ORDER

1. This is bunch of five appeals by the Revenue, pertaining to separate assessment years, (AYs) i.e., 2014-15, 2016-17 to 2019-20 (assessment yearwise), all are directed against the separate orders passed by the Learned Commissioner of Income-Tax (Appeals)-11, Ahmedabad (for short ‘Ld. CIT(A)’, which in turn arise, out of separate assessment orders passed by the Assessing Officer under section 143(3)/153A r.w.s. 143(3) of the Income Tax Act, 1961 (in short ‘the Act’).

2. Since, the issues involved in all the appeals are common and identical; therefore, these appeals have been heard together and are being disposed of by this consolidated order.

3. In this group of five appeals, four appeals are pertaining to M/s Aryan Arcade Ltd., and one appeal in IT(SS)A No.14/RJT/2024 for A.Y 2014-15 pertaining to Shri Gopal B. Chudasama, individual, who is main director in M/s Aryan Arcade Limited. Since the issue involved in these appeals are interconnected and mix, therefore, we shall adjudicate these appeals together to avoid conflicting decisions.

4. First, we shall take the appeals pertaining to M/s Aryan Arcade Ltd, wherein Revenue have filed four appeals which are pertaining to assessment years (AYs) 2016-17, 2017-18, 2018-19 and 2019-20. The grounds of appeal raised by the revenue in these four appeals are similar and identical. Therefore, in order to adjudicate these appeals, we take “lead” case IT(SS)A No.63/RJT/2023 for assessment year (AY) 2016-17, wherein the grounds of appeal raised by Revenue are as follows:

“(i) On the facts and in the circumstances of the case and in law, learned Commissioner (Appeals) erred in deleting the addition of Rs.17,83,19,200/-, as business income, ignoring the facts that during the course of search proceedings, one pen drive has found and seized from the premise of Himanshu Raiyai (accountant of the assessee as well as group concerns of the DECORA group), which contained key accounts of unaccounted transactions of the entire project and entire accounts were maintained in software known as MIRACLE and also contained certain excel files whereby unaccounted transactions relevant to the assessee company were maintained, on which the AO has relied upon.

(ii) On the facts and in the circumstances of the case and in law, the Ld.CIT(A) erred in adopting real estate business income @ 15% of unaccounted cash on-money receipts in place of @ 80% without appreciating the facts, evidences found and seized during the course of search and circumstances of the peculiar case.

(iii) On the facts and in the circumstances of the case and in law, the ld.CIT(A) has erred in determining business income on account of receipts of on-money from the real estate business on accrual basis (i.e. in the year of transfer of title and possession of property) instead of year of receipts without appreciating the facts, evidences found and seized during the course of search and circumstances of the peculiar case.

(iv) On the facts and in the circumstance of the case and in law, learned Commissioner (Appeals) erred in deleting the addition of Rs.2,83,20,000/- a income from sale of scrap and other miscellaneous income made by Assessing Officer, ignoring the facts that the entire Grand Central mall has been demolished and on the said land, construction of OM DECORA NINE SQUARE Building is coming up and the assessee received the above sum towards sales of IMLA (demolition scrap popularly known as IMLA in local parlance), which have been clearly found from relevant P&L A/c. from seized soft data contained in file OD.

(v) On the facts and in the circumstances of the case and in law, learned Commissioner (Appeals) erred in ignoring the facts that, Shri Nikhil Patel (key promoter of the DECORA group and stakeholder in the assessee-company) had admitted that unaccounted transactions are maintained in separate software of MIRACLE and the same were maintained by his accountant Shri Himanshu Raiyani in pen drive that was seized during the course of search proceedings. The entries reflected in pen drive data are totally unaccounted transactions.

(vi) On the facts and in the circumstances of the case and in law, learned Commissioner (Appeals) erred in ignoring the facts that during the course of search proceedings the bifurcation of page No.11,12,13 & 14 given in the seized documents, wherein it is clearly mentioned the names of the persons who had given advances in cash. These are on-money receipts which are not recorded in the regular books of accounts, on which AO has relied upon.

(vii) On the facts and in the circumstances of the case and in law, the Ld. CIT(A) ought to have upheld the order of the AO.

(viii) It is, therefore, prayed that the order of the Learned Commissioner(Appeals) be set aside and that of the AO be restored to the above extent.”

5. The relevant material facts, as culled out from the material on record, are as follows. The assessee filed its return of income u/s 139(1) on 24.03.2017 declaring total loss of Rs.21,15,440/-. Further, the loss claimed by the assessee was reduced to Nil vide order us/ 143(1) of the Act. A search and survey action by the name of “Operation Star Alliance” was carried out on the builders and financier groups in and around Rajkot. During the course of search action u/s 132 of the Act, the search was also carried out at the premises of the assessee on 26.09.2018, therefore, proceedings u/s 153A was initiated in the case of assessee and notice u/s 153A was issued on 08.02.2019. In response to the notice issued, assessee filed its return of income on 23.09.2019 declaring therein total loss of Rs.21,15,440/-.

6. The notice u/s 129 was issued on 09.11.2020 and thereafter notices u/s 143(2) r.w.s. 142(1) issued on various dates. The assessee-company was incorporated on 01.04.2010. Om Decora Square 9 project is a commercial project developed by the assessee. This is a commercial project having two towers of 14 floors comprising 364 shops and offices and show rooms at ground to 2nd floor. Initially on the land on which this project came up, there was a mall known as Grand Central mall. This mall was demolished and the project Om Decora Square 9 was developed on the said land. Although this is a public limited company, however, the stake holding is limited to following four families only.

| a. | | Gopal Chudasama and family – 35% stake |

| b. | | Chetan Rokad and family – 35% stake |

| c. | | Nikhil Patel and family – 20% stake |

| d. | | Kuldeep Rathore and family – 10% stake |

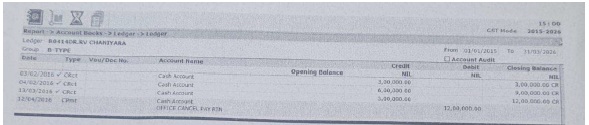

Along with the search on the assessee-company, the residential premises of Shri Himanshu Riyani was also covered under the search operation u/s 132A of the Act on 26.09.2018. During the course of search at the premises of Shri Himanshu Raiyani (accountant of the assessee as well as group concerns of the Decora group), one pen drive was found and seized which contained key accounts of unaccounted transactions of the entire project in a very systematic manner. The entire accounts were maintained in software known as Miracle. Further, the pen drive also contained certain excel files whereby unaccounted transactions relevant to the assessee-company were mentioned. The digital data pertaining to assessee-company comprised of 2 types, viz: (i) excel file mentioning unaccounted investment by the stakeholders in the assessee-company and (ii) miracle software contained account of the assessee-company by the name “OD’, thereby meaning Om Decora and GC meaning Gopal Chudasama. Shri Himanshu Raiyani during the course of search proceedings has accepted that the said pen drive contained unaccounted transactions. Shri Himanshu Raiyani, during the course of search proceedings averred that he carries out accounting work under the instruction of Shri Nikhil Patel. Further, the entire digital data was confronted with Shri Nikhil Patel (key promoter of the Decora group and stakeholder in the assessee-company) and he has accepted that the accounts maintained by Himanshu Raiyani in Mireacle software, belongs and pertain to the Decora and allied groups only. Therefore, the genuineness of the data ownership of the data and the transactions recorded therein, have been accepted to be belonging to the Decora group and others only including the assessee. In this regard the statement of Shri Nikhil Patel, is reproduced by the assessing officer on page number four of assessment order and Himanshu Rayani statement is reproduced on page number three of the assessment order.

7. The assessing officer noticed that the account of the assessee-company were scrupulously maintained in coded format named “OD’, Shri Himanshu Raiyani in his statement recorded u/s 132(4) of the Act on 26.09.2018 during the search operation at his residence decoded the name of concerns. The same has been confirmed by Shri Nikhil Patel main person of Decora group in response to Q.No.8 during his post search statement recorded u/s 131(1A) of the Act on 06.03.2019. Moreover, at the time of search, statement of Shri Nikhil Patel was also recorded. During the course of search Shri Nikhil Patel has accepted that the assessee-company is in receipt of on-money in cash which is over and above the documented price. Since the documents pertains to the assessee-company in which Shri Chetan Rokad and Shri Gopal Chudasama are major stakeholders, the statement of Shri Nikhil Patel was got countersigned by these persons. Further, during the course of post search proceedings, statement of Shri Nikhil Patel was recorded, which is reproduced by the assessing officer on page no.5 to 6 of the assessment order. Here again, he has reiterated that the assessee-company is involved in unaccounted transactions. From the above, it can be concluded that during the course of search, Shri Nikhil Patel had admitted that unaccounted transactions are maintained in separate software of Miracle and the same were maintained by his accountant, Shri Himanshu Raiyani in pen drive that was seized from latter’s residential premise. From the above, it can be seen that the contents of the materials seized in the form of digital data, from the residence of Shri Himanshu Raiyani has been admitted and accepted to be true and correct by both Shri Himanshu Raiyani and Shri Nikhil Patel. It is also undoubtedly clear that such entries were element of huge unaccounted transaction in within them.

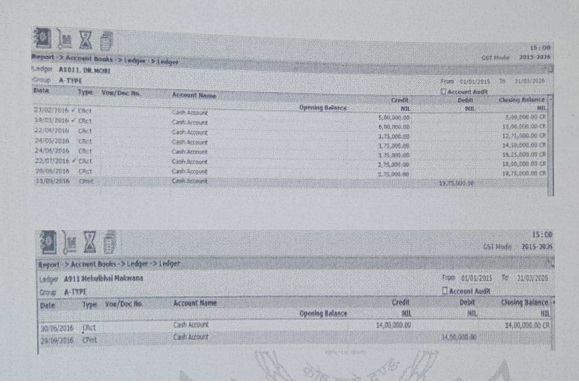

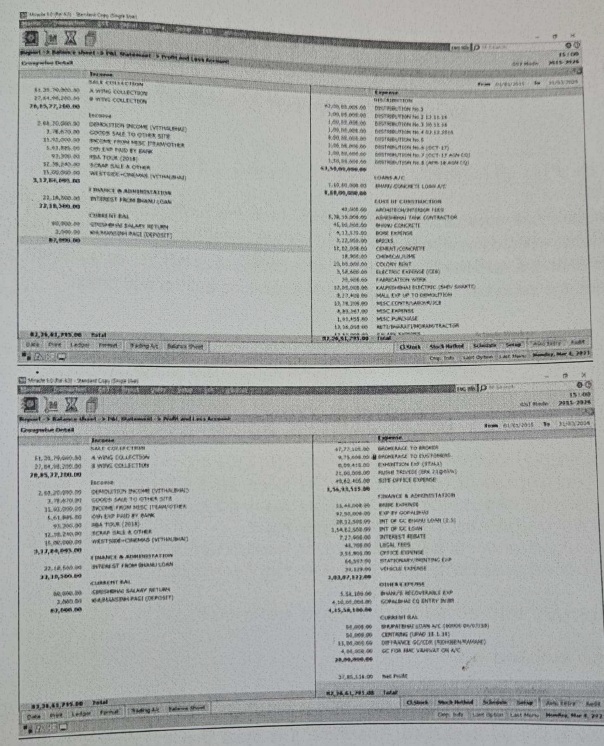

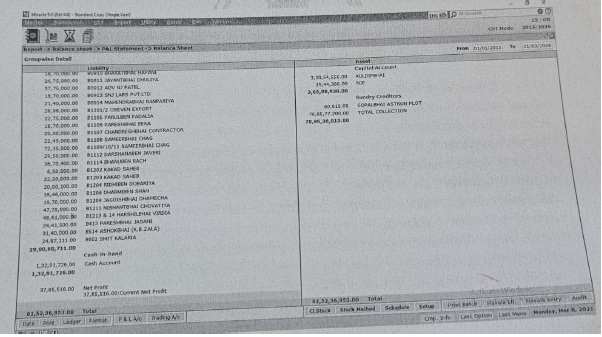

8. About unaccounted cash “on-money” of Rs.82,32,34,811/- in the sale consideration of offices and sops of Square 9 project, the assessing officer noticed that during the course of search at the residence of Shri Himanshu Raiyani, certain digital data was found and seized which were accounts of the assessee-company maintained by the name of “OD’ in Miracle software. These accounts were parallel books of the assessee whereby unaccounted transactions were mentioned. The same were printed, annexure, as Annexure-DD-1 and confronted to Shri Nikhl Patel. Page No.9-15 of Annexure DD-1 are those documents which revealed huge cash inflow in the form of advances received towards the booking of units in the project Om Decora Square, under the head income particulars’, there are details like sales collection, demolition income misc. income etc. The expense particulars reveals the details like distribution of cash by the stakeholders, cost of construction and selling expenses. The total gross inflow till the date of preparation of this account is Rs.82,32,34,811/-. In this connection, the assessing officer reproduced the profit and loss account and balance sheet on page number 11 to 18 of assessment order.

9. The assessing officer had gone through the profit and loss account and balance sheet of the assessee, which were reproduced on page number 11 to 18 of assessment order and noticed that these papers are titled as PROFIT AND LOSS account and BALANCE SHEET. The dates are from 01.01.2015 to 31.03.2026. Thus, it is from the beginning till endless (as this is parallel unaccounted accounts and therefore, the range is set by the person who maintains the same and year wise bifurcation is not made). The entries in Pendrive data reflect unaccounted transactions till the date of search & seizure action 26.09.2018. The broad break up of these accounts were discussed by the assessing officer in the assessment order.

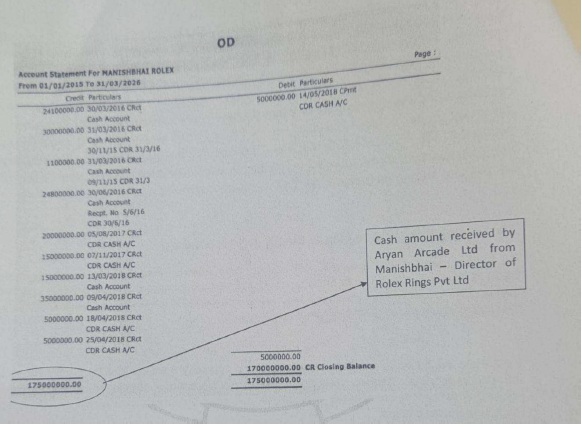

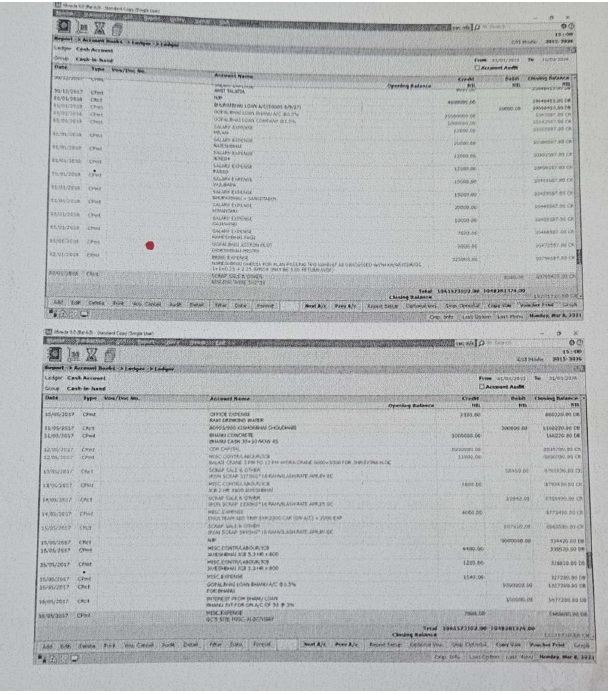

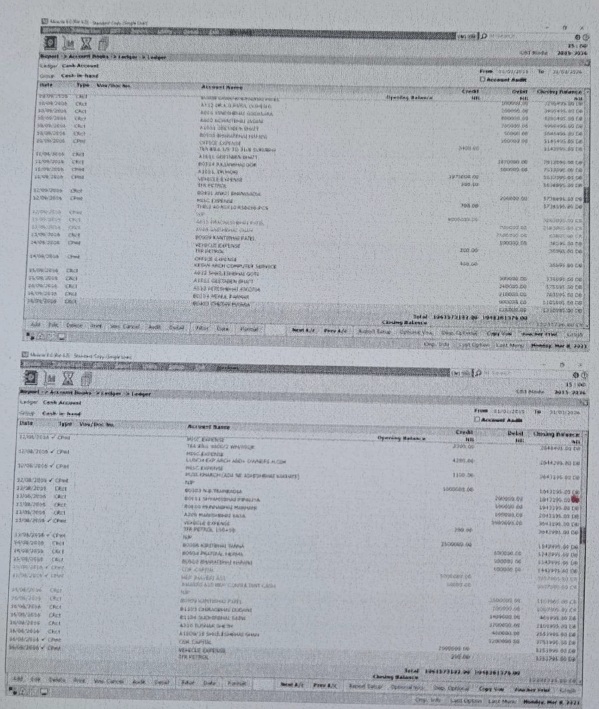

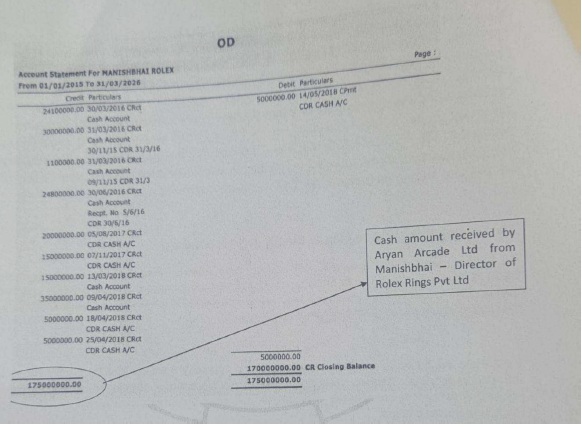

10. The assessing officer noticed from the broad break up of these accounts that there is credit entries (Sale Collection Rs.78,85,77,200/-, the top left of Page 9 of Annexure DD-1 produced in assessment order shows details of sale collection. There are two wings, viz: A-Wing and B-Wing. The total unaccounted cash collection towards sale is to the tune of Rs. 78,85,77,200/-. The bifurcation of this is given in page Nos. 11, 12, 13 and 14 of the seized documents as produced in assessment order. There is clear mention of names of the persons who had given advances in cash. These are on money receipts which are not recorded in the regular books of accounts. One important investor in the units of the assessee company is Shri Manishbhai of M/s. Rolex Bearings. He has paid the whole amount of Rs.17,00,00,000/- in cash, the same is reflected in page no. 12. The ledger of Manishbhai cash payment is reproduced by assessing officer on page number 19 of the assessment order.

11. The above ledger is retrieved from the Miracle database file named “OD”. Miracle Software maintained by Shri Himanshu Raiyani for unaccounted cash transaction of Square 9 project wherein date wise entries of unaccounted cash receipt in sale consideration of various units from their buyers and investors, have been posted. Similarly, there are ledgers of other units as well whereby on money receipts in cash have been clearly mentioned. From this, it can be concluded that they have been maintaining two set of books, one is accounted for and another is unaccounted and not reflected in the books of accounts i.e. cash account. The same fact, corroborates with the statement of Himanshu Raiyani taken during the search proceedings on 26/09/5018, in which he stated that cash portion is maintained separately and not reflected in the books of accounts of the company. The relevant statement is reproduced by the assessing officer on page number 20.The ledger is retrieved from the Miracle database file named “OD”. Miracle Software maintained by Shri Himanshu Raiyani for unaccounted cash transaction of Square 9 project wherein date wise entries of unaccounted cash receipt in sale consideration of various units from their buyers and investors, have been posted. Similarly, there are ledgers of other units as well whereby on money receipts in cash have been clearly mentioned. From this, it can be concluded that they have been maintaining two set of books, one is accounted for and another is unaccounted and not reflected in the books of accounts i.e. cash account. The same fact, corroborates with the statement of Himanshu Raiyani taken during the search proceedings on 26/09/5018, in which he stated that cash portion is maintained separately and not reflected in the books of accounts of the company.

12. Therefore, the assessee was asked to show cause as to why the ‘on money’ should not be brought to tax, as per the relevant provisions of the Act, therefore, assessing officer issued another show cause notice to the assessee.

13. In response, the assessee filed its written submission before the assessing officer and stated that loose paper in excel sheet found in possession of Shri Himanshu Raiyani do not belong to the assessee in as much as it does not contain name of assessee or the name of the project to which it belongs. Inference drawn by the Authorized Officer is nothing but on suspicion and suspicion alone. Without prejudice to this it was further submitted that, the loose paper referred to in the show-cause notice refers to three names i.e. CDR being Shri Chetan Dhirajlat Rokad, NP being Shri Nikhil Jamnadas Patel and KR being Shri Kuldip Rathod. Percentage stated against these three names taking together works out to 65% and for balance no name of whosoever has been stated. The loose paper excel working is also dated as on 25.01.2017 which is apparent from the right side at the top of the excel sheet. Based on these notings it was assumed that unaccounted investment has been made in acquisition of land by the assessee. The entire assertion and assumption is devoid of any merit and remains uncorroborated. It is not in dispute that all the three persons namely Shri Chetan Dhirajlal Rokad. Shri Nikhil Jamnadas Patel and Shri Kuldip Rathod were also subjected to simultaneous search and seizure proceedings with Shri Himanshu Raiyani. Had these persons made any cash payment as alleged some corroborative evidence notings/writings must have been found from their possession/ premises and/or in the material seized from their premises. Nothing of that sort was found except from Shri Himanshu Raiyani who was the accountant of some of the searched persons. Shri Himanshu Raiyani was found maintaining parallel memorial noting in Miracle Software in relation to cash transactions under the instructions and advice of Shri Nikhil J Patel. The transactions referred to in the Excel Sheet referred to in Para 4 of the show cause notice have not been found noted and jotted in the ‘Miracle’ Software either under the code name ‘OD’. Therefore, one can safely conclude and say that uncorroborated excel noting found in possession of Shri Himanshu Raiyani has no evidentiary value and no unaccounted investment was made.

14. The assessee submitted that Mr. HIMANSHU RAIYANI, in his statement on oath during search operation at his premises, had admitted and accepted contents of certain material in the form of digital data found and seized and contents of the material are true and correct. In this regards, the assessee submitted that Mr. Himanshu Raiyani had accepted and admitted that there are two set of Pen Drive(s) which contain different type of data. One Pen Drive contains accounted transactions and another one contain unaccounted transactions. He has specifically mentioned that he has recorded the transactions as per instructions given by Nikhilbhai Jamanbhai Patel, which directly establishes that he was not at all aware of the authenticity/genuineness and details of recorded transactions. The assessee is specifically emphasizing on this because even though the data seized, contains certain unaccounted transactions of the assessee, it is impossible to say that the contents are true and correct in all means and that it reflects true picture of unaccounted transactions of the assessee.

15. The assessee further submitted before the assessing officer that the digital data seized in the name of “OD” is nothing but memorial noting of transactions as reported by the assessee’s director(s) to Mr. Himanshu Raiyani.

16. After going through the reply of the assessee, the assessing officer observed that it clearly proves from the written submission of the assessee that Shri Himanshu Raiyani was regularly maintaining accounts of the assessee and he was instructed by Shri Nikhil J Patel, key promoter. Hence, the claim of the assessee that Shri Himanshu Raiyani was not accountant of the assessee, and that the seized materials do not belong to the assessee, is false and misleading. It is also pertinent to mention that when Shri Nikhil Patel, one of the directors, was confronted with the impugned seized document, wherein he categorically accepted that the impugned incriminating document pertains/ belongs to the assessee- company. Therefore, once the ownership of the said data has been accepted by Shri Nikhil Patel, the author of the same is inconsequential. Also, neither Shri Nikhil Patel nor Shri Himanshu Raiyani has even retracted their admission. Thus, on one hand the assessee is denying the documents, whereas, on the other hand, attempts are being made to justify the same. Therefore, this claim of the assessee is not acceptable. Interestingly, in para 7.5 of assessee’s own reply, the assessee had himself admitted that the figures mentioned in the ‘OD’ are actual transactions. Thus, this is conclusively proved that the contention of the assessee in regards to the above discussion is false and misleading. The relevant part of the submission whereby the assessee company has admitted that the figures mentioned in the ‘OD’ are actual transactions is as under.

“7.5 Total collection from the customers as per balance sheet appearing in memorial accounts kept by Shri Himanshu Raiyani stands at Rs. 80,81,59,711/- out of which only an amount of Rs. 17,60,81,000/- [as per working given below] remained with the assessee company and balance of Rs. 63,20,78,711/- has already been taken back by the respective customers on account of not proceeding with the purchase of unit in the project of the company and therefore, there was no occasion for our assessee to execute contract work in relation to additional amenities for which said amount was paid by the customers and therefore, was refunded. This amount of Rs. 63,20,78,711/-, therefore, cannot be considered as turnover/trading receipt/income of your assessee. Difference between the credit as per balance sheet of Rs. 80,81,59,711/- and credit as per profit & loss account of Rs. 78,85, 77,200/-i.e. Rs. 1,95,82,511/- is represented by cash on hand being amount yet to be incurred in relation to additional amenities as on 31/08/2018 i.e. the last entry appearing in the ‘OD’ account cash book”.

17. Therefore, assessing officer observed that as per assessee’s contention, that, total collection from the customers as per balance sheet appearing in memorial accounts kept by Shri Himanshu Raiyani stands at Rs.80,81,59,711/- out of which only an amount of Rs.17,60,81,000/- [as per working given below] remained with the assessee -company and balance of Rs.63,20,78,711/- has already been taken back by the respective customers on account of not proceeding with the purchase of unit in the project of the company and therefore, there was no occasion for our assessee to execute contract work in relation to additional amenities for which said amount was paid by the customers and therefore, was refunded. Now, if the contention of the assessee as discussed above is correct, then no actual cash would have been collected. Here the assessee accedes that the cash so received have also been refunded. Therefore, the assessee itself accepts that cash has been received.

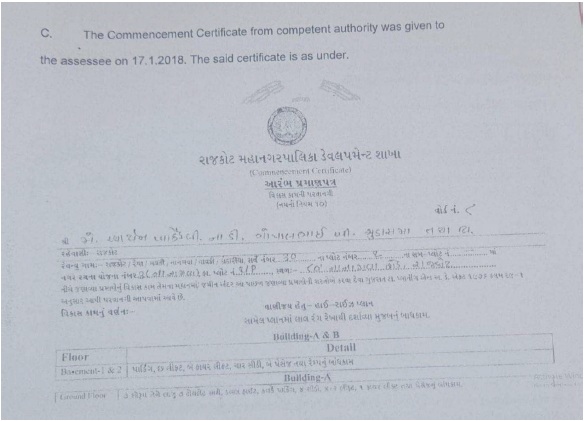

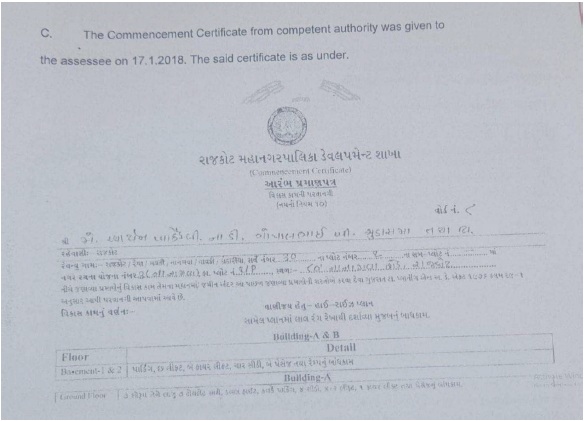

18. The assessing officer also discussed about the commencement certificate from competent authority, which is reproduced below:

Thus, the assessee should have started the construction work in the project post 17.01.2018 only. As per audited books of account, the assessee had made no bookings before financial year (FY) 2017-18. Interestingly, the assessee has received cash as early as from 07.10.2015, as per seized material contained in OD file. The sample file containing collection of ‘on money’ in the initial period is reproduced by the assessing officer in the assessment order. The assessing officer noticed that from 07.10.2015, onwards the assessee had started charging ‘on money’. In the parlance of the assessee, from 07.10.2015 onwards it had started collecting cash for extra work. This is highly improbable that a buyer pays the assessee cash advance for alleged additional work when the construction of the project has not even initiated. In other words, a prospective buyer negotiating about extra work like changing tiles, bathroom fittings, etc in the year 2015 for a project which got approval to start construction in the year 2018 is unacceptable. Therefore “on money” received prior to commencement of project is not “on money” but it is a “black money” and should be added in the hands of the assessee.

19. The assessing officer observed that there was an erstwhile mall on the land on which the project is constructed. This was demolished and the old structure was razed to ground. The assessee had received sale proceeds of such demolition and sale of scrap. This was first received on financial year (FY) 2015-16.

Whereas, the on money was collected even before the old structure was razed to ground. This implies that the prospective buyers were paying cash for additional work to the project even when the old structure was standing. This is highly unrealistic and therefore, not accepted by the assessing officer.

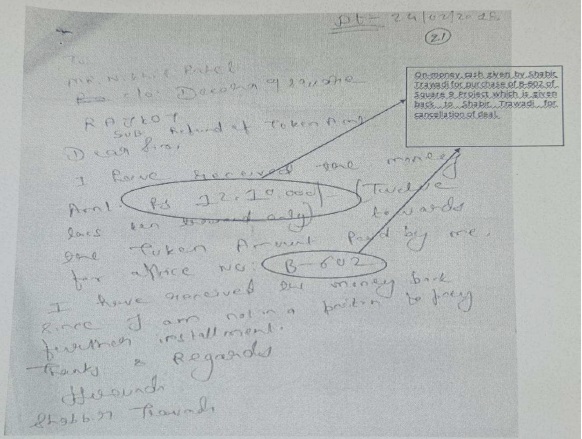

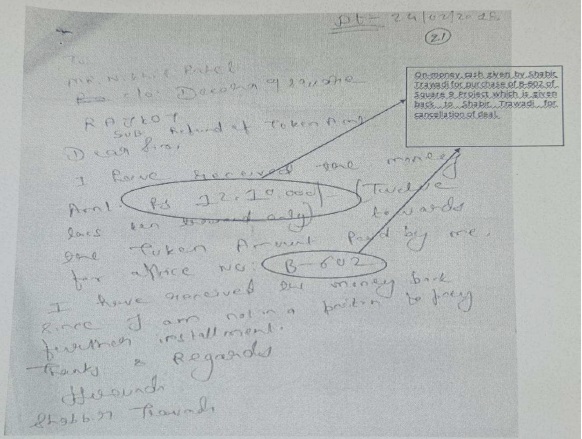

20. The assessing officer further noticed from Annexure A-6 (Page no. 21) found from the residence of Shri Chirag Patel, it is a letter with respect to confirmation of return of booking amount in respect of one office no. B-602 at Om Decora Square 9. It has been verified from the books that this transaction is not appearing anywhere. This proves that the assessee is charging ‘on money’. A copy of such letter is pasted here below, which gives a hint about the charging of cash ‘on money’. This letter is issued by one Shri Shabbir Travadi, whose statement has been recorded, wherein he has admitted to have agreed to purchase the office at Rs. 10,000 per sq foot. Although the source of cash payments in the hands of Shri Shabir Travadi is explained as it is withdrawals from his bank account, and hence, no adverse inference are drawn in his hands, however, the incident is being highlighted only to bring forth the fact that the assessee is charging cash on money which is over and above the documented price.

21. The assessing officer also analyzed the list of bookings culled out from the seized soft data-maintained ledger- wise in Miracle Software, which are reproduced in the assessment order page no.56 to 58.

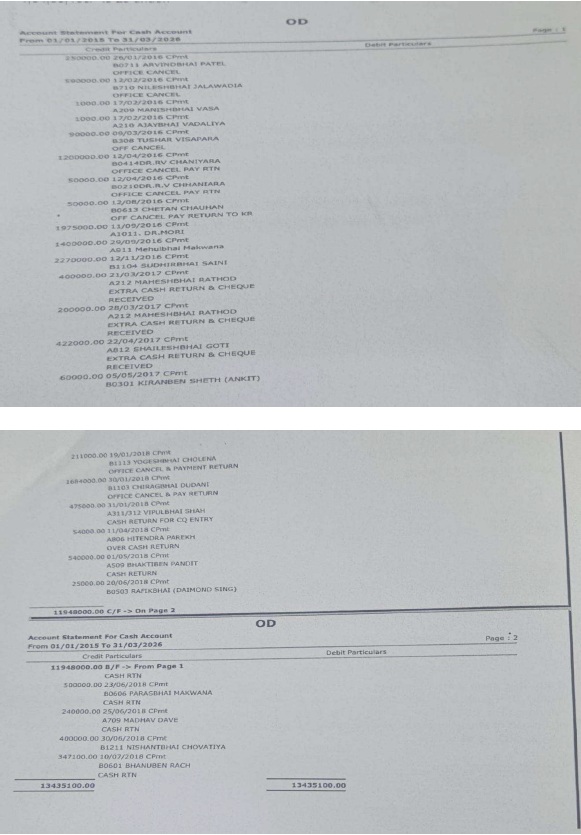

22. The assessing officer observed that the assessee contends that, out of total cash inflow of Rs 80,81,59,711/-, cash of Rs 63,20,78,711/- was returned back to the customers as they did not want to proceed with the proposed buying of the offices / shops. Indirectly, the assessee contends that this benefit of cash refund back to the customers have to be given credit to the assessee. The assessing officer observed that here the assessee is clearly misleading the department. If the cash of Rs 63,20,78,711/- is refunded back to the customers, then they would appear in the ledger account of the customers and not in DISTRIBUTION account. For example, the ledger of Shri Manishbhai Madeka of M/s Rolex Rings is reproduced below.

Here, from the above ledger it can be seen that, total cash received was Rs.17.50 crores. Out of this, Rs. 50 lac was returned back to Shri Manishbhai. This is duly appearing in the ledger of Shri Manishbhai. Some other examples are as under, from which it can be seen that, if there is any refund, the same is debited to ledger account of the individual buyer.

It is seen from the seized soft data that, upon cancellation of booking, there is refund of on money. The cash on money account reveals on money receipt of Rs.82,30,12,811/- whereas, there is refund of Rs.1,84,85,100/-, as appearing from various ledgers. Out of this ledger of refund of Rs.50,00,000 of Manishbhai has already been produced (supra). The ledger for the remaining refund of Rs.1,34,35,100/- is as under.

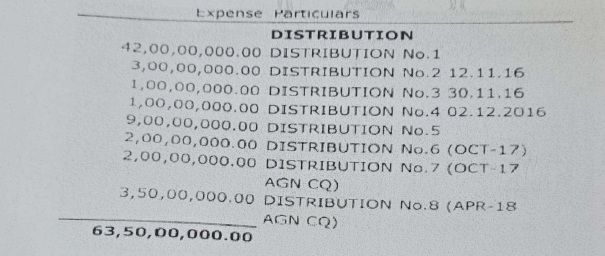

From the above ledger, it can be seen that, there is real refund of only Rs.1,84,35,100/-[1,34,35,100+50,00,000(Manishbhai Rolex)]and not Rs.63,20,78,711/-. Here it is important to discuss what DISTRIBUTION, as appearing the seized P&L account means, Shri Nikhil Patel was asked to explain what DISTRIBUTION means. He in his statement dated 28.9.2019 stated as under.

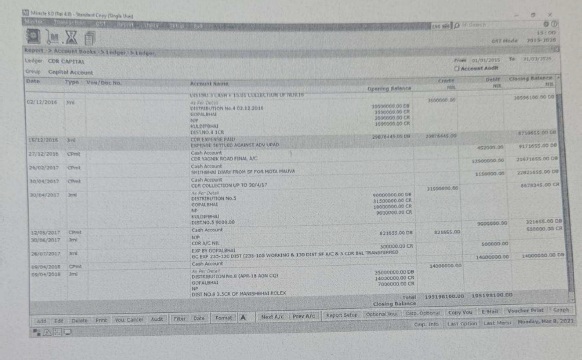

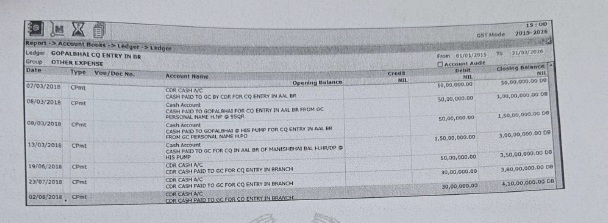

This gives a clear picture of what DISTRIBUTION means. On further digging deeper into the seized soft data, it is seen that, the distribution account originated from seven different ledgers. They are Gopalbhai, CDR Capital, NP, C.D.R, NJP, Kuldeepbhai and Chetanbhai ADV. Out of these seven accounts, it is observed that, fund is going out from these seven ledgers and on a particular date, corresponding debit entry has been passed in distribution account. However, it is observed that, money is not only going out, but there are cash inflow entries as well in two of these seven ledgers. Extract of those two ledgers is as under.

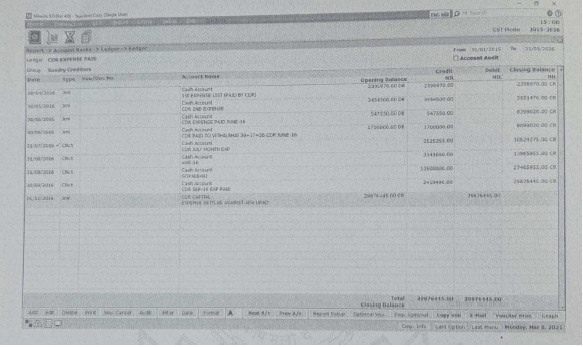

This is CDR Capital ledger. In this ledger, there is a credit entry from CDR expense paid account. The extract of CDR expense paid account is as under.

From the above ledger it can be seen that, cash has been brought back by the partner and credit has been given in CDR Expense paid account, which has been subsequently credited to CDR Capital account. This shows that amount which was earlier distributed, has been brought back into the business as and when required.

23. During the assessment proceedings, it was the plea of the assessee that, no income could be computed as per the provisions of section 43CB(1)(i) of the Act. Said income is to be computed in terms of provisions of section 43CB(1) (ii) of the Act by applying the straight line method over a period covered by the respective assessment years. According to section 43CB(1)(i), the profits and gains arising from a construction contract or a contract for providing services shall be determined on the basis of percentage of completion method in accordance with the income computation and disclosure standards notified under sub-section (2) of section 145. In short, the assessee means to say that, it is basically engaged in construction contract and hence, the applicable provision for taxation of income shall be section 43CB(1) of the Act. While submitting written submission, the assessee has stated its nature of activities as under:-

“After change of management, as stated above, the assessee undertook development of Om Decora Nine Square” commercial project on the land owned by it. All risks and rewards relating to the project belong to the assessee-company and ownership of the property owned by the company including the property under development are transferred in favour of the purchaser only at the time of execution of sale deed and on payment of agreed consideration as per the terms and conditions agreed and disclosed before the RERA.”

24. The assessee is registered in RERA and hence, it is a real estate developer and not a works contractor, as claimed now. Interestingly, the assessee got RERA approval in Sept 2018, whereas, it started taking on money as early as in 2015 when the project was not even commenced. The plea of works contractor is being taken only to deny the recognition of income on the “on money” receipts. Section 43CB was introduced in order to provide the legal sanctity to the ICDS-III (Construction Contract) and ICDS IV (Revenue Recognition). The term construction contract is not defined under the Act. However, it is defined under ICDS-III. ‘Construction contract’ is a contract specifically negotiated for the construction of an asset or a combination of assets that are closely interrelated or independent in terms of their design, technology and function for their ultimate purpose or use and includes:

(i) contract for the rendering of services which are directly related to the construction of the asset, for example, those for the services of project managers and architects;

(ii) contract for destruction or restoration of assets, and the restoration of the environment following the demolition of assets.

Plain reading of the above definition clearly suggests that the construction undertaken by a real estate developer does not satisfy the above definition as the contract is not negotiated for the construction of asset. The real estate developer constructs the asset as per his scheme and contracts with the buyer to sell the asset. Here, the land belongs to the assessee, the funds belongs to the assessee, the scheme, design, architecture, materials, equipments for construction, etc belongs to the assessee. It is developing a project and selling the same. If the contention of the assessee company in regard to alleged contractual work is accepted then the assessee company must had given contract to itself to carry out contract work. This is unfathomable and beyond rationality. Thus, no contractual work is involved and therefore, the provisions of section 43CB is not applicable.

25. The assessing officer, after considering the submissions of the assessee, finally concluded, as follows:

(a) That the seized soft data contains data till 31.8.2018 only. There might have been transactions which might have been incurred post 31.08.2018, which are not recorded in the seized soft data. Hence, the seized soft data cannot be relied upon solely to arrive at actual profit.

(b) That the seized data is data clubbed for various years, whereas, the entries in the books are segregated year wise. It is not possible to separate the entries year wise and head wise in the seized documents. Further there are several entries which are already recorded in the regular books of accounts. Therefore, there is overlapping of expenses in the seized soft data which cannot be separated. Hence, the seized soft data cannot be relied upon solely to arrive at actual profit.

(c) The seized soft data contained in MIRACLE software contains one cash book. There are instances of negative cash in the cash book as per seized data. Some of the instances are as under.

However, it is natural that, there cannot be negative cash balance in parallel unaccounted books of accounts. Therefore, the cash book as per seized soft data fails to aid in deriving actual profits.

(d) The soft data contains loans from financial institutions under the head INCOME. These are not revenue receipts but loans, which are items covered under the balance sheet.

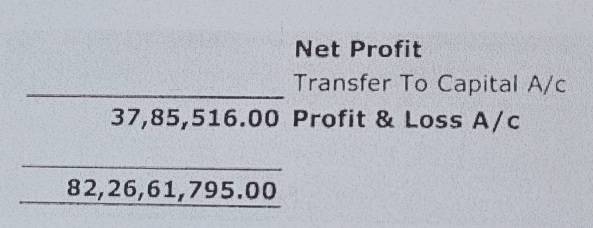

(e) The soft data contains profit of Rs.37,85,516/-. This is because the Distribution items have not been factored and the amount received on money already distributed amongst the directors/ shareholders has not been taken into account. The same is as under.

If the seized soft copy is to be relied upon, then the profit of the company is Rs.37.852 lacs, whereas, the project has just started in the year 2018. It is pertinent to mention that the assessee company has shown no profit in its audited books. Therefore, the seized soft data is not reliable in working out the real profit.

(f) The following particulars are appearing in the seized P&L account.

The commencement certificate for starting the project was received on 17.05.2018. Search took place on 26.09.2018. Therefore, it is clear that the project has started when the search took place. Since actual divisible profits cannot be determined before the completion of project, the distribution mentioned in the seized P&L account is not profits. Even the first sale document was registered after 31.03.2019. Secondly, the Distribution is appearing on the right hand side which is titled as Expense Particulars. These are therefore not in the nature of divisible profits and hence, no profits can be derived from the seized soft data.

(g) As discussed above, the distribution account originated from seven different ledgers. They are Gopalbhai, CDR Capital, NP, C.D.R, NJP, Kuldeepbhai and Chetanbhai ADV. Out of these seven accounts, it is observed that, fund is going out from these seven ledgers and on a particular date, corresponding debit entry has been passed in distribution account. However, from minute observation it is observed that, money is not only going out, but there are cash inflow entries as well in two of these seven ledgers.

(h) In a real estate firm, details of opening stock, closing stock and work in progress is key element in arriving at real profits. However, no such details are available in the seized soft P&L account. To make matters worse, the seized P&L account does not aid in arriving at the correct details of opening stock, closing stock and work in progress. The following is the extract of balance sheet of seized soft data.

Since there is evidence of on money receipts and cash expenditure towards cost of construction, it is obvious that the stocks as per books are hugely understated.

(i) The assessee has shown NIL profits in the regular books of accounts. The seized materials reveal substantial ‘on money’ receipts.

(j) Now, on the other hand, from the seized soft cash book, it is seen that the actual cash on money receipt is Rs.82,30,12,811/- crores for various years, and there is return back of Rs.1,84,85,100/- for various years. This is verifiable from the seized soft data. Thus, the net on money receipt is Rs.80,45,27,711/- (Rs. 82,30,12,811- Rs.1,84,85,100) for various years. Against this, cash expenditure as per seized soft data is Rs.12,97,68,179/- as per the seized soft data. Besides, the cash brought in by the shareholders (considered separately in their individual hands) is also treated as expenditure. This works out to Rs.6,87,94,600/-. Thus, the total expenses as emanating from the seized documents works out to Rs.19,85,62,779/-. By this standard, it is very clear that the assessee has cash surplus of receipt over expenditure, which safely concludes that the on money has resulted into income, which is suppressed.

(k) Further, the audited books are maintained on mercantile system whereas the seized books are maintained on cash/hybrid basis. Therefore, actual profit cannot be derived from either of the audited books, seized materials or combination of both.

(l) It is also pertinent to mention here that in the business of real estate, generally the construction related expenses are made initially through cash. Then the same are incurred through cheque in future and the cash paid earlier is received back. These cheque payments are then recorded in regular books of accounts as expenses. This is done in order to avail benefit of input credit of Indirect- Taxes and to reduce taxable income. However, on perusal of the seized soft data, it can be seen that the assessee has incurred substantial construction related expenses in cash, which, is beyond business prudence. Therefore, there is high probability that the assessee must have debited expenses in audited books which they have incurred in cash in the seized books of accounts. Thus, the assessee company’s books to that extent are unreliable to arrive at the actual profit of the assessee.

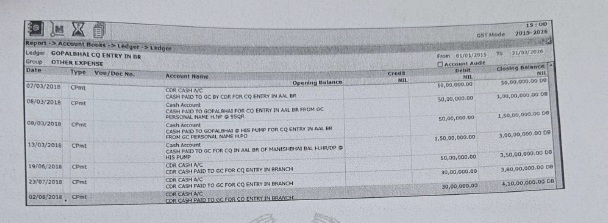

(m) Further, it is also seen that the ‘on money’ receipt is brought back through cheque in the books of the assessee- company through various stakeholders. To substantiate the same extract of ledger of Gopalbhai CQ entry in BR is produced below, whereby it can be seen that the unaccounted on money receipt is brought back by the stakeholders of Assessee- Company. However, on perusal of bank statements of Shri Gopal Chudasama, it is seen that such entries were not found. Therefore, the assessee -company might have routed the unaccounted cash receipts through third party accounts via Shri Gopal Chudasama. Therefore, there is high probability of overlap between seized and audited books of the assessee.

It is also seen that, in the audited accounts there is income from sale of scrap. On the other hand, the seized data in ‘OD’, there is sale of scrap. Both the scrap sale (as per books and as per seized document) are in cash. During the course of assessment proceedings, when the assessee was confronted to explain the scrap income as per seized data, it was submitted that, the same is as per books and thus already recorded in audited accounts.

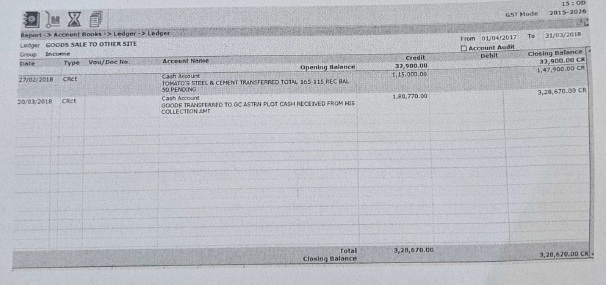

(n) There are various evidences of diversion of items like cement from the site of the assessee to other related sites and receipt in cash. One such ledger is as under.

26. Therefore, based on the above findings, the assessing officer was of the view that the audited books of the assessee- company are not reliable. When the books of account’s are rejected then on money should be taxed in the year of receipt. Further, the seized soft data is incomplete so as to arrive at actual profit in the case of the assessee company. Therefore, rejection of books is necessary in order to arrive at actual profit earned by the assessee. According to section 145(3) of the Act, where the assessing officer is not satisfied about the correctness or completeness of the accounts of the assessee, or where the method of accounting provided in sub-section (1) has not been regularly followed by the assessee, or income has not been computed in accordance with the standards notified under sub-section (2), the assessing officer may make an assessment in the manner provided in section 144 of the Act. Further, the following three broad parameter has been laid down by the Honorable bench of ITAT, Third Member Bench in the matter of Raja & Co v. Assessing officer.

| (a) | | Where assessing officer is not satisfied about the correctness or completeness of the accounts; or |

| (b) | | Where method of accounting cash or mercantile has not been regularly followed by the assessee; or |

| (c) | | Accounting Standards as notified by the ICAI have not been regularly followed by the assessee. |

27. The reasons enumerated supra clearly establishes that, the correctness and completeness of the accounts is doubtful as large cash receipts in the form of on money are not recorded in the regular books of accounts; the seized parallel P&L account contains details of capital receipt and capital expenditure, which shows that it is not clear as to whether the books are maintained in cash system or mercantile system or hybrid system, the seized soft data does not contain details of opening stock work in progress and closing stock, there is clear violation of provisions relating to cash transactions, there is evidence of sale of scrap in seized data as well as audited accounts which are not identifiable whether they are same or different transactions; transfer of materials to other sites in lieu of cash; etc. Since the actual profit could not be derived either from audited book, seized data or combination of both, therefore, assessing officer has no alternative but to reject the books, in order to judiciously derive the real income earned by the assessee. Accordingly, a show cause notice was issued to the assessee, asking it to show cause, as to why its books should not rejected and profits should not be estimated after considering expenditure incurred of 20% of the total on money receipts.

28. In response, the assessee submitted its reply, which is reproduced by the assessing officer in the assessment order vide page No. 79 to 81. The assessee submitted before the assessing officer that books of account of the assessee have been regularly maintained and day to day entries of all the transaction in respect of the main business of the books have been regularly recorded in the books of accounts. The entries and transactions of the books of account of the assessee are very well supported by the supporting bills and vouchers thereof. The contention of the assessee with reference to the regular books of accounts is that, the Books of account of the assessee have been regularly maintained; day to day entries of all the transaction in respect of the main business of the assessee in respect development and construction of Units have been regularly recorded in the books of accounts; the entries and transactions of the books of account of the assessee are very well supported by the supporting Bills and vouchers thereof, the books of accounts have been audited by the competent chartered accountant, method of accounting regularly followed by the assessee is consistent over years and no change in such method has been noticed. The contention of the assessee with reference to the seized data is that, the assessee has acknowledged and explained each and every page of Seized Material; that the nature of all the entries made there in are memorial noting; the nature of seized data has been duly explained along with nature of transactions recorded; the nature of income embedded in seized data is different from that recorded in regular books of accounts; reason and explanation as why some entries were not recorded in regular books of accounts, have been elaborately addressed; the nature of income as embedded in seized data and not recorded in regular books of accounts is in the nature of contract income which is very much different from income from sale of units; discrepancy in recording of transaction by the accountant vis-a-vis nature of actual transaction in memorial noting of “OD”, as seized during search action has been addressed in detail; that the additional income has been offered by the assessee to be taxed to complete the assessment peacefully, the proposal to add income at an immensely high rate is without any comparable cases of income earned and proposed to be estimated, that income has to be assessed as and when it accrues and in the manner in which accrues keeping in mind nature of transaction, accounting policy followed by the assesse, AS-9 Revenue Recognition, ICDS-III: Construction Contracts (Parallel to AS-7 issued by ICAI), Section 43CB of the Act, that the Sale Rate per sq. feet, for sale of units, is very well comparable and in fact higher than that of prevailing rates in other projects, in the vicinity; that the Profit Margin as declared and offered by the assessee, is absolutely just and comparable to similar size of projects, that there are no other evidences indicating that the receipts in seized documents were actual figures whereas expenses recorded in seized material are inflated. The assessee also contends that, while ascertaining a profit while rejecting books of accounts, the rate should not be ascertained arbitrarily, there must be some rationale for arriving at such profit and such profit rate must not exceed the profit rate as declared by industry in general and which have been accepted in Scrutiny Assessments.

29. However, the assessing officer rejected the above contention of the assessee and noted that all the claims made by the assessee have been exhaustively discussed supra. To summarize, during the course of search, some soft data were seized from the possession of Shri Himanshu Raiyani, accountant of the assessee. Shri Himanshu Raiyani admitted that these data pertained to the project OM DECORA 9 SQUARE developed by the assessee. This statement was cross confirmed by Shri Nikhil Patel, who admitted that some entries are accounted and some are unaccounted. The statements of both Shri Himanshu Raiyani and Shri Nikhil Patel are same as on date. In the said seized soft data, there were evidences of cash on money receipts to the tune of Rs. 80,45,27,711/-. The seized soft data also contains ledgers of individual buyers of the units wherein there is clear mention of receipt of cash. In the seized soft data, there is huge cash receipt of on money. Suppression of receipts and inflation of expenses affects the working of opening stock, WIP and closing stock. Besides, the seized cash book contained in the soft data shows negative cash balance. This may be due to non-recording of entries and cash taken by the Directors. Therefore, even the seized cash book does not give true and correct picture of receipts, expenses and profits. Many of the expenses recorded in the seized cash book are also appearing in the regular books of accounts. The assessee failed to segregate such duplication, despite repeated requests. The seized P&L account includes entries of capital receipt and capital expenditure. The figures of loans are recorded in the seized P&L account which includes cash loans as well as loans taken by cheque. This is the reason why the seized P&L account shows less profit, despite huge on money receipts and few recorded cash expenses. It is also seen that, there is income from sale of scrap in the seized document and in the audited accounts and both shows different figures. Also, there is transfer of material to other sites and proceeds of which is received in cash. Thus, on one hand the material cost is debited in the audited accounts, whereas, the cash is received on transfer of material to other sites.

30. The assessing officer further, noticed that the seized soft data contains data till 31.08.2018 only. There are many more expenses which might have been incurred post 31.08.2018, which is not recorded in the seized soft data. Also, the seized data is data clubbed for various years, whereas, the entries in the books are segregated year- wise. The assessee failed to separate the entries year- wise and head wise in the seized documents. It is further seen that, the profits as per regular books of accounts (from operation) are NIL. This is because large cash on money receipts are suppressed. The assessee also contends that, income has to be assessed as and when it accrues and in the manner in which accrues keeping in mind nature of transaction, accounting policy followed by the assesse, AS-9 Revenue Recognition, ICDS-III: Construction Contracts (Parallel to AS-7 issued by ICAI), Section 43CB of the Act. Here it needs to be appreciated that the assessee has never accepted the nomenclature of receipts as cash on money. Rather, it claims that these are contractual receipts for carrying out extra work. Although this contention has been rebutted supra, however, it is interesting to note that, on one hand the assessee says that income should be recognized as per AS-9 and ICDS-III whereas, on the other hand it is claiming it as contractual receipts. The contention of the assessee that the Sale Rate per sq. feet, for sale of units, is comparable and higher than that of prevailing rates in other projects, in the vicinity is also irrelevant because, multiple instances of on money receipt with detailed ledger containing name of the buyer, and ledger showing entire transaction, has been found and seized. Further, perusal of the seized soft reveals that the entire transactions are recorded on cash or hybrid basis. The transactions in the regular audited accounts are maintained on mercantile basis.

31. The assessing officer, in light of the above findings, noticed that neither the regular audited accounts nor the seized soft data shows true and fair picture of earnings of the assessee. Attempt was also made to club both the regular audited accounts and seized soft data. However, such an attempt was futile because, there is duplication of entries in both the seized data and regular books of accounts. Besides, the entries in the soft data are clubbed for the whole project and hence, could not be segregated year- wise. Therefore, there is no alternative but to invoke the provisions of section 145(3), to reject the books and estimate the profit of the assessee, year- wise. It is relevant to quote from the Memorandum to the Finance Bill 1995, through which section 145 was amended that explained the provisions as under:

“The existing section 145(1) of the Income tax Act provides for computation of income from business or profession or income from other sources in accordance with the method of accounting regularly employed by the assessee, income is generally computed by following one of the three methods of accounting namely (i) cash or receipt basis, (ii) accrual or mercantile basis and (iii) mixed or hybrid method which has elements of both the aforesaid methods. It has been noticed that many assessees are following the hybrid method in a manner that does not reflect the correct income. It is proposed to amend section 145 to provide that income chargeable under the head ‘Profits and gains of business or profession’ or ‘income from other source’ shall be computed only in accordance with either the cash or the mercantile system of accounting, regularly employed by an assessee.”

Therefore, assessing officer noted that various Courts have held that, the assessing officer shall point out the defects in the books of accounts before rejecting them. In a case, where the assessing officer has rejected the book results but has found no defects in the books of account of the assessee, the question arises as to whether the assessing officer in exercise of his powers under section 145(3) could make estimates without proper rejection of the book results and without finding fault in the books of account. The assessing officer has to give a finding of fact i.e., whether or not the income could properly be deduced from the accounts maintained by the assessee. What is to be determined by the assessing officer in exercise of his power is a question of fact i.e., whether or not income chargeable under the Act could properly deduced from the books of accounts. He must also decide this question with reference to the relevant material and in accordance with the correct principles. The following is the parameter for such a verification.

(a) Whether the assessee has regularly employed a method of accounting?

(b) Even if regular adoption of a method of accounting is there, whether the annual profits could properly be deduced from the method so employed?

(c) Whether the accounts are correctly maintained?

(d) Whether the accounts maintained are complete in the sense that there is no significant omission therein?

32. The jurisdictional ITAT Rajkot Bench in the case of ITO v. Girish M Mehta [2008] 296 ITR 125 (Delhi) has pointed out that the precondition for estimating business income of the assessee, where an assessee keeps accounts, is that the assessee’s books should have been found to be unreliabile or otherwise not capable of proving the assessee’s income. The Hon. Allahabad High Court in the case of Awadhesh Pratap Singh Abdul Rehman & Bros. v. CIT ITR 406 (Allahabad) has held that, it is difficult to catalogue the various types of defects in the account books of an assessee which may render rejection of account books on the ground that the accounts are not complete or correct from which the correct profit cannot be deduced, however, where a stock register, cash memos etc, coupled with other factors like vouchers in support of the expenses and purchases made are not forthcoming and the profits are low, it may give rise to a legitimate inference that all is not well with the books and the same cannot be relied upon to assess the income, profits or gains of an assessee. In such a situation the authorities would be justified to reject the account books under section 145(2) and to make the assessment in the manner contemplated in these provisions.

33. The Hon’ble Supreme Court in the case of Kachwala Gems v. Jt. CIT ITR 10 (SC) has upheld the rejection of books of accounts u/s. 145 and consequently the best judgement assessment u/s. 144 of the Act. In the case of Champa Lal Choudhary v. Dy. CIT SOT 398 (Jaipur) confirmed the rejection of books of accounts by holding that this is principally for the reason that the assessee’s books of account do not meet the test of deduction of true and correct profits there from in the absence of proper stock records, only whereupon can they be considered as correct and complete.

34. The assessing officer in light of the above discussions, noticed that the provisions of section 145(3) are invoked and the books of the assessee is hereby rejected. Now, the question is how the best judgement assessment has to be determined? For passing best judgement assessment order, either peer comparison or past history of the assessee is normally taken as a base. However, in the present case, the past history is also not reliable since the assessee is indulging in collecting huge on-money in cash and inflating expenditure by obtaining bill of purchase and collecting cash in lieu of cheque issued. Here, peer comparison is also not possible due to factoring of on-money receipts. Therefore, the best alternative to take basis of the cash receipt and cash expenditure as per the seized soft data. It is seen that, the total cash expenditure works out to Rs.19,85,62,779/- on a gross ‘on-money’ cash receipt of Rs.82,32,34,811/-, which roughly translates into profit of around 76%. This receipt of Rs.82,32,34,811/- includes refund of Rs.1,84,85,100/. The net of refund amount is Rs.80,47,49,711/- (Rs.82,32,34,811-Rs.1,84,85,100). Further, violation of provisions of section 40A(3); 40(a)(ia); 40A(2), etc. also needs to be factored in along with large cash transactions (both receipts and expenses), which are beyond acceptable business norms as per Act. Besides, loss of revenue due to evasion of tax by third parties viz., the contractors, unaccounted cash flow flowing due to cash loans, etc, are also required to be factored in. Further, the seized soft data contains details of expenses which otherwise would not have been allowable. For example, there is large expenditure incurred for payment of illegal gratification. On the other hand, considering that there may be expense which remained to be recorded in the seized software and also taking a reasonableness of the lapses on the part of the assessee and thus, taking all the above fact into consideration, the profit is estimated after allowing expenditure of 20% of the total on-money receipt appearing in the seized soft data. Here, higher profit is estimated because the assessee has not recognized single revenue during the year under consideration, although it had received huge ‘on-money’ in cash. The on-money detail are not for the entire project. It is for few units only. Against this, the claim of expenditure is for the entire project. Therefore, it is imperative and prudent to allow claim of expenditure incurred in cash, restricted to such units only instead of whole project.

35. The assessing officer, accordingly, noticed that the net on-money receipt for the year under consideration, as per the seized ledger is as under. The following is the summary of such ledgers such a seized cash book, seized CDR cash, seized KR cash, seized GC cash.

| A.Y. 2016-17 |

| Sr.No. | Particulars | Amount (Rs) |

| 1 | On-money cash | 22,36,09,000 | |

| Less refund | 9,32,000 | 22,26,77,000 |

| | | |

| 2 | On-money CDR cash book | | |

| Less, refund | | |

| 3 | On-money GC cash book | | |

| Less, refund | | |

| 4 | On-money KR cash book | | |

| Less refund | | |

| | | |

| Total on-money | 22,26,77,000.00 |

| Brokerage | | 2,22,000.00 |

| As per OD | | 22,28,99,000.00 |

Here the brokerage is added because, this is a journal entry which is made by debiting expenditure account and crediting booking advances, as under:

| Dt.16.01.16 | B803 | 2,22,000 |

| Credit JV Brokerage charge | |

36. The working of profit is as under:

| SN | AY | Net cash on-money as per seized soft data (A) | Profit @ 80% |

| 1 | 16-17 | 22,28,99,000 | 17,83,19,200 |

| 2 | 17-18 | 39,15,62,100 | 31,32,49,680 |

| 3 | 18-19 | 12,33,30,100 | 9,86,64,080 |

| 4 | 19-20 | 6,69,58,511 | 5,35,66,808 |

| | 80,47,49,711 | |

Accordingly, the income from business is determined at Rs.17,83,19,200/-, for assessment year 2016-17.

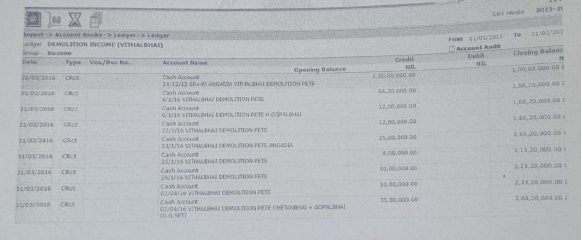

37. The assessing officer separately noticed about credit entries (demolition income vithalbhai & westside + cinemas vithalbhai – Rs.2,68,20,000/- & Rs.15,00,000/-). The assessing officer observed that entire Grand Central Mall has been demolished and on the said land, construction of OM Decora Nine Square building is coming up. The assessee received Rs.2,68,20,000/- and Rs.15,00,000/- towards sales of IMLA (demolition scrap popularly known as IMLA in local parlance). The relevant P&L account from seized soft data contained in file OD is as under:

A.Y 2016-17

| Income |

| 2,68,20,000.00 | Demolition income |

| (Vithalbhai) |

| 15,00,000.00 | W estside+Cinemas |

| (Vithalbhai) |

| 2,83,20,000.00 | |

The assessing officer noticed that above is the clear income of the assessee which has been suppressed. It is also clear that no expenditure is incurred, as it is outright contract given to Vithalbhai. Therefore, a show cause notice was issued to the assessee-company request it to explain the relevant entries in the seized books and why the same shall not be brought to tax under relevant provision of the Income-tax Act. In response to the same, the assessee furnished its reply which is reproduced below:

“Taxation of demolition income from Vithalbhai of Rs.2,68,20,000/-; Rs.15,00,000/- in resect of Westside+ Cinemas and Rs.34,64,095/-, on account of sale of goods to other sites, misc. item income, scrp sale etc, aggregating to Rs.3,17,84,095/

8.1 These amounts have been proposed to be taxed vide para 7 & 8 of the show cause taking cognizance of notings found in ‘OD’ account in ‘Miracle’ software. Breakup of aforesaid items is as under after adjusting debit of Rs.5,58,100/- in profit & loss account under the head Bhanu’ recoverable expenses which translates into net receipt of Rs:

| Demolition income (Vithalbhai) | 2,00,20,000 |

| Goods sold to other site | 3,78,000 |

| Income from misc. Items/others | 01,92,000 |

| Other expenses paid by bank | 5,61,885 |

| RBA tour | 93,000 |

| Scrap sale & other | 12,38,040 |

| Westside + Cinemas (Vithalbhai) | 05,00,000 |

| Total | 3,47,95,095 |

| Less: Bhanu’s recoverable expenses debited against other expenses paid by bank | 5,58,100 |

| Net receipts | 0,10,05,995 |

8.2 Out of the above following incomes have already been offered for taxation in the return of income for AY 2017-18, being included in the amount of Rs.18,87,62,230/- credited in the profit and loss account and therefore, are not required to be taxed again and balance of the amounts have already been considered in para 8.1 and therefore, need not required to be explained further.

| Demolition income (Vithalbhai) | 2,00,20,000 |

| Goods sold to other site | 3,78,000 |

| Income from misc. items/others | 1,09,2,000 |

| Scrap sale & others | 12,32,040 |

| Westside + Cinemas (Vithalbhai) | 05,00,000 |

| Total | 3,11,02,910 |

8.3 As regards furnishing of particulars of persons who bought the scrap from the assessee-company or Shri Vithalbhai who demolished the mall and paid demolition charges against lifting of debris from the construction site, it is submitted that since scrap sale and demolition was permitted only against receipt of cash consideration, no particular of such persons have been kept by your assessee in absolute terms and in absence of definite and complete address and other particulars on hand at present and matter being about five years old it is practically not possible to furnish such detail unless your assessee get some evidence as to location of their offices/premises etc. Sincere effort are made in this regard and if any conclusive evidence of their present where about is tracked your assessee will furnish the same a soon a such information is gathered. Without prejudice to this, it is submitted that Hon’ble Bombay High Court in relation to cash sales in the case of R.B. Jessaram Fatehchand v. CIT 75ITR 33 (Bom) has held that “in the case of cash transactions were delivery of goods is taken against cash payment, it is hardly necessary for the seller to bother about the name and address of the purchaser.”. This judgment has been quoted with approval by the Kerala High Court in the case of M. Durai Raj v. CIT dated 06.03.1971 holding that- “As observed in the Bombay High Court in R.B.Jessarm Fatehchand v. CIT, there is no need to have complete particulars of the names and addresses of customers in the case of cash transactions, and the absence of such particulars in the sale bills would not be a ground for not accepting the books of account of an assessee.” This issue was again come up before the Lucknow Bench of ITAT in the case of Kamlesh Kumar Jaiswal in ITA NO.534/LKW/2011 wherein judgment of Bombay High Court has again been followed with the remarks’ “To interpret in proper perspective, even though the sales were not verifiable as in the impugned case, the Hon’ble Curt held that lack of verification of cash sales could not be a valid ground for rejection of books of account.”

8.4 Though your assessee has offered scrap sale and demolition income in the return of income but said income was not assessable as income because receipts results into reducing in the cost of work-in-progress only and income accrues only when work-in-progress is finally sold resulting into receipt over the value of workin-progress. Reliance in this regard is placed on Ahmedabad ITAT in the case of Shri Kiritkumr Kntilal Shroff v. DCIT in ITA No.1024-25/Ahd/2008 and also Hon’ble Delhi High Court in CIT v. Eagle Theatres (Del). Identical view is taken by Tribunal in decision reported as ABCAUS 3179 (2019) (10 (ITAT following and relying upon Bokaro Steel Ld. 2361 ITR 315 (SC). In view of the above, these amounts are not to be assessed separately and on and above the income returned by your assessee.”

38. However, the assessing officer rejected the above contention of the assessee and observed that the books show scrap sales of Rs.18.87 crore which includes the scrap sales as per the seized documents. However, this contention is not acceptable due to following reasons:

| (a) | | There is clear specification of person to whom scrap has been sold in the seized soft data. Against this, no details of scrap sales as per books of Rs.18.87 crore has been filed. |

| (b) | | No details of persons to whom such scrap sales have been made, is furnished. |

| (c) | | The description of the scrap sales have not been filed. |

| (d) | | No evidence to prove that the scrap sold as per books are the same scrap which is contained in the seized soft data, has been filed. |

| (e) | | No agreements of such sales of scrap are filed. |

39. Therefore, the following items were treated by the assessing officer, as unaccounted receipts, not forming part of scrap sales of Rs.18.87, as shown in the books and hence, they are being added separately. A per the seized ledger contained in OD, the following receipts pertain to the year under consideration.

| Demolition income (Vithalbhai) | 2,68,20,000 |

| West side + Cinemas (Vithalbhai) | 15,00,000 |

| Total | 2,83,20,000 |

Accordingly, an addition of Rs.2,83,20,000/- was made by the assessing officer being income earned from demolition activities.

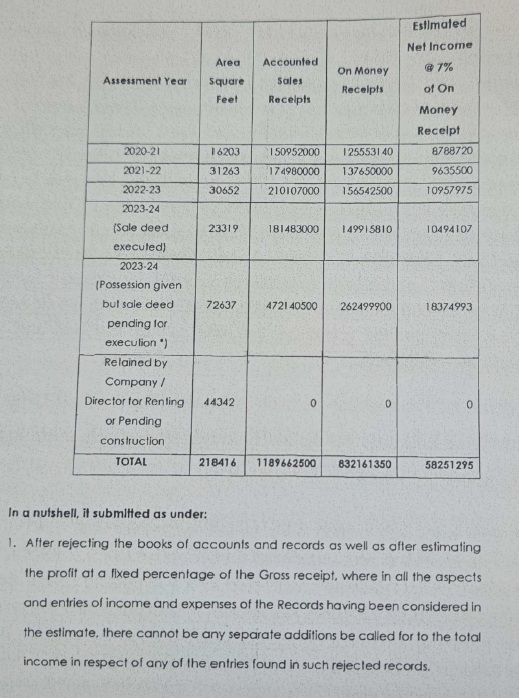

40. Aggrieved by the order of the Assessing Officer, assessee carried the matter in appeal before Ld. CIT(A) who has partly allowed the appeal of the assessee observing as follows:

“11.8 From the additions on account of on-money made by the AO, it has been observed that the AO had made total addition for A.Y.2016-17 to A.Y.2019-20 of Rs.64,37,99,768/- on account of estimated unaccounted on-money @ 80%. The details of year wise on-money receipt and estimated income are as under:-

| Sr. No. | AY | Cash on-money as per seized soft data | 80% of the on-money |

| 1 | 2016 17 | 22,28,99,000 | 17,83,19,200 |

| 2 | 2017 18 | 39,15,62,100 | 31,32,49,680 |

| 3 | 201819 | 12,33,30,100 | 3,86,64,080 |

| 4 | 2019 20 | 6,69,58,511 | 5,35,66,808 |

| Toal | 80,47,49,711 | 64,37,99,768 |

11.8.1 Against the said amount of on-money as per documents of Rs.80,47,49,711/, the appellant has moto extrapolated the same and has adopted amount at Rs.83,21,61,350/- as reproduced supra. Considering the said higher value and it has been noticed that the profit ratio of the appellant as per its regular books of accounts are as under:

G-20 Even if the Book Result of the appellant is considered for comparison, the same is as under:

| Assessment year | Gross receipts as per books | Returned inmeme |

| 2020-21 | 150952000 | 0001490 |

| 2021-22 | 174980000 | (85168859) |

| 2022-23 | 210107000 | 416931450) |

| Total | 536039000 | (199098819) |

Which works out to be the Net Loss @ 37.14% of the Gross receipt as recorded in the Books of accounts, which is only on account of higher administrative and Finance cost of the appellant.

11.8.2 ln view of the above, the average net profit comes (-)37 14% as per the books of account. However, it is also a fact that the appellant has made certain unaccounted expenses and unaccounted sale proceeds also which could not be denied. So, considering the unaccounted transactions and to pluck the leakage of revenue the books of accounts are rejected invoking the provisions of section 145 of the IT. Act.

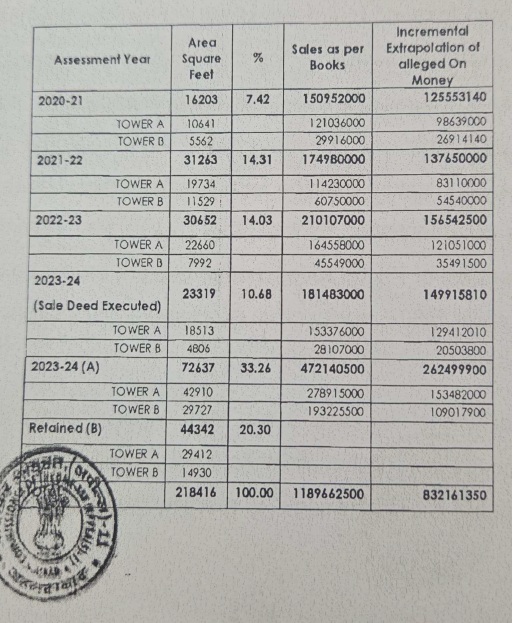

11.9 Hence, looking to the nature of various business, various discrepancies found during the search proceedings, various judicial pronouncements (supra), a settled issue that in case of unrecorded sales, the profit margin remains higher than the recorded sales, the lower profit margin shown in the books of account as compared to peers, the location and type of project taken by the appellant, the net income on account of the grounds of appeal relating to Real Estate business is taken at 15% which comes to Rs.12,48,24,203/- is confirmed. The year wise income under the head business is arrived accordingly and detailed hereunder:

| Assessment year | Estimated extrapolated on-money | On accrual and @15% as per unaccounted receipts |

| AY 2020-21 | 12,55,53,140 | 1,88,32,971 |

| AY 2021-22 | 13,76,50,000 | 2,06,47,500 |

| AY 2023-24 | 41,24,15,710 | 6,18,62,357 |

| Total | 83,21,61,350 | 12,46,24,203 |

11.9.1 ln a nutshell the addition confirmed vis-a-vis additions made on account of unaccounted receipts in respect of Real Estate business of the appellant is summarised as under:

| Particulars | Cash on- money as per seized soft data | Amount of addition (80% of on-money) | Receipts brought to tax and extrapolated by appellant. | Addition confirmed in the hands of the appellant |

| 2016-17 | 22,28,99,000 | 17,83,19,200 | — | — |

| 2017-18 | 39,15,62,100 | 31,32,49,680 | — | — |

| 2018-19 | 12,33,30,100 | 9,86,64,080 | — | — |

| 2020-21 | | | 12,55,53,140 | 1,88,32,971 |

| 2021-22 | | | 13,76,50,000 | 2,06,47,500 |

| 2022-23 | | | 15,65,42,500 | 2,34,81,375 |

| 2023-24 | | | 41,24,15,710 | 6,18,62,357 |

| Total | 80,47,49,711 | 64,37,99,768 | 83,21,61,350 | 12,48,24,203 |

11.10 Considering above facts. the AO is directed to tax undisclosed income as per tabular chart in para 11.9 & 11.9.1 hereinabove on year-to-year basis and also relief would be provided accordingly.

11.11 ln view of the above discussion and factual matrix of the case, the AO is directed to delete the addition made for the year under consideration i.e. AY 201617. Thus, the grounds of appeal no. 12 to 25 & 29 are partly allowed.”

41. The learned CIT(A), therefore reduced the estimated profit from 80% to 15%, by adopting different logic and different method and accepted the extrapolated figures submitted by the assessee before CIT(A). The assessing officer made the addition based on the real “on money” received by the assessee, however, ld. CIT(A) ignored the real “on money” received by the assessee and extrapolated the figures which is based on guess work of the assessee. Moreover, these extrapolated figures were accepted by the learned CIT(A) without application of mind and learned CIT(A) did not send these extrapolated figures (which were not there before the assessing officer, during the assessment proceedings), for examination of the assessing officer. Against this arbitrary action of the learned CIT(A), the revenue is in appeal before us.

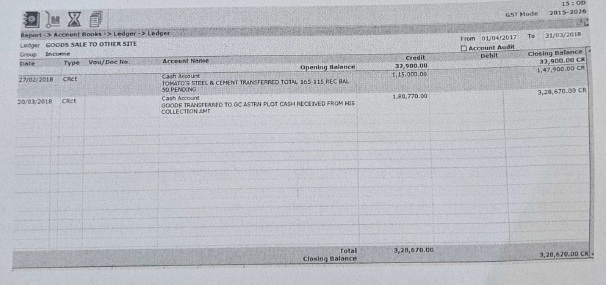

42. We have heard both the parties and carefully gone through the submission put forth on behalf of the assessee along with the documents furnished and the case laws relied upon, and perused the fact of the case including the findings of the ld CIT(A) and other materials brought on record. Before us, Ld. CIT-DR for the Revenue vehemently argued that during the appellate proceedings, the assessee submitted the following additional information/ documents, about incremental extrapolation of “on-money”, which was not before the assessing officer, which is reproduced below:

The ld. CIT-DR for the revenue submitted that ld. CIT(A) accepted the above reply of the assessee without examination the above reply with corroborative evidence found in the search and seizure proceedings. No opportunity was given to the assessing officer to examine the above extrapolated figures.

43. Ld.CIT-DR for the revenue further submitted that during the appellate proceedings, the assessee submitted the following chart of net profit/ gross profit of the subsequent years, which is reproduced below:

G-20 Even if the Book Result of the appellant is considered for comparison, the same is as under:

| Assessment year | Gross receipts as per books | Returned income |

| 2020-21 | 150952000 | 3001490 |

| 2021-22 | 174980000 | (85168859) |

| 2022-23 | 210107000 | (116931450) |

| Total | 536039000 | (199098819) |

Which works out to be the Net Loss @ 37.14% of the Gross receipt as recorded in the Books of accounts, which is only on account of higher administrative and Finance cost of the appellant.

The ld. CIT(A) has accepted this above chart of the assessee, and there is no finding of the ld. CIT(A) that he has examined the figures mentioned in the above chart with the corresponding figures found in the search and seizure proceedings, and from the accounts of the assessee. The ld. CIT(A) also not given an opportunity to the assessing officer to examine the above figures of subsequent years to determine the profit ratio. The ld. CIT(A) accepted the above figures of the assessee without examination, and reduced the estimated addition from 80% to 15% and not only that he accepted the extrapolated figures, as it is, given by the assessee, which were altogether were not before the assessing officer. Therefore, ld. CIT(A) has given the benefit based on the extrapolated figures, which were not the real figures, and the real figure of the ‘on-money’ were ignored by the ld.CIT(A). Therefore, ld.CIT-DR submitted that either addition made by the assessing officer should be sustained or the matter may be remanded back to the file of the ld. CIT(A) to adjudicate the issue afresh after giving an opportunity to the assessing officer for examination of the submission made by the assessee on different footing and extrapolated figures, during the appellate proceedings.

44. The ld. CIT-DR further submitted that in a statement recorded, Shri Nikhil J. Patel, partner, and accountant of the assessee and other partners of the assessee, accepted in their statements that assessee has accepted the “on-money”. Because, assessee’s books not were reliable, therefore based on the seized materials, the Assessing Office took the income and expenditure and made addition @ 80% of ‘on-money’. However, when assessee went in to appeal before ld. CIT(A), the ld.CIT(A) reduced the estimated addition on “on-money” from 80% to 15%, so the Revenue is in appeal before this Tribunal. The Ld. CIT-DR for the Revenue submitted that Assessing Officer has passed speaking order, in detailed manner and analysized the income and the expenditure, that is, what is the receipts of the entire group, on account of ‘on-money’ and then after the Assessing Officer came to the conclusion that ordinary expenses have already been claimed by the assessee in the regular books of account, therefore, Assessing Officer was of the view that the addition should be made based on the seized materials. Hence, the Assessing Officer, based on the seized material concluded that assessee has received the “on-money” and made the expenditure on account of “on-money” and reached a conclusion that out of “on-money”, the assessee made the expenditure to the extent of 20%, therefore, the Assessing Officer made addition @ 80% of the “on-money”. Hence, the addition made by the Assessing Officer may be sustained and order of Ld.CIT(A) may be rejected.

45. The Ld. CIT-DR for the Revenue also submitted that the issue of sale of scrap, has been dealt with by the Assessing Officer on page-81 and this issue is in AY 2017-18, the Assessing Officer made addition to the tune of Rs.2,83,20,000/-. However, the Ld. CIT(A) has deleted the said addition stating that scrap were included in the work-in-progress. However, Ld. CIT-DR pointed out that if any particular item is in work-in-progress in closing balance then it becomes opening work-in-progress in the next year. Therefore, the Ld. CIT(A) did not understand the accounting method and deleted the addition on wrong premises that the scrap amount was included in work-inprogress, however, the real fact is that scrap was never included in the workin-progress.

46. For A.Y 2018-19, Ld. CIT-DR for the Revenue pointed out that there was issue of interest on loan, on account of interest on loan, the Assessing Officer has analyzed the seized documents and then after made the addition. However, the Ld. CIT(A) has deleted the addition stating that this interest on loan, which is part of expenditure and such expenditure has already been considered by the Assessing Officer, therefore, the Ld.CIT-DR pointed out that this is wrong appreciation of facts.

47. For A.Y. 2019-20, the Ld.CIT-DR submitted that sale of scrap was made by the assessee and Assessing Officer made a detailed order and without verification of the findings of the Assessing Officer, Ld.CIT(A) has deleted the addition, which is not acceptable.

48. On the other hand, Ld. Counsel for the assessee took us through the assessment order and the seized materials and submitted that the Assessing Officer has pasted seized materials in the assessment order vide page-12 of assessment order, the net profit as per the profit and loss account is Rs.37,85,516/-. Therefore, the Assessing Officer ought to have made addition only for Rs.37,85,516/-, however, the Assessing Officer took favourable figures for revenue and ignored the figures which were favourable to the assessee. Therefore, Ld.Counsel submitted that if the addition is to be made based on the seized materials, then in that circumstances, the seized materials should be read as a whole. There should not be pick and choose theory from the seized materials. The documents have been seized by the search party during search proceedings therefore, these documents should be read entirely, which has not been done by the assessing officer.

49. The Ld. Counsel also pointed out that even the statement of employee was taken during the search proceeding, then opportunity of crossexamination is to be provided to assessee. However, no opportunity was given to assessee for cross-examination of employees.

50. The ld. Counsel for the assessee also submitted that during the search proceeding, a pen drive was found and in respect of said pen drive, the certificate u/s 65B of the Evidence Act, 1872 has not been taken by the Department and the Department has not provided, the assessee, the certificate in respect of the Evidence Act, therefore, entire assessment order may be quashed. The Ld. Counsel for the assessee also relied on the following judgments:

| (i) | | Vasireddy Vidya Sagar v. DCIT [IT Appeal Nos.524-526/Viz/2024, dated 07.03.2025] |

| (ii) | | Asnani Builders & Developers Ltd. v. ACIT [IT(SS)A No.11-14/Ind/2024, dated 25.10.2024] |

| (iii) | | Polisetty Somasundaram v. Dy. CIT (Visakhapatnam – Trib.) |