ORDER

1. These appeals preferred by the assessee are directed against separate orders dated 20.03.2017, 12.07.2017, and 31.07.2019 passed by the Learned Commissioner of Income-tax (Appeals)–4, Mumbai [hereinafter referred to as “the Ld. CIT(A)”] pertaining to the assessment years 2012–13, 2013–14, and 2014–15 respectively. Since common issues in dispute are involved in all these appeals, same were heard together and are being disposed of by this consolidated order for the sake of convenience and to avoid repetition of facts.

2. Firstly, we take up the appeal of the assessee for assessment year 2012-13. The grounds raised by the assessee are reproduced as under:

1. In the facts and circumstances of the case and in Law, the Ld CIT (A) erred in confirming disallowance u/s 14A of the Act in respect of the following:

a. Rule 8D(2)(i)

| i. | Interest to TATA Capital | Rs. 10,99,16,196 |

| ii. | Personnel expenses | Rs. 1,75,00,000 |

| iii. | Travelling expenses | Rs. 1,00,95,661 |

| iv. | Business Promotion expenses | Rs. 5,94,168 |

| v. | Rent | Rs. 45,00,000 |

| vi. | Repairs & Maintenance | Rs. 25,00,000 |

| vii. | Depreciation | Rs. 50,00,000 |

| b. | Rule 8D(2)(ii) | Rs. 1,16,79,947 |

| c. | Rule 8D(2)(iii) | Rs. 1,07,39,195 |

2. In the facts and circumstances of the case and in Law and without prejudice to (1) above the Ld. CIT(A) erred in confirming disallowance of Rs. 10,99,16,196 being interest paid to Tata Capital in respect of funds borrowed for strategic investment in shares of group companys despite the fact of assessing officer holding appellant to be engaged in business of investment.

3. In the facts and circumstances of the case and in Law, Without prejudice to (1) above, the CIT (A) erred in confirming disallowance of expenses under Rule 8D(2)(i) on account of Personnel expenses, Travelling expenses, Business Promotion expenses, Rent, Repairs Maintenance and Depreciation despite there being no direct nexus of these expenses with earning of income on which no tax is payable and further without prejudice to above, despite the fact that assessing officer has himself admitted assesse to be engaged in business of investment.

4. In the facts and circumstances of the case and in Law, the Ld CIT (A) erred in confirming disallowance of Rs.1,16,79,947/- out of interest paid despite the fact that assesse has sufficient own funds for making the investment and, without appreciating the fact that assessing officer has himself admitted assessee to be engaged in business of investment

5. Without prejudice to the Grounds No 1,2 and 3 on the facts and in the circumstances of the case and in law the learned CIT(A) erred in not appreciating the fact that no disallowance under section 14A read with Rule 8D can be made where no exempt income was received by the appellant during the year under consideration.

6. On the facts and in the circumstances of the case and in law, the learned CIT(A) p8: 319 erred in confirming disallowance of professional fees of INR 6,00,00,000 paid to Deep C Anand Foundation by attributing it towards incurred for promoting the interest of group companies and was not incurred for the business of the assessee.

7. On the facts and in the circumstances of the case and in law, the learned CIT(A) erred in confirming disallowance of UK Branch office expenses of INR 52,98,889 by treating the same as not incurred for the purpose of business of the assessee.

8. On the facts and in the circumstances of the case and in law, the learned CIT(A) erred in confirming disallowance of expenditure of INR 1,41,19,857 Net of depreciation of INR 15,68,873) incurred for carrying out routine repairs and maintenance in the branch office cum transit house at London as capitai1expenditure.

3. Briefly stated, the material facts of the case are that the assessee-company is engaged in the business of making investments in subsidiary concerns of the “Anand” Group as well as in other corporate entities. For the year under consideration, the assessee filed its return of income on 29.09.2012 declaring a total income of Rs. 36,53,72,580/-. The said return was selected for scrutiny, pursuant to which statutory notices under the relevant provisions of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) were issued and duly complied with. Consequent thereto, the assessment was completed under section 143(3) of the Act on 29.03.2015, determining the total income at Rs. 51,19,60,630/-, after making various additions and disallowances as set out in the assessment order.

4. On further appeal, the Ld. CIT(A) dismissed the appeal of the assessee and upheld the finding of the Assessing Officer.

5. The ground Nos. 1 to 5 of the appeal relate to the issue of disallowance u/s 14A of the Act r.w.r. 8D of the Income-tax Rules, 1962 (in short ‘the Rules’). Facts in brief qua the issue in dispute are that during the year under consideration, the assessee had earned dividend income amounting to Rs. 33,64,56,570/-. The assessee, on its own accord, made a suo-motu disallowance of Rs. 10,53,55,857/- under section 14A of the Act. The Assessing Officer, however, following the findings recorded by his predecessor in the assessment for assessment year 2011–12, proceeded to compute the disallowance in accordance with Rule 8D of the Rules.

5.1 The Assessing Officer first identified out of the total expenditure debited in the profit and loss account, interest expenditure of Rs. 10,99,16,196/- pertaining to the loan obtained from Tata Chemicals Ltd. as directly relatable to the earning of exempt income and accordingly disallowed the same under Rule 8D(2)(i) of the Rules.

5.2 Further, adopting the approach taken in the assessment for assessment year 2011–12, the Assessing Officer held certain expenses, on an ad hoc basis, to be directly connected with the earning of exempt income. These included personnel expenses of Rs. 1.75 crore, travelling and conveyance expenses of Rs. 1,00,95,661/-, business promotion expenses of Rs. 5,94,168/-, rent of Rs. 45,00,000/-, repairs and maintenance expenses of Rs. 25,00,000/-, and depreciation of Rs. 50,00,000/-.

5.3 In this manner, the Assessing Officer determined the total disallowance under Rule 8D(2)(i) at Rs. 15,01,06,025/- (Rs. 10,99,16,196 + Rs. 1,75,00,000 + Rs. 1,00,95,661 + Rs. 5,94,168 + Rs. 45,00,000 + Rs. 25,00,000 + Rs. 50,00,000).

5.4 Thereafter, invoking Rule 8D(2)(ii) of the Rules, the Assessing Officer observed that out of the total interest/finance expenses of Rs. 12,53,95,654/- debited in the profit and loss account, a sum of Rs. 10,99,16,196/- had already been disallowed under Rule 8D(2)(i) as directly relatable to the earning of exempt income. The balance interest expenditure of Rs. 1,54,79,458/- (Rs. 12,53,95,654 – Rs. 10,99,16,196) was accordingly disallowed on a proportionate basis in the ratio of average investments to average total assets, which worked out to Rs. 1,16,79,947/-.

5.5 Further, applying Rule 8D(2)(iii) of the Rules, the Assessing Officer computed disallowance at 0.5% of the average value of investments towards administrative expenses, which amounted to Rs. 1,07,39,195

5.6 Accordingly, the Assessing Officer determined the total disallowance under section 14A read with Rule 8D at Rs. 17,25,25,167/- (Rs. 15,01,06,025 + Rs. 1,16,79,947 + Rs. 1,07,39,195).

6. On further appeal, the Ld. CIT(A) upheld the disallowance following his finding in assessment year 2011-12. The relevant finding of the Ld. CIT(A) is reproduced as under:

“4. Ground No.2, 3 & 4 are against the disallowance of expenditure of Rs. 17,25,25,167/- and are interconnected, interdependent hence, taken together. According to the Assessing Officer, the Assessee does not do any business activities but has only earned dividend of Rs.33,64,56,517/-. Against this income, the Assessee has suo-motto disallowed expenditure of Rs. 10,53,857/- u/s. 14A r.w.r.8D. The same issue was therein A.Y.2011-12. However, disallowable expenditure is to be made according to the Rule 8D. Thus, after applying the Rule 8D, the Assessing Officer has disallowed Rs. 17,25,25,167/- against the claim of the Assessee of Rs. 10,53,55,857/-. Therefore, the balance amount of Rs.67169310/- has been added to the total income. Against the disallowance of expenditure, it is contended that the Ld. Assessing Officer has wrongly made the disallowance without properly appreciating the genuineness of expenditure suomotto offered for disallowance. According to the Ld. A.R., company has taken unsecured loans & inter-corporate deposits from Bank & related parties which is utilized for the purpose of the business. The details of interest was already given to the Assessing Officer by letter dated 20.10.2014, such funds have been utilized for making investment in share of Group Companies. The similar argument was also there in A.Y.2011-12 and same has been repeated in this year also.

4.1. I have considered the issue under appeal, carefully. I find that there was a similar issue in A.Y.2011-12 and matter was decided by Appellate Order dated 14.12.2015 in Para 4.3 which is as under :-

“4.3 I have considered the findings of the Assessing Officer and rival submission of the appellant, carefully. I find that during the year assessee has received dividend of Rs.35,14,87,406/-, interest income of Rs.17,265,656/- and professional fees of Rs.14,65,30,638/-. When there is dividend, which is exempt the corresponding expenditure has to be disallowed as per Section 14A r.w.r. 8D. Appellant has disallowed suo-motto an amount of Rs.9,08,52,583/- but there is no proper justification for such disallowance. As per the appellant’s admission by letter dated 23.10.2013, assessee was granted loan of Rs.60 crores by Tata Capital Ltd. Out of which Rs.15 crores was for purchase of 15% shares of Gabriel India Ltd. and Rs.45 crores was for investment in shares of Group Companies i.e. Rs.30 crores in shares of Mando Steering and Rs.15 crores in shares of Degremont. On such loan, there is interest expenses of Rs.6,89,82,540/- and processing fees of Rs.87,42,750/-. Thus, there is direct nexus of expenditure with exempt income. Assessing Officer has rightly pointed out the fact of such expenditure directly related to earning of exempt income. Similarly, most of the business expenses have been incurred for promoting the Anand Group of Companies businss hence element of expenditure embedded in personnel cost is very much there. Assessing Officer has disallowed only an amount of Rs.1.50 crores out of total expenditure of Rs.2.24 crores. I find that Ld. Assessing Officer has rightly done so. Similar is the fact related to traveling and conveyance expenses and other expenses mentioned by the Assessing Officer. Thus, the total disallowance worked out by the Assessing Officer to the extent of Rs.11,44,50,056/- is found to be directly related to earning the exempt income hence same is to be disallowed under Rule 8D, first limb. Similarly, in second limb interest expenditure has to be disallowed having indirect nexus. Of course third limb of Rule 8D (2) (iii) is also applicable. Thus the total disallowance of expenditure worked out by the Assessing Officer to the extent of Rs.15,11,02,307/- is sustainable. Appellant has not explained as to how disallowance offered by it to the extent of Rs.90852583/- is correct and disallowance has to be restricted to this amount. Therefore, after going through the written arguments and facts on records, I find no reason to discard the working of disallowable expenditure made by the Assessing Officer. Because of facts of the case, none of the decisions relied upon by the Ld. Authorised Representative is applicable, therefore, in the light of the above discussion, the disallowance of expenditure made by the Assessing Officer of Rs.15,11,02,307/- is sustained. Since, assessee has suomoto disallowed exp of Rs.90852583/-, the balance additional disallowance comes to Rs.60249724/-.”

With a view to maintain judicial consistency, the disallowance so made by the Assessing Officer and is hereby sustained.”

6.1 Before us, the Learned Counsel for the assessee submitted that the principal activity of the assessee-company comprises of managing its investments and exploring new investment opportunities. It was further submitted that the assessee also provides management, corporate, and support services to Spicer India Ltd., a concern forming part of the “Anand” Group. The Learned Counsel explained that the assessee purchases shares, grants loans, and provides requisite funding, which is generally sourced through borrowings from various companies.

6.2 It was contended that the assessee’s income consists of dividend income, interest income, income from the sale of investments, and professional fees received for rendering management and support services to group companies. The Learned Counsel argued that the assessee is, by its conduct and consistent course of dealings, a predominantly investment company engaged in the business of managing and holding investments. The funds have consistently been utilized for business purposes. It was further submitted that the shares of the “Anand” Group companies were acquired primarily with the object of maintaining and exercising controlling interest, and not with the intention of earning dividend income, which is merely incidental.

6.3 It was pointed out that the assessee had invested in equity shares, which, unlike preference shares, do not carry any assured return by way of dividend. The Learned Counsel submitted that such systematic and organized investment activity of the assessee has, since inception, been regarded as a business activity, and the expenditure incurred in relation thereto has consistently been treated as business expenditure. It was further brought to our attention that a similar view has been taken by the Coordinate Bench of the Tribunal in the assessee’s own case for AY 2010-11 and earlier assessment years.

6.4 The Learned Counsel submitted that, along with the receipt from the sale of investments, the assessee has also earned dividend income from such investments. Accordingly, it was contended that the expenditure incurred relates both to taxable activities (such as managing and realizing investments) and to non-taxable or exempt activities (such as earning dividend income). Hence, the same ought to be apportioned in proportion to the respective taxable and exempt income.

6.5 The Learned Counsel further submitted that the assessee’s business activities could be appropriately categorized under two heads: (i) strategic investment activity, and (ii) trading in shares. Placing reliance on the judgment of the Hon’ble Supreme Court in Maxopp Investment Ltd v. CIT ITR 640 (SC), it was submitted that disallowance under section 14A of the Act can be made only to the extent of expenditure relatable to earning exempt income, and such allocation must be made in proportion to the taxable and non-taxable income of the assessee.

6.6 The Learned Counsel for the assessee further submitted that the Assessing Officer has not recorded any dissatisfaction with regard to the correctness of the suo-motu disallowance made by the assessee under section 14A of the Act. In the absence of such satisfaction, the invocation of Rule 8D by the Assessing Officer, it was contended, is void ab-initio. It was submitted that, on this ground alone, the entire computation made by the Assessing Officer under Rule 8D deserves to be deleted, and the suo-motu disallowance offered by the assessee ought to be accepted.

6.7 With respect to the Assessing Officer’s action of treating a portion of the expenditure debited to the profit and loss account as directly incurred for earning exempt income and disallowing the same under Rule 8D(2)(i) of the Rules, the Learned Counsel submitted that the Assessing Officer has failed to demonstrate any proximate nexus between such expenditure and the earning of dividend income. It was urged that the expenses in the nature of personnel cost, travelling and conveyance, business promotion, depreciation, etc., were essentially incurred in the course of the assessee’s business of managing and monitoring its investments, and the dividend income was merely incidental to such business operations. Accordingly, it was contended that the Assessing Officer was not justified in holding that such expenses were directly attributable to the earning of exempt dividend income.

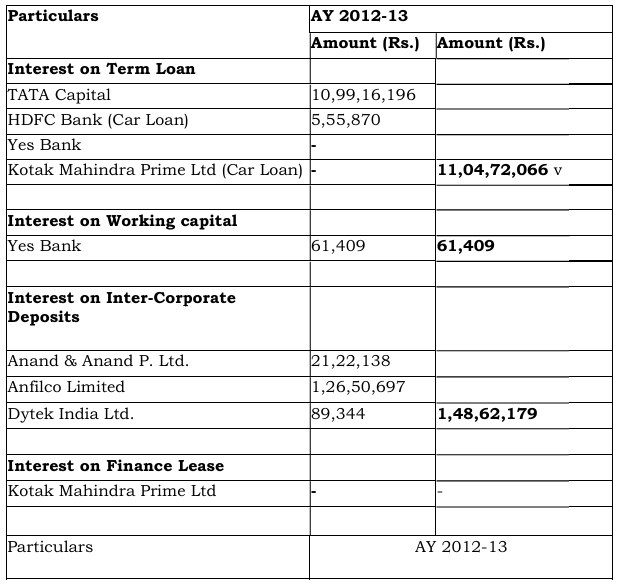

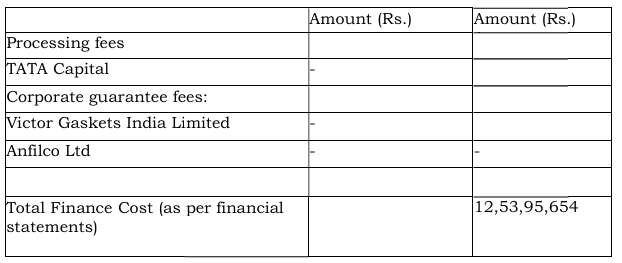

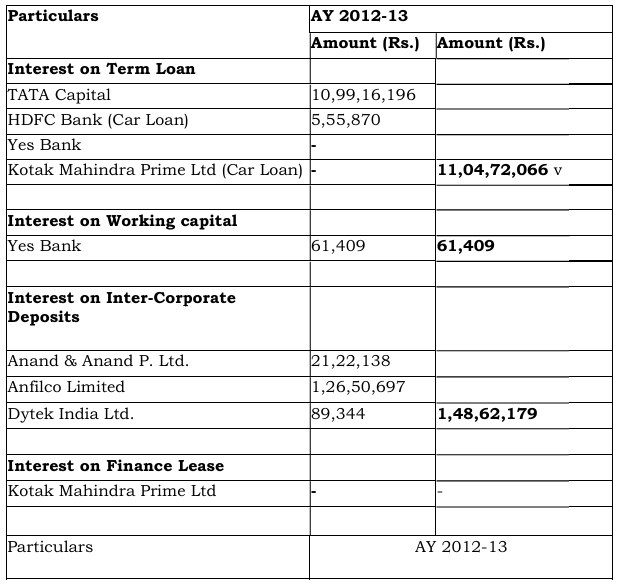

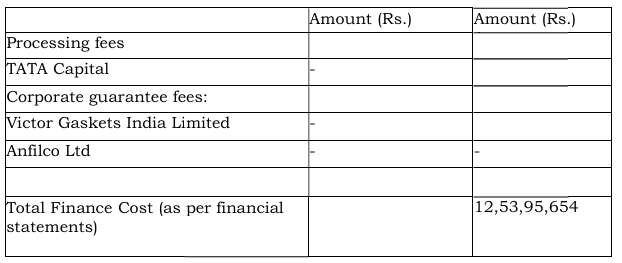

6.8 With reference to disallowance u/R 8D(2)(ii) of Rules, the Ld. counsel for the assessee before us filed a detailed break up, the total finance cost of Rs.12,53,95,654/- for the assessment year under consideration:

6.9 The Learned Counsel for the assessee submitted that the Assessing Officer had already disallowed a sum of Rs. 10,99,16,196/– under Rule 8D(2)(i) of the Income-tax Rules, 1962, being the interest expenditure incurred on a loan obtained from Tata Capital, treating the same as directly attributable to the earning of dividend income, which he is not justified. He further pointed out that the interest expenditure of Rs. 5,55,870/– was directly related to a car loan availed from HDFC Bank, while interest of Rs. 61,409/– paid to Yes Bank pertained to working capital facilities. Likewise, interest payments of Rs. 21,22,138/– to Anand & Anand Pvt. Ltd., Rs. 1,26,50,697/– to Anfilco Ltd., and Rs. 89,344/– to Dytek India Ltd. represented interest on inter-corporate deposits and were not related to any investment yielding exempt income.

6.10 The Learned Counsel accordingly contended that out of the total finance cost of Rs. 12,53,95,654/– debited to the profit and loss account, the interest to Tata Capital having already been disallowed, the balance interest amount of Rs. 1,16,79,947/– stood duly identified as being incurred for specific business purposes and not connected with any investment generating exempt income. Hence, the Assessing Officer was not justified in apportioning the said balance interest expenditure in the ratio of total investments to total assets while computing disallowance under Rule 8D(2)(ii) of the Rules.

6.11 The Learned Counsel further submitted that the Assessing Officer was also not justified in making an additional disallowance of 0.5% of the average value of investments towards administrative expenses under Rule 8D(2)(iii), when disallowance on account of administrative and related expenses had already been made separately.

6.12 The Learned Counsel for the assessee further invited our attention to the order of the Tribunal in the assessee’s own case for the assessment year 2011–12 in Asia Investments (P.) Ltd. v. Addl. CIT [IT Appeal No. 916(Mum) of 2016, dated 20-12-2024]. Referring to the said decision, it was submitted that the personnel of the assessee-company were engaged in multifarious business activities, and that the Assessing Officer had made an ad-hoc disallowance of Rs. 1,75,00,000/– without establishing any specific nexus between such expenditure and the earning of exempt income. The Learned Counsel contended that an ad hoc disallowance is impermissible under Rule 8D(2)(i) of the Income-tax Rules, 1962, unless a direct and proximate connection is demonstrated between the expenditure incurred and the earning of exempt income.

6.13 With regard to the disallowance of travelling expenses, the Learned Counsel submitted that such expenses were incurred by the top management of the company in the ordinary course of its business, including attending meetings with prospective investee companies and financiers, participating in seminars, gatherings, and conventions, and rendering management and advisory services. It was further explained that foreign travel undertaken by senior management personnel was aimed at studying global market trends, exploring new business opportunities, and understanding investor requirements.

6.14 As regards rent, it was submitted that the same pertained to properties taken on lease for business purposes, including the company’s U.K. office-cum-transit house, and that the corresponding repairs and maintenance expenses were incidental to such rented premises, being incurred for their proper upkeep and maintenance.

6.15 The Learned Counsel pointed out that in the assessment year 2010–11, in Asia Investments (P.) Ltd. v. Asstt. CIT [IT Appeal No. 5829(Mum) of 2015, dated 21-8-2019] disallowance had been made only under Rule 8D(2)(ii) and 8D(2)(iii), and not under sub-rule (i). Further, placing reliance on the decision of the Hon’ble Special Bench of the Tribunal in ACIT v. Vireet Investment (P) Ltd. (Delhi – Trib.)/[2017] 165 ITD 27 (Delhi – Trib.)], it was submitted that while computing the disallowance under Rule 8D(2)(ii) and Rule 8D(2)(iii), only those investments which have actually yielded exempt income during the relevant year should be taken into consideration.

6.16 The Learned Counsel further submitted that the Coordinate Bench of the Tribunal, in the assessee’s own case for the assessment year 2010–11,had accepted this contention and following the finding of ACIT v. Vireet Investments (P) Ltd (Delhi – Trib.)/(2017) 58 ITR(T) 313 (Delhi-Trib)(SB) directed to restrict the disallowance to the average value of investments which had actually yielded exempt income during the year.

7. On the contrary, the Ld. Departmental Representative (DR) relied on the order of the lower authorities.

8. We have carefully considered the rival submissions and perused the material placed on record. The undisputed facts reveal that the assessee has earned dividend income of Rs. 33,64,56,570/-, in addition to other taxable income. The assessee, on its own volition, has made a suo-motu disallowance of Rs. 10,53,55,857/- under section 14A of the Act. The Assessing Officer, however, relying upon the approach adopted by his predecessor in the assessment for assessment year 2011–12, proceeded to compute the disallowance by invoking Rule 8D of the Income-tax Rules, 1962 (hereinafter “the Rules”).

8.1 It is well settled that section 14A of the Act mandates the disallowance of expenditure incurred in relation to earning income which does not form part of the total income. Where common books of account are maintained for taxable as well as exempt activities, the Assessing Officer must examine the correctness of the suo-motu disallowance made by the assessee, having regard to the accounts maintained. Only upon being unsatisfied with the correctness of such claim, is he empowered, under section 14A(2), to resort to the computational mechanism prescribed under Rule 8D.

8.2 At the threshold, the assessee has raised a fundamental submission that the recording of satisfaction or dissatisfaction by the Assessing Officer, as contemplated under section 14A(2), is a mandatory precondition for the application of Rule 8D. It is urged that, in the present case, the Assessing Officer has not recorded any such satisfaction before invoking Rule 8D. For ready reference, paragraph 8 of the assessment order is reproduced hereunder:

8. Disallowance u/s.14A

8.1. During the year, the assessee has claimed dividend income of *33,64,56,517/-. The assessee has suo-moto disallowed an amount of Rs. 10,53,55,857/- as disallowance u/s 14A r.w.r. 8D. During the A.Y. 2011-12, the same issue was examined and various expenses, directly attributable to earning exempt income were added. Since there is no change in the facts of the case and the assessee has not been able to provide any satisfactory explanation for not making similar disallowance this year, the disallowance u/s 14A r.w.r. 8D is made, following the manner in which it was made in A.Y. 201112.

8.3 We have given our anxious consideration to the above extract and the assessment order in its entirety. We find that the Assessing Officer has neither recorded any express dissatisfaction nor can any implied dissatisfaction be reasonably inferred, save for a mechanical reliance on the order of his predecessor for an earlier assessment year. The statutory requirement under section 14A(2) is unequivocal: the Assessing Officer must record, having regard to the accounts, why he considers the assessee’s claim to be incorrect. Such satisfaction is the sine qua non for triggering the machinery provisions of Rule 8D. The omission to discharge this mandatory jurisdictional requirement renders the application of Rule 8D legally untenable. It is also pertinent to note that the Assessing Officer has not even adverted to, nor analysed, the break-up or nature of the suo-motu disallowance offered by the assessee. In view of the above, we hold that the disallowance made by the Assessing Officer under Rule 8D suffers from a fundamental jurisdictional infirmity and is, therefore, unsustainable in law. We accordingly direct the deletion of the disallowance computed under Rule 8D. The suo-motu disallowance offered by the assessee stands accepted.

9. The learned counsel for the assessee has further advanced, without prejudice, an alternative line of submissions on the merits of the disallowance made under section 14A of the Act. It is noted that while invoking Rule 8D, the Assessing Officer first proceeded to compute the disallowance under Rule 8D(2)(i). He segregated interest expenditure of Rs. 10,99,16,196/– pertaining to loans obtained from Tata Capital Ltd., characterising the same as expenditure directly relatable to the earning of exempt income, and accordingly disallowed it under Rule 8D(2)(i). Thereafter, he examined other expenditure debited to the profit and loss account and, relying solely upon the manner in which disallowance had been made in assessment year 2011–12, held that part of such expenditure was directly connected with the earning of exempt dividend income and again proceeded to disallow a portion thereof under Rule 8D(2)(i).

9.1 The ld counsel for the assessee submitted that the Assessing Officer has neither demonstrated nor established any proximate nexus between the said expenditure and the earning of exempt income. No objective basis or reasoning has been furnished to indicate how such expenditure could be said to be directly relatable to exempt income, nor is any rational method discernible behind the quantification of the disallowance, which appears to have been made on an ad hoc and presumptive basis. The Assessing Officer’s sole premise, carried over mechanically from assessment year 2011–12, appears to be his conclusion that the activity of making investments in subsidiaries does not constitute a business activity of the assessee, and that since income from the sale of investments is not declared as business income, the expenditure claimed in the profit and loss account is predominantly relatable to the earning of exempt income. Such a conclusion, bereft of factual examination and unaccompanied by statutory satisfaction as required under section 14A(2), cannot by itself justify a disallowance under Rule 8D(2)(i).

9.2 In the backdrop of the foregoing, and without prejudice to our principal finding that, in the absence of any satisfaction recorded under section 14A(2), the invocation of Rule 8D itself is vitiated, we consider it appropriate to analyse the matter on first principles. The assessee has explained that the suo-motu disallowance comprises disallowance of proportionate interest expenditure of Rs. 9,46,16,662/– in terms of Rule 8D(2)(ii), computed on the ratio of investments yielding exempt income to total assets, and a further sum of Rs. 1,07,39,195/– under Rule 8D(2)(iii), being 0.5% of the average value of investments which yielded exempt income.

9.3 It is a settled principle, as enunciated by the Hon’ble Supreme Court in Maxopp Investment Ltd. (supra), that where an assessee is engaged in a composite activity which yields both taxable and exempt income, the expenditure incurred cannot be wholly attributed to either activity. A proportionate apportionment is required, having regard to the proximate connection of the expenditure with the respective streams of income. The Supreme Court has held that even in cases where investment activity is interwoven with or incidental to the business activity, only that portion of expenditure which bears a proximate nexus to the earning of exempt income can be disallowed under section 14A of the Act.

9.4 Thus, applying the principle laid down in Maxopp Investment Ltd. (supra), even if Rule 8D were to be validly invoked, only the expenditure relatable to the earning of exempt income—determined on a rational and proportionate basis—could be subjected to disallowance. The suo-motu disallowance computed by the assessee appears to be consistent with this principle, whereas the disallowance made by the Assessing Officer lacks both statutory foundation and factual justification.

9.5 The Coordinate Bench of the Tribunal, in the assessee’s own case for the assessment year 2011–12 in ITA No. 916/Mum/2016, has referred to the aforesaid principle of apportionment as enunciated by the Hon’ble Supreme Court in Maxopp Investment (supra). The relevant finding of the Tribunal (supra), is reproduced below for ready reference:

“6.3.1. The question that fell for consideration before Hon’ble Supreme Court in the case of Maxopp Investment Ltd. v. CIT (supra) were on two factual background wherein, the question of apportionment of expenditure had arisen and predominant intent of investment in shares was pleaded, though on different facts, on the ground that the objective of investing in shares was not to the dividend income, but to either retain controlling interest over the company in which the investment was made or to earn the profit from trading in shares. The question was whether the disallowance under section 14 A of the Act could be invoked in the cases where exempt income was earned from shares held as “trading assets” or “stock in trade”.

6.3.2. The first set of facts relates to Maxopp Investment Ltd and the second set of facts relates to the State Bank of Patiala. In the case of Maxopp investment Ltd, the assessee therein was in the business of finance, investment and was dealing in shares and securities and that they held the shares and securities, partly as investments on the “capital account” and partly as “trading assets” for the purpose of acquiring and retaining control over its group companies, primarily Max India Ltd. Hon’ble Court noted that the profits resulting on the sale of shares held as “trading assets” were duly offered to tax as business income of the assessee.

6.3.3. In the case of State Bank of Patiala the assessee therein earned exempt income in the form of dividend was from securities held as an stock in trade.

6.4. Hon’ble Supreme Court had considered almost identical issue as is in the present facts of the assessee, that where, the shares/stocks were purchased of a company for the purpose of gaining control over the said company or as “stock in trade”, though incidentally income is also generated in the form of dividends as well. It was argued before the Hon’ble Court that, though incidentally income was also generated in the form of dividends, the dominant intention for purchasing the shares was not to earn the dividend income but to acquire and retain the controlling the business in the company in which shares were invested, or for the purpose of trading in the shares as business activity.

6.4.1. After considering the entire case law on this aspect in the light of the facts involved in both the facts, Hon’ble Court vide paragraph nos. 39-40 held as under:

“(39) In those cases, where shares are held as stock-in-trade, the main purpose is to trade in those shares and earn profits therefrom. However, we are not concerned with those profits which would naturally be treated as ‘income’ under the head ‘profits and gains from business and profession’. What happens is that, in the process, when the shares are held as ‘stock-in- trade’, certain dividend is also earned, though incidentally, which is also an income. However, by virtue of Section 10(34) of the Act, this dividend income is not to be included in the total income and is exempt from tax. This triggers the applicability of Section 14A of the Act which is based on the theory of apportionment of expenditure between taxable and non-taxable income as held in Walfort Share and Stock Brokers P Ltd. case. Therefore, to that extent, depending upon the facts of each case, the expenditure incurred in acquiring those shares will have to be apportioned.

(40) We note from the facts in the State Bank of Patiala cases that the AO, while passing the assessment order, had already restricted the disallowance to the amount which was claimed as exempt income by applying the formula contained in Rule 8D of the Rules and holding that section 14A of the Act would be applicable. In spite of this exercise of apportionment of expenditure carried out by the AO, CIT (A) disallowed the entire deduction of expenditure. That view of the CIT (A) was clearly untenable and rightly set aside by the ITAT. Therefore, on facts, the Punjab and Haryana High Court has arrived at a correct conclusion by affirming the view of the ITAT, though we are not subscribing to the theory of dominant intention applied by the High Court. It is to be kept in mind that in those cases where shares are held as ‘stock-in-trade’, it becomes a business activity of the assessee to deal in those shares as a business proposition. Whether dividend is earned or not becomes immaterial. In fact, it would be a quirk of fate that when the investee company declared dividend, those shares are held by the assessee, though the assessee has to ultimately trade those shares by selling them to earn profits. The situation here is, therefore, different from the case like Maxopp Investment Ltd. where the assessee would continue to hold those shares as it wants to retain control over the investee company. In that case, whenever dividend is declared by the investee company that would necessarily be earned by the assessee and the assessee alone. Therefore, even at the time of investing into those shares, the assessee knows that it may generate dividend income as well and as and when such dividend income is generated that would be earned by the assessee. In contrast, where the shares are held as stock-in-trade, this may not be necessarily a situation. The main purpose is to liquidate those shares whenever the share price goes up in order to earn profits. In the result, the appeals filed by the Revenue challenging the judgment of the Punjab and Haryana High Court in State Bank of Patiala also fail, though law in this respect has been clarified hereinabove.”

(emphasis supplied)

6.4.2. The view of Hon’ble Court is very clear from para 40 above that dominant intention is not important for the purposes of computing disallowance under section 14A. As the assessee has acquired the shares in the group companies and has held it as investment, whatever may be the dominant purpose, disallowance under section 14A r.w.Rule 8D is mandatory, if the assessee earns dividend from such investments. Respectfully following the view expressed by Hon’ble Supreme Court in case of Maxopp Investment Ltd. v. CIT (supra), we hold that the dominant purpose for making investment in shares is not important criteria, even though the assessee has acquired shares for having controlling interest in the group companies.

Accordingly Ground No.2 raised by the assessee stands dismissed.”

9.6 Though the Tribunal in AY 2011-12 has rejected the contention that no disallowance is warranted on the ground that the dominant purpose of the investment was strategic, it nevertheless accepted the theory of apportionment.

9.7 We observe that, in the facts before us, the assessee is admittedly engaged in the business of making and managing investments in its subsidiary companies, and that the dividend income has arisen only as an incidental outcome of such business activity. In these circumstances, the disallowance worked out by the Assessing Officer under section 14A of the Act, read with Rule 8D of the Rules, cannot be applied in a mechanical or undifferentiated manner.

9.8 It is incumbent upon the Assessing Officer to undertake a rational apportionment of the expenditure between taxable and non-taxable streams of income arising from the investment activity, and to identify with precision that part of the expenditure which is actually relatable to earning the exempt income. Only such expenditure, demonstrably connected with the exempt income, can lawfully be disallowed. The balance, being attributable to the assessee’s taxable business operations, must remain outside the purview of disallowance under section 14A.

9.9 We further note that the Coordinate Bench of the Tribunal, in the assessee’s own case for assessment year 2011–12, at paragraph 7.5 of its order, held that the interest expenditure of Rs. 10,99,16,196 paid to Tata Capital Ltd. could not be brought within the ambit of Rule 8D(2)(i) of the Rules. The relevant observation of the Tribunal reads as under:

“7.5. It is noted that, Ld.AO disallowed interest expenses amounting to Rs.6,89,82,540/-. In our view interest component cannot be considered for disallowance under Rule 8D(2)(i).

Accordingly we direct the same to be deleted from Rule 8(D)(2)(i).”

9.10 With respect, we are unable to subscribe to the aforesaid conclusion. The Tribunal proceeded on the premise that interest expenditure is amenable only to disallowance under Rule 8D(2)(ii). In our considered opinion, such a proposition does not accord with the statutory scheme. Rule 8D(2) clearly delineates two distinct categories of expenditure:

| (i) | | direct expenditure, including direct interest expenditure, incurred for the purpose of earning exempt income, which must be disallowed in full under sub-rule (i); and |

| (ii) | | indirect interest expenditure, being interest that cannot be specifically identified or segregated as relating either to taxable business activities or to investment activities yielding exempt income, which is to be apportioned proportionately under sub-rule(ii). |

9.11 Thus, where interest expenditure is demonstrably and directly incurred for the purpose of making investments that have yielded exempt income, the disallowance must appropriately fall under Rule 8D(2)(i), and not under the apportionment mechanism of Rule 8D(2)(ii). To this extent, we find merit in the approach adopted by the Assessing Officer and upheld by the Ld. CIT(A).

9.12 However, in determining the quantum of disallowance, the authority must remain guided by the ratio laid down by the Hon’ble Supreme Court in Maxopp Investment Ltd. (supra), which mandates a principled and reasonable apportionment so as to disallow only such expenditure as bears a proximate nexus with the earning of exempt income. Accordingly, while sustaining the finding that interest on the loan obtained from Tata Capital Ltd. is liable for disallowance under Rule 8D, we direct that the amount be restricted in accordance with the apportionment principles enunciated by the Hon’ble Supreme Court therein.

9.13 We note, at the outset, that for assessment year 2011–12, the Coordinate Bench had rejected the assessee’s plea for exclusion of various items of expenditure which were treated by the Assessing Officer as direct expenses for the purpose of disallowance under Rule 8D(2)(i). The Ld. CIT(A), in the year presently under consideration, has merely followed this earlier view. The relevant extract from the Tribunal’s order reads as under:

“7.6.2. On analysis of the P & L A/c. regarding the personal expenses, it is noted that under the head salaries and bonus in schedule 14 a sum of Rs.1,59,19,089/- has been incurred. The assessment order details the employees to whom the salary and bonus were paid due to non availability of separate books of accounts. The Ld.AO apportioned 1.5 crores under the head personal expenses as direct expenditure incurred towards the earning of exempt income. The reasoning for doing so was that, these employees were involved in the strategic investments made by the assessee in its group companies. It is pertinent to know that amongst the twelve employees four of them belong to Anand family.

Accordingly, we do not find any infirmity in considering Rs.1.5 crores as direct expenses towards earning of exempt income under rule 8D(2)(ii).”

9.14 Having considered the rival submissions and the record, we find that the central controversy turns upon the character of the assessee’s activity. The Assessing Officer proceeded on the premise that the activity of making and managing investments cannot partake the character of a business activity, and therefore, all related expenditure must be regarded as having been incurred for earning exempt dividend income. The assessee, however, contends that even when shares are held as investments, the activity of acquiring and holding controlling interest in group companies may, in appropriate cases, constitute a business activity. In support, the assessee has relied upon several judicial precedents—many rendered subsequent to the judgment of the Hon’ble Supreme Court in Maxopp Investment Ltd. (supra) where strategic investments or controlling stakes have been treated as business assets. These decisions include ACIT v. Tata Sons Ltd. (Mumbai – Trib.)/ITA No. 4630/Mum/2016, dt. August 7, 2020) (Mumbai ITAT); Bitwise Solutions Pvt. Ltd. v. DCIT [ITAppeal No. 756(Pune) of 2017, 29-4-2022] (Pune ITAT) ; AY 2011-12-RMZ Hotels (P.) Ltd. v. NFAC [IT Appeal No. 954 (Bang) of 2022, dated 22-2-2023]; CIT v. Future Corporate Resources Ltd. (Bombay); Tamilnadu Industrial Development Corpn. Ltd. (TIDCO) v. ACIT [IT Appeal No. 1181 (Chny) of 2018, dated 28-2-2020](Chennai ITAT) AY 2003-04. The assessee further submits, relying upon decisions such as Rajeev Lochan Kanoria (Calcutta HC), that even where investments are not held as stock-in-trade, the activity of managing group-level strategic investments may still constitute business activity.

9.15 It is further urged that although Maxopp mandates that disallowance under section 14A applies even to strategic investments, once such strategic investment activity is held to be part of the assessee’s indivisible business, any disallowance of indirect expenditure must fall under Rule 8D(2)(iii), and not under Rule 8D(2)(i). The assessee has also pointed out that even in the Tribunal’s subsequent order in Asia Investment (P.) Ltd. v. Addl. CIT [MA No. 103(Mum) OF 2025, dated26-8-2025] the entire personnel cost was not treated as directly relatable to exempt income, and the Assessing Officer was instead directed to apportion it. Accordingly, the assessee argues that in a mixed and indivisible business, no portion of personnel expense could be notionally classified as “direct” expenditure under Rule 8D(2)(i) in the absence of evidence, and the only permissible method of attribution is that prescribed under Rule 8D(2)(iii), being 0.5% of the average value of investments yielding exempt income.

9.16 On a careful consideration of the matter, we find that the assessee’s case involves a composite activity from which both taxable and exempt income arise. Under section 14A, only such expenditure as bears a clear and proximate connection with earning exempt income may be disallowed. Expenditure not so connected must be examined under section 37(1) to determine whether it is incurred wholly and exclusively for business purposes; but such expenditure cannot be denied deduction under section 14A merely because the assessee has earned exempt income. In the present case, the Assessing Officer’s premise is that strategic investments are not a part of the assessee’s business activity. On that basis, he has treated all related expenditure—including personnel cost, travelling, business promotion and rent—as directly connected with earning dividend income. However, no cogent evidence has been brought on record to demonstrate such a proximate nexus. The mere fact that the assessee promotes the interests of its subsidiaries does not, without more, establish that these expenses were incurred wholly or predominantly for earning dividend income.

9.17 Rule 8D itself provides that only expenditure directly relatable to exempt income can be disallowed under Rule 8D(2)(i); where such direct nexus is not established, the law mandates recourse to Rule 8D(2)(iii), which deals with attribution of indirect expenditure through a statutory formula. In the year under appeal, the Assessing Officer has neither identified nor demonstrated any direct connection between the impugned expenses and the earning of exempt income. Instead, he has resorted to an ad hoc quantification of certain expenses as “direct”, while simultaneously invoking the formulaic disallowance under Rule 8D(2)(iii). Such an approach, being unsupported by evidence and contrary to the statutory scheme, cannot be sustained—particularly when, in assessment year 2010–11 and earlier years, similar expenses were consistently considered only under Rule 8D(2)(iii) by the Coordinate Bench. The relevant finding is reproduced as under:

“5. Before us, the assessee contended that the computation made by the AO for disallowance under section 14A of the Act and confirmed by CIT(A) had considered the gross value of fixed assets and current assets rejecting the contention of the assessee that fixed assets should be considered under all depreciation and current assets should be considered under all current liabilities. The assessee also contended that there are conflicting views on the aspect of computation of disallowance under section 14A of the Act including investments which are strategic in nature or investments on which assessee have not receive any exempt income during the year under appeal. Now, before us the learned Counsel for the assessee conceded that the issue of investments which are strategic in nature is covered against the assessee by the decision of Hon’ble Supreme Court in the case of Maxopp Investment Ltd. v. CIT [2018] 402 ITR 640 (SC). However, the learned Counsel for the assessee stated that the investments on which assessee has not received any exempt income during the year under appeal, the issue is again covered in favour of assessee by the decision of Special Bench of this Tribunal of Delhi Special Bench in the case of ACIT v. Vireet Investments (P.) Ltd. [2017] 58 ITR(T) 313 (Delhi – Trib.) (SB). The learned Counsel for the assessee stated that the assessee has filed revised computation of disallowance under section 14A read with Rule 8D of the Rules, which is enclosed at page 33, wherein disallowance made amounting to 8,28,13,345/-. The learned Counsel for the assessee stated that the working given by assessee was not considered by the CIT(A) hence, the revised the computation, wherein the assessee has excluded the investment which is not received any exempt income during the year of appeal, is to be excluded.

6. When these facts were confronted to the learned Sr. Departmental Representative, he stated that the matter can be restored back to the file of the AO for re-computation of disallowance.

7. After hearing both the sides and going through the facts and circumstances of the case. We are of the view that the disallowance of interest under Rule 8D(2) (ii) and administrative expenses under Rule 8D(2)(iii) should be restricted to the investment giving rise to exempt income and no disallowance should be made on the investments which are not giving taxable income. The AO will look into the computation of disallowance made by assessee i.e. the revised computation filed before us on page 34 of assessee’s paper book. The AO will re-compute the disallowance in term of the above.

8. The next issue in this appeal of assessee is against the order of CIT(A) confirming the disallowance of interest on expenditure under section 37(1) of the Act made by the AO to the tune of Rs. 4,36,649/-. For this assessee has raised the following ground No. 2: –

“2. On the facts and in the circumstances of the case and in law, the learned CIT(A) erred in confirming disallowance of interest expenditure undersection 37(1) to the tune of INR 4,36,649/-

Without prejudice to the above, the CIT(A) erred in not directing the Assessing Officer to allow the above interest as the above interest has already been considered in disallowance worked out under section 14A of the Income Tax Act.

Without prejudice to the above, the CIT(A) erred in not directing the Assessing Officer that out of the total loans and advances, amount advanced to KCA Holdings Ltd. was at a lower rate of interest and therefore, if at all any disallowance of interest is to be made, such disallowance has to be restricted to the advance given to KCA holdings Ltd.”

9.18 We accordingly hold that the Assessing Officer has erred in treating portions of personnel and other administrative expenditure as directly relatable to earning exempt income without establishing the requisite proximate nexus. The ad hoc allocation of such expenses under Rule 8D(2)(i), coupled with a further disallowance under Rule 8D(2)(iii), amounts to an impermissible duplication and is contrary to the statutory framework. In view of the foregoing discussion, and having regard to the principles laid down by the Hon’ble Supreme Court in Maxopp Investment Ltd.(supra), the assessee’s grounds No. 2 and 3 merit acceptance. The disallowance under Rule 8D(2)(i) is therefore deleted, leaving only such attribution as is permissible under Rule 8D(2)(iii). Accordingly, the contention of the assessee raised in Grounds No. 2 and 3 of the appeal stands allowed.

9.19 With respect to the disallowance of Rs. 1,16,79,947/- made under Rule 8D(2)(ii), we find that the Assessing Officer has proceeded to apply the proportionate formula mechanically, without first ascertaining the actual utilisation of the borrowings on which the impugned interest was paid. Such an approach, in our considered view, overlooks the foundational requirement of section 14A read with Rule 8D—that only expenditure having a proximate and real nexus with the earning of exempt income may be disallowed.

9.20 The assessee, however, has placed before us detailed material, as noted in the preceding paragraphs, demonstrating that the relevant interest expenditure pertains to specific borrowings which were not deployed for making investments capable of yielding exempt income. For ready reference, the pertinent portion of the assessee’s submissions is reproduced below:

The Ld. counsel for the assessee submitted that interest amount of Rs. 10,99,16,196 incurred on loan from Tata Capital was already disallowed by the AO under Rule 8D(2)(i) as direct expenditure for earning dividend income. He submitted that the interest of Rs.5,55,870/- was directly related to the car loan from HDFC Bank. Similarly, he submitted that interest of Rs.61,409/- paid to Yes Bank was directly connected with the interest on working capital. Similarly, he submitted that interest of Rs.21,22,138/- paid to Anand & Anand P. Ltd. of Rs.1,26,50,697/- paid to Anfilco Ltd. and interest of Rs.89,344/- Dytek India Ltd. related to interest at another corporate deposits.

9.21 We note that in assessment year 2011–12, the Tribunal had upheld a similar disallowance under Rule 8D(2)(ii). However, the factual matrix in the present year stands materially distinguished. Here, the assessee has furnished specific, verifiable details establishing that the borrowings in question were utilised for purposes wholly unconnected with investment in tax-exempt assets. In the absence of any contrary evidence brought on record by the Revenue, and having regard to the settled principle that a proportionate disallowance of interest under Rule 8D(2)(ii) is permissible only where the nexus between borrowed funds and investments yielding exempt income cannot be segregated, we are unable to sustain the disallowance. Accordingly, the disallowance of Rs. 1,16,79,947/- made under Rule 8D(2)(ii) is directed to be deleted. Ground No. 4 of the assessee’s appeal, therefore, stands allowed.

9.22 As regards Ground No. 5, the assessee has contended that the Assessing Officer failed to apply the law as enunciated by the Hon’ble Special Bench of the Tribunal in Vireet Investment (P.) Ltd. (supra). The grievance of the assessee is that, while computing the disallowance under Rule 8D(2)(iii), the Assessing Officer adopted the value of the entire investment portfolio, without restricting the computation to those investments which actually yielded exempt income during the relevant previous year. This approach is in clear departure from the ratio of Vireet Investment (P.) Ltd. (supra), which holds that only income-yielding investments are to be considered for the purposes of Rule 8D(2)(iii). We also note that the said principle has been consistently followed by the Coordinate Bench in the assessee’s own case for assessment year 2010–11.

9.23 In light of the foregoing discussion, and applying the binding ratio of the Special Bench decision, we direct the Assessing Officer to re-compute the disallowance under Rule 8D(2)(iii) by taking into account only such investments as have actually generated exempt income during the relevant previous year. Accordingly, Ground No. 5 of the assessee’s appeal is allowed for statistical purposes.

9.24 For the sake of clarity, we reiterate that earlier in this order we have already deleted the entire disallowance made under section 14A on the ground that the Assessing Officer failed to record the mandatory satisfaction as required under the said provision. The findings now rendered in relation to Rule 8D are, therefore, purely on a without-prejudice basis.

10. Ground No. 6 of the assessee’s appeal pertains to the disallowance of professional fees amounting to Rs. 6 crores paid to Deep C Anand Foundation.

10.1 The brief background of the issue is that the Assessing Officer, relying upon the findings recorded by his predecessor for assessment year 2011–12, observed that the assessee-company had already made payments to Shri Deep C. Anand in his individual capacity. According to the Assessing Officer, a further payment made to him in a different capacity—as trustee of Deep C Anand Foundation—was not warranted. Proceeding on the premise that the assessee was merely an investment company entitled to deduction only for expenses necessary for the upkeep of its corporate structure (such as audit fees, statutory dues, and ROCrelated charges), the Assessing Officer concluded that the impugned expenditure had been incurred not for the assessee’s business, but for managing the affairs of group companies, and thus treated it as not allowable.

10.2 The assessee, however, contended that the professional fees were paid for high-level consultancy services rendered by the Foundation in support of its strategic investment operations. It was submitted that such expenditure was incurred wholly and exclusively for the purpose of business. The Assessing Officer, finding no detailed documentation of the services rendered and adopting the reasoning applied in assessment year 2011–12, disallowed the entire payment of Rs. 6 crores. The Ld. CIT(A), concurring with this view, sustained the disallowance on the ground that the assessee had failed to establish business necessity or demonstrate any tangible advantage resulting from the consultancy services.

10.3 Before us, the Ld. counsel for the assessee placed reliance on the order of the Tribunal in the assessee’s own case for assessment year 2011–12, wherein a similar disallowance had been deleted.

10.4 We have carefully considered the rival submissions and examined the record. The factual position, which remains undisputed, is that the assessee-company is engaged in making and managing strategic investments in various group entities, frequently in collaboration with foreign partners for acquisition of controlling interests in joint ventures. This factual matrix has also been recognized by the Tribunal in assessment year 2011–12, wherein it was observed:

“3. The assessee is stated to be investing company carrying on business of acquiring and exercising control over companies in Anand Group to provide long term finance and to provide managements consultancy services to various companies of Anand Group. It is submitted that, Anand Group is a global leader in manufacturing product for automotive industry and is a flagship company of the group, wherein Gabriel India Ltd., was formed to manufacture shock absorbers. It is submitted that, the group has established around 13 joint ventures and 7 technical collaborations. The assessee submitted that 99% of the investment held by the assessee are in the companies of Anand Group and has been classified as long term investments in its financial statements.”

10.5 The assessee has consistently maintained that the services rendered by Deep C Anand Foundation were intrinsically linked to its strategic investment operations and were necessitated by the nature and scale of its business. We find merit in this contention. The assessee’s investment portfolio comprises significant stakes in joint ventures with globally reputed automotive component manufacturers, and the need for professional advisory support in such arrangements cannot be doubted. It is a settled principle of law that the Assessing Officer cannot supplant the commercial judgment of a businessman with his own view of business necessity, nor can an expenditure be disallowed merely for want of immediate or measurable business outcome. The only test is whether the expenditure was incurred bona fide and in the ordinary course of business.

10.6 The Tribunal, while adjudicating the same issue in assessment year 2011–12, held that the expenditure was neither unreasonable nor excessive, and observed as under:

“7.6.3. It is also submitted that apart from the services received from Mr. Deep C. Mehta, the assessee had paid professional fees to one Mr. Aditya Narayan, M/s. Patel Investments and M/s. Rohit Arora & Associates, who were rendering various services in their individual capacities. The Ld.AR submitted that these individuals were taken on the rolls of an entity called Deep C Anand Foundation. The Ld.AR thus submitted that the services rendered under individual capacities, were rendered through Deep C Anand Foundation during the year under consideration. The Ld.AO disallowed Rs.1.6 crore the assessee under the head professional fees paid. It is the submission of the Ld.AR that in the preceding years the professional fees rendered by these three parties were not disallowed.

7.6.4. From the arguments advanced by both sides, it is noted that the Foundation has offered the money received from the assessee to taxation. Also that these are incurred for rendering professional services to Spicer India Ltd., and not for acquiring controlling interest. It is noted that Spicer India Ltd for the year under consideration has been allowed the amount paid to the assessee as business expenditure. Though this is related party transaction, there is no loss to the revenue. Further it is not the case of the revenue that the expenditure incurred by the assessee are unreasonable and excessive.”

10.7 In the absence of any distinguishing facts brought to our notice for the year under consideration, and respectfully following the findings of the Tribunal in assessment year 2011–12, we are of the view that the disallowance of Rs. 6 crores is unsustainable in law. The expenditure is demonstrated to have been incurred wholly and exclusively for the purposes of the assessee’s business activities, and the contrary conclusion of the Assessing Officer rests on an incorrect appreciation of the assessee’s business model.

10.8 We accordingly direct that the disallowance be deleted and the order of the Ld. CIT(A) on this issue be set aside. Ground No. 6 of the assessee’s appeal is, therefore, allowed.

11. Ground No. 7 of the appeal pertains to the disallowance of expenses amounting to Rs. 50,98,889/- incurred in respect of the assessee’s branch office in the United Kingdom.

11.1 The essential facts, briefly stated, are that the assessee maintained a branch office-cum-guest house in London and claimed expenditure of Rs. 52,98,889/- towards its upkeep. The assessee asserted that the premises were utilised by its senior management during overseas business visits undertaken in the normal course of its investment operations. The Assessing Officer, however, rejected this explanation, concluding that the expenditure was incurred not for the assessee’s own business but for advancing the business interests of its subsidiary companies. Following the view adopted in assessment year 2011–12, he disallowed the entire expenditure. The Ld. CIT(A), concurring with the Assessing Officer, upheld the disallowance on the premise that the expenditure did not promote the business of the assessee but that of its subsidiaries.

11.2 Before us, the Ld. counsel for the assessee submitted that the lower authorities failed to correctly appreciate the nature of the assessee’s business, which is that of making and managing strategic investments in joint ventures. He explained that the investment process necessarily involves identification, evaluation, and engagement with prospective foreign partners, which requires extensive research and due diligence, as well as constant interaction with the management of such target entities. Once the right entity is identified, the assessee invests in it, which may, in turn, evolve into a subsidiary or a controlled joint venture. Thus, the maintenance of a London office was fundamentally linked to facilitating these pre-investment activities and the assessee’s continuous interface with potential European partners. The Ld. counsel contended that both authorities below adopted an erroneous post-investment lens and, consequently, misdirected themselves in concluding that the expenditure benefitted subsidiaries alone. He further pointed out that although the Tribunal, in assessment year 2011–12, had addressed the matter in the context of Rule 8D(2)(i), it had not adjudicated upon the allowability of such expenditure under Section 37(1).

11.3 We have given thoughtful consideration to the rival submissions and examined the material placed on record. The short question for adjudication is whether the expenditure incurred on maintaining the London branch office and guest house qualifies for deduction under Section 37(1) of the Act.

11.4 As earlier noted, the assessee is engaged in the business of making strategic investments in joint ventures in the automotive components sector. Such investment activity does not commence with the mere act of investing; it necessarily includes the preinvestment stage involving identification of suitable foreign collaborators, evaluation of synergies, due diligence, and negotiation. These are activities which often require an overseas presence to enable meaningful engagement with prospective partners and to facilitate effective decision-making. Expenditure incurred for such purposes is intimately connected with the assessee’s business operations and cannot be disallowed merely because, at a subsequent stage, the entities identified during this pre-investment exercise become subsidiaries or joint ventures. The test under Section 37(1) is whether the expenditure was incurred wholly and exclusively for the purposes of business, and not whether the expenditure yielded immediate or direct profit.

11.6 It is pertinent to note that although the Tribunal, in assessment year 2011–12, observed that these expenses did not fall within the ambit of Rule 8D(2)(i) and were already subjected to disallowance under Section 14A, the Tribunal did not examine the question of their allowability under Section 37(1). We therefore consider the issue independently in the present year.

11.7 In the totality of facts and circumstances, we find that the expenditure on maintaining the London branch office and guest house was incurred bona fide and in the ordinary course of the assessee’s business, and satisfies the statutory requirement of being laid out wholly and exclusively for business purposes. The disallowance sustained by the lower authorities is consequently unsustainable. We, therefore, direct deletion of the disallowance and set aside the order of the Ld. CIT(A) on this issue. The ground No. 7 of the appeal is allowed.

12. Ground No. 8 of the appeal concerns the disallowance of expenditure amounting to Rs. 1,41,19,857/- incurred towards routine repairs and maintenance of the assessee’s branch office-cumtransit house at London, which the Assessing Officer treated as capital in nature.

12.1 The material facts, briefly stated, are that the Assessing Officer noticed a substantial increase in the assessee’s repairs and maintenance expenditure during the year. Payments aggregating to Rs. 1,52,77,730/- were made to Waverly Renovation Ltd., and Rs. 4,11,000/- to Vasudeva Manufacturing & Engineering Pvt. Ltd. The Assessing Officer held that the expenditure represented renovation and improvement of the building structure, thereby giving rise to a capital asset. In respect of the payment to Vasudeva Manufacturing & Engineering Pvt. Ltd., it was held that the supply, installation, testing, and commissioning of pumps could not be characterised as repairs. The entire claim was, therefore, disallowed as capital expenditure. The Ld. CIT(A), affirming the findings of the Assessing Officer, sustained the disallowance on the reasoning that the assessee had failed to demonstrate how the London property constituted a business asset or how the expenditure represented routine repairs. The Ld. CIT(A), observing as under:

“5.2. I have considered the findings of the Assessing Officer as well as rival submission of the Appellant/A.R., carefully. I find that Appellant has not explained as to how House at London is a business asset and how such expenditure of Rs.1,56,88,730/- is not a Capital Expenditure. Only general argument has been advanced without demonstrating as to how there is a routine repairs & maintenance of House at 9, Waterdelle Manor, 20, Hairwood Avenue, London (U.K.). Therefore, so far as finding of the Assessing Officer that such expenditure is a capital expenditure is concerned, such finding is worth-approval. Similarly, the bills of Vasudeva Manufacturing & Engineering Pvt. Ltd. is found to be for supply, installation & testing of pumps which is definitely a capital expenditure and not at all Renovation or Repairing which is Miscellaneous in nature. The Appellant has also not established the fact that as to how House Property at London is a business asset. Since the Assessing Officer has allowed the depreciation and has disallowed the capital expenditure of Rs. 14119857/- hence, there is no option but to confine to the finding of the Assessing Officer hence, disallowance of capital expenditure to the extent of Rs. 1,41,19,857/- is sustained.”

12.2 We have heard the rival submissions and examined the material placed on record. The issue that arises for determination is whether the expenditure of Rs. 1,56,88,730/- is to be regarded as capital or revenue in nature for the purposes of Section 37(1) of the Act.

12.3 Out of the total amount, a sum of Rs. 1,52,77,730/- pertains to payments made to Waverly Renovation Ltd. The invoices and the detailed description of work executed include painting, replacement of carpets, repair of kitchen leakages, ceiling and flooring rectification, soundproofing, radiator replacement, electrical work involving downlighters and switches, fitting of shelving units, repair and polishing of existing furniture, replacement of patio doors, and other refurbishment measures.

12.4 On a comprehensive appraisal of the nature of the work performed, we find no material to suggest that any new structure, addition, or expansion of the capital base of the property was undertaken. The expenditure is primarily aimed at preserving the existing structure and maintaining it in a functional and habitable condition. It neither brings into existence a new asset nor confers on the assessee an enduring benefit in the capital sense. In law, the test of “enduring benefit” must be applied pragmatically and not mechanically; expenditure which merely preserves or restores an existing asset to its original condition is revenue in character, notwithstanding the magnitude of the amount involved. We therefore hold that the expenditure of Rs. 1,52,77,730/- incurred on refurbishment by Waverly Renovation Ltd. is allowable as revenue expenditure under Section 37(1).

12.5 With respect to the payment of Rs. 4,11,000/- made to Vasudeva Manufacturing & Engineering Pvt. Ltd. for supply, installation, and commissioning of pumps, the assessee has not placed on record any material to show that the installation was by way of replacement of an existing system rather than acquisition of a new one. In the absence of evidence establishing that the expenditure was for restorative purposes, we are constrained to hold that the amount is capital in nature. Depreciation thereon shall, however, be allowable in accordance with law.

12.6 In view of the foregoing analysis, the addition to the extent of Rs. 4,11,000/- is sustained, whereas the balance addition of Rs. 1,52,77,730/- is directed to be deleted. The order of the Ld. CIT(A) is accordingly set aside to the extent indicated above.

13. Now, we take up the appeal of the assessee for assessment year 2013-14. The grounds raised by the assessee are reproduced as under:

1. In the facts and circumstances of the case and in law, the CIT(A) erred in not adjudicating the revised grounds of appeal filed before him.

2. Without prejudice to Ground no 1 on the facts and circumstances of the case and law, the CIT(A) ought to have held that holding shares to have controlling interest in the group is a business activity and consequentially erred in not directing the AO to allow expenses incurred for carrying on or in relation to business of strategic investment.

3. Without prejudice to Ground nos 1 and 2, on the facts and circumstances of the case and in law the CIT(A) ought to have held that no disallowance could have been made under section 14A to the extent of Rs. 17,25,25,167 towards direct expenditure, interest and other administrative expenditure, out of the expenditure incurred to carry on business of strategic investment.

4. Without prejudice to the Ground nos. 1, 2 & 3, on the facts and circumstances of the case and in law, the CIT(A) ought to have held that no disallowance under section 14A can be made where no exempt income was received by the appellate during the year under consideration.

5. Without prejudice to the Ground nos. 1,2,3,& 4, on the facts and in the circumstances of the case and in law the CIT(A) ought to have directed the AO to delete the disallowance made by AO towards interest expenditure of INR 12,41,47,597, Personnel expenses of INR 2,00,00,000, Travelling expense of INR 1,31,33,041, Business promotion expenses of INR 11,58,874, Rent expenses of INR 17,78,696, repairs expenses of INR 89,77,638, and depreciation of INR 61,27,043 by treating the same as directly linked for earning exempt income for the purpose of computing disallowance under section 14A r.w.r. 8D

Without prejudice to the above, the CIT(A) ought to have held that the expenses were incurred for the business of the assessee company and not for the business of the group companies.

6. On the facts and in the circumstances of the case and in law, the CIT(A) erred in confirming disallowance made by AO towards UK Branch office expenses of INR 15,23,314 by treating the same as incurred for promoting business of the group companies and were not incurred for the purpose of business of the appellant.

7. On the facts and in the circumstances of the case and in law, the CIT(A) erred in confirming the disallowance made by AO towards professional fees of Rs. 6,00,00,000 paid to Deep C. Anand Foundation by attributing it towards incurred for promoting the interest of group companies and was not incurred for the purpose of business of the appellant.

13.1 The issues in dispute raised in the aforesaid grounds stand squarely covered by our findings rendered while adjudicating the appeal for the Assessment Year 2012-13. Accordingly, these grounds are decided mutatis mutandis in terms of the said decision.

14. Now, we take up the appeal of the assessee for assessment year 2014-15. The grounds raised by the assessee are reproduced as under:

“1. In the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that holding shares to have controlling interest in the group is a business activity and consequentially erred in not directing the Ld. AO to allow expenses incurred for carrying on or in relation to business of strategic investment.

2. Without prejudice to Ground No. 1, in the facts and circumstances of the case and in law the Ld. CIT(A) ought to have held that no disallowance could have been made under section 14A to the extent of Rs. 19,29,64,978 towards direct expenditure, interest and other administrative expenditure, out of the expenditure incurred to carry on business of strategic investment.

3. Without prejudice to the Ground Nos. 1 & 2, in the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that no disallowance under section 14A can be made in respect of which no exempt income was received by the appellate during the year under consideration.

4. Without prejudice to the Ground nos. 1,2 & 3, in the facts and in the circumstances of the case and in law the Ld. CIT(A) ought to have directed the Ld. AO to delete the disallowance made by Ld. AO towards interest expenditure of Rs. 15,05,94,171, Personnel expenses of Rs. 2,00,00,000, Travelling expense of Rs. 1,05,34,529, Business promotion expenses of Rs. 32,90,237, Rent expenses of Rs. 46,00,000, repairs expenses of Rs. 49,00,000, and depreciation of Rs.30,00,000 by treating the same as directly linked for earning exempt income for the purpose of computing disallowance under section 14A r.w.r. &D by relying upon the order passed for earlier years without appreciating the fact that the facts of each year are different.

Without prejudice to the above, the Ld. CIT(A) ought to have held that the expenses were incurred for the business of the appellant and not for the business of the group companies.

5. On the facts and in the circumstances of the case and in law, Ld. the CIT(A) erred in confirming disallowance made by Ld AO towards UK Branch office expenses of Rs. 67.94,409 by treating the same as incurred for promoting business of the group companies and were not incurred for the purpose of business of the assessee company and observing that the appellant did not have any business expediency or justification for incurring UK office expenses.

6. On the facts and in the circumstances of the case and in law, the Ld. CIT(A) erred in confirming the disallowance made by Ld. AO towards professional fees of Rs. 6,00,00,000 paid to Deep C. Anand Foundation by attributing it towards incurred for promoting the interest of group companies and was not incurred for the purpose of business of the appellant and also stating that the appellant has not been able to establish the necessity of making substantial payments to Mr. Deep C Anand both as chairman of the company and as the trustee of Deep C Anand Foundation.”

14.1 The issues in dispute raised in the aforesaid grounds stand squarely covered by our findings rendered while adjudicating the appeal for the Assessment Year 2012-13. Accordingly, these grounds are decided mutatis mutandis in terms of the said decision.

15. In the result, all the three appeals are allowed partly.