Consistency in Approvals: Rejection of R&D Facility Approval Under Section 35(2AB) for Earlier Years Remanded for Reconsideration After Approval Granted for Subsequent Year

ISSUE

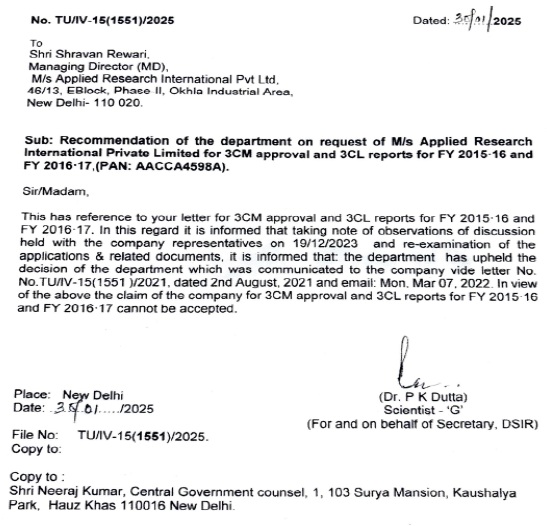

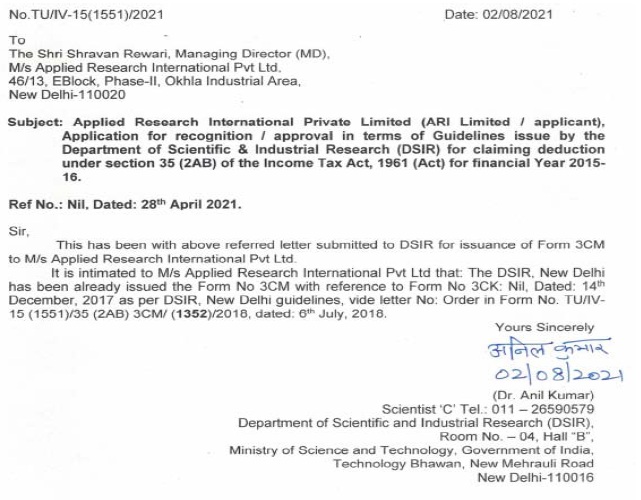

Whether the authorities are justified in rejecting the approval for an In-house R&D facility under Section 35(2AB) for earlier assessment years (2015-16 and 2016-17) when the same facility has been granted approval for the subsequent assessment year (2017-18), suggesting no fundamental impediment exists.

FACTS

The Claim: The assessee filed applications seeking recognition and approval for its in-house Research & Development (R&D) facility under Section 35(2AB) of the Income-tax Act, 1961.

The Years: The applications covered Assessment Years 2015-16 and 2016-17.

The Rejection: The competent authority rejected the applications for these specific years.

The Subsequent Approval: However, for the very next year (AY 2017-18), the authorities granted the requisite approval to the assessee’s R&D unit under the same section.

Assessee’s Plea: The assessee argued that since the facility was approved later, the rejection for the immediately preceding years was arbitrary, as the nature of the facility had not fundamentally changed.

HELD

No Principle Impediment: The Court/Tribunal observed that since approval was granted for AY 2017-18, there appeared to be no ‘in principle’ impediment or fundamental disqualification preventing the grant of the requisite certificate for the earlier years (2015-16 and 2016-17).

Direction: Consequently, the appellate authority directed the competent authorities (DSIR/Prescribed Authority) to reconsider the approval applications for AY 2015-16 and 2016-17 in light of the approval granted for the subsequent year.

Verdict: [Matter Remanded for Reconsideration]

KEY TAKEAWAYS

Doctrine of Consistency: While each assessment year is separate, administrative authorities cannot take contradictory stands on the same set of facts (the R&D facility) across consecutive years without a valid reason for the change.

Subsequent Conduct Matters: Securing approval in a later year is strong evidence that the facility meets the technical requirements. This can be used as a ground to challenge rejections in immediately preceding years if the infrastructure was effectively the same.

Remand vs. Direct Relief: Courts often prefer to “remand” (send back) technical matters to the DSIR (Department of Scientific and Industrial Research) rather than granting the deduction directly, as the DSIR is the expert body for R&D verification.

CM APPL. No. 31749 of 2024

“7.The lower authorities are reading more than what is provided by law. A plain and simple reading of the Act provides that on approval of the research and development facility, expenditure so incurred is eligible for weighted deduction

8. The Tribunal has considered the submissions made on behalf of the assessee and taken the view that the section speaks of:

(i) development of facility;

(ii) incurring of expenditure by the assessee for the development of such facility;

(iii) approval of the facility by the prescribed authority, which is DSIR; and

(iv) allowance of weighted deduction on the expenditure so incurred by the assessee

9. The provisions nowhere suggest or imply that the research and development facility is to be approved from a particular date and, in other words, it is nowhere suggested that the date of approval only will be the cut-off date for eligibility of weighted deduction on the expenses incurred from that date onwards. A plain reading clearly manifests that the assessee has to develop the facility, which presupposes incurring expenditure in this behalf, application to the prescribed authority, who after following proper procedure will approve the facility or otherwise and the assessee will be entitled to weighted deduction of any and all expenditure so incurred. The Tribunal has, therefore, come to the conclusion that on a plain reading of the section itself, the assessee is entitled to weighted deduction on expenditure so incurred by the assessee for development of facility. The Tribunal has also considered rule 6(5A) and Form No. 3CM and come to the conclusion that a plain and harmonious reading of the rule and Form clearly suggests that once facility if approved, the entire expenditure so incurred on development of the research and development facility has to be allowed for weighted deduction as provided by section 35(2AB). The Tribunal has also considered the legislative intention behind the above enactment and observed that to boost the research and development facility in India, the Legislature has provided this provision to encourage the development of the facility by providing deduction of weighted expenditure. Since what is stated to be promoted was development of facility, the intention of the Legislature by making the above amendment is very clear that the entire expenditure incurred by the assessee on development of facility, if approved, has to be allowed for the purpose of weighted deduction.

10. We are in full agreement with the reasoning given by the Tribunal and we are of the view that there is no scope for any other interpretation and since the approval is granted during the previous year relevant to the assessment year in question, we are of the view that the assessee is entitled to claim the weighted deduction in respect of the entire expenditure incurred under S.35(2AB) of the Act by the assessee.”

5. We are in full agreement with the aforesaid approach of the Gujarat High Court. No substantial question of law, therefore, arises. The appeal is dismissed.”