ORDER

Madhusudan Sawdia, Accountant Member. – This appeal is filed by Nippon Koei Co. Limited (“the assessee”), feeling aggrieved by the order passed by the Learned Assistant Director of Income Tax (Int. Taxation)-2, Hyderabad (“Ld. AO”), u/s 143(3) r.w.s. 144C(13) of the Income Tax Act (” the Act”),dated 31/10/2023 for the A.Y. 2021-22.

2. The assessee has raised the following grounds of appeal:

| 1. | | Wrongly disallowing interest paid on delay in depositing TDS Rs 210,265 on ground that it is not compensatory in nature |

| 2. | | Wrongly disallowing payment to Mr. Antony Burchell – an independent international Freelancer on the ground that his services and terms of engagement were akin to employment and therefore TDS ought to have been deducted therefrom when in fact he was a independent consultant per details provided by the assessee |

| 3. | | Wrongly disallowing Rs 349,255 being miscellaneous payments made to staff in Head office Japan on ground of non evidence of the payment proofeven though same was provided to Hon’ble DRP |

| 4. | | Wrongly disallowing debit of Rs 13,76,205 credited in project office’s books for bank Guarantee and performance Bonds arranged by Nk’s head office Tokyo from their global bankers situated in Tokyo on the ground that the same is “income” in hands of head office Tokyo and TDS should have been deducted there from. |

| 5. | | Dropping of penalty proceedings u/s 270 A of the Income tax Act – on the ground that of undisclosed income Our prayer thereto |

3. The brief facts of the case are that the assessee is a foreign company engaged in the business of engineering, consultancy, and electric power. The assessee filed its return of income for the Assessment Year 2021-22 declaring total income of Rs.6,27,12,098/- for its branch office in India. The case of the assessee was selected for scrutiny and accordingly, notice under section 143(2) of the Income Tax Act, 1961 (“the Act”) was issued on 27.06.2022. As the assessee was an eligible assessee within the meaning of clause (b) of sub-section (15) of section 144C of the Act, the Learned Assessing Officer (“Ld. AO”) passed a draft assessment order under section 144C(1) of the Act on 31.12.2022 proposing a total addition of Rs.3,47,02,323/-.

4. Against the draft order of the Ld. AO, the assessee filed its objections before the Learned Dispute Resolution Panel (“Ld. DRP”). The Ld. DRP issued its directions under section 144C(5) of the Act on 28.09.2023. Pursuant thereto, the Ld. AO passed the final assessment order under section 143(3) read with section 144C(13) of the Act on 31.10.2023, making the additions on account of Disallowance of interest paid under section 201(1A) of the Act of Rs.2,10,265/-, Disallowance of lead role expenditure of Rs.19,58,509/-, Disallowance of payment made to M/s. Antony Burchell of Rs. 3,08,08,089/-, Disallowance under section 44DA of the Act of Rs. 3,49,255/- and Disallowance under section 40(a) of the Act of Rs. 13,76,205/-. Accordingly, the Ld. AO made a total addition of Rs. 3,47,02,323/- and assessed the total income of the assessee at Rs.9,74,14,421/-.

5. Aggrieved with the final order of the Ld. AO, the assessee preferred an appeal before this Tribunal. The Learned Authorized Representative (“Ld. AR”) submitted that the Ground No.1 of the assessee pertains to disallowance of Rs.2,10,265/-made by the Ld. AO on account of interest paid under section 201(1A) of the Act for delay in deposit of tax deducted at source (“TDS”). The Ld. AR contended that such interest is compensatory in nature and not penal, and therefore allowable as a business expenditure under section 37(1) of the Act. In support, the Ld. AR placed reliance on the decision of this Tribunal in the case of Trinity Infraventures Ltd. v. ACIT [ITAppeal No.403(Hyd) of 2021, dated 25-8-2022], wherein the Tribunal deleted a similar disallowance made by the Ld. AO on account of interest paid for delayed deposit of TDS. Accordingly, the Ld. AR pleaded for deletion of the disallowance of Rs.2,10,265/-.

6. Per contra, the Learned Departmental Representative (“Ld. DR”) relied on the findings of the Ld. AO and submitted that the interest paid under section 201(1A) of the Act arises from failure to deposit TDS within the prescribed time and cannot be treated as expenditure incurred wholly and exclusively for business purposes. Accordingly, the Ld. DR prayed for upholding of the disallowance made by the Ld. AO.

7. We have carefully considered the rival submissions and perused the material available on record. The issue under consideration relates to the allowability of interest paid under section 201(1A) of the Act as a business expenditure. We have gone through the decision of this Tribunal in the case of Trinity Infraventures Ltd. (supra), as relied upon by the Ld. AR. On perusal of the same, we found that the decision of the Hon’ble Madras High Court in the case of CIT v. Chennai Properties & Investment Ltd. /[1999] 239 ITR 435 (Madras) was not considered by the Tribunal while passing that order. We have gone through the relevant portion of the order of the Hon’ble Madras High Court in the case of Chennai Properties & Investment Ltd (supra) which is to the following effect:

14. As already noticed, the payment of interest which takes colour from the nature of the levy with reference to which such interest is paid and the tax required to be paid but not paid in time, which rendered (sic) the assessee liable for payment of interest, was in the nature of a direct tax and in settlement of the income-tax payable under the Income-tax Ad The interest paid under section 201(1 A), therefore, would not assume the character of business expenditure and cannot be regarded as a compensatory payment as contended by the learned counsel for the assessee.

15. The counsel for the assessee in support of his submission that the interest paid by the assessee was merely compensatory in character besides relying on the case of Mahaiakshmi Sugar Mills Co. (supra) also relied on the decisions of the Apex Court in the cases of Prakash Cotton Mills (P.) Ltd. v. C/T[1993] 201ITR 684 / ; Malwa Vanaspati & Chemical Co. v. CIT] 1997] 225 ITR 383 and CIT v. Ahmedabad Cotton Mfg. Co. Ltd. v. CIT] 1994] 205 ITR 163. In all those cases, the Court was concerned with an indirect tax payable by the assessee in the course of its business and admissible as business expenditure. Further, liability for interest which had been incurred by the assessee therein was regarded as compensatory in nature and allowable as business expenditure.

16. The ratio of those cases is not applicable here. Income-tax is not allowable as business expenditure. The amount deducted as tax is not an item of expenditure. The amount not deducted and remitted has the character of tax and has to be remitted to the State and cannot be utilised by the assessee for its own business. The Supreme Court in the case of Bharat Commerce & Industries Ltd. (supra) rejected the argument advanced by the assessee that retention of money payable to the State as tax or income-tax would augment the capital of the assessee and the expenditure incurred, namely, interest paid for the period of such retention, would assume the character of business expenditure. The Court held that an assessee could not possibly claim that it was borrowing from the State the amounts payable by it as income-tax and utilising the same as capitalization in its business, to contend that the interest paid for the period of delay in payment of tax amounted to a business expenditure.

17. The question referred to us, therefore, is required to be and is answered in the negative, in favour of the revenue and against the assessee. The revenue shall be entitled to costs in the sum of Rs. 1,000.

8. On perusal of the above, we find that in Chennai Properties & Investment Ltd. (supra), the Hon’ble Madras High Court categorically held that interest paid on account of delayed remittance of TDS cannot be treated as business expenditure under section 37(1) of the Act and cannot be regarded as a compensatory payment. Therefore, following the binding judicial precedent of the Hon’ble Madras High Court, we hold that the interest paid under section 201(1A) of the Act is not allowable as a deduction under section 37(1) of the Act as business expenditure. Accordingly, we find no infirmity in the order of the Ld. AO in disallowing the sum of Rs.2,10,265/-. Consequently, Ground No.1 raised by the assessee stands dismissed.

9. Ground No. 2 of the assessee relates to disallowance of Rs.3,08,08,089/- under Section 40(a)(i). In this regard, the Ld. AR submitted that the assessee is engaged in providing consultancy services to Chennai Metro Rail Limited (“CMRL”) in connection with Chennai Metro Rail Project Phase-2. Since the assessee itself did not have the requisite expertise for carrying out certain technical functions, it engaged Mr. Anthony Burchell (“Mr. Tony”), an international expert, as an independent freelance consultant. The Ld. AR submitted that during the year under consideration, the assessee has made payment of Rs.3,08,08,089/- /- to Mr. Tony on account of the consultancy charges. However, the Ld. AO has treated the same as salary paid to Mr. Tony. As there was no TDS made by the assessee under section 192 of the Act, on the said payment, the Ld. AO disallowed the same under section 40(a)(i) of the Act. It was further submitted that the nature of services rendered by Mr. Tony is purely consultancy and that the assessee has discharged GST under Reverse Charge Mechanism (RCM) on such payments, which would arise only in the case of procurement of consultancy services, and not in the case of salary. Therefore, according to the Ld. AR, the GST characterization supports the consultancy nature of the arrangement. The Ld. AR also submitted that Mr. Tony issued invoices to the assessee for the consultancy services rendered. Such invoicing would never arise in the case of an employeremployee relationship. The payments were in the nature of professional fees and were not salary payments. Hence, TDS was not deductible under section 192 of the Act. It was also brought to our notice that for the immediately preceding assessment year, the Tribunal had restored the issue to the file of the Ld. AO to examine the nature of the services rendered in the light of GST payments. Therefore, the Ld. AR submitted that, following the principle of consistency, the present matter also requires similar treatment.

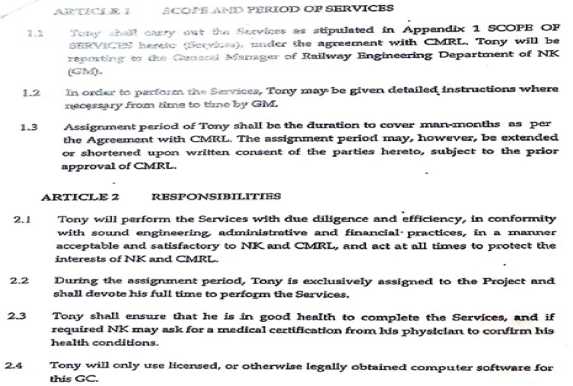

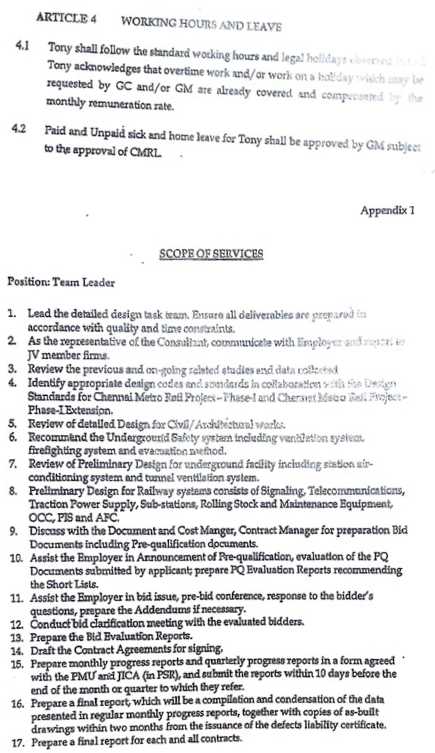

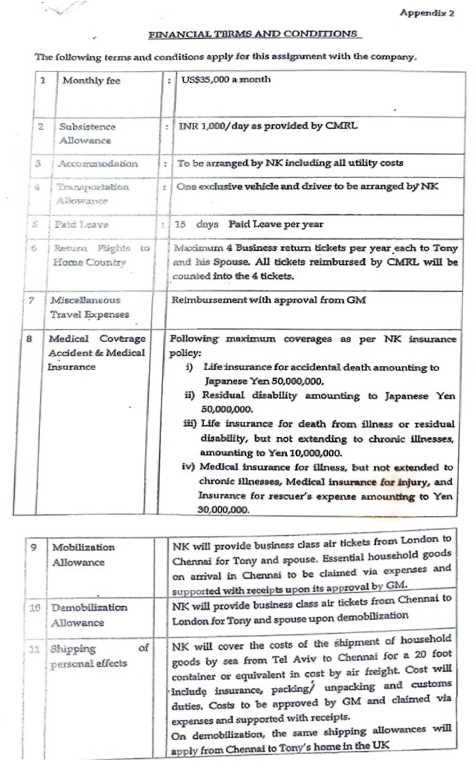

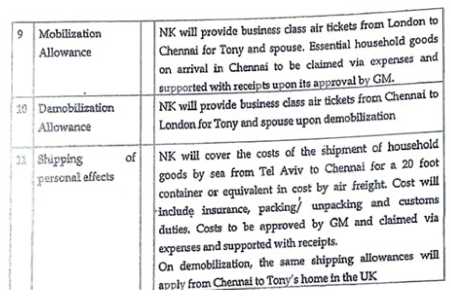

10. Per contra, the Ld. DR strongly supported the order of the Ld. AO and submitted that the agreement between the assessee and Mr. Tony, as examined by the Ld. AO, clearly establishes an employer-employee relationship. The Ld. DR invited our attention to Article 1, Article 2, Article 4, Appendix-1 (Scope of Services), and Appendix -2 (Financial Terms & Conditions) of the agreement of the assessee with Mr. Tony (page nos. 281 to 291 of the paper book), where it is specifically mentioned that:

| a. | | Mr. Tony shall report to the General Manager of Railway Engineering Department of the assessee (“GM”) (Article-1). |

| b. | | He shall receive instructions from the GM from time to time (Article-1). |

| c. | | He is exclusively assigned to the assessee’s project and shall devote his full time to the services (Article-2). |

| d. | | He is entitled to paid and unpaid leave, subject to approval from the GM (Article-4). |

| e. | | He is engaged as Team Leader of the assessee’s Design Task Team, which is part of the assessee’s organizational framework (Appendix-1). |

| f. | | At para no. 2, 10 and 11 of Appendix-1, the term “employer” has been used in the context of the assessee. |

| g. | | He shall be paid monthly fees of US$ 35,000 and shall be allowed 15 days paid leave per year (Appendix-2). |

10 .1 The Ld. DR emphasized that exclusive full-time engagement, reporting hierarchy, leave sanction process, and monthly payment structure are characteristics of a typical employer-employee arrangement. The Ld. DR also pointed out that Mr. Tony was engaged continuously for the entire year and also during the preceding year, which is not consistent with a freelance consultancy model. The use of term “employer” at Appendix-1 in the context of the assessee further strengthens the contention of the Revenue that Mr. Tony is an employee of the assessee. The Ld. DR therefore submitted that the payments made to Mr. Tony are salary, attracting TDS under section 192 of the Act, and since the assessee has failed to deduct tax, the disallowance under section 40(a)(i) of the Act has rightly been made and should be upheld.

11. In the rejoinder, the Ld. AR also clarified, by referring to the confirmation placed at page no. 395 of the paper book, that the term ’employer’ used in certain correspondences referred to CMRL and not to the assessee, and therefore the reliance placed by the Ld. DR on such terminology is misplaced. Thus, the Ld. AR prayed that the disallowance made by the Ld. AO under section 40(a)(i) of the Act may be deleted.

12. We have considered the rival submissions and perused the material available on record. While we note the clarification that the term “employer” was used in the context of CMRL and not the assessee, the decisive issue is not terminology, but the substance of the working relationship evidenced from the contractual terms and actual conduct. We have gone through Article 1, Article 2, Article 4, Appendix-1 (Scope of Services), and Appendix-2 (Financial Terms & Conditions) of the agreement of the assessee with Mr. Tony (page nos. 281 to 291 of the paper book), which is to the following effect:

12.1 On careful examination of the relevant clauses of the agreement, we find the following features:

| a. | | Mr. Tony shall report to the General Manager of Railway Engineering Department of the assessee (“GM”) (Article-1). |

| b. | | He shall receive instructions from the GM from time to time (Article-1). |

| c. | | He is exclusively assigned to the assessee’s project and shall devote his full time to the services (Article-2). |

| d. | | He is entitled to paid and unpaid leave, subject to approval from the GM (Article-4). |

| e. | | He is engaged as Team Leader of the assessee’s Design Task Team, which is part of the assessee’s organizational framework (Appendix-1). |

| f. | | At para no. 2, 10 and 11 of Appendix-1, the term “employer” has been used in the context of the assessee. |

| g. | | He shall be paid monthly fees of US$ 35,000 and shall be allowed 15 days paid leave per year (Appendix-2). |

12 .2 These attributes fundamentally align with an employeremployee relationship rather than that of an independent consultant. The payment of GST under RCM does not alter this conclusion, as GST classification cannot determine the nature of income for the purpose of the Act. Therefore, in our considered view, the payment made to Mr. Tony is to be treated as salary, attracting TDS under section 192 of the Act. Since no TDS was deducted, the disallowance made by the Ld. AO under section 40(a)(i) is upheld. Accordingly, Ground No. 2 of the assessee is dismissed.

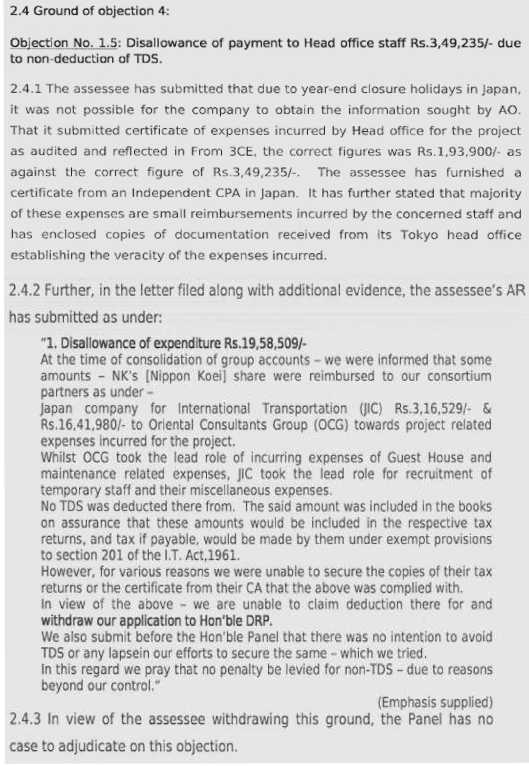

13. The Ground No.3 of the assessee pertains to the addition of Rs.3,49,255/- made by the Ld. AO on account of disallowance of certain expenses under section 44DA of the Act. It was submitted that these expenses represent small amounts incurred towards reimbursement of expenses incurred by the staff of the Head Office located in Japan. The Ld. AR submitted that though the assessee could not produce the necessary supporting evidence before the Ld. AO during the assessment proceedings, the same was duly furnished before the Ld. DRP along with explanations. The Ld. AR invited our attention to para nos. 2.4 to para no. 2.4.3 of the order of the Ld. DRP, wherein the relevant factual details were recorded. It was further submitted that although the Ld. DRP, in para no. 2.4.1 of its order, noted the factual position and the evidences furnished by the assessee, in the subsequent paragraphs, the Ld. DRP discussed certain unrelated issues and omitted to adjudicate this specific ground. Therefore, the Ld. AR prayed that the matter may be restored to the file of the Ld. AO for reconsideration of the issue afresh, after examining the evidences already produced before the Ld. DRP.

14. Per contra, the Ld. DR fairly accepted that there was no specific adjudication by the Ld. DRP on this issue and submitted that the issue may be remanded to the file of the Ld. AO for fresh adjudication.

15. We have carefully considered the rival submissions and perused the material available on record. We have gone through para nos. 2.4 to 2.4.3 of the Ld. DRP’s directions, which is to the following effect:

15 .1 On perusal of the above, we find that although the relevant facts and explanations were noted, there is no clear finding or adjudication given by the Ld. DRP on the disallowance made by the Ld. AO under section 44DA of the Act. Therefore, considering these facts and in the interest of justice, we deem it appropriate to set aside this issue to the file of the Ld. AO with a direction to re-adjudicate the matter afresh, after affording due opportunity of being heard to the assessee. The assessee shall be at liberty to file all necessary supporting evidences and documents, including those already submitted before the Ld. DRP, to substantiate its claim. Accordingly, Ground No.3 of the assessee is allowed for statistical purposes.

16. The issue involved in ground no.4 pertains to disallowance of Rs.13,76,205/- made under section 40(a) of the Act towards performance bond guarantee and bank guarantee charges. The Ld. AR submitted that the said expenditure was incurred by Head Office (“HO”) in Japan on behalf of the branch office in India towards charges paid to a lender in Japan against funds availed by the assessee in India, and subsequently the assessee reimbursed the same to its HO in Japan. It was further submitted that such payments are not in the nature of commission or brokerage to attract the provisions of section 194H of the Act, as there exists no principal-agent relationship between the assessee and the bank. In support of this contention, the Ld. AR relied on the decision of the Coordinate Bench of the Tribunal in the case of Navnirmaan Highway Project (P.) Ltd. v. DCIT [IT Appeal No.117(Delhi) of 2017, dated 03-09-2019), wherein it was held that when a bank issues a bank guarantee on behalf of an assessee, the relationship between the bank and the assessee is not that of a principal and agent. Therefore, the provisions of section 194H of the Act are not attractive in such cases. Accordingly, the Ld. AR prayed for deletion of Rs.13,76,205/-made under section 40(a) of the Act.

17. Per contra, the Ld. DR supported the order of the Ld. AO/DRP, contending that the assessee was required to deduct tax at source under section 194H of the Act and failure to do so warranted disallowance under section 40(a) of the Act. Accordingly, the Ld. DR prayed for upholding of the deletion of Rs.13,76,205/- made by the Ld. AO.

18. We have carefully considered the rival submissions and perused the material available on record. We find merit in the contention of the Ld. AR. The issue stands squarely covered by the decision of the Coordinate Bench of the Tribunal in the case of Navnirmaan Highway Project Pvt. Ltd. (supra). In this regard, we have gone through para no.7 of the order of the Coordinate Bench of the Tribunal in the case of Navnirmaan Highway Project Pvt. Ltd. (supra), which is to the following effect:

7. So, following the decision rendered by the coordinate Bench of the Tribunal, when the bank has issued bank guarantee on behalf of the assessee there is no principal — agent relationship between the bank and the assessee which is a mandatory condition for invoking the provisions contained uZs 19411 and in these circumstances, the assessee was not liable to deduct tax at source u/s 194H from payment of bank guarantee commission to the bank. Moreover, bank guarantee commission also partakes the character of interest u/s 2(28 A) of the Act and as such, exemption provided u/s 194A(3)(iii) is available to the assessee qua such payment. So, we are of the considered viewr that the Id. C1T (A) has erred in not following the decision rendered by the coordinate Bench of the Tribunal in Kotak Securities Ltd. (supra) on the ground that the decision of Kotak Securities Ltd. (supra) is not applicable having been pronounced before the issue of Notification No.56/2012 dated 31.12.2012 because ordinarily any provision of the statute has to be read having prospective effect and not having retrospective effect unless it is specifically provided. So, when there is no principal — agent relationship between the bank and the assessee, deduction of tax at source on commission or brokerage is not required for. Consequently, addition made by the AO and confirmed by the Id. C1T (A) is ordered to be deleted, thus the appeal filed by the assessee is hereby allowed.

18 .1 On perusal of the above, we find that the Tribunal has categorically held that no TDS is deductible under section 194H of the Act on bank guarantee charges as there is no principal-agent relationship between the bank and the assessee. Therefore, respectfully following the said judicial precedent, we hold that the payment made by the assessee towards performance bond guarantee and bank guarantee charges to the Bank are not in the nature of commission or brokerage to attract the provisions of section 194H of the Act, as there exists no principal-agent relationship between the assessee and the bank. Therefore, we hold that the disallowance made by the Ld. AO under section 40(a) of the Act is unsustainable. Hence, we direct the Ld. AO to delete the disallowance of Rs.13,76,205/- made under section 40(a) of the Act. Accordingly, Ground No.4 of the assessee is allowed for statistical purposes.

19. Ground No.5 raised by the assessee is in respect of initiation of penalty proceedings by the Ld. AO under section 270A of the Act. The initiation of penalty proceedings is only a consequential and preliminary step, and therefore, the ground raised by the assessee at this stage is premature. It is well settled that no appeal lies against mere initiation of penalty proceedings, as the cause of action would arise only when a penalty order is actually passed under section 270A of the Act. Accordingly, this ground of appeal does not survive for adjudication at this stage. Therefore, we hold that Ground No.5 raised by the assessee is premature and is dismissed as infructuous.

20. In the result, the appeal of the assessee is partly allowed for statistical purposes.