ORDER

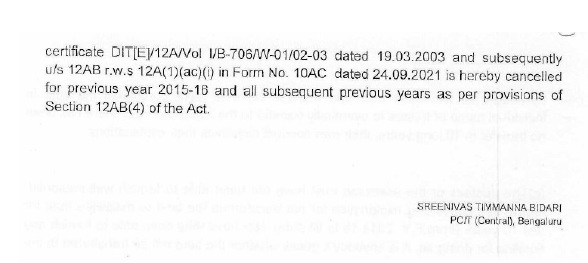

Prashant Maharishi, Vice President.- These are 4 appeals filed by M/S. Rukmini Educational Charitable Trust (the assessee/appellant) for the assessment years 2015-16, 2016-17, 2019-20 & 2022-23 against the order passed u/s. 12AB(4)(ii) of the Income-tax Act, 1961 [the Act] by The Principal Commissioner of Income Tax (Central), Bengaluru [ld. PCIT] on 30.9.2024 cancelling the registration granted to the assessee u/s 12 AA of the Income-Tax Act.

2. At the request of the assessee, we take the lead appeal for AY 2015-16 in ITA No. 2106/Bang/2024.

3. The brief facts of the case show that assessee, charitable Trust was established in 2003 and registration was granted u/s. 12AA of the Act on 19.3.2003 and subsequently u/s. 12AB on 24.9.2021. The original name of the trust was Bheemaneni Educational System Trust. The main objects of the trust of educational activities are as under:-

| “(a) | | To promote establish and conduct activities in the fields of education, literacy, science, technology, fine arts, tourism, environmental science, adventure culture, social, medical public health and/ or any other service activities to promote all round development of the general public and of the nation. |

| (b) | | To this end establish, promote, maintain manage, takeover and / or render assistance to schools, colleges, institutions, hospitals, research establishments in the areas of medicine, engineering, science & technology, social sciences, literature, entrepreneurial units, and such other institutions for the benefit of all sections of people without any discrimination of caste, creed, race or religion. |

| (c) | | To assist, promote, establish, run, takeover and or manage orphanage, rescue and/ or half-way homes for destitute, aged and the inform and/or senior citizens without discrimination of caste, creed, race, religion, status or standing. |

| (d) | | To give out grants, scholarships, stipends, rewards, awards, certificates, financial and/ or any other help in cash or kind in furtherance of the object of the trust.” |

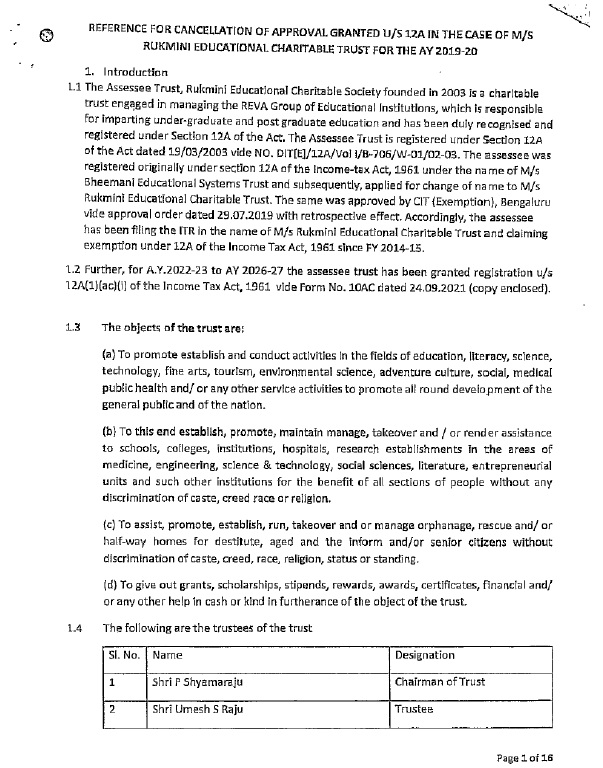

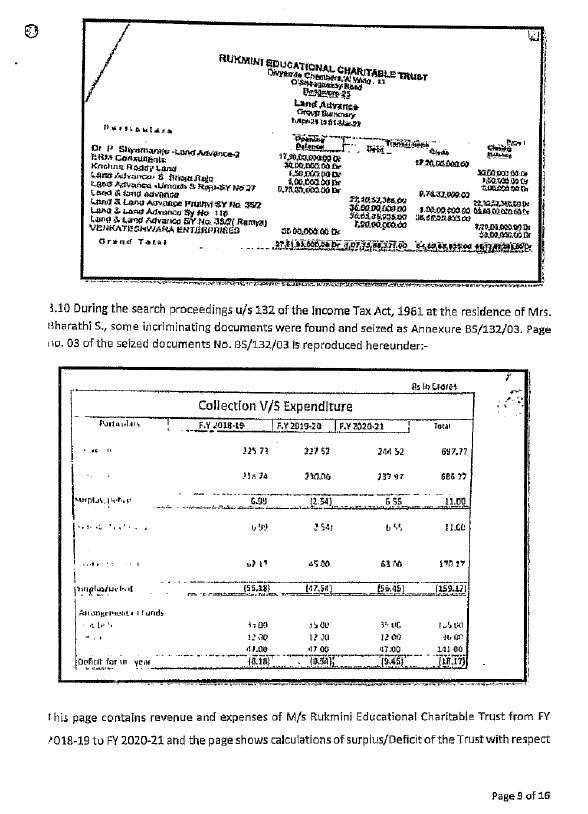

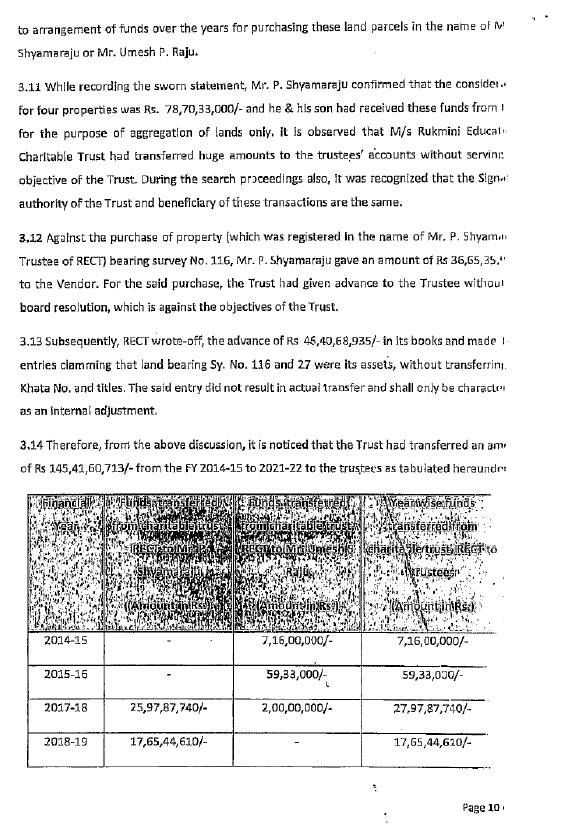

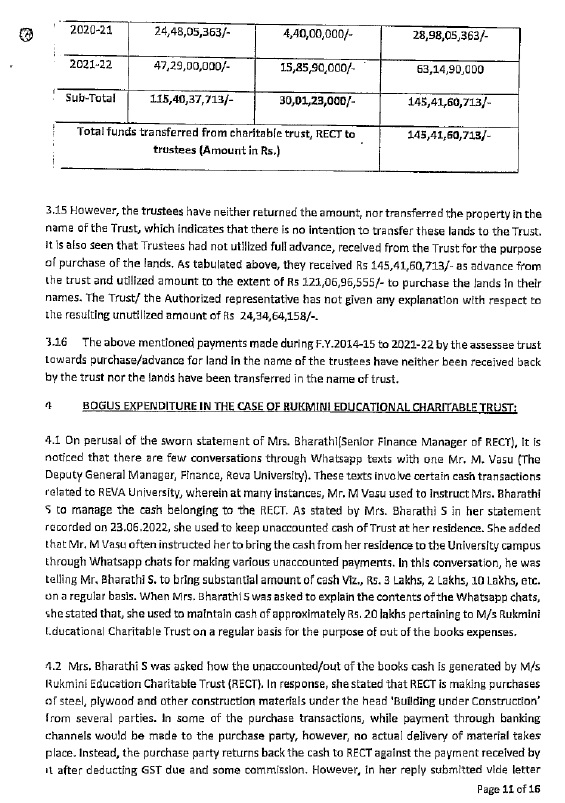

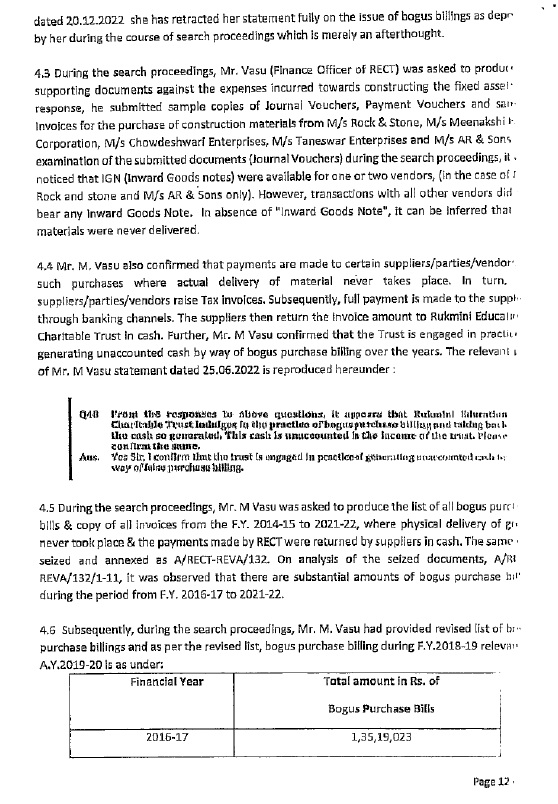

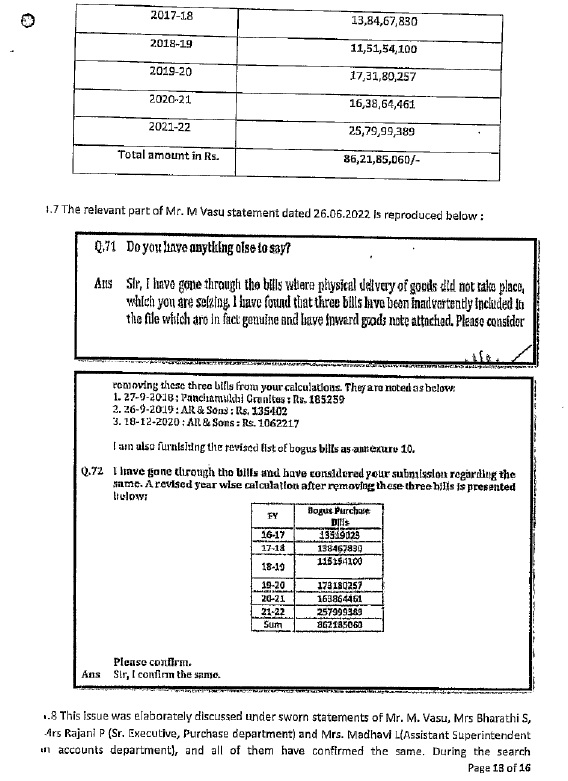

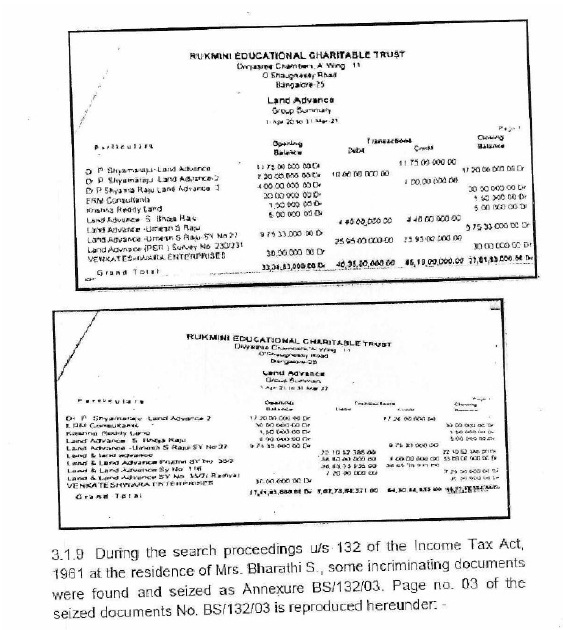

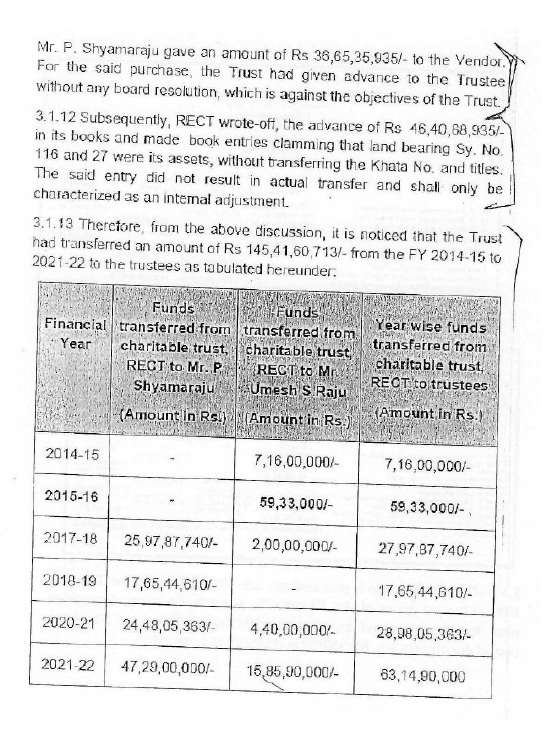

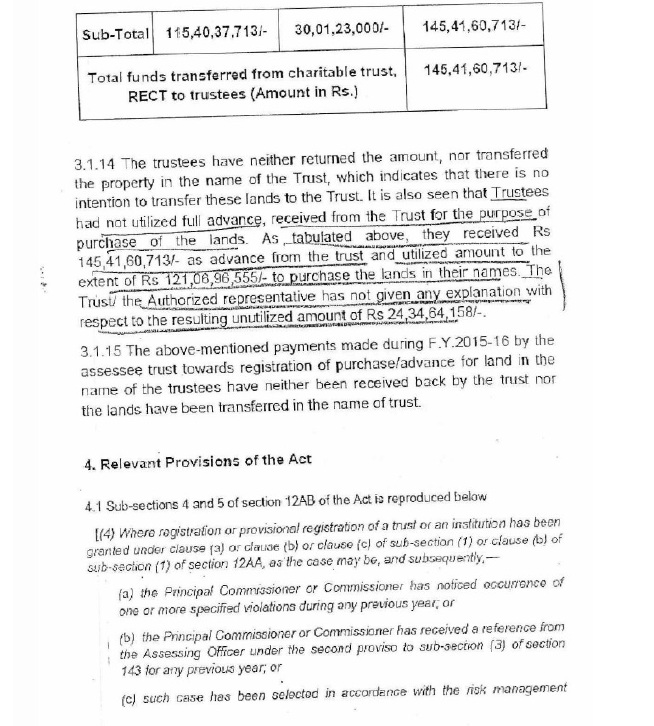

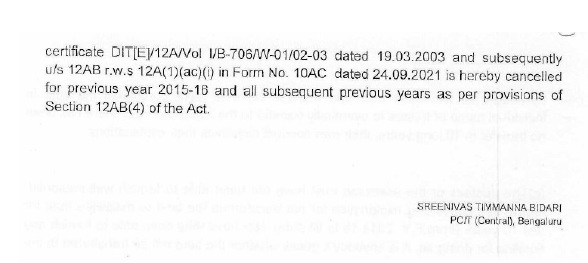

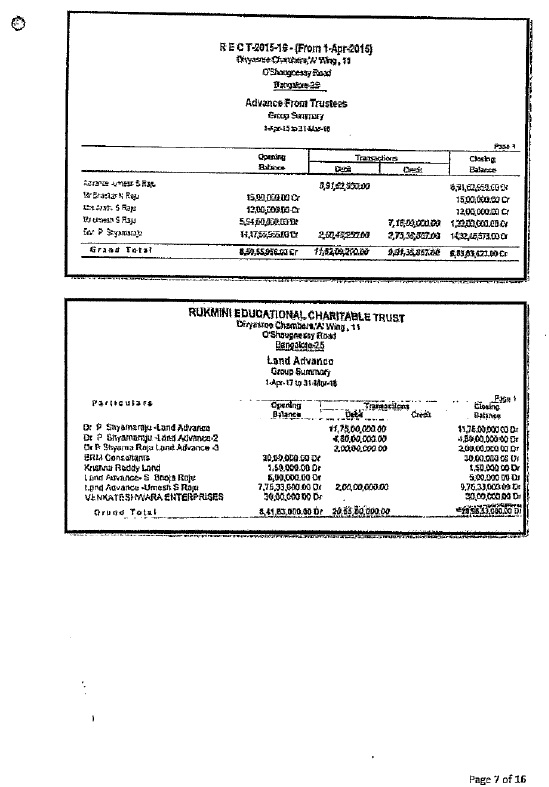

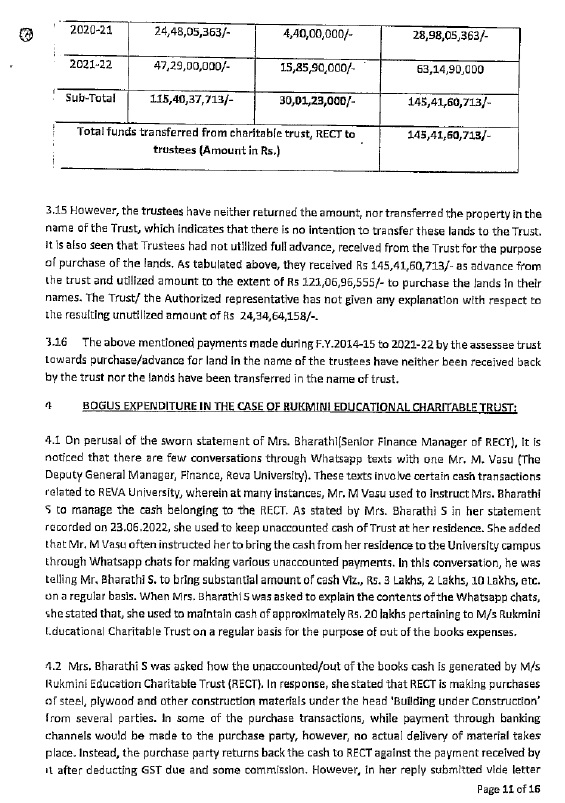

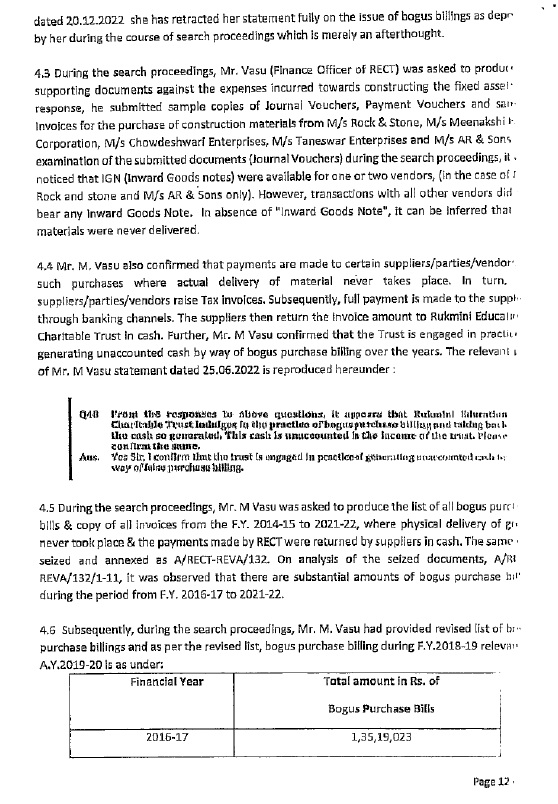

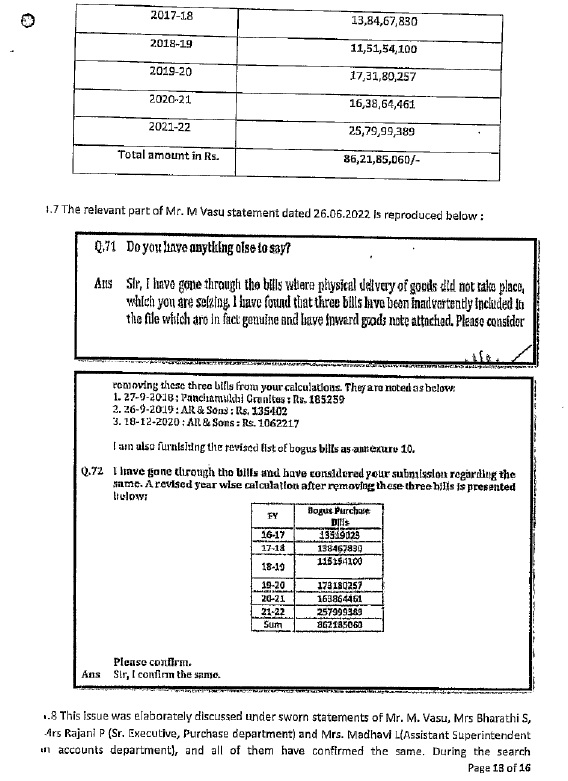

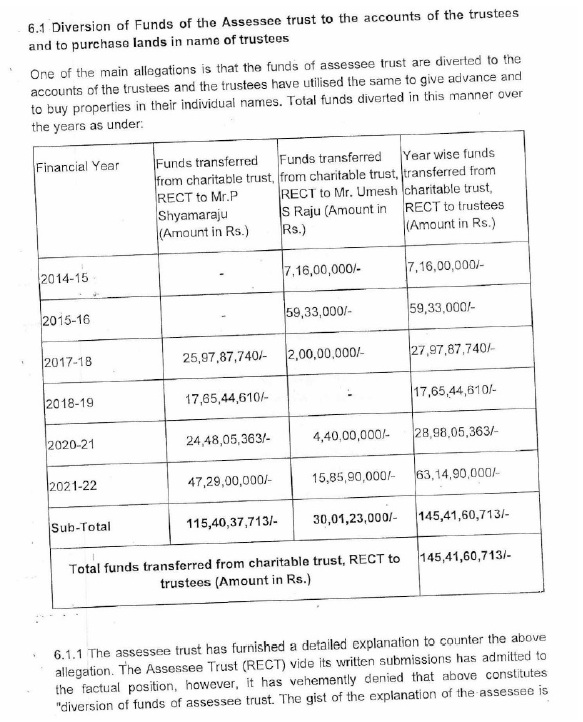

4. The trust was managed by one, Shri P Shyamaraju as Chairman, Shri Umesh S Raju, Shri Bhaskar N Raju & Smt. Aarthi B Raju, as the trustees. A search & seizure action was carried out u/s. 132 of the Act on 23.6.2022 in the case of Divyasree Infrastructure Projects Pvt. Ltd., Shyamarju & Company (India) Pvt. Ltd., assessee and other related entities. During the search several documents were found and seized and statement u/s. 132(4) of the Act was recorded of the directors, trustees and key employees of the finance department. The search operation showed that there are evidence relating to violation with respect to the diversion of trust funds to the trustees for purchase of land in their individual capacity and advances to related entities. There was bogus expenditure debited by the trust for generation of cash through bogus billing and invoices including unaccounted and unexplained cash transactions across several years.

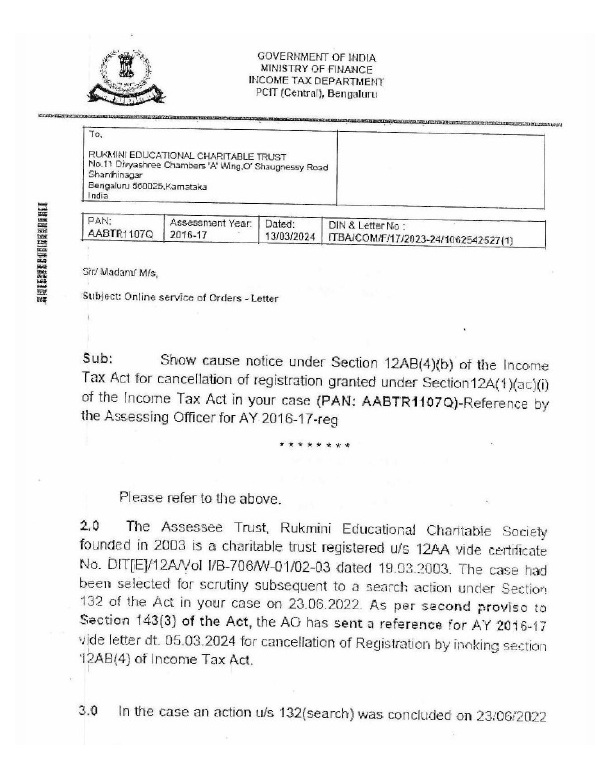

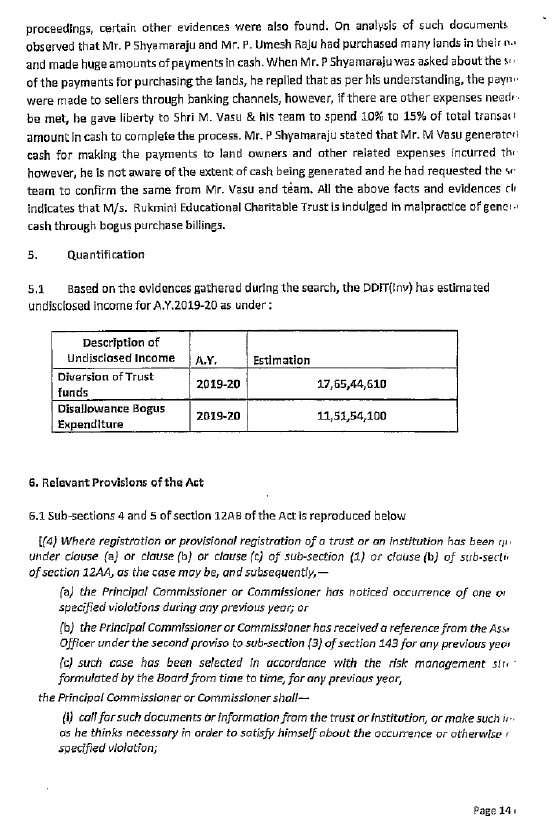

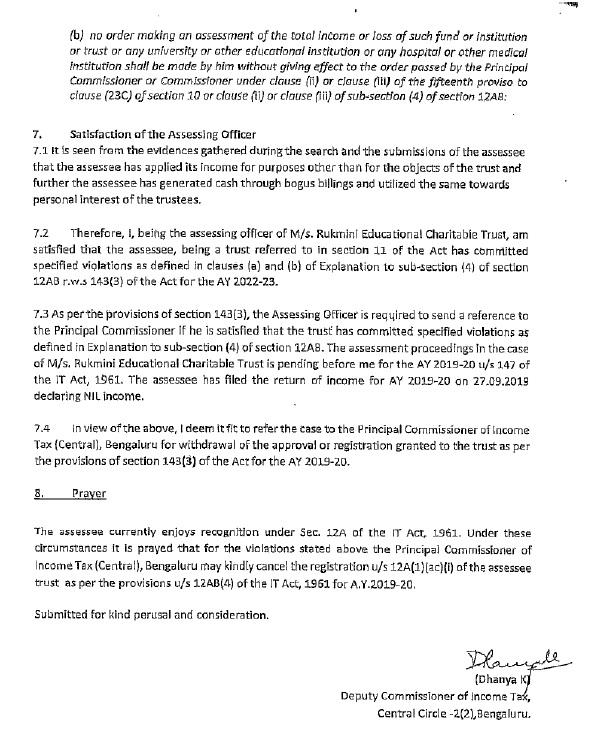

5. Based on the case of assessee selected for scrutiny and as per second proviso to section 143(3) reference was sent by the AO as per letter dated 5.3.2024 for cancellation of registration as under:-

6.

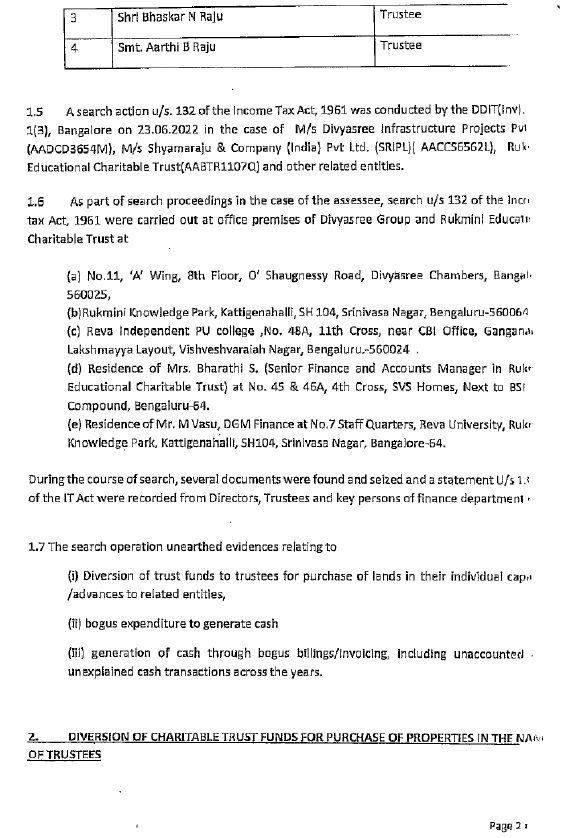

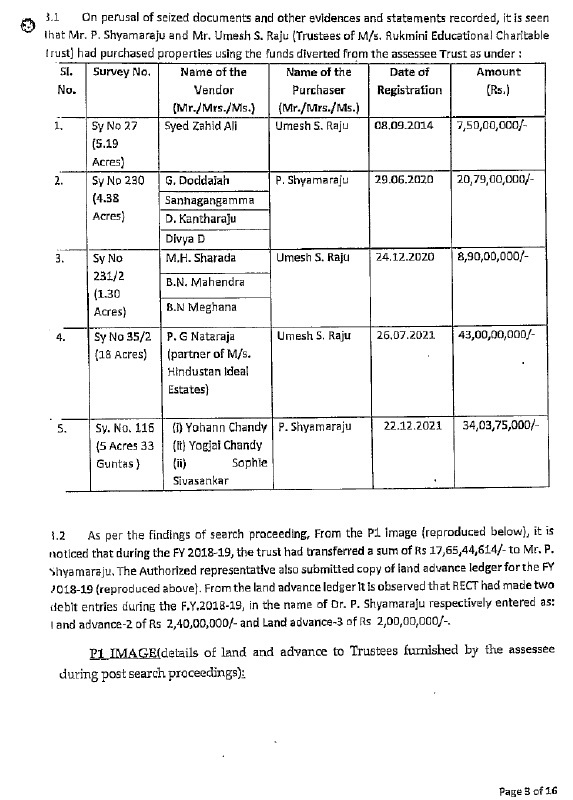

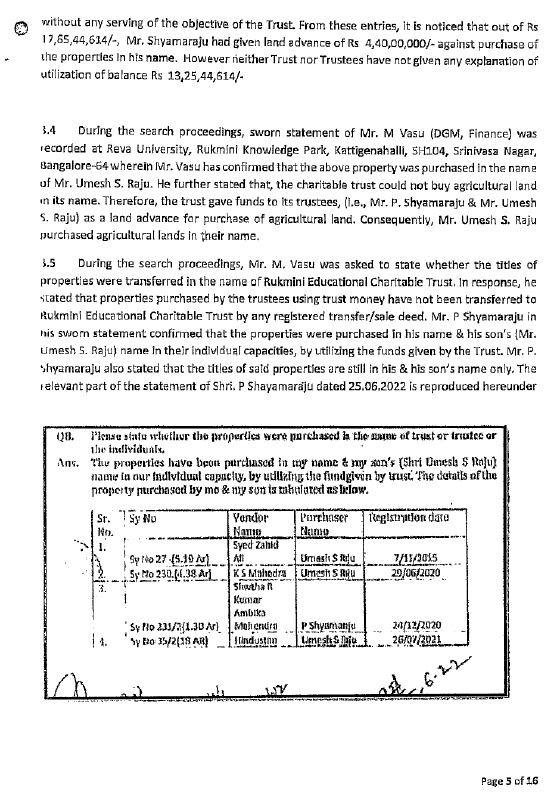

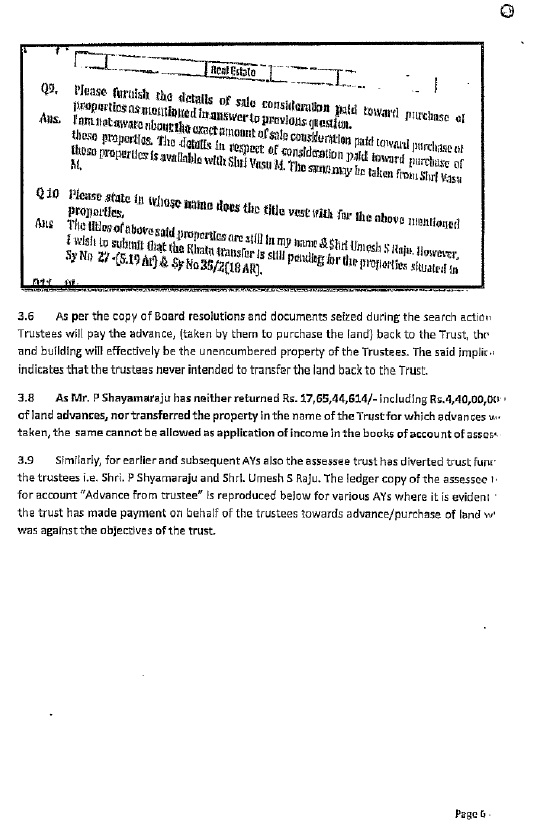

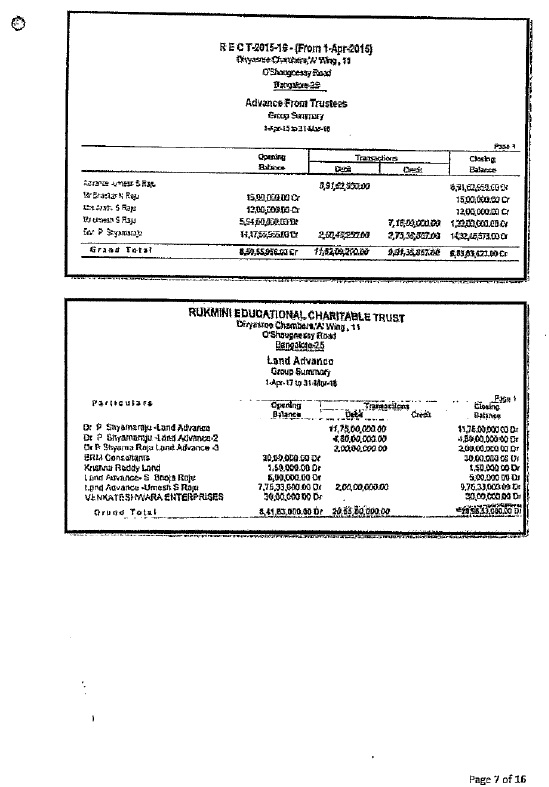

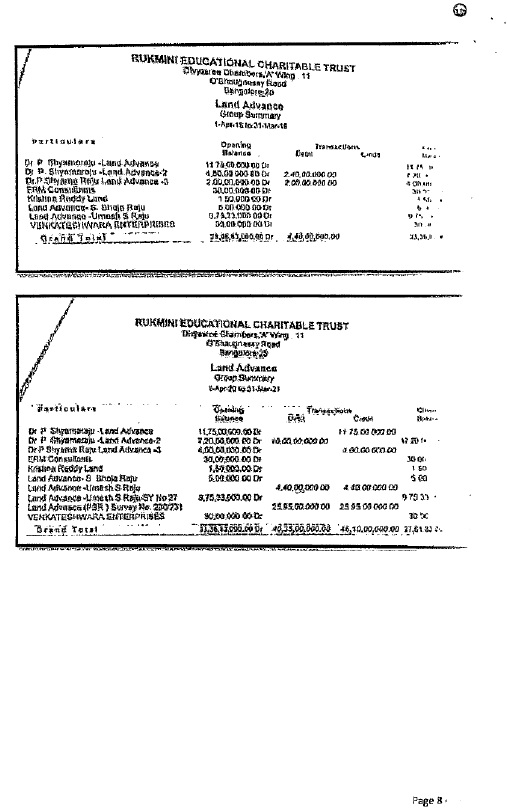

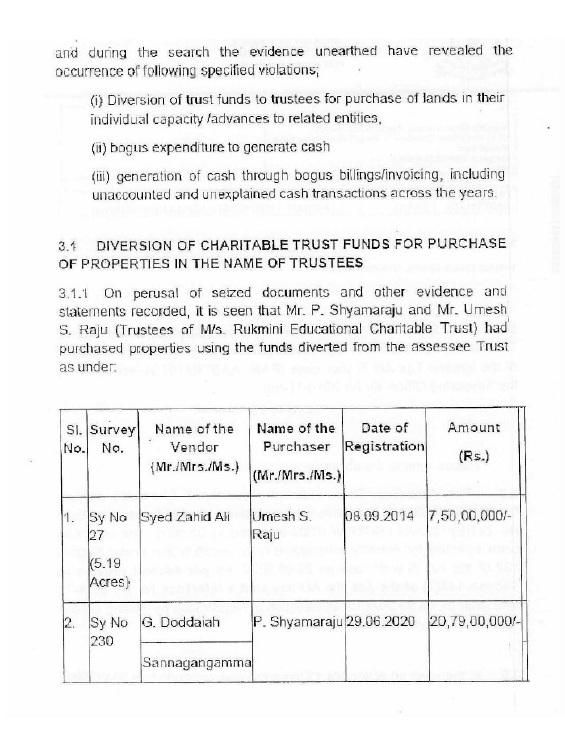

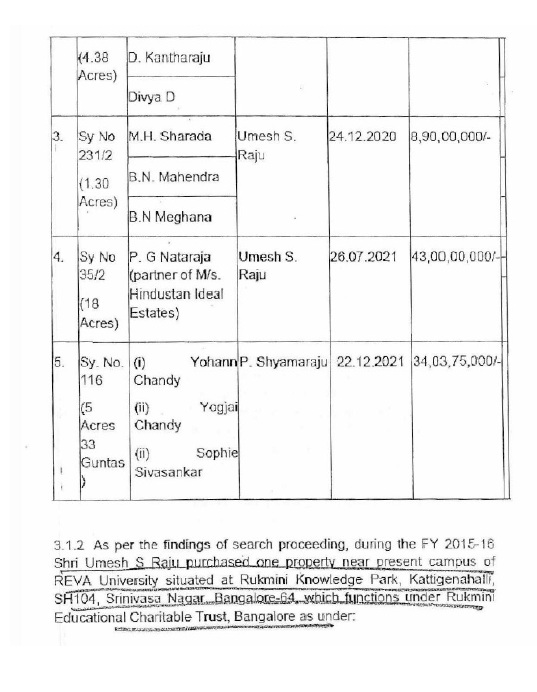

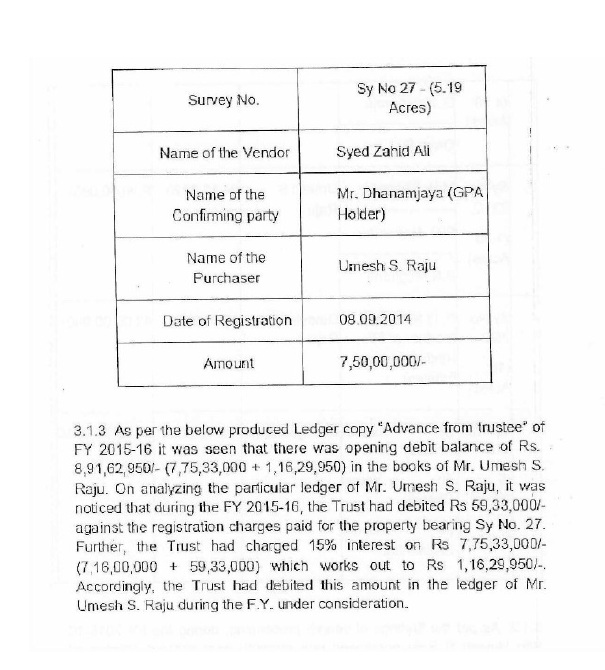

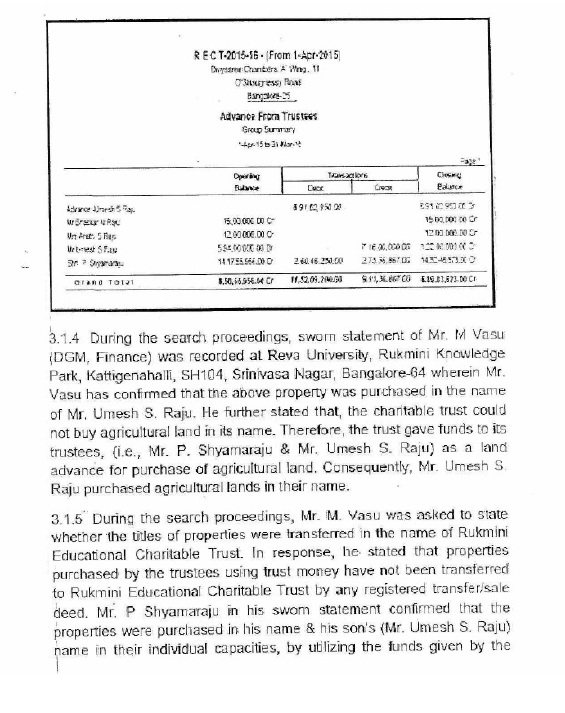

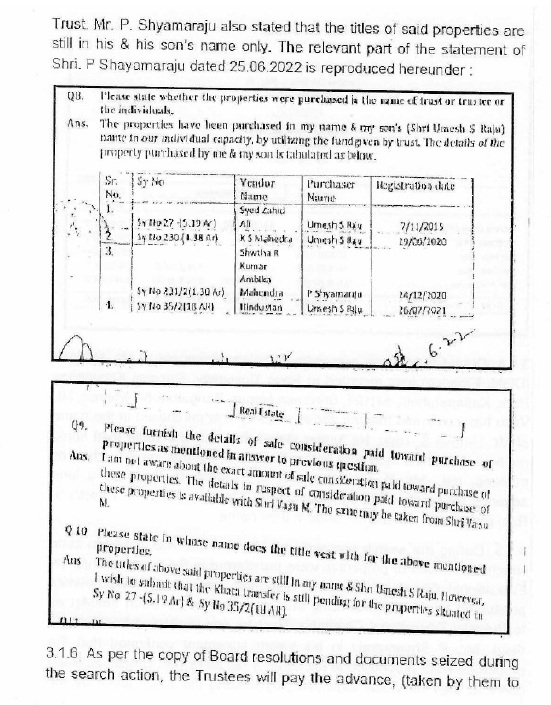

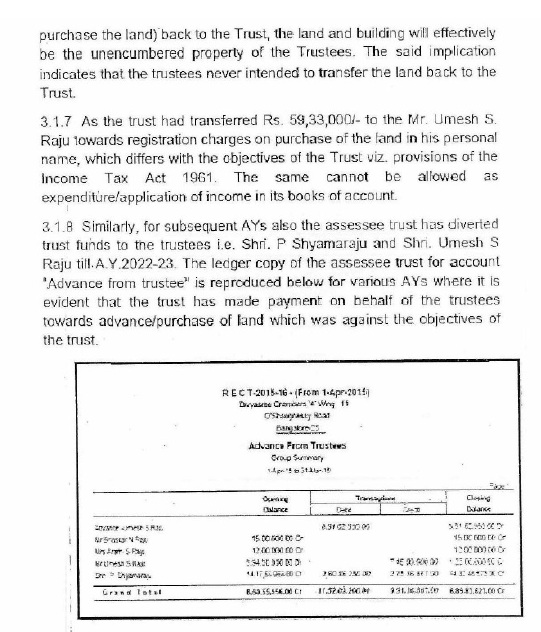

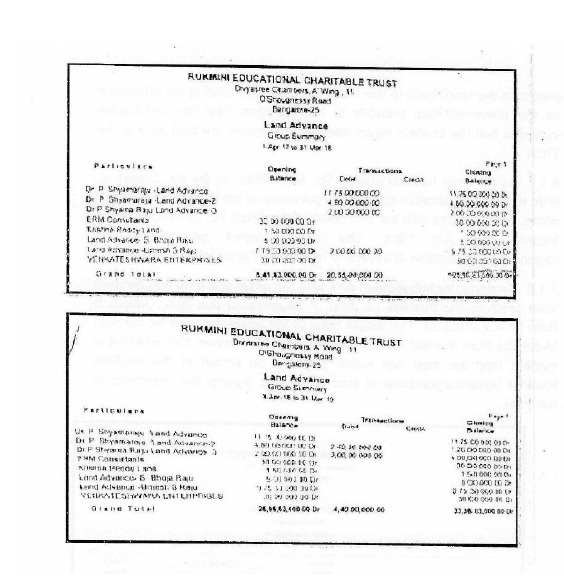

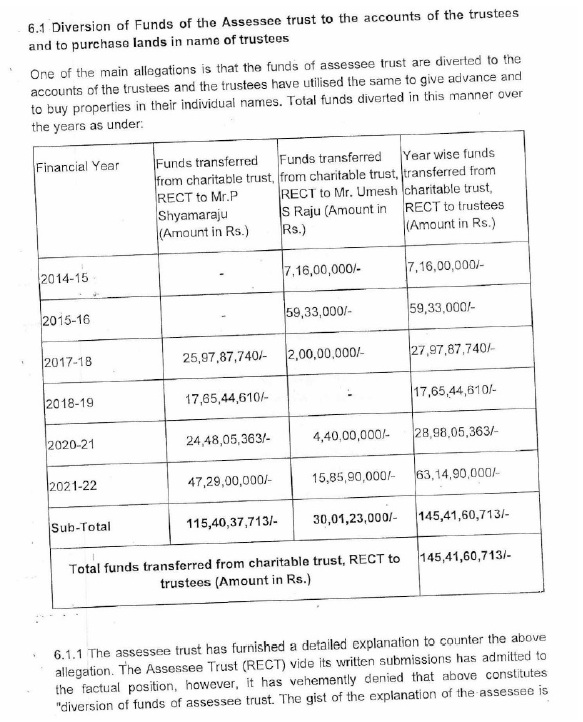

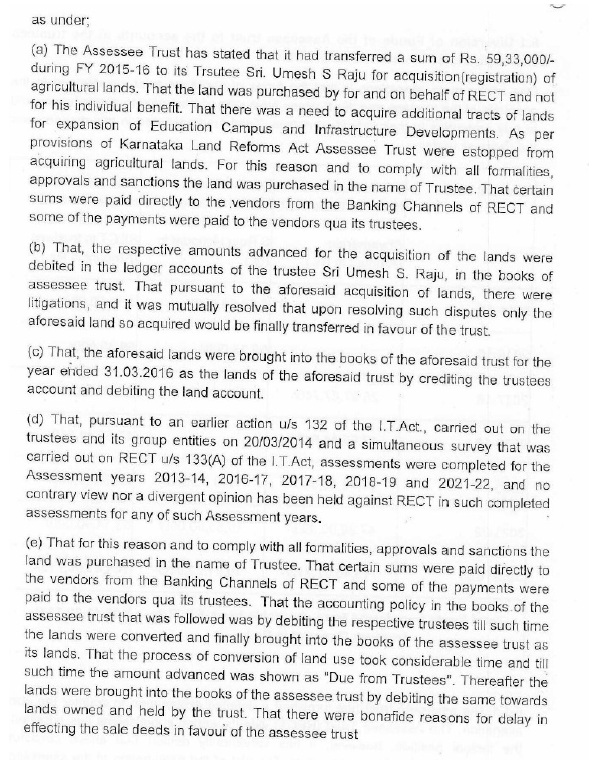

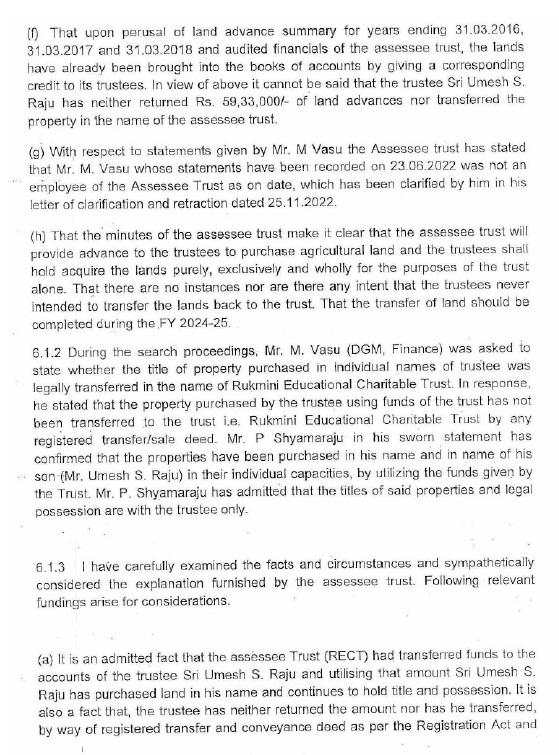

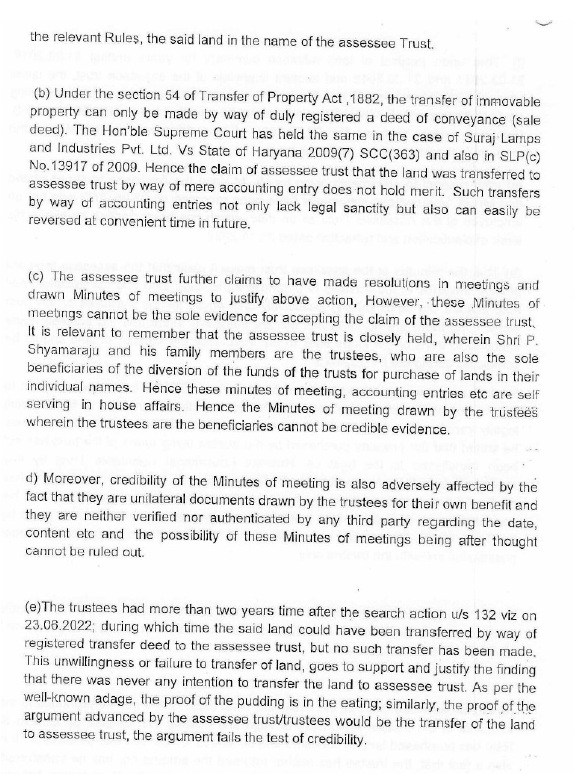

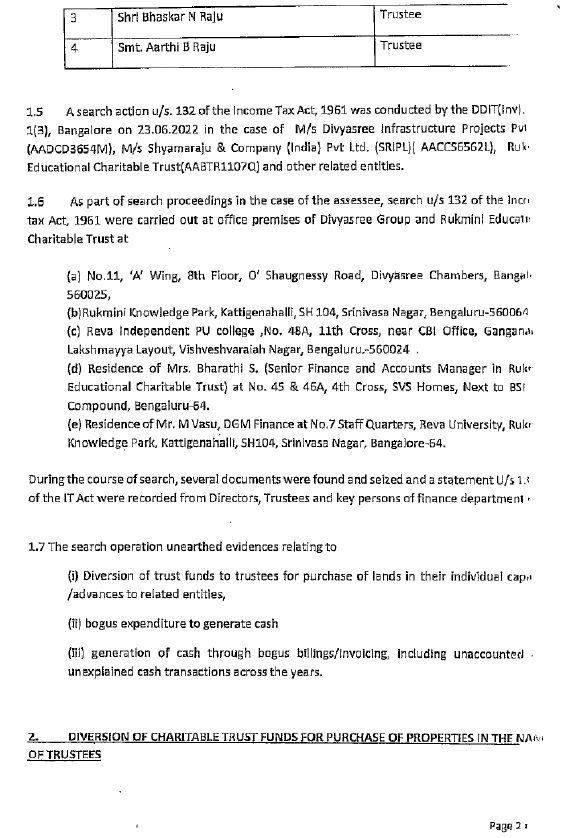

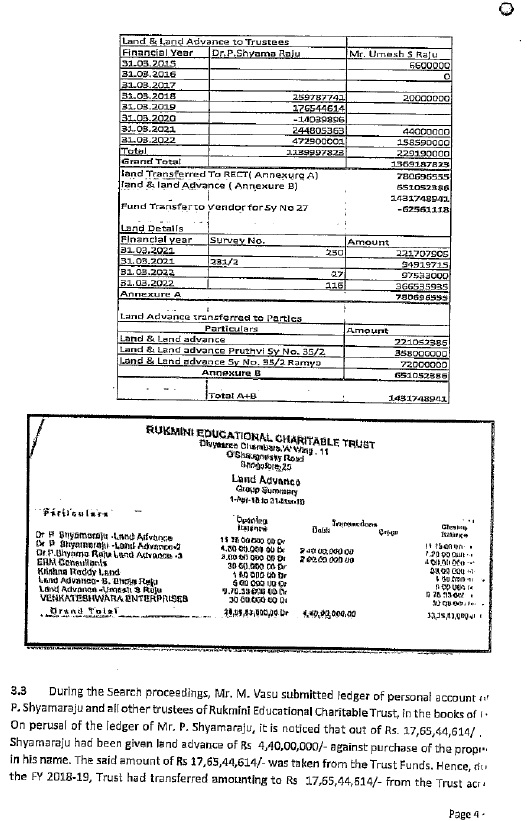

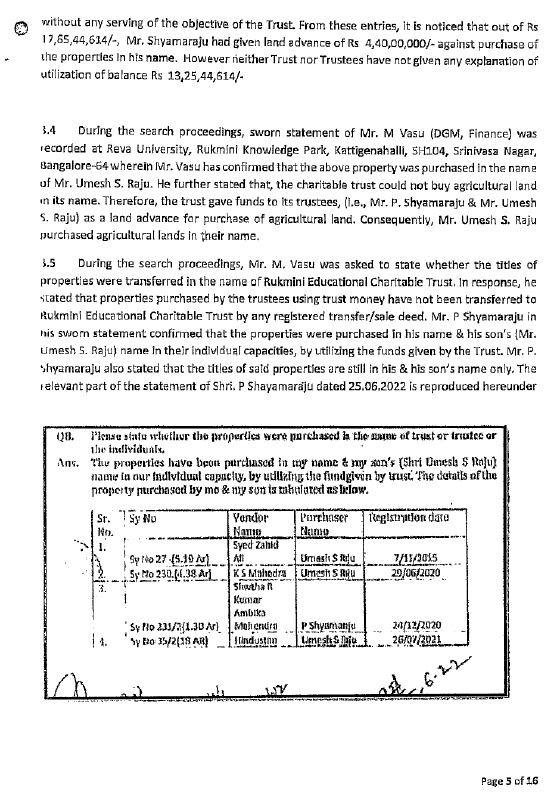

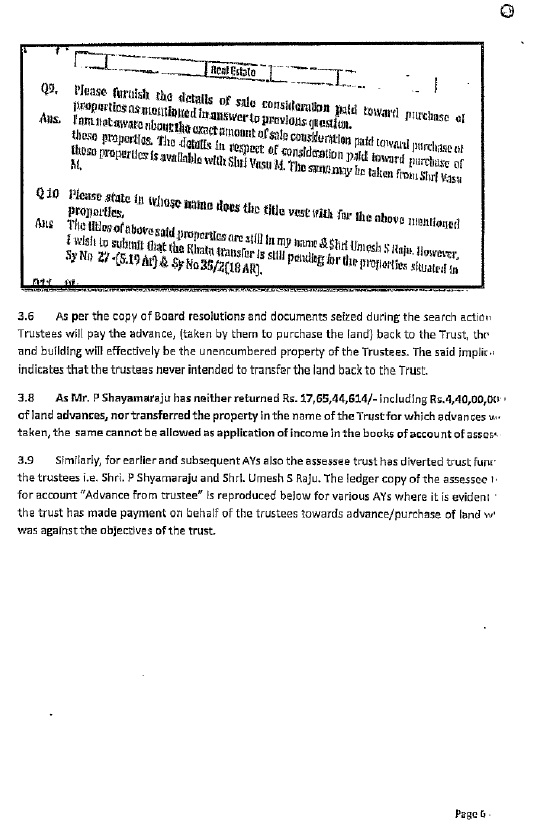

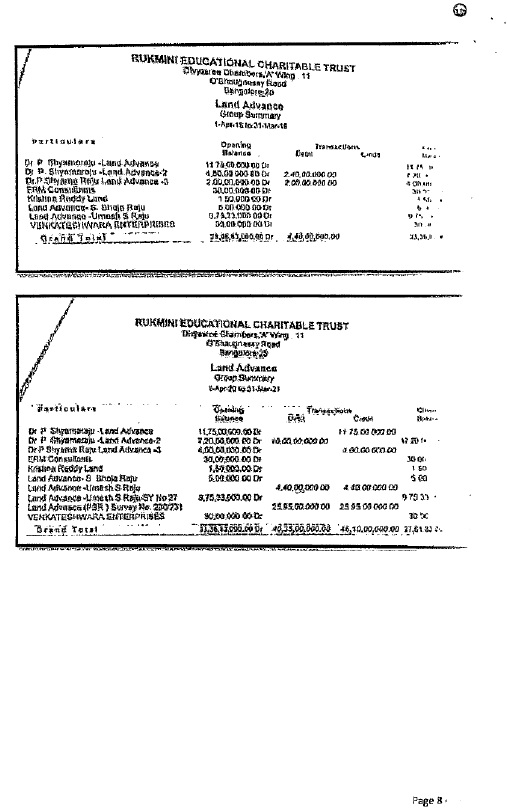

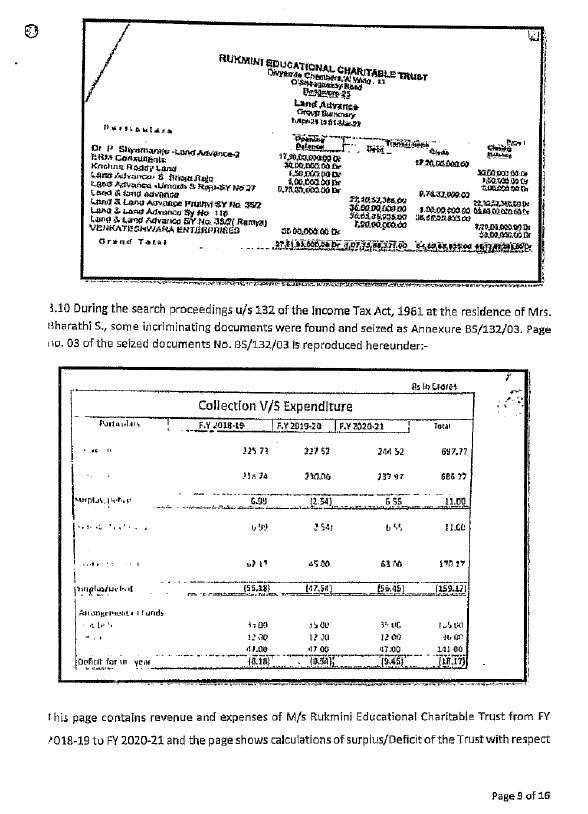

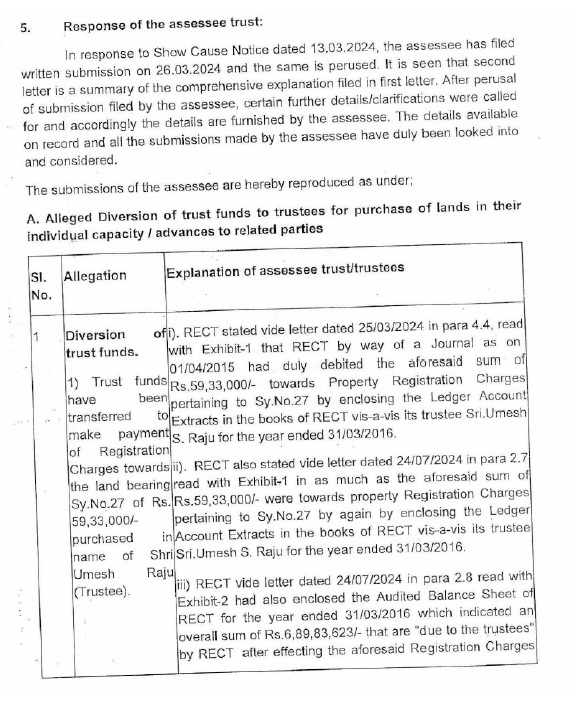

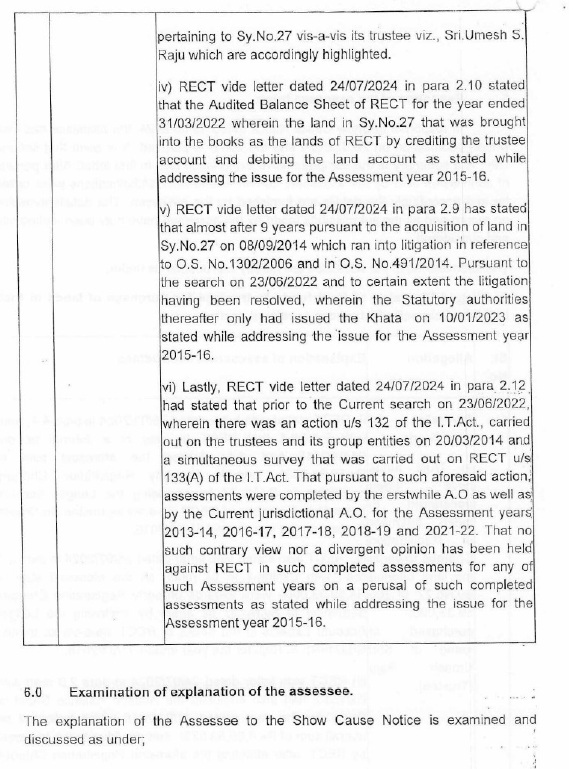

7. Based on these, a show cause notice was issued to the assessee on 13.3.2024 asking to explain why the registration granted to the trust should not be cancelled. In the show cause notice, the ld. PCIT noted that 5 instances show that there is a diversion of charitable trust fund for the purchase of property in the name of trustees of huge amount of approx. Rs.115 crores by the then trustees for purchase of property in their own name by utilising the fund of the trust. During the search statement of Mr. M. Vasu, who is the DGM (Finance) confirmed that the property was purchased in the name of trustees as the assessee could not buy agricultural land in its name. Therefore, the funds were used for purchase of agricultural land in the name of the trustees. It was also agreed by Mr. P. Shyamaraju, the Managing Trustee, that the land was purchased in his name and his sons in their individual capacity, by utilising the funds given by the trust and title of the said properties are still in his and his sons name. The ld PCIT further noted that as per the Board Resolution and documents seized during the search, it shows that trustee will pay the advance back to the trust which they have taken for purchase of the land and thus the land so purchased would be encumbered property of the trustees. The PCIT held that the implication of the same transaction is that the trustees never intend to transfer the land back to the trust. The ld. PCIT also extracted the ledger account of the trustees to show that the funds have never been returned nor the land is transferred to the trust.

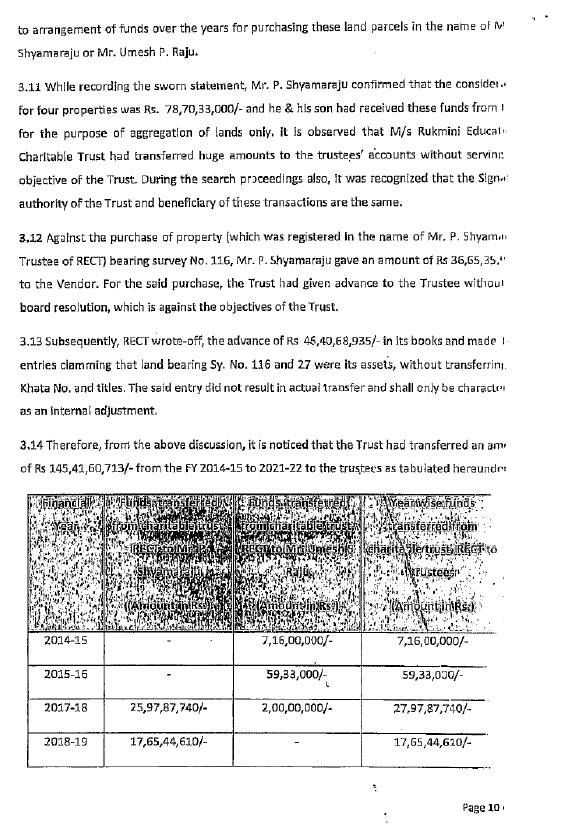

8. During the search proceedings at the residence of Mrs. Bharathi S., some incriminating documents were found showing the expenses of the trust which clearly show that the assessee trust has transferred money in the name of various trustees without any purpose. The findings were recorded in para 3.1.11 to 3.1.13. It is also noted that the assessee trust wrote off the advance of Rs.46,40,68,935 without actual transfer of the land. The ld. PCIT noted that a total sum of Rs.145,41,60,713 was transferred to the trustees starting from FY 2014-15 to 2021-22. These funds have never been returned nor the properties were transferred to the trust and the land were held in the name of the trustees.

9. Based on the above facts and noting down the various provisions of the Act u/s. 12AB, the ld. PCIT invoking the provisions of section 12AB(4) issued a show-cause notice for cancellation of the registration as under :-

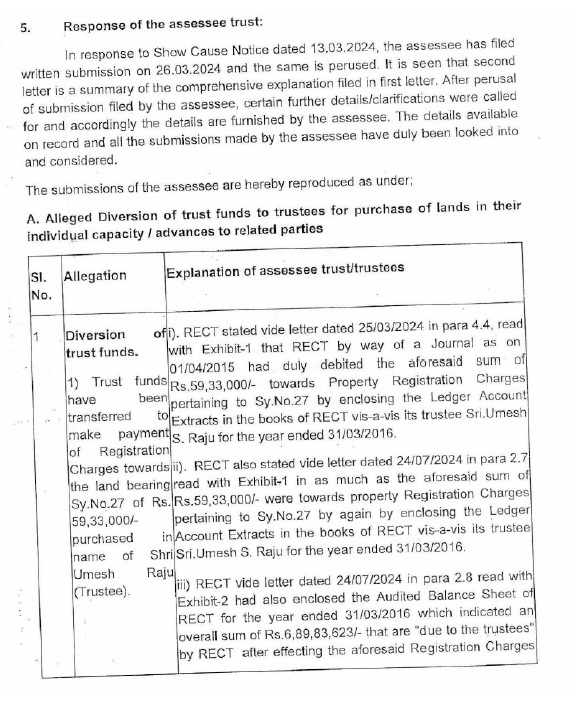

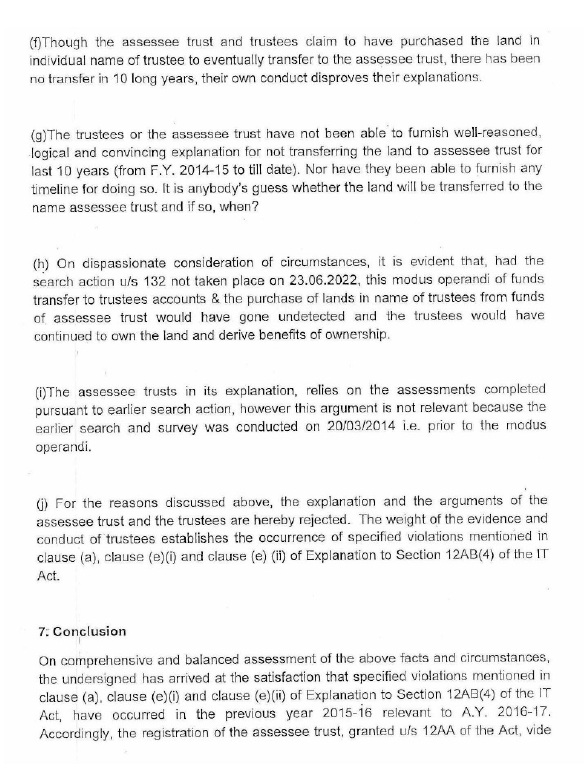

10. The assessee filed its written response on 26.3.2024 wherein mainly it was contended that the properties purchased in the name of the trustees which is backed by the resolution as it was an agricultural land, the assessee trust could not have acquired it and therefore the same is not a diversion of the fund. The ld. PCIT categorically noted that the submission of the assessee clearly admits that Rs.145,41,60,713 were transferred from the assessee-trust to the trustees in respective years, but assessee has denied that the above constitutes diversion of fund. In para 6.1.3, he rejected the contention of the assessee holding as under and finally concluded in para 7 cancelling the registration u/s. 12AA of the Act by the order dated as under :-

11. Assessee is aggrieved and is in appeal before us. On 25.11.2024 the assessee filed concise grounds of appeal replacing the original grounds wherein only 6 grounds of appeal were taken. By the same letter, the assessee also made a request for admission of additional ground stating that reference made by the AO is bad in law.

12. The concise grounds of appeal as per letter dated 25/11/2024 are as under:-

“CONCISE GROUNDS OF APPEAL

| 1. | | The PCIT (Central) has erred in cancelling the registration of the assessee-trust without having jurisdiction to do so. The exclusive jurisdiction of granting or cancelling the registration lies with the DIT(E) and not with the PCIT (Central). |

| 2. | | The PCIT (Central) has erred in cancelling the registration of the assessee-trust u/s. 12A of the Act, after invoking S. 12AB(4) of the Act. |

| 3. | | The PCIT (Central) has failed to appreciate that there was no new material found during the course of search. |

| 4. | | The PCIT (Central) has erred in cancelling the registration of the assessee-trust based on reference made by the A.O., which was illegal, beyond jurisdiction and without issuing prior show cause notice. |

| 5. | | The PCIT (Central) has erred in cancelling the registration of the assessee-trust without mentioning the specified violation as mandated u/s. 12AB(4) of the Act which is sine quo non for such cancellation. |

| 6. | | The PCIT (Central) has erred in cancelling the registration of the assessee-trust with retrospective effect from 01.04.2014 which is impermissible in law. |

| 7. | | The appellant craves leave to add to, amend, alter or delete the foregoing grounds of appeal. |

13. As per letter dated 25-11-2024 assessee also raised an additional ground of appeal as under :-

“ADDITIONAL GROUND OF APPEAL

Following ground of appeal is without prejudice to grounds of appeal raised in the appeal memo:

1. The Ld. PCIT (Central) has erred in not appreciating that the reference made by the Assessing Officer under second proviso to S. 143(3) of the Act is bad in law for the following reasons and hence Ld. PCIT had no jurisdiction to pass the impugned order.

| a. | | The Assessing Officer had not selected the return of income for scrutiny by issuing a notice u/s 143(2) of the Act and hence he was not in the session of the assessment proceedings. |

| b. | | The Assessing Officer had not carried out any inquiry nor issued any show cause notice in respect of issues under consideration and could not have formed any opinion in the matter. |

| c. | | there was no incriminating and/or fresh material found during the course of search and reassessment based on the same material is not permissible. |

| d. | | The reference ought to have been made to DIT (Exemption) who had a jurisdiction to cancel the registration and not to PCIT (Central).” |

14. The application for the submission of the additional ground of the assessee stated that it is challenged the cancellation of the registration of the assessee trust by the PCIT as per its order dated 30 September 2024 which was made on a reference made by the learned assessing officer on 5 March 2024. The assessee seeks to challenge the reference made by the learned assessing officer since it was done without any jurisdiction under section 153A of the act as no incriminating material was found during the course of search. The fact that the appellant had advanced the fund or the trustees as an advance against purchase of land was duly recorded in the accounts of the assessee trust. Therefore, the learned assessing officer did not have any reason to make reference to the principal Commissioner of income tax. Assessee placed reliance on the decision of the honourable Supreme Court in the case of Pr. CIT v. Abhisar Buildwell (P.) Ltd (SC)/[2023] 454 ITR 212 (SC)). The assessee submitted that though this proposition has been raised in ground No. 15 of the original grounds of appeal and in ground No. 6 of the concise grounds of appeal but out of fashion, the appellant would like to raise this ground challenging the above aspect of the matter specifically. It was stated that the additional ground of appeal raised by the assessee is purely legal in nature does not require any further investigation of facts and goes to the root of the matter and therefore same may be admitted relying upon the decision of National Thermal Power Corporation v. CIT (SC)/[1998] 229 ITR 383 (SC)), Jute Corporation of India Ltd v. CIT (SC)/[1991] 187 ITR 688 (SC)) and at another Ahmedabad Electricity Co. Ltd. v. CIT (Bombay)/[1993] 199 ITR 351 (Bombay)) (FB).

15. The learned authorised representative reiterated these facts and submitted that the additional ground deserves to be admitted.

16. The learned departmental representative the learned CIT DR vehemently objected to the same and submitted that now this additional ground does not survive as it has not been raised before the learned lower authorities.

17. We have carefully considered the rival contention and perused the orders of the learned that lower authorities as well as the application for additional ground raised before us and the contention raised by the learned authorised representative encountered by the learned CIT DR, we are inclined to admit this additional ground as it is legal in nature going to the root of the matter and does not require further investigation of facts. Accordingly, we admit this additional ground of appeal which would be adjudicated at the appropriate time.

Arguments of the LD AR

18. On the merits of the case on the concise ground raised by the assessee, Countering the findings of the ld. PCIT, Shri Vijay Mehta, CA, Shri Likith R. Prakash and Shri Avinash Mallya, Advocates, advanced various arguments and referred to various paper books filed before us.

19. Mr. Vijay Mehta, the ld. AR submitted 9 propositions on legal issues stating that reference made by the AO to the ld. PCIT is bad in law and further the order passed by the ld. PCIT is also bad in law. The written gist of such proposition was also placed vide letter dated 10.12.2024 filed on 11.12.2024 as under :-

“Propositions:-

| (a) | | Reference made by the assessing officer to Principal Commissioner of Income Tax is bad in law as the same has been done prior to selecting the case of the assessee for scrutiny by issuing notice under section 143 (2) of the act. (Applicable for assessment year 2015 – 16, 2016 – 17 and 2019 – 20) |

| (b) | | section 153 proviso gives extended time for completion of scrutiny assessment and not for commencing or conducting scrutiny assessment (applicable for assessment year 2015 – 16, 2016 – 17 and 2019 – 20) |

| (c) | | reference made by the assessing officer to Principal Commissioner of Income Tax is bad in law as the same was made by the AO without arriving at satisfaction about specified violation. Satisfaction referred to in the second proviso to section 143 (3) of the Act has to be the satisfaction of the learned assessing officer is not borrowed satisfaction. (Applicable to all four years) |

| (d) | | reference made by the assessing officer to Principal Commissioner of Income Tax is bad in law as the same is not pursuant to any bone fide exercise of the power and is applicable for all these four years. |

| (e) | | reference made by the assessing officer to Principal Commissioner of Income Tax is bad in law as the reference can be made only director of income tax (exemption) who has the power to withdraw registration and not the principal Commissioner of income tax (Central) for all the four years |

| (f) | | the order passed by the Principal Commissioner of Income Tax – Central is bad in law as reference is bad in law due to the above referred proposition which is applicable for all the four years |

| (g) | | the order passed by the PCIT Central is bad in law as only director of income tax (exemption) has power to withdraw registration and not principal Commissioner of income tax (Central) applicable for all these four years. |

| (h) | | the order passed by the PCIT – Central is bad in law as registration cannot be revoked retrospectively for assessment year 2015 – 16, 2016 – 17 and 2019 – 20. |

| (i) | | the order passed by the PCIT Central is bad in law as the principal Commissioner of income tax never informed the assessee as to what specified violation has taken place. Only in the order passed under section 12 AB (4) of the act, he mentions violation as per clause (a), e (i) and e (ii) which is applicable for all years. |

20. The learned authorised representative immediately stated that the relevant dates for his argument as under:-

| Sr No | Particulars | Date |

| 1 | Date of search | 23 June 2022 |

| 2 | Registration granted under section 12 A of the act | 19 March 2003 |

| 3 | Registration renewed according to the new provisions of the act | 24 September 2021 |

| 4 | Order passed under section 127 | 16 September 2022 |

| 5 | Notice for reopening issued under section 148 of the act | 20 March 2023 |

| 6 | Return filed by the assessee | 6 April 2023 |

| 7 | Reference made by the assessing officer for assessment year 2015 – 16, 2016 – 17 and 2019 – 20 | 5 March 2024 |

| 8 | Reference made by the assessing officer for assessment year 2022 – 23 | 19 February 2024 |

| 9 | Time limit available under section 153 (2) of the act | Up to 31st of March 2024 |

| 10 | Time limit available for issuance of notice under section 143 (2) of the act | 30 June 2024 |

21. The ld. AR furnished 3 sets of paperbooks. The 1st set of PB of 122 pages is containing certificate of registration, various correspondence with the AO and also the submissions made before the ld. PCIT (Central). The assessee also filed assessment orders passed u/s. 143(3) for subsequent years. In the 2nd PB, the assessee relied upon 6 judicial precedents, FAQs on Assessment published on Income Tax Website, Circular No.549 dated 31.10.1989 and extract from the Dictionary to show the meaning of ‘satisfaction’. In the 3rd Vol. of PB, the assessee once again filed 12 judicial precedents of various coordinate Benches to support its case and further Notification No.52 of 2014 issued by the CBDT.

22. During the course of hearing, the assessee also referred to the decision of the coordinate Bench in the case of Amala Jyothi Vidya Kendra Trust v. PCIT (Bangalore – Trib.)/[2024] 204 ITD 605 (Bangalore – Trib.) wherein it has been held that registration granted to the trust cannot be invoked for cancellation with retrospective effect. On the merits, the assessee submitted a map of the land holding by the assessee-trust and also submitted issues on the merits to show that there is no diversion of funds by the assessee to the trustees. He submitted that this issue pertains to assessment year 2015 – 16, 2016 – 17 and 2019 – 20.

23. The ld. AR, Shri Vijay Mehta first took us through the order passed by the ld. PCIT and submitted that the reference made by the ld. AO for cancellation of the registration as well as the order passed by the ld. PCIT, both are bad in law. He referred to the PB page 13 and submitted that on 16.3.2024 wherein it has been informed to the assessee that the case of assessee has been referred to the PCIT under 2nd proviso to sub-section (3) of section 143(3) of the Act for verification of cancellation of registration u/s. 12AB of the Act. He referred to para 2 of the order wherein in the last line it is mentioned that the AO has sent a reference on 5.3.2024. He submits that the notice issued to the assessee u/s. 143(2) of the Act is on 26.6.2024 which is placed at page 14-19 of the PB. His submission is that notice issued u/s. 143(2) of the Act is the initiation of assessment proceedings and without such a notice, the AO could not have assumed any such power to make a reference for cancellation of the registration. For this proposition, he referred to the decision of the Hon’ble Kerala High Court in the case of Travancore Diagnostics (P) Ltd. v. ACIT (Kerala)/[2016] 390 ITR 167 (Kerala)) and specifically relied upon para 28 & 30 and para 33 to 35 of the above decision. He further submitted that if such reference is not made, the assessment would have become time barred and therefore a reference was in fact made to buy the time for making the assessment. He referred to various timelines and submitted that in this case notice u/s. 148 of the Act was issued on 20.3.2023 and notice u/s. 143(2) was issued on 26.6.2024 by asking one year more from the end of the year in which notice was issued. Otherwise by 31.3.2024, the time limit for assessment by notice u/s. 143(2) would have been over. Thus the reference was made just to buy time for making the assessment, which would otherwise have become time barred.

24. The 2nd argument was that the reference was made by the ld. AO without arriving at the satisfaction of specified violation. He further submitted that it to be the satisfaction of the AO and not of anybody else. In the present case for all these years, such satisfaction of the AO is missing as it merely relied up on the findings of the Search. He referred to the reference made by the ld AO for all the four years and submitted that not a single inquiry, information sought from assessee, was carried out. Even the figures mentioned by the Investigation wing are reproduced as it is. Thus, there is no application of mind and therefore there cannot be any” satisfaction’ of AO. It is a borrowed satisfaction. For this proposition he referred to page 184-186 of the PB wherein the extract of judicial dictionary of K.J. Iyer was filed to show the meaning of the word ‘satisfaction’. He submits that ‘satisfaction’ is of far higher degree with the word ‘approval’. He submits that in this case there is no satisfaction of the AO about the specified violation and hence for all these 4 years, reference is bad in law.

25. He further submits that making of the reference for all these 4 years is not a bonafide action and is also not a proper exercise of the power as reference was made at fag end of the expiry of time limit for completion of assessment. Therefore, reference was just a ploy to buy the time limit. He also stated that in the forwarding letter for AY 202223, the dl AO himself mentioned this fact.

26. He further stated that the registration granted to the trust cannot be withdrawn retrospectively by invoking the provisions of section 12AB of the Act. He submits that though this proposition is applicable for the first 3 years of the appeal and not for AY 2022-23.

27. For this proposition he referred to the provisions of section 12AB(4) which is enacted w.e.f. 1.4.2022. He therefore submitted that this section cannot be invoked for cancelling the registration prior to AY 2020-21. He referred to the decision of the coordinate Bench in the case of Amala Jyothi Vidya Kendra Trust (supra). He further submitted that there are 12 decisions of the coordinate Benches wherein it has been held that registration cannot be cancelled with retrospective effect. Therefore, cancellation of the registration of the trust for AY 2015-16, 2016-17 & 2019-20 is bad in law. He also submitted that this issue is covered by following decisions over and above the decision of the Bangalore Bench stated above.

| (i) | | Pacific Academy of Higher Education and Research Society v. PCIT (Central), [ITA No. 04 & 05(Jodh) of 2020, dated 25-1-2023] wherein in on page No. 40 held that no retrospective cancellation could be made as neither in section 12 AA (3) nor in section 12 AA (4) it has been provided or is seen to have explicitly provided to have retrospective character or intent. |

| (ii) | | In Global Health Research and Management Institute v. PCIT [ITA No. 397(Jodh) of 2019, dated 25-1-2023] wherein in paragraph No. 11 and 13 the identical view is taken. |

| (iii) | | Mahadevia Charitable Trust v. PCIT [ITA No. 396(Jodh) of 2019, dated 25-1-2023] at page No. 19 a similar view was taken. |

| (iv) | | In Heart Foundation of India v. CIT [IT APPEAL No. 1524(Mumbai) OF 2023, dated 27-7-2023] in paragraph No. 9 has also held that there cannot be a retrospective application of such provisions of cancellation |

| (v) | | Islamic Academy of Education v. Principal Commissioner of Income-tax (Central) (Bangalore – Trib.)/ITA No. 610/Bang/2023 dated 28 February 2024 in paragraph No. 8.4 has held accordingly that registration cannot be cancelled retrospectively. |

| (vi) | | Decision of the honourable Madras High Court in case of Auro Lab Limited v. ITO (Madras)/[2019] 411 ITR 308 (Madras) |

| (vii) | | Maa Jagat Janani Seva Trust v. CIT Exemption (Cuttack – Trib.)/ 208 ITD 120 (Cuttack – Trib.) dated 16/7/2024 wherein in paragraph No. 5 the coordinate bench has held that retrospectively the registration so granted cannot be cancelled. |

28. He next submitted that the power of withdrawal of exemption granted is only available to the DIT(Exemptions) and does not rest with the PCIT. He stated that several coordinate Benches have held so relying on the decision of coordinate Bench in the case of Wholesale Cloth Merchant Association v. PCIT [ITA No.688(Jp) of 2019, dated 6-1-2021]. It was submitted that Notification No. 52 of 2014 issued by the CBDT gives such power only to the CIT(Exemptions), Bangalore and therefore as the ld. PCIT (Central) does not have the power to withdraw the registration, the order passed by him for all these 4 years is bad in law. He referred to several judicial precedents as under:-

| • | | Devi Shakuntala Thakral Charitable Foundation v. Pr. CIT [ITA No. 117(Indore) OF 2020, DATED 29-7-2022] wherein in paragraph No. 16 relying upon the decision of Jaipur bench. |

| •Oriental | | University v. Pr. CIT [ITA Nos. 115 and 116(Indore) of 2020, dated 29-7-2022] wherein in paragraph No. 16 the issue is dealt with. |

29. He further submitted that when reference made by the AO is as such bad in law, the order passed by the PCIT on such bad reference can never be good and hence on that ground also, the order of the ld. PCIT is bad in law.

30. Lastly, he submitted that ld. PCIT while passing the order has mentioned several specified violations which has taken place. He submitted that the assessee was never informed as to what are such specified violation, but assessee has come to know the same only vide the order of cancellation. The ld. AR referred to para 6.1.3 of the order and submitted that the violation mentioned at sl.No. (a), (e) were known to the assessee only through the order.

31. In view of the above arguments, learned authorised representative submitted that the reference by the AO and consequent order passed by the ld. PCIT is bad in law.

32. During the course of hearing, the assessee was asked to file the complete annual accounts of the assessee-trust for the respective years which were furnished in the form of PB submitted on 30.1.2025.

Arguments of the Ld CIT DR

33. In response to the argument of the ld. CIT DR, Ms. Nandini Das, submitted various documents in the case of the assessee from the file of PCIT as directed by the Bench. The ld. CIT(DR) also made a written statement stating the rebuttal of judicial precedents relied upon by the assessee. In such rebuttal, the ld. CIT(DR) also relied upon several Circulars and judicial precedents.

34. On the issue that whether the learned principal Commissioner of income tax is empowered to cancel the registration already granted or not she referred to the provisions of section 127 of the act and further referred to the provisions of section 12 double a of the act and submitted that the principal Commissioner is empowered to deal with the cases pertaining to the registration under section 12 AA/12 AB under the income tax act 1961. She submitted that if such empowerment was not to be legislatively envisaged in the said authority would not have been mentioned in the statute in the provisions of the act itself. In the absence it was her submission that statute in no way precludes the principal Commissioner from deciding the registration when the jurisdiction of the case lies with the said principal Commissioner. She further referred to circular No. 23/2022 dated 3 November 2022 wherein rationalisation of the provisions of charitable trust and institutions has been carried out as per the finance act 2022 which is effective from 1 April 2022. According to paragraph No. 9.3.3 of the above circular clearly specifies the powers of the principal Commissioner of income tax with regard to approval/registration or cancellation/withdrawal which amply clarifies the existence of jurisdiction with the principal Commissioner of income tax with regard to all the matters connected with the registration of trust including the application of the appellant in the instant case. Accordingly, she submitted that that the case laws cited by the learned authorised representative does not help the case of the assessee when the language of the law is clear. She further submitted that when the language of the law is clear, there is no need to look into outside aid to the interpretation. She submitted that the law does not prohibit the powers of the learned principal Commissioner of income tax to cancel the registration and therefore the intent of the Parliament is to be given prime importance. He submits that all the judicial precedents relied upon by the learned authorised representative has relied upon one and decision of wholesale cloth merchants Association (supra) which has not considered the provision also. Therefore she submitted that so far as the authority of the principal Commissioner of income tax is concerned to cancel the registration is according to the statute, in order and proper.

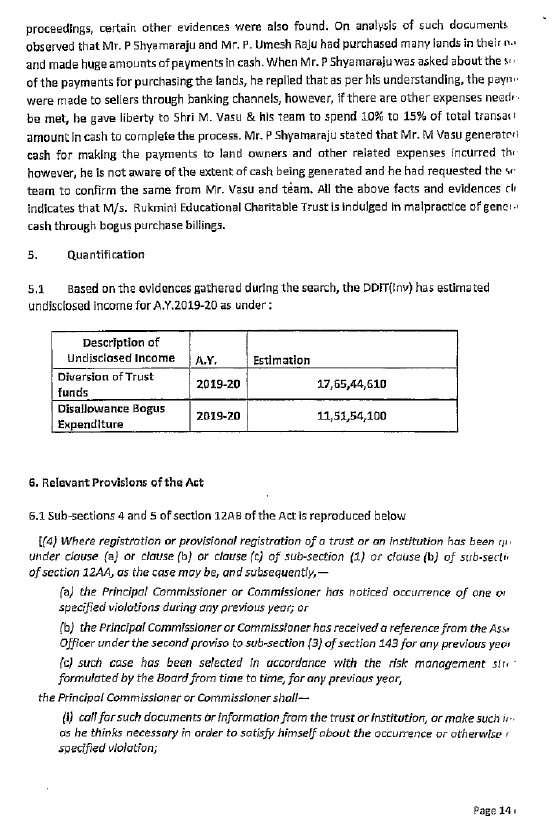

35. With respect to the argument of the learned authorised representative that the reference has been made prior to selecting the case of the assessee for scrutiny is invalid. She submitted that there is no such provision in the law that first the notice is to be issued under section 143 (2) of the act. She submitted that the notice to be issued under that particular provision is for the purpose of making the assessment. She referred to the reference made by the learned assessing officer dated 5 March 2024. It was submitted that the search operation carried out by the income tax department itself revealed that there is a diversion of trust fund or trust is for the purchase of land in their individual capacities, advances to related parties and further there are bogus expenditure incurred to generate a cash through bogus billing et cetera. This information was already available before the assessing officer as found during the course of search. Further the annual accounts of the trust are available with the assessing officer which clearly shows that there is a diversion of funds in the case of the assessee. In the proposal he has mentioned the details about the amount advanced to the trustees and related parties. It was mentioned that it is the satisfaction of the assessing officer which is required to be seen. She referred to paragraph No. 7 of the proposal wherein it was stated that evidence gathered during the search and the submission of the assessee that the assessee has applied its income for purposes other than for the purpose of the objects of the trust and further the assessee has generated cash through bogus billings and utilise the same towards personal interest of the trustees, he has sent a proposal. And therefore, there is no need that first the learned assessing officer should have issued notices under section 143 (2) of the act before sending the proposal.

36. It was further submitted that the allegation made by the assessee that the reference for cancellation of the registration is made purely to give an extended time for completion of scrutiny assessment is devoid of any merit, no such evidence are produced and therefore this argument does not hold any water. She further stated that there is a bona fides exercise of the powers conducted by the income tax department such as the assessing officer for making a reference, the learned principal Commissioner of income tax for cancellation of the registration. As no mala file is proved by the assessee, the existence of bona fides purposes is established.

37. With respect to the retrospective provisions, it is submitted that the provision enacted with effect from 1 April 2022, it does not mention any assessment year and therefore it is wrong to tell that it applies from that assessment year. It was submitted that the proposal of the cancellation and the cancellation order is made after the authorities available to the learned principal Commissioner of income tax therefore the allegation that it is applied retrospectively is not correct. She submitted that when the authorities granted to the learned principal Commissioner of income tax it was with respect to not related to any assessment year but the date from which he can exercises the authority. Therefore, the judicial precedents relied upon by the learned authorised representative are not showing that it is applicable from a particular assessment year only. No such circular, notification, the memorandum explaining the provisions, the notes on clauses speaks that such powers are to be exercised from a particular assessment year only.

Arguments of Ld AR on merits

38. On merits of the case, Shri Avinash Mallya, Advocate for the assessee argued the matter. He submitted a detailed paper book and submitted that there is no diversion of funds by the trustees of the trust and the agricultural lands and purchased in their name for the reason that the assessee trust could not have purchased them at that particular time. These lands are used for the activities of the trust and not for the personal purposes of the trustees. Therefore it was stated that there is no diversion of funds and accordingly there is no violation of the provisions of section 13 of the act. On the issue of the bogus billing is submitted that there is no such instances found during the course of search and therefore such reason is not correct.

Arguments of ld CIT DR On merits

39. The learned CIT DR vehemently supported the order of the learned principal Commissioner of income tax as well as the proposal of the learned AO which clearly says that the land is purchased in the name of the trustees of the trust, such land has never been transferred to the trust account, such as land is still being held in the name of the trustees, the funds of the trust have been used for purchase of those lands and therefore there is a clear-cut violation of the provisions of section 13 of the act. She extensively referred the orders of the learned principal Commissioner of income tax.

Clarification sought during hearing

40. Subsequently we have put the case for the clarification before the parties and it was asked that whether the learned principal Commissioner of income tax has exercised its powers retrospectively or not. The query that was raised is that assessee has challenged that the provisions of section 12 AB (4) though inserted with effect from 1 April 2022 but it is argued that that period prior to that would not be covered by the order of the learned principal Commissioner of income tax for cancellation of the registration.

41. The learned authorised representative submitted a note on August 11, 2025 wherein he submitted that that the provisions have been inserted with effect from 1 April 2022 and therefore there could not be applied for the period prior to the assessment year 2022 – 23. He relied upon the decision of the honourable Supreme Court in case of CIT v. Vertical Townships Private Limited (SC)/[2014] 367 ITR 466 (SC). He further stated that assessee has relied upon the 8 decisions during the course of the hearing and he stated that all the decisions of the coordinate benches have held that those provisions could not be applied prior to 14 2022. He further referred to another decision of Sri Srinivasa Educational and Charitable Trust v. DCIT(Bangalore – Trib.) / ITA No. 835/Bang/2023 dated 24 March 2025 wherein paragraph No. 17.4 and 17.5 it is further held that section 12 AB (4) could not be applied retrospectively. He submits that the learned judicial member is the party to the above decision. Thus, it was stated that these decisions of the coordinate Benches binds this Bench. He further stated that there are no contrary decisions to his knowledge.

42. The learned CIT DR vehemently submitted that the provisions have been inserted with effect from 1 April 2021 granting authority to the learned principal Commissioner of income tax to cancel the registration. He submits that any action after that date related to any of the previous assessment years could be subject to the cancellation according to the plain reading of the provisions of the act. It was submitted that it is not the presumption of retrospective witty but the application of the provisions of the law. She submits that from that date the provision has confirmed the power on an authority. Therefore after that date they can pass any order concerning to any assessment year whether it is prior to or the same assessment year. He submits that there is no reason to say that the authority is available only from a particular assessment year. He submits that though the decisions have been rendered by the coordinate benches but there is no authority available that this power is available only with effect from a particular assessment year.

Decision and Reasons

43. We have carefully considered the rival contentions and perused the orders of the ld PCIT and also the reference made by the ld AO for cancellation of Registration u/s 12AB 4 (ii) of the Act.

Relevant provisions of the Income tax Act

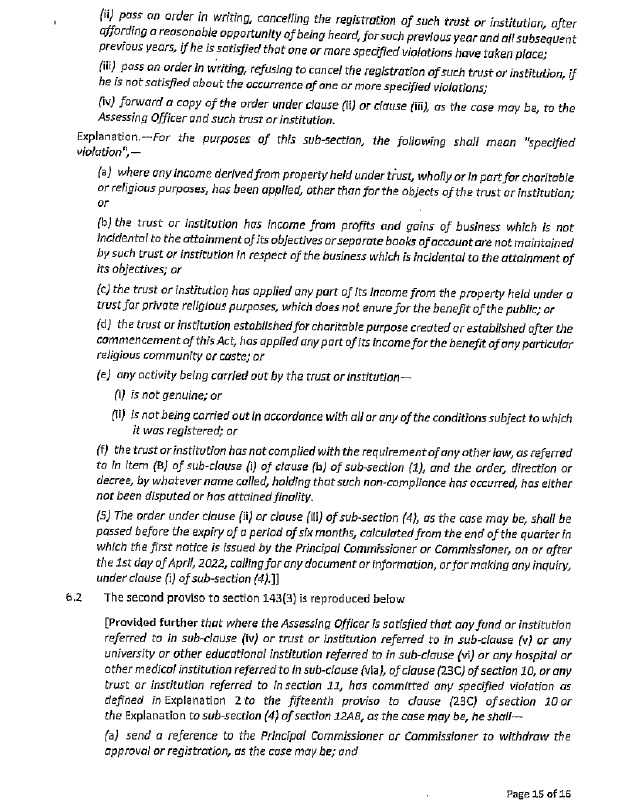

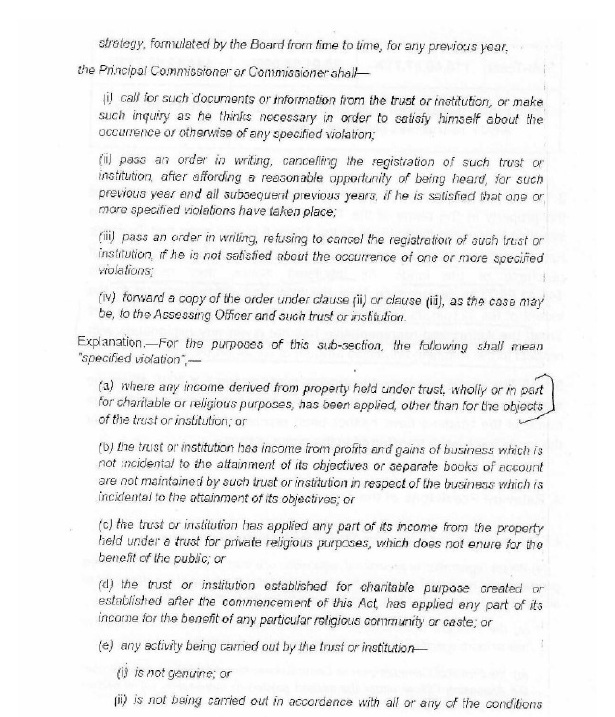

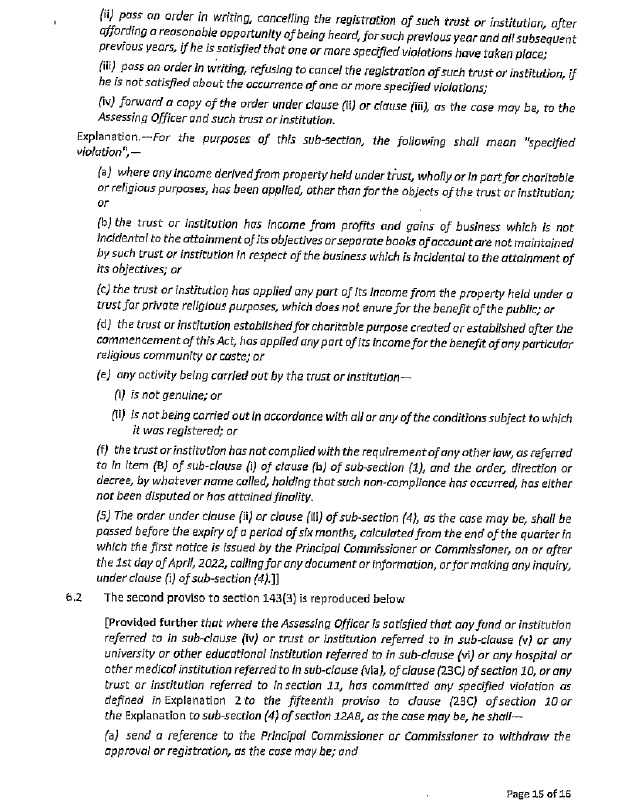

44. Provisions of section 12AB (4) are as under :-

[(4) Where registration or provisional registration of a trust or an institution has been granted under clause (a) or clause (b) or clause (c) of sub-section (1) or clause (b) of sub-section (1) of section 12AA, as the case may be, and subsequently,—

| (a) | the Principal Commissioner or Commissioner has noticed occurrence of one or more specified violations during any previous year; or |

| (b) | the Principal Commissioner or Commissioner has received a reference from the Assessing Officer under the second proviso to sub-section (3) of section 143 for any previous year; or |

| (c) | such case has been selected in accordance with the risk management strategy, formulated by the Board from time to time, for any previous year, |

the Principal Commissioner or Commissioner shall,—

| (i) | call for such documents or information from the trust or institution, or make such inquiry as he thinks necessary in order to satisfy himself about the occurrence or otherwise of any specified violation; |

| (ii) | pass an order in writing, cancelling the registration of such trust or institution, after affording a reasonable opportunity of being heard, for such previous year and all subsequent previous years, if he is satisfied that one or more specified violations have taken place; |

| (iii) | pass an order in writing, refusing to cancel the registration of such trust or institution, if he is not satisfied about the occurrence of one or more specified violations; |

| (iv) | forward a copy of the order under clause (ii) or clause (iii), as the case may be, to the Assessing Officer and such trust or institution. |

Explanation.—For the purposes of this sub-section, the following shall mean “specified violation”,—

| (a) | where any income derived from property held under trust, wholly or in part for charitable or religious purposes, has been applied, other than for the objects of the trust or institution; or |

| (b) | the trust or institution has income from profits and gains of business which is not incidental to the attainment of its objectives or separate books of account are not maintained by such trust or institution in respect of the business which is incidental to the attainment of its objectives; or |

| (c) | the trust or institution has applied any part of its income from the property held under a trust for private religious purposes, which does not enure for the benefit of the public; or |

| (d) | the trust or institution established for charitable purpose created or established after the commencement of this Act, has applied any part of its income for the benefit of any particular religious community or caste; or |

| (e) | any activity being carried out by the trust or institution,— |

| (i) | is not genuine; or |

| (ii) | is not being carried out in accordance with all or any of the conditions subject to which it was registered; or |

| (f) | the trust or institution has not complied with the requirement of any other law, as referred to in item (B) of sub-clause (i) of clause (b) of sub-section (1), and the order, direction or decree, by whatever name called, holding that such non-compliance has occurred, has either not been disputed or has attained finality 41[; or] |

| 41[(g) | the application referred to in clause (ac) of sub-section (1) of section 12A is not complete or it contains false or incorrect information.] |

45. On careful perusal of the above provisions of the act it is apparently clear that with respect to the any trust which is registered or provisionally registered and subsequently to the authority namely the principal Commissioner or Commissioner (i) notices that there are occurrences of one or more specified violation during any previous year or (ii) a reference has been received from the assessing officer under the second proviso to subsection (3) of section 143 for any previous year or (iii) if the such cases have been selected in accordance with the risk management strategy formulated by the board from time to time for any previous year, the principal Commissioner shall call for documents and information from the trust, make enquiry according to his own wisdom to satisfy himself that there is a specified violation and then he can pass an order in writing cancelling the registration of such trust after affording an opportunity of being heard for such previous year and all subsequent previous year if he is satisfied that one or more specified violations have taken place. If after enquiry he is satisfied that that there is no such violation, and he is not satisfied about the occurrence of one or more specified violation then he may refuse to cancel the registration. On the passing of the order, he will forward a copy of such order to the assessing officer as well as to the assessee trust.

46. The specified violations have been mentioned in explanation to section 12 AB (4) of the act. Namely such specified violations are if the income of the trust has been applied other than for the object of the trust or institution, the trust has earned income from profits and gains of business which is not incidental to the attainment of its objectives or assessee trust fails to maintain separate books of account in respect of such business which is incidental to the attainment of its objectives or the trust applies any income for private religious purposes which is not for the benefit of the public or the income of such trust is applied for the benefit of any particular religious community or caste. In other cases, if it finds that the activities carried out by the trust are not genuine and are not in accordance with the conditions subject to which it was registered over it has not complied with the requirement of any other law and such compliances have reached finality then also you can cancel the registration. He may also cancel the registration if the application made by the assessee trust contains any false or incorrect information. In view of this provision is the various proposition is raised by the learned authorised representative are required to be addressed to.

Whether the PCIT (Central) has power to cancel the registration granted by The CIT (E).

47. The first issue that arises is that whether the ld. PCIT has any jurisdiction to cancel the registration under the provisions of section 12AA(4) of the Act. Admittedly in this case the ld. PCIT has passed the order on 30.9.2024 for all these 4 assessment years. The argument of the ld. AR is that the ld. PCIT is not empowered to cancel the registration, but only it is the CIT(E). Plethora of judicial precedents of various coordinate Benches were cited. We find that it is not in dispute that according to section 127 of the Act, the case is transferred to the AO under the charge of PCIT, Bengaluru. According to the provisions of section 127, the jurisdiction rests with the AO about the whole of the ‘case’ for all proceedings under the I.T. Act. Therefore, no doubt such ‘ case’ includes all proceedings under this Act. Therefore, the Explanation to section 127 is more comprehensive which includes pending proceedings as well as proceedings to be initiated in future. Thus, the only meaning that can be assigned to the Explanation is that ‘case’ means entire proceedings under the Act. Nothing suggests that it should be only restricted to assessment only. Therefore, all these functions and powers assigned in the juridical hierarchy would also be available to the PCIT. Further the ld. CIT(DR) has submitted a letter dated 19.1.2024 wherein a reference was made to Notification No.52/2014 dated 22.10.2024 and then it is stated that the above Notification makes it clear that the CIT(E) does not exercise any jurisdiction in respect of persons claiming exemption u/s. 11 & 12 of the Act which have been assigned to the AO, subordinate to the PCIT u/s. 127 of the Act. Therefore para 2.13 of that letter clearly says that CIT(E) does not have any power to cancel the registration, there it is crystal clear that it is only the PCIT who will have the power to cancel the registration when an order u/s. 127 is passed. Further if it is held that only CIT (Exemption) has such power than the whole mechanism provided by the second proviso to section 143(3) would also fail. Therefore, we are of the considered and firm view that the proper and correct interpretation of the Notification mentioned in the letter dated 19.1.2024 undisputedly shows that the PCIT assumes the power to cancel the registration over the assessee trust if an order u/s. 127 is passed conferring the jurisdiction to the AO subordinate to him.

48. Though the ld. AR has relied upon several precedents of the Tribunal, we find that none of these decisions has considered the existence of Notification and communication dated 19.1.2024 wherein Notification No.52/2014 dated 22.10.2014 and Notification No.70/2014 dated 13.11.2014 were brought to their attention along with the above letter. Thus, the coordinate Benches whose decisions are cited before us were not shown the communication and Notification as shown before us which gives the power to the ld. PCIT (Central) over the case of the assessee for cancelling the registration u/s. 12AA of the Act. Accordingly, we find that the ld. PCIT (Central) has correctly assumed the power over the assessee for cancelling the registration. It is valid and legal. Thus, we reject the contention of the assessee that the PCIT(Central) does not have the jurisdiction to cancel the registration granted to the assessee by invoking the provisions of section 12AA(4) of the Act. Accordingly, we dismiss ground Nos. 1 & 2 of the appeal.

Whether reference made under second proviso to section 143(3) of the Act before issuance of any notice u/s 143 (2) of the Act is valid.

49. The second argument of the ld. AR is that the reference made by the ld. AO atleast for AY 2015-16, 2016-17 & 2019-20 is illegal as the reference is made to the ld. PCIT before even issue of notice u/s. 143(2) of the Act.

50. The provisions of section 143(3) wherein the 2nd proviso provides that where the AO is satisfied that as assessee trust committed any specified violation as defined in Explanation 2 to sub-section (4) of section 12AB, he shall send a reference to the PCIT to withdraw the approval and then he shall not pass an assessment order without giving effect to the order of the PCIT order under section 12AB(4) of the Act. Therefore, the necessary ingredient is that there has to be a satisfaction recorded of the AO first that the trust has committed any specified violation.

51. Now we find that for AY 2015-16 the return of income was filed by the assessee on 6.4.2023 in respect of notice u/s. 148 dated 20.3.2023. Further a notice u/s. 142(1) of the Act was issued on 6.11.2023. First notice u/s. 143(2) of the Act was issued on 26.6.2024. By this notice the AO has communicated to the assessee that the return of income filed by the assessee for AY 2015-16 on 6.4.2023 requires certain clarifications and therefore return of income has been selected for scrutiny.

52. Similarly for AY 2016-17 notice u/s. 148 of the Act was issued on 28.3.2023. Pursuant to that the assessee filed its return of income on 6.4.2023. Notice u/s. 142(1) of the Act was issued on 4.8.2023 and further the notice u/s. 143(2) r.w.s. 147 was issued on 26.6.2024.

53. Similarly for AY 2019-20 notice is issued u/s. 148 on 31.3.2023 in response to which the assessee filed its return of income on 6.4.2023. Notice u/s. 142(1) was issued on 4.8.2023 and notice u/s. 143(2) r.w.s. 147 of the Act was issued on 26.6.2024.

54. We find that the ld. AO has made a reference to the PCIT (Central), Bengaluru on 5.3.2024. Therefore, the contention of the assessee is that without issuing a notice u/s. 143(2) of the Act, how the ld. AO could have recorded a satisfaction that there is a specific violation as mentioned in the Explanation to section 12AB(4) of the Act.

55. We have carefully considered the above date lines and also the proposal for cancellation of approval submitted before us by the ld. CIT(DR) as per communication dated 20.12.2024. On careful consideration of the reference for cancellation of approval granted sent by the AO from para 1.5 onwards, he has merely mentioned the details found during the course of search proceedings. There is not a single paragraph which is arising out of the assessment proceedings. Para 7 clearly states that “it is seen from the evidence gathered during the search and the submissions of the assessee that the assessee applied its income for the purposes other than for the objects of the trust and further the assessee has generated cash through bogus billing and utilised the same towards personal interest of the assessee. Therefore, I am satisfied that the assessee trust has committed specified violation as defined in clause (a) & (b) of the Explanation.” Therefore, the whole reference shows that he has relied on only the search proceedings and the submission made by the assessee during the search proceedings. That has to be looked into with notice u/s. 143(2) of the Act issued for all these 3 years to the assessee only on 26.6.2024 and whereas the proposal for cancellation was made on 5.3.2024. Thus, it is clear that even before the return of income was being scrutinized for verification, whether there is only a prima facie believe of under-statement of income or the loss. According to the provisions of section 143(2) of the Act, the notices to be issued for verification of the return if the AO considers it necessary or expedient to ensure that the assessee has not under-stated the income or has not computed the excessive loss has not under-paid the tax in any manner, then only such notices are to be issued. The notice u/s. 143(2) has to be followed by a detailed enquiry, examination, verification and then has to be followed by the assessment u/s. 143(3) of the Act. Therefore prior to issue of such notices, there could not have been any satisfaction on the part of the AO that there is a specified violation. If the ld. AO simply borrows what is found during the course of search, then law makers would not have required the satisfaction of the AO himself about the specified violation. Such satisfaction could only have been arrived after proper verification of the details and obtaining the explanation of the assessee and then reaching at a conclusion that there is a specified violation as prescribed in Explanation to section 12AB(4) of the Act and then only the AO could have invoked the second proviso to section 143(3) of the Act. In view of the above facts, we do not subscribe that the AO has reached at a satisfaction for AYs 2015-16, 2016-17 and 2019-20 about specified violation. Therefore, for these reasons. We quash the order of the ld. PCIT cancelling the registration of the trust for AYs 2015-16, 2016-17 and 2019-20.

56. With respect to the order cancelling the registration for AY 2022-23, we find that the proposal was sent on 19.2.2024 wherein the notice u/s. 143(2) of the Act was issued to the assessee on 31.5.2023 on the return of income filed by the assessee on 30.9.2022. Therefore, on this ground, the order passed by the ld. PCIT on 30.9.2024 with respect to the AY 2022-23 is correctly passed.

Whether the Powers granted for cancellation with effect from 1/4/2022 applies only from AY 2022-23.

57. The next ground raised by the ld. AR is that the ld. PCIT has cancelled the registration for AYs 2015-16, 2016-17 and 2019-20 by an order dated 30.9.2024. It was argued before us that after the Finance Act, 2022, the scope of sub-section (4) & (5) of section 12AB of the Act have been widened which included the powers for cancellation of registration. According to the same, it provides for the circumstances under which the PCIT has power to withdraw or cancel the registration granted under the Act. Those circumstances are specified to show that when the PCIT notices on his own occurrences of one or more specified violation as per the Explanation and further when such violations are reported by the ld. AO, then he sends a reference under the 2nd proviso to section 143(3) that such specified violations have been committed. It can also be where the case has been selected on the risk management strategy noticing one or more specified violations. Then the ld. PCIT shall call for documents, information, make enquiry and then satisfy himself about the occurrence of such specified violation and then pass an order of either cancellation or refusing to cancel the registration. Thus, it is argued that as these powers have been vested w.e.f. 1.4.2022, it can only apply from AY 2022-23 and not prior to that. For this proposition, several judicial precedents are cited of the coordinate Benches.

58. The ld. CIT(DR) has vehemently submitted that the powers have been vested w.e.f. 1.4.2022 and nowhere it is stated that it has to be exercised only for AY 2022-23 onwards. It was further stated that retrospectivity could not have been presumed. If a view canvassed by the assessee is accepted then the provisions will become inoperative for some of the assessment years.

59. On a careful consideration of the facts and on reading the authoritative commentary of Sampath Iyengar on Law of Income Tax, 13th Edition, Vol. 3, at page 3269, it states that the cancellation of registration would be for the previous year in which specified violation has taken place and all subsequent previous years. The cancellation could be retrospective in nature if the specified violation is noticed from an earlier previous year. There appears no time limit as regards the number of previous years that have passed for the purpose of cancellation of registration, although on general principle, reasonable time limit may have to be read in. The cancellation of registration for an earlier previous year and of previous years subsequent thereto could trigger reassessment u/s. 147 subject to the time limits provided u/s. 149 of the Act. Therefore, according to this authoritative commentary, the retrospective powers are also available to cancel the registration even prior to the AY 2022-23.

60. The Notes on Clauses to the Finance Bill, 2022 wherein this amendment was brought into by amendment to clause (vii) also states that these amendments take effect from 1.4.2022.

61. Further the Memorandum also states that these amendments take effect from 1.4.2022. It does not refer to any assessment year.

62. Further the CBDT Circular No. 23/2022 dated 3.11.2022 in para 9.3.3 has categorically held that such provisions are effective from 1.4.2022, irrespective of assessment year.

63. Therefore, neither in the Memorandum of Finance Bill, Notes on Clauses and the CBDT Circular says that these amendments are effective only from assessment year 2022-23.

64. It is also plausible that from 1/4/2022 the ld CIT is empowered to cancel the registration if reference is received or if he notices Suo moto. It is the effective date of granting power to an authority and not applicability of a provision from a particular assessment year.

65. However, the several judicial precedents relied upon before us provides that such order could only be passed from AY 2022-23 only. The judicial discipline and the consistency binds us and further the Id. CIT(DR) also could not point out any contrary decision.

66. Therefore, respectfully following the same starting from the decision of the coordinate Bench in the case of Amala Jyothi Vidya Kendra Trust (supra) and the last decision pointed out before us in the case of Sri Srinivasa Educational & Charitable Trust (supra) wherein it has been held that the amendment made w.e.f. 1.4.2022 would only apply from assessment year 2022-23.

67. Therefore, the order passed by the ld. PCIT(Central), Bengaluru cancelling the registration u/s. 12AB(4) for AYs 2015-16, 2016-17 and 2019-20 by order dated 30.9.2024 deserves to be quashed. Hence the cancellation of registration for all these years by the ld. PCIT is invalid, unsustainable and hence quashed.

Reference by the AO, “satisfaction” of the Id AO mandatory for cancellation. [AY 2022-23]

68. Now with respect to AY 2022-23, it is stated before us that the order cancelling the registration is passed on 30.9.2024 and therefore it is made post 1.4.2022 i.e., after AY 2022-23 is also invalid for the reason that there is no reference of any specified violation which is issued as a show cause notice to the assessee. The ld. AR referred to the provisions of section 12AB(4) and submitted that the ld. PCIT on a reference received from the ld. AO should have called for such document or information from the trust or institution or made such enquiry as he thinks necessary in order to satisfy himself about the occurrence or otherwise of any specified violation. He could have cancelled the registration of such trust after affording a reasonable opportunity of hearing to the assessee and thereafter if he is satisfied that one or more specified violations have taken place. He referred to para 4 which is a show cause notice issued to the assessee on 13.4.2024. He noted that in the show cause notice there is no reference about which clause of the specified violation has taken place. He submits that para No.4 is the complete print of the show cause notice. It is his submission that there is no violation by the ld. PCIT about the mention of any of the specified violation as covered in Explanation to section 12AB(4) of the Act. He further submits that assessee has filed two submissions on 25.3.2024 & 24.7.2024 wherein it was submitted that there is no specified violation by the assessee. It was further stated that the order passed by the ld. PCIT is merely based on the material found during the course of search and no independent enquiry has been carried out. The ld. AR further referred to the meaning of the satisfaction and he submitted that the meaning of ‘satisfaction’ is greater than the word ‘approval’. He submits that assessee has retracted the statement and therefore, the importance of ” satisfaction” increases. He submits that the show cause notice of the ld. PCIT as well as reference made by the ld. AO are the same. He further stated that para 1 onwards it is identical. It was further stated that even the provisions of the Act are stated in the similar fashion.

69. The ld. CIT(DR) vehemently submitted that the ld. AO during the course of assessment proceedings sent a proposal for cancellation of the approval on 19.2.2024 and further the Addl. CIT also forwarded the above proposal to the PCIT. The proposal clearly stated that there is a diversion of trust fund of the trustees for purchase of land in their individual capacity and further there is generation of cash through bogus billing. Thus, it clearly falls into the specified violation under clause (a) & (b) of the Explanation. She submitted that the ld. PCIT has given an opportunity of hearing to the assessee and has also recorded the explanation or submission of the assessee and therefore there is no infirmity in the order passed by the ld. PCIT for AY 2022-23.

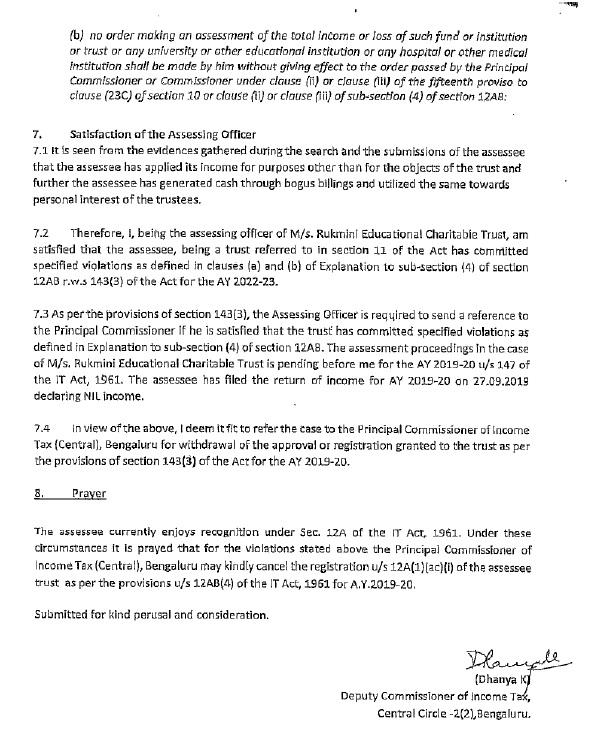

70. We have considered the rival contentions and perused the orders of the ld. lower authorities. The facts clearly show that the ld. AO on 19.2.2024 sent the proposal to the PCIT (Central), Bengaluru for cancellation of approval to the assessee trust for AY 2022-23. It was further stated that the assessment is getting time barred on 31.3.2024 for the impugned assessment year on the return of income filed by the assessee on 30.9.2022 declaring Nil income. The ld. AO has clearly stated that the assessee was registered u/s. 12A of the Act on 19.3.2003 and subsequently by order dated 29.7.2019 the CIT(E) examined the registration so granted to the trust on 24.9.2021 is applicable for AY 2022-23 to AY 2026-27. It was stated that during the course of search u/s. 132 of the Act on 23.6.2022 on the assessee and other related entities, the search operations unearthed the evidence regarding the diversion of funds of the trust for the purchase of land in the name of trustees and booking of bogus expenditure for generation of cash. In para 2 the clear details with respect to the allegation of diversion of funds to one corporate entity and vide para 3 the details with respect to the individual trustees and advances given to them found during the course of search was mentioned. Further as per para 4 the details of bogus expenditure booked for generation of cash and vide para 5 reference was made of unaccounted cash expenditure. In para 6 it is also the allegation of unaccounted cash utilized for land purchase and further in para 7, there is unexplained cash in the hands of the assessee. In para 8, it is specifically mentioned that based on the evidence gathered during the search, the DDIT (Inv.) has estimated the undisclosed income for respective years. In para 9, the relevant provisions of the Act were mentioned and in para 10 the ld. AO has stated as under:-

“10. Satisfaction of the Assessing Officer

10.1 It is seen from the evidences gathered during the search and the submissions of the assessee that the assessee has applied its income for purposes other than for the objects of the trust and further the assessee has generated cash through bogus billings and utilized the same towards personal interest of the trustee!)

10.2 Therefore, I, being the assessing officer of M/s. Rukmini Educational Charitable Trust, am satisfied that the assessee, being a trust referred to in section 11 of the Act has committed specified violations as defined in clauses (a) and (b) of Explanation to subsection (4) of section 12AB r.w.s 143(3) of the Act for the AY 202223.

10.3 As per the provisions of section 143(3), the Assessing Officer is required to send a reference to the Principal Commissioner if he is satisfied that the trust has committed specified violations as defined in Explanation to sub-section (4) of section 12AB. The assessment proceedings in the case of M/s. Rukmini Educational Charitable Trust is pending before me for the AYs 2015-16, 2016-17, 2019-20 u/s 147 of the IT Act, 1961 and for A,Y.2022-23 u/s 143(3) of the Act. The assessee has filed the return of income for AY 2022-23 on 30.9.2022 declaring NIL income.

10.4 In view of the above, I deem it fit to refer the case to the Principal Commissioner of Income Tax (Central), Bengaluru for withdrawal of the approval or registration granted to the trust as per the provisions of section 143(3) of the Act for the AY 2022-23.”

71. According to the provisions of 2nd proviso to section 143, there has to be a satisfaction of the AO which is arising during the course of assessment proceedings that the assessee has committed specified violation. The complete reference of the reference made by the ld. AO does not show any single instance about any enquiry or his satisfaction with respect to the specified violation. The complete reference has been made based on the evidence found during the course of search. The AO has not made any reference of the enquiries made by him about the specified violation. He has completely copied down what is stated by the DDIT including the amounts of such violation for each year. The law provides that it has to be the satisfaction of the AO and it could not be the borrowed satisfaction. It is also surprising that when the statement has been retracted, the ld AO still reiterated the conclusion of search party. It is more relevant in such case to have conducted some inquiry and examination. The coordinate Bench in the case of Sri Srinivasa Educational & Charitable Trust (supra) in para 17.6 onwards has dealt with an identical situation and in para 17.7 has held that the ld. AO has merely relied upon the search material and therefore it appears to be a case of borrowed satisfaction. One of us (the JM) is also a party to that decision. Accordingly, we find that the reference made by the ld. AO fails the criteria of his own satisfaction about the specified violation. As the case before us is that the reference has been received from the AO u/s. 143(3) invoking the 2nd proviso for the impugned assessment year falling under clause 12AB(4)(b), the mentioning of specified violation by the ld. PCIT when such violation mentioned by the ld. AO in the reference would not have met with the provisions of the law. The provisions of 2nd proviso to section 143 of the Act also speaks about the satisfaction of the AO about the specified violation. The reference made as per para 10 were merely on the basis of the search material and not his own satisfaction. Therefore, the order of the ld. PCIT based on such borrowed satisfaction of the ld. AO which makes the reference unsustainable, naturally the order passed on such reference is also unsustainable. Accordingly, the order passed u/s. 12AB(4) of the Act cancelling the registration for AY 2022-23 by the impugned order dated 30.9.2024 is not sustainable and hence quashed.

72. We state that we have not examined the merits of the case but restored the registration of the assessee u/s 12 AA of the Act by quashing the order passed by the ld PCIT cancelling the registration on reference made by the ld AO. The merits of the case would be dealt with separately in the assessment proceedings, without being influenced by this order.

73. In view of the above decision, the appeals filed by the assessee are partly allowed.