Solar Energy Society’s Voluntary Contributions Exempt; Not “Business Income” under Proviso to Sec 2(15)

Issue

Whether voluntary contributions received by a society engaged in the promotion of solar energy should be treated as taxable “membership fees” arising from commercial activity (invoking the proviso to Section 2(15)), or if they remain exempt charitable income under Sections 11 and 12.

Facts

Assessee: A society engaged in developing solar energy, making it affordable, and ensuring the growth of the solar industry (General Public Utility).

The Receipt: The society received amounts classified as “voluntary contributions” from various donors.

AO’s Action: The Assessing Officer (AO) treated these receipts as “annual membership fees,” arguing that the society’s activities were in the nature of trade, commerce, or business. Consequently, the AO invoked the Proviso to Section 2(15) to deny the exemption and taxed the receipts as business income.

Assessee’s Defense:

Variable Amounts: The donations were of different amounts, not a fixed fee, which distinguishes them from standard membership fees.

Specific Purpose: Details regarding the specific charitable purposes of the donations were provided.

Past Precedent: In earlier years, identical donations for the same objects were granted exemption under Sections 11, 12, and 80G.

Decision

Donation vs. Fee: The Tribunal found that the amounts contributed were voluntary and variable, not fixed fees for specific services. Therefore, characterizing them as “membership fees” or commercial receipts was factually incorrect.

Proviso Not Applicable: The proviso to Section 2(15) applies only when a charitable entity engages in trade, commerce, or business for a fee or cess. Since the assessee was receiving voluntary donations to promote a public cause (solar energy) without a commercial quid pro quo, the proviso was not attracted.

Consistency: Citing the principle of consistency, the Tribunal noted that the Revenue could not take a different view on the same facts that were accepted in earlier assessment years.

Ruling: The addition was deleted, and the society was held eligible for exemption under Sections 11 and 12.

Key Takeaways

“Quid Pro Quo” Test: For an activity to be hit by the Proviso to Section 2(15), there must be a commercial exchange (service for a fee). Voluntary contributions, even from industry players, do not automatically become “business income” unless they are directly linked to specific commercial benefits.

Environment as Charity: Promoting renewable energy falls under “preservation of environment” (Section 2(15) specific clause) or “advancement of any other object of general public utility.”

[Assessment year 2017-18]

(1) To arrange seminars, workshops, group discussions, exhibitions etc. on the subjects of mutual interest.

(ii) To work in close cooperation and coordination with the Government of India as also State Governments to achieve national goals for solar energy.

(iii) To provide a forum fchange of ideas and experience gained.

(iv) To generate white papers, research papers and studies on various issues affecting the solar industry

(v) To render advice and give suggestions to the policy makers in a constructive manner for a balanced and sustainable growth of the industry -on the lines of CII, FICCI and similar national industry associations

(vi) To help the Government and other institutions in carrying out research and demonstration of new technologies and products in the field of solar energy.

(vii) To interact with the central and state regulators and similar bodies such as CERC, CEA, state nodal agencies etc. for challenges effecting the solar industry.

(viii) To collaborate with similar international bodies and undertake activities of mutual interest.

(ix) To take up issues of immediate national interest including RPO enforcement, bankability of RECs, promoting indigenization in a sustainable manner, priority sector lending by nationalized banks and other financial institutions, availability of finance at internationally competitive rates and help in creation of dedicated financial institutions for supporting the solar energy related industry in India.

(x) To undertake all activities that may generate funds, create awareness about, lead to adaptation of, help in generation of new ideas and promotion of solar energy in general and in furtherance of the objects of the Public Trust.

(xi) To do all such things as the Trustees may decide from time to time for welfare of the Public Trust and in pursuance of the above objects of the Public Trust.”

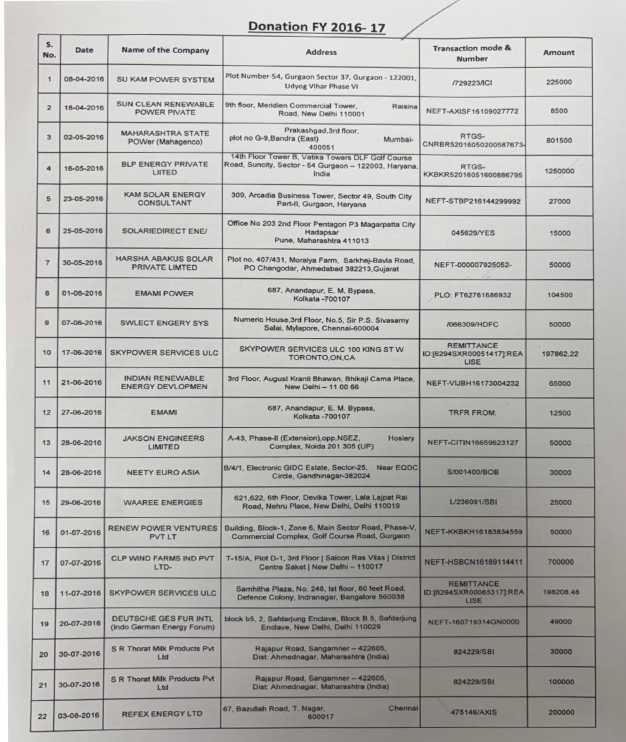

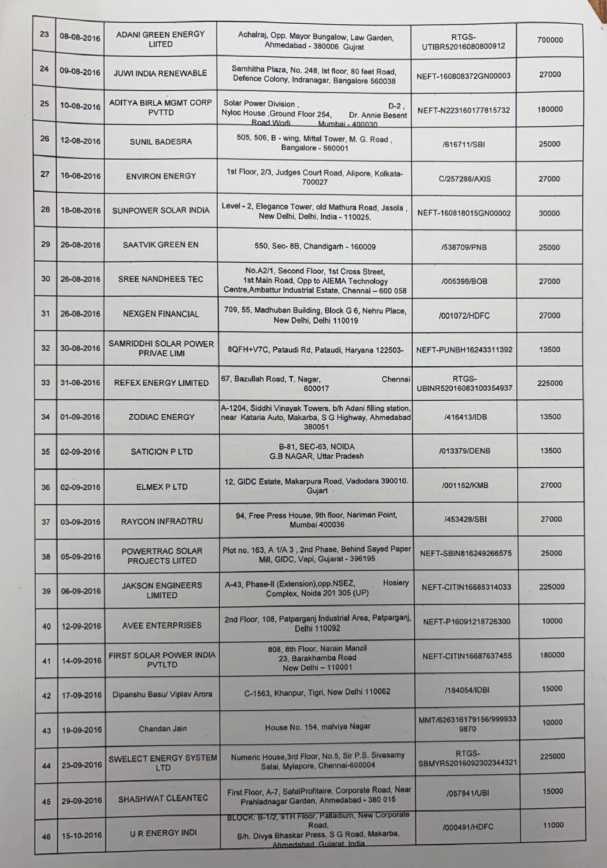

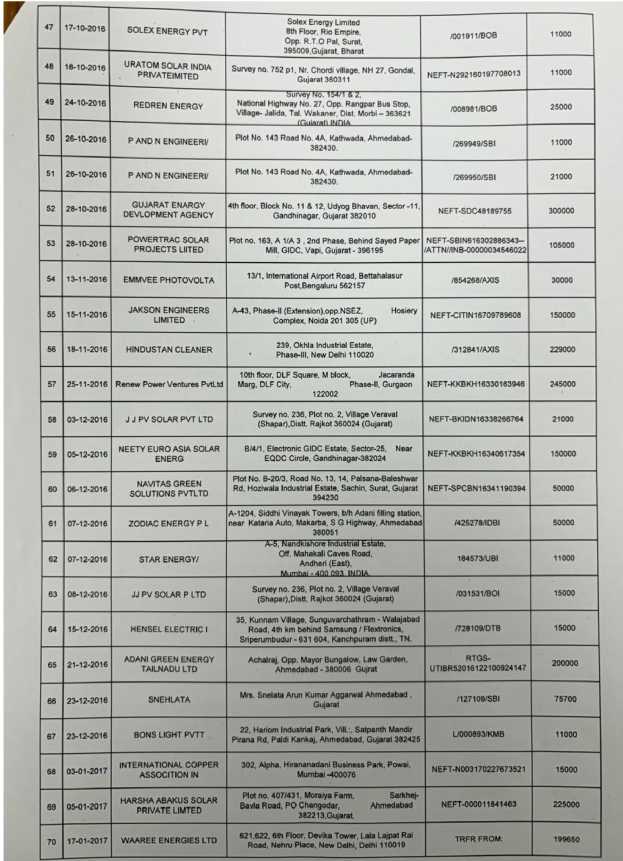

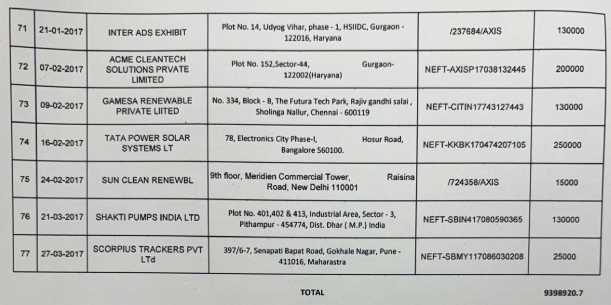

| (i) | For the Assessment Year 2017-18, the appellant filed its return of income declaring Nil income. During the relevant year, the trust received 78,63,150 as voluntary contributions, which were incorrectly classified by the Assessing Officer (AO) as “annual membership fees” without proper factual analysis. |

| (ii) | It is submitted that the amount of 78,63,150 consists of donations from multiple entities, as shown in the ledger. These contributions vary widely in quantum and timing. If these had been uniform membership fees, as alleged by the AO, the amount received from each contributor would have been identical or fixed by policy. However, the ledger clearly reveals that different donors contributed unequal and unstandardized amounts, which is inconsistent with the nature of a fee and confirms the voluntary and donation-based character of the receipts. |

| (iii) | Furthermore, no specific service or benefit was extended to any contributor in exchange for the donation. The funds were collectively utilized for charitable activities such as seminars, capacity-building, and solar energy awareness. Hence, there was no element of quid pro quo or commercial transaction. |

| (iv) | The AO has, without basis, presumed these receipts to be commercial in nature based solely on a few companies having mistakenly deducted TDS under section 194C. However, this deduction was done unilaterally by the payers, and it cannot alter the true nature of receipts in the hands of the appellant. |

| (v) | Accordingly, the classification of donations as “membership fees” is factually incorrect and legally untenable. The denial of exemption under sections 11 and 12 and the application of the proviso to section 2(15) are therefore unjustified: |

| (vi) | The donation ledger clearly shows varied amounts received from different entities, disproving the AO’s assumption of uniform membership fees. If these were fixed membership dues, all members would have paid the same amount. No contractual obligation, service agreement, or quid pro quo existed between the trust and the contributors. The contributions were voluntary in nature, with no service rendered in return. The funds were applied towards organizing awareness seminars, policy outreach, and renewable energy promotion, which fall squarely within the trust’s charitable objectives. The AO’s reliance on labels or mistaken TDS deductions by donors is misplaced; the substance and intent of the transaction matter, not the terminology or form used. |

| (a) | In the case of Commissioner of Income-tax-II, Thane v. Mumbai Metropolitan Regional Iron & Steel Market Committee ((1991) 192 ITR 290 (Bom.)], the High Court of Bombay held that Even if receipts resemble commercial form, the dominant intention and use of funds determine their nature. Voluntary contributions toward a charitable cause cannot be taxed as business income without proof of service rendered. |

| (c) | In the case of Commissioner of Income-tax (Exemptions) v. Ahmedabad Urban Development Authority [(2022) 448 ITR 304 (SC)], the Hon’ble Supreme Court of India held that Even if revenue is generated, the dominant purpose being charitable ensures exemption under section 11. |