ORDER

Om Prakash Kant, Accountant Member.- This appeal by the Revenue and cross-objection by the assessee are directed against order dated 06.12.2024 passed by the Ld. Commissioner of Income-tax (Appeals) – 50, Mumbai [in short ‘the Ld. CIT(A)’] for assessment year 2016-17.

2. The grounds raised by the Revenue in its appeal are reproduced as under:

| 1. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in deleting the disallowance of loss of Rs.1,96,04,400/- on account fictitious trading in BSE Equity Derivative Segment and disallowance of commission worked out thereon of Rs.3,92,088/-; |

| 2. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not appreciating the findings of the search and survey action conducted by the Investigation Wing under ‘Project Falcon’ during which it was revealed that the trading in BSE Equity Derivative Segment in cases of concerns under investigation were merely accommodation entries;. |

| 3. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not observing the fact that the assessee had been continuously booking losses which was not possible without premeditated, manipulative, synchronized and artificial trades; |

| 4. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in deleting the loss of Rs.11,50,557/- claimed by the assessee on account of trading in the scrips of Divine Multimedia India Limited/ Kaleidoscopic Films Ltd which were found to be fictitious trading on the basis of investigation conducted on the Naresh Jain and associates syndicate which was involved in the activity of providing accommodation entries; |

| 5. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not considering the admittance given by Shri Naresh Jain vide statement recorded on oath u/s 132(4) of the Act during the course of the search at his residence, that he had used the some scrips (including the scrips of Divine Multimedia India Limited/ Kaleidoscopic Films Ltd) for providing accommodation entries; |

| 6. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not considering the fact that many signed cheque-books, demat instruction slips etc of dummy persons who were used as exit providers, were found at the residence of Shri Bhupesh Jain, an associate of Shri Naresh Jain and a member of the syndicate who admitted to be indulged in the activity of providing accommodation entries; |

| 7. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not considering the statement of Shri Bhupesh Jain, an associate of Shri Naresh Jain and a member of the syndicate, wherein he had explained the entire modus operandi of the activity of providing accommodation entries through trading in scrips operated by Shri Naresh Jain; |

| 8. | | Whether in the circumstances of the case and in law, the Ld CIT(A) had erred in not considering the statement of Shri Bhavesh Pabari, an associate of Shri Naresh Jain and a member of the syndicate, wherein he had explained the movement of cash in the activity of providing accommodation entries through trading in scrips operated by Shri Naresh Jain; |

2.1 The grounds raised by the assessee in cross-objection is reproduced as under:

| 1. | | On the facts and in the circumstances of the case and in law, the Ld. CIT(A) erred in not considering that the assumption of jurisdiction by the Ld. Assessing Officer is bad in law as the conditions laid down under the Act for initiating reassessment proceedings u/s 147 of the Act have not been satisfied. |

| 2. | | On the facts and in the circumstances of the case and in law, the Ld. CIT (A) erred in dismissing the ground of cross examination, without appreciating the fact that assessment under section 147 r.w.s 143(3) of the Act was made relying on statements of third parties and without providing any opportunity of cross examination to the assessee which against the principles of natural justice. |

3. Briefly stated, the material facts of the case are that assessee, a partnership firm, has been carrying on the business of trading in shares, derivatives and futures & options for several years. For the year under consideration, it filed its return of income on 27.08.2016 declaring a total income of Rs.1,89,05,300/–. The said return was subjected to scrutiny and the assessment was completed under section 143(3) of the Income-tax Act, 1961 (“the Act”) on 12.12.2018, determining the total income at Rs.6,60,25,080/–.

3.1 Subsequently, the Assessing Officer received specific intelligence from the Investigation Wing, Mumbai indicating that the assessee had allegedly booked fictitious losses through coordinated and premeditated trading in illiquid stock options on the stock exchange, amounting to Rs.1,96,04,400/–. Further information was also received from the same Wing alleging that the assessee had availed accommodation entries in the nature of long-term capital gain/loss arising from manipulation of penny-stock prices by one Shri Naresh Jain and his associates, and that the assessee was a beneficiary to the extent of Rs.45,500/–

3.2 On the basis of the aforesaid information, the Assessing Officer recorded reasons to believe that income chargeable to tax had escaped assessment and, accordingly, issued notice under section 148 of the Act on 31.03.2021. In response, the assessee filed a return on 06.04.2021 declaring the same income as originally returned. The reasons recorded for reopening were furnished to the assessee on 07.06.2021; the objections filed by the assessee on 18.08.2021 were disposed of by the Assessing Officer through a speaking order dated 19.11.2021.

3.3 Thereafter, the assessee approached the Hon’ble Bombay High Court seeking disclosure of the underlying material based on which the reassessment proceedings had been initiated. Pursuant to the directions of the Hon’ble High Court vide order dated 22.02.2022, the Assessing Officer supplied to the assessee the information received from the Investigation Wing concerning alleged tax-evasion through manipulated transactions using expiry-day trades in the BSE options segment, along with a copy of the expiry-trade data on the BSE platform pertaining to the assessee for the financial year 2015-16.

3.4 In the course of reassessment proceedings, the assessee furnished multiple submissions and explanations in response to queries raised by the Assessing Officer. Upon consideration of the entire material on record, the Assessing Officer proceeded to treat the loss of Rs.1,96,04,400/– claimed on the BSE equity derivatives segment as a fictitious loss and made an addition accordingly. The Assessing Officer further made an addition of Rs.11,50,557/– treating the same as a bogus loss entry allegedly obtained from entities linked to Shri Naresh Jain.

4. In the appeal preferred before the learned CIT(A), the assessee assailed both the validity of the reassessment proceedings as well as the additions made on merits. The learned CIT(A), by the impugned order, upheld the initiation of reassessment proceedings but deleted the additions on merits in respect of both issues. Aggrieved by the deletion of the additions, the Revenue has preferred the present appeal before the Income Tax Appellate Tribunal (“the Tribunal”). Conversely, the assessee, being aggrieved by the affirmation of the validity of the reassessment, has filed a cross-objection.

5. We have heard the rival submissions advanced on behalf of the parties and have carefully perused the material placed on record. The reassessment order reveals that the Assessing Officer undertook an exhaustive examination of the assessee’s transactions in the equity derivatives segment, with particular focus on trades in illiquid stock options on the Bombay Stock Exchange. The reassessment itself was founded upon information emanating from the Directorate of Income Tax (Investigation), Mumbai, which had reported large-scale tax evasion through pre-arranged and coordinated trades in illiquid options, executed with the ostensible purpose of generating artificial and fictitious losses.

5.1 The Assessing Officer, drawing upon the said investigation report, recorded that several entities were consistently engaging in reversal or expiry-day trades in illiquid option series, resulting invariably in substantial losses to one party and corresponding gains to the counter-party. In support of this inference, reliance was placed upon the judgment of the Hon’ble Supreme Court in SEBI v. Rakhi Trading (P.) Ltd. , wherein it was held that synchronized transactions executed with prior meeting of minds, and intended to book artificial losses, constituted a manipulative and distortive device rather than genuine trading activity.

5.2 A detailed analysis of the assessee’s trades was thereafter undertaken. The Assessing Officer noted that the transactions in question were confined almost entirely to highly illiquid stock option series, predominantly executed on the date of expiry, and that the assessee had incurred losses in each such trade. Conversely, the respective counter-parties had earned matching profits. It was emphatically recorded that nearly 90% of the trades were entered into and permitted to expire on the very same day without any corresponding reversal or hedging transaction. Further, the quantities purchased by the assessee were found to match, with mathematical precision, the quantities sold by a single counter party in each instance, thereby, in the view of the Assessing Officer, evidencing a predetermined, synchronized, and orchestrated pattern of trading.

5.3 The Assessing Officer concluded that such a uniform trading pattern could not reasonably occur in the ordinary course of commerce, and that it was inconceivable for an experienced market participant such as the assessee to incur losses in every transaction unless the trades were pre-designed for the sole objective of creating artificial losses. Certain counter-parties—namely M/s JRM Securities Finance P Ltd ; Shri Tiruputi Steal Cost Ltd and members of the Jhaveri family were identified as having repeatedly engaged in such expiry-based trades with the assessee, suggesting collusion and manipulation. On the strength of this reasoning, the Assessing Officer held that the loss of Rs.1,96,04,400/– claimed on such trades represented a fictitious, pre-arranged loss intended exclusively to reduce taxable income, and accordingly disallowed the same as bogus and artificial.

5.4 Additionally, the Assessing Officer determined that commission expenditure of Rs.3,92,088/–, being 2% of the alleged fictitious loss, had been incurred for procuring such accommodation entries, and therefore brought the same to tax under section 69C of the Act. In essence, the Assessing Officer concluded that the assessee had indulged in manipulative, synchronized trading devised to generate artificial losses, and made additions to the income accordingly.

5.5 Regarding the second issue of accommodation entry of sale of penny stock of M/s Divine Multimedia Ltd provided by Mr Naresh Jain, the Assessing Officer contended that business loss claimed of Rs. 11,50,557/- was bogus or fictitious. The assessee however filed documentary evidence comprising of copies of contract notes, copies of De-mat accounts, copies of bank statement, lwdger accounts of brokers etc and submitted that assessee being a trader in a stock market, entered transactions with the aim of earning profit from frequent fluctuations in the stock market but suffered losses on said transactions. It was contended that assessee was not aware of Sri Naresh Jain and not involved or connected either in the manipulation of the stock price or availing of the accommodation entries. According to the assessee transaction was carried out on the platform of the stock exchange, without any interface and payment made through banking channel, the allegation of accommodation entry obtained are baseless and without any foundation. But, the learned Assessing Officer, rejected the contention of the assessee and disallowed the business loss of Rs. 11, 50, 557/-. On further appeal, the Ld. CIT(A) deleted the disallowance of business loss, which was made by the Assessing Officer.

5.6 Aggrieved with the finding of the Ld. CIT(A), the revenue is on appeal before the Tribunal whereas the assessee is before the Tribunal by way of cross objection.

6. Firstly, we take up the grounds raised by the assessee in cross-objection challenging the validity of the reassessment. The Ld. CIT(A) dismissed the grounds of the assessee related to validity of reassessment observing as under:

“9. Section 147 of the Act authorizes and permits the Assessing Officer to assess or reassess income chargeable to tax if he has reason to believe that income for any assessment year has escaped assessment. The word “reason” in the phrase “reason to believe” would mean cause or justification. If the Assessing Officer has cause or justification to know or suppose that income had escaped assessment, it can be said to have reason to believe that an income had escaped assessment. The expression cannot be read to mean that the Assessing Officer should have finally ascertained the fact by legal evidence or conclusion. The function of the Assessing Officer is to administer the statute with solicitude for the public exchequer with an inbuilt idea of fairness to taxpayers.

10. At the stage of issue of notice, the only question is whether there was relevant material on which a reasonable person could have formed a requisite belief. Whether the materials would conclusively prove the escapement is not the concern at that stage. At that stage, the final outcome of the proceeding is not relevant. In other words, at the initiation stage, what is required is “reason to believe”, but not the established fact of escapement of income. This is so because the formation of belief by the Assessing Officer is within the realm of subjective satisfaction, as held by the Hon’ble Apex Court in ITO v. Selected Dalurband Coal Co. (P.) Ltd. [1996] 217 ITR 597 (SC) and in the case of Raymond Woollen Mills Ltd. v. ??? [1999] 236 ITR 34 (SC).

11. The Hon’ble Apex Court in the case of ACIT v. Rajesh Jhaveri Stock Brokers Pvt. Ltd. (2007) (291 ITR 500 ) has categorically stated that “reason to believe” does not mean that the reason for re-opening should have been factually ascertained by legal evidence or conclusion before the reopening of an assessment. The relevant excerpts of the said judgment are reproduced hereunder:-

“29. In Asstt. CIT v. Rajesh Jhaveri Stock Brokers (P.) Ltd.ITR 500 (SC), relied upon by Mr. Putney, the Supreme Court held:-

’16 Section 147 authorises and permits the Assessing Officer to assess or reassess income chargeable to tax if he has reason to believe that income for any assessment year has escaped assessment. The word “reason” in the phrase “reason to believe” would mean cause or justification. If the Assessing Officer has cause or justification to know or suppose that income had escaped assessment, it can be said to have reason to believe that an income had escaped assessment. The expression cannot be read to mean that the Assessing Officer should have finally ascertained the fact by legal evidence or conclusion. The function of the Assessing Officer is to administer the statute with solicitude for the public exchequer with an inbuilt idea of fairness to taxpayers. As observed by the Supreme Court in Central Provinces Manganese Ore Co. Ltd. v. ITO [1991] 191 ITR 662, for initiation of action under section 147 (a) (as the provision stood at the relevant time) fulfilment of the two requisite conditions in that regard is essential. At that stage, the final outcome of the proceeding is not relevant. In other words, at the initiation stage, what is required is “reason to believe”, but not the established fact of escapement of income. At the stage of issue of notice, the only question is whether there was relevant material on which a reasonable person could have formed a requisite belief. Whether the materials would conclusively prove the escapement is not the concern at that stage. This is so because the formation of belief by the Assessing Officer is within the realm of subjective satisfaction (see ITO v. Selected Dalurband Coal Co. P. Ltd. ITR 34 (SC).

[1996] 217 ITR 597 (SC), Raymond Woollen Mills Ltd. v. ITO [1999] 236 ITR 34 (SC).

12. Any fresh information received by the AO can entitle him to issue notice u/s.148, if on the basis of such information he has prima facie reason to believe that income has escaped assessment. So much so that it was held by the Hon’ble Supreme Court in Claggett Brachi Co. Ltd. v. CIT 177 ITR 409 (SC) that information obtained during assessment proceedings of a subsequent year can also validate the proceedings initiated u/s.147 for earlier year. Similarly, Hon’ble Bombay High Court in the case of Anusandhan Investments Ltd. v. M.R. Singh, DCIT, 287 ITR 482 held that a notice issued u/s.148 based on assessment of subsequent assessment year is valid even if the appeal is pending for such assessment.

13. The Hon’ble Supreme Court in the case of Raymond Woollen Mills Ltd. v. ITO 236 ITR 34, 35 (SC) has held that for determining whether initiation of reassessment proceedings was valid, it has only to be seen whether there was prima facie some material on the basis of which the department could reopen the case. It further held that the sufficiency or correctness of the material is not a thing to be considered at this stage. The relevant portion of the said judgment is reproduced here under:-

“In this case, we do not have to give a final decision as to whether there is suppression of material facts by the assessee or not. We have only to see whether there was prima facie some material on the basis of which the Department could reopen the case. The sufficiency or correctness of the material is not a thing to be considered at this stage. We are of the view that the court cannot strike down the reopening of the case in the facts of this case. It will be open to the assessee to prove that the assumption of facts made in the notice was erroneous. The assessee may also prove that no new facts came to the knowledge of the Income-tax Officer after completion of the assessment proceeding. We are not expressing any opinion on the merits of the case. The questions of fact and law are left open to be investigated and decided by the assessing authority. The appellant will be entitled to take all the points before the assessing authority. The appeals are dismissed.

There will be no order as to costs.”

14. The Supreme Court in Malegaon Electricity Co. (P) Ltd. v. CIT (1970) 78 ITR 466 (SC) has observed, as under:

“It is true that if the ITO had made some investigation, particularly if he had looked into the previous assessment records, he would have been able to find out what the written down value of the assets sold was and consequently he would have been able to find out the price in excess of their written down value realized by the assessee. It can be said that the ITO if he had been diligent could have got all the necessary information from his records. But that is not the same thing as saying that the assessee had placed before the ITO truly and fully all material facts necessary for the purpose of assessment.

The law casts a duty on the assessee to ‘disclose fully and truly all material facts necessary for his assessment for that year'”.

15. From the above decisions, it can be seen that for re-opening of assessment, what is required under the law is that there should be some material on the basis of which the AO could form a belief that income chargeable to tax has escaped assessment. The material should be such that on the basis of which a reasonable person could form a prima facie belief that income chargeable to tax has escaped assessment. The reasons recorded need not conclusively prove that income has escaped assessment. Only prima facie belief is sufficient for reopening of assessment. In the facts and circumstances of the present case, I find that the AO had bona fide material or reason for forming a prima facie belief that income chargeable to tax in the hands of the appellant for the year under consideration has escaped assessment.

16. In view of the discussion in the foregoing paragraphs, it is held that reopening by the AO is valid and as per the provisions of the Act. Accordingly, the action of the AO in reopening the assessment u/s 147 of the Act is upheld and Ground No. 2 raised by the appellant is DISMISSED.”

7. Before us, the assessee has assailed the validity of the reassessment on multiple grounds.

7.1 The learned counsel for the assessee submitted, at the outset, that during the original scrutiny assessment completed under section 143(3) of the Act on 12.12.2018, the assessee had duly furnished all material particulars relating to its share and derivative transactions, including contract notes, demat statements, payment confirmations and broker-wise bank statements. It was contended that the assessee had made a full and true disclosure of all primary and material facts necessary for the assessment, and therefore, in the absence of any failure on its part, the jurisdictional condition for invoking section 147 stood unfulfilled. The reopening, it was urged, is thus without sanction of law.

7.2 The learned counsel further placed reliance upon the judgment of the Hon’ble Supreme Court in ITO v. Lakhmani Mewal Das [1976] 103 ITR 437, to contend that where all primary facts were fully and truly disclosed at the time of the original assessment, any subsequent attempt by the Assessing Officer to draw a different inference from the same material would amount merely to a change of opinion. Such a re-appraisal, it was submitted, cannot be made the basis for reopening a concluded assessment.

7.3 The learned counsel next submitted that the very foundation of the reopening was factually erroneous. Attention was invited to the reasons recorded, wherein it was alleged that the assessee had obtained an accommodation entry of Rs.45,500/– from Shri Naresh Jain. It was contended that the assessee had not purchased any of the securities alleged to have been manipulated by Shri Naresh Jain during the relevant year. The Assessing Officer, according to the learned counsel, had not undertaken any independent enquiry before issuing the notice under section 148, and had merely reproduced information provided by the Investigation Wing without any application of mind. Reliance in this regard was placed on the decision of the Hon’ble Gujarat High Court in Sagar Enterprises v. Asstt. CIT ITR 335 (Gujarat), wherein it was held that reasons based on factually incorrect premises cannot confer jurisdiction to reopen an assessment.

7.4 The learned counsel further assailed the reasons recorded as vague, non-specific and inconclusive. It was submitted that the Assessing Officer had merely set out a list of twelve scrips and the modus operandi allegedly unearthed in the investigation pertaining to Shri Naresh Jain, without anywhere stating that the assessee had dealt in those scrips. Thus, the reasons were said to be based on investigation conducted in the case of an unrelated third party, rendering them inherently misleading and incapable of supporting the statutory formation of belief. The counsel emphasised that reliance placed by the Assessing Officer on the decision in Rakhi Trading (P.) Ltd. (supra) was wholly misplaced, as the factual matrix of that case bore no nexus to the assessee’s transactions.

7.5 It was urged that the Assessing Officer had merely adopted the conclusions of the Investigation Wing in a mechanical manner, without independent application of mind, thereby rendering the reasons a mere “borrowed satisfaction.” The report of the Investigation Wing, it was submitted, was itself based only on exchange-level data and not on any enquiry with brokers, operators or counterparties alleged to be part of the purported scheme. No corroborative material, it was contended, had been furnished to the assessee to substantiate the allegations of pre-meditated transactions. According to the learned counsel, the entire reopening rested on unverified and undifferentiated data, and the Department had brought no material on record to demonstrate any actual collusion. Hence, the issuance of notice under section 148 was contended to be arbitrary and legally unsustainable.

7.6 Per contra, the learned Departmental Representative supported the order of the learned CIT(A) and contended that the reopening in the present case had been initiated within four years from the end of the relevant assessment year. Consequently, the first proviso to section 147—requiring a failure on the part of the assessee to make a full and true disclosure of all material facts—had no application to the facts of the case. It was submitted that the reassessment was founded upon specific and tangible information received from the Investigation Wing, Mumbai, pursuant to extensive enquiries carried out in respect of transactions on the Bombay Stock Exchange. The learned DR argued that the Assessing Officer had not revisited any issue previously examined in the original assessment, and therefore, the reopening could not be characterised as a mere change of opinion.

8. We have carefully considered the rival submissions and perused the material placed on record on the issue of the validity of the reassessment. The assessee’s first contention is founded upon the first proviso to section 147 of the Act, namely, that the Assessing Officer must demonstrate a failure on the part of the assessee to disclose fully and truly all material facts necessary for the assessment. In our considered view, this argument is misconceived. The said proviso becomes operative only where the original assessment has been completed under section 143(3) and the reassessment is sought to be made beyond four years from the end of the relevant assessment year. In the present case, the assessment year involved is A.Y. 2016-17 and the notice under section 148 was issued on 31.03.2021, which indisputably falls within the period of four years. Consequently, the condition embodied in the first proviso has no application to the facts before us.

8.1 The assessee’s next submission is that the reassessment is vitiated by a mere change of opinion. We find no merit in this contention. The reopening has been triggered on the basis of specific information received from the Investigation Wing of the Department, which had undertaken an extensive enquiry into transactions in illiquid stock options on the Bombay Stock Exchange. The formation of belief by the Assessing Officer was, therefore, not based on a re-examination of material already on record, but on tangible information coming into his possession subsequent to the original assessment. The doctrine of change of opinion is thus wholly inapplicable.

8.2 The assessee has further urged that the reopening rests on factually incorrect premises, particularly the reference to an accommodation entry allegedly obtained from Shri Naresh Jain. On a careful perusal of the reasons recorded, we find that the Assessing Officer has adverted to specific transactions in shares of Divine Multimedia Ltd. / Kaleidoscopic Films Ltd., the sale of which stands reflected in the assessee’s own books. The reasons, therefore, cannot be characterised as having been founded on a factual error so fundamental as to vitiate the assumption of jurisdiction.

8.3 The allegation that the reasons recorded were vague or nonconclusive also does not impress us. At the stage of recording reasons to believe, the Assessing Officer is not required to establish escapement of income to the point of conclusion; it is sufficient that there exists relevant and intelligible material from which a reasonable person could form such a belief. The information furnished by the Investigation Wing specifically pertained to expiryday trades in illiquid stock options undertaken by, inter alia, the assessee, and cannot be said to be either vague or extraneous.

8.4 The submission that the Assessing Officer acted without application of mind is equally unfounded. The record demonstrates that the Assessing Officer examined the information received, found it germane to the assessee’s transactions, and thereafter formed the belief that income had escaped assessment. The process adopted conforms to the statutory requirement.

8.5 The further contention that no fresh material had come to the possession of the Assessing Officer is factually untenable. The report of the Investigation Wing, based on a systematic analysis of exchange-level data and identifying patterns of synchronized and pre-meditated trading involving multiple entities including the assessee, constituted fresh and tangible material sufficient to trigger the jurisdiction under section 147.

8.6 In light of the foregoing discussion, we find no infirmity in the assumption of jurisdiction by the Assessing Officer. We accordingly uphold the order of the learned CIT(A) on this issue. The grounds raised by the assessee challenging the validity of the reassessment are, therefore, dismissed.

9. Now, we take up the grounds of the Revenue raised in its appeal challenging the addition on merit. The Ld. CIT(A) after considering the submission of the assessee on the issue of disallowance of fictitious losses, deleted the addition observing as under:

“18. I have considered the assessment order, submission of the appellant and facts available on record. In the assessment order, the AO has discussed the details of findings of Project Falcon carried out by the Investigation Directorate, Mumbai, regarding the claim of fictitious losses due to coordinated and predetermined trading in illiquid stock options. The AO found that the appellant has carried out such manipulative trading in the equity derivative segment. The observation of the AO is summarized as under:

1. The assessee is booking losses in all the transactions by virtue of expiry trades getting expired.

2. Almost 90% of the total trades are bearing zero trade age. It means the assesse is buying the various illiquid derivatives mostly on the day when they were supposed to be expired.

3. All the counterparties are continuously booking profits through trades executed with the assesse, resulting in continuous loss to the assessee company.

4. The assessee has purchased derivatives which were highly illiquid at the time of trading. The assesse traded in 1.80 lakh quantities in series code name “JSWEA8P75” on 06.08.2015, which was highly illiquid.

5. The assesse company has done a total of 17 different trades with 1 counterparty, i.e., M/s JRM Securities Finance Private Ltd.

The AO concluded that all these transactions are make-believe transactions. Therefore, the loss incurred from such transactions of Rs. 1,96,04,400/- is held as bogus, and the same is disallowed. The AO also added commission paid @2% on this transaction of Rs. 1,69,04, 400/-.Accordingly, the AO made an addition of Rs. 3,92,088/-.

19. During the appellate proceedings the appellant has submitted that during the year under consideration the appellant was engaged in the business of share trading in all the segments of stock market specially but not limited to delivery based, speculation, F&O, derivative, currency derivative, call options, put options etc. The total trade conducted by the appellant in stock market (both purchase and sale) in all the categories during the relevant previous year. The appellant has also submitted that the allegation levelled by AO that the appellant had taken manufactured loss by trading/making the position in particular scripts is baseless without appreciating that the appellant is engaged in the business of trading in share and securities, F&O trading and other market segments. The appellant has also contended that the appellant is whole time trader/speculator in the capital market, having traded in numerous stocks during the year, with turnover running into hundreds and thousands of crores. In the present case the appellant had turnover of 147.41 crores. The action of the Ld. AO of cheery Picking specific scripts, merely because the assessee has incurred losses, is not correct.

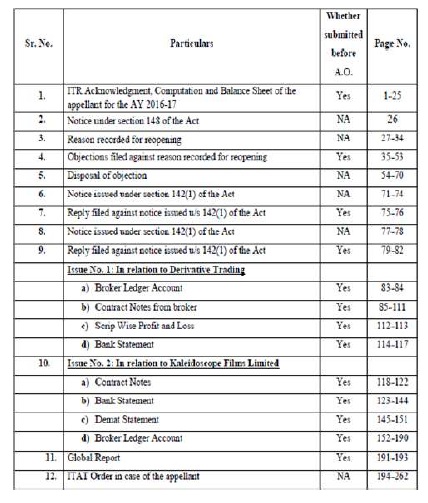

19.2 The appellant has further contended that during the course of assessment proceedings, the appellant had submitted the various documents in support of genuineness of transactions in the particular scripts in which losses have been disallowed by the Assessing officers. The List of documents submitted by the appellant during the assessment proceedings are reproduced as under:

19.3 The appellant has also contended that each transaction in shares are supported by copies of contract notes of stock broker evidencing transactions through BSE & NSE with payment of Securities Transaction Tax (STT) and margin money as per rules of Stock Exchange and SEBI. All the transactions in delivery based shares were received in the Demat account and transferred through the Demat account of the Appellant and all payments/receipts with the brokers are through proper banking channels and are reflected in the bank statements of the appellant.

19.4 Each contract cum bill of the Appellant has a unique contract number, settlement number, trade date, pay in date and pay out date. Further, each trade of the Appellant has a unique order no, order time, trade no, and trade time. All STT, Stamp Duty, Service Tax and other charges in respect of each transaction is paid and is reflected in all the contracts cum bills. The appellant has paid margin money on each contract executed in futures and options as per requirement of SEBI.

19.5 Further, in its submissions made during the appellate proceedings the appellant has placed its reliance on the several judgments of Hon’ble Mumbai Benches of the ITAT in which the Hon’ble Bench have decided the issue in favour of the assessee in similar transactions in the alleged penny stocks in which the additions were made on the reports of the Directorate of Investigations and orders of the SEBI.

20. On perusal of the profit and loss account for the AY under consideration, it is seen that the appellant has shown revenue of Rs. 25,35,10,605/- from the activity of trading of shares. It has also shown dividend income of Rs. 4,60,700/- and closing stock of shares of Rs. 1,55,10,586/-. The appellant has shown speculative loss of Rs. 15,197/- and loss from future and option trading of Rs. 1,20,14,502/-. On perusal of scrip-wise details of future and option trading, it is observed that during the year under consideration, the appellant has shown trading in around 34 scrips and has shown a cumulative loss of Rs. 1,20,14,502/-. The appellant has also shown profit from trading in some scrips.

21. On perusal of the audit report, it is observed that the appellant is a regular trader in stock market. The trading activities carried out in cash segment during the year under consideration is as under-

| Particular | No. of Shares | Value of Shares (in Rs.) |

| No. of the Stocks outstanding at 01.04.2012 | 27 | 15,48,87,939 |

| No. of Stock purchased during the year | 2 | 7,72,36,731 |

| No. of Stock sold during the year | 15 | 25,35,10,605 |

| No. of Stock Sold at Profits | 5 | 9,24,15,281 |

| No. of Stock Sold at Loss | 10 | 5,55,18,761 |

| No. of Stock at the end of the year | 15 | 1,55,10,586 |

| No. of Shares losses disallowed by the Ld. AO | 1 | 11,50,557 |

22. Apart from the cash market, the appellant had also done the trading in Futures and options and currency market. The details are as under:

| Sr. No | Nature of Trading | Amount in crores |

| 1. | F&O Sale | 56.57 |

| 2. | F &O Purchase | 57.77 |

| 3. | Amount disallowed by the Ld. AO | 1.96 |

23. From the above facts it is apparent that the appellant is a trader with huge volume in cash market segment and other segments of the trading activity. In the trading activity, it has earned profit as well as loss. It is also observed that the loss shown on account of trading in the scrip of JSWE is only Rs. 1,98,450/- Therefore, the contention of the AO that it has mainly traded in the scrip is factually incorrect.

24. It is also seen that the appellant has not been investigated by SEBI or any other regulatory authority regarding the alleged transactions. There is no allegation or adverse finding in case of appellant broker. The Assessing Officer, relying solely on an Investigation Wing report and analysis of certain trades concluded that the appellant engaged in accommodation entries by allegedly generating a bogus loss through these stocks. Being a trader inherently carries the risk of significant losses sometimes in particular scrips, which are typical in a trader’s normal course of business. These losses are a direct outcome of market volatility and are part of the trading process. This is not the isolated financial year in which the appellant had done the share market transaction. Merely because the options were purchased on the expiry date does not make the transactions fictitious. Further, letting the option expire instead of exercising the option is mainly to curtail the further losses. Further, it is not a case of reversal of trade as alleged by the AO. Therefore, the decision of the Hon’ble Supreme Court in the case of Rakhi Trading Pvt Ltd is not applicable in the facts of the case.

25. The Hon’ble Mumbai ITAT (In ITA 2637/ Mum/ 2022), in case of M/s Munish Financial on the identical issue of business of loss on trading of shares and securities has held in favour of the assesse by stating that the assesse being a regular trader in various scrips and entering into many scripts even if dealt with suspected scrip on the basis of movement of share prices and there is nothing on record to prove that the assesse has anywhere involved in any type of irregularities, and allowed the appeal of the assesse. The relevant part of the decision is reproduced as under-

11. Considered the rival submissions and material placed on record, we observe that assessee has dealt with various scrips particularly, Global Infratech Limited (GBL), Luminaire Technologies Limited, UNNO Industries Limited and Shree Shalin Textiles Ltd which are suspected to be penny stock and it is also fact on record that these scrips are categorized as penny stock as per the investigation wing, Kolkata reports and Assessing Officer has heavily relied on these reports and report of SEBI to come to the conclusion that the various scrips dealt with by the assessee are penny stock and he discussed various analysis made by the investigation wing of Kolkata and other agencies and relied on various submissions of various dealers in these scrips and proceeded to disallow the claim made by the assessee on the long term capital loss. We also notice from the record that assessee has submitted all the relevant documents of purchase and sale of these scrips in the recognized stock exchange and all the details were submitted before the Assessing Officer including the payments were made through banking channels only. The Assessing Officer completely overlooked the various documents and supporting evidences submitted by the assessee and he has not analysed these documents and he merely proceeded to make the addition based on the investigation carried on by the investigation agencies and he did not eventually make any investigation on the various documents submitted before him, merely because assessee has dealt with suspected scrips, therefore he has proceeded to make the disallowance. We observe from the record that assessee has purchased and sold these shares through recognized stock exchange and authorised brokers and nowhere it is brought on record that assessee is one of the party involved in the entry provider or involved in manipulating the prices or it is proved that assessee is one of the exit provider. It is fact on record that all the scrips in which assessee has dealt with were already proved to be a non penny stock based on the various decisions of the various Hon’ble High Courts and Tribunal benches. Apart from that, we observe that assessee is a regular trader in various scrips and particularly in this year assessee has dealt with more than 150 scrips and the transactions of the assessee in trading of shares having turnover of more than Rs..528.9 crores and also having substantial dividend and speculation income during this year. This proves to show that assessee is a regular investor and may be assessee has dealt with suspected scrip merely on the basis of movement of share prices and there is nothing on record to prove that assessee has anywhere involved in any types of irregularities. Therefore, we do not find any reason to interfere with the findings of the Ld.CIT(A). Accordingly, ground raised by the revenue is dismissed.

12. In the result, appeal filed by the Revenue is dismissed.”

26. On the identical issue of losses incurred from trading in illiquid options, the Hon’ble ITAT “D” Bench (Delhi) in case of M/s Kundan Rice Mills v. ACIT (ITA NO 853/DEL/2020) vide order dated 09.07.2020 has held as under:

“14.6 The issue in appeal regarding violation of provisions of SEBI Rule was decided based on the facts and circumstances available on record and intention of the parties and ultimately the issue with regard to avoidance of payment of tax and act of tax planning was not adjudicated because the Adjudicating Officer has not gone into this aspect. However, in the present case, the A.O./Ld. CIT(A) have not gone into the facts and material evidence on record and merely referring to the interim order of the SEBI and subsequent order have decided the issue against the assessee. Since in the case of Rakhi Trading Pvt. Ltd., (supra), the issue under Income Tax Act was also not adjudicated upon, therefore, in our humble opinion the decision in the case of Rakhi Trading Pvt. Ltd., (supra), would not support the case of Revenue.

14.7. Considering the totality of the facts and circumstances of the case in the light of material/evidences available on record and in the absence of any investigation carried-out by the authorities below, we are of the view that assessee has been able to establish that assessee company has suffered genuine business loss as had also been suffered in earlier years, therefore, authorities below should not have disallowed the same against the assessee. In view of the above findings, we set aside the Orders of the authorities below and delete the entire addition. In the result, Ground No.1 of the appeal of Assessee is allowed.”

The Hon’ble Tribunal has held that the loss shown from trading in illiquid options as genuine loss as there is no adverse material against the assesse.

27. In the following case the different benches of Hon’ble Tribunal have decided the issue in favour of the assesse on similar facts. ACIT 19(1) v. Adihemshree Financial, ITAT, Mumbai (ITA no. 933, to 936/ Mum/ 2024)

| 1. | | Raigarh Jute & Textile Mills Ltd v. ACIT CC- 8(2), ITAT,Kolkata (ITA no. 2286/ Kol/ 2019) |

| 2. | | Samrat Finvestors Private Limited v. ITO, Ward- 10(2), ITAT, Kolkata (ITA no. 840/Kol/2023) |

| 3.Samrat | | Finvestors Private Limited v. ITO, Ward- 10(2), ITAT, Kolkata (ITA no. 840/Kol/2023) |

28. In light of the aforementioned facts that the appellant is a regular trader in stock market and in view of the decisions discussed above, the loss shown of Rs 1,96,04,400 on account of trading in options cannot be held as bogus loss.

Therefore, the addition made by the A.O cannot be sustained. The A.O is directed to delete the addition of Rs 1,96,04,400. Similarly, the commission estimated to be paid in cash @ 2% of Rs 3,92,088 on this transaction will also not survive. Accordingly, this addition of Rs 3,92,088 is also deleted. Appeal on these grounds is thus ALLOWED.”

9.1 Aggrieved by the order of the learned CIT(A), the Revenue has preferred the present appeal before the Tribunal. The principal grievance urged in the grounds of appeal is that the learned CIT(A) erred in (i) deleting the disallowance of losses claimed by the assessee in respect of its BSE derivative transactions and (ii) in the scrip of Divine Multimedia Limited, without duly appreciating the material unearthed by the Investigation Wing, Mumbai, in relation to synchronised trades in illiquid stock options and reversal trades executed within a closed group of entities.

9.2 As far as losses on derivative transactions alleged to in illiquid stock, the learned Departmental Representative, supporting the assessment order, placed strong reliance on the findings of the Investigation Wing which formed an integral part of the Assessing Officer’s reasoning. It was submitted that the assessee was a participant in trades involving highly illiquid stock options, all of which were executed within a narrow window of zero to two days, with the sole object of generating artificial losses for the purposes of setting off genuine gains. According to the learned DR, such losses were merely a device to evade legitimate tax liability.

9.3 The learned DR further contended that the Assessing Officer on the basis of the investigation conducted under “Project Falcon,” clearly identified the assessee as a beneficiary of fictitious losses in the guise of long-term and short-term capital transactions. It was argued that the findings recorded by the learned CIT(A) were contrary to the material on record and failed to accord due weight to the investigation report which demonstrated clear instances of pre-arranged and manipulated trades.

9.4 On the other hand, the learned counsel for the assessee submitted that the assessee has been engaged, for more than a decade, in the regular business of trading in shares and derivatives and that the transactions under scrutiny constitute a routine component of such business activity. The assessee placed on record a paper book comprising pages 1 to 97 containing all primary evidences, including contract notes, broker ledger, bank statements and complete F&O transaction details.

9.5 The learned counsel submitted that the assessee had undertaken only three option-trade transactions during the relevant previous year, on 04.06.2015, 10.06.2015 and 06.08.2015, all of which were executed on the screen-based, anonymous trading system of a recognised stock exchange through duly registered brokers. It was emphasised that the magnitude of these trades was insignificant when viewed against the backdrop of the assessee’s overall trading volume and that all transactions were duly reflected in the audited financial statements.

9.6 Explaining the nature of the trades, it was submitted that the assessee had entered into expiry-week options where premiums are typically low due to time decay and the accelerated volatility prevailing near expiry. Such trades, according to the counsel, are a legitimate and recognised feature of derivative markets, and the premiums paid by the assessee represented the sole cost of acquiring a contractual right contingent on the underlying scrip moving favourably. It was further submitted that the assessee had dealt in multiple scrips and at multiple strike prices, all of which were duly listed on the BSE and within the exchange-prescribed ranges. No trade was in breach of SEBI regulations.

9.7 The learned counsel emphasised that the allegation of fictitious loss is misconceived, as the assessee had merely purchased options which eventually expired worthless. There were no corresponding sale transactions, and hence none of the characteristics commonly associated with pre-arranged or manipulated trades—such as matching purchase and sale quantities, circular trading, inflated entry prices or depressed exit prices—arose in the present case.

9.8 It was submitted that option pricing is governed by recognised market variables such as volatility, demand–supply, time value and the comparative movement of the underlying scrip. No statutory or regulatory prescription mandates that options must trade at intrinsic value. The premise adopted by the Assessing Officer, thus, was contrary to both market practice and regulatory norms.

9.9 The learned counsel also submitted that the assessee has no relationship, direct or indirect, with the alleged counterparties mentioned in the assessment order. Under the electronic, screenbased mechanism, orders are matched automatically on price–time priority, rendering it impossible for either participant to know the counter-party or selectively transact with any identified entity. There is no complaint from any investor, no adverse remark from the BSE, and SEBI has neither raised any query nor initiated any regulatory action against the assessee or its brokers. The data extracted by the Assessing Officer from BSE records, it was contended, was applied mechanically and without any correlation to the assessee’s actual trades.

9.10 The assessee also referred to the detailed submissions furnished before the Assessing Officer vide letters dated 15.03.2022 and 17.03.2022, wherein each allegation regarding the genuineness of trades was addressed point-by-point. It was urged that once primary evidences—namely contract notes, broker ledger, bank statements and F&O statements—were produced, the initial onus placed on the assessee stood satisfied. Thereafter, the burden shifted upon the Revenue to establish, with substantive material, that the transactions were sham. The Assessing Officer, however, proceeded to summarily reject the explanation without any independent enquiry, contrary to the settled law that suspicion cannot take the place of proof.

9.11 The learned counsel then dealt with the reliance placed by the Assessing Officer on the judgment of the Hon’ble Supreme Court in Rakhi Trading Pvt. Ltd. (supra). It was submitted that the facts of that case—such as identical buy-sell quantities, trades squared off within seconds, repetitive dealing with the same counter-parties, abnormal disparity between option price and underlying price movement, and concentrated volume in illiquid scrips—are entirely absent here. The assessee had only purchased options, had not executed any sale transactions, did not engage with any known counter-party, and its trades constituted no significant portion of market volume. It was submitted that the decision in Rakhi Trading (supra), cannot be applied mechanically divorced from its factual substratum.

9.12 The counsel further explained, by reference to standard derivative-market behaviour, that out-of-the-money options routinely expire at zero value, especially near expiry when volatility spikes. The mere fact that an option expires worthless cannot, therefore, lead to the inference of fictitious trading.

9.13 Summarising his submissions, the learned counsel contended that—

| (i) | | none of the factual indicators or market-manipulation patterns noted in SEBI’s investigation reports and relied upon by the Assessing Officer pertain to the assessee; |

| (ii) | | the assessee acted throughout as a bona fide trader within its financial and risk parameters; |

| (iii) | | all statutory and regulatory requirements were duly complied with; |

| (iv) | | profit or loss is a natural incident of legitimate market trading and cannot, without more, warrant an adverse inference; (v) no nexus with any alleged counter-party or entry operator has been established; and |

| (vi) | | once the assessee has produced all primary evidences substantiating the genuineness of trades, the burden shifts decisively to the Revenue to rebut the same with cogent material, which has not been done. |

9.14 It was, therefore, urged that the reopening as well as the consequential addition are founded on conjecture rather than evidence, and hence cannot be sustained in law.

10. We have heard the rival submissions of the parties and have carefully perused the material placed on record. The principal contention urged on behalf of the assessee is that the impugned transactions represent bona fide derivative trades carried out in the ordinary course of its long-standing business, and that the loss claimed is nothing other than the premium paid for acquiring the options which ultimately expired worthless.

10.1 On a consideration of the financial records, we find that the assessee has been consistently trading in shares and derivatives over the years, and the transactions of the year under appeal do not constitute any aberration. The contract notes placed before us, which remain uncontroverted, clearly reveal that the assessee did not enter into any reversal trades or matched transactions; the options purchased were permitted to run their natural course and expired on the exchange platform in the ordinary manner. The Departmental Representative has placed no material on record to dislodge this factual position.

10.2 The assessee has produced a complete set of documentary evidence, including broker’s ledger, contract notes, bank statements, and details of margins paid. It has also demonstrated, by reference to the architecture of the screen-based electronic trading system, that it is not possible for a market participant to identify or select a counter-party, the matching of orders being automated and governed by price–time priority. It is not in dispute that Securities Transaction Tax was duly paid, that all trades were routed through recognised brokers and banks, and that no adverse comment has emanated from SEBI or the BSE with respect to any of these transactions. Indeed, no material has been brought to our notice to suggest that any investigation was undertaken by the authorities below qua the assessee which would establish collusion, pre-arrangement, or manipulation.

10.3 In the totality of circumstances, and in the absence of any enquiry specific to the assessee, we are persuaded to accept the assessee’s contention that the loss incurred represents a genuine business loss. The fact that the assessee entered into only three option trades and thereafter discontinued such trading, reverting to its usual short-term share trading activity, further fortifies the bona fide nature of the transactions.

10.4 It is also of significance that the Revenue has not established any nexus between the assessee and the alleged counter-parties. In a system where anonymity is inherent and the identity of the opposite party is unknown to both sides, the burden lay heavily upon the Department to demonstrate, by cogent evidence, that the trades were collusive or pre-arranged. No such evidence has been adduced. Suspicion, however strong, cannot be elevated to proof; the theory of preponderance of probabilities cannot be stretched to substitute conjecture for material facts.

10.5 Once the assessee has discharged its initial onus by producing primary documents of unimpeached character, the burden shifts upon the Revenue to establish that the loss is not genuine. In the present case, the Revenue has failed to discharge this burden. The disallowance is thus unsustainable.

10.6 We have also considered the reliance placed by the Assessing Officer upon the decision of the Hon’ble Supreme Court in Rakhi Trading (P.) Ltd (supra). That decision turned upon the peculiar features of reversal trades executed with the same counter-party in a manner suggestive of manipulation. The factual matrix before us is wholly distinct. Here, there are no reversal trades, no matched buy-sell quantities, no repetitive dealings with the same party, and no trading in dubious or illiquid scrips. Indeed, the assessee’s trades pertain to well-known blue-chip companies such as JSW, SAIL, IDBI, PNB and NMDC. The assessee’s explanation that the trades were entered on the last day of the cycle in expectation of favourable price movement, and that the options were allowed to expire in the absence of such movement, is both plausible and consistent with normal market behaviour. The Assessing Officer has, moreover, selectively highlighted transactions resulting in loss and ignored instances where the assessee has earned profit from similar transactions.

10.7 We find no reference in the assessment record or the Investigation Wing’s report to any enquiry undertaken with the buyer or seller, or with any broker, which would lend support to the hypothesis of pre-committed or synchronised trading. The entire edifice of the addition rests upon presumption rather than proof.

10.8 We also find substance in the Assessee’s submission that no material has been brought on record by the Assessing Officer to establish that the Assessee was a participant in any pre-meditated or contrived scheme of generating artificial losses. Mere reliance on general investigation findings, without establishing a live nexus with the specific conduct of the Assessee, cannot, by itself, discredit otherwise documented and verifiable trades. This approach is consistent with the settled principle that, while tax authorities are empowered to pierce the veil of colourable transactions, such conclusion must rest on cogent and particularised evidence, and not on broad or undifferentiated suspicion (cf. the principle affirmed by the Hon’ble Supreme Court in similar contexts).

10.9 Viewed cumulatively with the findings recorded hereinbefore, we are therefore of the considered view that the Assessee has sufficiently discharged the onus cast upon it to establish the genuineness of the trades. The evidentiary record does not reveal any basis to disregard the transactions as non-genuine or to characterise them as part of a pre-arranged mechanism for tax evasion. Accordingly, the allegation of fictitious loss generation fails to withstand scrutiny.

10.10 In light of the foregoing discussion, we hold that the premium paid by the assessee represents the actual cost of the options and is allowable as a business loss. The disallowance made by the Assessing Officer is directed to be deleted. Ground No. 1 of the Revenue’s appeal is accordingly dismissed.

11. Grounds Nos. 2 to 9 raised by the Revenue concern the allegation that the assessee had availed accommodation entries and booked bogus Long-Term Capital Gain or Short-Term/Long-Term Capital Loss through trading in certain penny scrips stated to be controlled by one Shri Naresh Jain.

11.2 The brief factual backdrop is that a Search and Survey action under sections 132 and 133A was carried out on 19.03.2019 on a syndicate of persons stated to be led by Shri Naresh Jain by the DDIT (Inv.), Units 7(1) & 7(3), Mumbai. On the basis of the materials seized therein, the Assessing Officer proceeded to draw an inference that the assessee had participated in a larger accommodation-entry arrangement. The Ld. CIT(A), however, on a detailed appraisal of the record, deleted the addition for reasons recorded in paragraphs 30 to 33 of the impugned order, observing as under:

30. The AO received the information wherein it was informed that a search was conducted on Shri Naresh Jain. In this search, it was revealed that Shri Naresh Jain was involved in providing accommodation entries by rigging the scrip of various penny stocks. M/s Divine Multimedia Ltd is one is one such scrip manipulated by Shri Naresh Jain. The appellant has sold 35,000 shares of M/s Divine Multimedia Ltd for 45,150/- resulting in a loss of 11,50,557/-.

In the assessment order, the AO has discussed in detail the findings of the search conducted on Shri Naresh Jain. On the basis of the information received, the AO held that the business loss shown of 11,50,557/- on account of the sale of shares of M/s Divine Multimedia Ltd is bogus, and hence the same is disallowed.

31. The appellant contended that during the course of assessment proceedings, all the documentary evidence in the form of copies of contract notes, copies of de- mat accounts, copies of bank statements, ledger accounts of brokers, etc. were submitted before the AO. However, the AO ignored all these documentary evidences and solely on the basis of the findings of the search conducted on Shri Naresh Jain, held the loss shown by the appellant as bogus. It is further contended that the appellant is a trader and not an investor in the stock market. The trader aims to profit from the frequent fluctuations in the stock market and, in this course, may suffer losses due to such fluctuations. The appellant is not aware of Shri Naresh Jain and is not at all involved or connected either in manipulation of the stock prices or availing accommodation entries.

32. I have considered the assessment order, submission of the appellant, and facts available on record. While deciding the appeal on grounds No. 3 and 4, I have held that the appellant is a trader in the stock market and has shown a huge turnover from trading in shares, futures and options. It is apparent from the facts on record that the appellant has traded various scrips in the year under consideration, and one of the scrips is M/s Divine Multimedia Ltd. It is not the case that the appellant is a naïve investor/trader and traded in single scrip. Further, the appellant has furnished documentary evidence in the form of brokers’ notes, bank statements, and copies of de-mat account which prove that the purchases and sale transactions are carried out online through the stock exchange. It is not the case that the purchases are carried out offline.

33. There is no finding in the search conducted on Shri Naresh Jain that the appellant is involved in rigging the price of shares or availing accommodation entries by trading in such shares. There is no investigation conducted by SEBI in the case of the appellant. The A.O has solely relied on report of investigation unit. No independent inquiries have been conducted during the assessment proceeding. There is no evidence brought on record which indicates that transaction in the alleged scrip is an accommodation entry.

Therefore, considering the fact that the appellant is a regular trader in the stock market, and these shares have been purchased in regular trading activities, and in view of the decision of Hon’ble ITAT in the case of M/S Munish Financials, as discussed above, the addition made by the AO of the business loss of 11,50,557/- cannot be sustained. Therefore, the AO is directed to delete the same. Accordingly, the appeal on this ground is ALLOWED.”

11.3 Before us, the Ld. Departmental Representative elaborated upon the purported modus operandi, namely, that the shares of beneficiary entities were allegedly traded through paper or shell companies, enabling the routing of unaccounted money in the guise of exempt LTCG or contrived losses. According to the Revenue, the assessee’s transactions bore the imprint of this larger scheme.

11.4 The assessee, on the other hand, contended that its case stands on a wholly different footing. It was submitted that the assessee had no nexus—direct or indirect—with Shri Naresh Jain or any of his alleged associates. Despite specific directions of the Hon’ble Bombay High Court in Writ Petition No. 478 of 2022, the Assessing Officer did not furnish the statement of Shri Naresh Jain, though such statement was relied upon in the assessment order. This non-production, in the assessee’s submission, constitutes a clear infraction of the principles of natural justice. With regard to the alleged accommodation entry of Rs.45,500, the assessee categorically denied any transaction or acquaintance with the said person and maintained that the entire allegation is devoid of evidentiary support.

11.5 As regards the twelve scrips referred to in the show-cause notice, the assessee clarified that it had not purchased any of them. The only relevant transaction was the sale of shares of Divine Multimedia Ltd. amounting to Rs.45,150, the complete documentary trail of which—including contract notes, demat statements, and bank ledgers—was placed before the Assessing Officer.

11.6 Considerable reliance was placed by the assessee upon the order of the coordinate bench in the case of its sister concern, ACIT v. Munish Financial [IT Appeal Nos. 2637 & 2638/Mum/2022, dated 31-03-2023], where on identical allegations—though in respect of different scrips—the Tribunal held that mere reliance on investigation reports without any cogent evidence linking the assessee to the alleged operators cannot sustain an addition. The Tribunal had emphasised that the assessee in that case had furnished complete documentary evidence of bona fide purchase and sale through recognised stock exchanges; and that suspicion, however strong, cannot substitute. The relevant finding of the Tribunal (supra) is reproduced as under:

“11. Considered the rival submissions and material placed on record, we observe that assessee has dealt with various scrips particularly, Global Infratech Limited (GBL), Luminaire Technologies Limited, UNNO Industries Limited and Shree Shalin Textiles Ltd which are suspected to be penny stock and it is also fact on record that these scrips are categorized as penny stock as per the investigation wing, Kolkata reports and Assessing Officer has heavily relied on these reports and report of SEBI to come to the conclusion that the various scrips dealt with by the assessee are penny stock and he discussed various analysis made by the investigation wing of Kolkata and other agencies and relied on various submissions of various dealers in these scrips and proceeded to disallow the claim made by the assessee on the long term capital loss. We also notice from the record that assessee has submitted all the relevant documents of purchase and sale of these scrips in the recognized stock exchange and all the details were submitted before the Assessing Officer including the payments were made through banking channels only. The Assessing Officer completely overlooked the various documents and supporting evidences submitted by the assessee and he has not analysed these documents and he merely proceeded to make the addition based on the investigation carried on by the investigation agencies and he did not eventually make any investigation on the various documents submitted before him, merely because assessee has dealt with suspected scrips, therefore he has proceeded to make the disallowance. We observe from the record that assessee has purchased and sold these shares through recognized stock exchange and authorised brokers and nowhere it is brought on record that assessee is one of the party involved in the entry provider or involved in manipulating the prices or it is proved that assessee is one of the exit provider. It is fact on record that all the scrips in which assessee has dealt with were already proved to be a non penny stock based on the various decisions of the various Hon’ble High Courts and Tribunal benches. Apart from that, we observe that assessee is a regular trader in various scrips and particularly in this year assessee has dealt with more than 150 scrips and the transactions of the assessee in trading of shares having turnover of more than Rs..528.9 crores and also having substantial dividend and speculation income during this year. This proves to show that assessee is a regular investor and may be assessee has dealt with suspected scrip merely on the basis of movement of share prices and there is nothing on record to prove that assessee has anywhere involved in any types of irregularities. Therefore, we do not find any reason to interfere with the findings of the Ld.CIT(A). Accordingly, ground raised by the revenue is dismissed.”

11.7 Having carefully perused the material placed on record and the findings of the Ld. CIT(A), we find that the present case stands on the same factual footing as Munish Financial (supra). The assessee is a regular trader dealing in a large basket of scrips, has routed all transactions through recognised stock exchanges and authorised brokers, and has maintained supporting documents. The Revenue has not brought any material to demonstrate that the assessee participated in price manipulation, acted as an entry provider, or otherwise engaged in any colourable device except the general statement of sh Naresh Jain, which was not allowed to cross examined.

11.8 We have also examined the assessee’s financials, as placed in the paper book. The assessee has reported a turnover exceeding Rs.100 crores from trading activity. In such a scenario, fastening an allegation of collusion on the strength of a solitary transaction of a negligible sum—without substantiating any meeting of minds or any nexus with the alleged operators—would amount to substituting conjecture for evidence. The fact that certain brokers or operators may have been involved in manipulation cannot, ipso facto, lead to an inference that every investor or trader dealing in the same scrip is complicit in such activity, particularly, when transaction has been carried out on stock exchange platform without any interface.

11.9 On an overall conspectus of the matter, taking into account the scale and nature of the assessee’s trading operations, the documentary evidence adduced, and the absence of any direct incriminating material, we are satisfied that the loss claimed by the assessee arose in the normal course of business. We therefore concur with the conclusion of the Ld. CIT(A) that the disallowance made by the Assessing Officer is unsustainable.

11.10. In view of the foregoing discussion, and the Revenue having failed to rebut the factual findings recorded by the Ld. CIT(A), we find no infirmity in the impugned order on the issue in dispute. Accordingly, Grounds Nos. 4 to 8 raised by the Revenue are dismissed.

12. In the result, both the appeal of the Revenue as well as cross objection of the assessee are dismissed.