ORDER

1. The petitioner is before this Court seeking the following prayer:

“A) Issue an appropriate writ or order in the nature of Mandamus or otherwise, directing the Respondents to grant interest on delayed refund of Rs. 2,60,92,283/-at the rate of 6% from 25.05.2021 (being 90 days from 24.02.2021, i.e. date of issue of Form 5 by the designated authority) up to 10.01.2024 [being date of payment of refund] or alternatively at the rate of 6% for the period of delay from 31.07.2021 [i.e. the due date for passing of consequential order to Form 5 as per the Central Action Plan for FY 2021-22 formulated by the CBDT] to 10.01.2024 [being date of payment of refund];

(B) Issue an appropriate writ or order in the nature of Mandamus or otherwise, directing the Respondents to grant further interest on such interest as prayed in (A) above, from 10.01.2024 [being date of payment of refund without interest] upto the date of actual payment of interest;

(C) Grant such other relief’s as this honourable High Court may think fit including the costs of this writ petition.”

2. Facts in brief, germane, are as follows:

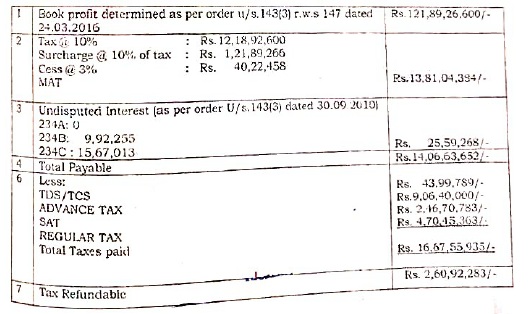

2.1. The petitioner is a Company incorporated under the provisions of the Companies Act, 1956 and is engaged in the business of manufacturing, trading and supply of sugar and its allied products. It transpires that the Assistant Commissioner of Income Tax, Circle-2(1), Belagavi, passes an order of assessment under Section 143(3) read with Section 147 of the Income Tax Act, 1961 (hereinafter referred to as the ‘Act’ for short) for the assessment year 2008-2009, determining the tax payable at Rs. 4,36,47,080/- as obtaining on 24-03-2016. The petitioner, aggrieved by the said determination, files an appeal before the Commissioner of Income Tax (Appeals) on 27-04-2016. The petitioner then files a declaration in Form No.1 and undertaking in Form No.2, in accordance with the provisions of the Direct Tax Vivad Se Vishwas Act, 2020 (hereinafter referred to as the ‘Act, 2020’ for short) for the impugned assessment year 2008-2009 on 11-07-2020.

2.2. The Principal Commissioner of Income Tax is said to have issued a certificate under Section 5(1) of the Act, 2020 in Form No.3 determining the amount refundable to the petitioner in terms of the scheme at Rs. 2,60,092,283/- for the said assessment year 2008-2009 and the determination is made on 19-01-2021. The petitioner then files an intimation of payment under Section 5(2) of the Act, 2020 in Form No.4 for the assessment year 2008-2009. It transpires that the order is passed declaring full and final settlement of tax arrears under Section 5(2) r/w Section 6 of the said Act, 2020. Giving effect to the order so passed on 24-02-2021 of full and final settlement and determining the tax refundable of Rs. 2,60,92,283/-, a communication comes to be issued to the petitioner on 11-04-2022.

2.3. An intimation letter is further issued on 08-07-2022 proposing to adjust the refund due of the aforesaid amount against the demand for the assessment year 2018-2019 raised under Section 270A of the Act. The petitioner then is said to have communicated on 11-07-2022 objecting to the proposed adjustment of refund against the demand for the assessment year 2018-2019 arising under Section 270A, on the ground that the demand for assessment year 2018-2019 had been stayed by this Court in a writ petition filed by the present petitioner and an interim order to that effect was operating as granted on 29-06-2022. The petitioner then communicates to the 1st respondent on 05-09-2022 seeking issue of refund of Rs. 2,60,92,283/- as was determined. An intimation was issued proposing to adjust the refund against a demand for assessment year 2018-2019 invoking the same provision that was earlier invoked. An appeal was filed against the said order, which comes to be dismissed as withdrawn in terms of the Act, 2020.

2.4. The petitioner then goes on objecting to the proposed adjustment of refund for the assessment years 2009-2010 and 2018-2019. Owing to such objections, it transpires that on 11-05-2023, the refund is said to have been released in favour of the petitioner, which comes to be informed to the petitioner on 12-06-2023. The petitioner then communicates to the department seeking the said refund, as it had not yet been into the account of the petitioner. The refund is then determined and stood credited to the bank account of the petitioner on 10-01-2024. The petitioner is now before the Court seeking interest to the amount of refund on 10-01-2024 which gave effect to the order in Form No.5 dated 24-02-2021 and beyond the due date by which the amount had to be paid – 31-07-2021. The petitioner sought interest for the said delayed payment of over 3 years, which the petitioner projected that it was a loss caused to them. No interest on refund is granted. Therefore the petitioner is before this Court seeking the aforesaid prayer.

3. Heard Sri Chythanya K.K., learned senior counsel appearing for petitioner and Sri M Thirumalesh, learned counsel appearing for the respondents.

4. The learned Senior Counsel Sri Chythanya K.K. appearing for the petitioner would vehemently contend that the refund amount ought to have been credited to the account of the petitioner way back in the year 2021, it is credited only in the year 2024. Therefore, there is delay. Interest is paid on delay, but the interest on interest is what the petitioner is now seeking. According to the learned Senior Counsel, the interest becomes a component of refund if it is not paid within time. Therefore, the petitioner becomes entitled to interest on the corpus, which becomes a part of the amount of refund. He would submit that the issue is no longer res integra. The High Courts of the country have considered this issue and have laid down the law that interest on interest should be paid to the assessee if there is delay on the part of the department. He would seek the same relief to be granted in the case at hand as well.

5. Per contra, the learned counsel Sri M. Thirumalesh, appearing for the respondents submits that the refund is already granted to the petitioner in Form No.5 which was dated 24-02-2021 and the due date was on 31-07-2021. Since the refund is already granted, the petitioner would not become entitled to any interest in terms of law, as the refund is processed under the Act, 2020, which notified a particular scheme. He would seek dismissal of the petition.

6. I have given my anxious consideration to the submissions made by the respective learned counsel and have perused the material on record.

7. The afore-narrated facts are a matter of record, they are beyond contest. The issue is with regard to the refund that the petitioner was entitled to, according to the respondents/department. Towards the said refund, the petitioner and the department have plethora of correspondences between them. The assessment of refund is made under the Direct Tax Vivad Se Vishwas Act, 2020. The communication that is germane to be noticed is dated 11-04-2022 and it reads as follows:

“Order Giving Effect To Order u/s 5(2) Read With Section 6 of

The Direct Taxes Vivad Se Vishwas Act, 2020

The assessment order u/s 143(3) r.w.s 147 of the Income Tax Act, 1961 has been passed on 24.03.2016 assessing the total income at NIL for the A.Y. 2008-09. The assessee filed the appeal before the CIT(A), Belagavi against the said assessment order. Further, the assessee has opted for Direct Tax Vivad Se Vishwas Scheme, 2020 and filed Form No.1. The Pr. Commissioner of Income Tax, Hubballi has issued Form No. 5 and passed order for full and final settlement of Tax arrears u/s 5(2) read with section 6 of the Direct Tax Vivad se Vishwas Act, 2020 granting immunity from penalty and prosecution under the Income Tax Act, 1961 in respect of tax arrears and waiver of interest. The same is given effect as under:

Sd/-

(SINGHVI RONAK KUNDANMAL, IRS)

Assistant Commissioner of Income Tax

Circle-1, Belagavi.”

The intimation is sent to the petitioner in terms of Section 245 of the Act. The said intimation reads as follows:

“Dear Sir/Madam,

Subject: Intimation under section 245 of Income Tax Act, 1961

Please refer to the proceedings under section 5(2) passed by CIRCLE 1, BELGAUM which has resulted into refund.

The refund determined will be adjusted against the outstanding demand as shown in “Outstanding Demand table” annexed herewith.

Your return has been processed at CPC and the same has resulted in refund. The refund so determined will be adjusted against the outstanding demand as shown in “Outstanding Demand table” annexed herewith.”

The petitioner objects to the intimation under Section 245, which projected adjustment for the assessment years 2008-2009 under Section 270A of the Act. The said objection of the petitioner reads as follows:

“To

The Assistant Commissioner of Income Tax

Circle 1, Belgaum

Respected Sir

Sub: Submission against intimation u/s 245 in the case of Shree Renuka Sugars Limited PAN: AADCS1728B for AY 2008-09

Ref: CPC Intimation u/s 245 DIN: CPC / 0809 / G8i / ITBA#10000000000001480838 dated 08-07-2022

This is to inform you that for AY 2008-09, we had applied under Vivad se Vishwas Act, 2020, for settlement of the appeal of the said year. On 24-02-2021, PCIT Hubli passed Order for Full and Final Settlement of Tax Arrear under section 5(2) read with section 6 of the Direct Tax Vivad se Vishwas Act, 2020, wherein he has determined by Certificate No. 219806080190121 dated 19/01/2021 the amount of Rs. 2,60,92,283/-refundable to us. Copy of order is enclosed vide Annexure I.

Now, we have received the above referred intimation u/s 245 from the Centralised Processing Center, wherein they have proposed to adjust this refund of Rs. 2,60,92,283/- against the demand raised u/s 270A for AY 2018-19 of Rs. 227,08,34,288/-Copy of the intimation is enclosed vide Annexure II. The intimation u/s 245 also stated the procedure to file an online response against this outstanding demand. However, when we tried to follow the steps provided, the portal showed a message stating “This demand is already confirmed by AO. Please contact your jurisdictional Assessing Officer for details”. Copy of screenshot is enclosed vide Annexure III.

Hence, we are making this submission to inform you that the Hon’ble High Court of Karnataka, Dharwad Bench, has already granted us a stay of demand against the demand raised u/s 270A for AY 2018-19 vide its order dated 29-06-2022. Copy of the order is enclosed vide Annexure IV.

Thus, we request you not to adjust the refund of AY 2008-09 of Rs. 2,60,92,283/- against the demand of AY 2018-19 of Rs. 227,08,34,288/-, for which the Hon’ble High Court of Karnataka, Dharwad Bench, has already granted a stay of demand, and also request you to issue the refund at the earliest.”

What could be gathered from the aforesaid communications is, that under the Act, 2020 refund of Rs. 2,60,92,283/- was determined under order in Form No.5 on 24-02-2021. On such determination, it was credited to the account of the petitioner, not on 24-02-2021, but on 10-01-2024. Therefore, there is clear delay of 35 months in crediting the amount of refund so determined by the respondents as on 24-02-2021.

8. The issue is, whether the petitioner would become entitled to interest on the said refund from 24-02-2021, till it reached the doors of the petitioner on 10-01-2024?

9. The determination of amount is admittedly Rs. 2,60,92,283/-. This forms the corpus of refund. It is delayed by 35 months. Therefore, the interest on refund ought to have been granted to the petitioner. Whether the amount of interest that stood determined or that is grantable to the petitioner from 24-02-2021 to 10-01-2024 forms the principle or the corpus for grant of an interest on that interest, is required to be considered, as that is what the learned senior Counsel has projected.

10. The said issue need not detain this Court for long or delve deep into the matter. Plethora of judgments are placed reliance upon by the learned senior Counsel, two of which, are germane to be noticed. The Apex Court in the case of Commissioner of Income-tax v. H.E.G. Ltd. (SC)/[2010] 324 ITR 331 (SC), has held as follows:

“1. Mr Ajay Vohra, learned counsel, appears for the respondent assessee. Delay condoned in SLP (C) No. CC 10437 of 2009. Leave granted.

2. In income tax matters, it is well settled that if the question is not properly framed, then, at times, confusion arises resulting in wrong answers. The present batch of civil appeals is an illustration of the proposition mentioned hereinabove. In the synopsis to the civil appeal arising out of SLP (C) No. 18045 of 2009, the question raised by the Department is whether the assessee was entitled to claim interest on interest under the provisions of Section 244-A of the Income Tax Act, 1961. In our view, on facts, the question framed was totally erroneous.

3. Annexure P-1 is income tax computation in civil appeal arising from SLP (C) No. 18045 of 2009. On going through the computation, we find that during Assessment Year 1993-1994, the amount paid by the assessee towards TDS was Rs 45,73,528. The tax paid after original assessment was Rs 1,71,00,320. The total of TDS amounting to Rs 45,73,528 plus tax paid after original assessment of Rs 1,71,00,320 stood at Rs 2,16,73,848. In other words, the total tax paid had two components viz. TDS + Tax paid after original assessment. The respondent was entitled to the refund of Rs 2,16,73,848 (consisting of Rs 1,71,00,320 and Rs 45,73,528 which payment was made after 57 months and which is the only item in dispute). The assessee claimed statutory interest for delayed refund of Rs 45,73,528 for 57 months between 1-4-1993 and 3112-1997 in terms of Section 244-A of the Income Tax Act. Therefore, this is not a case where the assessee is claiming compound interest or interest on interest as is sought to be made out in the civil appeals filed by the Department.

4. The next question which we are required to answer is—What is the meaning of the words “refund of any amount becomes due to the assessee” in Section 244-A?

5. In the present case, as stated above, there are two components of the tax paid by the assessee for which the assessee was granted refund, namely, TDS of Rs 45,73,528 and tax paid after original assessment of Rs 1,71,00,320. The Department contends that the words “any amount” will not include the interest which accrued to the respondent for not refunding Rs 45,73,528 for 57 months. We see no merit in this argument. The interest component will partake of the character of the “amount due” under Section 244-A. It becomes an integral part of Rs 45,73,528 which is not paid for 57 months after the said amount became due and payable. As can be seen from the facts narrated above, this is the case of short payment by the Department and it is in this way that the assessee claims interest under Section 244-A of the Income Tax Act. Therefore, on both the aforestated grounds, we are of the view that the assessee was entitled to interest for 57 months on Rs 45,73,528. The principal amount of Rs 45,73,528 has been paid on 3112-1997 but not of interest which, as stated above, partook the character of “amount due” under Section 244-A.

6. For the aforestated reasons, the civil appeal arising out of SLP (C) No. 18045 of 2008 filed by the Department fails and is dismissed, with no order as to costs.

7. In view of the above order, the civil appeals arising out of SLP (C) No. 18046 of 2009 and CC No. 10437 of 2009, filed by the Department, are also dismissed, with no order as to costs.”

(Emphasis supplied)

The High Court of Rajasthan, in an identical circumstance, in the case of Dwejesh Acharya v. Income-tax Officer [2023] 157 (Rajasthan)/2023 SCC OnLine Raj 5600, holds as follows:

“…. …. ….

10. A perusal of Form No. 5 (Annex. 9) clearly reveals that the order has been passed by the designated authority under the v. Act, 2020 and Rules determining the amount of Rs. 3,47,03,505 refundable to the petitioner in accordance with the provisions of the Act. Once the order in Form No. 5 has been issued on 8th March, 2021, the petitioner became entitled for the amount of refund. Admittedly, the said amount was refunded to the petitioner/adjustment towards the demands on 22nd Oct., 2021, 10th Jan., 2022, 20th Jan., 2022 and 30th May, 2022. No reason worth the name has been indicated in response for the delay in refunding the amount to which the petitioner became entitled on passing of order in Form No. 5 way back on 8th March, 2021.

11. The Delhi High Court in the case of Ms. Anjul (supra) while relying on one judgment of Hon’ble Supreme Court in Union of India Through Director of IT v. Tata Chemicals Ltd., (2014) 6 SCC 335 : (2014) 267 CTR (SC) 89 : (2014) 101 DTK (SC) 193 held that the State having received the money without right and having retained and used it, is bound to make the party good, just as an individual would do under like circumstances. The obligation to refund money received and retained without right implies and carries with it the right to interest.

12. Bombay High Court in the case of UPS Freight Services (supra) while following the order in the case of Ms. Anjul (supra) also ordered for payment of interest as per the rate prescribed under s. 244A of the IT Act in similar circumstances.

13. So far as the plea raised by learned counsel for the respondents with reference to provisions of Explanation to s. 7 of v. Act, 2020 is concerned, the same has been noticed for rejection only.

14. The provision of s. 7 of v. Act, 2020 reads as under:

“7. Any amount paid in pursuance of a declaration made under s. 4 shall not be refundable under any circumstances.

Explanation.—For the removal of doubts, it is hereby clarified that where the declarant had, before filing the declaration under sub-s. (1) of s. 4, paid any amount under the IT Act in respect of his tax arrear which exceeds the amount payable under s. 3, he shall be entitled to a refund of such excess amount, but shall not be entitled to interest on such excess amount under s. 244A of the IT Act.”

15. A bare perusal of the Explanation would reveal that the Explanation pertains to payment of any amount under the IT Act for the period before filing the declaration under sub-s. (1) of s. 4 of the v. Act, 2020 and nothing to do with the entitlement to interest for the period after issuance of Form No. 5 indicating entitlement of the petitioner to the amount of refund.

16. In view of the above discussion, for the delayed payment, the petitioner is entitled to interest on the refund amount for the delay beyond the period of 90 days from the date of refund i.e. 8th March, 2021.

17. Consequently, the writ petition is allowed. It is directed that the respondents-Revenue shall make payment of interest @ 6 per cent p.a. on the delayed refund amount w.e.f. 8th June, 2021 i.e. beyond the period of 90 days from the date of determination of refund amount on 8th March, 2021 till the date of actual/last payment. As the payment/adjustment has been made on various dates, interest would be calculated on the balance amount till each respective date. The payment of interest be made within 08 weeks from the date of this order.”

(Emphasis supplied)

The law is reiterated in plethora of cases, all interpreting the Act, 2020, which grants certain refund to the assessee.

11. In the light of the issue standing completely answered by the Apex Court and that of the High Court of Rajasthan, this Court need not delve deep into the matter with regard to whether the petitioner would be entitled to interest on interest. The petition thus deserves to succeed, on the aforesaid ground of the entitlement of the petitioner, as is determined by the Apex Court and the High Court of Rajasthan qua the assessee therein, who is similarly situate as the assessee in the case at hand.

12. For the aforesaid reasons, the following:

ORDER

| (i) | | Writ Petition is allowed. |

| (ii) | | A Mandamus issues directing payment of interest on delayed refund of Rs. 2,60,92,283/- @ 6% per annum from 25-05-2021 up to the date of payment of refund on 10-01-2024 and interest on the interest for the aforesaid period. |