ORDER

1. The present appeal preferred by the assessee emanates from the order of the Ld.CIT(Appeals)/NFAC, Delhi dated 23.04.2025 for the assessment year 2017-18 as per the grounds of appeal on record.

2. In this case, the assessee has filed both legal grounds as well as grounds on merits. The Ld. Counsel for the assessee submitted that he would assail the legal ground first and if the said legal ground is answered affirmative, then the grounds on merits shall become academic only.

3. The only legal contention raised by the Ld. Counsel for the assessee is that notice u/s.143(2) of the Income Tax Act, 1961 (for short ‘the Act’) was not issued to the assessee in respect of the assessment completed u/s. 144 of the Act, dated 24.11.2019. I take guidance from the judgment of the Hon’ble High Court of Delhi in the case of Shaily Juneja v. Asstt. CIT 476 ITR 665 (Delhi), wherein it was held that issuance of notice u/s.143(2) of the Act is sine-qua-non in respect of assessment framed u/s.143(3) & 144 of the Act. For the sake of completeness, the relevant observation of the aforesaid judgment are culled out as follows:

10. The aforesaid view came to be reiterated by the Court in Principal Commissioner of Income-Tax v. Dart Infrabuild Pvt Ltd, as would be evident from the following observations which appear in that decision:-

“15.2 The absence of notice, under section 143(2), impregnates the proceedings with a jurisdictional defect and, hence, renders it invalid in the eyes of the law. This position is no longer res integra, as demonstrated by the observations made in Principal CIT v. Shri Jai Shiv Shankar Traders Pot. Ltd.1 (page 452 of 383 ITR):

“12. The narration of facts as noted above by the court makes it clear that no notice under section 143(2) of the Act was issued to the assessee after December 16, 2010, the date on which the assessee informed the Assessing Officer that the return originally filed should be treated as the return filed pursuant to the notice under section 148 of the Act.

13. In DIT v. Society for Worldwide Inter Bank Financial, Tele- 2023 SCC OnLine Del 7382 communications’, this court invalidated a reassessment proceeding after noting that the notice under section 143(2) of the Act was not issued to the assessee pursuant to the filing of the return. In other words, it was held mandatory to serve the notice under section 143(2) of the Act only after the return filed by the assessee is actually scrutinised by the Assessing Officer.

14. The interplay of sections 143(2) and 148 of the Act formed the subject matter of at least two decisions of the Allahabad High Court in CIT v. Rajeev Sharma2 it was held that a plain reading of section 148 of the Act reveals that within the statutory period specified therein, it shall be incumbent to send a notice under section 143(2) of the Act. It was observed (page 687): The provisions contained in subsection (2) of section 143 of the Act is mandatory and the Legislature in its wisdom by using the word “reason to believe” had cast a duty on the Assessing Officer to apply mind to the material on record and after being satisfied with regard to escaped liability, shall serve notice specifying particulars of such claim.

In view of the above, after receipt of return in response to notice under section 148, it shall be mandatory for the Assessing Officer to serve a notice under sub-section (2) of section 143 assigning reason therein.in absence of any notice issued under sub-section (2) of section 143 after receipt of fresh return submitted by the assessee in response to notice under section 148, the entire procedure adopted for escaped assessment, shall not be valid.’

15. In a subsequent judgment in CIT v. Salarpur Cold Storage (P.) Ltd.3, it was held as under:

“10. Section 292BB of the Act was inserted by the Finance Act, 2008 with effect from April 1, 2008. Section 292BB of the Act provides a deeming fiction. The deeming fiction is to the effect that once the assessee has appeared in any proceeding or co-operated in any enquiry relating to an assessment or reassessment, it shall be deemed that any notice under the provisions of the Act, which is required to be served on the assessee, has been duly served upon him in time in accordance with the provisions of the Act. The assessee is precluded from taking any objection in any proceeding or enquiry that the notice was (i) not served upon him; or (ii) not served upon him in time; or (iii) served upon him in an improper manner. In other words, once the deeming fiction comes into operation, the assessee is precluded from raising a challenge about the service of a notice, service within time or service in an improper manner. The proviso to section 292BB of the Act, however, carves out an exception to the effect that the section shall not apply where the assessee has raised an objection before the completion of the assessment or reassessment. Section 292BB of the Act cannot obviate the requirement or complying with a jurisdictional condition. For the Assessing Officer to make an order of assessment under section 143(3) of the Act, it is necessary to issue a notice under section 143(2) of the Act and in the absence of a notice under section 143(2) of the Act, the assumption of jurisdiction itself would be invalid.’

16. In the same decision in Salarpur Cold Storage (P.) Ltd. (supra), the Allahabad High Court noticed that the decision of the Supreme Court in Asst. CIT v. Hotel Blue Moon’ where in relation to block assessment, the Supreme Court held that the requirement to issue notice under section 143(2) was mandatory. It was not ‘a procedural irregularity and the same is not curable and, therefore, the requirement of notice under section 143(2) cannot be dispensed with’.

17. The Madras High Court held likewise in Sapthagiri Finance and Investments v. ITO2. The facts of that case were that a notice under section 148 of the Act was issued to the assessee seeking to reopen the assessment for the assessment year 2000-01. However, the assessee did not file a return and therefore a notice was issued to it under section 142(1) of the Act. Pursuant thereto, the assessee appeared before the Assessing Officer and stated that the original return filed should be treated as a return filed in response to the notice under section 148 of the Act. The High Court observed that if thereafter, the Assessing Officer found that there were problems with the return which required explanation by the assessee then the Assessing Officer ought to have followed up with a notice under section 143(2) of the Act. It was observed that: “Merely because the matter was discussed with the assessee and the signature is affixed it does not mean the rest of the procedure of notice under section 143(2) of the Act was complied with or that on placing the objection the assessee had waived the notice for further processing of the reassessment proceedings. The fact that on the notice issued under section 143(2) of the Act, the assessee had placed its objection and reiterated its earlier return filed as one filed in response to the notice issued under section 148 of the Act and the Officer had also noted that the same would be considered for completing of assessment, would show that the Assessing Officer has the duty of issuing the notice under section 143(3) to lead on to the passing of the assessment. In the circumstances, with no notice issued under section 143(3) and there being no waiver, there is no justifiable ground to accept the view of the Tribunal that there was a waiver of right of notice to be issued under section 143(2) of the Act”

18. As already noticed, the decision of this court in CIT v. Vision Inc.1 proceeded on a different set of facts. In that case, there was a clear finding of the court that service of the notice had been effected on the assessee under section 143(2) of the Act. As already further noticed, the legal position regarding section 292BB has already been made explicit in the aforementioned decisions of the Allahabad High Court. That provision would apply in so far as failure of ‘service” of notice was concerned and not with regard to failure to „issue” notice. In other words, the failure of the Assessing Officer, in reassessment proceedings, to issue notice under section 143(2) of the Act, prior to finalising the reassessment order, cannot be condoned by referring to section 292BB of the Act.

19. The resultant position is that as far as the present case is concerned the failure by the Assessing Officer to issue a notice to the assessee under section 143(2) of the Act subsequent to December 26, 2010 when the assessee made a statement before the Assessing Officer to the effect that the original return filed should be treated as a return pursuant to a notice under section 148 of the Act, is fatal to the order of reassessment.” (emphasis is ours)”

11. It is also pertinent to note that the decision in Ashok Chaddha was also pressed into aid by the Revenue in Commissioner of Income-Tax v. Delhi Kalyan Samiti6. This becomes evident from a reading of Para 4.8 of that decision and where the submissions of the respondents therein came to be recorded as follows:-

“4.8 Mr. Dileep Shivpuri, learned Senior Standing counsel submitted that since the Assessee had failed to file its returns for the relevant AYs within the time prescribed in the notices issued under Section 148 of the Act, the said returns were invalid and were rightly ignored by the AO. He submitted that in the circumstances no notice under Section 143(2) of the Act was required to be issued to the Assessee. He further submitted that the present assessments were framed under Section 144(1)(b) of the Act – on account of failure on the part of an Assessee to comply with all terms of a notice issued under Section 142(1) of the Act or failure to comply with directions issued under Section 142(A) of the Act – and issuance of notice under Section 143(2) of the Act is not a necessary precondition for the same. He contended that the position would be no different even if the returns were filed in the regular course. Mr Dileep Shivpuri relied on the decision of this Court in Ashok Chaddha v. ITO: (2011) 337 ITR 399 (Delhi) in support of its contention that no notice under Section 143(2) was required to be issued.”

12. Having noticed the aforesaid contention, the Division Bench proceeded to hold as under:-

“9. It is now well established that if the AO does not accept the return filed by the Assessee on its face and he is required to issue a notice under Section 143(2) of the Act and provide an opportunity to the Assessee to produce the necessary material in support of his return. Mr Shivpuri had argued that a notice under Section 143(2) was required to be issued only in cases where the AO considers it necessary or expedient to do so and in cases where the Assessee had not filed its response to the notice under Section 142(1) it was not necessary for the AO to issue such notice under Section 143(2). In our view, this contention is bereft of any merits and completely ignores the scheme of the machinery provisions for assessment under the Act. It is now well settled by a number of decisions (See: Pr. CIT v. Silver Line and Anr.: 283 CTR 148 (Del), ACIT v. Hotel Blue Moon: 321 ITR 362 (SC)and CIT v. Pawan Gupta: 318 ITR 322 (Del)) that whenever the return filed by an Assessee is not accepted at its face, it is mandatory for the AO has to issue a notice under Section 143(2) of the Act for proceeding further. It is thus not open for the AO to not issue a notice under Section 143(2) of the Act and proceed directly under Section 144 of the Act by rejecting the return filed by the Assessee.

10. The decision of this Court in Ashok Chaddha (supra) was rendered in the context of Section 153A of the Act and in our view, the same is not applicable in the present case. This Court in several cases pertaining to proceedings under Section 147 has held that a notice under Section 143(2) is mandatory. [See: Alpine Electronics Asia (P.) Ltd. v. DGIT: 341 ITR 247 (Del), DIT v. Society for Worldwide Interbank Financial Telecommunication: 323 ITR 249 (Del), Pr. CIT v Shri Jai Shiv Shankar Traders Pvt. Ltd.: 282 CTR 435 (Del)and CIT v. Rajeev Verma: 336 ITR (All)]. It is also relevant to note that clause (b) of the proviso to Section 148(1) of the Act also specifically extends the period for issuance of notice under Section 143(2) of the Act.”

13. Consequently, and in light of the above, we find ourselves unable to sustain the submissions addressed by Mr. Agrawal. In the facts of our case, the failure to comply with Section 143(2) was conceded. The reassessment action would thus be liable to be quashed on this short ground alone.

14. We consequently allow the instant writ petitions and quash the impugned notices under Section 147/148 dated 30.03.2021 and 30.05.2022 as well as the orders of assessment dated 27.03.2022 and 26.07.2022.”

4. On the similar issue, the ITAT, Raipur in the case of Anil Kumar Parekh v. ITO (Raipur – Trib.)/ITA No. 194/RPR/2025, dated 28.07.2025 after relying on the aforesaid judgment has held and observed as follows:

“5. I have heard the Ld. Sr. DR and considered carefully all the material available on record. On perusal of the record, it is noted that the department has failed to produce any proof as regards the service of notice u/s.143(2) of the Act. It is settled legal position that the issuance of notice u/s.143(2) is sine-qua-non for framing of reassessment order or an order of assessment u/s.143(3) of the Act. Further, the A.O specifically states in his report that no details of its service are available in the system. I am of the considered view that failure to issue and serve notice by the department u/s. 143(2) of the Act renders the reassessment order invalid, bad in law and void ab initio.

6. The Ld. Sr. DR could not place on record any evidence/document to refute these facts already on record. The Ld. Sr. DR has relied on the findings of the A.O wherein though issuance of notice has been referred to, however as per admission of the department, there is no evidence regarding service of the same and without any service, issuance of notice is meaningless for the reason that the concerned assessee still does not know that in the case he is supposed to be ready regarding the proceedings and what defence he should prepare in his case which is essential with regard to principles of natural justice for providing fair and reasonable opportunity of hearing to every tax payer assessee.

7. At this stage, I find that Hon’ble Supreme Court in the case of ACIT v. Hotel Blue Moon, 321 ITR 362 (SC) has held that issuance of notice u/s. 143(2) of the Act is sine-qua-non for framing of an assessment u/s. 143(3) of the Act. In this case, reassessment has been completed u/s. 147 r.w.s. 144B of the Act but the ratio of the said judgment regarding non-service of notice u/s. 143(2) of the Act applies also to the facts of the assessee’s case. For the sake of clarity, the relevant observation of the Hon’ble Supreme Court is culled out as follows:

“If the Assessing Officer, for any reason repudiates the return filed by an assessee in response to notice under section 158BC(a) of the Income Tax Act, 1961 relating to a block assessment, the Assessing Officer must necessarily issue notice under section 143(2) of the Act within the time prescribed in the proviso to Section 143(2).

By making the issue of notice mandatory, section 158BC, dealing with block assessments, makes such notice the very foundation for jurisdiction. Such notice is required to be served on the person who is found to have undisclosed income.

Section 158BC provides for enquiry and assessment. After the return is filed, clause (b) of section 158BC provides that the Assessing Officer shall proceed to determine the undisclosed income of the block period in the manner laid down in section 158BB and “the provisions of section 142, sub-sections (2) and (3) of section 143, section 144 and section 145 shall, so far as may be, apply”. This indicates that this clause enables the Assessing Officer, after the return is filed, to complete the assessment under section 143(2) by following the procedure like issue of notice under section 143(2)/142. This does not pro-vide accepting the return as provided under section 143(1)(a) : the officer has to complete the assessment under section 143(3) only. If an assessment is to be completed under section 143(3) read with section 158BC, notice under section 143(2) should be issued within one year from the date of filing of the block return. Omission on the part of the assessing authority to issue notice under section 143(2) cannot be a procedural irregularity and is not curable. Therefore, the requirement of notice under section 143(2) cannot be dispensed with.”

8. Further, the Hon’ble High Court of Delhi in the case of Shaily Juneja v. ACIT, (Delhi)/[2025] 476 ITR 665 (Delhi) has dealt with the similar issue and held that issuance of notice u/s. 143(2) of the Act is mandatory in reassessment proceedings u/s. 147 of the Act. For the sake of completeness, the relevant observation of the aforesaid judgment are culled out as follows:

10. The aforesaid view came to be reiterated by the Court in Principal Commissioner of Income-Tax v. Dart Infrabuild Pvt Ltd5, as would be evident from the following observations which appear in that decision:-

“15.2 The absence of notice, under section 143(2), impregnates the proceedings with a jurisdictional defect and, hence, renders it invalid in the eyes of the law. This position is no longer res integra, as demonstrated by the observations made in Principal CIT v. Shri Jai Shiv Shankar Traders Pot. Ltd.1 (page 452 of 383 ITR):

“12. The narration of facts as noted above by the court makes it clear that no notice under section 143(2) of the Act was issued to the assessee after December 16, 2010, the date on which the assessee informed the Assessing Officer that the return originally filed should be treated as the return filed pursuant to the notice under section 148 of the Act.

13. In DIT v. Society for Worldwide Inter Bank Financial, Tele- 2023 SCC OnLine Del 7382 communications’, this court invalidated a reassessment proceeding after noting that the notice under section 143(2) of the Act was not issued to the assessee pursuant to the filing of the return. In other words, it was held mandatory to serve the notice under section 143(2) of the Act only after the return filed by the assessee is actually scrutinised by the Assessing Officer.

14. The interplay of sections 143(2) and 148 of the Act formed the subject matter of at least two decisions of the Allahabad High Court in CIT v. Rajeev Sharma2 it was held that a plain reading of section 148 of the Act reveals that within the statutory period specified therein, it shall be incumbent to send a notice under section 143(2) of the Act. It was observed (page 687): The provisions contained in subsection (2) of section 143 of the Act is mandatory and the Legislature in its wisdom by using the word “reason to believe” had cast a duty on the Assessing Officer to apply mind to the material on record and after being satisfied with regard to escaped liability, shall serve notice specifying particulars of such claim.

In view of the above, after receipt of return in response to notice under section 148, it shall be mandatory for the Assessing Officer to serve a notice under sub-section (2) of section 143 assigning reason therein.in absence of any notice issued under sub-section (2) of section 143 after receipt of fresh return submitted by the assessee in response to notice under section 148, the entire procedure adopted for escaped assessment, shall not be valid.’

15. In a subsequent judgment in CIT v. Salarpur Cold Storage (P.) Ltd.3, it was held as under:

“10. Section 292BB of the Act was inserted by the Finance Act, 2008 with effect from April 1, 2008. Section 292BB of the Act provides a deeming fiction. The deeming fiction is to the effect that once the assessee has appeared in any proceeding or co-operated in any enquiry relating to an assessment or reassessment, it shall be deemed that any notice under the provisions of the Act, which is required to be served on the assessee, has been duly served upon him in time in accordance with the provisions of the Act. The assessee is precluded from taking any objection in any proceeding or enquiry that the notice was (i) not served upon him; or (ii) not served upon him in time; or (iii) served upon him in an improper manner. In other words, once the deeming fiction comes into operation, the assessee is precluded from raising a challenge about the service of a notice, service within time or service in an improper manner.

The proviso to section 292BB of the Act, however, carves out an exception to the effect that the section shall not apply where the assessee has raised an objection before the completion of the assessment or reassessment. Section 292BB of the Act cannot obviate the requirement or complying with a jurisdictional condition. For the Assessing Officer to make an order of assessment under section 143(3) of the Act, it is necessary to issue a notice under section 143(2) of the Act and in the absence of a notice under section 143(2) of the Act, the assumption of jurisdiction itself would be invalid.’

16. In the same decision in Salarpur Cold Storage (P.) Ltd. (supra), the Allahabad High Court noticed that the decision of the Supreme Court in Asst. CIT v. Hotel Blue Moon’ where in relation to block assessment, the Supreme Court held that the requirement to issue notice under section 143(2) was mandatory. It was not ‘a procedural irregularity and the same is not curable and, therefore, the requirement of notice under section 143(2) cannot be dispensed with’.

17. The Madras High Court held likewise in Sapthagiri Finance and Investments v. ITO2. The facts of that case were that a notice under section 148 of the Act was issued to the assessee seeking to reopen the assessment for the assessment year 2000-01. However, the assessee did not file a return and therefore a notice was issued to it under section 142(1) of the Act. Pursuant thereto, the assessee appeared before the Assessing Officer and stated that the original return filed should be treated as a return filed in response to the notice under section 148 of the Act. The High Court observed that if thereafter, the Assessing Officer found that there were problems with the return which required explanation by the assessee then the Assessing Officer ought to have followed up with a notice under section 143(2) of the Act. It was observed that: “Merely because the matter was discussed with the assessee and the signature is affixed it does not mean the rest of the procedure of notice under section 143(2) of the Act was complied with or that on placing the objection the assessee had waived the notice for further processing of the reassessment proceedings. The fact that on the notice issued under section 143(2) of the Act, the assessee had placed its objection and reiterated its earlier return filed as one filed in response to the notice issued under section 148 of the Act and the Officer had also noted that the same would be considered for completing of assessment, would show that the Assessing Officer has the duty of issuing the notice under section 143(3) to lead on to the passing of the assessment. In the circumstances, with no notice issued under section 143(3) and there being no waiver, there is no justifiable ground to accept the view of the Tribunal that there was a waiver of right of notice to be issued under section 143(2) of the Act”

18. As already noticed, the decision of this court in CIT v. Vision Inc.1 proceeded on a different set of facts. In that case, there was a clear finding of the court that service of the notice had been effected on the assessee under section 143(2) of the Act. As already further noticed, the legal position regarding section 292BB has already been made explicit in the aforementioned decisions of the Allahabad High Court. That provision would apply in so far as failure of ‘service” of notice was concerned and not with regard to failure to „issue” notice. In other words, the failure of the Assessing Officer, in reassessment proceedings, to issue notice under section 143(2) of the Act, prior to finalising the reassessment order, cannot be condoned by referring to section 292BB of the Act.

19. The resultant position is that as far as the present case is concerned the failure by the Assessing Officer to issue a notice to the assessee under section 143(2) of the Act subsequent to December 26, 2010 when the assessee made a statement before the Assessing Officer to the effect that the original return filed should be treated as a return pursuant to a notice under section 148 of the Act, is fatal to the order of reassessment.” (emphasis is ours)”

11. It is also pertinent to note that the decision in Ashok Chaddha was also pressed into aid by the Revenue in Commissioner of Income-Tax v. Delhi Kalyan Samiti6. This becomes evident from a reading of Para 4.8 of that decision and where the submissions of the respondents therein came to be recorded as follows:-

“4.8 Mr. Dileep Shivpuri, learned Senior Standing counsel submitted that since the Assessee had failed to file its returns for the relevant AYs within the time prescribed in the notices issued under Section 148 of the Act, the said returns were invalid and were rightly ignored by the AO. He submitted that in the circumstances no notice under Section 143(2) of the Act was required to be issued to the Assessee. He further submitted that the present assessments were framed under Section 144(1)(b) of the Act – on account of failure on the part of an Assessee to comply with all terms of a notice issued under Section 142(1) of the Act or failure to comply with directions issued under Section 142(A) of the Act – and issuance of notice under Section 143(2) of the Act is not a necessary precondition for the same. He contended that the position would be no different even if the returns were filed in the regular course. Mr Dileep Shivpuri relied on the decision of this Court in Ashok Chaddha v. ITO: (2011) 337 ITR 399 (Delhi) in support of its contention that no notice under Section 143(2) was required to be issued.”

12. Having noticed the aforesaid contention, the Division Bench proceeded to hold as under:-

“9. It is now well established that if the AO does not accept the return filed by the Assessee on its face and he is required to issue a notice under Section 143(2) of the Act and provide an opportunity to the Assessee to produce the necessary material in support of his return. Mr Shivpuri had argued that a notice under Section 143(2) was required to be issued only in cases where the AO considers it necessary or expedient to do so and in cases where the Assessee had not filed its response to the notice under Section 142(1) it was not necessary for the AO to issue such notice under Section 143(2). In our view, this contention is bereft of any merits and completely ignores the scheme of the machinery provisions for assessment under the Act. It is now well settled by a number of decisions (See: Pr. CIT v. Silver Line and Anr.: 283 CTR 148 (Del), ACIT v. Hotel Blue Moon: 321 ITR 362 (SC)and CIT v. Pawan Gupta: 318 ITR 322 (Del)) that whenever the return filed by an Assessee is not accepted at its face, it is mandatory for the AO has to issue a notice under Section 143(2) of the Act for proceeding further. It is thus not open for the AO to not issue a notice under Section 143(2) of the Act and proceed directly under Section 144 of the Act by rejecting the return filed by the Assessee.

10. The decision of this Court in Ashok Chaddha (supra) was rendered in the context of Section 153A of the Act and in our view, the same is not applicable in the present case. This Court in several cases pertaining to proceedings under Section 147 has held that a notice under Section 143(2) is mandatory. [See: Alpine Electronics Asia (P.) Ltd. v. DGIT: 341 ITR 247 (Del), DIT v. Society for Worldwide Interbank Financial Telecommunication: 323 ITR 249 (Del), Pr. CIT v Shri Jai Shiv Shankar Traders Pvt. Ltd.: 282 CTR 435 (Del)and CIT v. Rajeev Verma: 336 ITR (All)]. It is also relevant to note that clause (b) of the proviso to Section 148(1) of the Act also specifically extends the period for issuance of notice under Section 143(2) of the Act.”

13. Consequently, and in light of the above, we find ourselves unable to sustain the submissions addressed by Mr. Agrawal. In the facts of our case, the failure to comply with Section 143(2) was conceded. The reassessment action would thus be liable to be quashed on this short ground alone.

14. We consequently allow the instant writ petitions and quash the impugned notices under Section 147/148 dated 30.03.2021 and 30.05.2022 as well as the orders of assessment dated 27.03.2022 and 26.07.2022.”

9. Respectfully following the aforesaid decisions on the same parity of reasoning, I hold that the reassessment framed by the A.O vide his order passed u/s.147 r.w.s 144B of the Act, dated 24.03.2022 without any service of notice u/s.143(2) of the Act to the assessee, is held to be invalid, arbitrary and bad in law, hence quashed.”

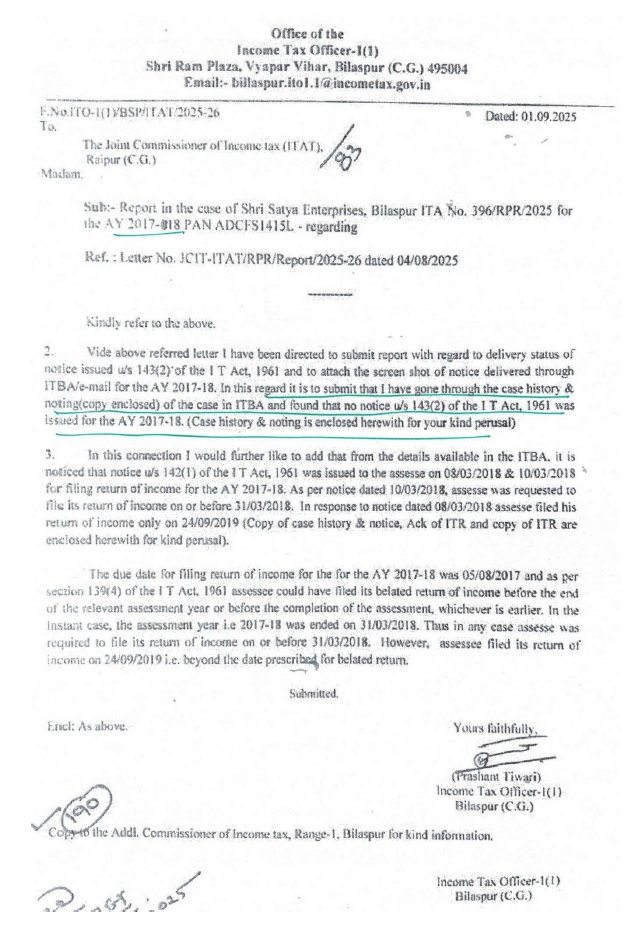

5. The Ld. Sr. DR has furnished a report from the jurisdictional A.O, wherein it is clearly evident that such notice u/s.143(2) of the Act was never issued to the assessee. For the sake of completeness, the said report of the A.O are extracted as follows:

6. Considering the aforesaid factual position and the judicial pronouncements that though assessment was completed u/s.144 of the Act in respect of the assessee, since the mandatory notice u/s. 143(2) of the Act was never issued to the assessee which makes the assessment vitiated, accordingly, such assessment framed u/s. 144 of the Act dated 24.11.2019 is held to be arbitrary, bad in law and void ab initio, hence quashed.

7. Since the assessment is quashed then all the other proceedings does not have any legal validity to be sustained. In other words, they are non-est as per law. As the legal issue has been answered in favour of the assessee therefore the grounds on merits etc. becomes academic only.

8. In the result, appeal of the assessee is allowed.