ORDER

1. The present appeal has been filed by the assessee against the order passed by the Ld. Commissioner of Income Tax (Appeals), (ld. CIT(A))/National Faceless Appeal Centre (NFAC), under Section 250 of the Income Tax Act, 1961, (hereinafter referred to as “Act”), confirming the levy of penalty under Section 270A of the Act.

2. The grounds raised by the assessee read as under:-

| 1. | | The ld. CIT(A) confirming the penalty u/sec. 270A at Rs.33,280/- (200%) is bad in law. Penalty levied on suo moto disallowance of deduction u/sec. 80GGC of Rs.80,000/-. |

| 2. | | Any other matter with prior permission of the chair. |

3. The facts relating to the case are that the assessee originally had filed return of income for the impugned year claiming deduction on account of donation made to political parties under Section 80GGC of the Act amounting to Rs.80,000/-. Subsequently, on the basis of information in the possession of the department, which emanated from search action conducted in the case of Registered Unrecognized Political Parties (RUPPs)group of Ahmedabad on 07.09.2022, it was revealed that there was a racket of providing bogus donation to unrecognized political parties involving the nexus of RUPPs, bogus intermediary entities and exit providers. As per the information, the assessee was found to have obtained an accommodation entry from Rashtriya Samajwadi Party (Secular) in the form of political donation of Rs.80,000/- made during the impugned year. Accordingly, the case of the assessee was reopened by issuing notice under Section 148 of the Act. In response to the said notice the assessee filed return of income withdrawing its claim of deduction under Section 80GGC of the Act, contending before the AO that the claim was withdrawn to buy peace of mind. Assessment thereafter was framed accepting the income returned by the assessee in response to the notice issued under Section 148 of the Act which was higher than the income originally returned by the assessee by the amount of deduction claimed under Section 80GGC of the Act amounting to Rs.80,000/-. The AO initiated penalty proceedings for misreporting of income as a consequence of underreporting of income, on account of misrepresentation of facts pertaining to alleged bogus donation made to political parties and levied penalty to the tune of 200% of the tax sought to be evaded on the same as per the provisions of Section 270A (9) of the Act. Accordingly a penalty of Rs.33280/-was levied on the assessee and the same was confirmed by the ld. CIT(A).

4. The contention of the learned counsel for the assessee before us against the levy of penalty was that:-

| (i) | | The AO had not specified the specific charge for which penalty was levied, which it has been held in various decisions of judicial authorities to be a necessary pre-requisite for valid assumption of jurisdiction to levy penalty. His contention was that neither the assessment order where the penalty was initiated nor the notice issued by the AO initiating penalty proceedings mentioned the specific charge for which penalty was being levied on the assessee. |

| (ii) | | The other contention raised by the learned counsel for the assessee was that, in the present case penalty had been levied for misreporting of income as a consequence of underreporting in terms of provisions of Section 270A (9) of the Act, and the fact of the matter was that, there was no case of underreporting of income at all by the assessee, since, in the returned income filed in response to the notice under Section 148 of the Act, the assessee had not claimed any deduction under Section 80GGC of the Act on account of donations made to political parties. That therefore, the assessee could not be charged with misreporting of income as a consequence of underreporting of income on account of any alleged bogus claim of deduction u/s 80GGC of the Act. |

In support of his contentions as above Ld. Counsel for the assessee has referred to a host of decisions of the coordinate benches of ITAT which shall be taken note of and considered by me while dealing with both the contentions of the learned counsel for the assessee as above.

5. The ld. DR on the other hand, has pointed out that the contention of the learned counsel for the assessee that the AO had not specified the charge for which penalty was initiated and levied on the assessee was raised before the AO by the assessee and dealt with by him pointing out the fact from record that the charge had been clearly specified by the AO in the assessment order while initiating penalty proceedings. With respect to the contention of the learned counsel for the assessee that there was no case of underreporting of income and therefore, the assessee could not be charged to have misreported his income as a consequence of underreporting of income, Ld. DR relied on the order of Ld. CIT(A), pointing out that the ld. CIT(A) had noted the assessee to have withdrawn her claim of deduction under Section 80GGC of the Act on becoming aware that the department had initiated reassessment proceedings on the assessee on the basis of information that the donation made by the assessee to the political party was bogus and a mere accommodation entry. That it was a clear case of misrepresentation of facts by the assessee in the original return of income, which was conveniently withdrawn on initiation of reassessment proceedings when cornered and the assessee therefore, was culpable of having misrepresented facts.

6. We have heard rival contentions and have gone through the orders of the authorities below. The issue before us pertains to the levy of penalty in terms of the provisions of Section 270A of the Act for misreporting of income as a consequence of underreporting of income. Since the assessee’s contention against levy of penalty are to the effect that it is not a case of underreporting of income and also that the AO has failed to specify the charge of misreporting of income in terms of Section 270A (9), it is relevant to consider the provisions of law dealing with underreporting of income and misreporting of income as a consequence of underreporting.

Section 270A (1) and (2) deal with the levy of penalty for underreporting of income, with sub-Section (1) empowering the competent authority to levy penalty for underreporting of income and sub-Section (2) specifying the circumstances in which an assessee will be treated to have underreported his income. The said Section 270A (1) and (2) are reproduced hereunder:-

Penalty for under-reporting and misreporting of income.

270A. (1) The Assessing Officer or 94[the Joint Commissioner (Appeals) or] the Commissioner (Appeals) or the Principal Commissioner or Commissioner may, during the course of any proceedings under this Act, direct that any person who has underreported his income shall be liable to pay a penalty in addition to tax, if any, on the under-reported income.

(2) A person shall be considered to have under-reported his income, if—

(a) the income assessed is greater than the income determined in the return processed under clause (a) of sub-section (1) of section 143;

(b) the income assessed is greater than the maximum amount not chargeable to tax, where no return of income has been furnished or where return has been furnished for the first time under section 148;

(c) the income reassessed is greater than the income assessed or reassessed immediately before such reassessment;

(d) the amount of deemed total income assessed or reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total income determined in the return processed under clause (a) of sub-section (1) of section 143;

(e) the amount of deemed total income assessed as per the provisions of section 115JB or section 115JC is greater than the maximum amount not chargeable to tax, where no return of income has been furnished or where return has been furnished for the first time under section 148;

(f) the amount of deemed total income reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total income assessed or reassessed immediately before such reassessment;

(g) the income assessed or reassessed has the effect of reducing the loss or converting such loss into income.

Sub-Section(3) is a machinery provision providing for the manner of computation of underreported income.It reads as under:-

(3) The amount of under-reported income shall be,—

(i) in a case where income has been assessed for the first time,—

(a) if return has been furnished, the difference between the amount of income assessed and the amount of income determined under clause (a) of sub-section (1) of section 143;

(b) in a case where no return of income has been furnished or where return has been furnished for the first time under section 148,—

(A) the amount of income assessed, in the case of a company, firm or local authority; and

(B) the difference between the amount of income assessed and the maximum amount not chargeable to tax, in a case not covered in item (A);

(ii) in any other case, the difference between the amount of income reassessed or recomputed and the amount of income assessed, reassessed or recomputed in a preceding order:

Provided that where under-reported income arises out of determination of deemed total income in accordance with the provisions of section 115JB or section 115JC, the amount of total under-reported income shall be determined in accordance with the following formula—

(A — B) + (C — D)

where,

A =”the” total income assessed as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called general provisions);

B =”the” total income that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of under-reported income;

C =”the” total income assessed as per the provisions contained in section 115JB or section 115JC;

D =”the” total income that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC been reduced by the amount of under-reported income:

Provided further that where the amount of under-reported income on any issue is considered both under the provisions contained in section 115JB or section 115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D.

…………………………………………………..

Sub-Section (6) lists the exclusions to underreported income as under:-

(6) The under-reported income, for the purposes of this section, shall not include the following, namely:—

(a) the amount of income in respect of which the assessee offers an explanation and the Assessing Officer or 95[the Joint Commissioner (Appeals) or] the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, is satisfied that the explanation is bona fide and the assessee has disclosed all the material facts to substantiate the explanation offered;

(b) the amount of under-reported income determined on the basis of an estimate, if the accounts are correct and complete to the satisfaction of the Assessing Officer or 95[the Joint Commissioner (Appeals) or] the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, but the method employed is such that the income cannot properly be deduced therefrom;

(c) the amount of under-reported income determined on the basis of an estimate, if the assessee has, on his own, estimated a lower amount of addition or disallowance on the same issue, has included such amount in the computation of his income and has disclosed all the facts material to the addition or disallowance;

(d) the amount of under-reported income represented by any addition made in conformity with the arm’s length price determined by the Transfer Pricing Officer, where the assessee had maintained information and documents as prescribed under section 92D, declared the international transaction under Chapter X, and, disclosed all the material facts relating to the transaction; and

(e) the amount of undisclosed income referred to in section 271AAB.

…………………………………………….

Sub-Section (7) prescribes levy of penalty at the rate of 50% of the amount of tax payable on underreported income. Sub-Section (8)provides that notwithstanding the exclusions provided in Sub-Section 6 to underreported income and the prescription of levy of penalty at the rate of 50% on the underreported income, if the underreported income is as a consequence of misreporting of income, then the penalty levied shall be equal to 200% of the amount of tax payable on the underreported income. Sub-Section (8) reads as under:-

(8) Notwithstanding anything contained in sub-section (6) or sub-section (7), where under-reported income is in consequence of any misreporting thereof by any person, the penalty referred to in sub-section (1) shall be equal to two hundred per cent of the amount of tax payable on under-reported income.

7. The cases of misreporting of income are specified under Sub-Section 9 as under:-

| (9) | | The cases of misreporting of income referred to in sub-section (8) shall be the following, namely:— |

| (a) | | misrepresentation or suppression of facts; |

| (b) | | failure to record investments in the books of account; |

| (c) | | claim of expenditure not substantiated by any evidence; |

| (d) | | recording of any false entry in the books of account; |

| (e) | | failure to record any receipt in books of account having a bearing on total income; and |

| (f) | | failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply |

8. The tax payable in respect of underreported income is prescribed under Sub-Section (10) as under:-

(10) The tax payable in respect of the under-reported income shall be—

(a) where no return of income has been furnished or where return has been furnished for the first time under section 148 and the income has been assessed for the first time, the amount of tax calculated on the under-reported income as increased by the maximum amount not chargeable to tax as if it were the total income;

(b) where the total income determined under clause (a) of sub-section (1) of section 143 or assessed, reassessed or recomputed in a preceding order is a loss, the amount of tax calculated on the under-reported income as if it were the total income;

(c) in any other case, determined in accordance with the formula—

(X-Y)

where,

X =”the” amount of tax calculated on the under-reported income as increased by the total income determined under clause (a) of sub-section (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order as if it were the total income; and

Y =”the” amount of tax calculated on the total income determined under clause (a) of subsection (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order.

………………………………………..

9. Thus section 270A prescribing levy of penalty for underreporting & also misreporting of income as a consequence of underreporting of income specifies what qualifies as underreporting of income (sub section (2)) and misreporting of income (sub section (9)), how underreporting of income is to be computed (sub section(3)), the exclusions to underreported incomes(sub section(6)),quantum of penalty to be levied for each default (sub section (8)) and the manner of calculation of tax on the underreported/misreported income for calculating the penalty to be levied thereon(sub section(10)).

Having taken note of the law with regards to levy of penalty for underreporting and misreporting of income under Section 270A of the Act as above, we shall now proceed to deal with the contentions raised by the learned counsel for the assessee, applying the law to the facts of the case before us.

Before proceeding the facts relating to the case are being reiterated as under:-

The assessee had initially filed return of income claiming deduction under Section 80GGC of the Act and Rs.80,000/- on account of donation given to a political party. Subsequently, the AO was in possession of information that the donation given by the assessee to the political party was only an accommodation entry and therefore the case of the assessee was reopened and notice issued under Section 148 of the Act. In response to the notice the assessee filed return of income and withdrew its claim of deduction under Section 80GGC of the Act. The explanation offered by the assessee for withdrawal of claim of deduction was that the same was done to buy peace of mind. The income returned by the assessee in response to the Section 148 of the Act which was higher than the income originally returned by the assessee by the amount of deduction claimed under Section 80GGC of the Act of Rs.80,000/- was accepted as and assessed by the AO in the order passed under Section 147 of the Act.

10. Considering the above facts and taking note of the law with regard to the levy of penalty under Section 270A of the Act, we shall now proceed to deal with each contention of the learned counsel for the assessee before us. We shall first deal with his contention that there was no underreporting of the income by the assessee, and therefore, no case of misreporting of income as a consequence of underreporting of income so as to attract levy of penalty in terms of Section 270A (9) of the Act at the rate of 200% of the amount tax payable on the deduction under Section 80GGC which was withdrawn by the assessee, in the return of income filed under Section 148 of the Act. This pleading of the assessee rests on the fact that in the return of income filed under Section 148 of the Act the assessee had not claimed any deduction under Section 80GGC of the Act, and the income returned by the assessee in response to notice under Section 148 of the Act was accepted by the AO. His contention therefore, was that since, the return filed by assessee in response to notice under Section 148 of the Act was accepted by the AO there was no case of underreporting of income by the assessee at all.

To deal with the same, we shall go through the provisions of Section 270A (2) of the Act which prescribes what is underreporting of income and which reproduced above. On going through the same, we find that the assessee’s case is squarely covered as underreporting of income by the circumstance specified in Clause (c) of Section 270A (2) of the Act which specifies underreporting of income to have occurred if the income reassessed is greater than the income assessed or reassessed immediately before such reassessment.

11. In the facts of the present case originally the returned income by the assessee was accepted under Section 143(1) of the Act and in the reassessment framed under Section 147 of the Act, the income reassessed was greater than that originally returned by the assessee to the extent of deduction claimed originally u/s80GGC of the Act withdrawn in the return filed in response to notice u/s 148 of the Act. The present case, I hold, therefore clearly qualifies as underreporting of income in terms of Clause (c) of Section 270A sub-Section (2) of the Act.

12. The contention of the assessee that the income returned by the assessee in response to the notice under Section 148 of the Act was accepted by the AO and therefore, there was no case of underreporting of income, does not stand the test of law since law provides that if the income reassessed is greater than the income originally assessed, it qualifies as a case of underreporting of income on this basis alone, and the fact that the assessee suo moto had withdrawn any claim of deduction in the return of income filed under Section 148 of the Act is of no consequence as per law for determining whether it is a case of underreporting of income.

13. Even going by a sub-clause (3) of Section 270A of the Act, which provides for the manner of determining underreported income, the assessee’s case squarely fits in the same wherein it provides that where income is assessed for the first time if return has been furnished, the difference between the amount of income assessed and the amount of income determined under clause (a) of subSection 1 of Section 143 is to be treated as underreported income. Therefore, for computing underreported income, what is to be considered only is the income assessed and the income determined under Section 143 (1)(a) of the Act, which in the facts of the present case reveal an underreporting of income to the tune of deduction claimed by the assessee under Section 80GGC of the Act since, the income assessed under Section 147 of the Act was higher to this extent as opposed to the amount of income determined under Section 143 (1)(a) of the Act. Therefore, even as per the machinery provision of Section 270A of the Act for determining the quantum of underreported income, I hold, the assessee’s case clearly qualifies for the same.

14. Coming to the exclusions provided under sub-Section (6) of the Act reproduced above, we find that the assessee’s case does not qualify under any of the exclusions provided therein. As per sub-clause (a) of sub-Section 6 the underreported income shall not be included if the assessee offers an explanation and the AO is satisfied that the explanation is bona fide and the assessee has disclosed all material facts to substantiate the explanation. In the facts of the present case, there is no explanation offered by the assessee for withdrawal of claim of deduction under Section 80GGC of the Act, except for stating that it was withdrawn to buy peace of mind. Such an explanation given by the assessee means that he had a bona fide claim but is withdrawing the same just to avoid litigation. However I find that the assessee at no point of time has exhibited that her claim of deduction of donation to the political party was a bona fide claim. The said exercise has not been carried out either during the assessment proceedings nor during penalty proceedings. At no juncture, has the assessee demonstrated with facts and evidences that her claim of deduction of donation made to political party was genuine. Having not done so, the explanation that she is withdrawing the claim in the return filed in response to notice u/s 148 of the Act to buy peace of mind does not appear to be a bona fide claim. Therefore, the assessee’s case does not qualify for exclusion under sub-clause (a) of subsection 6 of Section 270A of the Act.

15. The other exclusions specified under sub-section (6) in any case are not applicable in the facts of the present case since they relate to additions made on account of estimation or on account of transfer pricing adjustments,which is not the fact in the present case.

Considering the above, it is clear that in the facts of the present case the withdrawal of deduction by the assessee in the return of income filed under Section 148 of the Act qualified as underreporting of income in terms of Section 270A sub-section 2 of the Act. The contention of the learned counsel for the assessee therefore, that the present was not a case of underreporting of income so as to qualify as misreporting of income as a consequence of underreporting is therefore, dismissed.

16. Taking up the contention of the Ld. Counsel for the assessee that the assessee was never specified the charge for which penalty was initiated and levied for misreporting of income as a consequence of underreporting of income, his contention is that the instances of misreporting of income are specified under Section 270A (9) of the Act and the AO has not specified the specific instance in which the present case qualifies for misreporting of income.

17. We have gone through the penalty order passed by the Assessing Officer under Section 270A of the Act wherein this contention was raised by the assessee before the AO also and we have noted that he pointed out that in the assessment order passed the AO had clearly mentioned initiation of penalty for underreporting of income in consequence of misreporting ‘under Section 270 A (9) (a)_misrepresentation or suppression of facts’. The AO therefore, pointed out that while initiating penalty the specific charge of misrepresentation of income was specified referring to sub clause (a) of Section 270A sub-Section (9) of the Act by the AO. The learned counsel for the assessee was unable to controvert the above fact and the same was evident from a bare perusal of the assessment order. Therefore, it stands as a matter of fact that while initiating penalty proceedings in the assessment order passed under Section 147 of the Act the AO had specified the particular charge for which the assessee was held to have misreported his income by specifying that it was a case of misrepresentation or suppression of facts as specified under sub-clause (a) of Section 270A (9) of the Act. Having said so the assessee’s contention to this effect that the AO had not specified charge as per Section 270A (9) of the Act while initiating penalty stands dismissed being found to be factually incorrect.

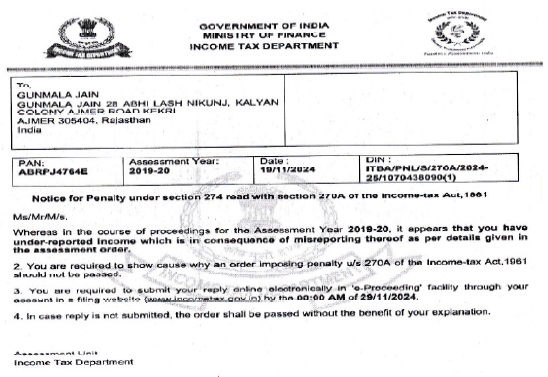

18. Taking up the next contention of the assessee that the notice issued to assessee initiating penalty proceedings under Section 270A of the Act did not specify the charge. We find that the said notice stands reproduced in the penalty order at Page 2 as under:-

A perusal of the above would reveal that in the notice the AO had specified that penalty proceedings were being initiated for underreporting of income as a consequences of misreporting as per details given in the assessment order, and the assessment order, as noted above by me, clearly specifies sub-clause (a) of Section 270A (9) to be the specific charge of misreporting of income in the present case, i.e., of suppression and misrepresentation of facts.

19. It is clearly evident, therefore, even the penalty notice cannot be faulted for having not specified the charge for which the assessee was held to have misreported her income. The contention of the learned counsel for the assessee therefore, that the penalty proceedings were initiated without specifying charge for misreporting of income is dismissed as it is found to be factually incorrect as noted above by us. All case laws relied upon by the Ld. Counsel for the assessee having not been demonstrated to have been rendered in the backdrop of identical facts and circumstances as in the present case they are of no assistance to the assessee.

In the light of the above, all the contentions raised by the assessee against the confirmation of penalty levied by the AO under Section 270A (9) amounting to Rs.33,280/-(200%) are rejected.The order of the ld. CIT(A) is confirmed. All grounds raised by the assessee are dismissed.

In effect appeal of the assessee is dismissed.