ORDER

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

2. The present petition has been filed by the Petitioner- M/s NBCC (India) Limited challenging the order dated 29th January, 2025 (‘hereinafter, the impugned order’) passed by the Office of Principal Commissioner of Central Goods and Service Tax, Delhi South Commissionerate.

3. In this case, the Petitioner- NBCC (India) Limited has developed the Kidwai Nagar (East) Area for General Pool Residential Accommodation, as also the commercial spaces.

4. It is the case of the Petitioner that a Memorandum of Understanding (hereinafter, ‘MOU’) was entered into between the NBCC (India) Limited and the Ministry of Urban Development (hereinafter, ‘MoUD’) on 16th July, 2013 for re-development of Kidwai Nagar (East).

5. An ESCROW agreement was also executed between the Petitioner, the MoUD and the Union Bank of India for operation and management of the lease proceeds from the Kidwai Nagar project. The Petitioner was identified as the implementing agency.

6. Thereafter, the Directorate General of GST Intelligence, Mumbai (hereinafter, ‘DGGI’) started an investigation against the Petitioner regarding the Kidwai Nagar project and the allegation by the DGGI was that an ESCROW Account was opened for collection of the lease amounts which is ultimately meant to be transferred to either the MoUD or the Consolidated Funds of India. In respect of the amounts lying in the ESCROW account, the impugned order has been passed seeking payment of Goods and Service Tax (hereinafter, ‘GST’).

7. It is the case of the Petitioner that so far, there are two kinds of entities from whom these amounts are received by the NBCC (India) Limited: business entities and non-business entities.

8. The said entities include: (1) Government Departments, (2) Autonomous Bodies and (3) Public Sector Undertakings (PSUs). Insofar as the Government Departments and the Autonomous Bodies are concerned, there is an exemption granted to the said institutions from paying GST.

9. However, in respect of others, the GST is to be deposited by reverse charge. The demand is, therefore, completely untenable qua NBCC (India) Limited.

10. On 19th May, 2025, notice was issued in this matter and the following directions were issued:

“12. Let instructions be sought in this matter as to whether the GST Department is in fact pressing for the GST demands, as raised in the impugned order, or whether the same ought to be resolved between the GST and the MoUD.

13. Let a meeting be held between the concerned Joint Secretaries at the MoUD and the Finance Ministry, in order to take a stand in this matter since as per the NBCC (India) Limited, the challenge in this case pertains to the Financial Year 2017-18 but the proceedings have also been commenced for subsequent years.

14. Let the meeting be held before 10th July, 2025. Subsequently, an affidavit be filed placing the Minutes of Meeting of the Joint Secretaries, by 31st July, 2025.”

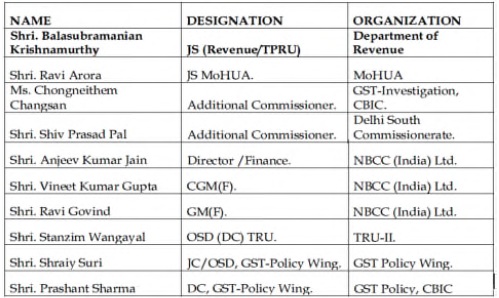

11. Thereafter, the matter was adjourned from time to time to place the decision of the meeting between the officials of the Ministries on record. A meeting is stated to have been held on 10th July, 2025 under the Chairmanship of the Joint Secretary, MoHUA, New Delhi. An affidavit in this regard was filed by Mr. Balasubramanian Krishnamurthy, Joint Secretary (TPRU), Department of Revenue. The various Officers who attended the meeting were as under:

12. Further, the Petitioner- M/s NBCC (India) Limited also made a representation to the Ministry of Finance on 12th August, 2025.

13. An office memorandum has been issued by the Ministry of Finance, dated 30th November, 2025, wherein it has been resolved as under:

“Kind attention is invited to the proceedings before the Hon’ble Delhi High Court in the matter of M/s NBCC (India) Limited (“NBCC) versus Additional Commissioner, CGST Delhi South, (W.P. (C) 6687/2025) concerning the levy of GST in relation to the Kidwai Nagar East Redevelopment Project. The case involves examination of GST liability arising from the leasing of commercial space by the Ministry of Urban Development (“MoUD”, now Ministry of Housing and urban affairs, “MoHUA’), involving M/s NBCC in its capacity as the executing and implementing agency under a Memorandum of Understanding (“MoU”) dated 16 July 2013.

1.1. Following an adjudication order dated 29 January 2025, which confirmed a GST demand of Rs. 45.36 crore against NBCC.

2. The facts of the case are briefly recounted as follows: i. M/s NBCC, a Government of India enterprise, was appointed as the implementing agency for the redevelopment of Kidwai Nagar East, New Delhi, pursuant to an MoU with the Ministry (“MoUD”, now MoHUA). The funding for the project was structured through lease proceeds from commercial and residential properties, with ultimate ownership and regulatory control resting with the Ministry.

ii. The CGST department raised a demand against NBCC, contending that NBCC, acting as agent of the Ministry, rendered taxable supply of leasing services and failed to discharge GST amounting to Rs 45.36 Crore on receipts of approximately Rs. 252.01 crore during FY 2017-18.

iii. NBC’s core defence is predicated on the principle of agency law and the factual matrix that NBCC acted solely as the executing arm of the principal (the Ministry), did not appropriate lease proceeds as revenues, and all funds were deposited into an escrow arrangement, managed by a committee constituted by the Ministry.

3. Analysis:

i. Section 86 of the CGST Act, 2017, reads as follows: “Where an agent supplies or receives any taxable goods on behalf of his principal, such agent and his principal shall, jointly and severally, be liable to pay the tax payable on such goods under this Act.”

ii It is mentioned that there is no corresponding statutory provision extending such liability to ‘services’. It therefore appears that the attempt to extend joint and several liability to the supply of services by an agent on behalf of the principal has no legal sanction within the CGST Act, 2017.

4. In view of the above, it is mentioned that:

i. Section 86 of the CGST Act, 2017 creates joint and several liability only for goods, not for services, and does not cover the present case.

ii. Where the Ministry is the principal supplier and remains available to accept any GST demand, initiation of proceedings against the agent appears to be unnecessary and without authority of law.

iii. Hence, it appears that the demand raised by CGST Delhi South has no merit. The same may please be brought to the attention of the Hon’ble Court.”

14. In view of the fact that the Ministry of Finance has clearly opined that the demand raised by CGST, Delhi South is of no merit, the impugned order dated 29th January, 2025 is accordingly set aside.

15. The petition is disposed of in these terms. Pending applications, if any, are also disposed of.