandere Social Foundation – (Pune – Trib.). |

4. On the other hand, the learned DR has submitted that the CIT (Exemption) has no power to condone the delay in filing the application and therefore, once the application was found to be belated, the same is liable to be rejected. He has relied upon the impugned order of the CIT (Exemption).

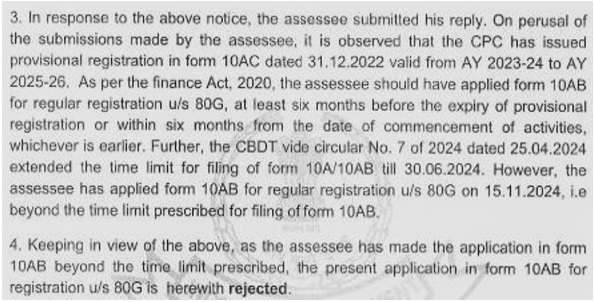

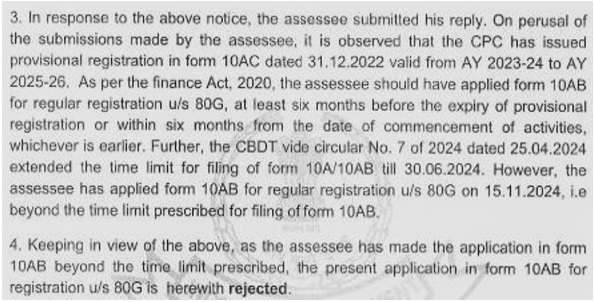

5. We have considered the rival submissions as well as the relevant material available on record. There is no dispute that the limitation for filing the application in Form 10AB for regular approval u/s 80G was to expire on 30/09/2024 and the assessee has filed the present application on 15/11/2024. Therefore, there is a delay of 46 days in filing the application which has been explained by the assessee with the reasons that due to the technical glitches in the system, the Auditor of the assessee made several attempts but could not upload the application within the period of limitation and it was finally uploaded only on 15/11/2024. The CIT (Exemption) has rejected the application in para 3 & 4 of the impugned order as under:

6. Thus, the CIT (Exemption) has referred and relied upon the circular No.7/2024 issued by the CBDT whereby the time period limit for filing the application in Form 10AB was extended till 30/06/2024. It is pertinent to note that the said circular was issued by the CBDT in respect of the cases where the time limit for filing the application already expired on 30/09/2023 whereas the time limit for filing the application in case of the assessee was available up to 30/09/2024 and therefore, the said circular of CBDT is not applicable and irrelevant for this case of the assessee before us as the provisional registration was valid up to 31/03/2025. Therefore, the reasons given by the CIT (Exemption) for rejecting the application are completely irrelevant and do not justify the rejection of the application. The assessee has explained the cause of the delay of 46 days in the affidavit and particularly in para 5 and 6 as under:

“5. The time limit for filing of Form 10AB for renewal of provisional registration is up to 30-09-2024 and Sri Ajeya Sankara Trust has filed the application for renewal on 15-112-24. Thus,, there was a delay of 46 days in filing the Form 10AB but filed before expiry of the time i.e.31-03-2025.

6. 6. The reasons for the delay in filing of Form 10AB:

| A) | | As per the New amendment, the applications as per Form 10A /Form 10AB has to be filed electronically through the efiling portal of the Income Tax department. |

| B) | | The Registration U/s 80G of Sri Ajeya Sankara Trust is in force till AY 2025-26 i.e., 31-03-2025. |

| C) | | The Auditor of the Trust has made several attempts to upload the application for renewal on portal of the Income tax department but the system did not accept the Form 10AB. He was also out of station for his personal and professional works. |

| D) | | The delay is attributable to non-functioning of portal of income tax department at the auditors place. The Hon’ble ‘B -Bench, ITAT, Hyderabad is requested to condone the delay in filing Form 10AB for a period of 46 days. |

| E) | | Frequent disruption in internet connection in the area of the Auditor of the Sri Ajeya Sankara Trust also contributed to the delay. |

For the above reasons, delay in fling the application for Renewal of 80G may kindly be condoned and request to grant 80G Renewal.”

7. The limitation for filing the application for grant of regular approval u/sec.80G(5) of the Act is provided in third proviso to this sub-section as under :

“Provided that the institution or fund referred to in clause (vi) shall make an application in the prescribed form and manner to the Principal Commissioner or Commissioner, for grant of approval –

| (i) | | where the institution or fund is approved under clause (vi)[as it stood immediately before its amendment by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020), within three months from the 1st day of April, 2021; |

| (ii) | | where the institution or fund is approved and the period of such approval is due to expire, at least six months prior to expiry of the said period: |

| (iii) | | where the institution or fund has been provisionally approved, at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activities, whichever is earlier, “[or] |

| (iv) | | where activities of the institution or fund have – |

| (A) | | not commenced, at least one month prior to the commencement of the previous year relevant to the assessment year from which the said approval is sought; |

| (B) | | commenced at any time after the commencement of such activities;” |

8. Thus, as per Clause-(iii) of said proviso, if an assessee was already granted provisional approval u/sec.80G, the application for regular approval has to be filed atleast six months prior to expiry of the period of provisional approval or within six months of commencement of it’s activities whichever is earlier. An identical limitation is provided for regular registration u/sec.12AB in Clause-(iii) of sec.12A(1)(ac) of the Act. However, proviso to sec.12A(1)(ac) was inserted conferring the powers to the Pr. CIT/ CIT to condone the delay in filing the application beyond the time allowed u/sec.12A(1)(ac) Clauses-(i) to (vi). The limitation provided u/sec.12A(1)(ac) as well as 3rd proviso to sec.80G(5) of the Act are identical in language and paramateria. However, there is no provision made for condonation of delay, if any, in filing the application for regular approval u/sec.80G(5) of the Act as it is provided in case of an application for regular registration u/sec.12AB of the Act. Thus, it is clear that there is an omission of not providing enabling provision for condonation of delay in filing the application for approval u/sec.80G is concerned.

9. In the case of the assessee, the provisional registration /approval was valid up-to the assessment year 2025-2026 i.e., upto 31st March, 2025 and, therefore, the limitation for filing the application in Form-10AB for regular approval u/sec.80G was available up-to 30th September, 2024. There was a delay of 46 days in filing the application for regular approval u/sec.80G(5). The learned CIT(E) rejected the application on the ground of delay, but, giving wrong reasons of CBDT Circular No.7/2024, dated 25.04.2024 which is not relevant for the application filed for regular approval when the limitation was available up-to 30.09.2024. The assessee has already explained the reasons for delay of 46 days in filing the application, but, in the absence of enabling provisions for condonation of delay, the Commissioner has no power to entertain and consider the said reasons for delay explained by the assessee. It is pertinent to note that this omission of not providing the condonation of delay for filing the regular approval u/sec.80G would lead to an undue hardship and gross injustice to the bonafide assessee/applicant who could not file the application for regular approval within the time limit provided u/sec.80G(5) read with 3rd proviso even in case when the delay in filing the application is beyond the control of the assessee and due to some technical reasons not attributable to the assessee. Therefore, earlier, the CBDT used to issue Circulars for extending the time limit for filing application which could not be filed within the time period and later-on an amendment was brought in sec.12A(1)(ac) by way of inserting proviso for conferring the powers to the Pr. CIT/CIT to condone the delay, but, there is no corresponding provision in sec.80G for condoning the delay in filing the application.

10. The period of limitation for filing the application atleast six months prior to the expiry of the period of provisional registration/provisional approval is set-out with the object, so that the regular registration/approval would be granted to the assessee before the expiry of provisional registration/approval and, therefore, there would be no gap between the validity of the provisional registration/approval and grant of regular registration/approval. Therefore, in case of any minor delay in filing the application without any remedy under the Act for condonation of the said delay caused by the reasons and circumstances beyond the control of the assessee/application and not attributable to the applicant would lead to a situation where the applicant would be left without any remedy. Hence, the Competent Authority/CBDT may deal with this hardship faced by the assessee/applicant for getting the regular registration u/sec.80G. The facts and circumstances in the case in hand make-out a fit case to be considered by the CBDT for condonation of delay. Accordingly, the assessee is directed to approach the CBDT for condonation of delay of 46 days in filing the application for regular approval u/sec.80G. Therefore, in the facts and circumstances of the case as discussed above, we set-aside the impugned order of the learned CIT(E) with the direction to the assessee to approach the CBDT for condonation of the delay in filing the application and then, the learned CIT(E) shall reconsider for regular approval u/sec.80G of the Act. Needless to say, the assessee be given an appropriate opportunity of hearing before passing the fresh order.

11. In the result, appeal of the Assessee is allowed for statistical purposes.