Order Quashed for Violation of Natural Justice: SCN Uploaded in ‘Additional Notices’ Tab Without Personal Hearing; Matter Remanded Subject to Cost

ISSUE

Whether an adjudication order passed pursuant to a Show Cause Notice (SCN) uploaded solely on the “Additional Notices” tab of the GST portal, without granting a proper opportunity of hearing or noticing the petitioner’s lack of reply, is valid in law.

FACTS

The SCN: The Revenue authorities issued a Show Cause Notice (SCN) for the period 2018-19.

The Upload: The SCN and the subsequent impugned order were uploaded on the “Additional Notices” tab on the GST portal, which the petitioner claimed they were unaware of.

The Defence: The petitioner contended that they missed the notice due to its obscure location on the portal and, consequently, filed no reply. The order was passed ex-parte without granting a personal hearing.

Precedent: The Court referred to its earlier decision in Sugandha Enterprises v. Commissioner of DGST ([2025] 179 taxmann.com 399 (Delhi)), where similar relief was granted under identical circumstances.

HELD

Natural Justice Denied: The High Court held that the petitioner did not get a proper opportunity of hearing. The placement of notices in the “Additional Notices” tab often leads to taxpayers missing them, which violates the principle of audi alteram partem.

Remand: To ensure fair adjudication, the impugned order was set aside.

Condition: The remand is subject to the petitioner paying a cost of Rs. 10,000/- to the authorities (likely for the delay/administrative burden caused).

Verdict: [In Favour of Assessee / Matter Remanded]

II. CHALLENGE TO LIMITATION EXTENSION (NOTIFICATIONS 56/2023 & 9/2023) STAYED

ISSUE

Whether the CBIC Notification Nos. 56/2023-CT (dated 28.12.2023) and 9/2023-CT (dated 31.03.2023), which extended the limitation period for issuing orders under Section 73 for FY 2018-19 (and others), are ultra vires the CGST Act.

FACTS

The Challenge: The assessee filed a writ petition challenging the validity of the government notifications that extended the time limit for adjudicating demands under Section 73 beyond the original statutory period.

The Provision: The extensions were issued invoking powers under Section 168A (Force Majeure/COVID-19 relief).

Supreme Court Pendency: The High Court noted that an identical challenge is currently pending before the Supreme Court in the case of HCC-SEW-MEIL-AAG JV v. Asstt. Commissioner of State Tax ([2025] 174 taxmann.com 1080 (SC)).

HELD

Outcome Linked to SC: The High Court ruled that the challenge to the validity of these notifications in the present proceedings would be subject to the outcome of the pending Supreme Court decision.

Status: The specific challenge to the notifications is effectively stayed/kept in abeyance pending the apex court’s ruling.

Verdict: [Matter Stayed / Subject to SC Outcome]

KEY TAKEAWAYS

“Additional Notices” Trap: This is a recurring issue. Courts are lenient if you missed a notice hidden in this tab, but they often impose a cost (like the Rs. 10,000 here) to discourage negligence. Always check User Services > View Additional Notices regularly.

Limitation Extension is Sub-Judice: If you are facing a demand for FY 2017-18, 2018-19, or 2019-20 that was issued strictly based on the extended limitation period (Notifications 9/2023 or 56/2023), do not accept it blindly. The validity of these extensions is currently being tested in the Supreme Court. Keep your appeal rights alive by citing the HCC-SEW-MEIL-AAG JV case.

| • | Notification No. 56/2023- Central Tax dated 28th December, 2023; and |

| • | Notification No. 56/2023- State Tax dated 11th July, 2024 |

| • | Notification No. 9/2023- Central Tax dated 31st March, 2023 |

| • | Notification No. 9/2023- State Tax dated 22nd June, 2023 |

| • | Notification No. 56/2023- Central Tax dated 28th December, 2023; and |

| • | Notification No. 56/2023- State Tax dated 11th July, 2024 |

| • | Notification No. 9/2023- Central Tax dated 31st March, 2023 |

| • | Notification No. 9/2023- State Tax dated 22nd June, 2023 (hereinafter, ‘the impugned notifications’). |

“1. The subject matter of challenge before the High Court was to the legality, validity and propriety of the Notification No.13/2022 dated 5-7-2022 & Notification Nos.9 and 56 of 2023 dated 31-3-2023 & 8-12-2023 respectively.

2. However, in the present petition, we are concerned with Notification Nos.9 & 56/2023 dated 31-3-2023 respectively.

3. These Notifications have been issued in the purported exercise of power under Section 168 (A) of the Central Goods and Services Tax Act. 2017 (for short, the “GST Act”).

4. We have heard Dr. S. Muralidhar, the learned Senior counsel appearing for the petitioner.

5. The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order under Section 73 of the GST Act and SGST Act (Telangana GST Act) for financial year 2019-2020 could have been extended by issuing the Notifications in question under Section 168-A of the GST Act.

6. There are many other issues also arising for consideration in this matter.

7. Dr. Muralidhar pointed out that there is a cleavage of opinion amongst different High Courts of the country. 8. Issue notice on the SLP as also on the prayer for interim relief, returnable on 7-32025.”

“65. Almost all the issues, which have been raised before us in these present connected cases and have been noticed hereinabove, are the subject matter of the Hon’ble Supreme Court in the aforesaid SLP.

66. Keeping in view the judicial discipline, we refrain from giving our opinion with respect to the vires of Section 168-A of the Act as well as the notifications issued in purported exercise of power under Section 168-A of the Act which have been challenged, and we direct that all these present connected cases shall be governed by the judgment passed by the Hon’ble Supreme Court and the decision thereto shall be binding on these cases too.

67. Since the matter is pending before the Hon’ble Supreme Court, the interim order passed in the present cases, would continue to operate and would be governed by the final adjudication by the Supreme Court on the issues in the aforesaid SLP-4240-2025.

68. In view of the aforesaid, all these connected cases are disposed of accordingly along with pending applications, if any.”

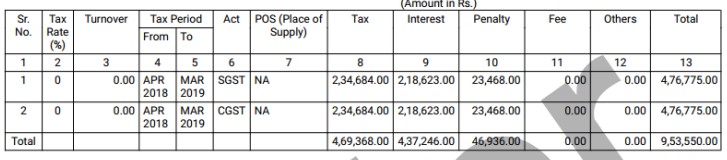

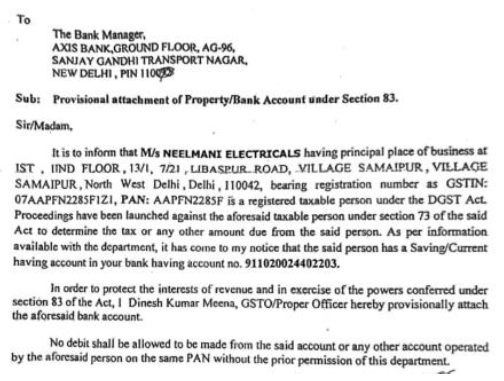

And whereas, the taxpayer had neither deposited the proposed demand nor filed their objections/ reply in DRC-06 within the stipulated period of time, therefore, following the Principle of Natural Justice, the taxpayer was granted opportunities of personal hearing for submission of their reply/objections against the proposed demand before passing any adverse order.

And whereas, neither the taxpayer filed objections/reply in DRC 06 nor appeared for personal hearing despite giving sufficient opportunities, therefore, the undersigned is left with no other option but to upheld the demand raised in SCN/DRC 01. DRC 07 is issued accordingly.

| (i) | Cost of Rs.10,000/- shall be deposited with the Delhi High Court Clerks Welfare Funds. The details of the said amount is as under: |

Name: Delhi High Court Clerks Association

A/c No: 15530100006282

IFSC Code: UCBA0001553

Branch: Delhi High Court

Branch Address: Shershah Road Delhi, New Delhi-110001

| (ii) | 25% of the balance in the following bank accounts of the Petitioner, which are stated to be frozen vide attachment order in FORM GST DRC-22 dated 9th September, 2025 shall be maintained in the said accounts: |

| Sl. No. | Closing Date | Final Amount |

| 1. | 14.11.2025 | 9,55,500.80/- |

| 2. | 13.11.2025 | 2,18,217.58/- |

| 3. | 14.11.2025 | 2,52,489.35/- |

| • | E-mail Address: advocatejaivardhan@gmail.com |

| • | Mobile No.: 9212395579 |