ORDER

1. The captioned appeal filed by the Revenue is arising from the order of the Ld. Commissioner of Income Tax (Appeals)-33, Noida [“Ld. CIT(A)”] dated 30.04.2025 passed under s. 250 of the Income Tax Act, 1961 [the Act] emanating from assessment order dated 28.03.2024 passed u/s 143(3) of the Act by the Assessing Officer [“AO”] for Assessment Year 2022-23.

2. Brief facts of the case are that a search and seizure operation u/s 132 of the Act was conducted on 28.07.2021 at the premises of the ACE and Kurle Group and then again on Ace & Rudra Group on 04.01.2022. The search warrant was in the name of M/s. ACE Infracity Developers Pvt. Ltd. The assessee company filed its return of income u/s 139(1) of the Act on 04.11.2022, declaring total income of INR 21,25,86,720/-. Based on the material available on record and considering the facts and circumstances of the case, assessment proceedings were initiated in terms of notice u/s 143(2) of the Act issued on 27.02.2023. Thereafter, the AO computed the total income of the assessee company at INR 22,94,83,823/- vide assessment order dated 28.03.2024 passed u/s 143(3) of the Act wherein addition of Rs. 40,00,000/- was made u/s 68 r.w.s. 115BBE of the Act towards the loan taken from M/s Hallow Securities Pvt. Ltd., addition of INR 87,25,098/- was made u/s 69A r.w.s. 115BBE of the Act towards cash balance held as unexplained and disallowance of INR 41,72,005/- was made u/s 37 of the Act towards various expenses.

3. Against the said order, assessee filed an appeal before Ld. CIT(A) who vide order dated 30.04.2025, allowed the appeal of the assessee and deleted all the additions/disallowance made by the AO.

4. Aggrieved by the order of Ld. CIT(A), Revenue is in appeal before the Tribunal by taking following grounds of appeal:-

1. “Whether on facts and circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in deleting the addition Rs.40,00,000/-made under Section 68 r.w.s. 115BBE of the Income Tax Act, 1961 on account of unexplained cash credit allegedly taken from M/s Hallow Securities Put. Ltd., without appreciating the fact that the assessee failed to discharge the initial onus of proving the creditworthiness and genuineness of the transactions along with supporting documentary evidences during the course of assessment proceedings.

2. Whether on facts and circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in deleting the addition of Rs.40,00,000/-made u/s 68 of the Act on account of unexplained cash credit taken from M/s Hallow Securities Pvt. Ltd., without – appreciating the fact that the said entity was classified as a confirmed shell company by the Ministry of Finance (Press Release dated 08.06.2018) and categorized as a High-Risk Financial Institution by FIU-INDfor non-compliance with PMLA and associated rules. It has also been corroborated by the Inspector’s report that the company has no physical presence.

3. Whether on the facts and the circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in deleting the addition of Rs. 87,25,098/- made under section 69A r.w.s. 115BBE of the Income-tax Act, 1961, on account of unexplained cash appearing in books of account, without appreciating that no physical cash was found at the premises during search and also no substantial explanation was offered by the assessee during the assessment proceedings.

4. Whether on the facts and the circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in deleting the disallowance of Rs.41,72,005/- made under section 37(1) of the Act, without appreciating that the assessee had failed to reconcile and correctly classify the nature of disallowable expenses including interest on delayed TDS payment, loss on sale of fixed assets and CSR expenditure which was rightly added back by the Assessing Officer in the income of the assessee.

5. That the order of CIT(A) being erroneous in law and facts be set aside and order of the A.O. be restored.

6. That the above grounds are without prejudice to each other and 5 appellant craves leave to add, alter OR amend any ground OR grounds on OR before the date of hearing of appeal. “

5. In Ground of appeal Nos. 1, 2, 5 & 6, the revenue has challenged the action of Id. CIT(A) in deleting the addition of Rs. 40,00,00,000/- taken from M/s Hallow Securities Pvt. Ltd.

6. We have heard the rival contentions and perused the material available on record. From the perusal of the assessment and appellate order, it is seen that on the issue of loan from M/s Hallow Securities Pvt. Ltd., all the observations and allegations made by AO are same as were made in the case of DCIT v. Allure Developers (P.) Ltd. [ITAppeal No. 3559(Delhi) of 2025, dated 26-11-2025] for Assessment Year 2020-21. The relevant observations by the Tribunal in deciding the appeal in ITA No.3559/Del/2025 are as under:-

19. “Heard the parties and perused the material available on records. In the present case the sole issue before us is the addition made of Rs. 17,74,00,000/- made by AO by holding the loans taken from M/s Hallow Securities Pvt. Ltd as unexplained u/ s 68 of the Act which stood deleted by Id. CIT(A). Before going further, the facts leading to the issue are summarized as under:

“A search action us/ 132 was carried out on ACE group of cases on 28.07.2021 and further on 04.01.2022. During the year assessee received loan of Rs. 26,74,00,000/- from a company M/s Hallow Securities Pvt. Ltd. which is a NBFC. The AO examined the genuineness of loan and after considering the financials of the lender company M/s Hallow Securities Pvt. Ltd., observed its financial position is not satisfactory to grant such a huge loan to the assessee. “

20. The AO has referred the statements of Sh. Nishant Chajjar, Director assessee company who was also the director of lender company M/s Hallow Securities Pvt. Ltd. who in reply to Q. NO. 14 stated that the cash/Hawala Transaction were handled by the other director of assessee company Sh. Prakash Kumar Jha. AO further observed that Shri Nishant is also directors of many companies managed and controlled by one Shri Ashish Begwani who alleged the key person and engaged in providing accommodation loans to assessee. The also referred the statements of Shri Ashish Begwani, recorded in the year 2017 wherein he explained the modus opemadi for providing accommodation entries to various beneficiaries.

21. During the course of assessment proceedings, assessee had submitted copy of TTR, bank statement, Audited Balance Sheet of M/s Hallow Securities Pvt. Ltd to establish the identity, genuineness of transaction and creditworthiness. Assessee further established that M/s Hallow Securities Pvt. Ltd. had sufficient funds available in its bank account as and when the funds were transferred to the assessee.

22. The AO admitted that M/s Hallow Securities Pvt. Ltd. is registered NBFC however, alleged that it is also engaged in providing accommodation entries of loan to various business houses. Assessee claimed that M/s Hallow Securities Pvt. Ltd has received CCDs amounting to Rs. 300 crores from M/s Teesta Retails Pvt. Ltd. during various financial years which is one of the group company of Reliance group. The AO observed that M/s Hallow Securities Pvt. Ltd. is a shell company as per the Press Release dated 08.06.2018 by Ministry of Finance. The AO has accepted part loans as genuine and made the addition of 17,74,00,000/- by doubting the source of this amount in the hands of the lender company M/s Hallow Securities Pvt. Ltd.

23. It is the contention of the assessee that no incriminating document whatsoever was found / seized during the course of search from the possession of the assessee or any of the directors or its employees. As the assessee no document is referred / relied upon by the AO for making the additions. He solely placed reliance on the statements of the director of assessee company and one of the employees of Ace group and also placed heavy reliance on the statements of one Shri Ashish Begwani, recorded during the search in his case in the year 2016-17 wherein he had admitted engaged in the business of providing accommodation entries. However, such statements were recorded three-four years back where transactions under dispute before us were carried out in the year 2019-20 thus these statements have no direct relevance with the loans taken by the assessee and therefore, cannot be made sole basis for alleging the loan taken by the assessee company in the year under appeal from M/ s Hallow Securities Pvt. Ltd. as unexplained/ bogus accommodation entries. The Hon’ble Supreme Court in the case of CIT-III, Pune v. Singhad Education Society in Civil Appeal No.l 1080/2017 arising out of SLP (C) No.25257/2015 has held as under:-

“The seized incriminating material have to pertain to the AY in question and have co-relation, document-wise, with the AY. This requirement u/s 153C is essential and becomes a jurisdictional fact. It is an essential condition precedent that any money, bullion or jewellery or other valuable articles or thing or books of accounts or documents seized or requisitioned should belong to a person other than the person referred to in S.l 53A. “

24. The Hon’ble Supreme Court in the case of Pr.CIT v. Abhisar Buildwell (P.)Ltd. reported in (SC) has also held that “no addition could be made dehorse the incriminating material”.

25. Further no addition could be made solely on the basis of statements of third party without bringing on record any corroborative evidence. In this regard we are in agreement with the observations made by the Id. CIT(A) at pages 91 to 95 of the order which is reproduced as under:

Standalone statements without corroborative evidence:

“The above, discussion reveals that the statements of Sh. Vishal Kumar and Sh. Nishant Chajjar reproduced by the AO in the assessment order are without corroborative evidence. The statements of the Directors of the Hallow Securities Pvt. Ltd. and the ACE Group le. Sh. Prakash Kumar Jha and Sh. Pratap Singh Rathi which were contrary to the statements of Nishant Chajjar and Vishal Kumar have not been reproduced in the assessment order, It is important for the Assessing Authority to analyze all the evidences available before him. Moreover, the statement of Nishant Chajjar makes no reference of advancing of bogus loan to the appellant meaning thereby that, even if, Hallow Securities Pvt. Ltd. was engaged in providing & receiving bogus loans apart from the regular business of NBFC (being a company of mixed conduct as established by the AO), still documentary evidence needed to be there to prove that funds advanced to the appellant were ingenuine. Such documentary evidence is conspicuously absent in the assessment order despite the fact that both the assessee group and M/s. Hallow Securities Pvt. Ltd. were searched.

It is pertinent to mention here that the standalone statement relied upon by the Assessing Officer cannot itself be considered as sufficient evidence to reach the conclusion as drawn by the AO in the assessment order, more so, for the reason that the said statements were equally rebutted by the other director of the appellant company. It is a well-settled principle of law that a statement unsupported by corroborative documentary evidence lacks evidentiary value.

In the present case, the AO has made the addition solely based on the statement of Sh. Vishal Kumar without producing any documentary evidence to substantiate the claim that cash was exchanged against the loans raised whereas, the director of the company had refuted the said allegation.

On the above issue, the Hon’ble Supreme Court of India in the case of Principal Commissioner of Income-tax (Central) v. Dwarka Prasad Aggarwal reported at (SC) has held as under:

“Section 68 of the Income-tax Act, 1961 – Cash credit (Illustrations) – High Court by impugned order held that where Assessing Officer solely based on statements of Directors recorded during a search operation conducted under section 132 on assessee, made addition under section 68 without probing deeper into income-tax returns of creditor companies and without scrutinizing documents furnished by assessee to prove genuineness of such credits, impugned addition was to be set aside – Whether SLP filed by revenue against impugned order was to be dismissed – Held, yes [Para 1] [In favour of assessee]”

Further, the judgment of Hon’ble High Court of Andhra Pradesh in the case of Commissioner of Income-tax-ll, Hyderabad v. Naresh Kumar Agarwal reported at (Andhra Pradesh) has held as under:

Where in absence of any incriminating material etc., found from premises of assessee during course of search, statement of assessee recorded under section 132(4) would not have any evidentiary value.

Further, the judgment of Hon’ble High Court of Madras in the case of Commissioner of Income-tax, Tiruchirappalli reported at Madras) has held as under:

Where addition of undisclosed income was made on basis of mere statement given by his son under section 132(4) which was not corroborated by any material evidence, neither such statement would be a conclusive evidence, nor any addition could be made.

Further, the judgment of Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax (Central) v. Naresh Nemchand Shah reported at 2023] (Gujarat) has held as under:

“Where pursuant to a survey, unsecured loans taken by assessee from GCSL were deemed non-genuine by Assessing Officer on basis of statement of director of GCSL, since apart from said statement, there was no other evidence against assessee and moreover, assessee had filed evidence in form of confirmation from creditor, audited accounts of creditor and copies of banks accounts to prove genuineness and creditworthiness of creditor which was within parameters of section 68, impugned addition made in that respect to be deleted”

Further, in the judgment of Hon’ble HIGH COURT OF CALCUTTA in the case of Principal Commissioner of Income-tax v. Sreeleathers reported at (Calcutta) it has been held as under:

It was noted that show-cause notice issued on assessee was only in respect of one lender company, namely, FGD – Assessee provided various documents in form of PAN card, income-tax acknowledgement, copy of bank statement, certification of incorporation, master data from register of companies, certificate of incorporation and annual account to prove FD’s identity and creditworthiness and genuineness of transaction – However, Assessing Officer by relying on statement of one AKA, who was alleged operator of such bogus companies, brushed aside these documents on mere ground that they did not absolve assessee from his responsibility of proving nature of transaction -It was noted that statement of AKA was not recorded in presence of assessee nor an opportunity of cross-examination was provided to it – Whether where there was no evidence brought on record by Assessing Officer to connect statement of AKA with loan transaction of assessee, said statement was of little avail and could not be basis of allegations – Held, yes – Whether, further, since assessee had discharged its initial burden by providing documentary evidences and burden had now shifted to Assessing Officer, who failed to bring on record any reason in writing as to why these documents did not establish identity of lender or proved genuineness of transaction, impugned assessment order passed by casually brushing aside these evidences was utterly perverse and liable to be quashed – Held, yes [Paras 4 and 5] [Matter remanded]

Further, the Hon’ble High Court of Kolkata in the case of Principal Commissioner of Income-tax v. Golden Goenka Fincorp Ltd. reported at (Calcutta) has held as under:

Where Assessing Officer solely based on statement of assessee’s director recorded during search operation treated share application money received by assessee-company as undisclosed income and made additions under section 68, since said statement was retracted during search operation and there was no cash trail or any other corroborative evidence or investigation brought on record by AO, impugned additions were to be deleted.

Further, the Hon’ble High Court of Gujarat in the case of Commissioner of Income-tax v. Shardaben K. Modi reported at (Gujarat) has held as under:

In absence of any independent material, statement ofassessee’s son recorder during survey would not form a valid basis for reopening assessment of assessee

Further, the Hon’ble High Court of Mumbai in the case of Principal Commissioner of Income-tax v. Bairagra Builders (P.) Ltd. reported at (Bombay) has held as under:

Section 68 of the Income-tax Act, 1961 – Cash credit (Loans) -Assessment years 2007-08 and 2012-13 – Assessee-company took unsecured loans from two companies – On basis of statement of one PKJ recorded during search and seizure operation that he had provided accommodation entries to assessee, Assessing Officer treated said loans as fake – Whether since Assessee had submitted all evidence to substantiate loans in question, including confirmation from creditors and loans were taken and repaid through banking channels, Assessing Officer was not justified in treating said unsecured loan as fake and making addition of interest paid on said loan to assessee’s income – Held, yes [Para 8] [In favor of assessee)

As has already been discussed above, the AO has relied upon statement of Nishant Chajjar and Vishal Kumar in the assessment order whereas, the statements of Prakash Kumar Jha and complete statement of Pratap Singh Rathi have not been discussed in the assessment order. It is also seen that the Investigation on the basis of source to source has been applied only to the funds received from Teesta Retails Pvt. Ltd. and HFCL but no such source-to-source investigation has been conducted with respect to the funds other than those received from Teesta Retails Pvt. Ltd. On the issue of cherry picking of statements/evidences, the Hon’ble Supreme Court in the case of RELIANCE INDUSTRIES LIMITED VERSUS SECURITIES AND EXCHANGE BOARD OF INDIA & ORS. reported at 2022 (8) TMI423 – SUPREME COURT has held as under:

“SEBI’s attempt to cherry-pick the documents it proposes to disclose – There is a dispute about the fact that certain excerpts of the opinion of Justice (Retd.) B. N Srikrishna, were disclosed to the appellant herein. It is the allegation of the appellant that while the parts which were disclosed, vaguely point to the culpability of the appellant, SEBI is refusing to divulge the information which, exonerate it. Such cherry-picking by SEBI only derogates the commitment to a fair trial. In the case at hand, SEBI could not have claimed privilege over certain parts of the documents and at the same time, agreeing to disclose some part. Such selective disclosure cannot be countenanced in law as it clearly amounts to cherry-picking. Appeal allowed.”

Further, in the judgment ofLd. ITAT Delhi Bench E in the case of M/s Lumax Industries Limited v. DCIT, Central Circle- 28, Delhi in ITA No. 947/Del/2021 vide its order dated 0d4.04.2024, it has been held as under:

“24. In the case in hand, the Ld. AO grossly erred in not taking cognizance of all the material found during the course of the search and not making any observation/comments on the other seized material. The Ld. AO cannot just cherry pick a particular piece of information to put reliance while concluding the proceedings against the Assessee. The Ld. A.O. cannot blow hot and cold at the same time by accepting and making a particular piece of evidence found during the course of search as his sole basis of addition and ignore the other documents/material, more particularly relating to the impugned transaction, found during the course of same sealed proceedings.

Further, the Ld. ITAT Bangalore Bench in the case of Mohammed Ibrahim Mohideen, Kerala v. Assistant Commissioner of Income-Tax, reported at ITA Nos.463 to 466, 485 & 486/Bang/2024 on 8 July, 2024 has held as under:

In our opinion, even the statement recorded to be considered as true, it has to be considered in its entirety and there shall not be any cherry picking and the AO cannot consider only the portion which is favorable to revenue.

Further, the Ld. ITAT Bench of Delhi in the case of HCL SINGAPORE PTE. LTD. C/O HCL TECHNOLOGIES LTD. VERSUS ASST. CIT CIRCLE INTERNATIONAL TAXATION 2(1) (1), DELHI reported at 2024(1) TMI 309 – ITAT DELHI has held as under:

From the perusal of the aforesaid statements of various employees which were recorded during the course of survey by the TDS officers, which were heavily relied upon by the Id. AO by cherry picking some of the questions and answers alone given by them, we find that prima facie all the statements of employees actually support the contentions of the assessee herein.

Further, the Ld. ITAT Bench of Bangalore in the case of M/S. HASSAN HAJEE & CO. VERSUS DEPUTY COMMISSIONER OF INCOME-TAX, MANGALORE (VICE VERSA) reported at 2022(9) TMI 1480 – ITAT BANGALORE has held as under:

The AO has taken notice of this statement. However, he intentionally ignored it as it was in favour of the assessee. The A.O. could not do cherry picking, if the Ld. AO considered the statement of Shri B. Kunhi where he has stated that payment of speed money was at Rs. 35 per M.T., there could be no addition on this count.

In view of the above discussion and stated judicial pronouncements, it is apparent that the statements reproduced by the AO without any corroborative evidence cannot be a sole basis for making addition in the case of the assessee. This is all the more true because the AO has himself proceeded to enquire into the source of source of the loans and gave relief to the extent of approximately Rs. 140 crores(Rs. 9 crore in the present case) in the whole ACE Group from the total loans received from M/s. Hallow Securities Pvt. Ltd. by ascribing the same to be from genuine sources. Still, it shall be important to examine the other relevant issues in the case in consequence to which enquiry was initiated with M/s. Hallow Securities Pvt. Ltd. “

26. As per section 68 of the Act, there must be a credit of amounts in the books maintained by an assessee and such credit has to be of a sum received during the previous year; and the assessee offer no explanation about the nature and source of such credit found in the books; or the explanation offered by the assessee in the opinion of the Assessing Officer is not satisfactory, it is only then the sum so credited may be charged to income-tax as the income of the assessee of that previous year. The expression “the assessee offer no explanation” means where the assessee offers no proper, reasonable and acceptable explanation as regards the sums found credited in the books maintained by the assessee. It is true that the opinion of the Assessing Officer for not accepting the explanation offered by the assessee as not satisfactory is required to be based on proper appreciation of material and other attending circumstances available on record. The opinion of the Assessing Officer is required to be formed objectively with reference to the material available on record. Application of mind is the sine qua non for forming the opinion.

27. In the instant case as observed above, assessee has filed following documentary evidences in support of the loan from M/s Hallow Securities Pvt. Ltd.

| (i) | | Confirmed Copy of account statement; |

| (ii) | | Bank statement of the lender company; |

| (iii) | | Audited financial statement of the lender company; |

| (iv) | | Copy ofITR acknowledgement of the lender company |

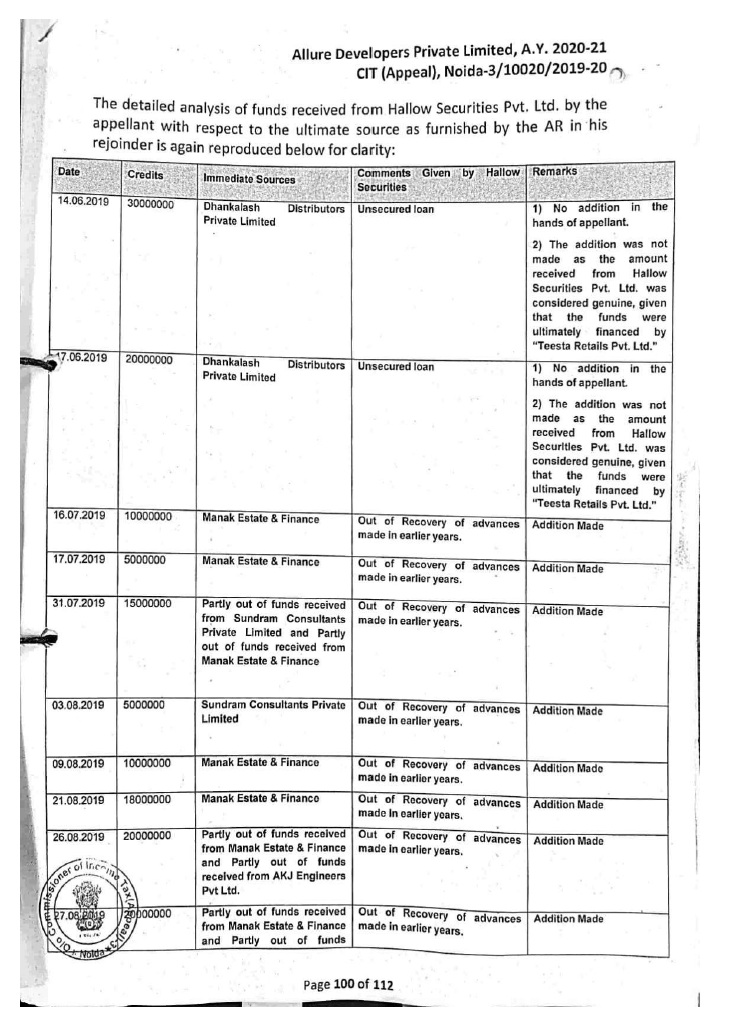

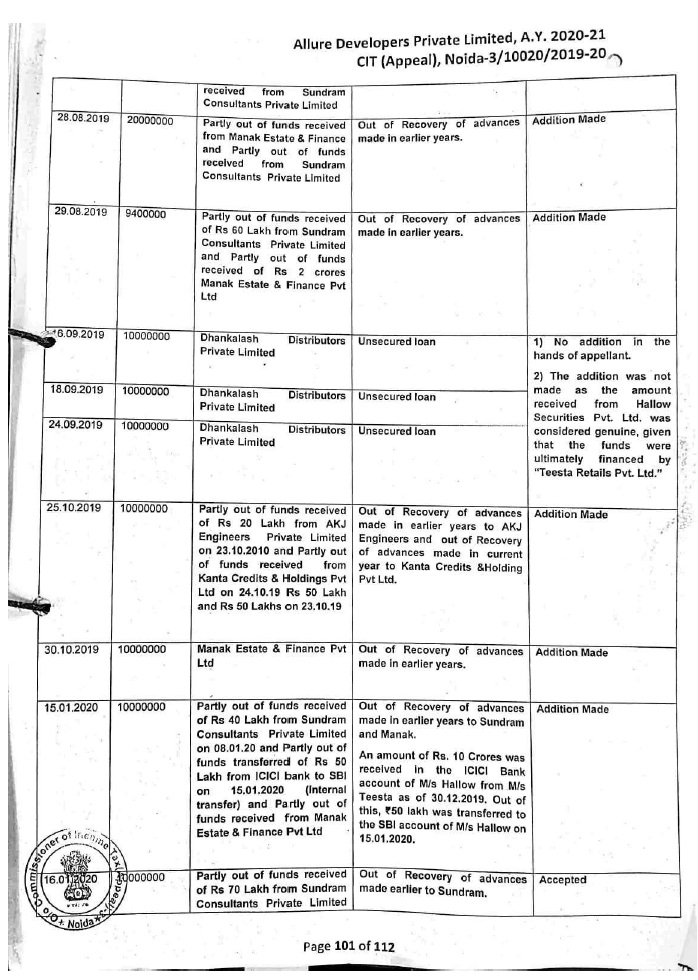

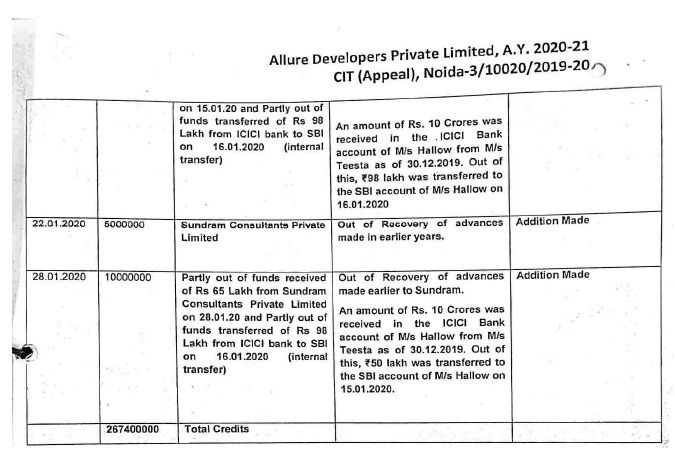

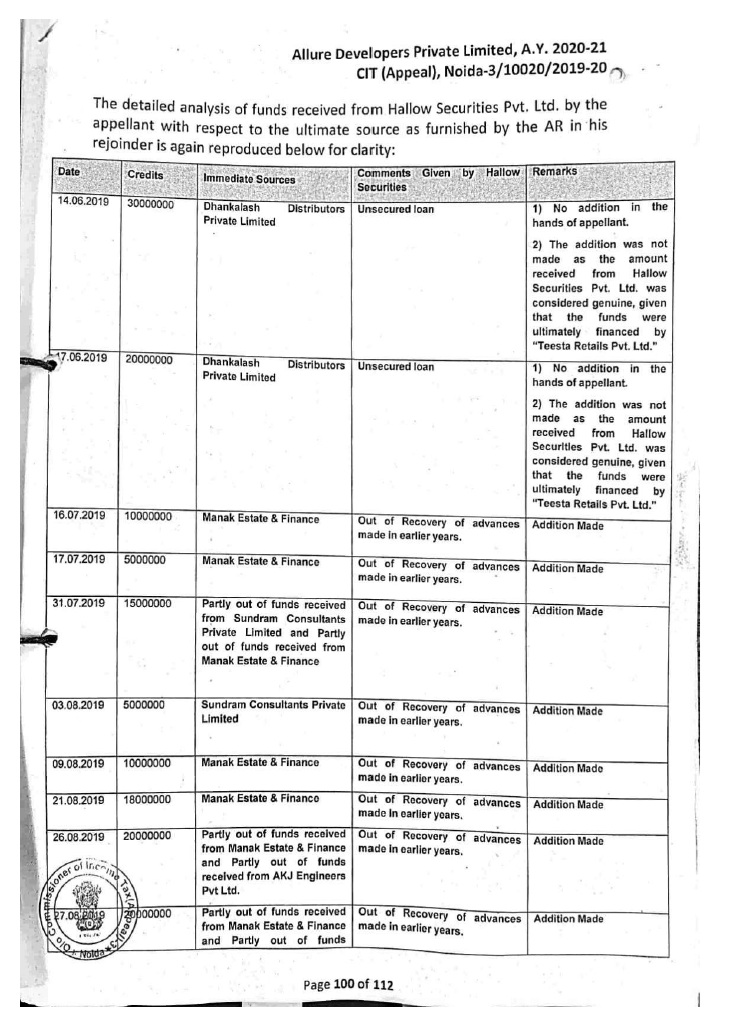

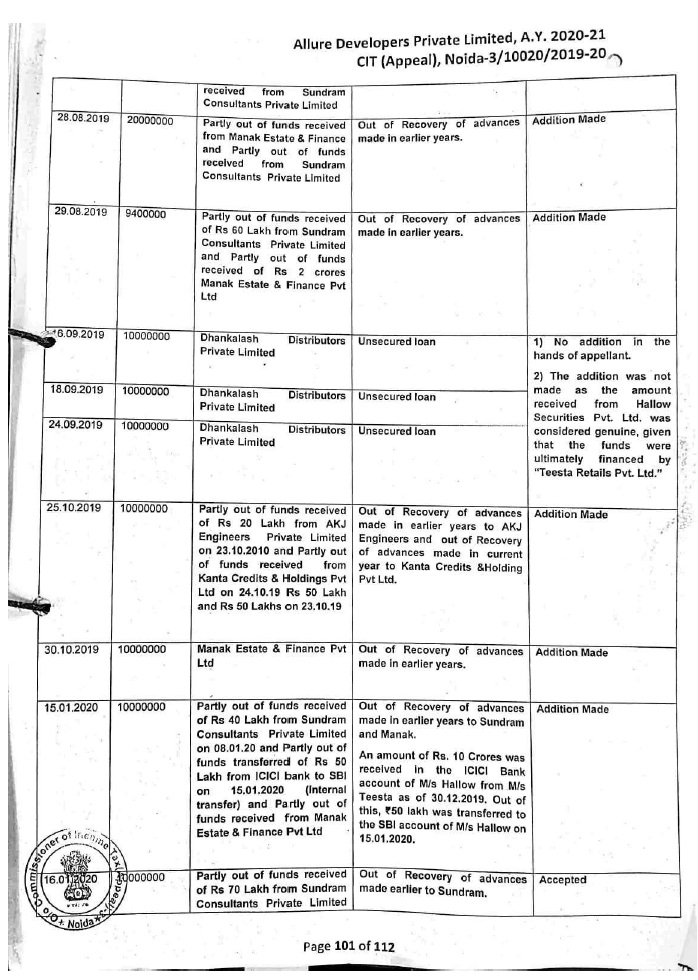

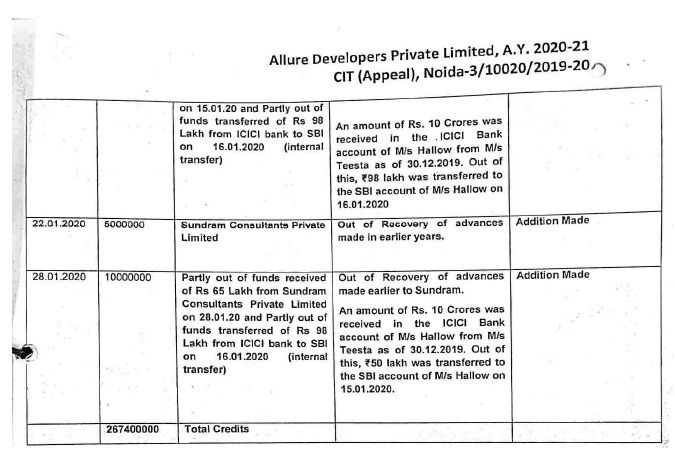

28. It is further seen that by filing the bank statement, assessee has not only proved the source in the hands of the lender company but further prove the source of source of the loan given to it by explaining each credit entry in the table submitted before then Id. CIT(A) as appearing at pages 100-102 of the order which is reproduced as under for sake of convenience:-

29. It is also relevant to state that an amendment is made vide Finance Act, 2022 wherein second proviso to section 68 is added so as to provide that the nature and source of any sum, whether in the form of loan or borrowing, or any other liability credited in the books of an assessee shall be treated as explained only if the source offunds is also explained in the hands of the creditor or loan provider. However, this additional onus toprove satisfactorily the source in the hands of the creditor, would not apply if the creditor is a well-regulated entity, i.e., it is a Venture Capital Fund, Venture Capital Company registered with SEBI. This amendment has taken effect from lst April, 2023 and accordingly applies in relation to the assessment year 2023-24 and subsequent assessment years. The year before us is AY 2020-21 thus this amendment is not applicable, yet the assessee has been able to establish the same as per the table reproduced herein above.

30. As observed above, the requirement of explaining ‘Source’ of ‘Source’ in respect of loans is applicable from A.Y. 2023-24 and subsequent years. Reliance in this regard is placed on the judgement of coordinate bench of Delhi ITAT in the case of M/s Mall Hotels Ltd. v. C 2T in ITA No. 2688/DEL/2014 dated 31.05.2022.

31. Further the Delhi Bench of ITAT in the case of ACIT v Smt. Prem Anand in ITA No. 3S14/Del/2014 vide order dated 13.04.2017 held that amendment made in section 68 of the Act w.e.f. 01.04.2013 empowers the A.O. to examine source of source in case of share application money / share capital / share premium from 01.04.2013 and this amendment does not give power to the A.O. to examine source of source ofnon-share capital cases.

32. As is evident from the chart as reproduced above, assessee has been able to establish the source of source in the hands of the lender company M/s Hallow Securities Pvt. Ltd. and the AO has wrongly under stood the said receipts as loans taken by the lender company whereas the same were repayment of the loans given by the lender company to all those companies thus the allegations made about the financial statements of the companies whose sums were credited in the bank account of the assessee prior to the funds transferred tot eh assessee is totally uncalled for and thus ignored and excluded and cannot be considered for examining the genuineness and creditworthiness of the lender company.

33. It is also relevant to state that the lander company has received funds in the shape of CCD from M/s Teesta Retails Pvt.Ltd who is having strong net worth and during the year assessee has received a sum of Rs. 60.00 crores out of total 300.00 crores received in FY 2019-20 to 2021-22. It is also observed by Id. CIT(A) that the RBI license issued was also submitted and in the assessment proceedings of one of the group company M/s Bright Buildtech Pvt. Ltd., who is also before us in the captioned appeals, loan received from M/s Hallow Securities Pvt. Ltd. out of the funds received from Teesta Retails were also accepted by the department, thus the funds to such extent cannot be held as unexplained.

34. Another issue raised by the revenue is that the lender company M/s Hallow Securities Pvt. Ltd. was declared as Shell company by the press release issued by the Ministry of Finance dt.08.06.2018 and further no opportunity was given to the AO to rebut the evidences filed by the assessee which are in the nature of additional evidences u/R 46A of the Act. In this context, it is seen that in order to verify this fact, Id. CTT(A) has made direct enquires from SFIO u/s 250(4) of the Act, who is the nodal agencies in this regard. The SFIO vide reply dt. 23.01,2025, as reproduced herein above, in clear terms has stated that no investigation is initiated/pending/disposal against the company i.e. M/s Hallow Securities Pvt. Ltd. the conclusion drawn by Id. CIT(A) on the basis of aforesaid report of SFIO are fully convincing and we concur these findings given by Id. CTT(A) which are reproduced as under:

“From the above press release, following conclusions can be drawn:

a. The red flagged companies which had not filed returns for last 2 years were deregistered from the ROC.

b. Directors of those companies which had not filed annual returns were disqualified.

c. The struck-off companies were restricted from using their bank accounts.

d. Genuine corporates were given benefit of condonation of delay scheme for filing the returns.

In view of the above, it was felt necessary to make enquiries both with Hallow Securities Pvt. Ltd. and SFIO (the Nodal Authority maintaining the database) to know, if any, proceedings were pending with respect to Hallow Securities Pyt Ltd. with SFIO and whether M/s. Hallow Securities Pvt. Ltd. had been regular in its compliances with ROC and RB etc. The exact correspondences with M/s. Hallow Securities Pvt. Ltd. and SEIO have already been reproduced above in the body of the order.

M/s. Hallow Securities Pt. Ltd. in response to enquiry from this office provided the following information:

a. Details of the annual returns filed with the ROC from AY 2018-19 till AY 2024-25.

b. Details of the annual returns filed with the RBI from AY 2018-19 till AY 2024-25.

c. No show cause has been received by the above company from the ROC since Financial Year 2017-18 (ie. even after a period of seven years of the press release quoted by the AO).

Enquiry letter was also issued to SFIO to know, if any, proceedings were pending with the Nodal Authority against M/s. Hallow Securities Pvt. Ltd. The response of SFIO authorities has already been reproduced in the body of the order above. The Nodal Authority (SFIO) has clearly reported that no proceedings are pending against M/s. Hallow Securities Pvt. Ltd. with their office”

35. Further from the perusal of observations at page 79 onwards of the order of Id. CIT(A) we find that CIT(A) has provided numerous opportunities to the AO for rebuttal/objections however, the AO has not availed any of the opportunity therefore, the Id. CIT(A) has made the enquiries in terms of the power conferred upon it in section 250(4) of the Act. The relevant observations of Id. CTT(A) are as under:

Reply of AO

“During the course of appellate proceedings, various reminders were issued to the Ayide this office emails dated 15.02.2025, 08.02.2025, 01.02.2025, 25.01.2025, 24.01.2025, 18.01.2025, 15.01.2025, 14.01.2025 & 08.01.2025 on various issues including enquiries conducted with Hallow Securities Pvt. Ltd.,

SFIO Report, Additional Grounds of Appeal etc. But no objections have been received from the AO till the date of finalization of appeal.

It is pertinent to point out that it was only during the course of enquiry done by this office that the assessee/third parties furnished the relevant evidences. The said evidences were called for under the powers of enquiry with the office of Commissioner Appeal). Hence, the assessee/third parties have not produced any additional evidence but have only furnished evidences as called tor during enquiry made by this office. In case, the AO is not able to collect complete material and take the issue to logical end, the evidence collected by the appellate authority from the assessee/third parties in continuation of the same trail initiated by the AO would be clarificatory evidence. The clarificatory evidence would only remove the doubts arising in the mind of the appellate authorities from the documents on record so that the issue under consideration is taken to a logical conclusion by making the argument more explicit so that the real income can be arrived at.

On the said issue, the Hon’ble High Court of Delhi in the case of Commissioner of Income-tax, Central-l v. Manish Build Well (P.) Ltd. reported at (Delhi) has held as under:

“Whether a distinction should be recognized and maintained between a case where assessee invokes rule 46A to adduce additional evidence before Commissioner (Appeals) and a case where Commissioner (Appeals), without being prompted by assessee, while dealing with appeal, considers it fit to cause or make a further enquiry by virtue of powers vested in him under subsection (4) of section 250 and it is only when he exercises his statutory suo moto power under above sub-section, that requirements of rule 46A need not be followed – Held, yes”

Further, the Hon’ble High Court of Karnataka in the case of Shankar Khandasari Sugar Mills v. CIT reported at has observed as under:

“The appellate authority should have accepted the material produced by the assessee as clarificatory in nature and considered the same to test the fairness and propriety of the estimate of income made by the Income-tax Officer. Though it was belated production of very relevant material, no prejudice (in its legal sense) would have resulted to the Revenue by considering the material produced by the assessee. In the absence of any prejudice to the Revenue, and the basis of the tax under the Act being to levy tax, as far as possible, on the real income, the approach should be liberal in applying the procedural provisions of the Act. An appeal is but a continuation of the original proceeding and what the Income-tax Officer could have done, the appellate authority also could do.”[Emphasis supplied] (p. 673)

Further, the Hon’ble High Court of Allahabad in the case of Smt. Mishingar Kaur v. Central Government reported at (1976) 104ITR 120 (ALL.) has held as under:

“The AAC could while disposing of an appeal, make such inquiry as he thought fit. He could permit a fresh or new ground to be raised in the appeal. No part of rule 46A whittles down or impairs the power to make further inquiry conferred upon the AAC by section 250. Similarly, sub-section (5) of the said section confers a power on the AAC to permit the appellant to raise afresh point. This power has not been even touched by rule 46A.”

Further, the Hon’ble High Court of Bombay in the case of Smt. Prabhavati S. Shah v. Commissioner of Income-tax reported at [1998) (BOM.) has held as under:

It is, thus, clear that the powers of the AAC are much wider than the powers of an ordinary court of appeal. The scope of his powers is coterminous with that of the ITO. He can do what the ITO can do. He can also direct the ITO to do what he failed to do. The power conferred on the AAC under the said subsection being quasi-judicial power, it is incumbent on him to exercise the same if the facts and circumstances justify. If the AAC fails to exercise his discretion judicially and arbitrarily refuses to make enquiry in a case where the facts and circumstances so demand, his action would be open for correction by a higher authority.

On a conjoint reading of section 250 and rule 46A, it is clear that the restrictions placed on the appellant to produce evidence do not affect the powers of the AAC under sub-section (4) of section 250. The purpose of rule 46A appears to be to ensure that evidence is primarily led before the ITO.

The AAC should have considered this evidence in exercise of his powers under sub-sections (4) and (5) of section 250 which he failed to do. Thus, it was a fit case where the AAC should have exercised the powers conferred upon him and taken on record the zerox copies of the cheque, the certificate from the bank and the copy of the account of the assessee with the said bank and considered the same for deciding the genuineness of the loan.”

Further, the Ld. ITAT Bench Calcutta in the case of INCOME-TAX OFFICER v. BAJORIA FOUNDATION reported at (CAL.) (MAG.) has held as under:

“Whether a harmonious interpretation of section 250, even if read with rule 46A, means that if facts of case warrant further enquiries, it is within powers of Commissioner (Appeals) to do so – Held, yes – Whether if prima facie an information is necessary to examine claim of assessee, Commissioner (Appeals) should consider necessary evidence in exercise of his powers under subsections (4) and (5) of section 250 – Held, yes”

Further, the Ld. ITAT Ahmedabad Bench ‘C in the case of Deputy Commissioner of Income-tax v. J.A. Infracon (P.) Ltd reported at (Ahmedabad – Trib.) has held as under:

Commissioner (Appeals) called for a remand report from Assessing Officer and issued notice under section 133(6) to aforesaid investor companies and in response to same, parties namely ATPL’ and ‘ALPL’ confirmed transactions With assessee company with necessary documents and evidences – These Confirmations were not controverted by Assessing Officer by way of bringing anything adverse on record – Further in spite of availability of all documents transaction with share applicant companies who had made share application on record, nothing had been brought on record by Assessing Officer to doubt in assessee company – Whether, on facts, Commissioner (Appeals) rightly deleted addition made by Assessing Officer – Held, yes [Paras 7, 8 and 11] [in favour of assessee]”

Further, the Hon’ble Supreme Court in the case of CIT v. Kanpur Coals Syndicate [1964] 53 ITR 225 has held that “the appellate Commissioner has plenary powers in disposing of an appeal. The Hon’ble Court further held that the scope of the power of C1T(A) is coterminous with the AO.”

Further, the Hon’ble High Court of Karnataka in the case of CIT v. K. S. Dattatreya has held that “as a revisional authority commissioner appeal can revise not only the ultimate computation arrived at but every process which lead to the ultimate computation or assessment”.

Further, the Hon’ble Kerala High Court in the case of V. Subramonia Aiyr v. CIT 1978] 113 ITR 685 held that “the power conferred on Appellate Authority by Section 246 which is exercised in accordance with procedure with Section 250 indicate and amplitude and width which is no less wide than that of an

ITO and the Appellate Authority could substitute the order of the ITO by one of his own.”

36. In view of the above clear observations of Id. CIT(A) we find that despite of repeated opportunities to the AO, no response was given thus the Id. CIT(A) had proceeded to decide the issue after making necessary enquires at his end. Accordingly, we find no error in such findings of Id. CIT(A) and accordingly this plea of the revenue is not acceptable.

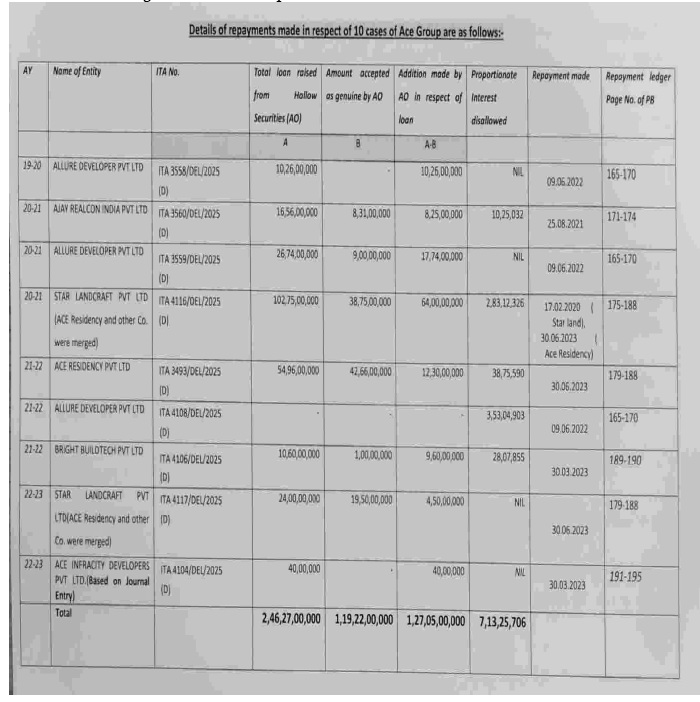

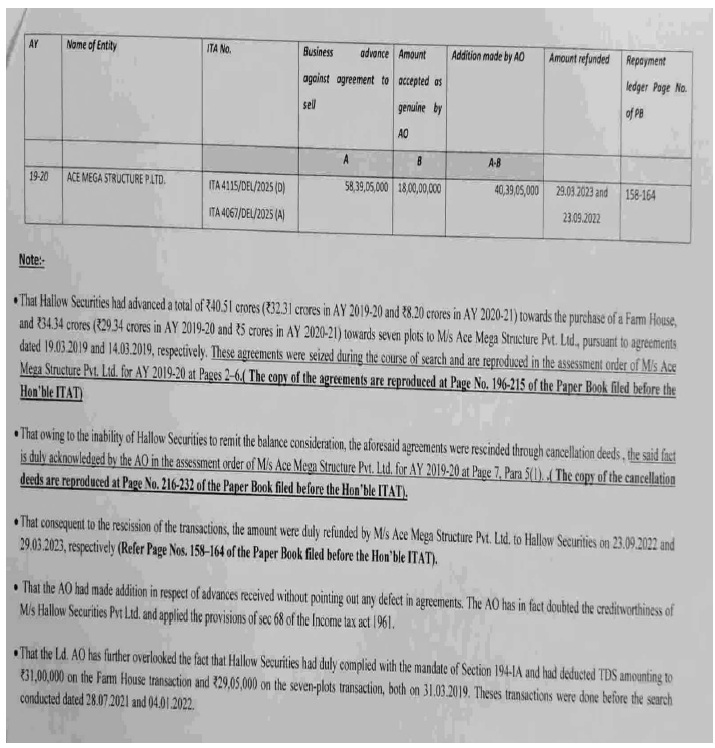

37. Another important aspect which has been considered by Id. CIT(A) is that the loans were repaid by the assessee in subsequent years and assessee has also field the copies of the relevant ledger accounts before us which are placed in the paper book. The assessee also filed a chart in this regard which is reproduced as under:

38. While accepting the plea of the assessee, Ld. CIT(A) has made following observations at page 109 of the order:

Repayment of Loan

“The AR further submitted that the loans under contention already stand repaid in the future years. The relevant copies of account of the repayment of loans are placed at pages 46 to 49 of the paper book, It has been held in a number of judgments that once an unsecured loan has been returned baek, the same cannot be treated as income u/ s 68.

On the above issue, the Hon’ble Supreme Court in the case of Assistant Commissioner of income-tax v. Gujarat

Television (P.) Ltd. reported at (SC) has held as under:

“SLP dismissed against order of High Court that where unsecured loans given to assessee were squared up on same date and nothing remained outstanding at end of day, much less at end of financial year, impugned reassessment proceedings to tax same under section 68 deserved to be quashed”

On the above issue, the Hon’ble High Court of Mumbai in the case of Principal Commissioner of Income-tax v. Bairagra Builders (P.) Ltd. reported at (Bombay) has held as under:

“Where assessee had taken unsecured loan from two companies and had submitted all evidences to substantiate loan including confirmation from creditors and loan was taken and repaid through banking channels, Assessing Officer was not justified in treating said unsecured loan as fake and unexplained cash credit”

Further, the Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax (Central v. Dharmesh Padamshibhai Patel soner reported at (Gujarat) has held as under:

However, Tribunal remanded matter back to Assessing Officer to verify identity of parties -It was noted that Tribunal had observed that assessee had furnished bank accounts of all lenders wherein loans claimed were duly reflected – Creditors were assessed to tax and their confirmations were filed – Further, loans were returned through banking channels before close of subsequent Financial year – Whether, on facts, an opportunity was rightly allowed by Tribunal to assessee to prove identity of lenders when their creditworthiness and genuineness of transactions as was held by Commissioner (Appeals), were already proved – Held, yes [Paras 15 and 16] In favour of assessee]

Further, the Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax (Central), Surat v. Neotech Education Foundation reported at (Gujarat) has held as under:

It was noted that Commissioner (Appeals) had observed that assessee had discharged its onus by furnishing necessary details such as a copy of PAN, bank details and TTRetc. in support of identity and creditworthiness of creditor and genuineness of transaction – He further noted that payment of loan to assessee as well as repayment of loan and interest by assessee were made by account payed cheques – Further, both lower authorities had concurrently held that initial burden of proof even if not discharged by assessee at level of Assessing Officer but every transaction was explained by production of documents by assessee before Commissioner (Appeals) where two remand reports were called for – Whether, on facts, impugned addition on account of loan amount made by Assessing Officer was to be deleted – Held, yes [Paras 9 to 11] [In favour of assessee]

Further, the Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax v. Merrygold Gems (P.) Ltd reported at (Gujarat] has held as under:

Section 68 of the Income-tax Act, 1961 – Cash credit (Scope of provision) – Assessment year 2016-17 – Assessing Officer made addition of certain amount to assessee’s income on account of unsecured loan treading same as unexplained cash credit under section 68 – Whether since amount of loan received by assessee was returned within same financial year, appellate authorities had rightly deleted addition made by Assessing Officer – Held, yes [Paras 9 and 11] [In favour of assessee]

Further, the Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax v. Ambe Tradecorp (P.) Ltd reported at (Gujarat) has held as under:

Where assessee took, loan from two parties and assessee had furnished requisite material showing identity of loan givers and that assessee was not beneficiary as loan was repaid in subsequent year, no addition under section 68 could be made on account of such loan

Further, the Hon’ble HIGH COURT OF GUJARAT in the case of Principal Commissioner of Income-tax v. Ojas Tarmake (P.) Ltd. reported at (Gujarat] has held as under:

Where assessee showed unsecured loans received during relevant assessment year and AO made addition on ground that assessee failed to discharge onus of liability as laid down under section 68, since amount of loan received by assessee was returned to loan party during year itself and all transactions were carried out through banking channels, impugned addition was to be deleted. “

39. We find that the sole allegation of the AO was that the assessee has taken the bogus accommodation entries in the shape of unsecured loans however, as discussed above, the revenue has failed to controvert the finding of the Id. CIT(A) who not only appreciate the facts of the case and the submissions made by the assessee but also make verification at his own end in terms of the powers u/s 250(4) of the Act when the AO has filed to response on the request of Id. CIT(A) of making verification of the submissions made by the assessee. It is further seen that the assessee has discharged the burden costed upon it of establishing the genuineness of the loans and creditworthiness of the lender company and further established the source of source though was not required under the law as existed at the relevant time. The conclusion drawn by Id. CTT(A) is as under:

Conclusion

“Accordingly, in view of the above discussion, following conclusions can be drawn:

| 1. | | The money advanced by Hallow Securities Pvt. Ltd. to the assessee company is out of the return back of advances given to other concerns by Hallow Securities Pvt. Ltd. during the earlier years or the year under consideration (or ACE Group meaning thereby that the creditworthiness of entities like Manak routed through the genuine entities like Teesta Retails Pyt. Ltd. and HFCL in Estate & Finance Pvt Ltd, Sundram Consultants Pt Ltd, AKJ Engineers Pvt Ltd, Kanta Credits and Holdings Pvt Ltd. becomes irrelevant. Hence, the application of Section 68 using the source of source theory to the case of the appellant becomes uncalled for in above circumstances. |

| 2. | | The fund flow statement of M/s. Hallow Securities Pvt. Ltd. from AY 2017-18 to AY 2022-23 reveals that there were sufficient funds available with Hallow Securities Pvt. Ltd. out of additions made by AO which were advanced to findings and discussion, it is observed that the bank credits in the hands of various concerns including the appellant. Without prejudice to the above M/s. Hallow Securities Pvt. Ltd. have already been added by the AO in the assessment orders of M/s. Hallow Securities Pvt. Ltd. for AY 2017-18 to Ar 2022-23, the adding the same money emanating from the said accounts in the hands of the assessee company would amount to double taxation of the same. |

| 3. | | The AO in the assessment proceedings of Hallow Securities Pt. Ltd. has excluded the funds advanced to ACE Group from the total credits added in the hands of Hallow Securities Pvt. Ltd. The exclusion of the funds advanced to the ACE Group from the total credits added by the AO in the hands of Hallow Securities Pvt. Ltd. is immaterial as when the total addition made in the hands of Hallow Securities Pvt. Ltd. is compared with the increase in the application of funds in its balance sheets over the years, a net surplus persists, clearly demonstrating that same funds have been subjected to multiple and duplicate additions. |

| 4. | | It is further evident that the exclusion of funds advanced to ACE Group from the current year’s credits in the hands of Hallow Securities Pvt. Ltd. is also inconsequential for the reason that the corresponding credits in earlier years have already been added to the income in the case of Hallow Securities Pvt. Ltd. Hence, once the original advances and credits forming the substratum of these transactions have been added to the income of Hallow Securities Pvt. Ltd., any subsequent reduction from the credits in accounts of Hallow Securities Pvt. Ltd. of the advances given to the ACE Group does not materially impact the overall transactions which need to be brought to tax. |

| 5. | | The loans received from M/s. Hallow Securities Pt. Ltd. have been returned back in future years. |

| 6. | | The statement of Sh. Vishal Kumar is without corroborative documentary evidence meaning that the said statement is standalone. |

| 7. | | The statement of the Directors i.e. Sh. Pratap Singh Rathi (who has denied the facts as narrated by Sh. Vishal Kumar) rebuts the statement of sh. Vishal Kumar. |

| 8. | | The AO has applied the source of source theory in ACE Group while giving relief with respect to the funds received from Hallow Securities Put. Ltd. via Teesta Retails Pvt. Ltd. Applying the same theory as applied by the AO to the other funds received by the appellant reveals that the said money majorly emanated out of the coffers of Hallow Securities Pvt. Ltd. during earlier years which were advanced to various entities and returned back. |

In view of the discussion on various issues carried out above, the addition made by the AO is not found to be sustainable and accordingly these grounds of appeal are allowed.

40. In view of the above discussion and further looking to the fact that when all the relevant details and documentary evidences produced by the assessee to establish the identity, creditworthiness and genuineness of the transactions, the said evidences cannot be rejected based on the statements of third party without any contrary documentary evidence, it is seen that transactions have been done through banking channels and on the date of making of loans, there was sufficient balance available in the bank account of the lender company, which proves the creditworthiness and genuineness of the transactions. It is also relevant that out total amount of loans of 27.27 crores received, the AO has despite of doubting the creditworthiness, had made the addition of INR. 17.74 crores only meaning thereby the creditworthiness for the remaining amount is not doubted though the facts and the circumstances while granting these loans remained the same. This creates serious doubts about the mode and manner of the additions made by the AO. Once it is accepted that the lender has creditworthiness for part of the amount, the remaining amount cannot be held as unexplained. There is no case of any cash deposited in the account of any of the lender company at the time of issuing cheques/RTGS in favour of the Assessee. Therefore, Appellant has duly discharged the burden costed upon it u/s 68 of the Act.

41. It is trite law that suspicion, howsoever strong, cannot take the place of proof as held in Umacharan Shaw & Bros. v. CIT (1959) 37 ITR 271 (SC). The Hon’ble Supreme Court in the case of Dhakeswari. Cotton Mills Ltd v. Commissioner of Income Tax. (1954) 26 ITR 775 (SC) has observed that powers given to the Revenue authority, howsoever, wide, do not entitle him to make the assessment on pure guess without reference to any evidence or material. The assessment cannot be framed only on bare suspicion. The assessment should rest on principles of law and one should avoid presumption of evasion in every matter. The assessee, in the instant case, has sufficiently demonstrated the genuineness of transaction and creditworthiness of the loan creditors. On a broader reckoning, the apprehension raised by the Revenue authorities militates against the tangible material and is thus extraneous. Accordingly, we find no infirmity in the order of Id. CIT(A) in deleting the additions made u/s 68 towards the unsecured loans of Rs. 17.74 crores by holding the same as accommodation entries. Accordingly, all the grounds of appeal of the revenue are dismissed.

7. From the perusal of the assessment and appellate order, it is seen that on the issue of loan from M/s Hallow Securities Pvt. Ltd., all the observations and allegations made by AO are same as were made in the case of M/s Allure Developers in AY 2020-21 in DCIT v. Allure Developers (P.) Ltd. [ITAppeal No. 3559(Delhi) of 2025, dated 26-11-2025]/ITA No. 3559/Del/2025.

8. Admittedly, there is no change in the facts and circumstances regarding the issue of loan taken from M/s Hallow Securities Pvt. Ltd. where in the case of M/s Allure Developers Pvt. Ltd while dismissing the appeal of the Revenue in ITA No.3559/Del/2025 for AY 2020-21, we held the same as genuine, therefore, by following the said observations made by us which are Mutatis Mutandis applied to facts of the present case, the addition made of Rs. 40,00,00,000/- u/s 68 r.w.s. 115BBE of the Act towards the loan taken from M/s Hallow Securities Pvt. Ltd. is hereby, deleted.

9. Ground of appeal No.3 raised by the Revenue is with respect to the deletion of addition of INR 87,25,098/- made u/s 69A r.w.s. 115BBE of the Act towards cash as per books of accounts held as unexplained by the AO.

10. Brief facts leading to this issue in that in the present case during the course of search carried out at the business premises of the assessee which is the corporate office of ACE Group, a sum of INR 87,25,098/- was found recorded in the books of accounts of the various group companies and since the Department has not found physical cash of this extent therefore, the addition is made in the hands of the assessee by holding the same as unexplained. The assessee during the course of assessment proceedings, stated that this amount of cash in hand was available at various projects sites of group companies however, the AO held the same as unexplained and made addition u/s 69A r.w.s. 115BBE of the Act. Ld. CIT(A) observed that said cash is duly recorded in the books of accounts of various group companies and therefore, provisions of section 69A are not applicable and could only be applied where unaccounted assets such as cash, bullion, jewellery etc. was found in the possession of the assessee, source of which remained unexplained.

11. Heard the parties and perused the material available on record. It is seen that the AO in para 6 of the assessment order discussed this issue in brief wherein AO himself has observed that total cash in hand of INR 87,25,098/- as per books of accounts out of which INR 79,37,705/- was pertained to the assessee company. However, the AO alleged that the source of this cash is not explained therefore, AO has made the addition. As the observations of the AO contradictory since he himself has admitted that this cash is duly recorded in the books of accounts therefore, the source of the same cannot be doubted and no addition could be made u/s 69A of the Act which reads as under:-

Unexplained money, etc.

69A. “Where in any financial year the assessee is found to be the owner of any money, bullion, jewellery or other valuable article and such money, bullion, jewellery or valuable article is not recorded in the books of account, if any, maintained by him for any source of income, and the assessee offers no explanation about the nature and source of acquisition of the money, bullion, jewellery or other valuable article, or the explanation offered by him is not, in the opinion of the Assessing Officer, satisfactory, the money and the value of the bullion, jewellery or other valuable article may be deemed to be the income of the assessee for such financial year. “

12. As per section 69A of the Act, if the assessee cash, bullion, jewellery or any valuable article etc. is found in possession of the assessee and failed to explain the source thereof. The same could be held as unexplained in the hands of the assessee. As it could be seen from the order of AO, the cash in hand of INR 87,25,098/-was duly recorded in the books of accounts as cash in hand of 18 group companies of the ACE Group and therefore, the source of the same is duly explained and cannot be held as unexplained.

13. It is further observed that Ld. CIT(A) has appreciated this fact and deleted the addition made which observations were not controverted by the Revenue before us.

14. In view of these facts, we find no error in the order of Ld.CIT(A) in deleting the addition so made. Accordingly, the order of Ld.CIT(A) is uphold on this issue. Ground of appeal No.3 raised by the Revenue is hence, dismissed.

15. Ground of appeal No.4 raised by the Revenue is with respect to the deletion of disallowance of INR 41,72,005/- made by AO u/s 37(1) pertaining to the expenses claimed on account of interest on delayed payment, loss on sale of fixed assets and CSR expenditure.

16. We have heard the rival contentions and perused the material available on record. The AO at page 51 of its order, had made a table according to which interest on delayed payment of TDS of INR 37,58,225/-, loss on sale on fixed assets of INR 4,13,780/-and further INR 90,82,651/- towards CSR expenses were claimed in the Profit & Loss account. AO observed that assessee had added back CSR expenses of INR 90,82,651/- in the total income as per return of income filed however, since it had not added back the expenses towards delayed payment of interest and loss on sale of fixed assets therefore, he made the disallowance of INR 41,72,005/- i.e. gross figure of expenses on account of interest on delayed payment of TDS and loss on sale of fixed assets.

17. Before Ld. CIT(A), assessee claimed that CSR expenses were disallowed and instead of classified under the head “CSR expenses” inadvertently the same was added under the head “personal expenses” where total expenditure of INR. 1,32,55,256/-were added back to the total income of the assessee company. The assessee further claimed that this amount of INR 1,32,55,256/-has three components viz interest on delayed payment of INR 37,58,225/-, loss on sale of fixed assets of INR 4,13,780/- and CSR expenditure of INR 90,82,651/- thus, any further disallowance would be double addition. Ld.CIT(A) after considering these facts has deleted the disallowance so made.

18. Before us, Revenue has failed to controvert such finding of Ld.CIT(A) who after considering the submissions of the assessee and also verifying the facts as narrated above and further appreciating the fact that the AO himself in the order had admitted that actual disallowance was made by the assessee at INR 1,32,55,256/- as per computation of income however, he further added the amount of INR 41,72,005/.

19. In view of these facts, we find no error in the order of Ld.CIT(A) in deleting the disallowance of Rs. 41,72005/- being double addition. Therefore, we confirmed the order of Ld.CIT(A) and dismissed Ground of appeal No.4 raised by the Revenue.

20. In the result, appeal of the Revenue is dismissed.